UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008; or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-29173

VERENIUM CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 22-3297375 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 55 Cambridge Parkway, Cambridge, MA | | 02142 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (617) 674-5300

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ Nox

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ Nox

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

| | |

| Large accelerated filer ¨ | | Accelerated filer x |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of June 30, 2008 was $50.0 million.*

The number of shares outstanding of the Registrant’s common stock was 74,009,371 as of March 12, 2009. The Registrant has no non-voting stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the Registrant’s Annual Meeting of Stockholders to be filed with the Commission on or before April 30, 2009 are incorporated by reference into Part III of this annual report on Form 10-K. With the exception of those portions that are specifically incorporated by reference into this annual report on Form 10-K, such proxy statement shall not be deemed filed as part of this report or incorporated by reference herein.

| * | Based on the closing price of the Registrant’s common stock on the Nasdaq Global Market on June 30, 2008 of $1.93 per share. Excludes the common stock held by executive officers, directors and stockholders whose ownership exceeded 10% of the common stock outstanding at June 30, 2008. This calculation does not reflect a determination that such persons are affiliates for any other purposes. |

VERENIUM CORPORATION

FORM 10-K

For the Year Ended December 31, 2008

INDEX

Forward Looking Statements

This report contains statements that are “forward-looking” and involve a high degree of risk and uncertainty.

Forward looking statements applicable to our business generally include statements related to:

| | • | | our estimates regarding market sizes and opportunities, as well as our future revenue, product revenue, profitability and capital requirements, |

| | • | | the length of time that we will be able to fund our operations with existing cash and cash commitments; |

| | • | | our expected cash needs, our ability to manage our cash and expenses and our ability to access future financing; |

| | • | | the expected benefits of our strategic partnership with BP; |

| | • | | our ability to continue as a going concern; |

| | • | | our expected future research and development expenses, sales and marketing expenses, and selling, general and administrative expenses; |

| | • | | the effects of governmental regulation and programs on our business and financial results; |

| | • | | our plans regarding future research, product development, business development, commercialization, growth, independent project development, collaboration, licensing, intellectual property, regulatory and financing activities; |

| | • | | our products and product candidates under development; |

| | • | | investments in our core technologies and in our internal product candidates; |

| | • | | the opportunities in our target markets and our ability to exploit them; |

| | • | | our plans for managing the growth of our business; |

| | • | | the benefits to be derived from our current and future strategic alliances; |

| | • | | our anticipated revenues from collaborative agreements, grants and licenses granted to third parties and our ability to maintain our collaborative relationships with third parties; |

| | • | | our ability to repay our outstanding debt (including in connection with any “make-whole” payments that may be due upon conversion of our 2008 Notes); |

| | • | | the impact of dilution to our shareholders and a decline in our share price and our market capitalization from future issuances of shares of our common stock; |

| | • | | our exposure to market risk; |

| | • | | the impact of litigation matters on our operations and financial results; and |

| | • | | the effect of critical accounting policies on our financial results. |

Forward looking statements applicable to our biofuels business include statements related to:

| | • | | potential growth in the use of ethanol, including cellulosic ethanol, the economic prospects for the ethanol industry and cellulosic ethanol and the advantages of cellulosic ethanol versus ethanol and other fuel sources; |

| | • | | the continued development of our pilot facility; |

| | • | | the optimization of our demonstration-scale facility and our plans to prove the economic and commercial viability of our cellulosic ethanol production process by the end of 2009; |

| | • | | the financing, development and construction of commercial-scale cellulosic ethanol facilities; |

1

| | • | | our ability to use multiple feedstocks to produce cellulosic ethanol; |

| | • | | our expectations regarding funding amounts from the U.S. Department of Energy; and |

| | • | | the implied value of our biofuels business model. |

Forward looking statements applicable to our specialty enzymes business include statements related to:

| | • | | our ability to increase or maintain our product revenue and improve or maintain product gross margins; and |

| | • | | our ability to maintain good relationships with the companies with whom we contract for the manufacture of certain of the products in our specialty enzymes business. |

Such statements are prospective, are only predictions and reflect our expectations and assumptions as of the date of this annual report on Form 10-K based on currently available operating, financial, and competitive information. The actual events or results may differ materially from those projected in such forward-looking statements. Risks and uncertainties and the occurrence of other events could cause actual events or results to differ materially from these predictions. The risk factors set forth below in Item 1A entitled “Risk Factors” should be considered carefully in evaluating us and our business. These forward-looking statements speak only as of the date of this annual report on Form 10-K. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

We use market data and industry forecasts throughout this report. We have obtained this information from internal surveys, market research, publicly available information, and industry publications. Industry publications generally state that the information they provide has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. Similarly, we believe that the surveys and market research we or others have performed are reliable, but we have not independently verified this information. We do not represent that any such information is accurate.

Trademarks

Cottonase, DirectEvolution, Fuelzyme, GigaMatrix, Luminase, PathwayLibraries, Purifine, Phyzyme, Pyrolase, are our registered trademarks. Celunol, Diversa, GeneReassembly, Gene Site Saturation Mutagenesis, GSSM, SingleCell, Tunable GeneReassembly, Verenium and are our trademarks. Phyzyme is a trademark of Danisco Animal Nutrition. Quantum is a trademark of Syngenta Animal Nutrition. Bayovac is a trademark of Bayer Animal Health. This report also refers to trade names and trademarks of other organizations, each of which is the property of its respective owner.

PART I

Overview

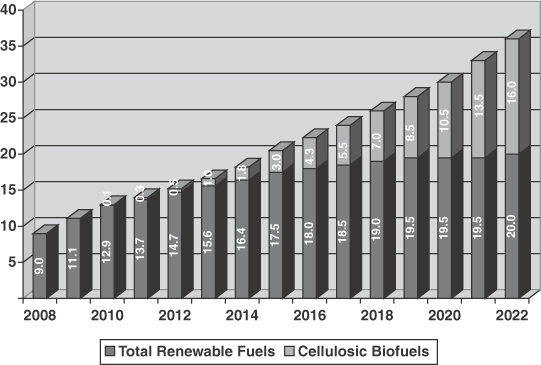

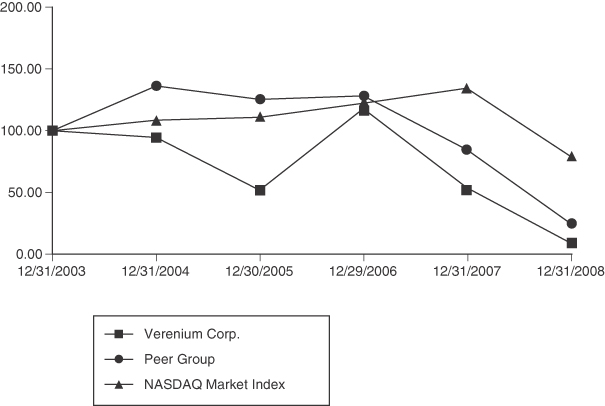

We were incorporated in Delaware in December 1992 under the name Industrial Genome Sciences, Inc. In August 1997, we changed our name to Diversa Corporation. On June 20, 2007, we completed a merger transaction with Celunol Corp. The combined company was renamed Verenium Corporation. We possess a portfolio of specialty enzyme products and are developing technical and operational capabilities designed to enable the production of low-cost, biomass-derived sugars for a number of major industrial applications, including the commercialization of advanced biofuels. In connection with the corporate name change, we also changed our NASDAQ ticker symbol from “DVSA” to “VRNM” and began trading under the new ticker symbol effective June 21, 2007.

2

We operate in two business segments, biofuels and specialty enzymes. Our biofuels business segment operates through our wholly-owned subsidiary, Verenium Biofuels Corporation, and is focused on developing unique technical and operational capabilities designed to enable the production and commercialization of biofuels, in particular ethanol produced from cellulosic biomass. We believe the most significant near-term commercial opportunity for our biofuels business segment is the large-scale commercial production of cellulosic ethanol derived from multiple biomass feedstocks, with our initial focus on energy canes and grasses. Our specialty enzymes segment develops high-performance enzymes for use within the alternative fuels, specialty industrial processes, and animal nutrition and health markets to enable higher throughput, lower costs, and improved environmental outcomes. We believe the most significant near-term commercial opportunity for our specialty enzymes business segment will be derived from continued sales, and gross product margins from our existing portfolio of enzyme products.

Our biofuels and specialty enzymes businesses are both supported by a research and development team with expertise in gene discovery and optimization, cell engineering, bioprocess development, biochemistry and microbiology. Over the past 16 years, our research and development team has developed a proprietary technology platform that has enabled us to apply advancements in science to discovering and developing unique solutions in complex industrial or commercial applications. We have dedicated substantial resources to the development of our proprietary technologies, which include capabilities for sample collection from the world’s microbial populations, generation of DNA libraries, screening of these libraries using ultra high-throughput methods capable of analyzing more than one billion genes per day, and optimization based on our gene evolution technologies. We have continued to shift more of our resources from technology development to commercialization efforts for our existing and future technologies and products. While our technologies have the potential to serve many large markets, our primary areas of focus for product development are (i) integrated solutions for the production of advanced biofuels, such as cellulosic ethanol, and (ii) specialty enzymes for alternative fuels, specialty industrial processes, and animal nutrition and health. We have current collaborations and agreements with market leaders, such as BP Biofuels North America LLC, or BP, Bunge Oils, Cargill Health and Food Technologies, and Syngenta AG, each of which complement our internal technology and product development efforts.

We expect to continue to invest in these commercialization efforts, primarily in the area of biofuels. We believe this will not only benefit our mission to advance the commercialization of cellulosic ethanol within our biofuels business unit, but will also enable us to create additional enzyme market opportunities that are focused on external applications for the broader biofuels industry.

To advance our efforts to accelerate technology development and commercialization of cellulosic ethanol, we have partnered with BP in two joint ventures. The first joint venture commenced in August 2008, and is focused on the further development and validation of our first-generation cellulosic ethanol technology, which will be deployed in our first commercial facility. The second joint venture commenced in February 2009, and will serve as the commercial entity for the deployment of cellulosic ethanol technology being developed and proven under the first joint venture. We recently announced plans to build our first 36 million gallons-per-year (MGY) commercial cellulosic ethanol plant in Highlands County, Florida. We, with BP, expect to break ground on this plant in 2010, and to begin producing cellulosic ethanol from this facility in 2012. The primary focus of our second joint venture with BP is to progress the development of this facility, as well as the development of a second potential commercial site on the Gulf Coast which was contributed to the joint venture, and to create future opportunities for leveraging cellulosic ethanol technologies.

We have a substantial intellectual property estate comprising more than 250 issued patents and more than 350 patent applications as of March 12, 2009. We believe that we can leverage our intellectual property estate to enhance and improve our technology development and commercialization efforts across both business units while maintaining protection of our key intellectual property assets.

3

Our Strategy

The key elements of our corporate strategy are to:

Develop integrated solutions for the emerging cellulosic ethanol industry for use in production facilities that we own and operate, individually or jointly with partners, as well as those of third-party licensees. We intend to use our leadership position to develop novel, high-performance enzymes and to advance our technology and process development capabilities, together with BP, at our pilot and demonstration-scale facilities in Jennings, Louisiana to exploit opportunities in the developing market for the production of cellulosic ethanol. We have established our business model based upon the belief that owning and managing cellulosic ethanol production facilities in conjunction with strategic partners, including BP, will allow us to create economic value by incorporating our scientific and engineering skills into the production facilities. Through our Galaxy Biofuels LLC, or Galaxy, joint venture with BP, we may also license our proprietary technology to extend our commercial reach and accelerate our market penetration.

Establish a sustainable, high-growth, profitable specialty enzyme business. Our specialty enzyme products and product candidates target high-value applications where we believe our enzyme discovery and optimization technologies can deliver superior, proprietary solutions. We believe our combination of independent and partnered products is positioned to generate substantial product revenues at attractive gross profit margins. In 2008 we generated approximately $49 million in such revenues, an increase of nearly 90% over 2007. We hope to achieve increased product sales and profit margins to support the future growth and profitability of our portfolio of products sold directly by us and by our partners.

The key elements of our strategy within our biofuels business are to:

Provide an end-to-end solution for the production of cellulosic ethanol from a broad variety of biomass feedstocks for incorporation into our facilities and those of third-party licensees. We are developing fully-integrated cellulosic ethanol production capabilities at our pilot and demonstration-scale facilities in Jennings, Louisiana to validate our production economics. We believe this will support commercial development of cost-effective end-to-end solutions for the production of ethanol from a variety of feedstocks, comprising:

| | • | | pre-treatment of biomass to make the biomass fibers accessible to enzymes; |

| | • | | enzyme cocktails to break down biomass to its constituent five-carbon and six-carbon sugars; and |

| | • | | fermentation organisms to convert the two types of sugars into fuel ethanol. |

We intend to use our integrated solutions, our ongoing research and development efforts, and our process improvements to support our strategy to own and manage, together with strategic partners including BP, cellulosic ethanol production facilities in the United States, and to make our technologies and know-how available to potential licensees throughout the world.

Be a leader in developing a cost-effective multi-feedstock commercial cellulosic ethanol production process. We believe that early cellulosic ethanol commercialization could provide significant benefits in setting standards for the emerging cellulosic ethanol industry, giving us access to worldwide business opportunities, and attracting important scientific and business talent, among other potential benefits. While our costs of production of cellulosic ethanol may initially be higher than ethanol produced from sugar, a combination of significantly lower feedstock costs for cellulosic biomass, as well as production process cost improvements have the potential to substantially reduce total production costs for cellulosic ethanol to levels well below that of ethanol produced from grain such as corn. Corn is currently the primary feedstock for ethanol production in the United States.

Be the market leader in the design, development and operation of cellulosic ethanol production plants in the United States. Through partnered and joint venture project development and ownership, we intend to advance a pipeline of commercial-scale cellulosic ethanol projects in the United States that we will own and operate, either independently or with other financial and operational partners, such as BP. We plan to develop cellulosic ethanol

4

projects in conjunction with strategic partners who will enhance the competitiveness and ability to finance ethanol projects. Our early joint development strategy is focused on projects with strategic partners who bring financial resources and/or key supplies or services to project development such as feedstocks, sites, agricultural resources, on-site biomass boiler facilities or ethanol off-take agreements.

The key elements of our strategy within our specialty enzyme business are to:

Deploy our enzyme technologies across diverse markets that represent unique and large commercial opportunities. We use our enzyme technologies to develop commercial solutions for a broad range of applications within the three focus areas for our enzyme business—alternative fuels, specialty industrial processes, and animal nutrition and health. These markets are largely served by a small number of large, well-established providers. We attempt to work collaboratively with those large industrial companies to develop differentiated, high performance enzyme solutions for their target markets, and to leverage their well-developed distribution capabilities to better exploit commercial opportunities. We believe that this multiple-market approach gives us the ability to broadly apply our unique enzyme development and manufacturing capabilities while minimizing commercialization risk.

Pursue corporate partnerships to enable the development of a broad portfolio of enzyme products and commercialize additional enzyme products. To date, we have commercialized 12 products independently and four products with our partners. We also have a pipeline of early- to late-stage product candidates that could be commercialized in the next several years, some of which may depend upon incremental investment from a strategic partner or partners.

We have identified key market segments where we hope to develop enzyme products through strategic partnerships. Our established criteria for entering into such partnerships include:

| | • | | commercial revenue opportunity and novelty of the product(s); |

| | • | | estimated time to market; |

| | • | | infrastructure requirements; industry-specific expertise necessary for successful commercialization; and |

| | • | | sufficiency of financial resources to fund development and commercialization efforts. |

We believe that partnerships will allow us to utilize our partners’ marketing and distribution networks, share the investment risk, and access additional resources to expand our product portfolio and market opportunities. In entering these agreements, we have typically sought to obtain a combination of technology access fees, research support payments, milestone payments, license or commercialization fees, and royalties or profit sharing income from the commercialization of products resulting from these alliances.

Protect and enhance our technology leadership position for the development of novel enzymes. We believe that our particular scientific, manufacturing, process engineering and technology capabilities represent a significant, sustainable competitive advantage which we expect to maintain and extend. These capabilities include an end-to-end enzyme product solution, consisting of:

| | • | | access to novel genetic material; |

| | • | | several technologies capable of screening more than a billion genes per day; |

| | • | | multiple evolution technologies for optimizing enzymes; |

| | • | | manufacturing know-how and capabilities; and |

| | • | | development of heterologous expression systems which allow for a broader range of organisms from which to develop product candidates. |

5

Our Business Segments—Biofuels and Specialty Enzymes

Our Biofuels Business

Biofuels Industry Overview

Biofuels are liquid fuels derived from agricultural and other natural or renewable sources. These fuels are used to complement the world’s supply of petroleum and other fossil fuels. A variety of factors contribute to an increasing awareness of and demand for biofuels including, but not limited to, the following:

| | • | | Macroeconomic factors affecting the global supply of, demand for and price of oil, including significantly increased demand for oil from developing countries whose economies are growing at high rates, such as China and India, coupled with uncertain supplies of oil from sources throughout the world; |

| | • | | Policies and initiatives developed across the world aimed at reducing dependence on imported sources of oil, particularly from countries and regions that have exhibited the greatest level of instability; |

| | • | | Increasing awareness and incorporation of “flexible fuel vehicles,” or FFVs, into the world auto supply that are capable of operating on a wider variety of blends of gasoline and ethanol; and |

| | • | | Broadening development of the required infrastructure to support the use of fuel ethanol, including expansion of distribution channels and retrofitting wholesale and retail points of distribution. |

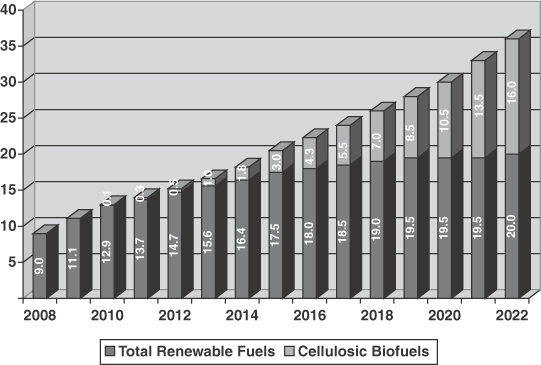

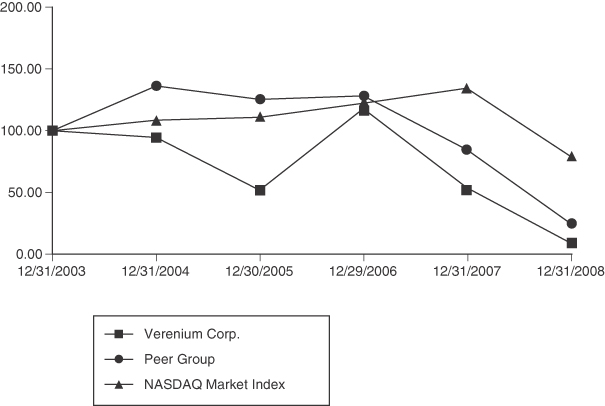

The Energy Independence and Security Act of 2007, or EISA, was signed into law in 2007 and amended the Renewable Fuels Standard, or RFS, which was established in 2005. The RFS now mandates minimum annual usage of 9 billion gallons of renewable fuel in 2008, growing to 36 billion gallons by 2022. This includes 100 million gallons of cellulosic ethanol beginning in 2010 increasing to 16 billion gallons by 2022. At current ethanol prices of approximately $1.65 to $1.90 per gallon, this would translate into an addressable market of at least $26 billion annually, not including market opportunities for cellulosic ethanol outside of the United States.

6

The figure below details the mandated United States consumption of biofuels as provided for by the EISA.

Figure 1: United States Mandated Renewal Fuels Production (Billions of Gallons)

Source: Renewable Fuels Association; www.ethanolRFA.org

Many industry experts, including the Renewable Fuels Association, or RFA, believe corn-based ethanol production growth will continue to its natural limit of 12 to 15 billion gallons per year, in annual production. United States-based demand for ethanol is expected to meet, if not exceed, this production supply for reasons that include the following:

| | • | | Strong legislative and government policy support—As stated above, the Energy Independence and Security Act of 2007 mandates minimum annual renewable fuel usage of 36 billion gallons per year by 2022, including 16 billion gallons of cellulosic biofuels. |

| | • | | Expansion of gasoline supply—By blending ethanol into gasoline, refiners can expand the volume of fuel available for sale especially when refinery capacity and octane sources are limited. We believe that increased pressure on domestic fuel refining capacity will result in greater demand for ethanol. |

| | • | | Favorable tax treatment—One factor contributing to ethanol’s attractive economics is the availability of a federal excise tax credit available to blenders/retailers, known as the volumetric ethanol excise tax credit, or VEETC. The credit is currently set at $0.45 per gallon and is scheduled to expire on December 31, 2010. In addition, the Farm, Energy and Conservation Act of 2008 instituted a $1.01 per gallon cellulosic biofuels production credit, inclusive of the VEETC. This credit is set to expire on December 31, 2012. As currently structured, the $0.56/gallon difference between the $1.01 credit and the VEETC is payable directly to producers; in the event the VEETC expires, the full credit will become payable to producers. |

| | • | | Environmental benefits—Ethanol, as an oxygenate, reduces tailpipe emissions when added to gasoline. The additional oxygen in the ethanol results in a more complete combustion of the fuel in engine |

7

| | cylinders, resulting in reduced carbon monoxide and nitrogen oxide emissions. Prior federal programs that mandated the use of oxygenated gasoline in areas with high levels of air pollution spurred widespread use of ethanol in the United States. |

| | • | | Geopolitical concerns—The United States currently imports up to 65% of its oil needs, a dependency that is expected to continue. Political unrest and attacks on oil infrastructure in the major oil-producing nations, particularly in the Middle East, have periodically disrupted the flow of oil, which has added a “risk premium” to world oil prices. At the same time, developing nations such as China and India have substantially increased their demand for oil. As a domestic, renewable source of energy, ethanol can help to reduce American dependence on foreign oil. |

| | • | | Ethanol as a gasoline substitute—Ethanol’s role in the United States is gradually shifting from that of an oxygenate/gasoline additive to a true gasoline complement/replacement. Most ethanol currently produced in the United States is used in a fuel blend of 10% ethanol and 90% gasoline called E10, which is used as an oxygenate/fuel additive. Further, during 2009, the US Environmental Protection Agency will evaluate a request from numerous grain ethanol producers to increase the maximum blend level in gasoline to as high as 15 percent. Automakers in the United States have been accelerating their work with FFV programs, according to the National Ethanol Vehicle Coalition (NEVC), resulting in an expanded fleet of vehicles capable of using a fuel blend of 85% ethanol and 15% gasoline, or E85. E85 contains significantly more ethanol than E10. Future widespread adoption of FFV’s could significantly increase ethanol demand and reduce the consumption of gasoline; however, widespread use of E85 in the United States is currently constrained by the lack of a broad distribution infrastructure and limited availability of FFVs. If more vehicles and service stations become E85 capable, this could act as a significant driver of United States ethanol consumption. While the push for E85 has lost momentum over the recent year due in large part to financial distress in the United States auto industry, the Obama Administration has considered support for a mandate for a minimum number of FFV’s by 2012. |

The Case for Cellulosic Ethanol

Of all of the alternative fuels produced biologically or from biomass, known as biofuels, that are sold or are being developed, we believe the most significant market is that for fuel ethanol. Within the fuel ethanol market, we believe the most attractive current or future opportunities for our biofuels business are for fuel ethanol derived from cellulosic (plant) biomass, otherwise known as “cellulosic ethanol.”

Fuel ethanol has historically been produced commercially in the United States by processing sugars derived from the starch within a grain source, such as corn kernels, and then fermenting these sugars into ethanol. Recent studies suggest that, even if all United States corn production were dedicated to ethanol production, this would still not match total gasoline demand. Other studies and news articles suggest that, well before this level of production could be achieved, the price of corn would begin to negatively impact the costs of animal feed and food based on corn. This has led to an active, public debate of the relative merits of additional corn-based production of fuel ethanol.

An alternative that seeks to meet the need for additional sources of liquid fuels while addressing many of the challenges presented by corn-based ethanol involves the production of fuel ethanol from cellulosic biomass, or cellulosic ethanol. Cellulosic biomass, either agricultural waste or crop residues, such as plant stalks, stems, or leaves, or crops grown specifically for their energy content rather than for their use as food or feed sources, presents an abundant alternative source of sugars that can be converted into ethanol. Examples of cellulosic biomass suitable for conversion to ethanol (or biofuel) include sugarcane bagasse, energy cane, sorghum, switchgrass, wood chips, and corn stover. The production of ethanol from cellulosic biomass offers expected advantages over corn-based ethanol production including:

| | • | | Low-cost, abundant sources of feedstocks that have no competitive food use—According to a joint report of the Department of Energy, or DOE, and the United States Department of Agriculture, or USDA, issued in 2005, land resources in the United States are capable of producing a sustainable |

8

| | supply of 1.3 billion tons per year of cellulosic biomass. The same report concluded that 1 billion tons of cellulosic biomass would be sufficient to displace 30% or more of the present petroleum consumption in the United States. In addition, according to an analysis by the Natural Resources Defense Council published in 2004, cellulosic biofuels could supply more than half of current transportation fuel needs in the United States by 2050, without decreasing the production of food and animal feed. |

| | • | | Ability to use lands unsuited to food agriculture—Many biomass crops can be grown on lands that are degraded, fallow or in pasture, in use for low-value agricultural crops, or otherwise unsuited for use in food crop agriculture. The production of biomass crops on such lands can relieve pressure on the diversion of prime agricultural lands, best suited for food production, into production of grain ethanol feedstocks. |

| | • | | Higher yields per acre: The use of high-biomass crops can result in significantly higher yields of ethanol, on a per-acre basis, than can be achieved using conventional grain ethanol technology. This yield advantage can result in significantly lower total land requirements, and reduce the pressure for conversion of lands into agriculture, a source of considerable controversy in the environmental community. |

| | • | | Reduced susceptibility to volatile commodity price risks—We believe that most biomass feedstocks can be obtained at lower cost and on more favorable contractual terms compared to the cost of corn feedstock. In addition, many cellulosic feedstocks contain lignin (the high energy component of plant biomass) which could be used to reduce operating costs by eliminating or reducing the use of natural gas and other external fuel sources. We expect that cellulosic ethanol production will entail much less exposure to market and commodity risks such as volatile prices for corn, natural gas, transportation, and corn by-products. |

| | • | | Superior carbon emissions profile that benefits the environment—Cellulosic ethanol is expected to produce less harmful greenhouse gas emissions than corn ethanol and gasoline. According to a report by Argonne National Laboratory, corn ethanol reduces greenhouse gas by 18% to 29% per vehicle mile traveled as compared to gasoline, while cellulosic ethanol reduces greenhouse gas emissions by approximately 85% per vehicle mile traveled. Other advantages of cellulosic ethanol may include realizing additional revenues through the sale of carbon credits given the substantially improved carbon emission profile of cellulosic ethanol. |

| | • | | Proximity to end-user markets—Cellulosic ethanol production facilities will not need to be located near corn allowing their facilities to be possibly located closer to end-user markets, potentially reducing transportation costs. |

While the cost-effective production of ethanol from cellulosic biomass has historically proven challenging using traditional technologies and methodologies, recent advances in the emerging industrial biotechnology industry relating primarily to the development and application of novel, high-performance enzymes and robust fermentation organisms have provided the industry with powerful new tools to address this objective. To date, there is no process that has been commercialized to make cellulosic ethanol cost-effectively. Nonetheless, a number of companies, academic or government institutions, and other non-profit organizations are actively pursuing one or more aspects of the production process, each seeking to provide economical solutions to enable the development and growth of the cellulosic ethanol market.

Generally speaking, efforts to convert cellulose into ethanol follow one of three main processes:

| | • | | thermochemical conversion of biomass into synthesis gas or “syngas” (a process often referred to as “gasification”), followed by catalytic conversion of the syngas into mixed alcohols that include ethanol and/or alkalines via modified chemistry; |

| | • | | thermochemical conversion of biomass into syngas, followed by biological conversion of the syngas into ethanol; or |

| | • | | enzymatic or chemical breakdown of biomass into component sugars, followed by biological fermentation of the sugars into ethanol. |

9

We have selected enzymatic breakdown of biomass for producing ethanol from cellulose because we believe it has distinct advantages over the thermochemical/gasification methods. Gasification methods present a number of challenges, including the capital intensity of the process, selectivity of the syngas conversion to ethanol, and alcohol tolerance of the organisms capable of converting syngas to ethanol. Furthermore, we believe that our abilities in enzymology, microbiology and process engineering provide a skill-set and foundation for us to successfully pursue an economically viable process for cellulosic ethanol production through enzymatic breakdown of biomass.

Our Process For Ethanol Production

Our process to produce ethanol from cellulosic material is illustrated below:

Figure 2: Process for Cellulosic Ethanol Production

Our process for producing cellulosic ethanol contains the following steps. While several steps are generic to other forms of ethanol production, there are three important steps (steps 4, 5 and 6, below) that we believe are unique to us and are accomplished by us in proprietary ways. The principal steps are as follows:

| | 1. | Biomass is delivered to the facility for storage; |

| | 2. | Biomass is prepared for processing based on its specific physical and chemical characteristics; |

| | 3. | Biomass undergoes mild acid hydrolysis and steam explosion to break down plant matter; |

| | 4. | Hemicellulose, in the form of syrup containing xylose and other C5 sugars, is drawn off for processing |

| | • | | C5 sugars are fermented using our proprietary, engineered E. coli bacterium, yielding a broth containing ethanol, referred to as “beer”; |

| | 5. | Residue, in the form of a semi-solid mixture of cellulose and lignin, is sent for further processing |

| | • | | Cellulose is hydrolyzed into C6 sugars using proprietary enzyme cocktails. C6 sugars are simultaneously fermented using a proprietary engineered bacteria. The C6 fermentation process also yields ethanol referred to as “beer”; |

| | 6. | Proprietary enzymes are produced on site which are optimized for a given biomass source to be used in Step 5; |

10

| | 7. | Beer from steps (4) and (5) is collected prior to distillation; |

| | 8. | Beer is distilled into high-grade ethanol through the removal of water and residues; |

| | 9. | Lignin-rich residue from distillation, or stillage, is burned, yielding steam for the process; and |

| | 10. | High-grade ethanol is ready for shipment to market. |

We have employed this process only in small-scale production, including in our laboratories and at our pilot- and demonstration-scale plants in Jennings, Louisiana. We can not guarantee that this process will be effective or efficient for commercial production.

We believe that the following elements of our planned production process will provide us with benefits over existing ethanol production processes:

| | • | | the ability to process both C5 and C6 sugars results in conversion rates in excess of 70% of the available carbohydrates in biomass material—leading to higher productivity per ton of input than other processes that convert only C6 sugars. We expect that this higher productivity will translate into lower feedstock costs for a targeted level of facility output (see Step 4 above); |

| | • | | our growth of a proprietary strain of fungus is designed to optimize ethanol production from a given biomass source (see Step 6 above). |

We have an exclusive worldwide license to use, develop and commercially exploit the ethanol production patent estate of the University of Florida Research Foundation, Inc., or UFRFI, numerous United States and foreign patents and patent applications and other related proprietary ethanol technology, and any extensions and improvements thereof for the production of ethanol, all of which is referred to herein as the UFRFI technology.

Our Biofuels Research and Technology

Our patented and proprietary technology and process know-how enable our production of fuel-grade ethanol from low-cost, abundant cellulosic biomass materials, such as agricultural and forestry wastes, dedicated energy crops, and wood. Our technology enables the release and fermentation of sugars in both cellulose and hemicellulose, promoting a high conversion rate of available sugars in a wide range of biomass feedstocks. Competing processes for producing cellulosic ethanol have focused on a single feedstock or only on particular sugars contained in a particular feedstock.

We currently conduct our research activities at our centralized research and development facility in San Diego, as well as at our pilot plant in Jennings, Louisiana. We have successfully conducted laboratory tests on a wide range of feedstocks to produce ethanol including sugar cane bagasse, energy cane, sorghum, corn fiber, sugar beet pulp, citrus pulp and citrus peels, wood wastes, such as saw and pulp mill waste, forestry wastes, such as hardwood and softwood thinnings, rice hulls, rice straw, and corn stover, and urban wastes, such as the paper portion of municipal solid waste and municipal green wastes. We believe our success in laboratory testing of a wide range of feedstocks will provide us the flexibility to utilize an array of feedstocks in our production process. Due to this feedstock flexibility, we believe we will be able to locate facilities in a variety of different geographic markets and, in many cases, closer to end-user markets.

In 2007, we completed a significant upgrade of our cellulosic ethanol pilot plant. We believe that this pilot plant is among the nation’s first pilot-scale cellulosic ethanol plants, and is a key asset of our on-going research and development program, providing us with the opportunity to refine production processes and validate our technology. In 2008, we completed construction of a 1.4 million gallons-per-year (MGY) demonstration plant on the same site, and in February 2009, we completed the commissioning of this facility. We plan to optimize the facility throughout 2009, and seek to have proven the economic and commercial viability of our cellulosic ethanol production process by the end of the year. We believe our demonstration-scale cellulosic ethanol facility

11

represents one of the first of its kind in the United States. Further, we believe that our combined pilot and demonstration plant facilities will enable us to refine our production processes in advance of building, or partnering with others to build, commercial-scale cellulosic ethanol production facilities. Both the pilot plant and the demonstration plant are located at a site we own in Jennings, Louisiana.

Our Strategic Partnership with BP

We have entered into a strategic partnership with BP to accelerate the development and commercialization of cellulosic ethanol, specifically in the field of conversion of biomass to fermentable sugars for the production, or the use in production, of ethanol. Our strategic partnership with BP is critical to our success in validating and commercializing our first-generation cellulosic ethanol technology. This strategic collaboration consists of two phases, which are described below and include a technology development joint venture and a commercial development joint venture.

In August 2008, we announced the initial phase of the partnership, which includes a joint technology development effort that utilizes our broad technology platform in an effort to supply enabling technology to support the development of a portfolio of low-cost, environmentally-sound cellulosic ethanol production facilities in the United States, and potentially throughout the world. During the initial 18-month phase of the joint development program, we expect to receive a total of $90 million in connection with our participation.

In connection with the joint development program, we formed Galaxy Biofuels LLC, or Galaxy, a special purpose entity, which is equally owned by BP and us, and entered into a Joint Development and License Agreement with BP. Galaxy has access to certain intellectual property rights held or controlled by the parties prior to entering the Joint Development and License Agreement, all of which will continue to be owned by the respective contributing company. Galaxy owns new intellectual property relating to cellulosic ethanol production developed through the joint development program and is responsible for administering the licensing of the technology package resulting from the joint development program. Prior to entering into this strategic partnership, we had no material relationship with BP.

We are primarily responsible for executing the joint development program and have agreed with BP that for a limited period we will not use our existing technology in any other technology development program in the defined field, with certain exceptions. The limited period may be extended if the joint development program between the parties is extended. While the primary focus of Galaxy is to encourage the use of the technology package resulting from the joint development program in facilities that are jointly-owned by BP and us in the United States, Galaxy may license the technology and the technology package to us and to BP separately, as well as to third-party commercial projects in the United States and elsewhere.

The financial terms of this phase of the strategic partnership include:

| | • | | $45 million, payable in three installments, for broad access to our cellulosic ethanol technology platform, production facilities, and employee scientific knowledge and expertise. We received cash payments of $24.5 million at closing and $6.5 million on January 2, 2009 and will receive an additional cash payment of $14.0 million on July 1, 2009. |

| | • | | $15 million paid on January 2, 2009 and an additional $2.5 million per month payable beginning February 2009 through and including January 2010 to co-fund various scientific and technical initiatives within the cellulosic ethanol field. |

On February 18, 2009, we announced the second phase of our strategic partnership, a joint venture to develop and commercialize cellulosic ethanol from non-food feedstocks. The joint venture company, Highlands Ethanol LLC, or Highlands, is owned equally by us and BP. Highlands will act as the commercial entity for the deployment of cellulosic ethanol technology being developed and proven under our joint development program with BP. This collaboration is intended to progress the development of one of the nation’s first commercial-scale

12

cellulosic ethanol facilities, located in Highlands County, Florida and to create future opportunities for leveraging cellulosic ethanol technologies.

Together, we and BP have agreed to commit a total of $45 million in funding and assets to Highlands, including an aggregate cash commitment of $22.5 million from BP and contribution by us of development assets related to our Highlands County, Florida development project and another commercial project site in early stages of development in the Gulf Coast region. Highlands will be led and supported by a team comprised of employees from both BP and Verenium and will be governed with equal representation from both companies.

Highlands will initially focus on developing and securing financing for the commercial-scale cellulosic ethanol facility in Highlands County, Florida and expects to break ground on that site in 2010. The estimated construction cost for this 36 MGY facility is between $250 and $300 million. We expect the first production of cellulosic ethanol from this plant to begin in 2012.

Our Biofuels Commercialization and Growth Strategy

We intend to be the market leader in the design, development, and operation of cellulosic ethanol production plants using the following strategies:

| | • | | Commercialization of Technology. Our strategy is to become one of the first and leading domestic producers of cellulosic ethanol. We intend to achieve this first through the successful operation of our pilot and demonstration-scale plants in Jennings, Louisiana. With our commercialization partner BP, we are moving forward with the design, development and plans for construction of the first commercial-scale cellulosic ethanol plant in Highlands County, Florida. |

| | • | | Project Development and Ownership. We intend to develop a pipeline of commercial-scale cellulosic ethanol projects in the United States that we will own and operate, either independently or with strategic partners, such as BP. |

| | • | | Joint Venture Project Development and Ownership. We intend to develop cellulosic ethanol projects in conjunction with partners who may enhance our competitiveness and ability to finance our projects. Our early joint development strategy is focused on projects, developed with BP, under which we intend to engage partners or suppliers who bring key supplies, services, and capabilities to project development such as engineering, construction and operations expertise, as well as feedstocks, sites, on-site biomass boiler facilities or ethanol off-take agreements. |

| | • | | Worldwide Licensing of Technology. We intend to pursue licensing arrangements ourselves and through the Galaxy joint venture with BP, including outside of the United States, to maximize the reach of our technology and increase our market penetration. We expect that these licensing efforts will accelerate after construction of a commercial plant is completed and the technology is proven at that scale. |

| | • | | Project Financing. We intend to employ well-developed project finance structures using a prudent level of non-recourse debt in order to finance our facilities at an optimal cost of capital. We estimate that construction costs for the first commercial plant in Florida will be as much as $300 million. We hope to finance the majority of the cost of the commercial plant with non-recourse project finance debt through a loan guarantee program sponsored by the DOE. Together with BP, we recently submitted a joint application for this loan guarantee. Under the program, the DOE could grant loan guarantees in an amount up to 80% of the total capital cost of the project. There can be no assurance that we or BP will be successful in obtaining all or a portion of this loan guarantee. |

| | • | | Management Depth and Industry Expertise. We will continue to augment our management team to maintain deep scientific talent and a full suite of project development skills, including expertise in areas such as agronomics, engineering, finance, and operations. |

13

Our strategy is based on providing an integrated and proprietary solution for the cellulosic ethanol industry by exploiting our current and expected scientific research, process engineering and optimization, project development, project finance and enterprise risk management skills.

We intend to utilize three scales of facilities in connection with the production of cellulosic ethanol. After a process for a given feedstock is developed at the laboratory scale, we test this process in our pilot plant, which is run as a research and development facility with components that generally have a capacity of less than 50,000 gallons of ethanol per year. The next stage of development is via a demonstration-scale plant, in which the process developed at the laboratory and the pilot plant is scaled-up to demonstrate the economics of producing cellulosic ethanol using the relevant feedstock and process at a scale of approximately 1.4 MGY. We intend to build, own, and operate multiple commercial-scale plants utilizing multiple feedstocks/processes throughout the United States and other parts of the world, either independently or with strategic and financial equity partners, including our commercialization partner, BP. Finally, assuming that the economics of producing cellulosic ethanol are adequately demonstrated in a commercial-level facility, we expect that, particularly for regions outside of the United States, we may enter into further licenses and/or strategic partnerships for our licensees and/or partners to deploy our technologies and processes in plants that they will build, own, and operate and from which we would derive royalties, profit-sharing, or other revenues, which we would share with BP through our Galaxy joint venture.

Where possible, plants may be co-located with other industrial facilities to leverage existing infrastructure, thus lowering capital and operating costs while accelerating commercial operation. We intend to develop and optimize the technologies and enzymes for the production of ethanol from biomass using our in-house research and development staff, strategic alliances, mergers and acquisitions, or a combination thereof.

Our planned activities under our commercial joint venture with BP may include executing agreements with strategic partners that may improve the competitiveness and financing attractiveness of our commercial projects. Our early partnering strategy also contemplates projects with strategic partners who bring key supplies or services to project development, such as feedstocks, sites, on-site biomass boiler facilities or ethanol off-take agreements. Industries offering these types of services and supply opportunities include the agriculture, industrial, petroleum refining, and gasoline blending industries, among others. Plants may be built at sites close to dedicated energy crops in order to minimize feedstock transportation costs. Because we believe our technology can accommodate many different feedstocks, and is not dependent upon geographic location or feedstock type, the potential for plant siting is broad and diverse.

We plan to generate economic return from jointly-owned commercial facilities through the sharing of net income generated from each commercial plant with our equity partners. We may also elect to sell a portion of any equity position we have in a commercial facility as a means to fund investments in future commercial facilities, research and development programs, acquisition of technologies, or to fund general working capital, as necessary.

Through our Galaxy joint venture with BP, we may also license our proprietary technology to extend our commercial reach and accelerate our market penetration, both outside the U. S. and domestically. In these instances, we may not pursue an equity interest in such projects, but instead may seek to earn license fees and royalties and fees related to technology transfer and process design. For example, under a technology transfer and license agreement, Marubeni Corp. and Tsukishima Kikai Co., Ltd., or TSK, currently operate a 1.4 million liters-per-year cellulosic ethanol demonstration plant using our proprietary technology in Osaka, Japan. We believe that this Marubeni/TSK plant represents the world’s first plant operating commercially to produce cellulosic ethanol from construction and demolition wood waste. Last year, through our relationship with Marubeni/TSK, construction was completed and operation began at a small scale plant in Sarubeni, Thailand, where our proprietary technology is used to commercially produce cellulosic ethanol from bagasse and molasses.

14

Our Specialty Enzymes Business

Within our specialty enzymes business, we have identified the following three focus areas in which we have pursued product opportunities either independently or through collaborations and distribution agreements with third parties:

| | • | | Specialty industrial processes; and |

| | • | | Animal nutrition and health. |

Within these three focus areas, we have a combination of (i) enzyme products that either we or one of our partners have commercialized; (ii) enzyme product candidates that either we or one of certain partners are developing; and (iii) research and development programs for the development of additional enzyme product candidates and new or improved products and processes. We plan to pursue strategic partners that would provide the necessary capital to further advance our early-stage programs and products. Through our independent and collaborative research and development programs, we have developed commercial enzyme products across multiple markets. In addition, we have developed a pipeline of enzyme product candidates that we expect to launch independently and/or in collaboration with strategic partners. To date, we have commercialized 16 products, either independently or in collaboration with our partners.

The following table lists the key current products in our product portfolio, market applications, our partners, the estimated market size, and the development status of each.

Figure 3. Specialty Enzymes Current Product Portfolio

We market our specialty enzymes through a combination of our direct sales force, independent commissioned sales agents, and marketing and distribution agreements with our collaborative partners. Danisco Animal Nutrition, or Danisco, has been our largest customer for the past several years. Danisco accounted for approximately 53%, 35%, and 18% of our total revenue for the years ended December 31, 2008, 2007 and 2006. Our second largest customer, Syngenta, accounted for 13%, 27%, and 46% of our total revenue for the years ended December 31, 2008, 2007, and 2006.

15

Enzymes for Alternative Fuels

We have developed, either independently or through our collaborations, a number of enzyme products and product candidates that may be utilized to convert various sources of starch into sugars that can be used to produce ethanol from grains, commonly referred to as “bioethanol.”

Fuelzyme-LF Enzyme

Fuelzyme—LFenzyme is a next-generation alpha amylase enzyme designed to significantly improve the efficiency and economics of ethanol production from corn and other grain or starch sources. This product dramatically lowers the viscosity of either a grain mash or starch stream and operates at a much higher temperature and at a significantly lower pH than other commercially available enzymes. These enhanced characteristics offer ethanol producers the potential for substantial throughput advantages and cost savings. It works in concert with other enzymes to efficiently convert the starch present in corn and other sources into sugars that can then be processed into ethanol. Ethanol producers have traditionally used other alpha amylase enzymes that do not reduce the mash or starch stream viscosity as efficiently as our enzyme, thus limiting plant capacity. In addition, the conventional alpha amylases operate at a higher pH than downstream fermentation, requiring costly process adjustment (pH reduction with sulfuric acid), whereas Fuelzyme™-LF optimum pH is much closer to that of the fermentation process. We manufacture this enzyme under our agreement with Fermic S.A. de C.V., a U.S. Food and Drug Administration-approved fermentation and synthesis plant located in Mexico City. We estimate that the addressable market for this product is in excess of $150 million per year in the United States.

Purifine Enzyme for Biodiesel Applications

We announced in October 2006 that Purifine enzyme was approved by the U.S. Environmental Protection Agency (EPA) for non-food applications, thus enabling commercial-scale trials in dedicated biodiesel plants to determine the extent to which Purifine enzyme can improve overall yield of biodiesel fuel from seed oil processing. While we developed our Purifine enzyme primarily for the edible oils market, it is used very early in the vegetable oil refining process, before the point where the refining process differentiates between food and non-food (biodiesel) applications. Our laboratory studies have shown that Purifine enzyme provides significant benefits in the simplified refining processes utilized during preparation of seed oils for biodiesel. These benefits include increased yield, reduced chemical usage, improved operating efficiency, and reduced waste by allowing a higher percentage of the vegetable oil feedstock to be recovered and converted to biodiesel.

Amylase-T Transgenic Corn Amylase

Syngenta has a project in development to produce corn enhanced through biotechnology that expresses high levels of alpha amylase. Using high amylase corn may result in improved process efficiency and possible savings in the cost of ethanol from corn starch, as it speeds up starch conversion into sugar and reduces the need for supplemental alpha amylase enzymes in the process. This transgenic amylase enzyme, which Syngenta refers to as “Corn Amylase,” was originally developed under our collaboration with Syngenta. According to Syngenta, initial pilot trials were successfully conducted in 2005, and registration dossiers have been submitted to United States regulatory authorities. We are entitled to receive royalties from Syngenta on sales of products incorporating Corn Amylase. We cannot predict with certainty when, if ever, any products incorporating Corn Amylase will receive regulatory approval in the United States or any other countries, or whether any such products will be accepted by the intended customers of such products.

Lignocellulosic Enzymes

In order to meet the increased demand for ethanol in the future, feedstocks other than starch will need to be utilized to produce alternative fuel. Many forms of cellulosic biomass can contribute to biofuels, including grain

16

crops and switch grass, or crop residues such as corn stalks, wheat straw, rice straw, grass clippings, and wood residues. These cellulose-containing natural waste products are widely abundant and can be sustainably produced. In addition to fuel, cellulosic biomass can be converted into chemicals used to manufacture products that would otherwise be made from petrochemicals, such as plastics, adhesives, and paints.

Cellulosic biomass has been a challenge for scientists to convert to ethanol. In the past, scientists have used harsh acids and high temperatures to try and break, or hydrolyze, the cellulose molecules into their individual sugar components. However, an economical process has never been developed using traditional chemistry.

We are developing lignocellulosic enzyme “cocktails” as part of our overall objective of developing a new, more cost-effective process to break down the more complex starting materials locked within cellulosic biomass into fermentable sugars that could be used to produce cellulosic ethanol. Over the years, we have had several research and development programs aimed at developing these cocktails of enzymes, including programs with Syngenta AG, DOE, Du-Pont Bio-Based Materials, and New Zealand’s Scion and AgResearch Institutes. Our current, active agreements are discussed below.

Syngenta AG

Under our collaborative agreement with Syngenta, we have been working on developing candidate cocktails of enzymes to produce cellulosic ethanol from sugarcane bagasse, with an emphasis on Brazil and other similar tropical regions where sugar cane is grown. Sugarcane bagasse is considered an attractive feedstock for several reasons:

| | • | | Sugar cane is already established in Brazil as the largest source of bioethanol, and sugar cane bagasse, unlike most other sources of plant fiber, is already collected at the processing site. |

| | • | | Sugar cane is one of the lowest cost sources of plant fiber and sugar, not taking into account the effect of subsidies and tax benefits for other feedstocks. |

| | • | | Many other countries, including the United States, China, and India, are sugar cane producers in addition to Brazil. |

| | • | | Success with one plant fiber source may more easily lead to success with other sources of cellulosic biomass with relatively minor modification. |

Our initial guaranteed funding period for our sugarcane bagasse program with Syngenta ended in 2008, and we do not expect significant future funding from Syngenta to support this program; however, we have retained development and intellectual property rights to this program, and plan to continue supporting the program internally and with additional grant funding from the DOE.

United States Department of Energy (DOE)

On July 14, 2008, the we announced that we had been awarded a grant from the DOE under a $40 million program to support the development of small-scale cellulosic ethanol biorefinery plants. The total award allocated to us under the program of $10.0 million will be used towards scaling and validating our cellulosic technology for commercialization at the demonstration-scale facility in Jennings, Louisiana.

In February 2008, we were awarded a $8.5 million grant for the development of improved enzyme systems to be used in converting biomass into clean, renewable cellulosic ethanol. The grants are being appropriated over a four-year period beginning in 2008 and expiring in 2011. Under this grant, we are leveraging our proprietary library of enzymes and DirectEvolution technology to develop and optimize more robust and cost-effective enzymes to breakdown biomass.

17

In March, 2007, we were selected as one of five recipients of a DOE project focused on developing highly efficient fermentative organisms to convert biomass material to ethanol. With the grant, we continue to advance the ethanologen platform licensed from the University of Florida. Further development of the fermentation organisms is focused on optimizing the ability to ferment sugars produced from a wide variety of feedstocks and to increase robustness in a commercial-scale fermentation process, while simultaneously reducing costs and increasing product yields.

New Zealand’s Scion and AgResearch Institutes

In July 2008, we announced that we were awarded a three-year, $5.4 million grant from the New Zealand Foundation for Research, Science and Technology for use in the next-stage of development by the New Zealand Lignocellulosic Bioethanol Initiative, a trans-Pacific research collaboration. This initiative builds from previous collaborative research among Verenium, New Zealand’s Crown Research Institutes Scion and AgResearch, and New Zealand’s largest pulp and paper producer, Carter Holt Harvey. With this award, the collaboration intends to further evaluate the viability of producing cellulosic ethanol from New Zealand’s softwood forest resource through pilot-scale trials of existing lab-scale research on pre-treatment and enzymatic processing.

Enzymes for Specialty Industrial Processes

Within the area of specialty industrial processes, we have identified a number of opportunities for high-value enzymes to potentially decrease processing time, improve product quality, lower total processing costs, and/or reduce harmful waste streams. In many cases, these enzymes are intended to replace or reduce the use of commodity chemicals that have been traditionally used in the applicable industrial process.

Purifine for Enhanced Processing of Edible Nutritional Oil

In January 2006, we announced that our Purifine enzyme received Generally Recognized As Safe, or GRAS, approval from the FDA for edible oil applications. Based on this approval, we launched Purifine on a commercial basis in 2007, and entered into an agreement with Bunge Oils, Inc. whereby we would take advantage of their process scale-up expertise to develop and validate the Purifine-based degumming process at scale. In addition, we are working with Bunge to develop next-generation enzyme products for vegetable oil processing.

Our Purifine enzyme is a novel oil processing enzyme designed to increase the yield of oil from oil seeds, creating a novel degumming process that converts low-value byproducts (phospholipids) to increased oil yields while still reducing the phosphorus content of the oil as required by the oil refining process. The total oil yield increase is expected to vary between 1-2%, depending on the phospholipid content of the crude vegetable oil. The enzyme has been developed to be compatible with current processing technologies, and, therefore, minimal capital investment is anticipated to be required to obtain the significant yield benefits that can be achieved with Purifine. Purifine is also expected to minimize chemical usage, improve operating efficiency, and reduce waste by allowing a higher percentage of oil to be recovered from oil seeds economically. We estimate the addressable market for Purifine within the global seed oil processing market to be in excess of $200 million annually.

Luminase for Pulp and Paper Processing

We have developed enzymes to aid in bleaching pulp, that reduce the need to use strong oxidizing chemicals, such as chlorine compounds. These enzymes can reduce the cost of pulp processing both by reducing the amount of oxidizing chemicals required and the expense associated with treating the waste water resulting from the use of these harsh chemicals.

In July 2004, we launched our Luminase PB-100 enzyme for pulp bleaching enhancement, and in 2006, we began marketing an additional product under the Luminase line of enzymes, Luminase PB-200 enzyme, for higher temperature processes. These products improve the response of pulp fiber to bleaching chemicals, which

18

can reduce the need for harsh bleaching chemicals or enable the customer to make whiter pulp for new products. Decreasing bleach chemicals lowers costs and offers a potential environmental benefit by reducing the amount of waste material requiring removal from pulp mill effluent. In mills, both Luminase PB-100 enzyme and Luminase PB-200 enzyme have outperformed competitive products, demonstrating bleach chemical cost savings of up to 20%. Additionally, Luminase enzymes may produce whiter pulp, potentially extending a customer’s market to new products.

Specialty Enzymes for Animal Nutrition and Health

Animal Feed Additives to Enhance Animal Nutrition

Animal feed additives are designed to increase absorption of essential vitamins and minerals, increase nutritional value and animal product yield, and reduce harmful materials in animal waste. We are developing several classes of enzymes, including phytases and carbohydrases, for the increased absorption of organic phosphorous and digestibility of carbohydrates, as well as the promotion of weight gain in livestock.

When used as an additive in animal feed applications, phytase enzymes allow higher utilization of naturally occurring phosphorus from the feed, thereby increasing its nutritional value and reducing phosphate pollution. We estimate that the worldwide market for phytase enzymes is more than $300 million per year, and growing at more than 5% per year. Recent estimated growth in the worldwide market for phytase enzymes has been driven by economics as well as regulatory pressure to decrease pollution caused by the phosphate-rich waste from swine and poultry farms that is a leading cause of water pollution. We have one commercial phytase product to address this market, and have one under development with Syngenta.

In March 2003, we launched Phyzyme XP in collaboration with our partner Danisco Animal Nutrition. The addition of Phyzyme XP to animal feed has been shown to reduce the need for inorganic phosphorus supplementation by approximately 20% and lower the level of harmful phosphates that are introduced to the environment through animal waste by approximately 30%, resulting in inorganic phosphate cost savings and a significant reduction in environmental pollution. We are responsible for manufacturing Phyzyme XP, and Danisco is responsible for its sales and marketing.

Through our collaboration with Syngenta, we have also developed a next-generation transgenic phytase product candidate, which Syngenta refers to as Corn Phytase, that is intended to be grown directly in corn. This product is intended to be both cost-effective and heat-stable. We are entitled to receive royalties from Syngenta on sales of products incorporating Corn Phytase. We cannot predict with certainty when, if ever, any products incorporating Corn Phytase will receive regulatory approval in the United States or any other countries, or whether any such products will be accepted by the intended customers of such products.

In December 2003, Quantum phytase, another animal feed enzyme we developed under our collaboration with Syngenta, received regulatory approval in Mexico and subsequently received regulatory approval in other countries, including Brazil. This was the first product we commercialized with Syngenta. In February 2008, AB Enzymes and AB Vista (collectively, “AB”), both subsidiaries of Associated British Foods plc, announced the acquisition of Syngenta’s Quantum Phytase feed enzyme business. Prior to this transaction, we supplied Quantum to Syngenta pursuant to a manufacturing and supply agreement. We do not currently manufacture Quantum for, or supply Quantum to, AB.

19

Animal Health Vaccines for Prevention or Treatment of Disease

Over the past several years, we worked on the development, optimization, and manufacture of vaccines for use in animal health. Our initial product, Bayovac SRS, was a proprietary and novel subunit recombinant vaccine for farmed salmon. Our single source of revenue was from Bayovac SRS through a licensing and collaboration agreement with Microtek International Inc, who distributed the product to a single customer, Bayer Animal Health, since its commercial launch in 2004.

In late 2007, because of new entrants into the animal vaccine market and resulting pressure on pricing and margins, we made the strategic decision to exit the animal health vaccine market to focus on product commercialization efforts in areas that are more strategic to our current focus, namely biofuels. In connection with this decision, we terminated our Licensing and Collaboration Agreement with Microtek, and discontinued sales of Bayovac SRS in 2008.

Our Strategic Partnerships

Our strategy includes pursuing strategic collaborations with market leaders in our target markets. In exchange for selected rights to our technologies, current and future products, these strategic alliances provide us funding and resources to develop and commercialize a larger product portfolio. In various instances, these strategic alliances allow us to leverage our partners’ established brand recognition, global market presence, established sales and distribution channels, and other industry-specific expertise. The key components of the commercial terms of such arrangements typically include some combination of the following types of fees: exclusivity fees, technology access fees, technology development fees and research support payments, as well as milestone payments, license or commercialization fees, and royalties or profit sharing from the commercialization of any products that result from the alliance. As of December 31, 2008, our strategic partners have provided us more than $315 million in funding since inception and are committed to additional funding of more than $100 million through 2012, subject to our performance under existing agreements. This includes the commitment by BP of $22.5 million to our recently announced Highlands joint venture, which will be used solely within the joint venture.

Our significant strategic partnerships include the following:

Biofuels

BP

As more fully described on page 12 and 13 of this annual report on Form 10-K, we have a two-phase strategic partnership with BP focused on the development and commercialization of cellulosic ethanol technology.

Specialty Enzymes

Syngenta

In addition to research collaborations we entered into in 1999 and 2003 with affiliates of Syngenta AG, a related party, in December 2006, we entered into a license and research agreement to supersede and replace the aforementioned research collaborations. This license and research agreement is focused on the discovery and development of a range of novel enzymes to economically convert pre-treated cellulosic biomass to mixed sugars—a critical step in the process of biofuel production. This license and research agreement allows us to independently develop and commercialize fermentation-based enzyme combinations from our proprietary platform, and we are free to pursue opportunities for the integrated commercialization of biofuels. Syngenta has exclusive access to enzymes from our platform to express in plants for enhanced cost-effective production, in addition to certain rights to develop a combination of transgenically-expressed enzymes and enzymes expressed

20

via fermentation as part of so-called “mixed delivery” enzyme cocktails. Under the terms of the agreement, Syngenta agreed to provide us guaranteed research funding of a minimum of $8 million in each of 2007 and 2008. We are also eligible to receive certain milestone and royalty payments aligned to product development success. We do not currently anticipate a significant level of future funding from Syngenta beyond the initial funding period.

The agreement has a 10-year term, and either party may terminate the license and research agreement upon the other party’s material uncured breach or default in the performance of any of its obligations under the agreement or in the event the other party becomes subject to voluntary or undismissed involuntary bankruptcy or similar proceedings. In addition, the license and research agreement with Syngenta may be terminated by Syngenta in the event that we undergo a change of control while we are performing research under the license and research agreement and either the change of control transaction is with or involving any entity that is a competitor of Syngenta or its affiliates or, as a result of the change of control, Syngenta reasonably determines in its sole judgment that such change of control would have an adverse effect on our ability or the ability of the surviving entity to perform the research collaboration agreement’s research program.

Revenue recognized under the Syngenta agreements was $9.4 million, $12.7 million and $22.7 million for the years ended December 31, 2008, 2007, and 2006.

Bunge Oils