UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________________________

Form 10-K

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED December 31, 2015 OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number 1-3701

__________________________________________________________________________________________

AVISTA CORPORATION

(Exact name of Registrant as specified in its charter)

|

| | |

| Washington | | 91-0462470 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 1411 East Mission Avenue, Spokane, Washington | | 99202-2600 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 509-489-0500

Web site: http://www.avistacorp.com

Securities registered pursuant to Section��12(b) of the Act: |

| | |

| Title of Class | | Name of Each Exchange on Which Registered |

| Common Stock, no par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Title of Class

Preferred Stock, Cumulative, Without Par Value

__________________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

| Large accelerated filer | x | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ¨ No x

The aggregate market value of the Registrant’s outstanding Common Stock, no par value (the only class of voting stock), held by non-affiliates is $1,909,309,138 based on the last reported sale price thereof on the consolidated tape on June 30, 2015.

As of January 31, 2016, 62,494,881 shares of Registrant’s Common Stock, no par value (the only class of common stock), were outstanding.

__________________________________________________________________________________________

Documents Incorporated By Reference

|

| | |

| Document | | Part of Form 10-K into Which Document is Incorporated |

Proxy Statement to be filed in connection with the annual meeting of shareholders to be held on May 12, 2016. Prior to such filing, the Proxy Statement filed in connection with the annual meeting of shareholders held on May 7, 2015. | | Part III, Items 10, 11, 12, 13 and 14 |

INDEX

|

| | | | |

Item No. | | | Page No. | |

| | | | | |

| | | | | |

| | | | | |

| | | Part I | | |

| 1 | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| 1A. | | | | |

| 1B. | | | | |

| 2 | | | | |

| | | | | |

| 3 | | | | |

| 4 | | | | * |

| | | Part II | | |

| 5 | | | | |

| 6 | | | | |

| 7 | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

|

| | | | |

| | | | | |

| | | | | |

| 7A. | | | | |

| 8. | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| 9. | | | | * |

| 9A. | | | | |

| 9B. | | | | |

| | | Part III | | |

| 10. | | | | |

| 11. | | | | |

| 12. | | | | |

| 13. | | | | |

| 14. | | | | |

| | | Part IV | | |

| 15. | | | | |

| | | | | |

| | | | | |

* = not an applicable item in the 2015 calendar year for Avista Corp.

ACRONYMS AND TERMS

(The following acronyms and terms are found in multiple locations within the document)

|

| | |

| Acronym/Term | Meaning |

| aMW | - | Average Megawatt - a measure of the average rate at which a particular generating source produces energy over a period of time |

| AEL&P | - | Alaska Electric Light and Power Company, the primary operating subsidiary of AERC, which provides electric services in Juneau, Alaska |

| AERC | - | Alaska Energy and Resources Company, the Company's wholly-owned subsidiary based in Juneau, Alaska |

| AFUDC | - | Allowance for Funds Used During Construction; represents the cost of both the debt and equity funds used to finance utility plant additions during the construction period |

| AM&D | - | Advanced Manufacturing and Development, does business as METALfx |

| ASC | - | Accounting Standards Codification |

| ASU | - | Accounting Standards Update |

| Avista Capital | - | Parent company to the Company’s non-utility businesses |

| Avista Corp. | - | Avista Corporation, the Company |

| Avista Energy | - | Avista Energy, Inc., an inactive electricity and natural gas marketing, trading and resource management business, subsidiary of Avista Capital |

| Avista Utilities | - | Operating division of Avista Corp. (not a subsidiary) comprising the regulated utility operations in the Pacific Northwest |

| BPA | - | Bonneville Power Administration |

| Capacity | - | The rate at which a particular generating source is capable of producing energy, measured in KW or MW |

| Cabinet Gorge | - | The Cabinet Gorge Hydroelectric Generating Project, located on the Clark Fork River in Idaho |

| Colstrip | - | The coal-fired Colstrip Generating Plant in southeastern Montana |

| Coyote Springs 2 | - | The natural gas-fired combined-cycle Coyote Springs 2 Generating Plant located near Boardman, Oregon |

| CT | - | Combustion turbine |

| Deadband or ERM deadband | - | The first $4.0 million in annual power supply costs above or below the amount included in base retail rates in Washington under the ERM in the state of Washington |

| Dekatherm | - | Unit of measurement for natural gas; a dekatherm is equal to approximately one thousand cubic feet (volume) or 1,000,000 BTUs (energy) |

| Ecology | - | The state of Washington’s Department of Ecology |

| Ecova | - | Ecova, Inc., a provider of facility information and cost management services for multi-site customers and energy efficiency program management for commercial enterprises and utilities throughout North America, subsidiary of Avista Capital. Ecova was sold on June 30, 2014. |

| EIM | - | Energy Imbalance Market |

| Energy | - | The amount of electricity produced or consumed over a period of time, measured in KWh or MWh. Also, refers to natural gas consumed and is measured in dekatherms. |

| EPA | - | Environmental Protection Agency |

| ERM | - | The Energy Recovery Mechanism, a mechanism for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Washington |

| FASB | - | Financial Accounting Standards Board |

| FERC | - | Federal Energy Regulatory Commission |

| GAAP | - | Generally Accepted Accounting Principles |

| GHG | - | Greenhouse gas |

| GS | - | Generating station |

| IPUC | - | Idaho Public Utilities Commission |

| IRP | - | Integrated Resource Plan |

|

| | |

| Jackson Prairie | - | Jackson Prairie Natural Gas Storage Project, an underground natural gas storage field located near Chehalis, Washington |

| Juneau | - | The City and Borough of Juneau, Alaska |

| kV | - | Kilovolt (1000 volts): a measure of capacity on transmission lines |

| KW, KWh | - | Kilowatt (1000 watts): a measure of generating output or capability. Kilowatt-hour (1000 watt hours): a measure of energy produced |

| Lancaster Plant | - | A natural gas-fired combined cycle combustion turbine plant located in Idaho |

| MPSC | - | Public Service Commission of the State of Montana |

| MW, MWh | - | Megawatt: 1000 KW. Megawatt-hour: 1000 KWh |

| NERC | - | North American Electricity Reliability Corporation |

| Noxon Rapids | - | The Noxon Rapids Hydroelectric Generating Project, located on the Clark Fork River in Montana |

| OPUC | - | The Public Utility Commission of Oregon |

| PCA | - | The Power Cost Adjustment mechanism, a procedure for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Idaho |

| PGA | - | Purchased Gas Adjustment |

| PLP | - | Potentially liable party |

| PUD | - | Public Utility District |

| PURPA | - | The Public Utility Regulatory Policies Act of 1978, as amended |

| RCA | - | The Regulatory Commission of Alaska |

| REC | - | Renewable energy credit |

| RTO | - | Regional Transmission Organization |

| Salix | - | Salix, Inc., a subsidiary of Avista Capital, launched in 2014 to explore markets that could be served with liquefied natural gas (LNG), primarily in western North America. |

| Spokane Energy | - | Spokane Energy, LLC (dissolved in the third quarter of 2015), a special purpose limited liability company and all of its membership capital was owned by Avista Corp. |

| Therm | - | Unit of measurement for natural gas; a therm is equal to approximately one hundred cubic feet (volume) or 100,000 BTUs (energy) |

| UTC | - | Washington Utilities and Transportation Commission |

| Watt | - | Unit of measurement for electricity; a watt is equal to the rate of work represented by a current of one ampere under a pressure of one volt |

Forward-Looking Statements

From time to time, we make forward-looking statements such as statements regarding projected or future:

| |

| • | strategic goals and objectives; |

| |

| • | business environment; and |

These statements are based upon underlying assumptions (many of which are based, in turn, upon further assumptions). Such statements are made both in our reports filed under the Securities Exchange Act of 1934, as amended (including this Annual Report on Form 10-K), and elsewhere. Forward-looking statements are all statements except those of historical fact including, without limitation, those that are identified by the use of words that include “will,” “may,” “could,” “should,” “intends,” “plans,” “seeks,” “anticipates,” “estimates,” “expects,” “forecasts,” “projects,” “predicts,” and similar expressions.

Forward-looking statements (including those made in this Annual Report on Form 10-K) are subject to a variety of risks and uncertainties and other factors. Most of these factors are beyond our control and may have a significant effect on our operations, results of operations, financial condition or cash flows, which could cause actual results to differ materially from those anticipated in our statements. Such risks, uncertainties and other factors include, among others:

Financial Risk

| |

| • | weather conditions (temperatures, precipitation levels and wind patterns) which affect both energy demand and electric generating capability, including the effect of precipitation and temperature on hydroelectric resources, the effect of wind patterns on wind-generated power, weather-sensitive customer demand, and similar effects on supply and demand in the wholesale energy markets; |

| |

| • | our ability to obtain financing through the issuance of debt and/or equity securities, which can be affected by various factors including our credit ratings, interest rates and other capital market conditions and the global economy; |

| |

| • | changes in interest rates that affect borrowing costs, our ability to effectively hedge interest rates for anticipated debt issuances, variable interest rate borrowing and the extent we recover interest costs through utility operations; |

| |

| • | changes in actuarial assumptions, interest rates and the actual return on plan assets for our pension and other postretirement benefit plans, which can affect future funding obligations, pension and other postretirement benefit expense and the related liabilities; |

| |

| • | external pressure to meet financial goals that can lead to short-term or expedient decisions that reduce the likelihood of long-term objectives being met; |

| |

| • | deterioration in the creditworthiness of our customers; |

| |

| • | the outcome of pending legal proceedings arising out of the “western energy crisis” of 2000 and 2001, specifically related to the Pacific Northwest refund proceedings; |

| |

| • | the outcome of legal proceedings and other contingencies; |

| |

| • | economic conditions in our service areas, including the economy's effects on customer demand for utility services; |

| |

| • | declining energy demand related to customer energy efficiency and/or conservation measures; |

| |

| • | changes in the long-term global and our utilities' service area climates, which can affect, among other things, customer demand patterns and the volume and timing of streamflows to our hydroelectric resources; |

| |

| • | changes in industrial, commercial and residential growth and demographic patterns in our service territory or changes in demand by significant customers; |

Utility Regulatory Risk

| |

| • | state and federal regulatory decisions that affect our ability to recover costs and earn a reasonable return including, but not limited to, disallowance or delay in the recovery of capital investments, operating costs and commodity costs and discretion over allowed return on investment; |

| |

| • | possibility that our integrated resource plans for electric and natural gas will not be acknowledged by the state commissions; |

Energy Commodity Risk

| |

| • | volatility and illiquidity in wholesale energy markets, including the availability of willing buyers and sellers, changes in wholesale energy prices that can affect operating income, cash requirements to purchase electricity and natural gas, value received for wholesale sales, collateral required of us by counterparties in wholesale energy transactions and credit risk to us from such transactions, and the market value of derivative assets and liabilities; |

| |

| • | default or nonperformance on the part of any parties from whom we purchase and/or sell capacity or energy; |

| |

| • | potential obsolescence of our power supply resources; |

Operational Risk

| |

| • | severe weather or natural disasters, including, but not limited to, avalanches, wind storms, wildfires, snow and ice storms, that can disrupt energy generation, transmission and distribution, as well as the availability and costs of materials, equipment, supplies and support services; |

| |

| • | explosions, fires, accidents, mechanical breakdowns or other incidents that may impair assets and may disrupt operations of any of our generation facilities, transmission and distribution systems or other operations and may require us to purchase replacement power; |

| |

| • | public injuries or damage arising from or allegedly arising from our operations; |

| |

| • | blackouts or disruptions of interconnected transmission systems (the regional power grid); |

| |

| • | terrorist attacks, cyber attacks or other malicious acts that may disrupt or cause damage to our utility assets or to the national economy in general, including any effects of terrorism, cyber attacks or vandalism that damage or disrupt information technology systems; |

| |

| • | work force issues, including changes in collective bargaining unit agreements, strikes, work stoppages, the loss of key executives, availability of workers in a variety of skill areas, and our ability to recruit and retain employees; |

| |

| • | increasing costs of insurance, more restrictive coverage terms and our ability to obtain insurance; |

| |

| • | delays or changes in construction costs, and/or our ability to obtain required permits and materials for present or prospective facilities; |

| |

| • | third party construction of buildings, billboard signs or towers within our rights of way, or placement of fuel receptacles within close proximity to our transformers or other equipment, including overbuild atop natural gas distribution lines; |

| |

| • | the loss of key suppliers for materials or services or disruptions to the supply chain; |

| |

| • | increasing health care costs and the resulting effect on employee injury costs and health insurance provided to our employees and retirees; |

| |

| • | adverse impacts to our Alaska operations that could result from an extended outage of its hydroelectric generating resources or its inability to deliver energy, due to its lack of interconnectivity to any other electrical grids and the extensive cost of replacement power (diesel); |

Compliance Risk

| |

| • | compliance with extensive federal, state and local legislation and regulation, including numerous environmental, health, safety, infrastructure protection, reliability and other laws and regulations that affect our operations and costs; |

| |

| • | the ability to comply with the terms of the licenses and permits for our hydroelectric or thermal generating facilities at cost-effective levels; |

Technology Risk

| |

| • | cyber attacks on us or our vendors or other potential lapses that result in unauthorized disclosure of private information, which could result in liabilities against us, costs to investigate, remediate and defend, and damage to our reputation; |

| |

| • | disruption to or breakdowns of information systems, automated controls and other technologies that we rely on for our operations, communications and customer service; |

| |

| • | changes in the costs to operate and maintain current production technology or to implement new information technology systems that impede our ability to complete such projects timely and effectively; |

| |

| • | changes in technologies, possibly making some of the current technology we utilize obsolete or the introduction of new technology that may create new cyber security related risk; |

| |

| • | insufficient technology skills, which could lead to the inability to develop, modify or maintain our information systems; |

Strategic Risk

| |

| • | growth or decline of our customer base and the extent to which new uses for our services may materialize or existing uses may decline, including, but not limited to, the effect of the trend toward distributed generation at customer sites; |

| |

| • | potential difficulties in integrating acquired operations and in realizing expected opportunities, diversions of management resources and losses of key employees, challenges with respect to operating new businesses and other unanticipated risks and liabilities; |

| |

| • | the potential effects of negative publicity regarding business practices, whether true or not, which could result in litigation or a decline in our common stock price; |

| |

| • | changes in our strategic business plans, which may be affected by any or all of the foregoing, including the entry into new businesses and/or the exit from existing businesses and the extent of our business development efforts where potential future business is uncertain; |

External Mandates Risk

| |

| • | changes in environmental laws, regulations, decisions and policies, including present and potential environmental remediation costs and our compliance with these matters; |

| |

| • | the potential effects of legislation or administrative rulemaking at the federal, state or local levels, including possible effects on our generating resources of restrictions on greenhouse gas emissions to mitigate concerns over global climate changes; |

| |

| • | political pressures or regulatory practices that could constrain or place additional cost burdens on our energy supply sources, such as campaigns to halt coal-fired power generation and opposition to other thermal generation, wind turbines or hydroelectric facilities; |

| |

| • | wholesale and retail competition including alternative energy sources, growth in customer-owned power resource technologies that displace utility-supplied energy or that may be sold back to the utility, and alternative energy suppliers and delivery arrangements; |

| |

| • | failure by us to identify changes in legislation, taxation and regulatory issues which are detrimental or beneficial to our overall business; and |

| |

| • | the risk of municipalization in any of our service territories. |

Our expectations, beliefs and projections are expressed in good faith. We believe they are reasonably based on, without limitation, an examination of historical operating trends, our records and other information available from third parties. However, there can be no assurance that our expectations, beliefs or projections will be achieved or accomplished. Furthermore, any forward-looking statement speaks only as of the date on which such statement is made. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances that occur after the date on which such statement is made or to reflect the occurrence of unanticipated events. New risks, uncertainties and other factors emerge from time to time, and it is not possible for us to predict all such factors, nor can we assess the effect of each such factor on our business or the extent that any such factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statement.

Available Information

Our Web site address is www.avistacorp.com. We make annual, quarterly and current reports available on our Web site as soon as practicable after electronically filing these reports with the U.S. Securities and Exchange Commission (SEC). Information contained on our Web site is not part of this report.

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

Avista Corporation, incorporated in the territory of Washington in 1889, is primarily an electric and natural gas utility with certain other business ventures. As of December 31, 2015, we employed 1,711 people in our Pacific Northwest utility operations (Avista Utilities) and 227 people in our subsidiary businesses (including our Juneau, Alaska utility operations). Our corporate headquarters are in Spokane, Washington, the second-largest city in Washington. Spokane serves as the business, transportation, medical, industrial and cultural hub of the Inland Northwest region (eastern Washington and northern Idaho). Regional services include government and higher education, medical services, retail trade and finance. Through our subsidiary AEL&P, we also provide electric utility services in the City and Borough of Juneau (Juneau), Alaska.

As of December 31, 2015, we have two reportable business segments as follows:

| |

| • | Avista Utilities – an operating division of Avista Corp. (not a subsidiary) that comprises our regulated utility operations in the Pacific Northwest. Avista Utilities generates, transmits and distributes electricity and distributes natural gas, serving electric and natural gas customers in eastern Washington and northern Idaho and natural gas customers in parts of Oregon. We also supply electricity to a small number of customers in Montana, most of whom are our employees who operate our Noxon Rapids generating facility. Avista Utilities also engages in wholesale purchases and sales of electricity and natural gas as an integral part of energy resource management and our load-serving obligation. |

| |

| • | AEL&P - a utility providing electric services in Juneau, Alaska and the primary operating subsidiary of AERC. We acquired AERC on July 1, 2014, and as of that date, AERC became a wholly-owned subsidiary of Avista Corp. See "Note 4 of the Notes to Consolidated Financial Statements" for further discussion regarding this acquisition. |

We have other businesses, including sheet metal fabrication, venture fund investments, real estate investments, a company that explores markets that could be served with LNG, as well as certain other investments of Avista Capital, which is a direct, wholly owned subsidiary of Avista Corp. These activities do not represent a reportable business segment and are conducted by various direct and indirect subsidiaries of Avista Corp., including AM&D, doing business as METALfx.

Total Avista Corp. shareholders’ equity was $1,528.6 million as of December 31, 2015, of which $57.4 million represented our investment in Avista Capital and $95.4 million represented our investment in AERC.

See “Item 6. Selected Financial Data” and “Note 21 of the Notes to Consolidated Financial Statements” for information with respect to the operating performance of each business segment (and other subsidiaries).

AVISTA UTILITIES

General

At the end of 2015, we supplied retail electric service to 375,000 customers and retail natural gas service to 335,000 customers across Avista Utilities' service territory. Avista Utilities' service territory covers 30,000 square miles with a population of 1.6 million. See “Item 2. Properties” for further information on our utility assets. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Economic Conditions and Utility Load Growth” for information on economic conditions in our service territory.

Electric Operations

General Avista Utilities generates, transmits and distributes electricity, serving electric customers in eastern Washington, northern Idaho and a small number of customers in Montana.

Avista Utilities generates electricity from facilities that we own and purchases capacity, energy and fuel for generation under long-term and short-term contracts to meet customer load obligations. We also sell electric capacity and energy, as well as surplus fuel in the wholesale market in connection with our resource optimization activities as described below.

As part of Avista Utilities' resource procurement and management operations in the electric business, we engage in an ongoing process of resource optimization, which involves the economic selection from available energy resources to serve our load obligations and then capture additional economic value through market transactions. We engage in transactions in the wholesale markets by selling and purchasing electric capacity and energy, fuel for electric generation, and derivative instruments related to capacity, energy, transport and fuel. Such transactions are part of the process of matching available resources with load obligations and hedging the related financial risks. These transactions range from terms of intra-hour up to multiple years. We make continuing projections of:

| |

| • | electric loads at various points in time (ranging from intra-hour to multiple years) based on, among other things, estimates of customer usage and weather, historical data and contract terms, and |

| |

| • | resource availability at these points in time based on, among other things, fuel choices and fuel markets, estimates of streamflows, availability of generating units, historic and forward market information, contract terms, and experience. |

On the basis of these projections, we make purchases and sales of electric capacity and energy, fuel for electric generation, and related derivative instruments to match expected resources to expected electric load requirements and reduce our exposure to electricity (or fuel) market price changes. Resource optimization involves scheduling and dispatching available resources as well as the following:

| |

| • | purchasing fuel for generation, |

| |

| • | when economical, selling fuel and substituting wholesale electric purchases, and |

| |

| • | other wholesale transactions to capture the value of generating resources, transmission contract rights and fuel delivery (transport) capacity contracts. |

This optimization process includes entering into hedging transactions to manage risks. Transactions include both physical energy contracts and related derivative instruments.

Avista Utilities' generation assets are interconnected through the regional transmission system and are operated on a coordinated basis to enhance load-serving capability and reliability. Avista acquires both long term and short term transmission capacity to facilitate all of our energy and capacity transactions. We provide transmission and ancillary services in eastern Washington, northern Idaho and western Montana.

Electric Requirements

Avista Utilities' peak electric native load requirement for 2015 occurred on August 12, 2015, at which time our peak electric native load was 1,638 MW. In 2014 and 2013, our peak electric native load requirements were 1,715 and 1,669 MW, respectively, both of which occurred during the winter.

Electric Resources

Avista Utilities has a diverse electric resource mix of Company-owned and contracted hydroelectric projects, thermal generating facilities, wind generation facilities, and power purchases and exchanges.

At the end of 2015, our Company-owned facilities had a total net capability of 1,841 MW, of which 55 percent was hydroelectric and 45 percent was thermal. See “Item 2. Properties” for detailed information on generating facilities.

Hydroelectric Resources Avista Utilities owns and operates six hydroelectric projects on the Spokane River and two hydroelectric projects on the Clark Fork River. Hydroelectric generation is typically our lowest cost source per MWh of electricity and the availability of hydroelectric generation has a significant effect on total power supply costs. Under normal streamflow and operating conditions, we estimate that we would be able to meet approximately one-half of our total average electric requirements (both retail and long-term wholesale) with the combination of our hydroelectric generation and long-term hydroelectric purchase contracts with certain PUDs in the state of Washington. Our estimate of normal annual hydroelectric generation for 2016 (including resources purchased under long-term hydroelectric contracts with certain PUDs) is 533 aMW (or 4.6 million MWhs).

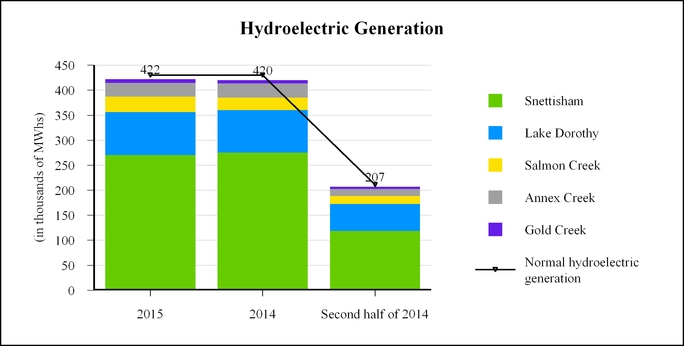

The following graph shows Avista Utilities' hydroelectric generation (in thousands of MWhs) during the year ended December 31:

| |

| (1) | Normal hydroelectric generation is determined by applying an upstream regulation calculation to median natural water flow information. Natural water flow is the flow of the rivers without the influence of dams, whereas regulated water flow takes into account any water flow changes from upstream dams due to releasing or holding back water. The calculation of normal varies annually due to the timing of upstream dam regulation throughout the year. |

Thermal Resources Avista Utilities owns the following thermal resources:

| |

| • | the combined cycle CT natural gas-fired Coyote Springs 2 located near Boardman, Oregon, |

| |

| • | a 15 percent interest in a twin-unit, coal-fired boiler generating facility, Colstrip 3 & 4, located in southeastern Montana, |

| |

| • | a wood waste-fired boiler generating facility known as the Kettle Falls Generating Station (Kettle Falls GS) in northeastern Washington, |

| |

| • | a two-unit natural gas-fired CT generating facility, located in northeastern Spokane (Northeast CT), |

| |

| • | a two-unit natural gas-fired CT generating facility in northern Idaho (Rathdrum CT), and |

| |

| • | two small natural gas-fired generating facilities (Boulder Park and Kettle Falls CT). |

Coyote Springs 2, which is operated by Portland General Electric Company, is supplied with natural gas under both term contracts and spot market purchases, including transportation agreements with bilateral renewal rights.

Colstrip, which is operated by Talen Energy LLC, is supplied with fuel from adjacent coal reserves under coal supply and transportation agreements in effect through 2019.

The primary fuel for the Kettle Falls GS is wood waste generated as a by-product and delivered by trucks from forest industry operations within 100 miles of the plant. A combination of long-term contracts and spot purchases has provided, and is expected to meet, fuel requirements for the Kettle Falls GS.

The Northeast CT, Rathdrum CT, Boulder Park and Kettle Falls CT generating units are primarily used to meet peaking electric requirements. We also operate these facilities when marginal costs are below prevailing wholesale electric prices. These generating facilities have access to natural gas supplies that are adequate to meet their respective operating needs.

See "Item 2. Properties - Avista Utilities - Generation Properties" for the nameplate rating and present generating capabilities of the above thermal resources.

Lancaster Plant We have the exclusive rights to capacity of the Lancaster Plant, a 270 MW natural gas-fired combined cycle combustion turbine plant located in northern Idaho, owned by an unrelated third-party. All of the output from the Lancaster Plant is contracted to us through 2026 under a power purchase agreement (PPA). Under the terms of the PPA, we make the dispatch decisions, provide all natural gas fuel and receive all of the electric energy output from the Lancaster Plant; therefore, we consider this plant in our baseload resources. See "Note 3 of the Notes to Consolidated Financial Statements" for further discussion of this PPA.

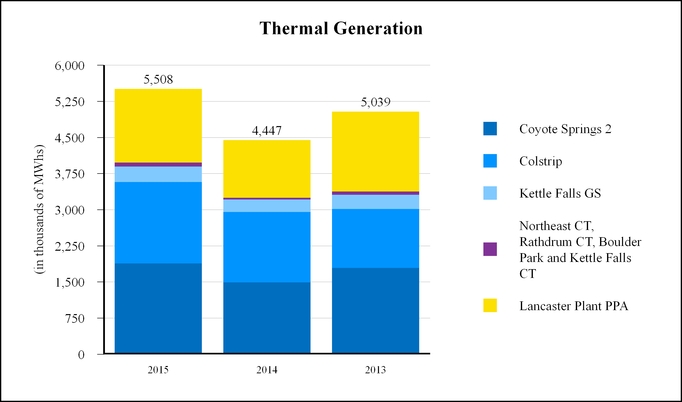

The following graph shows Avista Utilities' thermal generation (in thousands of MWhs) during the year ended December 31:

Wind Resources Palouse Wind is a wind generation project developed by Palouse Wind, LLC, and located in Whitman County, Washington. We have a 30-year PPA (expires in 2042) to acquire all of the power and renewable attributes produced by the project at a fixed price per MWh with a fixed escalation of the price over the term of the agreement. The project has a nameplate capacity of approximately 105 MW. Generation from Palouse Wind was 293,563 MWhs in 2015, 335,291 MWhs in 2014 and 297,027 MWhs in 2013. We have an annual option to purchase the wind project following the 10th anniversary of its December 2012 commercial operation date. The purchase price per the PPA is a fixed price per KW of in-service capacity with a fixed decline in the price per KW over the remaining 20 year term of the agreement.

Other Purchases, Exchanges and Sales In addition to the resources described above, we purchase and sell power under various long-term contracts and we also enter into short-term purchases and sales. Further, pursuant to the PURPA, as amended, we are required to purchase generation from qualifying facilities. This includes, among other resources, hydroelectric projects, cogeneration projects and wind generation projects at rates approved by the UTC and the IPUC.

See “Avista Utilities Operating Statistics – Electric Operations – Electric Energy Resources” for annual quantities of purchased power, wholesale power sales and power from exchanges in 2015, 2014 and 2013. See “Electric Operations” for additional information with respect to the use of wholesale purchases and sales as part of our resource optimization process and also see "Future Resource Needs" for the magnitude of these power purchase and sales contracts in future periods.

Hydroelectric Licenses

Avista Corp. is a licensee under the Federal Power Act (FPA) as administered by the FERC, which includes regulation of hydroelectric generation resources. Excluding the Little Falls Hydroelectric Generating Project, our other seven hydroelectric plants are regulated by the FERC through two project licenses. The licensed projects are subject to the provisions of Part I of the FPA. These provisions include payment for headwater benefits, condemnation of licensed projects upon payment of just compensation, and take-over of such projects after the expiration of the license upon payment of the lesser of “net investment” or “fair value” of the project, in either case, plus severance damages.

Cabinet Gorge and Noxon Rapids are under one 45-year FERC license issued in March 2001. See “Cabinet Gorge Total Dissolved Gas Abatement Plan” in “Note 19 of the Notes to Consolidated Financial Statements” for discussion of dissolved atmospheric gas levels that exceed state of Idaho and federal numeric water quality standards downstream of Cabinet Gorge during periods when we must divert excess river flows over the spillway as well as of our mitigation plans and efforts.

Five of our six hydroelectric projects on the Spokane River (Long Lake, Nine Mile, Upper Falls, Monroe Street and Post Falls) are under one 50-year FERC license issued in June 2009 and are referred to collectively as the Spokane River Project. The sixth, Little Falls, is operated under separate Congressional authority and is not licensed by the FERC.

Future Resource Needs

Avista Utilities has operational strategies to provide sufficient resources to meet our energy requirements under a range of operating conditions. These operational strategies consider the amount of energy needed, which varies widely because of the factors that influence demand over intra-hour, hourly, daily, monthly and annual durations. Our average hourly load was 1,047 aMW in 2015, 1,062 aMW in 2014 and 1,086 aMW in 2013.

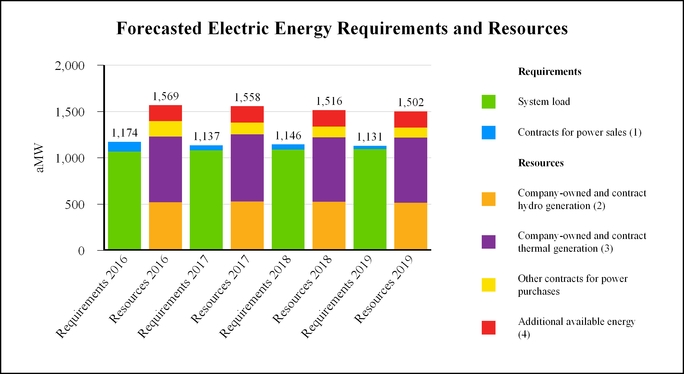

The following is a forecast of our average annual energy requirements and resources for 2016 through 2019:

| |

| (1) | The contracts for power sales decrease due to certain contracts expiring in each of these years. We are evaluating the future plan for the additional resources made available due to the expiration of these contracts. |

| |

| (2) | The forecast assumes near normal hydroelectric generation. |

| |

| (3) | Includes the Lancaster Plant PPA. Excludes Boulder Park GS, Kettle Falls CT, Northeast CT and Rathdrum CT, as these are considered peaking facilities and are generally not used to meet our base load requirements. |

| |

| (4) | The combined maximum capacity of Boulder Park GS, Kettle Falls CT, Northeast CT and Rathdrum CT is 278 MW, with estimated available energy production as indicated for each year. |

In August 2015, we filed our 2015 Electric IRP with the UTC and the IPUC. The UTC and IPUC review the IRPs and give the public the opportunity to comment. The UTC and IPUC do not approve or disapprove of the content in the IRPs; rather they only acknowledge that the IRPs were prepared in accordance with applicable standards if that is the case. The IRP details projected growth in demand for energy and the new resources needed to serve customers over the next 20 years. We regard the IRP as a tool for resource evaluation, rather than an acquisition plan for a particular project.

Highlights of the 2015 IRP include:

| |

| • | We have adequate resources between our owned and contractually controlled generation, combined with conservation and market purchases, to meet customer needs through 2020. |

| |

| • | 565 MW of additional generation capacity is required for the period 2020 through 2034. |

| |

| • | We expect to meet or exceed the renewable energy requirements of the Washington state Energy Independence Act through the 20-year IRP time frame with a combination of qualifying hydroelectric upgrades, the 30-year PPA with Palouse Wind, the Kettle Falls GS and selective REC purchases. |

| |

| • | Load growth is expected to be approximately 0.6 percent, a decline from the growth of 1.0 percent forecasted in 2013. This delays the need for a new natural gas-fired resource by one year. The decrease in expected load growth is primarily due to energy efficiency programs (using less energy to perform activities) over the next 20 years and the load impacts of increased prices. See "Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations – Forecasted Customer and Load Growth and Economic Conditions and Utility Load Growth" for further discussion regarding utility customer growth, load growth, and the general economic conditions in our service territory. The estimates of future load growth in the IRP and at "Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations – Forecasted Customer and Load Growth and Economic Conditions and Utility Load Growth" differ slightly due to the timing of when the two estimates were prepared and due to the time period that each estimate is focused on. |

| |

| • | Colstrip remains a cost effective and reliable source of power to meet future customer needs. |

| |

| • | Energy efficiency offsets more than half of projected load growth through the 20-year IRP time frame. |

| |

| • | Demand response (temporarily reducing the demand for energy) was eliminated from the Preferred Resource Strategy due to higher estimated costs. |

We are required to file an IRP every two years, with the next IRP expected to be filed during the third quarter of 2017. Our resource strategy may change from the 2015 IRP based on market, legislative and regulatory developments.

We are subject to the Washington state Energy Independence Act, which requires us to obtain a portion of our electricity from qualifying renewable resources or through purchase of RECs and acquiring all cost effective conservation measures. Future generation resource decisions will be impacted by legislation for restrictions on GHG emissions and renewable energy requirements.

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental Issues and Contingencies” for information related to existing laws, as well as potential legislation that could influence our future electric resource mix.

Natural Gas Operations

General Avista Utilities provides natural gas distribution services to retail customers in parts of eastern Washington, northern Idaho, and northeastern and southwestern Oregon.

Market prices for natural gas, like other commodities, can be volatile. Our natural gas procurement strategy is to provide reliable supply to our customers with some level of price certainty. We procure natural gas from various supply basins and over varying time periods. The resulting portfolio is a diversified mix of spot market purchases and forward fixed price purchases, utilizing physical and financial derivative instruments. We also use natural gas storage to support high demand periods and to procure natural gas when prices may be lower. Securing prices throughout the year and even into subsequent years provides a level of price certainty and can mitigate price volatility to customers between years.

Weather is a key component of our natural gas customer load. This load is highly variable and daily natural gas loads can differ significantly from the monthly forecasted load projections. We make continuing projections of our natural gas loads and assess available natural gas resources. On the basis of these projections, we plan and execute a series of transactions to hedge a portion

of our customers' projected natural gas requirements through forward market transactions and derivative instruments. These transactions may extend for multiple years into the future with the highest volumes hedged for the current and most immediate upcoming natural gas operating year (November through October). We also leave a portion of our natural gas supply requirements unhedged for purchase in the short-term spot markets.

Our purchase of natural gas supply is governed by our procurement plan, which is reviewed and approved annually by the Risk Management Committee (RMC), which is comprised of certain officers and other management personnel. Once approval is received, the plan is implemented and monitored by our gas supply and risk management groups.

The plan’s progress is also presented to the UTC and IPUC staff in semi-annual meetings, and updates are given to the OPUC staff quarterly. Other stakeholders (Public Counsel Unit of the Office of the Attorney General, Citizen Utility Board) are invited to participate. The RMC is provided with an update on plan results and changes in their monthly meetings. These activities provide transparency for the natural gas supply procurement plan. Any material changes to the plan are documented and communicated to RMC members.

As part of the process of balancing natural gas retail load requirements with resources, we engage in the wholesale purchase and sale of natural gas. We plan for sufficient natural gas delivery capacity to serve our retail customers for a theoretical peak day event. As such, we generally have more pipeline and storage capacity than what is needed during periods other than a peak day. We optimize our natural gas resources by using market opportunities to generate economic value that helps mitigate fixed costs. Wholesale sales are delivered through wholesale market facilities outside of our natural gas distribution system. Natural gas resource optimization activities include, but are not limited to:

| |

| • | wholesale market sales of surplus natural gas supplies, |

| |

| • | purchases and sales of natural gas to optimize use of pipeline and storage capacity, and |

| |

| • | participation in the transportation capacity release market. |

We also provide distribution transportation service to qualified, large commercial and industrial natural gas customers who purchase natural gas through third-party marketers. For these customers, we receive their purchased natural gas from such third-party marketers into our distribution system and redeliver it to the customers’ premise.

Optimization transactions that we engage in throughout the year are included in our annual purchased gas cost adjustment filings with the various commissions and they are subject to review for prudency during this process.

Natural Gas Supply Avista Utilities purchases all of its natural gas in wholesale markets. We are connected to multiple supply basins in the western United States and Canada through firm capacity transportation rights on six different pipeline networks. Access to this diverse portfolio of natural gas resources allows us to make natural gas procurement decisions that benefit our natural gas customers. These interstate pipeline transportation rights provide the capacity to serve approximately 25 percent of peak natural gas customer demands from domestic sources and 75 percent from Canadian sourced supply. Natural gas prices in the Pacific Northwest are affected by global energy markets, as well as supply and demand factors in other regions of the United States and Canada. Future prices and delivery constraints may cause our resource mix to vary.

Natural Gas Storage Avista Utilities owns a one-third interest in Jackson Prairie, an underground aquifer natural gas storage field located near Chehalis, Washington. Jackson Prairie has a total peak day deliverability of 12 million therms, with a total working natural gas capacity of 256 million therms. As an owner, our share is one-third of the peak day deliverability and total working capacity. We also contract for additional storage capacity and delivery at Jackson Prairie from Northwest Pipeline for a portion of their one-third share of the storage project.

We optimize our natural gas storage capacity by purchasing and storing natural gas when prices are traditionally lower, typically in the summer, and withdraw during higher priced months, typically during the winter. However, if market conditions and prices indicate that we should buy or sell natural gas during other times in the year, we engage in optimization transactions to capture value in the marketplace. Jackson Prairie is also used as a variable peaking resource and to protect from extreme daily price volatility during cold weather or other events affecting the market.

Future Resource Needs In August 2014, we filed our 2014 Natural Gas IRP with the UTC, IPUC and the OPUC. The natural gas IRPs are similar in nature to the electric IRPs and the process for preparation and review by the state commissions of both the electric and natural gas IRPs is similar. The IRP details projected growth in demand for energy and the new resources needed to serve customers over the next 20 years. We regard the IRP as a tool for resource evaluation, rather than an acquisition plan for a particular project.

Highlights of the 2014 IRP include:

| |

| • | We have sufficient natural gas transportation resources well into the future with resource needs not occurring during the 20 year planning horizon in Washington, Idaho, or Oregon. |

| |

| • | Natural gas commodity prices continue to be relatively stable due to robust North American supplies led by shale gas development; and |

| |

| • | As forecasted demand is relatively flat, we will monitor actual demand for signs of increased growth which could accelerate resource needs. |

We are required to file an IRP every two years, with the next IRP expected to be filed during the third quarter of 2016. Our resource strategy may change from the 2014 IRP based on market, legislative and regulatory developments.

Regulatory Issues

General As a public utility, Avista Corp. is subject to regulation by state utility commissions for prices, accounting, the issuance of securities and other matters. The retail electric and natural gas operations are subject to the jurisdiction of the UTC, the IPUC, the OPUC and the MPSC. Approval of the issuance of securities is not required from the MPSC. We are also subject to the jurisdiction of the FERC for licensing of hydroelectric generation resources, and for electric transmission services and wholesale sales.

Since Avista Corp. is a “holding company,” we are also subject to the jurisdiction of the FERC under the Public Utility Holding Company Act of 2005, which imposes certain reporting and other requirements. We, and all of our subsidiaries (whether or not engaged in any energy related business), are required to maintain books, accounts and other records in accordance with the FERC regulations and to make them available to the FERC and the state utility commissions. In addition, upon the request of any state utility commission, or of Avista Corp., the FERC would have the authority to review assignment of costs of non-power goods and administrative services among us and our subsidiaries. The FERC has the authority generally to require that rates subject to its jurisdiction be just and reasonable and in this context would continue to be able to, among other things, review transactions of any affiliated company.

Our rates for retail electric and natural gas services (other than specially negotiated retail rates for industrial or large commercial customers, which are subject to regulatory review and approval) are generally determined on a “cost of service” basis.

Rates are designed to provide an opportunity for us to recover allowable operating expenses and earn a return of and a reasonable return on “rate base.” Rate base is generally determined by reference to the original cost (net of accumulated depreciation) of utility plant in service, subject to various adjustments for deferred income taxes and other items. Over time, rate base is increased by additions to utility plant in service and reduced by depreciation and retirement of utility plant and write-offs as authorized by the utility commissions. Our operating expenses and rate base are allocated or directly assigned among five regulatory jurisdictions: electric in Washington and Idaho, and natural gas in Washington, Idaho and Oregon. In general, requests for new retail rates are made on the basis of net investment, operating expenses and revenues for a test year that ended prior to the date of the request, plus certain adjustments, which differ among the various jurisdictions, designed to reflect the expected revenues, expenses and net investment during the period new retail rates will be in effect. The retail rates approved by the state commissions in a rate proceeding may not provide sufficient revenues to provide recovery of costs and a reasonable return on investment for a number of reasons, including but not limited to, unexpected changes in revenues, expenses and investment following the time new retail rates are requested in the rate proceeding, and exclusion of certain costs and investment by the commission from the rate making process.

Our rates for wholesale electric and natural gas transmission services are based on either “cost of service” principles or market-based rates as set forth by the FERC. See “Notes 1 and 20 of the Notes to Consolidated Financial Statements” for additional information about regulation, depreciation and deferred income taxes.

General Rate Cases Avista Utilities regularly reviews the need for electric and natural gas rate changes in each state in which we provide service. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Regulatory Matters – General Rate Cases” for information on general rate case activity.

Power Cost Deferrals Avista Utilities defers the recognition in the income statement of certain power supply costs that vary from the level currently recovered from our retail customers as authorized by the UTC and the IPUC. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Regulatory Matters – Power Cost Deferrals and Recovery Mechanisms” and “Note 20 of the Notes to Consolidated Financial Statements” for information on power cost deferrals and recovery mechanisms in Washington and Idaho.

Purchased Gas Adjustment (PGA) Under established regulatory practices in each state, Avista Utilities defers the recognition in the income statement of the natural gas costs that vary from the level currently recovered from our retail customers as authorized by each of our jurisdictions. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Regulatory Matters – Purchased Gas Adjustments” and “Note 20 of the Notes to Consolidated Financial Statements” for information on natural gas cost deferrals and recovery mechanisms in Washington, Idaho and Oregon.

Federal Laws Related to Wholesale Competition

Federal law promotes practices that open the electric wholesale energy market to competition. The FERC requires electric utilities to transmit power and energy to or for wholesale purchasers and sellers, and requires electric utilities to enhance or construct transmission facilities to create additional transmission capacity for the purpose of providing these services. Public utilities (through subsidiaries or affiliates) and other entities may participate in the development of independent electric generating plants for sales to wholesale customers.

Public utilities operating under the FPA are required to provide open and non-discriminatory access to their transmission systems to third parties and establish an Open Access Same-Time Information System to provide an electronic means by which transmission customers can obtain information about available transmission capacity and purchase transmission access. The FERC also requires each public utility subject to the rules to operate its transmission and wholesale power merchant operating functions separately and to comply with standards of conduct designed to ensure that all wholesale users, including the public utility’s power merchant operations, have equal access to the public utility’s transmission system. Our compliance with these standards has not had any substantive impact on the operation, maintenance and marketing of our transmission system or our ability to provide service to customers.

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Competition” for further information.

Regional Transmission Organizations

Beginning with FERC Order No. 888 and continuing with subsequent rulemakings and policies, the FERC has encouraged better coordination and operational consistency aimed to capture efficiencies that might otherwise be gained through the formation of a Regional Transmission Organization (RTO) or an independent system operator (ISO).

Regional Transmission Planning

Avista Utilities meets its FERC requirements to coordinate transmission planning activities with other regional entities through ColumbiaGrid. ColumbiaGrid is a Washington nonprofit membership corporation with an independent board formed to improve the operational efficiency, reliability, and planned expansion of the transmission grid in the Pacific Northwest. We became a member of ColumbiaGrid in 2006 during its formation. ColumbiaGrid is not an ISO, but performs those functions that its members request, as set forth in specific agreements. Currently, ColumbiaGrid fills the role of facilitating our regional transmission planning as required in FERC Order No. 1000 and other clarifying FERC Orders. ColumbiaGrid and its members also work with other western organizations to address transmission planning, including WestConnect and the Northern Tier Transmission Group (NTTG). In 2011, we became a registered Planning Participant of the NTTG. We will continue to assess the benefits of entering into other functional agreements with ColumbiaGrid and/or participating in other forums to attain operational efficiencies and to meet FERC policy objectives.

Regional Energy Markets

The California Independent System Operator (CAISO) recently implemented an EIM in the western United States. Several Pacific Norhwest utilities are either participants in the CAISO EIM or plan to integrate into the market in the next few years, which could reduce bilateral market liquidity and transaction opportunities in the Pacific Northwest. Avista Utilities is monitoring the CAISO EIM implementation but currently does not plan to join as a participating member. We will continue to monitor the CAISO EIM expansion and the associated impacts. As market fundamentals and our business needs evolve, we will weigh the advantages and disadvantages of joining the CAISO EIM or other organized energy markets in the future.

Reliability Standards

Among its other provisions, the U.S. Energy Policy Act provides for the implementation of mandatory reliability standards and authorizes the FERC to assess penalties for non-compliance with these standards and other FERC regulations.

The FERC certified the NERC as the single Electric Reliability Organization authorized to establish and enforce reliability standards and delegate authority to regional entities for the purpose of establishing and enforcing reliability standards. The

FERC approved the NERC Reliability Standards, including western region standards, making up the set of legally enforceable standards for the United States bulk electric system. The first of these reliability standards became effective in June 2007. We are required to self-certify our compliance with these standards on an annual basis and undergo regularly scheduled periodic reviews by the NERC and its regional entity, the Western Electricity Coordinating Council (WECC). Our failure to comply with these standards could result in financial penalties of up to $1 million per day per violation. Annual self-certification and audit processes to date have demonstrated our substantial compliance with these standards. Requirements relating to cyber security are continually evolving. Our compliance with version 5 of the NERC's Critical Infrastructure Protection standard is driving several physical and electronic security initiatives in our control centers, generating stations and substations. We do not expect the costs of the physical and electronic securities initiatives to have a material impact to our financial results.

AVISTA UTILITIES ELECTRIC OPERATING STATISTICS

|

| | | | | | | | | | | |

| | Years Ended December 31, |

| | 2015 | | 2014 | | 2013 |

| ELECTRIC OPERATIONS | | | | | |

| OPERATING REVENUES (Dollars in Thousands): | | | | | |

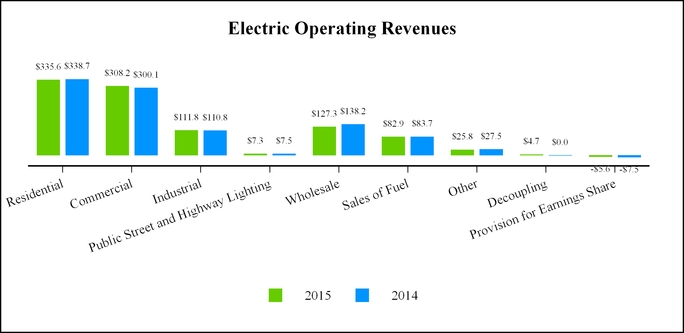

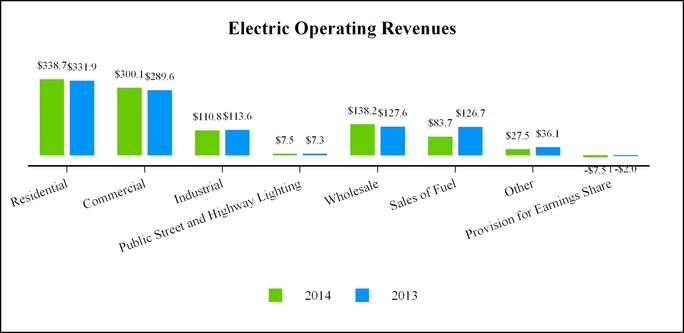

| Residential | $ | 335,552 |

| | $ | 338,697 |

| | $ | 331,867 |

|

| Commercial | 308,210 |

| | 300,109 |

| | 289,604 |

|

| Industrial | 111,770 |

| | 110,775 |

| | 113,632 |

|

| Public street and highway lighting | 7,277 |

| | 7,549 |

| | 7,267 |

|

| Total retail | 762,809 |

| | 757,130 |

| | 742,370 |

|

| Wholesale | 127,253 |

| | 138,162 |

| | 127,556 |

|

| Sales of fuel | 82,853 |

| | 83,732 |

| | 126,657 |

|

| Other | 25,839 |

| | 27,467 |

| | 36,071 |

|

| Decoupling | 4,740 |

| | — |

| | — |

|

| Provision for earnings sharing | (5,621 | ) | | (7,503 | ) | | (2,048 | ) |

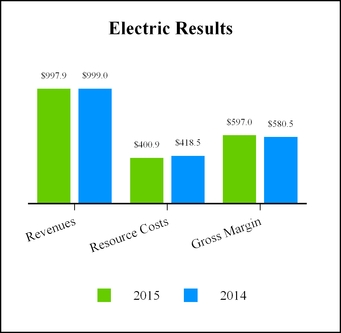

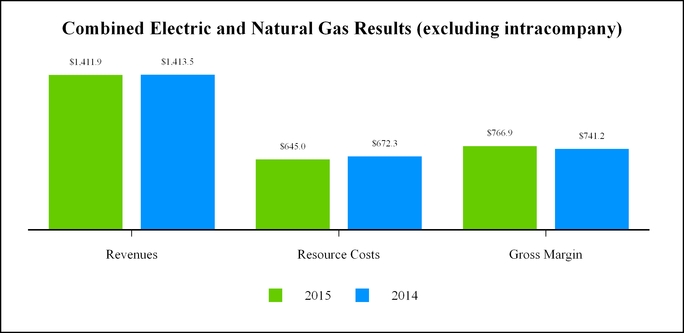

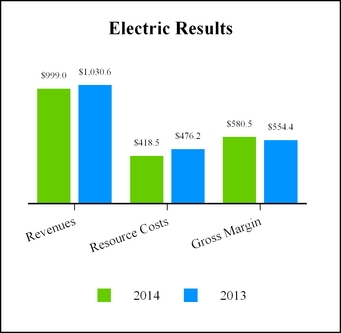

| Total electric operating revenues | $ | 997,873 |

| | $ | 998,988 |

| | $ | 1,030,606 |

|

| ENERGY SALES (Thousands of MWhs): | | | | | |

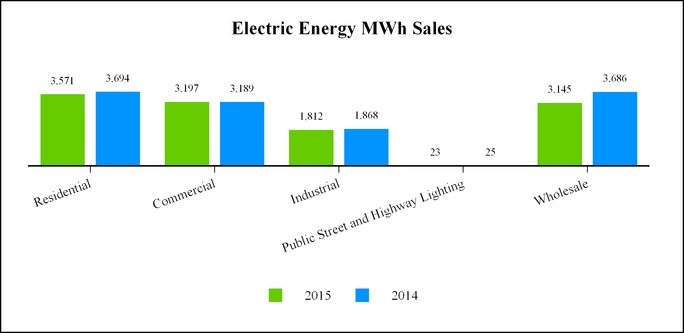

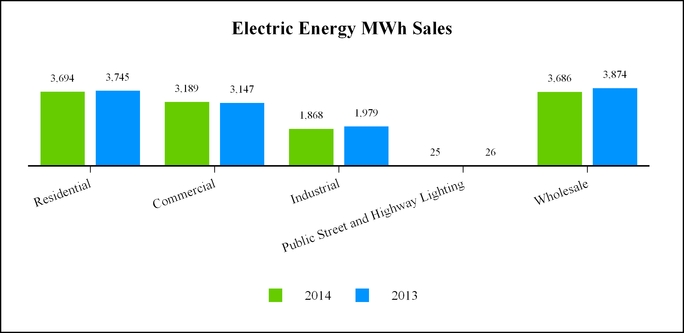

| Residential | 3,571 |

| | 3,694 |

| | 3,745 |

|

| Commercial | 3,197 |

| | 3,189 |

| | 3,147 |

|

| Industrial | 1,812 |

| | 1,868 |

| | 1,979 |

|

| Public street and highway lighting | 23 |

| | 25 |

| | 26 |

|

| Total retail | 8,603 |

| | 8,776 |

| | 8,897 |

|

| Wholesale | 3,145 |

| | 3,686 |

| | 3,874 |

|

| Total electric energy sales | 11,748 |

| | 12,462 |

| | 12,771 |

|

| ENERGY RESOURCES (Thousands of MWhs): | | | | | |

| Hydro generation (from Company facilities) | 3,434 |

| | 4,143 |

| | 3,646 |

|

| Thermal generation (from Company facilities) | 3,983 |

| | 3,252 |

| | 3,383 |

|

| Purchased power | 4,899 |

| | 5,615 |

| | 6,375 |

|

| Power exchanges | (2 | ) | | (25 | ) | | (20 | ) |

| Total power resources | 12,314 |

| | 12,985 |

| | 13,384 |

|

| Energy losses and Company use | (566 | ) | | (523 | ) | | (613 | ) |

| Total energy resources (net of losses) | 11,748 |

| | 12,462 |

| | 12,771 |

|

| NUMBER OF RETAIL CUSTOMERS (Average for Period): | | | | | |

| Residential | 327,057 |

| | 324,188 |

| | 321,098 |

|

| Commercial | 41,296 |

| | 40,988 |

| | 40,202 |

|

| Industrial | 1,353 |

| | 1,385 |

| | 1,386 |

|

| Public street and highway lighting | 529 |

| | 531 |

| | 527 |

|

| Total electric retail customers | 370,235 |

| | 367,092 |

| | 363,213 |

|

| RESIDENTIAL SERVICE AVERAGES: | | | | | |

| Annual use per customer (KWh) | 10,827 |

| | 11,394 |

| | 11,664 |

|

| Revenue per KWh (in cents) | 9.40 |

| | 9.17 |

| | 8.86 |

|

| Annual revenue per customer | $ | 1,017.21 |

| | $ | 1,044.76 |

| | $ | 1,033.54 |

|

| AVERAGE HOURLY LOAD (aMW) | 1,047 |

| | 1,062 |

| | 1,086 |

|

AVISTA UTILITIES ELECTRIC OPERATING STATISTICS

|

| | | | | | | | |

| | Years Ended December 31, |

| | 2015 | | 2014 | | 2013 |

| RETAIL NATIVE LOAD at time of system peak (MW): | | | | | |

| Winter | 1,529 |

| | 1,715 |

| | 1,669 |

|

| Summer | 1,638 |

| | 1,606 |

| | 1,577 |

|

| COOLING DEGREE DAYS: (1) | | | | | |

| Spokane, WA | | | | | |

| Actual | 805 |

| | 631 |

| | 709 |

|

| Historical average | 334 |

| | 394 |

| | 394 |

|

| % of average | 241 | % | | 160 | % | | 180 | % |

| HEATING DEGREE DAYS: (2) | | | | | |

| Spokane, WA | | | | | |

| Actual | 5,614 |

| | 6,215 |

| | 6,683 |

|

| Historical average | 6,491 |

| | 6,820 |

| | 6,780 |

|

| % of average | 86 | % | | 91 | % | | 99 | % |

| |

| (1) | Cooling degree days are the measure of the warmness of weather experienced, based on the extent to which the average of high and low temperatures for a day exceeds 65 degrees Fahrenheit (annual degree days above historic indicate warmer than average temperatures). In 2015, we switched to a rolling 20-year average for calculating cooling degree days, whereas in prior years we used a 30-year rolling average. |

| |

| (2) | Heating degree days are the measure of the coldness of weather experienced, based on the extent to which the average of high and low temperatures for a day falls below 65 degrees Fahrenheit (annual degree days below historic indicate warmer than average temperatures). In 2015, we switched to a rolling 20-year average for calculating heating degree days, whereas in prior years we used a 30-year rolling average. |

AVISTA UTILITIES NATURAL GAS OPERATING STATISTICS

|

| | | | | | | | | | | |

| | Years Ended December 31, |

| | 2015 | | 2014 | | 2013 |

| NATURAL GAS OPERATIONS | | | | | |

| OPERATING REVENUES (Dollars in Thousands): | | | | | |

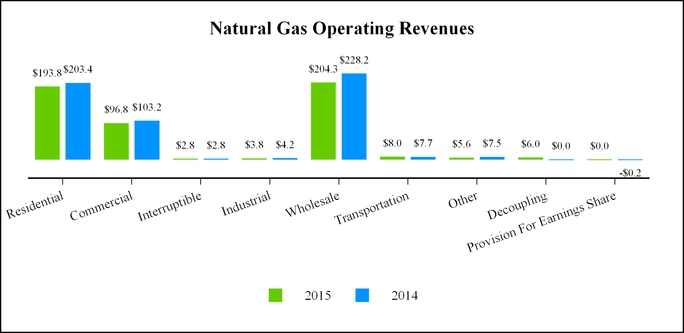

| Residential | $ | 193,825 |

| | $ | 203,373 |

| | $ | 206,330 |

|

| Commercial | 96,751 |

| | 103,179 |

| | 102,225 |

|

| Interruptible | 2,782 |

| | 2,792 |

| | 2,681 |

|

| Industrial | 3,792 |

| | 4,158 |

| | 3,599 |

|

| Total retail | 297,150 |

| | 313,502 |

| | 314,835 |

|

| Wholesale | 204,289 |

| | 228,187 |

| | 194,717 |

|

| Transportation | 7,988 |

| | 7,735 |

| | 7,576 |

|

| Other | 5,578 |

| | 7,461 |

| | 8,573 |

|

| Decoupling | 6,004 |

| | — |

| | — |

|

| Provision for earnings sharing | — |

| | (221 | ) | | (442 | ) |

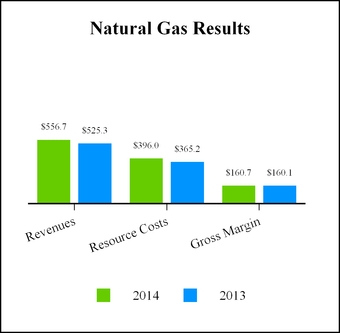

| Total natural gas operating revenues | $ | 521,009 |

| | $ | 556,664 |

| | $ | 525,259 |

|

| THERMS DELIVERED (Thousands of Therms): | | | | | |

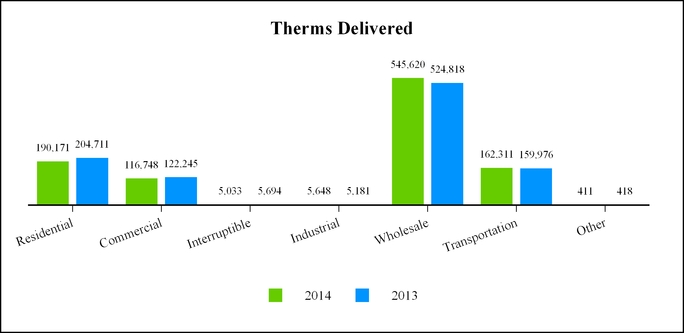

| Residential | 176,613 |

| | 190,171 |

| | 204,711 |

|

| Commercial | 107,894 |

| | 116,748 |

| | 122,245 |

|

| Interruptible | 4,708 |

| | 5,033 |

| | 5,694 |

|

| Industrial | 5,070 |

| | 5,648 |

| | 5,181 |

|

| Total retail | 294,285 |

| | 317,600 |

| | 337,831 |

|

| Wholesale | 809,132 |

| | 545,620 |

| | 524,818 |

|

| Transportation | 164,679 |

| | 162,311 |

| | 159,976 |

|

| Interdepartmental and Company use | 335 |

| | 411 |

| | 418 |

|

| Total therms delivered | 1,268,431 |

| | 1,025,942 |

| | 1,023,043 |

|

| NUMBER OF RETAIL CUSTOMERS (Average for Period): | | | | | |

| Residential | 296,005 |

| | 291,928 |

| | 288,708 |

|

| Commercial | 34,229 |

| | 34,047 |

| | 33,932 |

|

| Interruptible | 35 |

| | 37 |

| | 38 |

|

| Industrial | 261 |

| | 264 |

| | 259 |

|

| Total natural gas retail customers | 330,530 |

| | 326,276 |

| | 322,937 |

|

| RESIDENTIAL SERVICE AVERAGES: | | | | | |

| Annual use per customer (therms) | 593 |

| | 651 |

| | 709 |

|

| Revenue per therm (in dollars) | $ | 1.10 |

| | $ | 1.07 |

| | $ | 1.01 |

|

| Annual revenue per customer | $ | 650.83 |

| | $ | 696.66 |

| | $ | 714.67 |

|

| HEATING DEGREE DAYS: (1) | | | | | |

| Spokane, WA | | | | | |

| Actual | 5,614 |

| | 6,215 |

| | 6,683 |

|

| Historical average (2) | 6,491 |

| | 6,820 |

| | 6,780 |

|

| % of average | 86 | % | | 91 | % | | 99 | % |

| Medford, OR | | | | | |

| Actual | 3,534 |

| | 3,382 |

| | 4,576 |

|

| Historical average (2) | 4,150 |

| | 4,539 |

| | 4,539 |

|

| % of average | 85 | % | | 75 | % | | 101 | % |

| |

| (1) | Heating degree days are the measure of the coldness of weather experienced, based on the extent to which the average of high and low temperatures for a day falls below 65 degrees Fahrenheit (annual degree days below historic indicate warmer than average temperatures). |

| |

| (2) | In 2015, we switched to a rolling 20-year average for calculating heating degree days, whereas in prior years we used a 30-year rolling average. |

ALASKA ELECTRIC LIGHT AND POWER COMPANY

AEL&P is the primary operating subsidiary of AERC. AEL&P is the sole utility providing electrical energy in Juneau, Alaska. Juneau is a geographically isolated community with no electric interconnections with the transmission facilities of other utilities and no pipeline access to natural gas or other fuels. Juneau’s economy is primarily driven by government activities, tourism, commercial fishing, and mining, as well as activities as the commercial hub of southeast Alaska.

AEL&P owns and operates electric generation, transmission and distribution facilities located in Juneau. AEL&P operates five hydroelectric generation facilities with 102.7 MW of hydroelectric generation capacity as of December 31, 2015. AEL&P owns four of these generation facilities (totaling 24.7 MW of capacity) and has a PPA for the output of the Snettisham hydroelectric project (totaling 78 MW of capacity).

The Snettisham hydroelectric project is owned by the Alaska Industrial Development and Export Authority (AIDEA), a public corporation of the State of Alaska. AEL&P has a PPA and operating and maintenance agreement with the AIDEA to operate and maintain the facility. This PPA is a take-or-pay obligation expiring in December 2038, to purchase all of the output of the project.

For accounting purposes, this PPA is treated as a capital lease and as of December 31, 2015, the capital lease obligation was $64.5 million. Snettisham Electric Company, a non-operating subsidiary of AERC, has the option to purchase the Snettisham project at any time for the principal amount of the bonds outstanding at that time. See "Note 14 of the Notes to Consolidated Financial Statements" for further discussion of the Snettisham capital lease obligation.

As of December 31, 2015, AEL&P also had 93.9 MW of diesel generating capacity from three facilities to provide back-up service to firm customers when necessary.

The following graph shows AEL&P's hydroelectric generation (in thousands of MWhs) during the time periods indicated below:

Only the hydroelectric generation for the second half of 2014 in the graph above was included in Avista Corp.'s overall results for 2014. The full 12 months of 2014 in the graph above is presented for information purposes only.

As of December 31, 2015, AEL&P served approximately 17,000 customers. Its primary customers include city, state and federal governmental entities located in Juneau, as well as a mine located in the Juneau area. Most of AEL&P’s customers are served on a firm basis while certain of its customers, including its largest customer, are served on an interruptible sales basis. AEL&P maintains separate rate tariffs for each of its customer classes, as well as seasonal rates.

AEL&P’s operations are subject to regulation by the RCA with respect to rates, standard of service, facilities, accounting and certain other matters, but not with respect to the issuance of securities. Rate adjustments for AEL&P’s customers require approval by the RCA pursuant to RCA regulations. AEL&P's last general rate case was filed in 2010 and approved by the RCA in 2011. The RCA approved a capital structure including 53.8 percent equity and an authorized return on equity of 12.875 percent. We expect that AEL&P will maintain a similar capital structure going forward.

AEL&P is also subject to the jurisdiction of the FERC concerning the permits and licenses necessary to operate certain of its hydroelectric facilities. One of these licenses (for the Salmon Creek and Annex Creek hydroelectric projects) expires in 2018. Since AEL&P has no electric interconnection with other utilities and makes no wholesale sales, it is not subject to general FERC jurisdiction.

The Snettisham hydroelectric project is subject to regulation by the State of Alaska with respect to dam safety and certain aspects of its operations. In addition, AEL&P is subject to regulation with respect to air and water quality, land use and other environmental matters under both federal and state laws.

OTHER BUSINESSES

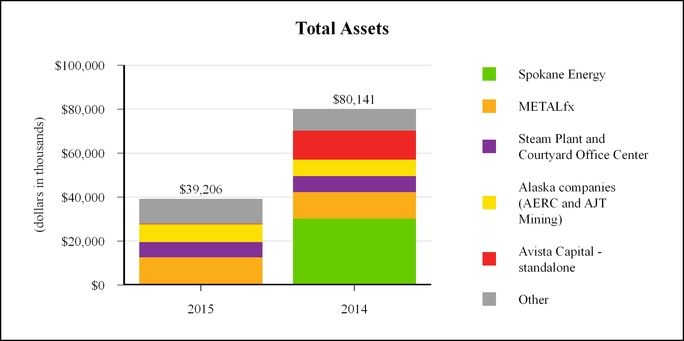

The following graph shows our assets related to our other businesses as of December 31 (dollars in thousands):

Spokane Energy was a special purpose limited liability company and all of its membership capital was owned by Avista Corp. Spokane Energy was formed in December 1998, to assume ownership of a fixed rate electric capacity contract between Avista Corp. and Portland General Electric Company. The fixed rate electric capacity contract, which expires in December 2016, was transferred from Spokane Energy to Avista Corp. during the second quarter of 2015. Spokane Energy was then dissolved during the third quarter of 2015. The fixed rate electric capacity contract has a value of $14.7 million as of December 31, 2015, compared to $28.2 million as of December 31, 2014.

AM&D doing business as METALfx performs custom sheet metal fabrication of electronic enclosures, parts and systems for the computer, construction, telecom, renewable energy and medical industries.

Steam Plant and Courtyard Office Center consist of real estate investments (primarily mixed use commercial and retail office space).

AJT Mining is a wholly-owned subsidiary of AERC and is an inactive mining company holding certain properties.

The assets at Avista Capital - standalone as of December 31, 2014 primarily consisted of the escrow receivables related to the sale of Ecova on June 30, 2014. The escrow receivables were settled and we received the proceeds during the fourth quarter of 2015. See "Note 5 of the Notes to Consolidated Financial Statements" for further detail regarding this transaction.

Our other investments and operations include emerging technology venture capital funds.

Over time as opportunities arise, we dispose of investments and phase out operations that do not fit with our overall corporate strategy. However, we may invest incremental funds to protect our existing investments and invest in new businesses that we believe fit with our overall corporate strategy.

We continue to evaluate the opportunity to bring natural gas to Juneau, Alaska. If we pursue this project, we estimate that the total investment for our local distribution company (LDC) project would be about $130 million over 10 years, with about half being invested during the first five years.

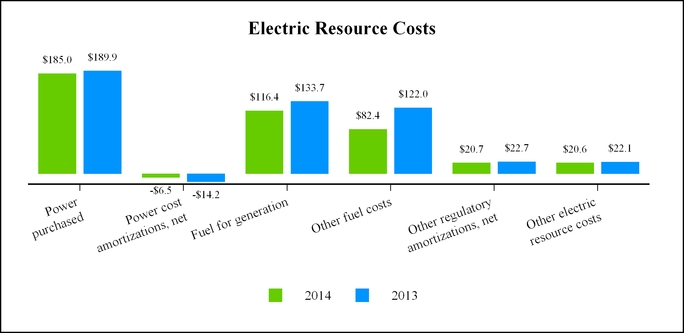

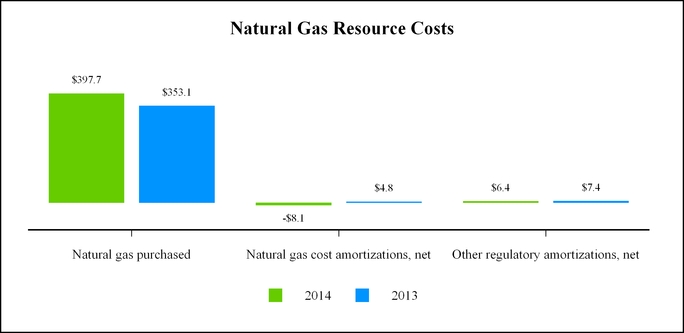

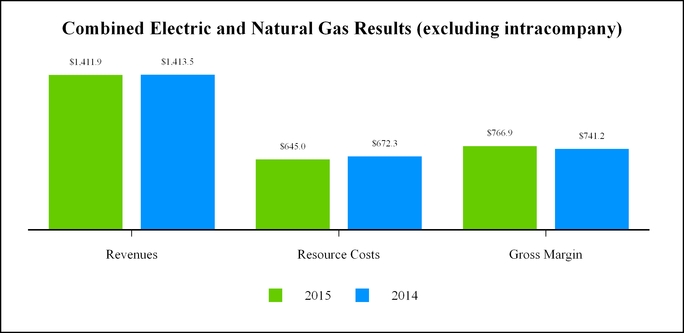

Lower oil prices have made it more difficult for customers to justify converting to natural gas. In addition, we have yet to secure a mechanism to provide funds that are needed to help customers with the conversion costs, thus challenging the economics of the project. In addition, the state of Alaska has not yet adopted legislation that would enable the state to provide customer assistance for conversions. We will continue our due diligence and we will be ready to proceed if and when the economics prove favorable for customers and our Company.