- EGBN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Eagle Bancorp (EGBN) 8-KFBR Capital Markets Fall Investor Conference

Filed: 30 Nov 10, 12:00am

Eagle Bancorp, Inc. is a rapidly growing commercial bank headquartered in

Eagle Bancorp, Inc. is a rapidly growing commercial bank headquartered in Positioned as an alternative solution between small community banks and regional /

Positioned as an alternative solution between small community banks and regional /

Founding members had extensive banking experience

Founding members had extensive banking experience Raised $16.5 million in initial subscription offering - 1997*

Raised $16.5 million in initial subscription offering - 1997* Commenced operations with three Maryland branches - July, 1998

Commenced operations with three Maryland branches - July, 1998 Second subscription offering raised $30 million - 2003*

Second subscription offering raised $30 million - 2003* Reached $500 million in assets in 2004

Reached $500 million in assets in 2004 Private placement of $12.1 million of subordinated debt - August 2008 (Current balance $9.3 million)

Private placement of $12.1 million of subordinated debt - August 2008 (Current balance $9.3 million) Fidelity & Trust Financial Corporation (“F&T”) acquisition completed - August 31, 2008

Fidelity & Trust Financial Corporation (“F&T”) acquisition completed - August 31, 2008 $1.4 billion of assets upon completion of acquisition

$1.4 billion of assets upon completion of acquisition Placed $38.2 million of TARP Preferred Stock - December, 2008 (Current balance $23.2 million)

Placed $38.2 million of TARP Preferred Stock - December, 2008 (Current balance $23.2 million) $55 million common stock offering - September, 2009

$55 million common stock offering - September, 2009 Reached $2.0 billion in assets - September, 2010

Reached $2.0 billion in assets - September, 2010

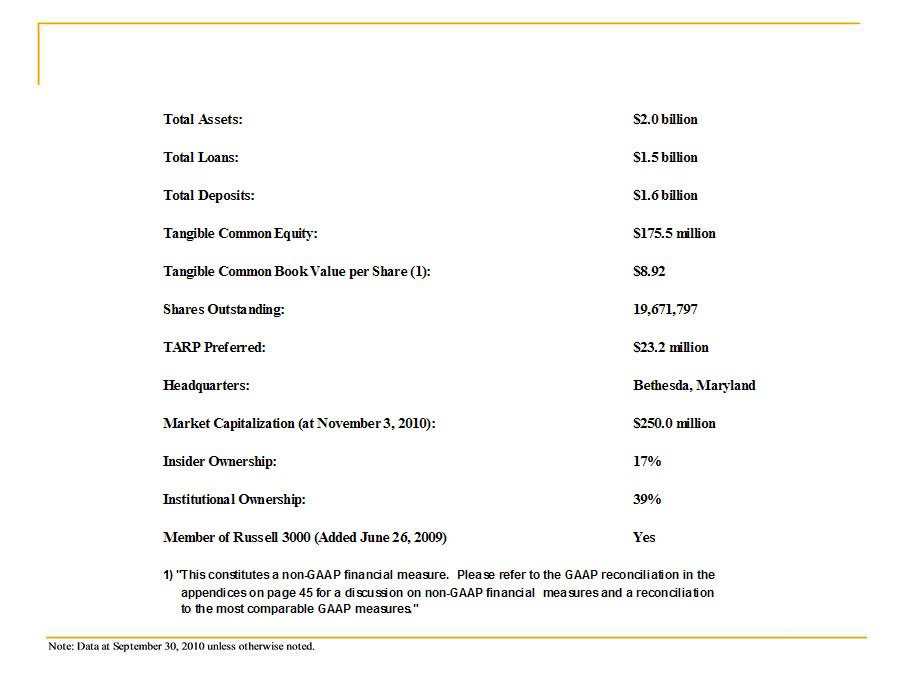

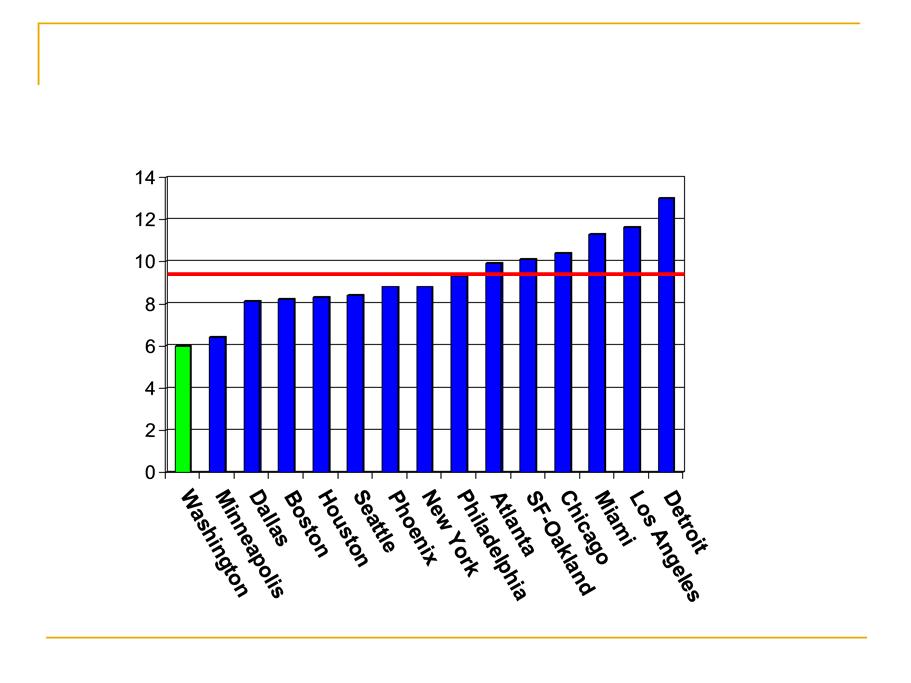

Population 6.2 Million

Population 6.2 Million 5th largest market in the U.S.

5th largest market in the U.S. Employment 2.9 Million

Employment 2.9 Million Average annual job creation is 37,500

Average annual job creation is 37,500 Highest in net new job growth in the U.S. over last decade

Highest in net new job growth in the U.S. over last decade Washington DC Metro area has highest concentration of fastest

Washington DC Metro area has highest concentration of fastest Gross Regional Product (GRP) $443 Billion

Gross Regional Product (GRP) $443 Billion 5th largest regional economy in the U.S.

5th largest regional economy in the U.S. 5.3% CAGR in GRP over last 20 years

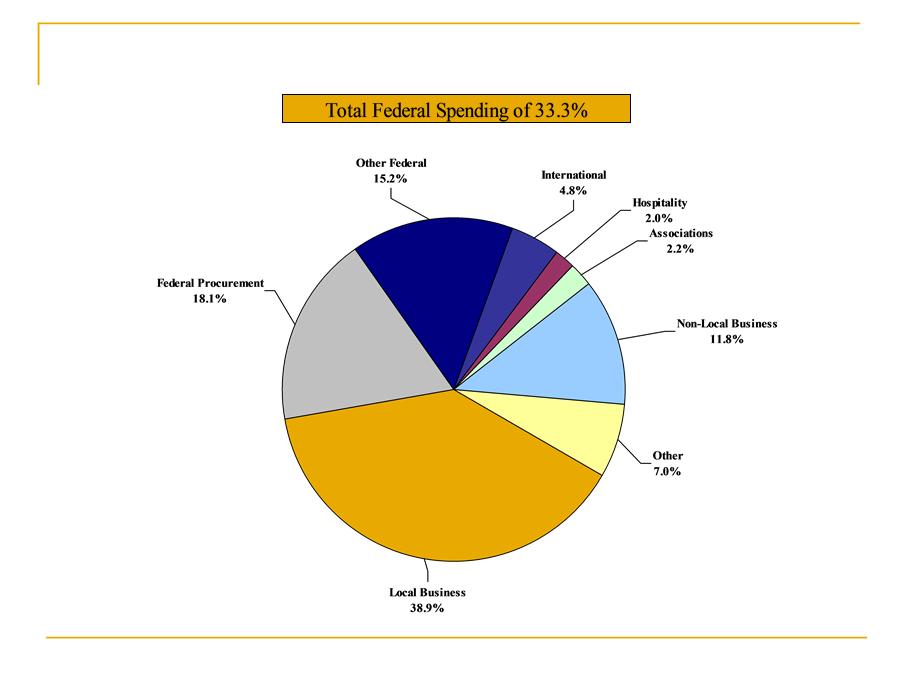

5.3% CAGR in GRP over last 20 years Federal Government Spending is 33.3% of GRP

Federal Government Spending is 33.3% of GRP

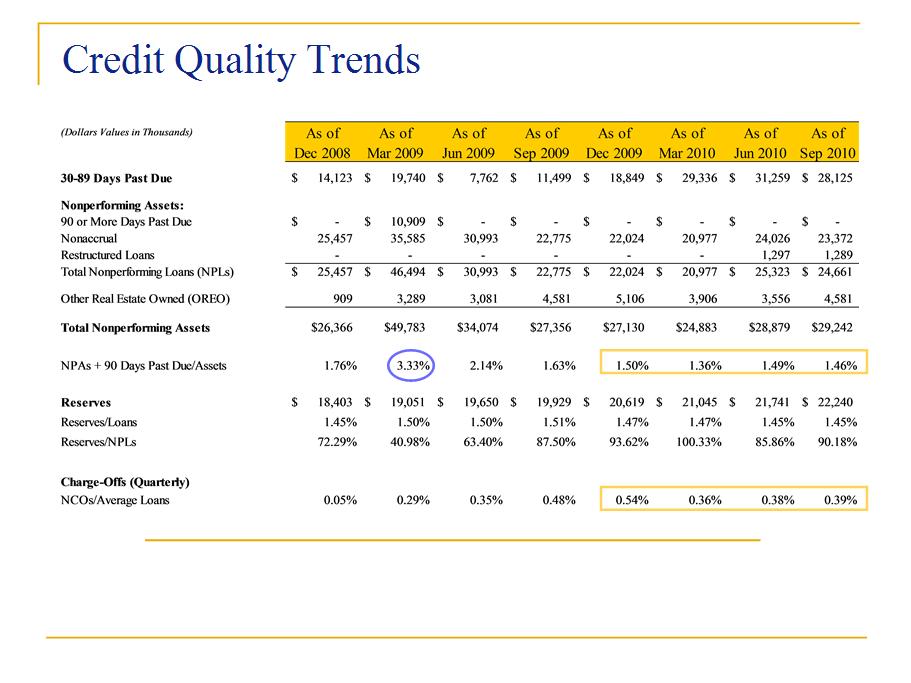

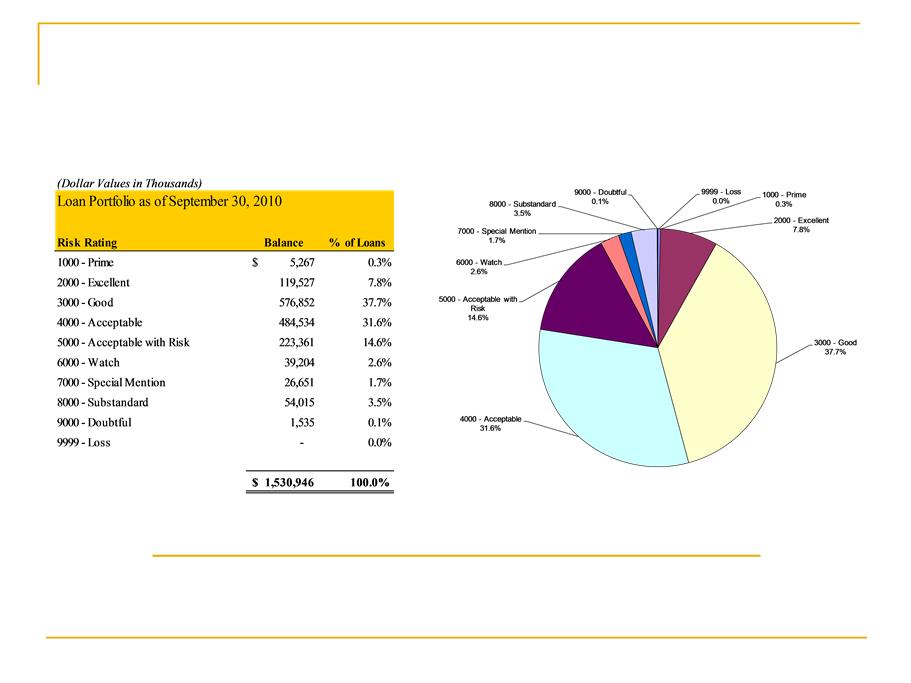

Asset Quality remains at a very strong level

Asset Quality remains at a very strong level An adequate Allowance is being maintained

An adequate Allowance is being maintained

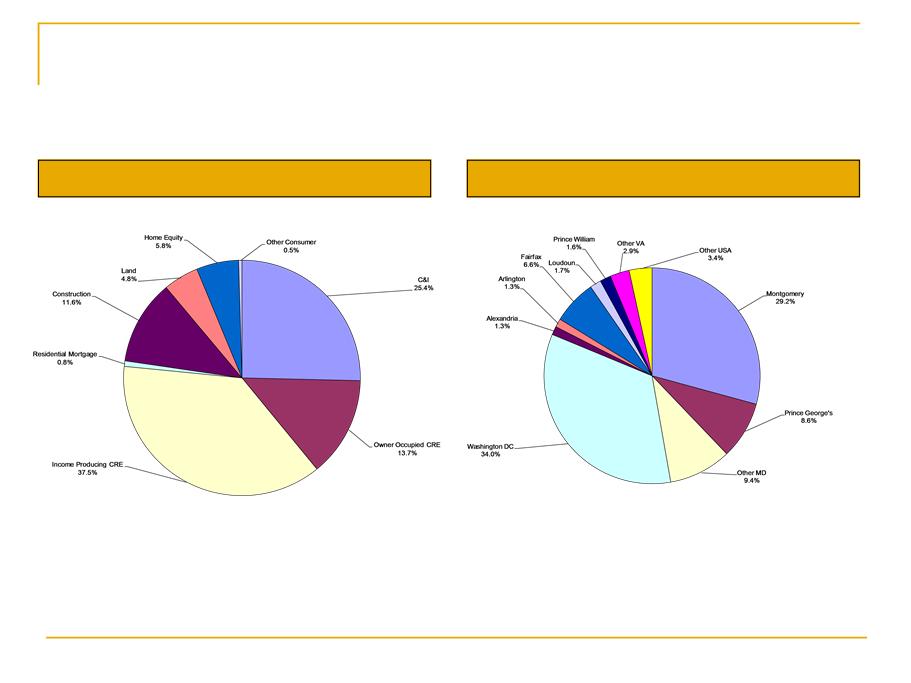

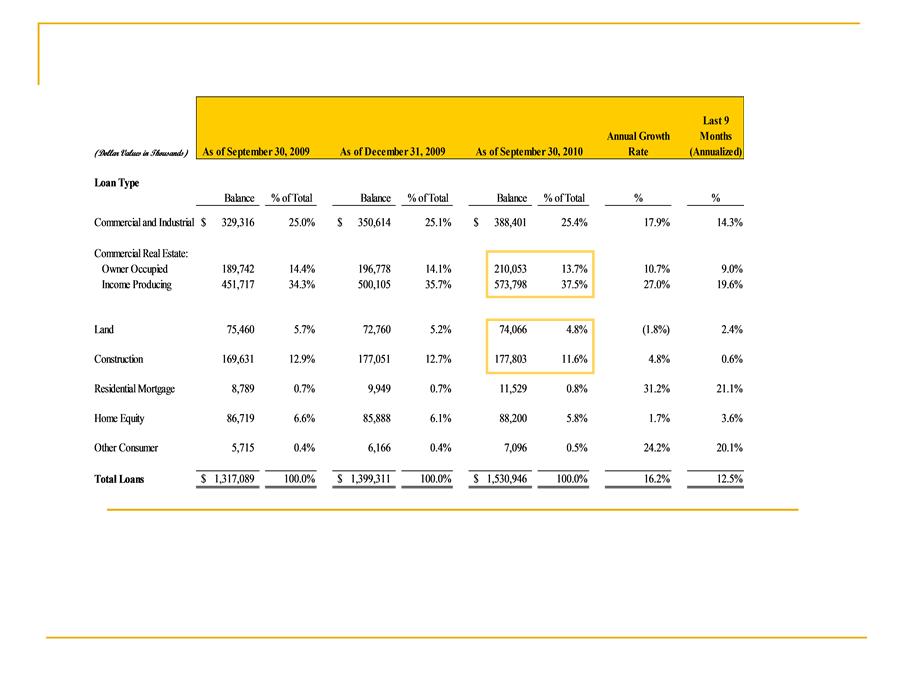

Focus on reducing construction as a percentage of the overall portfolio

Focus on reducing construction as a percentage of the overall portfolio Continued effort to grow C&I and Owner Occupied loans

Continued effort to grow C&I and Owner Occupied loans

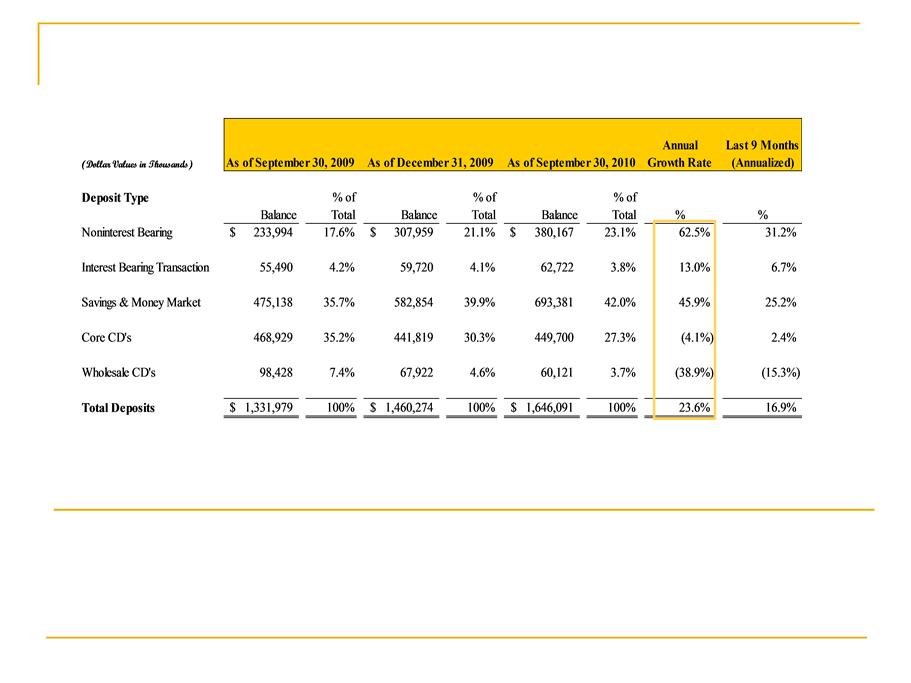

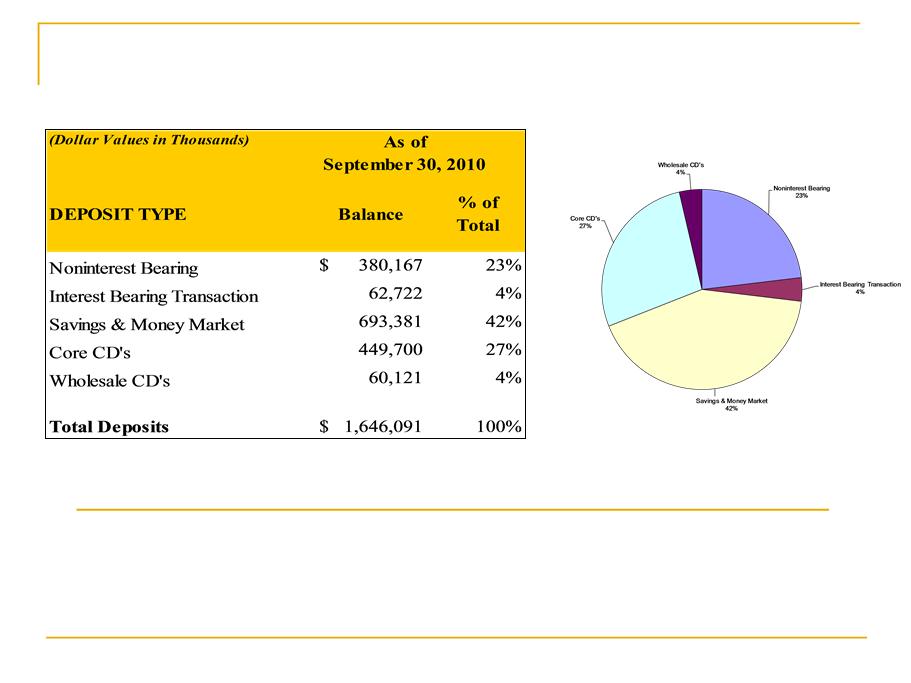

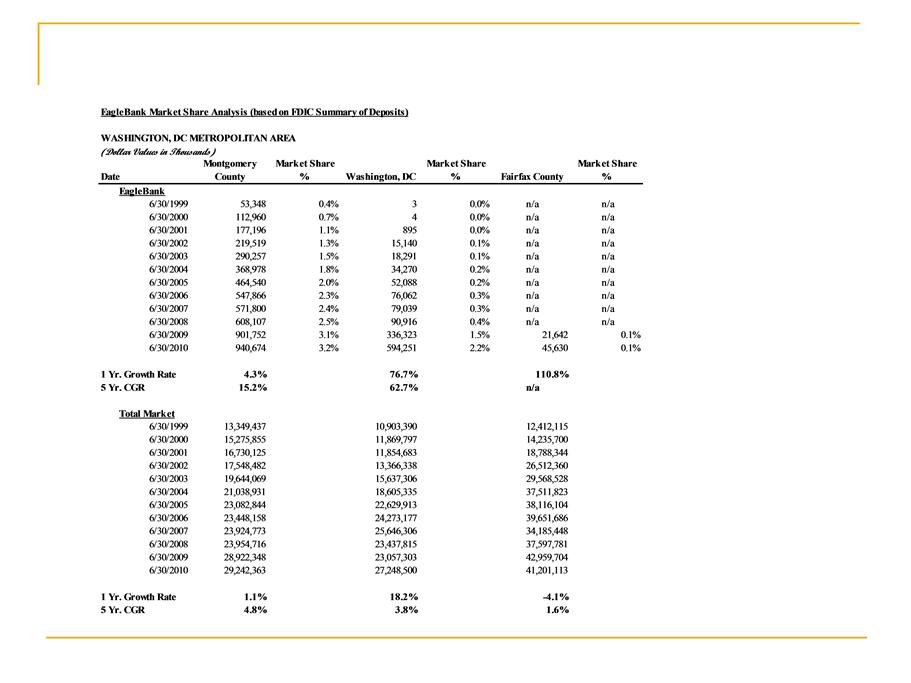

Commercial focus drives growth of Non-interest Bearing Demand accounts

Commercial focus drives growth of Non-interest Bearing Demand accounts Taking business from regional/super-regional banks, but demanding relationship pricing

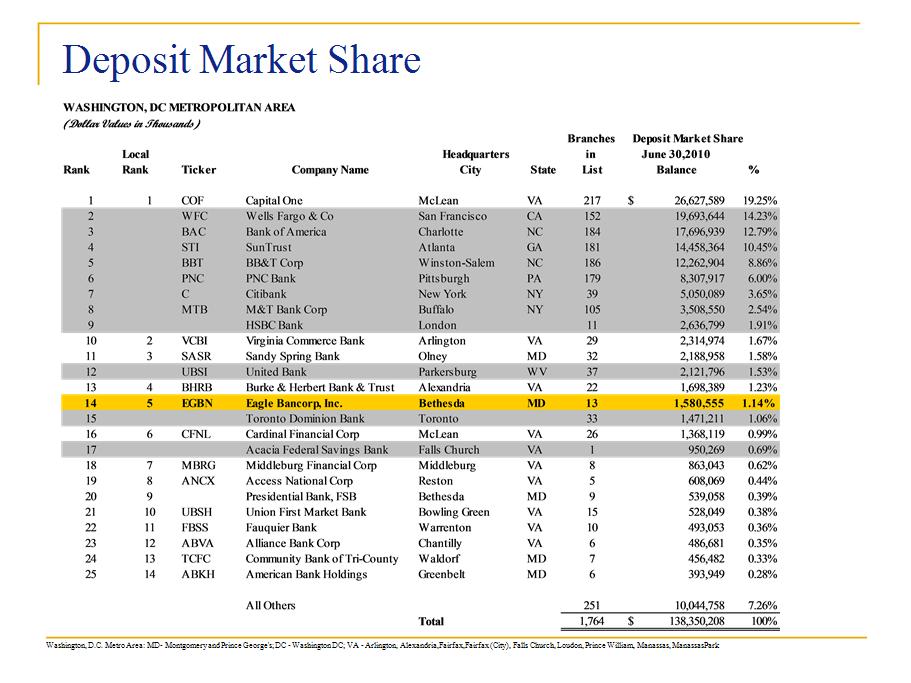

Taking business from regional/super-regional banks, but demanding relationship pricing Still have tremendous opportunity based on current market share in DC Metro Area

Still have tremendous opportunity based on current market share in DC Metro Area

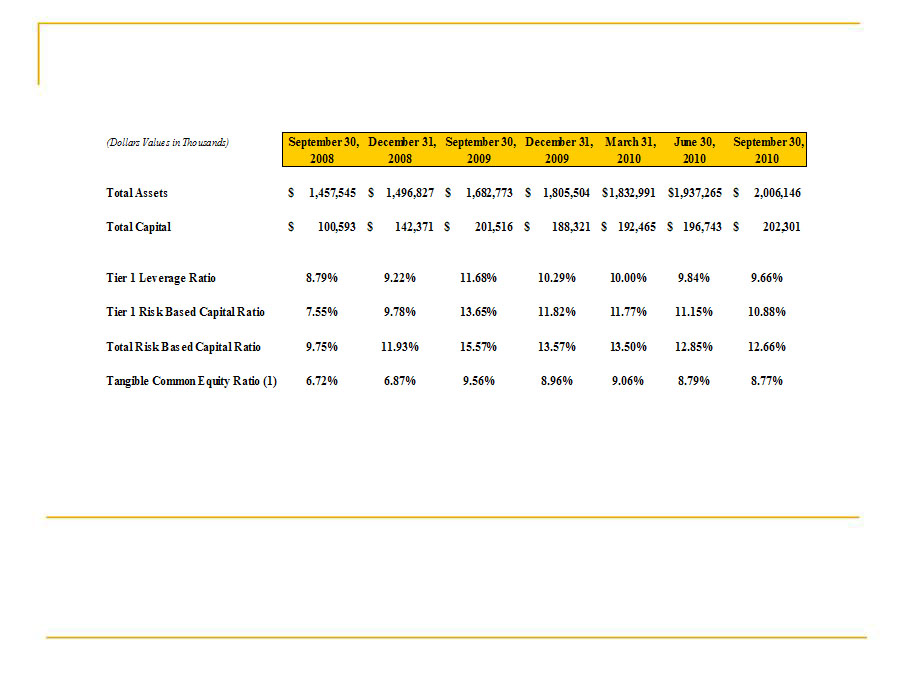

$12.1 million of Sub-debt raised in August, 2008, $2.9 million repaid in September, 2009

$12.1 million of Sub-debt raised in August, 2008, $2.9 million repaid in September, 2009 $38.2 million of TARP Preferred Stock placed in December, 2008, $15 million redeemed in

$38.2 million of TARP Preferred Stock placed in December, 2008, $15 million redeemed in $55.2 million raised through common stock offering in September, 2009

$55.2 million raised through common stock offering in September, 2009

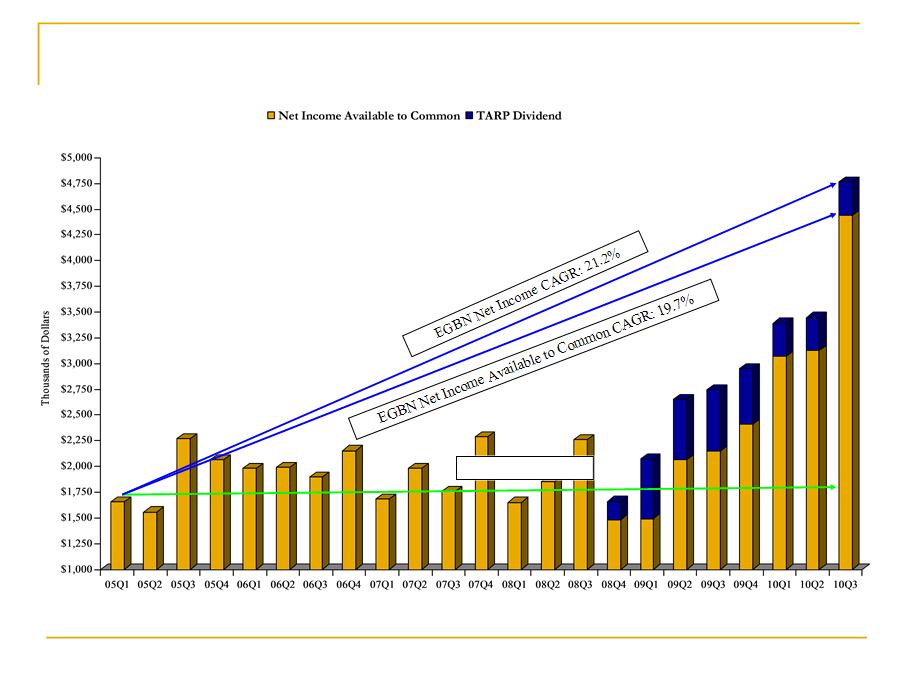

Focus on organic growth

Focus on organic growth Profitability

Profitability Potential acquisitions

Potential acquisitions Continued emphasis on credit quality

Continued emphasis on credit quality

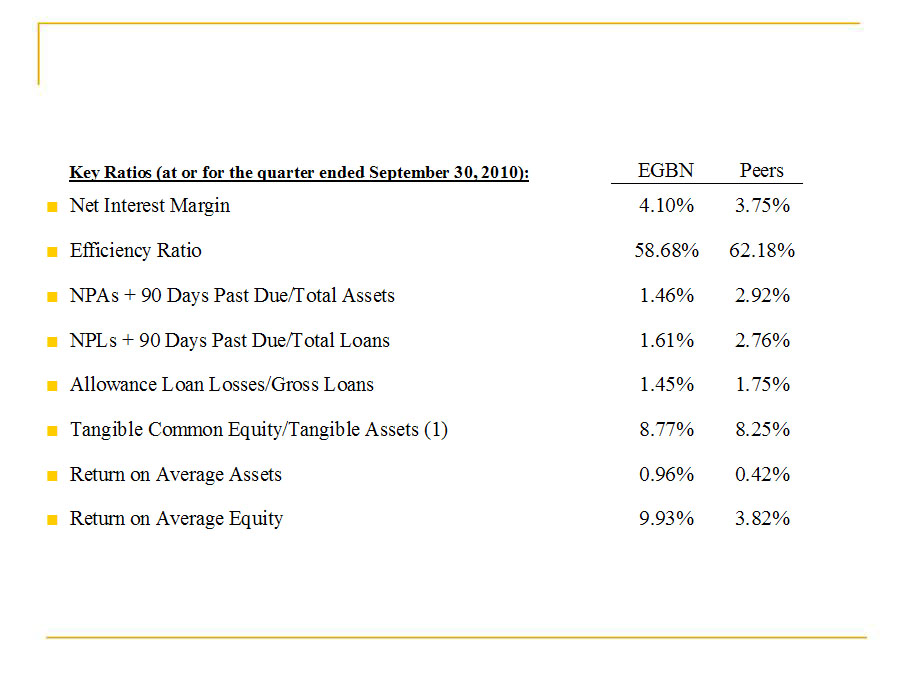

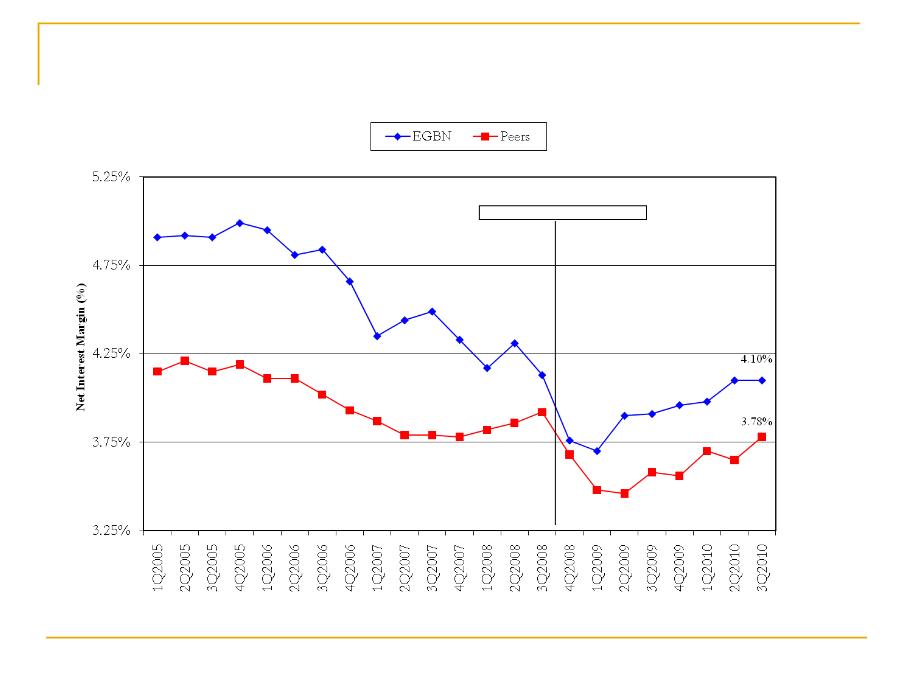

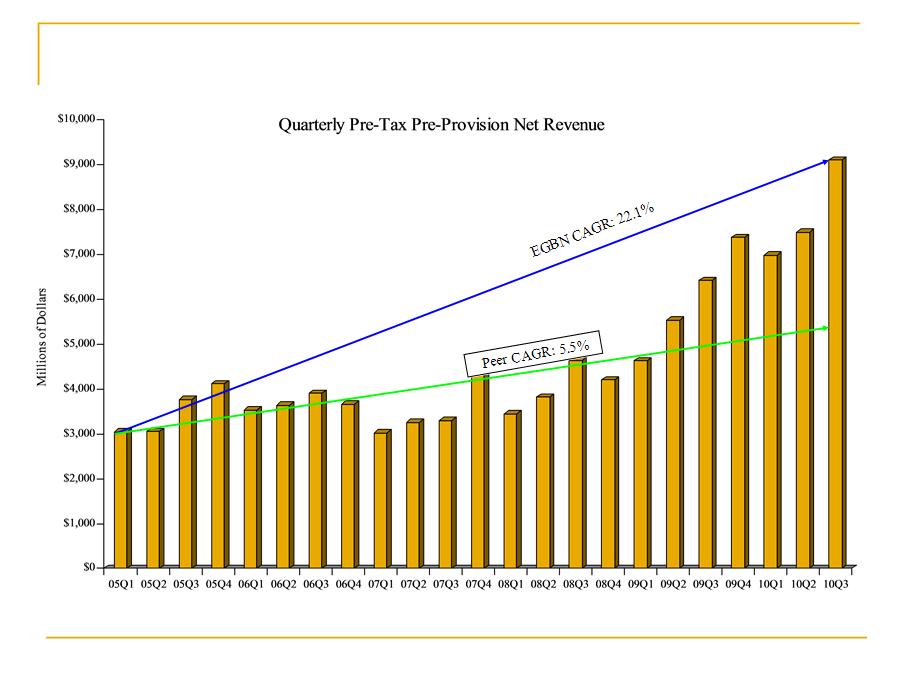

Driven by Profitability

Driven by Profitability Superior Net Interest Margin

Superior Net Interest Margin Emphasis on Core Deposits and Deep Relationship Banking

Emphasis on Core Deposits and Deep Relationship Banking Strong Organic Growth

Strong Organic Growth Geographic Market Positioning

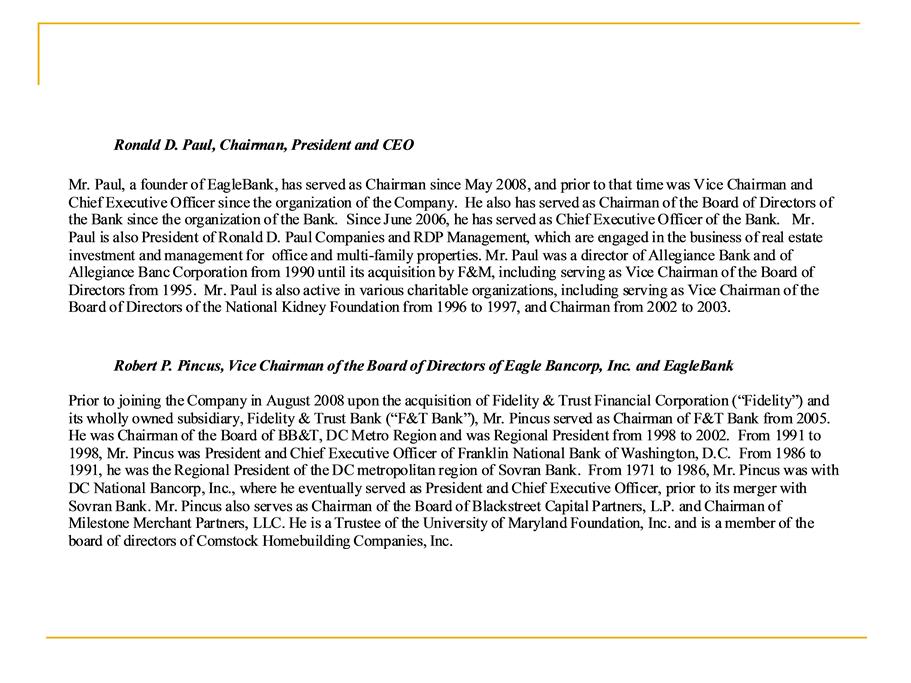

Geographic Market Positioning Experienced and Dedicated Board and Management Team - 17% Insider Ownership

Experienced and Dedicated Board and Management Team - 17% Insider Ownership Exceptional Asset Quality Record

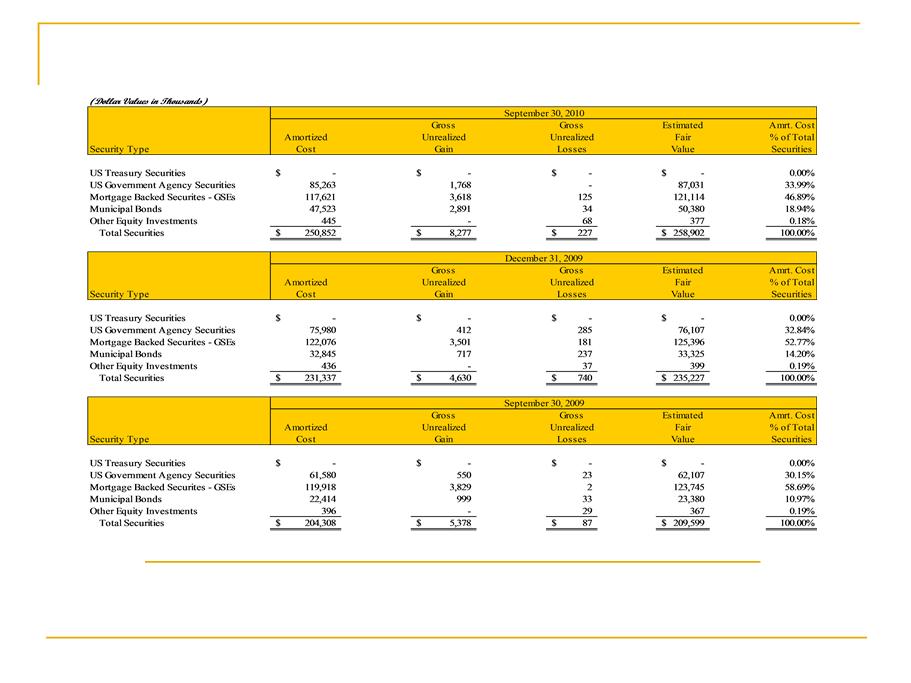

Exceptional Asset Quality Record Conservative Securities Portfolio

Conservative Securities Portfolio Proven Ability to Execute Acquisitions

Proven Ability to Execute Acquisitions

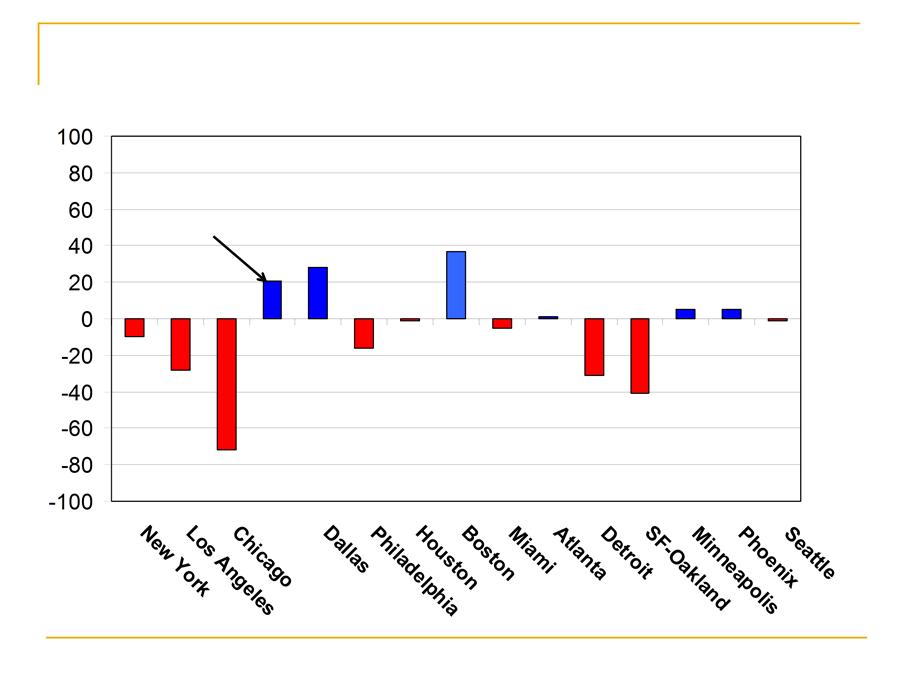

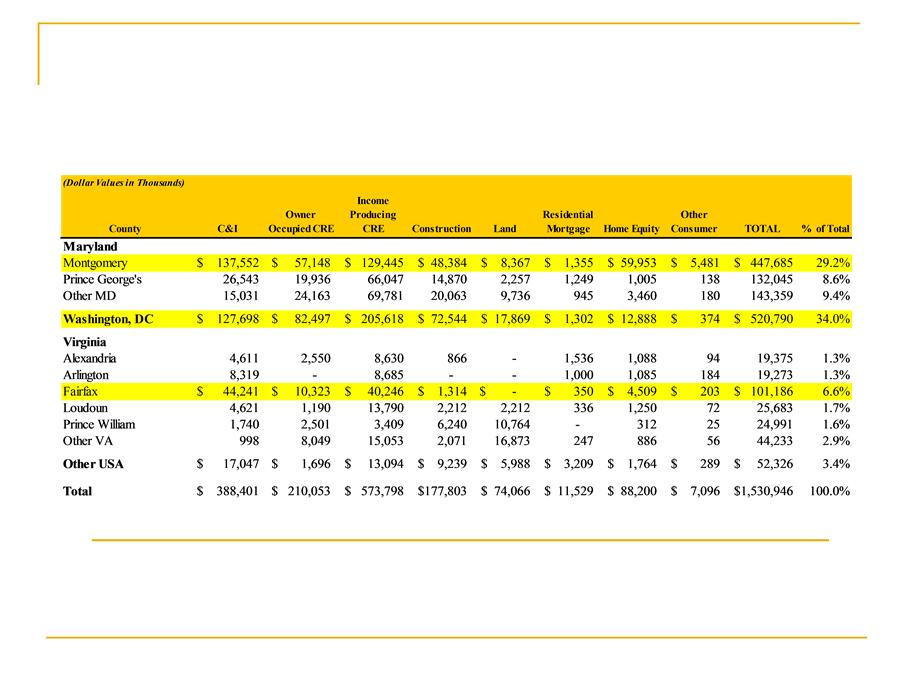

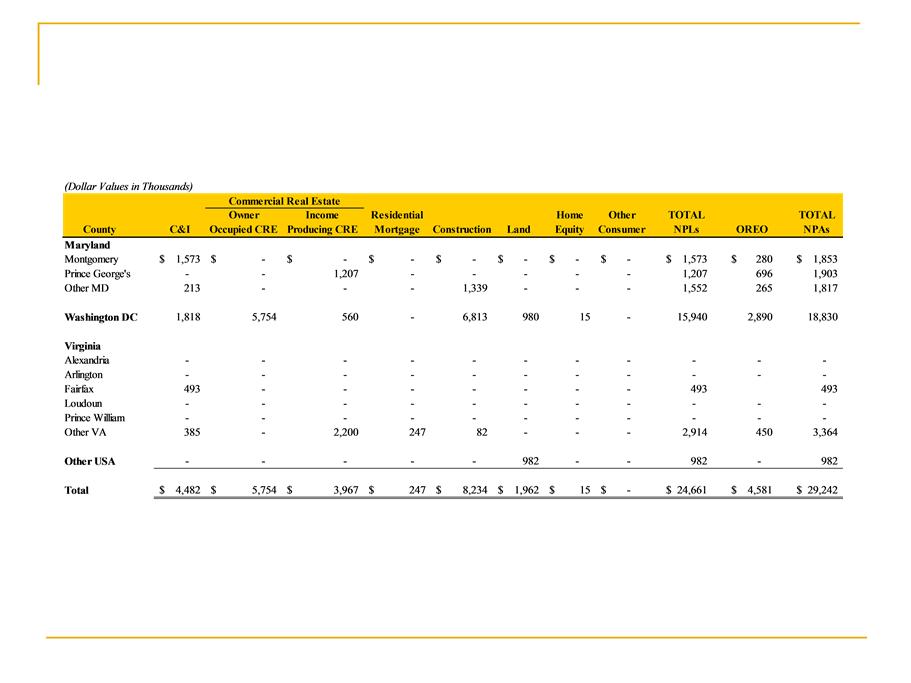

Concentration in quality markets: Washington, DC, Montgomery County,

Concentration in quality markets: Washington, DC, Montgomery County, Low levels of exposure to markets hit hardest by real estate downturn

Low levels of exposure to markets hit hardest by real estate downturn

Loan portfolio and risk ratings reviewed by independent, third-party

Loan portfolio and risk ratings reviewed by independent, third-party

Commercial focus drives growth of Non-Interest Bearing Demand accounts

Commercial focus drives growth of Non-Interest Bearing Demand accounts Taking market share from regional/super-regional banks, but demanding relationship

Taking market share from regional/super-regional banks, but demanding relationship Quickly becoming the leading community bank in Washington DC Metro Area

Quickly becoming the leading community bank in Washington DC Metro Area

Portfolio has $8.1 million of net unrealized gains at September 30, 2010

Portfolio has $8.1 million of net unrealized gains at September 30, 2010 No holdings of GSE equities or bank Trust Preferred or bank Trust Preferred CDOs

No holdings of GSE equities or bank Trust Preferred or bank Trust Preferred CDOs Average life of portfolio is 3.2 years

Average life of portfolio is 3.2 years Excludes Federal Reserve and Federal Home Loan Bank stock

Excludes Federal Reserve and Federal Home Loan Bank stock

Evaluated many acquisition opportunities in 12 year history and

Evaluated many acquisition opportunities in 12 year history and Acquisition of F&T completed on August 31, 2008

Acquisition of F&T completed on August 31, 2008 System conversion successfully completed one week after close

System conversion successfully completed one week after close Targeted expense savings achieved in methodical and thoughtful

Targeted expense savings achieved in methodical and thoughtful Contributions from key F&T employees have been meaningful

Contributions from key F&T employees have been meaningful Adopted best practices of both companies

Adopted best practices of both companies

Strategic Matters:

Strategic Matters: Strong cultural match

Strong cultural match Both institutions were growth oriented

Both institutions were growth oriented Both institutions were “high touch”

Both institutions were “high touch” Both institutions were “well connected” to community

Both institutions were “well connected” to community Financial Matters:

Financial Matters: Stock-for-stock transaction - 1,638,031 shares issued

Stock-for-stock transaction - 1,638,031 shares issued Acquisition cost - $13.1 million

Acquisition cost - $13.1 million Price to book value 83%

Price to book value 83% Business Matters:

Business Matters: Additional six banking offices in Maryland, Washington, DC and Tysons Corner

Additional six banking offices in Maryland, Washington, DC and Tysons Corner 79 additional employees

79 additional employees Total assets acquired: $471 million

Total assets acquired: $471 million Total loans acquired: $361 million

Total loans acquired: $361 million Total securities acquired: $ 99 million

Total securities acquired: $ 99 million Total deposits acquired: $385 million

Total deposits acquired: $385 million

Increase in FDIC Limit to $250,000 is a plus

Increase in FDIC Limit to $250,000 is a plus Revision to FDIC assessment base is a relative benefit to

Revision to FDIC assessment base is a relative benefit to No impact on EagleBank from the Volker Rule

No impact on EagleBank from the Volker Rule No direct impact on EagleBank from new derivatives rules.

No direct impact on EagleBank from new derivatives rules. Current organization structure is equipped to manage reporting

Current organization structure is equipped to manage reporting Modest impact to Debit and Credit Card fees

Modest impact to Debit and Credit Card fees New proxy rules are similar to prior experience from TARP

New proxy rules are similar to prior experience from TARP

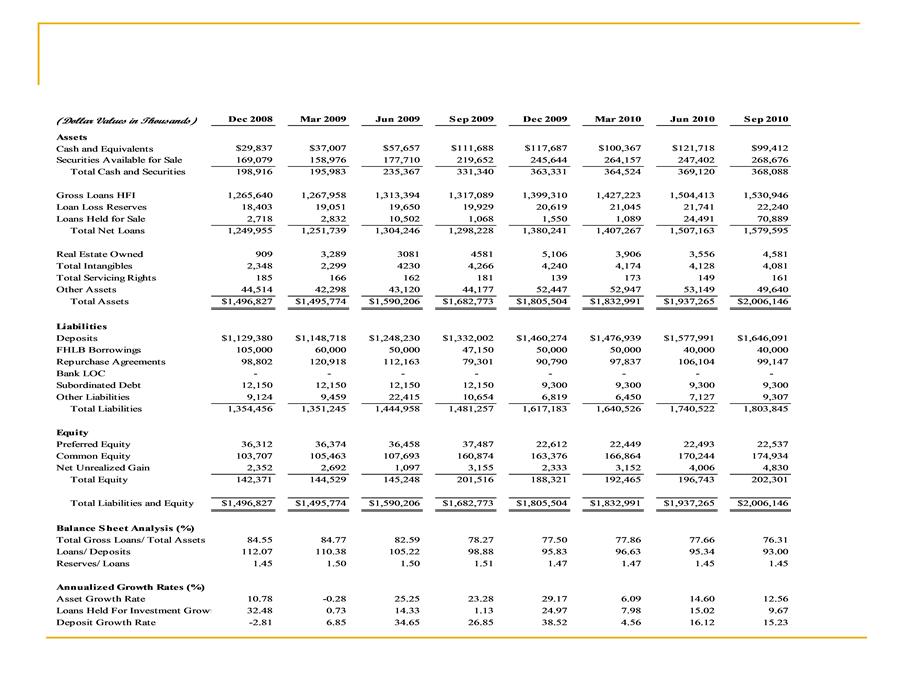

September 30, | December 31, | September 30, | December 31, | March 31, | June 30, | September 30, | |

(dollars in thousands except per share data) | 2008 | 2008 | 2009 | 2009 | 2010 | 2010 | 2010 |

Common stockholders' equity | $ 100,593 | $ 105,259 | $ 164,975 | $ 165,709 | $ 170,016 | $ 174,250 | $ 179,764 |

Less: Intangible assets | (2,863) | (2,533) | (4,447) | (4,379) | (4,347) | (4,277) | (4,242) |

Tangible common equity | $ 97,730 | $ 102,726 | $ 160,528 | $ 161,330 | $ 165,669 | $ 169,973 | $ 175,522 |

Book value per common share | $ 7.93 | $ 8.34 | $ 8.46 | $ 8.48 | $ 8.66 | $ 8.87 | $ 9.14 |

Less: Intangible book value per common share | (0.23) | (0.27) | (0.23) | (0.22) | (0.22) | (0.22) | (0.22) |

Tangible book value per common share | $ 7.70 | $ 8.07 | $ 8.23 | $ 8.26 | $ 8.44 | $ 8.65 | $ 8.92 |

Total assets | $ 1,457,545 | $ 1,496,827 | $ 1,682,773 | $ 1,805,504 | $ 1,832,991 | $ 1,937,265 | $ 2,006,146 |

Less: Intangible assets | (2,863) | (2,533) | (4,447) | (4,379) | (4,347) | (4,277) | (4,242) |

Tangible assets | $ 1,454,682 | $ 1,494,294 | $ 1,678,326 | $ 1,801,125 | $ 1,828,644 | $ 1,932,988 | $ 2,001,904 |

Tangible common equity ratio | 6.72% | 6.87% | 9.56% | 8.96% | 9.06% | 8.79% | 8.77% |

Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per common share are non-GAAP financial | |||||||

measures derived from GAAP-based amounts. We calculate tangible common equity to tangible assets by excluding the balance of intangible assets | |||||||

common stockholders' equity and dividing by tangible assets. We calculate tangible book value per common share by dividing tangible common equity | |||||||

by common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholders' equity by common | |||||||

shares outstanding. We believe that this information is important to shareholders' as tangible equity is a measure that is consistent with the | |||||||

calculation of capital for bank regulatory purposes, which excludes intangible assets from the calculation of risk based ratios. | |||||||