UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

| FOR THE QUARTERLY PERIOD ENDED September 30, 2021 OR |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

| FOR THE TRANSITION PERIOD FROM TO |

Commission file number 1-3701

AVISTA CORPORATION

(Exact name of Registrant as specified in its charter)

Washington |

| 91-0462470 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer |

1411 East Mission Avenue, Spokane, Washington 99202-2600

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 509-489-0500

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading Symbol(s) |

| Name of Each Exchange on Which Registered |

Common Stock |

| AVA |

| New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

As of October 31, 2021, 70,768,243 shares of Registrant’s Common Stock, no par value (the only class of common stock), were outstanding.

AVISTA CORPORATION

AVISTA CORPORATION

INDEX

Item No. |

|

| Page No. |

|

|

|

|

|

| iii | |

|

| 1 | |

|

| 4 | |

|

| ||

Item 1. |

| 5 | |

| Condensed Consolidated Statements of Income - |

| 5 |

|

| 6 | |

| Condensed Consolidated Balance Sheets - |

| 7 |

| Condensed Consolidated Statements of Cash Flows - |

| 8 |

| Condensed Consolidated Statements of Equity - |

| 10 |

|

| 11 | |

|

| 11 | |

|

| 12 | |

|

| 12 | |

|

| 14 | |

|

| 18 | |

| Note 6. Pension Plans and Other Postretirement Benefit Plans |

| 22 |

|

| 22 | |

|

| 23 | |

|

| 24 | |

|

| 24 | |

|

| 24 | |

|

| 25 | |

|

| 28 | |

|

| 28 | |

|

| 29 | |

|

| 29 | |

|

| 32 | |

|

| 34 | |

|

|

|

|

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 35 |

|

| 35 | |

|

| 35 | |

|

| 36 | |

|

| 39 | |

|

| 42 | |

i

|

| 43 | |

| Results of Operations - Alaska Electric Light and Power Company |

| 55 |

|

| 55 | |

|

| 56 | |

|

| 56 | |

|

| 56 | |

|

| 56 | |

|

| 57 | |

|

| 58 | |

|

| 58 | |

|

| 58 | |

|

| 58 | |

|

| 59 | |

|

| 61 | |

|

| 61 | |

|

| 62 | |

|

|

|

|

Item 3. |

| 63 | |

|

|

|

|

Item 4. |

| 63 | |

|

|

|

|

|

| ||

Item 1. |

| 64 | |

|

|

|

|

Item 1A. |

| 64 | |

|

|

|

|

Item 6. |

| 66 | |

|

|

|

|

|

| 67 | |

ii

AVISTA CORPORATION

ACRONYMS AND TERMS

(The following acronyms and terms are found in multiple locations within the document)

Acronym/Term | Meaning | |

aMW | - | Average Megawatt - a measure of the average rate at which a particular generating source produces energy over a period of time |

AEL&P | - | Alaska Electric Light and Power Company, the primary operating subsidiary of AERC, which provides electric services in Juneau, Alaska |

AERC | - | Alaska Energy and Resources Company, the Company's wholly-owned subsidiary based in Juneau, Alaska |

AFUDC | - | Allowance for Funds Used During Construction; represents the cost of both the debt and equity funds used to finance utility plant additions during the construction period |

ASC | - | Accounting Standards Codification |

ASU | - | Accounting Standards Update |

Avista Capital | - | Parent company to the Company’s non-utility businesses, with the exception of AJT Mining Properties, Inc., which is a subsidiary of AERC. |

Avista Corp. | - | Avista Corporation, the Company |

Avista Utilities | - | Operating division of Avista Corp. (not a subsidiary) comprising the regulated utility operations in the Pacific Northwest |

Capacity | - | The rate at which a particular generating source is capable of producing energy, measured in KW or MW |

Cabinet Gorge | - | The Cabinet Gorge Hydroelectric Generating Project, located on the Clark Fork River in Idaho |

CETA | - | Clean Energy Transformation Act |

Colstrip | - | The coal-fired Colstrip Generating Plant in southeastern Montana |

Cooling degree days | - | The measure of the warmness of weather experienced, based on the extent to which the average of high and low temperatures for a day exceeds 65 degrees Fahrenheit (annual degree days above historic indicate warmer than average temperatures) |

COVID-19 | - | Coronavirus disease 2019, a respiratory illness that was declared a pandemic in March 2020 |

Deadband or ERM | - | The first $4.0 million in annual power supply costs above or below the amount included in base retail rates in Washington under the ERM in the state of Washington |

EIM | - | Energy Imbalance Market |

Energy | - | The amount of electricity produced or consumed over a period of time, measured in KWh or MWh. Also, refers to natural gas consumed and is measured in dekatherms |

EPA | - | Environmental Protection Agency |

ERM | - | The Energy Recovery Mechanism, a mechanism for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Washington |

FASB | - | Financial Accounting Standards Board |

FCA | - | Fixed Cost Adjustment, the electric and natural gas decoupling mechanism in Idaho |

FERC | - | Federal Energy Regulatory Commission |

GAAP | - | Generally Accepted Accounting Principles |

Heating degree days | - | The measure of the coldness of weather experienced, based on the extent to which the average of high and low temperatures for a day falls below 65 degrees Fahrenheit (annual degree days below historic indicate warmer than average temperatures). |

IPUC | - | Idaho Public Utilities Commission |

KW, KWh | - | Kilowatt (1000 watts): a measure of generating power or capability. Kilowatt-hour (1000 watt hours): a measure of energy produced over a period of time |

MPSC | - | Public Service Commission of the State of Montana |

iii

AVISTA CORPORATION

MW, MWh | - | Megawatt: 1000 KW. Megawatt-hour: 1000 KWh |

Noxon Rapids | - | The Noxon Rapids Hydroelectric Generating Project, located on the Clark Fork River in Montana |

OPUC | - | The Public Utility Commission of Oregon |

PCA | - | The Power Cost Adjustment mechanism, a procedure for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Idaho |

PGA | - | Purchased Gas Adjustment |

PPA | - | Power Purchase Agreement |

RCA | - | The Regulatory Commission of Alaska |

REC | - | Renewable energy credit |

ROE | - | Return on equity |

ROR | - | Rate of return on rate base |

ROU | - | Right-of-use lease asset |

SEC | - | U.S. Securities and Exchange Commission |

Therm | - | Unit of measurement for natural gas; a therm is equal to approximately one hundred cubic feet (volume) or 100,000 BTUs (energy) |

Watt | - | Unit of measurement of electric power or capability; a watt is equal to the rate of work represented by a current of one ampere under a pressure of one volt |

WUTC | - | Washington Utilities and Transportation Commission |

iv

AVISTA CORPORATION

Forward-Looking Statements

From time to time, we make forward-looking statements such as statements regarding projected or future:

These statements are based upon underlying assumptions (many of which are based, in turn, upon further assumptions). Such statements are made both in our reports filed under the Securities Exchange Act of 1934, as amended (including this Quarterly Report on Form 10-Q), and elsewhere. Forward-looking statements are all statements except those of historical fact including, without limitation, those that are identified by the use of words that include “will,” “may,” “could,” “should,” “intends,” “plans,” “seeks,” “anticipates,” “estimates,” “expects,” “forecasts,” “projects,” “predicts,” and similar expressions.

Forward-looking statements (including those made in this Quarterly Report on Form 10-Q) are subject to a variety of risks, uncertainties and other factors. Most of these factors are beyond our control and may have a significant effect on our operations, results of operations, financial condition or cash flows, which could cause actual results to differ materially from those anticipated in our statements. Such risks, uncertainties and other factors include, among others:

Utility Regulatory Risk

Operational Risk

1

AVISTA CORPORATION

Cyber and Technology Risk

Strategic Risk

2

AVISTA CORPORATION

External Mandates Risk

Financial Risk

3

AVISTA CORPORATION

Energy Commodity Risk

Compliance Risk

Our expectations, beliefs and projections are expressed in good faith. We believe they are reasonable based on, without limitation, an examination of historical operating trends, our records and other information available from third parties. There can be no assurance that our expectations, beliefs or projections will be achieved or accomplished. Furthermore, any forward-looking statement speaks only as of the date on which such statement is made. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances that occur after the date on which such statement is made or to reflect the occurrence of unanticipated events. New risks, uncertainties and other factors emerge from time to time, and it is not possible for us to predict all such factors, nor can we assess the effect of each such factor on our business or the extent that any such factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statement.

Available Information

We file annual, quarterly and current reports and proxy statements with the SEC. The SEC maintains a website that contains these documents at www.sec.gov. We make annual, quarterly and current reports and proxy statements available on our website, https://investor.avistacorp.com/, as soon as practicable after electronically filing these documents with the SEC. Except for SEC filings or portions thereof that are specifically referred to in this report, information contained on these websites is not part of this report.

4

PART I. Financial Information

Item 1. Condensed Consolidated Financial Statements

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Avista Corporation

For the Three and Nine Months Ended September 30

Dollars in thousands, except per share amounts

(Unaudited)

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Utility revenues: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Utility revenues, exclusive of alternative revenue programs |

| $ | 306,398 |

|

| $ | 276,351 |

|

| $ | 1,019,756 |

|

| $ | 944,146 |

|

Alternative revenue programs |

|

| (10,499 | ) |

|

| (3,972 | ) |

|

| (13,069 | ) |

|

| (4,023 | ) |

Total utility revenues |

|

| 295,899 |

|

|

| 272,379 |

|

|

| 1,006,687 |

|

|

| 940,123 |

|

Non-utility revenues |

|

| 108 |

|

|

| 267 |

|

|

| 445 |

|

|

| 1,345 |

|

Total operating revenues |

|

| 296,007 |

|

|

| 272,646 |

|

|

| 1,007,132 |

|

|

| 941,468 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Utility operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Resource costs |

|

| 102,133 |

|

|

| 78,785 |

|

|

| 327,390 |

|

|

| 276,297 |

|

Other operating expenses |

|

| 85,625 |

|

|

| 85,551 |

|

|

| 267,233 |

|

|

| 266,251 |

|

Depreciation and amortization |

|

| 57,722 |

|

|

| 53,953 |

|

|

| 169,009 |

|

|

| 169,282 |

|

Taxes other than income taxes |

|

| 25,440 |

|

|

| 24,016 |

|

|

| 82,223 |

|

|

| 79,736 |

|

Non-utility operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Other operating expenses |

|

| 843 |

|

|

| 1,697 |

|

|

| 3,186 |

|

|

| 3,716 |

|

Depreciation and amortization |

|

| 30 |

|

|

| 146 |

|

|

| 230 |

|

|

| 569 |

|

Total operating expenses |

|

| 271,793 |

|

|

| 244,148 |

|

|

| 849,271 |

|

|

| 795,851 |

|

Income from operations |

|

| 24,214 |

|

|

| 28,498 |

|

|

| 157,861 |

|

|

| 145,617 |

|

Interest expense |

|

| 26,547 |

|

|

| 25,812 |

|

|

| 78,982 |

|

|

| 77,784 |

|

Interest expense to affiliated trusts |

|

| 102 |

|

|

| 128 |

|

|

| 317 |

|

|

| 606 |

|

Capitalized interest |

|

| (1,102 | ) |

|

| (1,009 | ) |

|

| (3,033 | ) |

|

| (2,979 | ) |

Other income-net |

|

| (10,267 | ) |

|

| (2,168 | ) |

|

| (23,992 | ) |

|

| (2,019 | ) |

Income before income taxes |

|

| 8,934 |

|

|

| 5,735 |

|

|

| 105,587 |

|

|

| 72,225 |

|

Income tax expense (benefit) |

|

| (5,432 | ) |

|

| 859 |

|

|

| 9,130 |

|

|

| 1,472 |

|

Net income |

| $ | 14,366 |

|

| $ | 4,876 |

|

| $ | 96,457 |

|

| $ | 70,753 |

|

Weighted-average common shares outstanding (thousands), basic |

|

| 70,054 |

|

|

| 68,194 |

|

|

| 69,582 |

|

|

| 67,638 |

|

Weighted-average common shares outstanding (thousands), diluted |

|

| 70,129 |

|

|

| 68,337 |

|

|

| 69,722 |

|

|

| 67,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Basic |

| $ | 0.21 |

|

| $ | 0.07 |

|

| $ | 1.39 |

|

| $ | 1.05 |

|

Diluted |

| $ | 0.20 |

|

| $ | 0.07 |

|

| $ | 1.38 |

|

| $ | 1.04 |

|

The Accompanying Notes are an Integral Part of These Statements.

5

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Avista Corporation

For the Three and Nine Months Ended September 30

Dollars in thousands

(Unaudited)

|

| Three months ended September 30: |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

Net income |

| $ | 14,366 |

|

| $ | 4,876 |

|

| $ | 96,457 |

|

| $ | 70,753 |

|

Other Comprehensive Income: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Change in unfunded benefit obligation for pension and other postretirement benefit plans - net of taxes of $81, $58, $247 and $171 respectively |

|

| 304 |

|

|

| 220 |

|

|

| 927 |

|

|

| 645 |

|

Total other comprehensive income |

|

| 304 |

|

|

| 220 |

|

|

| 927 |

|

|

| 645 |

|

Comprehensive income |

| $ | 14,670 |

|

| $ | 5,096 |

|

| $ | 97,384 |

|

| $ | 71,398 |

|

The Accompanying Notes are an Integral Part of These Statements.

6

CONDENSED CONSOLIDATED BALANCE SHEETS

Avista Corporation

Dollars in thousands

(Unaudited)

|

| September 30, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

Assets: |

|

|

|

|

|

| ||

Current Assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 19,224 |

|

| $ | 14,196 |

|

Accounts and notes receivable-less allowances of $12,360 and $11,387, respectively |

|

| 130,696 |

|

|

| 163,772 |

|

Materials and supplies, fuel stock and stored natural gas |

|

| 87,203 |

|

|

| 67,451 |

|

Regulatory assets |

|

| 37,768 |

|

|

| 13,673 |

|

Other current assets |

|

| 81,384 |

|

|

| 84,885 |

|

Total current assets |

|

| 356,275 |

|

|

| 343,977 |

|

Net utility property |

|

| 5,168,825 |

|

|

| 4,991,612 |

|

Goodwill |

|

| 52,426 |

|

|

| 52,426 |

|

Non-current regulatory assets |

|

| 875,952 |

|

|

| 750,443 |

|

Other property and investments-net and other non-current assets |

|

| 278,000 |

|

|

| 263,639 |

|

Total assets |

| $ | 6,731,478 |

|

| $ | 6,402,097 |

|

Liabilities and Equity: |

|

|

|

|

|

| ||

Current Liabilities: |

|

|

|

|

|

| ||

Accounts payable |

| $ | 102,824 |

|

| $ | 106,613 |

|

Current portion of long-term debt |

|

| 250,000 |

|

|

| 0 |

|

Short-term borrowings |

|

| 199,075 |

|

|

| 203,000 |

|

Regulatory liabilities |

|

| 75,559 |

|

|

| 46,435 |

|

Other current liabilities |

|

| 171,728 |

|

|

| 149,831 |

|

Total current liabilities |

|

| 799,186 |

|

|

| 505,879 |

|

Long-term debt |

|

| 1,898,235 |

|

|

| 2,008,534 |

|

Long-term debt to affiliated trusts |

|

| 51,547 |

|

|

| 51,547 |

|

Pensions and other postretirement benefits |

|

| 177,333 |

|

|

| 211,880 |

|

Deferred income taxes |

|

| 634,215 |

|

|

| 594,712 |

|

Non-current regulatory liabilities |

|

| 886,351 |

|

|

| 784,820 |

|

Other non-current liabilities and deferred credits |

|

| 182,975 |

|

|

| 214,999 |

|

Total liabilities |

|

| 4,629,842 |

|

|

| 4,372,371 |

|

Commitments and Contingencies (See Notes to Condensed Consolidated |

|

|

|

|

|

| ||

Equity: |

|

|

|

|

|

| ||

Shareholders’ Equity: |

|

|

|

|

|

| ||

Common stock, no par value; 200,000,000 shares authorized; 70,767,212 and |

|

| 1,349,960 |

|

|

| 1,286,068 |

|

Accumulated other comprehensive loss |

|

| (13,451 | ) |

|

| (14,378 | ) |

Retained earnings |

|

| 765,127 |

|

|

| 758,036 |

|

Total shareholders’ equity |

|

| 2,101,636 |

|

|

| 2,029,726 |

|

Total liabilities and equity |

| $ | 6,731,478 |

|

| $ | 6,402,097 |

|

The Accompanying Notes are an Integral Part of These Statements.

7

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Avista Corporation

For the Nine Months Ended September 30

Dollars in thousands

(Unaudited)

|

| 2021 |

|

| 2020 |

| ||

Operating Activities: |

|

|

|

|

|

| ||

Net income |

| $ | 96,457 |

|

| $ | 70,753 |

|

Non-cash items included in net income: |

|

|

|

|

|

| ||

Depreciation and amortization |

|

| 169,239 |

|

|

| 169,851 |

|

Deferred income tax provision and investment tax credits |

|

| 18,645 |

|

|

| (2,200 | ) |

Power and natural gas cost amortizations (deferrals), net |

|

| (40,178 | ) |

|

| (6,470 | ) |

Amortization of debt expense |

|

| 2,068 |

|

|

| 2,329 |

|

Stock-based compensation expense |

|

| 3,173 |

|

|

| 3,705 |

|

Equity-related AFUDC |

|

| (5,280 | ) |

|

| (5,030 | ) |

Pension and other postretirement benefit expense |

|

| 21,925 |

|

|

| 25,010 |

|

Other regulatory assets and liabilities and deferred debits and credits |

|

| 2,597 |

|

|

| 12,456 |

|

Change in decoupling regulatory deferral |

|

| 12,602 |

|

|

| 3,340 |

|

Gain on sale of investments |

|

| (1,816 | ) |

|

| (3,914 | ) |

Other |

|

| (12,697 | ) |

|

| 12,807 |

|

Contributions to defined benefit pension plan |

|

| (42,000 | ) |

|

| (22,000 | ) |

Cash paid for settlement of interest rate swap agreements |

|

| (17,568 | ) |

|

| (33,499 | ) |

Cash received for settlement of interest rate swap agreements |

|

| 324 |

|

|

| — |

|

Changes in certain current assets and liabilities: |

|

|

|

|

|

| ||

Accounts and notes receivable |

|

| 24,521 |

|

|

| 45,552 |

|

Materials and supplies, fuel stock and stored natural gas |

|

| (19,753 | ) |

|

| (2,444 | ) |

Collateral posted for derivative instruments |

|

| (9,944 | ) |

|

| 10,105 |

|

Income taxes receivable |

|

| 10,663 |

|

|

| 3,549 |

|

Other current assets |

|

| 7,902 |

|

|

| 6,352 |

|

Accounts payable |

|

| (889 | ) |

|

| (23,328 | ) |

Other current liabilities |

|

| 8,925 |

|

|

| 15,604 |

|

Net cash provided by operating activities |

|

| 228,916 |

|

|

| 282,528 |

|

|

|

|

|

|

|

| ||

Investing Activities: |

|

|

|

|

|

| ||

Utility property capital expenditures (excluding equity-related AFUDC) |

|

| (322,808 | ) |

|

| (297,834 | ) |

Issuance of notes receivable |

|

| (1,791 | ) |

|

| (4,343 | ) |

Equity and property investments |

|

| (12,621 | ) |

|

| (3,994 | ) |

Proceeds from sale of investments |

|

| 8,306 |

|

|

| 6,644 |

|

Other |

|

| 1,984 |

|

|

| (1,478 | ) |

Net cash used in investing activities |

|

| (326,930 | ) |

|

| (301,005 | ) |

The Accompanying Notes are an Integral Part of These Statements.

8

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

Avista Corporation

For the Nine Months Ended September 30

Dollars in thousands

(Unaudited)

|

| 2021 |

|

| 2020 |

| ||

Financing Activities: |

|

|

|

|

|

| ||

Net increase (decrease) in short-term borrowings |

| $ | 66,000 |

|

| $ | (35,800 | ) |

Proceeds from issuance of long-term debt |

|

| 70,000 |

|

|

| 165,000 |

|

Maturity of long-term debt and finance leases |

|

| (2,223 | ) |

|

| (2,129 | ) |

Issuance of common stock, net of issuance costs |

|

| 61,345 |

|

|

| 53,356 |

|

Cash dividends paid |

|

| (88,204 | ) |

|

| (82,281 | ) |

Other |

|

| (3,876 | ) |

|

| (4,818 | ) |

Net cash provided by financing activities |

|

| 103,042 |

|

|

| 93,328 |

|

|

|

|

|

|

|

| ||

Net increase in cash and cash equivalents |

|

| 5,028 |

|

|

| 74,851 |

|

|

|

|

|

|

|

| ||

Cash and cash equivalents at beginning of period |

|

| 14,196 |

|

|

| 9,896 |

|

|

|

|

|

|

|

| ||

Cash and cash equivalents at end of period |

| $ | 19,224 |

|

| $ | 84,747 |

|

The Accompanying Notes are an Integral Part of These Statements.

9

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

Avista Corporation

For the Three and Nine Months Ended September 30

Dollars in thousands

(Unaudited)

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

Common Stock, Shares: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Shares outstanding at beginning of period |

|

| 69,666,667 |

|

|

| 67,913,265 |

|

|

| 69,238,901 |

|

|

| 67,176,996 |

|

Shares issued |

|

| 1,100,545 |

|

|

| 821,196 |

|

|

| 1,528,311 |

|

|

| 1,557,465 |

|

Shares outstanding at end of period |

|

| 70,767,212 |

|

|

| 68,734,461 |

|

|

| 70,767,212 |

|

|

| 68,734,461 |

|

Common Stock, Amount: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Balance at beginning of period |

| $ | 1,303,411 |

|

| $ | 1,234,901 |

|

| $ | 1,286,068 |

|

| $ | 1,210,741 |

|

Equity compensation expense |

|

| 893 |

|

|

| 824 |

|

|

| 3,540 |

|

|

| 3,502 |

|

Issuance of common stock, net of issuance costs |

|

| 45,656 |

|

|

| 29,466 |

|

|

| 61,345 |

|

|

| 53,356 |

|

Payment of minimum tax withholdings for share-based |

|

| — |

|

|

| — |

|

|

| (993 | ) |

|

| (2,408 | ) |

Balance at end of period |

|

| 1,349,960 |

|

|

| 1,265,191 |

|

|

| 1,349,960 |

|

|

| 1,265,191 |

|

Accumulated Other Comprehensive Loss: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Balance at beginning of period |

|

| (13,755 | ) |

|

| (9,834 | ) |

|

| (14,378 | ) |

|

| (10,259 | ) |

Other comprehensive income |

|

| 304 |

|

|

| 220 |

|

|

| 927 |

|

|

| 645 |

|

Balance at end of period |

|

| (13,451 | ) |

|

| (9,614 | ) |

|

| (13,451 | ) |

|

| (9,614 | ) |

Retained Earnings: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Balance at beginning of period |

|

| 780,310 |

|

|

| 749,971 |

|

|

| 758,036 |

|

|

| 738,802 |

|

Net income |

|

| 14,366 |

|

|

| 4,876 |

|

|

| 96,457 |

|

|

| 70,753 |

|

Cash dividends on common stock |

|

| (29,549 | ) |

|

| (27,573 | ) |

|

| (89,366 | ) |

|

| (82,281 | ) |

Balance at end of period |

|

| 765,127 |

|

|

| 727,274 |

|

|

| 765,127 |

|

|

| 727,274 |

|

Total equity |

| $ | 2,101,636 |

|

| $ | 1,982,851 |

|

| $ | 2,101,636 |

|

| $ | 1,982,851 |

|

Dividends declared per common share |

| $ | 0.4225 |

|

| $ | 0.4050 |

|

| $ | 1.2675 |

|

| $ | 1.2150 |

|

The Accompanying Notes are an Integral Part of These Statements.

10

AVISTA CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

The accompanying condensed consolidated financial statements of Avista Corp. as of and for the interim periods ended September 30, 2021 and September 30, 2020 are unaudited; however, in the opinion of management, the statements reflect all adjustments necessary for a fair statement of the results for the interim periods. All such adjustments are of a normal recurring nature. The condensed consolidated financial statements have been prepared in accordance with GAAP for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. The Condensed Consolidated Statements of Income for the interim periods are not necessarily indicative of the results to be expected for the full year. These condensed consolidated financial statements do not contain the detail or footnote disclosure concerning accounting policies and other matters which would be included in full fiscal year consolidated financial statements; therefore, they should be read in conjunction with the Company's audited consolidated financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2020 (2020 Form 10-K).

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Avista Corp. is primarily an electric and natural gas utility with certain other business ventures. Avista Utilities is an operating division of Avista Corp., comprising its regulated utility operations in the Pacific Northwest. Avista Utilities provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho. Avista Utilities also provides natural gas distribution service in parts of northeastern and southwestern Oregon. Avista Utilities has electric generating facilities in Washington, Idaho, Oregon and Montana. Avista Utilities also supplies electricity to a small number of customers in Montana, most of whom are employees who operate the Company's Noxon Rapids generating facility.

AERC is a wholly-owned subsidiary of Avista Corp. The primary subsidiary of AERC is AEL&P, which comprises Avista Corp.'s regulated utility operations in Alaska.

Avista Capital, a wholly owned non-regulated subsidiary of Avista Corp., is the parent company of all of the subsidiary companies in the non-utility businesses, with the exception of AJT Mining Properties, Inc., which is a subsidiary of AERC. See Note 17 for business segment information.

Basis of Reporting

The condensed consolidated financial statements include the assets, liabilities, revenues and expenses of the Company and its subsidiaries and other majority owned subsidiaries and variable interest entities for which the Company or its subsidiaries are the primary beneficiaries. Intercompany balances were eliminated in consolidation. The accompanying condensed consolidated financial statements include the Company’s proportionate share of utility plant and related operations resulting from its interests in jointly owned plants.

Regulation

The Company is subject to state regulation in Washington, Idaho, Montana, Oregon and Alaska. The Company is also subject to federal regulation primarily by the FERC, as well as various other federal agencies with regulatory oversight of particular aspects of its operations.

Derivative Assets and Liabilities

Derivatives are recorded as either assets or liabilities on the Condensed Consolidated Balance Sheets measured at estimated fair value.

The WUTC and the IPUC issued accounting orders authorizing Avista Corp. to offset energy commodity derivative assets or liabilities with a regulatory asset or liability. This accounting treatment is intended to defer the recognition of mark-to-market gains and losses on energy commodity transactions until the period of delivery. Realized benefits and costs result in adjustments to retail rates through

11

AVISTA CORPORATION

PGAs, the ERM in Washington, the PCA mechanism in Idaho, and periodic general rate cases. The resulting regulatory assets associated with energy commodity derivative instruments have been concluded to be probable of recovery through future rates.

Substantially all forward contracts to purchase or sell power and natural gas are recorded as derivative assets or liabilities at estimated fair value with an offsetting regulatory asset or liability. Contracts that are not considered derivatives are accounted for on the accrual basis until they are settled or realized unless there is a decline in the fair value of the contract that is determined to be other-than-temporary.

For interest rate swap derivatives, Avista Corp. records all mark-to-market gains and losses in each accounting period as assets and liabilities, as well as offsetting regulatory assets and liabilities, such that there is no income statement impact. The interest rate swap derivatives are risk management tools similar to energy commodity derivatives. Upon settlement of interest rate swap derivatives, the regulatory asset or liability is amortized as a component of interest expense over the term of the associated debt. The Company records an offset of interest rate swap derivative assets and liabilities with regulatory assets and liabilities, based on the prior practice of the commissions to provide recovery through the ratemaking process.

The Company has multiple master netting agreements with a variety of entities that allow for cross-commodity netting of derivative agreements with the same counterparty (i.e. power derivatives can be netted with natural gas derivatives). In addition, some master netting agreements allow for the netting of commodity derivatives and interest rate swap derivatives for the same counterparty. The Company does not have any agreements which allow for cross-affiliate netting among multiple affiliated legal entities. The Company nets all derivative instruments when allowed by the agreement for presentation in the Condensed Consolidated Balance Sheets.

Fair Value Measurements

Fair value represents the price that would be received when selling an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the measurement date. Energy commodity derivative assets and liabilities, deferred compensation assets, as well as derivatives related to interest rate swaps and foreign currency exchange contracts, are reported at estimated fair value on the Condensed Consolidated Balance Sheets. See Note 12 for the Company’s fair value disclosures.

Contingencies

The Company has unresolved regulatory, legal and tax issues which have inherently uncertain outcomes. The Company accrues a loss contingency if it is probable that a liability has been incurred and the amount of the loss or impairment can be reasonably estimated. The Company also discloses loss contingencies that do not meet these conditions for accrual if there is a reasonable possibility that a material loss may be incurred. See Note 16 for further discussion of the Company's commitments and contingencies.

NOTE 2. NEW ACCOUNTING STANDARDS

There are no new accounting standards with a material impact to the Company.

NOTE 3. BALANCE SHEET COMPONENTS

Materials and Supplies, Fuel Stock and Stored Natural Gas

Inventories of materials and supplies, fuel stock and stored natural gas are recorded at average cost for our regulated operations and the lower of cost or net realizable value for our non-regulated operations and consisted of the following as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

Materials and supplies |

| $ | 58,238 |

|

| $ | 53,258 |

|

Fuel stock |

|

| 5,154 |

|

|

| 4,658 |

|

Stored natural gas |

|

| 23,811 |

|

|

| 9,535 |

|

Total |

| $ | 87,203 |

|

| $ | 67,451 |

|

12

AVISTA CORPORATION

Other Current Assets

Other current assets consisted of the following as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

Collateral posted for derivative instruments after netting with outstanding |

| $ | 10,604 |

|

| $ | 4,336 |

|

Prepayments |

|

| 18,523 |

|

|

| 24,411 |

|

Income taxes receivable |

|

| 39,151 |

|

|

| 49,814 |

|

Other |

|

| 13,106 |

|

|

| 6,324 |

|

Total |

| $ | 81,384 |

|

| $ | 84,885 |

|

Net Utility Property

Net utility property, which is recorded at original cost net of accumulated depreciation, consisted of the following as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

Utility plant in service |

| $ | 7,067,842 |

|

| $ | 6,809,797 |

|

Construction work in progress |

|

| 204,384 |

|

|

| 175,767 |

|

Total |

|

| 7,272,226 |

|

|

| 6,985,564 |

|

Less: Accumulated depreciation and amortization |

|

| 2,103,401 |

|

|

| 1,993,952 |

|

Total net utility property |

| $ | 5,168,825 |

|

| $ | 4,991,612 |

|

Other Property and Investments-Net and Other Non-Current Assets

Other property and investments-net and other non-current assets consisted of the following as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

Operating lease ROU assets |

| $ | 70,578 |

|

| $ | 71,891 |

|

Equity investments |

|

| 83,496 |

|

|

| 59,318 |

|

Finance lease ROU assets |

|

| 44,607 |

|

|

| 47,338 |

|

Non-utility property |

|

| 19,248 |

|

|

| 19,508 |

|

Notes receivable |

|

| 14,759 |

|

|

| 14,454 |

|

Investment in affiliated trust |

|

| 11,547 |

|

|

| 11,547 |

|

Deferred compensation assets |

|

| 9,917 |

|

|

| 9,174 |

|

Assets held for sale (1) |

|

| 0 |

|

|

| 3,462 |

|

Other |

|

| 23,848 |

|

|

| 26,947 |

|

Total |

| $ | 278,000 |

|

| $ | 263,639 |

|

Other Current Liabilities

Other current liabilities consisted of the following as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, |

|

| December 31, |

| ||

Accrued taxes other than income taxes |

| $ | 42,945 |

|

| $ | 45,099 |

|

Derivative liabilities |

|

| 24,797 |

|

|

| 14,008 |

|

Employee paid time off accruals |

|

| 28,321 |

|

|

| 26,495 |

|

Accrued interest |

|

| 29,278 |

|

|

| 17,083 |

|

Pensions and other postretirement benefits |

|

| 10,970 |

|

|

| 11,987 |

|

Other |

|

| 35,417 |

|

|

| 35,159 |

|

Total other current liabilities |

| $ | 171,728 |

|

| $ | 149,831 |

|

13

AVISTA CORPORATION

Other Non-Current Liabilities and Deferred Credits

Other non-current liabilities and deferred credits consisted of the following as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, |

|

| December 31, |

| ||

Operating lease liabilities |

| $ | 69,475 |

|

| $ | 67,716 |

|

Finance lease liabilities |

|

| 46,501 |

|

|

| 48,815 |

|

Deferred investment tax credits |

|

| 29,452 |

|

|

| 29,866 |

|

Asset retirement obligations |

|

| 16,425 |

|

|

| 17,194 |

|

Derivative liabilities |

|

| 5,580 |

|

|

| 37,427 |

|

Other |

|

| 15,542 |

|

|

| 13,981 |

|

Total |

| $ | 182,975 |

|

| $ | 214,999 |

|

Regulatory Assets and Liabilities

Regulatory assets and liabilities consisted of the following as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, 2021 |

|

| December 31, 2020 |

| ||||||||||

|

| Current |

|

| Non-Current |

|

| Current |

|

| Non-Current |

| ||||

Regulatory Assets |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Energy commodity derivatives |

| $ | 11,159 |

|

| $ | 0 |

|

| $ | 2,073 |

|

| $ | 5,722 |

|

Decoupling surcharge |

|

| 9,036 |

|

|

| 12,641 |

|

|

| 7,123 |

|

|

| 17,123 |

|

Deferred natural gas costs |

|

| 9,967 |

|

|

| 4,758 |

|

|

| 2,308 |

|

|

| 0 |

|

Deferred power costs |

|

| 7,606 |

|

|

| 4,043 |

|

|

| 1,775 |

|

|

| 1,562 |

|

Pension and other postretirement benefit plans |

|

| 0 |

|

|

| 192,220 |

|

|

| 0 |

|

|

| 198,746 |

|

Interest rate swaps |

|

| 0 |

|

|

| 195,909 |

|

|

| 0 |

|

|

| 214,851 |

|

Deferred income taxes (1) |

|

| 0 |

|

|

| 242,782 |

|

|

| 0 |

|

|

| 108,517 |

|

Settlement with Coeur d'Alene Tribe |

|

| 0 |

|

|

| 39,205 |

|

|

| 0 |

|

|

| 40,043 |

|

AFUDC above FERC allowed rate |

|

| 0 |

|

|

| 45,093 |

|

|

| 0 |

|

|

| 47,393 |

|

Demand side management programs |

|

| 0 |

|

|

| 3,124 |

|

|

| 0 |

|

|

| 3,814 |

|

Utility plant to be abandoned |

|

| 0 |

|

|

| 29,684 |

|

|

| 0 |

|

|

| 28,916 |

|

COVID-19 deferrals |

|

| 0 |

|

|

| 15,648 |

|

|

| 0 |

|

|

| 8,166 |

|

Other regulatory assets |

|

| 0 |

|

|

| 90,845 |

|

|

| 394 |

|

|

| 75,590 |

|

Total regulatory assets |

| $ | 37,768 |

|

| $ | 875,952 |

|

| $ | 13,673 |

|

| $ | 750,443 |

|

Regulatory Liabilities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Income tax related liabilities (1) |

| $ | 52,843 |

|

| $ | 475,607 |

|

| $ | 14,952 |

|

| $ | 399,677 |

|

Deferred power costs |

|

| 10,512 |

|

|

| 9,136 |

|

|

| 20,299 |

|

|

| 17,570 |

|

Decoupling rebate |

|

| 2,717 |

|

|

| 10,283 |

|

|

| 1,447 |

|

|

| 1,519 |

|

Utility plant retirement costs |

|

| 0 |

|

|

| 344,061 |

|

|

| 0 |

|

|

| 325,832 |

|

Interest rate swaps |

|

| 0 |

|

|

| 16,757 |

|

|

| 0 |

|

|

| 15,046 |

|

COVID-19 deferrals |

|

| 0 |

|

|

| 12,673 |

|

|

| 0 |

|

|

| 10,949 |

|

Other regulatory liabilities |

|

| 9,487 |

|

|

| 17,834 |

|

|

| 9,737 |

|

|

| 14,227 |

|

Total regulatory liabilities |

| $ | 75,559 |

|

| $ | 886,351 |

|

| $ | 46,435 |

|

| $ | 784,820 |

|

(1) In 2021, the Company received regulatory approval in all jurisdictions to change to flow-through tax treatment of certain basis adjustments, which was $128.8 million as of September 30, 2021.

NOTE 4. REVENUE

The revenue recognition model contained in ASC 606 requires an entity to identify the various performance obligations in a contract, allocate the transaction price among the performance obligations and recognize revenue when (or as) the entity satisfies each performance obligation.

14

AVISTA CORPORATION

Utility Revenues

Revenue from Contracts with Customers

General

The majority of Avista Corp.’s revenue is from rate-regulated sales of electricity and natural gas to retail customers, which has two performance obligations, (1) having service available for a specified period (typically a month at a time) and (2) the delivery of energy to customers. The total energy price generally has a fixed component (basic charge) related to having service available and a usage-based component, related to the delivery and consumption of energy. The commodity is sold and/or delivered to and consumed by the customer simultaneously, and the provisions of the relevant utility commission authorization determine the charges the Company may bill the customer. Given that all revenue recognition criteria are met upon the delivery of energy to customers, revenue is recognized immediately at that time.

Revenues from contracts with customers are presented in the Condensed Consolidated Statements of Income in the line item "Utility revenues, exclusive of alternative revenue programs."

Non-Derivative Wholesale Contracts

The Company has certain wholesale contracts which are not accounted for as derivatives and, accordingly, are within the scope of ASC 606 and considered revenue from contracts with customers. Revenue is recognized as energy is delivered to the customer or the service is available for a specified period of time, consistent with the discussion of rate-regulated sales above.

Alternative Revenue Programs (Decoupling)

ASC 606 retained existing GAAP associated with alternative revenue programs, which specified that alternative revenue programs are contracts between an entity and a regulator of utilities, not a contract between an entity and a customer. GAAP requires that an entity present revenue arising from alternative revenue programs separately from revenues arising from contracts with customers on the face of the Condensed Consolidated Statements of Income. The Company's decoupling mechanisms (also known as a FCA in Idaho) qualify as alternative revenue programs. Decoupling revenue deferrals are recognized in the Condensed Consolidated Statements of Income during the period they occur (i.e. during the period of revenue shortfall or excess due to fluctuations in customer usage), subject to certain limitations, and a regulatory asset or liability is established that will be surcharged or rebated to customers in future periods. GAAP requires that for any alternative revenue program, like decoupling, the revenue must be expected to be collected from customers within 24 months of the deferral to qualify for recognition in the current period Condensed Consolidated Statement of Income. Any amounts included in the Company's decoupling program that are not expected to be collected from customers within 24 months are not recorded in the financial statements until the period in which revenue recognition criteria are met. The amounts expected to be collected from customers within 24 months represents an estimate that must be made by the Company on an ongoing basis due to it being based on the volumes of electric and natural gas sold to customers on a go-forward basis.

Derivative Revenue

Most wholesale electric and natural gas transactions (including both physical and financial transactions), and the sale of fuel are considered derivatives, which are specifically scoped out of ASC 606. As such, these revenues are disclosed separately from revenue from contracts with customers. Revenue is recognized for these items upon the settlement/expiration of the derivative contract. Derivative revenue includes those transactions that are entered into and settled within the same month.

Other Utility Revenue

Other utility revenue includes rent, sales of materials, late fees and other charges that do not represent contracts with customers. Other utility revenue also includes the provision for earnings sharing. This revenue is scoped out of ASC 606, as this revenue does not represent items where a customer is a party that has contracted with the Company to obtain goods or services that are an output of the

15

AVISTA CORPORATION

Company’s ordinary activities in exchange for consideration. As such, these revenues are presented separately from revenue from contracts with customers.

Other Considerations for Utility Revenues

Gross Versus Net Presentation

Revenues and resource costs from Avista Utilities’ settled energy contracts that are “booked out” (not physically delivered) are reported on a net basis as part of derivative revenues.

Utility-related taxes collected from customers (primarily state excise taxes and city utility taxes) are taxes that are imposed on Avista Utilities as opposed to being imposed on its customers; therefore, Avista Utilities is the taxpayer and records these transactions on a gross basis in revenue from contracts with customers and operating expense (taxes other than income taxes). The utility-related taxes collected from customers at AEL&P are imposed on the customers rather than AEL&P; therefore, the customers are the taxpayers and AEL&P is acting as their agent. As such, these transactions at AEL&P are presented on a net basis within revenue from contracts with customers.

Utility-related taxes that were included in revenue from contracts with customers were as follows for the three and nine months ended September 30 (dollars in thousands):

| Three months ended September 30, |

|

| Nine months ended September 30, |

| ||||||||||

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

Utility-related taxes | $ | 13,816 |

|

| $ | 12,411 |

|

| $ | 46,971 |

|

| $ | 43,989 |

|

Significant Judgments and Unsatisfied Performance Obligations

The only significant judgments involving revenue recognition are estimates surrounding unbilled revenue and receivables from contracts with customers and estimates surrounding the amount of decoupling revenues that will be collected from customers within 24 months (discussed above).

The Company has certain capacity arrangements, where the Company has a contractual obligation to provide either electric or natural gas capacity to its customers for a fixed fee. Most of these arrangements are paid for in arrears by the customers and do not result in deferred revenue and only result in receivables from the customers. The Company does have one capacity agreement where the customer makes payments throughout the year. As of September 30, 2021, the Company estimates it had unsatisfied capacity performance obligations of $18.8 million, which will be recognized as revenue in future periods as the capacity is provided to the customers. These performance obligations are not reflected in the financial statements, as the Company has not received payment for these services.

16

AVISTA CORPORATION

Disaggregation of Total Operating Revenue

The following table disaggregates total operating revenue by segment and source for the three and nine months ended September 30 (dollars in thousands):

|

| Three months ended September 30, |

|

| Nine months ended September 30, |

| ||||||||||

|

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

Avista Utilities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenue from contracts with customers |

| $ | 266,789 |

|

| $ | 240,036 |

|

| $ | 886,078 |

|

| $ | 827,071 |

|

Derivative revenues |

|

| 28,087 |

|

|

| 24,075 |

|

|

| 91,151 |

|

|

| 79,361 |

|

Alternative revenue programs |

|

| (10,499 | ) |

|

| (3,972 | ) |

|

| (13,069 | ) |

|

| (4,023 | ) |

Deferrals and amortizations for rate refunds to customers |

|

| (156 | ) |

|

| 1,742 |

|

|

| 2,664 |

|

|

| 1,216 |

|

Other utility revenues |

|

| 2,531 |

|

|

| 1,683 |

|

|

| 7,348 |

|

|

| 5,484 |

|

Total Avista Utilities |

|

| 286,752 |

|

|

| 263,564 |

|

|

| 974,172 |

|

|

| 909,109 |

|

AEL&P |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenue from contracts with customers |

|

| 9,065 |

|

|

| 8,797 |

|

|

| 32,331 |

|

|

| 30,900 |

|

Deferrals and amortizations for rate refunds to customers |

|

| (48 | ) |

|

| (48 | ) |

|

| (143 | ) |

|

| (143 | ) |

Other utility revenues |

|

| 130 |

|

|

| 66 |

|

|

| 327 |

|

|

| 257 |

|

Total AEL&P |

|

| 9,147 |

|

|

| 8,815 |

|

|

| 32,515 |

|

|

| 31,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Other revenues |

|

| 108 |

|

|

| 267 |

|

|

| 445 |

|

|

| 1,345 |

|

Total operating revenues |

| $ | 296,007 |

|

| $ | 272,646 |

|

| $ | 1,007,132 |

|

| $ | 941,468 |

|

Utility Revenue from Contracts with Customers by Type and Service

The following table disaggregates revenue from contracts with customers associated with the Company's electric operations for the three and nine months ended September 30 (dollars in thousands):

|

| 2021 |

|

| 2020 |

| ||||||||||||||||||

|

| Avista |

|

| AEL&P |

|

| Total Utility |

|

| Avista |

|

| AEL&P |

|

| Total Utility |

| ||||||

Three months ended September 30: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

ELECTRIC OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenue from contracts with customers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Residential |

| $ | 94,803 |

|

| $ | 3,080 |

|

| $ | 97,883 |

|

| $ | 85,494 |

|

| $ | 3,150 |

|

| $ | 88,644 |

|

Commercial |

|

| 86,228 |

|

|

| 5,920 |

|

|

| 92,148 |

|

|

| 79,242 |

|

|

| 5,582 |

|

|

| 84,824 |

|

Industrial |

|

| 28,843 |

|

|

| 0 |

|

|

| 28,843 |

|

|

| 28,472 |

|

|

| 0 |

|

|

| 28,472 |

|

Public street and highway lighting |

|

| 1,877 |

|

|

| 65 |

|

|

| 1,942 |

|

|

| 1,845 |

|

|

| 65 |

|

|

| 1,910 |

|

Total retail revenue |

|

| 211,751 |

|

|

| 9,065 |

|

|

| 220,816 |

|

|

| 195,053 |

|

|

| 8,797 |

|

|

| 203,850 |

|

Transmission |

|

| 7,372 |

|

|

| 0 |

|

|

| 7,372 |

|

|

| 5,938 |

|

|

| 0 |

|

|

| 5,938 |

|

Other revenue from contracts with |

|

| 11,610 |

|

|

| 0 |

|

|

| 11,610 |

|

|

| 4,551 |

|

|

| 0 |

|

|

| 4,551 |

|

Total electric revenue from contracts |

| $ | 230,733 |

|

| $ | 9,065 |

|

| $ | 239,798 |

|

| $ | 205,542 |

|

| $ | 8,797 |

|

| $ | 214,339 |

|

Nine months ended September 30: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

ELECTRIC OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenue from contracts with customers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

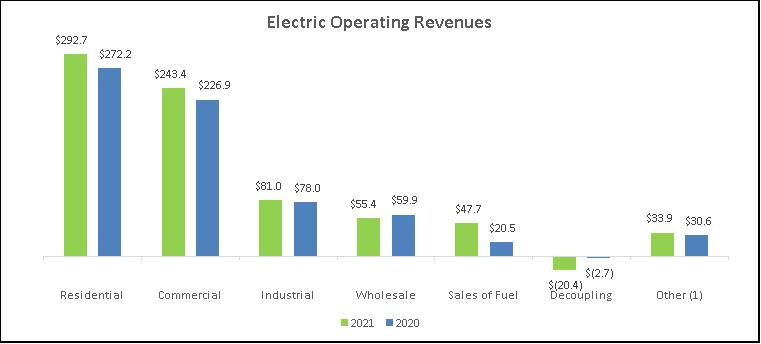

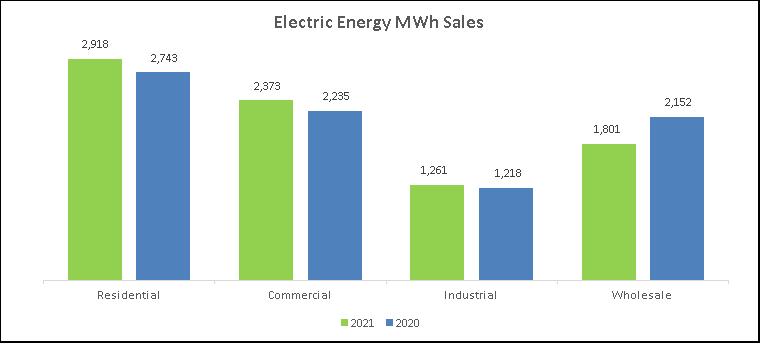

Residential |

| $ | 292,714 |

|

| $ | 13,379 |

|

| $ | 306,093 |

|

| $ | 272,231 |

|

| $ | 13,236 |

|

| $ | 285,467 |

|

Commercial |

|

| 243,370 |

|

|

| 18,768 |

|

|

| 262,138 |

|

|

| 226,876 |

|

|

| 17,479 |

|

|

| 244,355 |

|

Industrial |

|

| 80,983 |

|

|

| 0 |

|

|

| 80,983 |

|

|

| 77,999 |

|

|

| 0 |

|

|

| 77,999 |

|

Public street and highway lighting |

|

| 5,598 |

|

|

| 184 |

|

|

| 5,782 |

|

|

| 5,474 |

|

|

| 185 |

|

|

| 5,659 |

|

Total retail revenue |

|

| 622,665 |

|

|

| 32,331 |

|

|

| 654,996 |

|

|

| 582,580 |

|

|

| 30,900 |

|

|

| 613,480 |

|

Transmission |

|

| 15,668 |

|

|

| 0 |

|

|

| 15,668 |

|

|

| 14,121 |

|

|

| 0 |

|

|

| 14,121 |

|

Other revenue from contracts with |

|

| 24,282 |

|

|

| 0 |

|

|

| 24,282 |

|

|

| 13,256 |

|

|

| 0 |

|

|

| 13,256 |

|

Total electric revenue from contracts |

| $ | 662,615 |

|

| $ | 32,331 |

|

| $ | 694,946 |

|

| $ | 609,957 |

|

| $ | 30,900 |

|

| $ | 640,857 |

|

17

AVISTA CORPORATION

The following table disaggregates revenue from contracts with customers associated with the Company's natural gas operations for the three and nine months ended September 30 (dollars in thousands):

|

| Three months ended September 30, |

|

| Nine months ended September 30, |

| ||||||||||

|

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

|

| Avista Utilities |

|

| Avista Utilities |

|

| Avista Utilities |

|

| Avista Utilities |

| ||||

NATURAL GAS OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenue from contracts with customers |

|

|

|

|

|

|

|

|

|

|

|

| ||||

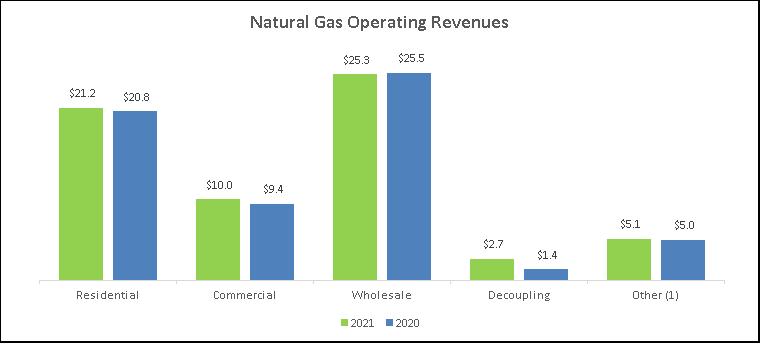

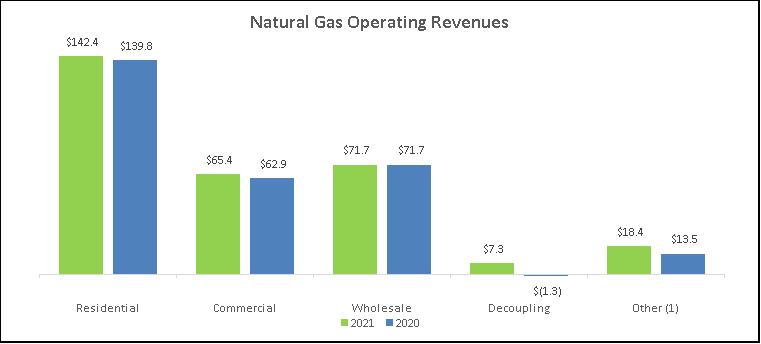

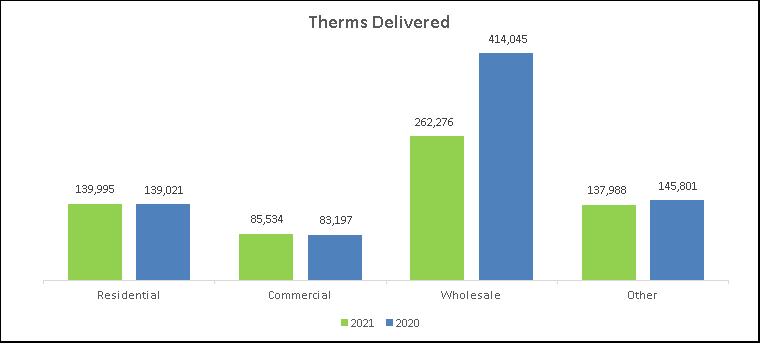

Residential |

| $ | 21,197 |

|

| $ | 20,835 |

|

| $ | 142,401 |

|

| $ | 139,833 |

|

Commercial |

|

| 10,055 |

|

|

| 9,340 |

|

|

| 65,428 |

|

|

| 62,883 |

|

Industrial and interruptible |

|

| 1,477 |

|

|

| 1,538 |

|

|

| 5,520 |

|

|

| 5,276 |

|

Total retail revenue |

|

| 32,729 |

|

|

| 31,713 |

|

|

| 213,349 |

|

|

| 207,992 |

|

Transportation |

|

| 1,921 |

|

|

| 1,656 |

|

|

| 6,177 |

|

|

| 5,747 |

|

Other revenue from contracts with customers |

|

| 1,406 |

|

|

| 1,125 |

|

|

| 3,937 |

|

|

| 3,375 |

|

Total natural gas revenue from contracts with customers |

| $ | 36,056 |

|

| $ | 34,494 |

|

| $ | 223,463 |

|

| $ | 217,114 |

|

NOTE 5. DERIVATIVES AND RISK MANAGEMENT

Energy Commodity Derivatives

Avista Corp. is exposed to market risks relating to changes in electricity and natural gas commodity prices and certain other fuel prices. Market risk is, in general, the risk of fluctuation in the market price of the commodity being traded and is influenced primarily by supply and demand. Market risk includes the fluctuation in the market price of associated derivative commodity instruments. Avista Corp. utilizes derivative instruments, such as forwards, futures, swap derivatives and options, in order to manage the various risks relating to these commodity price exposures. Avista Corp. has an energy resources risk policy and control procedures to manage these risks.

As part of Avista Corp.'s resource procurement and management operations in the electric business, Avista Corp. engages in an ongoing process of resource optimization, which involves the economic selection from available energy resources to serve Avista Corp.'s load obligations and the use of these resources to capture available economic value through wholesale market transactions. These include sales and purchases of electric capacity and energy, fuel for electric generation, and derivative contracts related to capacity, energy and fuel. Such transactions are part of the process of matching resources with load obligations and hedging a portion of the related financial risks. These transactions range from terms of intra-hour up to multiple years.

As part of its resource procurement and management of its natural gas business, Avista Corp. makes continuing projections of its natural gas loads and assesses available natural gas resources including natural gas storage availability. Natural gas resource planning typically includes peak requirements, low and average monthly requirements and delivery constraints from natural gas supply locations to Avista Corp.’s distribution system. However, daily variations in natural gas demand can be significantly different than monthly demand projections. On the basis of these projections, Avista Corp. plans and executes a series of transactions to hedge a portion of its projected natural gas requirements through forward market transactions and derivative instruments. These transactions may extend as much as three natural gas operating years (November through October) into the future. Avista Corp. also leaves a significant portion of its natural gas supply requirements unhedged for purchase in short-term and spot markets.

Avista Corp. plans for sufficient natural gas delivery capacity to serve its retail customers for a theoretical peak day event. Avista Corp. generally has more pipeline and storage capacity than what is needed during periods other than a peak-day. Avista Corp. optimizes its natural gas resources by using market opportunities to generate economic value that mitigates the fixed costs. Avista Corp. also optimizes its natural gas storage capacity by purchasing and storing natural gas when prices are traditionally lower, typically in the summer, and withdrawing during higher priced months, typically during the winter. However, if market conditions and prices indicate that Avista Corp. should buy or sell natural gas at other times during the year, Avista Corp. engages in optimization transactions to capture value in the marketplace. Natural gas optimization activities include, but are not limited to, wholesale market sales of surplus natural gas supplies, purchases and sales of natural gas to optimize use of pipeline and storage capacity, and participation in the transportation capacity release market.

18

AVISTA CORPORATION

The following table presents the underlying energy commodity derivative volumes as of September 30, 2021 that are expected to be delivered in each respective year (in thousands of MWhs and mmBTUs):

|

| Purchases |

|

| Sales |

| ||||||||||||||||||||||||||

|

| Electric Derivatives |

|

| Gas Derivatives |

|

| Electric Derivatives |

|

| Gas Derivatives |

| ||||||||||||||||||||

Year |

| Physical |

|

| Financial |

|

| Physical |

|

| Financial |

|

| Physical |

|

| Financial |

|

| Physical |

|

| Financial |

| ||||||||

Remainder 2021 |

|

| 0 |

|

|

| 31 |

|

|

| 4,891 |

|

|

| 24,320 |

|

|

| 18 |

|

|

| 103 |

|

|

| 2,587 |

|

|

| 13,033 |

|

2022 |

|

| 123 |

|

|

| 0 |

|

|

| 2,250 |

|

|

| 52,353 |

|

|

| 216 |

|

|

| 370 |

|

|

| 2,260 |

|

|

| 28,898 |

|

2023 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 18,825 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,360 |

|

|

| 7,060 |

|

2024 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 2,275 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,370 |

|

|

| 0 |

|

2025 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,115 |

|

|

| 0 |

|

As of September 30, 2021, there are 0 expected deliveries of energy commodity derivatives after 2025.

The following table presents the underlying energy commodity derivative volumes as of December 31, 2020 that are expected to be delivered in each respective year (in thousands of MWhs and mmBTUs):

|

| Purchases |

|

| Sales |

| ||||||||||||||||||||||||||

|

| Electric Derivatives |

|

| Gas Derivatives |

|

| Electric Derivatives |

|

| Gas Derivatives |

| ||||||||||||||||||||

Year |

| Physical |

|

| Financial |

|

| Physical |

|

| Financial |

|

| Physical |

|

| Financial |

|

| Physical |

|

| Financial |

| ||||||||

2021 |

|

| 1 |

|

|

| 224 |

|

|

| 10,353 |

|

|

| 65,188 |

|

|

| 17 |

|

|

| 451 |

|

|

| 5,448 |

|

|

| 39,273 |

|

2022 |

|

| 0 |

|

|

| 0 |

|

|

| 450 |

|

|

| 25,525 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,360 |

|

|

| 12,030 |

|

2023 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 4,950 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,360 |

|

|

| 900 |

|

2024 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,370 |

|

|

| 0 |

|

2025 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,115 |

|

|

| 0 |

|

As of December 31, 2020, there are 0 expected deliveries of energy commodity derivatives after 2025.

The electric and natural gas derivative contracts above will be included in either power supply costs or natural gas supply costs during the period they are scheduled to be delivered and will be included in the various deferral and recovery mechanisms (ERM, PCA and PGAs), or in the general rate case process, and are expected to be collected through retail rates from customers.

Foreign Currency Exchange Derivatives

A significant portion of Avista Corp.’s natural gas supply (including fuel for power generation) is obtained from Canadian sources. Most of those transactions are executed in U.S. dollars, which avoids foreign currency risk. A portion of Avista Corp.’s short-term natural gas transactions and long-term Canadian transportation contracts are committed based on Canadian currency prices. The short-term natural gas transactions are settled within 60 days with U.S. dollars. Avista Corp. hedges a portion of the foreign currency risk by purchasing Canadian currency exchange derivatives when such commodity transactions are initiated. The foreign currency exchange derivatives and the unhedged foreign currency risk have not had a material effect on Avista Corp.’s financial condition, results of operations or cash flows and these differences in cost related to currency fluctuations are included with natural gas supply costs for ratemaking.

The following table summarizes the foreign currency exchange derivatives that Avista Corp. has outstanding as of September 30, 2021 and December 31, 2020 (dollars in thousands):

|

| September 30, |

|

| December 31, |

| ||

Number of contracts |

|

| 22 |

|

|

| 22 |

|

Notional amount (in United States dollars) |

| $ | 7,692 |

|

| $ | 3,860 |

|

Notional amount (in Canadian dollars) |

|