© 2017 Mercury Systems, Inc. Proposed Acquisition of Themis Computer December 21, 2017

2 © 2017 Mercury Systems, Inc. Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the acquisition described herein. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays or unanticipated expenses due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, increases in interest rates, changes to cyber-security regulations and requirements, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2017. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS which are non-GAAP financial measures. Adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, the presentation of adjusted EBITDA, adjusted income from continuing operations and adjusted EPS is not meant to be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes the adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS financial measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals.

3 © 2017 Mercury Systems, Inc. © 2017 Mercury Systems, Inc. Agenda • Transaction overview • Acquisition strategic rationale • Review of acquired businesses • Financial summary

4 © 2017 Mercury Systems, Inc. Transaction overview Acquiring Themis Computer – a high-growth company specializing in C4I applications Strong organic growth driven by established positions on well-funded programs Delivers growth with strong profitability and cash flows Acquired business ~$57 mm estimated CY2017 revenue, ~23% adjusted EBITDA margin, pre-synergies Immediately accretive to adjusted EPS; consistent with Mercury’s target financial model Aligned with Mercury’s target of 22 – 26% adjusted EBITDA Cost synergies and achievable revenue synergies ~$1 mm expected annual run-rate cost synergies; numerous revenue opportunities Highly strategic acquisition consistent with Mercury's recent entry into C4I market Expected close in Q1 calendar 2018; Pro forma leverage of ~1.5x using existing revolver

5 © 2017 Mercury Systems, Inc. • Creates platform to further penetrate C4I market organically and through future acquisitions • Strengthens Mercury’s position in rugged server market as well as small and custom form factor computers • Significantly enhances ability to offer tactical cloud solutions, including high performance rugged computing, storage and security • Expands Navy and Army program portfolio and customer footprint, with complementary positions and expansion opportunities using Mercury’s well- developed channel • Leverages Mercury’s investment and capabilities in trusted computing Acquisition strategic rationale Highly aligned with our existing strategy and business

6 © 2017 Mercury Systems, Inc. Company snapshot Description • Leader in the design, manufacture and integration of commercial, SWaP-optimized rugged servers, computers and storage systems for U.S. and international defense programs • Products are used in C4I applications for key ground programs and are deployed on virtually every U.S. Navy surface ship and submarine • Locations: Fremont, CA (HQ); Fairfax, VA; Eybens, France Key Services and Product Offerings Key Customers Key Programs and Platforms • Rugged rack-mount servers primarily for naval C2 applications • Small form-factor tactical computers and switches primarily for ground C2 applications • Integrated platforms for tactical cloud-based C2 applications CPS JLTV WIN-T Aegis Sub-surface CG, CVN, LHD Class

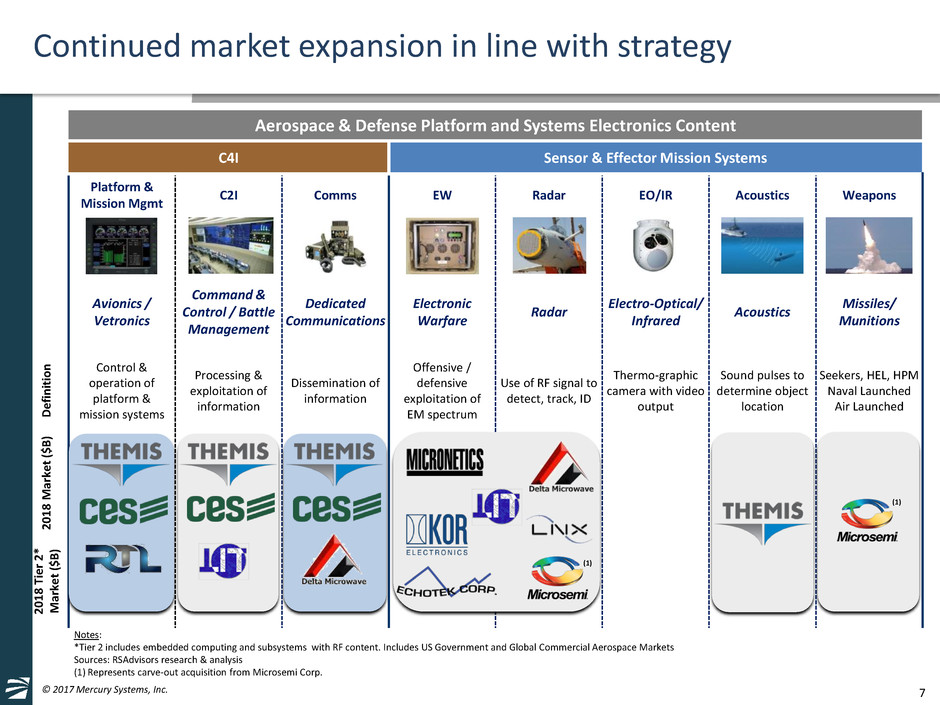

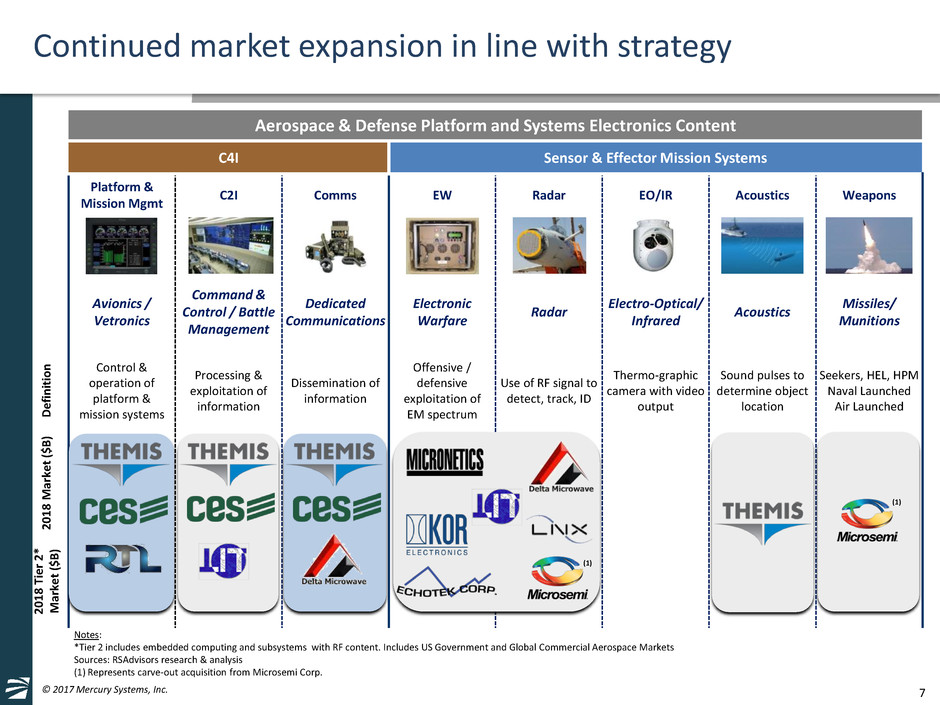

7 © 2017 Mercury Systems, Inc. Continued market expansion in line with strategy Aerospace & Defense Platform and Systems Electronics Content C4I Sensor & Effector Mission Systems Platform & Mission Mgmt C2I Comms EW Radar EO/IR Acoustics Weapons Avionics / Vetronics Command & Control / Battle Management Dedicated Communications Electronic Warfare Radar Electro-Optical/ Infrared Acoustics Missiles/ Munitions D e fi n itio n Control & operation of platform & mission systems Processing & exploitation of information Dissemination of information Offensive / defensive exploitation of EM spectrum Use of RF signal to detect, track, ID Thermo-graphic camera with video output Sound pulses to determine object location Seekers, HEL, HPM Naval Launched Air Launched 201 8 M ar ke t ($ B ) $8.1B 5.0% ‘18-22 CAGR $8.0B 4.4% ‘18-22 CAGR $3.6B 6.1% ‘18-22 CAGR $5.6B 4.2% ‘18-22 CAGR 201 8 T ie r 2* M ar ke t ($ B ) $6.8B 3.5% ‘18-22 CAGR $6.2B 4.9% ‘18-22 CAGR $4.7B 4.5% ‘18-22 CAGR $4.3B 6.1% ‘18-22 CAGR $4.2B 5.5% ‘18-22 CAGR $1.1B 7.3% ‘18-22 CAGR $2.6B 5.3% ‘18-22 CAGR (1) (1) Notes: *Tier 2 includes embedded computing and subsystems with RF content. Includes US Government and Global Commercial Aerospace Markets Sources: RSAdvisors research & analysis (1) Represents carve-out acquisition from Microsemi Corp.

8 © 2017 Mercury Systems, Inc. Consistent with past M&A transactions Acquisition Close Date Jan 2011 Dec 2011 Aug 2012 Dec 2015 May 2016 Nov 2016 Apr 2017 Jul 2017 Q3 FY18** Size $31mm $70mm $75mm $10mm $300mm $39mm $40.5mm Not Reported $180mm Strong Strategic Rationale Expand Addressable Market Revenue & Cost Synergies Accretive in Short Term Seller Founder Private Equity Public Founder Corporate Carve-out Private Equity Founder Founder Private Equity Sourcing Proprietary Negotiated Proprietary Negotiated Targeted Auction Proprietary Negotiated Proprietary Negotiated Proprietary Negotiated Targeted Auction Proprietary Negotiated Targeted Auction Learn Market Add Capabilities Scale Business Leverage Channel Maintain Conservative Balance Sheet Disciplined Approach to M&A * Represents carve-out acquisition from Microsemi Corp. ** Projected transaction close * ~$575mm of capital deployed in ~24 months

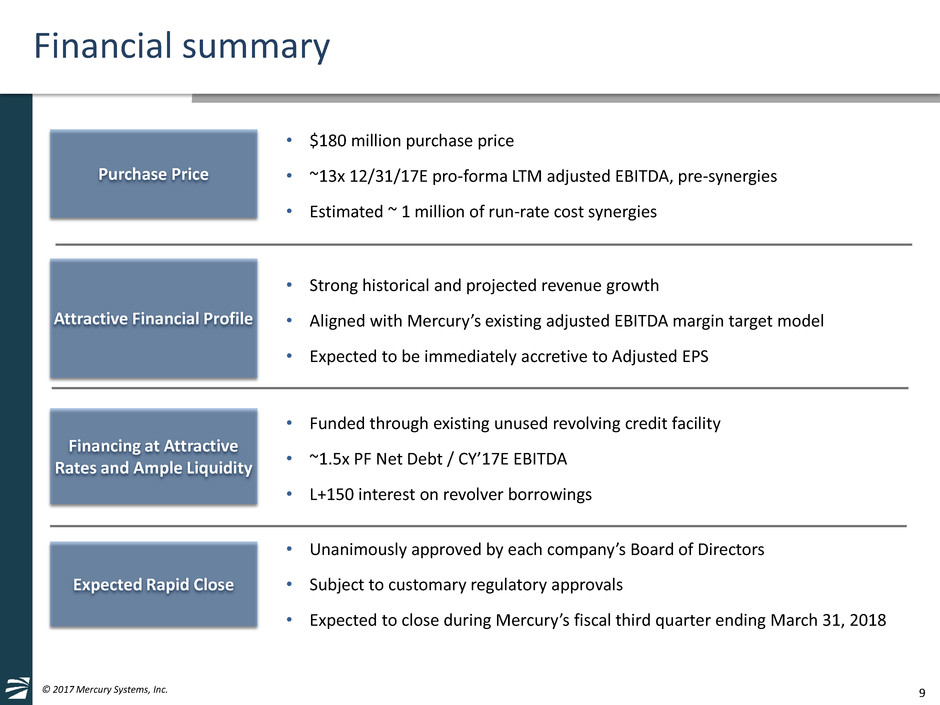

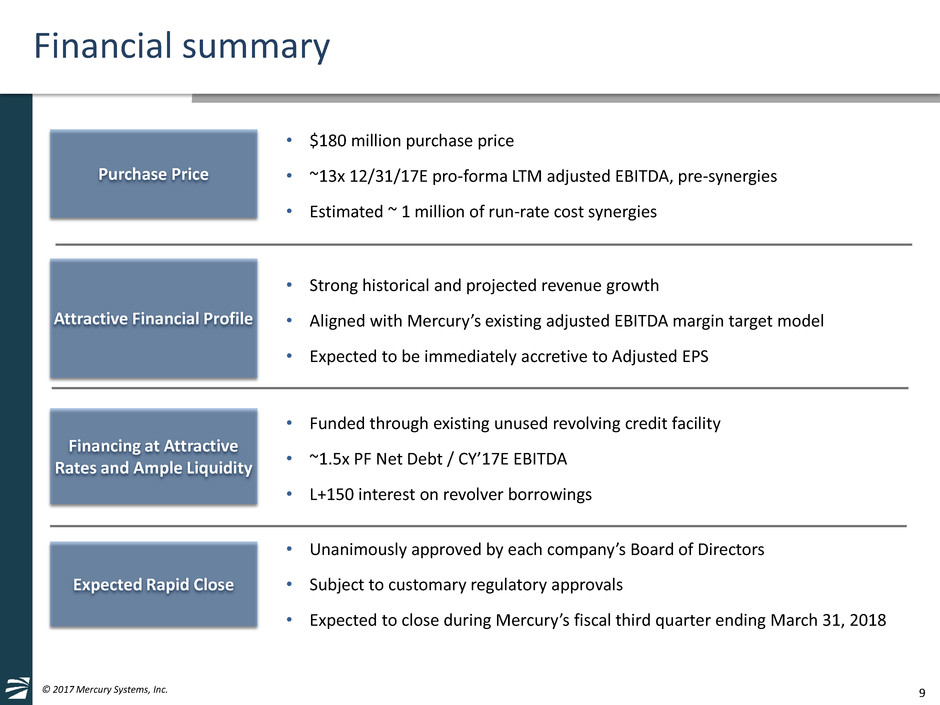

9 © 2017 Mercury Systems, Inc. Financial summary • $180 million purchase price • ~13x 12/31/17E pro-forma LTM adjusted EBITDA, pre-synergies • Estimated ~ 1 million of run-rate cost synergies Purchase Price Attractive Financial Profile • Strong historical and projected revenue growth • Aligned with Mercury’s existing adjusted EBITDA margin target model • Expected to be immediately accretive to Adjusted EPS Financing at Attractive Rates and Ample Liquidity • Funded through existing unused revolving credit facility • ~1.5x PF Net Debt / CY’17E EBITDA • L+150 interest on revolver borrowings Expected Rapid Close • Unanimously approved by each company’s Board of Directors • Subject to customary regulatory approvals • Expected to close during Mercury’s fiscal third quarter ending March 31, 2018

10 © 2017 Mercury Systems, Inc. • Platform acquisition aligned with C4I market penetration strategy • Access to new customers and programs • Opportunities for cost and revenue synergies • Accretive to Adj. EPS and aligned with Adj. EBITDA margin target • Leverages balance sheet at low cost of capital • Continued financial flexibility for additional acquisitions Summary