© 2016 Mercury Systems, Inc. Jefferies 12th Annual Industrials Conference Mark Aslett President and CEO Gerry Haines Executive Vice President and CFO August 10, 2016

2 © 2016 Mercury Systems, Inc. Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the products and services described herein. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays or unanticipated expenses due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, increases in interest rates, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2015. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS which are non-GAAP financial measures. Adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, the presentation of adjusted EBITDA, adjusted income from continuing operations and adjusted EPS is not meant to be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes the adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS financial measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto.

3 © 2016 Mercury Systems, Inc. …to address the industry's challenges and opportunities Pioneering a next generation defense electronics company… • High-tech commercial business model • Secure processing subsystems • Serving defense Prime contractor outsourcing needs • Deployed on 300+ programs with 25+ Prime contractors • FY16 $270M revenue; Growth YoY: – 15% revenue, – 37% GAAP income(1) – 29% Adj. EBITDA – 38% backlog • FY17 guidance(2): – $368M-$376M revenue – $15.5M-$18.1M GAAP income(1) – $82M-$86M Adj. EBITDA (1) GAAP income from continuing operations. (2) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or financing-related expenses and an effective tax rate of approximately 35% in the period discussed.

4 © 2016 Mercury Systems, Inc. Investor highlights Proven Management Team Pure play defense electronics company. Embedded on key growth programs aligned to DoD priorities Leading Positions on Well-funded Platforms Pacific pivot, aging platform modernization, foreign and international military sales, SOF quick reaction capabilities Aligned with Industry Growth Drivers Internally-funded R&D. IP retention. Commercial sales model. US development, manufacturing and support Next Generation Defense Electronics Business Model Secure processing subsystems, software and services for critical Defense and Intelligence applications Innovative Technology Leader Captive Prime outsourcing largest secular growth trend. RFM and secure processing content expansion on key DoD programs Low Risk Growth Strategy Scalable business, engineering and manufacturing platform to facilitate future acquisitions Business Platform Built to Scale Successful business transformation. Double-digit revenue growth with strong profitability

5 © 2016 Mercury Systems, Inc. We are deployed on 300+ programs with 25+ Primes RADAR EW EO/IR – C4I Triton; NATO AGS Global Hawk Aegis Aegis Ashore Patriot F-16 F-35 Global Hawk SEWIP Badger/Buzzard F-15 AH-64 Apache F-35 Fury P-8 F-16 Reaper/Gorgon Stare

6 © 2016 Mercury Systems, Inc. Mercury’s vision is to be the… Leading commercial provider of secure processing subsystems designed and made in the USA

7 © 2016 Mercury Systems, Inc. …provider of outsourced defense electronics subsystems Acquisitions have transformed Mercury into a pure play… • Acquired capability expands total addressable market • Moved up the value chain • Facilitates greater customer outsourcing • Accelerates customer supply chain consolidation • Disintermediate traditional competitors • Low-risk content expansion organic growth strategy • Integrating the carve-out businesses from Microsemi SECURE PROCESSING SECURE PROCESSING DIGITIZATION DIGITIZATION RFM RFM RFM RFM RFM RFM SECURE STORAGE SECURE STORAGE Defense Electronic Subsystem (1) (1) (1) (1) Represents carve-out acquisition from Microsemi Corp. (1)

8 © 2016 Mercury Systems, Inc. Defense will likely remain a $500B+ industry… …despite the ongoing political and budget uncertainty Crowding Out of Defense Spending and Investment: Rising interest rates, healthcare and social spending; MilPer expense growth, aging military platforms’ O&M costs rising Defense Procurement Reform 3.0: Firm-fixed-price contracts and less government-funded R&D changing economics and competitive dynamics of defense industry Political Dysfunction: Sequestration-driven cuts and repeated Continuing Resolutions disrupting DoD budget process and spending Industry Has Cut Capacity to Innovate: Reduced headcount, fewer engineers and aging workforce; Less IR&D and growth investments, increased dividends and buybacks Challenging Global Security Environment: Resurgent Russia, Chinese militarization and power projection, ISIS threat, North Korean agitation, Middle East instability

9 © 2016 Mercury Systems, Inc. 530 495 496 496 534 547 556 564 570 581 500 512 525 537 551 524 585 522 480 500 520 540 560 580 600 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 PBR16 2011 Budget Act PBR17 FY16 Enacted 2015 Budget Act Defense budget outlook improved Expect continuing resolution in GFY17 PBR17 adjusts FY17 to new budget caps but not FY18-21 Sources: National Defense Authorization Act of 2016, FY2017 President’s Budget Request. Numbers may not add due to rounding. Topline Base Authorization Budget vs. BCA Caps & Bipartisan Budget Act Agreement ($B)

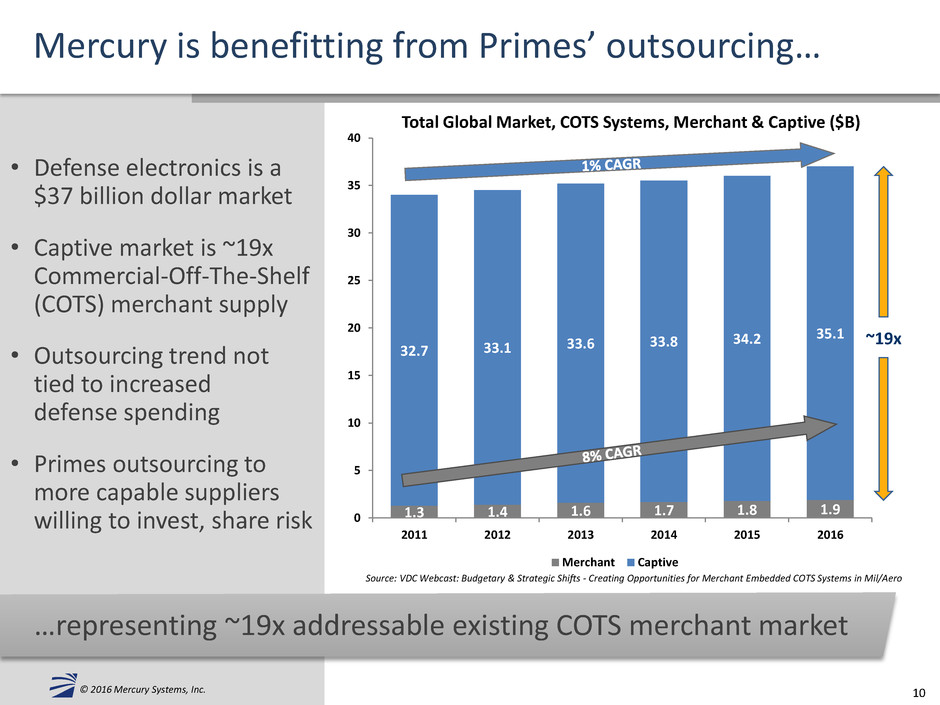

10 © 2016 Mercury Systems, Inc. …representing ~19x addressable existing COTS merchant market Mercury is benefitting from Primes’ outsourcing… • Defense electronics is a $37 billion dollar market • Captive market is ~19x Commercial-Off-The-Shelf (COTS) merchant supply • Outsourcing trend not tied to increased defense spending • Primes outsourcing to more capable suppliers willing to invest, share risk Source: VDC Webcast: Budgetary & Strategic Shifts - Creating Opportunities for Merchant Embedded COTS Systems in Mil/Aero 1.3 1.4 1.6 1.7 1.8 1.9 32.7 33.1 33.6 33.8 34.2 35.1 0 5 10 15 20 25 30 35 40 2011 2012 2013 2014 2015 2016 Merchant Captive ~19x Total Global Market, COTS Systems, Merchant & Captive ($B)

11 © 2016 Mercury Systems, Inc. …serving the US defense electronics industry How we operate as a high-tech commercial company… • Start with commercially available technology • Internal R&D funds the development of modular, reusable open innovations • Pre-integration improves affordability, time to market • Rapid customization and adaptation to platform • Mature technologies and manufacturing lower cost and reduce risk • Support rapidly changing commercial technology for a decade or more Fund Develop Integrate Mature Support Adapt Commercially Adapted Technologies

12 © 2016 Mercury Systems, Inc. …as customers seek affordable outsourced pre-integrated subsystems Business model built for speed, innovation and affordability… • Traditional COTS board model broken (“Plug-n-Pray”) – Product procurement cost low – Large hidden integration costs – Lower Prime IR&D spending – COTS lifecycle support difficult • Defense procurement reform – Less Government-funded cost-plus integration – Under firm fixed price, Prime bears risk and expense • Acquired and pre-integrating sensor chain technologies – More affordable, lower risk, simplifies supply chain – Open architectures and open middleware speed adoption Primes RFM Digital Secure Processing Mercury Pre-integrated Secure Subsystems Government Traditional COTS Model “Plug-n-Pray” Operating System COTS COTS COTS Proprietary Middleware Classified Prime/Gov’t IP 36+ months Time to Market 12 months Time to Market Open Middleware Application Ready Software Toolkit Classified Prime/Gov’t IP

13 © 2016 Mercury Systems, Inc. From highly leveraged Teraflop modules and RFM subassemblies… …to secure servers and pre-integrated sensor processing subsystems Rugged Secure Teraflop Server Blade Rugged Secure Servers for the Tactical Edge ATCA Secure Blade Server Integrated Microwave Assemblies MOSA Pre-integrated Sensor Processing Subsystems RF & Microwave MOSA Building Blocks 2U Secure Server

14 © 2016 Mercury Systems, Inc. • Pre-integrated end-to-end sensor capability unique • Lower integration costs, time, risk • Facilitates Prime outsourcing • DoD mandate • Unique capabilities • Important relationships • Critical programs • 2-3 years ahead of traditional competitors • Intel server class embedded processing • SWaP optimized packaging •Multiple form factors driving TAM expansion Factors leading to a unique market position for Mercury • Processing supply chain integrity • Modern, scalable, redundant RFM manufacture and test • Authored OpenVPX standard • RFM Digital MOSA Modular Open System Architecture Designed and Made in USA Server-class Processing Performance Integrated Product Security End-to-End Subsystem Capability

15 © 2016 Mercury Systems, Inc. Mercury’s capabilities and opportunity for growth… …are aligned to DoD investment priorities Pacific Pivot: Platforms need improved sensors, autonomy, electronic protection and attack, on-board exploitation. Greater demand for onboard processing Aging Platform Modernization: Port customer software to available state-of-the-art open architectures to rapidly and affordably upgrade electronics on aging military platforms International and Foreign Military Sales: Upgrade subsystems with security for export to expand addressable market, grow revenues and access international customer R&D funding Special Operations Forces Quick Reaction Capability: Provide rapid reaction and affordable new capabilities to support anti-terror and other special forces missions globally

16 © 2016 Mercury Systems, Inc. Defense industry growth drivers translate into specific… …company growth drivers that we are pursuing Outsourced Secure Processing Subsystems: Grow blade-server processing applications. Expand into other mission- critical secure compute applications beyond the sensor Outsourced Pre-Integrated Sensor Processing Subsystems: Provide more affordable pre-integrated MOSA sensor processing subsystems that preserves customer software value-add RF and Microwave Outsourcing: Grow share in integrated RF and microwave assemblies and MOSA RF subsystems by providing customers a better alternative

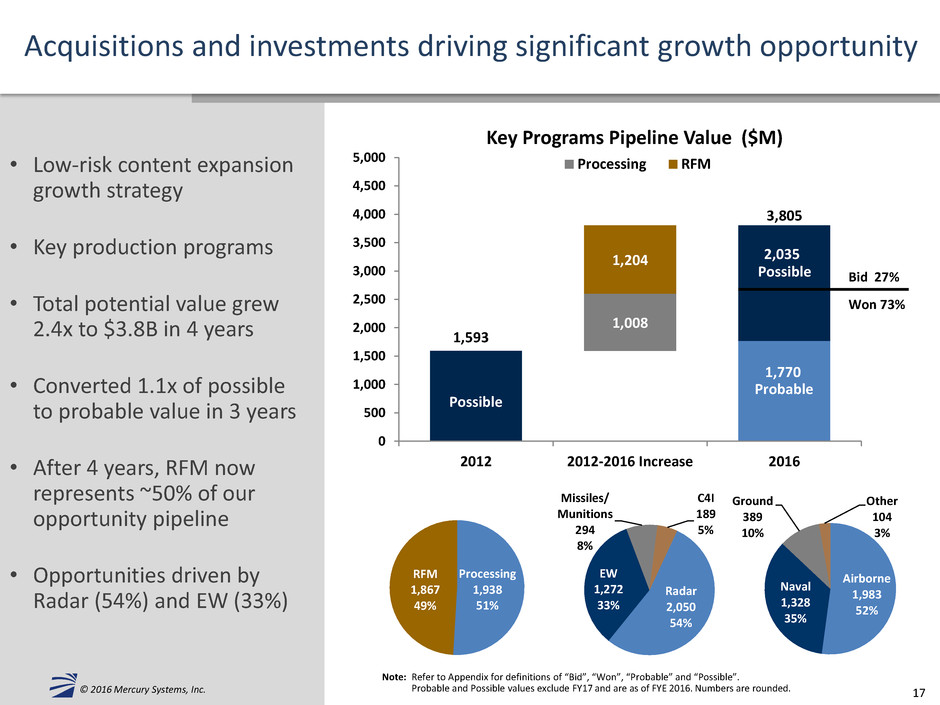

17 © 2016 Mercury Systems, Inc. Acquisitions and investments driving significant growth opportunity • Low-risk content expansion growth strategy • Key production programs • Total potential value grew 2.4x to $3.8B in 4 years • Converted 1.1x of possible to probable value in 3 years • After 4 years, RFM now represents ~50% of our opportunity pipeline • Opportunities driven by Radar (54%) and EW (33%) Note: Refer to Appendix for definitions of “Bid”, “Won”, “Probable” and “Possible”. Probable and Possible values exclude FY17 and are as of FYE 2016. Numbers are rounded. 1,770 1,593 2,035 1,008 1,204 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 2012 2012-2016 Increase 2016 Key Programs Pipeline Value ($M) Processing RFM 3,805 Probable Possible Possible Bid 27% Won 73% Processing 1,938 51% RFM 1,867 49% Airborne 1,983 52% Naval 1,328 35% Ground 389 10% Other 104 3% Radar 2,050 54% EW 1,272 33% Missiles/ Munitions 294 8% C4I 189 5%

18 © 2016 Mercury Systems, Inc. © 2016 Mercury Systems, Inc. Strategy and investments have positioned Mercury well • Pioneering a next-generation defense electronics business model • Unique technology and capabilities on key production programs • Low-risk content expansion growth strategy with demonstrable progress • Largest secular growth trend is Prime outsourcing • Above industry-average growth; dramatic improvement in profitability • Transformative acquisition drives strongly accretive growth

© 2016 Mercury Systems, Inc. Financial Overview Gerry Haines Executive Vice President & CFO

20 © 2016 Mercury Systems, Inc. We are pioneering a next-generation business model… …creating an opportunity for growth and strong returns Mercury Model Characteristics Implications and Benefits Merchant supplier of secure processing subsystems Little competition at the subsystem level Commercially designed, made in USA, military ready High barriers to entry; strong margins Strategic sales model targets DoD production programs Decades-long platforms yield strong revenue streams 11 – 13% of revenue on Research and Development Innovative design for reuse. Retain IP rights Anticipates goals of DoD procurement reforms Largest secular growth trend: Prime outsourcing

21 © 2016 Mercury Systems, Inc. 194 209 235 270 5% $9.9M 11% $23.5M 19% $44.4M 21% $57.3M 0 50 100 150 200 250 300 FY13 FY14 FY15 FY16 Revenue to Adjusted EBITDA trends Mercury Revenue ($M) Mercury Adj EBITDA (%, $M) Strong revenue growth and operating leverage… …yielded dramatic growth in adjusted EBITDA Notes: • Fiscal years ended June 30; FY13-15 figures are reported in the Company’s Form 10-Ks and FY16 from the Company’s earnings release issued on August 2, 2016.

22 © 2016 Mercury Systems, Inc. FY13-FY16 revenue CAGR of 12%... …with steady gross margin expansion, expense reduction R ev en u e ($ M ) GM / O p ex (% ) Notes: • FY13-16 figures are reported in the Company’s Form 10-Ks, Form 10-Qs and the Company’s earnings release issued on August 2, 2016. 46 46 50 52 51 51 53 54 54 57 60 64 58 60 66 85 42% 36% 42% 41% 43% 48% 46% 46% 44% 47% 47% 49% 47% 47% 46% 46% 67% 52% 46% 48% 50% 51% 48% 46% 43% 41% 37% 36% 42% 37% 36% 36% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 10 20 30 40 50 60 70 80 90 100 Q113 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Q415 Q116 Q216 Q316 Q416 Revenue GM% Opex %

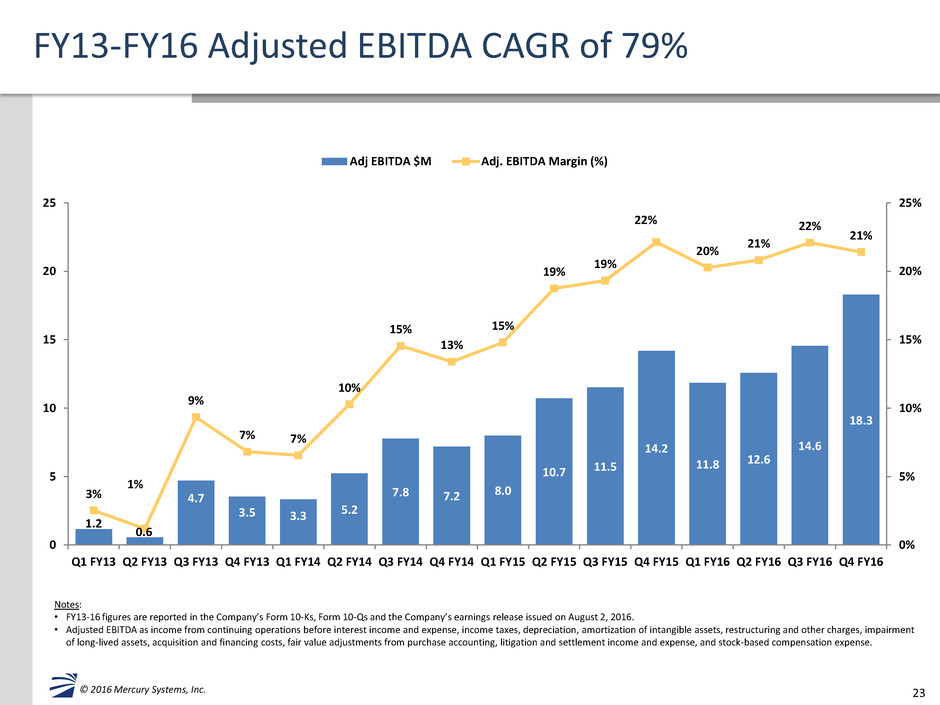

23 © 2016 Mercury Systems, Inc. FY13-FY16 Adjusted EBITDA CAGR of 79% Notes: • FY13-16 figures are reported in the Company’s Form 10-Ks, Form 10-Qs and the Company’s earnings release issued on August 2, 2016. • Adjusted EBITDA as income from continuing operations before interest income and expense, income taxes, depreciation, amortization of intangible assets, restructuring and other charges, impairment of long-lived assets, acquisition and financing costs, fair value adjustments from purchase accounting, litigation and settlement income and expense, and stock-based compensation expense. 1.2 0.6 4.7 3.5 3.3 5.2 7.8 7.2 8.0 10.7 11.5 14.2 11.8 12.6 14.6 18.3 3% 1% 9% 7% 7% 10% 15% 13% 15% 19% 19% 22% 20% 21% 22% 21% 0% 5% 10% 15% 20% 25% 0 5 10 15 20 25 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 Adj EBITDA $M Adj. EBITDA Margin (%)

24 © 2016 Mercury Systems, Inc. FY13-FY16 backlog CAGR of 28%... …yielded record backlog and revenue coverage exiting FY16 Notes: (1) Revenue Coverage Ratio = 12-month ending backlog/Next 12 months Revenue (or initial revenue estimate for current/future year). (2) Organic only; omits impact of Microsemi carve-out businesses acquired on May 2, 2016. (3) Estimate based upon guidance from the Company’s most recent earnings release; includes impact of Microsemi carve-out businesses. 109 144 166 239 136 174 208 288 0 50 100 150 200 250 300 FY13 FY14 FY15 FY16 Mercury Ending Backlog ($M) 12-Month Ending Backlog Total Ending Backlog 52% 61% Fwd Revenue Coverage Ratio⁽¹⁾ 66%(2) 64% - 65% Estimate(3)

25 © 2016 Mercury Systems, Inc. FY15 FY16 FY17 Production Years Probable Bid vs. Won Expansion Probable Possible Process RFM Total ($M) Total ($M) Aegis Sensor Processing FRP: FY14-25 Won 209 504 Processing Expansion FRP: FY19-25 Won 29 59 RFM FRP: FY16-25 Won/Bid 46 168 SEWIP Block 2 FRP: FY16-26 Won 199 294 Small Ship FRP: FY18-26 Won 67 94 Block 3 LRIP: FY18-20 Won 58 144 F-35 Existing LRIP: Up to FY21 Won 152 196 Processing LRIP: FY19-21 Bid 104 210 RFM LRIP: FY19-21 Bid 2 121 Radar Programs(1) LRIP/FRP Bid/Won 416 873 EW Programs(2) LRIP/FRP Bid/Won 253 575 Missiles/Guided Munitions(3) LRIP/FRP Bid/Won 212 378 C4I Programs(4) LRIP/FRP Bid/Won 23 189 Total: vs. Nov. 2012 % Growth: $1,770 1,138 56% $3,805 1,593 139% Program focus driving substantial growth potential Mercury’s perspective on phase, timing and potential value EMD LRIP FRP FMS (1) Radar includes Predator/Reaper, E-2D Hawkeye, F-16 SABR, BAMS/Triton, AWACS, LRDR, TFAL, Classified (2) EW includes F-15 EW, SIRFC/AIDEWS, DEWS, EPAWWS, ADAP, ProVision (3) Missiles/Guided Munitions includes PGK, MALD, SDBII (4) C4I includes P-8, Gorgon Stare, Classified Note: Refer to Appendix for definitions of “Bid”, “Won”, “Probable” and “Possible”. Probable and Possible values exclude FY17 and are as of FYE 2016. Numbers are rounded.

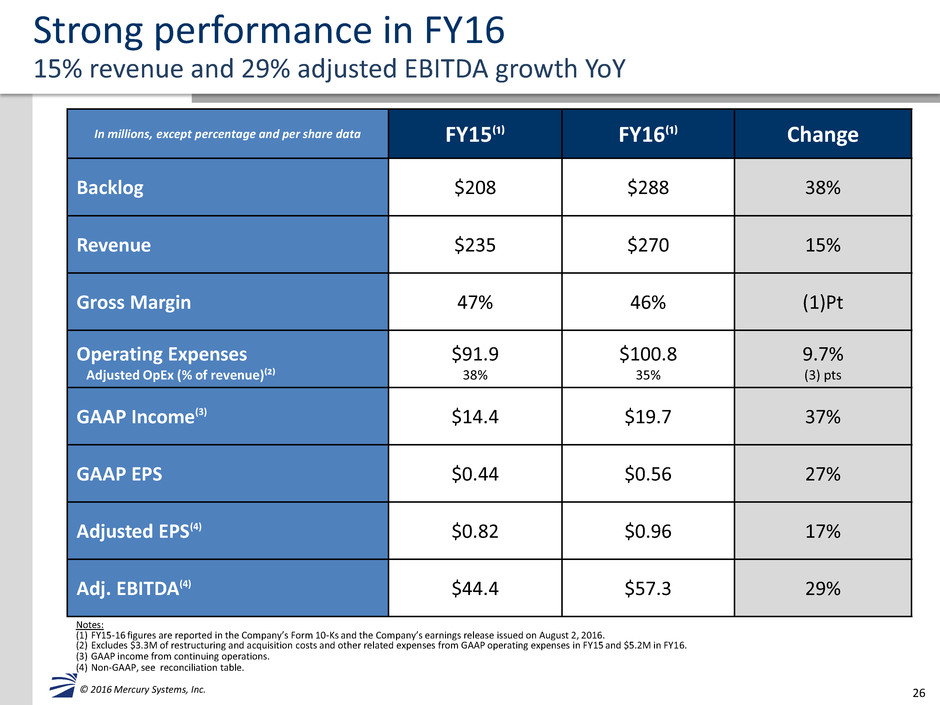

26 © 2016 Mercury Systems, Inc. Strong performance in FY16 15% revenue and 29% adjusted EBITDA growth YoY In millions, except percentage and per share data FY15⁽¹⁾ FY16⁽¹⁾ Change Backlog $208 $288 38% Revenue $235 $270 15% Gross Margin 47% 46% (1)Pt Operating Expenses $91.9 $100.8 9.7% Adjusted OpEx (% of revenue)⁽²⁾ 38% 35% (3) pts GAAP Income(3) $14.4 $19.7 37% GAAP EPS $0.44 $0.56 27% Adjusted EPS(4) $0.82 $0.96 17% Adj. EBITDA(4) $44.4 $57.3 29% Notes: (1) FY15-16 figures are reported in the Company’s Form 10-Ks and the Company’s earnings release issued on August 2, 2016. (2) Excludes $3.3M of restructuring and acquisition costs and other related expenses from GAAP operating expenses in FY15 and $5.2M in FY16. (3) GAAP income from continuing operations. (4) Non-GAAP, see reconciliation table.

27 © 2016 Mercury Systems, Inc. Q1 FY17 guidance vs. Q1 FY16 actual Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or financing-related expenses and an effective tax rate of approximately 35% in the period discussed. (2) Includes $2.1 million negative impact of inventory valuation step-up from purchase accounting. (3) GAAP income from continuing operations. (4) Non-GAAP, see reconciliation table. In millions, except percentage and per share data Q1FY16 Q1FY17⁽¹⁾ Change Revenue $58 $82-$87 41%-50% Gross Margin 47% 44%-45%(2) (2) – (3)pts Operating Expenses $24.4 $33-$34 35%-39% GAAP Income(3) $2.0 $1.0-$2.3 (50%)-15% GAAP EPS $0.06 $0.02-$0.06 0%-(67%) Adjusted EPS(4) $0.19 $0.19-$0.23 0%-21% Adj. EBITDA(4) $11.8 $17.0-$19.0 44%-60%

28 © 2016 Mercury Systems, Inc. FY17 annual guidance In millions, except percentage and per share data FY16(1) FY17(2) Change Revenue $270 $368-$376 36%-39% GAAP Income(3) $19.7 $15.5-$18.1 (21%)-(8%) GAAP EPS $0.56 $0.39-$0.45 (20%)-(30%) Adjusted EPS(4) $0.96 $0.96-$1.02 0%-6% Adj. EBITDA(4) $57.3 $82.0-$86.0 43%-50% Notes: (1) FY16 figures are reported in the Company’s Form 10-Ks and the Company’s earnings release issued on August 2, 2016. (2) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or financing-related expenses and an effective tax rate of approximately 35% in the period discussed. (3) GAAP income from continuing operations. (4) Non-GAAP, see reconciliation table.

29 © 2016 Mercury Systems, Inc. New target business model beginning FY17 Notes: (1) FY15-16 figures are reported in the Company’s Form 10-Ks and the Company’s earnings release issued on August 2, 2016. (2) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or financing-related expenses and an effective tax rate of approximately 35% in the period discussed. (3) GAAP income from continuing operations. (4) Non-GAAP, see reconciliation table. FY15⁽¹⁾ FY16⁽¹⁾ FY17(2) Revenue 100% 100% 100% 100% Gross Margin 47% 46% 45%-50% SG&A 21% 20% 16%-18% R&D 14% 12% 11%-13% Amortization 3% 3% ~5% 4%-5% GAAP Income(3) 6% 7% 4%-5% NA Adj. EBITDA(4) 19% 21% 22%-23% 22%-26% New Target Business Model

30 © 2016 Mercury Systems, Inc. Conservative balance sheet and flexible capital structure Ample liquidity, unused $100M revolver, $400M Universal Shelf capacity Notes: (1) Discontinued operations numbers are Mercury Intelligence Systems, which was divested in January 2015. (2) $200 Term Loan A facility entered into on May 2, 2016 in connection with closing of Microsemi carve-out acquisition. FY14 FY15 FY16 (In millions) Actual Actual Actual ASSETS Cash & cash equivalents 47.3 77.6 81.7 Accounts receivable, net 59.7 53.8 95.9 Inventory, net 31.7 32.0 58.3 PP&E, net 14.1 13.2 28.3 Goodwill and intangibles, net 193.1 186.1 460.7 Other 21.6 24.2 11.6 Assets of discontinued operations⁽¹⁾ 6.2 0.0 0.0 TOTAL ASSETS 373.7 386.9 736.5 LIABILITIES AND S/E AP and other liabilities 44.2 36.8 71.5 Debt 0.0 0.0 192.0 ⁽²⁾ Liabilities of discontinued operations⁽¹⁾ 2.4 0.0 0.0 Total liabilities 46.6 36.8 263.5 Stockholders' equity 327.1 350.1 473.0 TOTAL LIABILITIES AND S/E 373.7 386.9 736.5

31 © 2016 Mercury Systems, Inc. © 2016 Mercury Systems, Inc. Poised for continued, profitable growth • Recent acquisition transforms top and bottom lines • Substantial cost synergies and revenue opportunities • Above average growth & profitability driven by strong, well-established programs • Record backlog enhances forward visibility, facilitates operational execution • Conservative balance sheet and strong cash flows support growth, future M&A • Improving defense environment enhances opportunity set

© 2016 Mercury Systems, Inc. Appendix

33 © 2016 Mercury Systems, Inc. Q1 FY17 guidance (as of August 2nd) Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or financing-related expenses and an effective tax rate of approximately 35% in the period discussed. (2) Non-GAAP. In millions, except percentage and per share data Q1 FY16 Q1FY17(1) YoY Change Actual Est. Range Revenue $58 $82-$87 41%-50% GAAP Income from continuing operations $2.0 $1.0-$2.3 (50%)-15% Adj. EBITDA(2) $11.8 $17.0-$19.0 44%-60% Adj EBITDA Reconciliation: Income (loss) from continuing operations 2.0 $1.0-$2.3 Interest (income) expense, net (0.0) $1.8 Tax provision (benefit) 1.3 $0.5-$1.2 Depreciation 1.6 $3.3 Amortization of intangible assets 1.7 $4.5 Restructuring and other charges 0.3 $0.0 Impairment of long-lived assets 0.0 $0.0 Acquisition and financing costs 2.3 $0.0 Fair value adjustments from purchase accounting 0.0 $2.1 Litigation and settlement (income) expense, net 0.0 $0.0 Stock-based compensation expense 2.7 $3.8 Adj. EBITDA(2) $11.8 $17.0-$19.0 44%-60% GAAP EPS $0.06 $0.02-$0.06 ($0.04) to $0.00 Adjusted EPS(2) $0.19 $0.19-$0.23 $0.00 to $0.04

34 © 2016 Mercury Systems, Inc. FY17 guidance (as of August 2nd) In millions, except percentage and per share data FY16 FY17(1) YoY Change Actual Est. Range Revenue $270 $368-$376 36%-39% GAAP Income from continuing operations $19.7 $15.5-$18.1 (21%)-(8%) Adj. EBITDA(2) $57.3 $82.0-$86.0 43%-50% Adj EBITDA Reconciliation: Income (loss) from continuing operations 19.7 $15.5-$18.1 Interest (income) expense, net 1.0 $7.1 Tax provision (benefit) 5.5 $8.5-$9.9 Depreciation 6.9 $15.2 Amortization of intangible assets 8.8 $17.4 Restructuring and other charges 1.2 $0.0 Impairment of long-lived assets 0.2 $0.0 Acquisition and financing costs 4.7 $0.0 Fair value adjustments from purchase accounting 1.4 $2.8 Litigation and settlement (income) expense, net (1.9) $0.0 Stock-based compensation expense 9.6 $15.5 Adj. EBITDA(2) $57.3 $82.0-$86.0 43%-50% GAAP EPS $0.56 $0.39-$0.45 ($0.17) to ($0.11) Adjusted EPS(2) $0.96 $0.96-$1.02 $0.00 to $0.06 Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or financing-related expenses and an effective tax rate of approximately 35% in the period discussed. (2) Non-GAAP.

35 © 2016 Mercury Systems, Inc. Adjusted EPS reconciliation Notes: (1) Numbers shown are in cents. (000's) FY13 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 FY16 Diluted net earnings (loss) per share ⁽¹⁾ $ (0.46) $ (0.13) $ 0.02 $ 0.09 $ 0.14 $ 0.18 $ 0.44 $ 0.06 $ 0.14 $ 0.13 $ 0.22 $ 0.56 Income (loss) from continuing operations $(13,782) $ (4,072) $ 717 $ 2,886 $ 4,694 $ 6,132 $ 14,429 $ 1,960 $ 4,793 $ 4,526 $ 8,463 $ 19,742 Amortization of intangible assets 8,222 7,328 1,762 1,762 1,744 1,740 7,008 1,713 1,638 1,754 3,737 8,842 Restructuring and other charges 7,060 5,443 1,268 1,162 27 718 3,175 338 221 409 272 1,240 Impairment of long-lived assets - - - - - - - - 231 - - 231 Acquisition and financing costs 318 - - - 200 251 451 2,298 25 1,725 653 4,701 Fair value adjustments from purchase accounting 2,293 - - - - - - - - - 1,384 1,384 Litigation and settlement expenses - - - - - - - - - - (1,925) (1,925) Stock-based compensation expense 7,854 8,999 2,551 2,256 1,870 1,964 8,640 2,702 2,392 2,150 2,330 9,574 Impact to income taxes (8,776) (5,772) (1,956) (1,658) (1,088) (2,030) (6,733) (2,570) (1,475) (2,148) (3,782) (9,975) Adjusted income from continuing operations $ 3,189 $ 11,926 $ 4,342 $ 6,408 $ 7,447 $ 8,775 $ 26,970 $ 6,441 $ 7,825 $ 8,416 $ 11,132 $ 33,814 Diluted adjusted net earnings per share ⁽¹⁾ $ 0.10 $ 0.38 $ 0.13 $ 0.20 $ 0.22 $ 0.26 $ 0.82 $ 0.19 $ 0.23 $ 0.25 $ 0.29 $ 0.96 Weighted-average shares outstanding: Basic 30,128 31,000 31,635 32,052 32,298 32,436 32,114 32,778 33,120 33,251 37,811 34,241 Diluted 30,492 31,729 32,481 32,686 33,233 33,330 32,939 33,616 33,831 33,991 38,954 35,097

36 © 2016 Mercury Systems, Inc. Adjusted EBITDA reconciliation (000'S) FY13 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 FY16 Income (loss) from continuing operations $(13,782) $ (4,072) $ 717 $ 2,886 $ 4,694 $ 6,132 $ 14,429 $ 1,960 $ 4,793 $ 4,526 $ 8,463 $ 19,742 Interest expense (income), net 31 40 5 4 1 3 13 (22) (21) (36) 1,120 1,041 Tax provision (benefit) (10,501) (1,841) - 1,047 1,469 1,850 4,366 1,264 1,680 2,473 127 5,544 Depreciation 8,445 7,625 1,700 1,590 1,510 1,532 6,332 1,588 1,620 1,565 2,127 6,900 Amortization of intangible assets 8,222 7,328 1,762 1,762 1,744 1,740 7,008 1,713 1,638 1,754 3,737 8,842 Restructuring and other charges 7,060 5,443 1,268 1,162 27 718 3,175 338 221 409 272 1,240 Impairment of long-lived assets - - - - - - - - 231 - - 231 Acquisition and financing costs 318 - - - 200 251 451 2,298 25 1,725 653 4,701 Fair value adjustments from purchase accounting 2,293 - - - - - - - - - 1,384 1,384 Litigation and settlement expenses - - - - - - - - - - (1,925) (1,925) Stock-based compensation expense 7,854 8,999 2,551 2,256 1,870 1,964 8,640 2,702 2,392 2,150 2,330 9,574 Adjusted EBITDA $ 9,940 $ 23,522 $ 8,003 $ 10,707 $ 11,515 $ 14,190 $ 44,414 $ 11,841 $ 12,579 $ 14,566 $ 18,288 $ 57,274

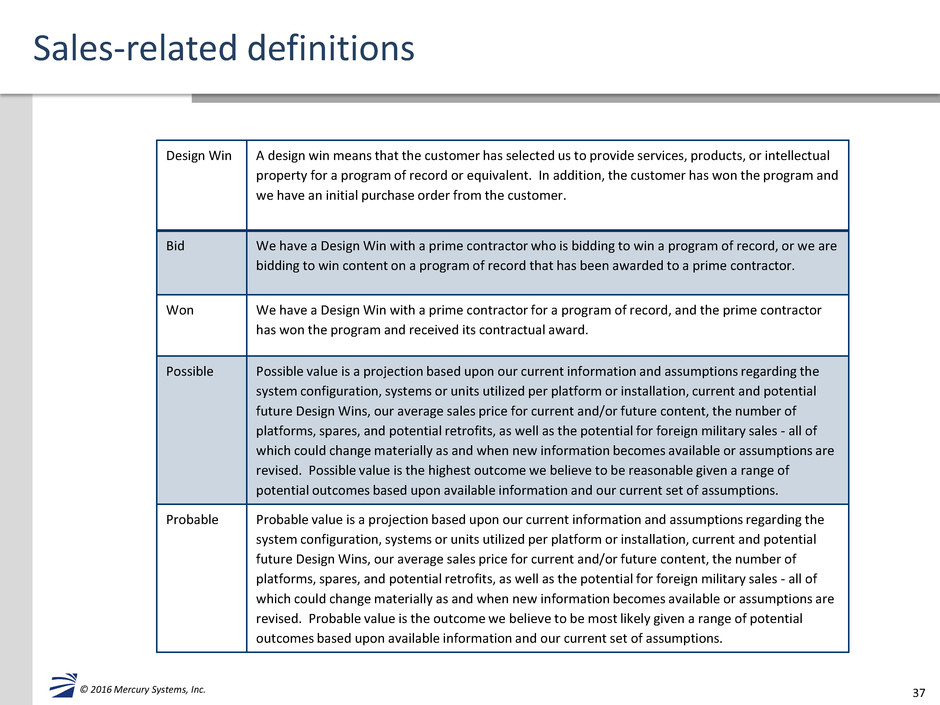

37 © 2016 Mercury Systems, Inc. Sales-related definitions Design Win A design win means that the customer has selected us to provide services, products, or intellectual property for a program of record or equivalent. In addition, the customer has won the program and we have an initial purchase order from the customer. Bid We have a Design Win with a prime contractor who is bidding to win a program of record, or we are bidding to win content on a program of record that has been awarded to a prime contractor. Won We have a Design Win with a prime contractor for a program of record, and the prime contractor has won the program and received its contractual award. Possible Possible value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Possible value is the highest outcome we believe to be reasonable given a range of potential outcomes based upon available information and our current set of assumptions. Probable Probable value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Probable value is the outcome we believe to be most likely given a range of potential outcomes based upon available information and our current set of assumptions.

38 © 2016 Mercury Systems, Inc. Glossary ADAP Advanced Decoy Architecture Payloads EMD Engineering and Manufacturing Development OpenVPX System-level specification for VPX, initiated by Mercury AEGIS Aegis Ballistic Missile Defense System EO/IR Electro-optical / Infrared PBR President's Budget Request AESA Active Electronically Scanned Array EPAWWS Eagle Passive Active Warning Survivability System PGK Precision Guided Kit AGS Alliance Ground Surveillance EW Electronic Warfare RFM Radio Frequency / Microwave AIDEWS Advanced Integrated Defensive Electronic Warfare Suite FMS Foreign Military Sales SABR Scalable Agile Beam Radar AMC Advanced Microelectronics Center FRP Full Rate Production SDB Small Diameter Bomb ATCA Advanced Telecommunications Architecture IMA Integrated Microwave Assembly SEWIP Surface Electronic Warfare Improvement Program AWACS Airborne Warning and Control System LRDR Long Range Discrimination Radar SIGINT Signals Intelligence BAMS Broad Area Maritime Surveillance LRIP Low-Rate Initial Production SIRFC Suite of Integrated RF Countermeasures BCA Budget Control Act MALD Miniature Air Launched Decoy SOF Special Operations Forces C4ISR Command, Control, Communications, Computers, Intelligence, Surveillance, Reconnaissance MILPER Military Personnel SWaP Size Weight and Power COTS Commercial off-the Shelf MOSA Modular Open Systems Architecture TAM Total Addressable Market DRFM Digital Radio Frequency Memory O&M Operations & Maintenance TFAL Terrain Following Airborne Laser