- SID Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Companhia Siderúrgica Nacional (SID) 6-KSID20211103_6K

Filed: 4 Nov 21, 12:00am

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA SIDERÚRGICA NACIONAL Publicly-Held Company Corporate Taxpayer’s ID (CNPJ/MF): 33.042.730/0001-04 Company Registry (NIRE): 35-3.0039609.0

| CSN MINERAÇÃO S.A. Publicly-Held Company Corporate Taxpayer’s ID (CNPJ/MF): 08.902.291/0001-15 Company Registry (NIRE): 31300025144

|

MATERIAL FACT

Companhia Siderúrgica Nacional (“CSN”) and CSN Mineração S.A. (“CSN Mineração”) (together “Companies”), informs its shareholders and the market in general the updates in financial and operational projections for the Companies, as follows:

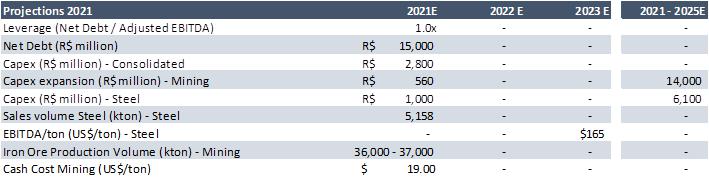

| (i) | Projection of reaching approximately R$560 million in Capex of mining expansion projects until the end of the annual balance sheet for 2021. |

| (ii) | Projection of producing a total iron ore volume plus purchases from third parties, between 36,000 – 37,000 kton until the end of the annual balance sheet of 2021. |

| (iii) | Projection of achieving the cost C1 of ore production of approximately $19.0/t, until the end of the annual balance sheet for 2021. |

Such projections will be updated in section 11 of the Companies' Reference Forms and will be available on the CVM's website in http://www.cvm.gov.br/ and on the Companies’ website in http://ri.csn.com.br/ and http://ri.csnmineracao.com.br/, within the legal deadline.

CSN and CSN Mineração clarifies that the information disclosed in this document represents an estimate and involves market factors beyond the Companies’ control. Therefore, they do not constitute a promise of performance on the part of both Companies’ and/or its Managers and, therefore, may undergo new changes.

São Paulo, November 03, 2021

Marcelo Cunha Ribeiro Executive Director of Finance and Investor Relations Officer Companhia Siderúrgica Nacional

| Pedro Barros Mercadante Oliva Investor Relations Officer

CSN Mineração S.A.

|

11.1 Projections

The Company clarifies that the information published in this item represents mere estimations, hypothetical data and in no way constitute a promise of performance on the part of the Company and/or its directors. The projections presented below involve market factors beyond the Company's control and, thus, may change.

| a) | Projection object. |

The Company estimates the following variables below.

| b) | Projected period and the validity of the projection. |

The projected period and expiration dates can be noticed in the table above, in item 11.1a), the numbers are always presented at the end of the fiscal year and duly published in the SFSs of each fiscal year.

| c) | Assumptions of the projection, with the indication of which ones can be influenced by the issuers administration and which escape its control. |

All the premises of the projections mentioned above are subject to external influence factors, which are outside of the Company's management control. Therefore, in the event of any material change in these assumptions, the Company may revise its estimates, changing them compared to those originally presented.

The main premise that can be influenced by the Company's management would be its production and sales volumes, alongside with its associated costs.

The volume of ore production considers our mining plan of 2021 with the increased production of the central plant, despite that, key factors such as sales price and raw material inputs are outside the company's control.

| d) | Values of the indicators that are the subject of the forecast. |

The values can be found above in item 11.1 a).

11.2 In the event that the issuer has published, during the last 3 fiscal years, projections on the evolution of its indicators:

a) inform which ones are being replaced by new projections included and which are being repeated.

Estimates maintained:

Projection to achieve leverage (measured by net debt ratio divided by EBITDA) of up to 1x at the end of 2021.

Projection to reach R$ 15,000 million of Net Debt at the closure of the annual balance sheet in 2021.

Projection to achieve Global Investments (Capex) of R$ 2,800 million at the end of the annual balance sheet in 2021.

Projection of reaching R$ 1,000 million of Capex in the Steel Industry at the end of the annual balance sheet in 2021.

Projection to achieve steel sales volume of 5,261ktons at the end of the annual balance sheet of 2021.

Projected to achieve EBITDA per ton of US$165/ton at the end of the 2023 annual balance sheet.

Replaced estimates:

CSN replaced the expenditure on Expansion Investments in Mining from the amount of R$ 1.0 billion to R$ 560 million in 2021.

CSN replaced the iron ore production volume in 2021 from 38-40Mton to 36-37Mton.

CSN replaced the C1 cash cost in mining from $16/ton to $19/ton at the end of the 2021 annual balance sheet.

b) regarding the projections related to periods already elapsed, compare the projected data with the effective performance of the indicators, clearly indicating the reasons that led to deviations in the projections.

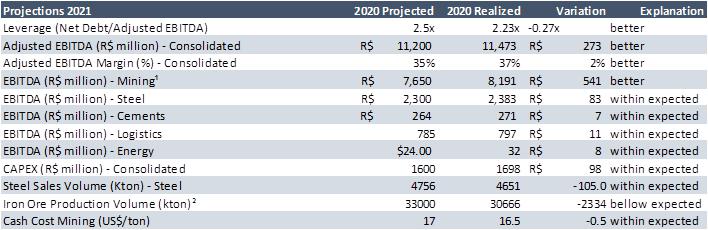

2020

And in relation to the largest deviations above and below the expectations, follows our evaluations.

¹Mining EBITDA – the R$541 million variation above expected was due to the higher iron ore price during 4Q20.

²Production Volume – the negative variation of 2,3Mton was due to rains, pandemic impacts and lower availability of iron ore compared to what was expected.

c) for projections for periods still in progress, to inform whether the projections remain valid on the date of delivery of the form and, where appropriate, to explain why they were abandoned or replaced.

Current and valid estimates:

Monitoring and changes in published projections.

CSN replaced the expenditure on Expansion Investments in Mining in the amount of R$ 1.0 billion to R$ 560 million for 2021. The reduction in investments on expansion projects, in the mining segment, is due to the fact that the main projects are still in the engineering phase and the purchase of equipment does not occur simultaneously to the disbursement, which are usually linked to deliveries.

CSN replaced the iron ore production volume in 2021 from 38-40Mton to 36-37Mton. The reduction in the expected volume production in 2021 is due to the expectation of lower acquisitions of third-party ores.

CSN replaced the C1 cash cost in mining from $16/ton to $19/ton at the end of the 2021 annual balance sheet. The increase in cash cost expected by the end of 2021 is the result of higher port expenses and higher level of fuel costs that occurred throughout the year.

| COMPANHIA SIDERÚRGICA NACIONAL | |

| By: | /S/ Benjamin Steinbruch |

Benjamin Steinbruch Chief Executive Officer | |

| By: | /S/ Marcelo Cunha Ribeiro |

Marcelo Cunha Ribeiro Chief Financial and Investor Relations Officer | |

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.