© 2014 Mercury Systems, Inc. Mark Aslett President and CEO Kevin Bisson SVP and CFO August 13, 2014 Jefferies 2014 Global Industrials Conference

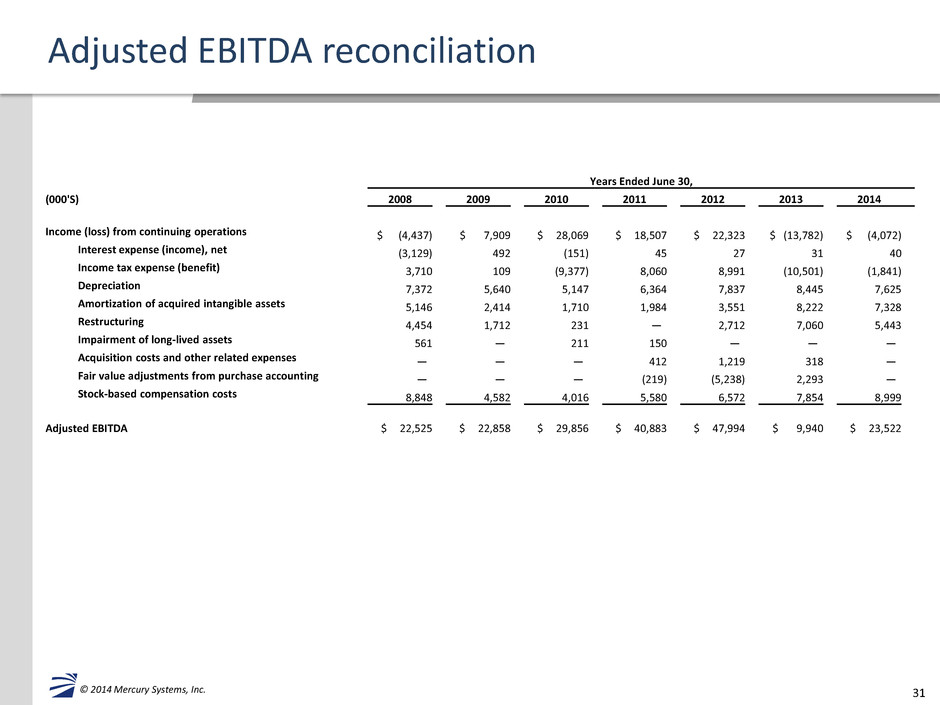

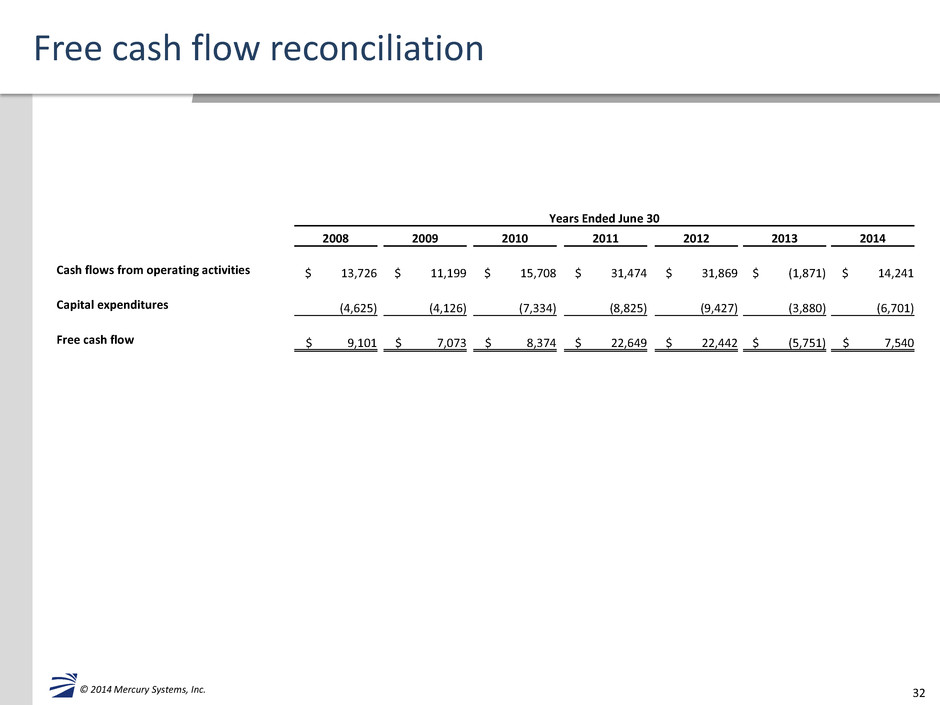

2 © 2014 Mercury Systems, Inc. Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to business performance and the Company’s plans for growth and improvement in profitability and cash flow. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions, divestitures and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2013. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA and free cash flow, which are non-GAAP financial measures. Adjusted EBITDA excludes certain non-cash and other specified charges. Free cash flow is defined as cash flow from operating activities less capital expenditures. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, the presentation of adjusted EBITDA and free cash flow is not meant to be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes the adjusted EBITDA and free cash flow financial measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto.

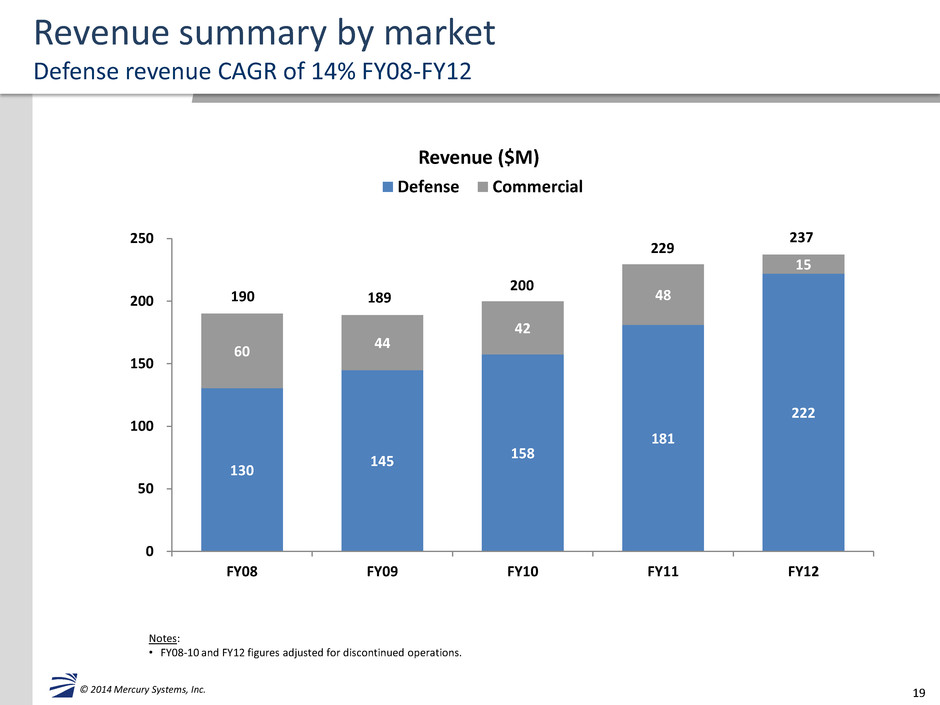

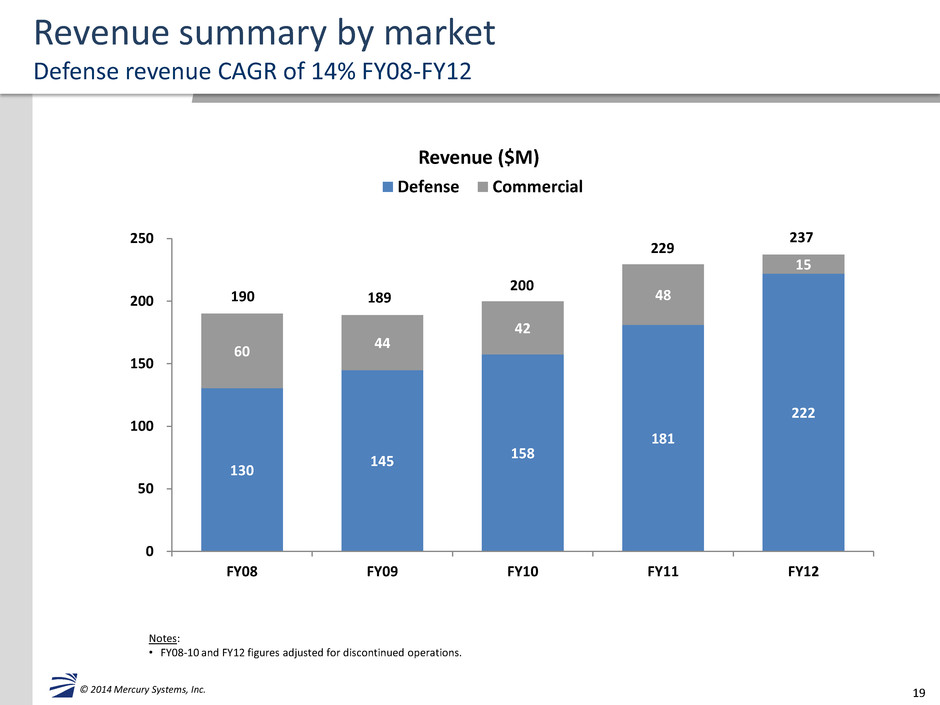

3 © 2014 Mercury Systems, Inc. Commercial provider of sensor processing subsystems & solutions Introducing Mercury Systems • MRCY on NASDAQ 1998 • Real-time sensor processing subsystems • High tech company; Scalable business model • Focused on Defense and Intelligence priorities • Deployed on ~300 programs with 25+ Prime contractors • FY14 $209M revenues; ~630 employees • Defense revenue 71% growth (14% CAGR) FY08–FY12

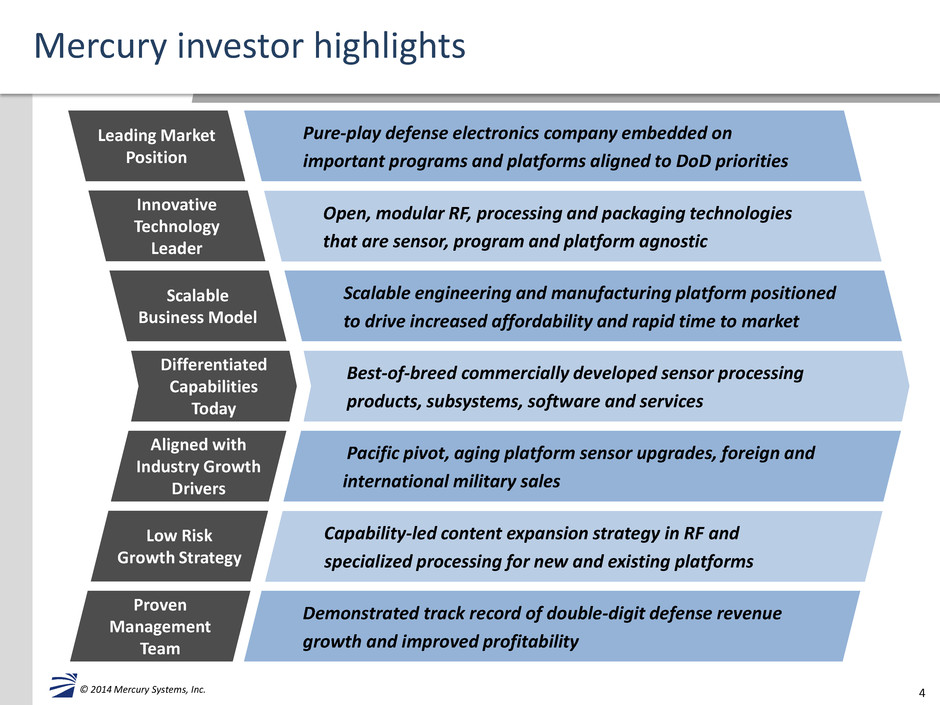

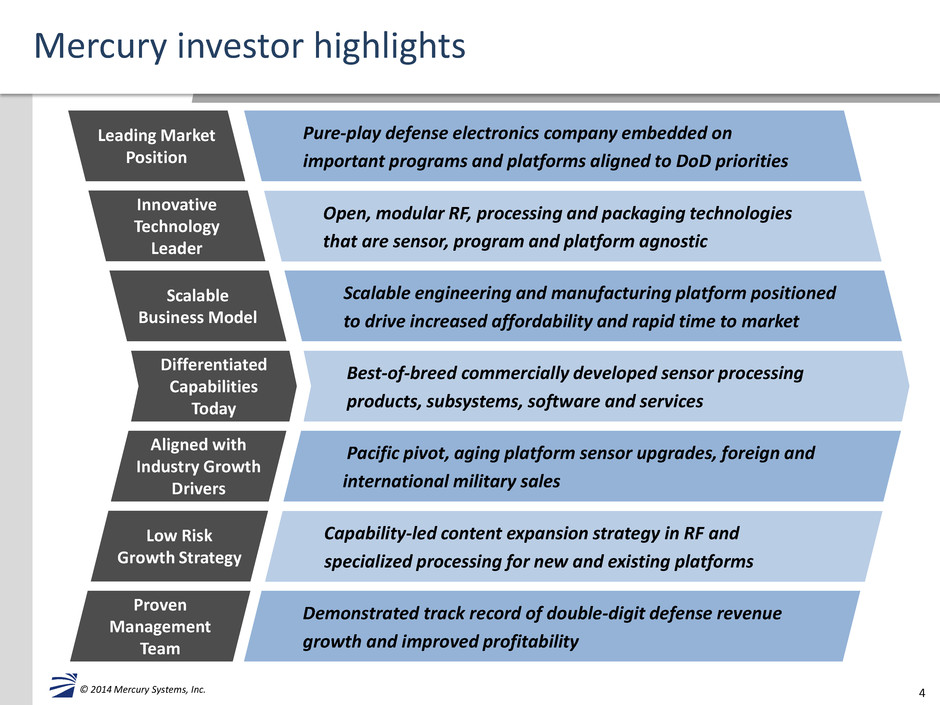

4 © 2014 Mercury Systems, Inc. Leading Market Position Pure-play defense electronics company embedded on important programs and platforms aligned to DoD priorities Scalable Business Model Scalable engineering and manufacturing platform positioned to drive increased affordability and rapid time to market Aligned with Industry Growth Drivers Pacific pivot, aging platform sensor upgrades, foreign and international military sales Proven Management Team Demonstrated track record of double-digit defense revenue growth and improved profitability Mercury investor highlights Best-of-breed commercially developed sensor processing products, subsystems, software and services Differentiated Capabilities Today Innovative Technology Leader Low Risk Growth Strategy Open, modular RF, processing and packaging technologies that are sensor, program and platform agnostic Capability-led content expansion strategy in RF and specialized processing for new and existing platforms

5 © 2014 Mercury Systems, Inc. Defense will likely remain a $500B+ industry… …despite the ongoing political and budget uncertainty Crowding Out Rising interest rates, healthcare and social spending; MilPer expense growth, aging military platforms’ O&M costs rising Procurement Reform Firm-fixed-price contracts and less government-funded R&D changing economics and competitive dynamics of defense industry Political Dysfunction Sequestration-driven cuts and repeated Continuing Resolutions disrupting DoD budget process and spending

6 © 2014 Mercury Systems, Inc. Mercury has unique and differentiated capabilities today… …that are aligned to the key industry growth drivers Pacific Pivot: Sensors going long, wide and high. Platforms need improved sensors, autonomy, electronic protection and attack, on-board exploitation Aging Platforms: Port customer software to available state-of-the-art open architectures to rapidly and affordably upgrade sensors on aging military platforms International Sales: Upgrade subsystems for export to expand addressable market, grow foreign sales and international customer R&D funding Outsourcing: Outsourcing to improve affordability and rate of innovation; Prime variable operating cost model and improved asset utilization

7 © 2014 Mercury Systems, Inc. We work with all the major primes – they’re telling us: “As we pivot to the Pacific the threats, missions and conops are technically more challenging and costly.” “The DoD is funding less R&D and is expecting industry to invest more themselves.” Growth Costs Margin “I need to keep my existing programs sold as the government seeks to recompete programs more often.” “I need to re-engineer my systems for export to enable FMS and international sales growth.” “My business has grown under cost plus, but the shift to firm-fixed-price requires a more variable cost model.” “My supply base is fragmented, costly and complex. I need to re-engineer it to improve affordability and lower risk.”

8 © 2014 Mercury Systems, Inc. We have addressed these challenges and opportunities… …with capabilities and strategies to drive growth and returns Innovation Capability Scalability Affordability

9 © 2014 Mercury Systems, Inc. Industry-leading processing product portfolio addresses need to collect, process and analyze sensor data in real-time • State-of-the-art specialized Intel server-class processing for sensor and mission computing • Pioneered GPU use for on-board big data exploitation • Best-in-class thermal management tied to Pacific pivot • Industry-leading, open, exportable architectures enable FMS/International sales • Open middleware and services enable rapid porting of customer software to our next generation hardware • Capability-led market and content expansion drives low-risk growth …and enable new sensor and mission processing capabilities today We’ve invested in computing innovations that expand our addressable market…

10 © 2014 Mercury Systems, Inc. Well positioned to benefit from AESA radar, electronic warfare, electronic countermeasure and ISR sensor upgrades • RF and microwave industry structure broken • Customers looking for a “better alternative” • Acquired three companies in RF, microwave and EW • Unique end-to-end sensor processing capabilities • Enables market expansion and increased outsourcing • Low-risk growth driven by content expansion …and enable fast, affordable, highly integrated solutions today We’ve acquired new RF and microwave capabilities that expand our addressable market, allowing us to competitively take share……

11 © 2014 Mercury Systems, Inc. …our business by capturing more RF and microwave content We have the capabilities and assets we need to expand… • Significant expansion of addressable market • RF/Microwave 3-5x content vs. traditional processing • R&D for new capabilities, to onboard outsourced designs, competitively take share • Acquisitions and AMC investment timely and key • RF/Microwave expected to be fastest growth business • Created scalable engineering and manufacturing platform PROCESSOR PROCESSOR DIGITIZATION DIGITIZATION POWER RF RF RF RF RF Traditional MRCY expertise & content New capability via recent acquisitions → 3-5x content potential for Mercury

12 © 2014 Mercury Systems, Inc. We’re creating a new model in the RF and microelectronics industry and a better alternative for our customers • Built a second world-class microelectronics facility; leverages ~$20M investment by prior owner • Built-in plant redundancy from a single supplier simplifies supply chain and improves affordability • Design and manufacturing engineering expertise to optimize new designs and onboard in-house work • Automated manufacturing and test. Scale from design to full production lowers risk • Co-invest R&D to design new, onboard in-house work and competitively take share …to accelerate outsourcing and to competitively take share We’ve built a scalable RF and microelectronics platform…

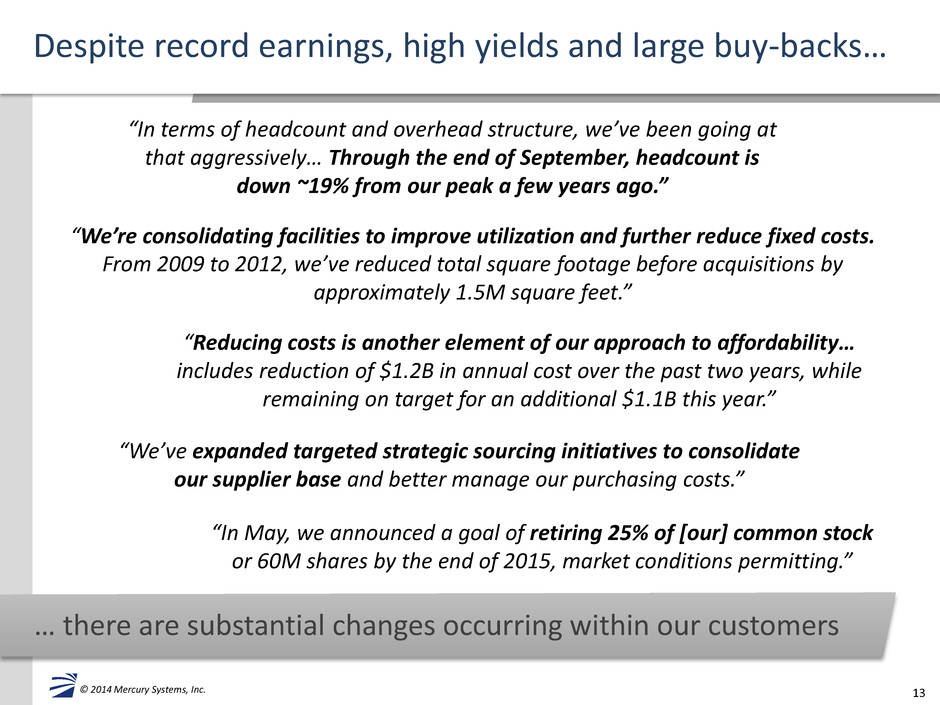

13 © 2014 Mercury Systems, Inc. Despite record earnings, high yields and large buy-backs… … there are substantial changes occurring within our customers “Reducing costs is another element of our approach to affordability… includes reduction of $1.2B in annual cost over the past two years, while remaining on target for an additional $1.1B this year.” “In May, we announced a goal of retiring 25% of [our] common stock or 60M shares by the end of 2015, market conditions permitting.” “We’re consolidating facilities to improve utilization and further reduce fixed costs. From 2009 to 2012, we’ve reduced total square footage before acquisitions by approximately 1.5M square feet.” “We’ve expanded targeted strategic sourcing initiatives to consolidate our supplier base and better manage our purchasing costs.” “In terms of headcount and overhead structure, we’ve been going at that aggressively… Through the end of September, headcount is down ~19% from our peak a few years ago.”

14 © 2014 Mercury Systems, Inc. Our customers are seeking more affordable sensor processing solutions • State-of-the-art portfolio and lower cost engineering design services improve affordability • Pre-integrated sensor processing subsystems require less customer or government R&D • Sensor, program and platform agnostic to break the “silos” • Experience and scale improve cost and lower risk as programs transition from development to production • Scalable RF and microelectronics design, development and manufacturing facilitate supply chain optimization …at a time when our customers need to outsource more Our strategy is improving affordability and value delivery…

15 © 2014 Mercury Systems, Inc. We are deployed on 300+ programs with 25+ Primes RADAR EW EO/IR – C4I Triton; NATO AGS Global Hawk SEWIP AEGIS AEGIS Ashore F-15 Patriot AH-64 Apache Reaper Gorgon Stare F-16 Badger/Buzzard Fury Global Hawk F-35 F-35 F-16 P-8

16 © 2014 Mercury Systems, Inc. FY13 FY14 FY15 FY16 Production Years Relevance Possible Pivot Upgrade FMS Total ($M) SEWIP Block 2 FRP: FY15-23 209-345 SEWIP Expansion FRP: FY15-23 110-120 SEWIP Deriv.** FRP: FY17-23 104-166 SEWIP Block3** LRIP: FY16 FRP: FY18-26 161-334 Badger/Buzzard FRP: FY13-23 105-151 Predator/Reaper FRP: FY13-19 92-155 AEGIS FRP: FY13-18 80-208 Patriot FRP: FY13-17 76-97 F-15 DEWS FRP: FY13-21 62-100 SIRFC/AIDEWS FRP: FY13-18 55-134 F-16 SABR FRP: FY15-19 55-83 F-35 JSF FRP: FY22+ 45-830 P-8 APY-10+ASW FRP: Up To FY23 30-75 Others E2D Hawkeye, MQ-4C Triton, MQ-9 Gorgon Stare, RQ-4 Global Hawk, SSEE 148-247 TOTAL: $1,332-$3,045 Key program update Mercury’s perspective on phase, timing and possible value EMD LRIP FRP FMS *Note: Possible values are a projection based upon our current information and assumptions regarding the system configuration, potential future design wins, our average sales price, the number of platforms and/or the number of potential retrofits, spares, as well as the potential for foreign military sales. Possible values include FY14. ** Programs are currently being competed with multiple Primes.

17 © 2014 Mercury Systems, Inc. Strategy, acquisitions and investments positioned us well… …to drive growth and improved returns for our customers Innovation: We’ve invested in innovations that expand our addressable market and facilitate low-risk growth tied to specialized sensor processing upgrades for the Pacific pivot, aging platforms and foreign sales Capability: We’ve acquired RF and microwave capabilities that expand our addressable market and facilitate low-risk growth driven by content expansion Scalability: We’ve created a scalable, redundant RF and microwave platform to address industry supply chain issues and customer program risks Affordability: Our R&D investments and scalable platform enable more affordable design, development and production of sensor processing subsystems

TM © 2014 Mercury Systems, Inc. Financial Overview

19 © 2014 Mercury Systems, Inc. Revenue summary by market Defense revenue CAGR of 14% FY08-FY12 Notes: • FY08-10 and FY12 figures adjusted for discontinued operations. 130 145 158 181 222 60 44 42 48 15 0 50 100 150 200 250 FY08 FY09 FY10 FY11 FY12 Revenue ($M) Defense Commercial 190 189 200 229 237

20 © 2014 Mercury Systems, Inc. Adjusted EBITDA more than doubled FY08-FY12 Achieved historic target business model in FY12 Notes: • FY08-FY09 figures are as reported in the Company’s fiscal 2010 Form 10K. FY10-11 figures are as reported in the Company’s fiscal 2012 Form 10K. FY12 figures are reported on a continuing operations basis. • Adjusted EBITDA excludes interest income and expense, income taxes, depreciation, amortization of acquired intangible assets, restructuring expense, impairment of long-lived assets, acquisition and other related expenses, fair value adjustments from purchase accounting, and stock-based compensation costs. 23 23 30 41 48 12% 12% 15% 18% 20% 0 10 20 30 40 50 60 FY08 FY09 FY10 FY11 FY12 Adj. EBITDA ($M, %) EBITDA Margin %

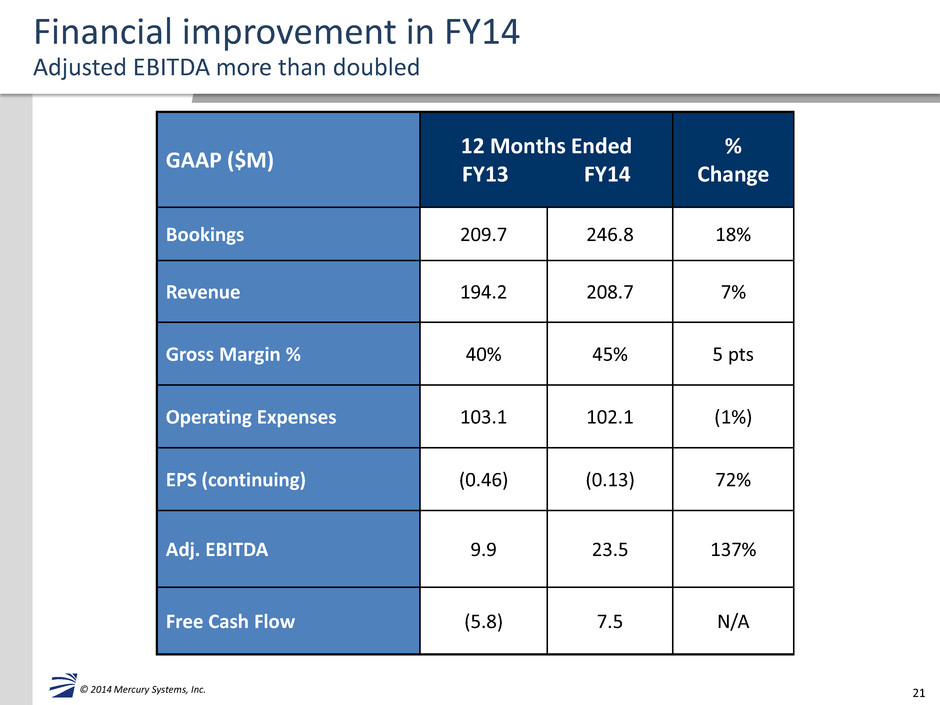

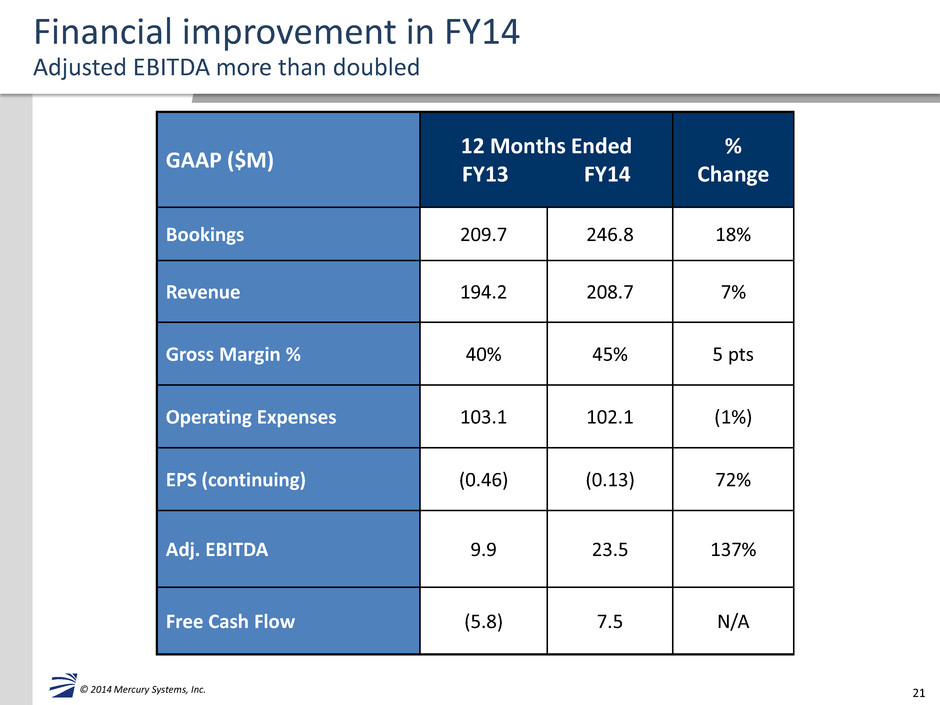

21 © 2014 Mercury Systems, Inc. Financial improvement in FY14 Adjusted EBITDA more than doubled GAAP ($M) 12 Months Ended FY13 FY14 % Change Bookings 209.7 246.8 18% Revenue 194.2 208.7 7% Gross Margin % 40% 45% 5 pts Operating Expenses 103.1 102.1 (1%) EPS (continuing) (0.46) (0.13) 72% Adj. EBITDA 9.9 23.5 137% Free Cash Flow (5.8) 7.5 N/A

22 © 2014 Mercury Systems, Inc. Solid balance sheet with ample liquidity No debt and unused $200M credit facility Notes: 1) Acquired Micronetics, Inc. for $72M in Q1 FY13. 2) Discontinued operations numbers are MIS. FY13 FY14 (In millions) Actual Actual ASSETS Cash & Investments 39.1 47.3 Accounts receivable, net 46.5 59.7 Inventory, net 37.4 31.7 PP&E, net 14.5 14.1 Goodwill and intangibles, net 199.9 193.1 Other 22.9 21.6 Assets of discontinued operations 14.1 6.2 TOTAL ASSETS 374.4 373.7 LIABILITIES AND S/E AP and other liabilities 43.2 44.1 Debt 0 0 Liabilities of discontinued operations 2.7 2.5 TOTAL LIABILITIES 45.9 46.6 Stockholders' equity 328.5 327.1 TOTAL LIABILITIES AND S/E 374.4 373.7

23 © 2014 Mercury Systems, Inc. Second half FY14 financial momentum GAAP ($M) FY14 H1 FY14 H2 % Change Bookings 92.6 154.2 67% Revenue 101.7 107.1 5% Gross Margin % 45% 46% 1 pt EPS (continuing) (0.10) (0.03) 70% Adj. EBITDA 8.5 15.0 75% Operating Cash Flow 9.5 4.7 (51%)

24 © 2014 Mercury Systems, Inc. FY14-15 integration plan Accelerating achievement of target business model • 12 month plan through mid-fiscal 2015 • Integration plan components – Facilities consolidation centering on new AMC in Hudson, NH to create a scalable manufacturing platform – Centralized administrative and manufacturing operations, operating on common systems – Rebalancing of R&D Investments • Gross annualized savings of $16 million upon completion; front-end loaded – Annualized savings of $13M or 80% from actions completed during fiscal 2014 – Incremental annualized savings of $3 million from 2015 actions

25 © 2014 Mercury Systems, Inc. Record backlog in FY14 Significant growth since FY12; well-positioned entering FY15 105 87 97 136 174 0 20 40 60 80 100 120 140 160 180 200 FY10 FY11 FY12 FY13 FY14 Mercury Ending Backlog ($M)

26 © 2014 Mercury Systems, Inc. FY15 guidance (as of August 5th) Notes: (1) The guidance included herein is from the Company’s earnings release and is as of the date of the earnings release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. (2) Excludes Restructuring and Acquisition Costs. Year Ending June 30, 2015 FY14 Actual Low High Revenue $224 $236 $209 GAAP EPS (Continuing) $0.21 $0.32 ($0.13) Adjusted EPS $0.27 $0.38 ($0.02) Adj EBITDA $37.0 $42.9 $23.5 Note - Adj EBITDA Adjustments: Net income (Continuing) 6.8 10.6 (4.1) Interest (income) expense, net 0.0 0.0 0.0 Income tax (benefit) expense 3.1 5.2 (1.8) Depreciation 7.1 7.1 7.6 Amortization of acquired intangible assets 7.0 7.0 7.3 Restructuring expenses 3.1 3.1 5.5 Stock-based compensation cost 9.9 9.9 9.0 Adj EBITDA $37.0 $42.9 $23.5 (1) (2)

27 © 2014 Mercury Systems, Inc. Q1 FY15 guidance (as of August 5th) Notes: (1) The guidance included herein is from the Company’s earnings release and is as of the date of the earnings release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. (2) Excludes Restructuring and Acquisition Costs. Quarter Ending September 30, 2014 Q1 FY14 Actual Low High Revenue $50 $55 $51 GAAP EPS (Continuing) ($0.06) ($0.01) ($0.08) Adjusted EPS ($0.04) $0.01 ($0.08) Adj EBITDA $4.2 $7.0 $3.3 Note - Adj EBITDA Adjustments: Net income (Continuing) (1.8) (0.2) (2.3) Interest (income) expense, net 0.0 0.0 0.0 Income tax (benefit) expense (1.1) (0.1) (1.3) Depreciation 1.7 1.7 1.9 Amortization of acquired intangible assets 1.8 1.8 2.0 Restructuring expenses 0.8 1.0 0.0 Stock-based compensation cost 2.8 2.8 3.0 Adj EBITDA $4.2 $7.0 $3.3 (1) (2)

28 © 2014 Mercury Systems, Inc. GAAP FY14 FY15 Revenue 100% 100% 100% Gross Margin 45% 46-47% 45-50% SG&A 26% 22-23% Low 20’s R&D 17% 14-15% 11-13% Amortization 3% 3% 2-3% Operating Income (1) (1%) 5-8% 12-13% Adj EBITDA 11% 17-18% 18-22% Current Target Business Model Achievement of target business model in FY15 (1) Operating Income excludes Restructuring and Acquisition Costs. (2) The guidance included herein is from the Company’s earnings release and is as of the date of the earnings release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. (2)

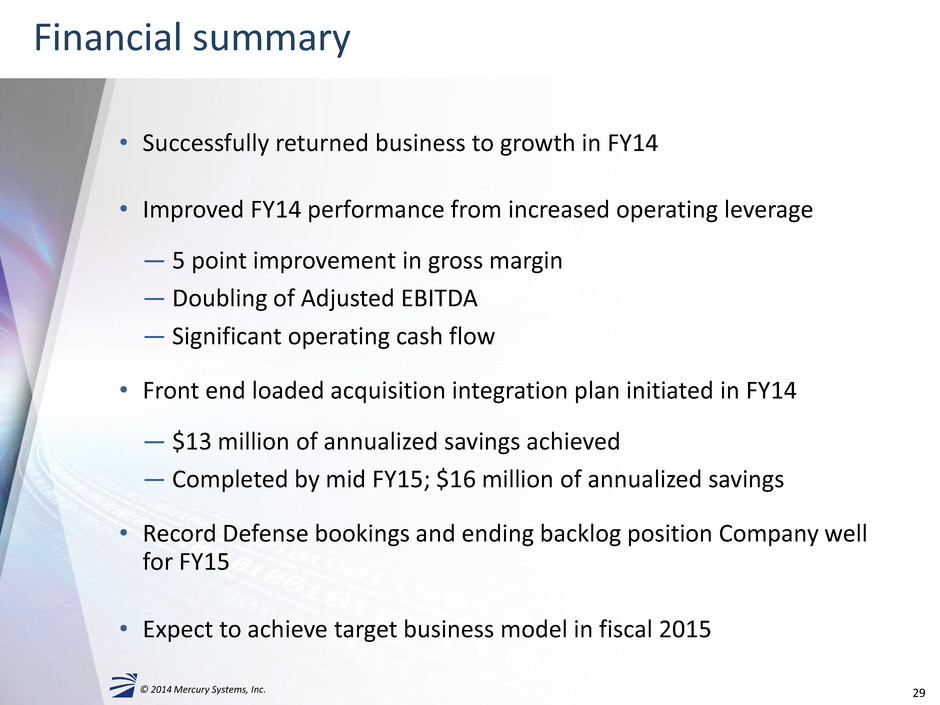

29 © 2014 Mercury Systems, Inc. © 2014 Mercury Systems, Inc. Financial summary • Successfully returned business to growth in FY14 • Improved FY14 performance from increased operating leverage — 5 point improvement in gross margin — Doubling of Adjusted EBITDA — Significant operating cash flow • Front end loaded acquisition integration plan initiated in FY14 — $13 million of annualized savings achieved — Completed by mid FY15; $16 million of annualized savings • Record Defense bookings and ending backlog position Company well for FY15 • Expect to achieve target business model in fiscal 2015

TM © 2014 Mercury Systems, Inc. Appendix

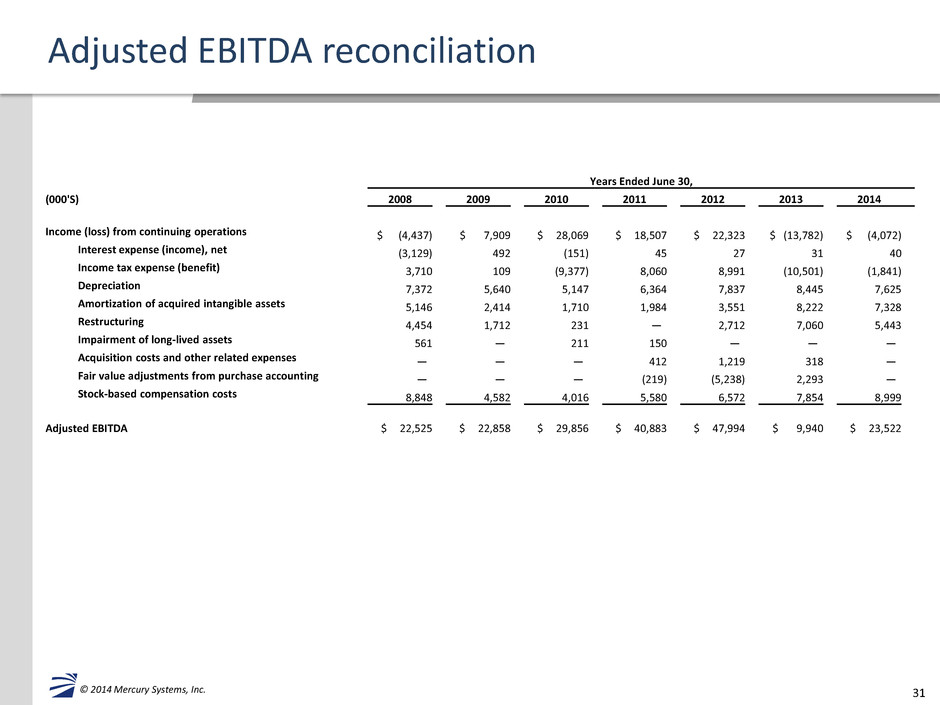

31 © 2014 Mercury Systems, Inc. Adjusted EBITDA reconciliation Years Ended June 30, (000'S) 2008 2009 2010 2011 2012 2013 2014 Income (loss) from continuing operations $ (4,437) $ 7,909 $ 28,069 $ 18,507 $ 22,323 $ (13,782) $ (4,072) Interest expense (income), net (3,129) 492 (151) 45 27 31 40 Income tax expense (benefit) 3,710 109 (9,377) 8,060 8,991 (10,501) (1,841) Depreciation 7,372 5,640 5,147 6,364 7,837 8,445 7,625 Amortization of acquired intangible assets 5,146 2,414 1,710 1,984 3,551 8,222 7,328 Restructuring 4,454 1,712 231 — 2,712 7,060 5,443 Impairment of long-lived assets 561 — 211 150 — — — Acquisition costs and other related expenses — — — 412 1,219 318 — Fair value adjustments from purchase accounting — — — (219) (5,238) 2,293 — Stock-based compensation costs 8,848 4,582 4,016 5,580 6,572 7,854 8,999 Adjusted EBITDA $ 22,525 $ 22,858 $ 29,856 $ 40,883 $ 47,994 $ 9,940 $ 23,522

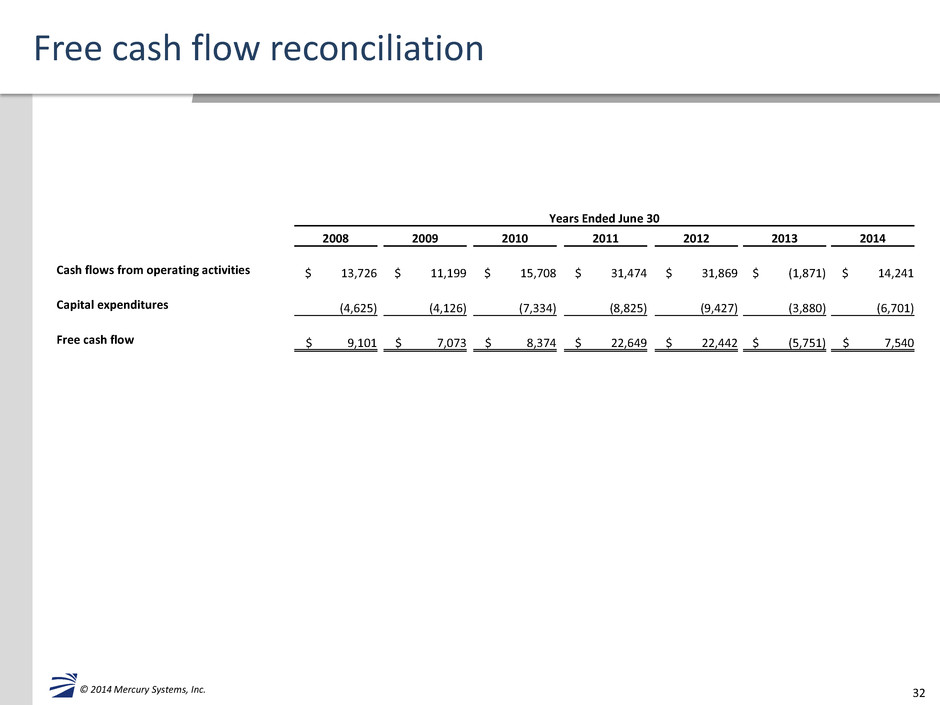

32 © 2014 Mercury Systems, Inc. Free cash flow reconciliation Years Ended June 30 2008 2009 2010 2011 2012 2013 2014 Cash flows from operating activities $ 13,726 $ 11,199 $ 15,708 $ 31,474 $ 31,869 $ (1,871) $ 14,241 Capital expenditures (4,625) (4,126) (7,334) (8,825) (9,427) (3,880) (6,701) Free cash flow $ 9,101 $ 7,073 $ 8,374 $ 22,649 $ 22,442 $ (5,751) $ 7,540