1 SubTitle: April 17, 2008 Exhibit 99.2

2 Title: Presentations Body: Paul R. Bechet, Chief Financial Officer Financial Highlights Charles Peck, President, Senior Loan Officer Loan Activity Jane M. Wolchonok, SVP, Retail Banking Retail Banking Highlights

3 Paul R. Bechet Chief Financial Officer

4 Title: Forward-Looking Information Body: This presentation contains forward-looking information for Brookline Bancorp, Inc. Such information constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) which involve significant risks and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, (1) economic conditions, (2) changes in the interest rate environment, (3) increased competition, (4) legislative or regulatory changes that adversely affect our business and (5) our ability to accomplish our growth goals.

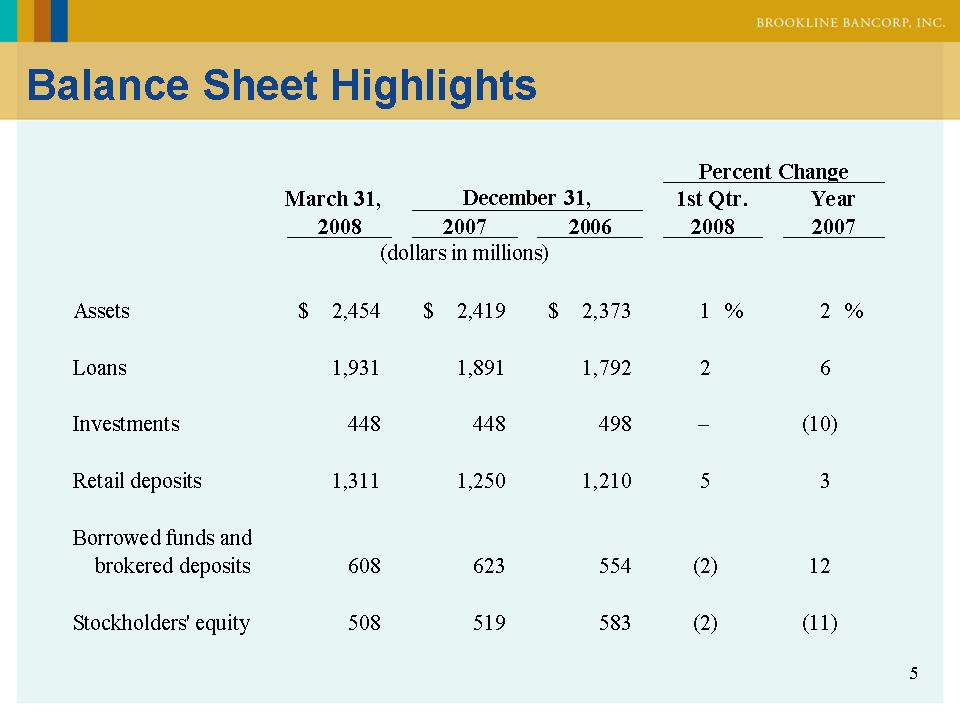

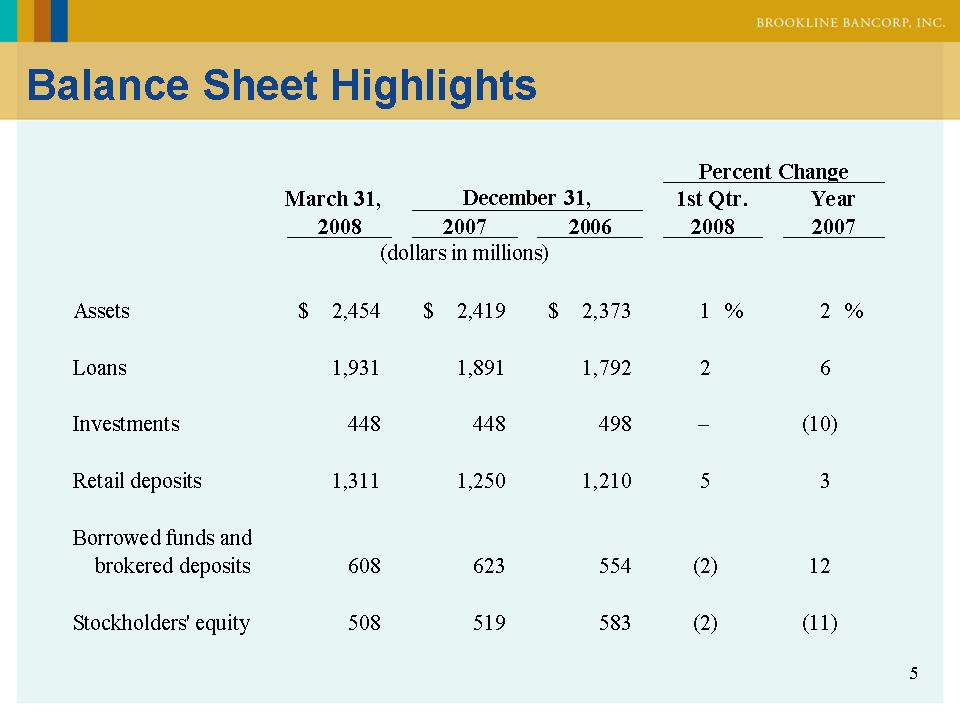

5 Balance Sheet Highlights

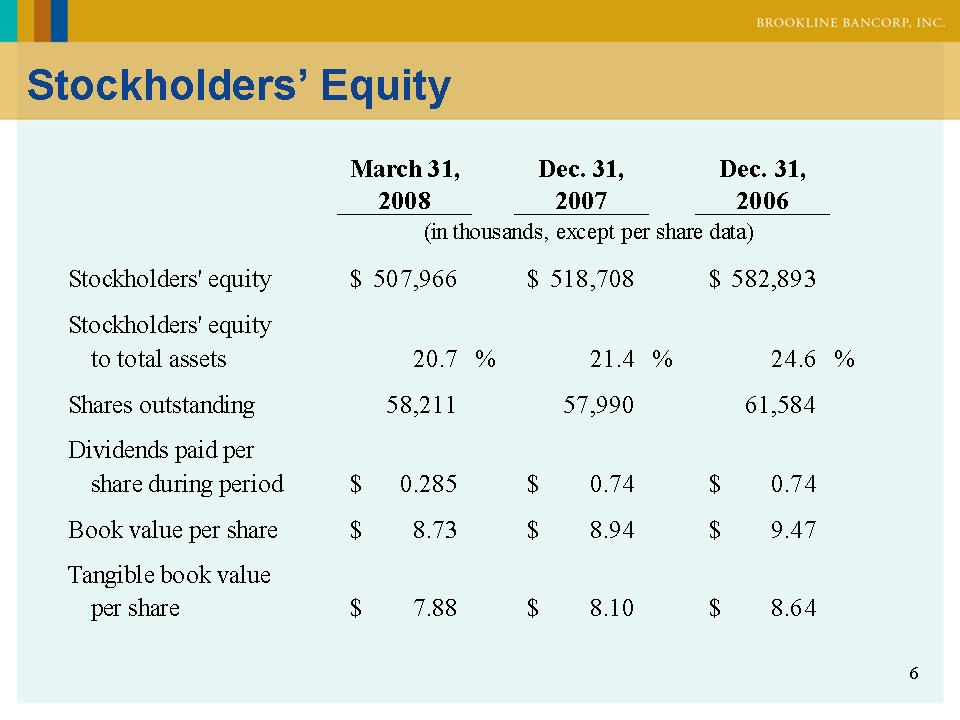

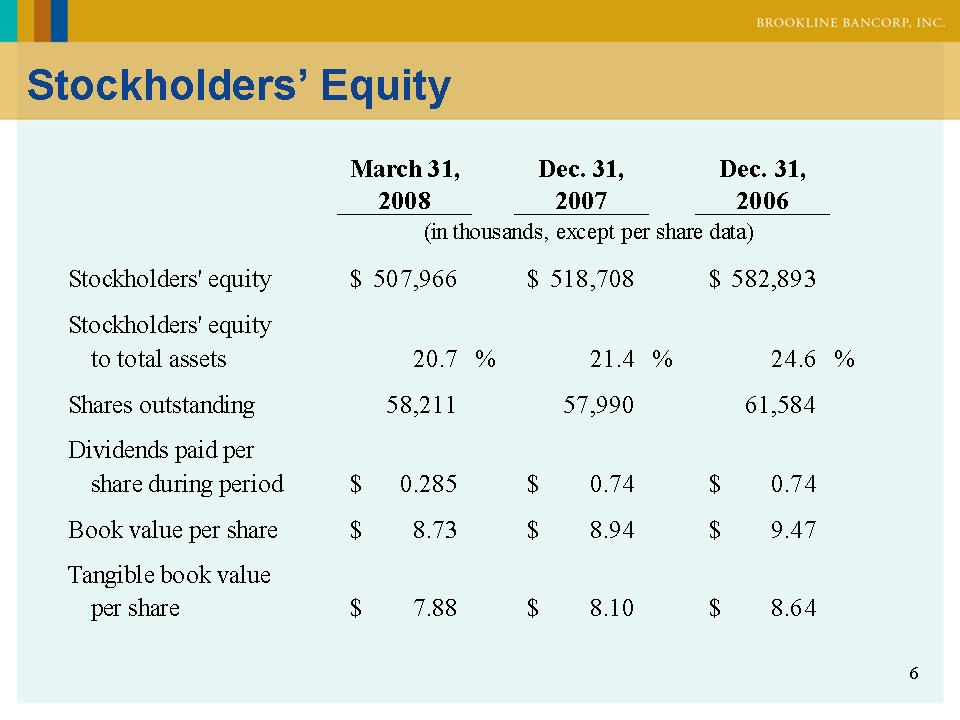

6 Stockholders’ Equity

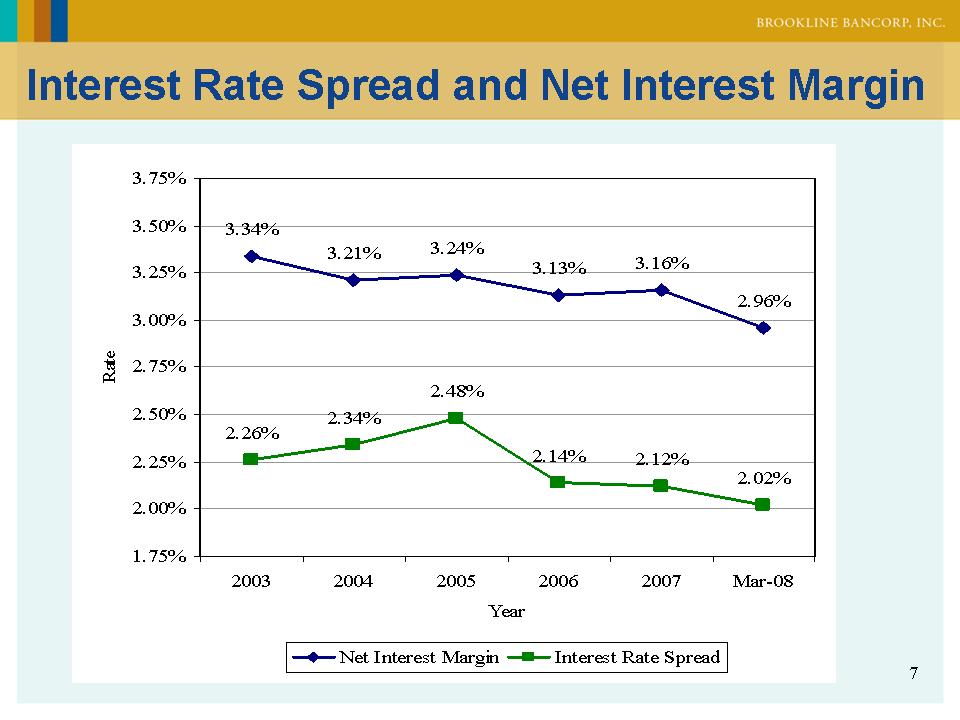

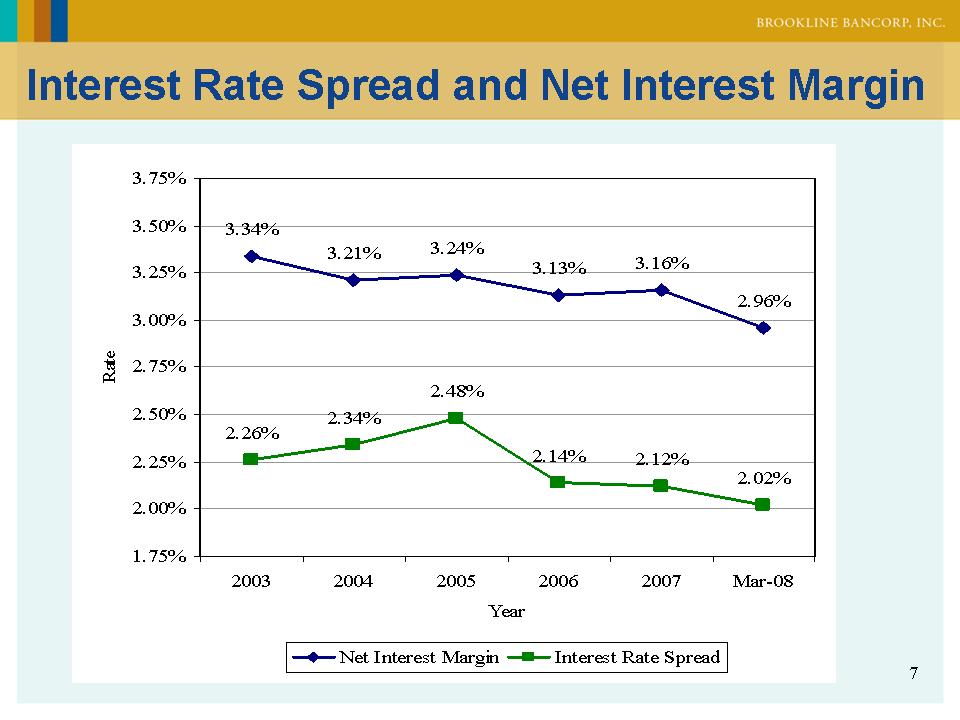

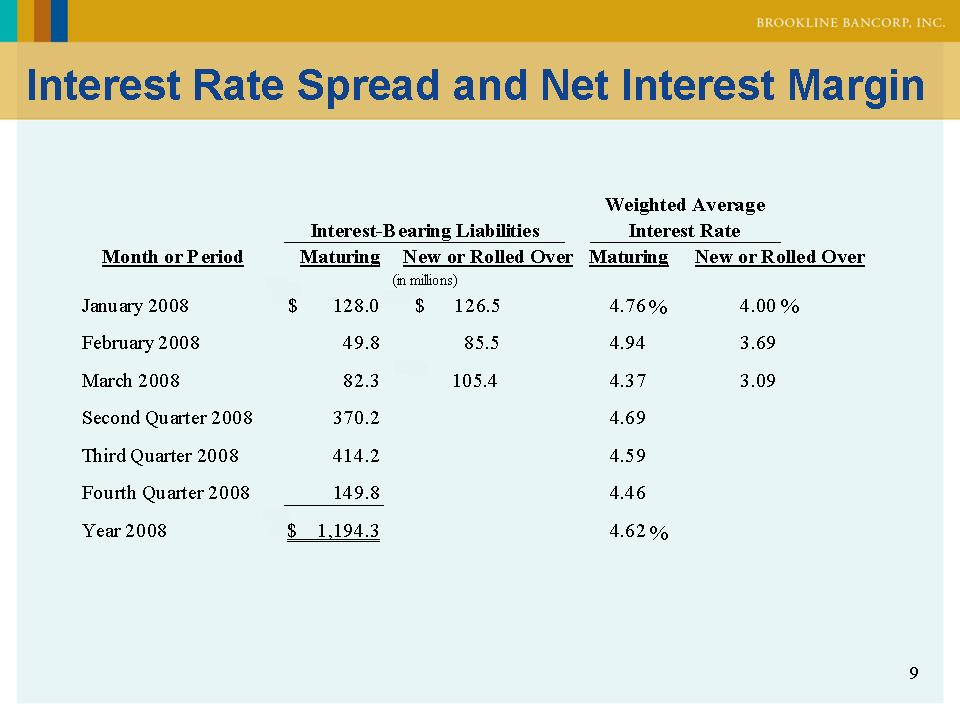

7 Interest Rate Spread and Net Interest Margin

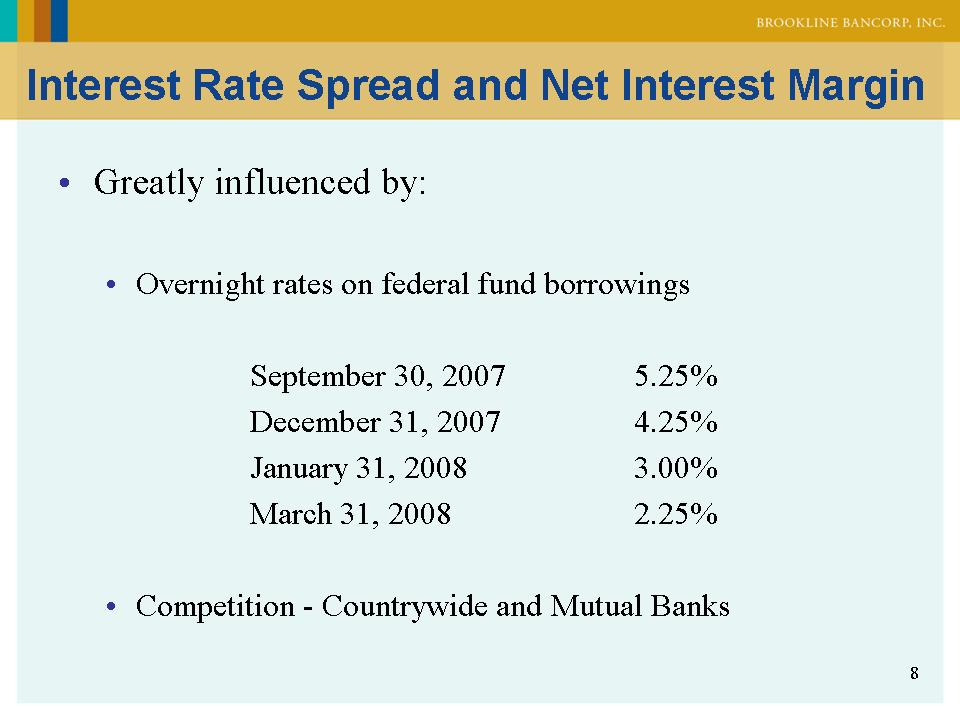

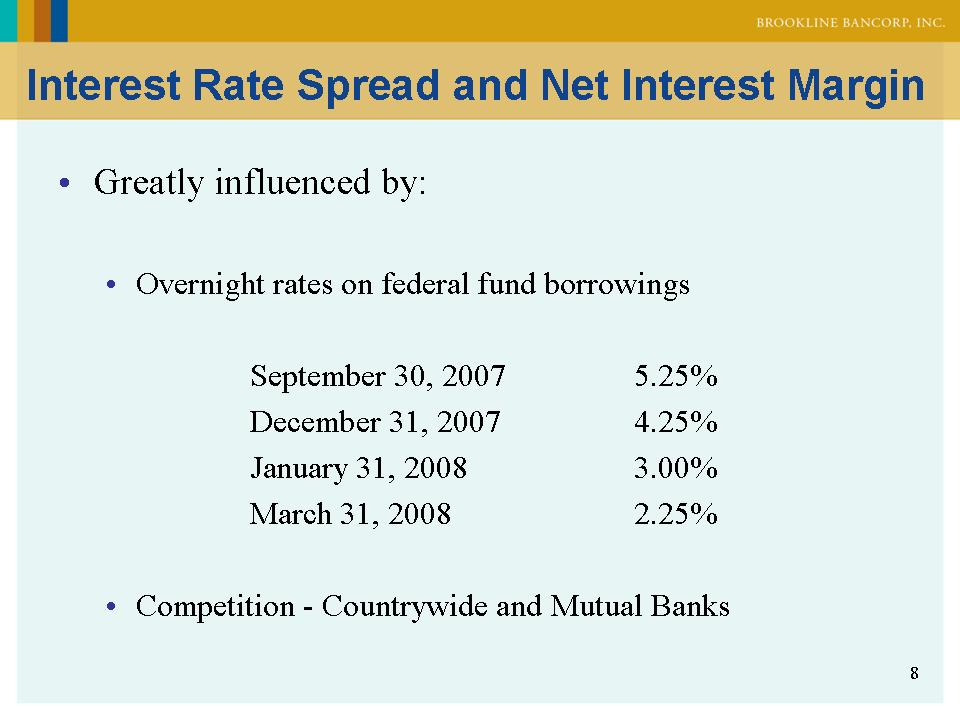

8 Interest Rate Spread and Net Interest Margin Greatly influenced by: Overnight rates on federal fund borrowings September 30, 2007 5.25% December 31, 2007 4.25% January 31, 2008 3.00% March 31, 2008 2.25% Competition - Countrywide and Mutual Banks

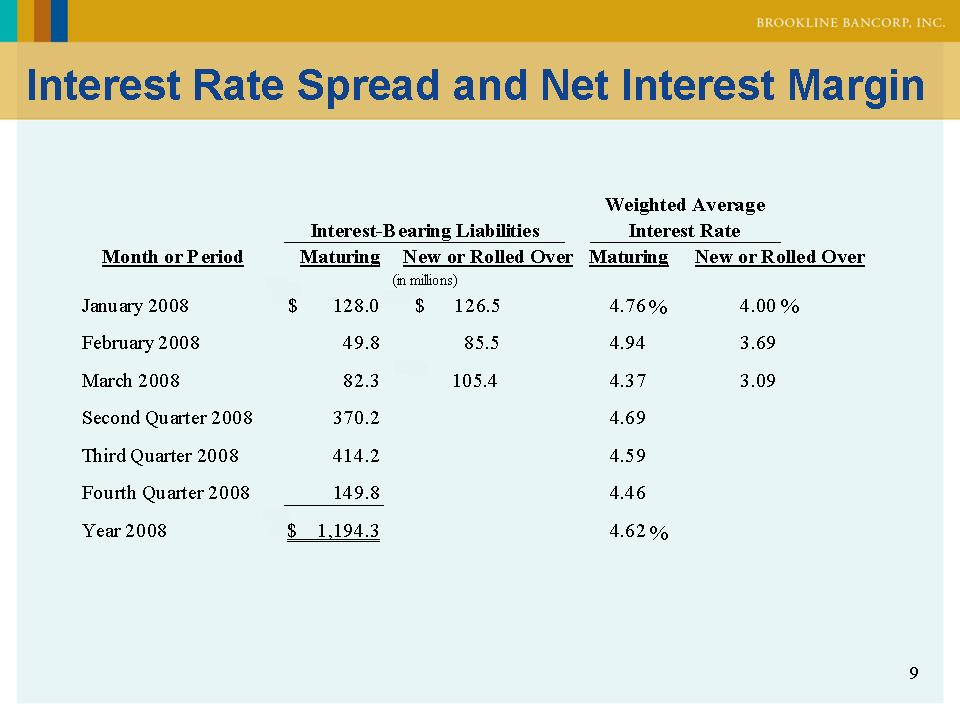

9 Interest Rate Spread and Net Interest Margin

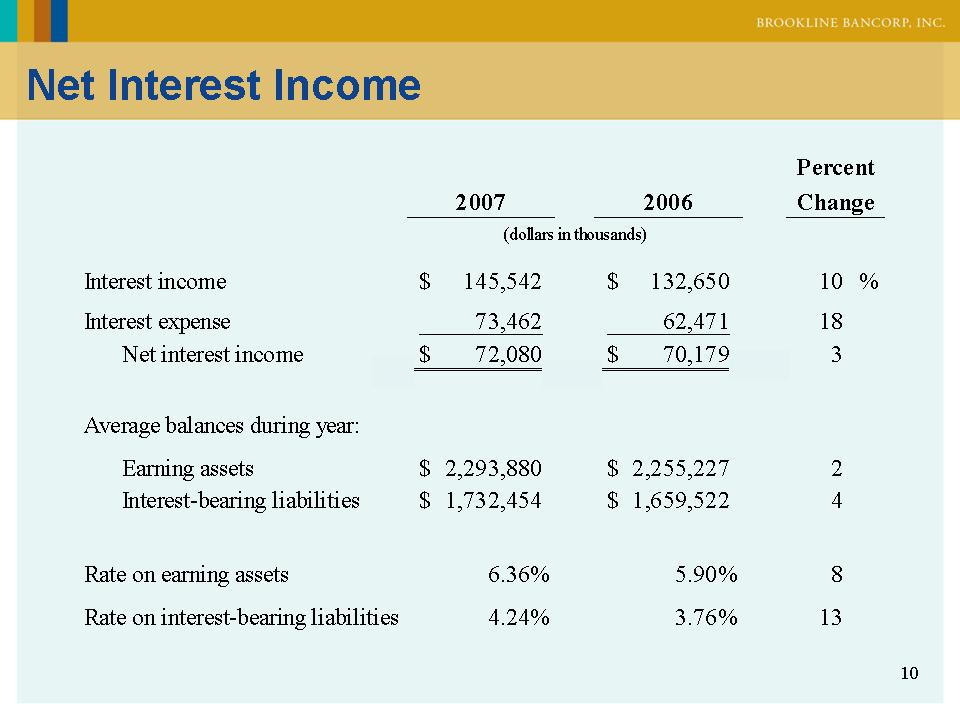

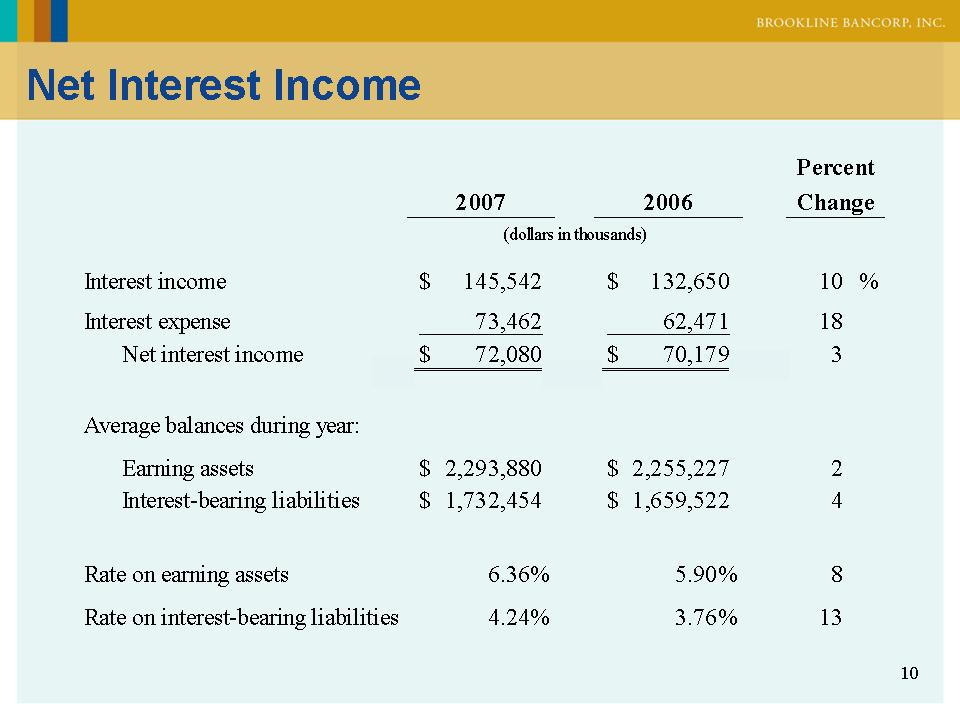

10 Net Interest Income

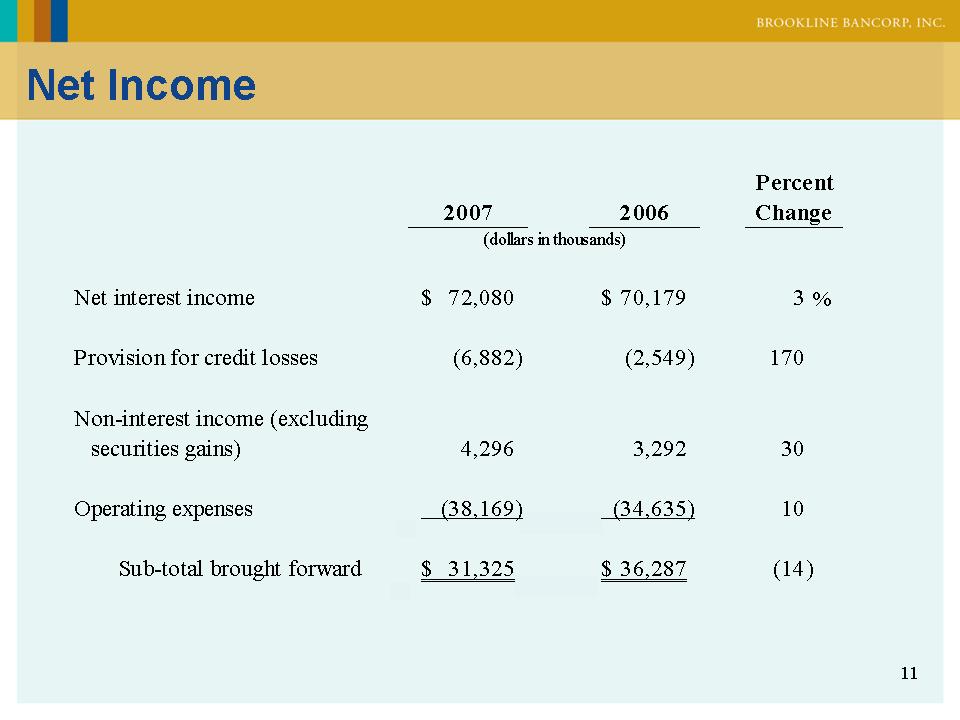

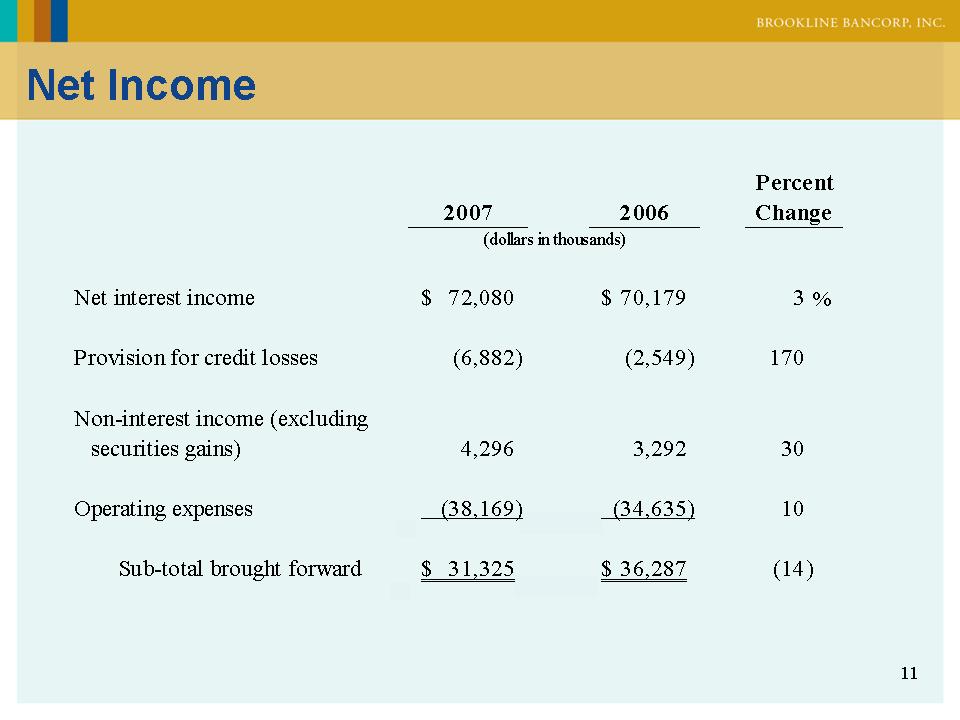

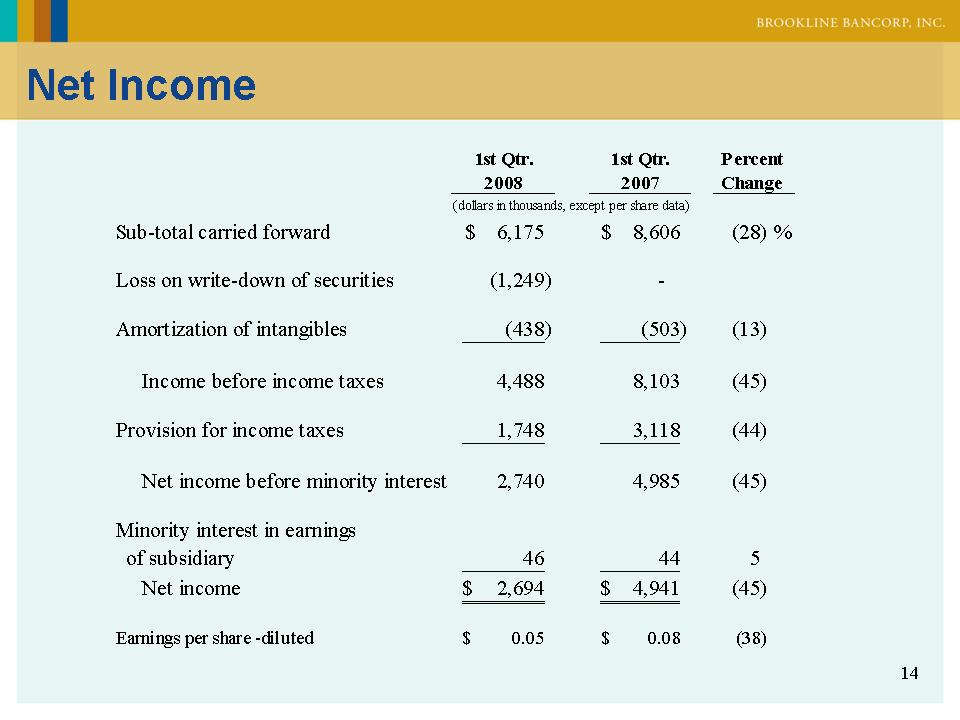

11 Net Income-

12 Net Income

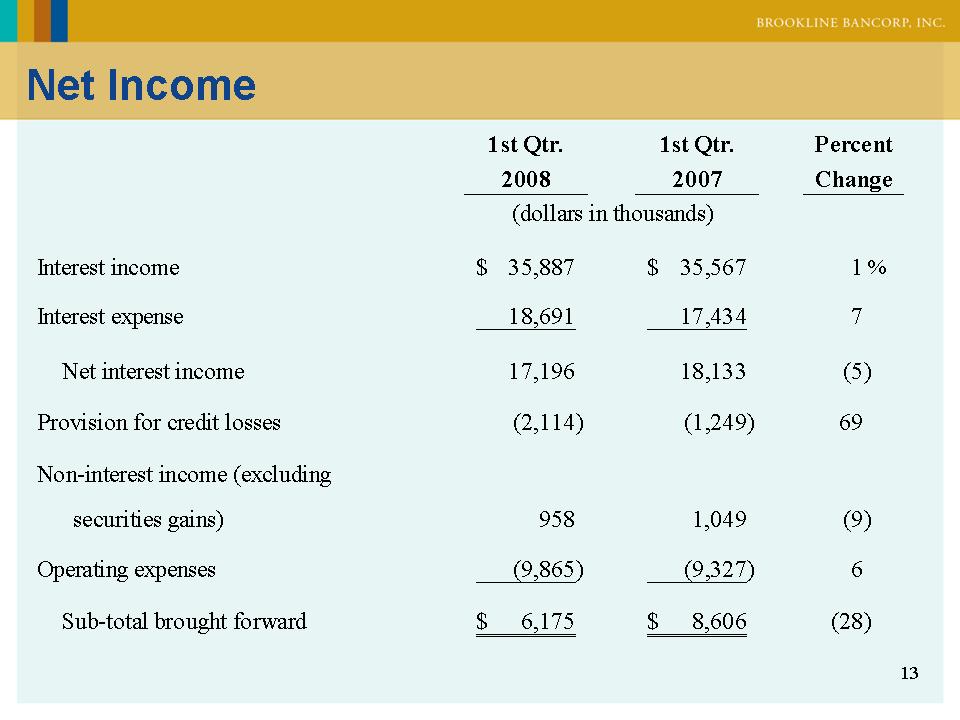

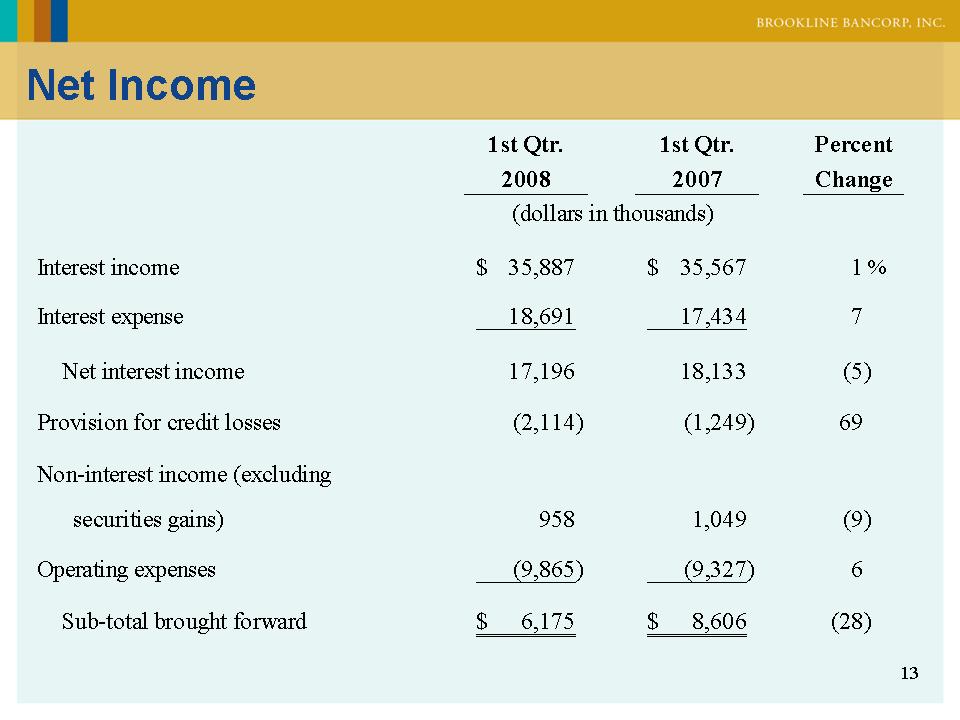

13 Net Income

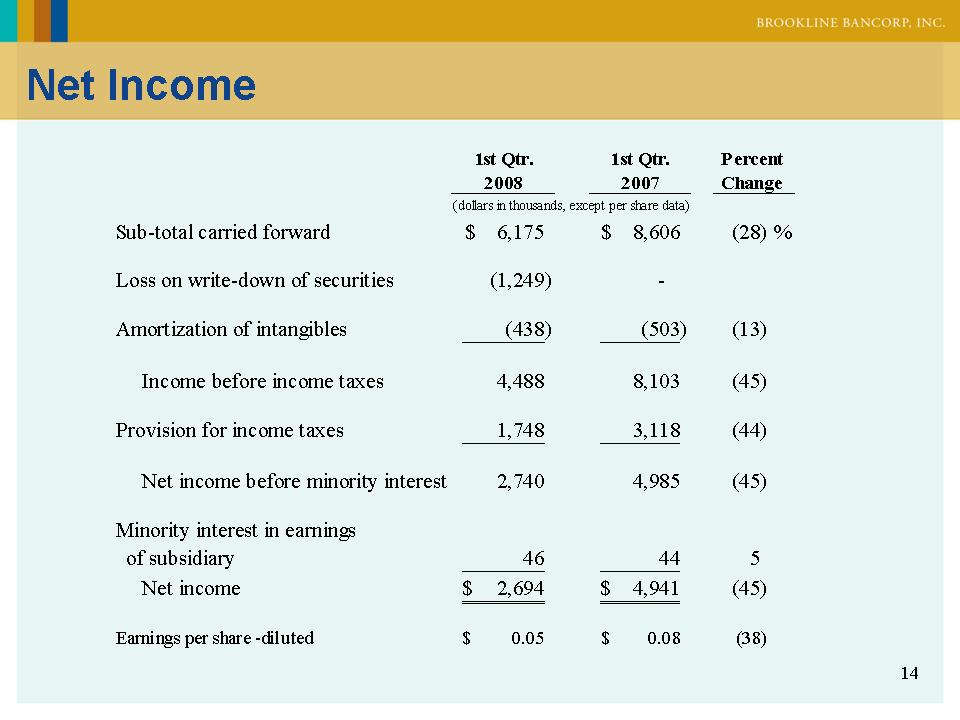

14 Net Income

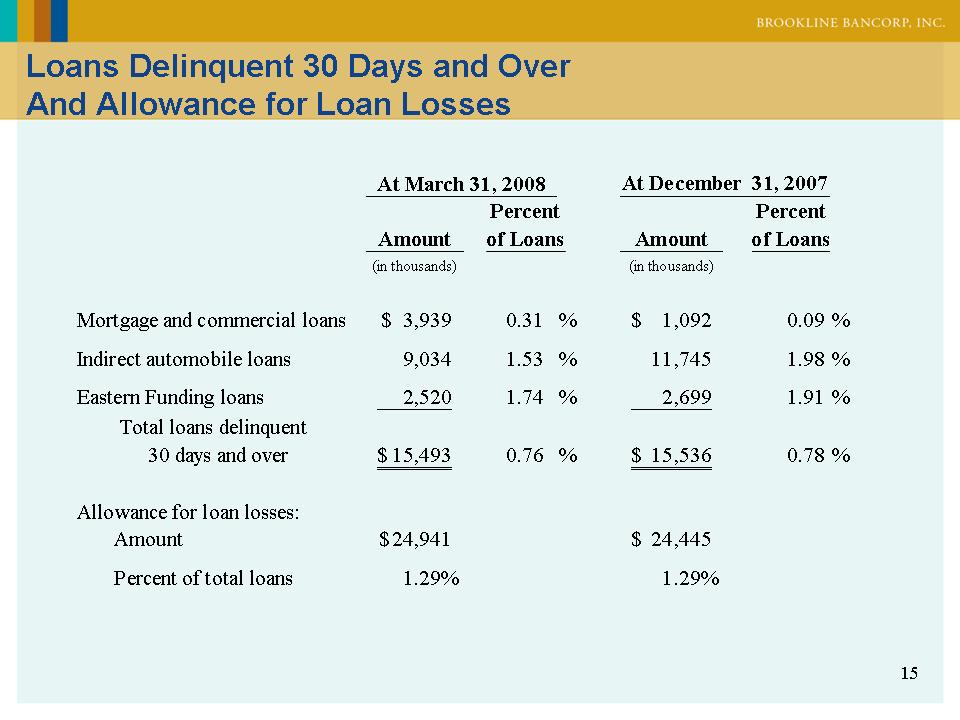

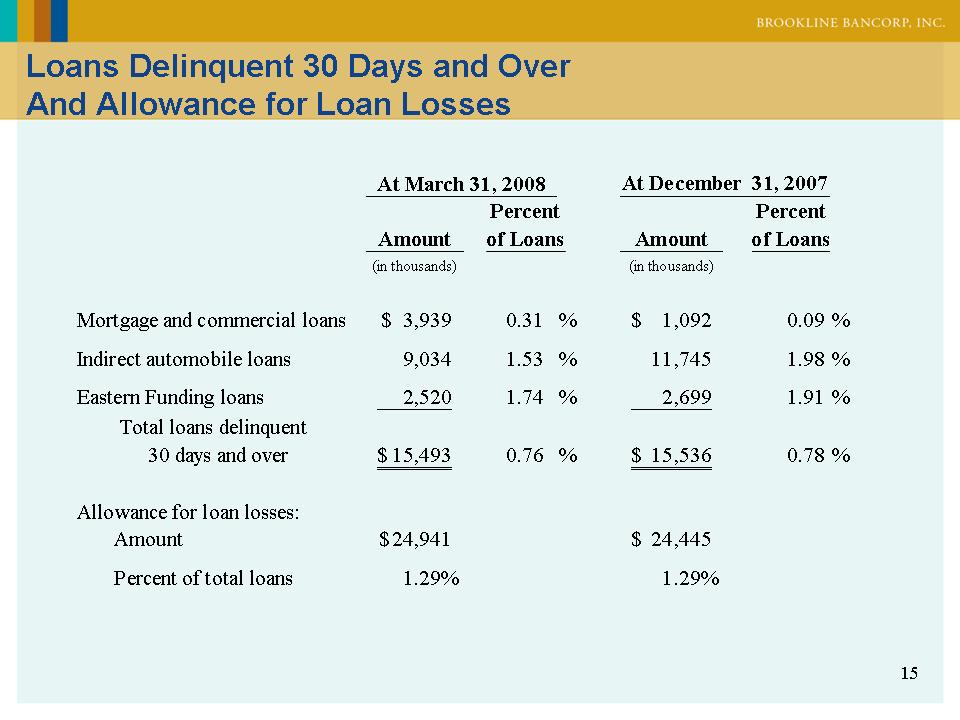

15 Loans Delinquent 30 Days and Over And Allowance for Loan Losses

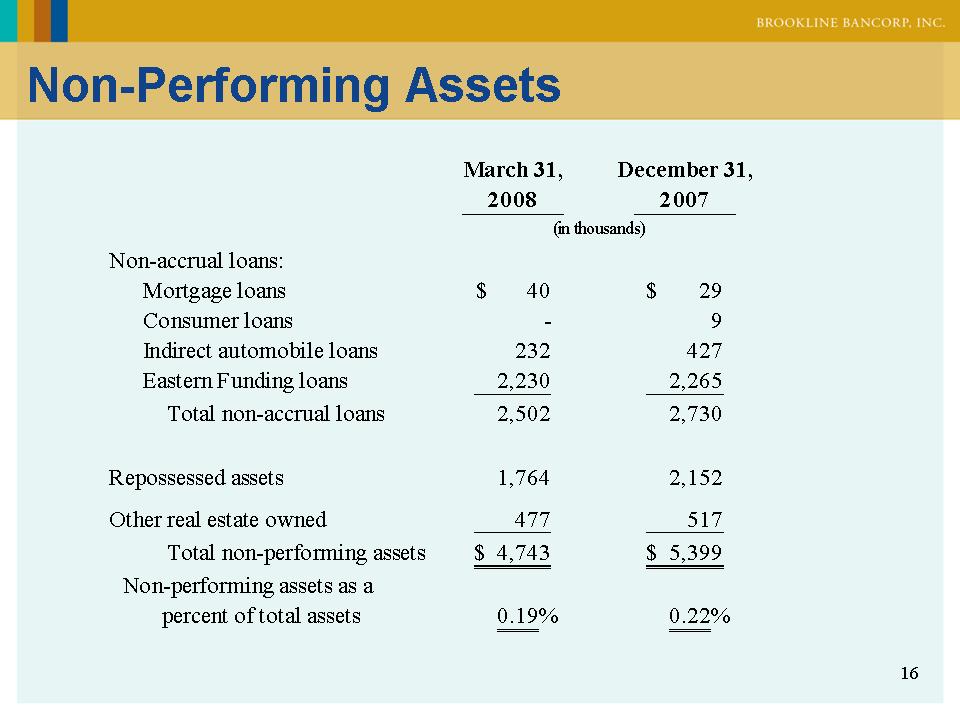

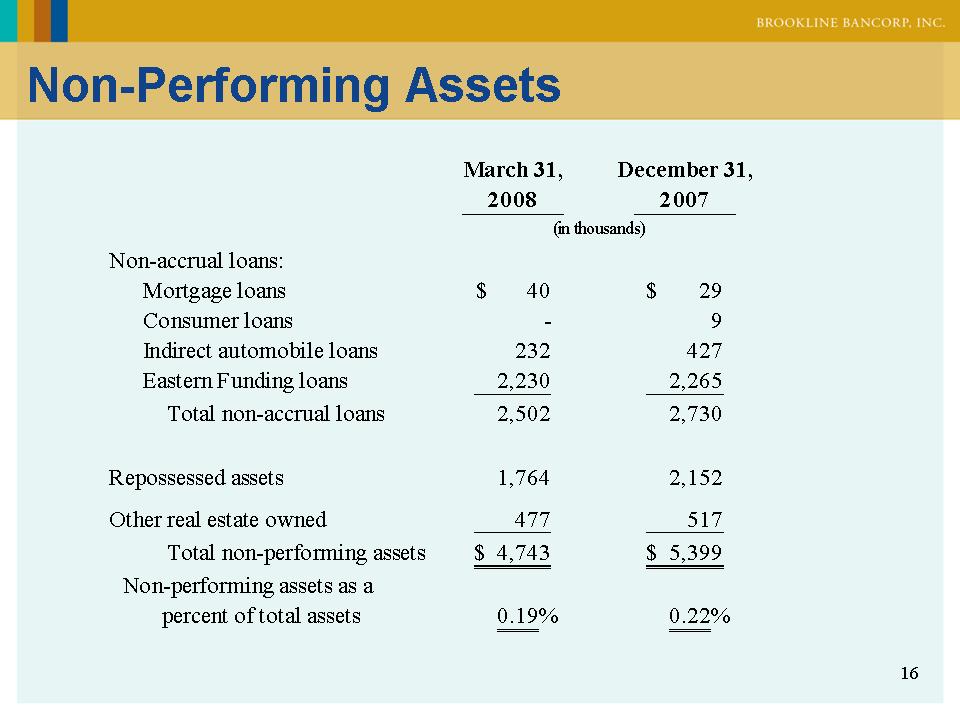

16 Non-Performing Assets

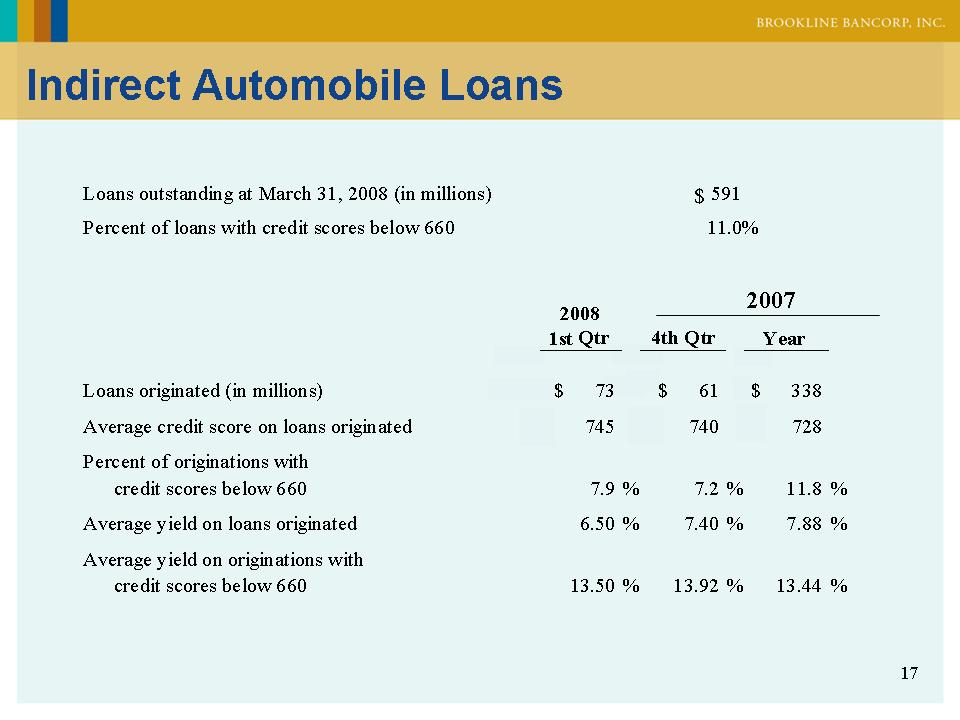

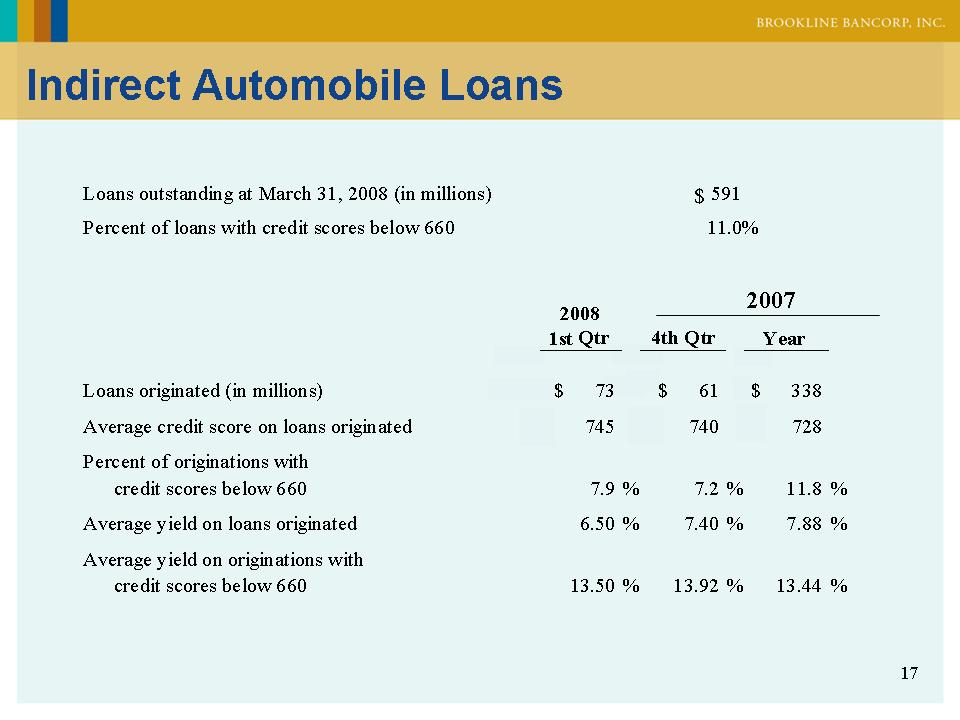

17 Indirect Automobile Loans

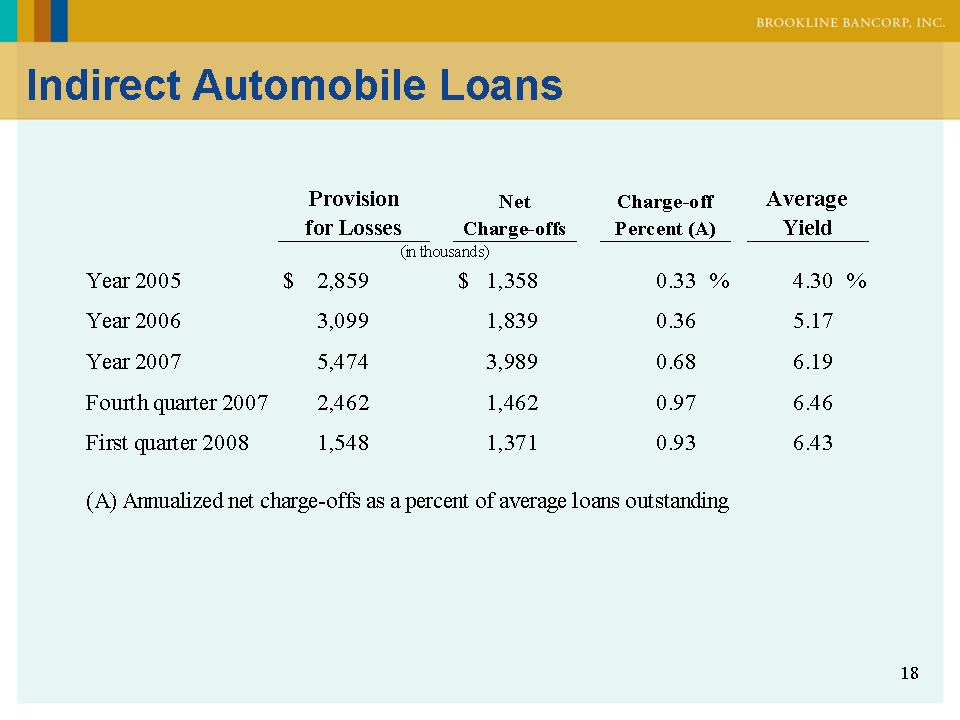

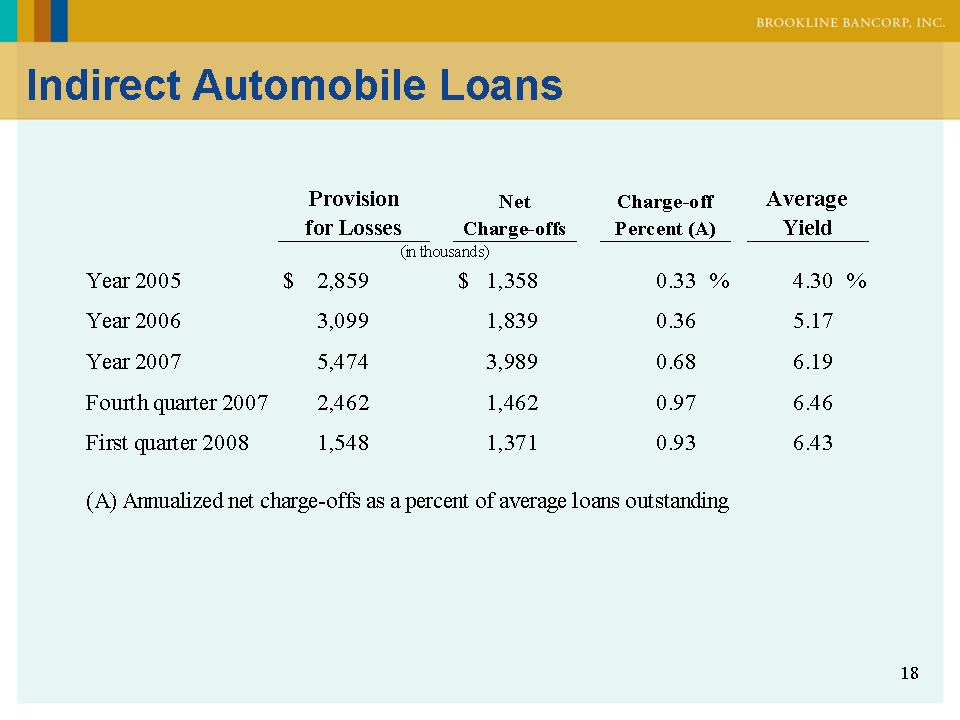

18 Indirect Automobile Loans

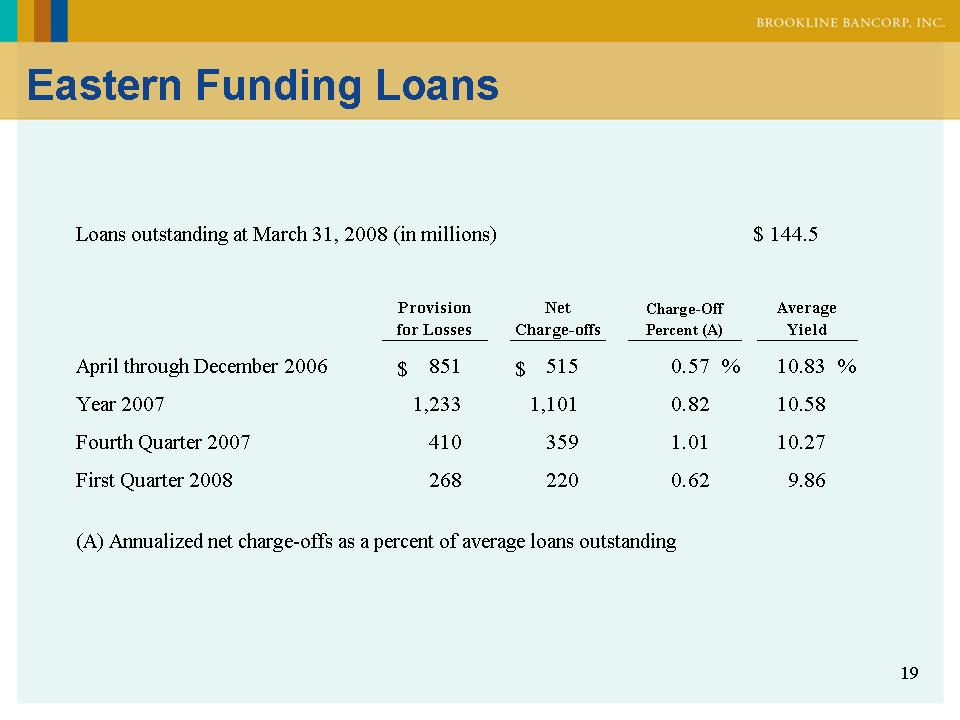

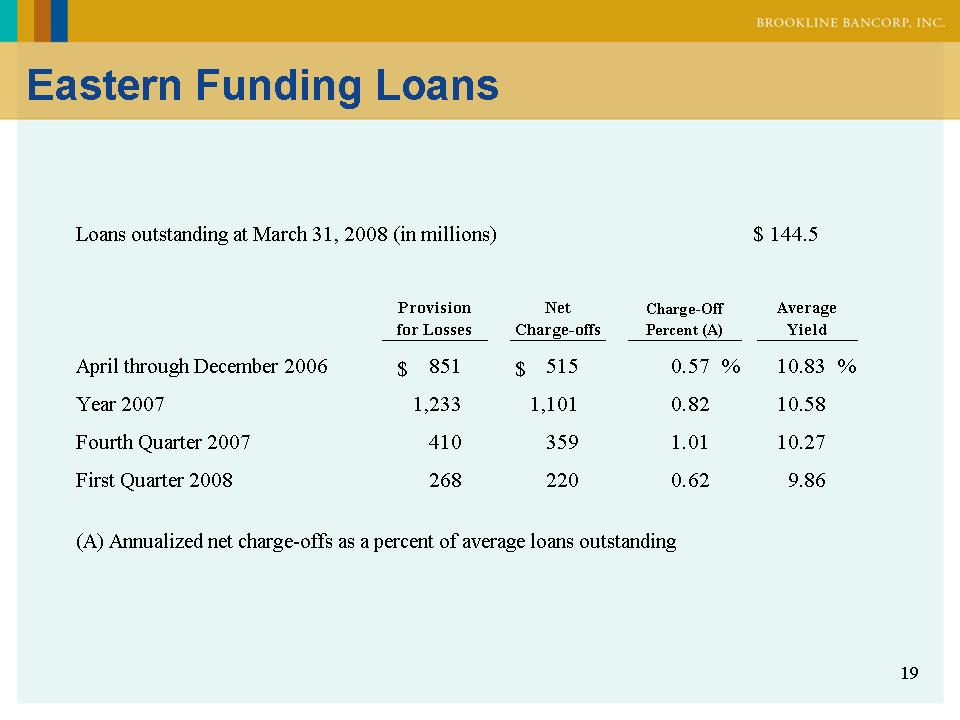

19 Eastern Funding Loans

20 Charles Peck President, Senior Loan Officer

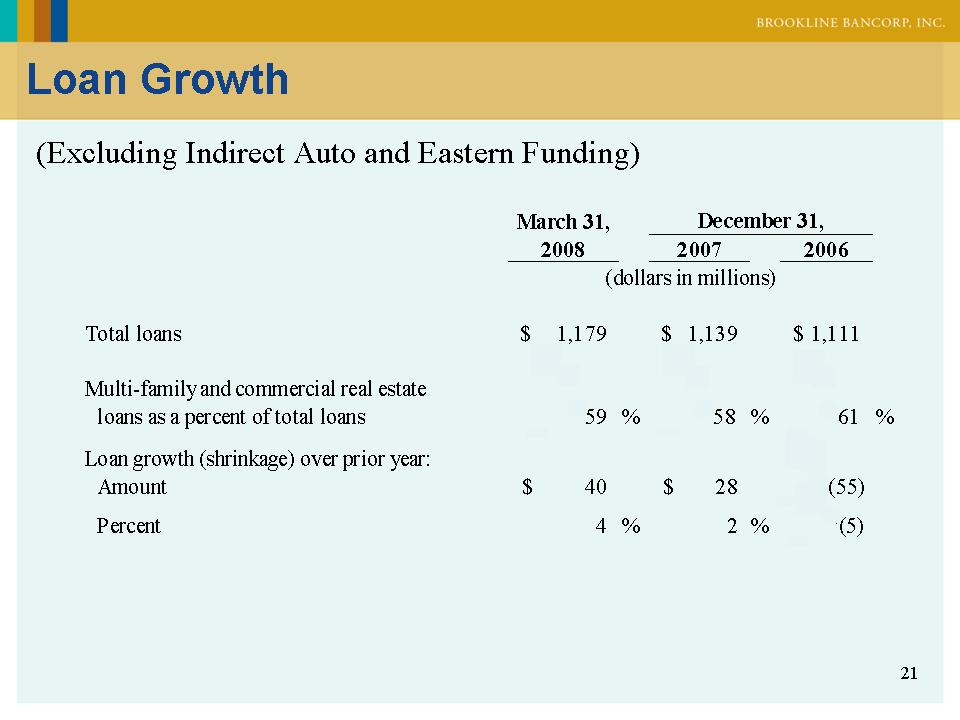

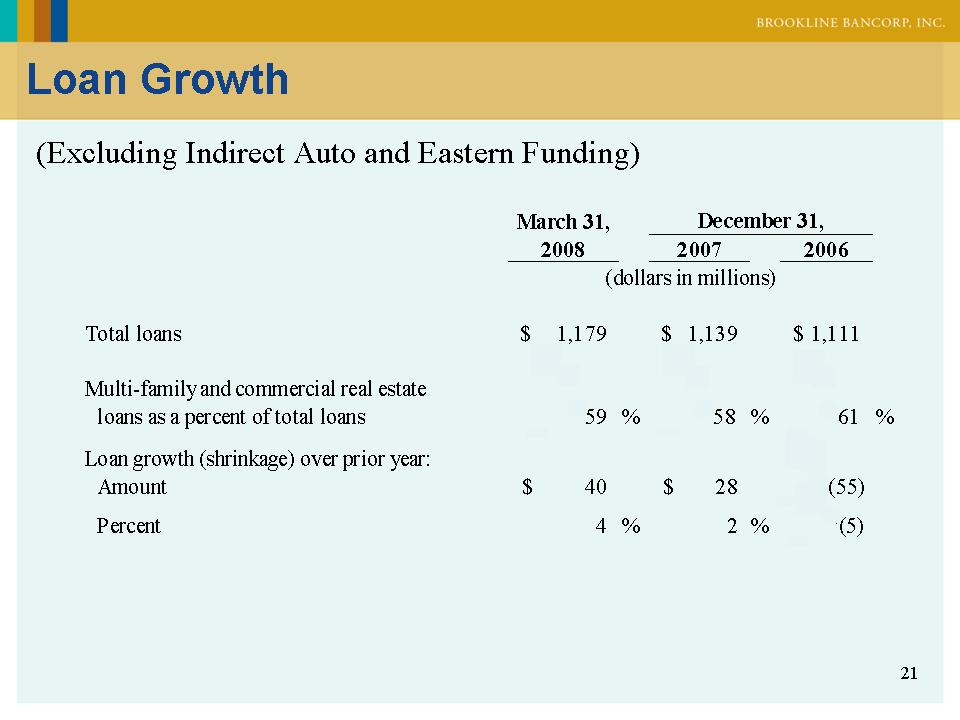

21 Loan Growth (Excluding Indirect Auto and Eastern Funding)

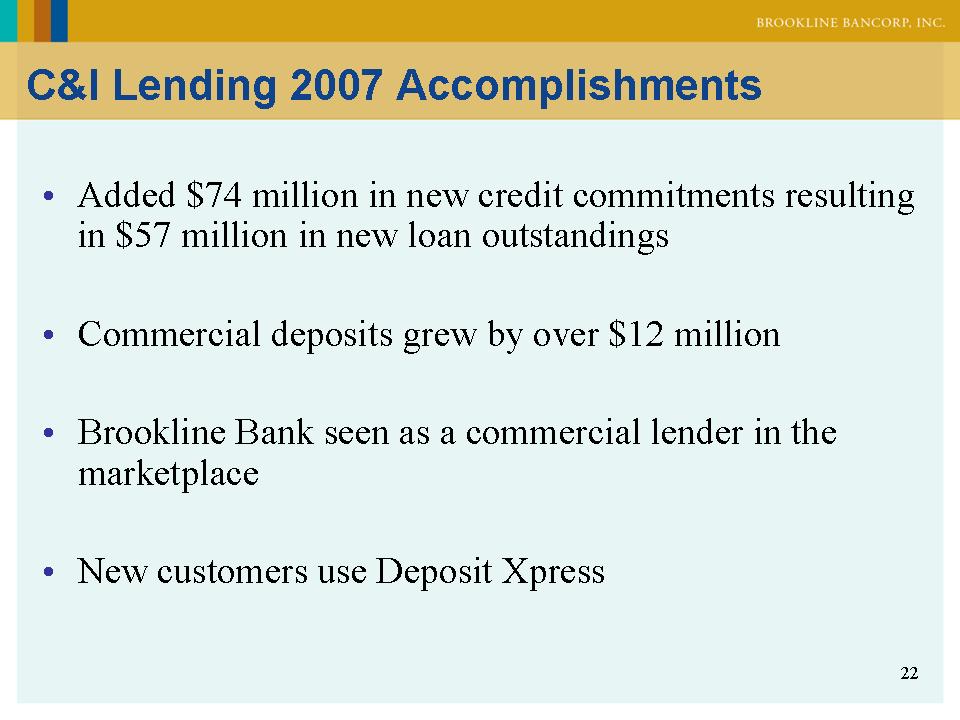

22 C&I Lending 2007 Accomplishments Added $74 million in new credit commitments resulting in $57 million in new loan outstandings Commercial deposits grew by over $12 million Brookline Bank seen as a commercial lender in the marketplace New customers use Deposit Xpress

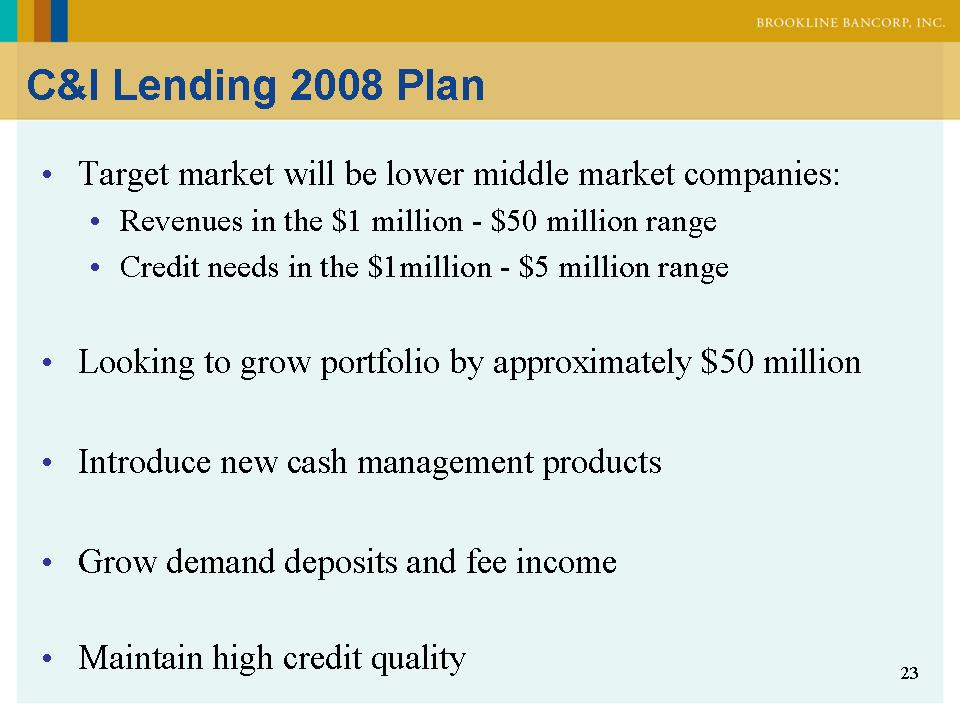

23 C&I Lending 2008 Plan Target market will be lower middle market companies: Revenues in the $1 million - $50 million range Credit needs in the $1million - $5 million range Looking to grow portfolio by approximately $50 million Introduce new cash management products Grow demand deposits and fee income Maintain high credit quality

24 Jane M. Wolchonok Senior Vice President Retail Banking

25 2007 Results Solid deposit growth Continued expansion of branch network Opened Needham Heights Burlington site leased Malden relocation Revamped consumer products & services Reduced checking from 6 to 3 Added services and improved non-interest income

26 2007 Results (cont’d) Technology enhancements a priority Focused branch staff on sales and service Collaborated with C&I lenders

27 Retail Banking Environment Intense competition Rates Branch expansion Technology-an ever growing role Products & services Processing

28 AMERICAN BANKER THE FINANCIAL SERVICES DAILY Fed Changing Policies to Goad Banks into Imaging.

29 2008 Retail Priorities Deposit growth with a focus on core accounts Continued improvement in branch service and sales results Continue branch expansion and renovation Partner with commercial lenders to focus on deposits

30 Enhance technology offerings and capabilities Continue updating product line and other services Explore new initiatives Focus on retail staff 2008 Retail Priorities (cont’d)