1st Quarter Fiscal Year 2020 Financial Results Mark Aslett President and CEO Conference call: Dial (877) 303-6977 in the USA and Canada, Michael Ruppert (760) 298-5079 in all other countries Executive Vice President and CFO Webcast login at www.mrcy.com/investor October 29, 2019, 5:00 pm ET Webcast replay available by 7:00 p.m. ET October 29, 2019 © 2019 Mercury Systems, Inc.

Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the acquisition described herein and to fiscal 2020 business performance and beyond and the Company’s plans for growth and improvement in profitability and cash flow. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of any U.S. Federal government shutdown or extended continuing resolution, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays or unanticipated expenses due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, increases in interest rates, changes to cyber-security regulations and requirements, changes in tax rates or tax regulations, changes to interest rate swaps or other cash flow hedging arrangements, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2019. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward- looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income, adjusted EPS, free cash flow, organic revenue and acquired revenue which are non-GAAP financial measures. Adjusted EBITDA, adjusted income, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, these non-GAAP measures should not be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes these non-GAAP measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto. © 2019 Mercury Systems, Inc. 2

Introduction • Continued strong results for Q1 FY20 • Record revenue, backlog and net income • Industry growth environment continues to be positive • Business model performing extremely well • Investing in people, technologies, capabilities to support organic growth • Organic growth accelerating, supplemented with strategic M&A • Raising organic and total FY20 revenue guidance • Now expect 11-12% organic revenue growth for FY20 © 2019 Mercury Systems, Inc. 3

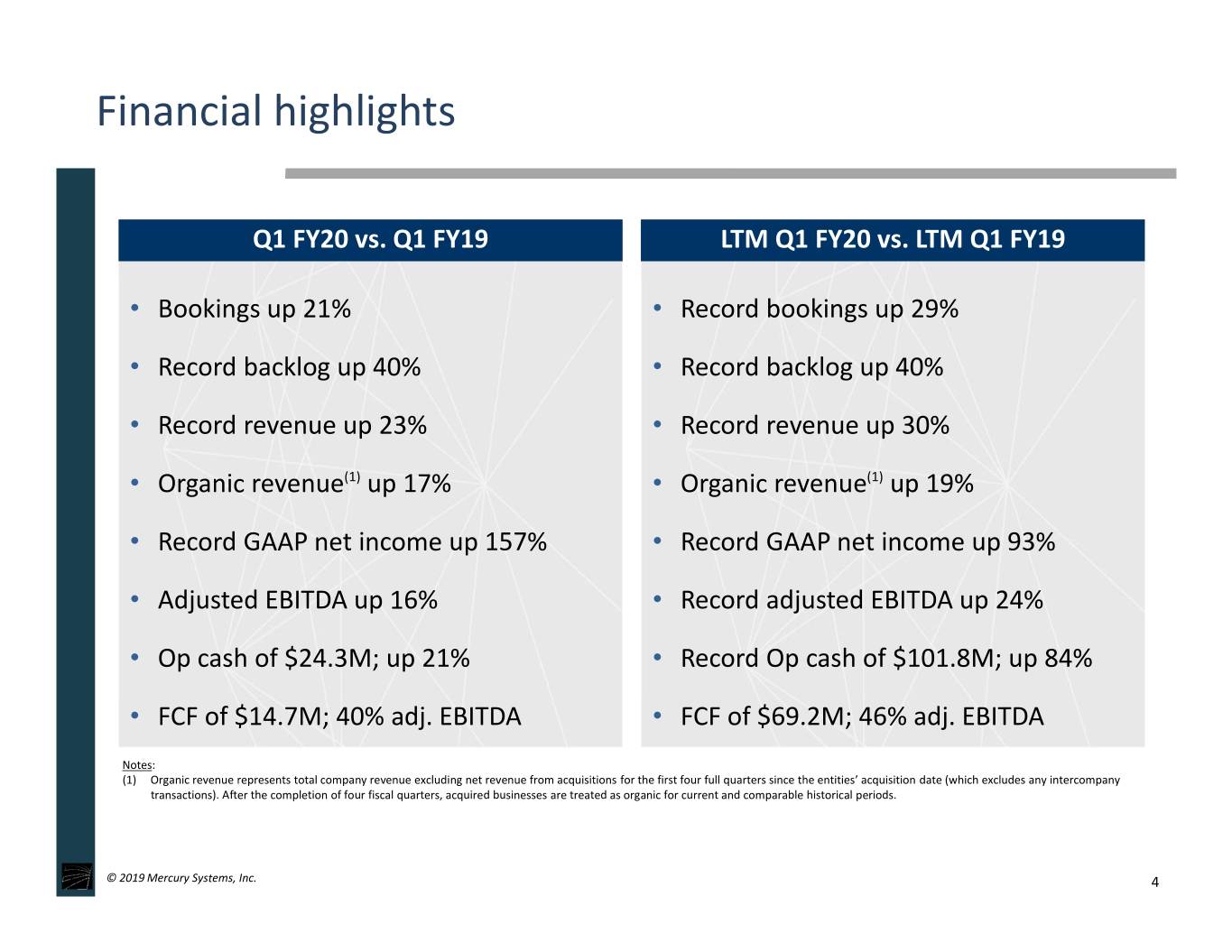

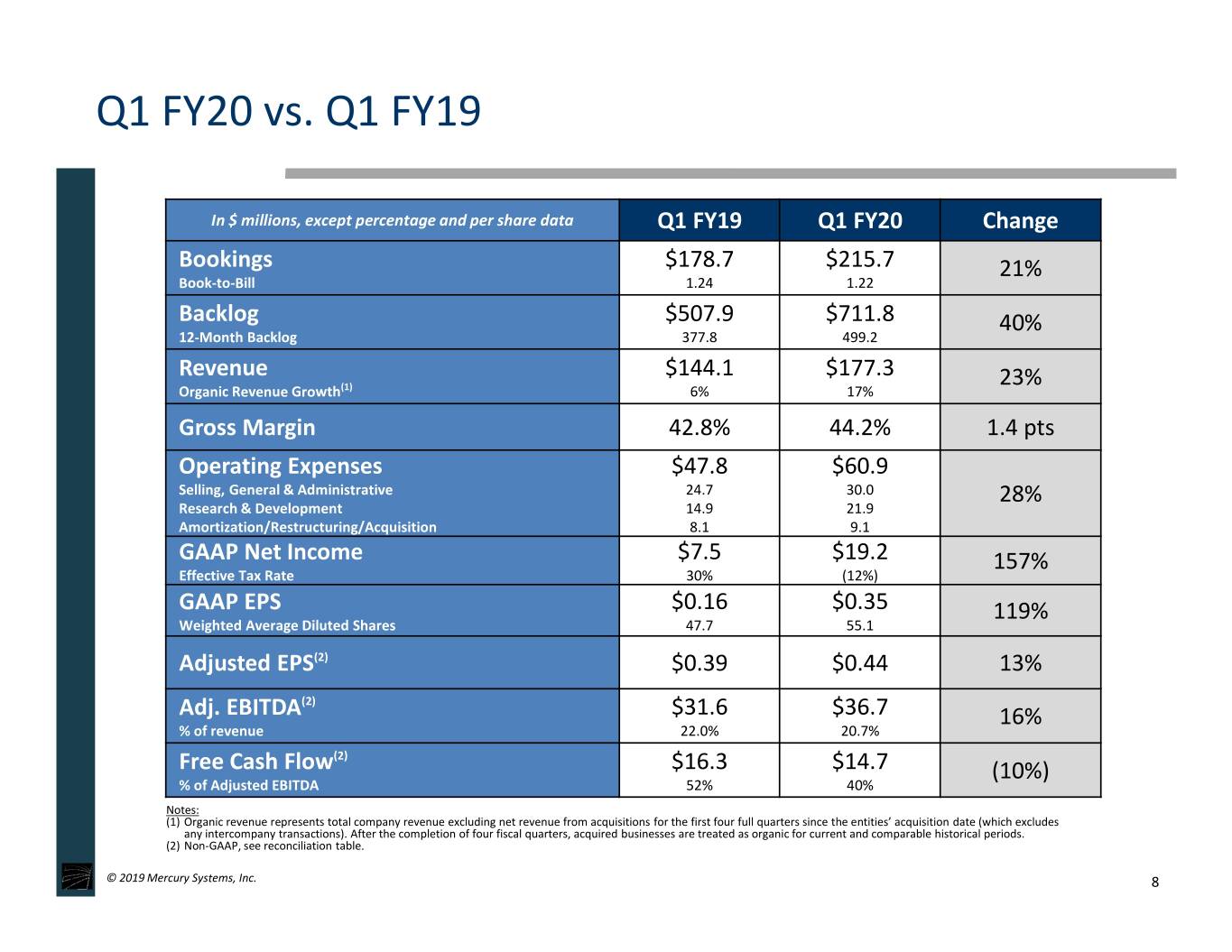

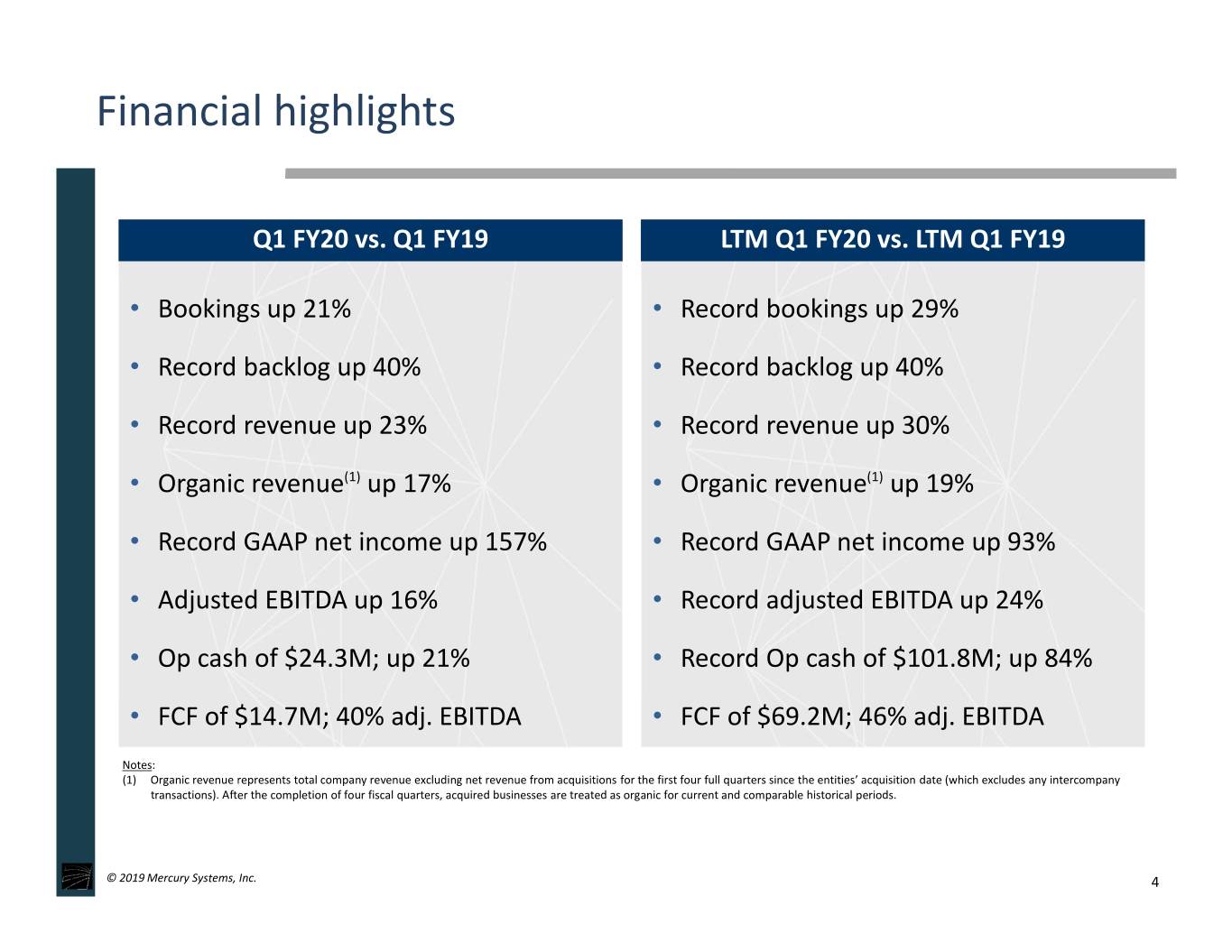

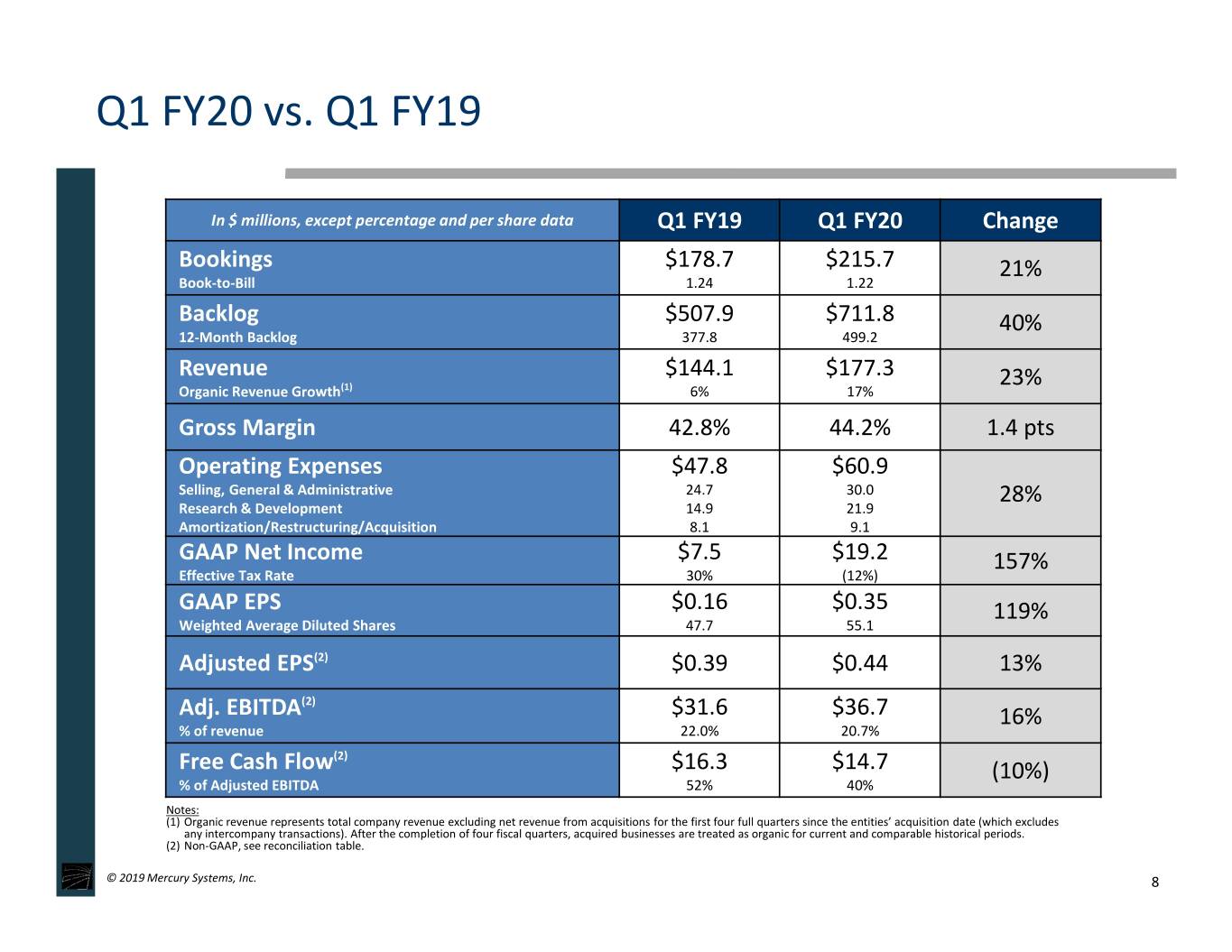

Financial highlights Q1 FY20 vs. Q1 FY19 LTM Q1 FY20 vs. LTM Q1 FY19 • Bookings up 21% • Record bookings up 29% • Record backlog up 40% • Record backlog up 40% • Record revenue up 23% • Record revenue up 30% • Organic revenue(1) up 17% • Organic revenue(1) up 19% • Record GAAP net income up 157% • Record GAAP net income up 93% • Adjusted EBITDA up 16% • Record adjusted EBITDA up 24% • Op cash of $24.3M; up 21% • Record Op cash of $101.8M; up 84% • FCF of $14.7M; 40% adj. EBITDA • FCF of $69.2M; 46% adj. EBITDA Notes: (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. © 2019 Mercury Systems, Inc. 4

Operational achievements • Continuing to invest in trusted domestic manufacturing capabilities • Focused on working capital and manufacturing operations efficiencies • Expect to complete West Coast RF manufacturing consolidation in Q2 FY20 • Investing $15M to expand scope of trusted microelectronics business • Be leading merchant supplier of custom commercial silicon into Defense • Integration of prior acquisitions progressing well: – Themis and Germane now fully integrated; business performing well – Athena and Syntonic integrations essentially complete – GECO integration expected to be completed Q2 FY20 – APC integration underway © 2019 Mercury Systems, Inc. 5

Favorable growth environment driving improved results • Two-year defense budget deal positive; cautious on extended CR potential • Defense outlays trending higher • Substantial growth in estimated LTV of top 30 programs and pursuits • Favorable trends – delayering, flight to quality, outsourcing, taking share • Strongly positioned in well-funded DoD priorities; need for rapid modernization • New opportunities in weapons systems, space, avionics processing, mission computing, and secure, rugged, embedded and rackmount servers • Sensor and effector mission systems (SEMS) revenue up 29% YoY, C4I up 11% © 2019 Mercury Systems, Inc. 6

Business outlook and summary • Expect long-term defense spending to increase at low single-digit CAGR • Continue delivering organic revenue growth higher than industry average rate • Supplement high level of organic growth with strategic M&A • Focus on sensor and effector mission systems and C4I markets • On track for another year of strong performance in fiscal 2020 • Continue to generate shareholder value through execution in key areas: – Drive double digit organic growth supplemented by accretive M&A – Invest in people, new technologies, facilities, manufacturing assets, business systems – Enhance margin, quality, on-time delivery and working capital via operational improvements – Grow revenues faster than operating expenses to improve operating leverage – Fully integrate acquired businesses to generate cost and revenue synergies Expect double-digit revenue and profitability growth, strong cash flow © 2019 Mercury Systems, Inc. 7

Q1 FY20 vs. Q1 FY19 In $ millions, except percentage and per share data Q1 FY19 Q1 FY20 Change Bookings $178.7 $215.7 21% Book-to-Bill 1.24 1.22 Backlog $507.9 $711.8 40% 12-Month Backlog 377.8 499.2 Revenue $144.1 $177.3 23% Organic Revenue Growth(1) 6% 17% Gross Margin 42.8% 44.2% 1.4 pts Operating Expenses $47.8 $60.9 Selling, General & Administrative 24.7 30.0 28% Research & Development 14.9 21.9 Amortization/Restructuring/Acquisition 8.1 9.1 GAAP Net Income $7.5 $19.2 157% Effective Tax Rate 30% (12%) GAAP EPS $0.16 $0.35 119% Weighted Average Diluted Shares 47.7 55.1 Adjusted EPS(2) $0.39 $0.44 13% (2) Adj. EBITDA $31.6 $36.7 16% % of revenue 22.0% 20.7% (2) Free Cash Flow $16.3 $14.7 (10%) % of Adjusted EBITDA 52% 40% Notes: (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. (2) Non-GAAP, see reconciliation table. © 2019 Mercury Systems, Inc. 8

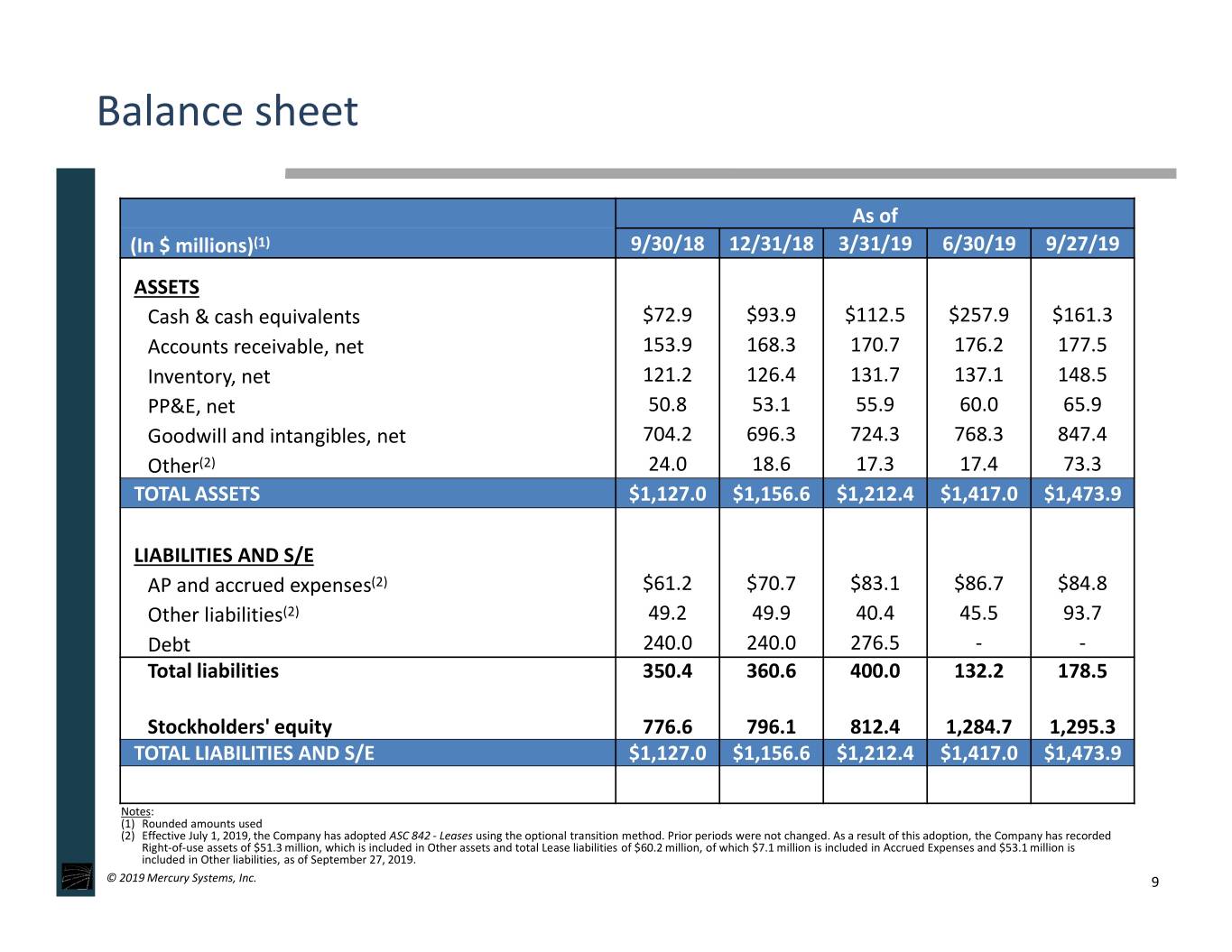

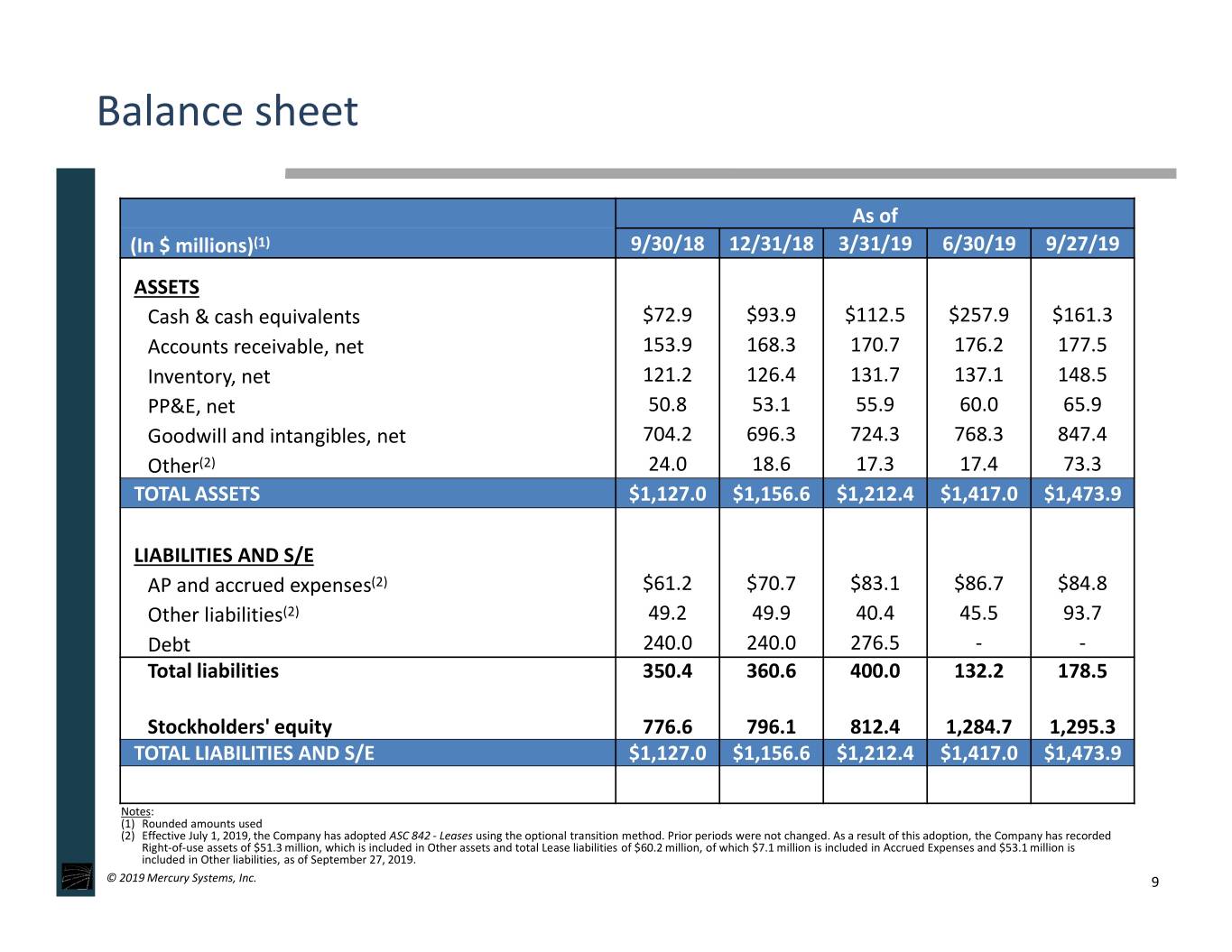

Balance sheet As of (In $ millions)(1) 9/30/18 12/31/18 3/31/19 6/30/19 9/27/19 ASSETS Cash & cash equivalents $72.9 $93.9 $112.5 $257.9 $161.3 Accounts receivable, net 153.9 168.3 170.7 176.2 177.5 Inventory, net 121.2 126.4 131.7 137.1 148.5 PP&E, net 50.8 53.1 55.9 60.0 65.9 Goodwill and intangibles, net 704.2 696.3 724.3 768.3 847.4 Other(2) 24.0 18.6 17.3 17.4 73.3 TOTAL ASSETS $1,127.0 $1,156.6 $1,212.4 $1,417.0 $1,473.9 LIABILITIES AND S/E AP and accrued expenses(2) $61.2 $70.7 $83.1 $86.7 $84.8 Other liabilities(2) 49.2 49.9 40.4 45.5 93.7 Debt 240.0 240.0 276.5 - - Total liabilities 350.4 360.6 400.0 132.2 178.5 Stockholders' equity 776.6 796.1 812.4 1,284.7 1,295.3 TOTAL LIABILITIES AND S/E $1,127.0 $1,156.6 $1,212.4 $1,417.0 $1,473.9 Notes: (1) Rounded amounts used (2) Effective July 1, 2019, the Company has adopted ASC 842 - Leases using the optional transition method. Prior periods were not changed. As a result of this adoption, the Company has recorded Right-of-use assets of $51.3 million, which is included in Other assets and total Lease liabilities of $60.2 million, of which $7.1 million is included in Accrued Expenses and $53.1 million is included in Other liabilities, as of September 27, 2019. © 2019 Mercury Systems, Inc. 9

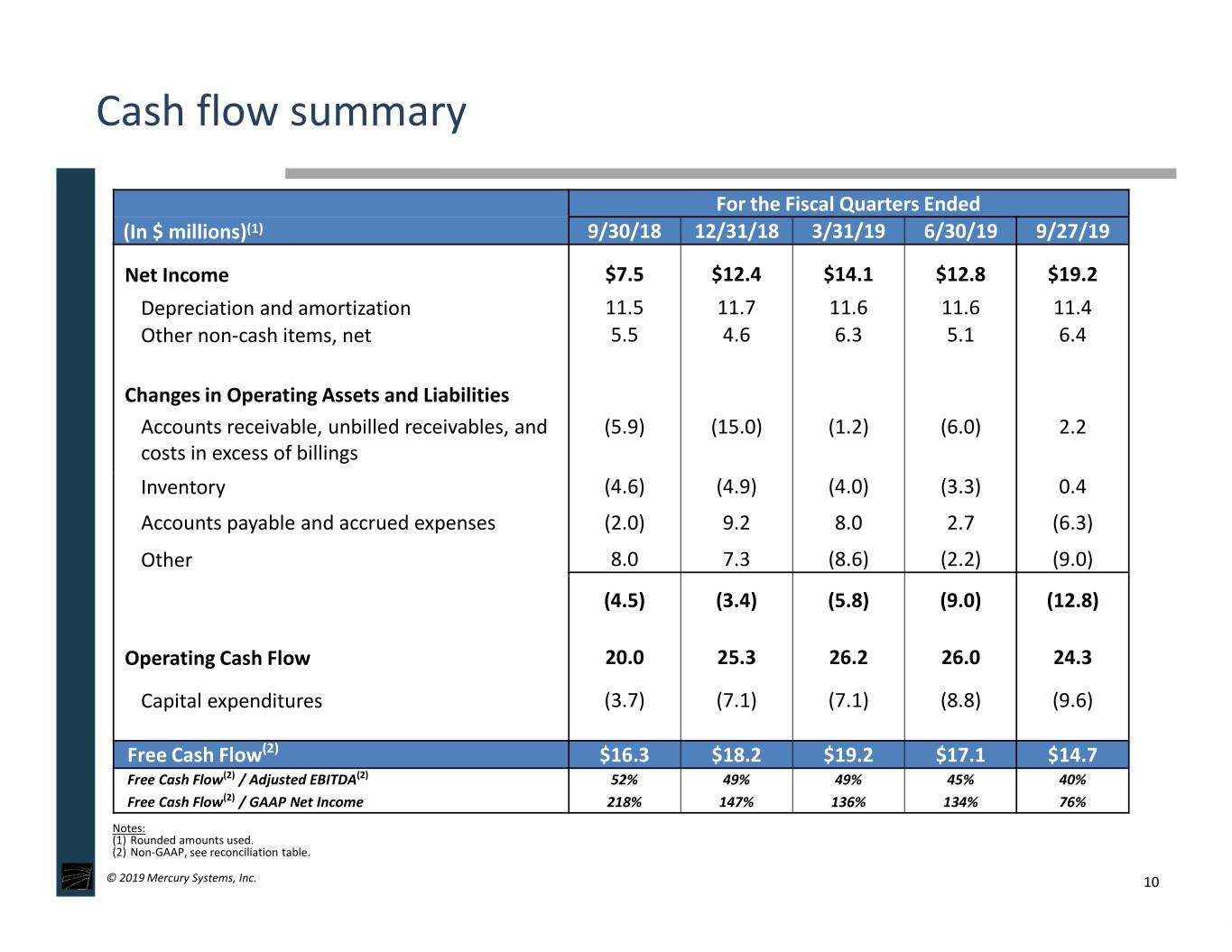

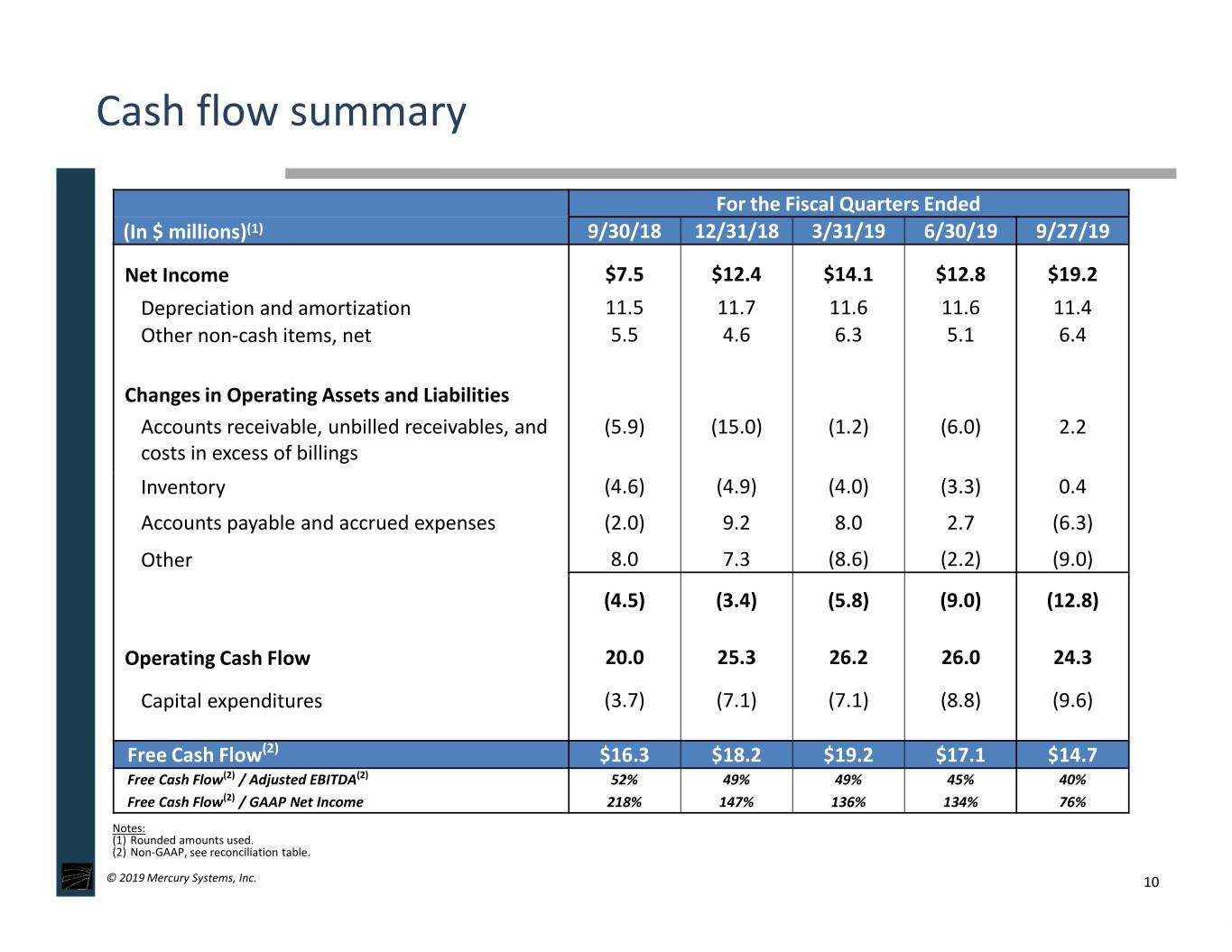

Cash flow summary For the Fiscal Quarters Ended (In $ millions)(1) 9/30/18 12/31/18 3/31/19 6/30/19 9/27/19 Net Income $7.5 $12.4 $14.1 $12.8 $19.2 Depreciation and amortization 11.5 11.7 11.6 11.6 11.4 Other non-cash items, net 5.5 4.6 6.3 5.1 6.4 Changes in Operating Assets and Liabilities Accounts receivable, unbilled receivables, and (5.9) (15.0) (1.2) (6.0) 2.2 costs in excess of billings Inventory (4.6) (4.9) (4.0) (3.3) 0.4 Accounts payable and accrued expenses (2.0) 9.2 8.0 2.7 (6.3) Other 8.0 7.3 (8.6) (2.2) (9.0) (4.5) (3.4) (5.8) (9.0) (12.8) Operating Cash Flow 20.0 25.3 26.2 26.0 24.3 Capital expenditures (3.7) (7.1) (7.1) (8.8) (9.6) Free Cash Flow(2) $16.3 $18.2 $19.2 $17.1 $14.7 Free Cash Flow(2) / Adjusted EBITDA(2) 52% 49% 49% 45% 40% Free Cash Flow(2) / GAAP Net Income 218% 147% 136% 134% 76% Notes: (1) Rounded amounts used. (2) Non-GAAP, see reconciliation table. © 2019 Mercury Systems, Inc. 10

Q2 FY20 guidance In $ millions, except percentage and per share data Q2 FY19(1) Q2 FY20(2) Change Revenue $159.1 $185.0 - $195.0 16% - 23% GAAP Net Income $12.4 $13.9 - $15.4 12% - 24% Effective tax rate(3) 26.6% 26.0% GAAP EPS $0.26 $0.25 - $0.28 (4)% - 8% Weighted-average diluted shares outstanding 47.7 55.0 Adjusted EPS(4) $0.47 $0.46 - $0.48 (2)% - 2% (4) Adj. EBITDA $37.0 $38.5 - $40.5 4% - 10% % of revenue 23.2% 20.8% Notes: (1) Q2 FY19 figures are as reported in the Company’s earnings release dated January 29, 2019. (2) The guidance included herein is from the Company’s earnings release dated October 29, 2019. For purposes of modeling and guidance, we have assumed no incremental restructuring, acquisition, other non-operating adjustments or non-recurring financing-related expenses. (3) The effective tax rate in the guidance included herein excludes discrete items. (4) Non-GAAP, see reconciliation table. (5) Effective as of July 1, 2019, the Company's fiscal year has changed to the 52-week or 53-week period ending on the Friday closest to the last day in June. All references in this presentation to the second quarter of fiscal 2020 are to the quarter ending December 27, 2019 and to fiscal 2020 are to the fiscal year ending July 3, 2020. © 2019 Mercury Systems, Inc. 11

FY20 annual guidance In $ millions, except percentage and per share data FY19(1) FY20(2)(5) Change Revenue $654.7 $775.0 - $790.0 18% - 21% GAAP Net Income $46.8 $72.9 - $77.8 56% - 66% Effective tax rate(3) 21.4% 26% GAAP EPS $0.96 $1.32 - $1.41 38% - 47% Weighted-average diluted shares outstanding 48.5 55.2 Adjusted EPS(4) $1.84 $2.03 - $2.11 10% - 15% (4) Adj. EBITDA $145.3 $169.5 - $175.5 17% - 21% % of revenue 22.2% 21.9-22.2% Notes: (1) FY19 figures are as reported in the Company’s earnings release dated July 30, 2019. (2) The guidance included herein is from the Company’s earnings release dated October 29, 2019. For purposes of modeling and guidance, we have assumed no incremental restructuring, acquisition, other non-operating adjustments or non-recurring financing-related expenses. (3) The effective tax rate in the guidance included herein excludes discrete items. (4) Non-GAAP, see reconciliation table. (5) Effective as of July 1, 2019, the Company's fiscal year has changed to the 52-week or 53-week period ending on the Friday closest to the last day in June. All references in this presentation to the second quarter of fiscal 2020 are to the quarter ending December 27, 2019 and to fiscal 2020 are to the fiscal year ending July 3, 2020. © 2019 Mercury Systems, Inc. 12

Summary • Q1 results highlight continued momentum in the business • Record revenue increased 23% YoY; 17% organic revenue growth • Revenue, net income, adj. EBITDA, EPS and adj. EPS exceeded guidance • Bookings exceeding $200M for second consecutive quarter • Achieved 1.22 book-to-bill and record ending backlog • Completed acquisition of American Panel Corporation (APC) • Raising full year guidance for APC and strong FY20 outlook © 2019 Mercury Systems, Inc. 13

Appendix © 2019 Mercury Systems, Inc. 14

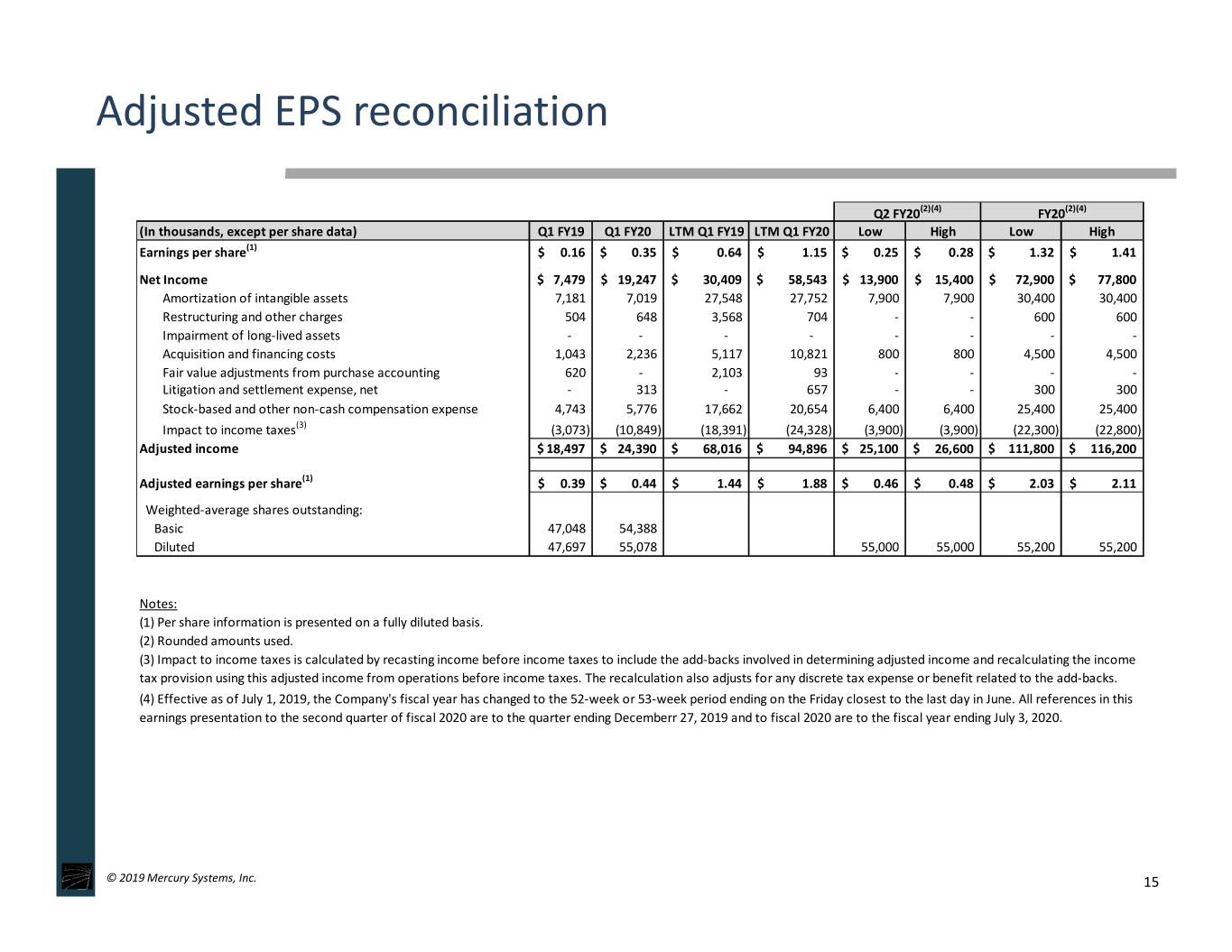

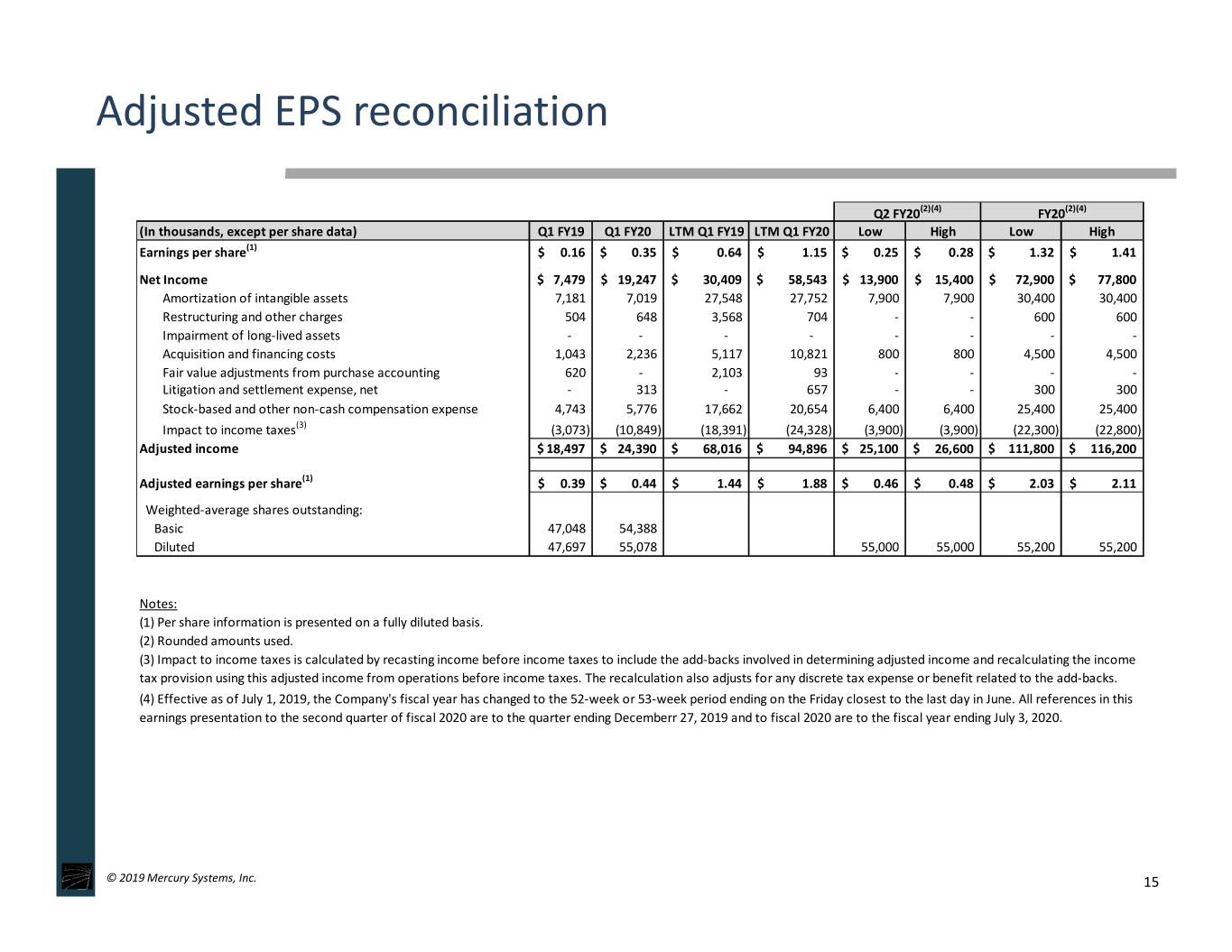

Adjusted EPS reconciliation Q2 FY20(2)(4) FY20(2)(4) (In thousands, except per share data) Q1 FY19 Q1 FY20 LTM Q1 FY19 LTM Q1 FY20 Low High Low High Earnings per share(1) $ 0.16 $ 0.35 $ 0.64 $ 1.15 $ 0.25 $ 0.28 $ 1.32 $ 1.41 Net Income $ 7,479 $ 19,247 $ 30,409 $ 58,543 $ 13,900 $ 15,400 $ 72,900 $ 77,800 Amortization of intangible assets 7,181 7,019 27,548 27,752 7,900 7,900 30,400 30,400 Restructuring and other charges 504 648 3,568 704 - - 600 600 Impairment of long-lived assets - - - - - - - - Acquisition and financing costs 1,043 2,236 5,117 10,821 800 800 4,500 4,500 Fair value adjustments from purchase accounting 620 - 2,103 93 - - - - Litigation and settlement expense, net - 313 - 657 - - 300 300 Stock-based and other non-cash compensation expense 4,743 5,776 17,662 20,654 6,400 6,400 25,400 25,400 Impact to income taxes(3) (3,073) (10,849) (18,391) (24,328) (3,900) (3,900) (22,300) (22,800) Adjusted income $ 18,497 $ 24,390 $ 68,016 $ 94,896 $ 25,100 $ 26,600 $ 111,800 $ 116,200 Adjusted earnings per share(1) $ 0.39 $ 0.44 $ 1.44 $ 1.88 $ 0.46 $ 0.48 $ 2.03 $ 2.11 Weighted-average shares outstanding: Basic 47,048 54,388 Diluted 47,697 55,078 55,000 55,000 55,200 55,200 Notes: (1) Per share information is presented on a fully diluted basis. (2) Rounded amounts used. (3) Impact to income taxes is calculated by recasting income before income taxes to include the add-backs involved in determining adjusted income and recalculating the income tax provision using this adjusted income from operations before income taxes. The recalculation also adjusts for any discrete tax expense or benefit related to the add-backs. (4) Effective as of July 1, 2019, the Company's fiscal year has changed to the 52-week or 53-week period ending on the Friday closest to the last day in June. All references in this earnings presentation to the second quarter of fiscal 2020 are to the quarter ending Decemberr 27, 2019 and to fiscal 2020 are to the fiscal year ending July 3, 2020. © 2019 Mercury Systems, Inc. 15

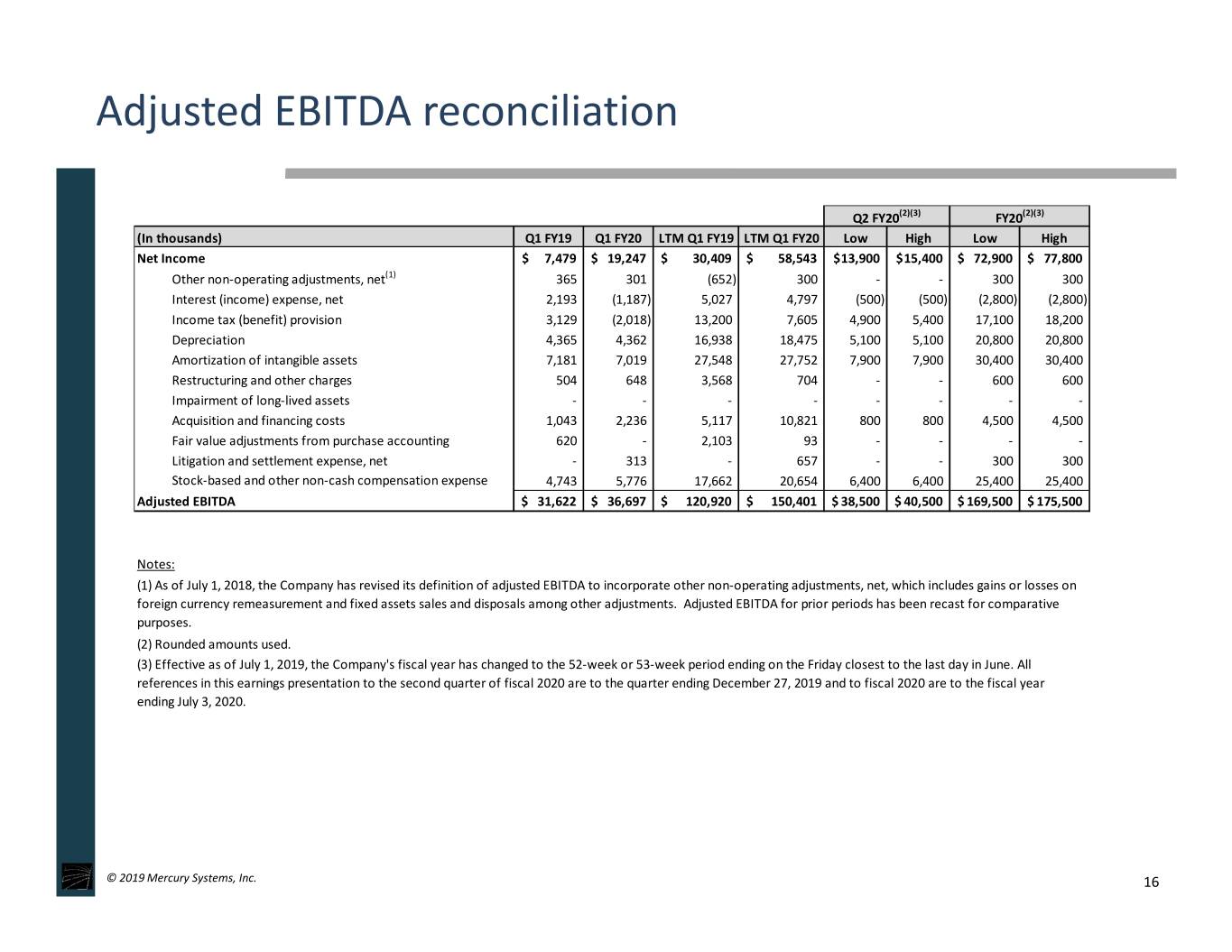

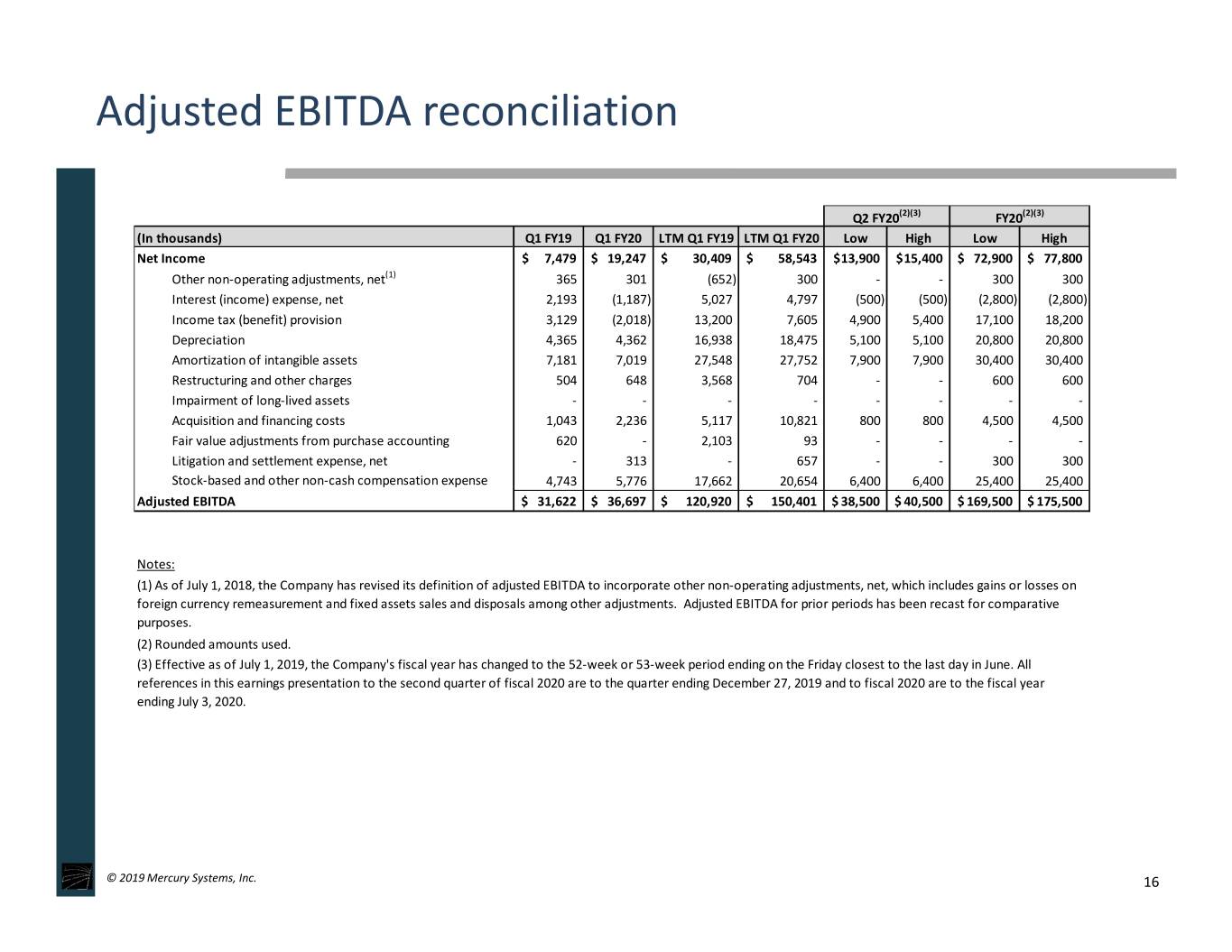

Adjusted EBITDA reconciliation Q2 FY20(2)(3) FY20(2)(3) (In thousands) Q1 FY19 Q1 FY20 LTM Q1 FY19 LTM Q1 FY20 Low High Low High Net Income $ 7,479 $ 19,247 $ 30,409 $ 58,543 $ 13,900 $ 15,400 $ 72,900 $ 77,800 Other non-operating adjustments, net(1) 365 301 (652) 300 - - 300 300 Interest (income) expense, net 2,193 (1,187) 5,027 4,797 (500) (500) (2,800) (2,800) Income tax (benefit) provision 3,129 (2,018) 13,200 7,605 4,900 5,400 17,100 18,200 Depreciation 4,365 4,362 16,938 18,475 5,100 5,100 20,800 20,800 Amortization of intangible assets 7,181 7,019 27,548 27,752 7,900 7,900 30,400 30,400 Restructuring and other charges 504 648 3,568 704 - - 600 600 Impairment of long-lived assets - - - - - - - - Acquisition and financing costs 1,043 2,236 5,117 10,821 800 800 4,500 4,500 Fair value adjustments from purchase accounting 620 - 2,103 93 - - - - Litigation and settlement expense, net - 313 - 657 - - 300 300 Stock-based and other non-cash compensation expense 4,743 5,776 17,662 20,654 6,400 6,400 25,400 25,400 Adjusted EBITDA $ 31,622 $ 36,697 $ 120,920 $ 150,401 $ 38,500 $ 40,500 $ 169,500 $ 175,500 Notes: (1) As of July 1, 2018, the Company has revised its definition of adjusted EBITDA to incorporate other non-operating adjustments, net, which includes gains or losses on foreign currency remeasurement and fixed assets sales and disposals among other adjustments. Adjusted EBITDA for prior periods has been recast for comparative purposes. (2) Rounded amounts used. (3) Effective as of July 1, 2019, the Company's fiscal year has changed to the 52-week or 53-week period ending on the Friday closest to the last day in June. All references in this earnings presentation to the second quarter of fiscal 2020 are to the quarter ending December 27, 2019 and to fiscal 2020 are to the fiscal year ending July 3, 2020. © 2019 Mercury Systems, Inc. 16

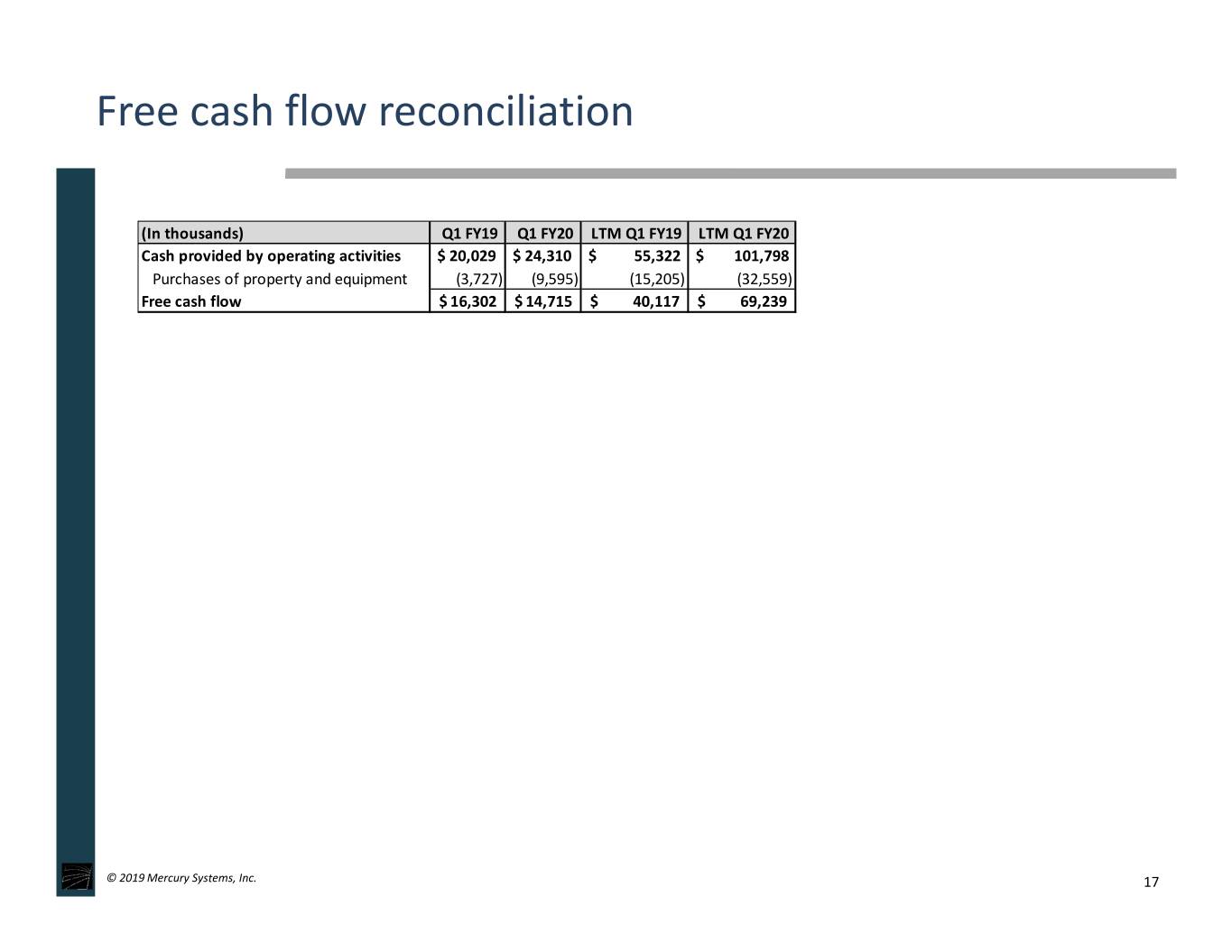

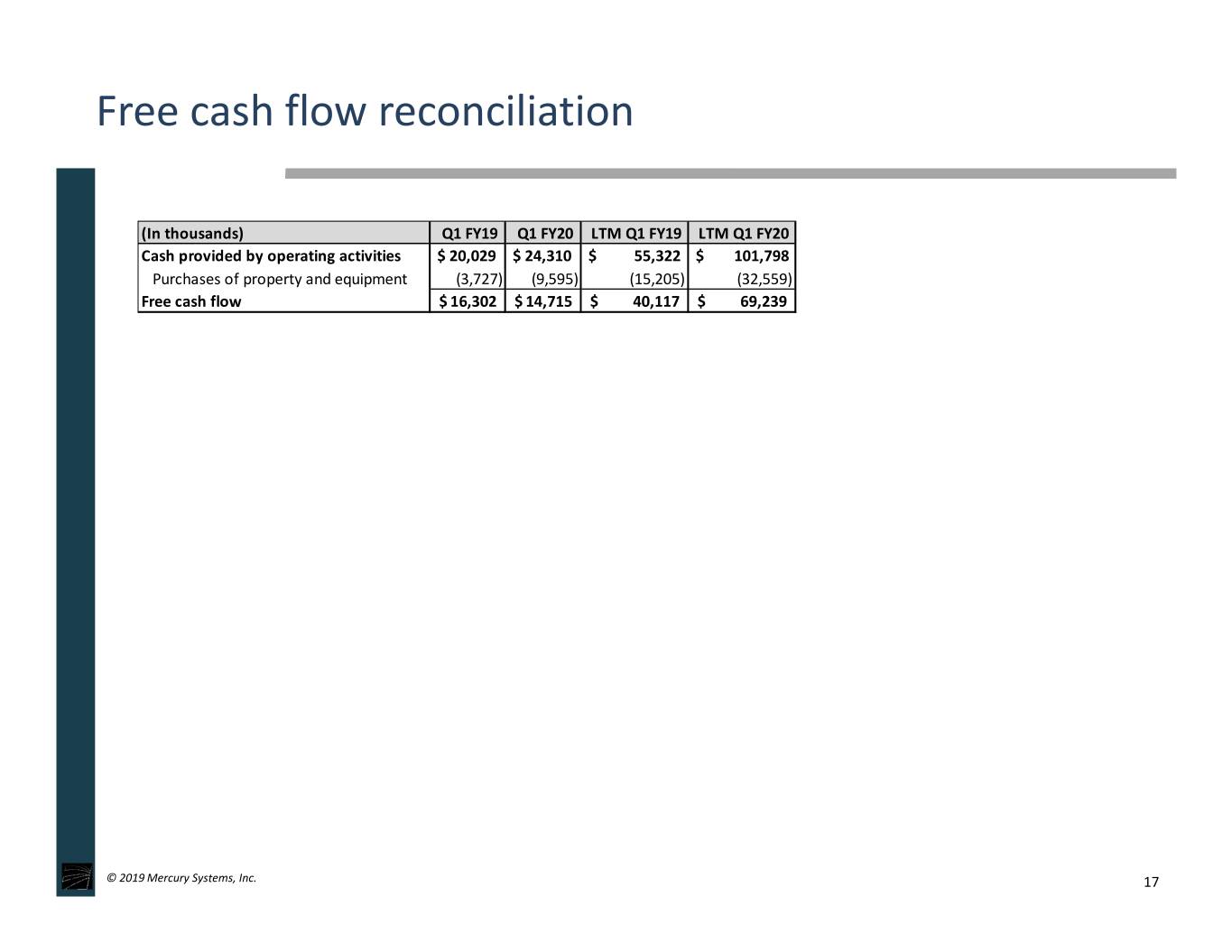

Free cash flow reconciliation (In thousands) Q1 FY19 Q1 FY20 LTM Q1 FY19 LTM Q1 FY20 Cash provided by operating activities $ 20,029 $ 24,310 $ 55,322 $ 101,798 Purchases of property and equipment (3,727) (9,595) (15,205) (32,559) Free cash flow $ 16,302 $ 14,715 $ 40,117 $ 69,239 © 2019 Mercury Systems, Inc. 17

Organic revenue reconciliation (In thousands) Q1 FY19 Q1 FY20 LTM Q1 FY19 LTM Q1 FY20 Organic revenue(1) $ 135,062 $ 158,053 $ 522,177 $ 622,087 Acquired revenue 8,994 19,251 8,994 65,905 Net revenues $ 144,056 $ 177,304 $ 531,171 $ 687,992 Notes: (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. © 2019 Mercury Systems, Inc. 18