As filed with the Securities and Exchange Commission on March 11, 2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08507

IRONWOOD SERIES TRUST

P.O. Box 588

Portland, ME 04112

(800) 472-6114

Warren J. Isabelle, President

Suite 240

21 Custom House Street

Boston, MA 02109

(800) 472-6114

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2008 – DECEMBER 31, 2008

| ITEM 1. | REPORT TO STOCKHOLDERS. |

IRONWOOD SERIES TRUST

www.ironwoodfunds.com

IRONWOOD ISABELLE SMALL COMPANY

STOCK FUND

Investment Shares Symbol: IZZYX

Institutional Shares Symbol: IZZIX

Annual Report

December 31, 2008

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

| 1 | ||

| 7 | ||

| 10 | ||

| 11 | ||

| 12 | ||

| 14 | ||

| 18 | ||

| 27 | ||

| 29 | ||

| 32 | ||

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

SHAREHOLDER LETTER

To our loyal shareholders: January 2009

For a longer term perspective, the Fund’s 1 year, 5 year and since inception average annual returns were -51.65%, -8.03% and

-0.53%, respectively. Performance data is for the period ended 12/31/2008, represents past performance and is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Investment shares is 2.14%. However, the Fund’s adviser has contractually agreed to waive a portion of its fees and/or reimburse expenses such that total operating expenses do not exceed 1.95%. Contractual waivers may be changed or eliminated at any time with consent of the Board of Trustees. Shares redeemed within 30 days of purchase will be charged a 2.00% redemption fee. For the most recent month-end performance, please call 800-472-6114.

A year that started off with cautious optimism ended as a near total disaster. 2008 was easily the worst year of performance in the Fund’s history and my career as a portfolio manager. The Fund declined to -51.65%, while over the same period, the Russell 2000 Index (the “Index”) of small capitalization stocks, the Index against which the Fund is bench-marked, fell to -33.79%. Under less severe and tumultuous conditions the degree to which the Fund underperformed would be a great cause for concern. However, the environment became so panicked toward year-end that the rule of emotion rendered every fundamental consideration temporarily (we hope) meaningless.

Through the first half of the year the hope was that the economy would ratchet down somewhat and in an orderly fashion: Inventory destocking would be followed again by a pick up in demand, more moderate but still

1

strengthening. While there was evidence that this did in fact happen, several ominous trends had taken hold which would ultimately provide not only the coupe de gras to the economic cycle, but deepen into the worst financial crisis since the great depression of the 1930’s.

Energy prices skyrocketed, with oil briefly surpassing the $140 per barrel mark. By far more importantly, financial institutions began to exhibit signs of distress in that their loan portfolios, particularly those related to mortgage debt, had become vulnerable, the valuation of which could then not be relied upon. By mid-year the estimate was that some $350 billion in write downs of these assets had already occurred.

Still, from January 1, 2008 to June 30, 2008, the Fund’s benchmark had fallen relatively modestly, -9.37%. While the Fund underperformed modestly, down about -12.49% from January 1, 2008 to June 30, 2008, we were modestly encouraged that the damage was under control and a soft landing might be at hand. Nothing could have been further from reality.

The second half saw a rapid acceleration in the decline of the financials, with both Bear Stearns and Lehman Brothers – two of the largest and oldest investment banking firms, ceasing to exist literally overnight. Energy prices collapsed as well, essentially confirming that commodities, too, were fueled by rampant speculation. Concern turned to panic, causing investors to flee stocks and bonds, which had devastating consequences for the Fund’s portfolio.

As we have asserted in the past when the environment is shocked as it was (and to an extent remains), risk is immediately and decisively shunned by investors. As small cap stocks are considered relatively more risky than large caps, they experience the effects first, with liquidity rapidly drying up. This lack of liquidity impacts pricing which impacts performance. Since the Fund’s portfolio was in large part constituted by companies on the small end of the small cap spectrum, the results were all the more pronounced.

2

The situation only got worse as the year progressed to its close. Not only did the environment continue to spiral toward near total collapse with credit markets freezing, government intervention proving ineffective, and economic output rapidly declining, but structural considerations weighed heavily upon portfolio performance. First, at the end of October, mutual funds engaged in massive selling to capture tax losses. Then, individual investors added to the insult, also selling en masse to capture tax losses. Finally, the house cleaning was completed as hedge funds faced heavy redemption pressures for year-end distributions and were forced to liquidate large portions of their holdings. This is where the real damage was done as the Fund saw a fourth quarter loss of -40.42% against -26.12% for the Russell 2000 Index. A terrible result without doubt, but it should be noted that stocks having a market capitalization of $250 million or less fell -43.9% for the quarter and an astounding -68.8% for the year (Source: Furey Research Partners & FactSet).

It is thus clear to us that by year end, emotion prevailed and logic failed. The Fund’s portfolio did well to largely avoid financial and later, energy stocks, but its stable of “very small” small cap stocks was simply abandoned by instantly risk averse investors and buffeted about by forced market conditions.

3

While performance was unacceptable at best, throughout the tumult, Ironwood has maintained its investment process and discipline in accordance with our stated investment philosophy.

| Respectfully Submitted, |

|

| Warren J. Isabelle |

| Portfolio Manager |

On December 30, 2008, the Board of Trustees of the Ironwood Series Trust (the “Trust”) and the Ironwood Isabelle Small Company Stock Fund (the “Fund”) approved the liquidation of the Fund and the termination of the Trust. The Fund will cease operations on or about February 27, 2009.

Investments in smaller companies carry greater risk than is customarily associated with larger companies for various reasons such as narrower product lines, limited financial resources, and less depth in management.

Returns for other share classes will vary. Total return figures include the reinvestment of dividends and capital gains. Moreover, some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Russell 2000 Index is an unmanaged, market value weighted index, which measures performance of those companies that are between the 1,000th and 3,000th largest in the market. One cannot invest directly in an index.

This letter must be preceded or accompanied by a Fund prospectus. Foreside Fund Services, LLC, distributor.

The views in this letter were those of the Fund manager as of December 31, 2008, and may not necessary reflect his views on the date this letter is first published or anytime thereafter. These views (i) are intended to assist shareholders in understanding the Fund’s present investment methodology and (ii) do not constitute investment advice.

4

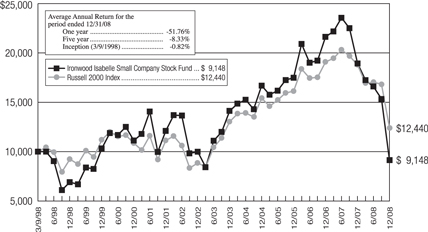

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

INVESTMENT CLASS

ILLUSTRATIONOF $10,000 INVESTMENT

The graph below reflects the change in value of a hypothetical $10,000 investment in the Ironwood Isabelle Small Company Stock Fund (the “Fund”) Investment Class compared with a broad-based securities market index since the Investment Class’ inception. The Russell 2000 Index is composed of the 2,000 smallest stocks in the Russell 3000 Index, a market weighted index of the 3,000 largest U.S. publicly traded companies. The Fund is professionally managed while the Index is unmanaged and not available for investment.

Performance data quoted represents past performance and is no guarantee of future results.

Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Investment shares is 2.14%. However, the Fund’s adviser has contractually agreed to waive a portion of its fees and/or reimburse expenses such that total operating expenses do not exceed 1.95%. Contractual waivers may be changed or eliminated at any time with the consent of the Board of Trustees. Shares redeemed within 30 days of purchase will be charged a 2.00% redemption fee. For the most recent month end performance, please call (800) 472-6114. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return figures include the reinvestment of dividends and capital gains. Some of the Fund’s fees have been waived or expenses reimbursed; otherwise total return would have been lower.

5

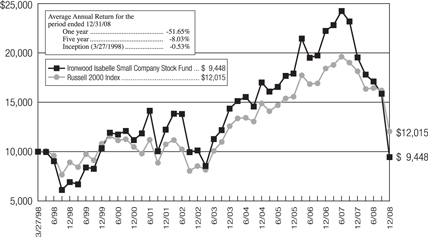

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

INSTITUTIONAL CLASS

ILLUSTRATIONOF $10,000 INVESTMENT

The graph below reflects the change in value of a hypothetical $10,000 investment in the Ironwood Isabelle Small Company Stock Fund (the “Fund”) Institutional Class compared with a broad-based securities market index since the Institutional Class’ inception. The Russell 2000 Index is composed of the 2,000 smallest stocks in the Russell 3000 Index, a market weighted index of the 3,000 largest U.S. publicly traded companies. The Fund is professionally managed while the Index is unmanaged and not available for investment.

Performance data quoted represents past performance and is no guarantee of future results.

Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Institutional shares is 2.28%. However, the Fund’s adviser has contractually agreed to waive a portion of its fees and/or reimburse expenses such that total operating expenses do not exceed 1.70%. Contractual waivers may be changed or eliminated at any time with the consent of the Board of Trustees. Shares redeemed within 30 days of purchase will be charged a 2.00% redemption fee. For the most recent month end performance, please call (800) 472-6114. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return figures include the reinvestment of dividends and capital gains. Some of the Fund’s fees have been waived or expenses reimbursed; otherwise total return would have been lower.

6

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

PORTFOLIOOF INVESTMENTS

DECEMBER 31, 2008

Shares | Security | Market | |||

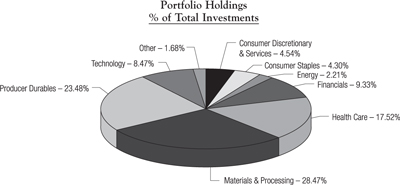

| Common Stock – 97.98% | |||||

| Consumer Discretionary & Services – 4.52% | |||||

| 87,675 | 4Kids Entertainment, Inc. † | $ | 171,843 | ||

| 694,205 | Danka Business Systems PLC, ADR † | 41,652 | |||

| 20,410 | Hooker Furniture Corp. | 156,341 | |||

| 72,774 | Westaff, Inc. † | 46,575 | |||

| 416,411 | |||||

| Consumer Staples – 4.29% | |||||

| 26,700 | Chiquita Brands International, Inc. † | 394,626 | |||

| Energy – 2.20% | |||||

| 80,300 | CE Franklin, Ltd. † | 202,356 | |||

| Financials – 9.30% | |||||

| 35,065 | Eastern Insurance Holdings, Inc. | 281,572 | |||

| 13,370 | Hanover Insurance Group, Inc. | 574,509 | |||

| 856,081 | |||||

| Health Care – 17.46% | |||||

| 8,970 | Analogic Corp. | 244,702 | |||

| 160,576 | Ariad Pharmaceuticals, Inc. † | 136,490 | |||

| 164,640 | Durect Corp. † | 558,130 | |||

| 353,845 | Novavax, Inc. † | 668,767 | |||

| 1,608,089 | |||||

| Materials & Processing – 28.37% | |||||

| 24,005 | AM Castle & Co. | 259,974 | |||

| 9,125 | Ampco-Pittsburgh Corp. | 198,013 | |||

| 209,400 | Chemtura Corp. | 293,160 | |||

| 144,118 | ICO, Inc. † | 455,413 | |||

| 85,176 | Material Sciences Corp. † | 132,023 | |||

| 17,030 | Olin Corp. | 307,902 | |||

| 270,875 | Omnova Solutions, Inc. † | 176,069 | |||

| 126,895 | PolyOne Corp. † | 399,719 | |||

| 34,150 | Wausau Paper Corp. | 390,676 | |||

| 2,612,949 | |||||

The accompanying notes are an integral part of the financial statements.

7

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

PORTFOLIOOF INVESTMENTS

DECEMBER 31, 2008 – (Continued)

Shares | Security | Market | |||

| Producer Durables – 23.40% | |||||

| 102,636 | Allied Defense Group, Inc. † | $ | 636,343 | ||

| 72,000 | CPI Aerostructures, Inc. † | 396,000 | |||

| 232,000 | Magnetek, Inc. † | 556,800 | |||

| 379,846 | Proliance International, Inc. † | 136,744 | |||

| 58,975 | Williams Controls, Inc. † | 429,338 | |||

|

| 2,155,225

| ||||

| Technology – 8.44% | |||||

| 140,242 | ActivIdentity Corp. † | 251,033 | |||

| 442,230 | InFocus Corp. † | 348,919 | |||

| 467,239 | SoftBrands, Inc. † | 17 7,551 | |||

| 777,503 | |||||

| Total Common Stock (Cost $15,500,531) | 9,023,240 | ||||

| Short-Term Investment – 1.68% | |||||

| Money Market Fund – 1.68% | |||||

| 154,486 | Fifth Third Institutional | 154,486 | |||

| Total Investments (Cost $15,655,017)* – 99.66% | $ | 9,177,726 | |||

| Other Assets Net of Liabilities – 0.34% | 30,947 | ||||

| NET ASSETS – 100.00% | $ | 9,208,673 | |||

† | Non-income producing security. | |||

ADR | American Depositary Receipt. | |||

PLC | Public Limited Company. | |||

* | Cost for Federal income tax purposes is $16,062,299 and net unrealized appreciation (depreciation) consists of: | |||

Gross Unrealized Appreciation | $ | 1,095,934 | ||

Gross Unrealized Depreciation | (7,980,507 | ) | ||

Net Unrealized Appreciation (Depreciation) | $ | (6,884,573 | ) | |

The accompanying notes are an integral part of the financial statements.

8

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

PORTFOLIOOF INVESTMENTS

DECEMBER 31, 2008 – (Continued)

The following is a summary of the inputs used to value the Fund’s net assets as of December 31, 2008.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to Note 2 – Security Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs | Investments in Securities | ||

Level 1 – Quoted Prices | $ | 9,023,240 | |

Level 2 – Other Significant Observable Inputs | $ | 154,486 | |

Level 3 – Significant Unobservable Inputs | $ | 0 | |

Total Investments | $ | 9,177,726 | |

The accompanying notes are an integral part of the financial statements.

9

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTOF ASSETSAND LIABILITIES

DECEMBER 31, 2008

ASSETS: | ||||

Investments in securities at market value | $ | 9,177,726 | ||

Receivable from adviser | 62,686 | |||

Receivable for securities sold | 1,528 | |||

Receivable for Fund shares sold | 3,337 | |||

Interest and dividends receivable | 49 | |||

Other receivable | 22,659 | |||

Prepaid expenses | 9,375 | |||

TOTAL ASSETS | 9,277,360 | |||

LIABILITIES: | ||||

Payable for Fund shares redeemed | 18,347 | |||

Payable for compliance services fees | 1,057 | |||

Payable for distribution fees | 1,731 | |||

Other accrued expenses | 47,552 | |||

TOTAL LIABILITIES | 68,687 | |||

NET ASSETS | $ | 9,208,673 | ||

NET ASSETS CONSIST OF: | ||||

Paid-in capital | 17,716,437 | |||

Accumulated net realized gain (loss) on investments | (2,030,473 | ) | ||

Net unrealized appreciation (depreciation) of investments | (6,477,291 | ) | ||

NET ASSETS | $ | 9,208,673 | ||

Investment Class Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial | $ | 8,032,585 | ||

Net asset value, offering and redemption price | $ | 4.26 | ||

Institutional Class Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial | $ | 1,176,088 | ||

Net asset value, offering and redemption price | $ | 4.53 | ||

The accompanying notes are an integral part of the financial statements.

10

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTOF OPERATIONS

| Year Ended December 31, 2008 | ||||

INVESTMENT INCOME | ||||

Dividends | $ | 107,392 | ||

Interest | 1,750 | |||

TOTAL INCOME | 109,142 | |||

EXPENSES | ||||

Investment advisory fees | 192,498 | |||

Administration fees | 29,934 | |||

Transfer agent fees | ||||

Investment Class Shares | 45,671 | |||

Institutional Class Shares | 19,845 | |||

Distribution fees | ||||

Investment Class Shares | 43,222 | |||

Accounting fees | 38,354 | |||

Custodian fees | 4,209 | |||

Professional fees | 202,368 | |||

Registration fees | 33,457 | |||

Trustees’ fees and expenses | 37,228 | |||

Compliance services fees | 65,730 | |||

Miscellaneous fees | 30,853 | |||

TOTAL EXPENSES | 743,369 | |||

Fees waived and expenses reimbursed | (372,900 | ) | ||

NET EXPENSES | 370,469 | |||

NET INVESTMENT INCOME (LOSS) | (261,327 | ) | ||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

Net realized gain (loss) on investments | (1,480,657 | ) | ||

Net change in unrealized appreciation (depreciation) of investments | (9,576,519 | ) | ||

Net realized and unrealized gain (loss) on investments | (11,057,176 | ) | ||

INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $ | (11,318,503 | ) | |

The accompanying notes are an integral part of the financial statements.

11

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTSOF CHANGESIN NET ASSETS

| Year Ended December 31, 2008 | Year Ended December 31, 2007 | |||||||

OPERATIONS | ||||||||

Net investment income (loss) | $ | (261,327 | ) | $ | (578,834 | ) | ||

Net realized gain (loss) on investments | (1,480,657 | ) | 7,806,603 | |||||

Net increase from payment by affiliates | — | 0 | ||||||

Net change in unrealized appreciation (depreciation) of investments | (9,576,519 | ) | (11,097,456 | ) | ||||

Increase (decrease) in net assets resulting from operations | (11,318,503 | ) | (3,869,687 | ) | ||||

DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

Net realized gains: | ||||||||

Investment Class | — | (6,967,854 | ) | |||||

Institutional Class | — | (587,620 | ) | |||||

Return of Capital: | ||||||||

Investment Class | — | (581,225 | ) | |||||

Institutional Class | — | (49,017 | ) | |||||

Total distributions to shareholders | — | (8,185,716 | ) | |||||

CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares subscribed: | ||||||||

Investment Class | 1,188,318 | 5,288,446 | ||||||

Institutional Class | 416,421 | 101,241 | ||||||

Reinvestment of distributions: | ||||||||

Investment Class | — | 7,369,864 | ||||||

Institutional Class | — | 630,855 | ||||||

Redemption of shares: | ||||||||

Investment Class | (8,207,094 | ) | (22,655,469 | ) | ||||

Institutional Class | (186,352 | ) | (1,120,793 | ) | ||||

Redemption fees: | ||||||||

Investment Class | 2,004 | 850 | ||||||

Institutional Class | 16 | — | ||||||

Increase (Decrease) in net assets from capital share transactions (a) | (6,786,687 | ) | (10,385,006 | ) | ||||

TOTAL INCREASE (DECREASE) IN NET ASSETS | (18,105,190 | ) | (22,440,409 | ) | ||||

The accompanying notes are an integral part of the financial statements.

12

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

STATEMENTSOF CHANGESIN NET ASSETS – (Continued)

| Year Ended December 31, 2008 | Year Ended December 31, 2007 | |||||||

NET ASSETS | ||||||||

Beginning of period | 27,313,863 | 49,754,272 | ||||||

End of period (including accumulated net investment loss of $0 and $0, respectively) | $ | 9,208,673 | $ | 27,313,863 | ||||

(a) Transactions in capital stock were: | ||||||||

Investment Class | ||||||||

Shares sold | 154,700 | 407,543 | ||||||

Reinvestment of distributions | — | 780,706 | ||||||

Shares redeemed | (1,112,333 | ) | (1,776,996 | ) | ||||

Increase (Decrease) in shares outstanding | (957,633 | ) | (588,747 | ) | ||||

Institutional Class | ||||||||

Shares sold | 49,943 | 8,759 | ||||||

Reinvestment of distributions | — | 63,022 | ||||||

Shares redeemed | (23,613 | ) | (92,669 | ) | ||||

Increase (Decrease) in shares outstanding | 26,330 | (20,888 | ) | |||||

The accompanying notes are an integral part of the financial statements.

13

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each year or period indicated.

Investment Class | Year Ended December 31, 2008 | Year Ended December 31, 2007 | ||||||

Net Asset Value, Beginning of Period | $ | 8.83 | $ | 13.45 | ||||

Increase (decrease) from investment operations: | ||||||||

Net investment loss (a) | (0.10 | ) | (0.19 | ) | ||||

Net realized and unrealized gains (losses) on investments | (4.47 | ) | (1.27 | ) | ||||

Net increase (decrease) from investment operations | (4.57 | ) | (1.46 | ) | ||||

Less distributions from: | ||||||||

Net realized gains | — | (2.92 | ) | |||||

Return of capital | — | (0.24 | ) | |||||

Total distributions to shareholders | — | (3.16 | ) | |||||

Redemption Fees (a) | — | (b) | — | (b) | ||||

Net Asset Value, End of Period | $ | 4.26 | $ | 8.83 | ||||

Total Return (c) | (51.76 | )% | (12.35 | )% | ||||

Ratios/Supplemental Data | ||||||||

Net assets, end of period (in 000s) | $ | 8,033 | $ | 25,127 | ||||

Ratio of expenses to average net assets: | ||||||||

Before waivers and/or reimbursements | 3.77 | % | 2.54 | % | ||||

After waivers and/or reimbursements | 1.95 | % | 1.95 | % | ||||

Ratio of net investment income (loss) to average net assets | (1.38 | )% | (1.45 | )% | ||||

Portfolio turnover rate | 20.10 | % | 42.76 | % | ||||

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.01 per share. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at the end of the period. Total return reflects performance based on net operating expenses. During any period in which fees were waived or expenses reimbursed, total return would have been lower if expenses had not been reduced. |

The accompanying notes are an integral part of the financial statements.

14

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS – (Continued)

Year Ended | Year Ended December 31, 2005 | Year Ended December 31, 2004 | ||||||||

| $ | 14.26 | $ | 16.31 | $ | 13.80 | |||||

| (0.21 | ) | (0.23 | ) | (0.19 | ) | |||||

| 3.51 | 0.91 | 2.70 | ||||||||

| 3.30 | 0.68 | 2.51 | ||||||||

| (4.11 | ) | (2.73 | ) | |||||||

| — | — | — | ||||||||

| (4.11 | ) | (2.73 | ) | |||||||

| — | — | — | ||||||||

| $ | 13.45 | $ | 14.26 | $ | 16.31 | |||||

| 23.68 | % | 4.81 | % | 18.12 | % | |||||

| $ | 46,187 | $ | 50,171 | $ | 70,825 | |||||

| 2.13 | % | 2.04 | % | 1.89 | % | |||||

| 1.90 | % | 1.95 | % | 1.86 | % | |||||

| (1.35 | )% | (1.47 | )% | (1.35 | )% | |||||

| 131.30 | % | 65.68 | % | 90.58 | % | |||||

The accompanying notes are an integral part of the financial statements.

15

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each year or period indicated.

Institutional Class | Year Ended December 31, 2008 | Year Ended December 31, 2007 | ||||||

Net Asset Value, Beginning of Period | $ | 9.37 | $ | 14.03 | ||||

Increase (decrease) from investment operations: | ||||||||

Net investment loss (a) | (0.09 | ) | (0.17 | ) | ||||

Net realized and unrealized gains (losses) on investments | (4.75 | ) | (1.33 | ) | ||||

Net increase (decrease) from investment operations | (4.84 | ) | (1.50 | ) | ||||

Less distributions from: | ||||||||

Net realized gains | — | (2.92 | ) | |||||

Return of capital | — | (0.24 | ) | |||||

Total distributions to shareholders | — | (3.16 | ) | |||||

Redemption Fees (a) | — | (b) | — | |||||

Net Asset Value, End of Period | $ | 4.53 | $ | 9.37 | ||||

Total Return (c) | (51.65 | )% | (12.11 | )% | ||||

Ratios/Supplemental Data | ||||||||

Net assets, end of period (in 000s) | $ | 1,176 | $ | 2,187 | ||||

Ratio of expenses to average net assets: | ||||||||

Before waivers and/or reimbursements | 4.66 | % | 2.68 | % | ||||

After waivers and/or reimbursements | 1.70 | % | 1.70 | % | ||||

Ratio of net investment income (loss) to average net assets | (1.12 | )% | (1.20 | )% | ||||

Portfolio turnover rate | 20.10 | % | 42.76 | % | ||||

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.01 per share. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at the end of the period. Total return reflects performance based on net operating expenses. During any period in which fees were waived or expenses reimbursed, total return would have been lower if expenses had not been reduced. |

The accompanying notes are an integral part of the financial statements.

16

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FINANCIAL HIGHLIGHTS – (Continued)

Year Ended | Year Ended December 31, 2005 | Year Ended December 31, 2004 | ||||||||

| $ | 14.68 | $ | 16.63 | $ | 14.03 | |||||

| (0.18 | ) | (0.20 | ) | (0.16 | ) | |||||

| 3.64 | 0.98 | 2.76 | ||||||||

| 3.46 | 0.78 | 2.60 | ||||||||

| (4.11 | ) | (2.73 | ) | — | ||||||

| — | — | — | ||||||||

| (4.11 | ) | (2.73 | ) | — | ||||||

| — | — | — | ||||||||

| $ | 14.03 | $ | 14.68 | $ | 16.63 | |||||

| 24.09 | % | 5.31 | % | 18.46 | % | |||||

| $ | 3,568 | $ | 11,576 | $ | 15,193 | |||||

| 2.27 | % | 1.81 | % | 1.63 | % | |||||

| 1.69 | % | 1.70 | % | 1.61 | % | |||||

| (1.15 | )% | (1.24 | )% | (1.10 | )% | |||||

| 131.30% | 65.68 | % | 90.58 | % | ||||||

The accompanying notes are an integral part of the financial statements.

17

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008

Note 1 – Organization

Ironwood Isabelle Small Company Stock Fund (formerly known as ICM/Isabelle Small Cap Value Fund) (the “Fund”) is a series of the Ironwood Series Trust (formerly known as ICM Series Trust) (the “Trust”), which was organized as a Massachusetts business trust pursuant to a Declaration of Trust dated November 18, 1997. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund offers two classes of shares, Investment Shares and Institutional Shares (collectively, the “Shares”), each of which has equal rights as to class and voting privileges. The Investment Shares have exclusive voting rights with respect to its distribution plan pursuant to Rule 12b-1 under the 1940 Act (“12b-1 Plan”) and are subject to 12b-1 Plan expenses. The Fund commenced operations on March 9, 1998 (March 27, 1998 for the Institutional Shares). The investment objective of the Fund is to seek capital appreciation by investing its assets primarily in relatively undervalued common stocks of domestic small companies.

On December 30, 2008, the Board of Trustees approved the liquidation of the fund and the termination of the trust. See Note 9.

Note 2 – Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“generally accepted accounting principles”).

Security Valuation. Exchange traded securities and over-the-counter securities listed on the NASDAQ National Market System for which market quotations are readily available are valued using the last reported sales price or the NASDAQ Official Closing Price (“NOCP”), provided by independent pricing services as of the close of trading on the New York Stock Exchange on each Fund business day. In the absence of a sale or NOCP, such securities are valued at the

18

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

mean of the last bid and asked price. Non-exchange traded securities for which quotations are available are generally valued at the mean between the current bid and asked prices. Money market instruments that mature in sixty days or less may be valued at amortized cost.

The Fund values securities at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the “Board”) if (1) market quotations are insufficient or not readily available; or (2) the adviser believes that the prices or values available are unreliable. Fair valuation is based on subjective factors and as a result, the fair value price of an asset may differ from the asset’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different net asset value (“NAV”) than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependant upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| Level 1 – | quoted prices in active markets for identical assets | |

| Level 2 – | other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.) | |

| Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The aggregate value by input level, as of December 31, 2008, for the Fund’s investments is included at the end of the Fund’s schedule of investments.

Investment Income and Securities Transactions. Securities transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are based on the identified cost basis for both financial statement and federal income tax purposes.

19

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

Dividend income is accrued and recorded on the ex-dividend date. Interest income and expenses are accrued daily.

Federal Income Taxes. The Trust intends to continue to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its net investment income and capital gains to shareholders. Accordingly no federal income tax provision is required.

As of December 31, 2008, there are no uncertain tax positions that would require financial statement recognition,

de-recognition, or disclosure. The Fund’s Federal tax returns filed in the three-year period ended December 31, 2008, remain subject to examination by the Internal Revenue Service.

Income and Expenses. Expenses directly attributable to a particular class are charged directly to such class. In calculating net asset value per share of each class, investment income, realized and unrealized gains and losses and expenses, other than class specific expenses, are allocated daily to each class of shares based on the proportion of net assets of each class at the beginning of that day.

Repurchase Agreements. The Fund may invest in repurchase agreements. The Fund will require the financial institution with which the Fund enters into a repurchase agreement to maintain collateral at all times with a value equal to the amount the Fund paid for the securities. In the event of default, the Fund may have difficulties with the disposition of any securities held as collateral.

Redemption Fees. A shareholder who redeems or exchanges shares within 30 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

20

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

Distributions to Shareholders. Distributions to shareholders from net investment income and net capital gain, if any, are declared and paid at least annually. The amount of distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. The differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund timing differences and differing characterizations of distributions made by the fund.

Use of Estimates. In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncements. In March 2008, Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“SFAS 161”), was issued and is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. SFAS 161 requires enhanced disclosures about the Fund’s use of and accounting for derivative instruments and the effect of derivative instruments on the Fund’s results of operations and financial position. Due to the impending liquidation of the Fund, management does not anticipate that SFAS 161 will impact the Fund.

Note 3 – Purchases and Sales of Securities

Purchases and sales of securities, other than short-term investments, aggregated $3,809,715 and $10,912,009, respectively, for the year ended December 31, 2008.

21

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

Note 4 – Advisory Fees, Servicing Fees, and Other Transactions with Related Parties

Investment Adviser – Ironwood Investment Management, LLC (formerly known as Ironwood Capital Management, LLC) (“Ironwood”) serves as the investment adviser for the Fund pursuant to an investment advisory agreement (the “Agreement”). Under the terms of the Agreement, Ironwood receives an investment advisory fee from the Fund, accrued daily and paid monthly, at an annual rate of 1.00% of the average daily net assets of the Fund. Pursuant to the terms of the Agreement, Ironwood is obligated for as long as the Agreement remains in effect, to limit total annual Fund operating expenses to 1.95% of the average daily net assets annually for the Investment Shares and 1.70% of the average daily net assets annually for the Institutional Shares, and to waive such fees and reimburse expenses to the extent that they exceed these amounts. For the year ended December 31, 2008, Ironwood waived and reimbursed fees of $371,489.

Distributor – Foreside Fund Services, LLC is the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with Ironwood or Atlantic Fund Administration, LLC (“Atlantic”).

The Fund has adopted a 12b-1 Plan with the respect to the Investment Shares in accordance with Rule 12-1 of the 1940 Act. Under the 12b-1 Plan, the Fund compensates the Distributor, at a rate of up to 0.25% of average daily net assets of the Investment Shares for distribution expenses borne or paid to others, by the Distributor.

Other Service Providers – As of June 2, 2008, as to fund accounting and fund administration and on June 16, 2008, as to transfer agency, Atlantic provides those services to the Fund.

Atlantic provides a Principal Financial Officer/Treasurer, Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

22

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

For the period January 1, 2008 through June 1, 2008, as to fund accounting and fund administration and through June 15, 2008, as to transfer agency, Citigroup Fund Services, LLC provided these services to the Fund.

For the period January 1, 2008 through June 1, 2008, Foreside Compliance Services, LLC (“FCS”), an affiliate of the Distributor, provided a Chief Compliance Officer and Anti-Money Laundering Officer as well as certain additional compliance support functions to the Fund. Foreside Management Services, LLC (“FMS”), another affiliate of the Distributor, previously provided a Principal Financial Officer/Treasurer to the Fund. Neither FCS or FMS had a role in determining the investment policies or which securities were to be purchased or sold by the Fund.

In addition, the Fund enters into separate service and operating agreements with financial intermediaries whereby the intermediaries make shares of the Fund available and provide account level services to their clients in exchange for a servicing fee. A portion of the fees paid to the intermediaries are included in transfer agent fees on the Statement of Operations. For the year ended December 31, 2008, Bank of New York Securities (“BONY Securities”) reimbursement accruals of $1,343 were received by the Fund due to the Fund’s direction of portfolio transactions to BONY Securities during the period.

The custodian, Fifth Third Bank (the “Custodian”), has agreed to compensate the Fund and decrease custody fees for interest on any cash balances left uninvested. For the year ended December 31, 2008, the Fund was reimbursed expenses of $68 by the Custodian.

No Trustee, officer or employee of Ironwood, the Distributor, or Atlantic, or any affiliate thereof, receives any compensation from the Trust for serving as a Trustee or officer of the Trust. Disinterested trustees received $37,228 in compensation from the Trust during the year ended December 31, 2008.

23

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

Note 5 – Line of Credit

The Fund has entered into a line of credit agreement with the Custodian to be used for temporary purposes, primarily for financing redemptions. The agreement provides that the Fund may borrow up to $5,000,000. The aggregate outstanding principal amount of all loans may not exceed $5,000,000. Interest is charged to the Fund, based on its borrowings, at a rate equal to the rate of interest on overnight facilities which the Custodian is offering to other borrowers and potential borrowers of comparable financial condition on the business day that a loan is made pursuant to the agreement.

During the year ended December 31, 2008, the Fund accrued $834 of interest expense from borrowings under the line of credit.

During the year ended December 31, 2008, the average borrowing was $132,671 and the average interest rate was 3.39%. As of December 31, 2008, the Fund had no loans outstanding under the line of credit.

Note 6 – Payments by Affiliate

For the year ended December 31, 2007, Ironwood reimbursed the Fund $7,972 for the realized loss on an investment that did not meet the investment guidelines of the Fund. The realized loss on this investment was $7,972. The reimbursement and realized loss are netted and the net amount is reflected on the Statement of Changes in Net Assets. The reimbursement had no effect on the total return of the Fund.

Note 7 – Federal Tax Information and Investment Transactions

Distributions during the fiscal years ended as noted were characterized for tax purposes as follows:

| 2007 | |||

Ordinary Income | $ | 1,065,281 | |

Long-Term Capital Gain | 6,490,193 | ||

Return of Capital | 630,242 | ||

Total | $ | 8,185,716 | |

24

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

As of December 31, 2008, distributable earnings (accumulated loss) on a tax basis were as follows:

Unrealized Appreciation (Depreciation) | $ | (6,884,573 | ) | |

Capital and Other Losses | (1,623,191 | ) | ||

Total | $ | (8,507,764 | ) | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

For tax purposes, the current year post-October loss was $1,448,449. This loss will be recognized for tax purposes on the first business day of the Fund’s next year.

As of December 31, 2008, the Fund has capital loss carryovers to offset future capital gains of $174,742, expiring in 2016.

On the Statement of Assets and Liabilities, as a result of net operating losses and income reclassifications, amounts for the year ended December 31, 2008 have been reclassified from what was previously reported. The reclassification has no impact on the net assets of the Fund.

Accumulated Net Investment Income (Loss) | $ | 261,327 | ||

Undistributed Net Realized Gain (Loss) | (22,659 | ) | ||

Paid-In-Capital | (238,668 | ) |

Note 8 – Other Information

On December 31, 2008, two shareholders held approximately 47% of the outstanding shares of the Fund’s Investment Shares. These shareholders are omnibus accounts, which are held on behalf of several individual shareholders. As of the same date, four shareholders held approximately 86% of the outstanding shares of the Fund’s Institutional Shares. One of these shareholders is an omnibus account, which is held on behalf of several individual shareholders.

25

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

NOTESTO FINANCIAL STATEMENTS

DECEMBER 31, 2008 – (Continued)

Note 9 – Subsequent Event

Pursuant to action taken by the Board of Directors on December 30, 2008, it is expected that the Fund will be liquidated on or about February 27, 2009. Given the limited number of shareholders currently in the Fund and the anticipated growth of the shareholder base, Ironwood does not believe that it can continue to operate the Fund in a cost effective manner. As such, the Board concluded that it would be in the best interest of the Fund and its shareholders to liquidate and terminate the Fund. Following liquidation, the Fund will distribute cash pro rata to all remaining shareholders who have not previously redeemed or exchanged all of their shares. Once the distribution is complete, the Fund will terminate.

26

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

REPORTOF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Shareholders and Board of Trustees

Of the Ironwood Series Trust:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of the Ironwood Isabelle Small Company Stock Fund, a series of the Ironwood Series Trust (the “Fund”), as of December 31, 2008, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the four years in the period then ended. The financial highlights for the year ended December 31, 2004 were audited by another independent registered public accounting firm whose report dated February 17, 2005 expressed an unqualified opinion on those financial highlights. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Fund is not required to have, nor were we engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2008, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

27

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

REPORTOF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Ironwood Isabelle Small Company Stock Fund as of December 31, 2008, the results of its operations for the year then ended, changes in net assets for the two years in the period then ended, and financial highlights for each of the four years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Grant Thornton LLP

Boston, Massachusetts

February 23, 2009

28

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

DECEMBER 31, 2008 – (Unaudited)

Shareholder Proxy Vote

At a special meeting of shareholders, held on September 2, 2008, shares were voted as follows on the proposal presented to shareholders:

| 1. | To approve a new investment advisory agreement between the Fund and Ironwood: |

For | Against | Abstain | ||

1,307,411 | 18,690 | 40,196 |

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (877) 472-6114 and on the SEC’s website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30, is available, without charge and upon request, by calling (800) 472-6114, on the Fund’s website www.ironwoodfunds.com and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on

Form N-Q. The Fund’s Forms N-Q are available, without charge and upon request, on the SEC’s website at www.sec.gov. or may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (202) 551-8090.

29

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

DECEMBER 31, 2008 – (Unaudited), (Continued)

Shareholder Expenses

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution fees with respect to Investment Shares and other Fund expenses. This example is intended to help you understand these ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on $1,000 invested at the beginning of the year and held for the entire period from July 1, 2008 through December 31,2008.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

30

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

ADDITIONAL INFORMATION

DECEMBER 31, 2008 – (Unaudited), (Continued)

| Beginning Account Value July 1, 2008 | Ending Account Value December 31, 2008 | Expenses Paid During Year* | |||||||

Investment Shares | |||||||||

Actual Return | $ | 1,000.00 | $ | 551.81 | $ | 7.61 | |||

Hypothetical Return | $ | 1,000.00 | $ | 1,015.33 | $ | 9.88 | |||

Institutional Shares | |||||||||

Actual Return | $ | 1,000.00 | $ | 552.44 | $ | 6.63 | |||

Hypothetical Return | $ | 1,000.00 | $ | 1,016.59 | $ | 8.62 | |||

| * | Expenses are equal to the Fund’s annualized expense ratios of 1.95% and 1.70% for Investment Shares and Institutional Shares, respectively, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year/366 (to reflect the half-year period). |

31

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FUND TRUSTEEAND OFFICERS

DECEMBER 31, 2008 – (Unaudited)

Name, Address | Position(s) | Length of | Principal Occupation(s) | |||

Interested Trustees | ||||||

WARREN J. ISABELLE, CFA(2) Ironwood Investment Management, LLC 21 Custom House Street Suite 240 Boston, MA 02110 Born: 1952 | Trustee, President and Chairman of the Board, Valuation Committee (member) | March 1998 to Present | Chief Investment Officer, Ironwood Investment Management, LLC, August 1997 to present; Managing Member, Ironwood Investment Management, LLC, August 1997 to January 2006. | |||

Independent Trustees | ||||||

DONALD A. NELSON, CPA c /o Ironwood Series Trust Three Canal Plaza Portland, ME 04101 Born: 1946 | Trustee, Audit Committee, Nominating Committee, Valuation Committee and Qualified Legal Compliance Committee (member) | March 1998 to Present | Associate Professor, Department of Accounting and Finance, Merrimack College, 1975 to present; Certified Public Accountant, 1972 to present. | |||

JOHN A. FIFFY c/o Ironwood Series Trust Three Canal Plaza Portland, ME 04101 Born: 1950 | Trustee, Audit Committee, Nominating Committee, Valuation Committee and Qualified Legal Compliance Committee (member) | March 1998 to Present | Acquisition Consultant, Compaq Computer Corporation (a computer hardware company), 1993 to present. | |||

32

IRONWOOD ISABELLE SMALL COMPANY STOCK FUND

FUND TRUSTEEAND OFFICERS

DECEMBER 31, 2008 – (Unaudited), (Continued)

Name, Address | Position(s) | Length of | Principal Occupation(s) | |||

Officers | ||||||

CHARLES J. DALY, ESQ. Ironwood Investment Management, LLC 21 Custom House Street Suite 240 Boston, MA 02110 Born: 1971 | Vice-President, Secretary | June 2007 to Present | Chief Compliance Officer, Counsel, Ironwood Investment Management, LLC, 2006 to present; Senior Counsel, BISYS Fund Services, Inc. 2003-2006; Associate, Goodwin Procter, LP, 2001-2003. | |||

STACEY E. HONG Three Canal Plaza Portland, ME 04101 Born: 1966 | Treasurer; Principal Financial Officer | June 2008 to Present | President, Atlantic Fund Administration, LLC since 2008; Director, Consulting Services, Foreside Fund Services, January 2007 - September 2007; Elder Care June 2005 - December 2006; Director, Fund Accounting, Citigroup December 2003 - May 2005; Director/Senior Manager/Manager, Accounting, Forum Financial Group April 1992 -November 2003; Auditor, Ernst & Young May 1988 - March 1992. | |||

| (1) | Term of service is indefinite. |

| (2) | Mr. Isabelle is an officer of Ironwood Investment Management, LLC (“Ironwood” or “Adviser”) and within the past two years owned a controlling interest in the Adviser. |

Each Trustee oversees the Fund, which is the only portfolio within the complex. No Trustee holds other directorships or trusteeships. The Statement of Additional Information (“SAI”) contains additional information about the Fund’s Trustees. The SAI is available for free, by contacting the Fund at (800) 472-6114.

33

IRONWOOD INVESTMENT MANAGEMENT, LLC

AND IRONWOOD FUNDS

The Ironwood Tree

is a small, hardy tree, which yields a very useful and solid wood. Patiently,

these trees remain under the forest canopy until taller neighbors fall.

Once given the opportunity, the Ironwood grows quickly

to reach its full potential. We believe this imagery is appropriate

for our firm as well as our investment style.

Ironwood Investment Management, LLC,

the investment manager of the Ironwood Isabelle Small Company

Stock Fund, is an independently managed investment management firm

specializing in investing in small company stocks.

Ironwood Series Trust

P.O. Box 588

Portland, ME 04112

1-800-472-6114

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, ME 04101

www.foreside.com

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees and expenses, experience of its management, and other information.

There are risks associated with investing in funds of this type that invest in stocks of small-sized companies, which tend to be more volatile and less liquid than stocks of larger companies. Past Fund performance is not indicative of future results.

For account information, current performance and prices, call 1-800-472-6114 between the hours of 9:00 a.m. and 5:00 p.m. (Eastern Time), Monday through Friday.

238-ANR-1208

| ITEM 2. | CODE OF ETHICS. |

| (a) | As of the end of the period covered by this report, Ironwood Isabelle Small Company Stock Fund (the “Registrant”) has adopted a code of ethics, which applies to its President and Treasurer. |

| (c) | There have been no amendments to the Registrant’s code of ethics that apply to its President and Treasurer. |

| (d) | There have been no waivers to the Registrant’s code of ethics that apply to its President and Treasurer. |

| (e) | Not applicable. |

| (f) | (1) A copy of the Code of Ethics is attached hereto. |

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Mr. Donald A. Nelson has been approved as the “Audit Committee financial expert.” The Board of Trustees of the Registrant has determined that he is “independent” for purposes of this item.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

| (a) | Audit Fees – The aggregate fees billed for each of the last two fiscal years (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant for the audit of the Registrant’s annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $32,146 in 2007 and $30,000 in 2008. |

| (b) | Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item 4 were $0 in 2007 and $0 in 2008. |

| (c) | Tax Fees – The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning (“Tax Services”) were $2,940 in 2007 and $3,255 in 2008. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns. |

| (d) | Other Fees – There were no other fees billed in the Reporting Periods for products and services provided to the Registrant by the principal accountant, other than the services reported above. |

| (e) | (1) Pursuant to the Registrant’s Audit Committee Charter (the “Charter”), before an auditor is engaged by the Registrant to render audit services, the Audit Committee must review and approve the engagement. In addition, the Registrant’s Audit Committee must review and approve in advance any proposal that the Registrant employ its auditor to render “permissible non-audit services” (as defined in the Charter consistent with Rule 2-01(c)(4) of Regulation S-X), except as described below. The Committee must also review and approve in advance any proposal (except as set forth below) that the investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant (an “Adviser-affiliated service provider”), employ the Registrant’s auditor to render non-audit services, if the engagement would relate directly to the operations and financial reporting of the Registrant. As a part of its review, the Committee must consider whether the provision of such services is consistent with the auditor’s independence. Pre-approval by the Committee of non-audit services is not required if: (1) (A) with respect to the Registrant, the aggregate amount of all such permissible non-audit services provided to the Registrant constitutes no more than 5% of the total amount of revenues paid to the auditor by the Registrant during the fiscal year in which the services are provided or (B) with respect to the adviser and any Adviser-affiliated service provider, the aggregate amount of all such non-audit services provided constitutes no more than 5% of the total amount of revenues (of the type that would have to be pre-approved by the Committee) paid to the auditor by the Registrant, the Adviser and |

any Adviser-affiliated service provider during the fiscal year in which the services are provided; (2) such services were not recognized by the Registrant at the time of the engagement to be non-audit services; and (3) such services are promptly brought to the attention of the Committee and approved prior to the completion of the audit by the Committee or its Delegate(s) (as defined below). The Committee may delegate to one or more of its members (“Delegates”) authority to pre-approve the auditor’s provision of audit services or permissible non-audit services to the Registrant, or the provision of non-audit services to the Adviser or any Adviser-affiliated service provider. Any pre-approval determination made by a Delegate shall be presented to the full Committee at its next meeting. The Committee shall communicate any pre-approval made by it or a Delegate to Registrant’s fund administrator, who will ensure that the appropriate disclosure is made in the Registrant’s periodic reports and other documents as required under the federal securities laws. |

| (e) | (2) No services included in (b) - (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Not applicable as less than 50%. |

| (g) | The aggregate non-audit fees billed by the principal accountant for services rendered to the Registrant for the Reporting Periods were $2,940 in 2007 and $3,255 in 2008. There were no fees billed in each of the Reporting Periods for non-audit services rendered by the principal accountant to the investment adviser. |

| (h) | The Registrant’s Audit Committee has considered whether the provision of any non-audit services rendered to the investment adviser, to the extent applicable, that were not pre-approved (not requiring pre-approval) is compatible with maintaining the Auditor’s independence. Any services provided by the principal accountant to the Registrant or to the investment adviser requiring pre-approval were pre-approved as required. |

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| (a) | Included as part of report to stockholders under Item 1. |

| (b) | Not applicable. |

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

Not applicable.

| ITEM 11. | CONTROLS AND PROCEDURES |

| (a) | The registrant’s President and Treasurer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) are effective, based on their evaluation of these disclosure controls and procedures as of a date within 90 days of the filing date of this report. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in rule 30a-3(d) under the Act) that occurred during the registrant’s second fiscal quarter of the period covered by this |

report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| ITEM 12. | EXHIBITS. |

| (a)(1) | Code of Ethics (Exhibit filed herewith). | |

| (a)(2) | Certifications pursuant to Rule 30a-2(a) of the Investment Company Act of 1940 as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith). | |

| (a)(3) | Not applicable. | |

| (b) | Certifications pursuant to Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Registrant Ironwood Series Trust | ||

| By | /s/ Warren J. Isabelle | |

| Warren J. Isabelle, President | ||

| Date | 3/10/09 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Warren J. Isabelle | |

| Warren J. Isabelle, President | ||

| Date | 3/10/09 | |

| By | /s/ Stacey E. Hong | |

| Stacey E. Hong, Treasurer | ||

| Date | 3/9/09 | |