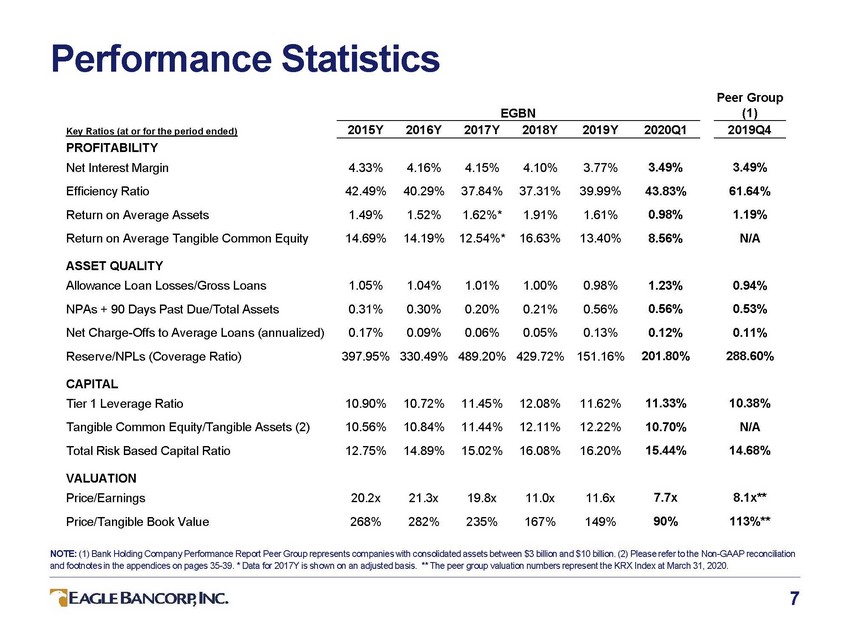

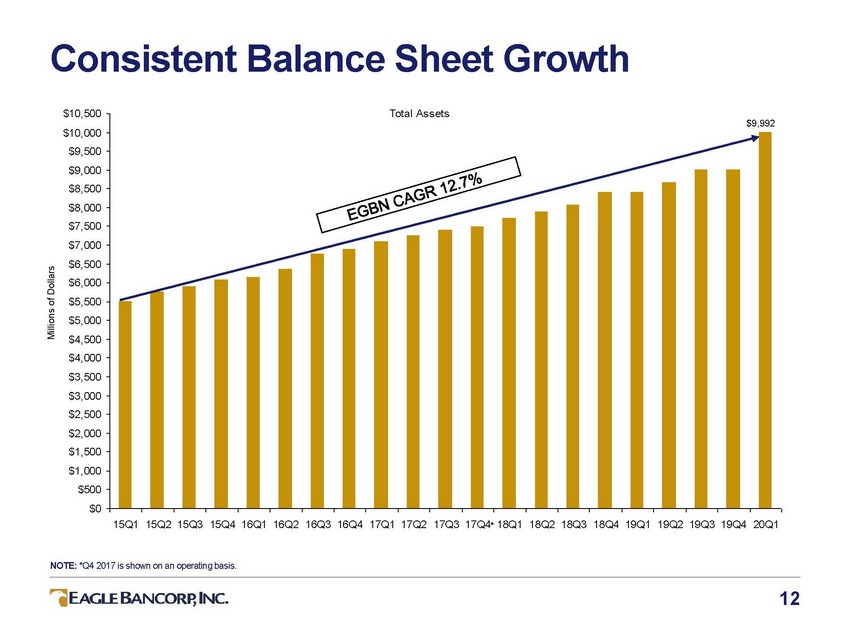

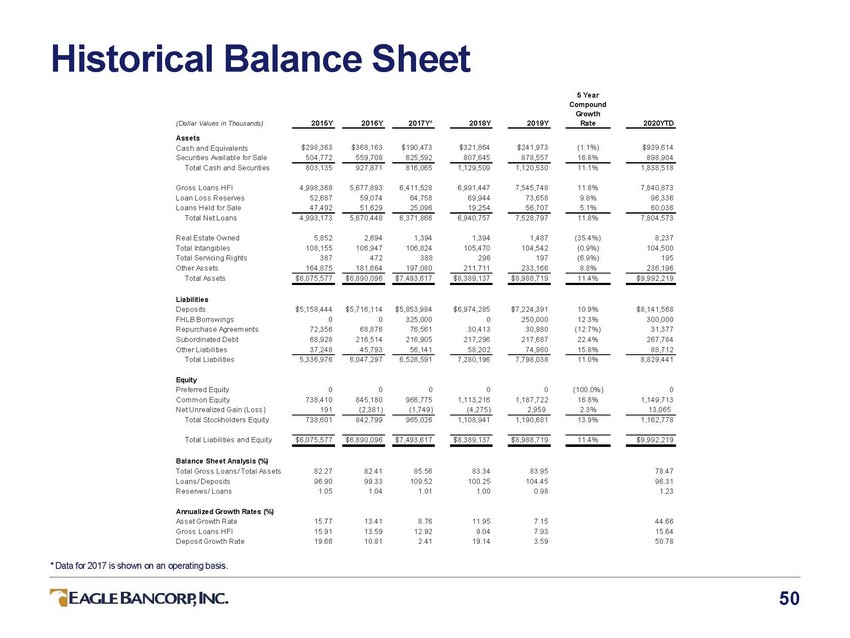

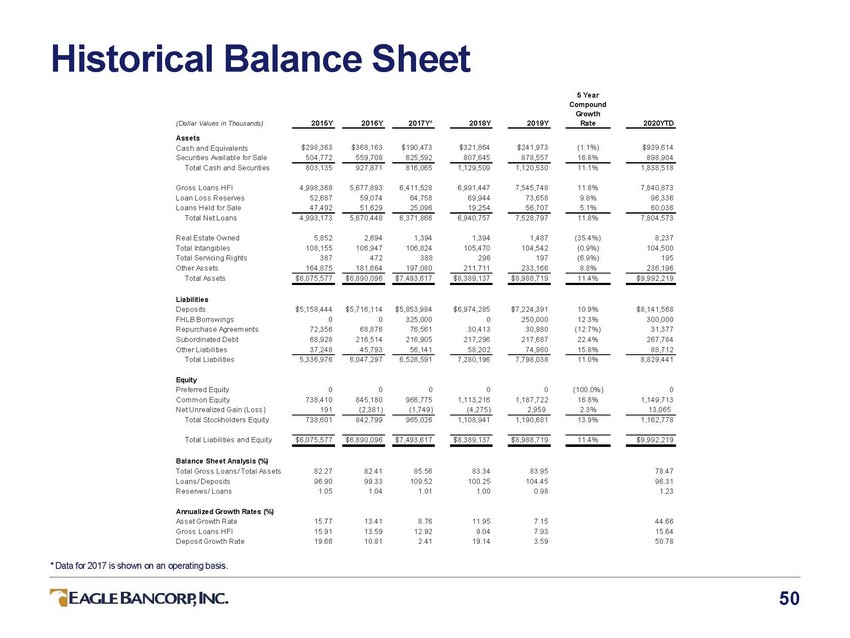

| Historical Balance Sheet 5 Year Compound Growth Rate 2015Y 2016Y 2017Y* 2018Y 2019Y 2020YTD (Dollar Values in Thousands) Assets Cas h and Equivalents Securities Available for Sale Total Cas h and Securities $298,363 504,772 $368,163 559,708 $190,473 625,592 $321,864 807,645 $241,973 878,557 (1.1%) 16.8% $939,614 898,904 803,135 927,871 816,065 1,129,509 1,120,530 11.1% 1,838,518 Gros s Loans HFI Loan Los s Res erves Loans Held for Sale Total Net Loans 4,998,368 52,687 47,492 5,677,893 59,074 51,629 6,411,528 64,758 25,096 6,991,447 69,944 19,254 7,545,748 73,658 56,707 11.8% 9.8% 5.1% 7,840,873 96,336 60,036 4,993,173 5,670,448 6,371,866 6,940,757 7,528,797 11.8% 7,804,573 Real Es tate Owned Total Intangibles Total Servicing Rights Other As s ets Total As s ets 5,852 108,155 387 164,875 2,694 106,947 472 181,664 1,394 106,824 388 197,080 1,394 105,470 296 211,711 1,487 104,542 197 233,166 (35.4%) (0.9%) (6.9%) 8.8% 8,237 104,500 195 236,196 $6,075,577 $6,890,096 $7,493,617 $8,389,137 $8,988,719 11.4% $9,992,219 Liabilities Depos its FHLB Borrowings Repurchas e Agreem ents Subordinated Debt Other Liabilities Total Liabilities $5,158,444 0 72,356 68,928 37,248 $5,716,114 0 68,876 216,514 45,793 $5,853,984 325,000 76,561 216,905 56,141 $6,974,285 0 30,413 217,296 58,202 $7,224,391 250,000 30,980 217,687 74,980 10.9% 12.3% (12.7%) 22.4% 15.8% $8,141,568 300,000 31,377 267,784 88,712 5,336,976 6,047,297 6,528,591 7,280,196 7,798,038 11.0% 8,829,441 Equity Preferred Equity Com m on Equity Net Unrealized Gain (Los s ) Total Stockholders Equity 0 738,410 191 0 845,180 (2,381) 0 966,775 (1,749) 0 1,113,216 (4,275) 0 1,187,722 2,959 (100.0%) 16.8% 2.3% 0 1,149,713 13,065 738,601 842,799 965,026 1,108,941 1,190,681 13.9% 1,162,778 Total Liabilities and Equity $6,075,577 $6,890,096 $7,493,617 $8,389,137 $8,988,719 11.4% $9,992,219 Balance Sheet Analysis (%) Total Gros s Loans / Total As s ets Loans / Depos its Res erves / Loans 82.27 96.90 1.05 82.41 99.33 1.04 85.56 109.52 1.01 83.34 100.25 1.00 83.95 104.45 0.98 78.47 96.31 1.23 Annualized Growth Rates (%) As s et Growth Rate Gros s Loans HFI Depos it Growth Rate 15.77 15.91 19.66 13.41 13.59 10.81 8.76 12.92 2.41 11.95 9.04 19.14 7.15 7.93 3.59 44.66 15.64 50.78 * Data for 2017 is shown on an operating basis. 50 |