As filed with the Securities and Exchange Commission on September 4, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08507

IRONWOOD SERIES TRUST

P.O. Box 588

Portland, ME 04112

(800) 472-6114

Warren J. Isabelle, President

Suite 240

21 Custom House Street

Boston, MA 02109

(800) 472-6114

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2008 – JUNE 30, 2008

| ITEM 1. | REPORT TO STOCKHOLDERS. |

IRONWOOD SERIES TRUST

www.ironwoodfunds.com

IRONWOOD ISABELLE SMALL COMPANY

STOCK FUND

Investment Shares Symbol: IZZYX

Institutional Shares Symbol: IZZIX

Semi-Annual Report

June 30, 2008

(Unaudited)

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

TABLEOF CONTENTS

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

SHAREHOLDER LETTER

To our shareholders :

My a last communication opened by lamenting how difficult the 4th quarter of 2007 was, the perfect storm, at least for us, developing out of a deteriorating economy, pressured further by rapidly escalating energy and commodity prices in addition to a financial system that appeared to be heading into full disarray.

The good news is that despite repeated assaults across all of these fronts, the overall economy has not gone off the cliff. The bad news is that the assaults keep coming, disrupting any nascent period of calm with renewed worry. Economic growth, as measured by Gross Domestic Product (GDP), continued to slip, falling to an annualized rate of 2.0% by year end 2007, well down from the 3% range observed over the previous three years. While recovering a bit in the first quarter of 2008 to 0.9% on a quarterly basis, from -0.2% in the fourth quarter of 2007, the pace is way off of the 4.8% turned in during the second and third quarters of last year. (Source: BEA, U.S. Dept of Commerce.) Already at record nominal levels, crude oil prices shot up another 53% to $141 per barrel. Finally, financial stocks suffered due to the subprime mortgage crisis causing financial institutions to write-off subprime related losses in excess of $350 billion. (Source: CBS MarketWatch 08-01-2008.) Housing prices continued to shrivel and transaction velocity slowed to a crawl.

Amid such adversity, markets generally do not fare well and this was no exception. For the six month period ended June 30, 2008 our benchmark, the Russell 2000 Index of small capitalization stocks returned -9.37%. The Ironwood Isabelle Small Company Stock Fund (the “Fund”) Investment Shares underperformed, returning -12.57% for the period. This was most disappointing, for through the first quarter of 2008 the Fund modestly outperformed the benchmark, returning -9.06% for the Fund versus -9.90% for the Russell 2000 Index.

1

Indeed it feels a bit like being stuck in a cold, rainy weather pattern that just will not seem to break, much like what we seem to experience every spring here in New England. Such periods can be psychologically debilitating especially if they persist. At some point you begin to think that the skies will never clear.

Indeed, it is still overcast with repeated periods of heavy rain and no lasting signs that a new pattern is emerging.

We’ve done our best at reviewing and re-analyzing our holdings in light of the current environment, and we believe that the portfolio is constructed with holdings that possess long-term upside value potential. In fact, over the past six months, we have only exited two companies, Ore Pharmaceuticals (NASD: ORXE), formerly known as Gene Logic, and Cherokee International (NASD: CHRK), while adding Wausau Paper (NYSE: WPP), a company we have held in the past.

Despite the intense effort, recent performance continues to frustrate us, while underwhelming our shareholders. We cannot seem to catch a break and somehow, for the time being, we are “out of synch” with the market. To be sure, in my now 25 years in the business of money management, I have seen and experienced this before but I must say that the situation has endured far longer than I would have expected.

What to do? I believe we have a solid team at Ironwood and a sound investment philosophy and therefore we and you, the shareholders, can come out of this period without permanent damage and positioned to benefit when the weather does break. Right now, we are refocusing on how we put our investment philosophy into practice to determine if in some way we have moved away from what I will call our best practices. If so, we will take immediate steps to correct them; if not, we will continue to refine our investment ideas as we have been doing, more confident than ever that they have been made appropriately, however challenging it may be in the interim.

In closing, I will remind everyone that I, too, am a shareholder in the Fund, and a significant one at that. Your pain is my pain, which I hope will lead you to conclude that I have great incentive and motivation and I believe we can position the Fund to generate results to an acceptable level.

2

As always, but more so during these difficult times, I am deeply grateful for your patience and continued support.

|

| Respectfully submitted, |

|

|

| Warren J. Isabelle |

| Portfolio Manager |

Investments in smaller companies carry greater risk than is customarily associated with larger companies for various reasons such as narrower product lines, limited financial resources and less depth in management. Returns shown are for the Fund’s Investment Shares; other share classes returns will vary.

The views in this report were those of the Fund manager as of June 30, 2008 and may not reflect his views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments in the Fund and do not constitute investment advice.

3

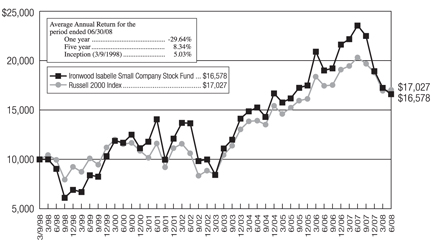

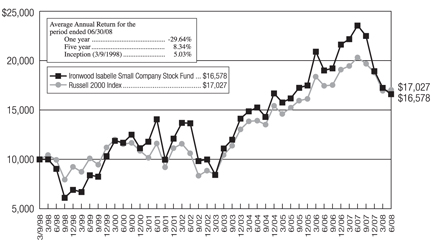

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

INVESTMENT CLASS

ILLUSTRATIONOF $10,000 INVESTMENT

The graph below reflects the change in value of a hypothetical $10,000 investment in the Ironwood Isabelle Small Company Stock Fund (the “Fund”) Investment Class compared with a broad-based securities market index since the Investment Class’ inception. The Russell 2000 Index is composed of the 2,000 smallest stocks in the Russell 3000 Index, a market weighted index of the 3,000 largest U.S. publicly traded companies. The Fund is professionally managed while the Index is unmanaged and not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Investment shares is 2.14%. However, the Fund’s adviser has contractually agreed to waive a portion of its fees and/or reimburse expenses such that total operating expenses do not exceed 1.95%. Contractual waivers may be changed or eliminated at any time with the consent of the Board of Trustees. Shares redeemed within 30 days of purchase will be charged a 2.00% redemption fee. For the most recent month end performance, please call (800) 472-6114. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return figures include the reinvestment of dividends and capital gains. Some of the Fund’s fees have been waived or expenses reimbursed; otherwise total return would have been lower.

4

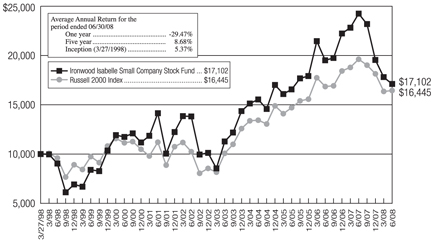

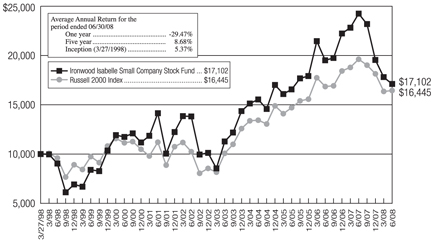

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

INSTITUTIONAL CLASS

ILLUSTRATIONOF $10,000 INVESTMENT

The graph below reflects the change in value of a hypothetical $10,000 investment in the Ironwood Isabelle Small Company Stock Fund (the “Fund”) Institutional Class compared with a broad-based securities market index since the Institutional Class’ inception. The Russell 2000 Index is composed of the 2,000 smallest stocks in the Russell 3000 Index, a market weighted index of the 3,000 largest U.S. publicly traded companies. The Fund is professionally managed while the Index is unmanaged and not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Institutional shares is 2.28%. However, the Fund’s adviser has contractually agreed to waive a portion of its fees and/or reimburse expenses such that total operating expenses do not exceed 1.70%. Contractual waivers may be changed or eliminated at any time with the consent of the Board of Trustees. Shares redeemed within 30 days of purchase will be charged a 2.00% redemption fee. For the most recent month end performance, please call (800) 472-6114. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return figures include the reinvestment of dividends and capital gains. Some of the Fund’s fees have been waived or expenses reimbursed; otherwise total return would have been lower.

5

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

PORTFOLIOOF INVESTMENTS

JUNE 30, 2008 – (Unaudited)

| | | | | |

| Shares | | Security | | Market

Value |

| | Common Stock – 95.33% | | | |

| | Consumer Discretionary & Services – 7.36% | | | |

| 87,675 | | 4Kids Entertainment, Inc. † | | $ | 649,672 |

| 694,205 | | Danka Business Systems plc, ADR † | | | 91,635 |

| 20,410 | | Hooker Furniture Corp. | | | 353,501 |

| 318,862 | | Westaff, Inc. † | | | 360,314 |

| | | | | |

| | | | | 1,455,122 |

| | | | | |

| | Consumer Staples – 2.05% | | | |

| 26,700 | | Chiquita Brands International, Inc. † | | | 405,039 |

| | | | | |

| | Energy – 5.91% | | | |

| 80,300 | | CE Franklin, Ltd. † | | | 805,409 |

| 13,355 | | International Coal Group, Inc. † | | | 174,283 |

| 4,075 | | PetroHawk Energy Corp. † | | | 188,713 |

| | | | | |

| | | | | 1,168,405 |

| | | | | |

| | Financials – 7.65% | | | |

| 47,895 | | Citizens First Bancorp, Inc. | | | 287,370 |

| 37,665 | | Eastern Insurance Holdings, Inc. | | | 587,574 |

| 15,020 | | Hanover Insurance Group, Inc. | | | 638,350 |

| | | | | |

| | | | | 1,513,294 |

| | | | | |

| | Health Care – 13.88% | | | |

| 8,970 | | Analogic Corp. | | | 565,738 |

| 223,576 | | Ariad Pharmaceuticals, Inc. † | | | 536,582 |

| 180,990 | | Durect Corp. † | | | 664,233 |

| 393,195 | | Novavax, Inc. † | | | 979,056 |

| | | | | |

| | | | | 2,745,609 |

| | | | | |

| | Materials & Processing – 35.42% | | | |

| 21,125 | | AM Castle & Co. | | | 604,386 |

| 9,125 | | Ampco-Pittsburgh Corp. | | | 405,880 |

| 52,650 | | Beacon Roofing Supply, Inc. † | | | 558,616 |

| 117,600 | | Chemtura Corp. | | | 686,784 |

| 110,337 | | ICO, Inc. † | | | 664,229 |

| 426,750 | | Industrial Enterprises of America, Inc. † | | | 34,140 |

| 100,560 | | Material Sciences Corp. † | | | 814,536 |

| 28,325 | | MFRI, Inc. † | | | 427,708 |

| 56,550 | | Novagold Resources, Inc. † | | | 421,297 |

The accompanying notes are an integral part of the financial statements.

6

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

PORTFOLIOOF INVESTMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

| | | | | | |

| Shares | | Security | | Market

Value | |

| | Materials & Processing (Continued) | | | | |

| 27,500 | | Olin Corp. | | $ | 719,950 | |

| 174,045 | | Omnova Solutions, Inc. † | | | 483,845 | |

| 126,895 | | PolyOne Corp. † | | | 884,458 | |

| 38,750 | | Wausau-Mosinee Paper Corp. | | | 298,762 | |

| | | | | | |

| | | | | 7,004,591 | |

| | | | | | |

| | Producer Durables – 14.99% | | | | |

| 149,625 | | Allied Defense Group, Inc. † | | | 834,908 | |

| 259,300 | | Magnetek, Inc. † | | | 1,096,839 | |

| 299,475 | | Proliance International, Inc. † | | | 284,501 | |

| 58,975 | | Williams Controls, Inc. † | | | 747,213 | |

| | | | | | |

| | | | | 2,963,461 | |

| | | | | | |

| | Technology – 8.07% | | | | |

| 152,334 | | ActivIdentity Corp. † | | | 415,872 | |

| 442,230 | | InFocus Corp. † | | | 663,345 | |

| 507,381 | | SoftBrands, Inc. † | | | 517,529 | |

| | | | | | |

| | | | | 1,596,746 | |

| | | | | | |

| | Total Common Stock

(Cost $20,365,677) | | | 18,852,267 | |

| | | | | | |

| | Short-Term Investment – 4.69% | | | | |

| | Money Market Fund – 4.69% | | | | |

| 928,571 | | Fifth Third Institutional Money Market, 2.49%

(Cost $928,571) | | | 928,571 | |

| | | | | | |

| | Total Investments

(Cost $21,294,248)* – 100.02% | | $ | 19,780,838 | |

| | Other Assets Net of Liabilities – (0.02)% | | | (4,238 | ) |

| | | | | | |

| | NET ASSETS – 100.00% | | $ | 19,776,600 | |

| | | | | | |

| † | Non–income producing security. |

| ADR | American Depositary Receipt. |

| plc | Public Limited Company. |

| * | Cost for Federal income tax purposes is substantially the same as for financial statement purposes and net unrealized appreciation (depreciation) consists of: |

| | | | |

Gross Unrealized Appreciation | | $ | 3,594,629 | |

Gross Unrealized Depreciation | | | (5,108,039 | ) |

| | | | |

Net Unrealized Appreciation (Depreciation) | | $ | (1,513,410 | ) |

| | | | |

The accompanying notes are an integral part of the financial statements.

7

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

PORTFOLIOOF INVESTMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“SFAS 157”.) This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements. SFAS 157 applies to fair value measurements already required or permitted by existing standards. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The changes to current GAAP from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements.

One key component of the implementation of SFAS 157 includes the development of a three-tier fair value hierarchy. The basis of the tiers is dependant upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | | | |

| Level 1 | | – | | quoted prices in active markets for identical assets |

| | |

| Level 2 | | – | | other significant observable inputs (including quoted prices of similar securities, interest rates, prepayments speeds, credit risk, etc.) |

| | |

| Level 3 | | – | | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The accompanying notes are an integral part of the financial statements.

8

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

PORTFOLIOOF INVESTMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

The following is a summary of the inputs used to value the Fund’s net assets as of June 30, 2008:

| | | |

Valuation Inputs | | Investments

in Securities |

Level 1 – Quoted Prices | | $ | 19,780,838 |

Level 2 – Other Significant Observable Inputs | | $ | 0 |

Level 3 – Significant Unobservable Inputs | | $ | 0 |

Total Investments | | $ | 19,780,838 |

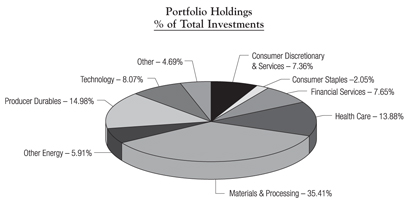

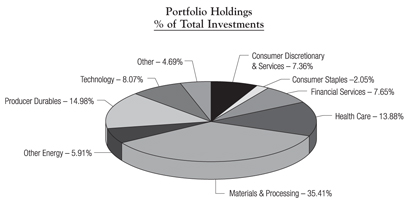

Portfolio Holdings

% of Total Investments

The accompanying notes are an integral part of the financial statements.

9

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTOF ASSETSAND LIABILITIES

JUNE 30, 2008 – (Unaudited)

| | | | |

ASSETS: | | | | |

Investments in securities at market value (cost $21,294,248) | | $ | 19,780,838 | |

Receivable for securities sold | | | 198,802 | |

Receivable for Fund shares sold | | | 172 | |

Interest and dividends receivable | | | 3,076 | |

Prepaid expenses | | | 26,292 | |

| | | | |

TOTAL ASSETS | | | 20,009,180 | |

| | | | |

LIABILITIES: | | | | |

Payable for securities purchased | | | 139,773 | |

Due to custodian | | | 15,239 | |

Payable for Fund shares redeemed | | | 14,190 | |

Other accrued expenses | | | 63,378 | |

| | | | |

TOTAL LIABILITIES | | | 232,580 | |

| | | | |

NET ASSETS | | $ | 19,776,600 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | | 20,427,159 | |

Accumulated net investment income (loss) | | | (162,547 | ) |

Accumulated net realized gain (loss) on investments | | | 1,025,398 | |

Net unrealized appreciation (depreciation) of investments | | | (1,513,410 | ) |

| | | | |

NET ASSETS | | $ | 19,776,600 | |

| | | | |

Investment Class Shares: | | | | |

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 2,290,725 shares outstanding) | | $ | 17,680,396 | |

| | | | |

Net asset value, offering and redemption price per Investment Class Share | | $ | 7.72 | |

| | | | |

Institutional Class Shares: | | | | |

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 255,568 shares outstanding) | | $ | 2,096,204 | |

| | | | |

Net asset value, offering and redemption price per Institutional Class Share | | $ | 8.20 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

10

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTOF OPERATIONS

| | | | |

| | | Six Months

Ended

June 30, 2008

(Unaudited) | |

INVESTMENT INCOME | | | | |

Dividends | | $ | 59,764 | |

Interest | | | 1,751 | |

| | | | |

TOTAL INCOME | | | 61,515 | |

| | | | |

EXPENSES | | | | |

Investment advisory fees | | | 116,299 | |

Administration fees | | | 13,247 | |

Transfer agent fees | | | | |

Investment Class Shares | | | 19,117 | |

Institutional Class Shares | | | 9,146 | |

Distribution fees | | | | |

Investment Class Shares | | | 26,353 | |

Accounting fees | | | 23,399 | |

Custodian fees | | | 2,998 | |

Professional fees | | | 116,317 | |

Registration fees | | | 16,644 | |

Trustees’ fees and expenses | | | 11,823 | |

Compliance services fees | | | 41,869 | |

Miscellaneous fees | | | 16,133 | |

| | | | |

TOTAL EXPENSES | | | 413,345 | |

Fees waived and expenses reimbursed | | | (189,283 | ) |

| | | | |

NET EXPENSES | | | 224,062 | |

| | | | |

NET INVESTMENT INCOME (LOSS) | | | (162,547 | ) |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

Net realized gain (loss) on investments | | | 1,552,555 | |

Net change in unrealized appreciation (depreciation) of investments | | | (4,612,638 | ) |

| | | | |

Net realized and unrealized gain (loss) on investments | | | (3,060,083 | ) |

| | | | |

INCREASE (DECREASE) IN NET ASSETS | | | | |

RESULTING FROM OPERATIONS | | $ | (3,222,630 | ) |

| | | | |

The accompanying notes are an integral part of the financial statements.

11

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTSOF CHANGESIN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

June 30, 2008

(Unaudited) | | | Year Ended

December 31, 2007 | |

OPERATIONS | | | | | | | | |

Net investment income (loss) | | $ | (162,547 | ) | | $ | (578,834 | ) |

Net realized gain (loss) on investments | | | 1,552,555 | | | | 7,806,603 | |

Net increase from payment by affiliates | | | — | | | | 0 | |

Net change in unrealized appreciation (depreciation) of investments | | | (4,612,638 | ) | | | (11,097,456 | ) |

| | | | | | | | |

Increase (decrease) in net assets resulting from operations | | | (3,222,630 | ) | | | (3,869,687 | ) |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Net realized gains: | | | | | | | | |

Investment Class | | | — | | | | (6,967,854 | ) |

Institutional Class | | | — | | | | (587,620 | ) |

| | | | | | | | |

Return of Capital: | | | | | | | | |

Investment Class | | | — | | | | (581,225 | ) |

Institutional Class | | | — | | | | (49,017 | ) |

| | | | | | | | |

Total distributions to shareholders | | | — | | | | (8,185,716 | ) |

| | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares subscribed: | | | | | | | | |

Investment Class | | | 632,841 | | | | 5,288,446 | |

Institutional Class | | | 347,024 | | | | 101,241 | |

Reinvestment of distributions: | | | | | | | | |

Investment Class | | | — | | | | 7,369,864 | |

Institutional Class | | | — | | | | 630,855 | |

Redemption of shares: | | | | | | | | |

Investment Class | | | (5,145,793 | ) | | | (22,655,469 | ) |

Institutional Class | | | (150,676 | ) | | | (1,120,793 | ) |

Redemption fees: | | | | | | | | |

Investment Class | | | 1,927 | | | | 850 | |

Institutional Class | | | 44 | | | | — | |

| | | | | | | | |

Increase (Decrease) in net assets from capital share transactions (a) | | | (4,314,633 | ) | | | (10,385,006 | ) |

| | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (7,537,263 | ) | | | (22,440,409 | ) |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

12

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTSOF CHANGESIN NET ASSETS – (Continued)

| | | | | | | | |

| | | Six Months Ended

June 30, 2008

(Unaudited) | | | Year Ended

December 31, 2007 | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 27,313,863 | | | | 49,754,272 | |

| | | | | | | | |

End of period (including accumulated net investment loss of $(162,547) and $0, respectively) | | $ | 19,776,600 | | | $ | 27,313,863 | |

| | | | | | | | |

(a) Transactions in capital stock were: | | | | | | | | |

Investment Class | | | | | | | | |

Shares sold | | | 75,002 | | | | 407,543 | |

Reinvestment of distributions | | | — | | | | 780,706 | |

Shares redeemed | | | (629,263 | ) | | | (1,776,996 | ) |

| | | | | | | | |

Increase (Decrease) in shares outstanding | | | (554,261 | ) | | | (588,747 | ) |

| | | | | | | | |

Institutional Class | | | | | | | | |

Shares sold | | | 39,495 | | | | 8,759 | |

Reinvestment of distributions | | | — | | | | 63,022 | |

Shares redeemed | | | (17,265 | ) | | | (92,669 | ) |

| | | | | | | | |

Increase (Decrease) in shares outstanding | | | 22,230 | | | | (20,888 | ) |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

13

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each year or period indicated.

| | | | | | | | |

Investment Class | | Six Months Ended

June 30, 2008

(Unaudited) | | | Year Ended

December 31, 2007 | |

Net Asset Value, Beginning of Period | | $ | 8.83 | | | $ | 13.45 | |

| | | | | | | | |

Increase (decrease) from investment operations: | | | | | | | | |

Net investment loss (a) | | | (0.05 | ) | | | (0.19 | ) |

Net realized and unrealized gains (losses) on investments | | | (1.06 | ) | | | (1.27 | ) |

| | | | | | | | |

Net increase (decrease) from investment operations | | | (1.11 | ) | | | (1.46 | ) |

| | | | | | | | |

Less distributions from: | | | | | | | | |

Net realized gains | | | — | | | | (2.92 | ) |

Return of capital | | | — | | | | (0.24 | ) |

| | | | | | | | |

Total distribution to shareholders | | | — | | | | (3.16 | ) |

| | | | | | | | |

Redemption Fees (a) | | | — | (b) | | | — | (b) |

Net Asset Value, End of Period | | $ | 7.72 | | | $ | 8.83 | |

| | | | | | | | |

Total Return (c)(d) | | | (12.57 | )% | | | (12.35 | )% |

Ratios/Supplemental Data | | | | | | | | |

Net assets, end of period (in 000s) | | $ | 17,680 | | | $ | 25,127 | |

Ratio of expenses to average net assets: | | | | | | | | |

Before waivers and/or reimbursements | | | 3.48 | % | | | 2.54 | % |

After waivers and/or reimbursements | | | 1.95 | % | | | 1.95 | % |

Ratio of net investment income (loss) to average net assets (e) | | | (1.42 | )% | | | (1.45 | )% |

Portfolio turnover rate | | | 12.34 | % | | | 42.76 | % |

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.01 per share. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at the end of the period. Total return reflects performance based on net operating expenses. During any period in which fees were waived or expenses reimbursed, total return would have been lower if expenses had not been reduced. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

The accompanying notes are an integral part of the financial statements.

14

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS – (Continued)

| | | | | | | | | | | | | | |

Year Ended December 31, 2006 | | | Year Ended

December 31, 2005 | | | Year Ended

December 31, 2004 | | | Year Ended

December 31, 2003 | |

| $ | 14.26 | | | $ | 16.31 | | | $ | 13.80 | | | $ | 9.76 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | (0.21 | ) | | | (0.23 | ) | | | (0.19 | ) | | | (0.13 | ) |

| | 3.51 | | | | 0.91 | | | | 2.70 | | | | 4.17 | |

| | | | | | | | | | | | | | | |

| | 3.30 | | | | 0.68 | | | | 2.51 | | | | 4.04 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | (4.11 | ) | | | (2.73 | ) | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | |

| | (4.11 | ) | | | (2.73 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | |

| $ | 13.45 | | | $ | 14.26 | | | $ | 16.31 | | | $ | 13.80 | |

| | | | | | | | | | | | | | | |

| | 23.68 | % | | | 4.81 | % | | | 18.12 | % | | | 41.39 | % |

| | | | | | | | | | | | | | |

| $ | 46,187 | | | $ | 50,171 | | | $ | 70,825 | | | $ | 67,983 | |

| | | | | | | | | | | | | | |

| | 2.13 | % | | | 2.04 | % | | | 1.89 | % | | | 1.94 | % |

| | 1.90 | % | | | 1.95 | % | | | 1.86 | % | | | 1.88 | % |

| | (1.35 | )% | | | (1.47 | )% | | | (1.35 | )% | | | (1.26 | )% |

| | 131.30 | % | | | 65.68 | % | | | 90.58 | % | | | 51.70 | % |

The accompanying notes are an integral part of the financial statements.

15

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each year or period indicated.

| | | | | | | | |

Institutional Class | | Six Months Ended

June 30, 2008

(Unaudited) | | | Year Ended

December 31, 2007 | |

Net Asset Value, Beginning of Period | | $ | 9.37 | | | $ | 14.03 | |

| | | | | | | | |

Increase (decrease) from investment operations: | | | | | | | | |

Net investment loss (a) | | | (0.05 | ) | | | (0.17 | ) |

Net realized and unrealized gains (losses) on investments | | | (1.12 | ) | | | (1.33 | ) |

| | | | | | | | |

Net increase (decrease) from investment operations | | | (1.17 | ) | | | (1.50 | ) |

| | | | | | | | |

Less distributions from: | | | | | | | | |

Net realized gains | | | — | | | | (2.92 | ) |

Return of capital | | | — | | | | (0.24 | ) |

| | | | | | | | |

Total distribution to shareholders | | | — | | | | (3.16 | ) |

| | | | | | | | |

Redemption Fees (a) | | | — | (b) | | | — | |

Net Asset Value, End of Period | | $ | 8.20 | | | $ | 9.37 | |

| | | | | | | | |

Total Return (c)(d) | | | (12.49 | )% | | | (12.11 | )% |

Ratios/Supplemental Data | | | | | | | | |

Net assets, end of period (in 000s) | | $ | 2,096 | | | $ | 2,187 | |

Ratio of expenses to average net assets: | | | | | | | | |

Before waivers and/or reimbursements | | | 4.22 | % | | | 2.68 | % |

After waivers and/or reimbursements | | | 1.70 | % | | | 1.70 | % |

Ratio of net investment income (loss) to average net assets (e) | | | (1.17 | )% | | | (1.20 | )% |

Portfolio turnover rate | | | 12.34 | % | | | 42.76 | % |

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.01 per share. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at the end of the period. Total return reflects performance based on net operating expenses. During any period in which fees were waived or expenses reimbursed, total return would have been lower if expenses had not been reduced. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

The accompanying notes are an integral part of the financial statements.

16

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS – (Continued)

| | | | | | | | | | | | | | |

Year Ended

December 31, 2006 | | | Year Ended

December 31, 2005 | | | Year Ended

December 31, 2004 | | | Year Ended

December 31, 2003 | |

| $ | 14.68 | | | $ | 16.63 | | | $ | 14.03 | | | $ | 9.89 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | (0.18 | ) | | | (0.20 | ) | | | (0.16 | ) | | | (0.10 | ) |

| | 3.64 | | | | 0.98 | | | | 2.76 | | | | 4.24 | |

| | | | | | | | | | | | | | | |

| | 3.46 | | | | 0.78 | | | | 2.60 | | | | 4.14 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | (4.11 | ) | | | (2.73 | ) | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | |

| | (4.11 | ) | | | (2.73 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | |

| $ | 14.03 | | | $ | 14.68 | | | $ | 16.63 | | | $ | 14.03 | |

| | | | | | | | | | | | | | | |

| | 24.09 | % | | | 5.31 | % | | | 18.46 | % | | | 41.86 | % |

| | | | | | | | | | | | | | |

| $ | 3,568 | | | $ | 11,576 | | | $ | 15,193 | | | $ | 18,253 | |

| | | | | | | | | | | | | | |

| | 2.27 | % | | | 1.81 | % | | | 1.63 | % | | | 1.61 | % |

| | 1.69 | % | | | 1.70 | % | | | 1.61 | % | | | 1.55 | % |

| | (1.15 | )% | | | (1.24 | )% | | | (1.10 | )% | | | (0.93 | )% |

| | 131.30 | % | | | 65.68 | % | | | 90.58 | % | | | 51.70 | % |

The accompanying notes are an integral part of the financial statements.

17

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

JUNE 30, 2008 – (Unaudited)

Note 1 – Organization

Ironwood Isabelle Small Company Stock Fund (formerly known as ICM/Isabelle Small Cap Value Fund) (the “Fund”) is a series of the Ironwood Series Trust (formerly known as ICM Series Trust) (the “Trust”), which was organized as a Massachusetts business trust pursuant to a Declaration of Trust dated November 18, 1997. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund offers two classes of shares, Investment Shares and Institutional Shares (collectively, the “Shares”), each of which has equal rights as to class and voting privileges. The Investment Shares have exclusive voting rights with respect to its distribution plan pursuant to Rule 12b-1 under the 1940 Act (“12b-1 Plan”) and are subject to 12b-1 Plan expenses. The Fund commenced operations on March 9, 1998 (March 27, 1998 for the institutional Shares). The investment objective of the Fund is to seek capital appreciation by investing its assets primarily in relatively undervalued common stocks of domestic small companies.

Note 2 – Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“generally accepted accounting principles”).

Security Valuation. Exchange traded securities and over-the-counter securities listed on the NASDAQ National Market System for which market quotations are readily available are valued using the last reported sales price or the NASDAQ Official Closing Price (“NOCP”), provided by independent pricing services as of the close of trading on the New York Stock Exchange on each Fund business day. In the absence of a sale or NOCP, such securities are valued at the mean of the last bid and asked price. Non-exchange traded securities for which quotations are available are generally valued at the mean between the current bid and asked prices. Money market instruments that mature in sixty days or less may be valued at amortized cost.

18

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

The Fund values securities at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the “Board”) if (1) market quotations are insufficient or not readily available; or (2) the Adviser believes that the prices or values available are unreliable. Fair valuation is based on subjective factors and as a result, the fair value price of an asset may differ from the asset’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different net asset value (“NAV”) than a NAV determined by using market quotes.

Investment Income and Securities Transactions. Securities transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are based on the identified cost basis for both financial statement and federal income tax purposes. Dividend income is accrued and recorded on the ex-dividend date. Interest income and expenses are accrued daily.

Federal Income Taxes. The Trust intends to continue to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its net investment income and capital gains to shareholders. Accordingly no federal income tax provision is required.

The Fund adopted Financial Accounting Standards Board (“FASB”) Interpretation No. 48, Accounting for Uncertainty in Income Taxes – an interpretation of FAS 109 (“FIN 48”) on January 1, 2007. FIN 48 prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return, and requires certain expanded disclosures. Management concluded that as of December 31, 2007, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund’s Federal tax returns filed in the three-year period ended December 31, 2007 remains subject to examination by the Internal Revenue Service.

19

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

Income and Expenses. Expenses directly attributable to a particular class are charged directly to such class. In calculating net asset value per share of each class, investment income, realized and unrealized gains and losses and expenses, other than class specific expenses, are allocated daily to each class of shares based on the proportion of net assets of each class at the beginning of that day.

Repurchase Agreements. The Fund may invest in repurchase agreements. The Fund will require the financial institution with which the Fund enters into a repurchase agreement to maintain collateral at all times with a value equal to the amount the Fund paid for the securities. In the event of default, the Fund may have difficulties with the disposition of any securities held as collateral.

Redemption Fees. A shareholder who redeems or exchanges shares within 30 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Distributions to Shareholders. Distributions to shareholders from net investment income and net capital gain if any, are declared and paid at least annually. The amount of distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. The differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund timing differences and differing characterizations of distributions made by the fund.

Use of Estimates. In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

20

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

New Accounting Pronouncements. In March 2008, Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“SFAS 161”), was issued and is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. SFAS 161 requires enhanced disclosures about the Fund’s use of and accounting for derivative instruments and the effect of derivative instruments on the Fund’s results of operations and financial position. Management is currently evaluating the impact the adoption of SFAS 161 will have on the Fund’s financial statement disclosures.

Note 3 – Purchases and Sales of Securities

Purchases and sales of securities, other than short-term investments, aggregated $2,822,819 and $8,115,837, respectively, for the six months ended June 30, 2008.

Note 4 – Advisory Fees, Servicing Fees, and Other Transactions with Related Parties

Investment Adviser – Ironwood Investment Management, LLC (formerly known as Ironwood Capital Management, LLC) (“Ironwood”) serves as the investment adviser for the Fund pursuant to an investment advisory agreement (the “Agreement”). Under the terms of the Agreement, Ironwood receives an investment advisory fee from the Fund, accrued daily and paid monthly, at an annual rate of 1.00% of the average daily net assets of the Fund. Pursuant to the terms of the Agreement, Ironwood is obligated for as long as the Agreement remains in effect, to limit total annual Fund operating expenses to 1.95% of the average daily net assets annually for the Investment Shares and 1.70% of the average daily net assets annually for the Institutional Shares, and to waive such fees and reimburse expenses to the extent that they exceed these amounts. For the six months ended June 30, 2008, advisory fees of $184,090 were waived by Ironwood.

21

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

Distributor – Foreside Fund Services, LLC is the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (“Atlantic”).

The Fund has adopted a 12b-1 Plan with the respect to the Investment Shares in accordance with Rule 12-1 of the 1940 Act. Under the 12b-1 Plan, the Fund compensates the Distributor, at a rate of up to 0.25% of average daily net assets of the Investment Shares for distribution expenses borne or paid to others, by the Distributor.

Other Service Providers – As of June 2, 2008, as to fund accounting and fund administration, and on June 16, 2008, as to transfer agency, Atlantic provides those services to the Fund.

Atlantic provides a Principal Financial Officer/Treasurer, Chief Compliance Officer, and an Anti-Money Laundering Compliance Officer to the Fund, as well as certain additional compliance support functions.

For the period January 1, 2008 through June 1, 2008, Foreside Compliance Services, LLC (“FCS”), an affiliate of the Distributor, provided a Chief Compliance Officer and Anti-Money Laundering Officer as well as certain additional compliance support functions to the Fund. Foreside Management Services, LLC (“FMS”), another affiliate of the Distributor, previously provided a Principal Financial Officer/Treasurer to the Fund. Neither FCS nor FMS had a role in determining the investment policies or which securities were to be purchased or sold by the Fund.

In addition, the Fund enters into separate service and operating agreements with financial intermediaries whereby the intermediaries make shares of the Fund available and provide account level services to their clients in exchange for a servicing fee. A portion of the fees paid to the intermediaries are included in transfer agent fees on the Statement of Operations. For the period ended June 30, 2008, Bank of New York Securities (“BONY Securities”) reimbursement accruals of $5,010 were received by the Fund due to the Fund’s direction of portfolio transactions to BONY Securities during the period.

22

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

The custodian, Fifth Third Bank (the “Custodian”), has agreed to compensate the Fund and decrease custody fees for interest on any cash balances left uninvested. For the six months ended June 30, 2008, the Fund was reimbursed expenses of $183 by the Custodian.

No Trustee, officer or employee of Ironwood, the Distributor, or Atlantic, or any affiliate thereof, receives any compensation from the Trust for serving as a Trustee or officer of the Trust. Disinterested trustees received $11,823 in compensation from the Trust during the six months ended June 30, 2008.

Note 5 – Line of Credit

The Fund has entered into a line of credit agreement with the Custodian to be used for temporary purposes, primarily for financing redemptions. The agreement provides that the Fund may borrow up to $5,000,000. The aggregate outstanding principal amount of all loans may not exceed $5,000,000. Interest is charged to the Fund, based on its borrowings, at a rate equal to the rate of interest on overnight facilities which the Custodian is offering to other borrowers and potential borrowers of comparable financial condition on the business day that a loan is made pursuant to the agreement.

During the period ended June 30, 2008, the Fund accrued $520 of interest expense from borrowings under the line of credit.

During the period ended June 30, 2008, the average borrowing was $140,962 and the average interest rate was 4.23%. As of June 30, 2008, the Fund had no loans outstanding under the line of credit.

Note 6 – Payments by Affiliate

For the year ended December 31, 2007, Ironwood reimbursed the Fund $7,972 for the realized loss on an investment that did not meet the investment guidelines of the Fund. The realized loss on this investment was $7,972. The reimbursement and realized loss are netted and the net amount is reflected on the Statement of Changes in Net Assets. The reimbursement had no effect on the total return of the Fund.

23

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

JUNE 30, 2008 – (Unaudited), (Continued)

Note 7 – Other Information

On June 30, 2008, two shareholders held approximately 47% of the outstanding shares of the Fund’s Investment Shares. These shareholders are omnibus accounts, which are held on behalf of several individual shareholders. As of the same date, four shareholders held approximately 86% of the outstanding shares of the Fund’s Institutional Shares. One of these shareholders is an omnibus account, which is held on behalf of several individual shareholders.

Note 8 – Federal Tax Information and Investment Transactions

As of December 31, 2007, distributable earnings (accumulated loss) on a tax basis were as follows:

| | | | |

Unrealized Appreciation (Depreciation) | | $ | 2,621,490 | |

Capital and Other Losses | | | (49,419 | ) |

| | | | |

Total | | $ | 2,572,071 | |

| | | | |

24

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

JUNE 30, 2008 – (Unaudited)

Investment Advisory Contract Approval

On February 15, 2008, Warren Isabelle, a Managing Director of Ironwood and the portfolio manager of the Fund, and Donald Collins, a Managing Director and portfolio manager of Ironwood, entered into an agreement (the “Transaction Agreement”) with Ironwood’s corporate parent and sole owner, MB Investment Partners & Associates, LLC (“MBIPA”), for the purchase of a majority interest in Ironwood from MBIPA (the “Transaction”). The Transaction closed on April 30, 2008. The Transaction substantially unwound the acquisition of all of the equity interests in Ironwood by MBIPA that occurred in January 2006, returning Ironwood to direct majority employee equity ownership.

The consummation of the Transaction resulted in a change in control of Ironwood and an assignment and automatic termination of the Agreement between Ironwood and the Trust pursuant to the terms of that Agreement. Meetings of the Trust’s Board of Trustees were called to consider appropriate action for the Fund, including consideration of an Interim Investment Advisory Agreement between the Trust and Ironwood (the “Interim Agreement”) to become effective upon the closing of the Transaction, a form of new investment advisory agreement (the “New Agreement”) between the Trust and Ironwood, and preparations for a meeting of the Fund’s shareholders to consider the New Agreement.

In determining whether to approve the Interim and New Agreements, the Board, including the Independent Trustees, considered various materials and representations provided by Ironwood and met with senior representatives of Ironwood. The Independent Trustees were advised by independent legal counsel throughout this process. The Board met on March 18, 2008 and May 30, 2008 to review and consider, among other things, information relating to the Transaction, the Interim and New Agreements and the related proxy materials.

In preparing for the meetings, the Board was provided with a variety of information about the Transaction and Ironwood. The Board received a summary of the Transaction Agreement, the Agreement, the Interim Agreement and the New Agreement. The Board also reviewed

25

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

JUNE 30, 2008 – (Unaudited), (Continued)

information concerning (1) Ironwood’s organizational structure and proposed organizational structure and senior personnel; (2) Ironwood’s operations; and (3) the personnel, operations and financial condition, and investment management capabilities, methodologies, and the performance of Ironwood as manager to the Fund. At the meetings, the Board was informed of the benefits Ironwood believed were likely to accrue to Ironwood and to the Fund and discussed, in general terms, Ironwood’s business plans for the organization. Ironwood informed the Board that the Transaction would not change the manner in which investment advisory services are provided to the Fund, the personnel responsible for providing such services or the advisory fee to be paid by the Fund for such services.

In addition to the above information and representations, the Board addressed each of the following overall factors: (1) the nature, extent and quality of the services provided to the Fund, including information on both the short-term and long-term investment performance of the Fund and comparisons to a relevant peer group of funds and an appropriate index; (2) the investment performance of the Fund and Ironwood relative to the Fund; (3) the advisory fees charged and total expense ratios of the Fund compared to a relevant peer group of funds; (4) Ironwood’s financial condition and the anticipated profitability to Ironwood with respect to its relationship with the Fund; (5) the extent to which economies of scale would be realized as the Fund grows; and (6) other benefits that, following the Transaction, may flow to Ironwood and its affiliates from their relationship with the Fund. Additionally, the Board took into consideration Ironwood’s representations and assurances to the effect that: (1) the duties and responsibilities of Ironwood will not be diminished relative to those set forth in the Former Agreement; (2) the personnel primarily responsible for providing investment and management services to the Fund will not change as a result of the Transaction; (3) the level and quality of advisory services provided to the Trust will not be adversely affected as a result of the Transaction or implementation of the Interim Agreement or the New Agreement; (4) the investment advisory fee to be paid by the Fund under the New Agreement will remain unchanged; and (5) the resources that would be available to Ironwood as a result of its continued affiliation with MBIPA will support Ironwood’s continuing efforts to increase assets and, as a result, reduce Fund expenses.

26

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

JUNE 30, 2008 – (Unaudited), (Continued)

With respect to facts and circumstances of the Transaction, and based on its review of materials and information provided to it by Ironwood, the Board determined to approve the Interim and New Agreements as being in the best interests of the Fund and its shareholders, and consistent with the expectations of the Fund’s shareholders. In so approving the New Agreement, the Board deemed the continuity in the identity of the Fund’s officers and the Fund’s principal portfolio managers as well as the continued access to business and financial resources of MBIPA to be of substantial importance but did not otherwise identify any single factor as controlling or of significantly more importance than any other. Accordingly, the Trustees, including the Independent Trustees, voted to approve the Interim Agreement and the New Agreement for the Fund and to submit the New Agreement to shareholders for approval.

If the shareholders of the Fund should fail to approve the New Agreement, the Board shall meet to consider appropriate action for the Fund, consistent with its fiduciary duties to the Fund. Such actions may include obtaining for the Fund interim investment advisory services at cost or at the current fee rate either from Ironwood or from another advisory organization. Thereafter, the Board would either negotiate a new investment advisory agreement with an advisory organization selected by the Board or make other appropriate arrangements.

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (800) 472-6114 and on the SEC’s website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30, is available without charge and upon request, by calling (800) 472-6114, on the Fund’s website www.ironwoodfunds.com and on the SEC’s website at www.sec.gov.

27

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

JUNE 30, 2008 – (Unaudited), (Continued)

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available, without charge and upon request, on the SEC’s website at www.sec.gov. or may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (202) 551-8090.

Shareholder Expenses

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution fees with respect to Investment Shares and other Fund expenses. This example is intended to help you understand these ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on $1,000 invested at the beginning of the year and held for the entire period from January 1, 2008 through June 30, 2008.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

28

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

JUNE 30, 2008 – (Unaudited), (Continued)

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

| | | | | | | | | |

| | | Beginning

Account Value

January 1, 2008 | | Ending

Account Value

June 30, 2008 | | Expenses

Paid During

Year* |

Investment Shares | | | | | | | | | |

Actual Return | | $ | 1,000.00 | | $ | 874.29 | | $ | 9.09 |

Hypothetical Return | | $ | 1,000.00 | | $ | 1,015.17 | | $ | 9.77 |

Institutional Shares | | | | | | | | | |

Actual Return | | $ | 1,000.00 | | $ | 875.14 | | $ | 7.93 |

Hypothetical Return | | $ | 1,000.00 | | $ | 1,016.41 | | $ | 8.52 |

| * | Expenses are equal to the Fund’s annualized expense ratios of 1.95% and 1.70% for Investment Shares and Institutional Shares, respectively, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year/366 (to reflect the half-year period). |

29

IRONWOOD INVESTMENT MANAGEMENT, LLC

AND IRONWOOD FUNDS

The Ironwood Tree

is a small, hardy tree, which yields a very useful and solid wood. Patiently,

these trees remain under the forest canopy until taller neighbors fall.

Once given the opportunity, the Ironwood grows quickly

to reach its full potential. We believe this imagery is appropriate

for our firm as well as our investment style.

Ironwood Investment Management, LLC,

the investment manager of the Ironwood Isabelle Small Company

Stock Fund, is an independently managed investment management firm

specializing in investing in small company stocks.

Ironwood Series Trust

P.O. Box 588

Portland, ME 04112

1-800-472-6114

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, ME 04101

www.foresides.com

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees and expenses, experience of its management, and other information.

There are risks associated with investing in funds of this type that invest in stocks of small-sized companies, which tend to be more volatile and less liquid than stocks of larger companies. Past Fund performance is not indicative of future results.

For account information, current performance and prices, call 1-800-472-6114 between the hours of 9:00 a.m. and 5:00 p.m. (Eastern Time), Monday through Friday.

238-SAR-0608

Not applicable.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| | (a) | Included as part of report to stockholders under Item 1. |

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

Not applicable.

| ITEM 11. | CONTROLS AND PROCEDURES |

| | (a) | The registrant’s President and Treasurer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) are effective, based on their evaluation of these disclosure controls and procedures as of a date within 90 days of the filing date of this report. |

| | (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in rule 30a-3(d) under the Act) that occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| | |

| (a)(1) | | Not applicable. |

| |

| (a)(2) | | Certifications pursuant to Rule 30a-2(a) of the Investment Company Act of 1940 as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith). |

| |

| (a)(3) | | Not applicable. |

| |

| (b) | | Certifications pursuant to Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant Ironwood Series Trust

| | |

| By | | /s/ Warren J. Isabelle |

| | Warren J. Isabelle, President |

| |

| Date | | 8/29/08 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By | | /s/ Warren J. Isabelle |

| | Warren J. Isabelle, President |

| |

| Date | | 8/29/08 |

| |

| By | | /s/ Stacey E. Hong |

| | Stacey E. Hong, Treasurer |

| |

| Date | | 8/29/08 |