© Mercury Systems, Inc. GOLDMAN SACHS INDUSTRIALS & MATERIALS CONFERENCE Mark Aslett President & CEO Mike Ruppert Executive Vice President & CFO May 11, 2021

© Mercury Systems, Inc. Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the acquisitions described herein and to fiscal 2021 business performance and beyond and the Company’s plans for growth and improvement in profitability and cash flow. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “i ntend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economicand business conditions, including unforeseen weakness in the Company’s markets, effects of epidemics and pandemics such as COVID, effects of any U.S. federal government shutdown or exten ded continuing resolution, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company’s products, shortages in components, production delays or unanticipated expenses due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in re alizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, increases in interest rates, changes to industrial security and cyber-security regulations and requirements, changes in tax rates or tax regulations, changes to interest rate swaps or other cash flow hedging arrangements, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended July 3, 2020. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income, adjusted EPS, free cash flow, organic revenue and acquired revenue, which are non-GAAP financial measures. Adjusted EBITDA, adjusted income, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, these non-GAAP measures should not be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes these non-GAAP measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto. 2

© Mercury Systems, Inc. Mercury Systems at-a-glance Innovation That Matters. By and For People Who Matter. 3 Transformational business model at the intersection of high tech and defense Deployed on 300+ programs – serving defense Primes and critical infrastructure providers Making commercial technology profoundly more accessible Our goal is to provide all processing solutions on every system requiring uncompromised computing Defense industry’s highest Glassdoor employee ratings Founded in 1981 NASDAQ: MRCY

© Mercury Systems, Inc. Mercury Systems by the numbers 4 2,300+ Number of team members globally, ~30% hold DoD security clearances $176M FY20 Adj. EBITDA $176M (22% margin) 32% CAGR FY15-FY20 4-5x Research & development relative investment compared to our industry 35+ Years of tech leadership in the A&D industry 25+ Prime customers: including virtually all leaders in the A&D industry 300+ Installed base: number of A&D programs with Mercury embedded $797M FY20 Revenue, 28% CAGR FY15-FY20 ~11% avg. organic growth FY15-FY20 12 Number of M&A transactions completed since FY14 24 Global state-of-the-art facilities

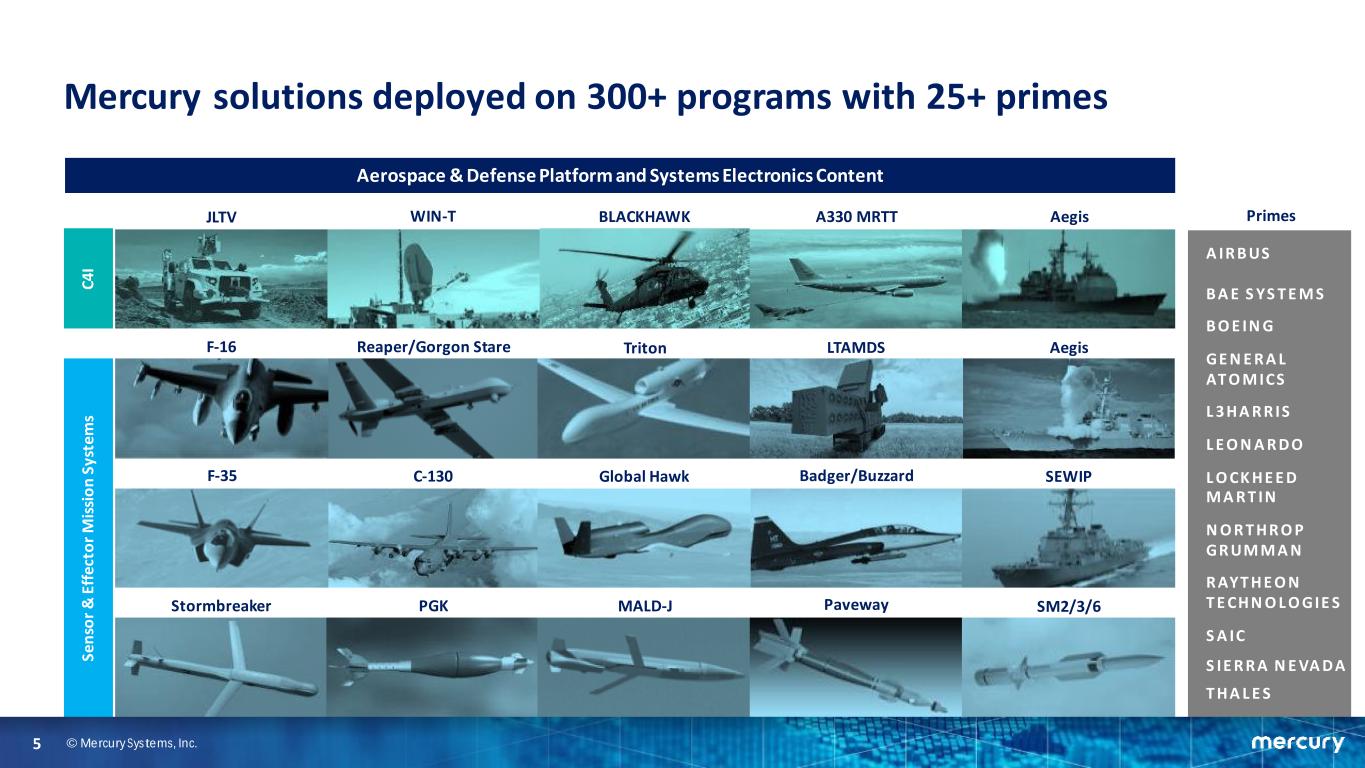

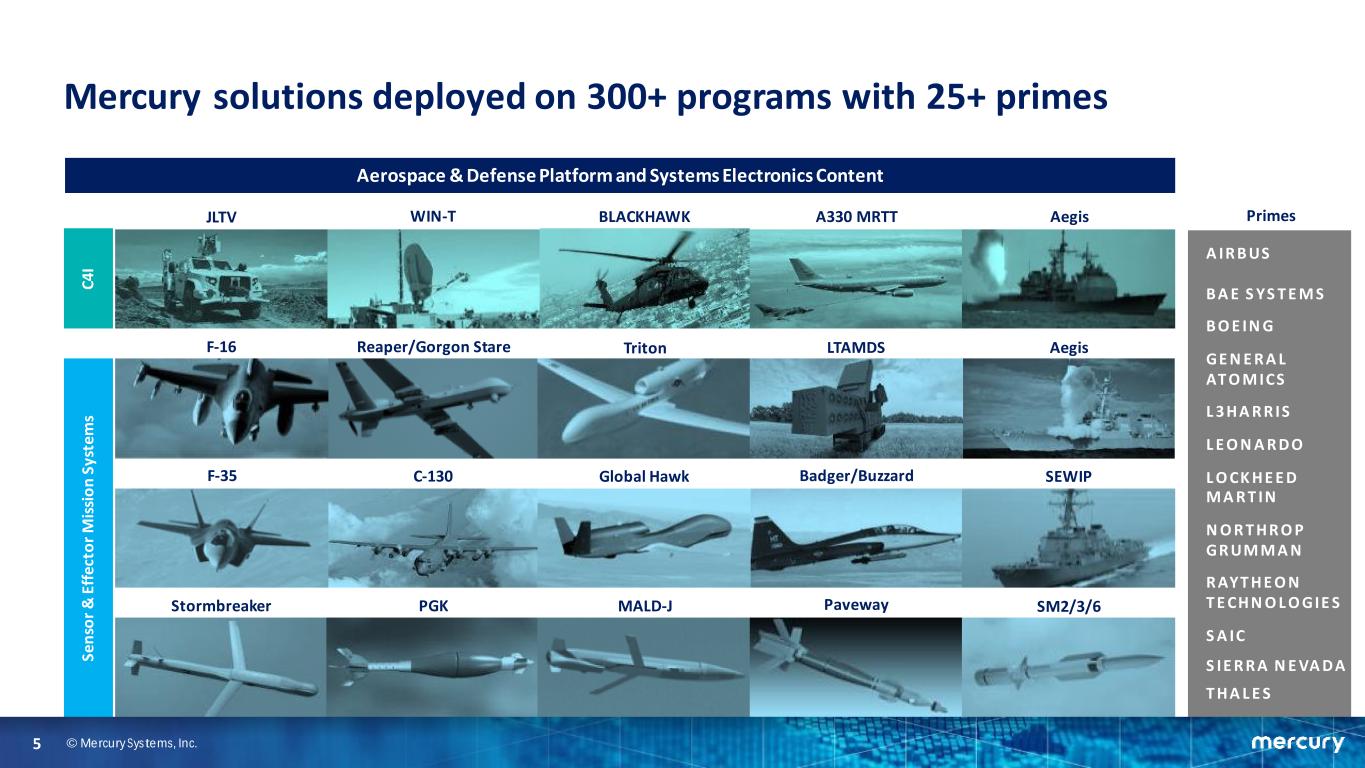

© Mercury Systems, Inc. Mercury solutions deployed on 300+ programs with 25+ primes 5 C 4 I S e n so r & E ff e ct o r M is si o n S y st e m s JLTV BLACKHAWK A330 MRTTWIN-T C-130 MALD-J SM2/3/6PavewayStormbreaker PGK Triton AegisLTAMDSF-16 Reaper/Gorgon Stare Global Hawk SEWIPBadger/BuzzardF-35 Aegis Aerospace & Defense Platform and Systems Electronics Content A IR B US B A E S YS T E M S B O E IN G GE N E R A L AT O M ICS L 3 H A R R IS L E O N A R D O L O CK H E E D M A R T IN N O R T H R O P GR UM M A N R AYT H E O N T E CH N O L O GIE S S A IC S IE R R A N E VA D A T H A L E S Primes

© Mercury Systems, Inc. Investment highlights Innovative growth company at intersection of high tech and defense Focused on large, growing, well-funded addressable markets Proven transformational business model investing 4-5x defense industry average in R&D Benefiting from outsourcing, supply chain delayering and “re-shoring” Low-risk content expansion strategies delivering above-average organic revenue CAGR Successful M&A and integration strategy targeting new capabilities and market expansion 6

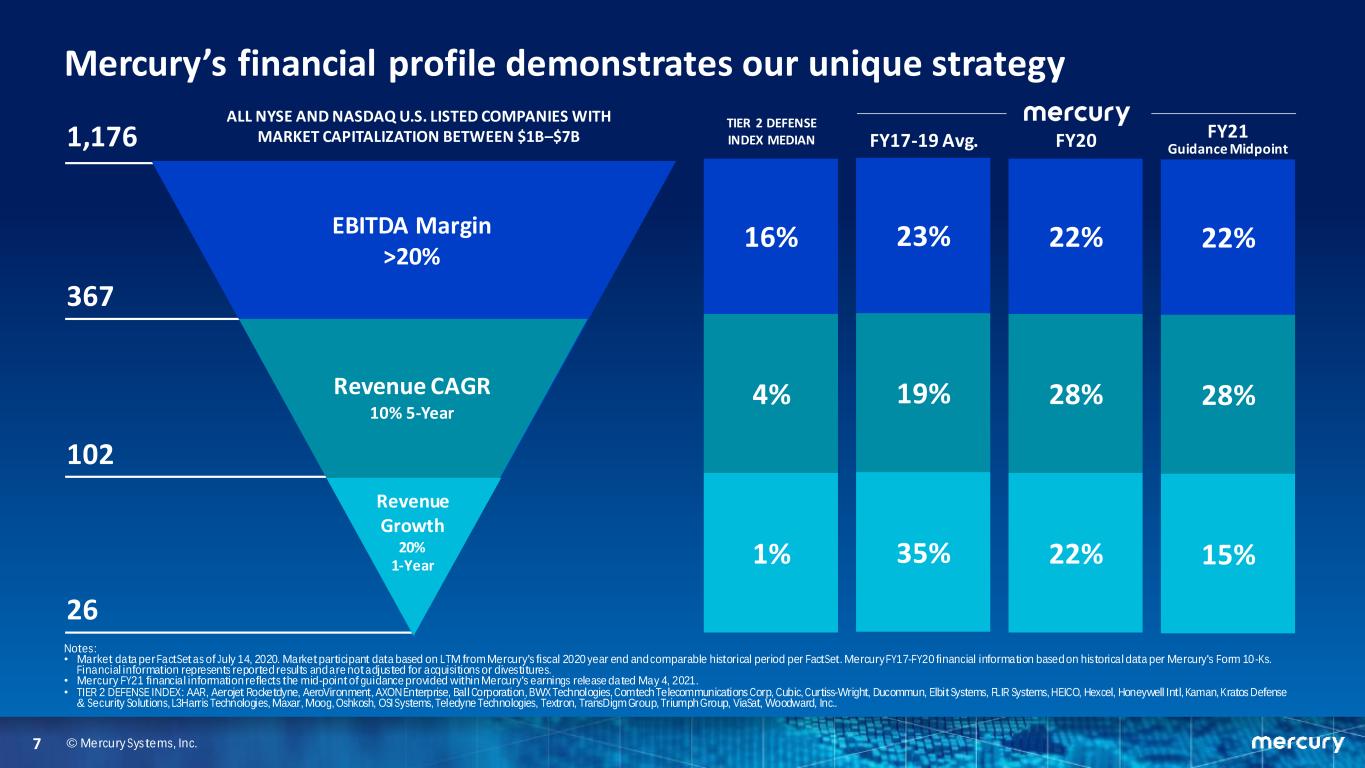

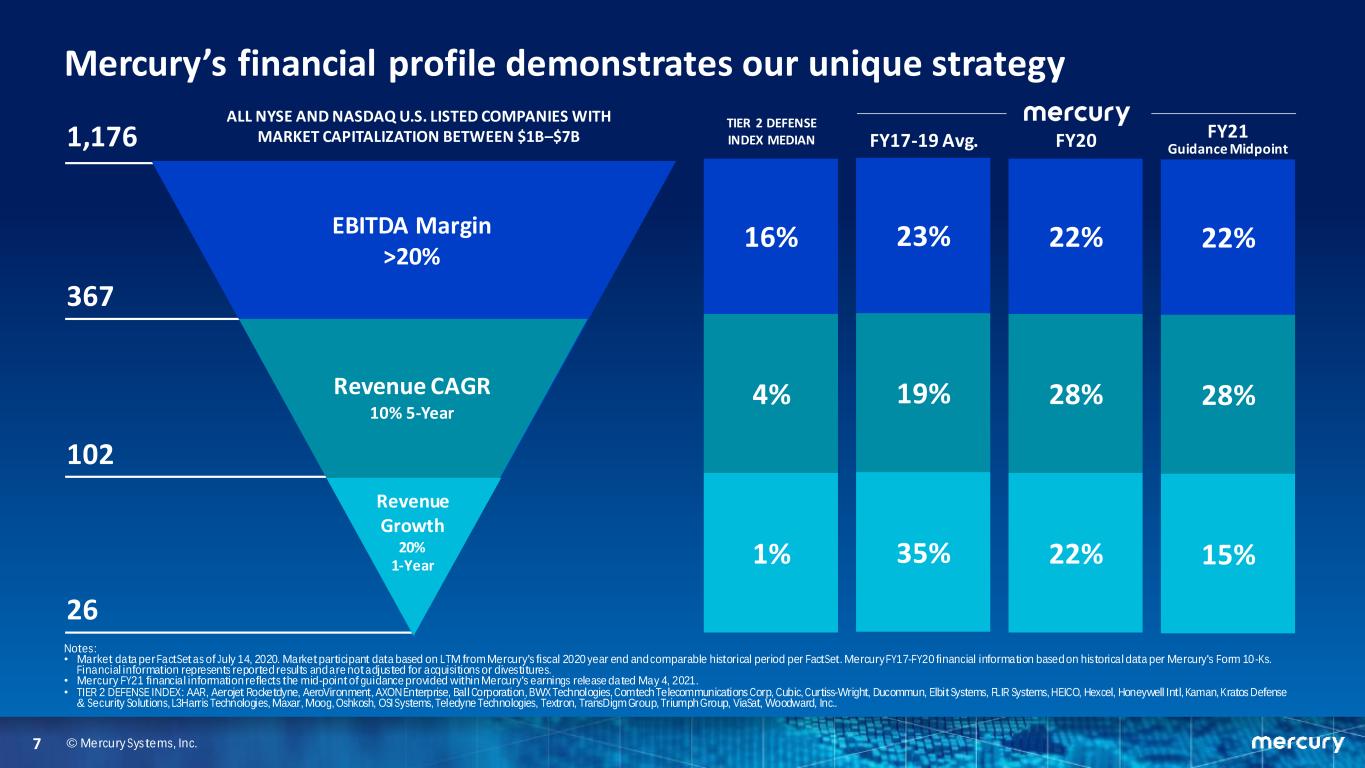

© Mercury Systems, Inc. 1,176 ALL NYSE AND NASDAQ U.S. LISTED COMPANIES WITH MARKET CAPITALIZATION BETWEEN $1B–$7B 26 102 367 23% 19% 35% 16% 4% 1% TIER 2 DEFENSE INDEX MEDIAN Mercury’s financial profile demonstrates our unique strategy EBITDA Margin >20% Revenue CAGR 10% 5-Year Revenue Growth 20% 1-Year 22% 28% 22% 22% 28% 15% FY17-19 Avg. FY20 FY21 Guidance Midpoint Notes: • Market data per FactSet as of July 14, 2020. Market participant data based on LTM from Mercury's fiscal 2020 year end and comparable historical period per FactSet. Mercury FY17-FY20 financial information based on historical data per Mercury's Form 10-Ks. Financial information represents reported results and are not adjusted for acquisitions or divestitures. • Mercury FY21 financial information reflects the mid-point of guidance provided within Mercury's earnings release dated May 4, 2021. • TIER 2 DEFENSE INDEX: AAR, Aerojet Rocketdyne, AeroVironment, AXON Enterprise, Ball Corporation, BWX Technologies, Comtech Telecommunications Corp, Cubic, Curtiss-Wright, Ducommun, Elbit Systems, FLIR Systems, HEICO, Hexcel, Honeywell Intl, Kaman, Kratos Defense & Security Solutions, L3Harris Technologies, Maxar, Moog, Oshkosh, OSI Systems, Teledyne Technologies, Textron, TransDigm Group, Triumph Group, ViaSat, Woodward, Inc.. 7

mrcy.com THANK YOU.

APPENDIX

© Mercury Systems, Inc. 1/ Invest to grow organically 2/ Expand capabilities, market access and penetration through M&A 4/ Continuously improve operational capability and scalability 3/ Invest in trusted, secure Innovation That Matters® 5/ Attract and retain the right talent Mercury strategy: A plan to meet market needs at speed 10

© Mercury Systems, Inc. Silicon: We are a leader in adapting commercially developed silicon technology to be purpose-built specifically for aerospace and defense. Safety: Design safety-certifiable processing systems up to the highest design assurance levels. Security: Investment in industry-leading embedded security capabilities and secure manufacturing facilities. Speed: Highest performance and densest processing solutions available onboard military platforms. SWaP: Everything optimized for size, weight and power, along with most advanced packaging and cooling technology. Software: Investment in the most advanced open middleware and software allowing customers to port their applications on top of open mission systems architecture. 6 highly differentiated capabilities: To invest in any one of these would be significant. We invest in all six. 11

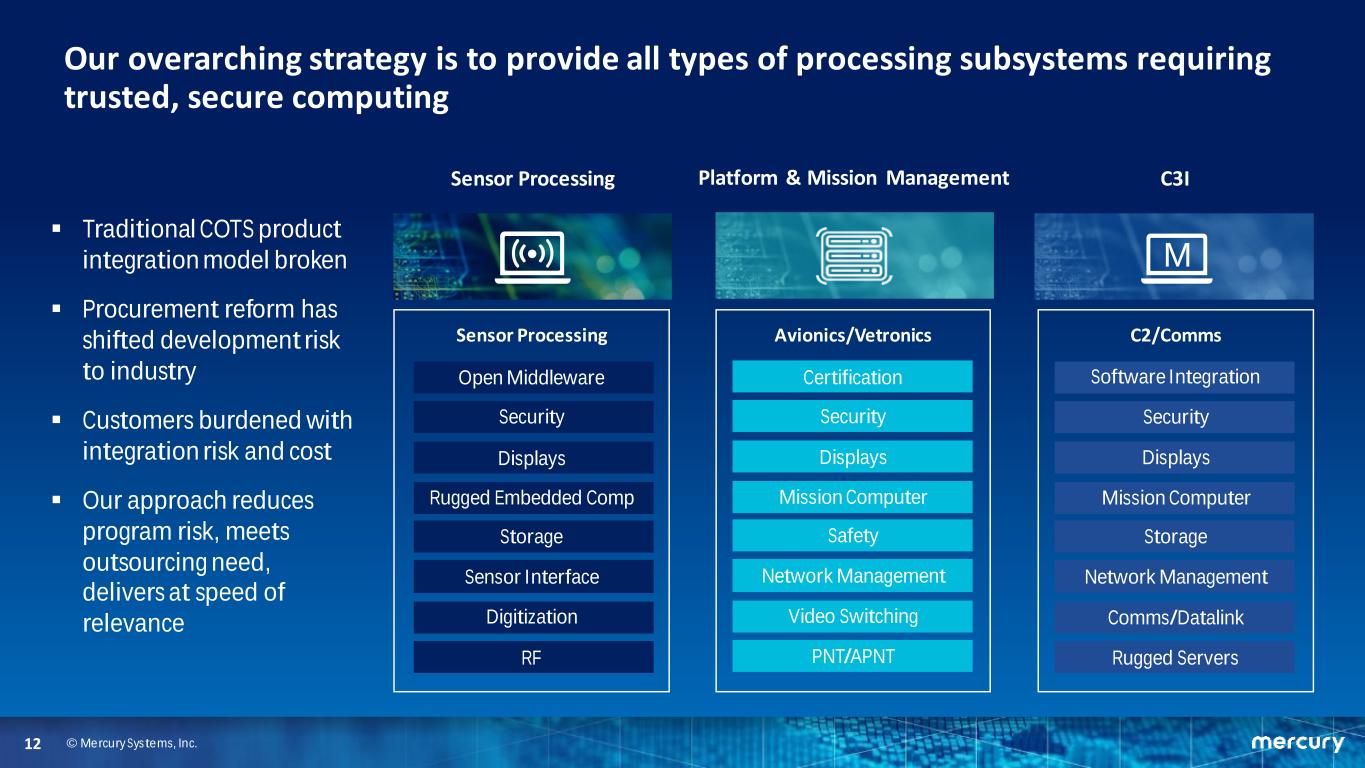

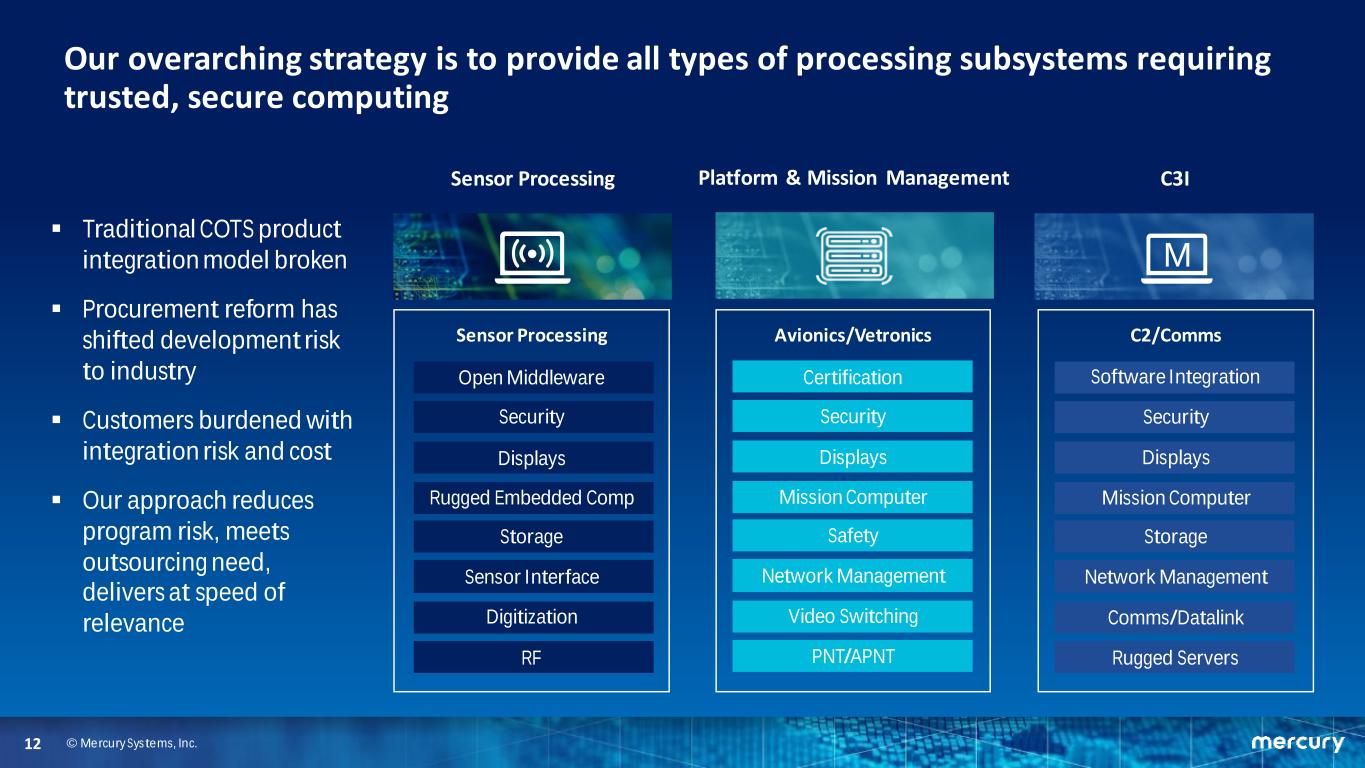

© Mercury Systems, Inc. C3I Software Integration Security Displays Mission Computer Storage Network Management Comms/Datalink Rugged Servers C2/Comms M Our overarching strategy is to provide all types of processing subsystems requiring trusted, secure computing Certification Security Displays Mission Computer Safety Network Management Video Switching PNT/APNT Avionics/Vetronics Platform & Mission ManagementSensor Processing Open Middleware Security Displays Rugged Embedded Comp Storage Sensor Interface Digitization RF Sensor Processing ▪ Traditional COTS product integration model broken ▪ Procurement reform has shifted development risk to industry ▪ Customers burdened with integration risk and cost ▪ Our approach reduces program risk, meets outsourcing need, delivers at speed of relevance 12

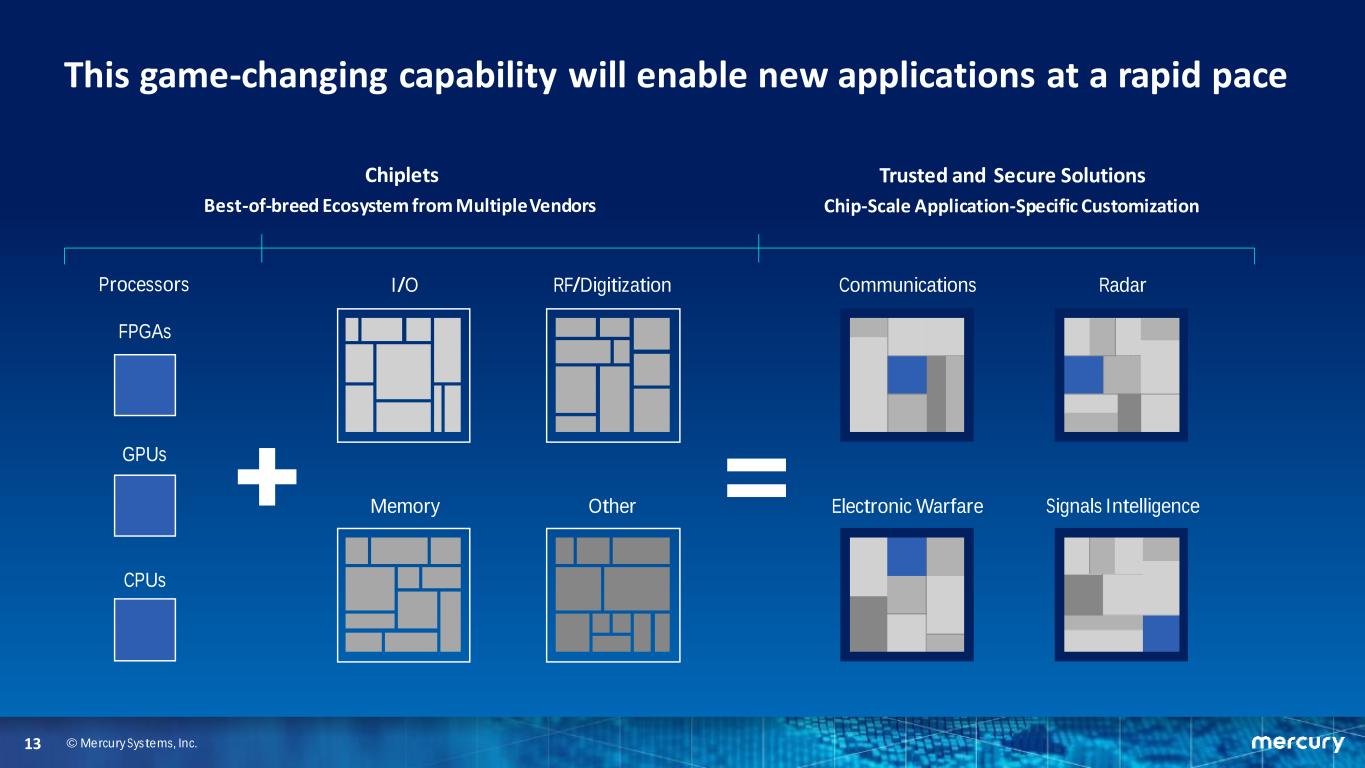

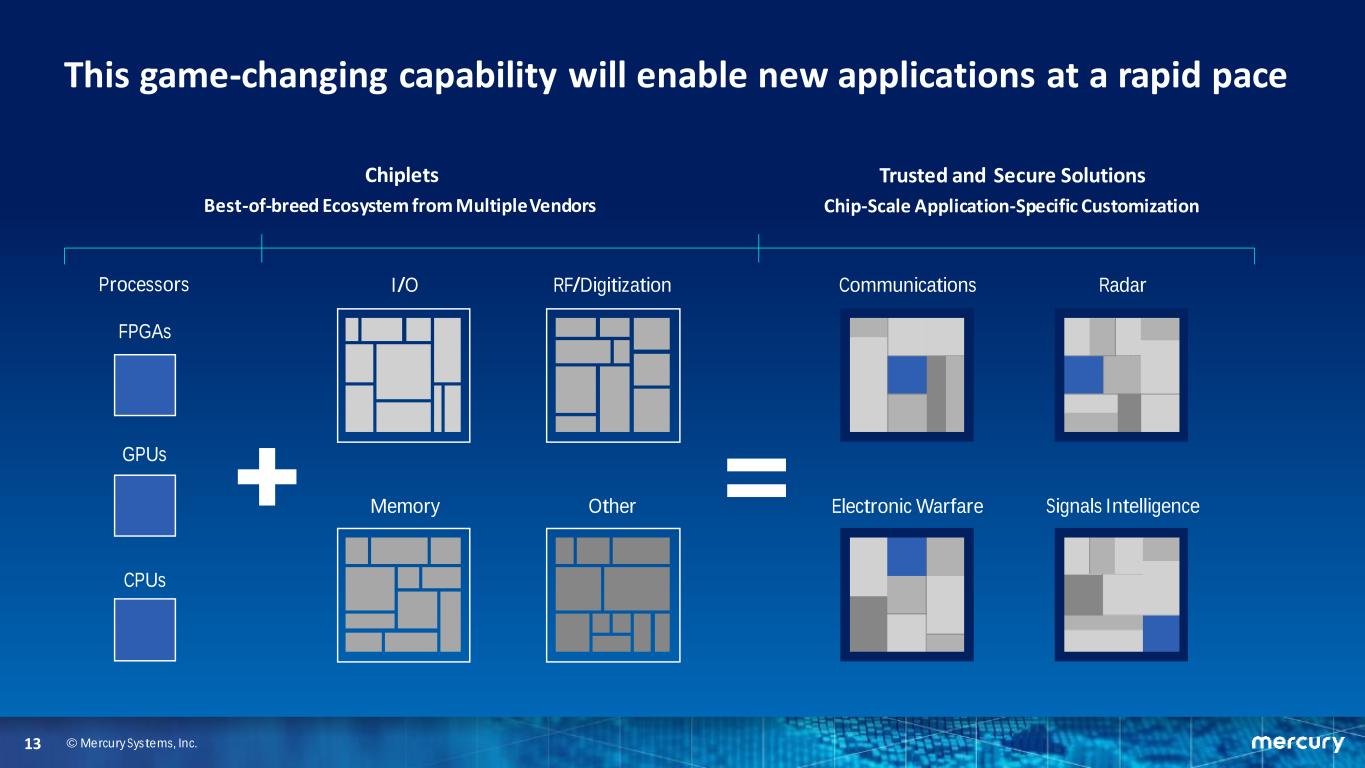

© Mercury Systems, Inc. This game-changing capability will enable new applications at a rapid pace Trusted and Secure Solutions Chip-Scale Application-Specific Customization Processors FPGAs GPUs CPUs I/O RF/Digitization Memory Other Chiplets Best-of-breed Ecosystem from MultipleVendors Communications Radar Signals IntelligenceElectronic Warfare 13

© Mercury Systems, Inc. We are simultaneously expanding our content footprint vertically while horizontally expanding our market access Up to another 2x higher-margin content increase per system as new trusted microelectronic capabilities enable new applications and performance Trusted and Secure Computing Up to a 12x increase in content per system as customers outsource more due to secure computing requirements and as system complexity grows SEMS Tier 2 market $16.4B 4.6% CAGR Move into adjacent submarkets and other system sensors C4I Tier 2 market $22.4B 4.1% CAGR Provide all other computers that need trust, security, safety Notes Tier 2 includes embedded computing and subsystems with RF content. Includes US Government and Global Defense & Commercial Aerospace Markets Sources: RSAdvisors research & analysis, November 2019. CAGRs referenced are for periods GFY19-GFY24. Numbers are rounded. 14

© Mercury Systems, Inc. Six major trends shaping the defense industry 1/ Defense spending pressures Political uncertainty, COVID-19 stimulus, interest payments, healthcare and social spending remain long-term headwinds; Pressures require prioritization within DoD 2/ Challenging global security environment National Defense Strategy is focused on near-peer threats; Chinese militarization and power projection, resurgent Russia; Drives technology requirements 3/ Defense electronics modernization underway Significant system upgrades underway to maintain and extend competitive advantage: Sensor & C4I as well as weapon systems modernization and readiness 4/ Investment and innovation challenges Primes increasing headcount but recruitment challenges and aging workforce; Relatively low IRAD requires focused investment and increased outsourcing 5/ Need access to commercial technology Leverage high-tech commercial investment and innovation; must be tailored for defense purposes. Microelectronics elevated to DoD’s #1 technology priority 6/ Imperative for U.S.-produced technology Supply chain globalization vs. need for trust, security and assurance. Need to onshore capacity and capability 15

© Mercury Systems, Inc. FY22 DoD initial request adds $10B over FY21 appropriated amount, but no out year guidance has been provided $522 $524 $598 $617 $633 $636 $715 $581 $606 $671 $685 $723 $705 $722 $737 $753 $768 $450 $500 $550 $600 $650 $700 $750 $800 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Budget Control Act 2011 (Base) Actual funding (Base) Actual funding (Base + OCO) FY21 Administration Request (Base + OCO) Subject to BCA BCA expired Topline Defense Budget Outlook (Discretionary BA, Current $B) Notes • FY20 051 appropriations amount $723B includes ~$8B of MILCON emergency requirements and ~$10B of CARES stimulus in OCO • Budget and BCA Caps represent the 051 account (DoD) • BBA 051 totals are estimated using 050 cap and typical 051 ratio • BCA Caps expire after FY21 Sources BBA 2019, FY21 PBR, CBO, CRS, OMB, FY20 DoD Green Book, FY18-21 Defense Appropriations bills, FY22 OMB “skinny budget” release, RSAdvisors research & analysis DEFENSE (BASE + OCO) CAGR 2021–2025 2.2% 2020–2025 1.2% 2018–2025 1.9% 2016–2025 3.2% (including CARES) FY22 REQUEST: $715B • Base only – discontinues OCO • No FY23 & beyond outlook provided • Excludes potential future stimulus or COVID relief funding 16 FY22 Administration Request (based on FY21 plan)

© Mercury Systems, Inc. Aerospace & Defense Platform and Systems Electronics Content C4I ($22.4B)* Sensor & Effector Mission Systems ($16.4B)* MARKET SEGMENT Platform & Mission Mgmt C2I Comms EW Radar EO/IR Acoustics Weapons 7 Avionics/ Vetronics Command & Control/Battle Management Dedicated Communications Electronic Warfare Radar Electro-Optical/ Infrared Acoustics Missiles/ Munitions DEFINITION Control & operation of platform & mission systems Processing & exploitation of information Dissemination of information Offensive / defensive exploitation of EM spectrum Use of RF signal to detect, track, ID Thermo-graphic camera with video output Sound pulses to determine object location Seekers, HEL, HPM Naval Launched Air Launched GFY19 ELECTRONICS MARKET ($B) $28.1B $37.6B $16.4B $8.8B $10.2B $11.6B $4.0B $5.8B 4.0% 2.7% 3.9% 4.2% 3.2% 3.5% 5.2% 4.0% ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR GFY19 TIER 2* MARKET ($B) $7.1B $7.7B $7.6B $5.4B $5.3B $1.8B $1.0B $2.9B 4.8% 3.7% 4.0% 4.3% 3.6% 4.8% 6.0% 4.4% ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR The A&D electronics systems market is ~ $125B annually Our total addressable market is now ~$40B Notes: *Tier 2 includes embedded computing and subsystems with RF content. Includes US Government and Global Defense & Commercial Aerospace Markets Sources: RSAdvisors research & analysis, November 2019. Numbers are rounded. 17

© Mercury Systems, Inc. Acquisitions and investments driving significant opportunity growth ▪ Defense prime contractors outsourcing more ▪ Outsourced integrated subsystems 74% of top 30 program lifetime value ▪ Content expansion driving above-average growth ▪ Defense primes’ flight to quality suppliers ▪ Supply chain delayering and reshoring ▪ Foreign military and international sales increasing Note: Probable and Possible values are as of the beginning of the referenced fiscal year. Numbers are rounded. 5,006 4,105 4,999 613 1,140 2,085 1,166 824 73 0 2,000 4,000 6,000 8,000 10,000 FY15 FY15-FY21 Increase FY21 TOP 30 PROGRAMS & PURSUITS ESTIMATED LIFETIME VALUE ($M) Radar EW C4I Weapons EO/IR Other 10,005 Probable Possible Total Pipeline 5,900 Pursuit 3,450 Won 6,555 18

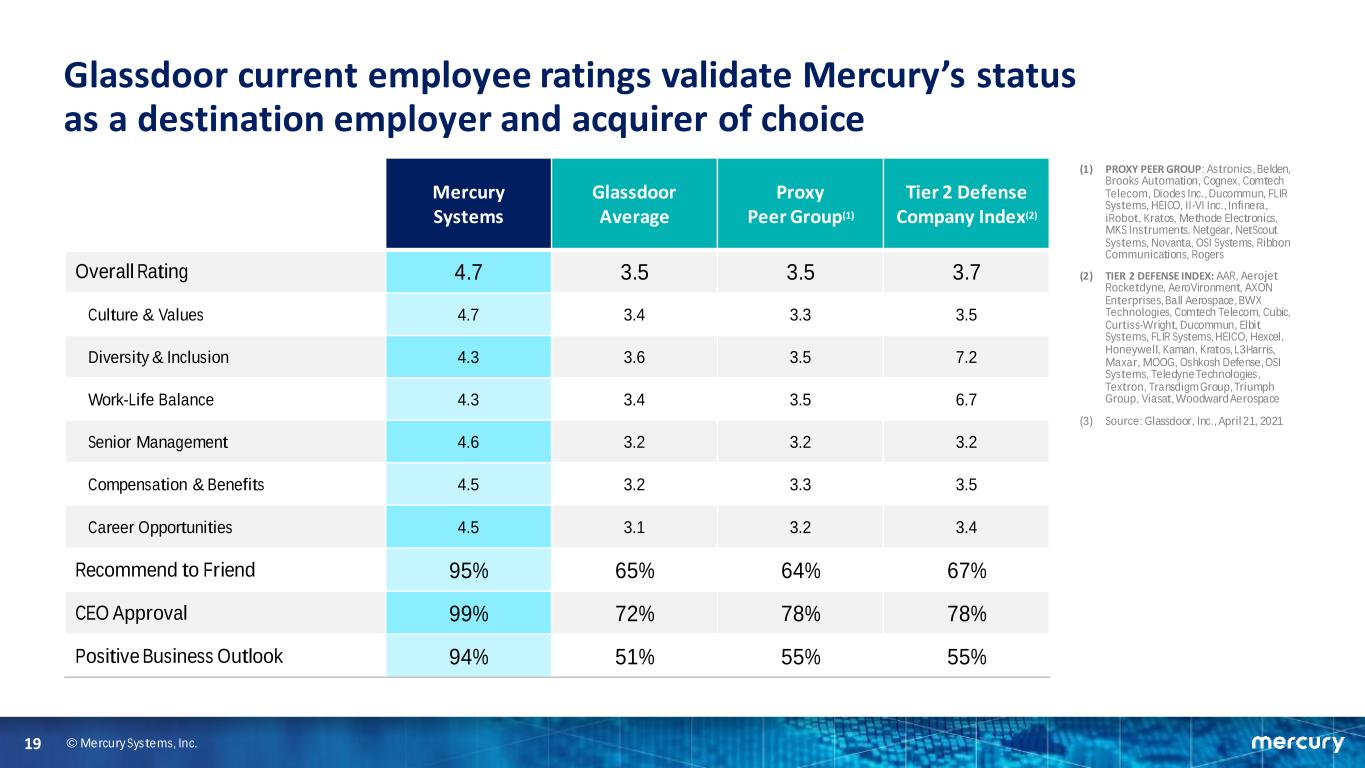

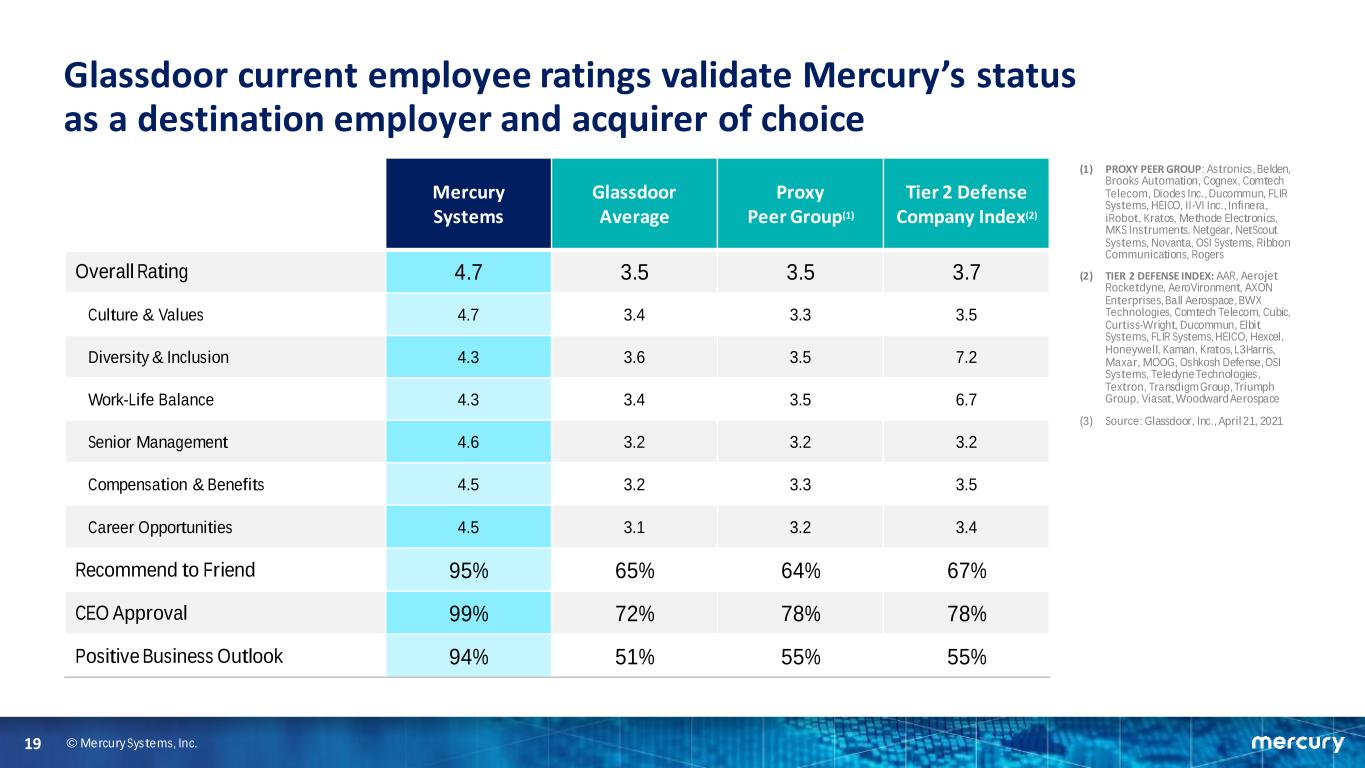

© Mercury Systems, Inc. Glassdoor current employee ratings validate Mercury’s status as a destination employer and acquirer of choice Mercury Systems Glassdoor Average Proxy Peer Group(1) Tier 2 Defense Company Index(2) Overall Rating 4.7 3.5 3.5 3.7 Culture & Values 4.7 3.4 3.3 3.5 Diversity & Inclusion 4.3 3.6 3.5 7.2 Work-Life Balance 4.3 3.4 3.5 6.7 Senior Management 4.6 3.2 3.2 3.2 Compensation & Benefits 4.5 3.2 3.3 3.5 Career Opportunities 4.5 3.1 3.2 3.4 Recommend to Friend 95% 65% 64% 67% CEO Approval 99% 72% 78% 78% Positive Business Outlook 94% 51% 55% 55% (1) PROXY PEER GROUP: Astronics, Belden, Brooks Automation, Cognex, Comtech Telecom, Diodes Inc., Ducommun, FLIR Systems, HEICO, II-VI Inc., Infinera, iRobot, Kratos, Methode Electronics, MKS Instruments, Netgear, NetScout Systems, Novanta, OSI Systems, Ribbon Communications, Rogers (2) TIER 2 DEFENSE INDEX: AAR, Aerojet Rocketdyne, AeroVironment, AXON Enterprises, Ball Aerospace, BWX Technologies, Comtech Telecom, Cubic, Curtiss-Wright, Ducommun, Elbit Systems, FLIR Systems, HEICO, Hexcel, Honeywell, Kaman, Kratos, L3Harris, Maxar, MOOG, Oshkosh Defense, OSI Systems, Teledyne Technologies, Textron, Transdigm Group, Triumph Group, Viasat, Woodward Aerospace (3) Source: Glassdoor, Inc., April 21, 2021 19

© Mercury Systems, Inc. We have executed on a disciplined and focused M&A strategy Notes: *Tier 2 includes embedded computing and subsystems with RF content. Includes US Government and Global Defense & Commercial Aerospace Markets Sources: RSAdvisors research & analysis, November 2019. Numbers are rounded. Aerospace & Defense Platform and Systems Electronics Content C4I ($22.4B)* Sensor & Effector Mission Systems ($16.4B)* MARKET SEGMENT Platform & Mission Mgmt C2I Comms EW Radar EO/IR Acoustics Weapons 7 Avionics/ Vetronics Command & Control/Battle Management Dedicated Communications Electronic Warfare Radar Electro-Optical/ Infrared Acoustics Missiles/ Munitions ACQUISITIONS ORGANIC GFY19 TIER 2* MARKET ($B) $7.1B $7.7B $7.6B $5.4B $5.3B $1.8B $1.0B $2.9B 4.8% 3.7% 4.0% 4.3% 3.6% 4.8% 6.0% 4.4% ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR ‘19-24 CAGR (1) 20

© Mercury Systems, Inc. Mercury M&A philosophy and value creation blueprint Culture & Values Full Integration Unify Brand Combine Like Entities Consolidate Manufacturing Deploy Common Processes & Systems Invest R&D Leverage G&A Accelerate Organic Growth Continuously Improve Deliver Results Assess cultural fit and rapidly enculturate the acquiree We believe in full integration – We’re not a holding company One Brand – Mercury Systems Combine like businesses or product lines to gain scale and efficiencies Invest capital to consolidate and modernize manufacturing facilities Deploy scalable enterprise processes, systems, security, collaboration Raise R&D to accelerate new design wins – Centralize G&A where possible Strategic account and solution sales model to accelerate organic growth Matrix structure drives clarity, consistency, continuous improvement Common business management process and operating cadence 21

© Mercury Systems, Inc. We’re a leader in trusted, secure technologies and subsystems ▪ Innovative growth company at intersection of high tech and defense ▪ Aligned with dominant industry trends ▪ Proven transformational business model for A&D industry ▪ Low-risk content expansion strategies with substantial headroom ▪ Successful M&A strategy targeting new capabilities and market expansion ▪ Clear purpose and positioning, unique business model, highly-engaged workforce 22

FINANCIAL OVERVIEW MICHAEL RUPPERT EXECUTIVE VICE PRESIDENT & CFO

© Mercury Systems, Inc. The evolution of Mercury Systems Notes (1) Trailing four fiscal quarters ended FY15 and FY20, respectively. Operational figures are based on fiscal year and fiscal quarter results as reported in the Company’s Form 10-Ks, Form 10- Qs and/or most recent earnings release. Historical results are as reported, not pro forma for acquisitions. (2) Valuation for FY15 based on basic shares from the cover page of the Company’s FY15 10-K and stock price as of June 30, 2015. Valuation for FY20 based on basic shares from the cover page of the Company’s Q3 FY20 10-Q and stock price as of June 30, 2020. (3) Non-GAAP, see reconciliation table. (4) Acquisitions completed and capital deployed in acquisitions FY15-FY20. Market Capitalization(2) $504 $4,373 9x Enterprise Value(2) $426 $4,165 10x Revenue(2) $235 $797 3x Adj. EBITDA(3) % Margin $44 19% $176 22% 4x +320 bps Adj. EPS(3) $0.80 $2.30 3x Number of Acquisitions(4) N.A. 11 N.M. Capital Deployed(4) N.A. $804 N.M. V a lu a ti o n O p e ra ti o n a l S tr a te g y In millions, except percentage and per share data. FY15(1) FY20(1) Change 24

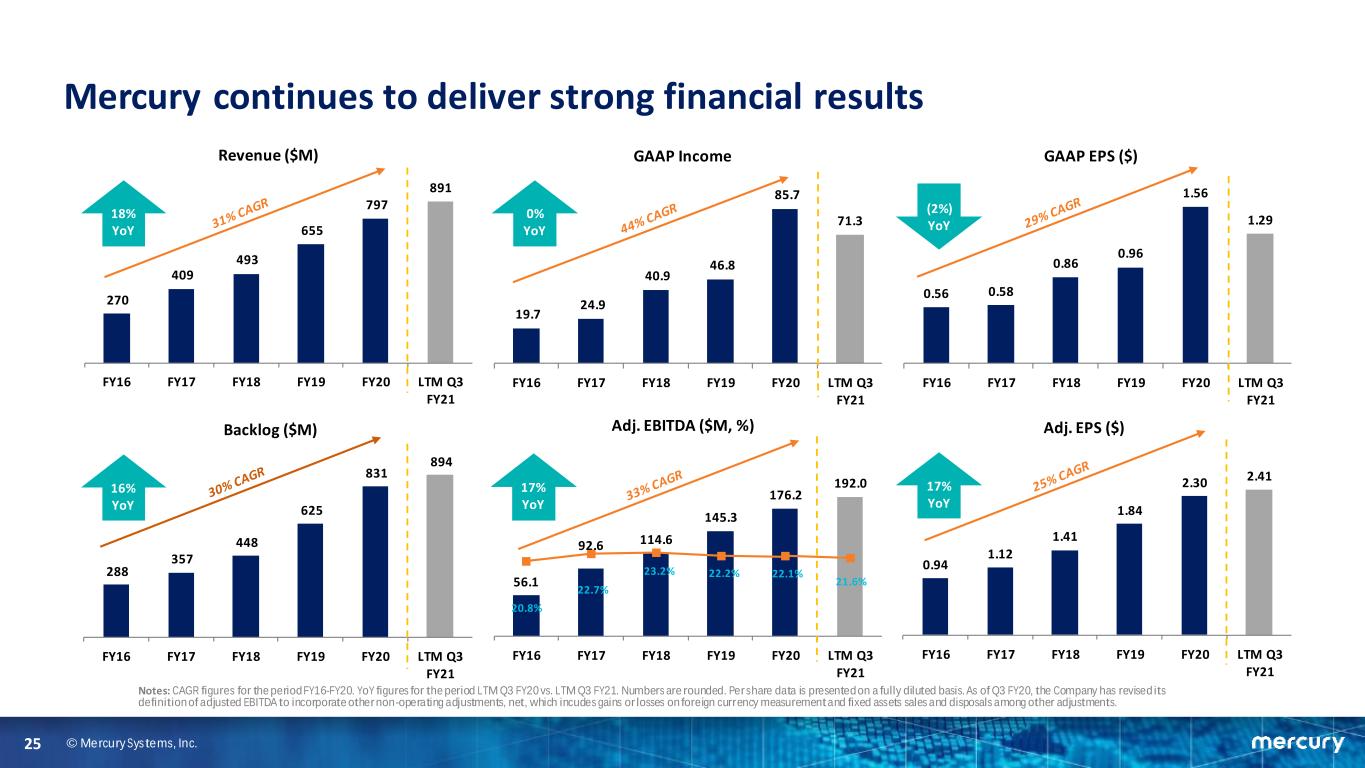

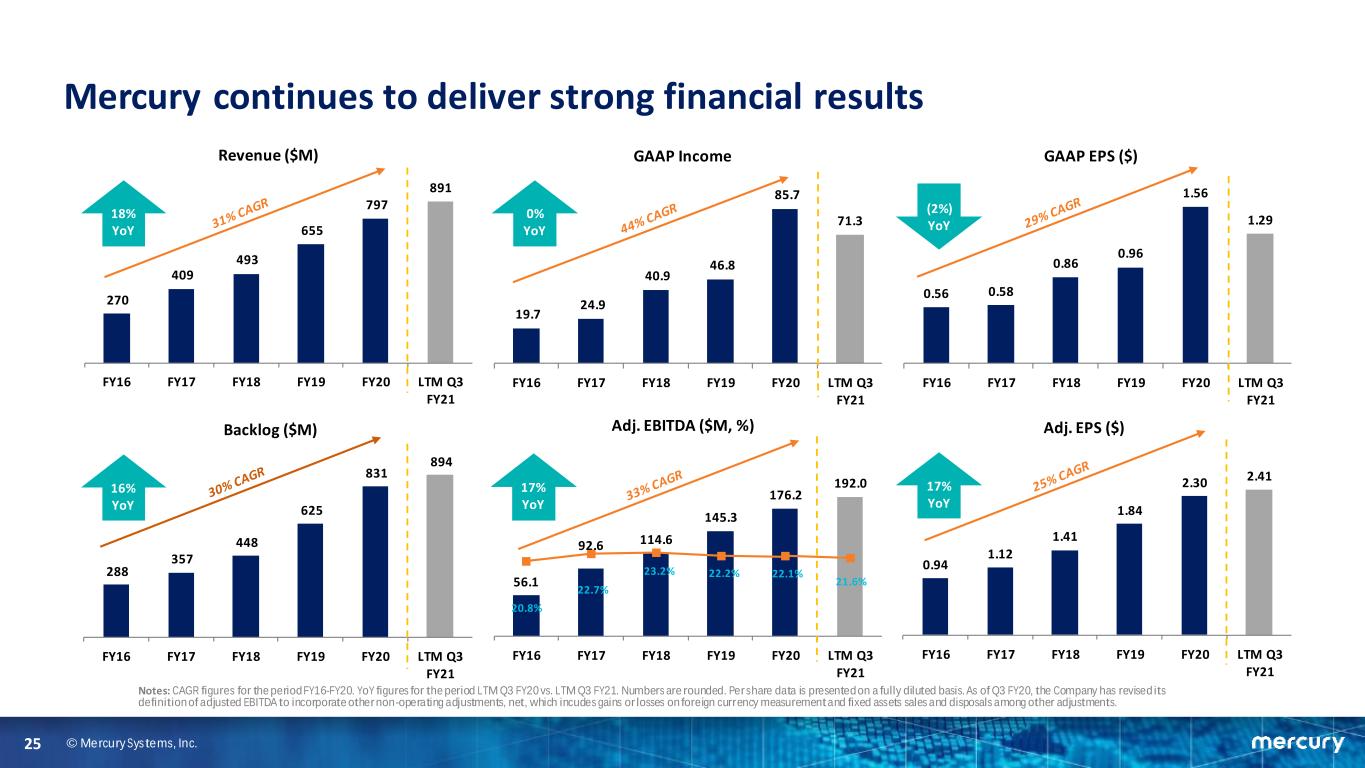

© Mercury Systems, Inc. Mercury continues to deliver strong financial results Notes: CAGR figures for the period FY16-FY20. YoY figures for the period LTM Q3 FY20 vs. LTM Q3 FY21. Numbers are rounded. Per share data is presented on a fully diluted basis. As of Q3 FY20, the Company has revised its definition of adjusted EBITDA to incorporate other non-operating adjustments, net, which incudes gains or losses on foreign currency measurement and fixed assets sales and disposals among other adjustments. 270 409 493 655 797 891 FY16 FY17 FY18 FY19 FY20 LTM Q3 FY21 Revenue ($M) 18% YoY 56.1 92.6 114.6 145.3 176.2 192.0 20.8% 22.7% 23.2% 22.2% 22.1% 21.6% FY16 FY17 FY18 FY19 FY20 LTM Q3 FY21 Adj. EBITDA ($M, %) 17% YoY 25 19.7 24.9 40.9 46.8 85.7 71.3 FY16 FY17 FY18 FY19 FY20 LTM Q3 FY21 GAAP Income 0% YoY 288 357 448 625 831 894 FY16 FY17 FY18 FY19 FY20 LTM Q3 FY21 Backlog ($M) 16% YoY 0.56 0.58 0.86 0.96 1.56 1.29 FY16 FY17 FY18 FY19 FY20 LTM Q3 FY21 GAAP EPS ($) 0.94 1.12 1.41 1.84 2.30 2.41 FY16 FY17 FY18 FY19 FY20 LTM Q3 FY21 Adj. EPS ($) 17% YoY (2%) YoY

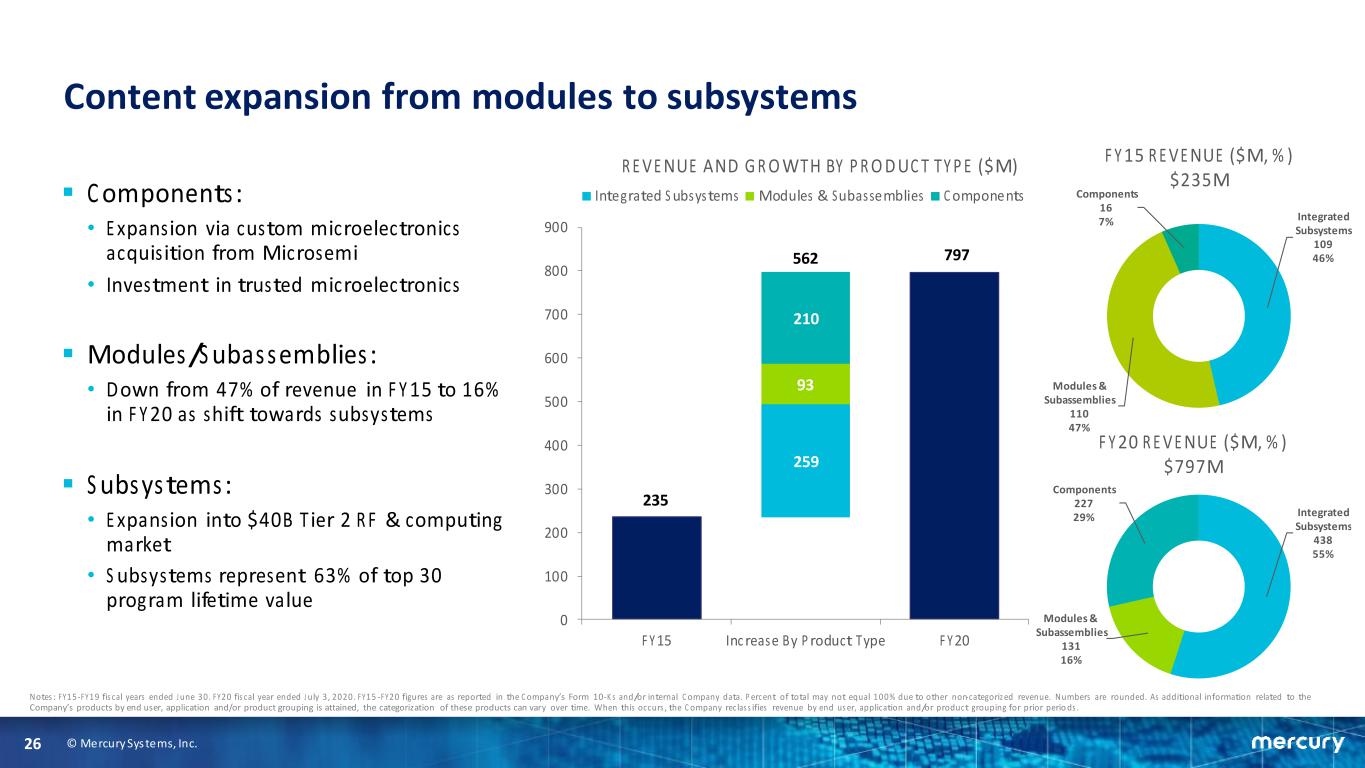

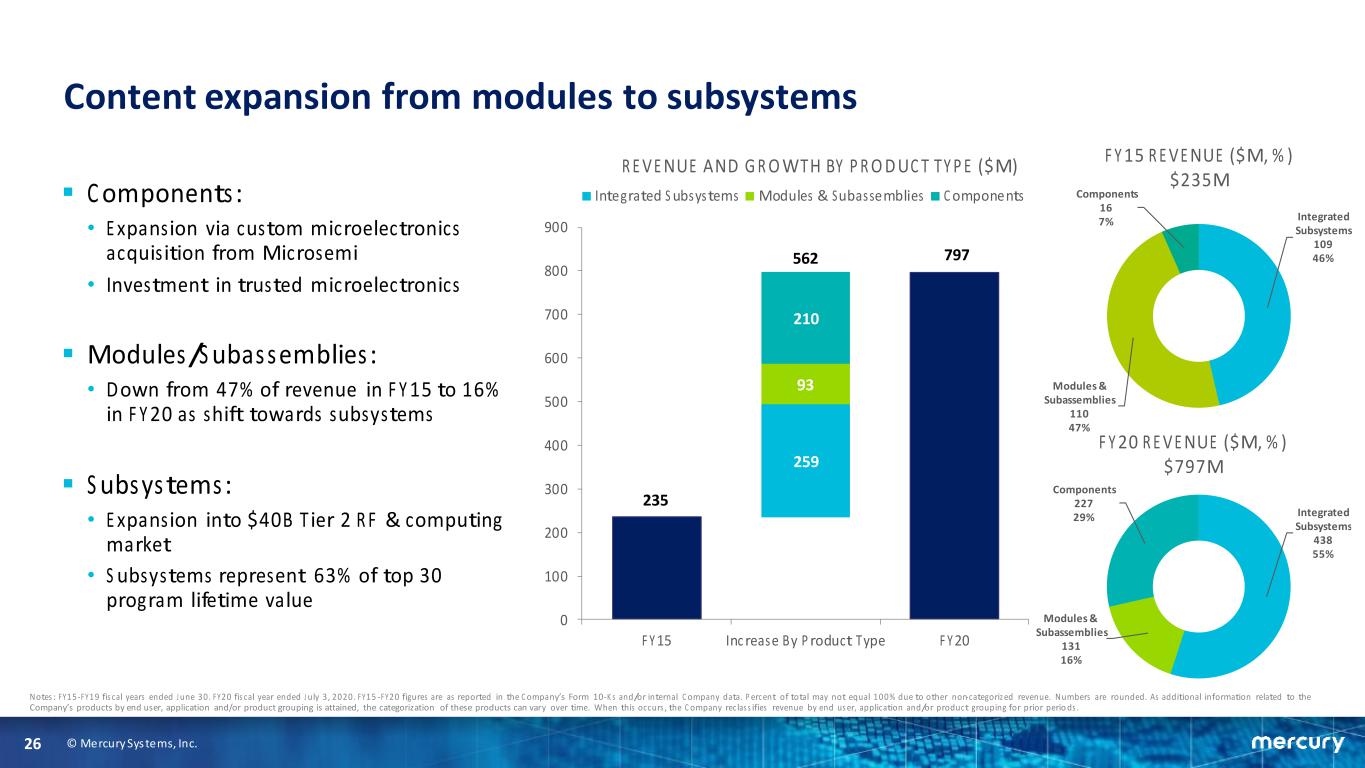

© Mercury Systems, Inc. Content expansion from modules to subsystems ▪ Components: • Expansion via custom microelectronics acquisition from Microsemi • Investment in trusted microelectronics ▪ Modules/Subassemblies: • Down from 47% of revenue in FY15 to 16% in FY20 as shift towards subsystems ▪ Subsystems: • Expansion into $40B Tier 2 RF & computing market • Subsystems represent 63% of top 30 program lifetime value Notes: FY15-FY19 fiscal years ended June 30. FY20 fiscal year ended July 3, 2020. FY15 -FY20 figures are as reported in the Company’s Form 10-Ks and/or internal Company data. Percent of total may not equal 100% due to other non-categorized revenue. Numbers are rounded. As additional information related to the Company’s products by end user, application and/or product grouping is attained, the categorization of these products can vary over time. When this occurs, the Company reclassifies revenue by end user, application and/or product grouping for prior periods. 235 797 259 93 210 0 100 200 300 400 500 600 700 800 900 FY15 Increase By Product Type FY20 REVENUE AND GROWTH BY PRODUCT TYPE ($M) Integrated Subsystems Modules & Subassemblies Components 562 Integrated Subsystems 109 46% Modules & Subassemblies 110 47% Components 16 7% FY15 REVENUE ($M, %) $235M Integrated Subsystems 438 55% Modules & Subassemblies 131 16% Components 227 29% FY20 REVENUE ($M, %) $797M 26

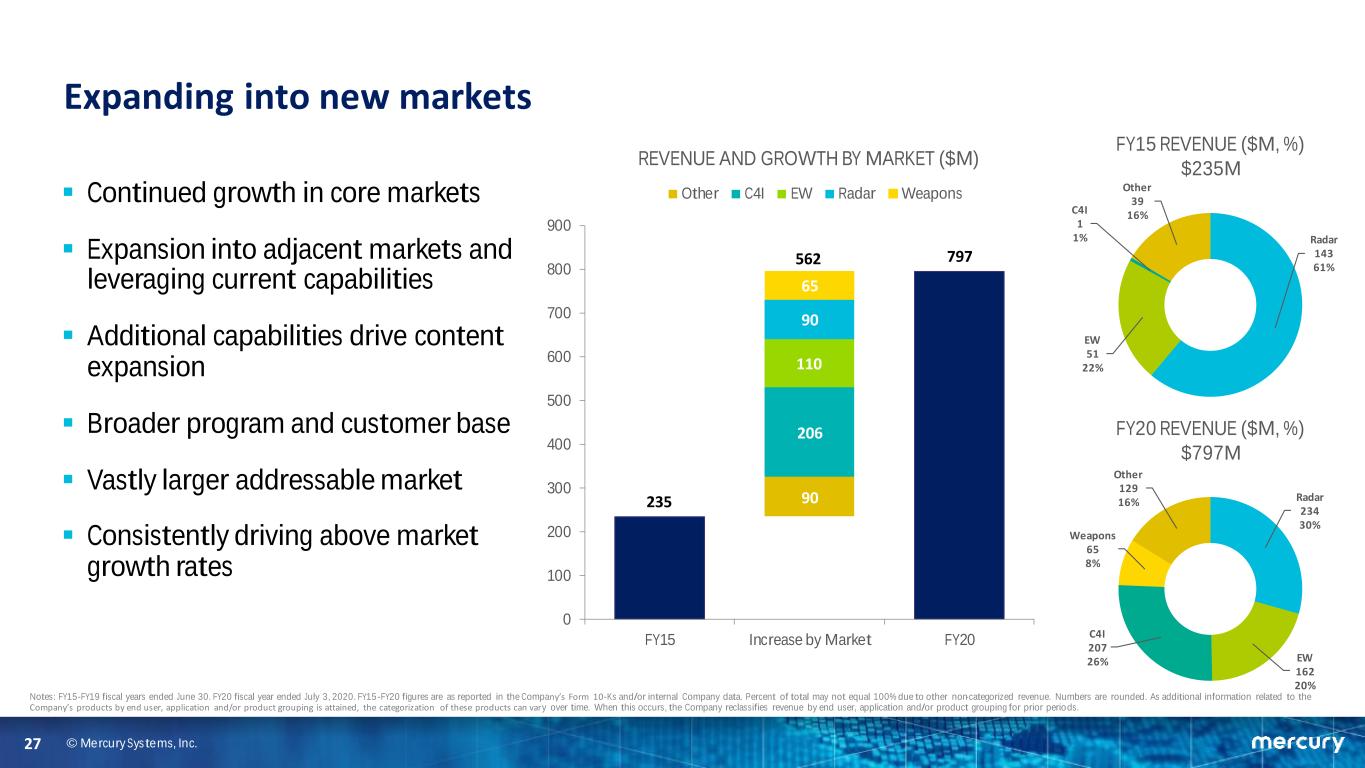

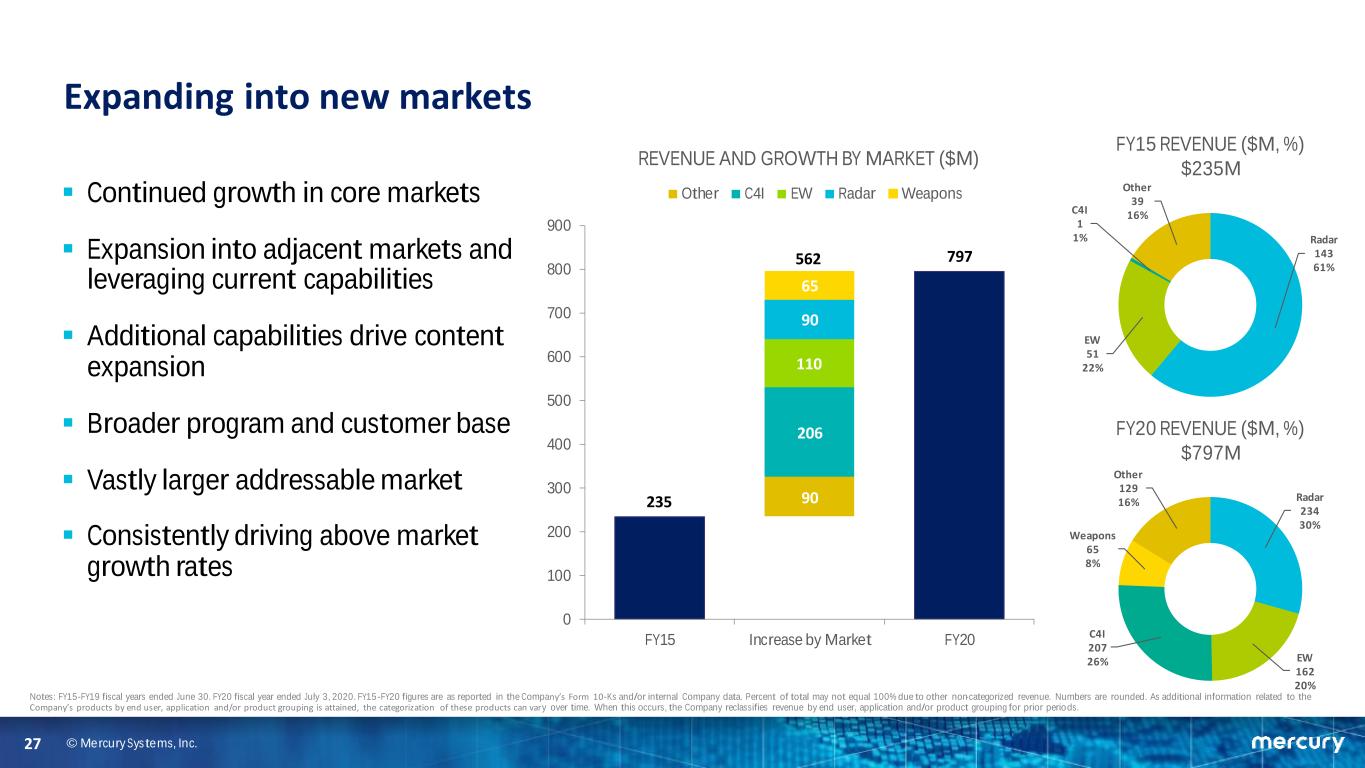

© Mercury Systems, Inc. Expanding into new markets ▪ Continued growth in core markets ▪ Expansion into adjacent markets and leveraging current capabilities ▪ Additional capabilities drive content expansion ▪ Broader program and customer base ▪ Vastly larger addressable market ▪ Consistently driving above market growth rates Radar 234 30% EW 162 20% C4I 207 26% Weapons 65 8% Other 129 16% FY20 REVENUE ($M, %) $797M Radar 143 61% EW 51 22% C4I 1 1% Other 39 16% FY15 REVENUE ($M, %) $235M 235 797 90 206 110 90 65 0 100 200 300 400 500 600 700 800 900 FY15 Increase by Market FY20 REVENUE AND GROWTH BY MARKET ($M) Other C4I EW Radar Weapons 562 Notes: FY15-FY19 fiscal years ended June 30. FY20 fiscal year ended July 3, 2020. FY15 -FY20 figures are as reported in the Company’s Form 10-Ks and/or internal Company data. Percent of total may not equal 100% due to other non-categorized revenue. Numbers are rounded. As additional information related to the Company’s products by end user, application and/or product grouping is attained, the categorization of these products can vary over time. When this occurs, the Company reclassifies revenue by end user, application and/or product grouping for prior periods. 27

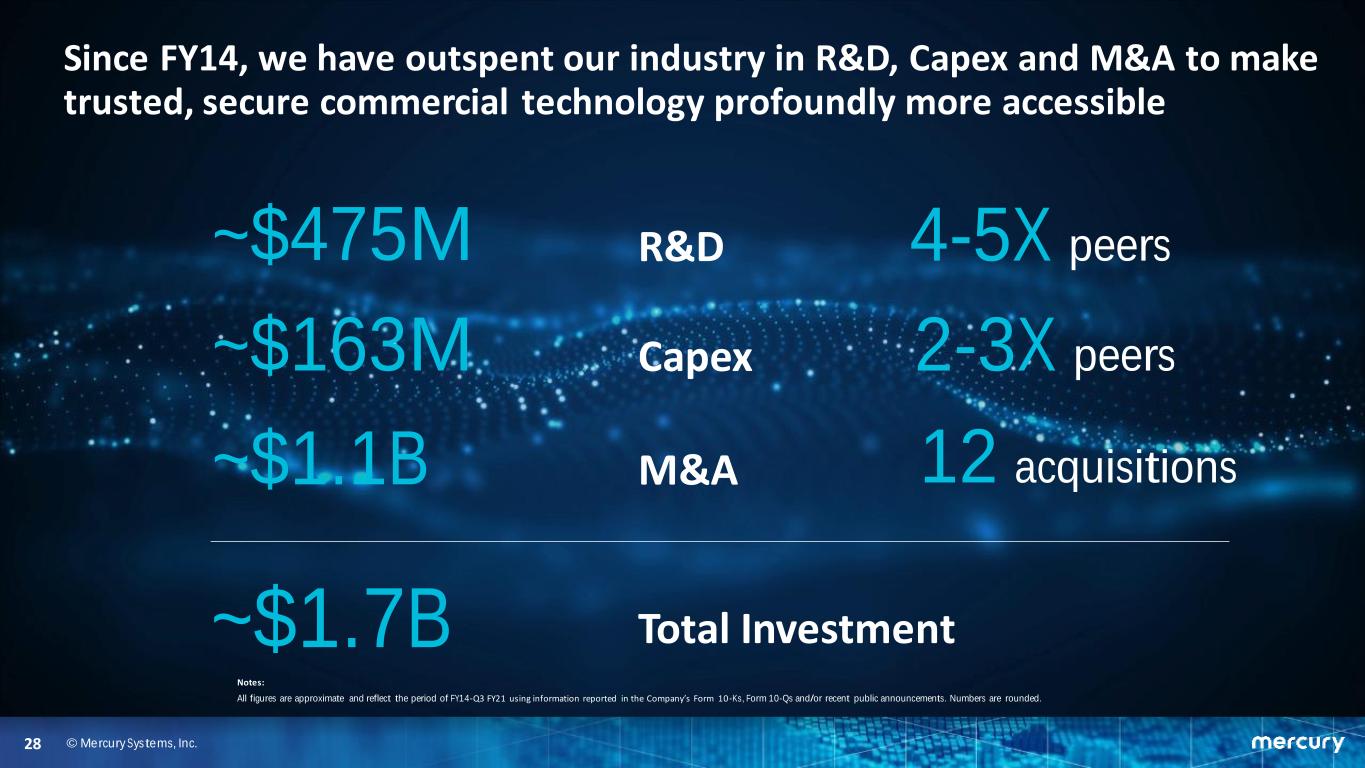

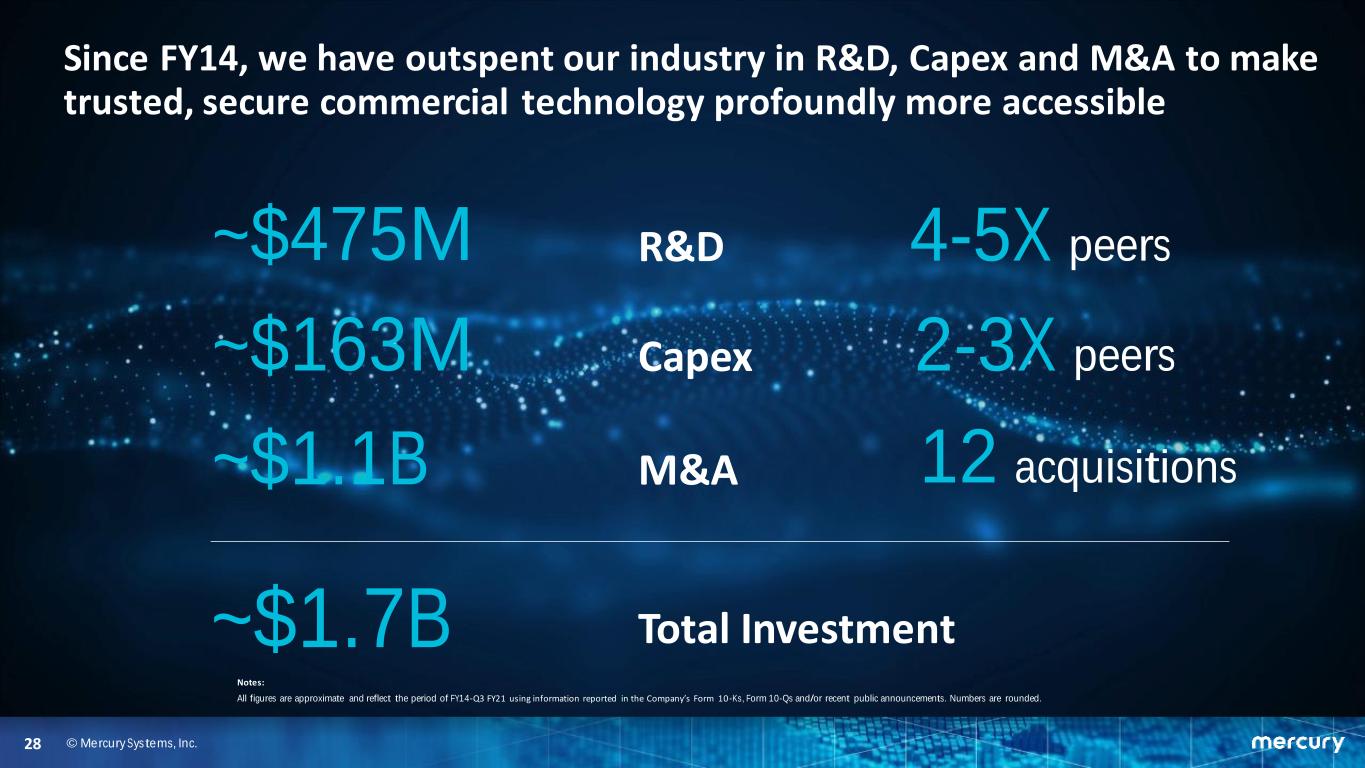

© Mercury Systems, Inc.28 Since FY14, we have outspent our industry in R&D, Capex and M&A to make trusted, secure commercial technology profoundly more accessible ~$475M ~$163M ~$1.1B ~$1.7B 4-5X peers 2-3X peers 12 acquisitions R&D Capex M&A Total Investment Notes: All figures are approximate and reflect the period of FY14-Q3 FY21 using information reported in the Company’s Form 10 -Ks, Form 10-Qs and/or recent public announcements. Numbers are rounded.

© Mercury Systems, Inc. LTM Q3 FY21 performance Notes (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. (2) Non-GAAP, see reconciliation table. (3) Effective as of July 1, 2019, the Company’s fiscal year has changed to the 52-week or 53- week period ending on the Friday closest to the last day of June. All references in this presentation to the third quarter of fiscal 2020 and full fiscal 2020 are to the quarter ended March 27, 2020 and the 53-week period ended July 3, 2020, and to the third quarter of fiscal 2021 and full fiscal 2021 are to the quarter ended April 2, 2021 and 52-week period ending July 2, 2021. (4) LTM figures are based on the trailing four fiscal quarters using information reported in the Company’s Form 10-Ks, Form 10- Qs and/or most recent earnings release. In $ millions, except percentage and per share data LTM Q3 FY20(3)(4) LTM Q3 FY21(3)(4) CHANGE Bookings Book-to-Bill $917.0 1.21 $899.5 1.01 (2%) Backlog 12-Month Backlog $769.8 544.8 $893.7 545.5 16% Revenue Organic Revenue Growth(1) $756.2 11% $890.5 10% 18% Gross Margin 45.0% 42.6% (2.4 pts ) Operating Expenses Selling, General & Administrative Research & Development Amortization/Restructuring/Acquisition $254.6 127.5 91.8 35.3 $294.0 138.2 112.8 43.0 15% GAAP Net Income Effective Tax Rate $71.3 10.4% $71.3 14.2% N.M. GAAP EPS $1.32 $1.29 (2%) Adjusted EPS(2) $2.06 $2.41 17% Adj. EBITDA(2) % of revenue $164.5 21.8% $192.5 21.6% 17% Operating Cash Flow $112.4 $98.8 (12%) Free Cash Flow(2) % of Adjusted EBITDA $71.8 44% $52.6 27% (27%) 29

© Mercury Systems, Inc. Total Capital Deployed: $1,114M Mercury recent acquisition history Company Expansion Primary Theme Closing Date Purchase Price ($M) Ending Debt Balance Funding LIT Security Dec-2015 $ 10 $ 0 Cash on Hand Microsemi (1) Weapons, EW, Security May-2016 $ 300 - Term Loan Cash on Hand April 2016 Equity Offering ($ 93) $ 200 Equity Offering CES Platform/Mission, Comm’s Nov-2016 $ 39 $ 190 Cash on Hand January 2017 Equity Offering ($ 216) $ 0 (2) Equity Offering Delta Microwave EW, Space Apr-2017 $ 41 $ 0 (2) Cash on Hand RTL Platform/Mission Jul-2017 $ 6 $ 0 Cash on Hand Themis C2I, Comm’s Feb-2018 $ 180 $ 195 Revolver Germane Systems C2I, Acoustics Jul-2018 $ 45 $ 240 Revolver GECO Platform/Mission Jan-2019 $ 37 $ 277 Revolver Athena Security Apr-2019 $ 46 $ 325 Revolver Syntonic Microwave EW Apr-2019 May 2019 Equity Offering ($ 455) $ 0 (3) Equity Offering APC Platform/Mission, Vectronics Sep-2019 $ 100 $ 0(4) Cash on Hand POC Platform/Mission, C2I Dec-2020 $310 $160(5) Revolver Cash on Hand Source: Company filings, Company investor presentations (1) Represents carve-out acquisition from Microsemi Corp. (2) On June 27, 2017, Mercury amended its senior secured credit facility, increasing and extending the revolving credit facility and utilizing the January 2017 equity offering proceeds to repay the remaining principal on the existing term loan. (3) Reflects repayment of debt with proceeds from the May 2019 common stock offering. (4) Reflects acquisition of American Panel Corporation (APC) on September 23, 2019 with proceeds from the May 2019 common stock offering. (5) Acquisition of POC on December 30, 2020 funded with $150M of cash on hand and $160M draw on revolver. 30

© Mercury Systems, Inc. Committed to maintaining differentiated and attractive financial profile Increase adj. EBITDA margins Grow organically at high-single / low-double digit Supplement w/strategic M&A ▪ Operating expense leverage ▪ Program production mix ▪ Operational improvements ▪ Full acquisition integration ▪ Alignment with DoD priorities ▪ Increased outsourcing and delayering ▪ Program content expansion ▪ Increased market share ▪ Large pipeline of targets ▪ Significant financial firepower ▪ Revolver with attractive terms ▪ Identify, execute, integrate 31

© Mercury Systems, Inc. Strategy and business model delivering financial performance well above industry average ▪ Track record of strong organic growth, profitability and strategic M&A ▪ Significant investment over last 5 years is competitive differentiator ▪ Poised for continued organic growth and margin expansion ▪ Well positioned for future M&A with strong pipeline and financial flexibility ▪ Clear strategy to continue to maintain unique financial profile 32

© Mercury Systems, Inc. Balance sheet As of (In $ millions)(1) 3/27/20 7/3/20 10/2/20 1/1/21 4/2/21 ASSETS Cash & cash equivalents $407.1 $226.8 $239.1 $109.1 $121.9 Restricted cash - - - 61.6 - Accounts receivable, net 214.0 210.7 207.8 240.2 264.0 Inventory, net 161.9 178.1 206.0 218.4 226.8 PP&E, net 78.7 87.7 94.7 125.4 128.3 Goodwill and intangibles, net 831.4 822.8 815.3 1,093.6 1,077.3 Other 78.5 84.6 90.2 100.8 85.0 TOTAL ASSETS $1,771.6 $1,610.7 $1,653.2 $1,949.2 1,903.3 LIABILITIES AND S/E AP and accrued expenses $109.6 $107.0 $119.7 $116.8 131.3 Deferred consideration - - - 61.6 - Other liabilities 112.6 118.9 125.6 180.1 158.0 Debt 200.0 - - 160.0 160.0 Total liabilities 422.2 225.9 245.3 518.5 449.3 Stockholders’ equity 1,349.4 1,384.8 1,407.9 1,430.6 1,454.0 TOTAL LIABILITIES AND S/E $1,771.6 $1,610.7 $1,653.2 $1,949.2 1,903.3 Notes (1) Rounded amounts used. 33

© Mercury Systems, Inc. Cash flow summary For the Fiscal Quarters Ended (In $ millions)(1) 3/27/20 7/3/20 10/2/20 1/1/21 4/2/21 Net Income $23.6 $27.2 $15.8 $12.7 $15.6 Depreciation and amortization 12.7 12.8 13.0 13.3 20.0 (Gain)/Loss on investment (3.8) (2.0) - 0.4 - Other non-cash items, net 8.5 6.8 4.5 8.0 5.7 Changes in Operating Assets and Liabilities Accounts receivable, unbilled receivables, and costs in excess of billings (20.7) 3.2 3.5 (10.3) (21.5) Inventory (8.2) (18.1) (27.8) (1.4) (8.4) Accounts payable and accrued expenses 18.4 (4.4) 10.8 (12.7) 5.1 Other (0.4) 3.2 3.1 14.0 6.7 (10.9) (16.1) (10.4) (10.4) (18.1) Operating Cash Flow 30.1 28.7 22.9 23.9 23.2 Capital expenditures (10.9) (11.5) (11.0) (13.8) (10.0) Free Cash Flow(2) $19.2 $17.2 $12.0 $10.2 $13.2 Free Cash Flow(2) / Adjusted EBITDA(2) 41% 35% 28% 22% 24% Free Cash Flow(2) / GAAP Net Income 82% 63% 76% 80% 85% Notes (1) Rounded amounts used. (2) Non-GAAP, see reconciliation table. 34

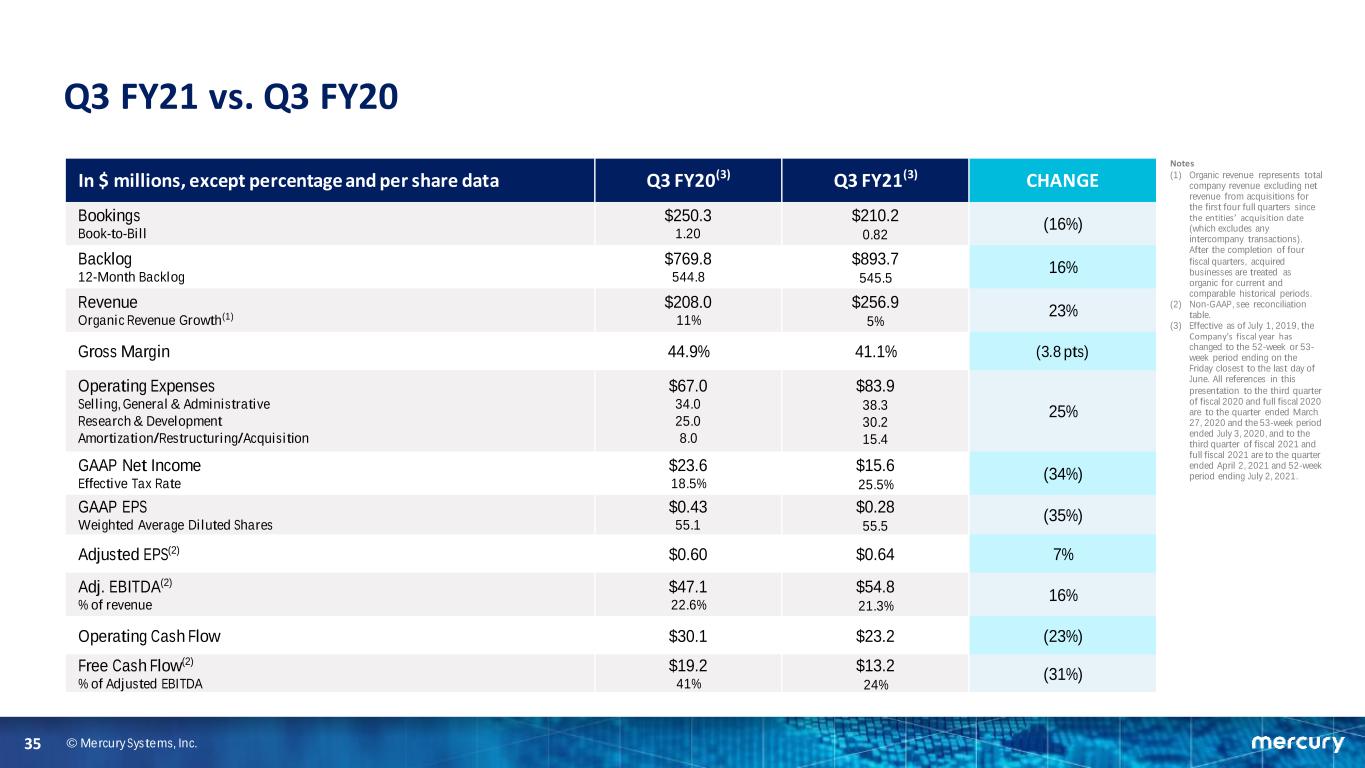

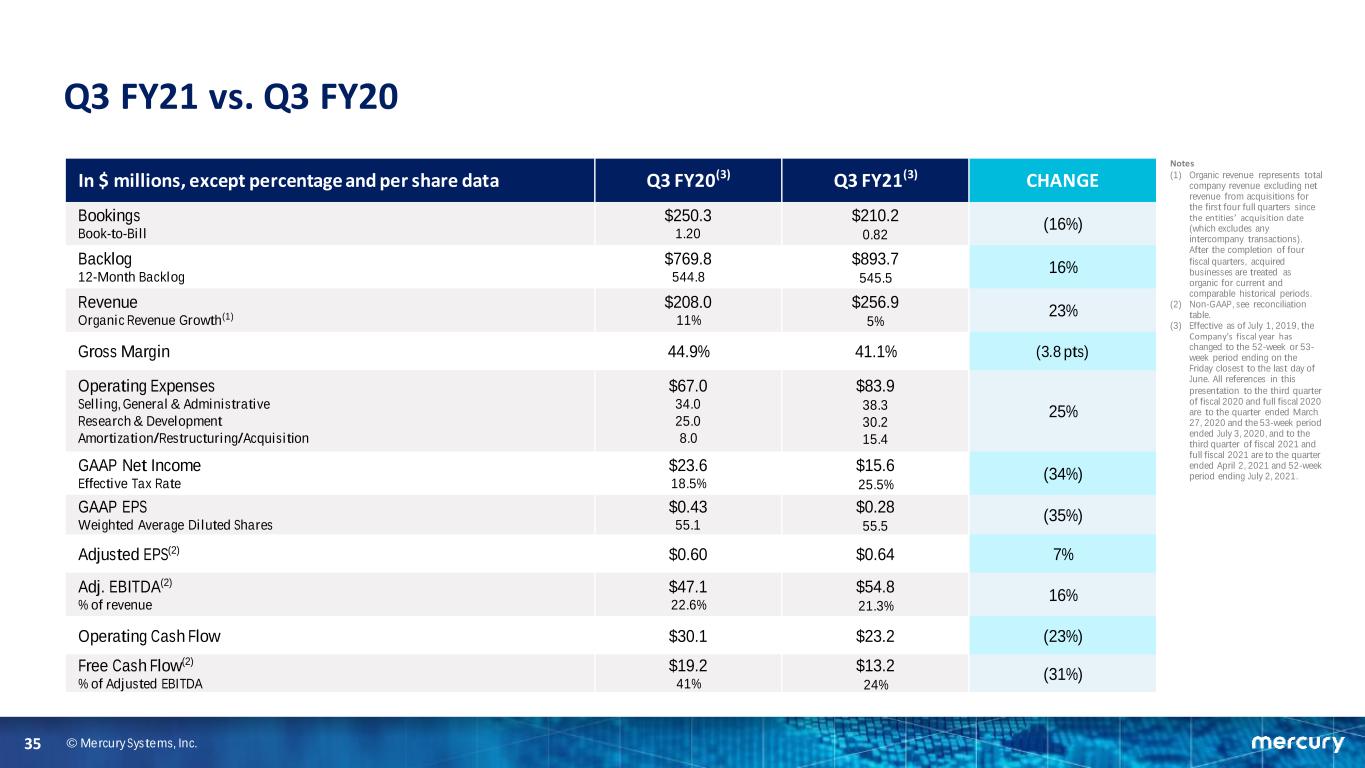

© Mercury Systems, Inc. Q3 FY21 vs. Q3 FY20 In $ millions, except percentage and per share data Q3 FY20(3) Q3 FY21(3) CHANGE Bookings Book-to-Bill $250.3 1.20 $210.2 0.82 (16%) Backlog 12-Month Backlog $769.8 544.8 $893.7 545.5 16% Revenue Organic Revenue Growth(1) $208.0 11% $256.9 5% 23% Gross Margin 44.9% 41.1% (3.8 pts) Operating Expenses Selling, General & Administrative Research & Development Amortization/Restructuring/Acquisition $67.0 34.0 25.0 8.0 $83.9 38.3 30.2 15.4 25% GAAP Net Income Effective Tax Rate $23.6 18.5% $15.6 25.5% (34%) GAAP EPS Weighted Average Diluted Shares $0.43 55.1 $0.28 55.5 (35%) Adjusted EPS(2) $0.60 $0.64 7% Adj. EBITDA(2) % of revenue $47.1 22.6% $54.8 21.3% 16% Operating Cash Flow $30.1 $23.2 (23%) Free Cash Flow(2) % of Adjusted EBITDA $19.2 41% $13.2 24% (31%) Notes (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. (2) Non-GAAP, see reconciliation table. (3) Effective as of July 1, 2019, the Company’s fiscal year has changed to the 52-week or 53- week period ending on the Friday closest to the last day of June. All references in this presentation to the third quarter of fiscal 2020 and full fiscal 2020 are to the quarter ended March 27, 2020 and the 53-week period ended July 3, 2020, and to the third quarter of fiscal 2021 and full fiscal 2021 are to the quarter ended April 2, 2021 and 52-week period ending July 2, 2021. 35

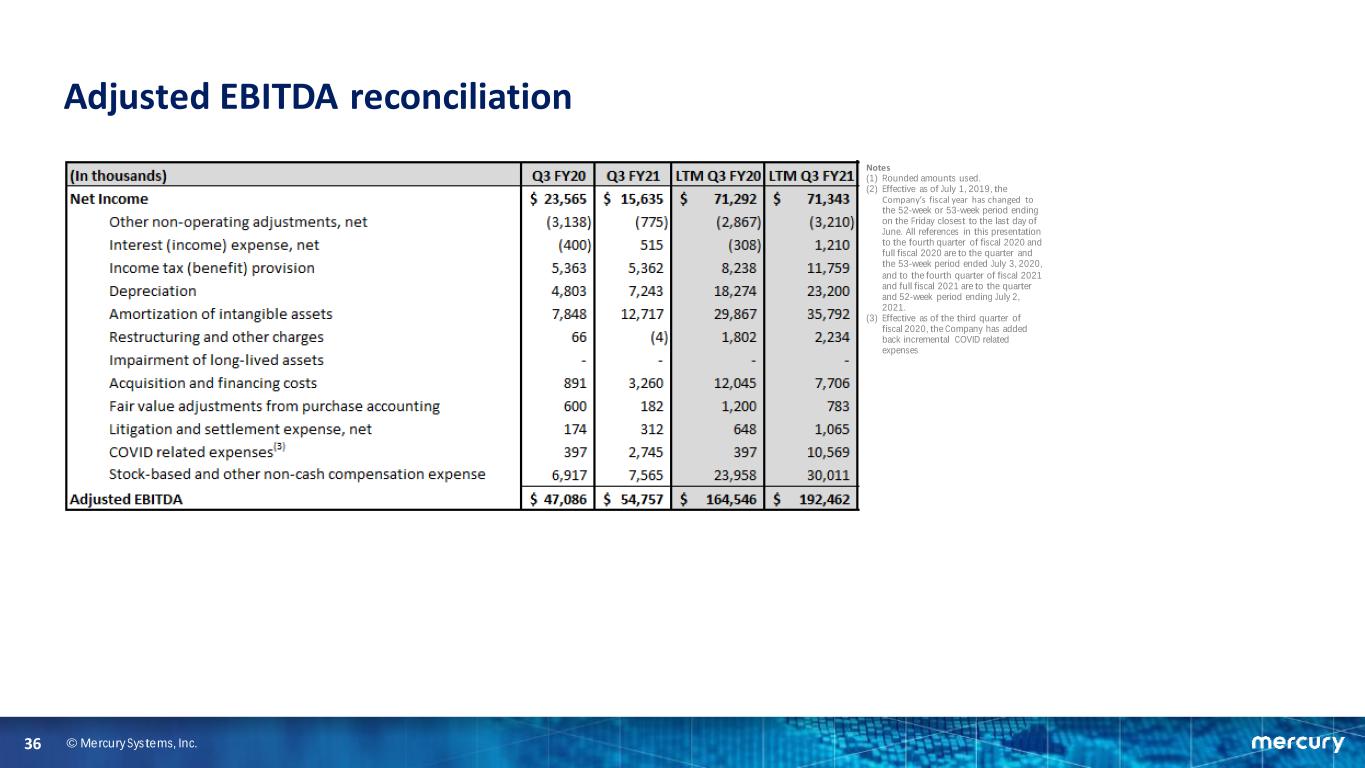

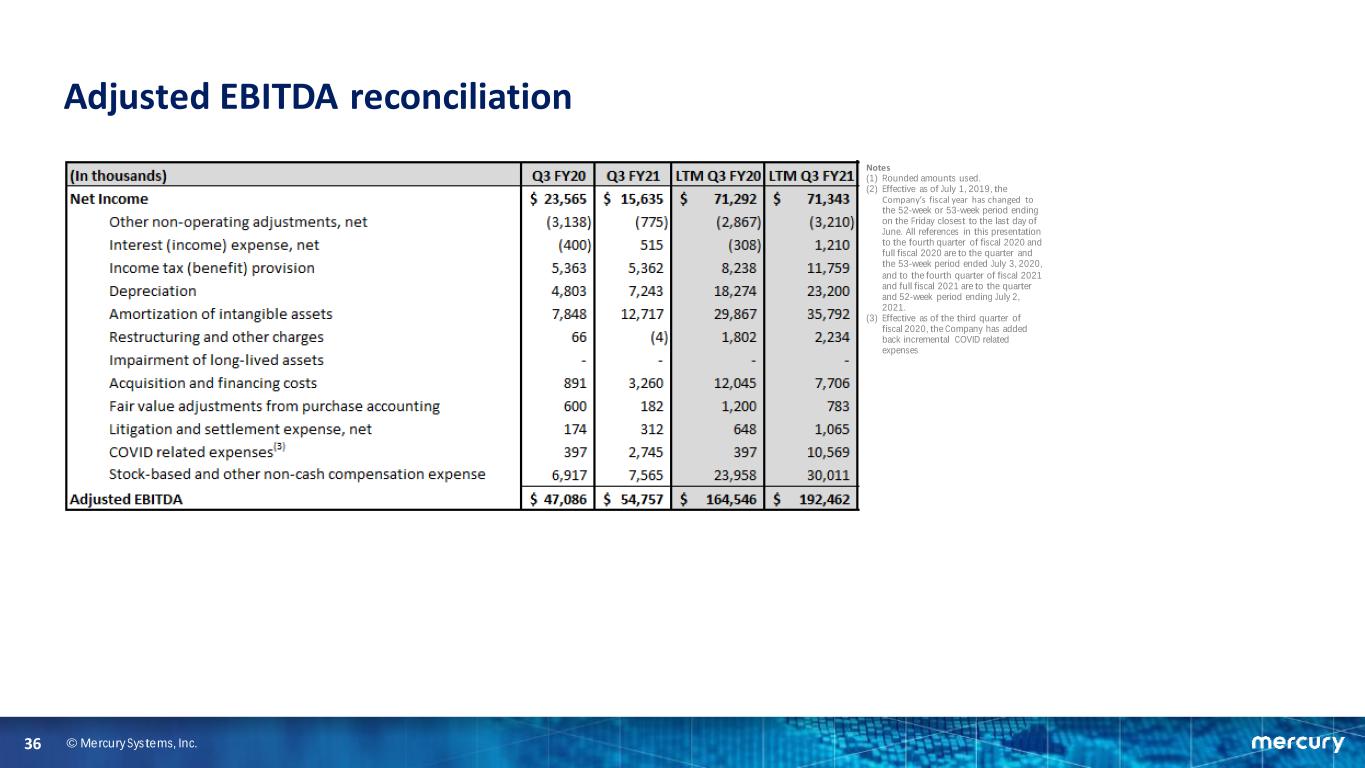

© Mercury Systems, Inc. Adjusted EBITDA reconciliation Notes (1) Rounded amounts used. (2) Effective as of July 1, 2019, the Company’s fiscal year has changed to the 52-week or 53-week period ending on the Friday closest to the last day of June. All references in this presentation to the fourth quarter of fiscal 2020 and full fiscal 2020 are to the quarter and the 53-week period ended July 3, 2020, and to the fourth quarter of fiscal 2021 and full fiscal 2021 are to the quarter and 52-week period ending July 2, 2021. (3) Effective as of the third quarter of fiscal 2020, the Company has added back incremental COVID related expenses 36

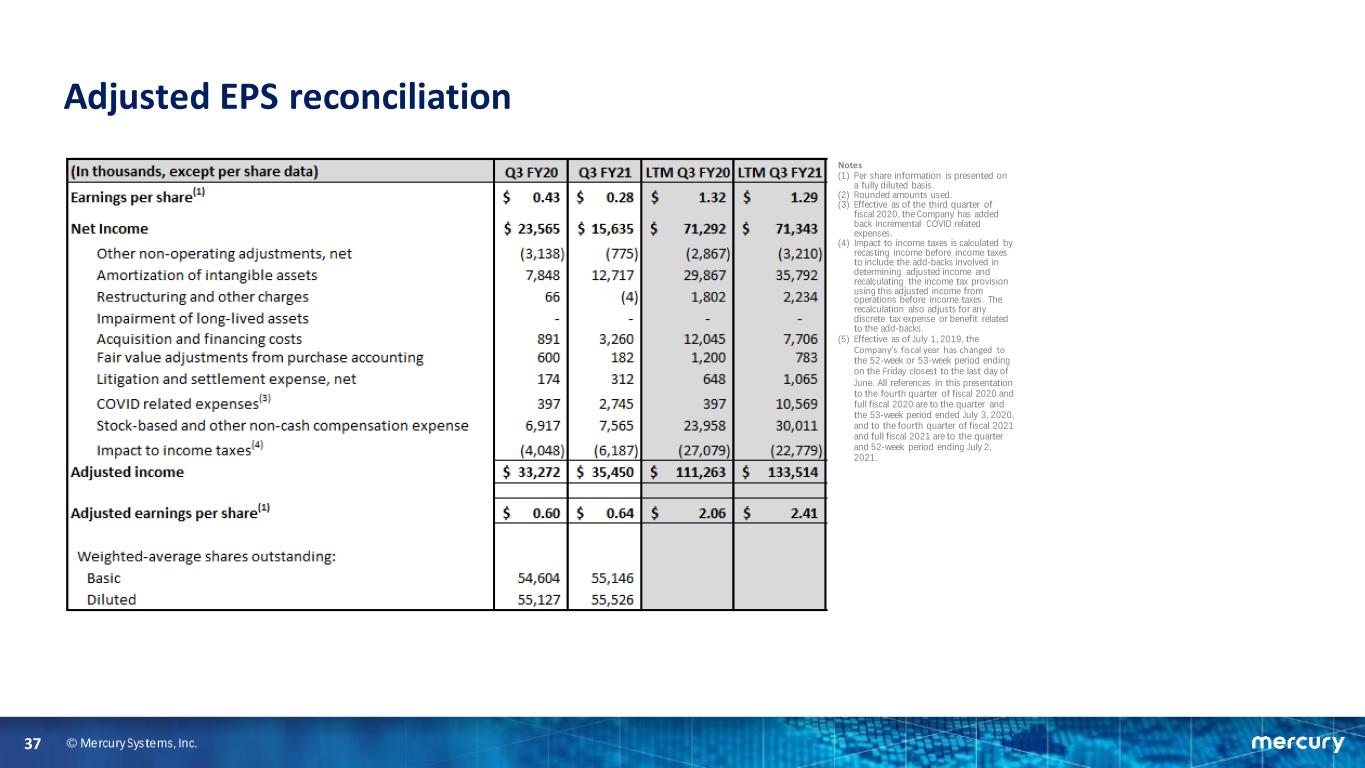

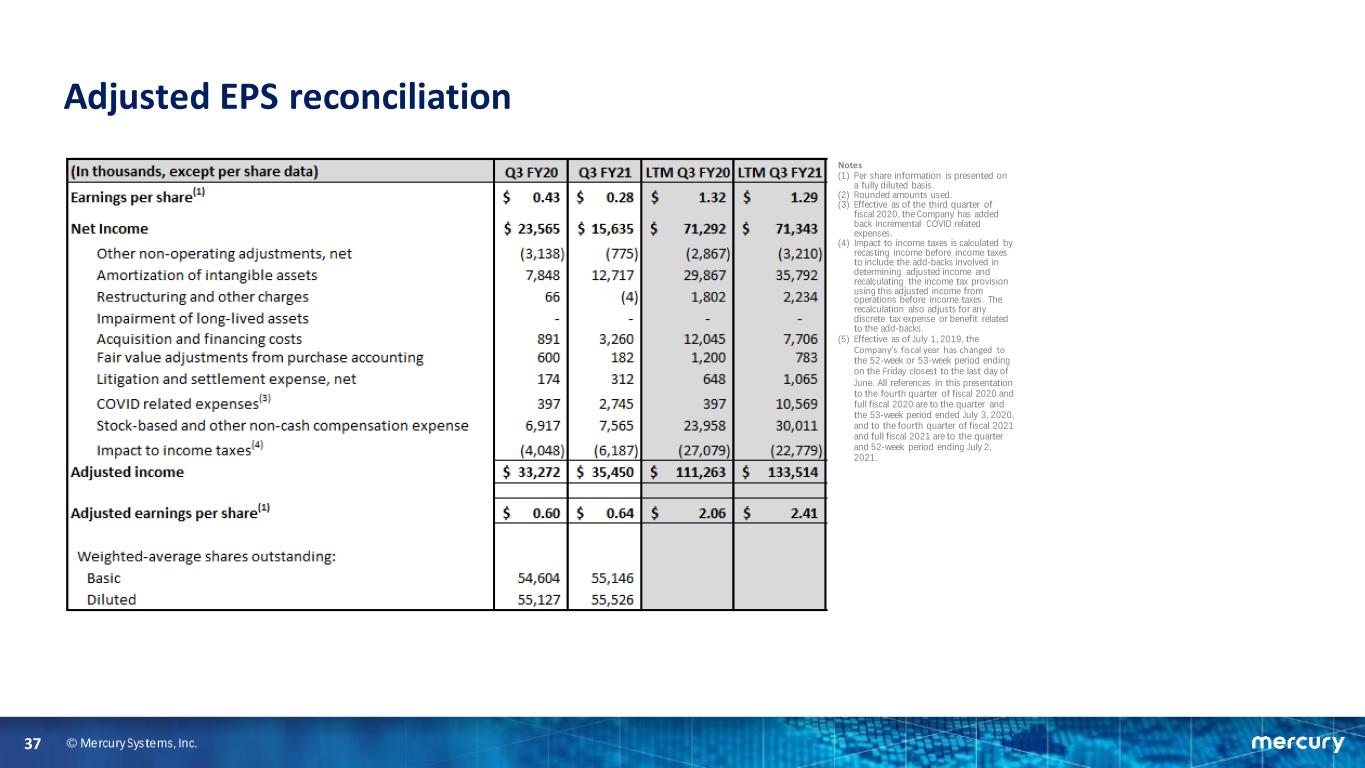

© Mercury Systems, Inc. Adjusted EPS reconciliation Notes (1) Per share information is presented on a fully diluted basis. (2) Rounded amounts used. (3) Effective as of the third quarter of fiscal 2020, the Company has added back incremental COVID related expenses. (4) Impact to income taxes is calculated by recasting income before income taxes to include the add-backs involved in determining adjusted income and recalculating the income tax provision using this adjusted income from operations before income taxes. The recalculation also adjusts for any discrete tax expense or benefit related to the add-backs. (5) Effective as of July 1, 2019, the Company’s fiscal year has changed to the 52-week or 53-week period ending on the Friday closest to the last day of June. All references in this presentation to the fourth quarter of fiscal 2020 and full fiscal 2020 are to the quarter and the 53-week period ended July 3, 2020, and to the fourth quarter of fiscal 2021 and full fiscal 2021 are to the quarter and 52-week period ending July 2, 2021. 37

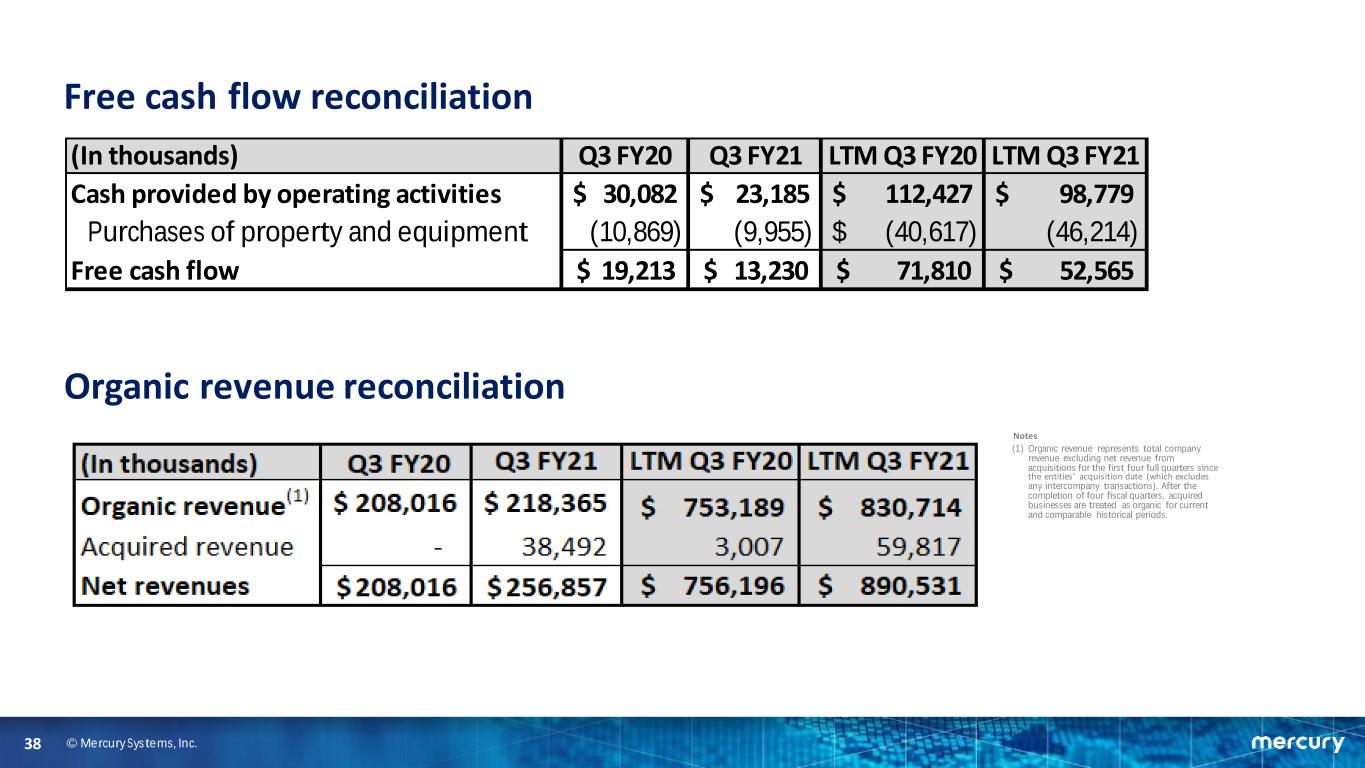

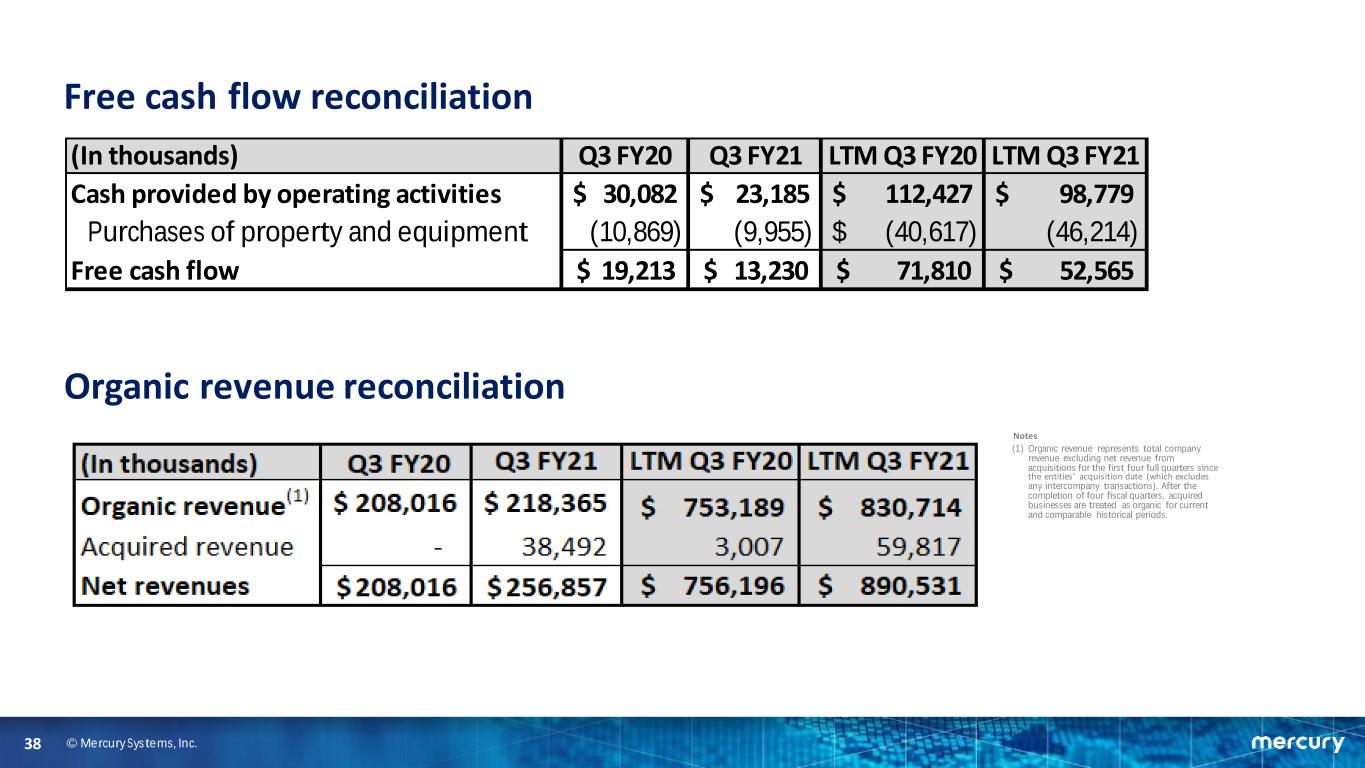

© Mercury Systems, Inc. Free cash flow reconciliation Organic revenue reconciliation Notes (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. (In thousands) Q3 FY20 Q3 FY21 LTM Q3 FY20 LTM Q3 FY21 Cash provided by operating activities $ 30,082 $ 23,185 $ 112,427 $ 98,779 Purchases of property and equipment (10,869) (9,955) $ (40,617) (46,214) Free cash flow 19,213$ 13,230$ 71,810$ 52,565$ 38

© Mercury Systems, Inc. Glossary API Application Programming Interface BCA Budget Control Act C4I Command, Control, Communications, Computers COTS Commercial off-the Shelf CPU Central Processing Unit EO/IR Electro-optical / Infrared EW Electronic Warfare FPGA Field Programmable Gate Array GPU Graphics Processing Unit I/O Input/Output IP Intellectual Property IRAD Internal Research And Development NTCD Non-traditional Defense Contractor OTA Other Transaction Authority PBR President's Budget Request R&D Research & Development RF Radio Frequency SEMS Sensor and Effector Mission Systems 39