UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005; or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-29173

DIVERSA CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 22-3297375 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 4955 Directors Place, San Diego, California | | 92121 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (858) 526-5000

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer.

| | | | |

| Large accelerated filer ¨ | | Accelerated filer x | | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of Act). Yes ¨ Nox

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of June 30, 2005 was $93,480,883 million.*

The number of shares outstanding of the Registrant’s common stock was 46,803,292 as of February 28, 2006.

DOCUMENTS INCORPORATED BY REFERENCE

Designated portions of the Registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission (the “Commission”) pursuant to Regulation 14A in connection with the 2006 Annual Meeting of Stockholders to be held on May 11, 2006 (the “2006 Annual Meeting”) are incorporated herein by reference into Part III of this report. Such Proxy Statement will be filed with the Commission not later than 120 days after the Registrant’s year ended December 31, 2005.

| * | Excludes the common stock held by executive officers, directors and stockholders whose ownership exceeded 10% of the common stock outstanding at June 30, 2005. This calculation does not reflect a determination that such persons are affiliates for any other purposes. |

DIVERSA CORPORATION

FORM 10-K

For the Year Ended December 31, 2005

INDEX

Forward Looking Statements

This report contains statements that are “forward-looking” and involve a high degree of risk and uncertainty. These include statements related to investments in our core technologies, investments in our internal product candidates, our ability to enter into additional biodiversity access agreements, the discovery, development, and/or optimization of novel genes, enzymes, and other biologically active compounds, the development and commercialization of products and product candidates, the opportunities in our target markets, the benefits to be derived from our current and future strategic alliances, the benefits to be derived from our recent strategic reorganization, our estimates for charges we expect to record in 2006 related to employee separation and facilities consolidation costs, our plans for future business development activities, our plans for our discontinued programs and products, including our sordarins anti-fungal program and other pharmaceutical programs, and our estimates regarding market sizes and opportunities, as well as our future revenue, product-related revenue, profitability, and capital requirements, all of which are prospective. Such statements are only predictions and reflect our expectations and assumptions as of the date of this report based on currently available operating, financial, and competitive information. The actual events or results may differ materially from those projected in such forward-looking statements. Risks and uncertainties and the occurrence of other events could cause actual events or results to differ materially from these predictions. The risk factors set forth below at pages 25-35 should be considered carefully in evaluating us and our business. These forward-looking statements speak only as of the date of this report. We expressly disclaim any intent or obligation to update these forward-looking statements.

We use market data and industry forecasts throughout this report. We have obtained this information from internal surveys, market research, publicly available information, and industry publications. Industry publications generally state that the information they provide has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. Similarly, we believe that the surveys and market research we or others have performed are reliable, but we have not independently verified this information. We do not represent that any such information is accurate.

Accentuase, DIVERSA®, Cottonase, DirectEvolution®, DiverseLibrary, GeneReassembly, Gene Site Saturation Mutagenesis, GigaMatrix, GSSM, Luminase, Purifine, Pyrolase, and SingleCell are trademarks of Diversa Corporation. ThermalAce is a trademark of Invitrogen Corporation. Phyzyme is a trademark of Danisco Animal Nutrition. Quantum is a trademark of Syngenta Animal Nutrition. Bayovac® is a registered trademark of Bayer Animal Health. Ultra-Thin is a trademark of Valley Research, inc. This report also refers to trade names and trademarks of other organizations.

PART I

We are a leader in applying proprietary genomic technologies for the rapid discovery and optimization of novel protein-based products, including (a) enzymes, which are catalytic proteins, and (b) antibodies, which are binding proteins. We are directing our integrated portfolio of technologies to the discovery, evolution, and production of commercially valuable molecules with agricultural, industrial, and chemical applications, such as enzymes, as well as optimized antibodies with pharmaceutical applications. While our technologies have the potential to serve many large markets, our key areas of focus for internal product development are alternative fuels, specialty industrial processes, and health and nutrition. In addition to our internal product development efforts, we have formed alliances with market leaders, such as BASF, Cargill Health and Food Technologies, DuPont Bio-Based Materials, Medarex, Merck, and Xoma. We have also formed a broad strategic relationship with Syngenta AG, a world-leading agribusiness company. We have two inactive subsidiaries, Innovase LLC and TNEWCO Inc.

1

We were incorporated in Delaware in December 1992 under the name Industrial Genome Sciences, Inc. In August 1997 we changed our name to Diversa Corporation. In January 2006, following a comprehensive review of our operations, we announced a strategic reorganization designed to focus our resources on advancing our most promising products and product candidates in three key areas: alternative fuels; specialty industrial processes; and health and nutrition. As a result of this decision, we discontinued development of a number of less promising products and programs and reduced our workforce by 83 employees. In the fourth quarter of 2005, we recorded a non-cash impairment charge of $45.7 million, and we expect to record additional charges of $15.0 to $17.0 million in 2006 related to employee separation and facilities consolidation costs.

Our Strategy

The key elements of our strategy are to:

Deploy our technologies across diverse markets. We use our technologies to develop commercial solutions for a broad range of applications within our three focus areas of alternative fuels, specialty industrial processes, and health and nutrition. We believe that this multi-market approach gives us the ability to capitalize on near-term revenue opportunities in lower-risk applications and longer-term opportunities in higher-risk applications.

Commercialize products independently and with partners in agricultural, chemical, and industrial markets. Our technologies can be applied to develop products for a wide range of agricultural, chemical, and industrial applications where development costs are lower and regulatory cycles are shorter compared to those for pharmaceutical products. Our key areas of focus for internal product development in these non-pharmaceutical markets are alternative fuels, specialty industrial processes, and selected areas within health and nutrition focused on animal health and nutrition. In addition to our internal product development efforts, we have formed alliances with numerous partners, including a broad relationship with Syngenta to pursue product opportunities within several of these focus areas. To date, we have commercialized eight products independently and four products with our partners and have multiple late-stage candidates that we expect to be commercialized in the next three years.

Leverage our evolution technologies to develop optimized, second-generation antibody therapeutics through collaborations. We are applying our established evolution technologies to optimize existing antibodies through strategic alliances. We have existing collaboration agreements for the development of optimized therapeutic antibodies with Merck, Medarex, and Xoma. We intend to continue to pursue product development initiatives under these collaborations and to seek additional therapeutic antibody optimization collaborations through which we can pursue additional product development activities. We intend to pursue these opportunities only through collaborations with partners under which we expect our unreimbursed costs to be minimal.

Utilize strategic alliances to enable the development of a broad portfolio of products. In all of our target markets, we have identified key market segments where we intend to develop products through strategic alliances. We have established criteria for entering into such alliances, including: required investment, estimated time to market, regulatory hurdles, infrastructure requirements, and industry-specific expertise necessary for successful commercialization. We believe that these alliances will allow us to utilize our partners’ marketing and distribution networks, share the investment risk, and access additional resources to expand our product portfolio. In entering these agreements, we typically seek to obtain a combination of technology access fees, research support payments, milestone payments, license or commercialization fees, and royalties or profit sharing income from the commercialization of products resulting from these alliances.

Protect and enhance our technology leadership position. We are advantaged relative to our competitors in that we have an end-to-end product solution consisting of access to novel genetic material, several technologies capable of screening more than a billion genes per day, multiple evolution technologies for optimizing enzymes and therapeutic antibodies, and manufacturing capabilities. We have protected our technologies with a substantial intellectual property estate, and we will continue to make investments in developing and protecting these assets.

2

Market Opportunities and Product Development Programs

Our strategy in the industrial enzyme area is to establish a sustainable, high-growth, profitable business that targets high-value applications where we believe our technologies can deliver superior, proprietary solutions and we can achieve attractive gross margins on product sales. Within the optimized therapeutic antibody arena, our strategy is to leverage our proven antibody evolution technologies across a portfolio of pharmaceutical discovery and development programs funded by strategic partners.

Through our independent and collaborative research and development programs, we have developed commercial products across multiple markets as well as a pipeline of product candidates that we expect to launch independently and in collaboration with strategic partners To date, we have commercialized the following products, either independently or in collaboration with our partners: Accentuase™-G enzyme, Bayovac® SRS vaccine for farmed salmon, Cottonase™ enzyme, Cyan Fluorescent Protein, Green Fluorescent Protein, Luminase™ PB-100 enzyme, Quantum™ phytase, Phyzyme™ XP phytase, Pyrolase™ 160 Enzyme, Pyrolase™ 200 Enzyme, ThermalAce™, and Ultra-Thin™ enzyme. Although we have not made any acquisitions specifically related to our current market focus areas, we have evaluated, and expect to continue to evaluate, acquisition opportunities that represent a strategic fit to our capabilities.

We have identified the following three focus areas in which we intend to pursue product opportunities either independently or through collaborations and distribution agreements with third parties:

| | • | | Specialty industrial enzymes; and |

Within each of these three focus areas, we have a combination of (i) products that either we or one of our partners have commercialized, (ii) product candidates that either we or one of our partners are developing, and (iii) research and development programs for the development of new product candidates.

The market opportunities we have identified within each of these focus areas, as well as our strategies for pursuing these opportunities, are discussed below.

Alternative Fuels

Alternative fuels refers to fuels derived from sources other than petroleum. In the past several years, a variety of factors have been contributing, and continue to contribute, to an increasing awareness of and demand for alternatives to petroleum-based fuels. Such factors include, but are not limited to, the following:

| | • | | Macroeconomic factors affecting the global supply of and demand for oil, including significantly increased demand for oil from developing countries whose economies are growing at high rates, such as China and India, coupled with flat or decreasing supplies of oil from stable sources throughout the world; |

| | • | | In the United States and other developed countries throughout the world, significantly and persistently higher prices for gasoline and other petroleum-based products due in large part to the macroeconomic factors discussed above; |

| | • | | In the United States, an increasing number of local, state, and federal policies and initiatives aimed at reducing the dependence on imported sources of oil, particularly oil imported from unstable regions of the world such as the Middle East; |

| | • | | In the United States, increasing visibility from vehicle manufacturers such as General Motors and Ford Motor Company regarding so-called “flexible fuel vehicles,” or FFVs, capable of operating on various blends of gasoline and ethanol, and the production and availability of FFVs throughout the United States; |

3

| | • | | In the United States, an increasing number of fuel stations that sell both gasoline and ethanol or blends of the two fuels. |

Of all of the alternative fuels that are sold or are being developed, the two most significant alternative fuels that present current or future opportunities for us are fuel ethanol and biodiesel fuel.

Fuel Ethanol

Ethanol, or ethyl alcohol, is commonly known as “grain alcohol,” as it is typically produced by extracting or using sugars derived from the starch within a grain source, such as corn kernels, and fermenting the sugars via fermentation to produce ethanol. Ethanol can be used as a fuel source to power combustion engines in an increasing number of different types of vehicles throughout the United States and the rest of the world. Enzymes are currently being sold to large-scale ethanol mills to enhance the efficiency and cost-effectiveness of the ethanol production process. While more traditional, small-scale production systems for manufacturing ethanol have in the past relied on the direct fermentation of the grain by yeast to produce ethanol, modern production systems for manufacturing ethanol at large scale have relied on the application of enzymes to more efficiently convert the starch from grains into sugars that can more readily be converted into ethanol via fermentation.

According to the Renewable Fuels Association (RFA), the national trade association for the United States ethanol industry, as of December 31, 2005, there were 95 ethanol plants in the U.S. having a combined production capacity of more than 4.3 billion gallons of ethanol per year, and there were 29 ethanol plants and nine expansions under construction with a combined annual capacity of more than 1.5 billion gallons of ethanol per year. Between 1980 and 1991, less than 1 billion gallons of ethanol were produced annually in the United States. In 2005, the U.S. ethanol industry produced a record 3.9 billion gallons of fuel ethanol, representing an increase of 15% from 2004 and 121% since 2001. The graph below shows historic U.S. fuel ethanol production from 1980 to 2005.

Source: Renewable Fuels Association; www.ethanolrfa.org

4

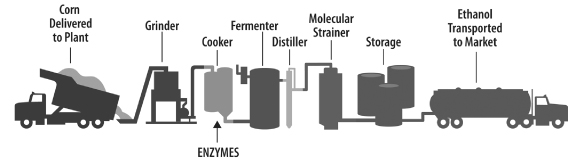

Figure 2: The current process for manufacturing bioethanol

Source: Renewable Fuels Association; Diversa Corporation

We have developed, either independently or through our collaborations, a number of enzyme products and product candidates that may be utilized to convert various sources of starch into sugars that can be used to produce ethanol, commonly referred to as “bioethanol.” The figure above shows the major steps in the process for manufacturing bioethanol from corn kernels, including the step in which enzymes are applied to convert the corn starch to fermentable sugars.

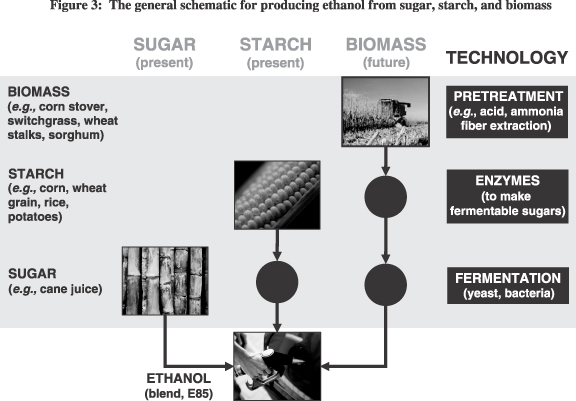

In addition, we have several research and development programs aimed at developing “cocktails” of enzymes to break down more complex starting materials commonly referred to as “biomass”—such as corn stover, wood chips, switchgrass, sugar cane bagasse, and municipal waste materials, for example—into fermentable sugars that could be used to produce ethanol, commonly referred to as “cellulosic ethanol” or “lignocellulosic ethanol.”

Ultra-Thin™ Enzyme

Ultra-Thin™ enzyme is a new, next-generation alpha amylase enzyme designed to significantly improve the efficiency and economics of ethanol production from corn and other starch sources. Distributed by Valley Research, inc. (“Valley Research”), this new product dramatically lowers the viscosity of the corn starch stream and operates at high temperature and at a lower pH than other commercially available enzymes, all of which offers ethanol producers the potential for substantial throughput advantages and cost savings. It works in concert with other enzymes to efficiently convert the starch present in corn and other sources into sugars that can then be processed into ethanol. Ethanol producers have traditionally used other alpha amylase enzymes that do not reduce the starch stream viscosity as efficiently as Ultra-Thin enzyme does and do not operate at an optimal pH, thus limiting plant capacity and requiring costly process adjustments. We manufacture Ultra-Thin enzyme under our agreement with Fermic S.A. de C.V. a U.S. Food and Drug Administration-approved fermentation and synthesis plant located in Mexico City. We estimate that the addressable market for this product is in excess of $50 million in the United States alone and is currently growing at a rate in excess of 10% per year given the significantly increasing demand for ethanol.

Amylase-T

Syngenta has a project in development to produce corn enhanced through biotechnology that expresses high levels of amylase. Using high amylase corn may result in improved process efficiency and possible savings in the cost of ethanol. This transgenic amylase enzyme, which we refer to internally as Amylase-T, was originally developed under our collaboration with Syngenta. We are entitled to receive royalties from Syngenta on sales of products incorporating Amylase-T. We cannot predict with certainty when, if ever, any products incorporating Amylase-T will receive regulatory approval in the United States or any other countries, or whether any such products will be accepted by the intended customers of such products.

5

Biomass-to-Ethanol Programs

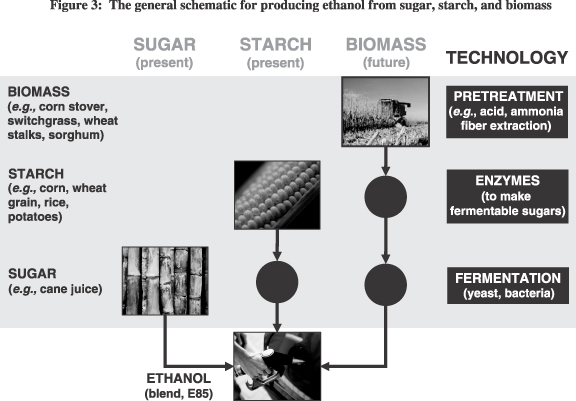

We have several research and development programs whose objective involves the production of ethanol from various sources of so-called “biomass.” The figure below shows a general schematic for producing ethanol from sugar, starch, and biomass, together with the associated technologies required for such production.

Since 2003, we have been collaborating with DuPont Bio-Based Materials on the development of an integrated corn-based biorefinery (“ICBR”) for the production of ethanol and other value-added chemical products from corn biomass. This multi-year program is being co-funded by the U.S. Department of Energy (“DOE”) and includes within the consortium the National Renewable Energy Lab, or NREL, which is part of the DOE. Our objective under the program is to discover, optimize, and manufacture a “cocktail” of enzymes that can efficiently convert the different components of an entire corn plant, including the stalk, into simple sugars that can then be used to make ethanol and other products.

In 2005, we announced that the performance of the enzymes we developed under the ICBR program with DuPont substantially exceeded the initial targets set by the Department of Energy, triggering a milestone payment to us of over five hundred thousand dollars. The performance of this enzyme mix is already superior to current commercial enzymes for biomass conversion. Accordingly, the next phase of the program is focused on improving the overall economics of the enzyme-based process.

Regarding biomass-to-ethanol opportunities in general, our strategy for generating ethanol from biomass is centered around using our technology platform to develop superior enzymes customized for the starting material and pre-treatment process and then working to produce them cost-effectively. We believe that this approach is much more likely to be ultimately successful than competing approaches which are based primarily on taking existing commercial enzymes and simply trying to produce them at low cost. Given the complexities of the process of producing ethanol from biomass, we believe that the same enzyme cocktail is unlikely to work with each source of biomass, each pre-treatment process, and each fermentation organism; rather, we expect that

6

customized sets of new and improved enzymes—that is, ones that are optimized for the specific source of biomass, the specific pre-treatment process, and the specific fermentation organism—will be required to make biomass-to-ethanol an economic reality.

Biodiesel

Biodiesel is the name of a clean burning alternative fuel that can be produced from renewable resources such as soybeans, canola, and other oilseeds. Biodiesel contains no petroleum, but it can be blended with petroleum diesel to create a biodiesel blend. It can be used in compression-ignition (diesel) engines with little or no modifications. Biodiesel is simple to use, biodegradable, and nontoxic.

Biodiesel’s properties with respect to the operation of diesel engines are similar to diesel fuels that are petroleum-based. Biodiesel has many positive attributes associated with its use, including its similar operating performance compared to conventional diesel fuel and the lack of changes required in facilities and maintenance procedures regarding its handling and use.

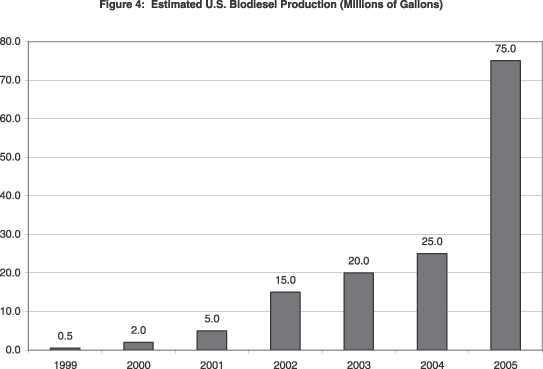

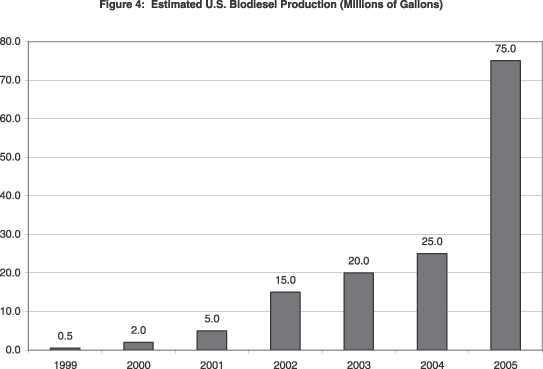

According to the National Biodiesel Board, as of January 2006, there were more than 53 companies that have invested in the development of biodiesel manufacturing plants and that are actively marketing biodiesel, with current production capacity estimated to be 354 million gallons per year. Thirty-five companies have reported that their plants are currently under construction and are scheduled to be completed within the next 18 months. Their combined capacity, if realized, would result in another 278 million gallons per year of biodiesel production. The graph below shows estimated production of biodiesel in the United States from 1999 to 2005.

Source: National Biodiesel Board; www.biodiesel.org

While we developed our Purifine™ enzymes primarily to improve the processing of edible vegetable oils, these enzymes, and / or similar enzymes in our DiverseLibrary™ collection of enzymes, may also improve the refining of biodiesel fuel based on a similar mechanism of action. We are currently investigating the utility of our oil processing enzymes to improve the refining of biodiesel fuels.

7

Specialty Industrial Processes

Within the area of specialty industrial processes, we have identified a number of industrial processing opportunities for high-value enzymes to potentially decrease processing time, improve product quality, lower total processing costs, and/or reduce harmful waste streams. In many cases, these enzymes are intended to replace or reduce the use of commodity chemicals that have been traditionally used in the applicable industrial process.

Pulp and Paper Processing

More than 190 million tons of pulp fiber and 340 million tons of paper and board products are produced annually worldwide. Environmental regulations are becoming increasingly stringent, and the use of harsh chemicals, such as chlorine for bleaching, is no longer preferred in most parts of the world. Substitute chemistries are more expensive, less effective, and more damaging to fiber. Reducing chemical usage in fiber processing through the use of biochemical products can decrease manufacturing and energy costs and environmental impact.

We have developed enzymes to aid in bleaching pulp, which reduce the need to use strong oxidizing chemicals, such as chlorine compounds. These enzymes can reduce the cost of pulp processing both by reducing the amount of oxidizing chemicals required and the expense associated with treating the waste water resulting from the use of these harsh chemicals.

In July 2004, we launched Luminase™ PB-100 enzyme for pulp bleaching enhancement. This product improves the response of pulp fiber to bleaching chemicals, which can reduce the need for harsh bleaching chemicals or enable the customer to make whiter pulp for new products. Decreasing bleach chemicals lowers costs and offers a potential environmental benefit by reducing the amount of waste material requiring removal from pulp mill effluent. In mills, Luminase PB-100 enzyme has outperformed competitive products, demonstrating bleach chemical cost savings of up to 20%. Beginning in late 2004 and continuing through 2005, we initiated several mill trials for our Luminase PB-100 enzyme. We are continuing to run these trials and schedule additional trials in 2006. Additionally, Luminase PB-100 enzyme may produce whiter pulp, potentially extending a customer’s market to new products. We intend to develop line extensions of additional Luminase enzymes that are capable of operating cost-effectively at higher temperature and pH ranges, in order to increase the number of mills that can be addressed by one or more Luminase enzymes, with product launches planned for 2006.

Enhanced Processing of Edible Nutritional Oil

Oils and fats are two of the most abundant and readily available renewable raw materials for use within the food, feed and chemical industries. The fatty acids contained in these lipids are extremely useful precursors for a wide variety of valuable molecules, including animal feed additives, nutritional oils, specialty chemicals and polymers. Current oil processing and oleochemical production processes are generally energy and capital intensive and utilize harsh chemical methods. Major process issues include yield loss, high volume waste streams, high processing costs, and utilization of toxic or environmentally harmful chemicals and solvents. Further, these chemical processes do not allow access to the full value of the feedstock because the processes lack selectivity and control of the fatty acid structure and functionality.

Despite the shortfalls associated with the current chemical processes, biological processes have not been extensively considered due in large part to the weak performance of alternative bioprocesses. Nevertheless, we believe significant opportunities exist to reduce processing costs and enable the utilization of low cost raw materials for higher value chemicals and materials if these limitations can be overcome.

We intend to develop superior enzymes to be employed in both commodity oils processing and also in specialty products such as margarines, cooking oils, and lubricants. Our enzymes will be directed to increasing

8

process efficiency and improving product qualities, such as reducing the cholesterol-causing components in margarine and cooking oils and improving the heat stability of lubricants. The first of such enzymes in development is Purifine™ enzyme, a novel oil processing enzyme designed to increase the yield of oil processing from oil seeds. This product has passed preliminary safety tests, and we expect to receive the results of toxicology studies in the first half of 2006. Assuming satisfactory toxicology results and anticipated timelines for the U.S. regulatory approval process, we anticipate that we could launch Purifine™ enzyme on a commercial basis in mid-2007, assuming it receives regulatory approval. Purifine™ enzyme is expected to minimize chemical usage, improve operating efficiency, and reduce waste by allowing a higher percentage of nutritional oil to be recovered from oil seeds economically.

Fine Chemicals

We are developing enzymes to aid in the manufacture of both fine chemicals, such as chiral pharmaceutical intermediates, as well as other high performance chemicals. These enzymes are used to create manufacturing efficiencies, reduce production costs, and accelerate the generation of new chemical products and processes. Today, we are well positioned to become a leading provider of integrated biological solutions and services to the chemical and pharmaceutical industries through strategic alliances. Historically, we have established collaborative agreements in this area with BASF, Cargill Health and Food Technologies, The Dow Chemical Company, DSM Pharma Products, DuPont Bio-Based Materials, and Givaudan Flavors Corporation. We expect to continue to establish or maintain collaborative relationships for the development of products for fine chemical applications, although we do not currently intend to invest our own financial resources in the development of internal products for these applications. We intend to pursue these opportunities only through collaborations with partners under which we expect our unreimbursed costs to be minimal.

Health and Nutrition Programs

Animal Feed Additives to Enhance Animal Nutrition

Animal feed additives are designed to increase absorption of essential vitamins and minerals, increase nutritional value and animal product yield, and reduce harmful materials in waste. In 2001 alone, over $8 billion was spent on animal feed additives that improve digestibility and increase nutritional value. We are developing several classes of enzymes, including phytases and carbohydrases, for the increased absorption of organic phosphorous and digestibility of carbohydrates, as well as the promotion of weight gain in livestock.

When used as an additive in animal feed applications, phytase enzymes allow higher utilization of naturally occurring phosphorus from the feed, thereby increasing its nutritional value and reducing phosphate pollution. The worldwide market for phytase enzymes was estimated to be more than $200 million in 2005. This growth has been driven by economics as well as regulatory pressure to decrease pollution caused by the phosphate-rich waste from swine and poultry farms that is a leading cause of water pollution. We have developed two phytase products to address this market.

In March 2003, we launched Phyzyme™ XP in collaboration with our partner Danisco Animal Nutrition. The addition of Phyzyme™ XP to animal feed reduces the need for inorganic phosphorus supplementation by approximately 20% and lowers the level of harmful phosphates that are introduced to the environment through animal waste by approximately 30%, resulting in inorganic phosphate cost savings and a significant reduction in environmental pollution. We are responsible for manufacturing Phyzyme XP, and Danisco is responsible for its sales and marketing.

In December 2003, our thermostable Quantum™ phytase, developed under our collaboration with Syngenta, received regulatory approval in Mexico and has subsequently received regulatory approval in other countries, including Brazil. Quantum phytase is currently under regulatory review for sale in the U.S. and several other countries. As reported by Syngenta, the results from more than 50 poultry and swine trials of this product show that Quantum phytase consistently outperforms other commercial phytases in a wide variety of diets. This is the

9

first product we have commercialized with Syngenta, and we believe it is indicative of our ability to deliver differentiated animal nutrition products.

Through our collaboration with Syngenta, we have also developed a next-generation transgenic phytase product candidate, which we refer to internally as Phytase-T, that is intended to be grown directly in corn. This product is intended to be both cost-effective and heat-stable, and it is expected to supplement Quantum phytase. We are entitled to receive royalties from Syngenta on sales of products incorporating Phytase-T. We cannot predict with certainty when, if ever, any products incorporating Phytase-T will receive regulatory approval in the United States or any other countries, or whether any such products will be accepted by the intended customers of such products.

Animal Health Vaccines for Prevention or Treatment of Disease

Over the past several years, we have worked on the development, optimization, and manufacture of vaccines for use in animal health. We have commercialized one vaccine product for farmed salmon, but we do not intend to invest additional resources in the development of additional animal health vaccines.

We formed a collaboration with Bayer Animal Health in 2003 to develop microbially-produced vaccine products initially focused on the prevention of infectious diseases in fish. Our initial product, Bayovac® SRS, is a proprietary and novel subunit recombinant vaccine for farmed salmon. This vaccine product has demonstrated superior protection against salmon rickettsial septicemia (SRS). SRS is the major infectious disease in Chilean aquaculture, typically killing upwards of 20% of untreated farmed salmon, which represent the highest value per pound of all farmed animals. Bayovac® SRS received regulatory approval in September 2004 in Chile, which produces 40% of the world’s farmed salmon, and we recorded our first sales of this product in September 2004.

Therapeutic Antibody Optimization Program

Our antibody optimization program focuses on the application of our technologies to improve existing antibody therapeutics with the objective of creating superior products. Our technologies have the potential to improve the potency, safety, and convenience of antibody therapeutics, as well as to decrease their manufacturing cost.

We believe that applying our directed evolution technologies to antibodies represents an attractive opportunity, because:

| | • | | Biotherapeutics, and in particular antibodies, are an emerging treatment modality that has demonstrated value in treating serious and chronic diseases; |

| | • | | Biotherapeutics are suitable for accelerated clinical development, because they potentially present fewer side effects as a result of their high target specificity; and |

| | • | | The development of improved versions of marketed biopharmaceuticals and / or clinical candidates for validated targets represents a lower-risk development strategy while still targeting highly profitable markets. |

Given the flexibility, comprehensiveness, and controlled nature of our proprietary technology platforms, we are in a unique position to tailor antibody therapeutics to the specific needs of the therapeutic indication. For instance, oncology indications require antibodies with a high degree of specificity and the ability to activate the immune system. On the other hand, antibodies for the treatment of immunological disorders are required to have a high affinity for their target while maintaining a very good side effect profile. Our technology platforms can be used to yield antibodies with the key properties outlined above.

Furthermore, some of the key issues associated with antibody therapeutics are related to their challenges in manufacturability and formulation. Our technology platforms can also potentially address these issues by

10

providing variants that, while maintaining their biological and pharmacological properties, provide better stability and solubility.

Monoclonal Antibody Market

Therapeutic antibodies comprise one of the fastest-growing classes of pharmaceutical products, generating worldwide sales of $10.5 billion in 2004. There are currently18 therapeutic antibodies on the market and over 300 candidates in various stages of clinical development. Currently, antibodies are mainly applied for serious indications in oncology and autoimmune diseases. The use of monoclonal antibodies as an emerging therapeutic modality represents an attractive market opportunity expected tomore than double in worldwide sales by 2010.

Shortcomings in Current Antibody Development

Initially, antibodies were generated using laboratory mice. These murine antibodies were often rejected by patients because they were recognized as foreign proteins, and the patients produced human anti-mouse antibodies, also known as HAMA response. This response reduces the effectiveness of the antibody by neutralizing its activity and clearing the antibody from circulation. HAMA response can also result in significant toxicity with subsequent administration of mouse antibodies.

Subsequent generations of antibodies have been re-engineered in an attempt to address these immunogenic complications, resulting in antibodies that are less mouse-like and more human-like. One such example is chimeric antibodies, which still contain approximately 38% mouse sequences. Some of the antibodies still manifested the HAMA responses initially observed in mouse antibodies. Scientists then developed CDR-grafted, or humanized, antibodies in which mouse sequences were minimized to represent less than 10% of the final antibody. This engineering process commonly results in alteration (reduction) of both affinity and, sometimes, specificity of the antibody.

Fully human antibodies represent the latest development in antibody generation. They are currently generated through the use of transgenic mice and phage display. Lines of transgenic mice have been engineered to carry the human germline genes encoding antibodies, but the following issues may be implicated by the generation of human antibodies using transgenic mice:

| | • | | Transgenic mice do not currently harbor the entire human gene repertoire, and therefore the diversity generated is unlikely to fully represent the human immune system. Similarly, B-cells do not express all potential human antibodies. |

| | • | | The antibody selection and maturation processes in a biological system may result in fewer therapeutically relevant candidates. |

| | • | | From a process perspective, transgenic mouse-based antibody generation requires a hybridoma phase that represents a long and inefficient process, and there are very limited opportunities to influence or direct the process, thereby greatly limiting the ability to engineer antibodies. |

The other approach to screen for fully human antibodies is based on a phage display platform. It is important to emphasize that phage display is a selection tool only. In this sense, the limitations associated with phage display as a screening tool will bias any antibodies selected in the process. These limitations include those antibodies that can effectively be expressed and displayed, potential conformational changes or distortions associated with the display, and the high frequency of repeated hits identified in any given screen.

11

Advantages of Our Antibody Optimization Program

The emerging antibody therapeutic market, in our view, is transitioning from a first generation of products to next generations, where the ability to engineer and build in desired properties will likely be increasingly demanded and likely to provide products with superior performance.

In this context, we believe that our antibody program offers the following value propositions:

| | • | | Medicinal Evolution of Antibody Therapeutics. We employ a robust process that enables the generation of a large number of candidates which can be screened, not only for biological properties, but also for improved process development requirements (e.g., formulation, solubility, and stability). Our antibody generation capability can yield a diverse selection of antibodies that is potentially capable of responding to many disease targets. Our optimization technologies can rapidly create large numbers of variants, which can then be the subject of multiple selections for the variant(s) with the optimal characteristics. |

| | • | | Broad Intellectual Property Protection. We provide the opportunity to create a broad intellectual property position around a given antigen and / or a given antibody by characterizing all potential antibodies naturally produced by the human immune system as well as derivatives with functional properties. |

We intend to continue to develop optimized therapeutic antibodies in collaboration with strategic partners. However, given our focus in the near-term on industrial enzyme product opportunities, we do not intend to invest a significant amount of our own financial resources in the development of optimized antibody therapeutics under such collaborations or under internal programs.

Small Molecule Drug Discovery Program

Our small molecule drug discovery programs have been based on two unique technology platforms, whose competitive properties can be outlined as follow:

High-Throughput Culturing Platform (HTC)

| | • | | HTC provides access to previously uncultured microorganisms by creating nano-environments similar to those encountered in natural habitats. The specific technology and an extensive report on its findings have been published in the Proceedings of the National Academy of Sciences. |

| | • | | Novel isolates can be cultured and assayed for biological activities of interests in a high-throughput manner. |

| | • | | The isolates can be investigated for novel chemical structures by using high-throughput mass spectrometry coupled with proprietary software for compound analysis (MQuest). This chemical screening enables us to analyze more of the metabolites within each organism and to identify novel chemistries that may be broadly applicable to all therapeutic areas. |

Recombinant Natural Product Platform (RNP)

| | • | | We are able to access genetic diversity from the estimated 99% of microbial organisms that account for the Earth’s untapped diversity. |

| | • | | Our patented DNA recovery technologies, together with a suitable expression host, enable us to access previously undiscovered pathways from natural microbial sources and to ensure that those compounds we discover can be expressed in sufficient quantities to be exploited further. |

| | • | | RNP represents a new paradigm in compound discovery and is a highly complementary approach to HTC. We expect the two approaches to accelerate the hit-to-lead process and enable viable options for commercial production of novel compounds discovered through this process. |

12

To date, our program has produced a number of confirmed broad-spectrum hits in the antibacterial / antifungal area. Approximately 4% of these are novel structures, and we have profiled many of these compounds for spectrum, potency, and selectivity in order to prioritize them for potential lead optimization by medicinal chemistry and / or biotransformation.

In January 2006, pursuant to a corporate reorganization, we announced our intention to discontinue further investment in the development of our small molecule programs for human pharmaceuticals. We intend to explore opportunities to sell or out-license these programs to third parties.

Our Technologies and Advantages

Traditional Approaches and Their Limitations

Enzymes have been shown to catalyze more than 3,000 individual chemical reactions. Nearly all of the currently characterized enzymes have been isolated from organisms that were cultured in the laboratory, representing only a small percentage of the billions of species believed to exist. The reasons for this include:

| | • | | Less than 1% of microbial species will grow under standard laboratory conditions; |

| | • | | Enzymes and other bioactive molecules may only be produced at specific times during growth or under specific conditions not present in the lab; |

| | • | | Even when enzymes are found, recovery of the corresponding genes can be difficult. |

Accordingly, biodiversity remains largely untapped.

Once an enzyme or small molecule of interest is discovered, the genetic sequence of the gene or genes encoding it can be studied, and genetic variation can be introduced in an attempt to modify its function through a process of test tube evolution. Genetic variation is generated predominantly by two methods: mutation and recombination. Mutation is the introduction of changes into a gene. Mutation can be achieved by several methods, including forcing the DNA to replicate in a manner that intentionally causes random changes. Mutagenesis has been achieved by randomly introducing single nucleotide changes into a gene in an attempt to alter a single amino acid within the corresponding protein. Random methods have deficiencies that make it virtually impossible to generate all 19 possible amino acid changes at each position within the protein. The best method to generate all amino acid changes at each site requires multiple, appropriately positioned DNA base changes (non-random methods). Historically, on average, three or fewer changes are explored due to deficiencies in mutation and sampling methods. Recombination, or shuffling, the other method for producing genetic variation, is the mixing of two or more related genes to form hybrids. However, the generation of improved variants has, to date, been inefficient and laborious, or has allowed only closely related genes to be recombined.

Once a desired gene is found and optimized, commercial production requires insertion of the gene into a production system or host. Almost all of the current commercial enzymes used in industrial applications today were derived from cultured microorganisms and produced in these or similar organisms referred to as homologous expression. However, genes encoding unique biomolecules may not be able to be expressed and commercially produced in traditional systems. Thus, traditional methods present both the problem of novel biomolecule identification and the challenge of commercial production of any identified biomolecules.

Biodiversity Access

Our discovery program begins with access to biodiversity. Biodiversity can be defined as the total variety of life on earth, including genes, species, ecosystems, and the complex interactions between them. We have collected microbial samples from numerous types of ecosystems represented on earth, including such environments as geothermal and hydrothermal vents, acidic soils and boiling mud pots, alkaline springs, marine and freshwater sediments, savanna grasslands, rainforests, montane and subalpine landscapes, industrial sites,

13

arctic tundra, and dry Antarctic valleys. We have also sampled microbial communities living in close association with insects, arachnids, and nematodes, as well as the symbionts residing within marine sponges and soft corals. All of our samples from the countries within our biodiversity access network have been acquired through agreements that permit broad access to biologically diverse environments within such countries. These agreements are generally with domestic land management agencies and scientific research institutions associated with appropriate government agencies. Our relationships have been founded on the fundamental principles of the Convention on Biological Diversity: (1) conservation of biological diversity; (2) the sustainable use of its resources; and (3) the fair and equitable sharing of the benefits derived from the utilization of genetic resources.

We believe our ability to create expanded libraries using minute samples of genetic material collected from diverse environments is an important factor to our success. Our need to use only small environmental samples results in minimal impact to the surrounding ecosystem, enabling us to enter into formal genetic resource access agreements. In 1997, we signed a Cooperative Research and Development Agreement with Yellowstone National Park, which was the first agreement of its kind for the U.S. National Park Service. To date, we have obtained samples under various access agreements from Alaska, Antarctica, Australia, Bermuda, Costa Rica, Ghana, Hawaii, Iceland, Indonesia, Kenya, Mexico, the Meadowlands Superfund site, Puerto Rico, Russia, the San Diego Zoological Society, South Africa, and Yellowstone National Park. We also access marine and terrestrial samples from Antarctica, as well as deep-sea hydrothermal vents off the shores of Costa Rica and the Pacific Northwest. Many of these samples are taken using deep-sea submersibles or remotely operated vehicles.

We intend to enter into additional agreements to further strengthen our biodiversity access program by expanding the network of countries from which we obtain samples. Using our proprietary techniques to recover the genes from these samples, we have constructed our DiverseLibrary collection. We intend to expand this DiverseLibrary collection, which we estimate currently contains the total genomes of millions of unique microorganisms. We believe that the application of our proprietary technologies to this vast resource of genetic material will provide us with a myriad of product candidates for attractive commercial applications.

Screening

We have developed an array of automated, ultra high-throughput screening technologies and enrichment strategies. Our proprietary rapid screening capabilities are designed to discover novel biomolecules by screening for biological activity, known as expression-based screening, as well as by identifying specific DNA sequences of interest, known as sequence-based screening.

We have developed numerous assays capable of expression-based screening from thousands to over 1 billion clones per day. Our key screening technologies include SingleCell™ screening and high-throughput robotic-based screening. Our ultra high-throughput SingleCell screening system uses Fluorescence Activated Cell Sorting, or FACS, a technology that enables the rapid identification of biological activity within a single cell or individual organism. Our SingleCell screens have been developed to identify clones based on activity or DNA sequences. This system incorporates a laser with multiple wavelength capabilities and the ability to screen up to 50,000 clones per second, or over 1 billion clones per day. Our robotic screening systems use high-density (1536 wells) microtiter plates and are capable of screening and characterizing over 1 million clones per day. If the clone expresses an activity or contains a DNA sequence of interest, we isolate it for further analysis.

We have also developed rapid methods for sequence-based screening for targeted genes directly from purified DNA. One of these methods, genomic biopanning, is a powerful alternative to traditional methods, especially when the gene is toxic or unstable, or when the expression assay is laborious and time consuming. Using our proprietary techniques, it is possible to screen billions of clones per day for DNA sequences of interest.

Because we conduct patented, activity-based screening, we are able to use gene sequences with known function from our proprietary database to identify the function of genes in public databases based on their

14

sequences. These newly identified sequences are then added to the repertoire of proprietary sequences in our own database. As more microbial genomes are sequenced, our ability to associate gene sequence with enzyme function will be enhanced. This sequence database provides us with unique opportunities to find and patent more sequences with similar function and the potential to modify these sequences in order to create optimized catalysts and other biomolecules for various commercial applications.

Our GigaMatrix™ platform is an ultra high-throughput screening platform that is the first system known to utilize plates with a 100,000-well density. Exponentially more efficient than standard 96-, 384-, or 1536-well screening systems, the GigaMatrix platform combines automated robotics and a 100,000-well format contained in the 3.3” x 5” footprint of a standard plate.

The GigaMatrix platform permits rapid screening of genes and gene pathways, and is expected to increase the productivity of our discovery programs for products such as novel enzymes. In 2002, we developed the capability to screen in plates with one million wells and initiated screening in this ultra-high density format.

The GigaMatrix technology, employing over 12,000 wells per square centimeter, greatly expands the amount of molecular diversity that can be screened to discover products. The platform also dramatically reduces equipment and operator time through massively parallel dispensing and reading of biological samples. The GigaMatrix plates, with wells each about the diameter of a human hair, are reusable and require only miniscule volumes of reagents, making them highly cost effective.

Our DirectEvolution® Technologies

The genetic code is structured such that a sequence of three nucleotides defines an amino acid. Nature uses 20 common amino acids in proteins arranged in a sequence, defining the protein structure and activity. Over the course of almost 4 billion years of evolution, nature has sampled countless sequence possibilities to evolve proteins to function optimally within the cell. However, when a protein is removed from its natural cellular environment and used to perform reactions, such as an enzyme used to catalyze a chemical process, its function may not be optimal. Laboratory methods can accelerate the evolutionary process of optimization outside of the cell by creating a large number of variants for screening. In the traditional method for improving proteins, called site-directed mutation, a single site is typically targeted for change based on prior knowledge of the protein structure. Other traditional techniques, including random mutation, typically produce single nucleotide changes which can only access a limited number of alternative amino acids, typically fewer than 3 of the possible 19 alternatives. These methods are limited by their inability to produce all DNA and amino acid sequence variations. Furthermore, the large number of resulting sequences presents formidable screening challenges.

We believe our techniques overcome the limitations of these traditional methods, not only because of our superior screening capabilities, but also by increasing the number and types of sequence variations we can create. Our evolution technologies used to modify the DNA sequence of the genes, our DirectEvolution technologies, include Gene Site Saturation Mutagenesis™ (GSSM™) and Tunable GeneReassembly™. Our GSSM technology is a patented method of creating a family of related genes that all differ from a parent gene by at least a single amino acid change at a defined position. By performing GSSM on a gene encoding a protein, we create all possible single amino acid codon substitutions within that protein, removing the need for prior knowledge about the protein structure and allowing all possibilities to be tested in an unbiased manner. The family of variant genes created using GSSM is then available to be screened for proteins with improved qualities, such as increased ability to work at high temperature, increased reaction rate, resistance to deactivating chemicals, or other properties important in a chemical process. Individual changes in the gene that cause improvements can then be combined to create a single highly improved version of the protein. Additionally, our patented GSSM methodology employs a more comprehensive approach than other methods of site-directed mutation.

In addition to altering single genes using our patented GSSM technique, we use our patented Tunable GeneReassembly technology for the reassembly of related or unrelated genes from two or more different species

15

or strains. Our Tunable GeneReassembly technology recombines multiple genes to create a large population of new gene variants. The new genes created by Tunable GeneReassembly are then screened for one or more desired characteristics. This evolutionary process can be repeated on reassembled genes until new genes expressing the desired properties are identified. Tunable GeneReassembly technologies can be used to evolve properties which are coded for by single or multiple genes. We have received over 20 patents worldwide for our broad portfolio of proprietary processes for evolution, from gene shuffling based on interrupted DNA synthesis, to Tunable GeneReassembly, GSSM, and a number of additional evolution technologies. Further, this suite of multiple, patented evolution technologies successfully overcomes the limitations of traditional shuffling techniques. For instance, unlike widespread shuffling technologies that require highly related gene sequences to achieve successful recombination, our proprietary Tunable GeneReassembly technology also allows unrelated genes to be combined to maximize evolved improvements.

We believe that the ability to selectively apply our GSSM or Tunable GeneReassembly technologies to optimize proteins provides us with a distinct competitive advantage. GSSM is better suited in some situations, for example, in the optimization of a protein’s stability or its immune response characteristics. With respect to stability, applying GSSM may significantly improve temperature tolerance through combining amino acid alterations at defined positions, while maintaining the protein’s overall characteristics, such as specificity. In one program, we have used this technology to improve enzyme stability by a factor of 30,000. Similarly, adverse immune system responses may be avoided by the incremental changes created by GSSM compared to traditional stochastic methods. In contrast, random shuffling technologies that cause block shifts in DNA structure may be more likely to reduce stability and create undesirable immune response characteristics.

Current Alliances and Other Agreements

Our strategy includes pursuing strategic alliances with market leaders in our target markets. In exchange for selected rights to future products, these strategic alliances provide us funding and resources to develop and commercialize a larger product portfolio. In various instances, these strategic alliances allow us to leverage our partners’ established brand recognition, global market presence, established sales and distribution channels, and other industry-specific expertise. The key components of the commercial terms of such arrangements typically include some combination of the following types of fees: exclusivity fees, technology access fees, technology development fees and research support payments, as well as milestone payments, license or commercialization fees, and royalties or profit sharing from the commercialization of any products that result from the alliance. As of December 31, 2005, our strategic partners have provided us approximately $240 million in funding since inception and are committed to additional funding of more than $60 million through 2010, subject to our performance under existing agreements, excluding milestone payments, license and commercialization fees, and royalties or profit sharing.

Collaborative revenue accounted for 63% of total revenue for the year ended December 31, 2005, 73% of total revenue for the year ended December 31, 2004, and 86% of total revenue for the year ended December 31, 2003. As a result of our recent reorganization, we expect to de-emphasize certain collaborations that are not strategic to our current market focus.

To date, we have entered into the following strategic alliances and other agreements:

Research and Development Collaborations

Syngenta

In January 1999, we entered the agricultural biotechnology arena through a strategic alliance with Syngenta Biotechnology, Inc. (formerly Syngenta Agribusiness Biotechnology Research, Inc.), referred to below as Syngenta Biotechnology. This alliance covered a multi-project collaborative research and development agreement to develop products for crop enhancement and improved agronomic performance. Under the terms of

16

the agreement, we utilized our unique discovery and screening technologies to identify and optimize genes and gene pathways for use in transgenic crops. The initial projects focused on new genomic approaches that would provide improved performance and quality traits in crops and enhance production. In conjunction with the transaction, Syngenta Biotechnology purchased 5,555,556 shares of our Series E convertible preferred stock (which converted to shares of our common stock upon completion of our initial public offering), paid a technology access fee, and provided project research funding to us, for aggregate total proceeds of $12.5 million. We recognized the research payments on a percentage of completion basis as research was performed. We recognized the technology access fee in 1999, as all the research required under the collaboration was completed by December 31, 1999. During 2000, we expanded our collaboration agreement with Syngenta Biotechnology to further develop and optimize novel synthesis routes to crop protection chemicals.

In December 1999, we formed a five-year strategic alliance with Syngenta Seeds AG, referred to below as Syngenta Seeds. Through a contract joint venture, named Zymetrics, we pursued opportunities jointly with Syngenta Seeds in the fields of animal feed and agricultural product processing. Both parties shared in the management of the venture and funded a portion of its sales and marketing costs. Under the agreement, Syngenta Seeds received exclusive, worldwide rights in the field of animal feed and project exclusive, worldwide rights in the field of agricultural product processing. Syngenta Seeds agreed to pay us $20.0 million for the rights granted under this agreement. In May 2004, we entered into an agreement with Syngenta that continued the development and commercialization of novel animal feed enzymes beyond the five-year initial term of our 1999 Zymetrics joint venture agreement. Under the agreement, Syngenta has agreed to continue its collaboration with us in the area of animal feed enzymes on an exclusive basis, paid us an exclusivity fee, and committed to continued research and development funding. As of November 30, 2004, the Zymetrics joint-venture related agreements expired in accordance with their terms; however, we are entitled a share of the profits in the form of royalties on any future product sales that result from products developed under these agreements.

In February 2003, we completed a series of transactions with Syngenta Participations AG, or Syngenta, and its wholly-owned subsidiary, Torrey Mesa Research Institute, or TMRI. Under the transactions, the companies formed an extensive research collaboration whereby we are entitled to receive a minimum of $118.0 million in research and development funding over the initial seven-year term of the related research collaboration agreement, and will be eligible to receive certain milestone payments and royalties upon product development and commercialization. Additionally, we acquired certain property and equipment from TMRI and certain licenses from Syngenta to intellectual property rights used in activities conducted at TMRI that primarily involve tools, technologies and methods relating to proteomics, metabolomics, RNA dynamics, and bioinformatics and methods to analyze and link these components of genomics or that primarily relate to TMRI’s fungal program, for use outside of Syngenta’s exclusive field as defined in the related research collaboration agreement. In consideration, we issued to Syngenta and TMRI a total of 6,034,983 shares of common stock and a warrant to purchase 1,293,211 shares of common stock at $22.00 per share that is exercisable for ten years starting in 2008. The total value of the acquisition was approximately $74.0 million, including transaction fees.

The purchase price was allocated, based upon a third party valuation, to tangible assets, consisting primarily of computer and lab equipment, and identifiable intangible assets, consisting of acquired in-process research and development, core technology, and the value associated with the research collaboration agreement. The in-process research and development was recorded as expense upon closing of the transactions. Prior to December 31, 2005, the tangible assets were being depreciated over their estimated useful lives of three to five years, the core technology was being amortized over its estimated life of fifteen years, and the value associated with the research collaboration agreement was being amortized over its estimated useful life of seven years. During the fourth quarter of 2005, in connection with our strategic reorganization, we assessed the carrying values of these assets and technologies on our balance sheet and determined that such assets and technologies were impaired. As a result we have written off the carrying value of these assets and technologies on our balance sheet as of December 31, 2005.

Either party may terminate our research collaboration agreement with Syngenta upon the other party’s material uncured breach or default in the performance of any of its obligations under the research collaboration

17

agreement or in the event the other party becomes subject to voluntary or undismissed involuntary bankruptcy or similar proceedings. In addition, our research collaboration agreement with Syngenta may be terminated by Syngenta in the event that we undergo a change of control while we are performing research under the research collaboration agreement and either the change of control transaction is with or involving any entity that is a competitor of Syngenta or its affiliates or, as a result of the change of control, Syngenta reasonably determines in its sole judgment that such change of control would have an adverse effect on our ability or the ability of the surviving entity to perform the research collaboration agreement’s research program.

In 2002, we entered into a manufacturing agreement with an affiliate of Syngenta to supply commercial quantities of Quantum phytase at a fixed price, determined by a negotiated formula, that is subject to adjustment during the term of the agreement. In addition, we are entitled to receive royalties from Syngenta on their sales of Quantum phytase.

Revenue recognized under the Syngenta agreements was $24.3 million, $36.9 million, and $29.2 million for the years ended December 31, 2005, 2004 and 2003.

DuPont Bio-Based Materials

In 2003, we entered into a six-year alliance with DuPont Bio-Based Materials to discover and develop novel biocatalysts for the production of fuel ethanol, 1,3 propanediol, and other added-value chemicals from renewable resources such as corn and biomass. The program with DuPont, referred to as an “Integrated Corn-Based Biorefinery” program, is part of a grant consortium funded by the U.S. Department of Energy to develop a biorefinery capable of producing high-value chemical products from biomass. DuPont is expecting to receive $19 million in matching funds from the U.S. Department of Energy over four years. Under our collaboration agreement with DuPont regarding this biorefinery program, we have received research funding, as well as milestone payments, and we are entitled to additional milestone payments as well as royalties on any new products developed under the agreement that incorporate our technologies.

Cargill Health and Food Technologies

In 2005, we signed a collaboration agreement with Cargill Health and Food Technologies to discover and develop novel enzymes for the cost-effective production of a proprietary Cargill product. Under the terms of the agreement, we received upfront payments and research funding, and we are entitled to receive milestone payments, license fees, and royalties on products that may be developed under the agreement.

Bayer Animal Health

In December 2003, we formed a collaboration with Bayer Animal Health to develop and market products to prevent infectious diseases in fish. Under the agreement, we collaborated to complete the development and registration of an existing pipeline of microbially-produced vaccine candidates for aquaculture previously developed by a Bayer venture. Under the agreement, we were responsible for developing and manufacturing these microbially-produced vaccine candidates, which were to be marketed and distributed by Bayer in designated countries on an exclusive basis. We completed the registration of and launched commercially the first vaccine product under this agreement, Bayovac®-SRS, in Chile in 2004 and advanced the development of a number of additional vaccine candidates. In January 2006, pursuant to a corporate reorganization, we announced our intention to discontinue further investment in the development of these additional vaccine candidates. We intend to continue to sell Bayovac®-SRS in Chile and to continue to explore opportunities to sell this product in other markets.

Merck & Co., Inc.

In December 2004, we entered into an agreement with Merck & Co., Inc. to collaborate on the development of therapeutic antibodies for a key target by applying our proprietary MedEv™ platform. Under the terms of the

18

agreement, we received an upfront payment and received research funding. In mid-2005, we amended this agreement to provide for additional research and development activities as well as terms for additional research funding, milestone payments, and royalties.

DSM Pharma Chemicals

In December 2003, we entered into a collaborative agreement with DSM Pharma Chemicals to discover and develop biocatalytic solutions designed to simplify and lower the cost of a variety of chemical transformations. Under the terms of the agreement, DSM will identify targeted chemical conversions, we will work to develop appropriate biocatalysts, and DSM will scale-up these processes to manufacture pharmaceutical intermediates and active ingredients. We receive research payments and are entitled to milestones and royalties on products commercialized by DSM.

The Dow Chemical Company

From 1997 to 2000, we entered into a number of collaboration and license agreements with The Dow Chemical Company, or Dow, involving various industrial enzyme research and development programs and products. In June 2000, we formed a 50/50 joint venture with Dow, named Innovase LLC, to develop and commercialize innovative products for the industrial enzyme market segment. Under the various joint venture related agreements, we received exclusivity fees, technology development fees, and research and development payments. We were also required to fund certain operating expenses of the joint venture, excluding certain expenses for which Dow was responsible under the joint venture agreement.

In December 2003, we signed a definitive agreement with Dow to restructure the Innovase joint venture. Under the terms of the restructuring agreement, rights to all products and product candidates developed by Innovase were conveyed to us, and the companies mutually agreed to terminate all exclusivity and non-competition arrangements for the industrial enzyme fields related to the Innovase joint venture. Dow divested its 50% ownership interest to us and paid us $5.0 million. All joint venture related agreements involving Dow and us were terminated.

Revenue recognized under the Dow agreements was $1.8 million and $10.7 million for the years ended December 31, 2004 and 2003. No revenue was recognized under any of the Dow agreements for the year ended December 31, 2005, as such agreements expired prior to such time.

Givaudan S.A.

In November 2004, we entered into a license agreement with Givaudan S.A. for Accentuase™-G enzyme, a novel enzyme product that significantly improves the efficient production of a natural flavor ingredient. As of the date we licensed this enzyme to Givaudan, the new proprietary biocatalytic process incorporating Accentuase-G enzyme had been successfully scaled up by Givaudan for commercial production. Under the terms of the collaborative agreement initiated in January 2002, we received a license fee and became entitled to receive royalties from Givaudan’s sales or use of the flavor ingredient. We also manufacture the enzyme product for Givaudan under a supply agreement entered into concurrently with this license. In 2005, we amended our license agreement with Givaudan to eliminate our right to receive royalties on Givaudan’s sales or use of the flavor ingredient in exchange for a one-time payment.

Government Grants and Contracts

To date we have received grants contracts for more than $25.0 million in funding from a number of government agencies, including the U.S. Department of Defense, the U.S. Department of Energy, and the National Institutes of Health. Revenue related to government grants and contracts was $10.1 million, $10.2 million, and $3.9 million for the years ended December 31, 2005, 2004, and 2003. As a result of our recent reorganization, we expect to de-emphasize grants and contracts that are not strategic to our current market focus.

19

Manufacturing, Supply, and Distribution Agreements

Danisco Animal Nutrition

In May 1996, we entered into a collaboration agreement with Danisco Animal Nutrition (formerly Finnfeeds International Ltd) to jointly identify and develop a novel phytase enzyme that when used as an additive in animal feed applications allows higher utilization of phytic acid phosphates from the feed, thereby increasing its nutritional value. The addition of phytase to animal feed reduces the need for inorganic phosphorus supplementation and lowers the level of harmful phosphates that are introduced to the environment through animal waste, resulting in inorganic phosphate cost savings and a significant reduction in environmental pollution. Following the completion of the initial objectives of our agreement with Danisco, in December 1998, we entered into a license agreement with Danisco to commercialize an enzyme developed under the collaboration agreement. Under the terms of the license agreement, we granted Danisco an exclusive license to manufacture, use, and sell the developed enzyme. In consideration for the license, we are paid a royalty on related product sales made by Danisco equal to 50% of the cumulative profits generated by Danisco on such sales. In March 2003, the FDA approved Phyzyme XP Animal Feed Enzyme, which we developed in collaboration with Danisco. Additionally, we entered into a manufacturing agreement with Danisco to supply commercial quantities of Phyzyme XP at our cost to manufacture such quantities. Revenue recognized from transactions with Danisco, including contract manufacturing performed on behalf of Danisco, was $5.2 million, $2.0 million, and $2.0 million for the years ended December 31, 2005, 2004, and 2003.

Valley Research, inc.

In 2005, we signed, and later amended, a distribution agreement with Valley Research, inc. (“Valley”) covering our Ultra-Thin alpha amylase enzyme and potentially additional enzyme products. Under the amended agreement, we appointed Valley as our exclusive distributor in the United States for Ultra-Thin enzyme for ethanol and high fructose corn sweetener applications, subject to certain limitations, and subject to certain conditions required to be met for such exclusivity to be maintained. The term of this distribution agreement regarding Ultra-Thin enzyme is for a period of five years following regulatory approval of such enzyme by the FDA’s Center for Veterinary Medicine, which approval was obtained on February 24, 2006.

License or Other Acquisition Agreements

In addition to our strategic alliances, we have entered into various agreements whereby we have in-licensed or otherwise acquired patented technologies to supplement our internally developed technologies, the most significant of which we have outlined below.

Terragen Discovery, Inc.