- SID Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Companhia Siderúrgica Nacional (SID) 6-KSIDITR1Q20_6K

Filed: 15 Jun 20, 12:00am

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Company Information |

|

Capital Breakdown | 1 |

Parent Company Financial Statements |

|

Balance Sheet – Assets | 2 |

Balance Sheet – Liabilities | 3 |

Statement of Income | 4 |

Statement of Comprehensive Income | 5 |

Statement of Cash Flows | 6 |

Statement of Changes in Shareholders’ Equity |

|

01/01/2020 to 03/31/2020 | 7 |

01/01/2019 to 03/31/2019 | 8 |

Statement of Value Added | 9 |

Consolidated Financial Statements |

|

Balance Sheet - Assets | 10 |

Balance Sheet - Liabilities | 11 |

Statement of Income | 12 |

Statement of Comprehensive Income | 13 |

Statement of Cash Flows | 14 |

Statement of Changes in Shareholders’ Equity |

|

01/01/2020 to 03/31/2020 | 15 |

01/01/2019 to 03/31/2019 | 16 |

Statement of Value Added | 17 |

Comments on the Company’s Consolidated Performance | 18 |

Notes to the quarterly financial information | 34 |

Comments on the Performance of Business Projections | 82 |

Reports and Statements |

|

Unqualified Independent Auditors’ Review Report | 85 |

Officers Statement on the Financial Statements | 87 |

Officers Statement on Auditor’s Report | 88 |

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Company Information / Capital Breakdown

Number of Shares (Units) | Current Quarter 03/31/2020 |

|

Paid-in Capital |

|

|

Common | 1,387,524,047 |

|

Preferred | 0 |

|

Total | 1,387,524,047 |

|

Treasury Shares |

|

|

Common | 7,409,500 |

|

Preferred | 0 |

|

Total | 7,409,500 |

|

Page 1

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Balance Sheet - Assets | |||

(R$ thousand) | |||

Code | Description | Current Quarter 03/31/2020 | Previous Year 12/31/2019 |

1 | Total Assets | 46,214,834 | 44,814,611 |

1.01 | Current assets | 9,986,891 | 9,719,866 |

1.01.01 | Cash and cash equivalents | 1,425,986 | 392,107 |

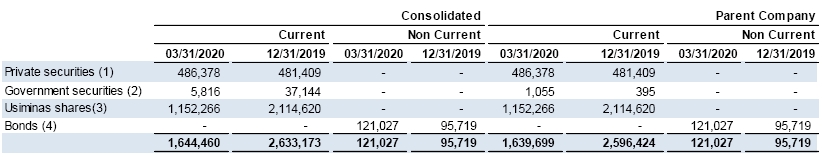

1.01.02 | Financial investments | 1,639,699 | 2,596,424 |

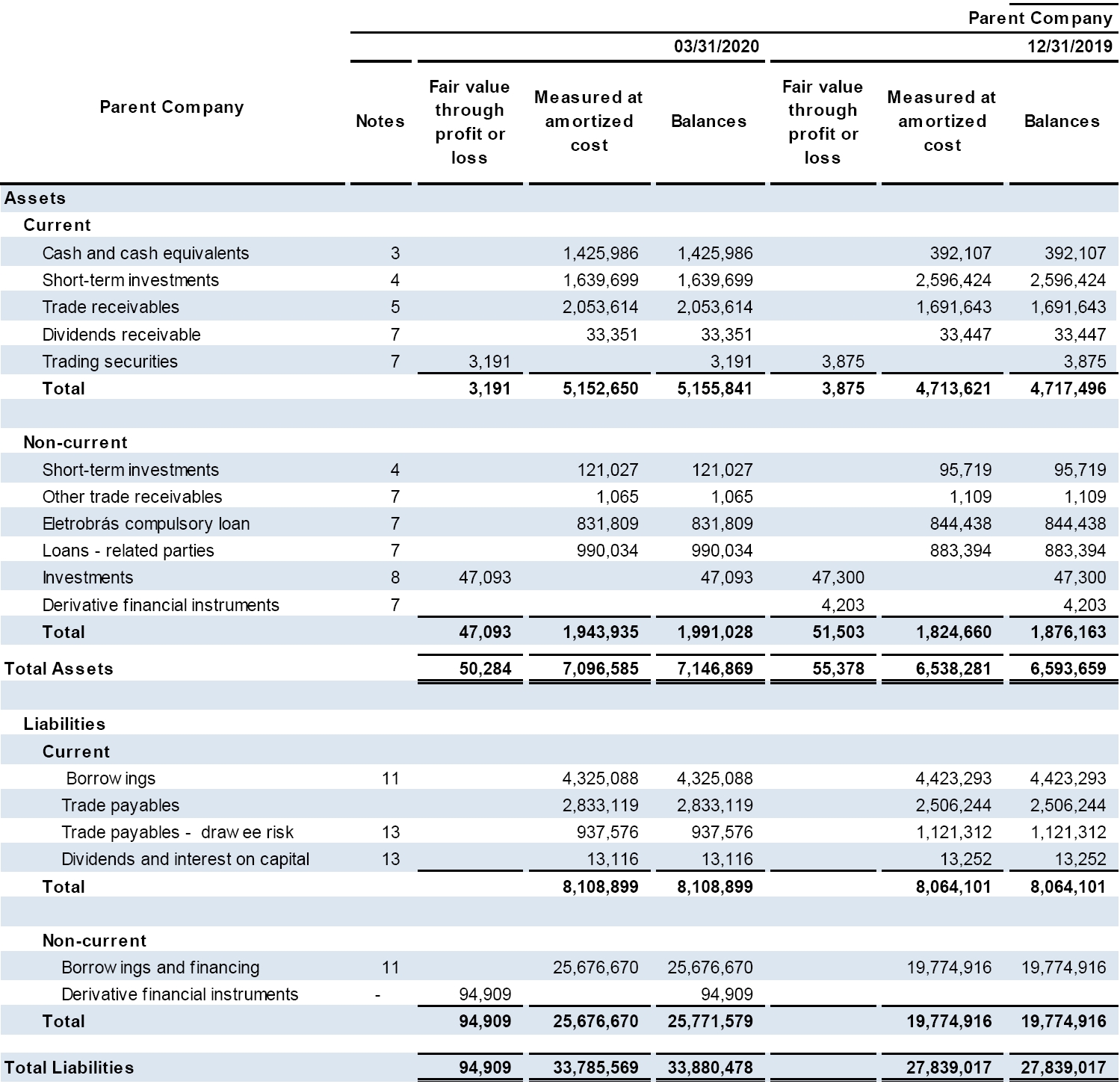

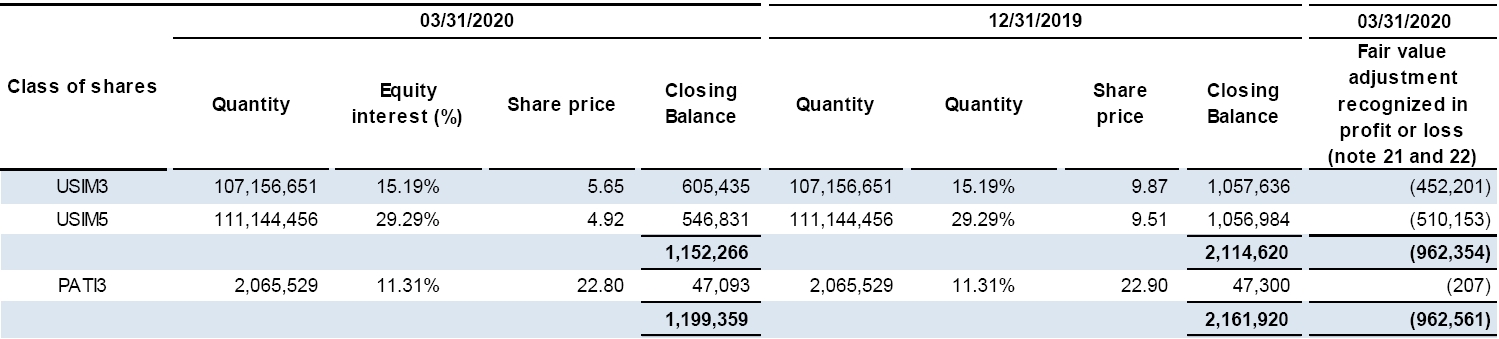

1.01.02.01 | Financial investments measured a fair value through profit or loss | 1,152,266 | 2,114,620 |

1.01.02.01.03 | Financial investments measured a fair value through profit or loss – Usiminas’ shares | 1,152,266 | 2,114,620 |

1.01.02.03 | Financial investments at amortized cost | 487,433 | 481,804 |

1.01.03 | Trade receivables | 2,053,614 | 1,691,643 |

1.01.04 | Inventory | 3,470,304 | 3,736,716 |

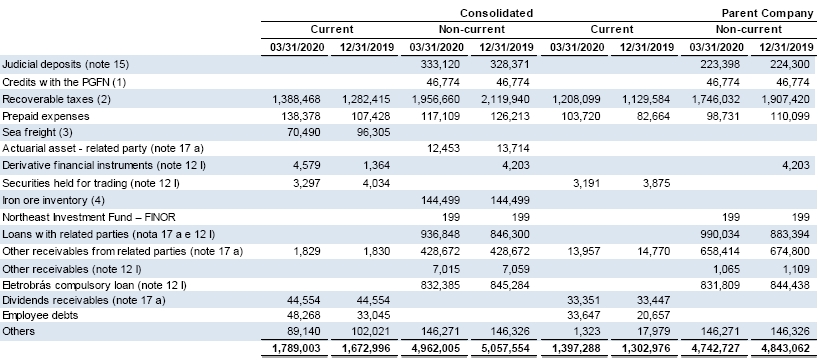

1.01.08 | Other current assets | 1,397,288 | 1,302,976 |

1.01.08.03 | Others | 1,397,288 | 1,302,976 |

1.01.08.03.01 | Recoverable taxes | 1,208,099 | 1,129,584 |

1.01.08.03.02 | Prepaid expenses | 103,720 | 82,664 |

1.01.08.03.03 | Dividends receivable | 33,351 | 33,447 |

1.01.08.03.04 | Others | 52,118 | 57,281 |

1.02 | Non-current assets | 36,227,943 | 35,094,745 |

1.02.01 | Long-term assets | 7,299,609 | 7,374,332 |

1.02.01.03 | Financial investments at amortized cost | 121,027 | 95,719 |

1.02.01.07 | Deferred taxes assets | 2,435,855 | 2,435,551 |

1.02.01.10 | Other non-current assets | 4,742,727 | 4,843,062 |

1.02.01.10.03 | Recoverable taxes | 1,746,032 | 1,907,420 |

1.02.01.10.04 | Judicial deposits | 223,398 | 224,300 |

1.02.01.10.05 | Prepaid expenses | 98,731 | 110,099 |

1.02.01.10.06 | Receivable from related parties | 1,648,448 | 1,558,194 |

1.02.01.10.07 | Others | 1,026,118 | 1,043,049 |

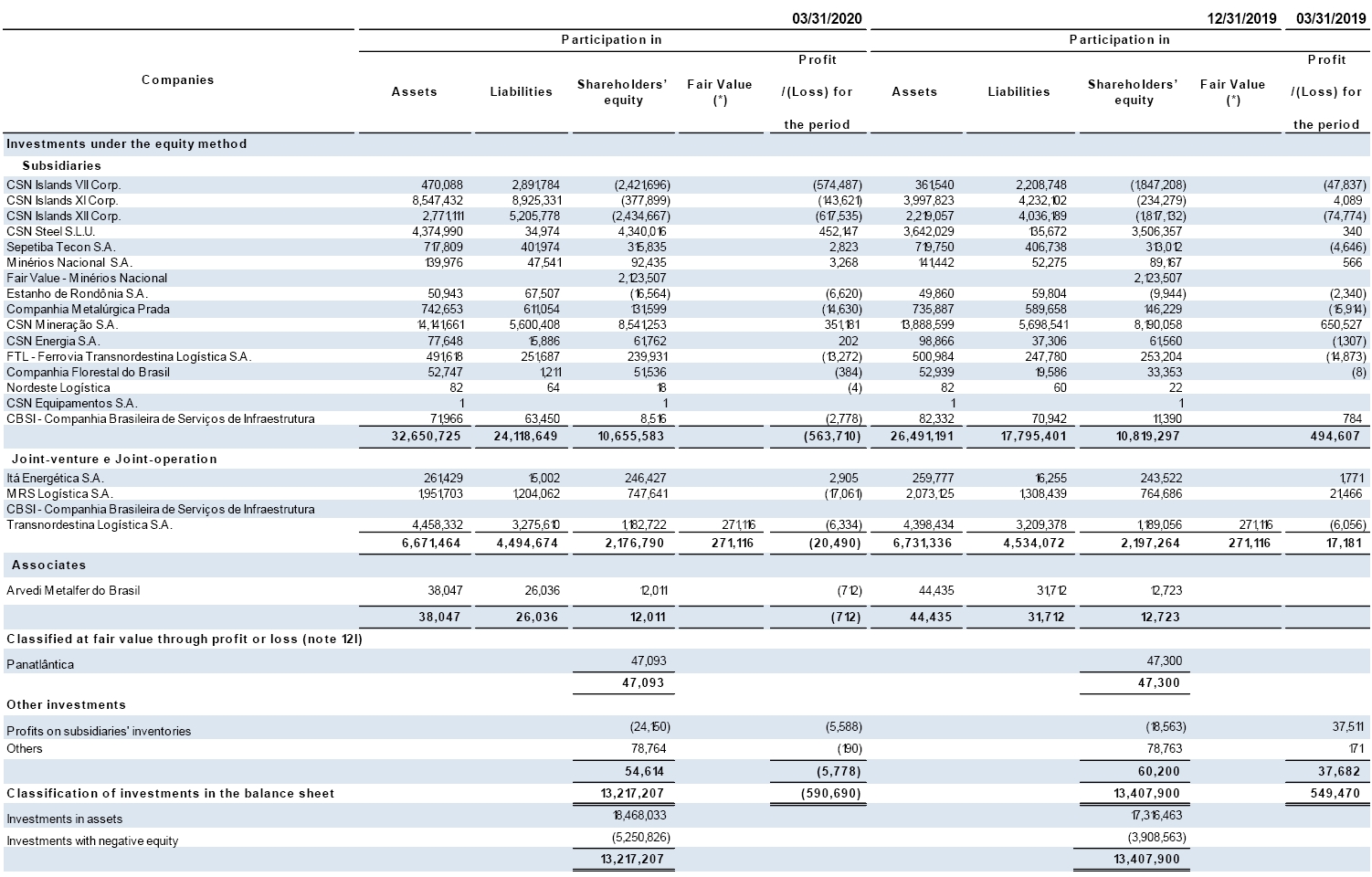

1.02.02 | Investments | 18,614,972 | 17,402,191 |

1.02.02.01 | Equity interest | 18,468,033 | 17,316,463 |

1.02.02.02 | Investment Property | 146,939 | 85,728 |

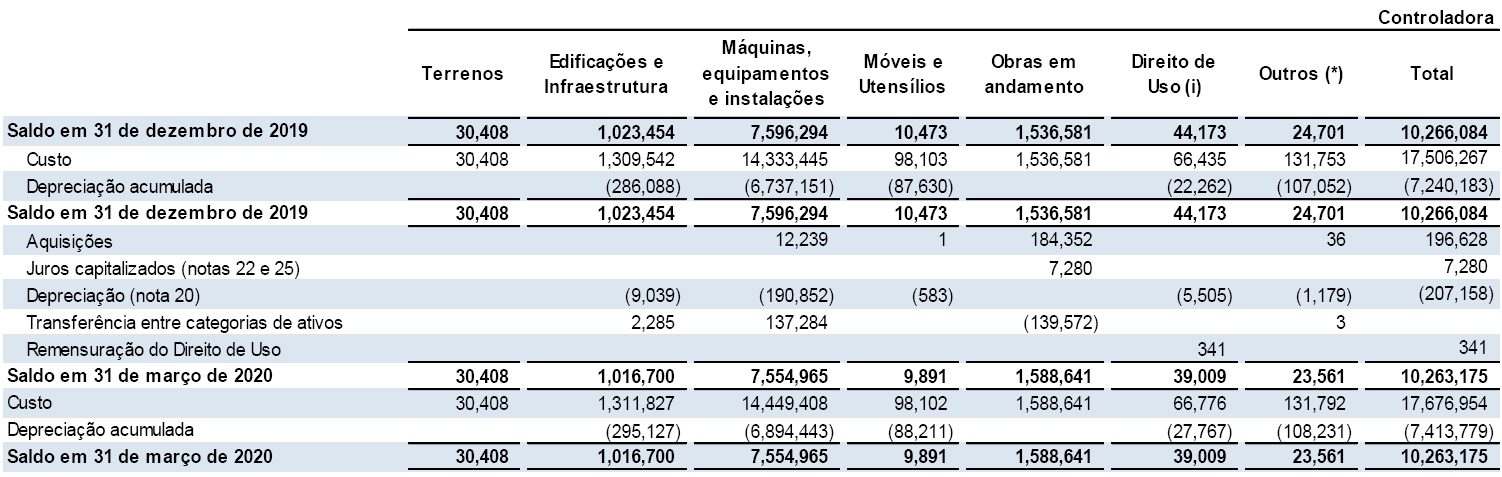

1.02.03 | Property, plant and equipment | 10,263,175 | 10,266,084 |

1.02.03.01 | Property, plant and equipment in operation | 10,224,167 | 10,221,911 |

1.02.03.02 | Right of use in leases | 39,008 | 44,173 |

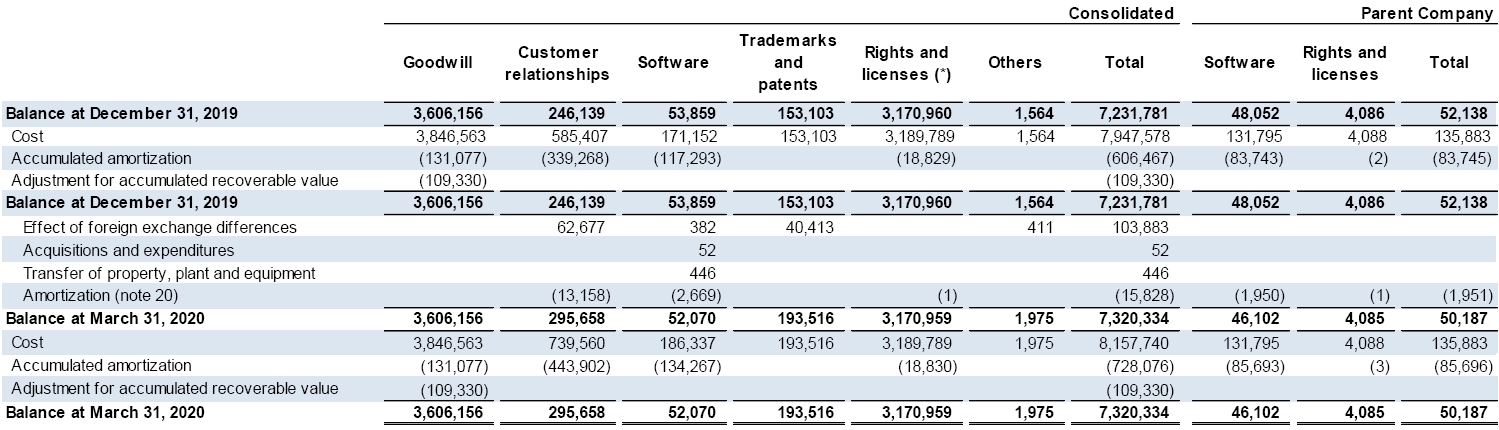

1.02.04 | Intangible assets | 50,187 | 52,138 |

Page 2

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Balance Sheet – Liabilities | |||

(R$ thousand) | |||

Code | Description | Current Quarter 03/31/2020 | Previous Year 12/31/2019 |

2 | Total Liabilities | 46,214,834 | 44,814,611 |

2.01 | Current liabilities | 9,293,987 | 9,224,591 |

2.01.01 | Payroll and related taxes | 156,175 | 170,792 |

2.01.02 | Trade payables | 2,833,119 | 2,506,244 |

2.01.03 | Tax payables | 84,615 | 78,911 |

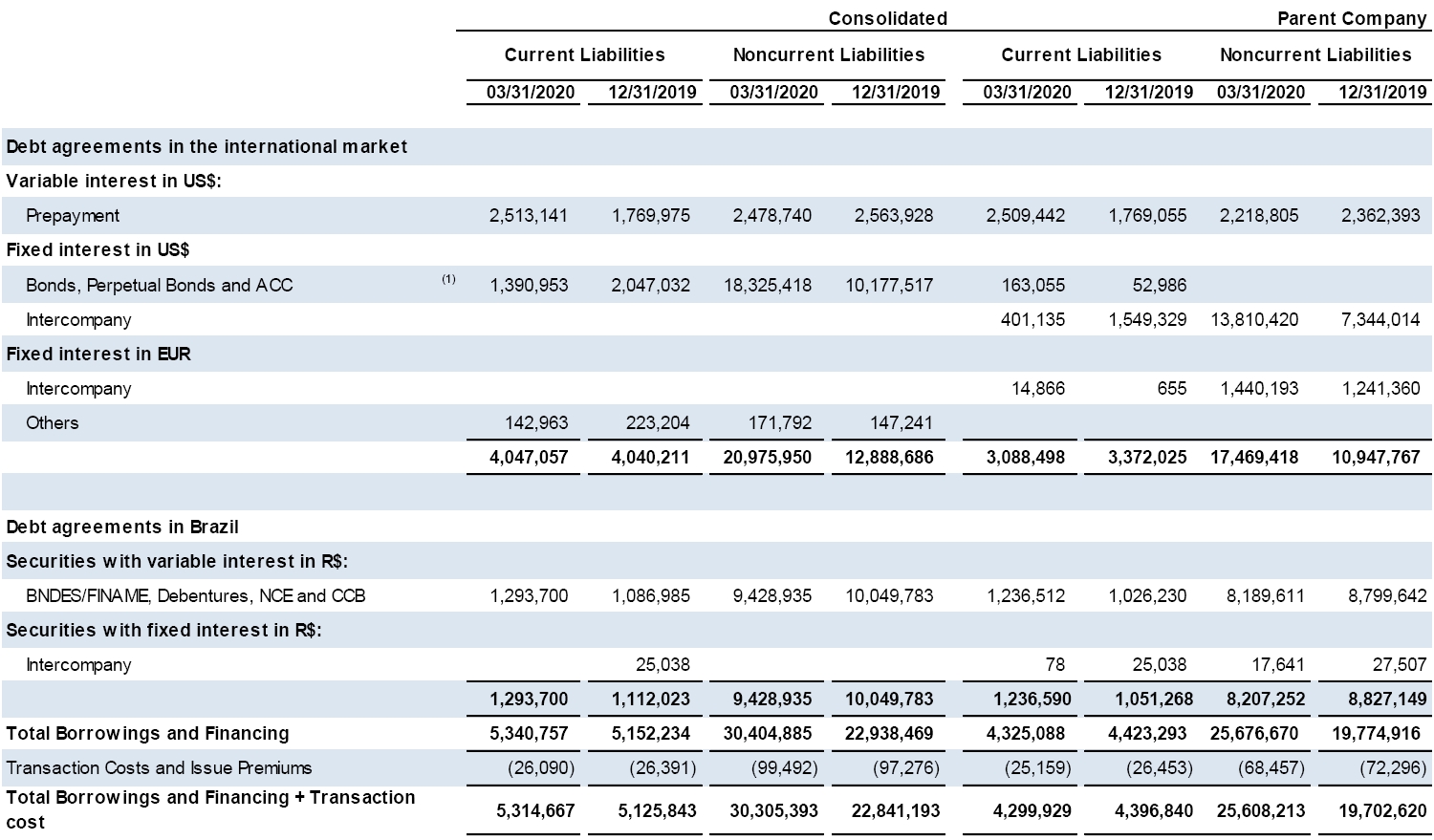

2.01.04 | Borrowings and financing | 4,299,929 | 4,396,840 |

2.01.05 | Other payables | 1,882,455 | 2,019,788 |

2.01.05.02 | Others | 1,882,455 | 2,019,788 |

2.01.05.02.04 | Dividends and interests on shareholder´s equity | 13,116 | 13,252 |

2.01.05.02.05 | Advances from clients | 64,046 | 72,404 |

2.01.05.02.06 | Trade payables – Drawee risk | 937,576 | 1,121,312 |

2.01.05.02.07 | Lease liabilities | 14,897 | 17,269 |

2.01.05.02.08 | Other payables | 852,820 | 795,551 |

2.01.06 | Provisions | 37,694 | 52,016 |

2.01.06.01 | Provision for tax, social security, labor and civil risks | 37,694 | 52,016 |

2.02 | Non-current liabilities | 32,750,837 | 25,415,476 |

2.02.01 | Borrowings and financing | 25,608,213 | 19,702,620 |

2.02.02 | Other payables | 428,804 | 356,942 |

2.02.02.02 | Others | 428,804 | 356,942 |

2.02.02.02.03 | Lease liabilities | 26,078 | 28,671 |

2.02.02.02.04 | Derivative financial instruments | 94,909 | - |

2.02.02.02.05 | Other payables | 307,817 | 328,271 |

2.02.04 | Provisions | 6,713,820 | 5,355,914 |

2.02.04.01 | Provision for tax, social security, labor and civil risks | 374,935 | 370,703 |

2.02.04.02 | Other provisions | 6,338,885 | 4,985,211 |

2.02.04.02.03 | Provision for environmental liabilities and decommissioning of assets | 175,875 | 164,464 |

2.02.04.02.04 | Pension and healthcare plan | 912,184 | 912,184 |

2.02.04.02.05 | Provision for losses on investments | 5,250,826 | 3,908,563 |

2.03 | Shareholders’ equity | 4,170,010 | 10,174,544 |

2.03.01 | Share Capital | 4,540,000 | 4,540,000 |

2.03.02 | Capital reserves | 32,720 | 32,720 |

2.03.04 | Profit reserves | 4,431,200 | 4,431,200 |

2.03.04.01 | Legal reserve | 278,576 | 278,576 |

2.03.04.02 | Earnings reserves | 4,210,888 | 4,210,888 |

2.03.04.09 | Treasury shares | (58,264) | (58,264) |

2.03.05 | Accumulated profit/(losses) | (1,360,851) | - |

2.03.08 | Other comprehensive income | (3,473,059) | 1,170,624 |

Page 3

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Statement of Income (R$ thousand) | |||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 |

3.01 | Revenues from sale of goods and rendering of services | 3,031,309 | 3,021,217 |

3.02 | Costs from sale of goods and rendering of services | (2,778,380) | (2,833,088) |

3.03 | Gross profit | 252,929 | 188,129 |

3.04 | Operating (expenses)/income | (1,262,912) | 308,308 |

3.04.01 | Selling expenses | (162,239) | (120,144) |

3.04.02 | General and administrative expenses | (50,192) | (56,117) |

3.04.04 | Other operating income | 74,847 | 219,694 |

3.04.05 | Other operating expenses | (534,638) | (284,595) |

3.04.06 | Equity in results of affiliated companies | (590,690) | 549,470 |

3.05 | Profit before financial income (expenses) and taxes | (1,009,983) | 496,437 |

3.06 | Financial income (expenses) | (351,172) | (458,764) |

3.06.01 | Financial income | 53,376 | 101,370 |

3.06.02 | Financial expenses | (404,548) | (560,134) |

3.06.02.01 | Net exchange differences over financial instruments | 931,016 | (72,099) |

3.06.02.02 | Financial expenses | (1,335,564) | (488,035) |

3.07 | Profit (loss) before taxes | (1,361,155) | 37,673 |

3.08 | Income tax and social contribution | 304 | (45,245) |

3.09 | Profit (loss) from continued operations | (1,360,851) | (7,572) |

3.11 | Profit (loss) for the year | (1,360,851) | (7,572) |

3.99 | Earnings per share – (Reais / Share) | - | - |

3.99.01 | Basic earnings per share | - | - |

3.99.01.01 | Common shares | (0.98604) | (0.00551) |

3.99.02 | Diluted earnings per share | - | - |

3.99.02.01 | Common shares | (0.98604) | (0.00551) |

Page 4

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Statement of Comprehensive Income | |||

(R$ thousand) | |||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 |

4.01 | (Loss) profit for the year | (1,360,851) | (7,572) |

4.02 | Other comprehensive income | (4,643,683) | 150,183 |

4.02.01 | Actuarial gains over pension plan of subsidiaries, net of taxes | 31 | 30 |

4.02.02 | Cumulative translation adjustments for the year | 380,042 | (21,804) |

4.02.04 | Losses in cash flow hedge | (5,390,043) | (18,440) |

4.02.05 | Cash flow hedge reclassified to income upon realization | 364,818 | 184,217 |

4.02.06 | Gain (Loss) on net investment hedge from investments in subsidiaries | 1,469 | 6,180 |

4.03 | Comprehensive income for the year | (6,004,534) | 142,611 |

Page 5

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Statements of Cash Flows – Indirect Method (R$ thousand) | |||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 |

6.01 | Net cash from operating activities | (43,913) | (948,165) |

6.01.01 | Cash from operations | 145,068 | 82,028 |

6.01.01.01 | Profit (loss) for the period | (1,360,851) | (7,572) |

6.01.01.02 | Financial charges in borrowing and financing raised | 276,982 | 349,039 |

6.01.01.03 | Financial charges in borrowing and financing granted | (16,540) | (12,414) |

6.01.01.04 | Charges on lease liabilities | 956 | 965 |

6.01.01.05 | Equity in results of affiliated companies | 590,690 | (549,470) |

6.01.01.06 | Deferred tax | (304) | 45,256 |

6.01.01.07 | Provision for tax, social security, labor, civil and environmental risks | (10,090) | (69,429) |

6.01.01.08 | Monetary and exchange variations, net | (547,893) | 259,413 |

6.01.01.09 | Write-off of property, plant and equipment and Intangible assets | - | 13,542 |

6.01.01.10 | Provision for environmental liabilities and decommissioning of assets | 11,411 | (5,158) |

6.01.01.11 | Updated shares – Fair value through profit or loss | 962,561 | (127,653) |

6.01.01.12 | Depreciation, amortization and depletion | 209,495 | 158,007 |

6.01.01.13 | Accrued/(reversal) for consumption and services | 21,527 | 19,504 |

6.01.01.16 | Others provisions | 7,124 | 7,998 |

6.01.02 | Changes in assets and liabilities | (188,981) | (1,030,193) |

6.01.02.01 | Trade receivables - third parties | (19,768) | 16,862 |

6.01.02.02 | Trade receivables - related parties | (394,990) | (275,407) |

6.01.02.03 | Inventories | 266,412 | (371,991) |

6.01.02.04 | Receivables - related parties/dividends | 814 | (635) |

6.01.02.05 | Tax assets | 82,873 | (54,342) |

6.01.02.06 | Judicial deposits | 902 | (11,405) |

6.01.02.09 | Trade payables | 326,875 | (118,919) |

6.01.02.10 | Trade payables – Drawee Risk | (183,736) | 235,181 |

6.01.02.11 | Payroll and related taxes | (14,616) | 4,512 |

6.01.02.12 | Taxes in installments – REFIS | 5,679 | (65,858) |

6.01.02.13 | Payables to related parties | 113,756 | (6,136) |

6.01.02.14 | Advance with related parties | (20,289) | - |

6.01.02.15 | Interest paid | (268,170) | (368,593) |

6.01.02.16 | Interest received | 198 | - |

6.01.02.19 | Others | (84,921) | (13,462) |

6.02 | Net cash investment activities | (297,419) | (104,805) |

6.02.01 | Investments / AFAC / Acquisitions of Shares | (2,180) | (4,847) |

6.02.02 | Purchase of property, plant and equipment and intangible assets | (196,628) | (158,189) |

6.02.05 | Intercompany loans granted | (98,614) | (49,698) |

6.02.06 | Intercompany loans received | 4,076 | - |

6.02.08 | Financial Investments, net of redemption | (4,073) | 107,929 |

6.03 | Net cash used in financing activities | 1,375,211 | 807,103 |

6.03.01 | Borrowings and financing raised | 80,744 | 2,246,890 |

6.03.02 | Transactions cost - Borrowings and financing | (1,980) | (28,810) |

6.03.03 | Borrowings and financing – related parties | 2,205,145 | 1,581,639 |

6.03.04 | Amortization of borrowings and financing | (889,247) | (2,763,750) |

6.03.05 | Amortization of borrowings and financing - related parties | (13,053) | (222,553) |

6.03.06 | Amortization of leases | (6,262) | (6,313) |

6.03.07 | Dividends and interest on shareholder’s equity | (136) | - |

6.05 | Increase (decrease) in cash and cash equivalents | 1,033,879 | (245,867) |

6.05.01 | Cash and equivalents at the beginning of the year | 392,107 | 539,853 |

6.05.02 | Cash and equivalents at the end of the year | 1,425,986 | 293,986 |

Page 6

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Statement of Changes in Equity - 01/01/2020 to 03/31/2020 (R$ thousand) | |||||||

Code | Description | Paid-in capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity |

5.01 | Opening balances | 4,540,000 | 32,720 | 4,431,200 | - | 1,170,624 | 10,174,544 |

5.03 | Adjusted opening balances | 4,540,000 | 32,720 | 4,431,200 | - | 1,170,624 | 10,174,544 |

5.05 | Total comprehensive income | - | - | - | (1,360,851) | (4,643,683) | (6,004,534) |

5.05.01 | Profit (loss) for the period | - | - | - | (1,360,851) | - | (1,360,851) |

5.05.02 | Other comprehensive income | - | - | - | - | (4,643,683) | (4,643,683) |

5.05.02.04 | Translation adjustments for the year | - | - | - | - | 380,042 | 380,042 |

5.05.02.06 | Actuarial gains/(losses) on pension plan, net of taxes | - | - | - | - | 31 | 31 |

5.05.02.07 | (Loss) / gain on the percentage change in investments | - | - | - | - | (5,025,225) | (5,025,225) |

5.05.02.08 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | 1,469 | 1,469 |

5.07 | Closing balance | 4,540,000 | 32,720 | 4,431,200 | (1,360,851) | (3,473,059) | 4,170,010 |

Page 7

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Statement of Changes in Equity - 01/01/2019 to 03/31/2019 | |||||||||||

(R$ thousand) | |||||||||||

Code | Description | Paid-in capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity | ||||

5.01 | Opening balances | 4,540,000 | 32,720 | 3,064,827 | - | 1,065,188 | 8,702,735 | ||||

5.03 | Adjusted opening balances | 4,540,000 | 32,720 | 3,064,827 | - | 1,065,188 | 8,702,735 | ||||

5.05 | Total comprehensive income | - | - | - | (7,572) | 150,183 | 142,611 | ||||

5.05.01 | Profit (loss) for the period | - | - | - | (7,572) | - | (7,572) | ||||

5.05.02 | Other comprehensive income | - | - | - | - | 150,183 | 150,183 | ||||

5.05.02.04 | Translation adjustments for the year | - | - | - | - | (21,804) | (21,804) | ||||

5.05.02.06 | Actuarial gains/(losses) on pension plan, net of taxes | - | - | - | - | 30 | 30 | ||||

5.05.02.07 | (Loss) / gain on the percentage change in investments | - | - | - | - | 165,777 | 165,777 | ||||

5.05.02.08 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | 6,180 | 6,180 | ||||

5.07 | Closing balance | 4,540,000 | 32,720 | 3,064,827 | (7,572) | 1,215,371 | 8,845,346 | ||||

Page 8

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Parent Company Financial Statements / Statement of Value Added | ||||||

(R$ thousand) | ||||||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 | |||

7.01 | Revenues | 3,772,385 | 3,901,138 | |||

7.01.01 | Sales of products and rendering of services | 3,769,699 | 3,751,792 | |||

7.01.02 | Other revenues | 4,729 | 127,754 | |||

7.01.04 | Allowance for (reversal of) doubtful debts | (2,043) | 21,592 | |||

7.02 | Raw materials acquired from third parties | (3,469,351) | (3,373,861) | |||

7.02.01 | Cost of sales and services | (2,878,256) | (3,060,346) | |||

7.02.02 | Materials, electric power, outsourcing and other | (585,281) | (304,580) | |||

7.02.03 | Impairment/recovery of assets | (5,814) | (8,935) | |||

7.03 | Gross value added | 303,034 | 527,277 | |||

7.04 | Retentions | (209,001) | (158,007) | |||

7.04.01 | Depreciation, amortization and depletion | (209,001) | (158,007) | |||

7.05 | Wealth created | 94,033 | 369,270 | |||

7.06 | Value added received | (392,985) | 657,660 | |||

7.06.01 | Equity in results of affiliates companies | (590,690) | 549,470 | |||

7.06.02 | Financial income | 53,376 | 101,370 | |||

7.06.03 | Others | 144,329 | 6,820 | |||

7.06.03.01 | Others and exchange gains | 144,329 | 6,820 | |||

7.07 | Wealth for distribution | (298,952) | 1,026,930 | |||

7.08 | Wealth distributed | (298,952) | 1,026,930 | |||

7.08.01 | Personnel | 355,029 | 347,839 | |||

7.08.01.01 | Salaries and wages | 249,708 | �� 241,697 | |||

7.08.01.02 | Benefits | 69,873 | 70,631 | |||

7.08.01.03 | Severance payment (FGTS) | 35,448 | 35,511 | |||

7.08.02 | Taxes, fees and contributions | 156,377 | 119,424 | |||

7.08.02.01 | Federal | 113,851 | 60,064 | |||

7.08.02.02 | State | 42,526 | 59,360 | |||

7.08.03 | Remuneration on third-party capital | 550,493 | 567,239 | |||

7.08.03.01 | Interest | 1,335,564 | 488,035 | |||

7.08.03.02 | Rental | 1,618 | 1,030 | |||

7.08.03.03 | Others | (786,689) | 78,174 | |||

7.08.03.03.01 | Others and exchange losses | (786,689) | 78,174 | |||

7.08.04 | Remuneration on Shareholders' capital | (1,360,851) | (7,572) | |||

7.08.04.03 | Retained earnings (accumulated losses) | (1,360,851) | (7,572) | |||

Page 9

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Balance Sheet - Assets | |||

(R$ thousand) | |||

Code | Description | Current Quarter 03/31/2020 | Previous Year 12/31/2019 |

1 | Total assets | 52,723,083 | 50,869,276 |

1.01 | Current assets | 14,385,591 | 12,725,805 |

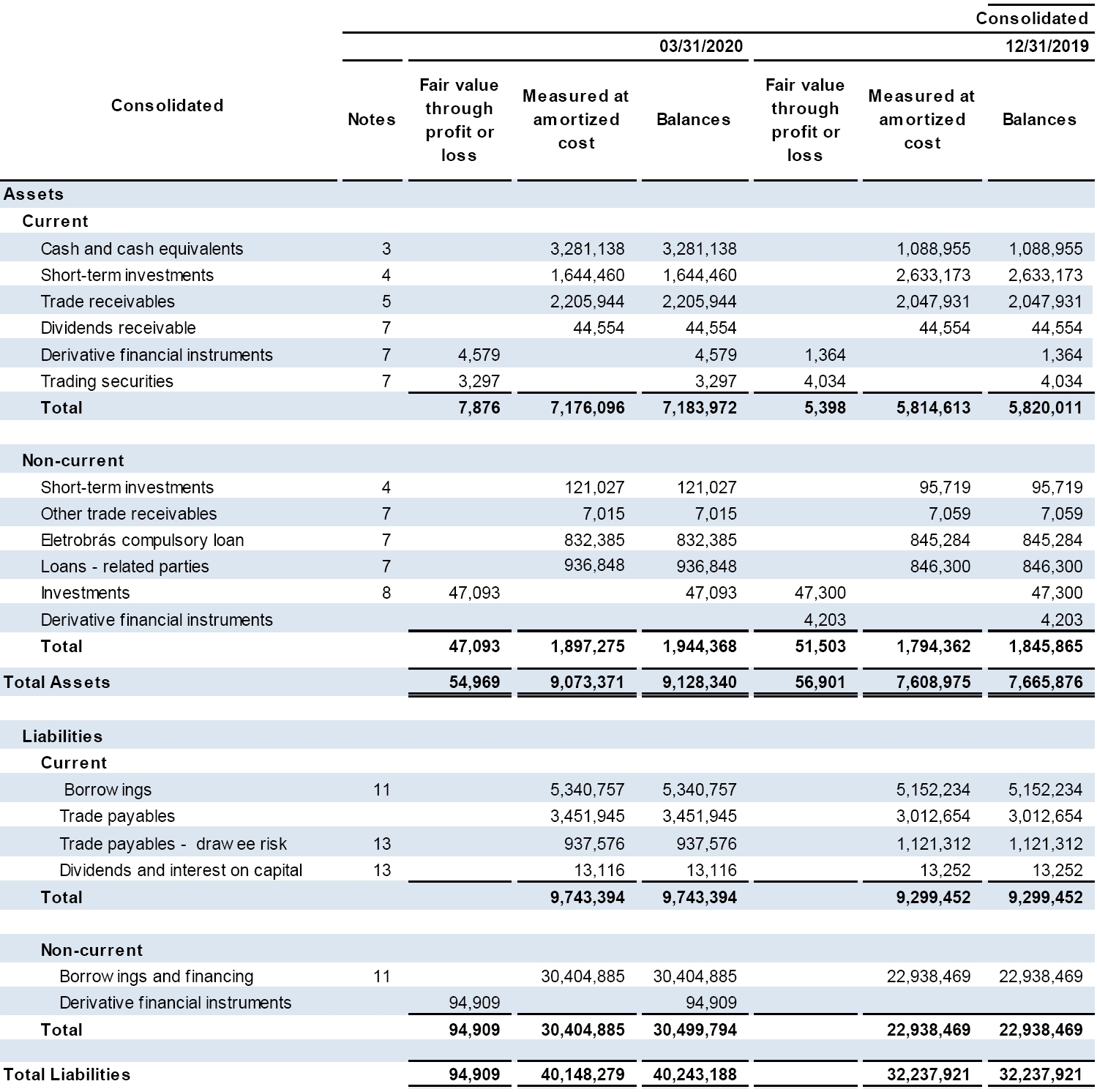

1.01.01 | Cash and cash equivalents | 3,281,138 | 1,088,955 |

1.01.02 | Financial investments | 1,644,460 | 2,633,173 |

1.01.02.01 | Financial investments measured a fair value through profit or loss | 1,152,266 | 2,114,620 |

1.01.02.01.03 | Financial investments measured a fair value through profit or loss – Usiminas’ shares | 1,152,266 | 2,114,620 |

1.01.02.03 | Financial investments at amortized cost | 492,194 | 518,553 |

1.01.03 | Trade receivables | 2,205,944 | 2,047,931 |

1.01.04 | Inventory | 5,465,046 | 5,282,750 |

1.01.08 | Other current assets | 1,789,003 | 1,672,996 |

1.01.08.03 | Others | 1,789,003 | 1,672,996 |

1.01.08.03.01 | Recoverable taxes | 1,388,468 | 1,282,415 |

1.01.08.03.02 | Prepaid expenses | 208,868 | 107,428 |

1.01.08.03.03 | Dividends receivable | 44,554 | 44,554 |

1.01.08.03.04 | Derivative financial instruments | 4,579 | 1,364 |

1.01.08.03.05 | Others | 142,534 | 237,235 |

1.02 | Non-current assets | 38,337,492 | 38,143,471 |

1.02.01 | Long-term assets | 7,558,528 | 7,626,577 |

1.02.01.03 | Financial investments at amortized cost | 121,027 | 95,719 |

1.02.01.07 | Deferred taxes assets | 2,475,496 | 2,473,304 |

1.02.01.10 | Other non-current assets | 4,962,005 | 5,057,554 |

1.02.01.10.03 | Recoverable taxes | 1,956,660 | 2,119,940 |

1.02.01.10.04 | Judicial deposits | 333,120 | 328,371 |

1.02.01.10.05 | Prepaid expenses | 129,562 | 126,213 |

1.02.01.10.06 | Receivable from related parties | 1,365,520 | 1,274,972 |

1.02.01.10.07 | Others | 1,177,143 | 1,208,058 |

1.02.02 | Investments | 3,600,997 | 3,584,169 |

1.02.02.01 | Equity interest | 3,438,752 | 3,482,974 |

1.02.02.02 | Investment Property | 162,245 | 101,195 |

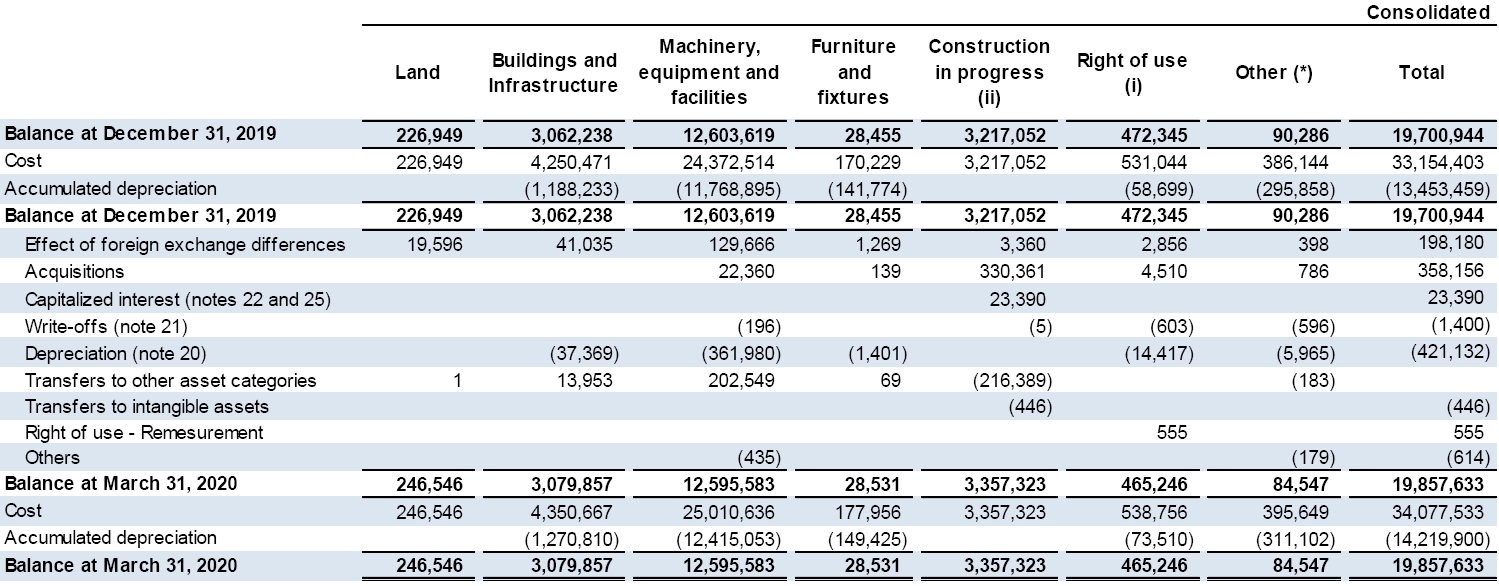

1.02.03 | Property, plant and equipment | 19,857,633 | 19,700,944 |

1.02.03.01 | Property, plant and equipment in operation | 19,392,387 | 19,228,599 |

1.02.03.02 | Right of use in leases | 465,246 | 472,345 |

1.02.04 | Intangible assets | 7,320,334 | 7,231,781 |

Page 10

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Balance Sheet – Liabilities | ||||

(R$ thousand) | ||||

Code | Description | Current Quarter 03/31/2020 | Previous Year 12/31/2019 | |

2 | Total Liabilities | 52,723,083 | 50,869,276 | |

2.01 | Current liabilities | 11,970,831 | 11,619,957 | |

2.01.01 | Payroll and related taxes | 308,501 | 317,510 | |

2.01.02 | Trade payables | 3,451,945 | 3,012,654 | |

2.01.03 | Tax payables | 486,766 | 541,027 | |

2.01.04 | Borrowings and financing | 5,314,667 | 5,125,843 | |

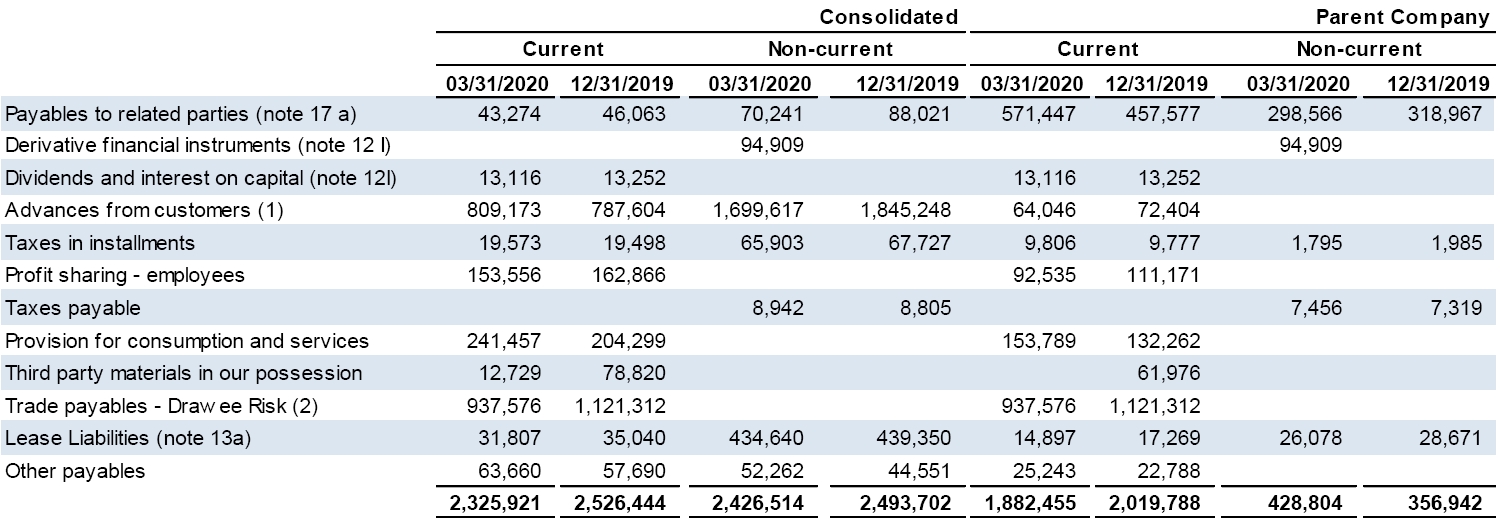

2.01.05 | Other payables | 2,325,921 | 2,526,444 | |

2.01.05.02 | Others | 2,325,921 | 2,526,444 | |

2.01.05.02.04 | Dividends and interests on shareholder´s equity | 13,116 | 13,252 | |

2.01.05.02.05 | Advances from clients | 809,173 | 787,604 | |

2.01.05.02.06 | Trade payables – Drawee risk | 937,576 | 1,121,312 | |

2.01.05.02.07 | Lease liabilities | 31,807 | 35,040 | |

2.01.05.02.09 | Other payables | 534,249 | 569,236 | |

2.01.06 | Provisions | 83,031 | 96,479 | |

2.01.06.01 | Provision for tax, social security, labor and civil risks | 83,031 | 96,479 | |

2.02 | Non-current liabilities | 35,345,710 | 27,887,387 | |

2.02.01 | Borrowings and financing | 30,305,393 | 22,841,193 | |

2.02.02 | Other payables | 2,426,514 | 2,493,702 | |

2.02.02.02 | Others | 2,426,514 | 2,493,702 | |

2.02.02.02.03 | Advances from clients | 1,699,617 | 1,845,248 | |

2.02.02.02.04 | Lease liabilities | 434,640 | 439,350 | |

2.02.02.02.05 | Derivative financial instruments | 94,909 | - | |

2.02.02.02.06 | Other payables | 197,348 | 209,104 | |

2.02.03 | Deferred taxes assets | 620,227 | 589,539 | |

2.02.04 | Provisions | 1,993,576 | 1,962,953 | |

2.02.04.01 | Provision for tax, social security, labor and civil risks | 536,751 | 526,768 | |

2.02.04.02 | Other provisions | 1,456,825 | 1,436,185 | |

2.02.04.02.03 | Provision for environmental liabilities and decommissioning of assets | 544,641 | 524,001 | |

2.02.04.02.04 | Pension and healthcare plan | 912,184 | 912,184 | |

2.03 | Shareholders’ equity | 5,406,542 | 11,361,932 | |

2.03.01 | Share Capital | 4,540,000 | 4,540,000 | |

2.03.02 | Capital reserves | 32,720 | 32,720 | |

2.03.04 | Profit reserves | 4,431,200 | 4,431,200 | |

2.03.04.01 | Legal reserve | 278,576 | 278,576 | |

2.03.04.02 | Earnings reserves | 4,210,888 | 4,210,888 | |

2.03.04.09 | Treasury shares | (58,264) | (58,264) | |

2.03.05 | Accumulated profit/(losses) | (1,360,851) | - | |

2.03.08 | Other comprehensive income | (3,473,059) | 1,170,624 | |

2.03.09 | Profit attributable to the non-controlling interests | 1,236,532 | 1,187,388 | |

Page 11

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Statements of Income | |||||

(R$ thousand) | |||||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 | ||

3.01 | Revenues from sale of goods and rendering of services | 5,334,653 | 6,005,466 | ||

3.02 | Costs from sale of goods and rendering of services | (4,017,707) | (4,021,495) | ||

3.03 | Gross profit | 1,316,946 | 1,983,971 | ||

3.04 | Operating (expenses)/income | (1,221,313) | (803,252) | ||

3.04.01 | Selling expenses | (390,915) | (573,484) | ||

3.04.02 | General and administrative expenses | (119,055) | (120,181) | ||

3.04.04 | Other operating income | 102,689 | 228,952 | ||

3.04.05 | Other operating expenses | (768,924) | (364,372) | ||

3.04.06 | Equity in results of affiliated companies | (45,108) | 25,833 | ||

3.05 | Profit before financial income (expenses) and taxes | 95,633 | 1,180,719 | ||

3.06 | Financial income (expenses) | (1,201,138) | (635,099) | ||

3.06.01 | Financial income | 65,131 | 111,314 | ||

3.06.02 | Financial expenses | (1,266,269) | (746,413) | ||

3.06.02.01 | Net exchange differences over financial instruments | 364,882 | (113,564) | ||

3.06.02.02 | Financial expenses | (1,631,151) | (632,849) | ||

3.07 | Profit (loss) before taxes | (1,105,505) | 545,620 | ||

3.08 | Income tax and social contribution | (206,204) | (458,857) | ||

3.09 | Profit (loss) from continued operations | (1,311,709) | 86,763 | ||

3.11 | Consolidated Profit (loss) for the year | (1,311,709) | 86,763 | ||

3.11.01 | Profit attributable to the controlling interests | (1,360,851) | (7,572) | ||

3.11.02 | Profit attributable to the non-controlling interests | 49,142 | 94,335 | ||

3.99 | Earnings per share – (Reais / Share) | - | - | ||

3.99.01 | Basic earnings per share | - | - | ||

3.99.01.01 | Common shares | (0.98604) | (0.00551) | ||

3.99.02 | Diluted earnings per share | - | - | ||

3.99.02.01 | Common shares | (0.98604) | (0.00551) | ||

| |||||

Page 12

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Statement of Comprehensive Income | ||||

(R$ thousand) | ||||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 | |

4.01 | Consolidated profit (loss) for the year | (1,311,709) | 86,763 | |

4.02 | Other comprehensive income | (4,643,681) | 150,183 | |

4.02.01 | Actuarial gains over pension plan of subsidiaries, net of taxes | 33 | 30 | |

4.02.02 | Cumulative translation adjustments for the year | 380,042 | (21,804) | |

4.02.04 | Losses in cash flow hedge | (5,390,043) | (18,440) | |

4.02.05 | Cash flow hedge reclassified to income upon realization | 364,818 | 184,217 | |

4.02.06 | (Loss)/gain on hedge of net investment in foreign operations. | 1,469 | 6,180 | |

4.03 | Consolidated comprehensive income for the year | (5,955,390) | 236,946 | |

4.03.01 | Profit attributable to the controlling interests | (6,004,534) | 142,611 | |

4.03.02 | Profit attributable to the non-controlling interests | 49,144 | 94,335 | |

| ||||

Page 13

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Statements of Cash Flows – Indirect Method | |||

(R$ thousand) | |||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 |

6.01 | Net cash from operating activities | 466,933 | 1,185,970 |

6.01.01 | Cash from operations | 1,166,186 | 1,018,203 |

6.01.01.01 | Profit attributable to the controlling interests | (1,360,851) | (7,572) |

6.01.01.02 | Results of non-controlling shareholders | 49,142 | 94,335 |

6.01.01.03 | Financial charges in borrowing and financing raised | 470,990 | 465,928 |

6.01.01.04 | Financial charges in borrowing and financing granted | (11,481) | (13,946) |

6.01.01.05 | Charges on lease liabilities | 13,056 | 4,957 |

6.01.01.06 | Equity in results of affiliated companies | 45,108 | (25,833) |

6.01.01.07 | Deferred taxes assets | (11,351) | 89,039 |

6.01.01.08 | Provision for tax, social security, labor, civil and environmental risks | (8,685) | (69,853) |

6.01.01.09 | Monetary and exchange variations, net | 522,571 | 239,582 |

6.01.01.10 | Write-off of property, plant and equipment and Intangible assets | 1,400 | 13,712 |

6.01.01.11 | Provision for environmental liabilities and decommissioning of assets | 20,640 | 7,592 |

6.01.01.12 | Updated shares – Fair value through profit or loss | 962,561 | (127,653) |

6.01.01.13 | Depreciation, amortization and depletion | 437,507 | 328,070 |

6.01.01.14 | Accrued/(reversal) for consumption and services | 37,158 | 8,853 |

6.01.01.17 | Other provisions | (1,579) | 10,992 |

6.01.02 | Changes in assets and liabilities | (699,253) | 167,767 |

6.01.02.01 | Trade receivables - third parties | (89,849) | (713,057) |

6.01.02.02 | Trade receivables - related party | (31,572) | (92,283) |

6.01.02.03 | Inventory | (13,512) | (653,465) |

6.01.02.04 | Receivables - related parties/dividends | �� - | 447 |

6.01.02.05 | Tax assets | 57,227 | (41,211) |

6.01.02.06 | Judicial deposits | (4,749) | (11,569) |

6.01.02.08 | Trade payables | 341,567 | (170,461) |

6.01.02.09 | Trade payables – Drawee risk | (183,736) | 235,181 |

6.01.02.10 | Payroll and related taxes | (14,420) | 14,014 |

6.01.02.11 | Taxes in installments – REFIS | (61,612) | 282,973 |

6.01.02.12 | Payables to related parties | (20,572) | (30,173) |

6.01.02.13 | Advances from clients | (130,568) | 1,935,831 |

6.01.02.14 | Interest paid | (511,242) | (590,621) |

6.01.02.16 | Others | (36,215) | 2,161 |

6.02 | Net cash investment activities | (404,851) | (220,750) |

6.02.02 | Purchase of property, plant and equipment and intangible assets | (353,698) | (313,579) |

6.02.04 | Receipt/(payment) in derivative transactions | - | (372) |

6.02.07 | Intercompany loans granted | (82,089) | (40,643) |

6.02.08 | Intercompany loans received | 3,022 | 16,796 |

6.02.09 | Financial Investments, net of redemption | 27,914 | 117,048 |

6.03 | Net cash used in financing activities | 2,157,127 | (514,817) |

6.03.01 | Borrowings and financing raised | 4,553,970 | 2,465,845 |

6.03.02 | Transactions cost - Borrowings and financing | (9,131) | (28,810) |

6.03.03 | Amortization of borrowings and financing | (2,363,666) | (2,939,145) |

6.03.04 | Dividends and interest on shareholder’s equity | (136) | - |

6.03.05 | Amortization of leases | (23,910) | (12,707) |

6.04 | Exchange rate on translating cash and cash equivalents | (27,026) | 3,670 |

6.05 | Increase (decrease) in cash and cash equivalents | 2,192,183 | 454,073 |

6.05.01 | Cash and equivalents at the beginning of the year | 1,088,955 | 2,248,004 |

6.05.02 | Cash and equivalents at the end of the year | 3,281,138 | 2,702,077 |

Page 14

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Statements of Changes in Equity - 01/01/2020 to 03/31/2020 | |||||||||

(R$ thousand) | |||||||||

Code | Description | Paid-in capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity | Non-controlling interests | Shareholders’ equity |

5.01 | Opening balances | 4,540,000 | 32,720 | 4,431,200 | - | 1,170,624 | 10,174,544 | 1,187,388 | 11,361,932 |

5.03 | Adjusted opening balances | 4,540,000 | 32,720 | 4,431,200 | - | 1,170,624 | 10,174,544 | 1,187,388 | 11,361,932 |

5.05 | Total comprehensive income | - | - | - | (1,360,851) | (4,643,683) | (6,004,534) | 49,144 | (5,955,390) |

5.05.01 | (Loss) profit for the year | - | - | - | (1,360,851) | - | (1,360,851) | 49,142 | (1,311,709) |

5.05.02 | Other comprehensive income | - | - | - | - | (4,643,683) | (4,643,683) | 2 | (4,643,681) |

5.05.02.04 | Translation adjustments for the year | - | - | - | - | 380,042 | 380,042 | - | 380,042 |

5.05.02.06 | Actuarial (loss)/gain on pension plan, net of taxes | - | - | - | - | 31 | 31 | 2 | 33 |

5.05.02.07 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | (5,025,225) | (5,025,225) | - | (5,025,225) |

5.05.02.08 | (Loss) / gain on hedge of net investment in foreign operations | - | - | - | - | 1,469 | 1,469 | - | 1,469 |

5.07 | Closing balance | 4,540,000 | 32,720 | 4,431,200 | (1,360,851) | (3,473,059) | 4,170,010 | 1,236,532 | 5,406,542 |

Page 15

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Statements of Changes in Equity - 01/01/2019 to 03/31/2019 | |||||||||

(R$ thousand) | |||||||||

Code | Description | Paid-in capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity | Non-controlling interests | Shareholders’ equity |

5.01 | Opening balances | 4,540,000 | 32,720 | 3,064,827 | - | 1,065,188 | 8,702,735 | 1,310,705 | 10,013,440 |

5.03 | Adjusted opening balances | 4,540,000 | 32,720 | 3,064,827 | - | 1,065,188 | 8,702,735 | 1,310,705 | 10,013,440 |

5.05 | Total comprehensive income | - | - | - | (7,572) | 150,183 | 142,611 | 94,335 | 236,946 |

5.05.01 | (Loss) profit for the year | - | - | - | (7,572) | - | (7,572) | 94,335 | 86,763 |

5.05.02 | Other comprehensive income | - | - | - | - | 150,183 | 150,183 | - | 150,183 |

5.05.02.04 | Translation adjustments for the year | - | - | - | - | (21,804) | (21,804) | - | (21,804) |

5.05.02.06 | Actuarial (loss)/gain on pension plan, net of taxes | - | - | - | - | 30 | 30 | - | 30 |

5.05.02.07 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | 165,777 | 165,777 | - | 165,777 |

5.05.02.08 | (Loss) / gain on hedge of net investment in foreign operations | - | - | - | - | 6,180 | 6,180 | - | 6,180 |

5.06 | Internal changes in shareholders’ equity | - | - | - | - | - | - | 2 | 2 |

5.06.04 | Non-controlling interests in subsidiaries | - | - | - | - | - | - | 2 | 2 |

5.07 | Closing balance | 4,540,000 | 32,720 | 3,064,827 | (7,572) | 1,215,371 | 8,845,346 | 1,405,042 | 10,250,388 |

Page 16

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE

Quarterly Financial Information - March 31, 2020 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Financial Statements / Statements of Value Added | ||||||

(R$ thousand) | ||||||

Code | Description | Year to date 01/01/2020 to 31/03/2020 | YTD previous year 01/01/2019 to 31/03/2019 | |||

7.01 | Revenues | 6,143,475 | 6,948,101 | |||

7.01.01 | Sales of products and rendering of services | 6,137,834 | 6,795,881 | |||

7.01.02 | Other revenues | 6,962 | 131,521 | |||

7.01.04 | Allowance for (reversal of) doubtful debts | (1,321) | 20,699 | |||

7.02 | Raw materials acquired from third parties | (4,758,610) | (4,677,204) | |||

7.02.01 | Cost of sales and services | (3,776,787) | (3,742,381) | |||

7.02.02 | Materials, electric power, outsourcing and other | (961,472) | (893,674) | |||

7.02.03 | Impairment/recovery of assets | (20,351) | (41,149) | |||

7.03 | Gross value added | 1,384,865 | 2,270,897 | |||

7.04 | Retentions | (436,293) | (328,070) | |||

7.04.01 | Depreciation, amortization and depletion | (436,293) | (328,070) | |||

7.05 | Wealth created | 948,572 | 1,942,827 | |||

7.06 | Value added received | 698,088 | 95,823 | |||

7.06.01 | Equity in results of affiliated companies | (45,108) | 25,833 | |||

7.06.02 | Financial income | 65,131 | 111,314 | |||

7.06.03 | Others | 678,065 | (41,324) | |||

7.06.03.01 | Others and exchange gains | 678,065 | (41,324) | |||

7.07 | Wealth for distribution | 1,646,660 | 2,038,650 | |||

7.08 | Wealth distributed | 1,646,660 | 2,038,650 | |||

7.08.01 | Personnel | 584,191 | 610,988 | |||

7.08.01.01 | Salaries and wages | 432,137 | 457,968 | |||

7.08.01.02 | Benefits | 108,569 | 108,793 | |||

7.08.01.03 | Severance payment (FGTS) | 43,485 | 44,227 | |||

7.08.02 | Taxes, fees and contributions | 424,401 | 631,219 | |||

7.08.02.01 | Federal | 352,361 | 551,594 | |||

7.08.02.02 | State | 63,146 | 74,681 | |||

7.08.02.03 | Municipal | 8,894 | 4,944 | |||

7.08.03 | Remuneration on third-party capital | 1,949,777 | 709,680 | |||

7.08.03.01 | Interest | 1,631,151 | 632,849 | |||

7.08.03.02 | Rental | 5,441 | 5,342 | |||

7.08.03.03 | Others | 313,185 | 71,489 | |||

7.08.03.03.01 | Others and exchange losses | 313,185 | 71,489 | |||

7.08.04 | Remuneration on Shareholders' capital | (1,311,709) | 86,763 | |||

7.08.04.03 | Retained earnings (accumulated losses) | (1,360,851) | (7,572) | |||

7.08.04.04 | Non-controlling interests in retained earnings | 49,142 | 94,335 | |||

Page 17

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

Comments on the Company’s Consolidated Performance

São Paulo, May 23, 2020

Results for the First Quarter of 2020

Companhia Siderúrgica Nacional (“CSN”) (B3 S.A. – Brasil, Bolsa e Balcão: CSNA3) (NYSE: SID)announces its results for the first quarter of 2020 (1Q20) in Brazilian Reais, in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), and with Brazilian accounting practices, which are fully convergent with international accounting standards, issued by the Accounting Pronouncements Committee (CPC) and approved by the Brazilian Securities and Exchange Commission (CVM), pursuant to CVM Instruction 485 of 09/01/10.

All comments presented herein refer to the Company’s consolidated results for thefirst quarter of 2020 (1Q20) and comparisons refer to the fourth quarter of 2019 (4Q19) and the first quarter of 2019 (1Q19). The Real/U.S. dollar exchange rate was R$5.1987 on 03/31/2020, R$4.0307 on 12/31/2019 and R$3.8967 on 03/31/2019.

Operating and Financial Highlights in 1Q20

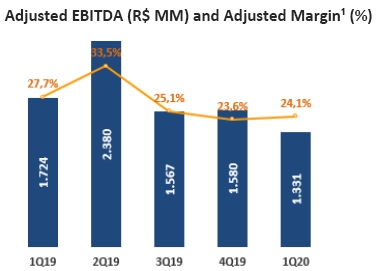

· Adjusted EBITDAreachedR$1,331 million in1Q20, even with a lower iron ore production.

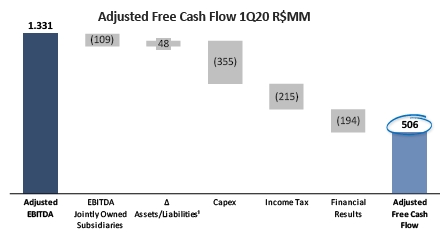

· Adjusted Free Cash FlowreachedR$506MM,reflecting actions for liquidity protection.

· Iron ore productiontotaled 5.9 million tons in the 1Q20, 39% lower YoY, due to heavy rains in the region and delay in new mining fronts.

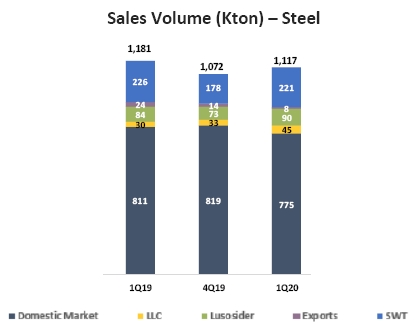

· Steel Sales Volumereached 1,140 thousand tons,2% higher than in 4Q19.Steel EBITDA showed sequentialgrowth of 68%, totalling R$298MM.

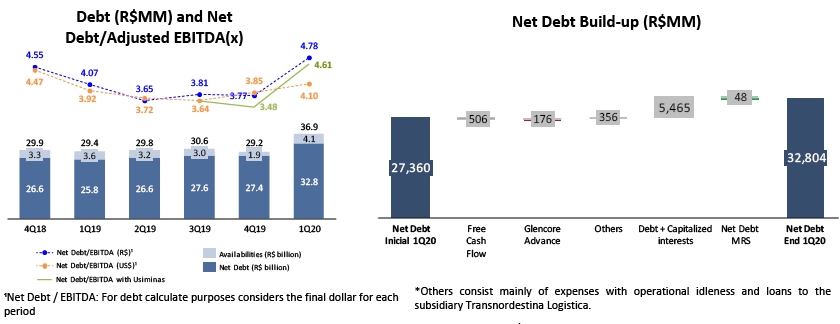

· Net debt/EBITDA reached 4.78x,or 1.01x higher than 4Q19, due to strong exchange rate variation.

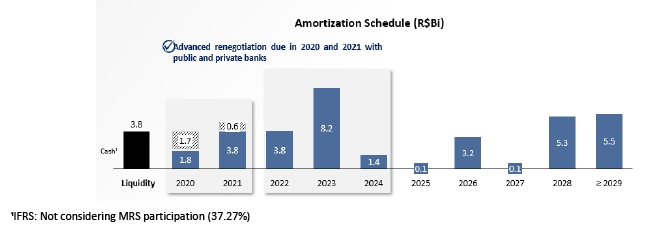

· NewBondsissued due 2028 in the amount of US$1.0 billion, providing significant increase in debt’s maturities.

Highlights | 1Q19 | 4Q19 | 1Q20 |

|

| Variation | ||||||||

1Q20 | x | 1Q19 | 1Q20 | x | 4Q19 |

|

|

| ||||||

Steel Sales (thousand tons) | 1,175 | 1,117 | 1,140 |

|

| (3%) | 2% |

| ||||||

- Domestic Market | 811 | 819 | 775 |

|

| (4%) | (5%) |

| ||||||

- Subsidiaries Abroad | 340 | 283 | 356 |

|

| 5% | 26% |

| ||||||

- Exports | 24 | 14 | 8 |

|

| (64%) | (41%) |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Iron Ore Sales (thousand tons) | 8,859 | 10,334 | 5,609 |

|

| (37%) | (46%) |

| ||||||

- Domestic Market | 1,169 | 953 | 1,806 |

|

| (7%) | 14% |

| ||||||

- Exports | 7,690 | 9,382 | 4,524 |

|

| (41%) | (52%) |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Consolidated Results (R$ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenue | 6,005 | 6,524 | 5,335 |

|

| (11%) | (18%) |

| ||||||

Gross Profit | 1,948 | 2,108 | 1,317 |

|

| (32%) | (38%) |

| ||||||

Adjusted EBITDA¹ | 1,724 | 1,580 | 1,331 |

|

| (23%) | (16%) |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Adjusted Net Debt² | 25,772 | 27,360 | 32,804 |

|

| 27% | 20% |

| ||||||

Adjusted Cash and Cash Equivalents² | 3,601 | 1,857 | 4,129 |

|

| 15% | 122% |

| ||||||

Net Debt / Adjusted EBITDA | 4.07x | 3.77x | 4.78x |

|

| 0.71x | 1.01x |

| ||||||

¹ Adjusted EBITDA is calculated based on net profit/loss, plus depreciation and amortization, income tax, net financial result, share of profit (loss) of investees and other operating income (expenses), and includes the proportionate share of EBITDA of jointly owned subsidiaries MRS Logística and CBSI. Adjusted EBITDA includes stakes of 100% in CSN Mineração, 37.27% in MRS and 50% in CBSI (until November/2019).

² Adjusted net debt and adjusted cash and cash equivalents includes the stakes of 100% in CSN Mineração, 37.27% in MRS and 50% in CBSI (until November/2019), excluding forfaiting and drawee risk operations.

Page 18

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

CSN’s Consolidated Result

· Net revenuein 1Q20 totaled R$5,335 million, 11% and 8% less than 1Q19 and 4Q19, respectively. The decrease in iron ore sales volume was due to the heavy rainfall and delay in new mining fronts.

· In1Q20,cost of goods sold totaled R$4,018 million, 9.3% lower than the previous quarter.

· In1Q20,gross profitreached R$1,317 million, a 34% contraction compared to 1Q19. Gross margin decreased 8.3 p.p. versus 1Q19, to 24.7% in 1Q20, due to a punctual drop in iron ore volumes.

· In 1Q20, selling,general and administrative expensestotaled R$510 million, 26.5% lower YoY, while net revenue, in the same comparison basis, reached 11%.Selling expensesstrongly decreased by 32% in1Q20, whilegeneral and administrative expensesdropped 2.8% in the same period, corresponding 2.1% of net revenue, stable when compared to 1Q19.

· Other operating income and expenseswas negative by R$666MM, mainly due to cash flow hedging and to idle capacity in mining equipment.

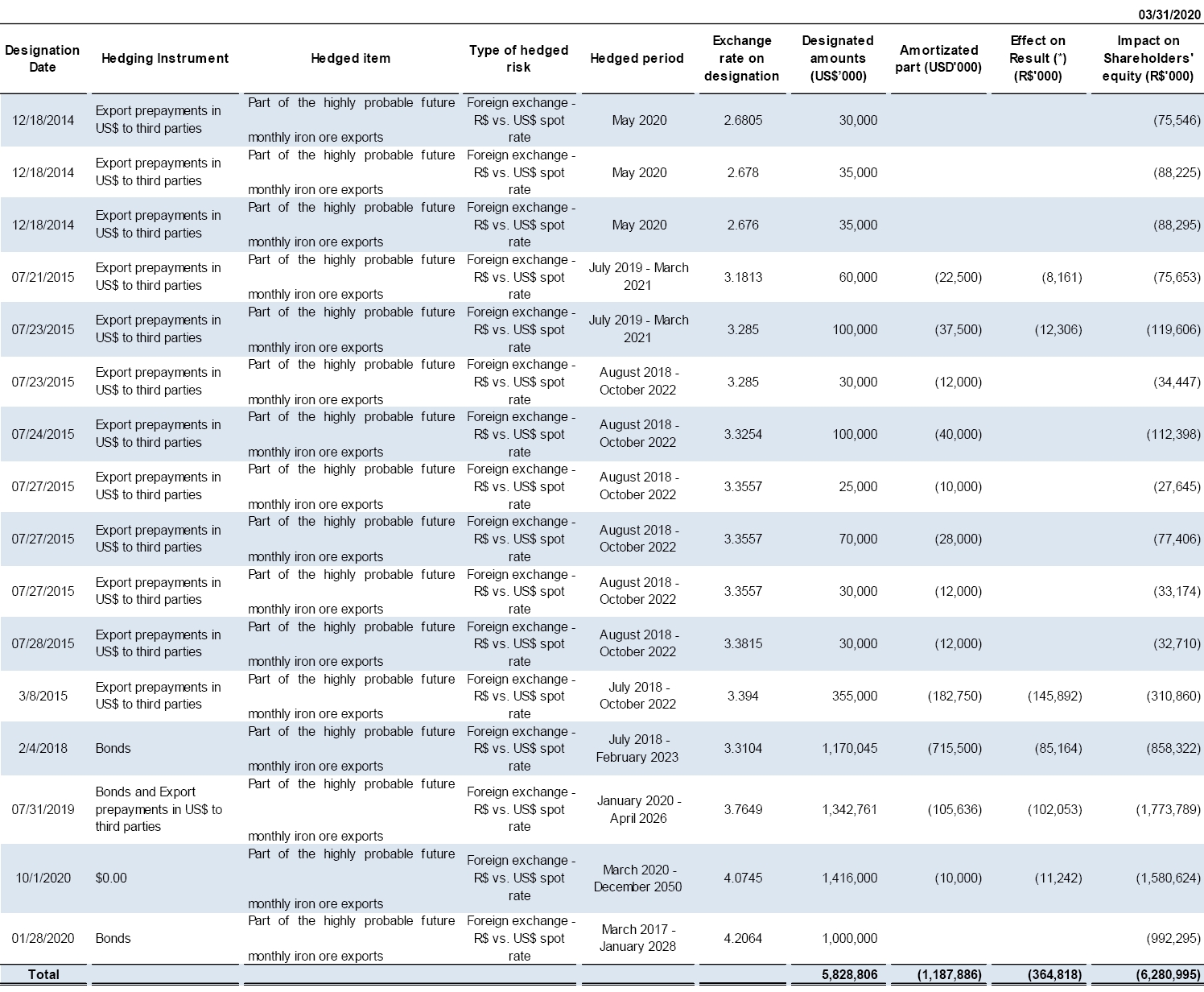

· Financial resultwas negative by R$1,201MM, impacted by the exchange rate variation and Usiminas’ shares drop providing negative results without cash impact in the amount of R$962MM.

Financial Result (R$ million) | 1Q19 | 4Q19 | 1Q20 |

Financial Result - IFRS | (635) | (298) | (1,201) |

Financial Revenue | 111 | 68 | 65 |

Financial Expenses | (746) | (366) | (1,266) |

Financial Expenses (ex-exchange rate variation) | (633) | (624) | (1,631) |

Result with Exchange Rate Variation | (113) | 258 | 365 |

Monetary and Exchange Rate Variation | (125) | 605 | (4,928) |

Hedge Accounting | 12 | (355) | 5,389 |

Derivative Result | 0 | 8 | (96) |

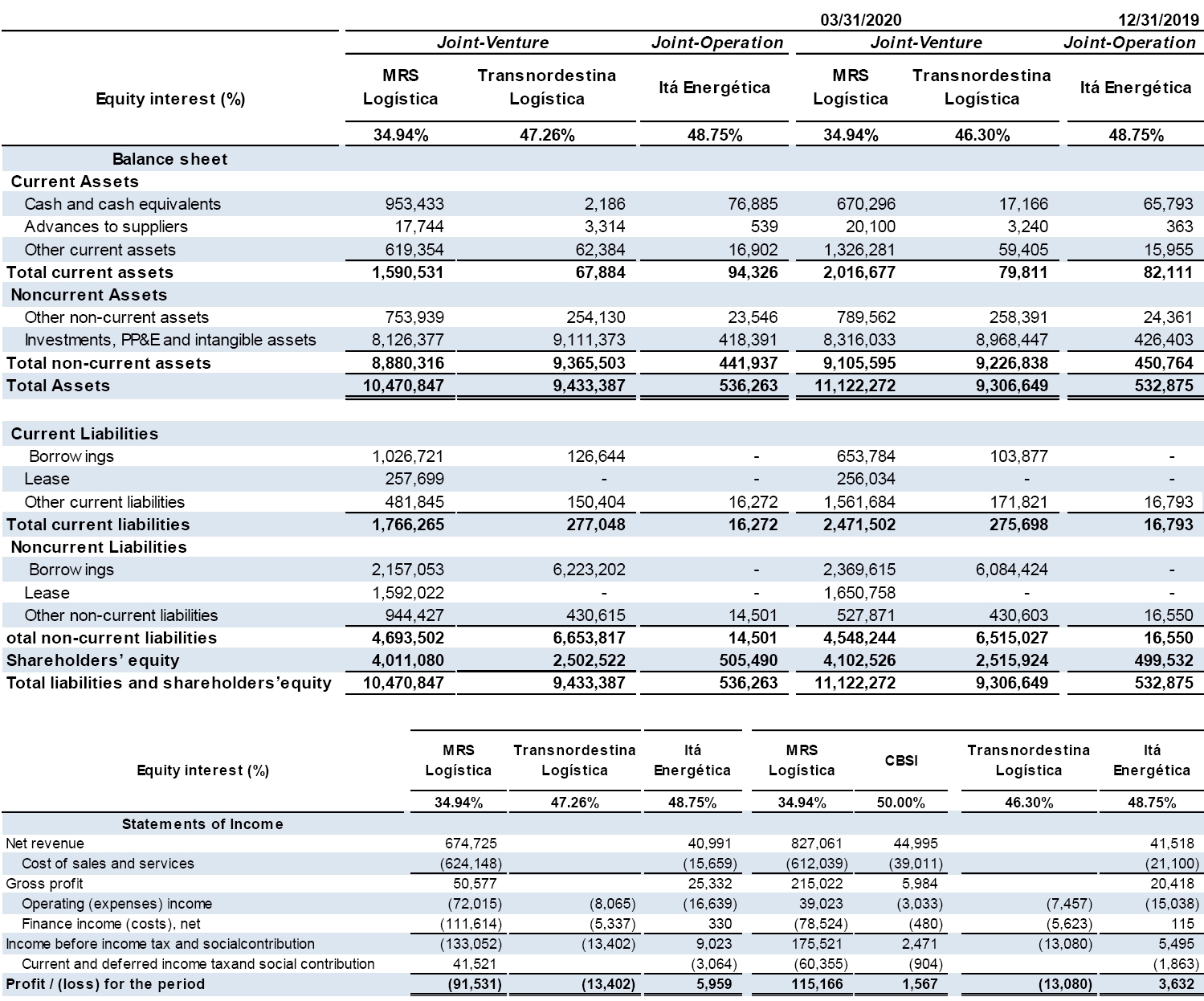

· Equity result of affiliated companies was negative by R$45 million in1Q20 versus a positive amount of R$7 million in 4Q19, mainly due to the negative result from MRS caused by a strong reduction of cargoes with heavy rains above historical average.

Equity Results of Affiliated Companies | 1Q19 | 4Q19 | 1Q20 |

MRS Logística | 43 | 16 | (34) |

CBSI | 1 | 2 | - |

TLSA | (6) | (2) | (6) |

Arvedi Metalfer BR | - | (1) | (1) |

Eliminações | (12) | (8) | (4) |

Equity in Results of Affiliated companies | 26 | 7 | (45) |

Page 19

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

· In1Q20, the Company registered a net loss of R$1,312 million, versus a net gain of R$87 million in 1Q19, mainly due to non-operational issues and non-cash such as hedge accounting and market value loss in Usiminas shares.

Adjusted EBITDA (R$ million) | 1Q19 | 4Q19 | 1Q20 | Variation | |||||

1Q20 | x | 1Q19 | 1Q20 | X | 4Q19 | ||||

Net Profit /(Loss) for the period | 87 | 1,134 | (1,312) | (1,608%) | (216%) | ||||

(-) Depreciation | 306 | 432 | 415 | 36% | (4%) | ||||

(+) Income tax and social contribution | 459 | (474) | 206 | (55%) | (143%) | ||||

(+) Net financial result | 635 | 298 | 1,201 | 89% | 303% | ||||

EBITDA (ICVM 527) | 1,487 | 1,390 | 511 | (66%) | (63%) | ||||

(+) Other Operating Income/Expenses | 135 | 103 | 666 | 393% | 547% | ||||

(+) Equity in Results of Affiliated Companies | (26) | (7) | 45 | (273%) | (743%) | ||||

(-) Proportional EBITDA of Jointly Owned Subsidiaries | 127 | 94 | 109 | (14%) | 16% | ||||

Adjusted EBITDA | 1,724 | 1,580 | 1,331 | (23%) | (16%) | ||||

*The Company discloses adjusted EBITDA excluding interests in investments and other operating income (expenses) with the understanding that these items should not be considered when calculating recurring operating cash flow.

· Adjusted EBITDA reached R$1,331 million in1Q20, versus R$1,580 million in 4Q19, due to low iron ore production as a result of severe rain, although partially compensated by the gradual evolution of steel’s result. Adjusted EBITDA margin reached 24.1%, or 0.6 p.p. higher in the same comparison basis.

¹Adjusted EBITDA margin is calculated as the ratio between adjusted EBITDA and adjusted net revenue, which considers stakes of 100% in CSN Mineração and 37.27% in MRS and 50% in CBSI (until November/19).

Adjusted Free Cash Flow¹

Adjusted Free Cash Flow in 1Q20 reached R$506MM, negatively influenced by lower cash generation measured by EBITDA in mining segment, due to severe rain in the period.

Page 20

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

¹ Adjusted free cash flow is calculated from adjusted EBITDA less EBITDA of joint ventures, Capex, Income tax, financial result and variation of working capital ¹, excluding the impact of Glencore’s prepay.

²Adjusted Working Capital comprises the variation in NWC (-R$ 187 million), plus variation in long-term asset and liability accounts (+ R$ 192 million, mainly reclassification of PIS / COFINS credits), and adjusted by following non-cash launches in the period: (i) Receipt of Property in Payment (-R$ 61 million), and (ii) Recognition of Tax Credits (+ R$ 104 million).

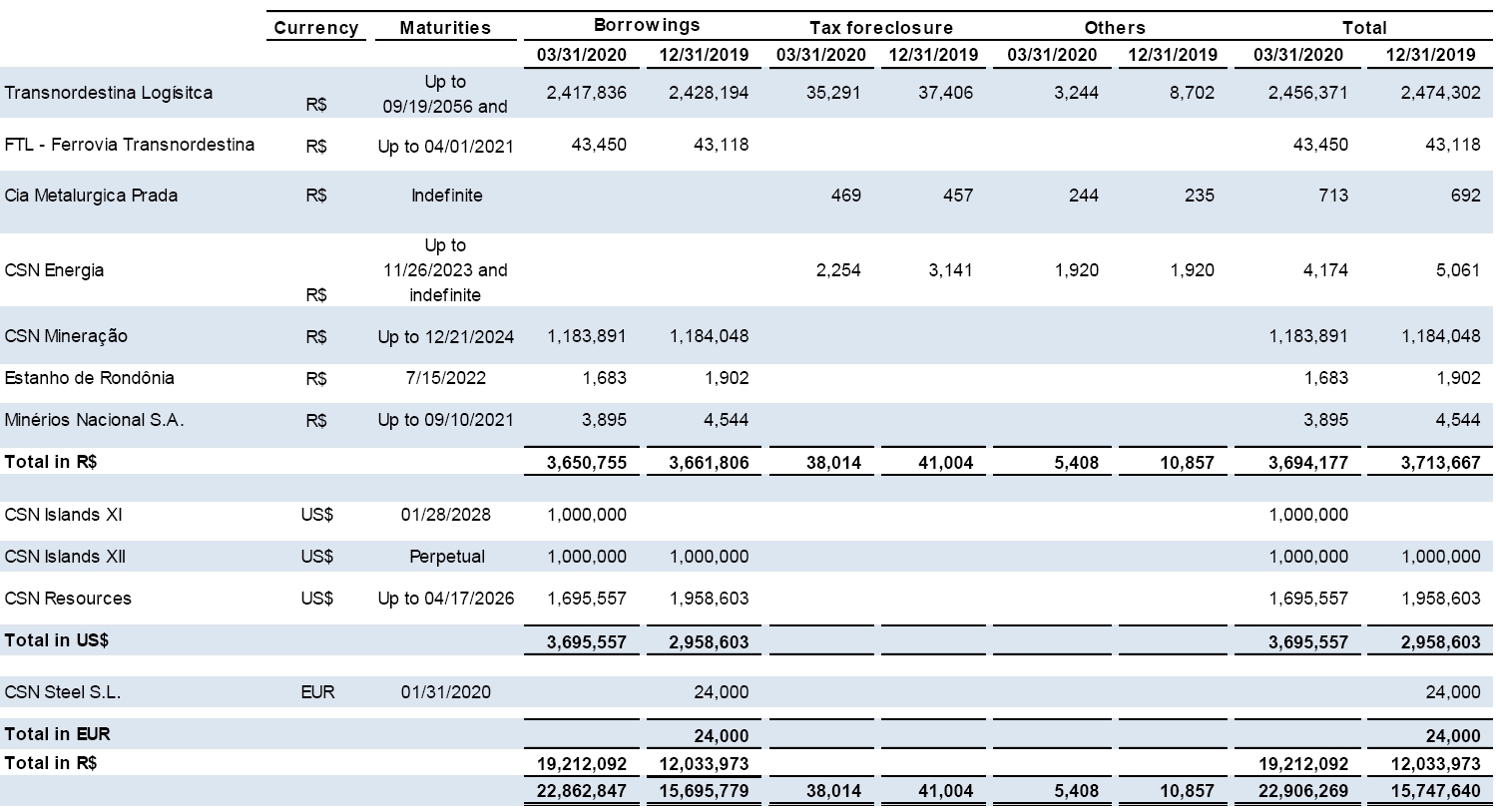

Debt

On 03/31/2020, consolidated net debt was R$32,804 million, while net debt/EBITDA, reached 4.78x, or 1.01x higher than in 4Q19. Debt evolution in the quarter was impacted by the exchange rate variation, with no cash impact, considering a longer duration of debt in dollars.

In 1Q20, the Company issued new Bonds due in 2028 in the amount of US$1.0 billion, obtaining an increase in its debt duration. Additionally, the liquidity support obtained solves the Company’s short-term financial obligations.

Page 21

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

Foreign Exchange Exposure

Net FX exposure on the consolidated balance sheet on 03/31/2020 was US$374 million, as shown in the table below.

Foreign Exchange Exposure | 03/31/2019 | 12/31/2019 | 03/31/2020 |

(in US$ ‘000) | IFRS | IFRS | IFRS |

Cash | 99 | 105 | 293 |

Accounts Receivable | 486 | 346 | 323 |

Other | 7 | 4 | 3 |

Total Assets | 593 | 455 | 619 |

Loans and Financing | (4,053) | (4,097) | (4,730) |

Trade Payables | (125) | (69) | (87) |

Other Payables | (3) | (3) | (3) |

Total Liabilities | (3,181) | (4,169) | (4,819) |

|

|

| |

Natural Foreign Exchange Exposure (Assets - Liabilities) | (2,589) | (3,714) | (4,200) |

Cash Flow Hedge Accounting | 1,862 | 2,531 | 4,641 |

Swap CDI x Dollar | - | (67) | (67) |

Net Foreign Exchange Exposure | (1,726) | (1,250) | 374 |

Hedge Accounting adopted by CSN correlates projected export in dollars with scheduled debt payments in the same currency. Therefore, the exchange rate variation of the dollar-denominated debt is temporarily accounted for under shareholders’ equity, being recorded in the income statement when dollar revenues from exports are received.

Investments

A total of R$354 million were invested in1Q20, due to the slowdown in expenses in several sustaining projects in the steel segment, within the context of the stoppage of blast furnace #3 which occurred during 2Q19. In mining, investments were related mostly with operational continuity.

Investments (R$ million) | 2018 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | 2019 | 1Q20 |

|

|

|

Steel | 637 | 160 | 212 | 405 | 576 | 1,353 | 170 |

|

|

|

Mining | 505 | 118 | 190 | 165 | 174 | 647 | 132 |

|

|

|

Other | 175 | 35 | 44 | 40 | 96 | 215 | 51 |

|

|

|

Total Investments - IFRS | 1,318 | 314 | 446 | 610 | 846 | 2,216 | 354 |

|

|

|

Net Working Capital

Net Working Capital invested in the business totaledR$3,826 million in 1Q20, raising the financial cycle in 8 days when compared to 4Q19, due to higher accounts receivable and inventory balance, but partially offset by trade payables.

Net Working Capital analysis applied to the business disregard Glencore’s advance, as shown in the table below:

Net Working Capital (R$ million) | 1Q19 | 4Q19 | 1Q20 | Variation | ||||||

1Q20 | x | 1Q19 | 1Q20 | X | 4Q19 | |||||

Assets | 10,293 | 8,997 | 9,451 | (842) | 454 | |||||

Accounts Receivable | 2,838 | 2,048 | 2,206 | (632) | 158 | |||||

Inventories | 5,663 | 5,283 | 5,465 | (198) | 182 | |||||

Prepaid Taxes | 764 | 828 | 889 | 125 | 61 | |||||

Credit from PIS/COFINS | 658 | 455 | 500 |

| (158) | 45 | ||||

Anticipated Expenses | 194 | 204 | 209 |

| 15 | 5 | ||||

Dividends Receivable | 45 | 44 | 44 |

| (2) | - | ||||

Other AssetsNWC¹ | 131 | 137 | 139 |

| 9 | 3 | ||||

Liabilities | 5,696 | 5,359 | 5,625 | (71) | 267 | |||||

Trade Payables | 3,528 | 4,134 | 4,390 | 862 | 255 | |||||

Payroll and Related Taxes | 415 | 429 | 461 | 46 | (18) | |||||

Taxes Payable | 181 | 222 | 271 | 89 | 49 | |||||

Advances from Customers | 106 | 104 | 110 | 4 | 77 | |||||

Provision for Consumption | 298 | 162 | 186 |

| (112) | 24 | ||||

Other LiabilitiesNWC² | 1,168 | 258 | 208 |

| (960) | (50) | ||||

Net Working Capital | 4,596 | 3,639 | 3,826 | (771) | 187 | |||||

Average Term (days) | 1Q19 | 4Q19 | 1Q20 | Variation | ||||||

1Q20 | x | 1Q19 | 1Q20 | X | 4Q19 | |||||

Receivables | 37 | 25 | 32 | (5) | 7 | |||||

Payables | 76 | 84 | 95 | 19 | 11 | |||||

Inventories³ | 109 | 92 | 104 | (5) | 12 | |||||

Financial Cycle | 70 | 33 | 41 | (29) | 8 | |||||

¹Other Assets NWC: Consider: Advances and other Accounts Receivable

²Other Liabilities NWC: Consider Other payable accounts, payable dividends, installment taxes and other provisions.

³ Invetories term average term doesn’t consider Warehouse.

Page 22

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

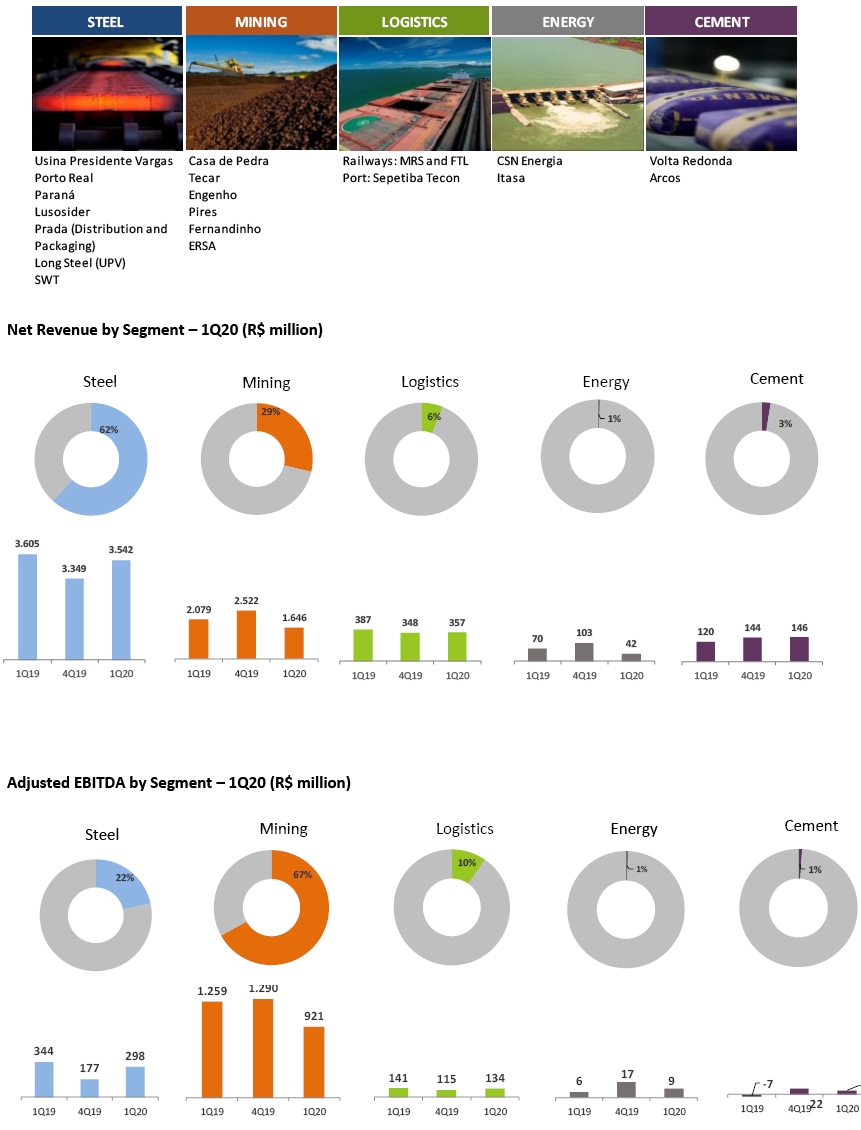

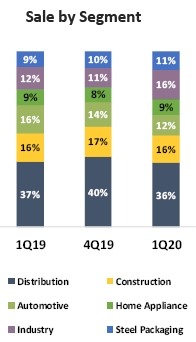

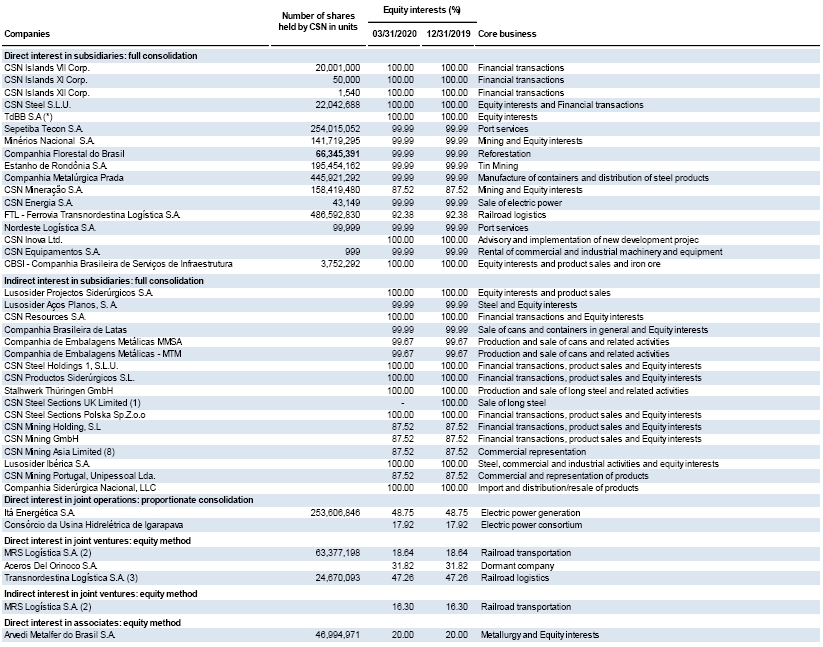

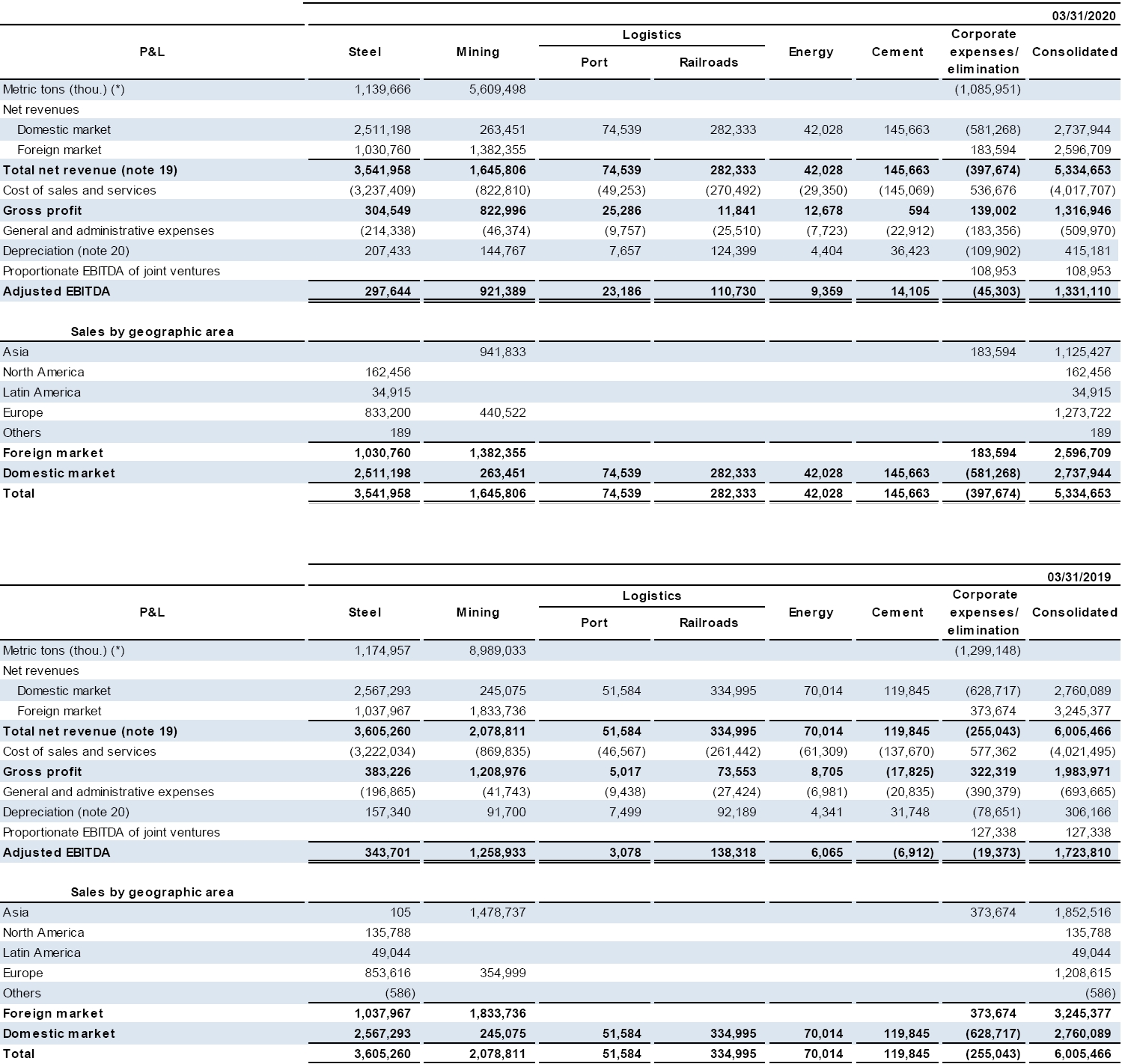

Results by Business Segment

The Company maintains integrated operations in five business segments: Steel, Mining, Logistics, Energy and Cement. The main assets and/or companies comprising each segment are presented below:

Page 23

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

1Q20 Results | Steel | Mining | Port Logistics | Railway Logistics | Energy | Cement | Corporate Expenses/ Eliminations | Consolidated |

(R$ million) | ||||||||

Net Revenue | 3,542 | 1,646 | 75 | 282 | 42 | 146 | (398) | 5,335 |

Domestic Market | 2,511 | 263 | 75 | 282 | 42 | 146 | (581) | 2,738 |

Foreign Market | 1,031 | 1,382 | - | - | - | - | 184 | 2,597 |

COGS | (3,237) | (823) | (49) | (270) | (29) | (145) | 537 | (4,018) |

Gross Profit | 305 | 823 | 25 | 12 | 13 | 1 | 139 | 1,317 |

SG&A | (214) | (46) | (10) | (26) | (8) | (23) | (183) | (510) |

Depreciation | 207 | 145 | 8 | 124 | 4 | 36 | (110) | 415 |

Proportional EBITDA of jointly owned subsidiaries | - | - | - | - | - | 109 | 109 | |

Adjusted EBITDA | 298 | 921 | 23 | 111 | 9 | 14 | (45) | 1,331 |

4Q19 Results | Steel | Mining | Port Logistics | Railway Logistics | Energy | Cement | Corporate Expenses/ Eliminations | Consolidated |

(R$ million) | ||||||||

Net Revenue | 3,349 | 2,522 | 55 | 292 | 103 | 144 | 57 | 6,524 |

Domestic Market | 2,529 | 242 | 55 | 292 | 103 | 144 | (606) | 2,761 |

Foreign Market | 820 | 2,280 | - | - | - | - | 663 | 3,763 |

COGS | (3,171) | (1,323) | (39) | (260) | (84) | (141) | 590 | (4,429) |

Gross Profit | 178 | 1,199 | 16 | 32 | 20 | 3 | 646 | 2,095 |

SG&A | (230) | (43) | (9) | (32) | (7) | (24) | (696) | (1,041) |

Depreciation | 228 | 134 | 7 | 100 | 4 | 43 | (85) | 432 |

Proportional EBITDA of jointly owned subsidiaries | - | - | - | - | - | - | 94 | 94 |

Adjusted EBITDA | 177 | 1,290 | 15 | 100 | 17 | 22 | (41) | 1,580 |

1Q19 Results | Steel | Mining | Port Logistics | Railway Logistics | Energy | Cement | Corporate Expenses/ Eliminations | Consolidated |

(R$ million) | ||||||||

Net Revenue | 3,605 | 2,079 | 52 | 335 | 70 | 120 | (255) | 6,005 |

Domestic Market | 2,567 | 245 | 52 | 335 | 70 | 120 | (629) | 2,760 |

Foreign Market | 1,038 | 1,834 | - | - | - | - | 374 | 3,245 |

COGS | (3,222) | (870) | (47) | (261) | (61) | (138) | 577 | (4,021) |

Gross Profit | 383 | 1,209 | 5 | 74 | 9 | (18) | 322 | 1,984 |

SG&A | (197) | (42) | (9) | (27) | (7) | (21) | (390) | (694) |

Depreciation | 157 | 92 | 7 | 92 | 4 | 32 | (79) | 306 |

Proportional EBITDA of jointly owned subsidiaries | - | - | - | - | - | - | 127 | 127 |

Adjusted EBITDA | 344 | 1,259 | 3 | 138 | 6 | (7) | (19) | 1,724 |

Steel Results

According to the World Steel Association (WSA), global crude steel production totaled 443.0 million tons (Mton) in1Q20, 1.4% lower YoY. Asia produced 315.2 Mton, drop of 0.3%, while the European Union and North America reduced by 10% and 4.0%, respectively YoY.

· In1Q20, CSN’s slab productiontotaled 884 thousand tons, 14% higher than in 4Q19, normalizing production after the revamp of blast furnace #3 in 2H19.

Steel Production | 1Q19 | 4Q19 | 1Q20 | Variation | |||||

(thousand tons) | 1Q20 | x | 1Q19 | 1Q20 | x | 4Q19 | |||

Total Slabs (UPV + Third parties) | 1,040 | 934 | 943 | (9%) | 1% | ||||

Slab Production | 830 | 775 | 884 | 7% | 14% | ||||

Third-party Slabs | 210 | 160 | 58 | (72%) | (64%) | ||||

Total Flat Rolled Products | 927 | 845 | 928 | - | 10% | ||||

Total Long Rolled Products | 51 | 61 | 51 | - | (17%) | ||||

Page 24

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

In1Q20, total sales reached1,140 thousand tons,2% higher compared to 4Q19, mainly due to higher sales in the foreign market. Domestic sales started to slowdown in the third week of March, due to the COVID-19 pandemic effects in some important segments.

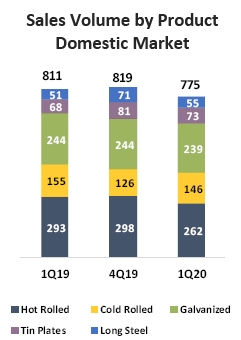

| · | In1Q20, volume of steel sold in thedomestic markettotaled 775 thousand tons, 5% less than 4Q19. Of this total, 720 thousand tons are flat steel and 55 thousand tons were long steel. According to the Brazilian Steel Institute (IABr), apparent consumption reached 5.1 million tons, decreasing 0.6% versus 1Q19. Brazilian crude steel production reached 8 million tons, decreasing 7% YoY. |  | |

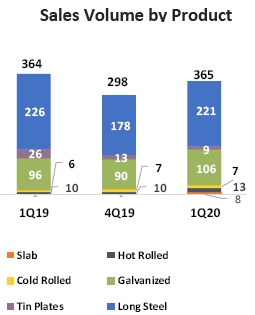

| · | In foreign markets,sales in1Q20totaled 365 thousand tons, 22% higher QoQ, due to seasonality at SWT/Lusosider/LLC. In this period, 8 thousand tons were exported directly, and 356 thousand tons were sold through subsidiaries overseas, with 45 thousand tons by LLC, 221 thousand tons by SWT, and 90 thousand tons by Lusosider. |  | |

Page 25

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

· In1Q20, CSN maintained a highshare of coated products of its total sales volume, following the strategy of adding more value to its product mix. Sales of coated products such as galvanized and tin plates accounted for 49% of flat steel sales, considering all the markets in which the Company operates. In the domestic market, coated products maintained 43% of flat steel sales in 1Q20.

According to ANFAVEA (National Association of Automobile Manufacturers),in 1Q20, the production of automobiles, light commercial vehicles, trucks and busesreached 585,889 thousand units, decreasing 16% YoY. Exports recorded a lower performance, totaling sales of 88,998 thousand vehicles, a 14.9% reduction in volume YoY.

According toABRAMAT (Construction Material Manufacturers’ Association), sales of construction materials increased 2.4% in 1Q20 on a YoY basis.

According toIBGE(Brazilian Institute of Geography and Statistics), production of home appliances increased by 11.8% in the last twelve months until March 2020, versus the same period in 2019. |  |

| · | Net revenuefrom Steel operations reached R$3,542 million in1Q20, 6% higher than in4Q19. This was due to higher sales volume in the foreign market and higher prices in both, domestic and foreign markets. Theaverage pricein domestic market was4% highercompared to the previous quarter, due to an increasing in steel prices. In the foreign market, the average price was 3% higher in the same comparison basis. |

|

| · | Cost of goods soldincreased by 2% in1Q20 over 4Q19, totaling R$3,237 million. | |

| · | Slab production cost in1Q20reached R$2,036/t, impacted by (1) power outage by utility company due to technical malfunction at a substation in January; (2) high humidity of raw materials impacted performance of the blast furnace in February. | |

| · | Since January, with production volumes stabilizing, slab cost has been positively evolving in a consistent way. | |

| · | Adjusted EBITDAreached R$298 million in1Q20, 68% higher than in 4Q19, with EBITDA margin at 8.4% in 1Q20. |

Page 26

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

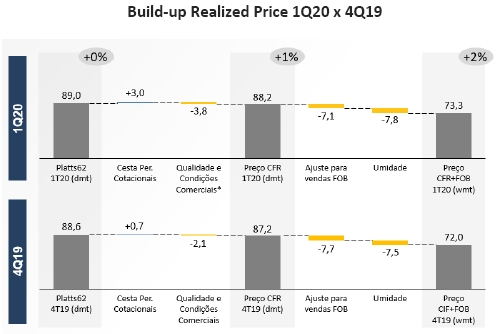

Earnning Results

In1Q20, resilient steel demand in China (+1.4% YoY of gross steel production) and the prospect of an iron ore balance deficit, due to the heavy rainfall in Minas Gerais, had a lightly positive effect on prices. Within this context,iron ore reached an average price of US$89.00/dmt (Platts, Fe62%, N. China), stable when compared with the 4Q19 (US$88.61/dmt).

As for maritime freight, the BCI-C3 (Tubarão-Qingdao) route reached an average of US$13.79/wmt in 1Q20, 33% lower than the previous quarter, influenced by balanced supply and demand of vessels, as well as, oil prices at lower levels.

· In1Q20,iron ore production totaled 5.9 million tons, 39% lower YoY due to heavy rainfall in the region and delay in new mining fronts.

· In1Q20,sales volume reached 5.6 million tons, 37% lower YoY due to production restrictions, even with good availability of iron ore from third parties.

Mining Production Volume and Sales | 1Q19 | 4Q19 | 1Q20 | Variation | ||||||

(thousand tons) | 1Q20 | x | 1Q19 |

| 1Q20 | x | 4Q19 | |||

Total Production | 9,719 | 8,859 | 5,942 | (39%) |

| (33%) | ||||

Sales to UPV | 1,169 | 953 | 1,086 | (7%) | 14% | |||||

Volume Sold to Third Parties | 7,690 | 9,382 | 4,524 | (41%) | (52%) | |||||

Total Sales | 8,859 | 10,334 | 5,609 | (37%) |

| (46%) | ||||

Production volumes includes third party iron ore purchases.

Production and sales volumes includes CSN’s 100% stake in CSN Mineração.

· In1Q20,net revenuefrom mining operations totaled R$1,646 million, 35% lower than the previous quarter, due to lower sales volume (-37%).

· The Platts 62 index reachedUS$89.0/dmt stable when compared to the previous quarter. CIF+FOB prices reachedUS$73.3/wmt, 2% higher than the previous quarter. The positive variation in 1Q20 is explained by the pricing basket of the quotational period and for a lower reduction on FOB freights.

· Cost of goods soldin the mining segment totaledR$823 million in1Q20, decreasing 5.4% on a YoY comparison. The FOB Cash Cost was USD21.3/t in 1Q20, or 11% higher YoY due to lower production volumes and a lower operational fixed dilution, that must return to normalized levels in the upcoming quarters.

· EBITDA reached R$921 million in 1Q20, with an EBITDA margin of 56%, providing a good quarter result even with a lower sales volume.

Page 27

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

CSN’s Logistics Results

Railway Logistics: In1Q20,net revenuereached R$282 million, withEBITDAof R$111 million andEBITDA marginof 39.2%.

Port Logistics: In1Q20, Sepetiba Tecon shipped 112 thousand tons of steel products, in addition to 2 thousand tons of general cargo, approximately 37 thousand containers and 488 thousand tons of bulk cargo.Net revenuereached R$75 million, with anEBITDAof R$23 million, andEBITDA marginof 31.1%.

Sepetiba TECON Highlights | 1Q19 | 4Q19 | 1Q20 | Variation | ||||||||||

1Q20 | x | 1Q19 | 1Q20 | x | 4Q19 | |||||||||

Container Volume (thousand units) | 43 | 39 | 37 |

|

| (14%) | (4%) |

| ||||||

Steel Volume (thousand tons) | 162 | 137 | 112 |

|

| (31%) | (18%) |

| ||||||

General Cargo Volume (thousand tons) | 1 | 3 | 2 |

|

| 229% | (31%) |

| ||||||

Bulk Volume (thousand tons) | 56 | 16 | 488 |

|

| 772% | 3003% |

| ||||||

Vehicles Volume (thousand units) | - | 2 | - |

|

| - | - |

| ||||||

CSN’s Energy Results

According to EPE (Energy Research Company), electricity consumption in Brazil decreased by 0.9% in 1Q20, versus the same period in 2019. The industrial segment reduced by 0.4% in the quarter, while residential and commercial segments decreased by 0.3% and 2.2%, respectively in the same comparison basis.

In 1Q20,the volume of energy traded decreased, totaling anet revenueof R$42 million, withEBTIDAof R$9 million andEBITDA margin of 22.3%.

CSN’s Cement Results

In 1Q20, domestic cement sales totaled 12.6 million tons, according to preliminary data from SNIC (National Cement Industry Association). This amount represents a decrease of 0.3% over the same period in 2019.

In 1Q20,net revenuereached R$146 million, 1.4% more than the previous quarter and 20.2% higher than in the same period in 2019, due to higher sales volume (+19%) compared to 1Q19, in addition to higher prices, generating anEBITDA of R$14 million andEBITDA margin of 9.7%%.

Page 28

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

Capital Markets

In 1Q20, CSN’s share depreciated 52.48%, while the Ibovespa decreased 15.49%. Daily traded volume (CSNA3) on B3 was R$159 million. On the New York Stock Exchange (NYSE), CSN’s American Depositary Receipts (ADR’s) depreciated 63.81% while the Dow Jones moved down 24.08%. On the NYSE, the average daily traded value of CSN’s ADR (SID) was US$12 million.

4Q19 | 1Q20 | |

Number of shares (in thousands) | 1,387,524 | 1,387,524 |

Market Cap |

|

|

Closing price (R$/share) | 14.11 | 6.98 |

Closing price (US$/ADR) | 3.45 | 1.31 |

Market cap (R$ million) | 20,805 | 9,685 |

Market cap (US$ million) | 5,230 | 1,818 |

Total return including Dividends and Interest on Equity |

|

|

CSNA3 | 6.73% | (52.48%) |

SID | 8.83% | (63.81%) |

Ibovespa | 11.14% | (15.49%) |

Dow Jones | 7.40% | (24.08%) |

Volume |

|

|

Daily average (thousand shares) | 10,651 | 14,491 |

Daily average (R$ thousand) | 137,760 | 158,635 |

Daily average (thousand ADRs) | 3,505 | 4,447 |

Daily average (US$ thousand) | 10,901 | 12,056 |

Source: Bloomberg | ||

Conference Call in Portuguese with Simultaneous Translation into English | CFO and IRO–Marcelo Cunha Ribeiro Leo Shinohara (leonardo.shinohara@csn.com.br) José Henrique Triques (jose.triques@csn.com.br) Sandra Saad (sandra.saad@csn.com.br) Guilherme Vinco (guilherme.vinco@csn.com.br)

|

May 15, 2020 | |

03:00 p.m. (US EDT) | |

04:00 p.m. (Brasilia Time) | |

Phone.:+1 929 378-3440 / +1 516 300-1066 | |

Code: CSN | |

Replay Phone: +55 113127-4999 | |

Replay Code:11977050 | |

Webcast:click here | |

| |

Some of the statements contained herein are forward-looking statements that express or imply expected results, performance or events. These include future results that may be implied by historical results and the statements under ‘Outlook’. Actual results, performance or events may differ materially from those expressed or implied by the forward-looking statements as a result of several factors, such as the general and economic conditions in Brazil and other countries, interest rate and exchange rate levels, protectionist measures in the USA, Brazil and other countries, changes in laws and regulations and general competitive factors (on a global, regional or national basis). |

Page 29

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

CONSOLIDATED SALES VOLUME (in thousands of tons)

| 1Q19 | 4Q19 | 1Q20 | Variation | ||||||

| 1Q20 | x | 1Q19 |

| 1Q20 | x | 4Q19 | |||

Flat Steel | 760 | 748 | 720 | (40) |

| (28) | ||||

Slab | - | - | - | - | - | |||||

Hot Rolled | 293 | 298 | 262 | (31) | (36) | |||||

Cold Rolled | 155 | 126 | 146 | (9) | 20 | |||||

Galvanized | 244 | 244 | 239 | (5) | (5) | |||||

Tin Plates | 68 | 81 | 73 | 5 | (8) | |||||

UPV Long Steel | 51 | 71 | 55 | 4 | (16) | |||||

DOMESTIC MARKET | 811 | 819 | 775 | (36) |

| (44) | ||||

| ||||||||||

| 1Q19 | 4Q19 | 1Q20 | 1Q20 | x | 1Q19 |

| 1Q20 | x | 4Q19 |

Flat Steel | 137 | 119 | 144 | 7 |

| 25 | ||||

Slab | - | - | 8 | 8 | 8 | |||||

Hot Rolled | 10 | 10 | 13 | 3 | 3 | |||||

Cold Rolled | 6 | 7 | 7 | 1 | - | |||||

Galvanized | 96 | 90 | 106 | 10 | 16 | |||||

Tin Plates | 26 | 13 | 9 | (17) | (4) | |||||

Long Steel Profiles | 226 | 178 | 221 | (5) |

| 43 | ||||

FOREIGN MARKET | 364 | 298 | 365 | 1 |

| 67 | ||||

|

|

|

| |||||||

| 1Q19 | 4Q19 | 1Q20 | 1Q20 | x | 1Q19 |

| 1Q20 | x | 4Q19 |

Flat Steel | 897 | 867 | 864 | (33) |

| (3) | ||||

Slab | - | - | 8 | 8 | 8 | |||||

Hot Rolled | 303 | 307 | 276 | (27) | (31) | |||||

Cold Rolled | 161 | 133 | 153 | (8) | 20 | |||||

Galvanized | 340 | 334 | 345 | 5 | 11 | |||||

Tin Plates | 94 | 94 | 82 | (12) | (12) | |||||

UPV Long Steel | 51 | 71 | 55 | 4 | (16) | |||||

Long Steel Profiles | 226 | 178 | 221 | (5) |

| 43 | ||||

TOTAL MARKET | 1,175 | 1,117 | 1,140 | (35) |

| 23 | ||||

Page 30

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

INCOME STATEMENT | |||

CONSOLIDATED – Brazilian Corporate Law (in thousands of reais) | |||

| 1Q19 | 4Q19 | 1Q20 |

Net Sales Revenue | 6,005,466 | 6,523,816 | 5,334,653 |

Domestic Market | 2,760,089 | 2,760,705 | 2,737,944 |

Foreign Market | 3,245,377 | 3,763,111 | 2,596,709 |

Costs of Goods Sold (COGS) | (4,021,495) | (4,429,143) | (4,017,707) |

COGS, excluding Depreciation and Depletion | (3,722,830) | (4,009,168) | (3,614,107) |

Depreciation/Depletion allocated to COGS | (298,665) | (419,975) | (403,600) |

Gross Profit | 1,983,971 | 2,094,673 | 1,316,946 |

Gross Margin (%) | 33% | 32% | 25% |

Selling Expenses | (572,205) | (907,221) | (387,639) |

General and Administrative Expenses | (113,959) | (121,879) | (110,750) |

Depreciation and Amortization Expenses | (7,501) | (11,798) | (11,581) |

Other Income (Expenses), net | (135,420) | (102,574) | (666,235) |

Equity in Results of Affiliated Companies | 25,833 | 6,747 | (45,108) |

Operating Income Before the Financial Result | 1,180,719 | 957,948 | 95,633 |

Net Financial Result | (635,099) | (298,335) | (1,201,138) |

Income before Income Tax and Social Contribution | 545,620 | 659,613 | (1,105,505) |

Income Tax and Social Contribution | (458,857) | 474,329 | (206,204) |

Profit for the Period | 86,763 | 1,133,942 | (1,311,709) |

Page 31

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

BALANCE SHEET |

CONSOLIDATED – Brazilian Corporate Law (in thousands of reais) |

12/31/2019 | 03/31/2020 | |

Current assets | 12,725,805 | 14,385,591 |

Cash and cash equivalents | 1,088,955 | 3,281,138 |

Financial Investments | 2,633,173 | 1,644,460 |

Accounts Receivable | 2,047,931 | 2,205,944 |

Inventory | 5,282,750 | 5,465,046 |

Other Current Assets | 1,672,996 | 1,789,003 |

Taxes to recover | 1,282,415 | 1,388,468 |

Prepaid expenses | 203,733 | 208,868 |

Dividends receivable | 44,554 | 44,554 |

Derivative financial instruments | 1,364 | 4,579 |

Others | 140,930 | 142,534 |

Non-current Assets | 38,143,471 | 38,337,492 |

Long-term Assets | 7,626,577 | 7,558,528 |

Financial Investments valued at amortized cost | 95,719 | 121,027 |

Deferred Taxex | 2,473,304 | 2,475,496 |

Other non-current assets | 5,057,554 | 4,962,005 |

Tax to recover | 2,119,940 | 1,956,660 |

Judicial deposits | 328,371 | 333,120 |

Prepaid expenses | 139,927 | 129,562 |

Credts Related Parties | 1,274,972 | 1,365,520 |

Others | 1,194,344 | 1,177,143 |

Investments | 3,584,169 | 3,600,997 |

Shareholdings | 3,482,974 | 3,438,752 |

Investment Properties | 101,195 | 162,245 |

Property, plant and equipmet | 19,700,944 | 19,857,633 |

Fixed Assets in Operation | 19,228,599 | 19,392,387 |

Lease | 472,345 | 465,246 |

Intangible Assets | 7,231,781 | 7,320,334 |

TOTAL ASSETS | 50,869,276 | 52,723,083 |

Current Liabilities | 11,619,957 | 11,970,831 |

Payroll and Related Taxes | 317,510 | 308,501 |

Trade Payables | 3,012,654 | 3,451,945 |

Taxes Payable | 541,027 | 486,766 |

Loans and Financing | 5,125,843 | 5,314,667 |

Other Payables | 2,526,444 | 2,325,921 |

Dividends and JCP Payable | 13,252 | 13,116 |

Customer Advances | 787,604 | 809,173 |

Payables – Drawee Risk | 1,121,312 | 937,576 |

Lease Liabilities | 35,040 | 31,807 |

Other Payables | 569,236 | 534,249 |

Provisions for Tax, Social Security, Labor and Civil Risks | 96,479 | 83,031 |

Non-current Liabilities | 27,887,387 | 35,345,710 |

Loans, Financing and Debentures | 22,841,193 | 30,305,393 |

Other Payables | 2,493,702 | 2,426,514 |

Customer Advances | 1,845,248 | 1,699,617 |

Lease Liabilities | 439,350 | 434,640 |

Derivative financial instruments |

| 94,909 |

Other Payables | 209,104 | 197,348 |

Deferred Taxes | 589,539 | 620,227 |

Provisions for Tax, Social Security, Labor and Civil Risks | 526,768 | 536,51 |

Other Provisions | 1,436,185 | 1,456,825 |

Provisions for Environmental Liabilities and Deactivation | 524,001 | 544,641 |

Pension and Health Plan | 912,184 | 912,184 |

Equity | 11,361,932 | 5,406,542 |

Paid-up Capital | 4,540,000 | 4,540,000 |

Capital Reserve | 32,720 | 32,720 |

Profit Reserve | 4,431,200 | 4,431,200 |

Accumulated Earnings | (1,360,851) | |

Other Comprehensive Income | 1,170,624 | (3,473,059) |

Non-controlling Interest | 1,187,388 | 1,236,532 |

TOTAL LIABILITIES AND EQUITY | 50,869,276 | 52,723,083 |

Page 32

CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE |  | |

Quarterly Financial Information –June30, 2019 – CIA SIDERURGICA NACIONAL | Version: 1 | |

CASH FLOW

CONSOLIDATED – Brazilian Corporate Law (in thousands of reais)

1Q19 | 4Q19 | 1Q20 | |

Net Cash generated by Operating Activities | 1,185,970 | 1,111,510 | 466,933 |

Net income (loss) for the period attributable to controlling shareholders | (7,572) | 1,044,514 | (1,360,851) |

Net income attributable to non-controlling shareholders | 94,335 | 89,428 | 49,142 |

Charges on loans and financing raised | 465,928 | 410,529 | 470,990 |

Charges on loans and financing granted | (13,946) | (13,509) | (11,481) |

Charges on lease liabilities | 4,957 | 16,177 | 13,056 |

Depreciation, depletion and amortization | 328,070 | 454,075 | 437,507 |

Equity in results of affiliated companies | (25,833) | (6,747) | 45,108 |

Deferred taxes | 89,039 | (777,754) | (11,351) |

Provisions for tax, social security, labor, civil and environmental risk | (69,853) | (31,638) | (8,685) |

Monetary and exchange rate variation, net | 239,582 | (65,389) | 522,571 |

Write-off of fixed and intangible assets | 13,712 | 74,797 | 1,400 |

Actuarial liability provision | - | (20,194) | - |

Adjusted shares – VJR | (127,653) | (246,525) | 962,561 |

Provisions for decommissioning and environmental liabilities | 7,592 | 9,233 | 20,640 |

Monetary correction of compulsory loan to Eletrobrás | (1,715) | - | - |

Provisions (reversal) for consumption and services | 8,853 | (181,587) | 37,158 |

Credit from Pis and Cofins | - | (160,609) | - |