© 2018 Mercury Systems, Inc. Investor Presentation Mark Aslett President and CEO Michael Ruppert Executive Vice President and CFO March 1, 2018

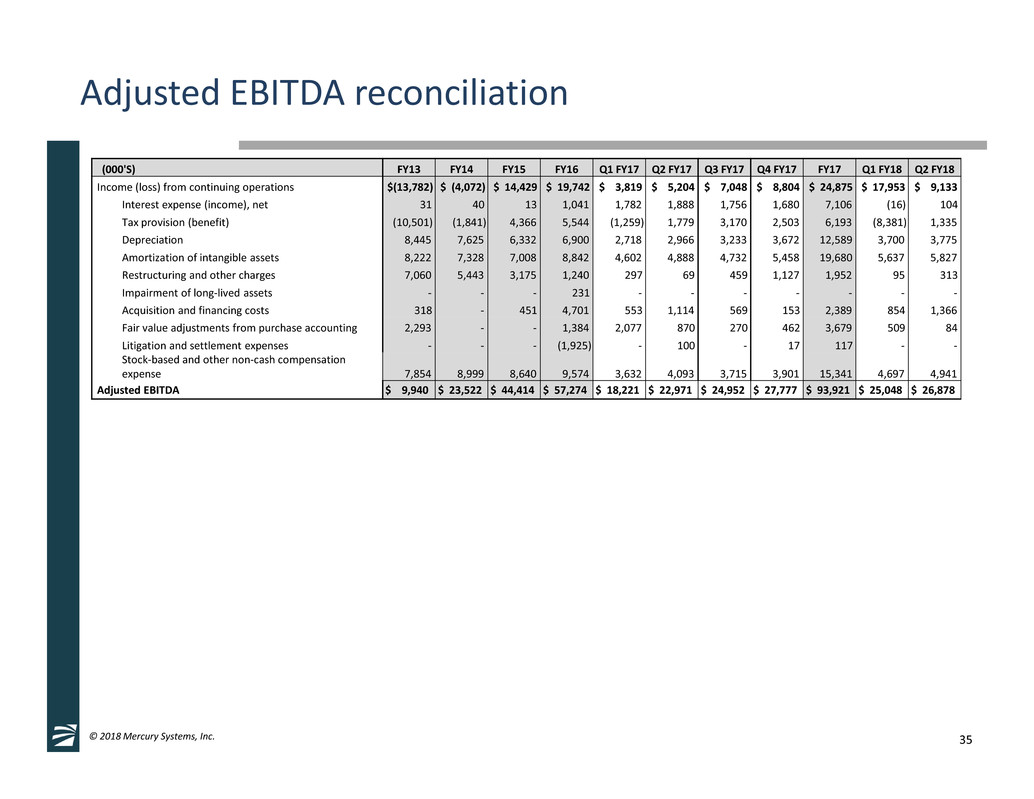

2© 2018 Mercury Systems, Inc. Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to fiscal 2018 business performance and beyond and the Company’s plans for growth and improvement in profitability and cash flow. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of any U.S. Federal government shutdown or extended continuing resolution, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, changes to cyber-security regulations and requirements, changes in tax rates or tax regulations, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2017. The Company cautions readers not to place undue reliance upon any such forward- looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS which are non-GAAP financial measures. Adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, the presentation of adjusted EBITDA, adjusted income from continuing operations and adjusted EPS is not meant to be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes the adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS financial measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto.

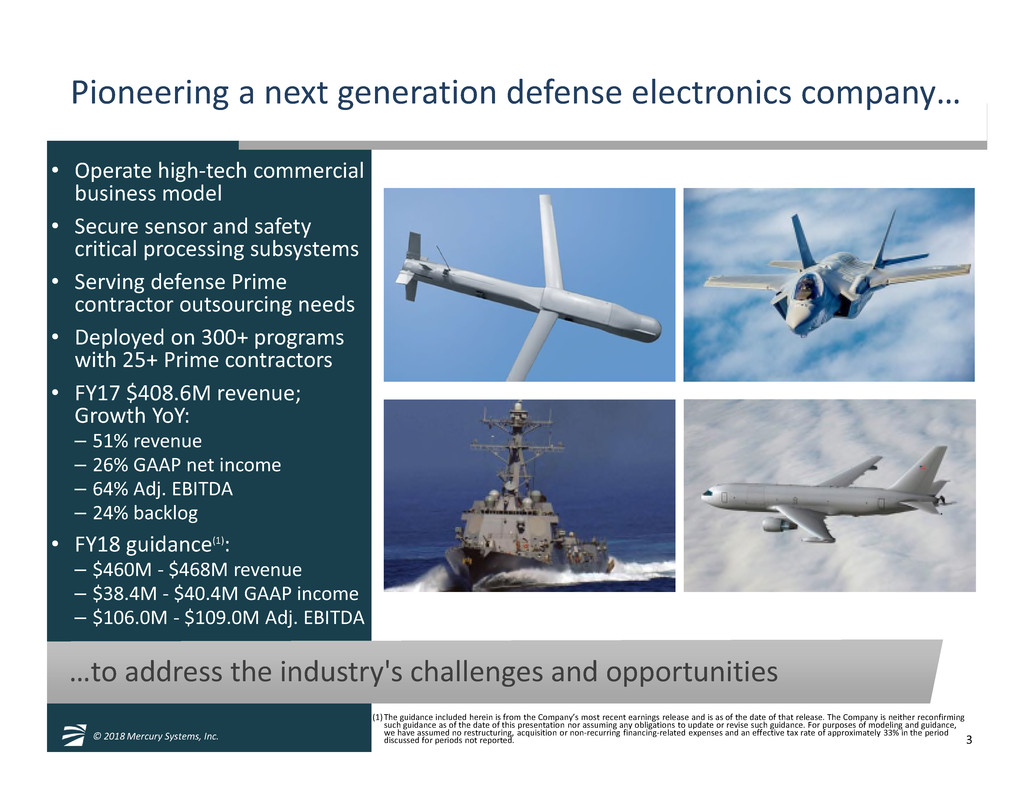

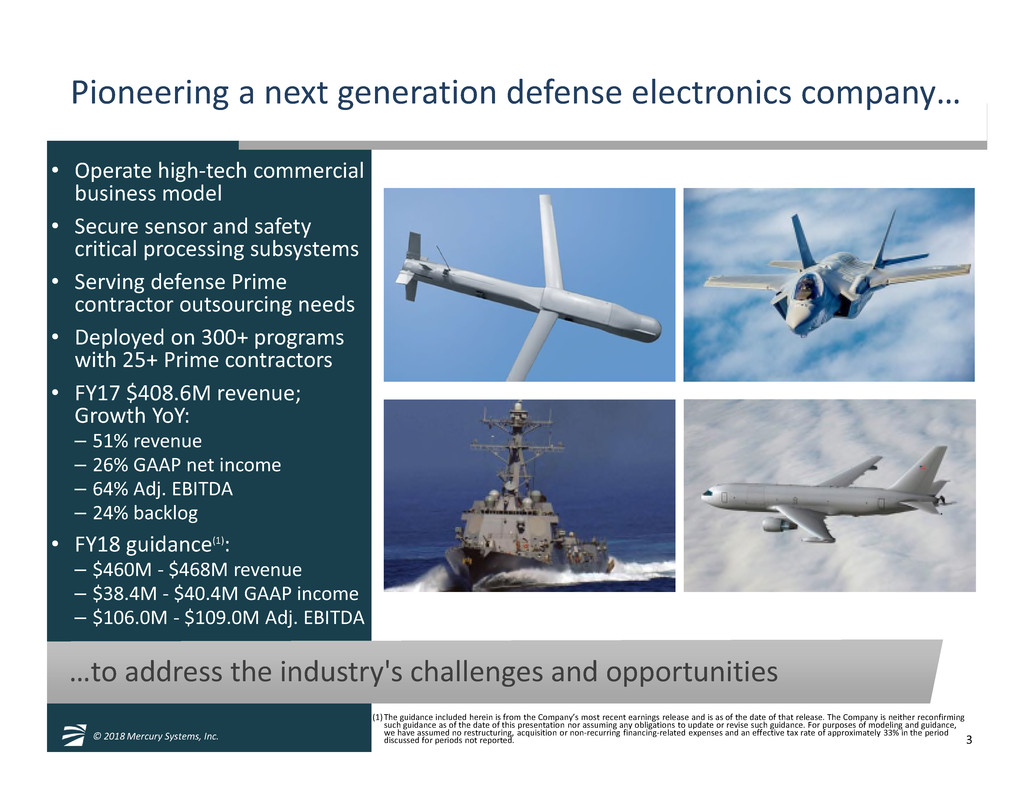

3© 2018 Mercury Systems, Inc. …to address the industry's challenges and opportunities Pioneering a next generation defense electronics company… • Operate high-tech commercial business model • Secure sensor and safety critical processing subsystems • Serving defense Prime contractor outsourcing needs • Deployed on 300+ programs with 25+ Prime contractors • FY17 $408.6M revenue; Growth YoY: – 51% revenue – 26% GAAP net income – 64% Adj. EBITDA – 24% backlog • FY18 guidance(1): – $460M - $468M revenue – $38.4M - $40.4M GAAP income – $106.0M - $109.0M Adj. EBITDA (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or non-recurring financing-related expenses and an effective tax rate of approximately 33% in the period discussed for periods not reported.

4© 2018 Mercury Systems, Inc. Strategy delivering above average growth and profitability Focused on economic core – aerospace and defense electronics Focused on Core Markets Expanded addressable market and moved up value chain High-tech R&D investment level for aerospace and defense electronics Built trusted RF, digital and custom microelectronics manufacturing Solution sales and strategic account management Strengthened team, processes, systems and balance sheet Acquired New Capabilities Increased IR&D Spend Trusted Domestic Manufacturing Transformed Go To Market Model Built Scalable M&A Platform 1 2 3 4 5 6 Defense electronics destination employer and acquirer of choice Destination Employer7

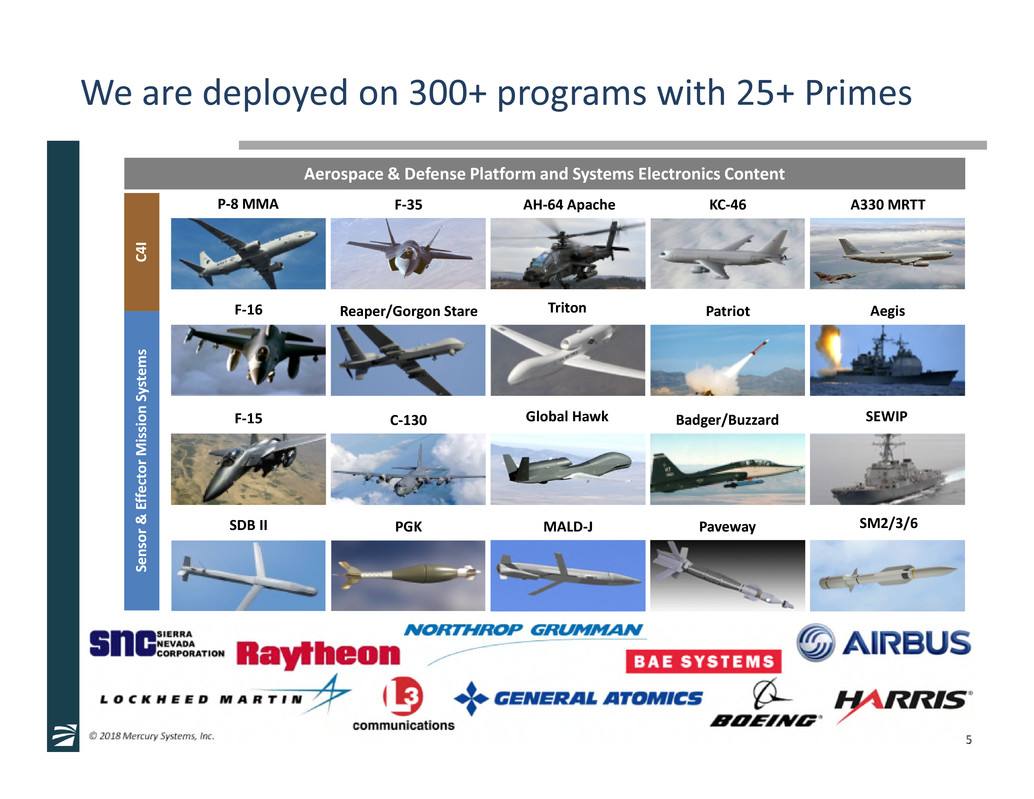

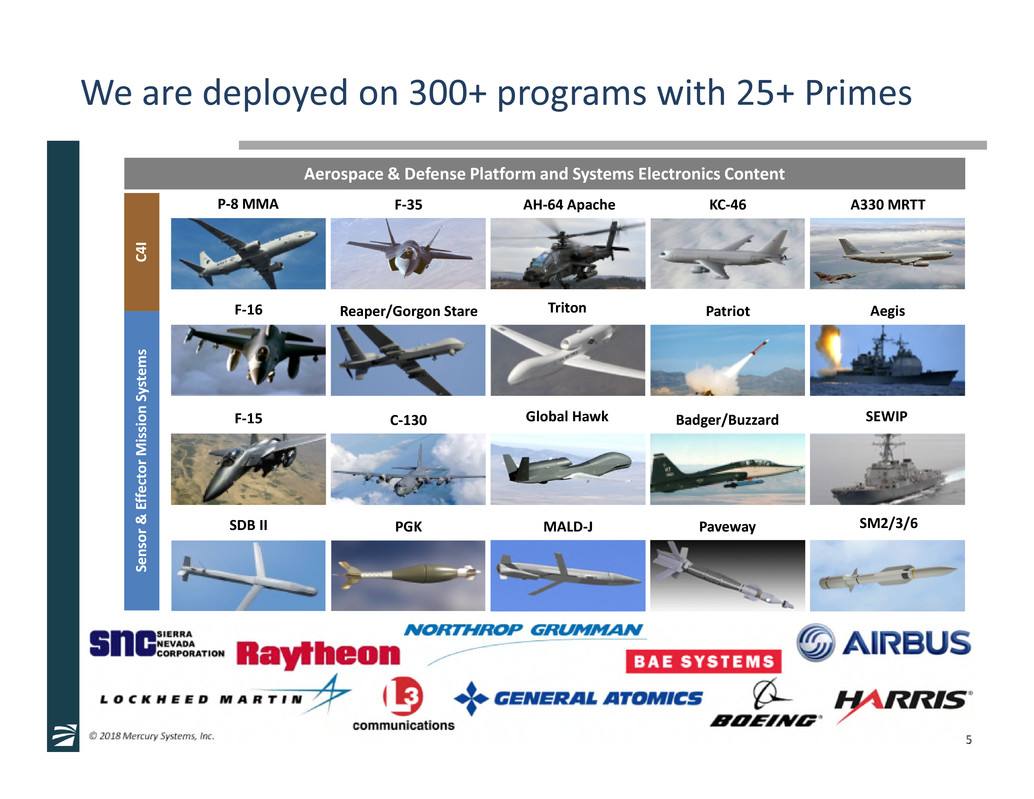

5© 2018 Mercury Systems, Inc. We are deployed on 300+ programs with 25+ Primes C 4 I Se n so r & Ef fe ct o r M is si o n Sy st em s P-8 MMA KC-46 A330 MRTTF-35 C-130 MALD-J SM2/3/6PavewaySDB II PGK Triton AegisPatriotF-16 Reaper/Gorgon Stare Global Hawk SEWIPBadger/BuzzardF-15 AH-64 Apache Aerospace & Defense Platform and Systems Electronics Content

6© 2018 Mercury Systems, Inc. Mercury’s vision is to be the… Leading commercial provider of secure sensor and safety-critical processing subsystems

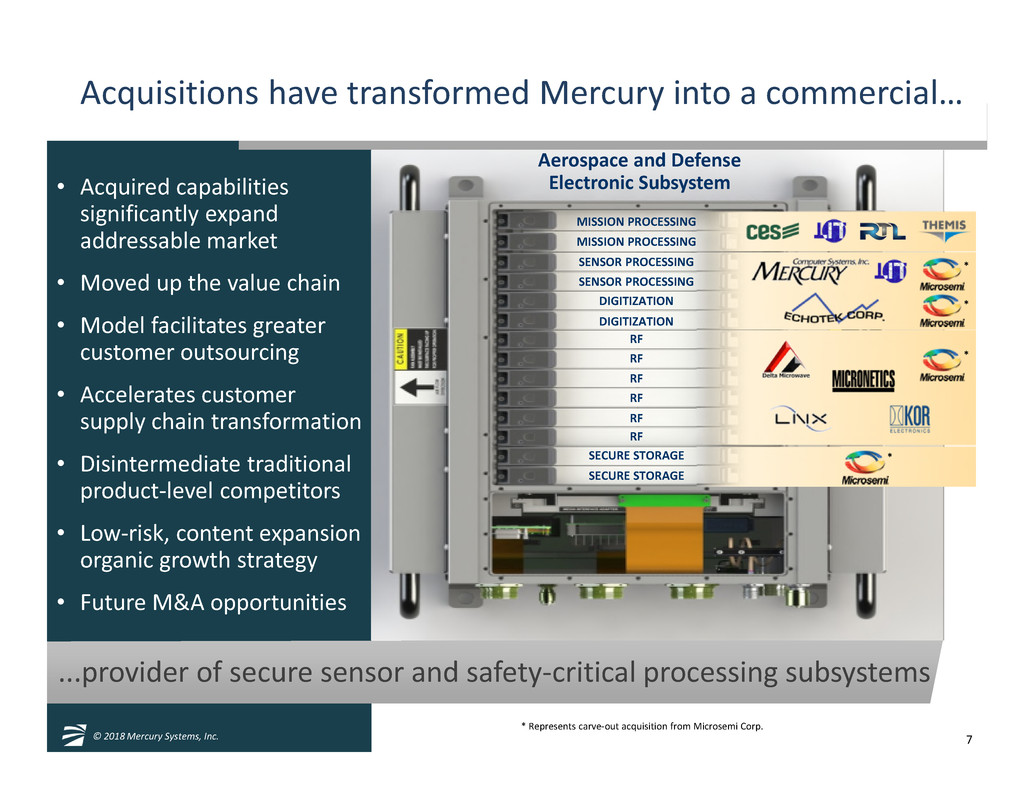

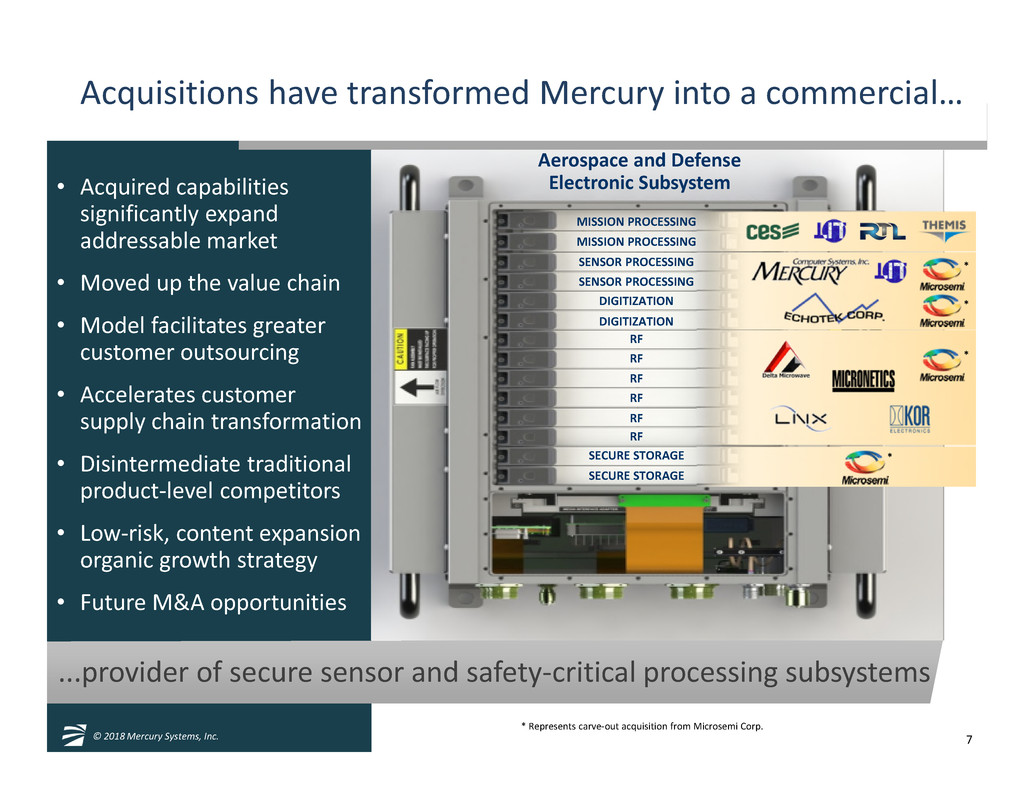

7© 2018 Mercury Systems, Inc. ...provider of secure sensor and safety-critical processing subsystems Acquisitions have transformed Mercury into a commercial… • Acquired capabilities significantly expand addressable market • Moved up the value chain • Model facilitates greater customer outsourcing • Accelerates customer supply chain transformation • Disintermediate traditional product-level competitors • Low-risk, content expansion organic growth strategy • Future M&A opportunities * Represents carve-out acquisition from Microsemi Corp. DIGITIZATION RF RF RF RF RF SECURE STORAGE SECURE STORAGE RF DIGITIZATION SENSOR PROCESSING SENSOR PROCESSING MISSION PROCESSING MISSION PROCESSING Aerospace and Defense Electronic Subsystem * * * *

8© 2018 Mercury Systems, Inc. Five major trends shaping the defense industry Increased Defense Spending Cycle: Rising interest rates, healthcare and social spending remain issues; MilPer expense growth, aging military platforms’ O&M costs rising Challenging Global Security Environment: Resurgent Russia, Chinese militarization and power projection, ISIS, North Korean threat, Middle East instability Innovation Challenges: Increasing headcount but recruitment challenges and aging workforce; Relatively low IR&D requires focused investment and greater outsourcing Defense Procurement Reform: Firm-fixed-price contracts changing economics and industry competitive dynamics despite increased defense spending Political Dysfunction: Budget Control Act and repeated Continuing Resolutions disrupting DoD budget process and spending

9© 2018 Mercury Systems, Inc. The Bipartisan Budget Deal of 2018 provides a significant near-term impulse to defense spending… …but funding levels in 2020 and beyond remain to be determined Topline Base Authorization Budget vs. BCA Caps (Discretionary BA, Current $B) Notes: Budget and BCA Caps represent the 051 account (DoD), FY18 is estimate based on Bipartisan Budget Deal Sources: CBO, CRS, OMB, DoD Green Book, House FY18 Concurrent Budget Resolution, RSAdvisors research & analysis 524 601 686 704 713 730 747 499 522 672 617 631 647 664 681 564 581 606 $450 $500 $550 $600 $650 $700 $750 $800 2015 2016 2017 2018 2019 2020 2021 2022 2023 FY18 Bipartisan Budget Deal (Base) Administration 2019 Base + OCO request Actual funding (Base) FY18 Bipartisan Budget Deal (Base + OCO) Administration 2019 Base request Actual funding (Base + OCO) Budget Control Act 2011 base

10© 2018 Mercury Systems, Inc. Mercury’s capabilities and drivers of growth are aligned… Sensor and C4I modernization and new platforms Weapon systems readiness and modernization Defense Prime contractors outsourcing more Defense Primes’ flight to quality suppliers Defense Primes and government delayering supply chains Foreign military and international sales increasing …to DoD investment priorities and overall A&D industry trends

11© 2018 Mercury Systems, Inc. …likely the Defense industry's largest secular growth opportunity Captive outsourcing by Defense prime contractors… • 2018 A&D electronics is $103 billion market • US Defense is nearly half of total market at $51B • Tier 2 compute & RF – Global $32B; 5% CAGR – US $16B; 5.7% CAGR • Small percentage of Tier 2 compute & RF estimated to be currently outsourced • Primes outsourcing more subsystems to fewer but more capable suppliers • Source: RSAdvisors research & analysis $103 $106 $110 $113 $117 $51 $53 $54 $55 $57 $32 $34 $36 $37 $39 $16 $17 $18 $19 $20 $0 $20 $40 $60 $80 $100 $120 2018 2019 2020 2021 2022 Global A&D Electronics Systems Market ($B) US Defense Tier 2 Compute & RF Global Aerospace & Defense Electronic Systems Market Global Tier 2 Compute & RF US Defense Electronic Systems Market

12© 2018 Mercury Systems, Inc. Mercury’s addressable market increased ~8x supporting continued… …above industry average growth, returns and future acquisitions Sources: RSAdvisors research & analysis. Mercury market expansion reflects the Company’s acquisitions and expanded offerings from R&D investments. $3.9 $16.5 $32.3 $19.7 $8.8 0 5 10 15 20 25 30 35 Historic Addressable Market Mercury Market Expansion Current Addressable Market Mercury's Tier 2 Addressable Market (2018 $B) Compute RF U.S. Defense Tier 2 Compute & RF Global Tier 2 Compute & RF Comm'l Aerospace 4.7 15% U.S. Defense 16.5 51% RoW Defense 11.1 34% Airborne 12.1 37% Naval 5.1 16% Ground 6.0 19% Space 1.9 6% Classified/ Other 2.4 7% Commercial 4.7 15% Platform & Mission Mgmt 6.8 20% C3 & Intelligence Systems 10.9 31% EW 4.3 12% Radar 4.2 12% Weapons 2.6 7% Other 6.1 18%

13© 2018 Mercury Systems, Inc. …which in turn is driving strong results Acquisitions and investments driving significant opportunity growth… • Total potential value grew >3x to $4.9B in 5 years • Significant EW, C4I, weapons opportunity pipeline • Acquisitions brought new programs and capabilities • Larger, more diversified, program base reduces risk • Content expansion driving above average growth • Outsourced integrated subsystems 45% of top 30 program estimated life value Note: Refer to Appendix for definitions of “Probable”, “Possible”, “Pursuit”, and “Won”. Probable and Possible values are as of the beginning of the referenced fiscal year. Numbers are rounded. 2,111 1,593 2,798 714 939 1,039 378 0 1,000 2,000 3,000 4,000 5,000 6,000 FY13 FY13-FY18 Increase FY18 Top 30 Programs & Pursuits Estimated Lifetime Value ($M) Radar EW C4I Weapons Other 4,909 Probable Possible Total Pipeline 3,316 Pursuit 2,230 Won 2,679 Radar 1,459 30% EW 1,757 36% C4I 1,039 21% Weapons 378 8% Other 275 5% Airborne 3,370 69% Naval 1,228 25% Ground 311 6% Integrated Subsystems 2,217 45% Modules & Subassemblies 2,450 50% Components 241 5%

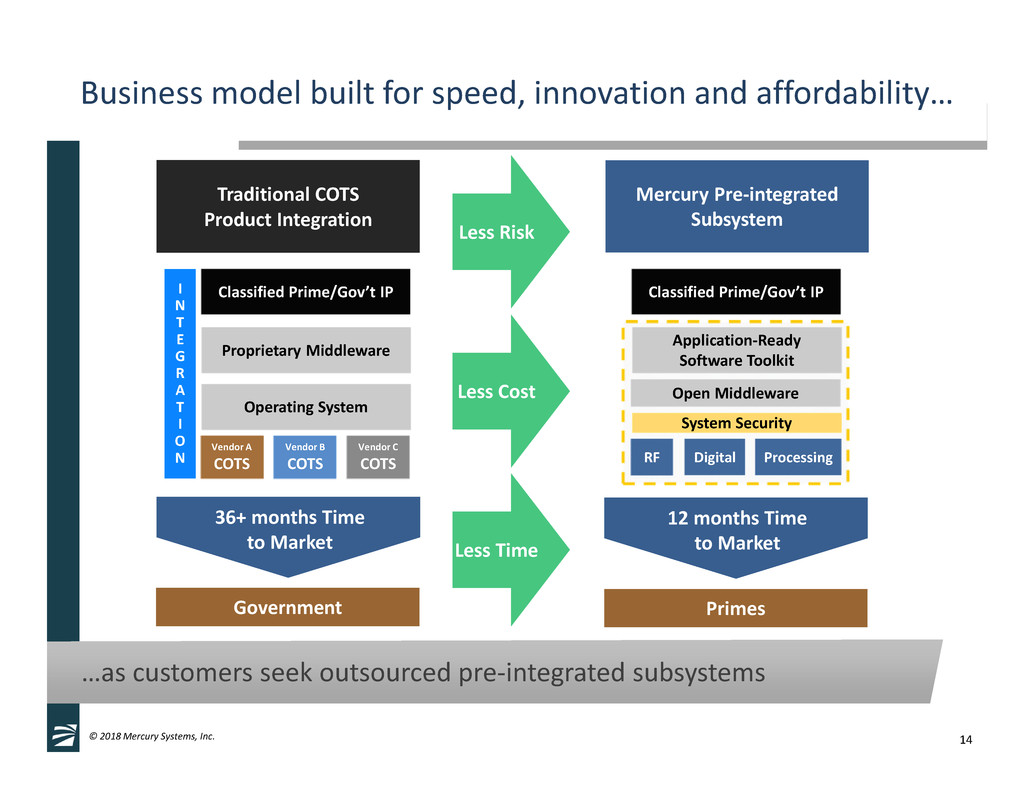

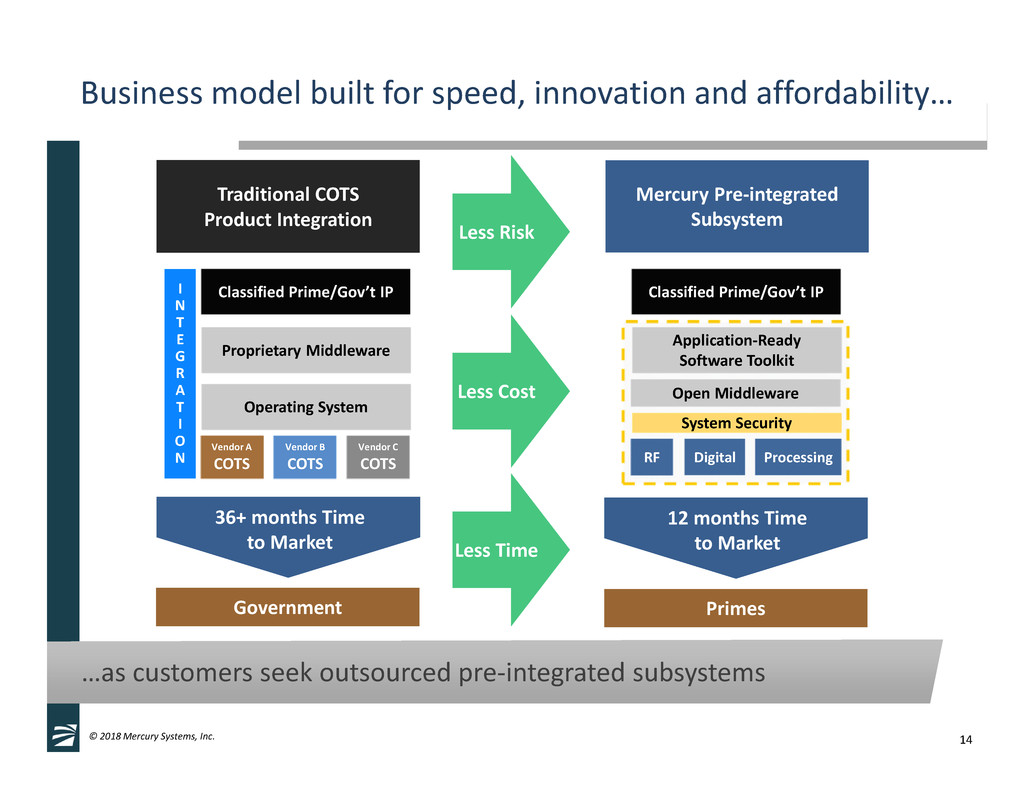

14© 2018 Mercury Systems, Inc. Business model built for speed, innovation and affordability… …as customers seek outsourced pre-integrated subsystems Primes RF Digital Processing Mercury Pre-integrated Subsystem Government Traditional COTS Product Integration 36+ months Time to Market 12 months Time to Market Open Middleware Application-Ready Software Toolkit Classified Prime/Gov’t IP System Security Less Cost Less Time Less Risk Operating System Vendor A COTS Vendor B COTS Vendor C COTS Proprietary Middleware Classified Prime/Gov’t IPI N T E G R A T I O N

15© 2018 Mercury Systems, Inc. Only high-tech commercial company with the technology… ...and domain expertise for secure sensor and safety-critical processing SPEED SWaP SOFTWARE SECURITY SAFETY Secure Sensor and Safety-Critical Processing Solutions ACQUIRE DIGITIZE PROCESS STORAGE EXPLOIT DISSEMINATE Highest Safety Design Assurance Levels (DAL) Highest Performance Processing & RFM Best Size, Weight & Power with State-of-the-Art Cooling Technology Industry-leading Embedded SecurityOpen Software for Low Risk Integration and Investment Protection

16© 2018 Mercury Systems, Inc. We have executed on a disciplined and focused M&A strategy Aerospace & Defense Platform and Systems Electronics Content C4I Sensor & Effector Mission Systems Platform & Mission Mgmt C2I Comms EW Radar EO/IR Acoustics Weapons Avionics / Vetronics Command & Control / Battle Management Dedicated Communications Electronic Warfare Radar Electro-Optical/ Infrared Acoustics Missiles/ Munitions D e fi n it io n Control & operation of platform & mission systems Processing & exploitation of information Dissemination of information Offensive / defensive exploitation of EM spectrum Use of RF signal to detect, track, ID Thermo-graphic camera with video output Sound pulses to determine object location Seekers, HEL, HPM Naval Launched Air Launched 2 0 1 8 M ar ke t ($ B ) $8.1B 5.0% ‘18-22 CAGR $8.0B 4.4% ‘18-22 CAGR $9.3B 2.2% ‘18-22 CAGR $3.6B 6.1% ‘18-22 CAGR $5.6B 4.2% ‘18-22 CAGR 2 0 1 8 Ti e r 2 * M ar ke t ($ B ) $6.8B 3.5% ‘18-22 CAGR $6.2B 4.9% ‘18-22 CAGR $4.7B 4.5% ‘18-22 CAGR $4.3B 6.1% ‘18-22 CAGR $4.2B 5.5% ‘18-22 CAGR $2.4B 3.5% ‘18-22 CAGR $1.1B 7.3% ‘18-22 CAGR $2.6B 5.3% ‘18-22 CAGR (1) (1) Notes: *Tier 2 includes Embedded computing and subsystems with RF content. Includes US Government and Global Commercial Aerospace Markets Sources: RSAdvisors research & analysis (1) Represents carve-out acquisition from Microsemi Corp.

17© 2018 Mercury Systems, Inc. Strategy and investments have positioned Mercury well • Pioneering a next-generation defense electronics business model • Unique technology and capabilities on key production programs • Substantial total addressable market expansion enabling future growth • Low-risk content expansion growth strategy with demonstrable progress • Largest secular growth opportunity = captive Prime outsourcing • Above industry-average growth and profitability • Business platform built to grow and scale through future acquisitions

© 2018 Mercury Systems, Inc. Financial Overview Mike Ruppert Executive Vice President and CFO

19© 2018 Mercury Systems, Inc. The evolution of Mercury Systems 425% Market Capitalization $472 $2,477 504%Enterprise Value $398 $2,404 105%Revenue(1) $218 $447 209%Adj. EBITDA(1) $34 $105 115%Adj. EPS(1) $0.59 $1.27 V al u at io n O p e ra ti o n al In millions, except percentage and per share data. Notes: (1) LTM figures are based on the trailing four fiscal quarters using information reported in the Company’s Form 10-Ks, Form 10-Qs and/or most recent earnings release. (2) As of Dec. 31, 2014 and Dec. 31, 2017, share data from FactSet. Dec. 31, 2017(1)Dec. 31, 2014 (2) % Increase / (Decrease)

20© 2018 Mercury Systems, Inc. 1,119 Mercury’s financial profile puts it in a unique category ALL NYSE AND NASDAQ COMPANIES WITH MARKET CAPITALIZATION BETWEEN $750mm - $3bn LTM based on most recently reported quarters 6 Companies 93 Companies 305 Companies EBITDA Margin >20% Revenue CAGR >10% 4-Year Companies LTM Revenue Growth >25% 23% EBITDA Margin LTM 22% 4-Year CAGR 33% LTM Notes: • Mercury LTM figures are based on the trailing four fiscal quarters using information reported in the Company’s Form 10-Ks, Form 10-Qs and/or most recent earnings release. • Source: FactSet; market data for most recently reported quarters as of February 15, 2018. • Financials represent reported results and are not adjusted for acquisitions or divestitures. • NASDAQ companies represent those that are U.S. listed. • TIER 2 DEFENSE INDEX: AAR Corporation, Aerojet Rocketdyne, AeroVironment, AXON Enterprises, Ball Aerospace, BWX Technologies, Comtech Telecom, Cubic Corp, Curtiss Wright Corp, Ducommun, Esterline Technologies, Elbit Systems, FireEye, FLIR Systems, Harris Corp, Heico, Hexcel, Honeywell Intl, Kaman, KBR, Kratos Defense, L-3 Communications, MDA, Mercury Systems, MOOG, Orbital ATK, Oshkosh Truck, OSI Systems, Rockwell Collins, Sparton, Teledyne Technologies, Textron, Transdigm Group, Triumph Group, United Technologies, Vectrus, Viasat Inc, VSE Corporation, Woodward Aerospace. 20% EBITDA Margin LTM 1% 4-Year CAGR 5% LTM TIER 2 DEFENSE INDEX LTM based on most recently reported quarters

21© 2018 Mercury Systems, Inc. Strong revenue growth and operating leverage… …yielded dramatic growth in adjusted EBITDA Notes: (1) Fiscal years ended June 30; FY13-17 figures are as reported in the Company’s Form 10-Ks. (2) LTM figures are based on the trailing four fiscal quarters using information reported in the Company’s Form 10-Ks, Form 10-Qs and/or most recent earnings release. 194 209 235 270 409 337 447 5% $9.9M 11% $23.5M 19% $44.4M 21% $57.3M 22% $74.0M 23% $104.7M 23% $93.9M 0% 10% 20% 30% 40% 0 50 100 150 200 250 300 350 400 450 FY13 FY14 FY15 FY16 FY17 LTM Q2 FY17 LTM Q2 FY18 Revenue to Adjusted EBITDA trends Mercury Revenue ($M) Mercury Adj EBITDA (%, $M)

22© 2018 Mercury Systems, Inc. 109 144 166 239 291 27 30 41 49 66 136 174 208 288 357 0 50 100 150 200 250 300 350 400 FY13 FY14 FY15 FY16 FY17 Mercury Ending Backlog ($M) 12-Month Ending Backlog > 12-Month Backlog Fwd Revenue Coverage Ratio⁽¹⁾ 63% 68% 63% 50% 64% FY13-FY17 backlog CAGR of 27%... …strong backlog and revenue coverage exiting FY17 Notes: (1) Revenue Coverage Ratio = 12-month ending backlog/Next 12 months revenue based on initial revenue guidance (or midpoint of range) issued for subsequent year.

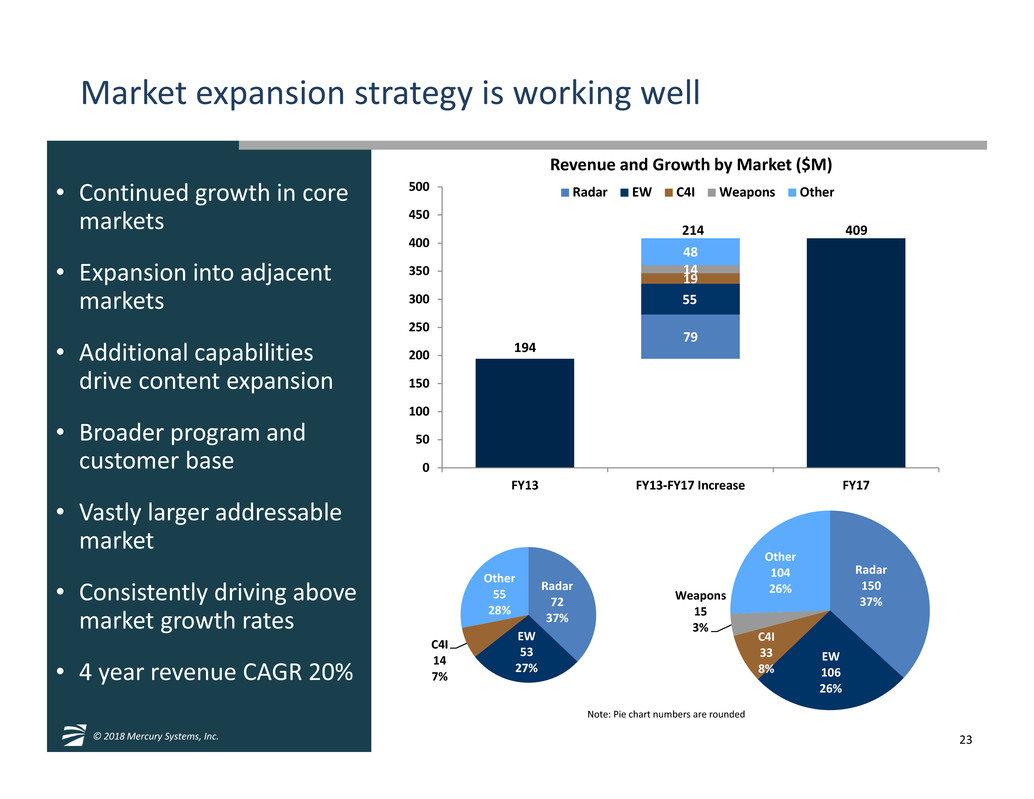

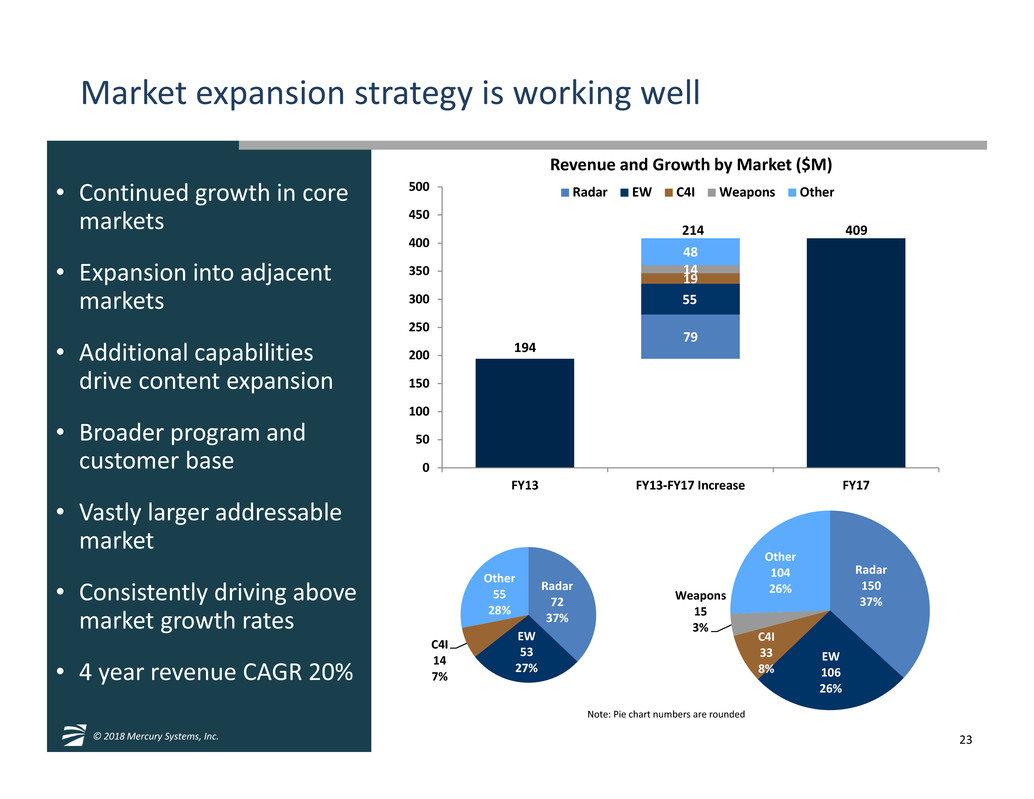

23© 2018 Mercury Systems, Inc. Market expansion strategy is working well • Continued growth in core markets • Expansion into adjacent markets • Additional capabilities drive content expansion • Broader program and customer base • Vastly larger addressable market • Consistently driving above market growth rates • 4 year revenue CAGR 20% 14 Programs Radar 72 37% EW 53 27% C4I 14 7% Other 55 28% 194 409 79 55 19 14 48 0 50 100 150 200 250 300 350 400 450 500 FY13 FY13-FY17 Increase FY17 Revenue and Growth by Market ($M) Radar EW C4I Weapons Other 214 Radar 150 37% EW 106 26% C4I 33 8% Weapons 15 3% Other 104 26% Note: Pie chart numbers are rounded

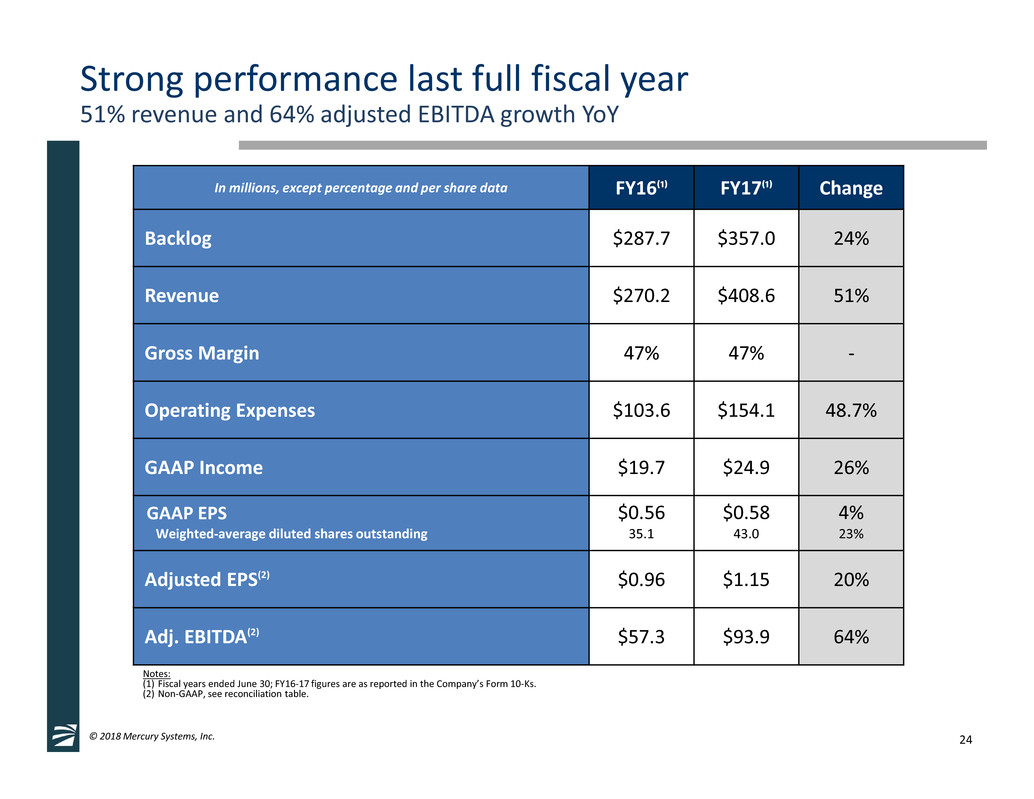

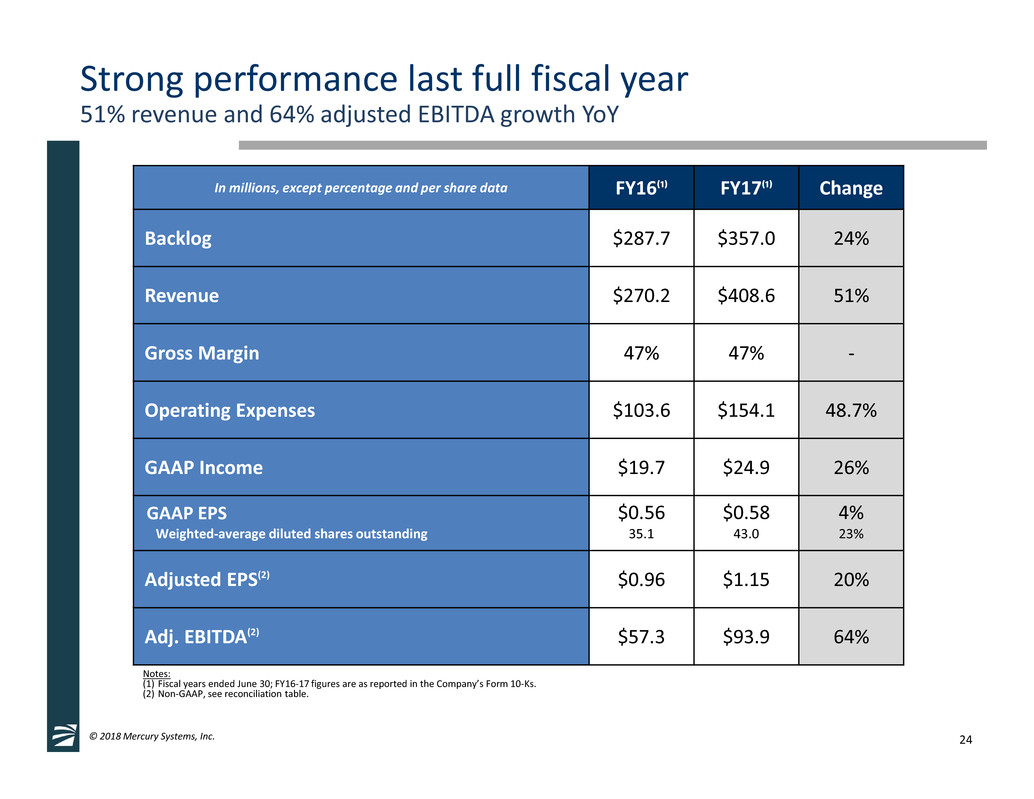

24© 2018 Mercury Systems, Inc. Strong performance last full fiscal year 51% revenue and 64% adjusted EBITDA growth YoY Notes: (1) Fiscal years ended June 30; FY16-17 figures are as reported in the Company’s Form 10-Ks. (2) Non-GAAP, see reconciliation table. In millions, except percentage and per share data FY16⁽¹⁾ FY17⁽¹⁾ Change Backlog $287.7 $357.0 24% Revenue $270.2 $408.6 51% Gross Margin 47% 47% - Operating Expenses $103.6 $154.1 48.7% GAAP Income $19.7 $24.9 26% GAAP EPS $0.56 $0.58 4% Weighted-average diluted shares outstanding 35.1 43.0 23% Adjusted EPS(2) $0.96 $1.15 20% Adj. EBITDA(2) $57.3 $93.9 64%

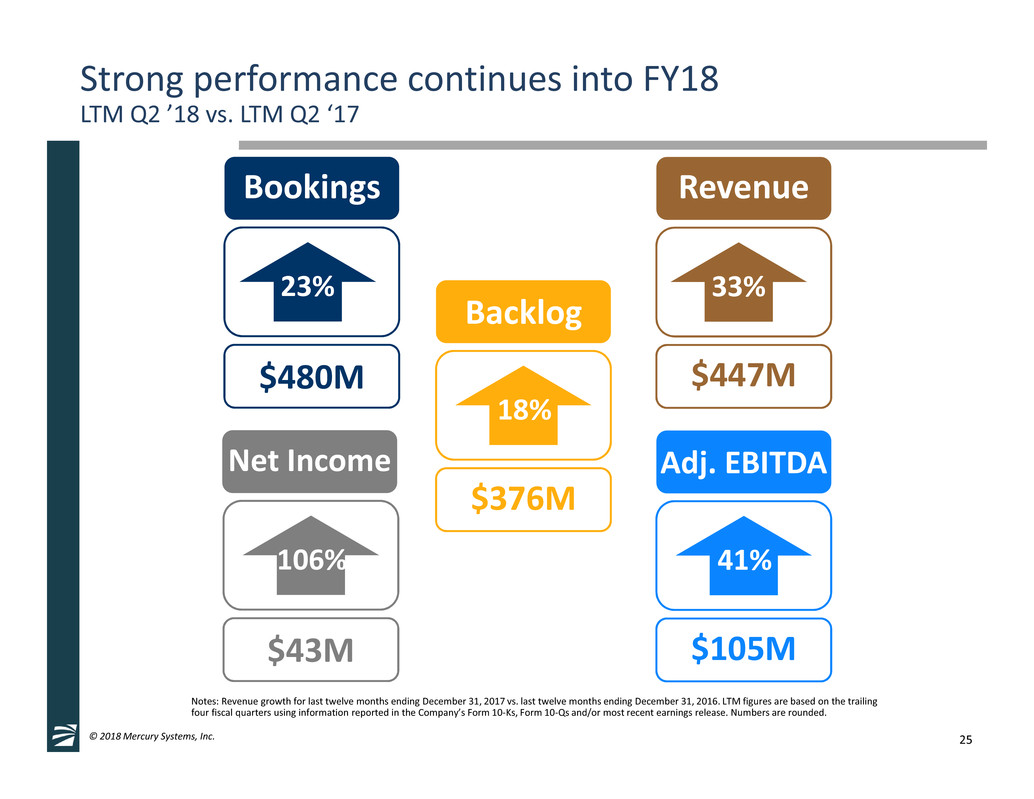

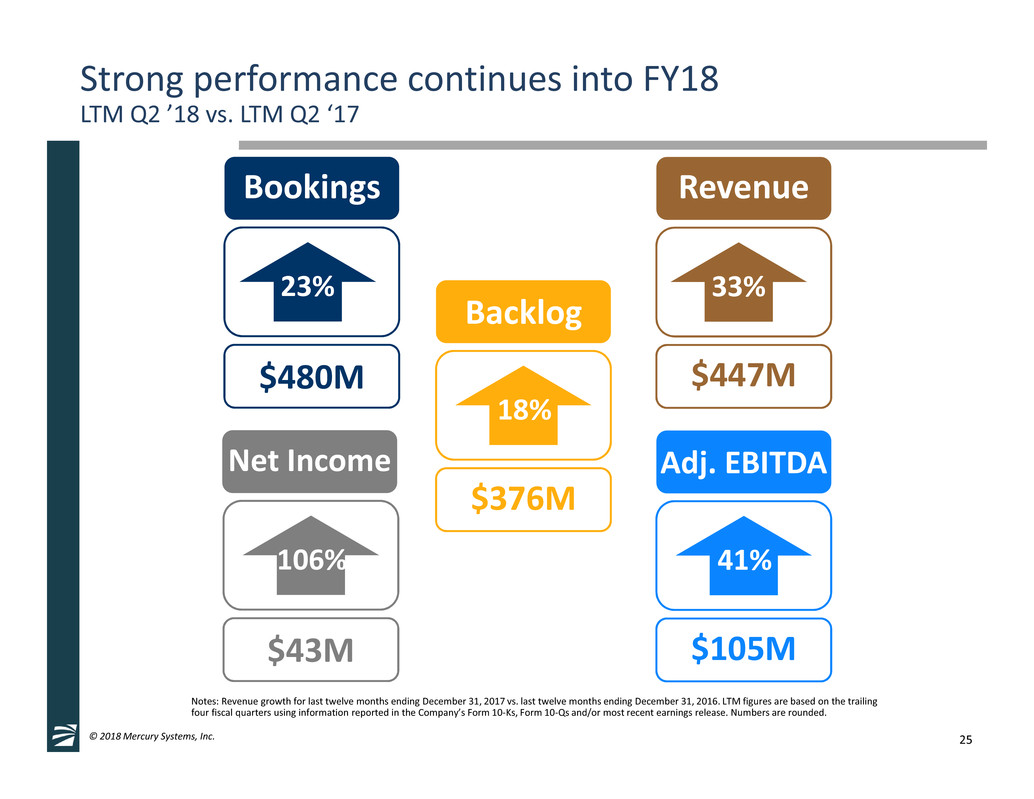

25© 2018 Mercury Systems, Inc. Strong performance continues into FY18 LTM Q2 ’18 vs. LTM Q2 ‘17 33% Revenue $447M 41% Adj. EBITDA $105M 106% Net Income $43M Notes: Revenue growth for last twelve months ending December 31, 2017 vs. last twelve months ending December 31, 2016. LTM figures are based on the trailing four fiscal quarters using information reported in the Company’s Form 10-Ks, Form 10-Qs and/or most recent earnings release. Numbers are rounded. 18% Backlog $376M 23% Bookings $480M

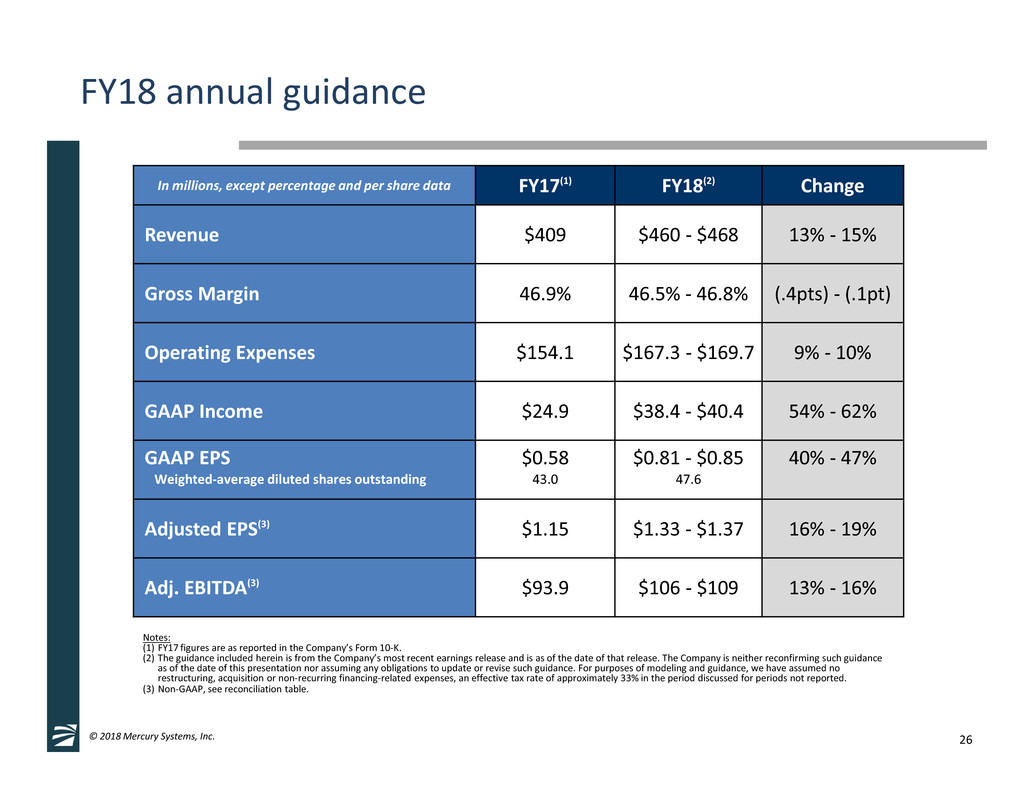

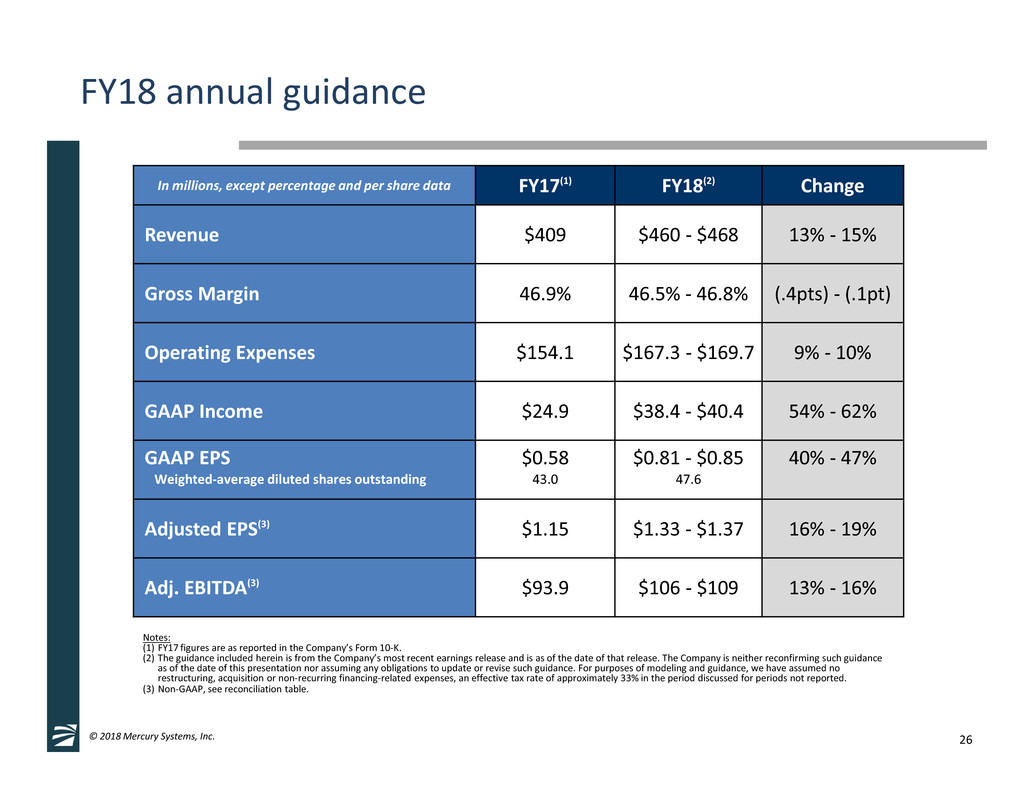

26© 2018 Mercury Systems, Inc. FY18 annual guidance In millions, except percentage and per share data FY17(1) FY18(2) Change Revenue $409 $460 - $468 13% - 15% Gross Margin 46.9% 46.5% - 46.8% (.4pts) - (.1pt) Operating Expenses $154.1 $167.3 - $169.7 9% - 10% GAAP Income $24.9 $38.4 - $40.4 54% - 62% GAAP EPS $0.58 $0.81 - $0.85 40% - 47% Weighted-average diluted shares outstanding 43.0 47.6 Adjusted EPS(3) $1.15 $1.33 - $1.37 16% - 19% Adj. EBITDA(3) $93.9 $106 - $109 13% - 16% Notes: (1) FY17 figures are as reported in the Company’s Form 10-K. (2) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or non-recurring financing-related expenses, an effective tax rate of approximately 33% in the period discussed for periods not reported. (3) Non-GAAP, see reconciliation table.

27© 2018 Mercury Systems, Inc. Achieving target business model Notes: (1) FY16 and FY17 figures are as reported in the Company’s Form 10-K. (2) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or non-recurring financing-related expenses, an effective tax rate of approximately 33% in the period discussed for periods not reported. (3) Non-GAAP, see reconciliation table. FY16(1) FY17(1) FY18(2) Revenue 100% 100% 100% 100% Gross Margin 47% 47% 47% 45 - 50% SG&A 20% 19% 16 - 18% R&D 13% 13% 11 - 13% Amortization 3% 5% 5% 4 - 5% GAAP Income 7% 6% 8-9% NA Adj. EBITDA(3) 21% 23% 23% 22 - 26% Target Business Model

28© 2018 Mercury Systems, Inc. Conservative balance sheet $400M revolving credit facility, universal shelf for future investments FY16 FY17 Q2 FY18 (In millions) Actual Actual Actual ASSETS Cash & cash equivalents 81.7 41.6 32.0 Accounts receivable, net 95.9 113.7 123.0 Inventory, net 58.3 81.1 105.9 PP&E, net 28.3 51.6 51.6 Goodwill and intangibles, net 460.7 509.9 505.5 Other 11.6 17.8 17.8 TOTAL ASSETS 736.5 815.7 835.8 LIABILITIES AND S/E AP and other liabilities 71.2 90.3 86.6 Debt 192.3 0.0 0.0 Total liabilities 263.5 90.3 86.6 Stockholders' equity 473.0 725.4 749.2 TOTAL LIABILITIES AND S/E 736.5 815.7 835.8 Note: On February 1, 2018 (Q3FY18); the transaction closed with Mercury acquiring both Ceres and its wholly-owned subsidiary, Themis. Mercury drew $195 million on its existing $400 million revolving credit facility to facilitate the closing of the acquisition, with the higher amount reflecting an estimated adjustment for working capital, including cash, expected to be received with the acquired company at closing.

29© 2018 Mercury Systems, Inc. We actively develop potential acquisition targets across all channels Acquisition Close Date Jan 2011 Dec 2011 Aug 2012 Dec 2015 May 2016 Nov 2016 Apr 2017 Jul 2017 Feb 2018 Size $31M $70M $75M $10M $300M $39M $40.5M Not Reported $180M Strong Strategic Rationale Expand Addressable Market Revenue & Cost Synergies Accretive in Short Term Seller Founder Private Equity Public Founder Corporate Carve-out Private Equity Founder Founder Private Sourcing Proprietary Negotiated Proprietary Negotiated Targeted Auction Proprietary Negotiated Proprietary Negotiated Proprietary Negotiated Targeted Auction Proprietary Negotiated Targeted Auction Learn Market Add Capabilities Scale Business Leverage Channel Maintain Conservative Balance Sheet Disciplined Approach to M&A * Represents carve-out acquisition from Microsemi Corp. * ~$580M of capital deployed in ~24 months

30© 2018 Mercury Systems, Inc. • Improving defense environment; fast-moving streams enhance opportunities • Acquisitions have transformed top and bottom lines • Broader base of larger, more diversified programs • Record backlog enhances forward visibility, facilitates operational execution • Sustained growth & profitability – above industry averages • Strong financial position supports organic growth and future M&A Poised for continued, profitable growth

© 2018 Mercury Systems, Inc. Appendix

32© 2018 Mercury Systems, Inc. Strong LTM performance 33% revenue and 41% adjusted EBITDA growth YoY Notes: (1) LTM figures are based on the trailing four fiscal quarters using information reported in the Company’s Form 10-Ks, Form 10-Qs and/or most recent earnings release. (2) Non-GAAP, see reconciliation table. In millions, except percentage and per share data LTM Q2 FY17⁽¹⁾ LTM Q2 FY18⁽¹⁾ Change Backlog $318.8 $376.4 18% Revenue $337.0 $446.9 33% Gross Margin 46.4% 46.9% 0.5 pt Operating Expenses $129.2 $163.6 27% GAAP Income $20.9 $42.9 106% GAAP EPS $0.55 $0.92 68% Adjusted EPS(2) $1.05 $1.27 20% Adj. EBITDA(2) $74.0 $104.7 41%

33© 2018 Mercury Systems, Inc. FY18 guidance (as of January 24th) Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or non-recurring financing-related expenses and an effective tax rate of approximately 33% in the period discussed for periods not reported. (2) Non-GAAP. In millions, except percentage and per share data FY17 FY18⁽¹⁾ YoY Change Actual Est. Range Revenue $409 $460 - $468 13% - 15% GAAP Income $24.9 $38.4 - $40.4 54% - 62% Adj EBITDA⁽²⁾ $93.9 $106.0 - $109.0 13% - 16% Adj EBITDA Adjustments: Income (loss) from continuing operations 24.9 38.4 - 40.4 Interest (income) expense, net 7.1 0.1 Tax provision (benefit) 6.2 5.7 - 6.6 Depreciation 12.6 16.0 – 16.0 Amortization of intangible assets 19.7 22.5 Restructuring and other charges 2.0 0.4 Impairment of long-lived assets 0.0 0.0 Acquisition and financing costs 2.4 3.5 Fair value adjustments from purchase accounting 3.7 0.6 Litigation and settlement expenses 0.1 0.0 Stock-based and other non-cash compensation expense 15.3 18.9 Adj EBITDA⁽²⁾ $93.9 $106.0 - $109.0 13% - 16% GAAP EPS $0.58 $0.81 - $0.85 $0.23 to $0.27 Adjusted EPS⁽²⁾ $1.15 $1.33 - $1.37 $0.18 to $0.22

34© 2018 Mercury Systems, Inc. Adjusted EPS reconciliation Notes: (1) Numbers shown are in cents. (000's) FY13 FY14 FY15 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 FY17 Q1 FY18 Q2 FY18 Diluted net earnings (loss) per share⁽¹⁾ $ (0.46) $ (0.13) $ 0.44 $ 0.56 $ 0.10 $ 0.13 $ 0.16 $ 0.19 $ 0.58 $ 0.38 $ 0.19 Income (loss) from continuing operations $(13,782) $ (4,072) $ 14,429 $ 19,742 $ 3,819 $ 5,204 $ 7,048 $ 8,804 $ 24,875 $ 17,953 $ 9,133 Amortization of intangible assets 8,222 7,328 7,008 8,842 4,602 4,888 4,732 5,458 19,680 5,637 5,827 Restructuring and other charges 7,060 5,443 3,175 1,240 297 69 459 1,127 1,952 95 313 Impairment of long-lived assets - - - 231 - - - - - - - Acquisition and financing costs 318 - 451 4,701 553 1,114 569 153 2,389 854 1,366 Fair value adjustments from purchase accounting 2,293 - - 1,384 2,077 870 270 462 3,679 509 84 Litigation and settlement expenses - - - (1,925) - 100 - 17 117 - - Stock-based and other non-cash compensation expense 7,854 8,999 8,640 9,574 3,632 4,093 3,715 3,901 15,341 4,697 4,941 Impact to income taxes (8,776) (5,772) (6,733) (9,975) (6,085) (4,441) (3,574) (4,501) (18,602) (11,951) (8,611) Adjusted income from continuing operations $ 3,189 $ 11,926 $ 26,970 $ 33,814 $ 8,895 $ 11,897 $ 13,219 $ 15,421 $ 49,431 $ 17,794 $ 13,053 Diluted adjusted net earnings per share ⁽¹⁾ $ 0.10 $ 0.37 $ 0.82 $ 0.96 $ 0.22 $ 0.30 $ 0.29 $ 0.32 $ 1.15 $ 0.37 $ 0.28 Weighted-average shares outstanding: Basic 30,128 31,000 32,114 34,241 38,865 39,151 43,773 46,211 41,986 46,504 46,752 Diluted 30,492 31,729 32,939 35,097 39,865 39,985 44,814 47,472 43,018 47,489 47,447

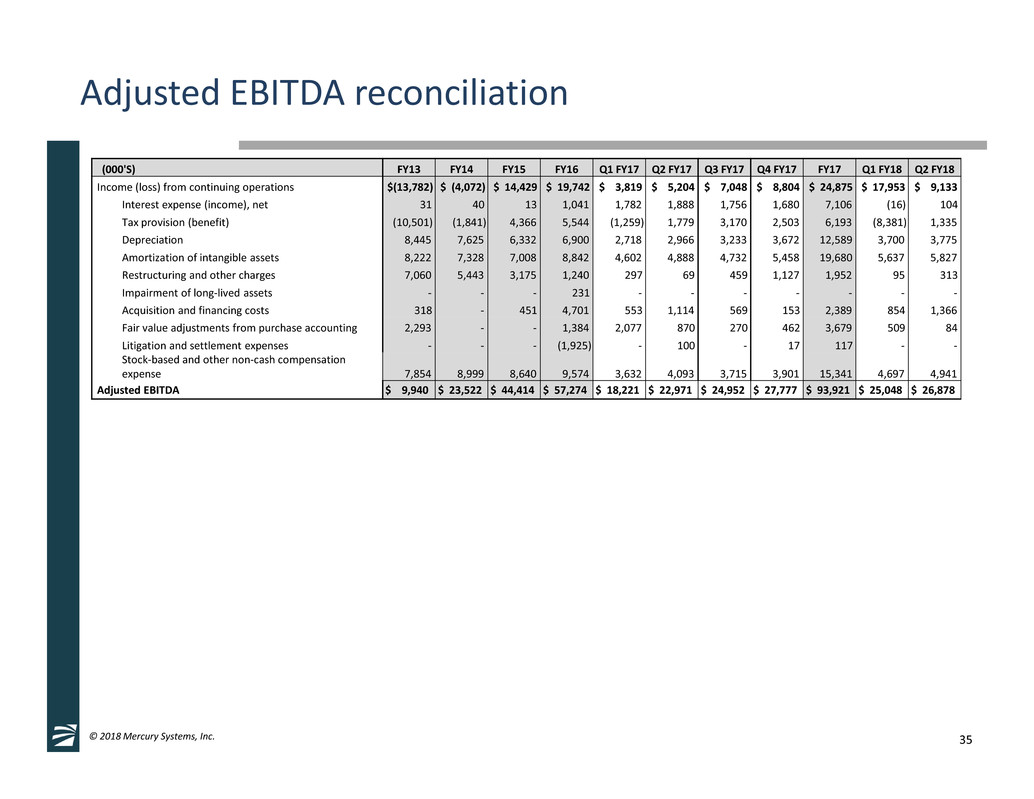

35© 2018 Mercury Systems, Inc. Adjusted EBITDA reconciliation (000'S) FY13 FY14 FY15 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 FY17 Q1 FY18 Q2 FY18 Income (loss) from continuing operations $(13,782) $ (4,072) $ 14,429 $ 19,742 $ 3,819 $ 5,204 $ 7,048 $ 8,804 $ 24,875 $ 17,953 $ 9,133 Interest expense (income), net 31 40 13 1,041 1,782 1,888 1,756 1,680 7,106 (16) 104 Tax provision (benefit) (10,501) (1,841) 4,366 5,544 (1,259) 1,779 3,170 2,503 6,193 (8,381) 1,335 Depreciation 8,445 7,625 6,332 6,900 2,718 2,966 3,233 3,672 12,589 3,700 3,775 Amortization of intangible assets 8,222 7,328 7,008 8,842 4,602 4,888 4,732 5,458 19,680 5,637 5,827 Restructuring and other charges 7,060 5,443 3,175 1,240 297 69 459 1,127 1,952 95 313 Impairment of long-lived assets - - - 231 - - - - - - - Acquisition and financing costs 318 - 451 4,701 553 1,114 569 153 2,389 854 1,366 Fair value adjustments from purchase accounting 2,293 - - 1,384 2,077 870 270 462 3,679 509 84 Litigation and settlement expenses - - - (1,925) - 100 - 17 117 - - Stock-based and other non-cash compensation expense 7,854 8,999 8,640 9,574 3,632 4,093 3,715 3,901 15,341 4,697 4,941 Adjusted EBITDA $ 9,940 $ 23,522 $ 44,414 $ 57,274 $ 18,221 $ 22,971 $ 24,952 $ 27,777 $ 93,921 $ 25,048 $ 26,878

36© 2018 Mercury Systems, Inc. Sales-related definitions Design Win A design win means that the customer has selected us to provide services, products, or intellectual property for a program of record or equivalent. In addition, the customer has won the program and we have an initial purchase order from the customer. Pursuit We have a Design Win with a prime contractor who is bidding to win a program of record, or we are bidding to win content on a program of record that has either already been awarded to a prime contractor or that the prime contractor is also bidding on. Won We have a Design Win with a prime contractor for a program of record, and the prime contractor has won the program and received its contractual award. Possible Possible value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Possible value is the highest outcome we believe to be reasonable given a range of potential outcomes based upon available information and our current set of assumptions. Probable Probable value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Probable value is the outcome we believe to be most likely given a range of potential outcomes based upon available information and our current set of assumptions.

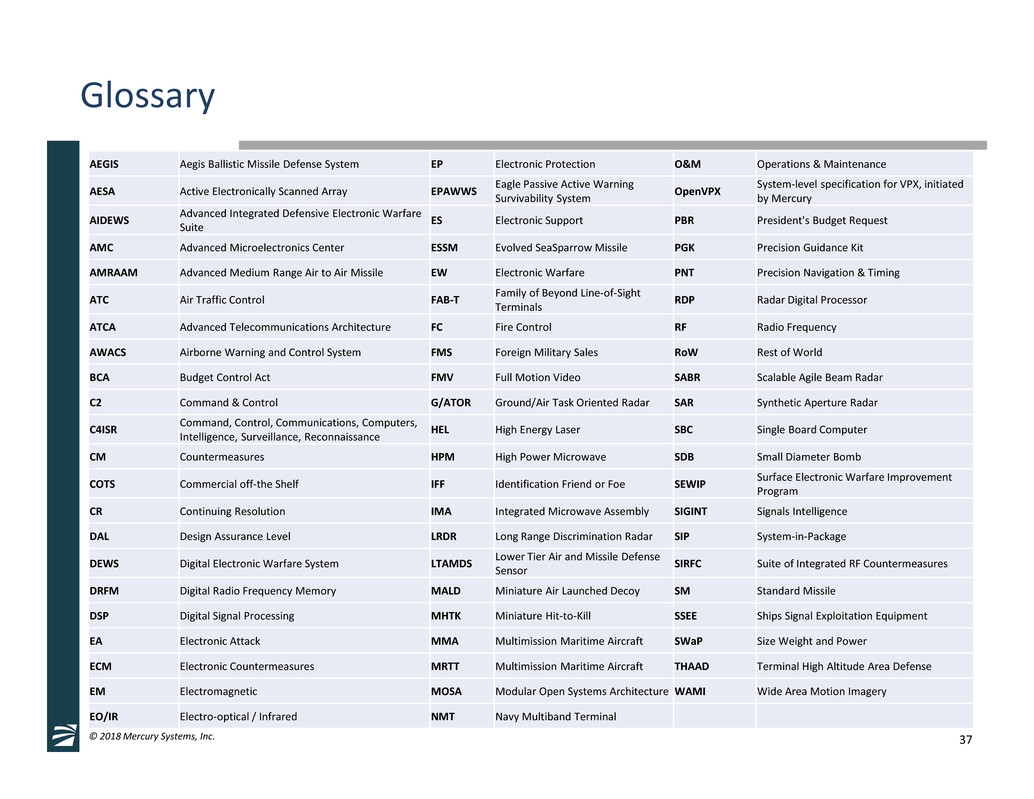

37© 2018 Mercury Systems, Inc. Glossary AEGIS Aegis Ballistic Missile Defense System EP Electronic Protection O&M Operations & Maintenance AESA Active Electronically Scanned Array EPAWWS Eagle Passive Active Warning Survivability System OpenVPX System-level specification for VPX, initiated by Mercury AIDEWS Advanced Integrated Defensive Electronic Warfare Suite ES Electronic Support PBR President's Budget Request AMC Advanced Microelectronics Center ESSM Evolved SeaSparrow Missile PGK Precision Guidance Kit AMRAAM Advanced Medium Range Air to Air Missile EW Electronic Warfare PNT Precision Navigation & Timing ATC Air Traffic Control FAB-T Family of Beyond Line-of-Sight Terminals RDP Radar Digital Processor ATCA Advanced Telecommunications Architecture FC Fire Control RF Radio Frequency AWACS Airborne Warning and Control System FMS Foreign Military Sales RoW Rest of World BCA Budget Control Act FMV Full Motion Video SABR Scalable Agile Beam Radar C2 Command & Control G/ATOR Ground/Air Task Oriented Radar SAR Synthetic Aperture Radar C4ISR Command, Control, Communications, Computers, Intelligence, Surveillance, Reconnaissance HEL High Energy Laser SBC Single Board Computer CM Countermeasures HPM High Power Microwave SDB Small Diameter Bomb COTS Commercial off-the Shelf IFF Identification Friend or Foe SEWIP Surface Electronic Warfare Improvement Program CR Continuing Resolution IMA Integrated Microwave Assembly SIGINT Signals Intelligence DAL Design Assurance Level LRDR Long Range Discrimination Radar SIP System-in-Package DEWS Digital Electronic Warfare System LTAMDS Lower Tier Air and Missile Defense Sensor SIRFC Suite of Integrated RF Countermeasures DRFM Digital Radio Frequency Memory MALD Miniature Air Launched Decoy SM Standard Missile DSP Digital Signal Processing MHTK Miniature Hit-to-Kill SSEE Ships Signal Exploitation Equipment EA Electronic Attack MMA Multimission Maritime Aircraft SWaP Size Weight and Power ECM Electronic Countermeasures MRTT Multimission Maritime Aircraft THAAD Terminal High Altitude Area Defense EM Electromagnetic MOSA Modular Open Systems Architecture WAMI Wide Area Motion Imagery EO/IR Electro-optical / Infrared NMT Navy Multiband Terminal