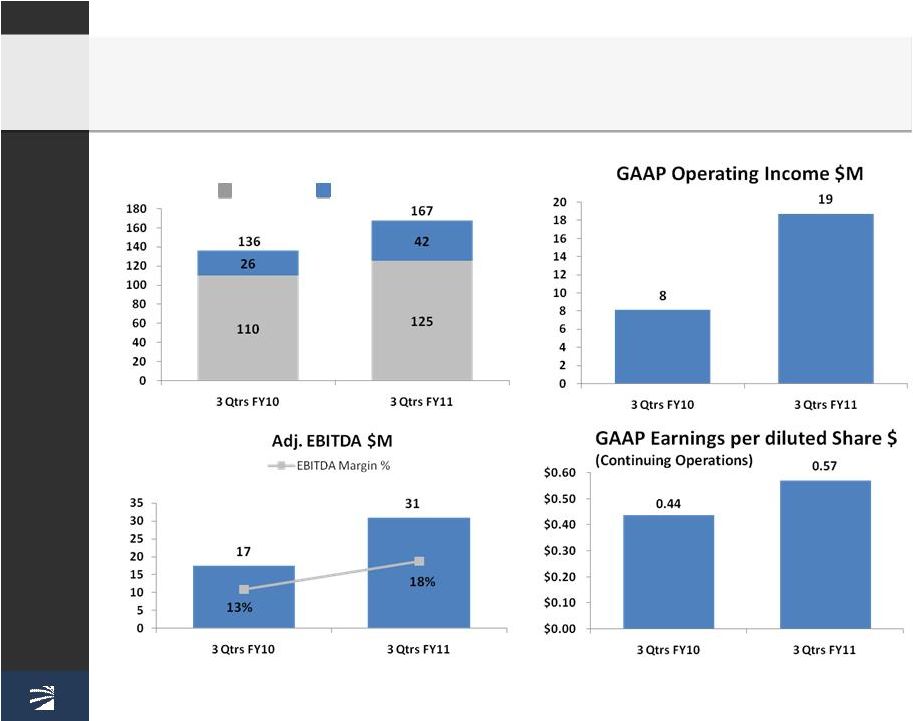

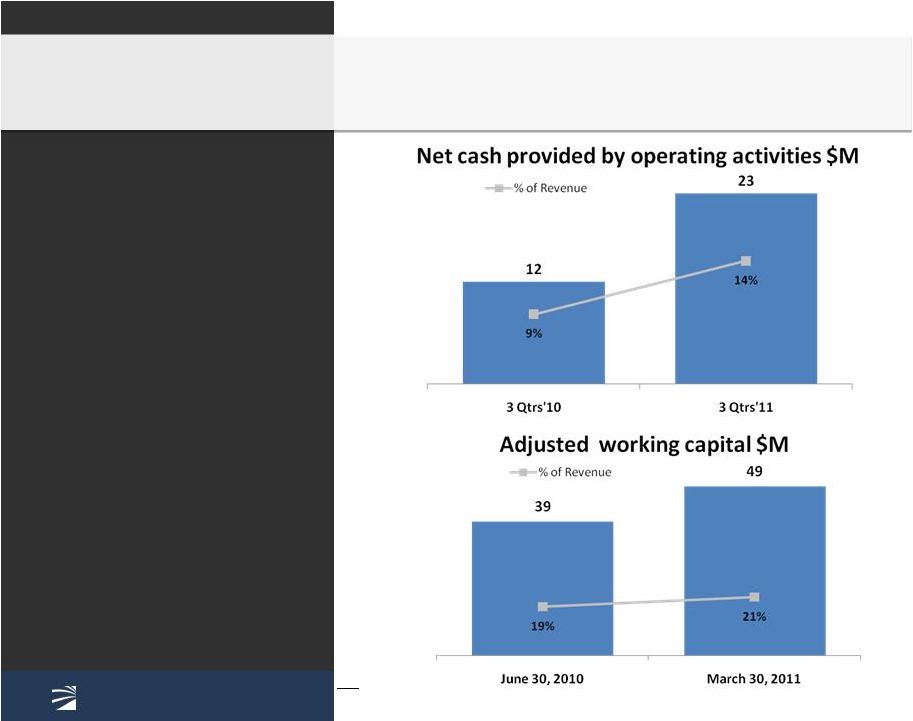

© 2011 Mercury Computer Systems, Inc. Forward-Looking Safe Harbor Statement 2 This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to fiscal 2011 business performance and beyond and the Company’s plans for growth and improvement in profitability and cash flow. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “probable,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, continued funding of defense programs, the timing of such funding, changes in the U.S. Government’s interpretation of federal procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and divestitures or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2010. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA; free cash flow; cash and marketable securities, net of debt; and adjusted working capital, which are non-GAAP financial measures. Adjusted EBITDA excludes certain non-cash and other specified charges. Free cash flow is defined as cash flow from operating activities less capital expenditures. Cash and marketable securities, net of debt is defined as cash and cash equivalents, short-term marketable securities and related receivables, and long-term marketable securities less total borrowings under line of credit and total notes payable. Adjusted working capital is defined as accounts receivable, net of allowance for doubtful accounts and inventory less accounts payable and accrued expenses. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, the presentation of adjusted EBITDA; free cash flow; cash and marketable securities, net of debt; and adjusted working capital is not meant to be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes the adjusted EBITDA; free cash flow; cash and marketable securities, net of debt; and adjusted working capital financial measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures |