UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

INFORMATION REQUIRED IN A PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.______________)

| | | | | |

Filed by Registrant ☒ | |

Filed by Party other than Registrant ☐ | |

| Check the appropriate box: | |

☐ Preliminary Proxy Statement | ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6 (e)(2)) |

☒ Definitive Proxy Statement | ☐ Definitive Additional Materials |

| ☐ Soliciting Materials Pursuant to §240.14a-12 | |

Eagle Bancorp, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

The Annual Meeting of Shareholders Will Be Held

on Thursday, May 16, 2024 at 10:00 A.M., EDT

Virtual Meeting Only – No Physical Meeting Location

To The Shareholders of Eagle Bancorp, Inc.

Proxy Statement

The Board of Directors of Eagle Bancorp, Inc. is soliciting your proxy for use at the Annual Meeting of Shareholders, to be held virtually on Thursday, May 16, 2024 at 10:00 A.M., EDT, and at any adjournment or postponement of the meeting. You may join the Annual Meeting remotely by visiting http://www.viewproxy.com/EagleBankCorp/2024/VM and entering in your control number and the password received in your registration confirmation. If you wish to attend the Annual Meeting virtually, you must register in advance by 11:59 PM EDT on May 14, 2024. (Please see “How do I register in advance to attend, vote, and submit questions or comments at the Annual Meeting virtually?” in the Question and Answer section at the end of this document for more information.) Audio only access to the meeting will be available by calling 1 (562) 247-8422 and inputting access code 183-007-774. A shareholder may request the Company to provide a physical location from which to access the virtual meeting, subject to any restrictions in effect under federal or state law. Shareholders must submit their request for a physical location to the Company by close of business on Tuesday, May 14, 2024.

This proxy statement and proxy card are being made available to shareholders of the Company on or about April 3, 2024, to shareholders of record as of March 21, 2024, the record date for the meeting. A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which includes our audited financial statements, also accompanies this proxy statement.

In this proxy statement, we refer to (a) Eagle Bancorp, Inc. as the “Company,” “Eagle,” “we,” "our," or “us,” (b) the Company Board of Directors as the “Board” or “Board of Directors” and (c) EagleBank, our wholly owned subsidiary, as “EagleBank” or the “Bank.”

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 16, 2024. A copy of this proxy statement, our Annual Report on Form 10-K for the year ended December 31, 2023, and our Report to Shareholders is available online at http://www.viewproxy.com/EagleBankCorp/2024.

This year, we are using the “Notice and Access” method of providing proxy materials to our beneficial shareholders via the Internet instead of mailing printed copies. We believe that this process will provide beneficial shareholders with a convenient and quick way to access the proxy materials, including this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023. Also accessible is our Report to Shareholders and an authorization for a proxy to vote your shares. This allows us to conserve natural resources and reduce the costs of printing and distributing the proxy materials.

Most shareholders will not receive paper copies of the proxy materials unless they request them. Instead, the Important Notice Regarding Availability of Proxy Materials, which we refer to as the Notice and Access card, has been mailed to our beneficial shareholders to provide instructions regarding how to access and review all of the proxy materials on the Internet. The Notice and Access card also tells you how to submit your proxy vote via the Internet or telephone. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials printed on the Notice and Access card.

To ensure that as many shares as possible are represented, we strongly recommend that you vote in advance of the Annual Meeting, even if you plan to attend remotely.

We have decided to host the Annual Meeting by means of remote communication this year (i.e., a virtual-only meeting), as allowed by applicable law. Note that the decision to proceed with a virtual-only meeting this year does not mean we will utilize a virtual-only format or any means of remote communication for future annual meetings.

Shareholders may submit questions about topics of importance to the Company's business and operations, matters described in the proxy statement and updates on the Company's activities and performance either before the meeting, starting on May 16, 2024 or during the meeting. Questions pertinent to meeting matters will be answered during the meeting, subject to time limitations. Shareholders may access the meeting across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tables and cell phones) running the most updated version of applicable software and plugins. We encourage you to log on to the meeting site by 9:30 AM EDT on the day of the meeting to account for any unexpected technical difficulties. For further assistance should you need it, you may email VirtualMeeting@viewproxy.com or call 866-612-8937. Please refer to the Q&A at the end of the document for more details.

Notice of Meeting:

| | | | | |

The Annual Meeting of Shareholders of Eagle Bancorp, Inc. (the “Company”) will be held at 10:00 A.M., EDT on Thursday, May 16, 2024 at http://www.viewproxy.com/EagleBankCorp/2024/VM (with audio only access available at 1 (562) 247-8422 access code 183-007-774* for the following purposes:

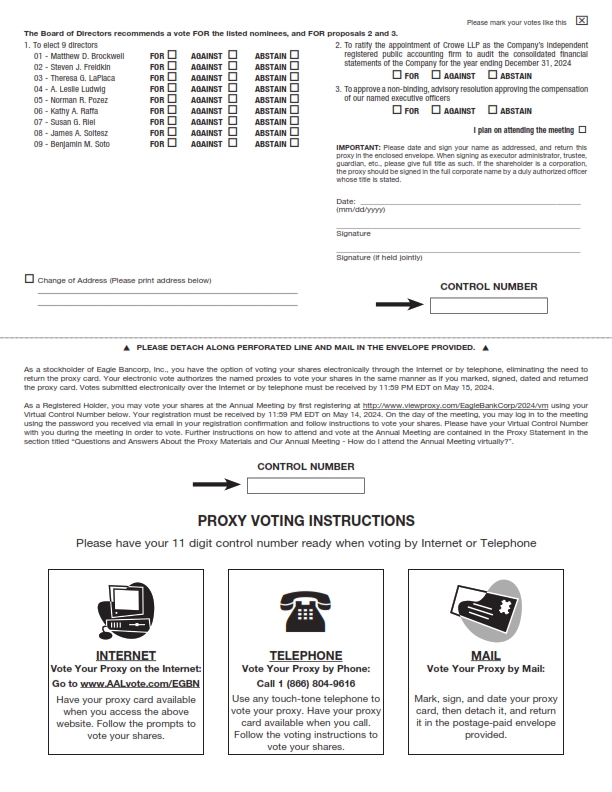

1.To elect nine directors to serve until the 2025 Annual Meeting of Shareholders or until their successors are duly elected and qualified; 2.To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm to audit the consolidated financial statements of the Company for the year ending December 31, 2024; 3.To approve a non-binding, advisory resolution approving the compensation of our named executive officers; and 4.To transact any other business that may properly come before the meeting or any adjournment or postponement of the meeting.

Shareholders of record as of the close of business on March 21, 2024 are entitled to notice of and to vote at the meeting or any adjournment or postponement of the meeting.

To attend the virtual meeting at http://www.viewproxy.com/EagleBankCorp/2024/VM, please enter the password received in your registration confirmation. Please follow the instructions on your proxy card, Notice and Access card or voter instruction form for additional information. Audio only access to the meeting will be available by dialing 1 (562) 247-8422 and inputting access code 183-007-774. A shareholder may request the Company to provide a physical location from which to access the virtual meeting, subject to any restrictions in effect under federal or state law. Shareholders must submit their request for a physical location to the Company by close of business on Tuesday, May 14, 2024.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the meeting, we urge you to vote and submit your proxy in order to ensure the presence of a quorum.

Registered shareholders may vote: •By Internet: go to https://www.aalvote.com/EGBN; •By toll-free telephone: call 1 (866) 804-9616; or •By mail: mark, sign, date and promptly mail the enclosed proxy card in the enclosed postage-paid envelope.

If your shares are not registered in your name, please see the voting instructions provided by your recordholder (typically your broker) on how to vote your shares. You will need additional documentation from your recordholder in order to vote in person at the virtual meeting.

* We have decided to host the Annual Meeting by means of remote communication this year (i.e., a virtual-only meeting), as allowed by applicable law. Note that the decision to proceed with a virtual-only meeting this year does not mean we will utilize a virtual-only format or any means of remote communication for future annual meetings. |

| By Order of the Board of Directors, Jane E. Cornett, Corporate Secretary April 3, 2024 |

Table of Contents

| | | | | | | | |

| Eagle Bancorp, Inc. | ii | 2024 Proxy Statement |

Forward-looking Statements: This proxy statement contains forward-looking statements within the meaning of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such as “may,” “will,” “can,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” “could,” “strive,” “feel” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors, and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results in the future may differ materially from those indicated herein. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company’s past results are not necessarily indicative of future performance. All information is as of the date of this proxy statement. Any forward-looking statements made by or on behalf of the Company speak only as to the date they are made. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason.

No Incorporation By Reference: Web links throughout this document are provided for reference and convenience only. Information from our website or any other web link included in this document is not incorporated by reference into this proxy statement, unless explicitly stated otherwise.

| | | | | | | | |

| Eagle Bancorp, Inc. | iii | 2024 Proxy Statement |

About Eagle

Introduction

The Company, headquartered in Bethesda, Maryland, was incorporated under the laws of the State of Maryland on October 28, 1997, to serve as the bank holding company for EagleBank. The Company was formed by a group of local business people and professionals with significant prior experience in community banking in the Company's market area, together with an experienced community bank senior management team.

The Bank operates as a community bank alternative to the super-regional financial institutions, which dominate the Bank’s primary market area, which is the Washington, D.C. metropolitan area. The market is the 6th largest regional economy in the United States. The Bank operates a commercially oriented business model and has expertise in commercial and commercial real estate lending, delivering financial services to small and mid-sized businesses and non-profit organizations. The cornerstone of the Bank’s philosophy is to provide superior, personalized service to its clients. The Bank focuses on relationship banking, providing each client with a number of services, familiarizing itself with, and addressing, client needs in a proactive, personalized fashion. The Bank’s business model allows it to operate a branch light strategy with the expense savings from a smaller branch system being invested in quality, well trained personnel and IT systems delivering convenience and security to our customers. The Company’s capital ratios are well above those required to be considered well capitalized. The Board of Directors is committed to building upon the Company’s 26 years of successful operations by providing oversight of the Bank’s strategy and operations, and maintaining the highest standard of corporate governance.

Our Mission

Our mission is to be the most trusted, experienced and client-centric bank across the Washington, D.C. region and beyond. We do this through our Relationships FIRST philosophy, putting our customers, communities, employees, and shareholders at the forefront of everything we do, delivering the most compelling service and value.

Our Values Put Relationships F•I•R•S•T

•Flexible

We begin our relationships based on our time-tested tradition of listening to our customers, collaborating with colleagues and designing a comprehensive, creative solution that brings value to and appreciation from our customers. We enhance the relationships with empowered ‘YES, We Can’ service and live up to our strong belief that formulas do not make good banking sense, relationships do. We are entrepreneurial – it is our differentiator.

•Involved

We build our relationships by developing a rapport that is based on partnership, mutual respect and a desire to delight. We are unwavering in our commitment to the goals and growth of our customers, colleagues and community through volunteerism. We believe that doing the little extras and staying involved with our customers demonstrates our difference.

•Responsive

We shape our relationships by taking ownership for being ever-responsive, from beginning to end, day in and day out. We understand that reliable, accurate and time-sensitive communication is fundamental to preserving reputation and relationships, internally and externally.

•Strong

We strengthen our relationships each time we are called upon for our expertise and know-how. We are committed to enhancing our professional knowledge in order to remain credible, current and strong partners with our customers, colleagues and community. Our history of sustaining a well-capitalized and profitable position emphasizes our strength and reinforces our relationships. We believe that diversity of talent equals diversity of thought, and only serves to strengthen our role as community builders.

| | | | | | | | |

| Eagle Bancorp, Inc. | 1 | 2024 Proxy Statement |

•Trusted

We uphold our relationships with honesty, openness, and reliability. Our actions reflect our values, and underscore our commitment to a diverse and inclusive environment. We can be counted on to do the right thing. We understand that underlying a sound, long-lasting relationship is the essential element of trust. Trust can be lost in a moment, so we are vigilant in our actions and words.

Corporate Social and Environmental Responsibility

Since its founding, EagleBank has been committed to principles of community engagement, inclusiveness and sustainability. The following summary sets forth the activities undertaken by the Bank that reflect its leadership with regards to social and environmental responsibility.

Economic Development Activities

EagleBank is recognized as one of the leading commercial real estate lenders in the Washington D.C. metropolitan area, but we are more than that. We aim to meet the banking and credit needs of all the communities in which we conduct business. Assisting low and moderate income individuals and organizations as well as supporting consumers and small businesses in transitional neighborhoods is key to meeting the mission of the Bank.

Affordable Housing: We take a special interest in helping our local communities provide affordable housing.

•In 2023, we announced financing for several projects to provide affordable housing, affordable transit and schools including:

◦$9 million revolving line of credit to Kids in Need of Defense (KIND) to support their working capital for a new contract with Vera Institute of Justice, Inc.(October 2023)

◦$10.2 million Series 2023 Tax Exempt District of Columbia Industrial Revenue Bond to support the fee simple acquisition and upcoming construction project renovations for Sela Public Charter School (August 2023)

◦$25 million for a 142 unit affordable multi-family project in the District of Columbia. The property is being developed by several developers and the District of Columbia Housing Authority (February 2023)

◦Up to $55 million via District of Columbia Tax-Exempt Revenue Bonds to support Mundo Verde Bilingual Public Charter School (February 2023)

•In 2023, we also originated 5 community development loans totaling $87 million to institutions that provide housing for low and moderate income individuals. Of these loans, 1 helped finance housing that included affordable units and resulted in 156 affordable units. Over the past three years, our community development loans have contributed to 3,092 affordable housing units.

•In addition to loans, as of December 31, 2023, we held investments of $92 million in Community Reinvestment Act qualified bonds, which funded 371 single family mortgages in low and moderate income census tracts throughout the Washington D.C. metropolitan area. In addition, we have committed over $74 million to purchasing Low Income Housing Tax Credits which helps to finance low and moderate income multifamily apartment buildings in our region.

•In 2020, we committed $5 million to the Washington Housing Initiative Impact Pool, which invests in the preservation and creation of affordable workforce housing in the region.

Small Business Lending: Small business support has always been a cornerstone of EagleBank’s commitment to the Washington, D.C. metropolitan area.

•We have been a Small Business Administration ("SBA") Lender over the last two decades and provide financing under both the 7a and 504 programs offered by the SBA.

| | | | | | | | |

| Eagle Bancorp, Inc. | 2 | 2024 Proxy Statement |

•We have relationships with state and local governments and government agencies, and have worked with them to develop cooperative economic development programs. With Montgomery County, Maryland we worked to design the Small Business Plus! Program in which the County places deposits in local banks and participating banks commit to make loans to local small businesses. In 2023, EagleBank made 54 loans totaling $94 million in small business loans under this program. Since the inception of the program in 2012, we have made 1,254 loans totaling $937 million in small business loans, excluding loans originated under the SBA's Paycheck Protection Program.

Environmental, Social and Governance

In early 2023, we formed an ESG Task Force (the "Task Force"), composed of leaders from across the Company, to support the Company's ongoing commitment to ESG matters. The Task Force is granted responsibility:

•To assist in setting the Company’s general strategy with respect to ESG, and to consider and recommend policies, practices, and disclosures that conform with the strategy.

•To consider current and emerging ESG trends that may affect the business, operations, performance or public image of the Company or are otherwise pertinent to the Company and its stakeholders, and to make recommendations on how the Company’s policies, practices and disclosures can adjust to or address these current trends.

•To provide a report on ESG-related matters to the Governance and Nominating Committee of the Board of Directors at least twice a year.

Philanthropy

We believe in giving back and in fostering good corporate citizenship. As a result, we have dedicated resources to the community through the EagleBank Foundation which raises money for breast cancer research and treatment, survivorship and caregiver knowledge, as well as for other cancers.

•Since inception, the EagleBank Foundation has provided over $6.0 million to local hospitals, charities and organizations. This year contributions were distributed to Adventist HealthCare's Shady Grove Medical Center, Holy Cross Hospital Foundation, Suburban Hospital, MedStar Washington Hospital Center, Hope Connections for Cancer Support, Brem Foundation to Defeat Breast Cancer, The Children's Inn at NIH, Children's National Hospital, and several other worthy groups.

•In 2023, EagleBank Foundation provided about $470 thousand in contributions or sponsorship funding to many civic and non-profit organizations in the Washington, D.C. metropolitan area.

•EagleBank also offers the Matching Gifts Program to support employees in their contributions to worthy causes. The program matches contributions made by employees to eligible 501(c)(3) organizations up to $200 each year.

•We are committed and proud to promote volunteerism as a way to enrich our communities, build teamwork and enhance the lives of customers and team members throughout the region. In 2023, our employees spent over 2,673 hours supporting 60 organizations throughout Northern Virginia, Suburban Maryland and the District of Columbia.

Equal Opportunity, Education and Employee Development

Human capital management is a critical component of our sustainability programs and a key driver of our Company’s success. EagleBank takes a Total Reward approach in attracting, retaining and rewarding its employees. Our average employee tenure is 6.3 years with 24.0% of our staff having 10 or more years of service with the Company.

•We provide equal employment opportunity for all persons in regards to hiring, working conditions, compensation, benefits and appointments for advancement and training and development. We partner with and support local veteran, disability and workforce readiness programs. Managers receive training on equal employment, unconscious bias, retaliation and harassment.

•We value diversity at every level of the organization. Of our total work force, 57% are women and 65% are racial and ethnic minorities. In 2023, 81% of our hires were from diverse groups, including women, underrepresented minorities, veterans and peoples with disabilities.

| | | | | | | | |

| Eagle Bancorp, Inc. | 3 | 2024 Proxy Statement |

•A Diversity, Equity, and Inclusion Council (DEIC) was formed in 2020 to continue to foster innovative actions that will help to continue to develop an inclusive and equitable work environment valuing the contributions of all employees. Those contributions also extend to the diverse communities the Bank serves. To identify areas of opportunity and programs to support these efforts, the DEIC comprises 19 employees from across the company and has five areas of focus - employee resource groups, employee mentorship programs, communication, training & development and higher education initiatives. During 2023, the DEIC:

◦Added additional Employee Resource Groups (ERGs) bringing a total of four active ERG’s who develop programs and activities that foster a diverse and inclusive workplace.

◦Graduated its first Mentorship Program cohort. The Mentorship Program pairs skilled and knowledgeable mentors with mentees. Mentors have the opportunity to deepen coaching and listening skills as well as engage and empower others while the mentees have the opportunity to enhance communications and interpersonal skills and grow their personal network within the bank. Ten mentor-mentee pairings were established during the first cohort and completed the 18-month program. The bank is in the process of establishing its second cohort that will have up to eight mentor-mentee pairings.

◦Awarded five scholarships to employees through a new Scholarship Program which awards up to $5,000 per employee.

•We promote professional development by offering an array of on-demand courses, instructor-led courses and resource materials on a number of topics that enable employees to grow personally and professionally, which should benefit their careers. In May of 2024, we will launch the EagleBank Leadership Institute which will focus on providing our people managers and future leaders with the skills necessary to effectively manage and develop teams.

•Scholarship programs and professional internships have always been a component of the Company’s approach to development. As part of our sponsorship agreement with George Mason University we provide $70,000 for scholarships and $35,000 for internships to participate in the EagleBank Summer Internship. The internship program is offered by our Commercial and Real Estate Lending Divisions. Students enrolled in these programs assist with lending projects, data and analytical reporting, and portfolio management services.

Compliance and Ethics

Our culture of integrity starts with our Code of Business Conduct and Ethics (“Code”) which applies to all employees, directors and executive officers of Eagle Bancorp, Inc. and its subsidiaries. In addition, we look to engage with third-parties that share our commitment to our Relationships F-I-R-S-T core values.

•New employees are required to complete training on the Code within 30 days from their date of hire and annually acknowledge the Code and the Business Conduct Ethics and Conflicts of Interest Policy.

•Role-based in-person and online training is provided to advance understanding of regulatory and policy requirements in specific compliance areas such as Regulation O and Related Party Transactions.

•Our management team is focused on fostering a culture of trust so that employees at every level feel comfortable speaking up about concerns or potential conflicts of interest. To that end the Ethics Office facilitates an annual survey of all employees to disclose potential conflicts of interest and field questions regarding the Code. Employees are strongly encouraged to be proactive in seeking guidance and to promptly contact the Ethics Office with questions regardless of the nature of the matter. Management takes all questions raised seriously and enforces a strict non-retaliation policy.

•All complaints and concerns regarding possible violations of, or non-compliance with, our Code, a policy or a law or regulation, or retaliatory acts against anyone who makes such a complaint or assists in the investigation of such a complaint, may be made directly to the chair of the Audit Committee or by phone or internet using our confidential hotline at ethicspoint.com. Reports may be made anonymously.

| | | | | | | | |

| Eagle Bancorp, Inc. | 4 | 2024 Proxy Statement |

Corporate Governance

The Company believes that strong corporate governance practices are a critical component of the management of any successful financial institution and are integral to achieving long-term shareholder value. The Board of Directors is committed to conducting business according to the highest standards and oversees management to develop the appropriate policies and practices for the Company’s customer interactions, day-to-day operations and participation as a responsible member of our community. The Board monitors best practices and gathers feedback from multiple sources, including our shareholders, to assure our adherence to this commitment.

Key corporate governance principles include:

•Commitment to corporate governance, social and environmental responsibility

•Oversight of Company strategy and performance

•Risk oversight by the Board's Risk Committee

•Code of Business Conduct and Ethics

•Corporate Governance Guidelines

•7 of 9 Directors are Independent under stock exchange rules and Securities and Exchange Commission ("SEC") rules (8 of 10 Directors who served at any time in fiscal year 2023 were Independent under stock exchange rules and SEC rules)

•Separation of Chief Executive Officer (“CEO”) and Chair of the Board roles

•Independent Lead Director

•Diversity of Board membership

•Active shareholder engagement process

•Board and Committee authority to retain independent advisors

•Executive compensation plans designed to align management with long-term shareholder interests

•Biennial Board and Committee evaluation process

•Committee charters are reviewed annually

•Regular executive session meetings of Independent Directors

•Board participation in CEO, executive officer and key personnel succession planning

•Policy providing for return of incentive compensation (“Clawback Policy”)

•Executive incentive compensation plans include long-term time-vested equity awards and performance-vested equity awards

Critical corporate governance practices that the Company has enacted include:

•Annual election of Board members

•Majority approval required for Director elections (resignation if majority approval is not received)

•Annual “Say-on-Pay” advisory votes on executive compensation

•No shareholder rights plan (“Poison Pill”)

•Double trigger clause on executive severance change-of-control payments

•Share ownership requirements for Directors and Executive Officers

•Policies prohibiting hedging and short sales, and limiting pledging of Company stock

Later sections of this proxy statement provide further details of our corporate governance policies and procedures, our approach to managing risk within the Company, the design of our executive compensation plans and the resulting compensation awarded to each executive. Copies of the Code of Business Conduct and Ethics, the Corporate Governance Guidelines and the Clawback Policy can be found at http://ir.eaglebankcorp.com/govdocs.

| | | | | | | | |

| Eagle Bancorp, Inc. | 5 | 2024 Proxy Statement |

Board Oversight of Environmental, Social and Governance Matters

•The Board's Governance and Nominating Committee reviews and provides oversight with respect to the Company's implementation of sound corporate governance principles and practices, including environmental, social and governance ("ESG") matters.

•In early 2023, the Company formed an ESG Task Force (the "Task Force"), composed of leaders from a cross section of the Company, to support the Company's ongoing commitment to ESG matters. The Task Force, which reports to the Board's Governance and Nominating Committee at least twice a year, monitors emerging ESG trends and assists in setting the Company's ESG strategy and initiatives.

•Additionally, for the DEIC, our CEO is the Executive Sponsor and two members of the Board of Directors are the liaisons between the Board and the DEIC.

Shareholder Engagement

Our Engagement Process

Our Board and management are committed to engaging with our shareholders and soliciting their views and input on performance, corporate governance, executive compensation and other matters.

Year-Round Engagement and Board Reporting. Our management team and certain board members conduct outreach to shareholders and other stakeholders throughout the year and inform our Board about the issues that matter most to them. In 2023, our engagement efforts included obtaining feedback from institutional shareholders, retail shareholders, proxy advisory firms, consultants and investor relations professionals. Our outreach process is to have direct conversations with shareholders and stakeholders as well as quarterly earnings calls, investor conferences and our annual shareholder meeting. Our publications and communications with shareholders and stakeholders is in the form of an Annual Report, Proxy Statement, regular SEC filings, press releases and our corporate web site.

Transparency and Informed Corporate Governance Enhancements. Our Board regularly reviews our corporate governance practices and policies, including our shareholder engagement practices, with an eye toward continual improvement. Shareholder input is shared with our Board, facilitating a dialogue that provides shareholders with insight into our corporate governance practices and informs them of our Company’s enhancement of those practices. In addition to considering shareholder sentiments, our Board reviews the voting results of our Annual Meetings, the corporate governance practices of our peers and other companies, and current trends in corporate governance.

Outreach to Shareholders. We value the opinion of our shareholders and conduct an outreach program to many of our largest shareholders to encourage an open dialogue on executive compensation, ESG matters and other topics relevant to our business. As a result of these conversations, we continue to evaluate and update our compensation and corporate governance practices. Greater detail can be found later in this proxy statement, in the Compensation Discussion and Analysis section.

| | | | | | | | |

| Eagle Bancorp, Inc. | 6 | 2024 Proxy Statement |

Shareholder Communications

If you wish to communicate with the Board of Directors or an individual director, you can (a) write to Eagle Bancorp, Inc., 7830 Old Georgetown Road, Bethesda, Maryland 20814, Attention: Jane E. Cornett, Corporate Secretary, (b) email jcornett@eaglebankcorp.com, (c) call (301) 986-1800 or (d) go to https://ir.eaglebankcorp.com/corporate-profile/default.aspx and click “Contact Us” in the upper right hand corner. Your letter should indicate that you are a shareholder, and whether you own your shares as a registered holder or in street name. Depending on the subject matter, management will: (a) forward the communication to the director or directors to whom it is addressed; (b) handle the inquiry directly or delegate it to appropriate employees, such as where the communication is a request for information, a stock related matter, or a matter related to the ordinary course of conduct of the Company’s banking business; or (c) not forward the communication where it is primarily commercial or political in nature, or where it relates to an improper, frivolous or irrelevant topic.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| WRITE | | CALL | | EMAIL | | WEB |

| | | | | | |

Corporate Secretary

Eagle Bancorp, Inc.

7830 Old Georgetown Road, 3rd Floor Bethesda, Maryland 20814 | | (301) 986-1800 | | jcornett@eaglebankcorp.com | | https://ir.eaglebankcorp.com/corporate-profile/default.aspx click “Contact Us” in the upper right hand corner |

| | | | | | | | |

| Eagle Bancorp, Inc. | 7 | 2024 Proxy Statement |

Voting Securities and Principal Shareholders

Ownership of Securities by Directors, Nominees and Officers

The following table sets forth certain information concerning the number and percentage of whole shares of the Company’s common stock beneficially owned by its directors, its executive officers whose compensation is disclosed in this proxy statement ("named executive officers" or "NEO's"), and by its directors and all executive officers as a group, as of March 21, 2024. Except as otherwise indicated, all shares are owned directly, the named person possesses sole voting and sole investment power with respect to all such shares, and none of such shares are pledged as security. Unvested shares of restricted stock (time-vested only) are included in ownership amounts.

| | | | | | | | | | | | | | |

| Name | Position | Shares | Percent Ownership(1) |

| Directors (9) |

| Matthew D. Brockwell | Director of Company and Bank | 28,195 | | | * |

| Steven J. Freidkin | Director of Company and Bank | 30,357 | | | * |

| Theresa G. LaPlaca | Director of Company and Bank | 28,183 | | (2) | * |

| A. Leslie Ludwig | Director of Company and Bank | 40,163 | | (3) | * |

| Norman R. Pozez | Executive Chairman of Company and Bank | 99,782 | | (4) | * |

| Kathy A. Raffa | Director of Company and Bank | 50,756 | | | * |

| Susan G. Riel | President, Chief Executive Officer and Director of Company and Bank | 346,685 | | (5) | * |

| James A. Soltesz | Director of Company and Bank | 46,001 | | | * |

| Benjamin M. Soto | Director of Company and Bank | 42,029 | | (6) | * |

| Other Named Executive Officers (6) |

| Eric R. Newell | Executive Vice President, Chief Financial Officer of Company | 17,115 | | | * |

| Charles D. Levingston | Executive Vice President, Chief Financial Officer of Bank (former Chief Financial Officer of Company) | 36,130 | | | * |

| Antonio F. Marquez | Former Executive Vice President of Company; Former SEVP, President of Commercial Banking | 49,730 | | (7) | * |

| Lindsey S. Rheaume | Executive Vice President of Company; EVP, Chief Lending Officer – Commercial and Industrial of Bank | 9,075 | | | * |

| Ryan A. Riel | Executive Vice President of Company, EVP & Chief Real Estate Lending Officer of Bank | 35,339 | | | * |

| Janice L. Williams | Executive Vice President of Company; SEVP, Chief Credit Officer of Bank | 107,877 | | | * |

| Other Executive Officers (1 officer) | 19,177 | | | * |

All Directors and Executive Officers as a Group (15 persons) (8) | 936,864 | | | 3.10% |

*-less than five percent ownership.

(1)Represents the percentage of 30,186,040 shares issued and outstanding as of March 21, 2024. Certain shares beneficially owned by the Company’s directors and executive officers may be held in accounts with third party firms, where such shares may from time to time be subject to a security interest for margin credit provided in accordance with such firm’s policies.

(2)Includes 100 shares held jointly with Ms. LaPlaca's spouse.

(3)Includes 250 shares held by Ms. Ludwig's IRA.

(4)Includes 26,164 shares held by Mr. Pozez’s IRA.

(5)Includes 58,410 shares held jointly with Ms. Riel’s spouse and 19,735 shares held in Trust.

(6)Includes 2,050 shares held jointly with Mr. Soto's spouse.

(7)Shares are as of the last date of public report in May 2023 and include 3,050 shares held in Trust.

(8)Includes shares owned by directors, director nominees and current executive officers.

| | | | | | | | |

| Eagle Bancorp, Inc. | 8 | 2024 Proxy Statement |

Beneficial Owners of More than 5% of the Common Stock of the Company

The entities listed in the table below were beneficial owners of 5% or more of the shares of the Company's Common Stock outstanding as of December 31, 2023, based on information filed with the SEC. Except as set forth below, the Company knows of no other person or persons who may beneficially own in excess of five percent of the Company’s common stock.

| | | | | | | | | | | |

| Name | Address | Shares | Percent of Class |

BlackRock, Inc.(1) | 55 East 52nd Street, New York, NY 10055 | 4,378,503 | 14.63% |

The Vanguard Group(2) | 100 Vanguard Boulevard, Malvern, PA 19355 | 3,362,689 | 11.24% |

State Street Corporation(3) | 1 Congress Street, Suite 1, Boston, MA 02114 | 1,562,472 | 5.22% |

(1)Based solely on Schedule 13G filed on January 23, 2024. The Schedule 13G indicates that BlackRock, Inc. has sole voting power with respect to 4,332,673 of these shares, shared voting power with respect to none of these shares, sole dispositive power with respect to 4,378,503 of these shares and shared dispositive power with respect to none of these shares.

(2)Based solely on Schedule 13G filed on February 13, 2024. The Schedule 13G indicates that The Vanguard Group has sole voting power with respect to none of these shares, shared voting power with respect to 44,402 of these shares, sole dispositive power with respect to 3,290,151 of these shares and shared dispositive power with respect to 72,538 of these shares.

(3)Based solely on Schedule 13G filed on January 24, 2024. The Schedule 13G indicates that State Street Corporation has sole voting power with respect to none of these shares, shared voting power with respect to 177,097 of these shares, sole dispositive power with respect to none of these shares and shared dispositive power with respect to 1,562,472 of these shares.

Executive Officers Who Are Not Directors

Set forth below is certain information regarding persons who are executive officers of the Company and who are not directors of the Company. Except as otherwise indicated, the occupation listed has been such person’s principal occupation for at least the last five years.

Eric R. Newell

Mr. Newell, 44, is Executive Vice President and Chief Financial Officer of the Company since September 2023 and interim Chief Risk Officer of EagleBank since February 2024. Prior to joining Eagle Bancorp, Inc., Mr. Newell was the Executive Vice President & Chief Financial Officer at Equity Bancshares (NYSE:EQBK) since April 2020, a $5.1 billion community bank headquartered in Wichita, Kansas. During that tenure, Mr. Newell led and oversaw the finance, information technology, and loan, deposit, and payment operations teams. Before Equity, Mr. Newell was the Chief Financial Officer of United Financial Bancorp, Inc (NASDAQ:UBNK) a $7.1 billion commercial bank based in Hartford, CT, from November 2013 until its sale to Peoples United Bank in October 2019. Earlier roles include AllianceBernstein L.P., Fitch Ratings, Inc, and the Federal Deposit Insurance Corporation. Mr. Newell earned his Certified Financial Analyst designation in 2009, a Masters of Science in Business Analytics from Northeastern University, and a Bachelor of Science in Business Administration with a concentration in Finance & Marketing also earned from Northeastern University in Boston, MA.

Charles D. Levingston, CPA

Mr. Levingston, 44, Executive Vice President and Chief Financial Officer of the Bank since April 2017, and previously served as Executive Vice President and Chief Financial Officer of the Company from April 2017 to September 2023 and Executive Vice President of Finance at the Bank. Mr. Levingston, a Certified Public Accountant, served in various financial and senior management roles at the Bank prior to his current role. Mr. Levingston joined the Bank in January 2012, and previously worked at The Federal Reserve Banks of Atlanta and Philadelphia as a commissioned Bank Examiner, and at PricewaterhouseCoopers as a Manager in the Advisory practice. He has over 23 years of experience in the banking industry.

| | | | | | | | |

| Eagle Bancorp, Inc. | 9 | 2024 Proxy Statement |

Lindsey S. Rheaume

Mr. Rheaume, 63, Executive Vice President and Chief Lending Officer – Commercial and Industrial of the Bank and Executive Vice President of the Company, joined the Company in December 2014. Prior to joining the Company, he served as Relationship Executive for JPMorgan Chase, responsible for business development in the Washington, D.C., suburban Maryland and Northern Virginia market. Previously, he served as Executive Vice President and Commercial Lending Manager at Virginia Commerce Bank, which was acquired by United Bankshares, Inc. in 2014, where he managed the bank's entire commercial and industrial lending activities. Earlier in his career, he held various senior commercial lending, credit, and leadership positions with SunTrust Bank, GE Capital and Bank of America. He has over 38 years of experience in the banking industry.

Ryan A. Riel

Mr. Riel, 46, is Executive Vice President and Chief Real Estate Lending Officer. He joined the Company in 2001. He has held many roles at the bank including credit analyst, relationship manager, team leader and senior market executive. Mr. Riel sits on the Board of Directors of the EagleBank Foundation, and on the Board for George Mason University Center for Real Estate Entrepreneurship. He is a current Trustee for The Children’s Inn at NIH and previously served on the Board of Directors at the Inn for ten years. He earned a Bachelor’s Degree in Economics from West Virginia University.

Paul Saltzman, Esquire

Mr. Saltzman, 63, is Executive Vice President and Chief Legal Officer. He joined the Company in January 2020 as the Chief Legal Officer. He is responsible for the Ethics Office and all non-lending related legal and litigation matters at the Bank. Mr. Saltzman was a Partner in the Banking and Financial Institutions Advisory Practice at White & Case and Vice Chairman at Deutsche Bank, where he initially helped lead capital stress testing and regulatory remediation and then led the payments and transaction banking business in the Americas region. Prior to that Mr. Saltzman was President of The Clearing House Association (now BPI), leading the banking industry’s lobbying efforts during the implementation of Dodd-Frank reforms, as well as serving as General Counsel of the affiliated Clearing House Payments Company, which owns and operates the nation’s payments infrastructure. He holds a B.A. from Clark University, Phi Beta Kappa, and a J.D. from Boston University School of Law. He has over 39 years of experience in the financial services industry.

Janice L. Williams, Esquire

Ms. Williams, 67, Senior Executive Vice President and Chief Credit Officer of the Bank since February 2020, and formerly Executive Vice President – Chief Credit Officer of the Bank and Vice President of the Company, has served with the Company as Credit Officer, Senior Credit Officer, and Chief Credit Officer since 2003. Prior to employment with the Bank, Ms. Williams served with Capital Bank, Sequoia Bank, and American Security Bank. Additionally, Ms. Williams, a graduate of Georgetown University Law Center and a Member of the Maryland Bar, was previously employed in the private practice of law in Maryland. She has over 29 years of experience in the banking industry.

| | | | | | | | |

| Eagle Bancorp, Inc. | 10 | 2024 Proxy Statement |

Proposal 1: Election of Directors

The Board of Directors has nominated nine persons for election as directors at the 2024 Annual Meeting, for a term until the 2025 Annual Meeting of Shareholders or until their successors have been elected and qualified. All nominees currently serve as directors on our Board and were elected by you at our 2023 Annual Meeting of shareholders.

•Average age of independent directors: 60 years

•Independent directors: 78% of board

•Board refreshment: 8 new directors in last eight years

•Board representation by directors identifying as women: 44%

•Board representation by directors identifying as racial and ethnic minorities: 11%

We are presenting for election by the shareholders the following nine nominees to our Board of Directors. We are proud of our Board members and the diversity found in the group.

| | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Independent | Principal Occupation | Committee Memberships |

| Matthew D. Brockwell | 62 | 2019 | Yes | Chief Financial Officer of the University of Oklahoma | Governance & Nominating (Chair) and Audit |

| Steven J. Freidkin | 40 | 2021 | Yes | CEO and Founder of Ntiva | Technology Oversight (Chair) and Risk |

| Theresa G. LaPlaca | 64 | 2019 | Yes | Founder & President – TLP Leadership Advisory Services | Risk (Chair) and Audit |

| A. Leslie Ludwig | 62 | 2019 | Yes | Co-founder – L&L Advisors | Compensation (Chair) and Risk |

| Norman R. Pozez | 69 | 2008 | No | Chairman and CEO – Uniwest Companies, Inc. | Technology Oversight |

| Kathy A. Raffa | 65 | 2018 | Yes | (Retired) Office Managing Partner – Marcum, LLP | Audit (Chair) and Governance & Nominating |

| Susan G. Riel | 74 | 2017 | No | President & CEO: Eagle Bancorp and EagleBank | Technology Oversight |

| James A. Soltesz | 69 | 2019 | Yes | CEO – Soltesz, Inc. | Compensation, Governance & Nominating and Risk |

| Benjamin M. Soto | 55 | 2019 | Yes | Principal of Premium Title and Escrow, LLC | Compensation and Technology Oversight |

Unless you vote AGAINST, or ABSTAIN with respect to, one or more nominees for election as director, all proxies received in response to this solicitation will be voted for the election of the nominees. Each of the nominees for election as a director currently serves as a member of the Board of Directors of the Company and as a member of the Board of Directors of the Bank. Each nominee has indicated a willingness to serve if elected. However, if any nominee becomes unable to serve, the proxies received in response to this solicitation will be voted for a replacement nominee selected in accordance with the best judgment of the person named as proxy.

The rules of The Nasdaq Stock Market (“Nasdaq”) require that a majority of the members of the Board be “independent directors.” The Board of Directors has determined that each director and nominee for election as director, other than Mr. Pozez and Ms. Riel, is an “independent director” as that term is defined in Rule 5605(a)(2) of the Nasdaq rules. The Board has also considered whether the members of the Audit, Compensation, and Governance & Nominating Committees are independent under the heightened standards of independence required by Sections 5605(c)(2)(A) and 5605(d)(2)(A), respectively, of the Nasdaq Rules, and has determined that they are. Additionally, each of the persons who served on the Board of Directors during fiscal year 2023 (including Mr. Ernest

| | | | | | | | |

| Eagle Bancorp, Inc. | 11 | 2024 Proxy Statement |

D. Jarvis, a former independent director of the Company and the Bank who did not stand for reelection as a director at the 2023 Annual Meeting), was independent within the meaning of Rule 5605(a)(2), other than Mr. Pozez and Ms. Riel. In making these determinations, the Board of Directors was aware of and considered the loan and deposit relationships with directors and their related interests which the Company enters into in the ordinary course of its business, the arrangements that are disclosed under “Certain Relationships and Related Party Transactions” in this proxy statement, and the compensation arrangements described under “Director Compensation.”

As required under applicable Nasdaq listing standards, our independent directors meet in executive sessions at which only independent directors are present.

Set forth below is information concerning the nominees for election as directors. Except as otherwise indicated, the occupation listed has been such person’s principal occupation for at least the last five years. Each of the nominees also serves as a director of the Bank as it is the Company’s policy to have the same members on the boards of the Company and the Bank.

Nominees for the Board of Directors

Matthew D. Brockwell - SENIOR VICE PRESIDENT & CHIEF FINANCIAL OFFICER, THE UNIVERSITY OF OKLAHOMA

Matthew Brockwell became the Chief Financial Officer of the University of Oklahoma ("OU") in December 2021. He is responsible for all aspects of the University’s financial management as well as risk management, information technology, and human resources. Prior to his role at OU, Mr. Brockwell was a CPA and spent 21 years as a Financial Services Audit Partner with PricewaterhouseCoopers LLP ("PwC"). There he held leadership roles in PwC’s US Financial Services practice. He has over 36 years of experience working with financial services firms in the US and abroad. His practice included both SEC registered and privately held companies, as well as both foreign and US financial regulators. Mr. Brockwell obtained a B.A. from the University of Oklahoma, an MBA from the Columbia Graduate School of Business and attended the Stonier Graduate School of Banking.

Steven J. Freidkin - CEO AND FOUNDER OF NTIVA, INC.

Steven Freidkin has over 25 years of experience in the field of IT and is the CEO and founder of Ntiva, Inc., a full-service technology firm offering managed IT services and support, including cyber security services and advanced IT consulting. Founded in 2004, Ntiva now has over 450 employees who serve over 1,400 clients. Mr. Freidkin, an alumnus of the Robert H. Smith School of Business at the University of Maryland, has led Ntiva through two successful partnership transactions as well as more than a dozen acquisitions. Mr. Freidkin works with Ntiva clients to align their growth efforts with efficient, secure technology creating an environment for businesses to thrive. Mr. Freidkin's philanthropic work and charitable giving have all focused on helping people and their businesses. He is an active member on a multitude of boards and organizations including Young Presidents Organization (YPO), Capital Camps & Retreat Center and American Friends of the Hebrew University.

Theresa G. LaPlaca - FOUNDER & PRESIDENT OF TLP LEADERSHIP ADVISORY SERVICES, LLC

Theresa G. LaPlaca is a Leadership Coach for TLP Leadership Advisory Services, a firm she founded after her retirement as an Executive Vice President at Wells Fargo & Company. Prior to her retirement in 2019, she was the Executive Vice President and Head of the Conduct Risk Management Group and a member of the Management Committee at Wells Fargo. Prior to that she was the Chief Financial Officer of Wells Fargo’s Wealth and Investment Management businesses. Ms. LaPlaca previously served as the Chief Financial Officer for CitiStreets Retirement Services Division. She is a past member of the Queens University of Arts Advisory Board and previously served as a Board Director and Treasurer of the Nevins Foundation and the St. Anthony Foundation of Charlotte. Ms. LaPlaca obtained a Bachelors in Education from Shenandoah University.

A. Leslie Ludwig - CO-FOUNDER OF L&L ADVISORS

A. Leslie Ludwig is the co-founder of L&L Advisors, a commercial real estate consulting firm, and a retired Partner and Chairperson of the Management Committee at JBG Smith (formerly The JBG Companies), where she oversaw the Finance, Accounting, Human Resources, Investor Relations, Insurance and Marketing functions. In 2012, Ms. Ludwig started a women's initiative at The JBG Companies to lead diversity efforts for the company. Ms. Ludwig serves on

| | | | | | | | |

| Eagle Bancorp, Inc. | 12 | 2024 Proxy Statement |

the board of the Frostburg State University Foundation and was formerly a member of CREW (Commercial Real Estate Women), on the Investment Advisory Committee for the National Multifamily Housing Corporation, the Virginia Tech Real Estate Industry Advisory Board and the Advisory Board of CREW. Ms. Ludwig obtained a B.A. from Frostburg State University.

Norman R. Pozez - EXECUTIVE CHAIRMAN OF EAGLE BANCORP, INC.; EXECUTIVE CHAIRMAN OF EAGLEBANK; CHAIRMAN & CHIEF EXECUTIVE OFFICER OF UNIWEST COMPANIES

Norman Pozez is Chairman and Chief Executive Officer of The Uniwest Companies which include, Uniwest Construction, Inc., Uniwest Commercial Realty, Inc., and Uniwest Hospitality, Inc. Prior to these appointments, Mr. Pozez was Chief Operating Officer of The Hair Cuttery of Falls Church, Virginia, and served as Regional Director of Real Estate and Construction for Payless Shoe Source. Mr. Pozez is a licensed Real Estate Broker in Washington, D.C., Maryland and Virginia. Mr. Pozez obtained an A.B. Degree, magna cum laude, from Washington University in St. Louis and a JD from the Washburn University School of Law.

Kathy A. Raffa - (Retired) OFFICE MANAGING PARTNER OF MARCUM, LLP'S WASHINGTON, D.C., REGION

Kathy Raffa was the former Office Managing Partner for Marcum LLP’s Washington, D.C. region, one of the largest independent public accounting and advisory services firms in the nation, prior to her retirement in October 2023. Previously Ms. Raffa was the President of Raffa, PC, a top 100 accounting firm based in Washington, D.C., until its merger in 2018 with Marcum, LLP. She was an Audit Partner for thirty years and oversaw a wide range of services for nonprofit clients. Prior to Raffa, PC, she spent the first 10 years of her career at Coopers & Lybrand (now PwC). She has CPA certificates from the District of Columbia and Maryland and is a recent former member of the Board of Trustees of Trinity Washington University. Ms. Raffa obtained a Bachelor of Science in Economics from the Wharton School at the University of Pennsylvania.

Susan G. Riel - PRESIDENT & CHIEF EXECUTIVE OFFICER OF EAGLE BANCORP, INC.; PRESIDENT & CHIEF EXECUTIVE OFFICER OF EAGLEBANK

Ms. Riel is President and Chief Executive Officer of the Company and Bank. She is responsible for leading the Bank’s overall growth strategies and enhancing shareholder value. Prior to being named CEO in 2019, Ms. Riel was Senior Executive Vice President and Chief Operating Officer of the Bank, and Executive Vice President of the Company. Ms. Riel has been with the Company since 1998, and has been a member of the Company Board of Directors since 2017 and the Bank Board since 2018. Ms. Riel is a Corporate Advisory Council member for Children’s National and serves on the Innovation Committee for George Mason University. In addition, Ms. Riel is also a Board member of the EagleBank Foundation.

James A. Soltesz - CHIEF EXECUTIVE OFFICER OF SOLTESZ, INC.

James Soltesz has served as Chief Executive Officer of Soltesz, Inc., an engineering and consulting firm, since 2000. Mr Soltesz serves on the Board of Directors of the Montgomery County Economic Development Corporation. He formerly served on the Board of Trustees of Georgetown Preparatory School, Mater Dei School, as a Life Director of the Maryland-National Capital Area Building Industry Association, and the Catholic Charities Foundation. Mr. Soltesz also chaired the Montgomery County Executive Business Advisory Board, and has served as a director of the Bank since 2007. Mr. Soltesz holds an M.B.A. from the University of Cincinnati, an M.S. in Civil Engineering from Georgia Institute of Technology and a B.S. in Civil Engineering from Purdue University.

Benjamin M. Soto - PRINCIPAL OF PREMIUM TITLE & ESCROW, LLC

Benjamin Soto is a real estate transactions attorney and principal of Premium Title and Escrow, LLC, a Washington, D.C.-based full service title company providing commercial and residential real estate closings in DC, MD and VA. He is also the owner of Paramount Development, LLC, which is focused on the acquisition and ground up development of commercial buildings and hotels in Washington, D.C. He is a former board member of the National Bar Association, and the DC Sports and Entertainment Commission, and a former Vice-Chair of the DC Board of Real Property Assessment and Appeals. Mr. Soto is a Board Director of the DC Chamber of Commerce, the DC Public Education Fund and the National Foundation for Affordable Housing Solutions. Mr. Soto has served as a Director of the Bank since 2006. Mr. Soto earned a B.S. in Finance & Administration from the American University and a JD from the Washington College of Law.

| | | | | | | | |

| Eagle Bancorp, Inc. | 13 | 2024 Proxy Statement |

Board Diversity

In August 2021, the SEC approved amendments to the Listing Rules of Nasdaq related to board diversity. New Listing Rule 5605(f) (the “Diverse Board Representation Rule”) requires each Nasdaq-listed company, subject to certain exceptions, (1) to have at least one director who self-identifies as female, and (2) to have at least one director who self-identifies as Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, two or more races or ethnicities, or as LGBTQ+, or (3) to explain why the company does not have at least two directors on its board who self-identify in the categories listed above. In addition, new Listing Rule 5606 (the “Board Diversity Disclosure Rule”) requires each Nasdaq-listed company, subject to certain exceptions, to provide statistical information about the company’s board of directors, in a uniform format, related to each director’s self-identified gender, race, and self-identification as LGBTQ+. We are not required to fully comply with the Diverse Board Representation Rule until 2025. However, in the matrix below, we have provided the statistical information required by the Board Diversity Disclosure Rule.

| | | | | | | | | | | | | | |

Board Diversity Matrix (as of March 21, 2024)(1) |

| Total number of directors | 9 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 4 | 5 | — | — |

| | | | |

| Part II: Demographic Background | | | | |

| African American or Black | — | 1 | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 4 | 4 | — | — |

| Two or more races or Ethnicities | — | — | — | — |

| LGBTQ+ | — | — | — | — |

| Did not disclose demographic background | — | — | — | — |

| | | | | | | | |

| Eagle Bancorp, Inc. | 14 | 2024 Proxy Statement |

Director Skills and Qualifications

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Experience | Other Public Company | Leader-ship | Account-ing / Finance | Designated Audit Committee Financial Expert | Mergers & Acquisi-tions | Commer-cial Real Estate | Compen-sation | Risk Manage-ment | Info. Tech. |

| Matthew D. Brockwell | | ✓ | ✓ | ✓ | ✓ | | | ✓ | |

| Steven J. Freidkin | | ✓ | | | ✓ | | | ✓ | ✓ |

| Theresa G. LaPlaca | ✓ | ✓ | ✓ | | ✓ | | | ✓ | |

| A. Leslie Ludwig | | ✓ | ✓ | | | ✓ | ✓ | ✓ | |

| Norman R. Pozez | ✓ | ✓ | ✓ | | ✓ | ✓ | ✓ | ✓ | |

| Kathy A. Raffa | | ✓ | ✓ | ✓ | | | | ✓ | |

| Susan G. Riel | ✓ | ✓ | | | ✓ | | ✓ | ✓ | |

| James A. Soltesz | | ✓ | | | | ✓ | ✓ | | |

| Benjamin M. Soto | | ✓ | ✓ | | ✓ | ✓ | ✓ | | ✓ |

Board Leadership Structure

The Company structures its Board leadership consistent with the best interests of the Company and its shareholders, and consistent with a culture of corporate trust, integrity, confidence, and overall transparency.

Chairman - As Chairman, Mr. Pozez has significant core responsibilities including:

•Chairs Board meetings

•Chairs the Annual Meeting of Shareholders

•Guides discussions at Board meetings and encourages director participation and input

•Engages with directors between Board meetings to further identify items for consideration

•Sets Board meeting schedules and agendas in consultation with the CEO, Chief Legal Officer ("CLO") and Corporate Secretary

Executive Chairman - Mr. Pozez's appointment as Executive Chairman is part of our overall management succession plan. His appointment allows Ms. Riel, our CEO, to provide ongoing operational guidance to Mr. Pozez based on her long tenure as an executive officer of the Company, and for Mr. Pozez based on his leadership experience at other companies and his knowledge of commercial real estate to provide strategic advice and guidance to Ms. Riel. As Executive Chairman, Mr. Pozez has significant core responsibilities including:

•Interacts regularly with the CEO, CFO, CLO and other members of the senior staff regarding matters relevant to the Board’s oversight responsibilities and company operations

•Regularly attends management committee meetings, including the Asset/Liability Committee, Management Credit Review Committee and the Enterprise Risk Management Committee, and is a voting member of the Disclosure Controls Committee and the Management Loan Committee

•Meets frequently with clients and shareholders and communicates necessary feedback to the Board and management

| | | | | | | | |

| Eagle Bancorp, Inc. | 15 | 2024 Proxy Statement |

Lead Independent Director - In order to ensure independent oversight at the highest levels, the Board of Directors appointed a Lead Independent Director. This role has been held by James A. Soltesz since 2021. The responsibilities of the Lead Independent Director include:

•Serve as an independent sounding board on the development and presentation of significant issues, plans and strategies for Board consideration with the Chair

•Preside at all meetings of the Board at which the Chairman is not present

•Preside at all meetings and executive sessions of independent directors

•Develop and approve meeting agendas and approve materials for meetings of independent directors

•As needed, serve as a conduit of views, concerns and issues between the Chairman and the independent directors

•Be available for consultation and direct communication upon the reasonable request of major shareholders

•Perform such other duties as the Board may from time to time delegate or assign to assist the Board in the fulfillment of its responsibilities

Board Committees - The board maintains five standing committees at the Company level in connection with the discharge of its duties. These committees and the Committee Chairs are as follows:

| | | | | |

| Name | Committee Chair |

| Matthew D. Brockwell | Governance & Nominating |

| Steven J. Freidkin | Technology Oversight |

| Theresa G. LaPlaca | Risk |

| A. Leslie Ludwig | Compensation |

| Kathy A. Raffa | Audit |

The Company will continue to evaluate its structure and practices to maintain the highest standards of corporate governance.

Board and Committee Oversight of Risk

One of the many duties of the Board is to oversee the Company’s risk management policies and practices to ensure that the appropriate risk management systems are designed and operate effectively throughout the Company. The Company faces a broad array of risks, including but not limited to credit, interest rate/market, liquidity, operational, technology, compliance/regulatory, legal, human capital, reputational and strategic risks. The Board of Directors of the Company, all of the members of which are also members of the Board of Directors of the Bank, is actively involved in the Company’s and Bank’s risk oversight activities. These Directors, working through several chartered committees of the Company Board, including the Risk Committee, with the assistance of chartered management committees, review and approve critical policies of the Company and Bank. The Boards of Directors regularly review reports from the Board and management committees of the Company and Bank. The Board exercises its role of risk oversight in a variety of ways, including the following:

| | | | | |

| Board or Committee | Risk Oversight |

| Board of Directors | •Monitors overall corporate performance, including financial results, the integrity of financial and other controls, and the effectiveness of the Company’s legal, credit, compliance and enterprise risk management programs, risk governance practices, and risk mitigation efforts. •Oversees management’s implementation and utilization of appropriate risk management policies and systems at all levels of the Company. •Reviews risks in the context of the Company’s annual strategic planning and the annual budget review. •Receives reports from management on, and routinely considers, critical risk topics, including: operational, financial, regulatory, strategic, security, human capital, legal, reputational, and technology/cybersecurity, as well as any emerging risks that might affect the Company. |

| | | | | | | | |

| Eagle Bancorp, Inc. | 16 | 2024 Proxy Statement |

| | | | | |

| Board or Committee | Risk Oversight |

| Audit Committee | •Assists the Board in fulfilling its oversight of financial risk exposures and implementation and effectiveness of the Company’s compliance with legal and regulatory requirements, disclosure controls, policies and programs. •Oversees qualifications, performance and independence of our Company's independent registered public accounting firm. •Oversees performance of the Company's Internal Audit function and the Chief Audit Executive, and reviews reports from the Chief Audit Executive. •Reviews Quarterly Financial Statements and approves Annual Reporting to the SEC on Form 10K and Quarterly Reporting to the SEC on Form 10Q. •Monitors compliance with the Code of Business Conduct and Ethics and Related Party Transactions Policy. •Reports its discussions to the Board for consideration and action when appropriate. |

| Compensation Committee | •Assists the Board in fulfilling its oversight of risks that may arise in connection with the Company’s compensation programs and practices. •Reviews the design and goals of the Company’s compensation programs and practices in the context of possible risks to the Company’s financial and reputational well-being. •Determines compensation (cash and non-cash) of non-employee directors. •Reviews the Company’s strategies and supporting processes of management succession planning, leadership development, and executive retention. •Reviews, discusses and recommends for inclusion in the Company’s proxy statement, the Compensation Disclosure and Analysis and the Compensation Committee Report. •Approves all incentive programs, including Senior Executive Incentive Plan (“SEIP”), Long Term Incentive Plan (“LTIP”), and Executive Officer compensation and benefits. •Approves compensation and benefits for Related Parties and employee with the title of executive vice president and above. •Reports its discussions to the Board for consideration and action when appropriate. |

| Governance & Nominating Committee | •Assists the Board in fulfilling its oversight of risks that may arise in connection with the Company’s governance structures and processes. •Conducts periodic evaluations of the Company’s governance practices and Board performance. •Reviews shareholder proposals submitted to the Company. •Identifies qualified Board members and evaluates performance of the Directors. •Reports its discussions to the Board for consideration and action when appropriate. |

| Risk Committee | •Assists the Board by providing oversight of the Company’s risk governance framework and risk functions, including the strategies, policies, procedures, processes, and systems established by management to identify, measure, monitor, and manage major risks of the Company. •Promotes a robust and effective risk culture, facilitates Board-level oversight of risk-related issues, and serves as a resource to management by overseeing major risks across the Company and enhancing management’s and the Board’s understanding of the Company’s overall risk appetite and risk management activities and effectiveness. •Monitors emerging risks that might affect the Company and proposes action plans to the Board as deemed necessary. •Periodically reviews and monitors the quality of the loan portfolio and adequacy of the allowance for credit losses. •Reviews and recommends approval of the Bank’s loan policies to the full Board of Directors. •Approves and recommends to the Board for approval loans within acceptable risk tolerances which can be lawfully made to executive officers, directors, their spouses or related interests. •Makes recommendations to the Board, including those with regard to the overall risk profile and capital of the Company. •Reports its discussions to the Board for consideration and action when appropriate. |

| Technology Oversight Committee | •Assists the Board by providing heightened oversight of the Company’s information technology (“IT”) risk governance framework and IT functions, including the strategies, policies, procedures, processes, and systems established by management to identify, measure, monitor, and manage major IT risks of the Company. •Assesses whether the Company's cyber and technology programs effectively support the Company's business objectives and strategies. •Monitors technology trends that may affect the Company's strategic plans. •Receives reports from management concerning technology operations, including software development performance projects, technical operations performance, technology architecture, data security, and significant technology projects. •Approves policies related to technology issues at the Company. |

| | | | | | | | |

| Eagle Bancorp, Inc. | 17 | 2024 Proxy Statement |

The Board of Directors has adopted written charters of the Audit, Compensation, Governance & Nominating, Risk, and Technology Oversight Committees. Copies of the Committees’ charters can be found at https://ir.eaglebankcorp.com/corporate-overview/documents/default.aspx.

2023 Meetings, Committees, and Procedures of the Board of Directors

Our Board of Directors met fifteen (15) times during 2023. All members of the Board of Directors of the Company attended at least 75% of the meetings held by the Board of Directors and all committees on which such member served during 2023 or any portion thereof.

The Board of Directors of the Company have standing committees for Audit, Compensation, Governance & Nominating, Risk, and Technology Oversight. The following table sets forth the membership of these committees throughout 2023, and meeting information for each of these committees during the fiscal year ended December 31, 2023.

| | | | | | | | | | | | | | | | | |

| Name | Audit Committee | Compensation Committee | Governance & Nominating Committee | Risk Committee(1) | Technology Oversight Committee |

| Matthew D. Brockwell | X | | C | | |

| Steven J. Freidkin | | | | X | C |

| Theresa G. LaPlaca | X | | | C | |

| A. Leslie Ludwig | | C | | X | |

| Norman R. Pozez | | | | | X |

| Kathy A. Raffa | C | | X | | |

| Susan G. Riel | | | | | X |

| James A. Soltesz | | X | X | X | |

| Benjamin M. Soto | | X | | | X |

Number of Meetings in 2023(2) | 13 | 12 | 3 | 4 | 11 |

C: Denotes Chair of Committee.

(1) Comprises the membership at December 31, 2023. At points during the year ended December 31, 2023, the Risk Committee membership included Mr. Soto.

(2) Some meetings were considered compensated by the annual retainer and did not have an associated per meeting fee.

Audit Committee

The Audit Committee is responsible for the selection, review and oversight of the Company’s independent registered public accounting firm (occasionally referred to as the “independent accountants”), the approval of all audit, review and attestation services provided by the independent accountants, the integrity of the Company’s financial reporting and disclosure practices and evaluation of the Company’s internal controls and internal control function and accounting procedures, including review and approval of quarterly and annual filings with the SEC on Forms 10-Q and 10-K and internal audit department plans and reports. It also reviews audit reports with the Company’s independent accountants. Each member of the Audit Committee is independent, as determined under the definition of independence adopted by Nasdaq for audit committee members in Rule 5605(c)(2)(A). The Board of Directors has determined that Ms. Raffa and Mr. Brockwell are “audit committee financial experts” as defined under SEC regulations.

The Audit Committee is also responsible for the pre-approval of all non-audit services provided by its independent accountants. Non-audit services are only provided by the independent auditors to the extent permitted by law. Pre-approval is required unless a “de minimis” exception is met. To qualify for the “de minimis” exception, the aggregate amount of all such non-audit services provided to the Company must constitute not more than five percent of the total amount of revenues paid by the Company to its independent accountants during the fiscal year in which the non-audit services are provided; such services were not recognized by the Company at the time of the engagement to be non-audit services; and the non-audit services are promptly brought to the attention of the committee and approved by one or more members of the committee to whom authority to grant such approval has been delegated by the

| | | | | | | | |

| Eagle Bancorp, Inc. | 18 | 2024 Proxy Statement |

committee prior to the commencement of the non-audit services.

Compensation Committee

The Compensation Committee makes determinations with respect to salary levels, bonus compensation and equity compensation awards for executive officers, among others. The Compensation Committee has the sole responsibility for determining executive compensation, including that of the named executive officers, and for establishing compensation philosophy. Each member of the Compensation Committee is independent, as determined under the definition of independence adopted by Nasdaq for compensation committee members in Rule 5605(d)(2)(A). The Compensation Committee reviews and approves the Company’s strategies and supporting processes of management succession planning, leadership development, and executive retention.

During 2023, the Compensation Committee retained and worked with Newcleus Compensation Advisors and Aon Human Capital Solutions (formerly known as McLagan), a division of Aon PLC (“Aon”) to provide independent executive compensation advice and market compensation information.

Governance & Nominating Committee