UNITED STATES

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2007

POLYAIR INTER PACK INC.

(Registrant's name)

330 Humberline Drive,

Toronto, Ont.

Canada M9W 1R5

(416) 679-6600

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F __X___ Form 40-F _____

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _____ No __X___

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-__________.

EXHIBIT INDEX

| | |

| Exhibit Number | Description of Document |

1. | Company Press Release |

| 2. | Consolidated Financial Statements |

| 3. | Management's Discussion and Analysis |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

POLYAIR INTER PACK INC.

Date: February 9, 2007

By: /s/ MICHAEL FREEL

Name: Michael Freel

Title: Director of Finance

Exhibit 1

POLYAIR INTER PACK INC. ANNOUNCES 2006 RESULTS

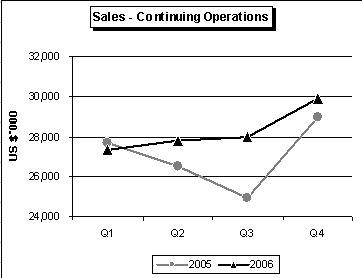

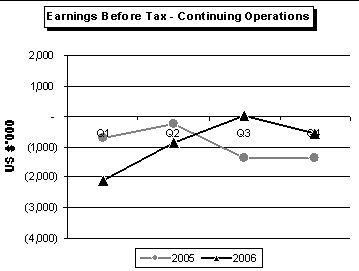

TORONTO, January 29, 2007 - Polyair Inter Pack Inc. (“PPK” or the “Company”) (TSX/AMEX: PPK) reported a net loss from continuing operations of $3.6 million or $0.53 per share on sales of $113.0 million for the fiscal year ended October 31, 2006, compared with a net loss from continuing operations of $2.4 million on sales of $108.1 million for the prior year. For the quarter ended October 31, 2006 the Company reported a net loss from continuing operations of $1.5 million or $0.22 per share on sales of $29.9 million, compared with a net loss from continuing operations of $1.4 million on sales of $29.0 million for the fourth quarter of 2005. In its year end financial results, the Company reported results from its Pool Division and its PXL and PSC subsidiaries as discontinued operations to reflect the actual and planned sale of these businesses.

All amounts are expressed in thousands of U.S. dollars, except for number of shares outstanding and per share amounts.

| | | | | 3 Months Ended | | 12 Months Ended | |

| | | | | 31-Oct | | 31-Oct | | 31-Oct | | 31-Oct | |

| | | | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | | | |

| Sales from continuing operations | | | | | | | | | | | |

| - Packaging Products | | | | $ | 29,910 | | $ | 28,955 | | $ | 112,977 | | $ | 108,076 | |

| | | | | | | | | | | | | | | | |

| Earnings from continuing operations | | | | | | | | | | | | | | | |

| before Interest, Taxes, Depreciation | | | | | 2,020 | | | 1,850 | | | 5,532 | | | 5,764 | |

| and Amortization (EBITDA)** | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net Loss from continuing operations | | | | | (1,462 | ) | | (1,385 | ) | | (3,602 | ) | | (2,389 | ) |

| Net Loss from discontinued operations | | | | | (6,897 | ) | | (6,978 | ) | | (19,905 | ) | | (13,280 | ) |

| Net Loss | | | | $ | (8,359 | ) | $ | (8,363 | ) | $ | (23,507 | ) | $ | (15,669 | ) |

| | | | | | | | | | | | | | | | |

| Net loss per share from continuing operations | | | | | | | | | | | | | | | |

| - Basic | �� | | | $ | (0.22 | ) | $ | (0.20 | ) | $ | (0.53 | ) | $ | (0.36 | ) |

| - Diluted | | | | $ | (0.22 | ) | $ | (0.20 | ) | $ | (0.53 | ) | $ | (0.36 | ) |

| | | | | | | | | | | | | | | | |

| Net loss per share from discontinued operations | | | | | | | | | | | | | | | |

| - Basic | | | | $ | (1.01 | ) | $ | (1.03 | ) | $ | (2.93 | ) | $ | (1.99 | ) |

| - Diluted | | | | $ | (1.01 | ) | $ | (1.03 | ) | $ | (2.93 | ) | $ | (1.99 | ) |

| | | | | | | | | | | | | | | | |

| Net loss per share | | | | | | | | | | | | | | | |

| - Basic | | | | $ | (1.23 | ) | $ | (1.23 | ) | $ | (3.46 | ) | $ | (2.35 | ) |

| - Diluted | | | | $ | (1.23 | ) | $ | (1.23 | ) | $ | (3.46 | ) | $ | (2.35 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding | | | | | | | | | | | | | | | |

(in millions) - Basic | | | | | 6.8 | | | 6.8 | | | 6.8 | | | 6.7 | |

| - Diluted | | | | | 6.8 | | | 6.8 | | | 6.8 | | | 6.7 | |

| | | | | | | | | | | | | | | | |

| Prior period amounts have been reclassifed from statements previously presented to conform to the presentation of the 2006 year end Consolidated Financial Statements. |

| | | | | | | | | | | | | | | | |

| ** EBITDA is not a recognized measure under Canadian Generally Accepted Accounting Principles and readers are cautioned that EBITDA should not be considered as an alternative to net income or loss or cash from operating activities as an indicator of the Company's performance or cash flows. EBITDA, as calculated by the Company, is net income or loss before extraordinary items, net interest expenses and other, depreciation and amortization, and income taxes. Full interim financial statements along with Management's Discussion and Analysis can be obtained from SEDAR (www.sedar.com) and the Company's web site at www.polyair.com |

The results of the Company’s Packaging Division have continued to improve from those reported earlier in the fiscal year due to increased sales volumes and gross margins. Gross margins improved to 15.4% from 13.2% in the fourth quarter of the 2005 fiscal year, primarily due to the combined impact of lower material costs and reduced overheads. Offsetting the Company’s operating gains in the fourth quarter of 2006 were higher interest rate costs. The Company reported a net loss from continuing operations of $1.5 million, partly due to a $0.9 million net tax provision in the quarter.

In its discontinued operations, comprising mainly the Pool Division, the Company recorded a loss of $6.9 million reflecting writedowns of assets associated with the discontinued business components, and professional and other costs associated with exiting the discontinued businesses. In the fourth quarter, the Company also completed the sale and lease-back of its Toronto head office building at 330 Humberline Drive. The $7.1 million gain earned on this transaction has been deferred and will be recognized over the 10 year life of the lease.

The Company’s operating bank debt has been reduced to $9.5 million from $21.1 million at the end of 2005, and total debt stood at $25.6 million compared to $41.3 million last year. The previously announced $5 million offer to finance which the Company received from an investment fund in October 2006, is currently being re-negotiated by the parties in light of the Company’s various asset sales and its modified capital requirements.

“The last fiscal year has been challenging for the Company and I am pleased to report progress in improving the profitability of the packaging business and the sale of non-core assets. The progress achieved is a testament to the commitment and effort of our employees, combined with the support we received from our lenders and customers” stated Victor D’Souza, interim CEO in announcing the Company’s results.

Polyair Inter Pack Inc. (www.Polyair.com) in its Packaging Division manufactures and distributes a wide range of protective packaging products in North America. The Company operates nine manufacturing facilities, seven of which are in the US where it generates the majority of its sales.

Certain information included in this news release contains statements that are forward-looking, such as statements relating to anticipated future revenues of the company, financing and the sale of non-packaging assets. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of Polyair Inter Pack Inc. In addition, Polyair Inter Pack Inc. expressly disclaims any obligation to publicly update or alter its previously issued forward-looking statements.

For more information contact:

Stysia Reay

Polyair Inter Pack Inc.

Phone: 416-679-6591

Email: sreay@polyair.com

Exhibit 2

Consolidated Financial Statements

POLYAIR INTER PACK INC.

Years ended October 31, 2006, 2005 and 2004

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL

REPORTING

The accompanying consolidated financial statements of Polyair Inter Pack Inc. (“Polyair”) and all the information in the Management Discussion and Analysis are the responsibility of management and have been approved by the Board of Directors.

The financial statements have been prepared by management in accordance with Canadian generally accepted accounting principles. The financial statements include certain amounts that are based on the best estimates and judgements of management, and in their opinion present fairly, in all material respects, Polyair’s financial position, results of operations and cash flows. Management has prepared the financial information presented elsewhere in the Management Discussion and Analysis and has ensured that it is consistent with the financial statements.

Management of Polyair, in furtherance of the integrity of the financial statements, has developed and maintains a system of internal controls. Management believes the internal controls provide reasonable assurance that transactions are properly authorized and recorded, financial records are reliable and form a proper basis for the preparation of financial statements and that Polyair’s assets are properly accounted for and safeguarded.

The Board of Directors is responsible for overseeing Management’s responsibility for financial reporting and is ultimately responsible for reviewing and approving the financial statements. The Board of Directors is assisted in meeting this responsibility through the Audit Committee.

The Audit Committee is appointed by the Board of Directors and its members are outside, unrelated directors. The Audit Committee meets periodically with management, as well as the external auditors, to discuss internal controls over the financial reporting process, auditing matters and financial reporting issues to satisfy itself that each party is properly discharging its responsibilities, and to review the Management Discussion and Analysis, the financial statements and the external auditor’s report. The Audit Committee reports its findings to the Board for consideration when approving the financial statements for issuance to the shareholders. The Audit Committee also considers, for review by the Board of Directors and approval by the shareholders, the engagement or re-appointment of the external auditors.

The financial statements have been audited by BDO Dunwoody LLP, the external auditors, in accordance with Canadian generally accepted auditing standards on behalf of the shareholders. BDO Dunwoody LLP has full and free access to the Audit Committee.

Victor D’Souza Michael Freel

Interim Chief Executive Officer Director of Finance

AUDITORS' REPORT TO THE SHAREHOLDERS

We have audited the consolidated balance sheet of Polyair Inter Pack Inc. as at October 31, 2006 and the consolidated statement of income and retained earnings and cash flows for the year ended October 31, 2006. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at October 31, 2006 and the results of its operations and its cash flows for the year ended October 31, 2006 in accordance with Canadian generally accepted accounting principles.

The consolidated financial statements as at October 31, 2005 and 2004 and for the years then ended were audited by other auditors who expressed an opinion without reservation on those consolidated financial statements in their report dated January 23, 2006.

/s/BDO Dunwoody LLP

Chartered Accountants

Toronto, Canada

January 24, 2007

POLYAIR INTER PACK INC.

Consolidated Balance Sheets

(In thousands of U.S. dollars)

As at October 31

| | | | | | |

| | | | | | |

| | | 2006 | | 2005 | |

| | | | | Restated * | |

ASSETS | | | | | |

Current Assets: | | | | | |

| Cash | | $ | 248 | | $ | 183 | |

| Accounts receivable, net | | | 13,811 | | | 23,264 | |

| Inventory (note 4) | | | 9,966 | | | 28,421 | |

| Prepaid expenses and other | | | 1,281 | | | 2,603 | |

| Income taxes receivable | | | 1,916 | | | 1,953 | |

| Future income tax | | | 1,807 | | | 1,422 | |

| Assets held for sale (note 5) | | | 4,577 | | | - | |

| | | | 33,606 | | | 57,846 | |

| | | | | | | | |

Property, plant and equipment, net (note 6) | | | 29,880 | | | 38,749 | |

Future income tax | | | 5,126 | | | 1,969 | |

Intangible and other assets, net (note 7) | | | 3,583 | | | 2,800 | |

Assets held for sale (note 5) | | | 1,074 | | | - | |

| | | $ | 73,269 | | $ | 101,364 | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | |

Current liabilities: | | | | | | | |

| Bank indebtedness (note 8) | | $ | 9,503 | | $ | 21,096 | |

| Accounts payable and accrued liabilities | | | 34,309 | | | 31,685 | |

| Due to joint venture | | | 351 | | | - | |

| Income taxes payable | | | 46 | | | 113 | |

| Liabilities of business being sold (note 5) | | | 1,485 | | | - | |

| Current portion of long-term debt (note 9) | | | 15,411 | | | 20,161 | |

| | | | 61,105 | | | 73,055 | |

| | | | | | | | |

Other long-term liabilities | | | 129 | | | - | |

Deferred gain (note 10) | | | 7,071 | | | - | |

Convertible note (note 11) | | | 653 | | | 876 | |

Future income tax | | | 3,293 | | | 3,720 | |

| | | | | | | | |

Shareholders' equity: | | | | | | | |

| Convertible note (note 11) | | | 3,613 | | | 3,613 | |

| Capital stock (note 12) | | | 13,183 | | | 13,183 | |

| Contributed surplus | | | 366 | | | 212 | |

| Retained earnings / (deficit) | | | (20,273 | ) | | 3,234 | |

| Cumulative translation account | | | 4,129 | | | 3,471 | |

| | | | 1,018 | | | 23,713 | |

| Basis of presentation (note 2) | | | | | | | |

| | | $ | 73,269 | | $ | 101,364 | |

| | | | | | | | |

| * Restated to reflect accounting policy change - see note 3 (o) | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | | | |

On behalf of the Board:

Fred A. Litwin Victor D’Souza

Chairman of the Board Interim Chief Executive Officer

POLYAIR INTER PACK INC.

Consolidated Statements of Income and Retained Earnings

(In thousands of U.S. dollars, except per share amounts)

Years ended October 31

| | 2006 | | 2005 | | 2004 | | |

| | | | | | Restated* | | | Restated * | | |

Sales | $ | 112,977 | | $ | 108,076 | | $ | 96,458 | | |

Cost of sales | | 97,611 | | | 92,551 | | | 81,239 | | |

| | | | | | | | | | | |

Gross profit | | 15,366 | | | 15,525 | | | 15,219 | | |

Selling, general and administrative expenses | | 16,334 | | | 16,866 | | | 15,431 | | |

Net interest expense and other | | 2,523 | | | 2,368 | | | 1,304 | | |

(Loss) / Income before income taxes | | (3,491 | ) | | (3,709 | ) | | (1,516 | ) | |

| | | | | | | | | | | |

Income taxes (recovery): | | | | | | | | | | |

| Current | | 1,130 | | | (246 | ) | | (238 | ) | |

| Future | | (1,019 | ) | | (1,074 | ) | | (43 | ) | |

| | | 111 | | | (1,320 | ) | | (281 | ) | |

(Loss) / income for the period from continuing operations | $ | (3,602 | ) | $ | (2,389 | ) | $ | (1,235 | ) | |

| | | | | | | | | | | |

(Loss) / income from discontinued operations, net of tax (note 13) | | (19,905 | ) | | (13,280 | ) | | 230 | | |

| | | | | | | | | | | |

Extraordinary Gain, Net of Taxes (note 22) | | - | | | - | | | 948 | | |

| | | | | | | | | | | |

Net (loss ) / income | | (23,507 | ) | | (15,669 | ) | | (57 | ) | |

| | | | | | | | | | | |

Retained earnings (deficit), beginning of period | | 3,234 | | | 18,903 | | | 18,960 | | |

| | | | | | | | | | | |

Retained earnings (deficit), end of period | $ | (20,273 | ) | $ | 3,234 | | $ | 18,903 | | |

| | | | | | | | | | | |

Net (loss) / income per share from continuing operations | | | | | | | | | | |

| Basic | $ | (0.53 | ) | $ | (0.36 | ) | $ | (0.20 | ) | |

| Diluted | $ | (0.53 | ) | $ | (0.36 | ) | $ | (0.20 | ) | |

Net (loss) / income per share from discontinued operations | | | | | | | | | | |

| Basic | $ | (2.93 | ) | $ | (1.99 | ) | $ | 0.19 | | |

| Diluted | $ | (2.93 | ) | $ | (1.99 | ) | $ | 0.19 | | |

Net (loss) / income per share | | | | | | | | | | |

| Basic | $ | (3.46 | ) | $ | (2.35 | ) | $ | (0.01 | ) | |

| Diluted | $ | (3.46 | ) | $ | (2.35 | ) | $ | (0.01 | ) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Weighted average number of shares outstanding | | | | | | | | | | |

| Basic | | 6,797,250 | | | 6,673,370 | | | 6,130,264 | | |

| Diluted | | 6,797,250 | | | 6,673,370 | | | 6,130,264 | | |

| | | | | | | | | | | |

| * Restated to reflect accounting policy change - see note 3 (o) | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | | | | | | |

POLYAIR INTER PACK INC.

Consolidated Statements of Cash Flows

(In thousands of U.S. dollars)

Years ended October 31

| | | | | | | | |

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

Operating activities: | | | | | | | |

| Net (loss) / income | | $ | (23,507 | ) | $ | (15,669 | ) | $ | (57 | ) |

| Items which do not involve cash: | | | | | | | | | | |

| Depreciation and amortization | | | 7,365 | | | 8,625 | | | 7,231 | |

| Loss (gain) on sale of assets | | | 531 | | | 210 | | | (616 | ) |

| Extraordinary items | | | - | | | - | | | (948 | ) |

| Impairment of Property, plant and equipment | | | 954 | | | 2,866 | | | - | |

| Stock based compensation | | | 153 | | | 129 | | | 83 | |

| Future income taxes and other | | | (3,629 | ) | | (2,512 | ) | | 1,361 | |

| | | | | | | | | | | |

| Change in non-cash operating working capital: | | | | | | | | | | |

| Accounts receivable | | | 7,741 | | | 2,092 | | | (256 | ) |

| Inventory | | | 18,387 | | | 14,052 | | | (9,504 | ) |

| Prepaid expenses and other | | | 1,255 | | | (94 | ) | | (190 | ) |

| Accounts payable and accrued liabilities | | | 2,302 | | | (4,144 | ) | | 8,523 | |

| Income taxes payable/receivable | | | 22 | | | (537 | ) | | (3,023 | ) |

| Interest on convertible debenture | | | (265 | ) | | (184 | ) | | (194 | ) |

| | | | 11,309 | | | 4,834 | | | 2,410 | |

| | | | | | | | | | | |

Investing activities | | | | | | | | | | |

| Purchase and deposits on building and equipment | | | (1,912 | ) | | (5,734 | ) | | (10,064 | ) |

| Net proceeds on the sale of capital assets | | | 7,174 | | | 51 | | | 616 | |

| Due to (from) joint venture | | | 219 | | | (31 | ) | | 168 | |

| Other | | | (664 | ) | | (481 | ) | | (394 | ) |

| | | | 4,817 | | | (6,195 | ) | | (9,674 | ) |

Financing activities: | | | | | | | | | | |

| Increase in long-term debt | | | - | | | 1,717 | | | 8,620 | |

| Repayment of long-term debt | | | (4,787 | ) | | (6,100 | ) | | (4,521 | ) |

| Net increase in bank indebtedness | | | (11,727 | ) | | 2,084 | | | 4,269 | |

| Stock options exercised | | | - | | | 1,670 | | | 1,585 | |

| | | | (16,514 | ) | | (629 | ) | | 9,953 | |

| | | | | | | | | | | |

Effect of currency translation on cash balances | | | 453 | | | (113 | ) | | (1,291 | ) |

| | | | | | | | | | | |

Increase / (Decrease) in cash | | | 65 | | | (2,103 | ) | | 1,398 | |

Cash, beginning of year | | | 183 | | | 2,286 | | | 888 | |

| | | | | | | | | | | |

Cash, end of year | | $ | 248 | | $ | 183 | | $ | 2,286 | |

| | | | | | | | | | | |

Supplemental cash flow information: | | | | | | | | | | |

| Interest paid | | | 3,893 | | | 3,306 | | | 2,581 | |

| Net income taxes (recovered) / paid | | | (421 | ) | | (1,119 | ) | | 1,334 | |

| | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | | | | | | |

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

1. Nature of the business:

Polyair Inter Pack Inc. (the "Company" or “Polyair”) is a public company whose shares trade on the Toronto and American Stock Exchanges. The Company manufactures and distributes packaging product and swimming pool covers.

2. Basis of presentation:

The Company’s banking agreements contain several covenants, which require the Company to meet a certain maximum level of pre-tax losses and minimal level of tangible net worth tested on a quarterly basis. During the fiscal year the Company and its lenders agreed on several amendments to the covenants and other terms of its credit facilities. These amendments were required in order to accommodate losses incurred, to provide working capital and to allow divesture of the Pool Division. Following these amendments, the Company was in compliance with all debt covenants as at October 31, 2006.

The Company is currently negotiating with its lenders covenants for its 2007 fiscal year. The Company’s ongoing ability to meet covenants that are established will be dependent on an improvement in its profitability. At October 31, 2006 this improvement has not been clearly established and accordingly the Company believes it appropriate to continue to classify the term loans provided by these lenders as current. Under the terms of the Company’s lending agreements, violation of the primary financial covenants constitutes an event of default, which enables the lenders to demand repayment on the bank indebtedness, trigger cross defaults on the term loans thereby allowing the lenders to demand repayment of these loans, as well as take possession of the collateral security.

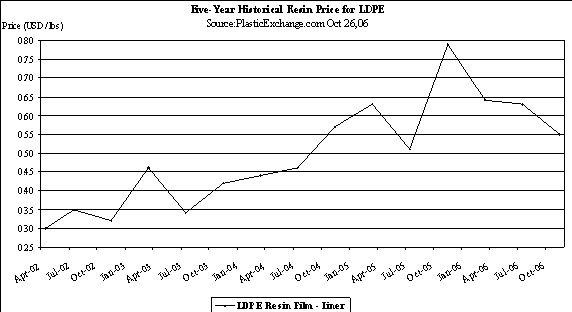

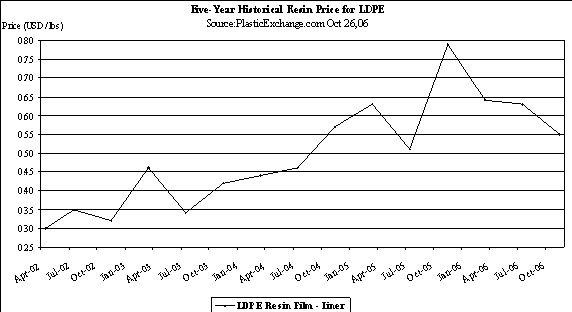

These Consolidated Financial Statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes that the Company will be able to meet its financial covenant tests and generate positive cash flows from operations. In order for this to be realized the Company is dependent upon the continued support of the Company’s lenders and creditors and increased profitability of the Company’s packaging business, which is sensitive to the volume and price of packaging products sold, freight costs, and the cost of resin (a significant raw material component in the packaging business). If these assumptions are not met, the Company may not be able to realize its assets and discharge its liabilities in the normal course of operations. If the going concern assumption is not appropriate for these Consolidated Financial Statements, adjustments would be necessary in the carrying value of assets and liabilities and the reported revenues and expenses.

In 2006 the Company reported its Pool Division as a discontinued operation and sold operating assets associated with this division so that by year-end the only remaining assets were trade and other receivables. The Company operated its Pool Division from two wholly owned subsidiaries; the Canadian subsidiary sought protection under the Companies’ Creditors Arrangement Act (“CCAA”) in order to complete the sale of its assets and make a proposal to

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

2. Basis of presentation (continued):

its unsecured creditors to settle their claims. This proposal was agreed to by the Canadian subsidiary’s creditors subsequent to the Company’s year end.

The Company signed an agreement, effective October 31, 2006 for the sale of its 50.1% interest in PXL Cross Linked Foam Corporation (“PXL”), a Canadian based company that manufactures and distributes cross linked foam. The results from this business have been reported under results from discontinued operations in the 2006 financial statements.

In late 2006, the Board of Directors agreed to seek a buyer for its 76% interest in P.S.C. Mouldings Corporation (“PSC”), a business that manufactures and distributes expanded polystyrene products. Negotiations are underway with a purchaser and if successful the sale will conclude in the second quarter of 2007. The Company has reported this business as a discontinued operation in its 2006 fiscal year.

3. Significant accounting policies:

The consolidated financial statements of the Company have been prepared by management in accordance with accounting principles generally accepted in Canada.

(a) Basis of consolidation:

The consolidated financial statements include the accounts of the Company and those of its subsidiaries. Intercompany transactions and balances are eliminated on consolidation. The accounts also include the Company’s proportionate share of assets and liabilities of two joint ventures, PXL Cross Linked Foam Corporation (50.1% owned) and GCPC, Inc. (50.1% owned) (note 21).

| (b) | Reporting currency and foreign currency translation: |

The Company's reporting currency is the U.S. dollar and the Company’s functional currency is the Canadian dollar. The U.S. dollar is the functional currency of the Company’s United States operations. The Canadian dollar is the functional currency of the Company's Canadian operations.

Monetary items denominated in currencies other than the operation’s functional currency, such as cash and accounts receivable, are translated into the functional currency of the respective operations at exchange rates in effect at the balance sheet dates. Non-monetary items denominated in foreign currencies, such as property, plant and equipment are translated at rates of exchange in effect when the assets are acquired or obligations incurred. Revenue and expenses in currencies other than the operation’s functional currency are translated at rates in effect at the time of the transaction. Foreign exchange gains and losses arising from such translations are included in income.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

3. Significant accounting policies (continued):

The Company’s Canadian operations are translated into U.S. dollars using the current rate method. Under this method, all assets and liabilities are translated at the year-end rate of exchange and all revenues and expense items are translated at the average rate of exchange for the year. Exchange rate differences arising on this translation are deferred into the Cumulative Translation Account reported as a component of shareholders’ equity.

(c) Revenue recognition:

Revenue from product sales is recognized when product is shipped to the customer, the customer takes ownership and assumes risk of loss, and collection of the relevant receivable is reasonably assured. Customer returns are recorded as an adjustment to sales. The Company estimates and accrues its customer returns based on historical trends and known return goods authorizations.

(d) Inventory:

Raw materials are stated at the lower of cost and replacement cost. Finished goods are stated at the lower of cost, determined by the first-in, first-out method, and net realizable value.

(e) Property, plant and equipment:

Property, plant and equipment are recorded at cost. Depreciation is recorded once assets are in use and is calculated using the straight-line method at annual rates designed to amortize the cost over their estimated useful lives as follows:

Building 2-1/2%

Machinery, equipment, furniture and fixtures 10% - 50%

Computer equipment 33%

Leasehold improvements Over term of lease plus

first renewal term

Property, plant and equipment, and other long-lived assets, are tested for impairment whenever events or changes in circumstances indicate that the carrying values of such assets exceed the projected future undiscounted cash flows. In these circumstances the Company reduces the carrying value of the assets to their fair value and recognizes an impairment charge.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

3. Significant accounting policies (continued):

| (f) | Intangible and other assets: |

Patent, trademarks and license agreements are stated at cost, net of accumulated amortization. Amortization is provided over the useful lives of the intangible assets (5 to 20 years) using the straight-line method.

Goodwill is the residual amount that results when the purchase price of an acquired business exceeds the sum of the amounts allocated to the assets acquired, less liabilities assumed, based on their fair values. Goodwill is allocated, as of the date of the business combination, to the Company's reporting units that are expected to benefit from the synergies of the business combination.

Goodwill is not amortized and is tested for impairment annually, or more frequently, if events or changes in circumstances indicate that the asset might be impaired. The impairment test is carried out in two steps. In the first step, the carrying amount of the reporting unit is compared with its fair value. When the fair value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not to be impaired and the second step of the impairment test is unnecessary.

The second step is carried out when the carrying amount of a reporting unit exceeds its fair value, in which case, the implied fair value of the reporting unit's goodwill is compared with its carrying amount to measure the amount of the impairment loss, if any. The implied fair value of goodwill is determined in the same manner as the value of goodwill is determined in a business combination described in the preceding paragraph, using the fair value of the reporting unit as if it was the purchase price. When the carrying amount of reporting unit goodwill exceeds the implied fair value of the goodwill, an impairment loss is recognized in an amount equal to the excess.

Deferred financing costs are amortized using the straight-line method over the term of the related financing. The amortization of deferred financing costs is included in Net interest expense and other.

| (g) | Financial instruments: |

In 2006, the Company did not enter into any foreign exchange contracts to hedge its exposure. In 2005, and prior, the Company entered into future foreign currency exchange contracts to manage foreign currency exposures. These contracts are not designated and documented as hedging relationships in accordance with Accounting Guideline 13, Hedging Relationships, and accordingly are measured at fair value with changes in fair value recorded in the statements of income and retained earnings.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

3. Significant accounting policies (continued):

(h) Income taxes:

The Company follows the assets and liability method of accounting for income taxes. Under this method, future income tax assets and liabilities reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts employed for income tax purposes and the benefit of losses to be carried forward to future years for income tax purposes.

Future tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on future tax assets and liabilities of a change in tax rates is recognized in income in the year that the rate changes. A valuation allowance is provided to the extent that it is more likely than not that future income tax assets will not be realized.

(i) Stock-based compensation plan:

The Company has a stock-based compensation plan, which is described in note 12.

The Company adopted recommendations of The Canadian Institute of Chartered Accountants with respect to the accounting for stock-based compensation and other stock-based payments, using the fair value-based method. Under the fair value method, compensation costs attributable to awards to Company employees are measured at fair value at the date of the grant, amortized over the vesting period on a straight-line basis, and charged to earnings with a related credit to Contributed Surplus. Consideration paid by employees on exercise of stock options is recorded as share capital. These recommendations were applied to all stock-based payments granted on or after November 1, 2002.

(j) Exit and disposal costs:

The Company recognizes costs associated with exit or disposal activities at fair value in the period in which the liability is incurred. Special termination benefits are recognized at fair value at the communication date.

(k) (Loss) income per share:

Basic (loss) income per share is computed using the weighted average number of common shares outstanding during the year. Diluted income per share is computed using the weighted average number of common and potential common shares outstanding during the year. Potential common shares consist of the incremental number of common shares issuable upon the exercise of stock options and the conversion of the convertible note.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

3. Significant accounting policies (continued):

(l) Use of estimates:

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year.

The Company maintains a provision for obsolete inventory. In evaluating, the adequacy of the Company’s provision for inventory obsolescence a number of factors are considered including level of inventory in relationship to historical and forecasted sales, changes in demand for products, planned obsolescence and product replacement. The Company’s provision for inventory obsolescence may require adjustment as these factors change.

The Company maintains accounts receivable allowances for estimated losses resulting from the inability of its customers to make payments. It performs periodic credit evaluations of its customers and with the exception of the Pool Division’s exports sales, it typically does not carry collateral or credit insurance. The Company’s estimate of the allowance for doubtful accounts may prove insufficient if a greater than expected numbers of customers are delinquent in their payments.

(m) Environmental obligations:

The Company’s operations are subject to numerous environmental laws, regulations and guidelines adopted by various governmental authorities in the jurisdictions in which the Company operates. Liabilities are recorded when known or considered probable and can be reasonably estimated. The Company provides for environmental liabilities using best estimates. Actual environmental liabilities could differ significantly from these estimates.

| (n) | Asset retirement obligations |

The Company recognizes the fair value of a future asset retirement obligation as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long-lived assets that results from the acquisition, construction, development, and/or normal use of the assets. The Company concurrently recognizes a corresponding increase in the carrying amount of the related long-lived asset that is depreciated over the life of the asset. The fair value of the asset retirement obligation is estimated using the expected cash flow approach that reflects a range of possible outcomes discounted at a credit-

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

3. Significant accounting policies (continued):

adjusted risk-free interest rate. Subsequent to the initial measurement, the asset retirement obligation is adjusted at the end of each period to reflect the passage of time and changes in the estimated future cash flows underlying the obligation. Changes in the obligation due to the passage of time are recognized in income as an operating expense using the interest method. Changes in the obligation due to changes in estimated cash flows are recognized as an adjustment of the carrying amount of the related long-lived asset that is depreciated over the remaining life of the asset.

| (o) | Accounting policy changes |

The accounting policy with regard to the Convertible Note was changed in 2006; the effect of this change is covered in Note 11- Convertible Note.

4. Inventory:

| | | | 2006 | | | 2005 | |

| | | | | | | | |

| | | | | | | | |

| Raw materials | | $ | 6,917 | | $ | 17,220 | |

| Finished goods | | | 3,049 | | | 11,201 | |

| | | | | | | | |

| | | $ | 9,966 | | $ | 28,421 | |

| | | | | | | | |

5. Assets and Liabilities of Business Held for Sale:

In the first quarter of 2007, the Company completed the sale of its 50.1% interest in PXL. The Company reported $2.4 million of assets associated with this business under Assets held for sale and $1.5 million of liabilities under Liabilities of business being sold.

The Company has also decided to sell its 76% interest in PSC and at October 31, 2006 has reported $3.2 million as Assets held for sale. To reflect the valuation ascribed by the anticipated proceeds, machinery and intangibles related to this business were written down by a total of $1.1 million in the fourth quarter of 2006. This charge was booked to results from discontinued operations.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

6. Property, plant and equipment:

| | | | | | | | | | | |

| | | | | | | | | | | |

| 2006 | | | Cost | | | Accumulated depreciation | | | Net book value | |

| | | | | | | | | | | |

| Land | | $ | 132 | | $ | - | | $ | 132 | |

| Building | | | 8,217 | | | 1,827 | | | 6,390 | |

| Machinery, equipment, furniture & fixtures | | | 59,433 | | | 37,792 | | | 21,641 | |

| Computer equipment | | | 3,356 | | | 3,004 | | | 352 | |

| Leasehold improvements | | | 3,890 | | | 2,719 | | | 1,171 | |

| Construction in progress | | | 86 | | | - | | | 86 | |

| Computer equipment under capital lease | | | 216 | | | 108 | | | 108 | |

| | | $ | 75,330 | | $ | 45,450 | | $ | 29,880 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| 2005 | | | Cost | | | Accumulated depreciation | | | Net book value | |

| | | | | | | | | | | |

| Land | | $ | 132 | | $ | - | | $ | 132 | |

| Building | | | 8,226 | | | 1,619 | | | 6,607 | |

| Machinery, equipment, furniture & fixtures | | | 64,996 | | | 37,464 | | | 27,532 | |

| Computer equipment | | | 3,619 | | | 3,060 | | | 559 | |

| Leasehold improvements | | | 6,281 | | | 4,453 | | | 1,828 | |

| Construction in progress | | | 1,920 | | | - | | | 1,920 | |

| Computer equipment under capital lease | | | 206 | | | 35 | | | 171 | |

| | | $ | 85,380 | | $ | 46,631 | | $ | 38,749 | |

| | | | | | | | | | | |

In 2005, as a result of substantial losses incurred in the Pool products segment, the Company evaluated this segment’s Property, plant and equipment to determine if their carrying value exceeded their projected undiscounted future cash flows. The Company determined that it was appropriate to reduce the carrying value of these assets and recognized an impairment charge of $2,866. In 2006, all of the Property, plant and equipment of this division were sold and further losses of $443 where incurred.

In anticipation of the proceeds that will be received from the sale of the Company’s interest in its PSC subsidiary, the Company determined that is was appropriate to reduce the carrying value of the Property, plant and equipment of this business and recognized an impairment charge of $0.6 million.

All of the charges above have been included under results from Discontinued Operations.

Construction in progress represents primarily costs paid to vendors for machinery and equipment constructed or developed over time. Depreciation expense is not booked on these assets until they become available for commercial use.

7. Intangible and other assets:

| | | | | | | | | | | |

2006 | | | Cost | | | Accumulated amortization | | | Net book value | |

| | | | | | | | | | | |

| Patent, trademarks and license agreements | | $ | 443 | | $ | 342 | | $ | 101 | |

| Deferred financing costs | | | 634 | | | 369 | | | 265 | |

| Goodwill | | | 392 | | | 59 | | | 333 | |

| Other assets | | | 2,884 | | | - | | | 2,884 | |

| | | $ | 4,353 | | $ | 770 | | $ | 3,583 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

2005 | | | Cost | | | Accumulated amortization | | | Net book value | |

| | | | | | | | | | | |

| Patent, trademarks and license agreements | | $ | 816 | | $ | 432 | | $ | 384 | |

| Deferred financing costs | | | 652 | | | 278 | | | 374 | |

| Goodwill | | | 1,226 | | | 302 | | | 924 | |

| Other assets | | | 1,118 | | | - | | | 1,118 | |

| | | $ | 3,812 | | $ | 1,012 | | $ | 2,800 | |

| | | | | | | | | | | |

Other assets include $809 (2005 - $727) representing the Company’s proportionate share of the amount it advanced to its joint venture PXL, $123 (2005 - $0) representing the Company’s proportionate share of the amount it advanced to its joint venture GPCP, Inc., $1,425 (2005 - $0) representing a mortgage receivable, an advance of $106 (2005 - $391) to another business partner for the purpose of funding the development of a new product line and for the construction of machinery and equipment and deferred development costs of $421(2005 - $0) for the development of a new product line.

The mortgage receivable was acquired as a result of the disposition of a property by the Pool Division’s Canadian subsidiary. As part of a Plan of Arrangement agreed to by the subsidiary’s creditors, all proceeds ultimately realized as a result of holding the mortgage will be used to settle creditor claims.

In anticipation of the proceeds that will be received from the sale of the Company’s interest in its PSC subsidiary, the Company determined that is was appropriate to reduce the carrying value of the goodwill of this business and recognized an impairment charge of $0.6 million. The charge was included under results from discontinued operations.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

8. Bank indebtedness:

Bank indebtedness consists of a revolving, working capital credit facility that provides the Company with a maximum of $20.0 million for working capital with availability determined periodically based on eligible accounts receivable and inventory. Based on October 31, 2006 collateral balances, the available credit facility is $14.6 million of which the Company has used $3.1 million for the issuance of letters of credit and has drawn $9.5 million for operating cash.

The Company renewed its banking agreement on October 31, 2005 for a three-year term. This agreement contained financial covenants that required the company to meet a certain maximum level of pre-tax losses and to maintain a certain minimum tangible net worth. During 2006, the Company’s lenders revised the covenants to accommodate losses the company has incurred and to limit capital expenditures.

| | | | 2006 | | | 2005 | |

| US dollar working capital credit facility, interest | | | | | | | |

| payable at U.S. prime plus 0.75% or LIBOR plus | | | | | | | |

| 3.5% at the option of the Company. | | $ | 6,824 | | $ | 9,402 | |

| | | | | | | | |

| Canadian dollar working capital credit facility, | | | | | | | |

| interest payable at Canadian prime plus 1.25% or | | | | | | | |

| LIBOR plus 3.5% at the option of the Company. | | $ | 2,679 | | $ | 11,694 | |

| | | | | | | | |

| | | $ | 9,503 | | $ | 21,096 | |

| | | | | | | | |

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

9. Long-term debt:

| | | 2006 | | 2005 | |

| Canadian dollar equipment loans repayable by monthly blended | | | | | | | |

| principal and interest payments, bearing interest at rates ranging | | | | | | | |

| from 6.95% to 7.65%, maturing at various dates ranging from | | | | | | | |

| August 2007 to February 2010. | | $ | 3,840 | | $ | 4,887 | |

| | | | | | | | |

| Canadian dollar bank loan repayable by monthly principal payments, | | | | | | | |

| bearing interest at Canadian prime plus 1.75%, or LIBOR plus 3.75% at the | | | | | | | |

| option of the company, maturing on November 2010. | | | 1,336 | | | 1,872 | |

| | | | | | | | |

| U.S. dollar equipment loans repayable by monthly blended principal payments, | | | | | | | |

| bearing interest at LIBOR plus 3.15%. Maturing on September 2007 | | | 769 | | | 1,675 | |

| | | | | | | | |

| U.S. dollar bank loans repayble by monthly principal payments, bearing interest | | | | | | | |

| at U.S. prime plus 1.25%, or LIBOR plus 3.75% at the option of the Company, | | | | | | | |

| maturing at various dates ranging from June 2011 to May 2014. | | | 7,160 | | | 8,606 | |

| | | | | | | | |

| U.S. dollar municipal equipment loans repayable by monthly blended principal | | | | | | | |

| and interest payments, bearing interest at fixed rate 3%, maturing at various | | | | | | | |

| dates ranging from March 2007 to May 2007. | | | 163 | | | 506 | |

| | | | | | | | |

| U.S. dollar Industrial Revenue Bonds, repayable by quarterly sinking fund | | | | | | | |

| installments, bearing interest at a floating rate, based on the rates prevalent | | | | | | | |

| for the highest rated short-term, U.S. federal tax-exempt obligations, | | | | | | | |

| maturing June 1, 2016. | | | 2,283 | | | 2,425 | |

| | | | | | | | |

| Canadian dollar Capital lease obligation, repayable by monthy principal and | | | | | | | |

| interest payments, bearing interest at 8.34% per annum, maturing | | | | | | | |

| August 2009. | | | 158 | | | 190 | |

| | | | | | | | |

| | | | 15,709 | | | 20,161 | |

| | | | | | | | |

| Less: Liabilities of business being sold | | | (298 | ) | | - | |

| | | | | | | | |

| | | $ | 15,411 | | $ | 20,161 | |

| | | | | | | | |

The bank operating and term loans are secured by a first charge on substantially all the assets of the Company and are governed by the same lending agreement. The Industrial Revenue Bonds are secured by a first charge on specific land and buildings and supported by a letter of credit. Equipment loans are secured by a first charge on specific equipment.

Certain of the Canadian dollar loans are secured in part by assets, which will be disposed of as part of the disposition of the PSC business. The Company will be required to pay back approximately $0.4 million of this loan upon closing of this transaction.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

9. Long-term debt (continued):

| | | | | |

| Under the terms of the debt agreements, the following are the original repayment terms: | | | | |

| | | | | |

| 2007 | | $ | 3,891 | |

| 2008 | | | 3,071 | |

| 2009 | | | 2,601 | |

| 2010 | | | 1,876 | |

| 2011 | | | 1,193 | |

| Thereafter | | | 2,779 | |

| | | $ | 15,411 | |

| | | | | |

10. Deferred Gain

In 2006, the Pool Division sold a property that is used as the Company’s head office and Toronto manufacturing plant, for $8.4 million. Cash proceeds from this sale were used to repay bank debt and the Pool Division took back a five-year second mortgage from the purchaser for $1.4 million. Interest on this mortgage receivable accrues at a rate of 6.5% per annum and is payable at maturity.

The Company’s Canadian packaging subsidiary entered into a lease with the purchaser to lease the property for a term of 10 years. Accordingly, the net gain on the sale of $7.1 million has been deferred and will be amortized on a straight-line basis over the term of the lease. The amortized gain will be recorded in future periods under results from continuing operations.

11.Convertible note:

In May 2003, the Company, through its Pool Division, acquired certain swimming pool and pool equipment assets from Jacuzzi Inc. and Jacuzzi Leisure Products Inc. (Atlantic/Jacuzzi acquisition) at a purchase cost of $40.2 million. As part of the acquisition, the Company issued a $5.0 million unsecured convertible note, bearing interest of 6% per annum, maturing March 31, 2009. This note is convertible at the option of the holder, at any time after March 31, 2004 (or upon commencement of a take over bid) into 598,802 common shares at a price of $8.35 per share. The Company may prepay the note, at any time after March 31, 2006 in cash or by issuance of 598,802 Series A preference shares, which carry similar conversion features.

As the Company is required to make interest payments in cash while the note is outstanding, the discounted present value of future interest payments to maturity is classified as a liability on the balance sheet. As the Company has the unrestricted ability to satisfy payment of the principal amount of the note with equity, the discounted present value of the note at maturity has been classified as equity, including $462 of the proceeds allocated to the value of the note holders' conversion option.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

11.Convertible note (continued):

Change in Accounting Policy

Effective December 1, 2005, the Canadian Institute of Chartered Accountants' Emerging Issues Committee withdrew Abstract 71 "Financial Instruments That May Be Settled At The Issuer's Option In Cash or Its Own Equity Instruments" (EIC 71). The Company had previously followed the guidance set out under this abstract such that an amount representing accretion of the equity carrying value to the face amount of the note over its term to maturity, on an after tax basis, had been accounted for as a reduction of equity and as a prior deduction in calculating earnings per common share. As a result of the withdrawal of EIC 71, a contractual obligation that can be settled in a Company's own shares, the number of which depends on the amount of the obligation represents a liability to the Company. A contractual obligation that can be settled in a fixed number of the Company's own shares represents an equity instrument to the Company. As the Company is able to satisfy the convertable debenture with a fixed number of shares, the equity carrying value of the debenture is not accreted and accordingly the equity carrying value remains at its historic value.

As a result of the retroactive implementation of this new standard and the restatement of prior period amounts, the Consolidated Statement of Income and Retained Earnings and Consolidated Balance Sheet have changed for the current and prior years as follows:

| | | | | | | | | | | |

Increase (decrease) in | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | | |

Consolidated Statement of Income and Retained Earnings | | | | | | | | | | |

| | | | | | | | | | | |

Convertible Note Charge | | | (282 | ) | | (158 | ) | | (164 | ) |

| | | | | | | | | | | |

| | | | | | | | | | | |

Consolidated Balance Sheet | | | | | | | | | | |

| | | | | | | | | | | |

Convertible Note | | | (1,012 | ) | | (730 | ) | | (468 | ) |

| | | | | | | | | | | |

Retained Earnings / Deficit | | | 695 | | | 413 | | | 255 | |

| | | | | | | | | | | |

Cumulative Translation Acount | | | 317 | | | 317 | | | 213 | |

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

12. Capital stock:

Authorized:

598,802 Series A preference shares,

non-voting, cumulative, bearing dividend at an annual rate of $0.501 per share,

redeemable and convertible, at the option of the holder, into an equivalent number of common shares

Unlimited common shares

Issued common shares:

| | | | | | | |

| | | | 2006 | | | 2005 |

| | | | Shares | | | | | | Amount | | | Shares | | | | | | Amount |

| | | | | | | | | | | | | | | | | | | |

| Outstanding, beginning of year | | | 6,797,250 | | | | | $ | 13,183 | | | 6,448,350 | | | | | $ | 11,513 |

| Options exercised during year | | | - | | | | | | - | | | 348,900 | | | | | | 1,670 |

| | | | | | | | | | | | | | | | | | | |

| Outstanding, end of year | | | 6,797,250 | | | | | $ | 13,183 | | | 6,797,250 | | | | | $ | 13,183 |

Stock options:

All options are set to expire 10 years from the date of grant. The Company has authorized options to purchase 1,141,000 common shares since the inception of the plan, and amended the plan in 2005 to authorize an additional 300,000 options for a total of 1,441,000 options. At October 31, 2006, 119,800 remain outstanding (2005 - 241,400) at prices ranging from Cdn. $6.00 to $13.44 per share. At year end, the weighted average remaining contractual life of the outstanding options was 6.17 years (2005 - 5.30 years; 2004 - 3.24 years) and 77,228 (2005 - 147,550; 2004 - 472,594) options were exercisable at prices ranging from Cdn. $6.00 to $13.44 per share.

| | | | | | |

| | Options | | | Average exercised price ($Cdn.) |

| | 2006 | | | 2005 | | | 2004 | | | 2006 | | | 2005 | | | 2004 |

| | | | | | | | | | | | | | | | | |

| Outstanding, beginning of year | 241,400 | | | 542,700 | | | 868,750 | | $ | 8.33 | | $ | 6.54 | | $ | 6.34 |

| Granted | - | | | 102,400 | | | - | | | - | | | 10.65 | | | - |

| Exercised | - | | | (348,900 | ) | | (321,850 | ) | | - | | | (6.00 | ) | | (6.00 |

| Forfeited | (121,600 | ) | | (54,800 | ) | | (4,200 | ) | | (7.19 | ) | | (9.50 | ) | | (8.66 |

| | | | | | | | | | | | | | | | | |

| Outstanding, end of year | 119,800 | | | 241,400 | | | 542,700 | | $ | 9.49 | | $ | 8.33 | | $ | 6.54 |

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

12. Capital stock (continued):

The following table summarizes information about stock options outstanding at October 31, 2006:

| | | | Options outstanding | | | Options exercisable |

| Exercise prices ($Cdn.) | | | Number outstanding | | | Weighted average remaining contractual life (years | ) | | Number exercisable |

| | | | | | | | | | |

| $ 6.00 | | | 33,600 | | | 3.67 | | | 29,768 |

| $ 6.82 | | | 7,000 | | | 5.42 | | | 4,583 |

| $ 10.00 | | | 23,100 | | | 6.42 | | | 16,555 |

| $ 10.65 | | | 34,700 | | | 8.21 | | | 12,434 |

| $ 12.60 | | | 1,400 | | | 6.83 | | | 888 |

| $ 13.44 | | | 20,000 | | | 6.75 | | | 13,000 |

| | | | | | | | | | |

| | | | | | | Assumptions | | | | | | | | | |

| | | | | | | | | Risk-free interest rate | | | Weighted average fair value | | | Expected life | | | Vesting period |

| | | | | | | | | | | | | | | | | | | |

| Options granted: | | | | | | | | | | | | | | | | | | |

| | | | 2006 | | | No options granted | | | | | | | | | | | | |

| | | | 2005 | | | 23% | | | 3.54% | | | 3.54 | | | 9 | | | 5 |

| | | | 2004 | | | No options granted | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

During the year, the Company, using the assumptions in the table above and the Black-Scholes option-pricing model, recognized stock-based compensation expense of $153 (2005 - $129, 2004 - $83). This amount was credited to contributed surplus.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

13. Discontinued operations:

The operating results of the Pool Division, PXL and PSC have been classified as discontinued operations and comparative figures have been restated. Net revenues, results from operations, losses from disposals of assets and income tax impacts have been set out below.

| | | | | | | |

| | | | 2006 | | | 2005 | | | 2004 |

Revenues | | | | | | | | | |

| Pool Division | | $ | 64,839 | | $ | 78,908 | | $ | 87,361 |

| Packaging Division (PXL & PSC) | | | 10,947 | | | 9,190 | | | 8,129 |

| | | | 75,786 | | | 88,098 | | | 95,490 |

(Loss) / Income from operations: | | | | | | | | | |

| Pool Division | | | (19,992 | ) | | (16,405 | ) | | 467 |

| Packaging Division (PXL & PSC) | | | (827 | ) | | 190 | | | 5 |

| | | | (20,819 | ) | | (16,215 | ) | | 472 |

| | | | | | | | | | |

(Loss) from disposal of assets - Pool Division | | | (3,729 | ) | | - | | | - |

| | | | | | | | | | |

Net (loss) / income before tax: | | | | | | | | | |

| Pool Division | | | (23,721 | ) | | (16,405 | ) | | 467 |

| Packaging Division (PXL & PSC) | | | (827 | ) | | 190 | | | 5 |

| | | | (24,548 | ) | | (16,215 | ) | | 472 |

Income taxes (recovery): | | | | | | | | | |

| Pool Division | | | (4,674 | ) | | (3,042 | ) | | 292 |

| Packaging Division (PXL & PSC) | | | 31 | | | 107 | | | (50 |

| | | | (4,643 | ) | | (2,935 | ) | | 242 |

| | | | | | | | | | |

Net (loss) / income from discontinued operations | | | | | | | | | |

| Pool Division | | | (19,047 | ) | | (13,363 | ) | | 175 |

| Packaging Division (PXL & PSC) | | | (858 | ) | | 83 | | | 55 |

| | | | (19,905 | ) | | (13,280 | ) | | 230 |

| | | | | | | | | | |

The assets and liabilities of the Pool Division are aggregated on the balance sheet with the assets and liabilities of the continuing packaging business. The stated liabilities include the liabilities of the Canadian subsidiary that carried on the pool business in Canada. This legal entity is currently under protection from its creditors through a filing under the Companies’ Creditors Arrangement Act, and a Plan of Arrangement for settling $8.8 million of trade liabilities of this subsidiary has been agreed to by the subsidiary’s creditors. While these liabilities have been valued at their historical values, as the assets of this entity available to settle the liabilities are substantially less than the value of the liabilities, it is anticipated that these liabilities will be settled for an estimated 15% to 20% of their book value.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

14. (Loss) income per share:

The following table sets forth the calculation of basic and diluted income per share:

| | | | | | | | |

| | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | Restated* | | | Restated * | |

Net (loss) / income from continuing operation before extraordinary gain | | $ | (3,602 | ) | $ | (2,389 | ) | $ | (1,235 | ) |

Net (loss) / income from discontinued operations, net of tax (note 13) | | | (19,905 | ) | | (13,280 | ) | | 230 | |

Net (loss) / income available to common shareholders before extraordinary gain | | | (23,507 | ) | | (15,669 | ) | | (1,005 | ) |

| | | | | | | | | | | |

Extraordinary Gain, Net of Taxes | | | - | | | - | | | 948 | |

| | | | | | | | | | | |

Net (loss) / income available to common shareholders | | | (23,507 | ) | | (15,669 | ) | | (57 | ) |

| | | | | | | | | | | |

Denominator: | | | | | | | | | | |

| Weighted average number of shares outstanding | | | 6,797,250 | | | 6,673,370 | | | 6,130,264 | |

| Effect of dilutive securities: | | | | | | | | | | |

| Employee stock options* | | | - | | | - | | | - | |

| Convertible note* | | | - | | | - | | | - | |

Weighted average shares - diluted* | | | 6,797,250 | | | 6,673,370 | | | 6,130,264 | |

| | | | | | | | | | | |

| * Excludes the effects of 119,800 (2005 - 241,400) stock options to purchase common shares and the | | | | | |

| potential issuance of 598,802 (2005 - 598,802) common shares upon conversion of the convertible note | | | | | | |

| that are anti-dilutive. | | | | | | | | | | |

| | | | | | | | | | | |

Net (loss) / income per share (based on income before extraordinary gain) from continuing operations: | | | | | | | | | | |

| Basic | | $ | (0.53 | ) | $ | (0.36 | ) | $ | (0.20 | ) |

| Diluted | | $ | (0.53 | ) | $ | (0.36 | ) | $ | (0.20 | ) |

Net (loss) / income per share (based on income before extraordinary gain) from discontinued operations: | | | | | | | | | | |

| Basic | | $ | (2.93 | ) | $ | (1.99 | ) | $ | 0.04 | |

| Diluted | | $ | (2.93 | ) | $ | (1.99 | ) | $ | 0.04 | |

Net (loss) / income per share (based on income after extraordinary gain) from continuing operations: | | | | | | | | | | |

| Basic | | $ | (0.53 | ) | $ | (0.36 | ) | $ | (0.20 | ) |

| Diluted | | $ | (0.53 | ) | $ | (0.36 | ) | $ | (0.20 | ) |

Net (loss) / income per share (based on income after extraordinary gain) from discontinued operations: | | | | | | | | | | |

| Basic | | $ | (2.93 | ) | $ | (1.99 | ) | $ | 0.19 | |

| Diluted | | $ | (2.93 | ) | $ | (1.99 | ) | $ | 0.19 | |

| | | | | | | | | | | |

Weighted average number of shares outstanding | | | | | | | | | | |

| Basic | | | 6,797,250 | | | 6,673,370 | | | 6,130,264 | |

| Diluted | | | 6,797,250 | | | 6,673,370 | | | 6,130,264 | |

| | | | | | | | | | | |

| * Restated to reflect accounting policy change - see note 3 (o) | | | | | | | | | | |

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

15. Income taxes:

| | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | | |

| Current income taxes (recovery): | | | | | | | | | | |

| U.S. federal | | $ | 988 | | $ | 153 | | $ | (34 | ) |

| U.S. state | | | 186 | | | 29 | | | (6 | ) |

| Canada | | | (44 | ) | | (428 | ) | | (198 | ) |

| | | | 1,130 | | | (246 | ) | | (238 | ) |

| Future income taxes (recovery): | | | | | | | | | | |

| U.S. federal | | | (754 | ) | | (501 | ) | | 20 | |

| U.S. state | | | (142 | ) | | (93 | ) | | 8 | |

| Canada | | | (123 | ) | | (480 | ) | | (71 | ) |

| | | | (1,019 | ) | | (1,074 | ) | | (43 | ) |

| | | | | | | | | | | |

| | | $ | 111 | | $ | (1,320 | ) | $ | (281 | ) |

| | | | | | | | | | | |

The Company's income tax expense (recovery) differs from the amount that would have resulted by applying Canadian statutory tax rate of approximately 36.1% (2005 - 36.1%; 2004 -36.1%) to income as described below:

| | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | | |

| Income tax (recovery) expense calculated | | | | | | | | | | |

| using statutory tax rates | | $ | (10,122 | ) | $ | (7,192 | ) | $ | (377 | ) |

| Non-deductible amounts | | | 269 | | | 89 | | | 35 | |

| Manufacturing and processing | | | | | | | | | | |

| profits deduction (increase) | | | 417 | | | 214 | | | 15 | |

| Foreign earnings subject to different | | | | | | | | | | |

| tax rates | | | (118 | ) | | (345 | ) | | 198 | |

| Valuation allowance taken | | | 4,216 | | | 3,441 | | | - | |

| Large Corporations Tax | | | - | | | - | | | 85 | |

| Other | | | 806 | | | (462 | ) | | 5 | |

| | | | (4,532 | ) | | (4,255 | ) | | (39 | ) |

| | | | | | | | | | | |

| Less taxes (recovery) related to discontinuing operations | | | (4,643 | ) | | (2,935 | ) | | 242 | |

| | | | | | | | | | | |

| Tax (recovery) on results from continuing operations | | $ | 111 | | $ | (1,320 | ) | $ | (281 | ) |

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

15. Income taxes (continued):

A summary of the principal components of future tax assets and liabilities calculated in accordance with Canadian accounting principles at October 31 is as follows:

| | | | 2006 | | | 2005 | |

| | | | | | | | |

| Current future tax assets: | | | | | | | |

| Donations | | $ | 31 | | $ | 8 | |

| Inventory | | | 13 | | | 184 | |

| Accounts Payable and Accrued Liabilities | | | 2,830 | | | 1,328 | |

| | | | 2,874 | | | 1,520 | |

| Valuation allowance | | | (1,067 | ) | | (98 | ) |

| | | | 1,807 | | | 1,422 | |

| | | | | | | | |

| Non-current future tax assets: | | | | | | | |

| Intangible and other assets | | | 56 | | | 248 | |

| Property, Plant and Equipment | | | 10 | | | 1,236 | |

| Non-capital losses carried forward | | | 8,966 | | | 3,169 | |

| Capital losses carried forward | | | 21 | | | 58 | |

| Corporate R&D and minimum tax credit | | | 100 | | | 337 | |

| Other long term assets | | | 2,339 | | | 86 | |

| Long-term debt | | | 662 | | | 479 | |

| | | | 12,154 | | | 5,613 | |

| Valuation allowance | | | (7,028 | ) | | (3,644 | ) |

| | | | 5,126 | | | 1,969 | |

| | | | | | | | |

| | | | 6,933 | | | 3,391 | |

| | | | | | | | |

| Current future tax liabilities: | | | | | | | |

| | | $ | - | | $ | - | |

| | | | | | | | |

| Non-current future tax liabilities: | | | | | | | |

| Plant, Property & Equipment | | $ | (1,756 | ) | $ | (3,127 | ) |

| Long-term debt | | | (743 | ) | | (563 | ) |

| Intangible and other liabilities | | | (794 | ) | | (30 | ) |

| | | | (3,293 | ) | | (3,720 | ) |

| | | | | | | | |

| Net future tax assets (liabilities) | | $ | 3,640 | | $ | (329 | ) |

| | | | | | | | |

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

15. Income taxes (continued):

The Company has recorded future tax assets of $6,933 after a valuation allowance of $8,095 is taken into consideration. The valuation allowance is primarily for accumulated tax losses in the Pool Division’s Canadian subsidiary, and is due to the inability of this subsidiary to generate sufficient future taxable income to fully utilize these losses, due to the discontinuance of its business. In order to fully realize the remaining future income tax assets, the Company needs to generate future taxable income of approximately $19,208. Based on projections of future taxable income over the periods in which the future income tax assets are deductible, management believes it is more likely than not that the Company will realize the benefits of the future tax assets, net of the existing valuation allowance.

The Company and its subsidiaries have non-capital losses carried forward of $24,393. These non-capital losses have expiry dates ranging from 2011 to 2026. The company has recorded a valuation allowance of $4,026 against $11,641 of these losses to recognize those losses, which it does not expect to utilize. The losses above include federal non-capital loss carry forwards of $1,222 relating to one of the Company's U.S. subsidiaries. Of this amount $1,116 is restricted and becomes available to be utilized at the rate of $106 each year from 2007 to 2018. Some of the Company's U.S. subsidiaries also have state non-capital losses carried forward resulting in a future tax asset of $270, which has expiry dates ranging from 2015 to 2026.

16. Commitments:

The Company has production facilities under operating leases and computer equipment under capital leases. Rental expenses for all operating leases for the year totalled $3,275 (2005 - $3,175).

Future minimum rental payments to be made for all non-cancellable operating leases are as follows:

| | | | | |

| 2007 | | $ | 3,521 | |

| 2008 | | | 3,145 | |

| 2009 | | | 2,861 | |

| 2010 | | | 2,746 | |

| 2011 | | | 2,729 | |

| Thereafter | | | 8,911 | |

| | | $ | 23,913 | |

Minimum lease payments include $1.1 million per year for a property formerly used by the discontinued pool business. The Company is seeking to sublet this property.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

16. Commitments (continued):

Minimum lease payments for capital leases in aggregate and for the next five years are as follows:

| | | Obligations under Capital Leases |

| 2007 | $ | 63 |

| 2008 | | 63 |

| 2009 | | 51 |

Total minimum lease payment | $ | 177 |

| | | |

| Interest included in minimum payments at 8.34% | | 19 |

| Present value of net minimum lease payments | | 158 |

| Less: Current portion | | 51 |

| | $ | 107 |

At October 31, 2006, the Company had commitments of $57 (2005 - $584) related to the completion of machinery and equipment under construction.

During 2005 the Company entered into a joint venture agreement with GPCP, Inc., which requires the Company to invest up to $550 for capital equipment and working capital over a two-year period. No costs were incurred in 2005 and $247 was invested in 2006.

17. Contingencies:

In the course of operations, the Company may be subject to litigation and claims. During 2006, the Company was subject to numerous claims initiated by creditors of the Pool Division, due to this Division’s inability to fulfill all of its creditor obligations. All significant creditor claims have been accounted for as accounts payable or accrued liabilities. Additionally any claims filed solely against the Canadian pool company have been stayed due to the subsidiary’s filing under the Companies’ Creditors Arrangement Act.

With respect to other actions against the Company and its subsidiaries, it is not possible to determine the amounts that may be ultimately assessed against the Company with respect to any existing or potential claims.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

18. Related party transactions:

The Company is party to certain agreements and transactions with companies that are related either by common ownership or family relationship to a significant shareholder of the Company.

PSC paid management fees of Cdn $205 (U.S. $180) (2005 - U.S. $168) to a company of which a director and officer is related by family to a director and significant shareholder of Polyair Inter Pack Inc. This transaction was measured at the amount agreed to by the parties. These fees are paid under a July 1999 agreement that the Company entered into when it acquired an interest in PSC this agreement runs to July 1, 2009.

During the third quarter 2006, following the evaluation of offers by several purchasers, the Company sold the Pool Accessories business of its Pool Division to a company of which a former officer is a non-controlling shareholder.

During 2006, the Company sold a property that had been subject to a Put/Call agreement with a company (the “Optionee”) affiliated to a director and significant shareholder of the Company. The Put/Call agreement was entered into in March 2004 and it allowed the Optionee the contractual right to purchase the property, subject to the standard conditions of obtaining free and clear title. It also included a transfer restriction clause wherein the Company agreed not to sell or otherwise dispose of the property without notice to the Optionee and without the purchaser of the property agreeing to the terms of the Put/Call agreement. In September 2004, the purchaser exercised the call on the property. However title to the property was not conveyed at that time, as the Company’s lenders, who had a security charge against the property, did not provide their consent and free and clear title could not be obtained by the Optionee.

In the fourth quarter of 2006 the Company signed an agreement for the sale of this property with an unrelated third party. The agreement provided for the sale of the property for Cdn $9.4 million (US $8.4 million) with a secured vendor take back second mortgage of Cdn $1.6 million (US $1.4 million) and the balance to be paid in cash. The Optionee agreed to give up its transfer restriction rights to the property under the Put/Call agreement and to consent to the sale of the property in return for a payment of Cdn $1.5 million (US $1.3 million). The terms of the proposed payment were reviewed by an independent committee of the Company’s Board of Directors, approved by the Company’s Board of Directors and was consented to by the Company’s lenders.

POLYAIR INTER PACK INC.

Notes to Consolidated Financial Statements

(In thousands of U.S. dollars, except per share amounts and except where noted)

October 31, 2006, 2005 and 2004

19. Financial instruments:

The Company’s financial instruments consist of cash, accounts receivable, accounts payable and accrued liabilities, long-term debt, and working capital credit facility. The Company periodically uses derivative financial instruments, including future contracts to manage its foreign currency exposures. During 2006, the Company did not use future contracts

The fair values of the Company's financial instruments are as follows:

(a) Short-term financial assets and liabilities:

Short-term financial assets and liabilities are amounts that are expected to be settled within one year. The carrying amounts in the consolidated balance sheets approximate the fair value because of the short-term nature of these instruments.

As disclosed in note 2, the long-term portion of the term debt has been classified as a current liability.

(b) Long-term debt:

Long-term debt includes term loans and debenture loans that are not expected to be settled within one year. The carrying value of long-term debt approximates fair values as the interest rates charged on this debt approximate market rates for debt with similar terms and conditions.

20. Segmented information:

In its continuing operations the Company manufactures and markets packaging products. The Company operates principally in the United States and Canada.

By geographic region: | | | | | | | | | | |

| | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | | |