© Mercury Systems, Inc. WEBCAST LOGIN AT WWW.MRCY.COM/INVESTOR WEBCAST REPLAY AVAILABLE BY 7:00 P.M. ET NOVEMBER 5, 2024 Bill Ballhaus Chairman and CEO David Farnsworth Executive Vice President and CFO November 5, 2024, 5:00 pm ET FIRST QUARTER FISCAL YEAR 2025 FINANCIAL RESULTS 1

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the Company's focus on enhanced execution of the Company's strategic plan under a refreshed Board and leadership team. You can identify these statements by the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of any U.S. federal government shutdown or extended continuing resolution, effects of geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in or cost increases related to completing development, engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. government’s interpretation of, federal export control or procurement rules and regulations, changes in, or in the interpretation or enforcement of, environmental rules and regulations, market acceptance of the Company's products, shortages in or delays in receiving components, supply chain delays or volatility for critical components, production delays or unanticipated expenses including due to quality issues or manufacturing execution issues, adherence to required manufacturing standards, capacity underutilization, increases in scrap or inventory write-offs, failure to achieve or maintain manufacturing quality certifications, such as AS9100, the impact of supply chain disruption, inflation and labor shortages, among other things, on program execution and the resulting effect on customer satisfaction, inability to fully realize the expected benefits from acquisitions, restructurings, and operational efficiency initiatives or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, effects of shareholder activism, increases in interest rates, changes to industrial security and cyber-security regulations and requirements and impacts from any cyber or insider threat events, changes in tax rates or tax regulations, such as the deductibility of internal research and development, changes to interest rate swaps or other cash flow hedging arrangements, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, litigation, including the dispute arising with the former CEO over his resignation, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 28, 2024 and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income, adjusted EPS, and free cash flow, which are non-GAAP financial measures. Adjusted EBITDA, adjusted income, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non- GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, these non-GAAP measures should not be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes these non-GAAP measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto. 2

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Today’s call ▪ Opening remarks on business and results ▪ Update on our four focus areas ▪ Expectations for performance for FY25 and beyond ▪ Q&A 3

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Business and results ▪ Optimistic about our strategic positioning and expectations on delivering predictable organic growth with expanding margins and robust free cash flow. ▪ Q1 results generally as expected and reflect solid progress in each of our four priority focus areas. ▪ Improved execution across our portfolio, notably in our Common Processing Architecture area. ▪ Continued to expand record backlog to over $1.3 billion. ▪ Reduced operating expense enabling increased positive operating leverage. ▪ Continued progress on free cash flow drivers, with net working capital down $97 million year- over-year. 4

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Delivering predictable performance ▪ Focus on delivering predictable performance positively impacted results, primarily in three areas. ▪ Continued progress on mitigating what we believe to be predominantly transitory impacts. ▪ Continued progress in ramping toward full rate production in our Common Processing Architecture product area. ‒ Expect to have full capacity online as we move through the second half of the year. ‒ Progress in the quarter contributed to over $50 million in follow-on orders in this area. ▪ Focus on improved operational performance generated acceleration of deliveries in the quarter. 5

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Driving organic growth ▪ Q1 bookings of $247.7 million resulted in record backlog of over $1.3 billion. ▪ In line with expectations, over 90% of Q1 bookings were production in nature. ▪ Secured several marquee wins in the quarter, reflecting customers’ continued trust in Mercury to support critical franchise programs. ▪ Engagements with customers highlight Mercury’s unique capabilities to provide mission-critical processing at the edge that align with customers’ priorities and what we view as strong demand in growth markets. 6

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Expanding margins ▪ Remain focused on the following levers in our efforts to achieve targeted adjusted EBITDA margins in the low to mid 20% range: ‒ Executing on development programs and minimizing cost growth impacts. ‒ Getting back toward a more historical 20/80 mix of development to production programs. ‒ Driving organic growth to generate positive operating leverage. ‒ Achieving cost efficiencies. ▪ Q1 adjusted EBITDA margin in line with expectations and indicative of progress on each of these levers. ▪ Q1 gross margin largely driven by average margin in backlog coming into FY25. ▪ Expect backlog margin to increase as we continue to bring in new bookings that we believe will be in-line with our targeted margin profile. ▪ Operating expenses down significantly year-over-year as a result of actions to streamline and focus operations. 7

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Driving improved free cash flow conversion and release ▪ Continued progress on drivers of free cash flow, in particular in reducing net working capital which is down 14.6% year-over-year. ▪ Inventory down $11.8 million year-over-year, with an increase in deferred revenue reflecting focus on improved contract terms. ▪ Unbilled receivables down $90.3 million year-over-year, reflecting focus on progressing programs in order to deliver for our customers and collect cash. ▪ We believe continuous improvement related to program execution and hardware delivery, just- in-time material, and appropriately timed payment terms will lead to continued reduction in net working capital and improved free cash flow performance going forward. 8

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Expectations for FY25 and beyond ▪ Optimistic about our expected ability over time to deliver results in-line with our target profile. ▪ Continue to expect that revenue for the first half will be approximately in line with last year. ▪ Continue to expect FY25 revenue to be relatively flat year-over year with an increase in run rate as we exit the fiscal year. ▪ Continue to expect low double digit adjusted EBITDA margins overall for FY25, with adjusted EBITDA margins in the high single-digit range for the first half of the year and expanding in the second half. ▪ Expect to be cash flow positive in FY25, with second half free cash flow higher than the first half. 9

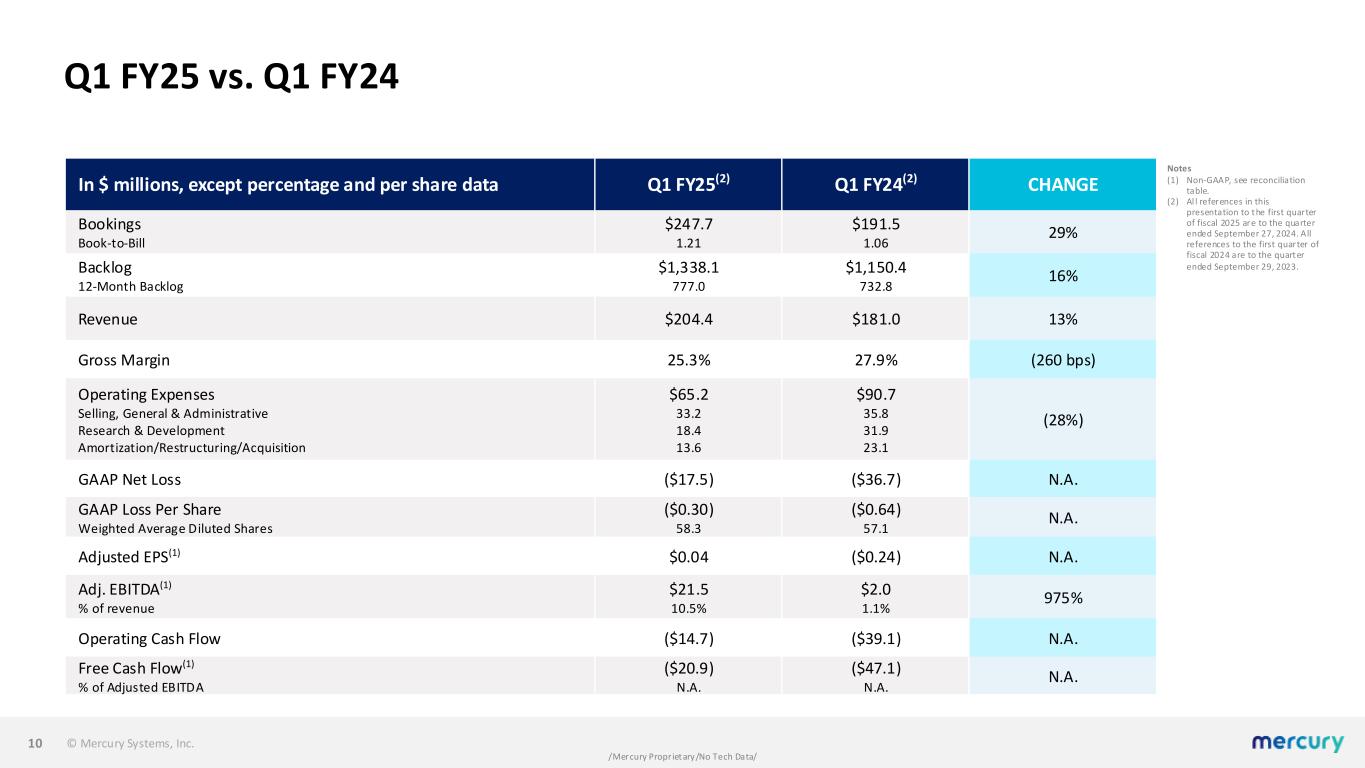

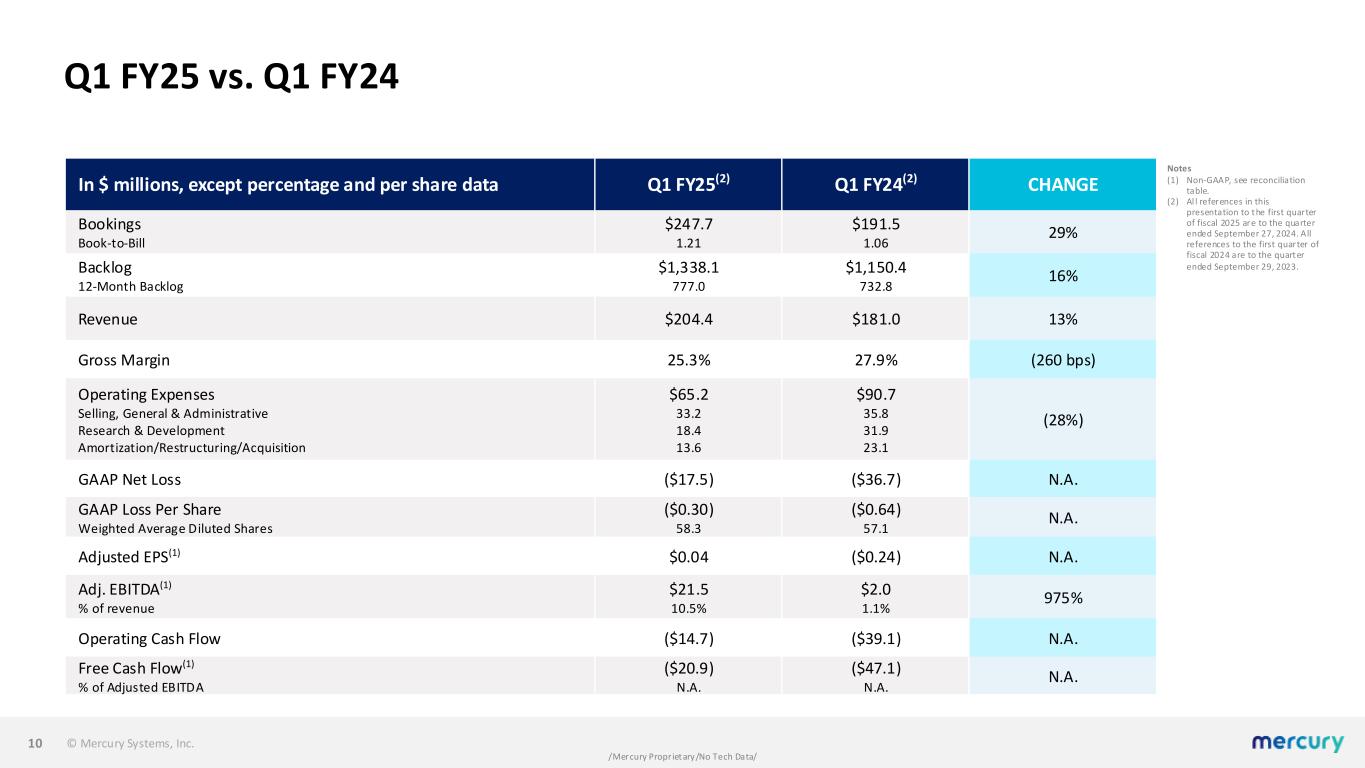

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Q1 FY25 vs. Q1 FY24 10 In $ millions, except percentage and per share data Q1 FY25(2) Q1 FY24(2) CHANGE Bookings Book-to-Bill $247.7 1.21 $191.5 1.06 29% Backlog 12-Month Backlog $1,338.1 777.0 $1,150.4 732.8 16% Revenue $204.4 $181.0 13% Gross Margin 25.3% 27.9% (260 bps) Operating Expenses Selling, General & Administrative Research & Development Amortization/Restructuring/Acquisition $65.2 33.2 18.4 13.6 $90.7 35.8 31.9 23.1 (28%) GAAP Net Loss ($17.5) ($36.7) N.A. GAAP Loss Per Share Weighted Average Diluted Shares ($0.30) 58.3 ($0.64) 57.1 N.A. Adjusted EPS(1) $0.04 ($0.24) N.A. Adj. EBITDA(1) % of revenue $21.5 10.5% $2.0 1.1% 975% Operating Cash Flow ($14.7) ($39.1) N.A. Free Cash Flow(1) % of Adjusted EBITDA ($20.9) N.A. ($47.1) N.A. N.A. Notes (1) Non-GAAP, see reconciliation table. (2) Al l references in this presentation to the first quarter of fiscal 2025 are to the quarter ended September 27, 2024. All references to the first quarter of fiscal 2024 are to the quarter ended September 29, 2023.

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Balance sheet 11 As of (In $ millions)(1) 9/29/23 12/29/23 3/29/24 6/28/24 9/27/24 ASSETS Cash & cash equivalents $89.4 $168.6 $142.6 $180.5 $158.1 Accounts receivable and unbilled receivables, net 480.0 433.7 417.2 415.5 422.8 Inventory, net 363.0 354.2 343.0 335.3 351.1 PP&E, net 117.2 114.4 113.9 110.4 105.1 Goodwill and intangibles, net 1,223.6 1,211.4 1,199.9 1,188.6 1,177.4 Other 127.6 154.0 161.6 148.6 154.5 TOTAL ASSETS $2,400.8 $2,436.3 $2,378.1 $2,378.9 $2,369.0 LIABILITIES AND S/E AP and accrued expenses $147.2 $144.7 $136.9 $160.4 $135.4 Other liabilities 136.3 170.6 151.9 154.2 182.3 Debt 576.5 616.5 616.5 591.5 591.5 Total liabilities 860.0 931.8 905.3 906.1 909.2 Stockholders’ equity 1,540.8 1,504.5 1,472.8 1,472.8 1,459.8 TOTAL LIABILITIES AND S/E $2,400.8 $2,436.3 $2,378.1 $2,378.9 $2,369.0 Notes (1) Rounded amounts used.

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Cash flow summary 12 Notes (1) Rounded amounts used. (2) Non-GAAP, see reconciliation table. For the Fiscal Quarters Ended (In $ millions)(1) 9/29/23 12/29/23 3/29/24 6/28/24 9/27/24 Net Loss ($36.7) ($45.6) ($44.6) ($10.8) ($17.5) Depreciation and amortization 22.7 22.2 21.8 21.4 21.2 Other non-cash items, net (3.7) 1.6 27.5 0.3 5.6 Cash settlement for termination of interest rate swap 7.4 - - - - Changes in Operating Assets and Liabilities Accounts receivable, unbilled receivables, and costs in excess of billings 27.0 42.7 8.6 (1.9) (6.1) Inventory (27.6) 12.1 8.5 7.1 (13.9) Accounts payable and accrued expenses (13.0) (5.2) (7.7) 26.6 (27.0) Other (15.2) 17.6 (31.9) 29.1 23.0 (28.8) 67.2 (22.5) 60.9 (24.0) Operating Cash Flow (39.1) 45.5 (17.8) 71.8 (14.7) Capital expenditures (8.0) (8.0) (7.9) (10.4) (6.2) Free Cash Flow(2) ($47.1) $37.5 ($25.7) $61.4 ($20.9) Free Cash Flow(2) / Adjusted EBITDA(2) N.A. N.A. N.A. 197.1% N.A. Free Cash Flow(2) / GAAP Net (Loss) Income N.A. N.A. N.A. N.A. N.A.

© Mercury Systems, Inc. APPENDIX

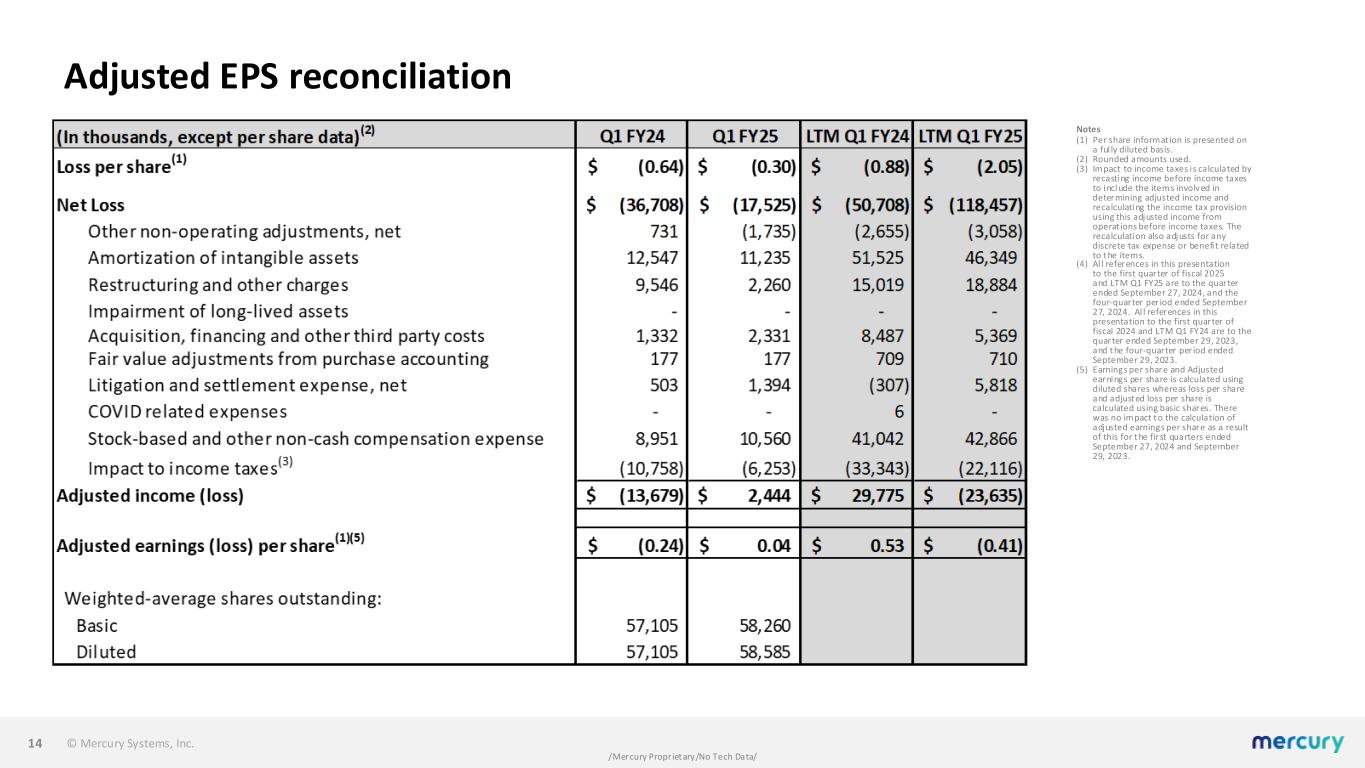

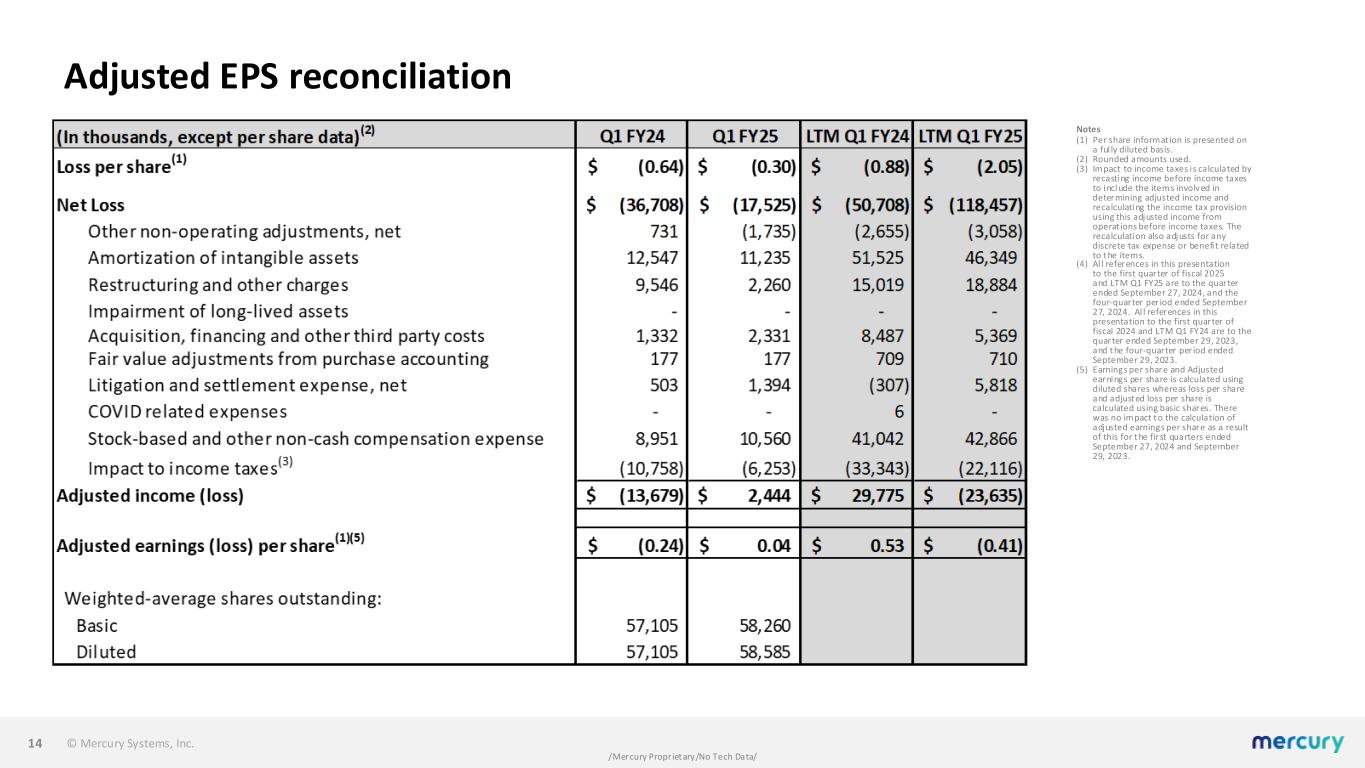

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Adjusted EPS reconciliation 14 Notes (1) Per share informat ion is presented on a ful ly diluted basis. (2) Rounded amounts used. (3) Impact to income taxes i s calculated by recasting income before income taxes to include the items involved in determining adjusted income and recalculating the income tax provision using this adjusted income from operat ions before income taxes. The recalculation also adjusts for any discrete tax expense or benefi t related to the items. (4) Al l references in this presentation to the first quarter of fiscal 2025 and LTM Q1 FY25 are to the quarter ended September 27, 2024, and the four-quarter period ended September 27, 2024. Al l references in this presentation to the first quarter of fiscal 2024 and LTM Q1 FY24 are to the quarter ended September 29, 2023, and the four-quarter period ended September 29, 2023. (5) Earnings per share and Adjusted earnings per share is calculated using diluted shares whereas loss per share and adjusted loss per share is calculated using basic shares. There was no impact to the calculation of adjusted earnings per share as a result of this for the first quarters ended September 27, 2024 and September 29, 2023.

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Adjusted EBITDA reconciliation 15 Notes (1) Rounded amounts used. (2) Al l references in this presentation to the first quarter of fiscal 2025 and LTM Q1 FY25 are to the quarter ended September 27, 2024, and the four-quarter period ended September 27, 2024. Al l references in this presentation to the first quarter of fiscal 2024 and LTM Q1 FY24 are to the quarter ended September 29, 2023, and the four-quarter period ended September 29, 2023.

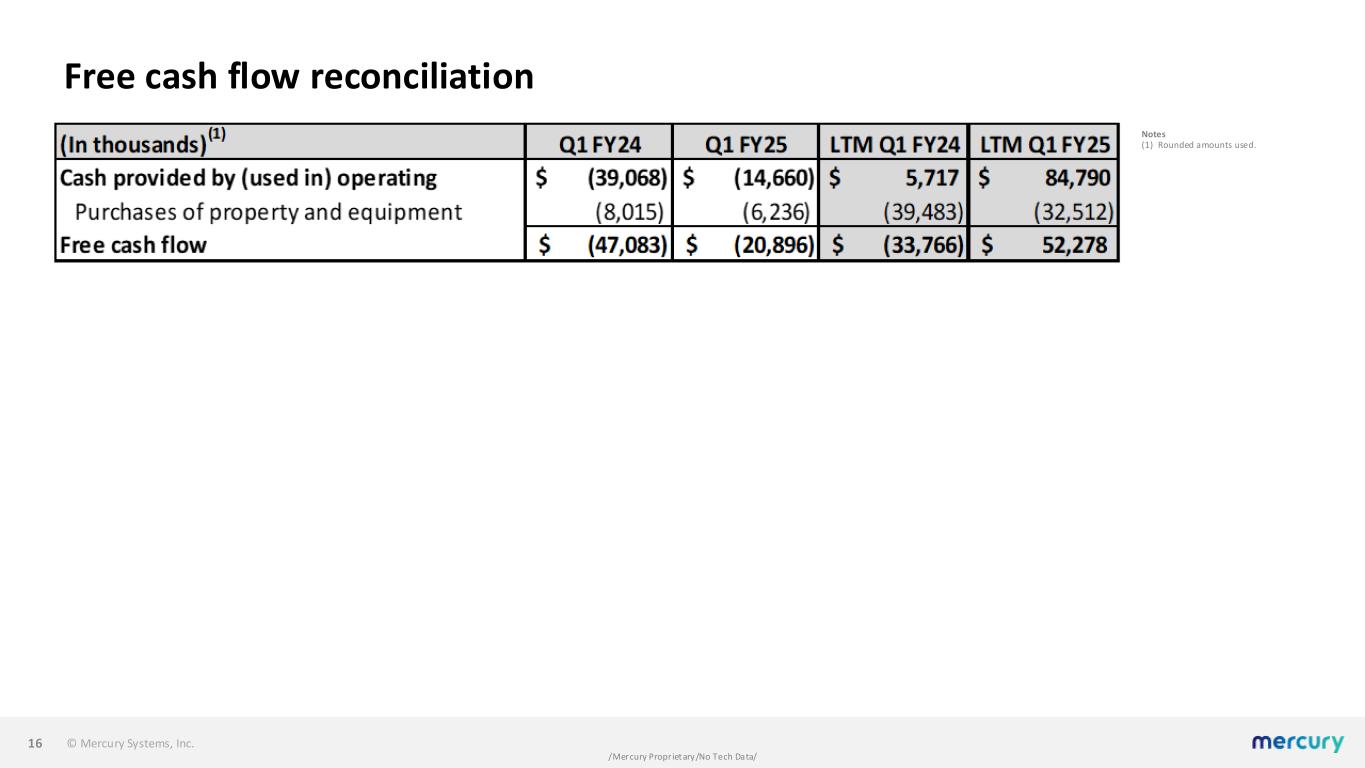

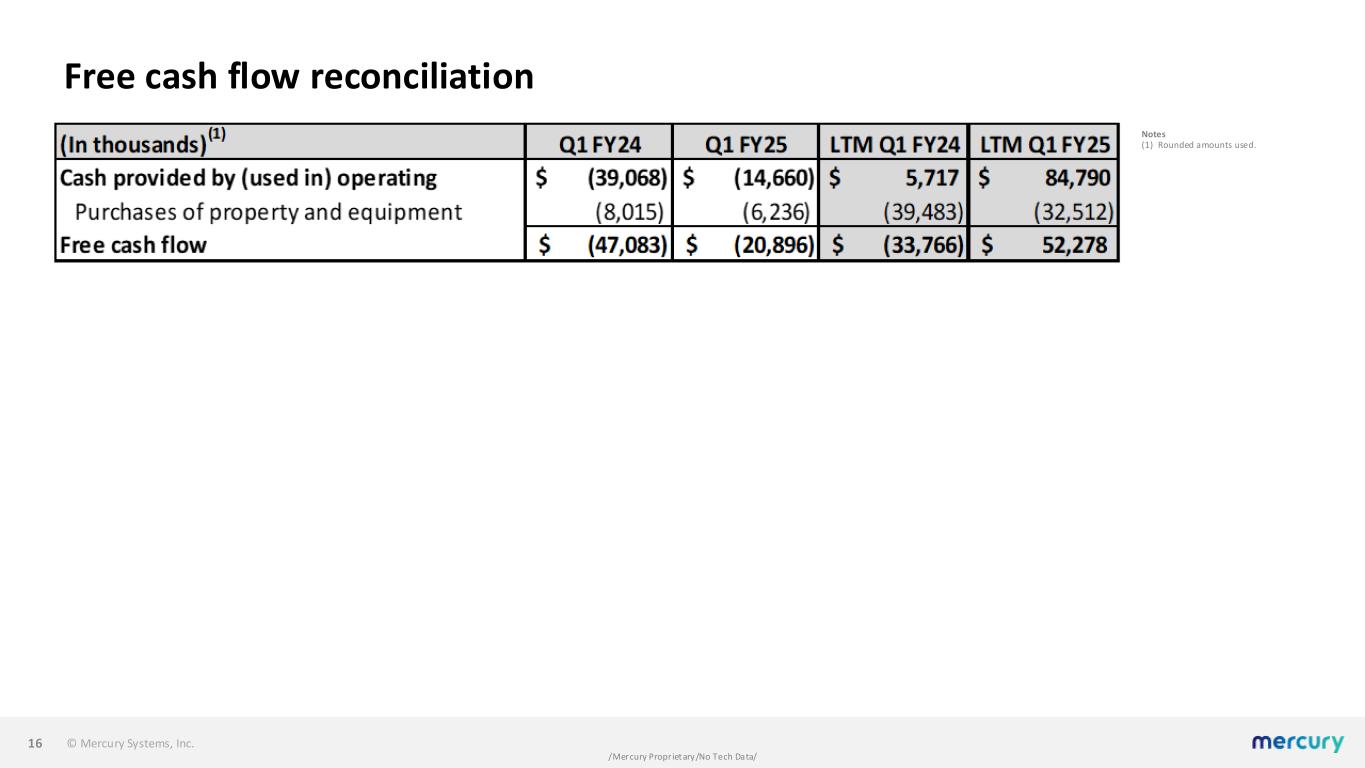

© Mercury Systems, Inc. /Mercury Proprietary/No Tech Data/ Free cash flow reconciliation 16 Notes (1) Rounded amounts used.