EXHIBIT 99.1

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Adams Harkness 25th Annual Summer Seminar

August 2, 2005

Jay Bertelli, Chief Executive Officer

Bob Hult, Chief Financial Officer

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Forward-Looking Safe Harbor Statement

This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to anticipated fiscal 2006 business performance and the result of acquisitions. You can identify these statements by our use of the words “may,” “will,” “should,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, general economic and business conditions, including unforeseen economic weakness in the Company’s markets, effects of continued geo-political unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, continued funding of defense programs, timing of such funding, market acceptance of the Company’s products, shortages in components, production delays due to performance quality issues with outsourced components, failure of the parties to satisfy the closing conditions related to the Echotek Corp. acquisition, inability to fully realize the expected benefits from acquisitions or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, difficulties in retaining key employees and customers, and various other factors beyond the Company’s control. These risks and uncertainties also include such additional risk factors as are discussed in the Company’s recent filings with the U.S. Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter ended March 31, 2005. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. The Company may, in its discretion, provide information in future public announcements regarding its outlook that may be of interest to the investment community. The format and extent of future outlooks may be different from the format and extent of the information contained in this release.

References by the Company to non-GAAP operating income and non-GAAP earnings per share refer to costs and expenses or earnings per share excluding equity-based compensation cost. GAAP requires that this cost be included in costs and expenses and accordingly used to determine operating income and earnings per share. The Company’s management uses non-GAAP operating income, and associated non-GAAP net income (which is the basis for non-GAAP earnings per share) to make operational and investment decisions, and the Company believes that they are among several useful measures for an enhanced understanding of its operating results. Excluding the equity compensation cost from GAAP operating income will enable investors to perform a meaningful comparison of the Company’s operating results to prior periods. In these prior periods, the Company’s GAAP financial results were not required to include expenses associated with stock option compensation, and now these expenses will be included within operating expenses in the GAAP presentation. The Company also believes that providing non-GAAP earnings per share affords investors a view of earnings that may be more easily compared to peer companies. The Company believes these non-GAAP measures will aid investors’ overall understanding of its financial results by providing a higher degree of transparency for certain expenses, particularly those related to equity-based compensation costs, as well as providing a level of disclosure that will help investors understand how the Company plans and measures its own business. However, non-GAAP net income should be construed neither as an alternative to GAAP net income or earnings per share as an indicator of its operating performance, nor as a substitute for cash flow from operations as a measure of liquidity, because the items excluded from the non-GAAP measures often have a material impact on the Company’s results of operations. Therefore, management does, and investors should, use non-GAAP measures in conjunction with the Company’s reported GAAP results.

2 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Company Overview

FY05 Revenues: $250 M

Founded in 1981

Leading provider of innovative, engineered computing solutions for compute-intensive applications

Office locations in U.S., UK, France, Germany and Japan;

R&D centers in U.S., France, and Germany

830 employees worldwide;

350 engineers

Investment in knowledge of customer applications

60%* Defense Electronics

20%* Imaging & Visualization Solutions

20%* OEM Solutions

June Fiscal Year End

*Approximate FY05 revenue composition

3 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Mercury Technology in Action

Image and Signal Processing

Wafer Inspection

Sensor data- scanned wafers

J-STARS Aircraft

Radar Image Display

3-D Image

Reconstruction

Mobile C-Arm

(Digital X-Ray)

MERCURY TECHNOLOGY

4 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Defense Electronics Group (DEG)

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

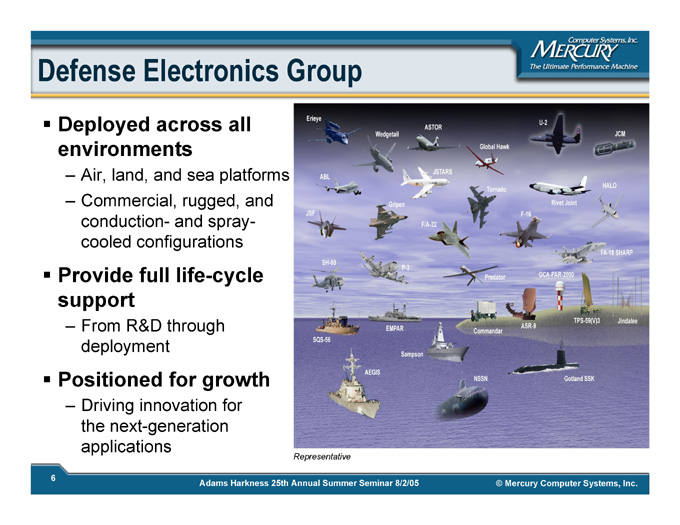

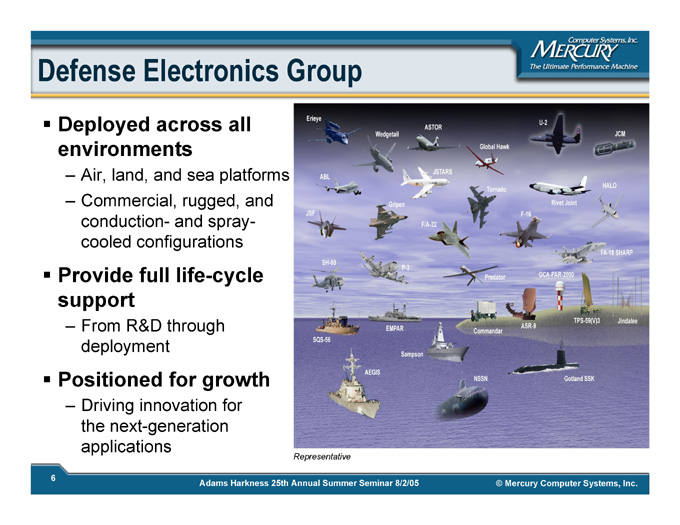

Defense Electronics Group

Deployed across all environments

Air, land, and sea platforms

Commercial, rugged, and conduction- and spray-cooled configurations

Provide full life-cycle support

From R&D through deployment

Positioned for growth

Driving innovation for the next-generation applications

Representative

Erieye

ABL

JSF

SH-60

SQS-56

Wedgetail

Gripen

P-3

EMPAR

AEGIS

Sampson

ASTOR

JSTARS

F/A-22

Global Hawk

Tornado

Predator

Commandar

NSSN

U-2

F-16

ASR-9

Rivet Joint

GCA-PAR-2000

TPS-59(V)3

Gotland SSK

JCM

HALO

FA-18 SHARP

Jindalee

6 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

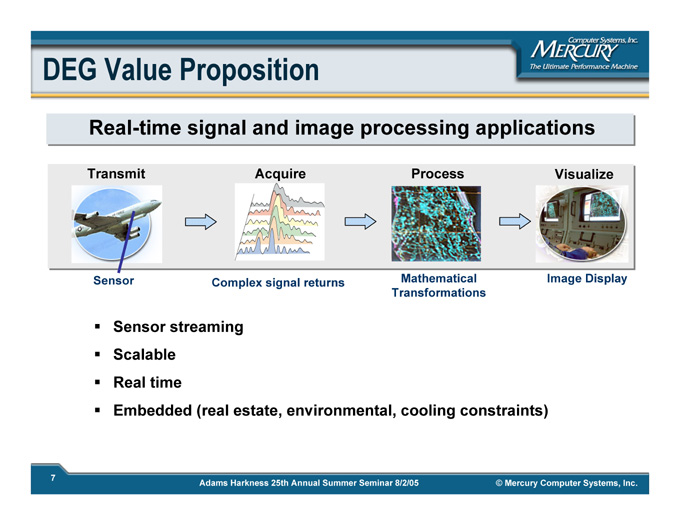

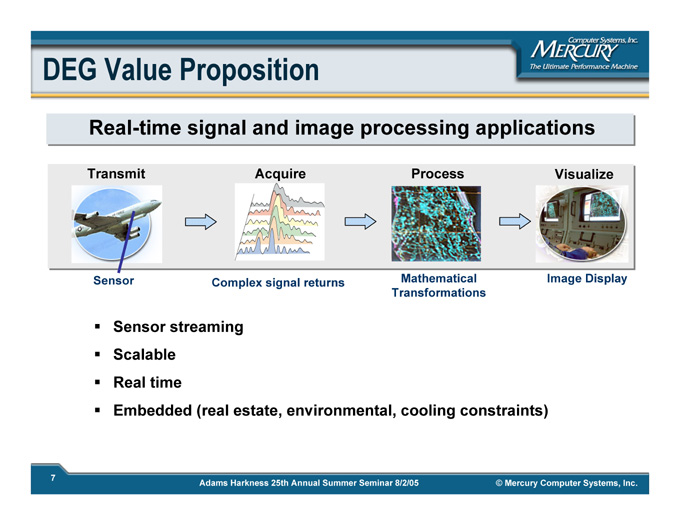

DEG Value Proposition

Real-time signal and image processing applications

Process

Acquire

Visualize

Transmit

Mathematical Transformations

Sensor

Complex signal returns

Image Display

Sensor streaming

Scalable

Real time

Embedded (real estate, environmental, cooling constraints)

7 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

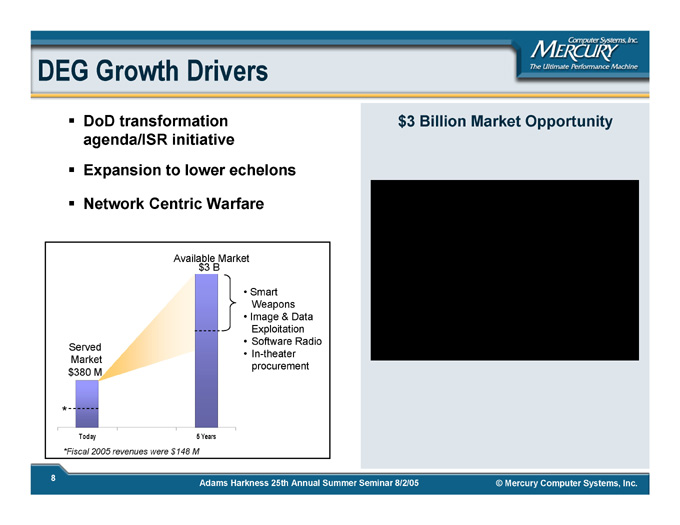

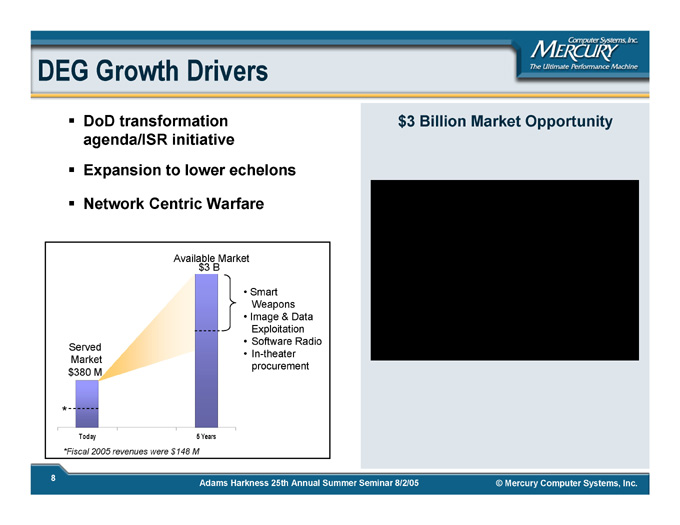

DEG Growth Drivers

DoD transformation agenda/ISR initiative

Expansion to lower echelons

Network Centric Warfare

$3 Billion Market Opportunity

Available Market $3 B

Smart Weapons

Image & Data Exploitation

Software Radio

In-theater procurement

Served Market $380 M

*

Today 5 Years

*Fiscal 2005 revenues were $148 M

8 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Imaging & Visualization

Solutions (IVS)

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

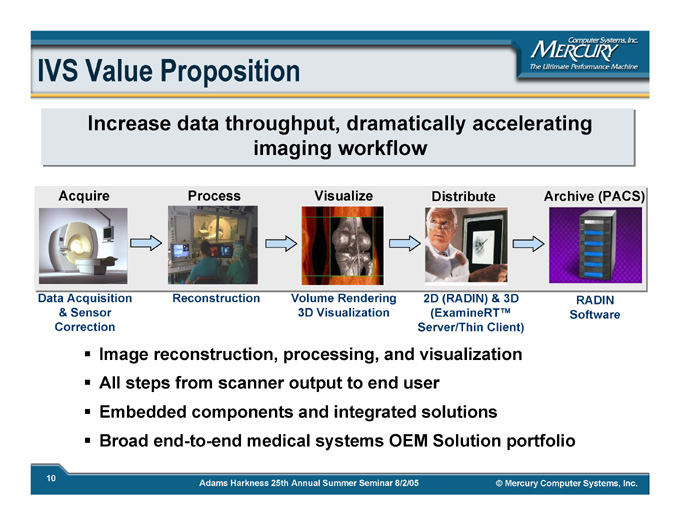

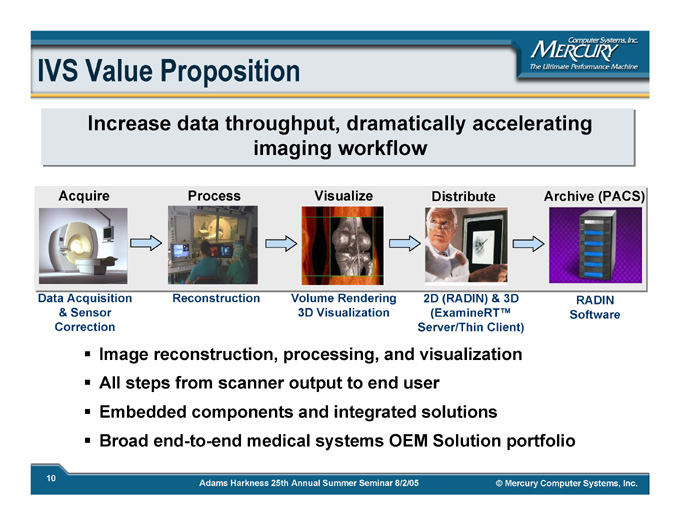

IVS Value Proposition

Increase data throughput, dramatically accelerating imaging workflow

Visualize

Acquire

Archive (PACS)

Distribute

Process

Volume Rendering 3D Visualization

Reconstruction

2D (RADIN) & 3D

(ExamineRT™ Server/Thin Client)

RADIN Software

Data Acquisition & Sensor Correction

Image reconstruction, processing, and visualization

All steps from scanner output to end user

Embedded components and integrated solutions

Broad end-to-end medical systems OEM Solution portfolio

10 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Market Opportunities

Diagnostic medical imaging including molecular imaging

Interventional imaging and image-guided procedures

Biotechnology including drug discovery and molecular dynamics

Picture archive and communication systems (PACS)

PHILIPS

GE

SIEMENS

Medtronic When Life Depends on Medical Technology

BrainLAB

pfizer

FEI COMPANY

TOOLS FOR NANOTECH

ZEISS

FUJIFILM FUJIFILM Medical Systems USA

AGFA Agfa

Schlumberger

Landmark

A Halliburton Company

Geosciences (oil & gas)

Simulation

11 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

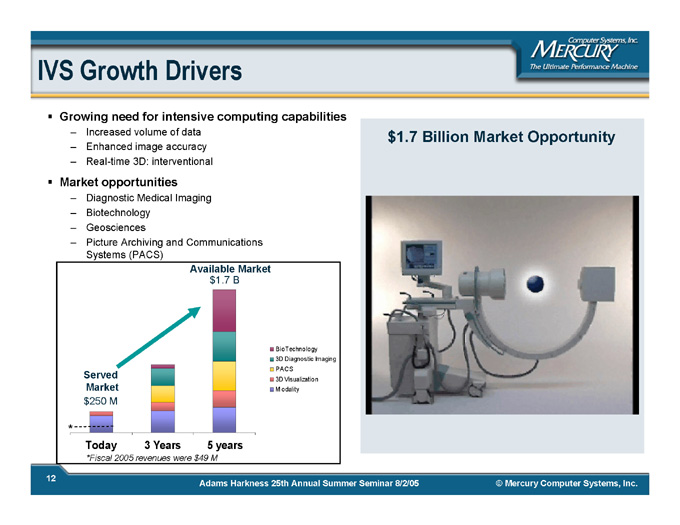

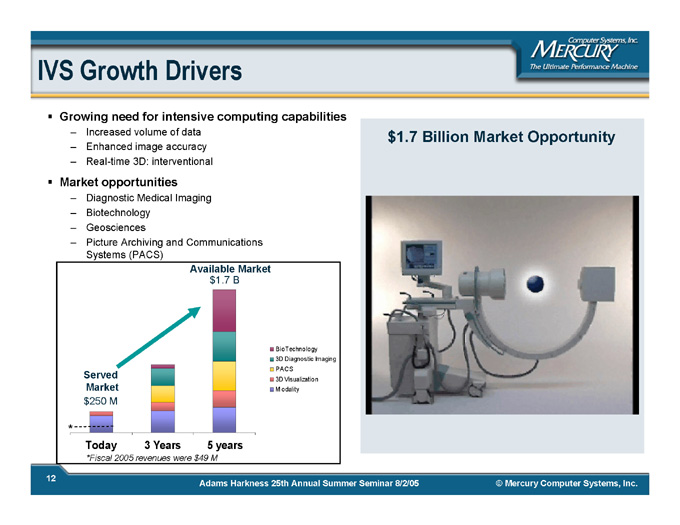

IVS Growth Drivers

Growing need for intensive computing capabilities

Increased volume of data

Enhanced image accuracy

Real-time 3D: interventional

Market opportunities

Diagnostic Medical Imaging

Biotechnology

Geosciences

Picture Archiving and Communications Systems (PACS)

$1.7 Billion Market Opportunity

Available Market $1.7 B

Served Market $250 M

*

Today 3 Years 5 Years

Bio Technology

3D Diagnostic Imaging

PACS

3D Visualization

Modality

*Fiscal 2005 revenues were $49 M

12 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

OEM Solutions Group (OSG)

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

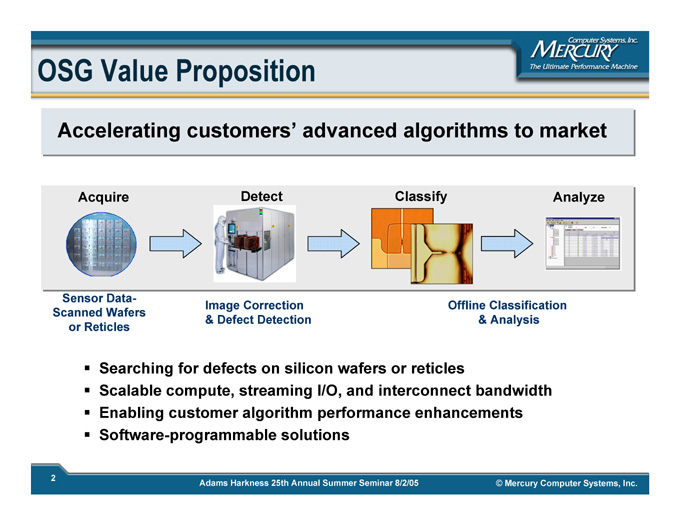

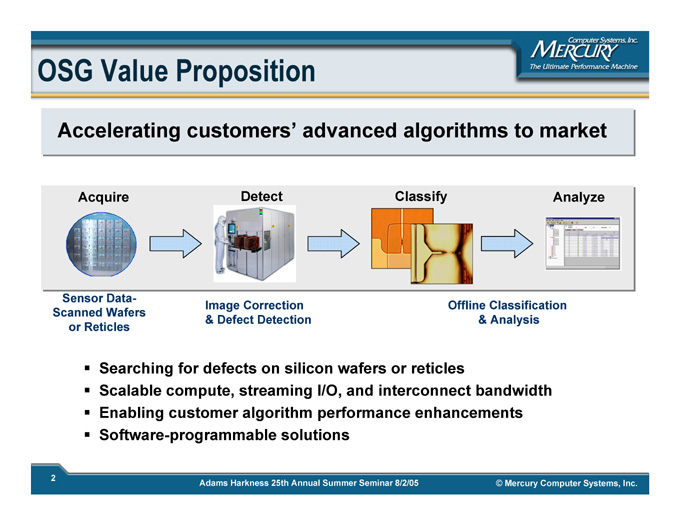

OSG Value Proposition

Accelerating customers’ advanced algorithms to market

Detect

Analyze

Acquire

Classify

Sensor Data- Scanned Wafers or Reticles

Image Correction & Defect Detection

Offline Classification & Analysis

Searching for defects on silicon wafers or reticles

Scalable compute, streaming I/O, and interconnect bandwidth

Enabling customer algorithm performance enhancements

Software-programmable solutions

2 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

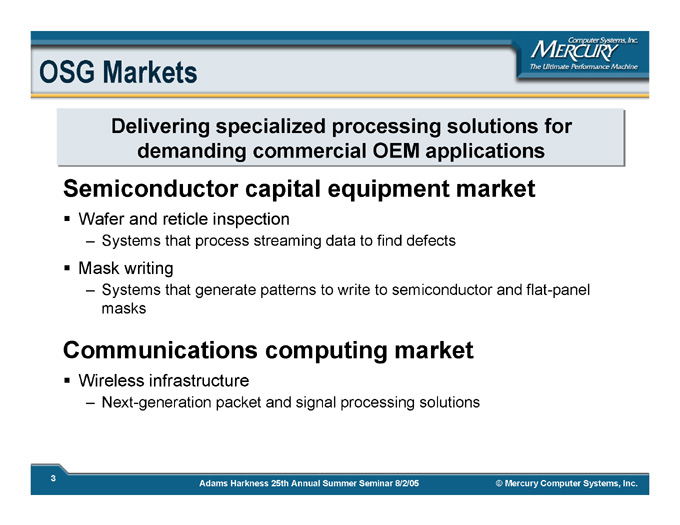

OSG Markets

Delivering specialized processing solutions for demanding commercial OEM applications

Semiconductor capital equipment market

Wafer and reticle inspection

Systems that process streaming data to find defects

Mask writing

Systems that generate patterns to write to semiconductor and flat-panel masks

Communications computing market

Wireless infrastructure

Next-generation packet and signal processing solutions

3 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

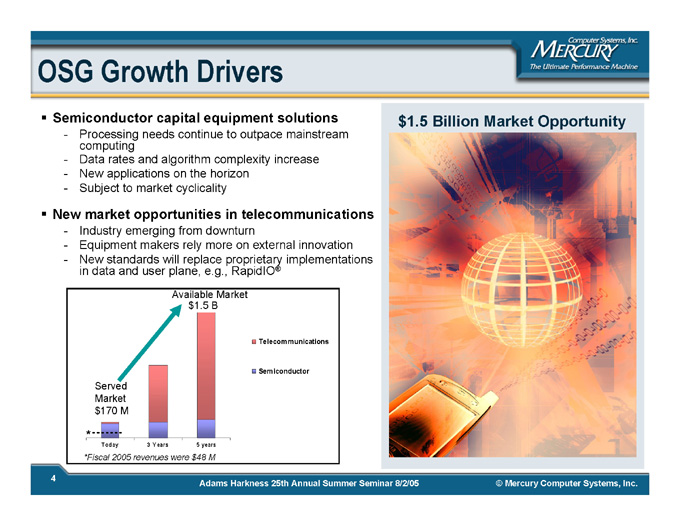

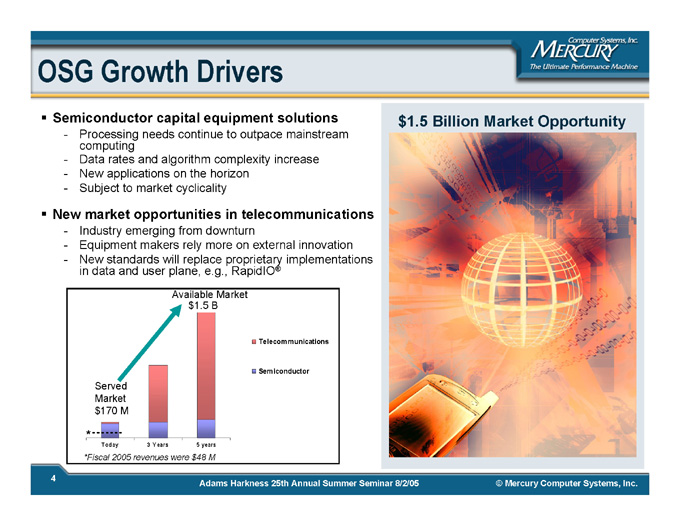

OSG Growth Drivers

Semiconductor capital equipment solutions

Processing needs continue to outpace mainstream computing

Data rates and algorithm complexity increase

New applications on the horizon

Subject to market cyclicality

New market opportunities in telecommunications

Industry emerging from downturn

Equipment makers rely more on external innovation

New standards will replace proprietary implementations in data and user plane, e.g., RapidIO®

$1.5 Billion Market Opportunity

Available Market $1.5 B

Telecommunications

Semiconductor

Served Market $170 M

*

5 years

3 Years

Today

*Fiscal 2005 revenues were $48 M

4 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

Financial

Overview

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

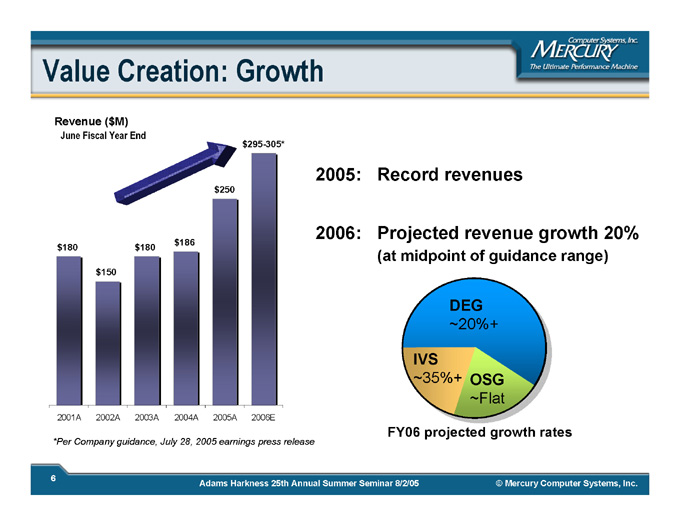

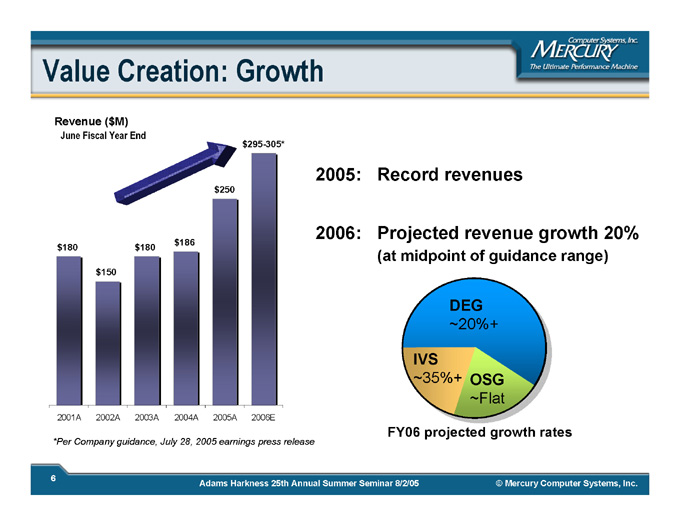

Value Creation: Growth

Revenue ($M)

June Fiscal Year End

$180

$150

$180

$186

$250

$295-305*

2001A

2002A

2003A

2004A

2005A

2006E

2005: Record revenues

2006: Projected revenue growth 20% (at midpoint of guidance range)

DEG ~20%+

IVS ~35%+

OSG ~Flat

FY06 projected growth rates

*Per Company guidance, July 28, 2005 earnings press release

6 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

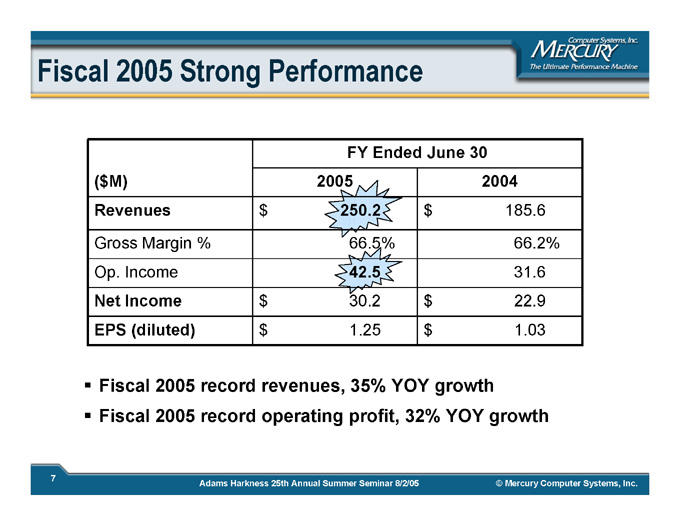

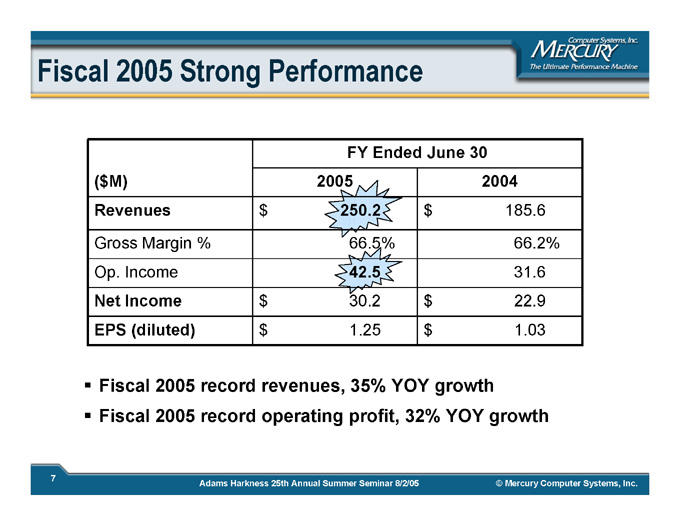

Fiscal 2005 Strong Performance

FY Ended June 30

($M) 2005 2004

Revenues $250.2 $185.6

Gross Margin % 66.5% 66.2%

Op.Income 42.5 31.6

Net Income $30.2 $22.9

EPS (diluted) $1.25 $1.03

Fiscal 2005 record revenues, 35% YOY growth

Fiscal 2005 record operating profit, 32% YOY growth

7 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

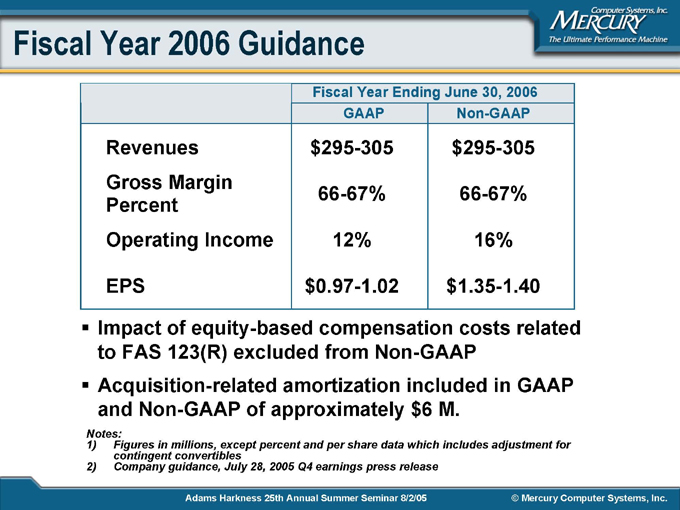

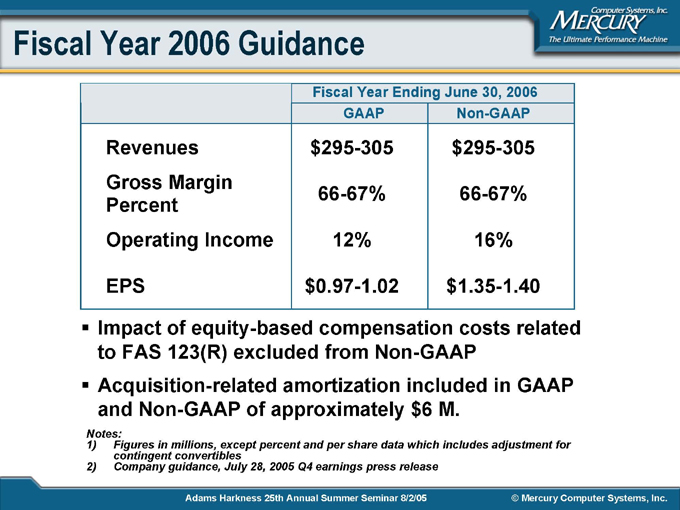

Fiscal Year 2006 Guidance

Fiscal Year Ending June 30, 2006

GAAP Non-GAAP

Revenues $295-305 $295-305

Gross Margin Percent 66-67% 66-67%

Operating Income 12% 16%

EPS $0.97-1.02 $1.35-1.40

Impact of equity-based compensation costs related to FAS 123(R) excluded from Non-GAAP

Acquisition-related amortization included in GAAP and Non-GAAP of approximately $6M

Notes:

1) Figures in millions, except percent and per share data which includes adjustment for contingent convertibles

2) Company guidance, July 28, 2005 Q4 earnings press release

8 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

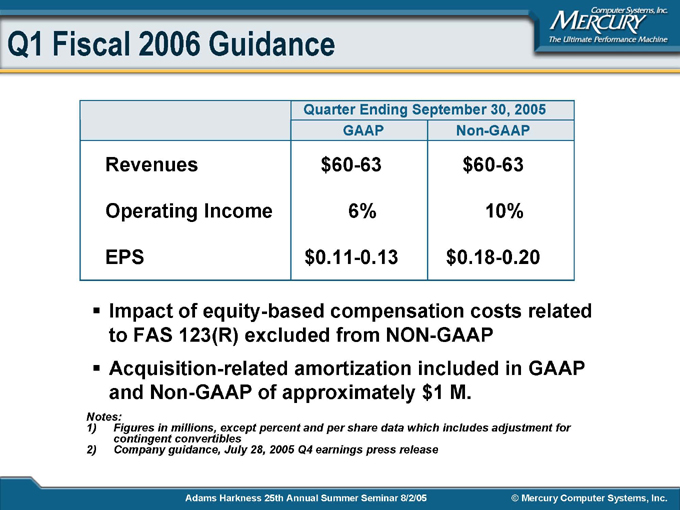

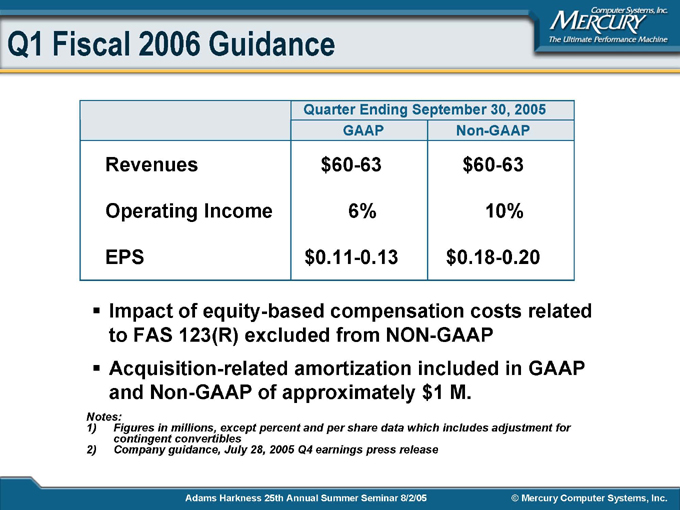

Q1 Fiscal 2006 Guidance

Impact of equity-based compensation costs related to FAS 123(R) excluded from NON-GAAP

Acquisition-related amortization included in GAAP and Non-GAAP of approximately $1M

Quarter Ending September 30, 2005

GAAP Non-GAAP

Revenues $60-63 $60-63

Operating Income 6% 10%

EPS $0.11-0.13 $0.18-0.20

Notes:

1) Figures in millions, except percent and per share data which includes adjustment for contingent convertibles

2) Company guidance, July 28, 2005 Q4 earnings press release

9 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

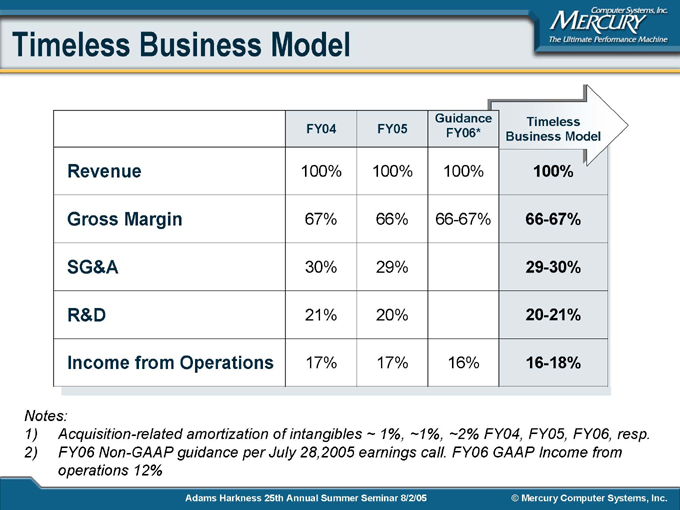

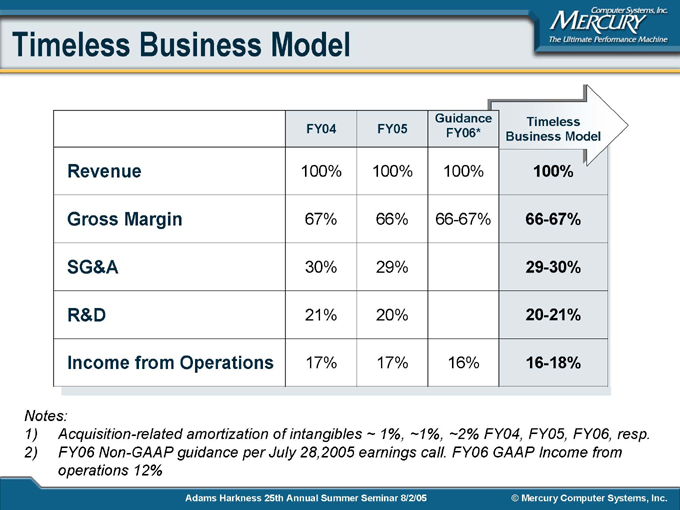

Timeless Business Model

Guidance Timeless FY04 FY05 FY06* Business Model

Revenue 100% 100% 100% 100% Gross Margin 67% 66% 66-67% 66-67% SG&A 30% 29% 29-30% R&D 21% 20% 20-21%

Income from Operations 17% 17% 16% 16-18%

Notes:

1) Acquisition-related amortization of intangibles ~ 1%, ~1%, ~2% FY04, FY05, FY06, resp.

2) FY06 Non-GAAP guidance per July 28, 2005 earnings call. FY06 GAAP Income from operations 12%

Adams Harkness 25th Annual Summer Seminar 8/2/05 © Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

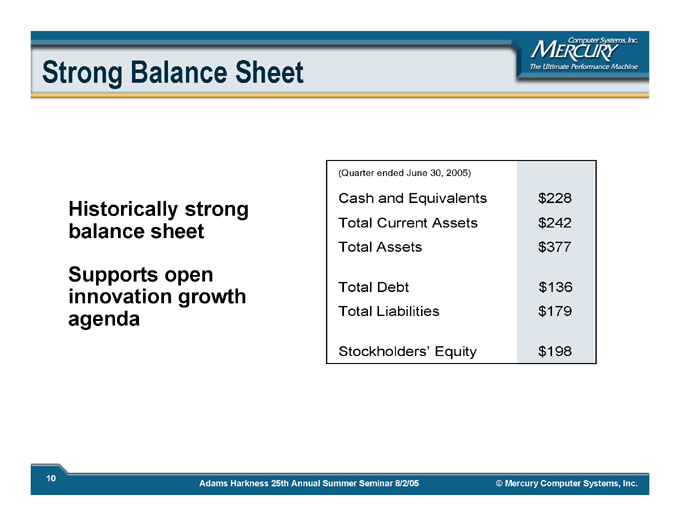

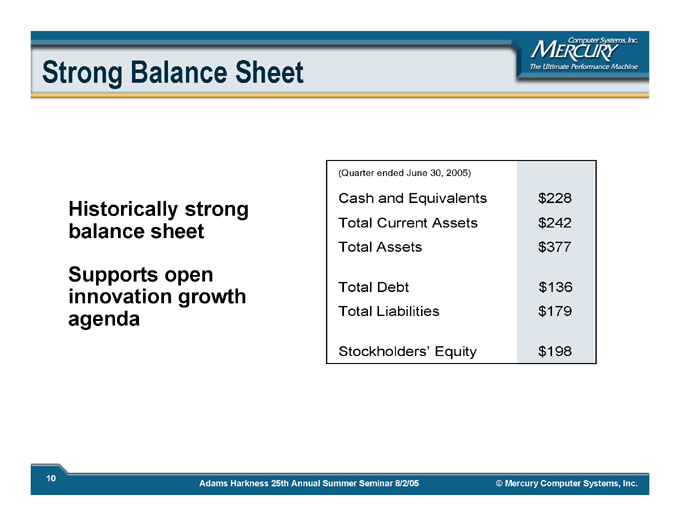

Strong Balance Sheet

Historically strong balance sheet

Supports open innovation growth agenda

(Quarter ended June 30, 2005)

Cash and Equivalents $228

Total Current Assets $242

Total Assets $377

Total Debt $136

Total Liabilities $179

Stockholders’ Equity $198

10 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

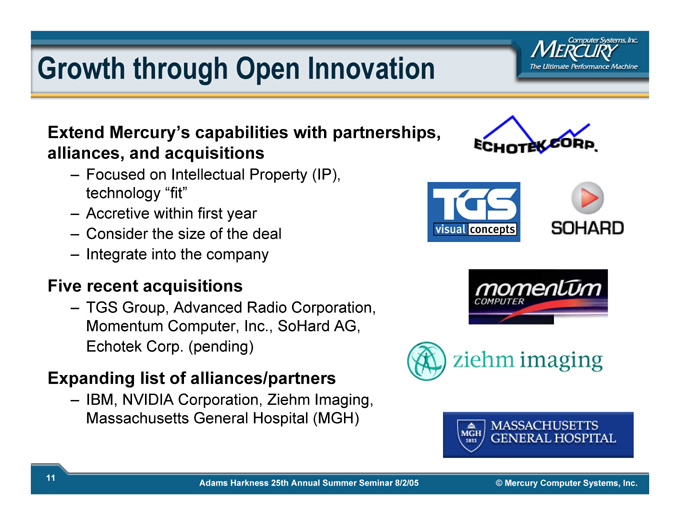

Growth through Open Innovation

Extend Mercury’s capabilities with partnerships, alliances, and acquisitions

Focused on Intellectual Property (IP), technology “fit”

Accretive within first year

Consider the size of the deal

Integrate into the company

Five recent acquisitions

TGS Group, Advanced Radio Corporation, Momentum Computer, Inc., SoHard AG,

Echotek Corp. (pending)

Expanding list of alliances/partners

IBM, NVIDIA Corporation, Ziehm Imaging, Massachusetts General Hospital (MGH)

ECHOTEK CORP.

TGS visual concepts

SOHARD

momentum COMPUTER

ziehm imaging

MASSACHUSETTS GENERAL HOSPITAL MGH 1811

11 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

MRCY Summary

Strong competitive position in attractive and growing markets

Diversified revenue base – defense and commercial

Straightforward operating model and financial structure

Strong balance sheet, operating cash flow with significant financing flexibility

Open innovation strategy through partnerships and acquisitions to enhance capability to deliver solutions across target markets

Sustain a 25% or better long-term revenue growth rate

12 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.

Computer Systems, Inc.

MERCURY

The Ultimate Performance Machine

www.mc.com

NASDAQ: MRCY

13 Adams Harkness 25th Annual Summer Seminar 8/2/05

© Mercury Computer Systems, Inc.