Exhibit 99.2

April 28, 2022 1 1Q 2022 Financial Results

Forward Looking Statements 2 Certain statements contained in this presentation are not historical facts and may constitute forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We may also make forward - looking statements in other documents we file with the Securities and Exchange Commission ("SEC"), in our annual reports to shareholders, in press releases and other written materials, and in oral statements made by our officers, directors or employees. You can identify forward looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate, ”assume,” “outlook,” “will,” “should,” and other expressions that predict or indicate future events and trends and which do not relate to historical matters, including statements regard the potential effects of the COVID - 19 pandemic on the Company’s business, credit quality, financial condition, liquidity and results of operations. Forward - looking statements involve risks and uncertainties. The Company’s actual results could differ materially from those projected in the forward - looking statements as a result of, among other factors, ongoing disruptions due to the COVID - 19 pandemic, general business and economic conditions on a national basis and in the local markets in which the Company operates; changes in consumer behavior due to changing political business and economic conditions or legislative or regulatory initiatives; the possibility that future credit losses may be higher than currently expected; reputational risk relating to the Company’s participation in the Paycheck Protection Program and other pandemic - related legislative and regulatory initiatives and programs; and turbulence in capital and debt markets; and the risks outlined in the Company’s Annual Report on Form 10 - K, as updated by its Quarterly Reports on Form 10 - Q and other filings submitted to the SEC. The Company does not undertake any obligation to update any forward - looking statement to reflect circumstances or events that occur after the date the forward - looking statements are made.

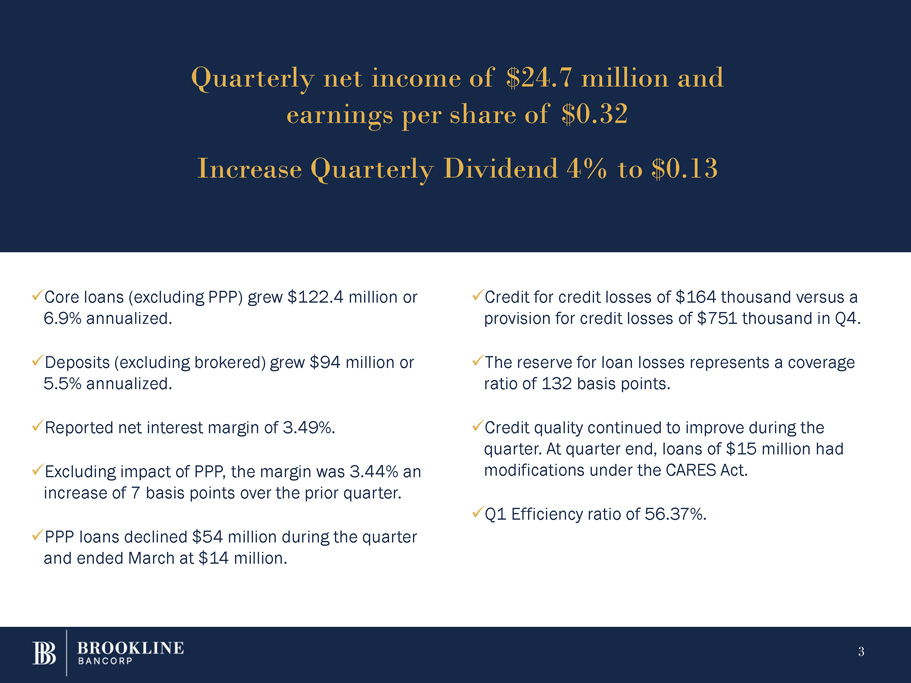

x Core loans (excluding PPP) grew $122.4 million or 6.9% annualized. 3 x Deposits (excluding brokered) grew $94 million or 5.5% annualized. x Reported net interest margin of 3.49%. x Excluding impact of PPP, the margin was 3.44% an increase of 7 basis points over the prior quarter. x Q1 Efficiency ratio of 56.37%. x PPP loans declined $54 million during the quarter and ended March at $14 million. x Credit for credit losses of $164 thousand versus a provision for credit losses of $751 thousand in Q4. x The reserve for loan losses represents a coverage ratio of 132 basis points. x Credit quality continued to improve during the quarter. At quarter end, loans of $15 million had modifications under the CARES Act. Quarterly net income of $24.7 million and earnings per share of $0.32 Increase Quarterly Dividend 4% to $0.13

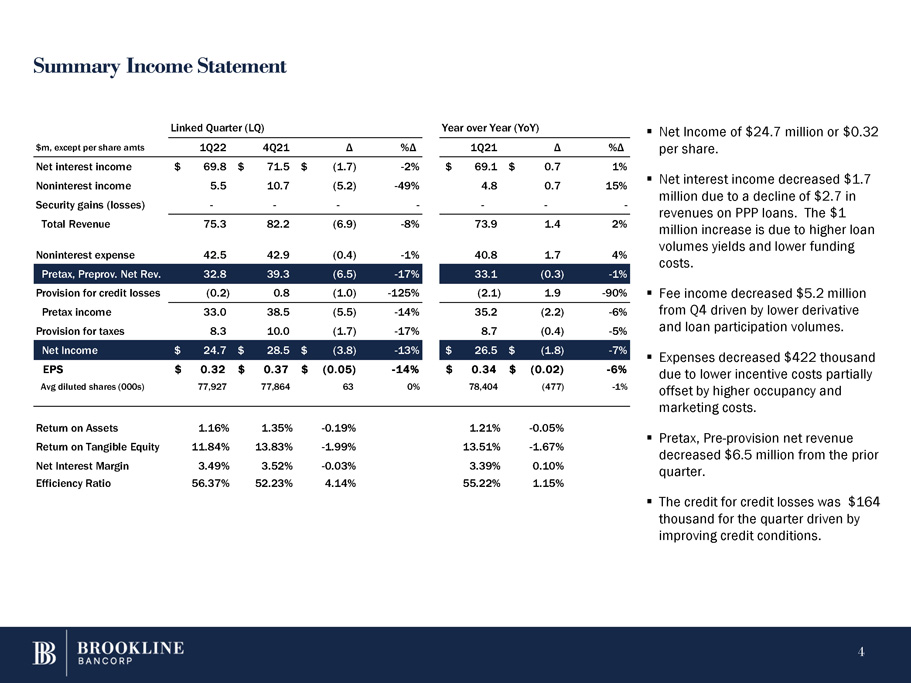

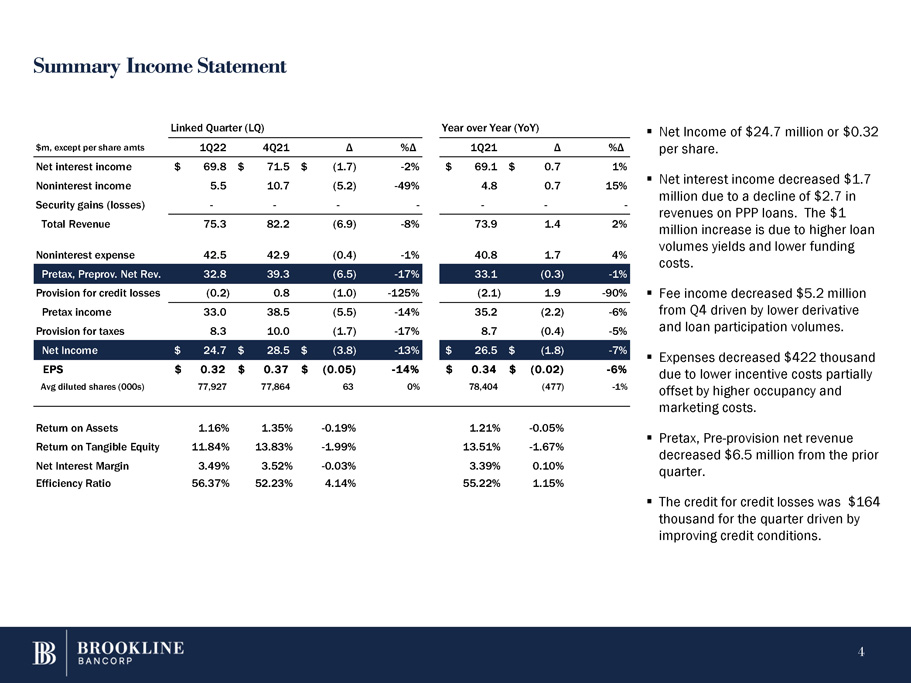

Summary Income Statement ▪ Net Income of $24.7 million or $0.32 ▪ Net interest income decreased $1.7 million due to a decline of $2.7 in revenues on PPP loans. The $1 million increase is due to higher loan volumes yields and lower funding costs. Fee income decreased $5.2 million from Q4 driven by lower derivative and loan participation volumes. ▪ Expenses decreased $422 thousand due to lower incentive costs partially offset by higher occupancy and marketing costs. $m, except per share amts 1Q22 4Q21 Δ %Δ 1Q21 Δ %Δ per share. Net interest income $ 69.8 $ 71.5 $ (1.7) - 2% $ 69.1 $ 0.7 1% Noninterest expense 42.5 42.9 (0.4) - 1% 40.8 1.7 4% Pretax, Preprov. Net Rev. 32.8 39.3 (6.5) - 17% 33.1 (0.3) - 1% Provision for credit losses (0.2) 0.8 (1.0) - 125% (2.1) 1.9 - 90% ▪ Pretax income 33.0 38.5 (5.5) - 14% 35.2 (2.2) - 6% Provision for taxes 8.3 10.0 (1.7) - 17% 8.7 (0.4) - 5% ▪ Pretax, Pre - provision net revenue decreased $6.5 million from the prior quarter. Return on Tangible Equity 11.84% 13.83% - 1.99% 13.51% - 1.67% Net Interest Margin 3.49% 3.52% - 0.03% 3.39% 0.10% Efficiency Ratio 56.37% 52.23% 4.14% 55.22% 1.15% ▪ The credit for credit losses was $164 thousand for the quarter driven by improving credit conditions. Net Income $ 24.7 $ 28.5 $ (3.8) - 13% $ 26.5 $ (1.8) - 7% EPS $ 0.32 $ 0.37 $ (0.05) - 14% $ 0.34 $ (0.02) - 6% Avg diluted shares (000s) 77,927 77,864 63 0% 78,404 (477) - 1% Noninterest income 5.5 10.7 (5.2) - 49% 4.8 0.7 15% Security gains (losses) - - - - - - - Total Revenue 75.3 82.2 (6.9) - 8% 73.9 1.4 2% Return on Assets 1.16% 1.35% - 0.19% 1.21% - 0.05% Linked Quarter (LQ) Year over Year (YoY) 4

Margin – Yields and Costs Estimated PPP Impact: 1Q22 Prior Quarter LQ Δ PPP Loans $ 40 $ 1.4 14.00% $ 120 $ 4.1 13.20% $ (80) $ (2.7) 0.80% Loans, excl. PPP 7,145 70.4 3.94% 6,955 69.5 4.00% 190 0.9 - 0.06% Earning Assets, excl. PPP 8,086 73.8 3.65% 7,934 72.9 3.68% 152 0.9 - 0.03% Net Interest Inc., excl. PPP 8,086 68.5 3.44% 7,934 67.4 3.37% 152 1.1 0.06% Estimated PPP Margin Impact 0.05% 0.15% - 0.09% Margin excluding PPP 3.44% 3.37% 0.07% 1Q22 Prior Quarter LQ Δ $ millions Avg Bal Interest Yield Avg Bal Interest Yield Avg Bal Interest Yield Loans $ 7,185 $ 71.8 4.00% $ 7,075 $ 73.6 4.16% $ 110 $ (1.8) - 0.16% Investments & earning cash 941 3.4 1.44% 979 3.4 1.38% (38) - 0.06% Interest Earning Assets $ 8, 12 6 $ 75.2 3.70% $ 8, 05 4 $ 77.0 3.82% $ 72 $ (1.8) - 0.12% Interest bearing deposits $ 5, 16 4 $ 3.8 0.30% $ 5, 10 3 $ 4.1 0.32% $ 61 $ (0.3) - 0.02% Borrowings 318 1.5 1.88% 273 1.4 2.05% 45 0.1 - 0.17% Interest Bearing Liabilities $ 5, 48 2 $ 5.3 0.39% $ 5, 37 6 $ 5.5 0.40% $ 10 6 $ (0.2) - 0.01% Net interest spread 3.31% 3.42% - 0.11% Net interest income, TEB / Margin $ 69.9 3.49% $ 71.5 3.52% $ (1.6) - 0.03% LESS: Tax Equivalent Basis (TEB) Adj. - - - Net Interest Income $ 69.9 $ 71.5 $ (1.6) 5

Summary Balance Sheet ▪ Loans increased $69 million in the quarter driven by solid core net loan growth. ▪ Allowance for Loan Losses declined $4 million due to improving credit PPP loans). ▪ Deposits increased $44 million as core deposits continued to grow. ▪ Borrowings increased $36 million to maintain liquidity targets. Cash & equivalents 293 328 (35) - 43% 131 162 124% environment and economic outlook. Intangibles 163 163 - 0% 163 - 0% Other assets 319 336 (17) - 20% 378 (59) - 16% ▪ ALLL coverage of 1.32% (excluding Stockholders' Equity 982 995 (13) - 5% 945 37 4% ▪ Stockholders’ Equity declined $13 Total Liabilities & Equity $ 8,634 $ 8,603 $ 31 1% $ 8,560 $ 943 11% million due to the accounting impact of marking to market TBV per share $ 10.56 $ 10.73 $ (0.17) - 6% $ 10.01 $ 0.55 5% securities classified as available for Actual shares outstanding (000) 77,622 77,613 9 0% 78,148 (526) - 1% sale. Tang. Equity / Tang. Assets 9.67% 9.87% - 0.20% 9.31% 0.36% Loans / Deposits 101.82% 101.48% 0.34% 105.84% - 4.02% ALLL / Gross Loans 1.32% 1.38% - 0.06% 1.51% - 0.19% ALLL / Loans excl PPP 1.32% 1.40% - 0.08% 1.65% - 0.33% Linked Quarter (LQ) Year over Year (YoY) $m, except per share amts 1Q22 4Q21 Δ %Δ annual. 1Q21 Δ %Δ Gross Loans, investment $ 7,223 $ 7,154 $ 69 4% $ 7,268 $ (45) - 1% Allowance for loan losses (95) (99) 4 - 16% (110) 15 - 14% Net Loans 7,128 7,055 73 4% 7,158 (30) 0% Securities 731 721 10 6% 730 1 0% Total Assets $ 8,634 $ 8,603 $ 31 1% $ 8,560 $ 74 1% Deposits $ 7,094 $ 7,050 $ 44 2% $ 6,867 $ 227 3% Borrowings 393 357 36 40% 546 (153) - 28% Reserve for unfunded loans 16 15 1 27% 14 2 14% Other Liabilities 149 186 (37) - 80% 188 (39) - 21% Total Liabilities 7,652 7,608 44 2% 7,615 37 0% 6

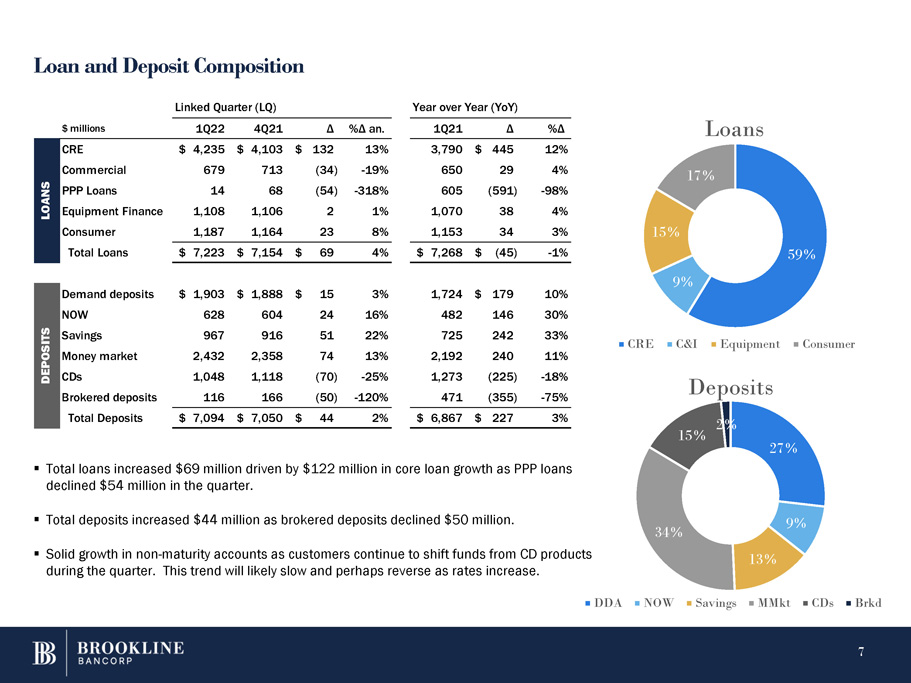

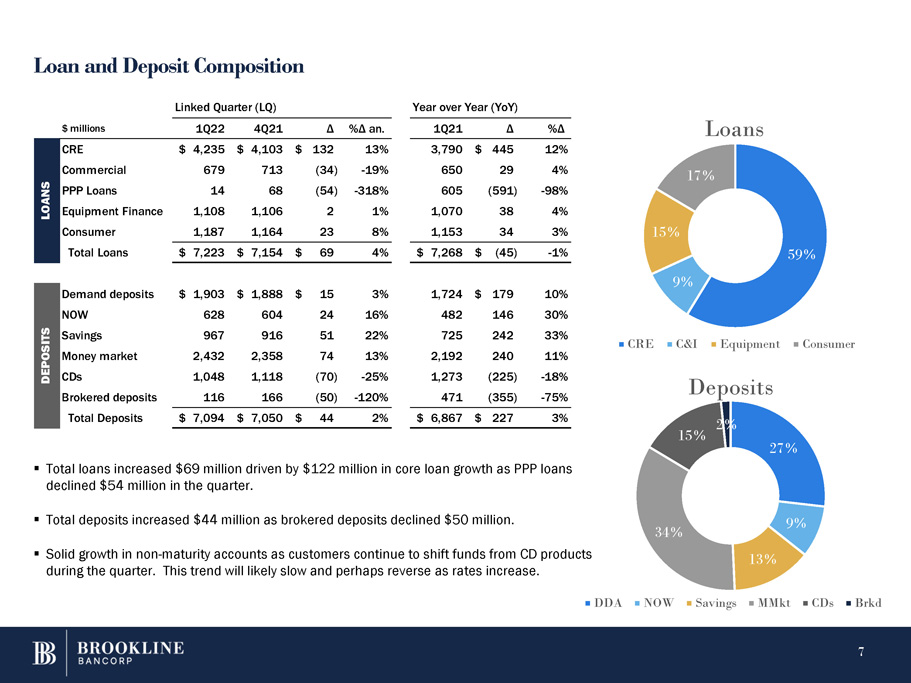

Loan and Deposit Composition 59% 9% 15% Loans 17% 27% 9% 13% 34% 15% 2% CRE C&I Equipment Consumer Deposits DDA NOW Savings MMkt CDs Brkd Demand deposits $ 1,903 $ 1,888 $ 15 3% 1,724 $ 179 10% NOW 628 604 24 16% 482 146 30% ITS Savings 967 916 51 22% 725 242 33% PO S Money market 2,432 2,358 74 13% 2,192 240 11% D E CDs 1,048 1,118 (70) - 25% 1,273 (225) - 18% Brokered deposits 116 166 (50) - 120% 471 (355) - 75% Total Deposits $ 7,094 $ 7,050 $ 44 2% $ 6,867 $ 227 3% $ millions 1Q22 4Q21 Δ %Δ an. 1Q21 Δ %Δ $ 4,235 679 14 1,108 1,187 $ 4,103 713 68 1,106 1,164 $ 132 13% (34) - 19% (54) - 318% 2 1% 23 8% CRE Commercial PPP Loans Equipment Finance Consumer Total Loans 3,790 650 605 1,070 1,153 $ 445 12% 29 4% (591) - 98% 38 4% 34 3% $ 7,223 $ 7,154 $ 69 4% $ 7,268 $ (45) - 1% Linked Quarter (LQ) Year over Year (YoY) LOANS ▪ Total loans increased $69 million driven by $122 million in core loan growth as PPP loans declined $54 million in the quarter. 7 ▪ Total deposits increased $44 million as brokered deposits declined $50 million. ▪ Solid growth in non - maturity accounts as customers continue to shift funds from CD products during the quarter. This trend will likely slow and perhaps reverse as rates increase.

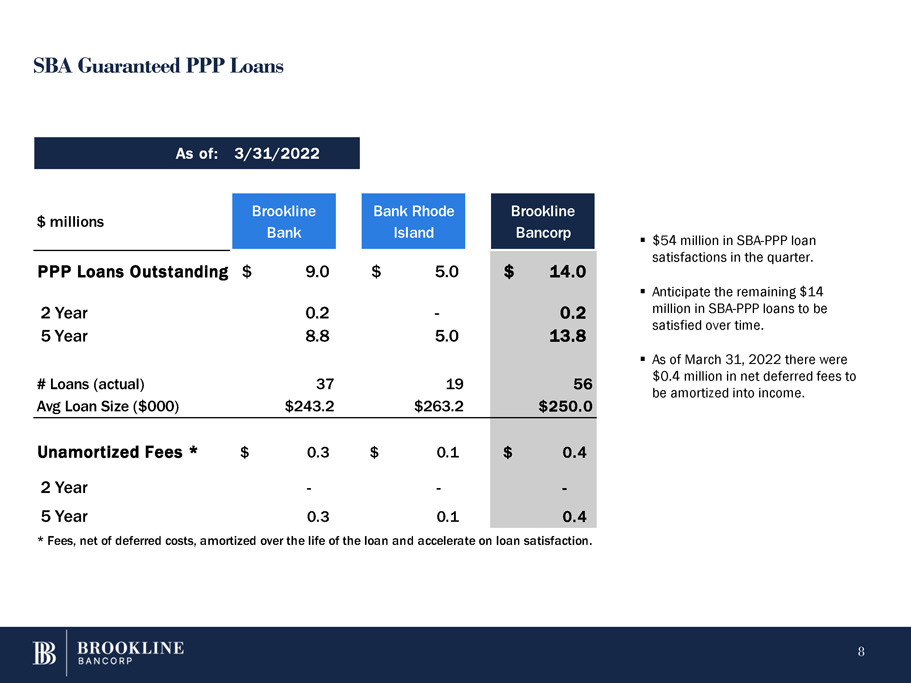

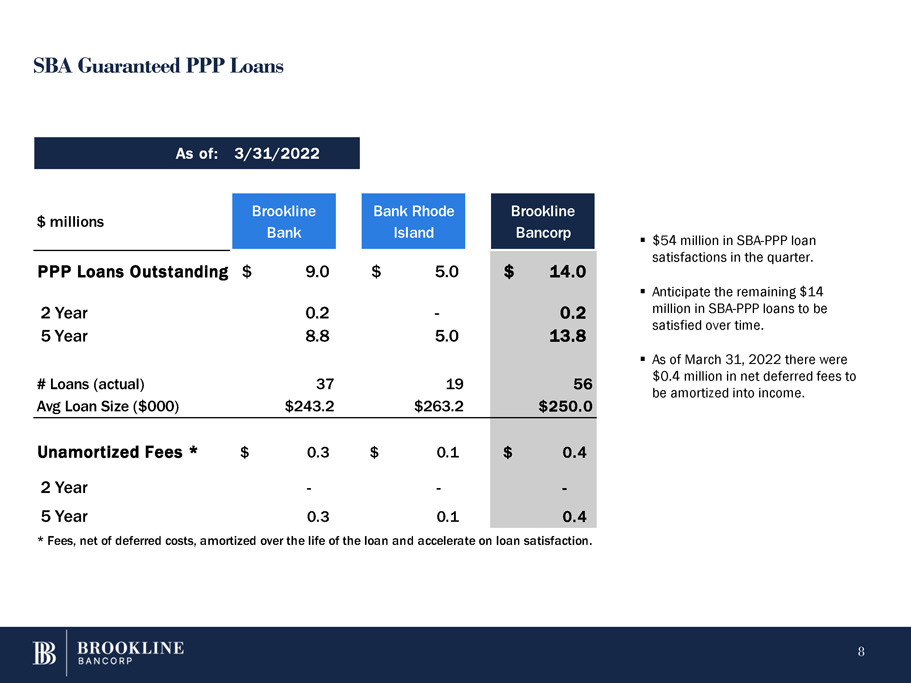

SBA Guaranteed PPP Loans $54 million in SBA - PPP loan satisfactions in the quarter. Anticipate the remaining $ 14 million in SBA - PPP loans to be satisfied over time . As of March 31, 2022 there were $0.4 million in net deferred fees to be amortized into income. As of: 3/31/2022 * Fees, net of deferred costs, amortized over the life of the loan and accelerate on loan satisfaction. $ millions PPP Loans Outstanding 2 Year Brookline Bank $ 9.0 0.2 Bank Rhode Island $ 5.0 - Brookline Bancorp $ 14.0 0.2 ▪ ▪ 5 Year 8.8 5.0 13.8 ▪ # Loans (actual) 37 19 56 Avg Loan Size ($000) $243.2 $263.2 $250.0 Unamortized Fees * $ 0.3 $ 0.1 $ 0.4 2 Year - - - 5 Year 0.3 0.1 0.4 8

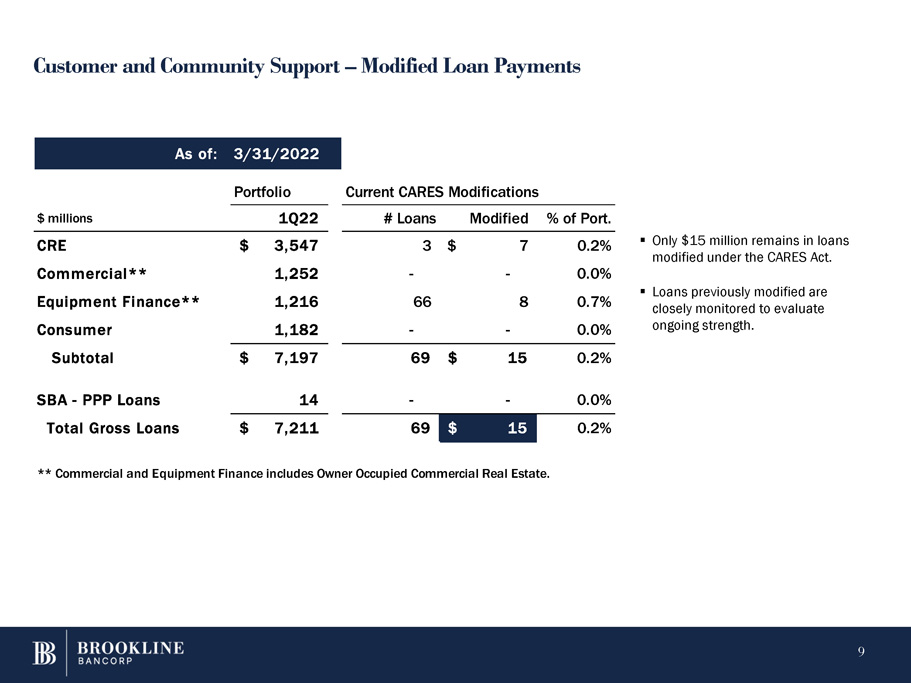

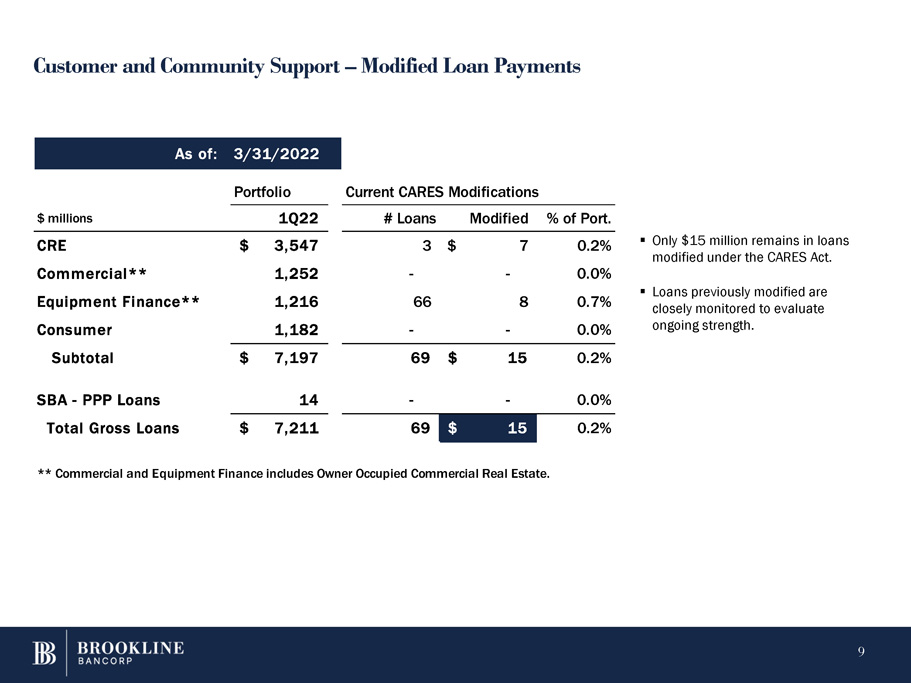

Customer and Community Support – Modified Loan Payments Commercial** Equipment Finance** 1,252 1,216 - - 0.0% 0.7% As of: 3/31/2022 Portfolio Current CARES Modifications $ millions 1Q22 # Loans Modified % of Port. CRE $ 3,547 3 $ 7 0.2% 66 8 Consumer 1,182 - - 0.0% Subtotal $ 7,197 69 $ 15 0.2% 0.0% 0.2% SBA - PPP Loans 14 - - Total Gross Loans $ 7,211 69 $ 15 ** Commercial and Equipment Finance includes Owner Occupied Commercial Real Estate. ▪ Only $15 million remains in loans modified under the CARES Act. 9 ▪ Loans previously modified are closely monitored to evaluate ongoing strength .

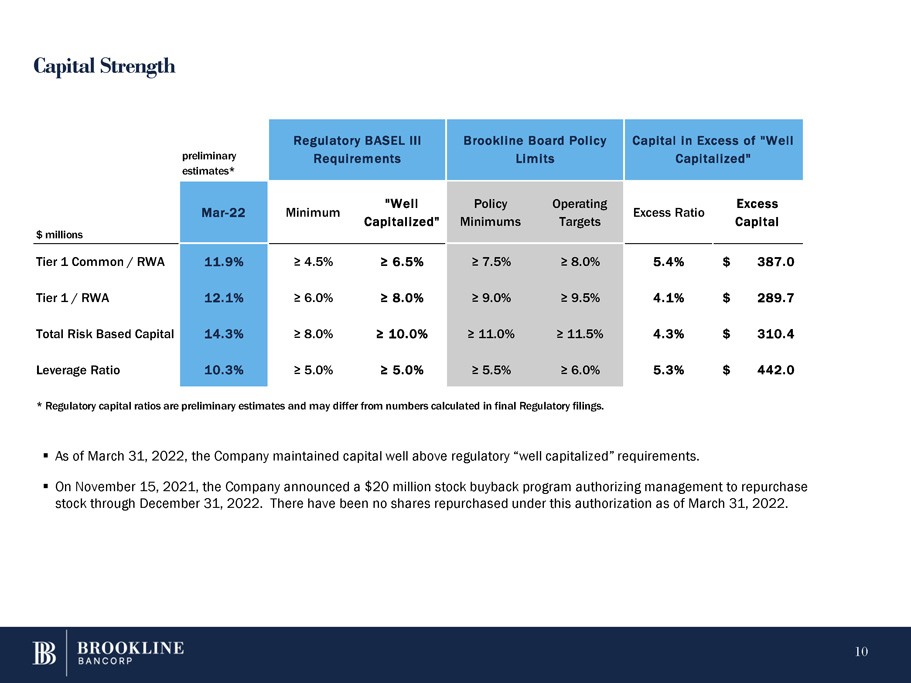

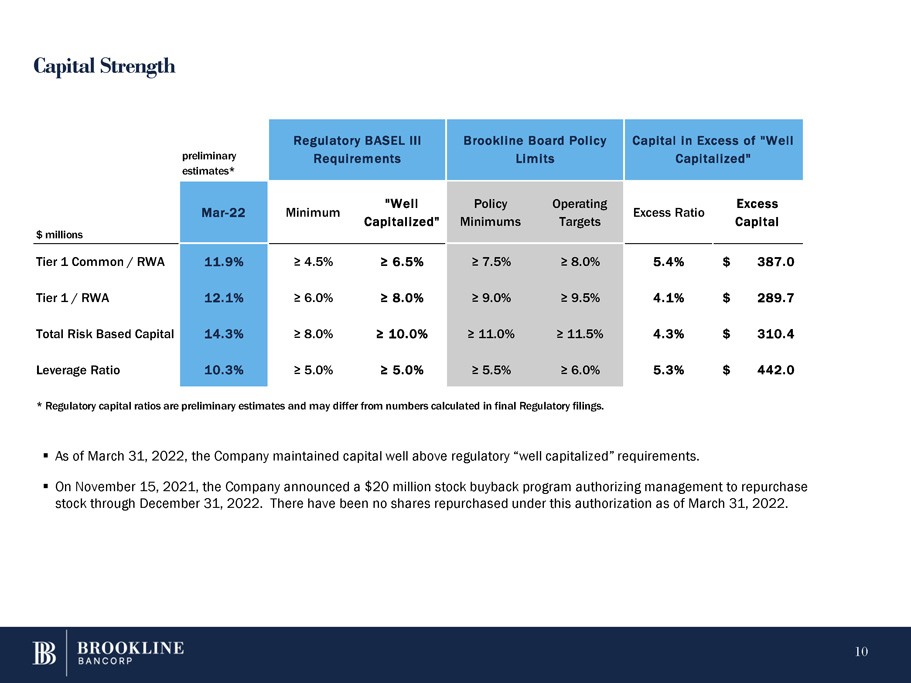

Capital Strength 10 ▪ As of March 31, 2022, the Company maintained capital well above regulatory “well capitalized” requirements. ▪ On November 15, 2021, the Company announced a $20 million stock buyback program authorizing management to repurchase stock through December 31, 2022. There have been no shares repurchased under this authorization as of March 31, 2022. preliminary estimates* Regulatory BASEL III Requirements Brookline Board Policy Limits Capital in Excess of "Well Capitalized" $ millions Mar - 22 Minimum "Well Capitalized" Policy Minimums Operating Targets Excess Ratio Excess Capital Tier 1 Common / RWA 11.9% ≥ 4.5% ≥ 6.5% ≥ 7.5% ≥ 8.0% 5.4% $ 387.0 Tier 1 / RWA 12.1% ≥ 6.0% ≥ 8.0% ≥ 9.0% ≥ 9.5% 4.1% $ 289.7 Total Risk Based Capital 14.3% ≥ 8.0% ≥ 10.0% ≥ 11.0% ≥ 11.5% 4.3% $ 310.4 Leverage Ratio 10.3% ≥ 5.0% ≥ 5.0% ≥ 5.5% ≥ 6.0% 5.3% $ 442.0 * Regulatory capital ratios are preliminary estimates and may differ from numbers calculated in final Regulatory filings.

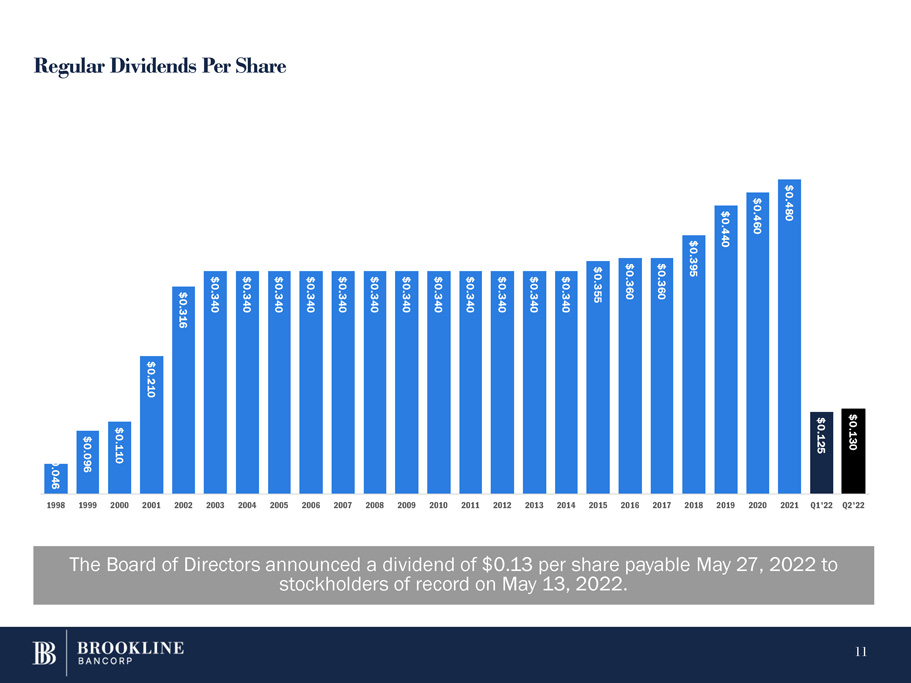

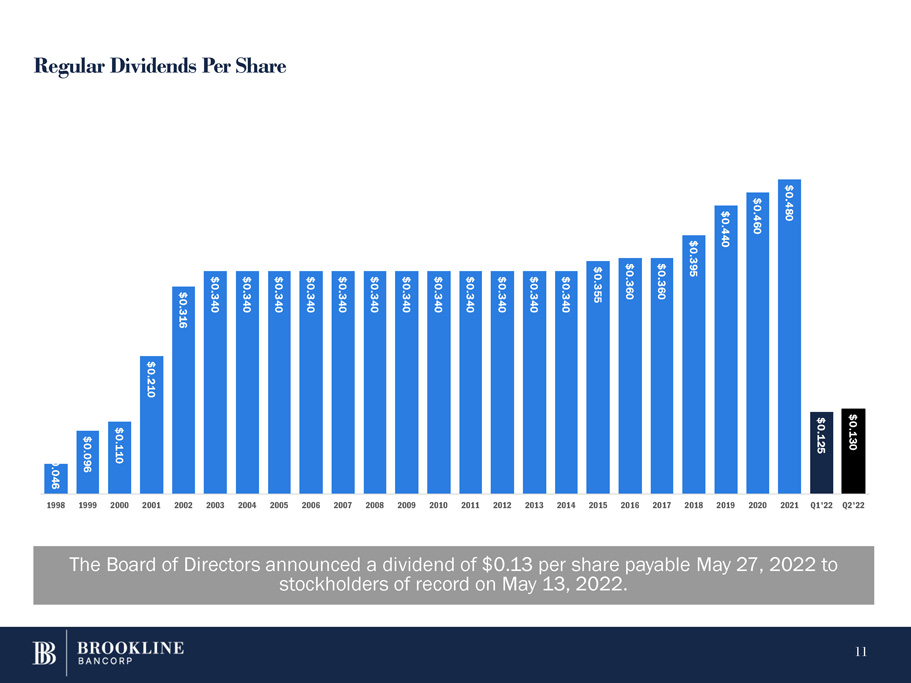

Regular Dividends Per Share The Board of Directors announced a dividend of $0.13 per share payable May 27, 2022 to stockholders of record on May 13, 2022. 0.046 11 $0.096 $0.110 $0.210 $0.316 $0.340 $0.340 $0.340 $0.340 $0.340 $0.340 $0.340 $0.340 $0.340 $0.340 $0.340 $0.340 $0.355 $0.360 $0.360 $0.395 $0.440 $0.460 $0.480 $0.125 $0.130 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1'22 Q2'22

QUESTIONS Paul A. Perrault, Chairman and Chief Executive Officer Carl M. Carlson, Co - President and Chief Financial Officer Thank You. 12

APPENDIX 13

Non Performing Assets and Net Charge Offs 14 1Q22 4Q21 Δ 1Q21 Δ Non Performing Assets (NPAs), in milli ons CRE $ 8.3 $ 10.9 $ (2.6) $ 7.5 $ 0.8 C&I 13.1 17.4 (4.3) 19.0 (5.9) Consumer 4.1 4.2 (0.1) 4.5 (0.4) Total Non Performing Loans (NPLs) 25.5 32.5 (7.0) 31.0 (5.5) Other real estate owned - - - 5.3 (5.3) Other repossessed assets 1.0 0.7 0.3 1.1 (0.1) Total NPAs $ 26.5 $ 33.2 $ (6.7) $ 37.4 $ (10.9) NPLs / Total Loans 0.35% 0.45% - 0.10% 0.43% - 0.08% NPAs / Total Assets 0.31% 0.39% - 0.08% 0.44% - 0.13% Net Charge Offs (NCOs), in millions CRE loans $ - $ - $ - $ - $ - C&I loans 1.9 2.1 (0.2) 1.8 0.1 Consumer loans - - - - - Total Net Charge Offs $ 1.9 $ 2.1 $ (0.2) $ 1.8 $ 0.1 NCOs / Loans (annualized) 0.11% 0.12% - 0.01% 0.10% 0.01% Linked Quarter (LQ) Year over Year (YoY)

Major Loan Segments with Industry Breakdown $3,545 $1,253 $1,224 $1,187 1Q22 Loans outstanding ($millions) – Excludes PPP Loans Investment CRE 49% Commercial 17% Equipment Finance 17% Consumer 17% Perm Constr Total % Total % Total % Total % Food & Lodging Manufacturing Finance and Ins Wholesale Trade Professional RE Agents / Brokers Health Care / Social Construction Retail Arts, Entert., Rec Condo Trans./Warehousing Other Services $ 234 19% 153 12% 138 11% 85 7% 84 7% 129 10% 98 8% 39 3% 72 6% 72 6% 45 4% 18 1% 86 7% Residential Home Equity Other Consumer Purchase Mtge $ 804 68% 331 28% 44 4% 8 1% Total $ 1,187 100% - Apartment Retail Office Industrial Mixed Use 1 - 4 Family Hotel Land Other 313 $ 947 $ 67 $ 1,014 29% 545 9 554 16% 633 1 634 18% 483 8 491 14% 316 12 328 9% 7 15 22 1% 140 12 152 4% 12 12 0% 25 338 10% Total $ 3,384 $ 161 $ 3,545 100% Fitness - Macrolease 172 14% Eastern Funding Core Laundry $ 501 41% Grocery 42 3% Dry Cleaning 10 1% Restaurant 0 0% Car Wash 5 0% EF CRE 121 10% Other EF 32 3% Specialty Vehicle Tow Truck 161 13% Heavy Tow 64 5% FedEx 40 3% Trailer 19 2% Other Vehicle 57 5% Total $ 1,253 100% Total $ 1,224 100% Loans, excluding PPP SBA - PPP Loans Total Loans Outstanding $ 7,209 14 $ 7,223 Owner Occupied CRE included in Commercial and Equipment Finance 15

CRE – Loan to Value (LTV) 31% 42% 34% 34% 43% 3% 32% 31% 28% 51% 47% 61% 59% 44% 67% 47% 54% 29% 17% 11% 5% 6% 13% 30% 21% 15% 14% 0% 29% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Apartment Retail Office Medical Hotel Restaurant Other Exposures by LTV Industrial 50% and lower Mixed Use 50 - 70 70 - 80 80+ Non Owner Occupied CRE and Multifamily Exposures at March 31, 2022. 34% 51% 3% 12% 16 Overall 54% LTV

34% 49% 28% 24% 25% 56% 56% 21% 9% 9% 8% 2% 4% 1% 16% 6% 5% 7% 8% 9% 3% 18% 19% 20% 0% 10% 10% 15% 7% 17% 16% 19% 15% 17% 10% 4% 12% 4% 8% 12% 8% 22% 4% 3% 14% 19% 14% 28% 40% 22% 26% 15% 21% 3% 9% 2% 3% 4% 0% 2 0 % 0% 25% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Apartment Retail Office 2016 and Before Restaurant Other Non Owner Occupied CRE and Multifamily Exposures at March 31, 2022. Exposures by Year of Origination Industrial Mixed Use Medical Hotel 2017 2018 2019 2020 2021 2022 5 % CRE - Vintage 23 % 9 % 14 % 9 % 7 % 33 % 17

Consumer Loans – LTV / FICO 18 700+ 85% 650 - 699 9% 599 - 600 - 649 1% 1% N/A 4% 50% or less 32% 50% - 69% 36% 70% - 80% 29% 80%+ 3% 50% or less 36% 50% - 69% 29% 70% - 80% 33% 80%+ 2% Resid. 1 - 4 59% LTV Resid. 1 - 4 FICO Home Equity FICO 700+ 93% Home Equity 56% LTV 1Q22

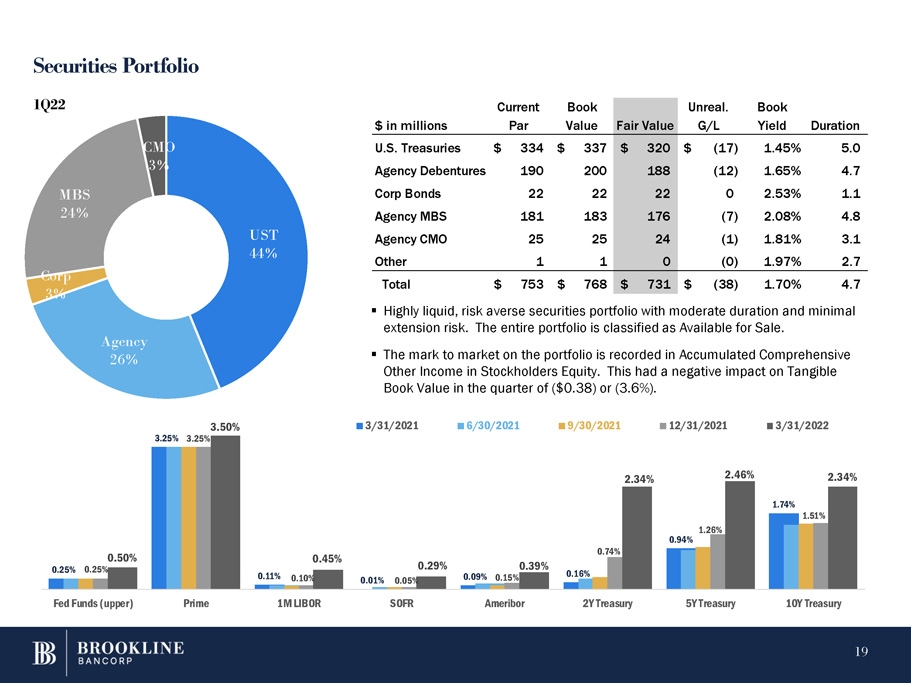

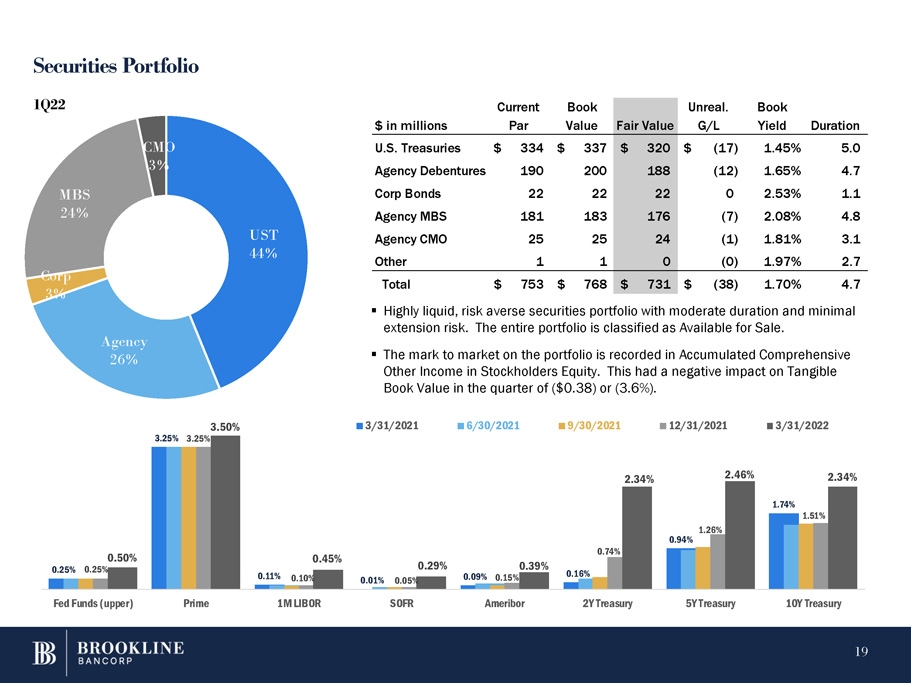

Securities Portfolio ▪ Highly liquid, risk averse securities portfolio with moderate duration and minimal extension risk. The entire portfolio is classified as Available for Sale. ▪ The mark to market on the portfolio is recorded in Accumulated Comprehensive Other Income in Stockholders Equity. This had a negative impact on Tangible Book Value in the quarter of ($0.38) or (3.6%). 0.25% 0.11% 0.01% 0.16% 3.25% 3.25% 0.10% 0.05% 0.74% 1.74% 1.51% 1.26% 0.94% 0.50% 0.25% 3.50% 0.45% 0.29% 0.39% 0.09% 0.15% 2.34% 2.46% 2.34% Fed Funds (upper) Prime 1M LIBOR SOFR Ameribor 2Y Treasury 5Y Treasury 10Y Treasury 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/31/2022 $ in millions Current Par Book Value Fair Value Unreal. G/L Book Yield Duration U.S. Treasuries $ 334 $ 337 $ 320 $ (17) 1.45% 5.0 Agency Debentures 190 200 188 (12) 1.65% 4.7 Corp Bonds 22 22 22 0 2.53% 1.1 Agency MBS 181 183 176 (7) 2.08% 4.8 Agency CMO 25 25 24 (1) 1.81% 3.1 Other 1 1 0 (0) 1.97% 2.7 Total $ 753 $ 768 $ 731 $ (38) 1.70% 4.7 Agency 26% 19 CMO 3% MBS 24% UST 44% Corp 3% 1Q22

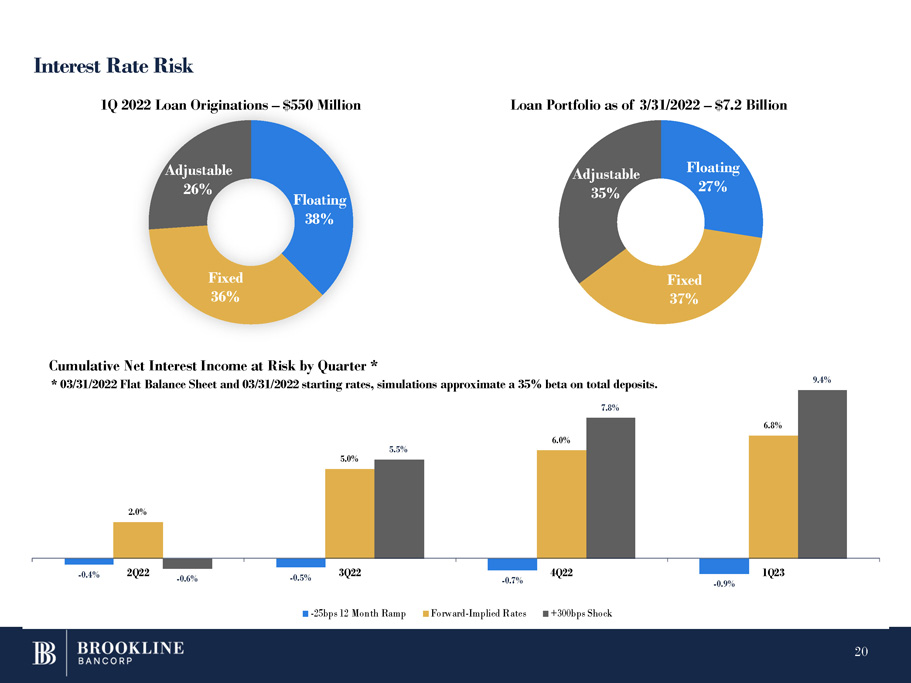

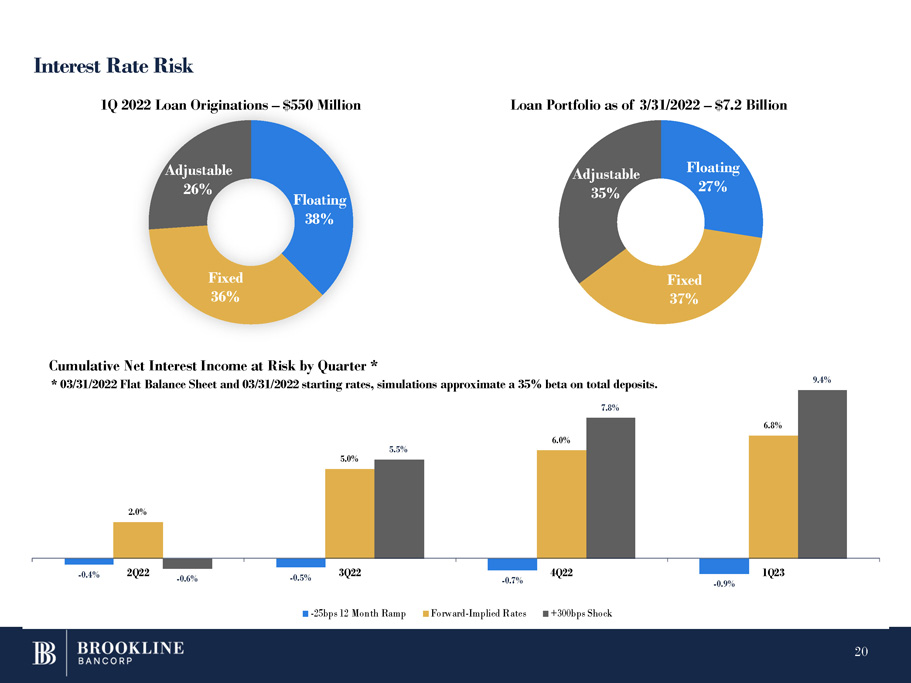

- 0.4% - 0.5% - 0.7% - 0.9% 2.0% 6.0% 6.8% - 0.6% 5.5% 5.0% 9.4% 2Q22 3Q22 4Q22 1Q23 - 25bps 12 Month Ramp Forward - Implied Rates +300bps Shock Interest Rate Risk 1Q 2022 Loan Originations – $550 Million Cumulative Net Interest Income at Risk by Quarter * * 03/31/2022 Flat Balance Sheet and 03/31/2022 starting rates, simulations approximate a 35% beta on total deposits. 7.8% Floating 38% Fixed 36% Adjustable 26% Floating 27% 20 Fixed 37% Adjustable 35% Loan Portfolio as of 3/31/2022 – $7.2 Billion

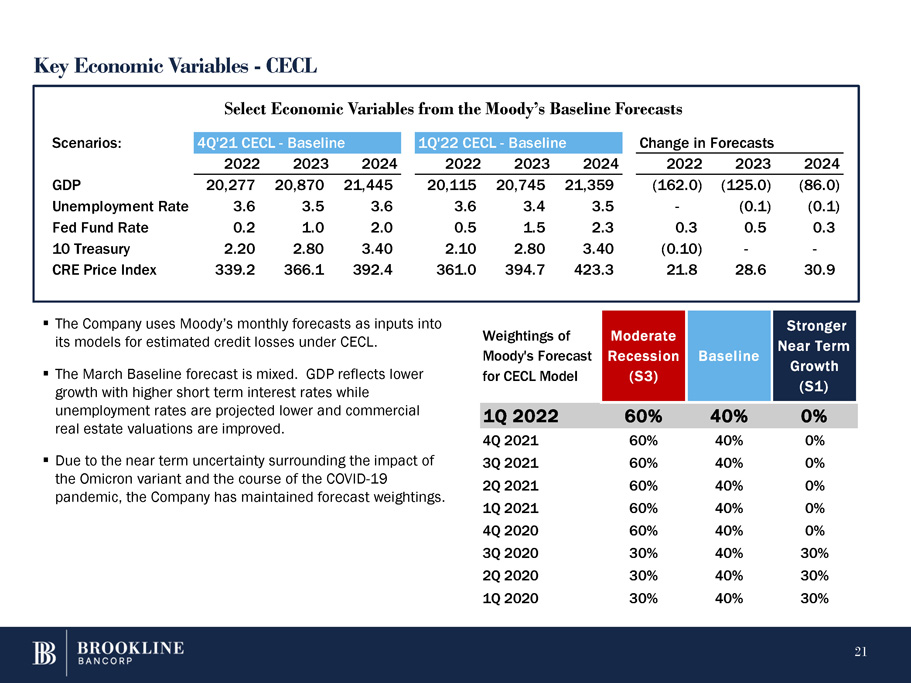

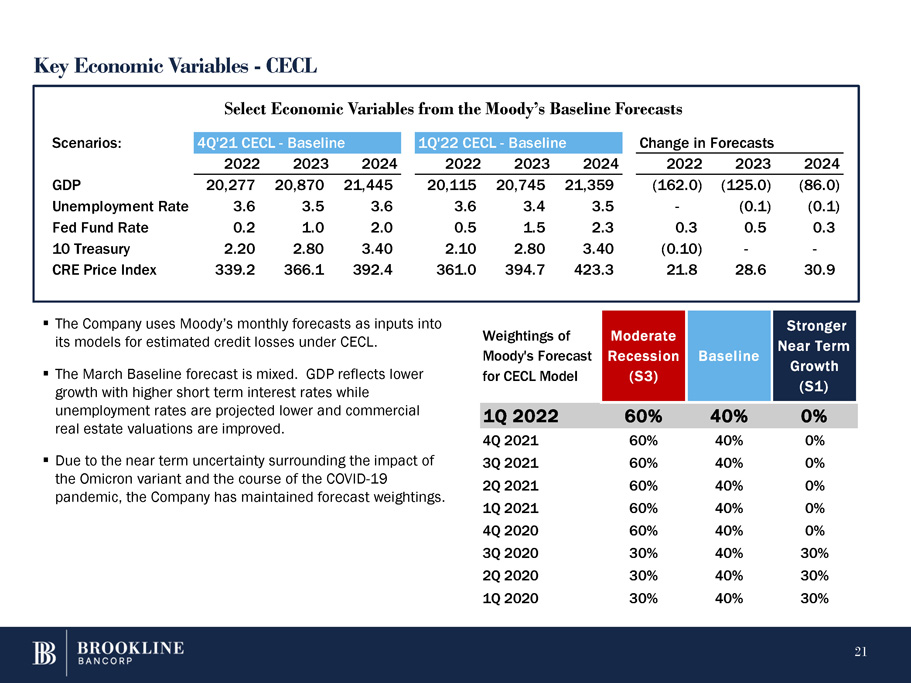

Key Economic Variables - CECL Select Economic Variables from the Moody’s Baseline Forecasts ▪ The Company uses Moody’s monthly forecasts as inputs into its models for estimated credit losses under CECL. ▪ The March Baseline forecast is mixed. GDP reflects lower growth with higher short term interest rates while unemployment rates are projected lower and commercial real estate valuations are improved. ▪ Due to the near term uncertainty surrounding the impact of the Omicron variant and the course of the COVID - 19 pandemic, the Company has maintained forecast weightings. 21 Scenarios: 4Q'21 CEC L - Baselin e 1Q'22 CEC L - Baselin e Change in Forecasts 2022 2023 2024 2022 2023 2024 2022 2023 2024 GDP 20,277 20,870 21,445 20,115 20,745 21,359 (162.0) (125.0) (86.0) Unemployment Rate 3.6 3.5 3.6 3.6 3.4 3.5 - (0.1) (0.1) Fed Fund Rate 0.2 1.0 2.0 0.5 1.5 2.3 0.3 0.5 0.3 10 Treasury 2.20 2.80 3.40 2.10 2.80 3.40 (0.10) - - CRE Price Index 339.2 366.1 392.4 361.0 394.7 423.3 21.8 28.6 30.9 Weightings of Moody's Forecast for CECL Model Moderate Recession (S3) Baseline Stronger Near Term Growth (S1) 1Q 2022 60% 40% 0% 4Q 2021 60% 40% 0% 3Q 2021 60% 40% 0% 2Q 2021 60% 40% 0% 1Q 2021 60% 40% 0% 4Q 2020 60% 40% 0% 3Q 2020 30% 40% 30% 2Q 2020 30% 40% 30% 1Q 2020 30% 40% 30%