Corporate Profile

Cavalry Bancorp, Inc. (the “Company”), a Tennessee corporation, is a bank holding company which owns Cavalry Banking (the “Bank”), the oldest and largest independent community bank in Rutherford County, Tennessee. The Bank is a Federal Reserve member and state chartered commercial bank. The primary Federal regulator for both the Company and the Bank is the Board of Governors of the Federal Reserve System. The Bank is also under the supervision of the Tennessee Department of Financial Institutions. In addition to traditional banking services, the Company and its subsidiaries provide a wide range of other financial products and services. Cavalry Mortgage, a division of the Bank, provides mortgage lending assistance in Rutherford County and the surrounding market area. The Bank’s Main Office location houses a consumer and commercial lending department as well as a newly-expanded construction lending department. Cavalry Investments, another division of the Bank, provides a complete array of investment options, while the Investment and Trust division contributes a full range of trust services. The Bank’s subsidiary, Miller & Loughry Insurance and Services, Inc., offers a complete selection of insurance products, as well as human resource services and personnel assistance. The Company and its subsidiaries are located throughout the Middle Tennessee area at the following locations:

114 West College Street Murfreesboro, TN 37130 615/893-1234 | 123 Cason Lane Murfreesboro, TN 37128 615/893-1812 | 604 North Main Street Shelbyville, TN 37160 931/684-6166 |

| | | |

2035 Southeast Broad Street Murfreesboro, TN 37130 615/895-0905 | 1645 Northwest Broad Street Murfreesboro, TN 37129 615/895-3380 | 269 South Lowry Street Smyrna, TN 37167 615/459-2535 |

| | | |

1745 Memorial Boulevard Murfreesboro, TN 37129 615/890-2919 | 2604 South Church Street Murfreesboro, TN 37127 615/848-1966 | 467 Sam Ridley Parkway West Smyrna, TN 37167 615/459-6828 |

| | | |

Cavalry Financial Center 214 West College Street Murfreesboro, TN 37130 615/893-1234 | | Miller & Loughry Insurance and Services, Inc. 214 West College Street Murfreesboro, TN 37130 615/896-9292 |

| | | |

| | | |

Table of Contents

Letter to Our Shareholders | |

Corporate Information | 1 |

Selected Financial Data | 2 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 4 |

Report of Independent Registered Public Accounting Firm | 21 |

Consolidated Financial Statements | 22 |

Notes to Consolidated Financial Statements | 29 |

Board of Directors, Community Board, Officers | Inside Back Cover |

Letter To Our Shareholders:

As our community grows, so grows Cavalry Bancorp, Inc. (the "Company") and Cavalry Banking (the "Bank"). 2004 was a great year!

Located in the heart of Tennessee in Rutherford County, the Bank reaped the benefit of location, location, location, by virtue of calling Murfreesboro, Tennessee home. The market for the Company is among the fastest growing in the United States and quickly gaining regional and national recognition as one of the nation's most attractive markets. Recently, the Nashville Chamber of Commerce credited Rutherford County as one of the major contributors of Nashville being selected the #1 city in the United States for business expansion and relocation.

The year 2004 was a year of historical significance as the Company celebrated its 75th year of serving our communities. New milestones were achieved as the Bank continued double digit growth and ended the year with growth in every area. In 2004, total assets increased 12% to $579 million, total deposits grew 12% to $507 million, and total loans increased 23% to $433 million. Total stockholder equity stood at 9.30% of assets or $53.8 million.

2004 was also an unusual year as it provided a unique opportunity for your Board of Directors to deploy capital management tools by rewarding stockholders with a one-time special dividend of $1.50 per share and increasing the regular quarterly cash dividend by 16.7% to $0.07 per share. The Board also authorized the acceleration of future expense associated with the Employee Stock Ownership Plan and the 1999 Stock Option Plan. This one-time, non-cash charge of $5.3 million will eliminate the expense associated with those plans going forward and should enhance future earnings. Net income was $429,000, or $0.06 per diluted share, and reflects the one-time charge taken in the fourth quarter, as mentioned above and explained in footnotes 12 and 13 of the consolidated financial statements.

The Bank's growth is directly related to its ability to provide more products and services than other institutions in our market. In 2004, CAVBizsolutions became an umbrella for products and services provided to businesses. The coordination of these services positions the Bank as a one-stop solution for all business financial needs, including human resources, insurance, investments, wealth management, and banking. The Cavalry Auction Team began with a committed group of employees dedicated to assisting individuals that purchase property at public auctions and has become a very vibrant source of business opportunities. The Private Banking Group completed its first full year of operation with a degree of success that required the addition of another full time person dedicated to personal service. Another addition was the dedication of a full time person to the Bank@School program which has Cavalry Banks in various schools within our area that promotes the development of financial skills in school age children. We believe that young customers today are the customers of the Bank tomorrow. During 2004, we expanded our offices of Miller and Loughry Insurance with additional highly qualified personnel which has already proven to be a successful decision.

In 2004, the Bank culminated a year of celebrating its 75th anniversary by hosting an outdoor community concert in the street between the main office and the financial center office in Murfreesboro. Tagged as "Boogie In The 'Boro", it was a huge success having an estimated crowd of 7,000. This gift to the community is an example of the Bank's total involvement in its communities. While the Bank is a major participant and contributor toward the Chamber of Commerce, Middle Tennessee Sate University, Special Kids, Boys and Girls Club, Middle Tennessee Medical Foundation, American Heart Association, and others, it is the employees and the thousands of hours they commit to various organizations that help make our communities a better place to live.

We are fortunate to live in a community that is diversified and progressive with a good quality of life. As our community continues to grow, so will Cavalry. The Board of Directors and your management team remain committed to sound growth and increased returns for our investors.

|  |  |

Ed C. Loughry, Jr. Chairman & Chief Executive Officer | Ronald F. Knight President & Chief Operating Officer | William S. Jones Executive Vice President & Chief Administrative Officer |

Corporate Information

Corporate Address

114 West College Street

Murfreesboro, Tennessee 37130

(615) 893-1234

Transfer Agent and Registrar

Mellon Investor Services LLC

85 Challenger Road

Ridgefield Park, NJ 07660

Independent Registered Public Accounting Firm

Rayburn, Bates & Fitzgerald, P.C.

5200 Maryland Way, Suite 300

Brentwood, Tennessee 37027

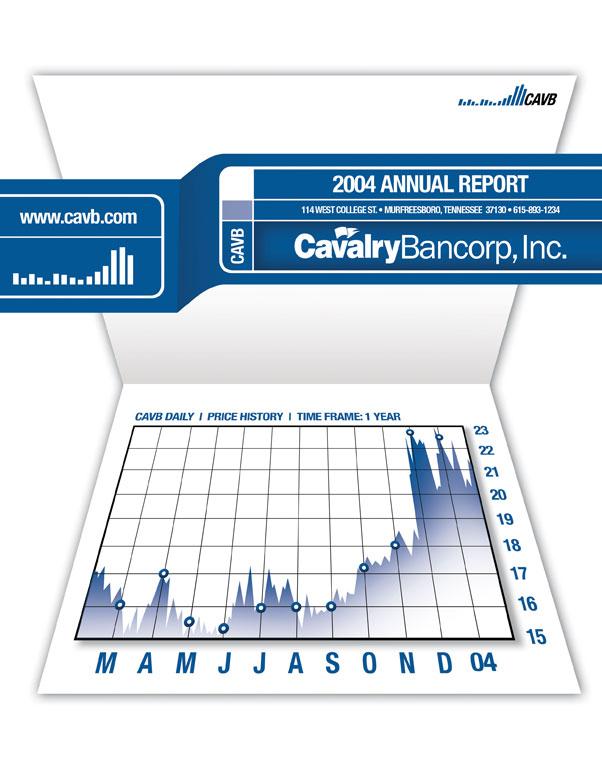

Market Price of the Company’s Common

Stock and Related Security Matters

The common stock of Cavalry Bancorp, Inc. is listed on the Nasdaq National Market System under the symbol “CAVB.” The following table discloses on a quarterly basis the high and low bid and closing prices and dividends declared for the stock for the years ended December 31, 2004 and 2003.

| | | 2004 | |

| | | Fourth Quarter | | Third Quarter | | Second Quarter | | First Quarter | |

| Market Price: | | | | | | | | | | | | | |

| High | | $ | 23.94 | | | 17.23 | | | 17.49 | | | 18.99 | |

| Low | | | 16.61 | | | 15.25 | | | 15.00 | | | 14.81 | |

| Close | | | 23.00 | | | 17.10 | | | 15.80 | | | 16.84 | |

| | | | | | | | | | | | | | |

| Dividends Declared | | $ | 1.57 | | | 0.06 | | | 0.06 | | | 0.06 | |

| | | 2003 | |

| | | Fourth Quarter | | Third Quarter | | Second Quarter | | First Quarter | |

| Market Price: | | | | | | | | | | | | | |

| High | | $ | 19.98 | | | 18.75 | | | 18.81 | | | 16.31 | |

| Low | | | 16.66 | | | 15.60 | | | 15.77 | | | 13.10 | |

| Close | | | 17.68 | | | 16.75 | | | 16.98 | | | 16.23 | |

| | | | | | | | | | | | | | |

| Dividends Declared | | $ | 0.06 | | | 0.06 | | | 0.05 | | | 0.05 | |

The Bank may not declare or pay a cash dividend on any of its stock if the effect thereof would cause the Bank’s regulatory capital to be below the amount required for the liquidation account established in connection with the mutual to stock conversion. At the close of business on March 1, 2005, there were approximately 1,200 registered shareholders and 2,400 non-registered or “street name” shareholders of the Company’s common stock.

Annual Meeting

The annual Meeting of Shareholders of Cavalry Bancorp, Inc. will be held at 10:00 a.m. Central Daylight Time, April 28, 2005, in the Fifth Floor Auditorium of the main office of Cavalry Banking, 114 West College Street, Murfreesboro, Tennessee.

A COPY OF THE FORM 10-K, INCLUDING CONSOLIDATED FINANCIAL STATEMENTS, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WILL BE FURNISHED WITHOUT CHARGE TO SHAREHOLDERS AS OF THE RECORD DATE FOR VOTING AT THE ANNUAL MEETING OF SHAREHOLDERS UPON WRITTEN REQUEST TO IRA B. LEWIS, JR., SECRETARY, CAVALRY BANCORP, INC., 114 WEST COLLEGE STREET, MURFREESBORO, TENNESSEE 37130.

The SEC maintains an internet site that contains reports, proxy and information statements and other information about issuers, like us, that file electronically with the SEC. The address of that site is http://www.sec.gov.

Internet Information

Information on the Company’s and the Bank’s history, locations, products and services can be accessed on the internet at http://www.cavb.com.

A link to the Company’s electronic filings with the SEC may also be found at http://www.cavb.com.

Cavalry Bancorp, Inc. and Subsidiaries

Selected Financial Data

The following tables set forth certain information concerning the consolidated financial position and results of operations of the Company at the dates and for the periods indicated.

| | | At December 31, | |

| | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| | | (Dollars in thousands) | |

Financial Condition Data: | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total assets | | $ | 578,670 | | | 515,172 | | | 464,365 | | | 432,874 | | | 384,285 | |

| Loans receivable, net | | | 430,526 | | | 350,412 | | | 300,524 | | | 280,239 | | | 279,478 | |

| Loans held-for-sale | | | 2,501 | | | 2,648 | | | 17,800 | | | 10,423 | | | 4,183 | |

| Investment securities held-to-maturity | | | - | | | - | | | - | | | 637 | | | 594 | |

| Investment securities available-for-sale | | | 42,183 | | | 55,123 | | | 37,926 | | | 41,808 | | | 32,247 | |

| Cash and cash equivalents | | | 63,135 | | | 70,913 | | | 73,162 | | | 69,281 | | | 45,025 | |

| Deposits | | | 506,534 | | | 454,257 | | | 407,752 | | | 380,990 | | | 336,534 | |

| Borrowings | | | 2,835 | | | 2,889 | | | 2,944 | | | 998 | | | 1,578 | |

| Total shareholders’ equity | | | 53,833 | | | 54,427 | | | 49,746 | | | 48,806 | | | 43,971 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | For the Year Ended December 31, |

| | | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | | (Dollars in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | |

Operating Data: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Interest and dividend income | | $ | 25,068 | | | 21,936 | | | 23,257 | | | 28,108 | | | 29,436 | |

| Interest expense | | | 5,555 | | | 5,616 | | | 7,193 | | | 12,649 | | | 13,070 | |

| | | | | | | | | | | | | | | | | |

| Net interest income | | | 19,513 | | | 16,320 | | | 16,064 | | | 15,459 | | | 16,366 | |

| Provision for loan losses | | | 875 | | | 101 | | | 497 | | | 661 | | | 306 | |

| | | | | | | | | | | | | | | | | |

| Net interest income after provision for loan losses | | | 18,638 | | | 16,219 | | | 15,567 | | | 14,798 | | | 16,060 | |

| | | | | | | | | | | | | | | | | |

| Gains on sale of loans, net | | | 2,773 | | | 5,473 | | | 3,401 | | | 2,537 | | | 1,548 | |

| Other non-interest income | | | 10,125 | | | 9,138 | | | 8,217 | | | 5,763 | | | 4,147 | |

| Non-interest expense | | | 28,573 | | | 23,371 | | | 20,177 | | | 18,664 | | | 14,700 | |

| | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 2,963 | | | 7,459 | | | 7,008 | | | 4,434 | | | 7,055 | |

| Income tax expense | | | 2,534 | | | 2,965 | | | 2,891 | | | 2,435 | | | 3,003 | |

| | | | | | | | | | | | | | | | | |

| Net income | | $ | 429 | | | 4,494 | | | 4,117 | | | 1,999 | | | 4,052 | |

| | | | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | 0.07 | | | 0.70 | | | 0.64 | | | 0.31 | | | 0.64 | |

| Diluted earnings per share | | $ | 0.06 | | | 0.67 | | | 0.62 | | | 0.31 | | | 0.64 | |

| Dividends declared per share | | $ | 1.75 | | | 0.22 | | | 0.20 | | | 0.20 | | | 0.20 | |

Cavalry Bancorp, Inc. and Subsidiaries

Selected Financial Data (Continued)

Key Financial Ratios: | | | | | | | | | | | |

| | | | |

| | | For the Year Ended December 31, | |

| | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

Performance Ratios: | | | | | | | | | | | |

| Return on average assets (1) | | | 0.08 | % | | 0.96 | | | 0.97 | | | 0.50 | | | 1.11 | |

| Return on average equity (2) | | | 0.77 | | | 8.60 | | | 8.36 | | | 4.33 | | | 9.90 | |

| Interest rate spread (tax equivalent) (3) | | | 3.84 | | | 3.68 | | | 4.00 | | | 3.65 | | | 4.22 | |

| Net interest margin (tax equivalent) (4) | | | 4.10 | | | 3.93 | | | 4.28 | | | 4.24 | | | 4.89 | |

| Average interest-earning assets to average interest-bearing liabilities | | | 122.41 | | | 118.10 | | | 114.94 | | | 117.19 | | | 117.19 | |

| Non-interest expense as a percent of average total assets | | | 5.40 | | | 5.00 | | | 4.77 | | | 4.67 | | | 4.02 | |

| Efficiency ratio (5) | | | 88.16 | | | 75.56 | | | 72.89 | | | 78.56 | | | 66.63 | |

| Dividend payout ratio (6) | | | 2,500.00 | | | 31.43 | | | 31.25 | | | 64.52 | | | 31.25 | |

| | | | | | | | | | | | | | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | |

| Non-accrual and 90 days or more past due loans as a percent of total loans, net | | | 0.17 | | | 0.24 | | | 0.17 | | | 0.14 | | | 0.04 | |

| Non-performing assets as a percent of total assets | | | 0.13 | | | 0.17 | | | 0.16 | | | 0.13 | | | 0.05 | |

| Allowance for loan losses as a percent of total loans receivable | | | 1.12 | | | 1.28 | | | 1.46 | | | 1.38 | | | 1.34 | |

| Allowance for loan losses as a percent of non-performing loans | | | 650.13 | | | 526.78 | | | 878.68 | | | 1,134.52 | | | 3,443.09 | |

| Net charge-offs to average outstanding loans | | | 0.14 | | | 0.07 | | | 0.10 | | | 0.15 | | | 0.07 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Capital Ratios: (7) | | | | | | | | | | | | | | | | |

| Total equity-to-assets ratio | | | 9.30 | | | 10.56 | | | 10.71 | | | 11.27 | | | 11.44 | |

| Average equity to average assets (8) | | | 10.50 | | | 11.17 | | | 11.64 | | | 11.56 | | | 11.19 | |

| (1) | Net income divided by average total assets. |

| (2) | Net income divided by average equity. |

| (3) | Difference between weighted average yield on interest-earning assets and weighted average rate on interest-bearing liabilities. |

| (4) | Net interest income as a percentage of average interest-earning assets. |

| (5) | Other expenses divided by the sum of net interest income and other income. |

| (6) | Dividends per share divided by net income per share. |

| (7) | During 2001, the Company repurchased 25,000 shares for $271,000. During 2002, the Company repurchased 250,064 shares for $3.2 million. During 2003, the Company repurchased 28,112 shares for $461,000. During 2004, the Company repurchased 132,043 shares for $2.0 million. |

| (8) | Average total equity divided by average total assets. |

Cavalry Bancorp, Inc. and Subsidiaries

Management's Discussion & Analysis of Financial Condition

and Results of Operations

General

Management's discussion and analysis of financial condition and results of operations is intended to assist in understanding the financial condition and results of operations of the Company. The information contained in this section should be read in conjunction with the Consolidated Financial Statements and accompanying Notes contained in this Annual Report.

Private Securities Litigation Reform Act Safe Harbor Statement

This Annual Report contains forward-looking statements within the meaning of the federal securities laws. These statements are not historical facts, rather statements based on the Company's expectations regarding its business strategies and their intended results and its future performance. Forward-looking statements are preceded by terms such as "expects," "believes," "anticipates," "intends," and similar expressions.

Forward-looking statements are not guarantees of future performance. Numerous risks and uncertainties could cause the Company's actual results, performance, and achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government; changes in market conditions in the Company’s principal market area; adverse changes in the financial condition of the Company’s loan customers; competitive pressures on loan or deposit terms; legislative and regulatory changes; and other factors disclosed periodically in the Company's filings with the Securities and Exchange Commission.

Because of the risks and uncertainties in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere from time to time by the Company or on its behalf. The Company assumes no obligation to update any forward-looking statements.

The Company’s Business and Strategy

Cavalry Bancorp, Inc. (the “Company”), a Tennessee corporation, is a holding company which owns Cavalry Banking (the “Bank”). The Bank is a Federal Reserve member and state chartered commercial bank whose principal office is located in Murfreesboro, Tennessee. The Bank has nine branch locations throughout the Middle Tennessee area.

The Bank’s operations are divided into four distinct segments: banking, mortgage banking, insurance, and trust services. The Bank is a community-oriented financial institution whose principal business consists of attracting deposits from the general public and utilizing those funds to originate a wide assortment of loans to both individuals and business owners residing in the Middle Tennessee area. The Bank also offers investment management and trust services, brokerage services and annuity services. Additionally, Miller & Loughry Insurance and Services, Inc. (“Miller & Loughry”), a 100%-owned subsidiary of the Bank, offers a complete range of personal and commercial insurance services along with personnel and human resource services. Miller & Loughry also provides comprehensive life and health insurance services for both individuals and companies.

The banking segment offers a vast assortment of deposit options for both individuals and business owners. Services offered include traditional demand deposit and savings accounts, certificates of deposit, individual retirement accounts, and money market products. The banking segment also includes the consumer and commercial lending department which originates consumer loans, commercial real estate and business loans, construction loans, and land acquisition and development loans. This segment also includes the merchant services department, which provides business owners with credit card processing, check collection services, and Web-based bill pay services. An additional component of this segment is an investment brokerage department, which provides various investment opportunities to customers. The banking segment’s profitability relies heavily on net interest income (discussed below) and deposit and other fee income.

The mortgage banking segment originates one-to-four family mortgage loans for sale in the secondary market and also services residential mortgage loans for other investors. This segment’s income is greatly influenced by market rates, outside competition, the general economy of the surrounding market area, and current levels of refinancing. This segment’s profitability depends primarily on its net gains on the sale of loans as well as the collection of fees, such as fees paid for the sale of servicing rights.

The insurance segment is an independent insurance agency offering customers commercial insurance, property and home insurance, life and health insurance, and human resource services. This segment’s profitability is largely generated through commissions earned from the sale of various insurance products. Another important profit component is fee income received for providing human resource services to local small business clients.

Cavalry Bancorp, Inc. and Subsidiaries

Management's Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

The Company’s Business and Strategy (Continued)

The trust segment offers an array of investment management accounts, personal trusts, custodial and corporate trust services, and employee benefit services. This segment’s profitability is wholly dependent on the fees collected for services related to these products.

The Bank’s overall profitability depends significantly on its net interest income, which is the difference between the income it receives on its loan and investment portfolio and its cost of funds, consisting of interest paid on deposits and other borrowings. Net interest income is also affected by the relative amounts of interest-earning assets and interest-bearing liabilities of the Bank. When the amount of interest income earned on interest-earning assets equals or exceeds the interest expense generated by interest-bearing liabilities, a positive interest rate spread is recognized and net interest income is generated.

The Bank’s profitability is also dependent on its other income and expenses. Other income consists of deposit-related fees, merchant services fees, income associated with the origination and sale of mortgage loans, loan servicing fees, commissions from the sales of insurance and financial instruments, and trust fees. Other expenses include compensation and benefits expense, occupancy and equipment charges, advertising and public relations expense, data processing expenses and other general operating costs.

The Bank’s operating results can be significantly impacted by local economic and competitive conditions, fluctuations in the market interest rate, and changes in government legislation and regulatory policies. Deposit balances can be influenced by interest rates paid on competing personal investments and the level of income and savings for the surrounding market area. The level of lending activity can be influenced by the demand for housing and the general economy of the Bank’s market area, as well as outside competition from other lending institutions.

Critical Accounting Policies

The Company’s consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States of America and follow general practices within the industries in which it operates. The Company’s accounting policies are fundamental to understanding these financial statements. Certain accounting policies involve significant judgments and complex assumptions by management which may have a material impact on the carrying value of certain assets and liabilities; management considers these accounting policies to be critical accounting policies. Based on this definition, management considers the allowance for loan losses to be its most critical accounting policy. The Company’s allowance for loan losses methodology incorporates a variety of risk considerations, both quantitative and qualitative, in establishing an allowance that management believes to be appropriate for each reporting date. Quantitative factors include the Company’s historical loss experience, delinquency and charge-off trends, collateral values, and changes in non-performing loans. The Company also incorporates known information about individual loans, including borrower’s sensitivity to interest rate movements and other relevant factors. Qualitative factors include the general economic environment in the Company’s markets, including economic conditions throughout the Southeast and the state of industries predominant in the Middle Tennessee area. The details of this methodology are discussed in the section of this Management’s Discussion and Analysis entitled “Critical Accounting Estimates.”

Management also considers its policy on non-accrual loans to be a critical accounting policy. Loans are classified as non-accrual loans when principal or interest is delinquent for 90 days or more. Once a loan is categorized as non-accrual, all previously recorded earned income is reversed and income is no longer accrued on an on-going basis. When the deficiency is cured, the loan is taken out of non-accrual status, the related income is recorded on the books, and interest income will start accruing again as usual.

The final critical accounting policy identified by management relates to the sale of loans. The Bank sells mortgage loans for cash proceeds equal to the principal amount of the loans sold but with yield rates which reflect the current market rate. Gain or loss is recorded at the time of sale in an amount reflecting the difference between the contractual interest rates of the loans sold and the current market rate. The gain (or loss) on sales includes any fees received for release of servicing.

Critical Accounting Estimates

The preparation of the financial statements requires management to make certain judgments and assumptions in determining accounting estimates. Accounting estimates are considered critical if (a) the estimate requires management to make assumptions about matters that were highly uncertain at the time the estimate was made, and (b) different estimates reasonably could have been used in the current period that would have a material impact on the presentation of the Company’s financial condition, changes in financial condition, or results of operations. Based on these assumptions, management considers the calculation of the allowance for loan losses to be the Company’s most critical accounting estimate. The following is a discussion of the key elements of the Company’s methodology.

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Critical Accounting Estimates (Continued)

The Company evaluates loans at two levels to arrive at the final allowance for loan losses amount. The first level is the individual loan level. The evaluation process begins with an internal loan review performed by the credit department. This department conveys their recommendations of impaired loans to the asset classification committee, which is an internal team consisting of selected senior management and senior lenders. The asset classification committee, based on those recommendations, evaluates the overall loan portfolio and specifically identifies individual loans for impairment. An independent third party team also evaluates the loan portfolio annually and identifies specific loans they consider impaired. Impairment is evaluated by comparing the outstanding loan amount to (a) the fair value of the underlying collateral or (b) the present value of expected future cash flows. Based on this evaluation, a specific reserve amount is then determined on a loan by loan basis.

The second level of evaluation is the overall portfolio level. All loans that were not specifically evaluated for impairment are classified into one of four categories based on credit risk characteristics. These categories are real estate mortgage loans, real estate construction loans, commercial loans, and installment and other consumer loans. Senior management then assigns factors to each category to reflect (a) historical loss trends; (b) the overall market economy; and (c) growth trends. The Company includes an additional factor over and above the initial assessment for consumer loans and construction development loans, as senior management feels these are traditionally higher risk loans. Based on these evaluations, a general reserve value is derived and added to the specific reserve amount discussed above.

While management uses the best information available to establish the allowance for loan losses, these evaluations are inherently subjective as they require material estimations in many cases. The Company’s methodology may be impacted in future periods by changes in economic conditions or by the discovery of information with respect to borrowers not known by management at the time of their evaluations. Additionally, as an essential part of their examination process, various regulatory agencies review the Company’s allowance for loan losses and may require adjustments based on their assessment of information available to them at the time of their review. As of December 31, 2004, management considers the Company’s methodology for allowance for loan losses to be sound and the balance is considered to be adequate to absorb inherent losses in the loan portfolio.

The following table sets forth an analysis of the Bank's gross allowance for loan losses and activity within the allowance for the periods indicated.

| | | Year Ended December 31, | |

| | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| | | (Dollars in thousands) | |

| | | | | | | | | | | | |

| Allowance at beginning of period | | $ | 4,525 | | | 4,657 | | | 4,470 | | | 4,235 | | | 4,136 | |

| Provision for loan losses | | | 875 | | | 101 | | | 497 | | | 661 | | | 306 | |

| Recoveries: | | | | | | | | | | | | | | | | |

| Commercial | | | 8 | | | 2 | | | 73 | | | 5 | | | 6 | |

| Real estate - construction | | | - | | | - | | | - | | | - | | | - | |

| Real estate - mortgage | | | - | | | - | | | 113 | | | 2 | | | - | |

| Installment and other consumer | | | 54 | | | 101 | | | - | | | 107 | | | 23 | |

| Total recoveries | | | 62 | | | 103 | | | 186 | | | 114 | | | 29 | |

| | | | | | | | | | | | | | | | | |

| Charge-offs: | | | | | | | | | | | | | | | | |

| Commercial | | | (368 | ) | | (70 | ) | | (188 | ) | | (118 | ) | | (68 | ) |

| Real estate - construction | | | - | | | - | | | - | | | - | | | - | |

| Real estate - mortgage | | | (6 | ) | | (55 | ) | | - | | | (81 | ) | | (48 | ) |

| Installment and other consumer | | | (225 | ) | | (211 | ) | | (308 | ) | | (341 | ) | | (120 | ) |

| Total charge-offs | | | (599 | ) | | (336 | ) | | (496 | ) | | (540 | ) | | (236 | ) |

| Net charge-offs | | | (537 | ) | | (233 | ) | | (310 | ) | | (426 | ) | | (207 | ) |

| Allowance at end of period | | $ | 4,863 | | | 4,525 | | | 4,657 | | | 4,470 | | | 4,235 | |

| Allowance for loan losses as a percentage of total loans receivable at the endof the period | | | 1.12 | % | | 1.28 | | | 1.46 | | | 1.38 | | | 1.34 | |

| Net charge-offs to average loans during the period | | | (0.14 | )% | | (0.07 | ) | | (0.10 | ) | | (0.15 | ) | | (0.07 | ) |

| Allowance for loan losses as a percentage of non-performing loans at end of theperiod | | | 650.13 | % | | 526.78 | | | 878.68 | | | 1,134.52 | | | 3,443.09 | |

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Critical Accounting Estimates (Continued)

The Company has been sufficiently reserved on a consistent basis. Management feels that their past evaluations and estimations have been reasonable and that their methodology for determining this provision is satisfactory. However, a decline in economic conditions or other factors beyond management’s control could significantly alter the amount of losses the Company recognizes in the future.

The following table sets forth the breakdown of the allowance for loan losses by category at the dates indicated.

| | | At December 31, | |

| | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| | | Amount | | Percent of Loans In Category to Total Loans | | Amount | | Percent of Loans In Category to Total Loans | | Amount | | Percent of Loans In Category to Total Loans | | Amount | | Percent of Loans In Category to Total Loans | | Amount | | Percent of Loans In Category to Total Loans | |

| | | (Dollars in thousands) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Commercial | | $ | 1,188 | | | 41.7 | % | | 1,352 | | | 35.4 | | | 1,833 | | | 32.2 | | | 2,209 | | | 44.1 | | | 2,024 | | | 41.0 | |

| Real estate - construction | | | 1,717 | | | 21.7 | | | 1,800 | | | 19.4 | | | 1,107 | | | 20.7 | | | 844 | | | 16.4 | | | 840 | | | 17.7 | |

| Real estate - mortgage | | | 814 | | | 26.2 | | | 887 | | | 34.4 | | | 1,017 | | | 38.7 | | | 388 | | | 24.1 | | | 406 | | | 23.3 | |

| Installment and other consumer | | | 1,144 | | | 10.4 | | | 486 | | | 10.8 | | | 612 | | | 8.4 | | | 734 | | | 15.4 | | | 777 | | | 18.0 | |

| Unallocated | | | - | | | N/A | | | - | | | N/A | | | 88 | | | N/A | | | 295 | | | N/A | | | 188 | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total allowance for loan losses | | $ | 4,863 | | | 100.0 | % | | 4,525 | | | 100.0 | | | 4,657 | | | 100.0 | | | 4,470 | | | 100.0 | | | 4,235 | | | 100.0 | |

Comparison of Financial Condition at December 31, 2004 and December 31, 2003

Total Assets. Total assets increased 12.33%, from $515.2 million at December 31, 2003 to $578.7 million at December 31, 2004. This overall increase is due primarily to a 22.86% increase in the loan portfolio. This increase is partially offset by a 23.47% decrease in available-for-sale investments securities. The details of these changes are described below.

Investment Securities. Available-for-sale investment securities decreased from $55.1 million at December 31, 2003 to $42.2 million at December 31, 2004. During 2004, the Company sold lower yielding agency securities and used the proceeds to purchase higher yield mortgage-backed securities and collateralized mortgage obligations. Additionally, the Company sold securities to increase liquidity to help fund the growth in the loan portfolio.

Loans Receivable, Net. Loans receivable, net, increased 22.86%, from $350.4 million at December 31, 2003 to $430.5 million at December 31, 2004. Although the Company’s portfolio increased in most lending areas, commercial lending and construction lending experienced the largest increases. Commercial loans increased 44.40%, from $126.8 million at December 31, 2003 to $183.1 million at December 31, 2004. Construction loans increased 36.87%, from $69.7 million at December 31, 2003 to $95.4 million at December 31, 2004. Consumer loans increased 18.09%, while mortgage loans decreased 7.20%. During 2004, the Bank sold the majority of its mortgage loan production. Additionally, as a result of principal payments and payoffs, the mortgage loan portfolio decreased. The Bank has increased its presence in the construction lending market and, since economic conditions remain favorable in the Bank’s primary market area, the Bank anticipates continuing to increase its portfolio of consumer, commercial and construction loans.

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Comparison of Financial Condition at December 31, 2004 and December 31, 2003 (Continued)

Non-Accrual Loans. Non-accrual loans totaled approximately $748,000 and $859,000 at December 31, 2004 and 2003. These levels are relatively low and are consistent with prior years. See the section of this Management’s Discussion and Analysis entitled “Critical Accounting Policies” and Note 1 of Notes to Consolidated Financial Statements.

The following table sets forth information with respect to the Bank's non-accrual loans and other non-performing assets at the dates indicated.

| | | At December 31, | |

| | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| | | (Dollars in thousands) | |

| | | | | | | | | | | | |

| Loans accounted for on a nonaccrual basis: | | | | | | | | | | | | | | | | |

| Commercial | | $ | 147 | | | 243 | | | 257 | | | - | | | - | |

| Real estate - construction | | | 317 | | | - | | | - | | | 97 | | | 10 | |

| Real estate - mortgage | | | 222 | | | 574 | | | - | | | 233 | | | 71 | |

| Installment and other consumer | | | 62 | | | 42 | | | 273 | | | 64 | | | 42 | |

| Total | | | 748 | | | 859 | | | 530 | | | 394 | | | 123 | |

| | | | | | | | | | | | | | | | | |

| Accruing loans which are contractually past due 90 days or more | | | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | |

| Total of nonaccrual and 90 days past due loans | | | 748 | | | 859 | | | 530 | | | 394 | | | 123 | |

| | | | | | | | | | | | | | | | | |

| Foreclosed assets | | | 16 | | | - | | | 203 | | | 184 | | | 86 | |

| | | | | | | | | | | | | | | | | |

| Total nonperforming assets | | $ | 764 | | | 859 | | | 733 | | | 578 | | | 209 | |

| | | | | | | | | | | | | | | | | |

| Restructured loans | | $ | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | |

| Non-accrual and 90 days or more past due loans as a percentage of total loans, net | | | 0.17 | % | | 0.24 | | | 0.17 | | | 0.14 | | | 0.04 | |

| | | | | | | | | | | | | | | | | |

| Non-accrual and 90 days or more past due loans as a percentage of total assets | | | 0.13 | % | | 0.17 | | | 0.11 | | | 0.09 | | | 0.03 | |

| | | | | | | | | | | | | | | | | |

| Non-performing assets as a percentage of total assets | | | 0.13 | % | | 0.17 | | | 0.16 | | | 0.13 | | | 0.05 | |

| | | | | | | | | | | | | | | | | |

| Total loans, net | | $ | 433,027 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total assets | | $ | 578,670 | | | | | | | | | | | | | |

Loans Held for Sale. Loans held for sale decreased 3.85%, from $2.6 million at December 31, 2003 to $2.5 million at December 31, 2004. This reflects a decrease in the volume of loans originated during December 2004 compared to December 2003.

Goodwill. On January 4, 2002, the Bank completed the purchase of 100% of the issued and outstanding capital stock of Miller & Loughry for cash of approximately $2.0 million. Miller & Loughry is an independent insurance agency located in Murfreesboro, Tennessee. The transaction resulted in approximately $1.8 million of goodwill (See Note 2 of Notes to Consolidated Financial Statements). Goodwill is not amortized, but is tested for impairment on at least an annual basis in accordance with SFAS 142,Goodwill and Other Intangible Assets. Based on the results of the impairment testing that was performed, the value of the goodwill has not declined and is properly recorded as of December 31, 2004.

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Comparison of Financial Condition at December 31, 2004 and December 31, 2003 (Continued)

Deposits. Customer deposits have increased 11.49%, from $454.3 million at December 31, 2003 to $506.5 million at December 31, 2004. The Bank has experienced continued growth in all deposit categories. Non-interest bearing deposits increased 12.85%, from $72.4 million at December 31, 2003 to $81.7 million at December 31, 2004. Interest bearing demand deposits increased 11.59%, from $208.0 million at December 31, 2003 to $232.1 million at December 31, 2004. Savings deposits increased 10.00%, from $21.0 million at December 31, 2003 to $23.1 million at December 31, 2004. Certificates of deposit increased 10.99%, from $152.8 million at December 31, 2003 to $169.6 million at December 31, 2004. These increases are a direct result of the Company’s continued efforts to promote and grow deposit accounts, particularly transaction accounts.

Borrowings. Total borrowings remained constant from December 31, 2003 to December 31, 2004. During 2004, the Bank maintained three notes with the Federal Home Loan Bank of Cincinnati, Ohio. No new borrowings were entered into during 2004 or 2003.

Shareholders’ Equity. Total shareholder’s equity decreased 1.10%, from $54.4 million at December 31, 2003, to $53.8 million at December 31, 2004. This decrease was primarily the result of lower earnings in 2004 due to the Company taking a one time, non-cash, pre-tax charge of $5.3 million resulting from (a) the remaining unallocated shares of the Employee Stock Ownership Plan (ESOP) being committed to be released as a result of the repayment of a note payable which encumbered these shares; and (b) the acceleration of vesting of all director and officer stock options granted under the 1999 Stock Option Plan (SOP). (See Notes 12 and 13 of the Notes to Consolidated Financial Statements.) This one time charge contributed to the resulting reduced earnings of $429,000 for 2004. Other increases to shareholders’ equity include the allocation of shares under the Bank's ESOP that totaled $6.6 million. In addition, $5.3 million in proceeds was received, along with a $1.5 million tax benefit recognized, from the issuance of common stock as a result of stock options being exercised. These increases were offset by the repurchase and retirement of 132,043 shares of the Company’s common stock for $2.0 million, and dividends of $12.5 million for the year ended December 31, 2004. These dividends include a special dividend of $1.50 per share declared in the fourth quarter, as the Company’s Board of Directors determined that unneeded capital should be returned to shareholders. (See Note 14 of the Notes to Consolidated Financial Statements.) Additionally, the Bank experienced a decline of $111,000 in the valuation allowance for available-for-sale investment securities, net of tax effect. On September 20, 2001, the Company’s Board of Directors authorized the repurchase of up to 710,480 shares of the Company’s outstanding common stock; as of December 31, 2004, 435,219 shares have been repurchased under this repurchase program.

Comparison of Operating Results for the Years Ended December 31, 2004, 2003, and 2002

Presented below is a comparative summary of key income statement components and their related variances for the three years ended December 31, 2004, 2003, and 2002. The significant changes will be discussed in the summary that follows.

| | | | | Dollar Variance | | Percent Variance | |

| | | | | | | | | 2004 | | 2003 | | 2004 | | 2003 | |

| | | For the Year Ended December 31, | | over | | over | | over | | over | |

| | | 2004 | | 2003 | | 2002 | | 2003 | | 2002 | | 2003 | | 2002 | |

| | | (Dollars in thousands, except per share data) | |

| | | | | | | | | | | | | | | | |

| Interest and dividend income | | $ | 25,068 | | | 21,936 | | | 23,257 | | | 3,132 | | | (1,321 | ) | | 14.28 | % | | (5.68 | ) |

| Interest expense | | | 5,555 | | | 5,616 | | | 7,193 | | | (61 | ) | | (1,577 | ) | | (1.09 | ) | | (21.92 | ) |

| Net interest income | | | 19,513 | | | 16,320 | | | 16,064 | | | 3,193 | | | 256 | | | 19.56 | | | 1.59 | |

| Provision for loan losses | | | 875 | | | 101 | | | 497 | | | 774 | | | (396 | ) | | 766.34 | | | (79.68 | ) |

| Non-interest income | | | 12,898 | | | 14,611 | | | 11,618 | | | (1,713 | ) | | 2,993 | | | (11.72 | ) | | 25.76 | |

| Non-interest expense | | | 28,573 | | | 23,371 | | | 20,177 | | | 5,202 | | | 3,194 | | | 22.26 | | | 15.83 | |

| Income taxes | | | 2,534 | | | 2,965 | | | 2,891 | | | (431 | ) | | 74 | | | (14.54 | ) | | 2.56 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 429 | | | 4,494 | | | 4,117 | | | (4,065 | ) | | 377 | | | (90.45 | )% | | 9.16 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | 0.07 | | | 0.70 | | | 0.64 | | | | | | | | | | | | | |

| Diluted earnings per share | | $ | 0.06 | | | 0.67 | | | 0.62 | | | | | | | | | | | | | |

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Comparison of Operating Results for the Years Ended December 31, 2004, 2003, and 2002 (Continued)

Net Income. Net income increased $377,000 or 9.16% from 2002 to 2003, primarily due to higher net interest income, lower provision for loan losses, and an increase in non-interest income, particularly in the gains on sale of loans. Net income decreased $4.1 million or 90.45% from 2003 to 2004, primarily due to a 22.26% increase in non-interest expense. This increase in non-interest expense is a result of the remaining unallocated shares of the ESOP being committed to be released as a result of the repayment of a note payable which encumbered these shares, as well as the acceleration of vesting of officer and director stock options in the SOP plan. Additionally, non-interest income decreased $1.7 million or 11.72% from 2003 to 2004, primarily due to a $2.7 million or 49.33% decrease in gains on sale of loans. The ESOP and SOP transactions mentioned above resulted in a one time, pre-tax charge of $5.3 million that caused the Company’s financial ratios to decline significantly. Diluted earnings per share increased from $0.62 in 2002 to $0.67 in 2003, then decreased to $0.06 in 2004. Return on average assets has declined from 0.97% in 2002 to 0.96% in 2003, then down to 0.08% for 2004. Although net income for fiscal year 2002 to fiscal year 2003 increased by 9.16%, average assets increased 10.46%, from $423.4 million to $467.7 million, resulting in a slight decrease of 0.01% in the return on average assets ratio. Return on average equity increased from 8.36% in 2002 to 8.60% in 2003, then decreased to 0.77% in 2004.

Net Interest Income. The Bank faced declining interest rate environments during 2002 and 2003, but during 2004 interest rates stabilized and then began to climb. These changing environments caused yields and costs to fluctuate when comparing the three year periods. Net interest income has increased 21.12% over the past three years, from $16.1 million in 2002 to $19.5 million in 2004. Total interest and dividend income has varied, decreasing from $23.3 million in 2002 to $21.9 million in 2003, then increasing to $25.1 million in 2004. The decrease from 2002 to 2003 is due to a decline in average yield on interest-earning assets, from 6.20% in 2002 to 5.28% for 2003. This decrease was partially offset by an increase in average interest-earning assets, which rose from $375.2 million in 2002 to $415.7 million in 2003. This increase from 2002 to 2003 was a result of an increase in available-for-sale investment securities along with an increase in loans receivable. The increase in interest and dividend income from 2003 to 2004 is primarily due to a 21.18% increase in volume of average net loans receivable, along with a 32.64% increase in average yield on investment securities available-for-sale. Average yield on interest-earning assets declined slightly over this same period, from 5.28% in 2003 to 5.26% in 2004.

Average loans receivable have steadily increased over the three year reporting period, from $296.6 million in 2002 to $328.2 million in 2003, and then to $397.7 million in 2004. This increase in volume was offset by a decrease in average yields for the same three year period, with a 2002 yield of 7.08%, a 2003 yield of 6.17%, and a 2004 yield of 5.83%.

Average investment securities available-for-sale have varied over the three year reporting period. The average balance was $36.7 million for 2002, $48.2 million for 2003, and $41.8 million for 2004. Yields have varied as well, from 3.98% in 2002, to 2.39% in 2003, to 3.17% on a tax-equivalent basis for taxable and tax-exempt securities combined in 2004. During 2004, the Bank restructured its portfolio to extend maturities and to increase yields.

Average interest-bearing deposits with other financial institutions has steadily declined over the three year reporting period, with an average balance of $38.5 million in 2002, $36.4 million in 2003, and $34.7 million in 2004. Yields have varied over the three year reporting period, with a 2002 yield of 1.60%, a 2003 yield of 1.05%, and a 2004 yield of 1.35%.

Total interest expense has decreased 22.22% over the three year reporting period, from $7.2 million in 2002, to $5.6 million in 2003 and 2004. Although rates began to increase in 2004, the Company concentrated its growth in lower-costing deposits. Average deposits and borrowings increased 19.45% over the three year reporting period, from $326.4 million in 2002, to $352.0 million in 2003 and $389.9 million in 2004. The Company’s average cost of funds has steadily declined over this three year period, going from 2.20% in 2002, to 1.60% in 2003, to 1.42% in 2004. The Company’s overall interest rate spread has remained consistent over the three year reporting period, from 4.00% in 2002, to 3.68% in 2003, to 3.84% in 2004, on tax equivalent basis. Net interest margin has varied over the three year reporting period, from 4.28% in 2002, to 3.93% in 2003 and 4.10% in 2004, on a tax equivalent basis.

Average Balances, Interest and Average Yields/Costs

The following table sets forth certain information for the periods indicated regarding average balances of assets and liabilities as well as the total dollar amounts of interest income from average interest-earning assets, interest expense on average interest-bearing liabilities, and average yields and costs. Such yields and costs for the periods indicated are derived by dividing income or expense by the average balances of assets or liabilities, respectively, for the periods presented. Average balances are derived from daily balances for the years then ended.

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Comparison of Operating Results for the Years Ended December 31, 2004, 2003, and 2002 (Continued)

Average Balances, Interest and Average Yields/Costs (Continued)

| | | Year ended December 31, | |

| | | 2004 | | 2003 | | 2002 | |

| | | Average Balance | | Interest and Dividends | | Yield/ Cost | | Average Balance | | Interest and Dividends | | Yield/ Cost | | Average Balance | | Interest And Dividends | | Yield/ Cost | |

| | | (Dollars in thousands) | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans receivable, net (1) | | $ | 397,742 | | $ | 23,183 | | | 5.83 | % | | 328,227 | | | 20,267 | | | 6.17 | | | 296,600 | | | 21,007 | | | 7.08 | |

| Investment securities available-for-sale, taxable | | | 37,324 | | | 1,171 | | | 3.14 | | | 48,183 | | | 1,152 | | | 2.39 | | | 36,719 | | | 1,462 | | | 3.98 | |

| Investment securities available-for-sale, tax exempt (3) | | | 4,501 | | | 153 | | | 3.40 | | | - | | | - | | | - | | | - | | | - | | | - | |

| Interest-bearing deposits with other financial institutions | | | 34,726 | | | 469 | | | 1.35 | | | 36,380 | | | 383 | | | 1.05 | | | 38,497 | | | 615 | | | 1.60 | |

| Federal Home Loan Bank and Federal Reserve Bank stock | | | 3,051 | | | 144 | | | 4.72 | | | 2,921 | | | 134 | | | 4.59 | | | 3,358 | | | 173 | | | 5.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | | 477,344 | | | 25,120 | | | 5.26 | | | 415,711 | | | 21,936 | | | 5.28 | | | 375,174 | | | 23,257 | | | 6.20 | |

| Non-interest-earning assets | | | 51,335 | | | | | | | | | 51,985 | | | | | | | | | 48,179 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | 528,679 | | | | | | | | | 467,696 | | | | | | | | | 423,353 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings deposits | | | 22,056 | | | 43 | | | 0.20 | | | 19,959 | | | 64 | | | 0.32 | | | 15,816 | | | 77 | | | 0.49 | |

| Demand deposits | | | 208,010 | | | 1,322 | | | 0.64 | | | 179,482 | | | 1,143 | | | 0.64 | | | 159,642 | | | 1,676 | | | 1.05 | |

| Certificates of deposit | | | 157,017 | | | 4,093 | | | 2.61 | | | 149,642 | | | 4,311 | | | 2.88 | | | 149,314 | | | 5,392 | | | 3.61 | |

| Total deposits | | | 387,083 | | | 5,458 | | | 1.41 | | | 349,083 | | | 5,518 | | | 1.58 | | | 324,772 | | | 7,145 | | | 2.20 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Borrowings | | | 2,860 | | | 97 | | | 3.39 | | | 2,914 | | | 98 | | | 3.36 | | | 1,643 | | | 48 | | | 2.92 | |

| Total interest-bearing liabilities | | | 389,943 | | | 5,555 | | | 1.42 | | | 351,997 | | | 5,616 | | | 1.60 | | | 326,415 | | | 7,193 | | | 2.20 | |

| Non-interest-bearingliabilities (2) | | | 83,244 | | | | | | | | | 63,438 | | | | | | | | | 47,671 | | | | | | | |

| Total liabilities | | | 473,187 | | | | | | | | | 415,435 | | | | | | | | | 374,086 | | | | | | | |

| Shareholders' equity | | | 55,492 | | | | | | | | | 52,261 | | | | | | | | | 49,267 | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 528,679 | | | | | | | | | 467,696 | | | | | | | | | 423,353 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income (3) | | | | | $ | 19,565 | | | | | | | | | 16,320 | | | | | | | | | 16,064 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest rate spread (tax equivalent) | | | | | | | | | 3.84 | % | | | | | | | | 3.68 | | | | | | | | | 4.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest margin | | | | | | | | | 4.10 | % | | | | | | | | 3.93 | | | | | | | | | 4.28 | |

| Ratio of average interest-earning assets to average interest-bearing liabilities | | | | | | | | | 122.41 | % | | | | | | | | 118.10 | | | | | | | | | 114.94 | |

| (1) | Does not include interest on loans 90 days or more past due. Includes loans originated for sale. Interest income includes amortization of fees of $1.1 million, $1.0 million and $898,000 for the years ended December 31, 2004, 2003 and 2002, respectively. |

| (2) | Includes non-interest bearing deposits of $77.5 million, $59.9 million and $44.7 million for the years ended December 31, 2004, 2003 and 2002, respectively. |

| (3) | The Company had tax-free investments during the year ended December 31, 2004. Yields and corresponding income amounts are adjusted to a fully taxable equivalent. The Company had no tax-free investments during the years ended December 31, 2003 and 2002. |

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Comparison of Operating Results for the Years Ended December 31, 2004, 2003, and 2002 (Continued)

Yields Earned and Rates Paid

The following table sets forth for the periods and at the dates indicated the weighted average yields earned on the Company’s assets and the weighted average interest rates paid on the Company’s liabilities, together with the interest rate spread and net interest margin on interest-earning assets. Yields are stated on a tax equivalent basis.

| | | At December 31, | | Year Ended December 31, | |

| | | 2004 | | 2004 | | 2003 | | 2002 | |

| Weighted average yield on: | | | | | | | | | | | | | |

| Loans receivable, net | | | 5.77 | % | | 5.83 | | | 6.17 | | | 7.08 | |

| Investment securities available-for-sale, taxable | | | 3.44 | | | 3.14 | | | 2.39 | | | 3.98 | |

| Investment securities available-for-sale, tax exempt | | | 4.73 | | | 3.40 | | | - | | | - | |

| Interest-bearing deposits with other financial institutions | | | 2.11 | | | 1.35 | | | 1.05 | | | 1.60 | |

| Federal Reserve Bank and Federal Home Loan Bank stock | | | 4.80 | | | 4.72 | | | 4.59 | | | 5.15 | |

| All interest-earning assets | | | 5.42 | | | 5.26 | | | 5.28 | | | 6.20 | |

| | | | | | | | | | | | | | |

| Weighted average rate paid on: | | | | | | | | | | | | | |

| Savings deposits | | | 0.20 | | | 0.20 | | | 0.32 | | | 0.49 | |

| Demand deposits | | | 0.88 | | | 0.64 | | | 0.64 | | | 1.05 | |

| Certificates of deposit | | | 2.79 | | | 2.61 | | | 2.88 | | | 3.61 | |

| Borrowings | | | 3.37 | | | 3.39 | | | 3.36 | | | 2.92 | |

| All interest-bearing liabilities | | | 1.60 | | | 1.42 | | | 1.60 | | | 2.20 | |

| | | | | | | | | | | | | | |

| Interest rate spread (spread between weighted average rate on all interest-earning assets and all interest-bearing liabilities) on a tax-equivalent basis | | | 3.82 | % | | 3.84 | | | 3.68 | | | 4.00 | |

| | | | | | | | | | | | | | |

| Net interest margin (net interest income (expense) as a percentage of average interest-earning assets) on a tax-equivalent basis | | | N/A | | | 4.10 | | | 3.93 | | | 4.28 | |

Rate/Volume Analysis

The following table sets forth, on a tax equivalent basis, the effects of changing rates and volumes on net interest income of the Company. Information is provided with respect to (i) effects on interest income attributable to changes in volume (changes in volume multiplied by prior rate) and (ii) effects on interest income attributable to changes in rate (changes in rate multiplied by prior volume). The net change attributable to the combined impact of volume and rate has been allocated proportionately to the change due to volume and the change due to rate.

| | | Year Ended December 31, 2004 Compared to Year Ended December 31, 2003 Increase (Decrease) | | Year Ended December 31, 2003 Compared to Year Ended December 31, 2002 Increase (Decrease) | | Year Ended December 31, 2002 Compared to Year Ended December 31, 2001 Increase (Decrease) | |

| | | Due to | | | | Due to | | | | Due to | | | |

| | | Rate | | Volume | | Total | | Rate | | Volume | | Total | | Rate | | Volume | | Total | |

| | | | | | | | | (Dollars in thousands) | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans receivable, net (1) | | $ | (1,373 | ) | | 4,289 | | | 2,916 | | | (2,979 | ) | | 2,239 | | | (740 | ) | | (4,282 | ) | | 1,143 | | | (3,139 | ) |

| Investment securities, taxable | | | 279 | | | (260 | ) | | 19 | | | (766 | ) | | 456 | | | (310 | ) | | (575 | ) | | (567 | ) | | (1,142 | ) |

| Investment securities, tax exempt | | | - | | | 153 | | | 153 | | | - | | | - | | | - | | | - | | | - | | | - | |

| Interest-bearing deposits with other financial institutions | | | 103 | | | (17 | ) | | 86 | | | (198 | ) | | (34 | ) | | (232 | ) | | (825 | ) | | 222 | | | (603 | ) |

| Federal Reserve Bank and Federal Home Loan Bank stock | | | 4 | | | 6 | | | 10 | | | (16 | ) | | (23 | ) | | (39 | ) | | (54 | ) | | 87 | | | 33 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total net change in income on interest-earning assets | | | (987 | ) | | 4,171 | | | 3,184 | | | (3,959 | ) | | 2,638 | | | (1,321 | ) | | (5,736 | ) | | 885 | | | (4,851 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings deposits | | | (28 | ) | | 7 | | | (21 | ) | | (33 | ) | | 20 | | | (13 | ) | | (73 | ) | | 20 | | | (53 | ) |

| Demand deposits | | | (4 | ) | | 183 | | | 179 | | | (741 | ) | | 208 | | | (533 | ) | | (2,355 | ) | | 570 | | | (1,785 | ) |

| Certificates of deposit | | | (430 | ) | | 212 | | | (218 | ) | | (1,093 | ) | | 12 | | | (1,081 | ) | | (3,066 | ) | | (569 | ) | | (3,635 | ) |

| Borrowings | | | 1 | | | (2 | ) | | (1 | ) | | 13 | | | 37 | | | 50 | | | 3 | | | 14 | | | 17 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total net change in expense on interest-bearing liabilities | | | (461 | ) | | 400 | | | (61 | ) | | (1,854 | ) | | 277 | | | (1,577 | ) | | (5,491 | ) | | 35 | | | (5,456 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net change in net interest income | | $ | (526 | ) | | 3,771 | | | 3,245 | | | (2,105 | ) | | 2,361 | | | 256 | | | (245 | ) | | 850 | | | 605 | |

(1) Does not include interest on loans 90 days or more past due. Includes loans originated for sale.

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Comparison of Operating Results for the Years Ended December 31, 2004, 2003, and 2002 (Continued)

Provision for Loan Losses. The provision for loan losses is the charge to operating earnings that management determines to be necessary to maintain the allowance for loan losses at an adequate level. This level reflects management’s estimate of probable incurred losses in the loan portfolio based on concentrations, trends in historical loss experience, specifically identified impaired loans and general economic conditions. Please refer to this Management’s Discussion and Analysis, Critical Accounting Estimates section for details on the methodology in calculating this provision. The Bank’s credit management systems have resulted in low loan loss experience; however, there is no guarantee that this experience will continue.

The provision for loan losses has varied over the past three years, decreasing from $497,000 in 2002 to $101,000 in 2003, then increasing to $875,000 in 2004. Charge-offs have varied as well since 2002, dropping from $496,000 to $336,000 in 2003, then increasing to $599,000 in 2004. Recoveries have declined over this three year period, with $186,000 recovered in 2002, $103,000 recovered in 2003, and $62,000 recovered in 2004. The allowance for loan losses has varied over the three year period, with a balance of $4.7 million in 2002, $4.5 million in 2003, and $4.9 million in 2004. Non-accrual loans have increased since 2002, from $530,000 to $748,000 in 2004. Total non-performing assets (which includes non-accrual loans and foreclosed assets) increased 4.23%, from $733,000 in 2002 to $764,000 in 2004. (See Note 6 in Notes to Consolidated Financial Statements.) Non-accrual and 90 days or more past due loans as a percentage of total loans was 0.17%, 0.24% and 0.17% for the years ended December 31, 2002, 2003 and 2004, respectively. Non-performing assets as a percentage of total assets were 0.13%, 0.17% and 0.16% for the years ending December 31, 2004, 2003 and 2002, respectively.

For the three years ended December 31, 2004, management believes the provision for loan losses and the allowance for loan losses to be adequate.

Non-Interest Income. Non-interest income increased 11.21% over the three year reporting period, from $11.6 million in 2002 to $12.9 million in 2004. This increase is attributable to a number of factors. In the banking segment, there was a 42.11% increase over the three year reporting period in deposit servicing fees and charges, from $3.8 million in 2002 to $5.4 million in 2004. This increase occurred evenly over the three year period and is primarily due to a steady increase in the volume of transaction accounts. The increase also reflects an increase in service charges as well as an increase in overdraft and non-sufficient funds fees.

Commissions and other non-banking fees increased 13.64%, from $2.2 million in 2002 to $2.5 million in 2004. This increase is primarily due to an increase in the volume of insurance clients as well as increases in the amount of premiums paid.

The mortgage banking segment experienced varied results over the three year reporting period, with a 60.92% increase in gains on sale of loans from 2002 to 2003, and a 49.33% decline in gains on sale of loans from 2003 to 2004. The increase from 2002 to 2003 was the result of a significant increase in the volume of loans originated and sold during 2003 when compared to 2002. This increase in volume is due to mortgage rates dropping in 2002 and remaining at low levels throughout 2003, causing a surge in refinancing activities. Additionally, the Company continued efforts at expanding the Cavalry Mortgage division during 2003. The decrease from 2003 to 2004 was the result of an overall decline in the volume of mortgage loans originated and sold during 2004 when compared to 2003. This decline in volume is due to a rise in interest rates during 2004 along with a drop in refinancing activity in 2004. Additionally, the Company closed two Nashville-area mortgage offices during 2004 as a result of a declining market for mortgage loan activity.

Non-Interest Expense. Non-interest expense has increased over the three year period ended December 31, 2004, increasing approximately $8.4 million or 41.61% from 2002 to 2004. This increase is mainly attributable to an increase in employee compensation and benefits expense, which has increased 51.18% over the three year reporting period, from $12.7 million in 2002, to $15.2 million in 2003, to $19.2 million in 2004. Reasons for this increase include the opening of a new branch during 2003, which resulted in an increase in personnel. Additionally, the Bank experienced a significant increase in employee health insurance costs, retirement benefits expense, and associated payroll tax expense, causing our overall employee benefit expense to increase 164.71% from $3.4 million in 2002 to $9.0 million in 2004. Included in the retirement expense is the cost of the ESOP. The recorded expense for the ESOP was $6.5 million, $1.7 million and $1.3 million for the years ended December 31, 2004, 2003, and 2002, respectively. Compensation expense is determined by multiplying the per share market price of the Corporation’s stock at the time the shares were committed to be released by the number of shares to be released. The number of shares released annually was based on repayments of the note payable that was acquired at the time of conversion by the ESOP trust to the Company. As previously discussed, the remaining unallocated shares of the ESOP were committed to be released as a result of the repayment of a note payable which encumbered these shares, resulting in a charge of $5.1 million. This program was expected to adversely impact earnings for the next three years, and the adverse impact would increase with increases in the Company’s stock price. In addition, the annual ESOP expense reduced the comparability of the Company’s operating results to those of its peer institutions. Also, the Board of Directors voted to accelerate vesting of all director and officer stock options granted under the 1999 SOP, resulting in a charge of $138,000. (See Note 12 and Note 13 of the Notes to Consolidated Financial Statements.)

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Comparison of Operating Results for the Years Ended December 31, 2004, 2003, and 2002 (Continued)

Non-Interest Expense. (Continued)The Company experienced a 100.00% increase in professional fees, from $514,000 in 2002 to $1.0 million in 2004, due to increased internal audit, external audit, and consulting fees as a result of implementing the internal control requirement of the Sarbanes-Oxley Act of 2002.

Equipment expenses increased by 29.63% over the three year reporting period, from $2.7 million in 2002 to $3.5 million in 2004. This increase is primarily due to an increase of 72.78% in equipment maintenance contracts and an increase of 57.99% in equipment rental and leases. Equipment maintenance contracts increased due to the mid-2002 purchase of equipment to implement new bank-wide software. The equipment associated with this implementation was under a maintenance contract free of charge for the first year of use. Therefore, 2004 was the first full year of maintenance costs associated with this new equipment. Equipment rental and leases expense increased due to an increased number of equipment leases entered into during 2004. Other expenses increased as a result of an increased volume of loan and deposit activity.

Income Tax Expense. Income tax expense was $2.5 million, $3.0 million, and $2.9 million for the years ended December 31, 2004, 2003, and 2002, respectively. The increase from 2002 to 2003 is a result of higher income before taxes for the years ended December 31, 2003 and 2002. The effective tax rate for fiscal year 2004 was 85.5%, fiscal year 2003 was 39.8%, and fiscal year 2002 was 41.1%. The increase in the effective tax rate for 2004 resulted from non-deductible compensation expense recognized as a result of committing to release the remaining encumbered ESOP shares by repaying the note payable. (See Notes 11 and 12 of Notes to Consolidated Financial Statements.)

Contractual Obligations, Commitments, Contingent Liabilities, and Off-Balance Sheet Arrangements

The Company has various financial obligations, including contractual obligations and commitments, which may require future cash payments.

Contractual Obligations. The following table presents, as of December 31, 2004, significant fixed and determinable contractual obligations to third parties by payment date. Further discussion of the nature of each obligation is included in Notes 9, 10 and 19 of Notes to Consolidated Financial Statements as referenced in the table below.

| | | Payments Due In | | | |

| | | One Year or Less | | One to Three Years | | Three to Five Years | | Over Five Years | | Total | |

| | | (Dollars in thousands) | |

| | | | | | | | | | | | |

| Deposits without a stated maturity (a) (note 9) | | $ | 336,928 | | | - | | | - | | | - | | | 336,928 | |

| Certificates of deposits (a) (note 9) | | | 93,421 | | | 54,237 | | | 21,938 | | | 10 | | | 169,606 | |

| Borrowed funds (b) (note 10) | | | 54 | | | 2,108 | | | 108 | | | 565 | | | 2,835 | |

| Operating leases (note 19) | | | 222 | | | 155 | | | 15 | | | - | | | 392 | |

| Purchase obligations | | | 1,180 | | | 1,802 | | | - | | | - | | | 2,982 | |

(a) Excludes interest

(b) Includes interest on fixed rate obligations

The Company’s operating lease obligations represent short and long-term lease and rental payments for certain software and data processing and other equipment. Purchase obligations represent obligations under arrangements to purchase goods or services that are enforceable and legally binding on the Company and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction.

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Contractual Obligations, Commitments, Contingent Liabilities, and Off-Balance Sheet Arrangements (Continued)

Commitments and Other Off-Balance Sheet Arrangements. The following table details the amounts and expected maturities of significant commitments as of December 31, 2004. Further discussion of these commitments is included below and in Note 17 of Notes to Consolidated Financial Statements.

| | | One Year or Less | | One to Three Years | | Three to Five Years | | Over Five Years | | Total | |

| | | (Dollars in thousands) | |

| Commitments to extend credit: | | | | | | | | | | | | | | | | |

| Residential real estate | | $ | 53,187 | | | - | | | - | | | - | | | 53,187 | |

| Other commercial and consumer lines of credit | | | 40,219 | | | - | | | - | | | - | | | 40,219 | |

| Standby letters of credit | | | 8,261 | | | - | | | - | | | - | | | 8,261 | |

| Net commitments to sell mortgage loans | | | 6,096 | | | - | | | - | | | - | | | 6,096 | |

The Company utilizes financial instruments with off-balance sheet risk in the normal course of business to meet the financing needs of its customers and to reduce its own exposure to fluctuation in interest rates. These financial instruments include commitments to originate fixed and variable rate mortgage loans held-for-investment and held-for-sale, unused lines of credit, and funds committed to construction lending. The contract or notional amounts of those instruments reflect the extent of involvement the Company has in particular classes of financial instruments.

Commitments to originate fixed and variable rate mortgage loans are agreements to lend to a customer as long as there is no violation of any condition established in the commitment. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. Since some commitments expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. Undisbursed lines of credit and standby letters of credit do not necessarily represent future cash requirements, in that these commitments often expire without being drawn upon.

The Company minimizes its exposure to loss under these commitments by requiring that customers meet certain conditions prior to disbursing funds. The Company receives collateral to support commitments for which collateral is deemed necessary. The most significant category of collateral includes real estate properties underlying mortgage loans.

Contingent Liabilities. The Company may also incur liabilities upon the occurrence of certain events. In the opinion of management, the financial position of the Company will not be affected materially as a result of such contingent liabilities as discussed in Note 19 of Notes to Consolidated Financial Statements.

Quantitative and Qualitative Disclosure About Market Risk

Asset and Liability Management

The Company, like other financial institutions, is subject to direct and indirect market risk. Direct market risk exists from changes in interest rates. The Company’s net income is dependent on its net interest income. Net interest income is susceptible to interest rate risk to the degree that interest-bearing liabilities mature or reprice on a different basis than interest-earning assets. When interest-bearing liabilities mature or reprice more quickly than interest-earning assets in a given period, a significant increase in market rates of interest could adversely affect net interest income. Similarly, when interest-earning assets mature or reprice more quickly than interest-bearing liabilities, falling interest rates could result in a decrease in net income.

In an attempt to manage its exposure to changes in interest rates, management monitors the Company’s interest rate risk. The Company has an asset/liability management committee that monitors the Company’s interest rate risk position and profitability and reports this information to the board of directors quarterly. Management also reviews the securities portfolio, formulates investment strategies, and oversees the timing and implementation of transactions to help achieve attainment of the board’s objectives in the most effective manner. Notwithstanding the Company’s interest rate risk management activities, the potential for changing interest rates is an uncertainty that can have an adverse effect on net income.

In adjusting the Company’s asset/liability position, the asset/liability management committee attempts to manage the Company’s interest rate risk while maintaining or enhancing net interest margins. At times, depending on the level of general interest rates, the relationship between long-term and short-term interest rates, market conditions and competitive factors, the board and management may decide to increase the Company’s interest rate risk position to increase its net interest margin. The Company’s results of operations and net portfolio values remain vulnerable to decreases in interest rates and to fluctuations in the differences between long-term and short-term interest rates.

Cavalry Bancorp, Inc. and Subsidiaries

Management’s Discussion & Analysis of Financial Condition

and Results of Operations (Continued)

Quantitative and Qualitative Disclosure About Market Risk (Continued)

Asset and Liability Management (Continued)

One approach used to quantify interest rate risk is the net portfolio value analysis. In essence, this analysis calculates the difference between the present value of liabilities and the present value of expected cash flows from assets and off-balance-sheet contracts. The following table sets forth, at December 31, 2004, an analysis of the Company’s interest rate risk as measured by the estimated changes in the net portfolio value resulting from instantaneous and sustained parallel shifts in the yield curve (+ or - 200 basis points).

Changes (In Basis Points) in Interest Rates | Estimated Change in Net Portfolio Value | Estimated Change in Net Portfolio Value | Board Approved Limits |

| | (Dollars in Thousands) | (Percentage) | (Percentage) |

| | | | |

| +200 bp | (240) | (0.5) | (20) |

| +100 bp | (86) | (0.2) | (10) |

| 0 bp | - | - | - |

| -100 bp | (364) | (0.8) | (10) |