Exhibit 99.1

Ticker: EGBN www.EagleBankCorp.com Investor Presentation November 2017

1 Forward Looking Statements This presentation contains forward looking statements within the meaning of the Securities and Exchange Act of 1934 , as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions . In some cases, forward - looking statements can be identified by use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases . These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty . For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company’s Annual Report on Form 10 - K and other periodic and current reports filed with the SEC . Because of these uncertainties and the assumptions on which this discussion and the forward - looking statements are based, actual future operations and results in the future may differ materially from those indicated herein . Readers are cautioned against placing undue reliance on any such forward - looking statements . The Company’s past results are not necessarily indicative of future performance . The Company does not undertake to publicly revise or update forward - looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law . This presentation was delivered digitally . The Company makes no representation that subsequent to delivery of the presentation it was not altered . For the most current, accurate information, please refer to www . eaglebankcorp . com and go to the Investor Relations tab . For further information on the Company please contact : Michael T . Flynn 240 - 497 - 2040 mflynn@eaglebankcorp . com

2 Company Overview ▪ Eagle Bancorp, Inc. is a growth - oriented community bank headquartered in Bethesda, Maryland ▪ Focused on the Washington, DC metropolitan area, with 21 branches ▪ Commercially - oriented business model with deep relationships of loans, core deposits and related products ▪ #1 in deposit market share among community banks headquartered in the Washington, DC metropolitan area ▪ Largest market capitalization of any community bank based in the Washington, DC metropolitan area ▪ L argest and most profitable bank headquartered and operating in the state of Maryland

3 Investment Highlights ▪ Focused on Profitability and Balanced Financial Performance ▪ Strong Net Interest Margin = 4.14% ▪ Clean Asset Quality: NPAs/Assets = 0.24% ▪ Low Charge - Off History: NCOs/Average Loans = 0.00% ▪ Driven by Long - Term, Deep Customer Relationships ▪ Demonstrated Consistent Organic Growth ▪ Strategic Geographic Market Positioning ▪ Dedicated Board Focused on Vision ▪ Proven Ability to Evaluate and Execute Acquisitions NOTE: Financial data at or for the quarter ended September 30, 2017.

Experienced Senior Management Team 4 Years Years in with Name Title/Function Banking EGBN Ronald D. Paul Chairman, President & CEO 30 19 Susan G. Riel Sr. EVP & COO - EagleBank, EVP Eagle Bancorp 41 19 Charles D. Levingston EVP & Chief Financial Officer - Eagle Bancorp & EagleBank 17 6 Laurence E. Bensignor EVP & General Counsel - Eagle Bancorp & EagleBank 7 7 Antonio F. Marquez EVP & Chief Real Estate Lending Officer 32 6 Lindsey S. Rheaume EVP & Chief C&I Lending Officer 32 3 Janice L. Williams EVP & Chief Credit Officer 23 14

5 Summary Statistics NOTE: Data at September 30, 2017 unless otherwise noted. (1) Please refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. Total Assets: $7.4 billion Total Loans: $6.1 billion Total Deposits: $5.9 billion Tangible Common Equity: $826.8 million (1) Tangible Book Value per Common Share: $24.19 (1) Shares Outstanding (at close October 31, 2017): 34,178,014 Market Capitalization (at close October 31, 2017): $2.28 billion Insider Ownership: 10.1% Institutional Ownership: 68% Member of Russell 2000 Yes

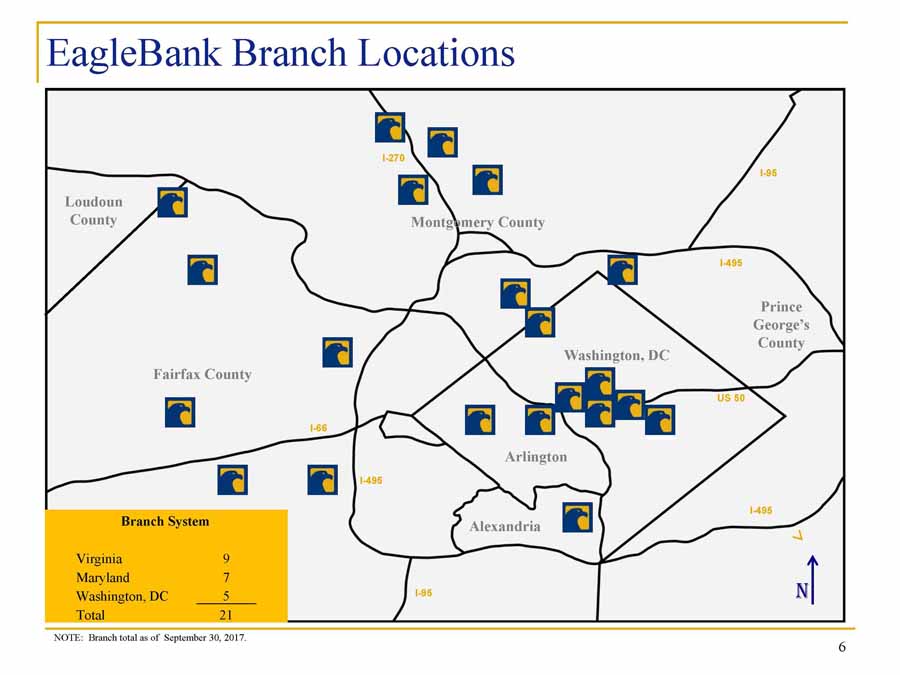

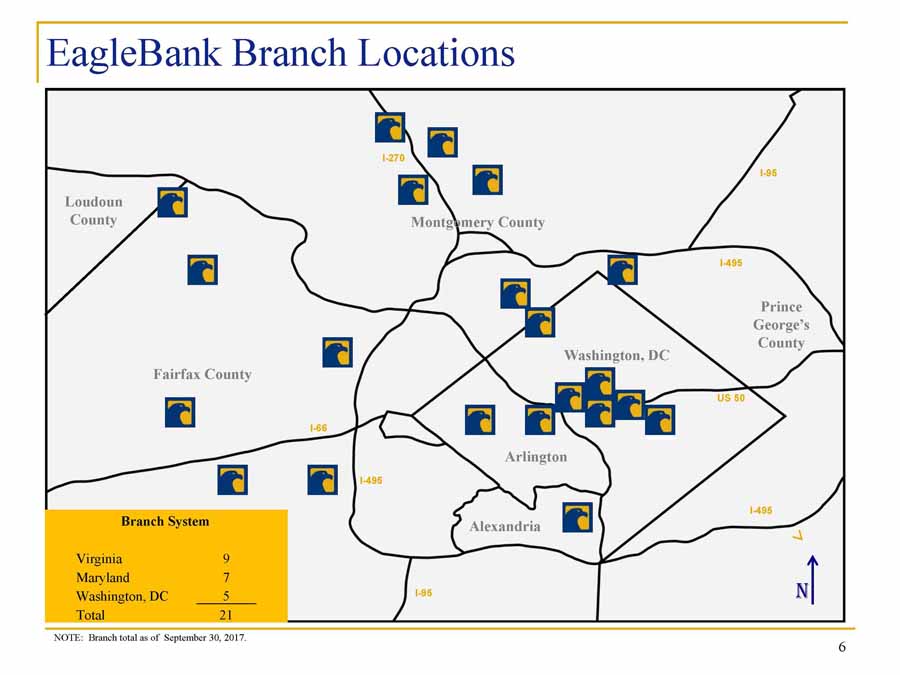

EagleBank Branch Locations Montgomery County Prince George’s County Fairfax County Loudoun County Washington, DC N I - 270 I - 95 I - 495 US 50 I - 95 I - 495 I - 66 I - 495 Branch System Virginia 9 Maryland 7 Washington, DC 5 Total 21 NOTE: Branch total as of September 30, 2017. Arlington Alexandria 6

(Dollar values in thousands) Washington, DC Metropolitan Area Local June 30, June 30, 2017 Community 2016 2017 Annual Market Rank Banks Company Name Branches Balance Balance Growth Share 1 Bank of America Corp. 153 30,275,134 31,960,708 5.6% 16.1% 2 Wells Fargo & Co. 163 31,872,851 31,634,621 -0.7% 15.9% 3 Capital One Financial Corp. 136 25,654,173 27,715,433 8.0% 13.9% 4 SunTrust Banks Inc. 156 18,602,750 19,627,554 5.5% 9.9% 5 BB&T Corp. 183 13,470,334 13,923,629 3.4% 7.0% 6 PNC Financial Services Group Inc. 181 12,496,495 13,684,214 9.5% 6.9% 7 United Bankshares Inc. 70 5,386,027 8,587,160 59.4% 4.3% 8 Citigroup Inc. 34 7,911,000 8,115,000 2.6% 4.1% 9 1 Eagle Bancorp Inc. 21 5,404,317 5,953,269 10.2% 3.0% 10 M&T Bank Corp 77 4,241,489 4,433,787 4.5% 2.2% 11 Toronto-Dominion Bank 48 3,164,248 3,952,541 24.9% 2.0% 12 2 *Sandy Spring Bancorp Inc. 34 2,741,591 3,006,830 9.7% 1.5% 13 3 Burke & Herbert Bank & Trust Co. 25 2,262,071 2,342,964 3.6% 1.2% 14 HSBC Holdings Plc 12 2,289,874 2,334,734 2.0% 1.2% 15 4 Access National Bank 16 1,054,862 2,147,518 103.6% 1.1% 16 5 *WashingtonFirst Bankshares Inc. 19 1,563,287 1,750,497 12.0% 0.9% 17 6 Revere Bank 8 802,715 1,385,487 72.6% 0.7% 18 Union Bank & Trust 18 1,190,392 1,379,334 15.9% 0.7% 19 7 *Old Line Bank 14 961,395 1,068,276 11.1% 0.5% 20 8 John Marshall Bank 6 762,331 879,000 15.3% 0.4% 21 9 Capital Bank 3 718,690 865,655 20.4% 0.4% 22 10 First Virginia Community Bank 6 678,504 857,408 26.4% 0.4% 23 11 Community Bank of the Chesapeake 9 723,726 817,956 13.0% 0.4% 24 12 Congressional Bank 6 677,495 750,723 10.8% 0.4% 25 13 The Fauqier Bank 11 540,897 572,199 5.8% 0.3% All Other Market Participants 184 13,033,151 8,973,375 -31.1% 4.5% Market Total 1,593 188,479,799 198,719,872 5.4% 100.0% 7 Deposit Market Share NOTE: Washington , D.C. Metro Area as defined in FDIC Summary of Deposits Report. Data excludes: E*Trade whose deposits are substantially from outside of the defined market area. * Merger Pending. SOURCE: FDIC , as of June 30, 2016 and June 30, 2017. 78.1%

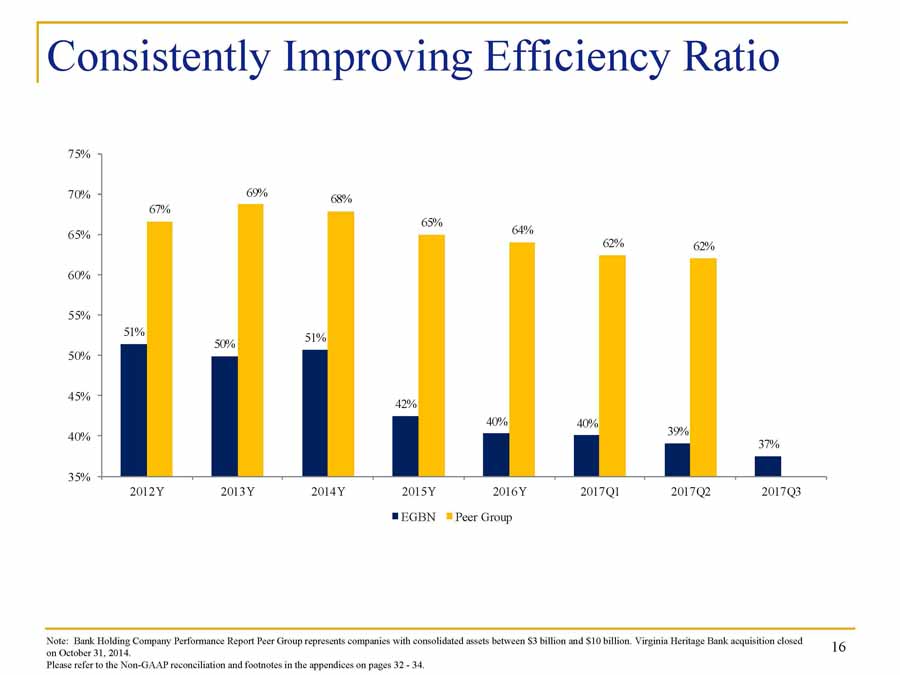

Performance Statistics NOTE: (1) Bank Holding Company Performance Report Peer Group represents companies with consolidated assets between $3 billion an d $10 billion. (2) Please refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. * Impact of July 2016 Sub - Debt raise in 2016Y was (9bps) and Q1 2017 was (16bps) . 8 Peer Group (1) Key Ratios (at or for the period ended) 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 2017Q2 ■ Net Interest Margin 4.30% 4.44% 4.33% 4.16%* 4.14%* 4.16% 4.14% 3.48% ■ Efficiency Ratio 49.90% 50.67% 42.49% 40.29% 40.06% 39.10% 37.49% 62.01% ■ NPAs + 90 Days Past Due/Total Assets 0.90% 0.68% 0.31% 0.30% 0.22% 0.26% 0.24% 0.58% ■ Allowance Loan Losses/Gross Loans 1.39% 1.07% 1.05% 1.04% 1.03% 1.02% 1.03% 0.99% ■ Reserve/NPLs (Coverage Ratio) 165.66% 205.30% 397.95% 330.49% 416.91% 356.00% 379.11% 231.61% ■ Net Charge-Offs to Average Loans (annualized) 0.23% 0.17% 0.17% 0.09% 0.04% 0.02% 0.00% 0.07% ■ Tangible Common Equity/Tangible Assets (2) 8.86% 8.54% 10.56% 10.84% 10.97% 11.15% 11.35% N/A ■ Tier 1 Leverage Ratio 10.93% 10.69% 10.90% 10.72% 11.51% 11.61% 11.78% 10.02% ■ Return on Average Assets 1.37% 1.31% 1.49% 1.52% 1.62% 1.60% 1.66% 1.04% ■ Return on Average Common Equity 14.60% 13.50% 12.32% 12.27% 12.74% 12.51% 12.86% 6.62% ■ Earnings Per Share (Diluted) $1.76 $1.95 $2.50 $2.86 $0.79 $0.81 $0.87 N/A EGBN

$0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 $7,000 $7,500 Millions of Dollars 12Q3 12Q4 13Q1 13Q2 13Q3 13Q4 14Q1 14Q2 14Q3 14Q4 15Q1 15Q2 15Q3 15Q4 16Q1 16Q2 16Q3 16Q4 17Q1 17Q2 17Q3 Total Assets Consistent Balance Sheet Growth NOTE: Virginia Heritage Bank acquisition closed on October 31, 2014. 9

$8,000 $9,000 $10,000 $11,000 $12,000 $13,000 $14,000 $15,000 $16,000 $17,000 $18,000 $19,000 $20,000 $21,000 $22,000 $23,000 $24,000 $25,000 $26,000 $27,000 $28,000 $29,000 $30,000 Thousands of Dollars 12Q3 12Q4 13Q1 13Q2 13Q3 13Q4 14Q1 14Q2 14Q3 14Q4 15Q1 15Q2 15Q3 15Q4 16Q1 16Q2 16Q3 16Q4 17Q1 17Q2 17Q3 Net Income Available to Common SBLF Dividend Consistent Net Income Growth $29,874 10 NOTE: Virginia Heritage Bank acquisition closed on October 31, 2014.

4.32% 4.30% 4.44% 4.33% 4.16% 4.14% 4.16% 4.14% 3.59% 3.56% 3.58% 3.49% 3.48% 3.43% 3.48% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 EGBN Peer Group Net Interest Margin NOTE: Bank Holding Company Performance Report Peer Group represents companies with consolidated assets between $3 billion and $10 billion . Virginia Heritage Bank acquisition closed on October 31, 2014 . * Impact of July 2016 Sub - Debt raise in 2016 was (9bps), Q1 2017 was (16bps). 11 * *

0.49% 0.37% 0.33% 0.36% 0.44% 0.56% 0.57% 0.60% 0.68% 0.52% 0.45% 0.42% 0.44% 0.47% 0.49% 0.00% 0.25% 0.50% 0.75% Cost of Funds EGBN Peer Group 4.81% 4.67% 4.77% 4.69% 4.60% 4.70% 4.73% 4.74% 4.35% 4.13% 4.06% 3.93% 3.93% 3.91% 3.96% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Yield on Average Earning Assets EGBN Peer Group Yields and Cost of Funds NOTE: Bank Holding Company Performance Report Peer Group represents companies with consolidated assets between $3 billion and $10 billion. Virginia Heritage Bank acquisition closed on October 31, 2014 . * Impact of July 2016 Sub - Debt Raise in 2016 was (5bps), Q1 2017 was (9bps) to Yield on Average Earnings Assets. The Sub - Deb t raise impact on Cost of Funds in 2016 was 4 bps, Q1 2017 was 7bps. 12 * * * * 5.68% 5.51% 5.37% 5.24% 5.11% 5.13% 5.14% 5.19% 5.32% 4.96% 4.72% 4.48% 4.41% 4.35% 4.41% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Yield on Loans EGBN Peer Group

$1.95 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 EPS (Reported) EPS (Operating) Earnings per Share $2.50 13 $2.08 $1.76 $1.46 NOTE: There was a 10% stock dividend paid on the common stock on June 14, 2013. Virginia Heritage Bank acquisition closed on October 31, 2014. EPS (Operating) for 2014 is net of merger related expenses; Please refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. $2.86 $0.79 $0.81 $0.87

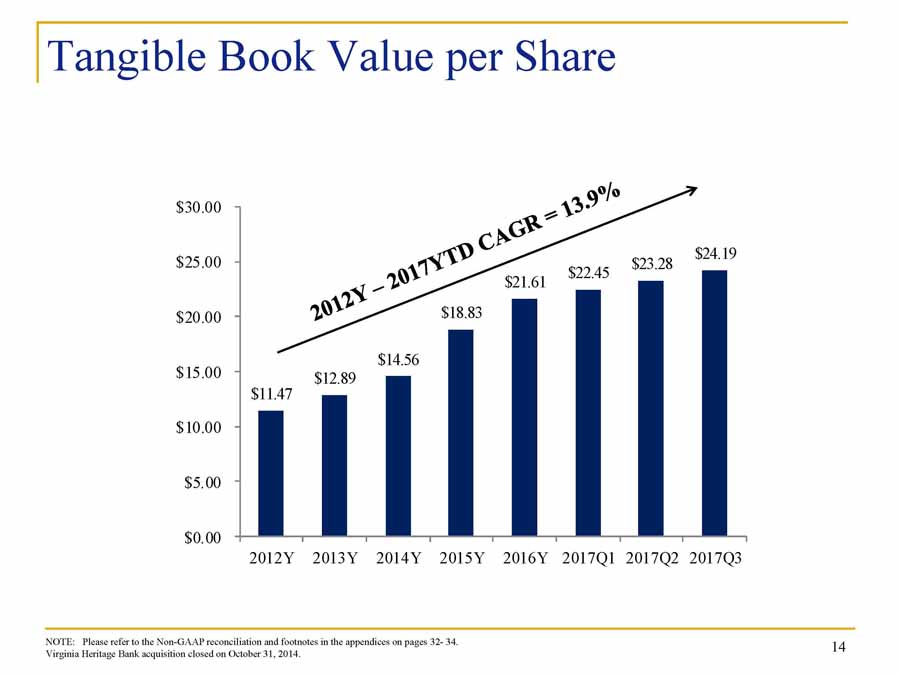

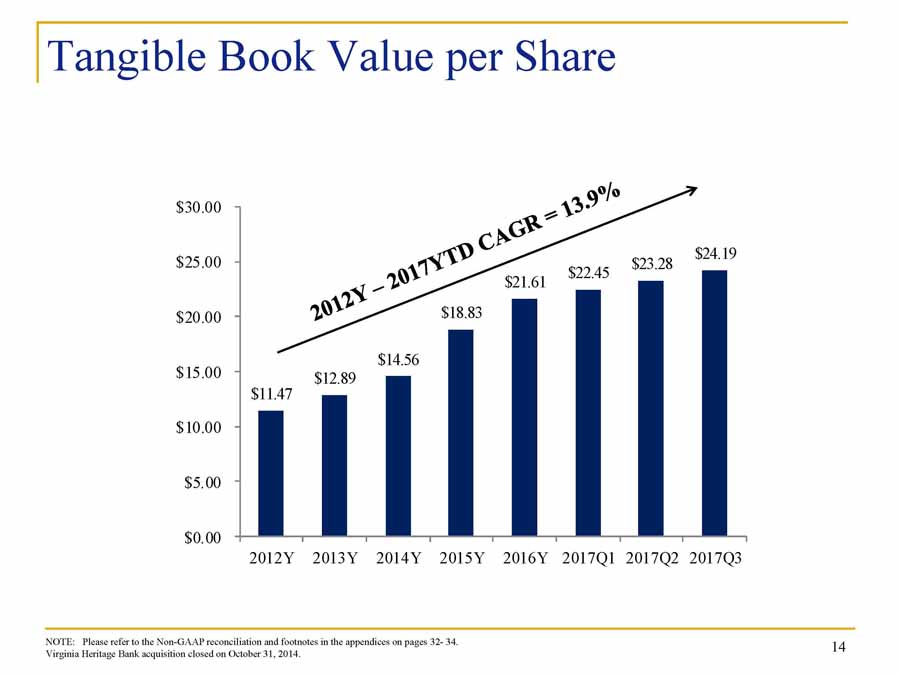

$11.47 $12.89 $14.56 $18.83 $21.61 $22.45 $23.28 $24.19 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Tangible Book Value per Share NOTE: Please refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. Virginia Heritage Bank acquisition closed on October 31, 2014 . 14

$0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 Revenue ($000s) Non-Int Expense ($000s) Consistent Increases in Operating Leverage NOTE: P lease refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. Virginia Heritage Bank acquisition closed on October 31, 2014 . Data for Q2, Q3, Q4 2014 are shown on an operating basis, net of merger related expenses. 15

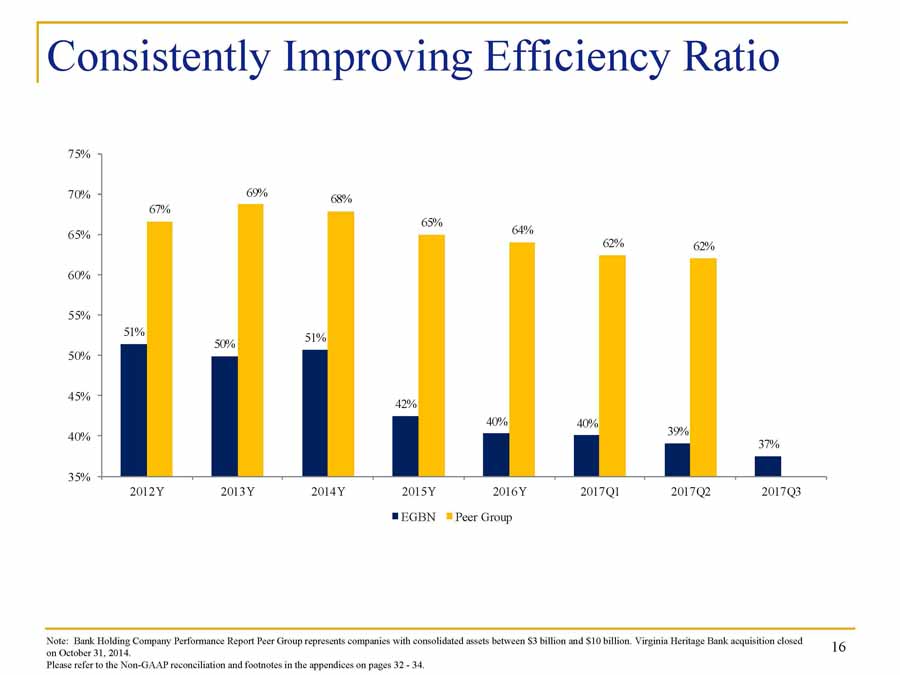

Consistently Improving Efficiency Ratio Note: Bank Holding Company Performance Report Peer Group represents companies with consolidated assets between $3 billion an d $ 10 billion. Virginia Heritage Bank acquisition closed on October 31, 2014 . P lease refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. 16 51% 50% 51% 42% 40% 40% 39% 37% 67% 69% 68% 65% 64% 62% 62% 35% 40% 45% 50% 55% 60% 65% 70% 75% 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 EGBN Peer Group

17 Moderate Interest Rate Risk Position Note: Virginia Heritage Bank acquisition closed on October 31, 2014 . ▪ Both assets and liabilities remain short with repricing durations at 22 months on loans and 20 months on deposits ▪ A 100 bps shock increase would increase Net Interest Income by about $14.5 million or 5.1% on a static balance sheet over a 12 month period (Dollar value in thousands) Interest Rate Indicators and Trends 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Repricing Duration of Assets and Liabilities (months) Investments 45 50 49 47 43 40 38 40 Loans 25 26 27 25 23 22 21 22 Deposits 38 32 34 32 27 27 26 20 Borrowings 17 16 30 40 64 47 40 29 Economic Value of Assets and Liabilities Book Value of Portfolio Loans 2,493,095$ 2,945,158$ 4,312,399$ 4,998,368$ 5,618,820$ 5,827,264$ 5,991,232$ 6,130,063$ Economic Value of Portfolio Loans 2,515,409$ 2,979,180$ 4,314,618$ 5,000,717$ 5,624,085$ 5,831,920$ 6,000,387$ 6,155,087$ Premium (Discount) in Loans 0.9% 1.2% 0.1% 0.0% 0.1% 0.1% 0.2% 0.4% Book Value of Deposits 2,897,222$ 3,225,413$ 4,310,768$ 5,158,445$ 5,717,837$ 5,789,489$ 5,867,697$ 5,916,506$ Economic Value of Deposits 2,706,461$ 3,148,113$ 4,197,226$ 5,002,426$ 5,548,300$ 5,611,329$ 5,658,080$ 5,764,823$ Premium (Discount) in Deposits -6.6% -2.4% -2.6% -3.0% -3.0% -3.1% -3.6% -2.6% Book Value of Equity 349,976$ 393,864$ 620,761$ 738,602$ 842,799$ 879,844$ 908,590$ 933,982$ Economic Value of Equity 445,637$ 504,253$ 734,935$ 896,974$ 1,030,450$ 1,074,515$ 1,135,746$ 1,089,331$ Equity Premium Percentage 27.3% 28.0% 18.4% 21.4% 22.3% 22.1% 25.0% 16.6% Interest Rate Shock Analysis SHORT TERM EFFECTS (dollars in thousands) Net Interest Income - Flat balance Sheet 131,479$ 146,422$ 202,091$ 250,826$ 270,909$ 276,749$ 282,164$ 283,574$ Net Interest Income - + 100 basis point shock 131,164$ 143,418$ 197,675$ 250,113$ 276,988$ 288,452$ 297,891$ 298,113$ Percentage Change -0.2% -2.1% -2.2% -0.3% 2.2% 4.2% 5.6% 5.1% Net Interest Income - + 200 basis point shock 134,029$ 144,773$ 199,613$ 257,705$ 289,966$ 304,637$ 315,859$ 313,806$ Percentage Change 1.9% -1.1% -1.2% 2.7% 7.0% 10.1% 11.9% 10.7% Net Interest Income - + 300 basis point shock 139,317$ 148,470$ 203,701$ 266,070$ 303,319$ 321,078$ 333,973$ 329,495$ Percentage Change 6.0% 1.4% 0.8% 6.1% 12.0% 16.0% 18.4% 16.2% Net Interest Income - + 400 basis point shock 144,830$ 152,069$ 207,441$ 274,468$ 316,719$ 337,624$ 352,067$ 345,338$ Percentage Change 10.2% 3.9% 2.6% 9.4% 16.9% 22.0% 24.8% 21.8% Net Interest Income - - 100 basis point shock 130,826$ 141,639$ 200,680$ 244,895$ 264,079$ 266,342$ 272,332$ 267,907$ Percentage Change -0.5% -3.3% -0.7% -2.4% -2.5% -3.8% -3.5% -5.5% Net Interest Income - - 200 basis point shock 129,851$ 137,192$ 196,217$ 241,220$ 256,318$ 258,145$ 262,636$ 244,534$ Percentage Change -1.2% -6.3% -2.9% -3.8% -5.4% -6.7% -6.9% -13.8%

(1) Core deposits include CDAR’s and ICS reciprocal deposits. Commercial focus drives growth of Noninterest Bearing Demand accounts Wholesale Deposits used to enhance favorable cost of funds, not a strategy to replace growth in core deposits Deposit Composition and Growth 18 (Dollar Values in Thousands) Annual Growth Rate Deposit Type % of % of % of Balance Total Balance Total Balance Total % Noninterest Bearing 1,668,271$ 30.0% 1,775,684$ 31.1% 1,843,157$ 31.2% 10.5% Interest Bearing Transaction 297,973 5.4% 289,122 5.1% 429,247 7.3% 44.1% Core Savings & Money Market (1) 2,390,367 43.0% 2,484,621 43.4% 2,353,946 39.7% (1.5%) Core CD's (1) 516,946 9.3% 537,703 9.4% 555,387 9.4% 7.4% Wholesale Money Market 412,151 7.4% 417,938 7.3% 464,925 7.9% 12.8% Wholesale CD's 272,441 4.9% 211,046 3.7% 267,290 4.5% (1.9%) Total Deposits 5,558,149$ 100% 5,716,114$ 100% 5,913,952$ 100% 6.4% As of December 31, 2016 As of September 30, 2017As of September 30, 2016

Balanced Loan and Deposit Growth 19 NOTE: Virginia Heritage Bank acquisition closed on October 31, 2014. $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $ in Billions Total Loans Total Deposits

Detail of Loan Portfolio NOTE: Data as of September 30, 2017 Concentration in quality markets: Washington, DC, Montgomery County, Fairfax County Held for Sale residential mortgages not included 20 (Dollar Value in Thousands) County C&I Owner Occupied CRE Income Producing CRE CRE Bridge Financing Owner Occupied Const. CRE Construction Land Residential Mortgage Consumer TOTAL % of Total Maryland Montgomery 315,912$ 108,466$ 249,933$ 188,012$ 12,925$ 121,374$ 3,111$ 21,495$ 59,489$ 1,080,717$ 17.8% Prince George's 94,105 120,996 107,952 23,817 20,066 65,384 10,288 620 2,061 445,289 7.3% Baltimore 35,122 15,580 84,978 78,335 16,189 5,695 - - 468 236,367 3.9% Anne Arundel 9,746 24,787 34,668 738 - 35 2,170 1,835 1,369 75,348 1.2% Frederick 6,011 788 66,430 6,547 - - 3,662 766 441 84,645 1.4% Howard 22,498 3,530 31,785 7,461 - 516 4,627 777 2,418 73,612 1.2% Eastern Shore 3,270 10,064 66,404 - - - - 2,073 203 82,014 1.3% Charles 180 20,496 5,719 - - - - 463 29 26,887 0.4% Other MD 5,192 12,388 20,931 - - 6,739 4,491 - 613 50,354 0.8% Washington DC 319,683 207,434 662,616 461,627 4,648 406,521 7,716 44,680 14,806 2,129,731 35.1% Virginia Fairfax 166,881 58,409 222,450 76,319 - 90,057 12,039 11,742 15,185 653,082 10.7% Loudoun 31,764 50,306 41,227 18,137 - 55,465 997 1,248 3,464 202,608 3.3% Arlington 65,040 940 76,913 13,731 - 28,583 3,865 1,014 2,257 192,343 3.2% Alexandria 36,549 20,665 37,159 38,460 - 28,586 1,118 2,736 2,186 167,459 2.8% Prince William 5,878 35,927 77,643 5,253 - 20,276 7,280 322 1,740 154,319 2.5% Fauquier 1,516 3,772 7,568 - - 2,764 - - 281 15,901 0.3% Other VA 17,400 42,025 97,473 25,970 2,000 1,402 3,394 357 869 190,890 3.1% Other USA 107,437 13,007 49,219 13,473 - - 17,338 19,332 2,832 222,638 3.7% Total $1,244,184 $749,580 $1,941,068 $957,880 $55,828 $833,397 $82,096 $109,460 $110,711 $6,084,204 100.0% % of Total 20.4% 12.3% 32.1% 15.7% 0.9% 13.7% 1.3% 1.8% 1.8% 100.0%

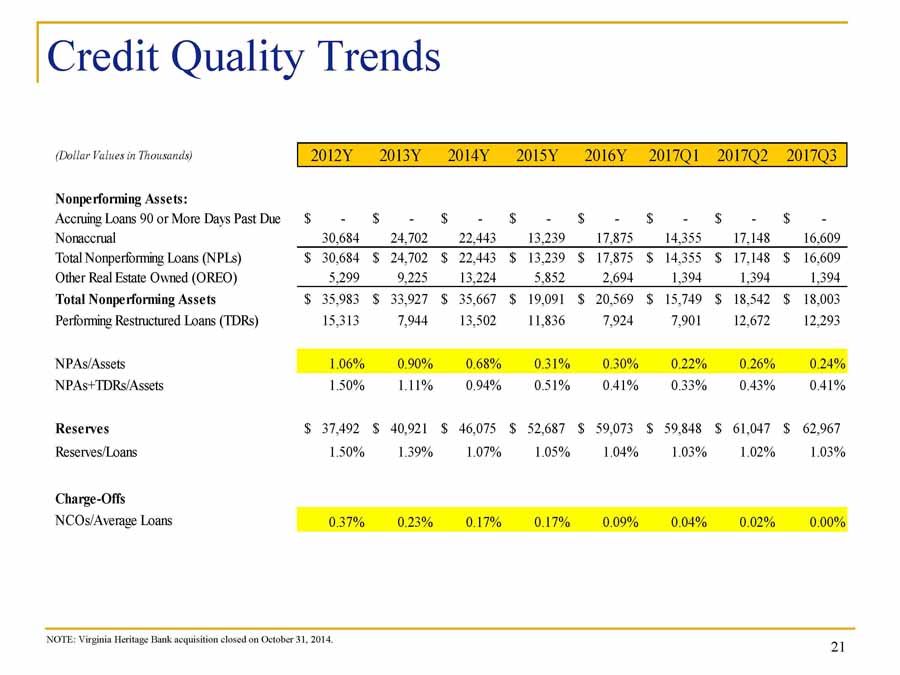

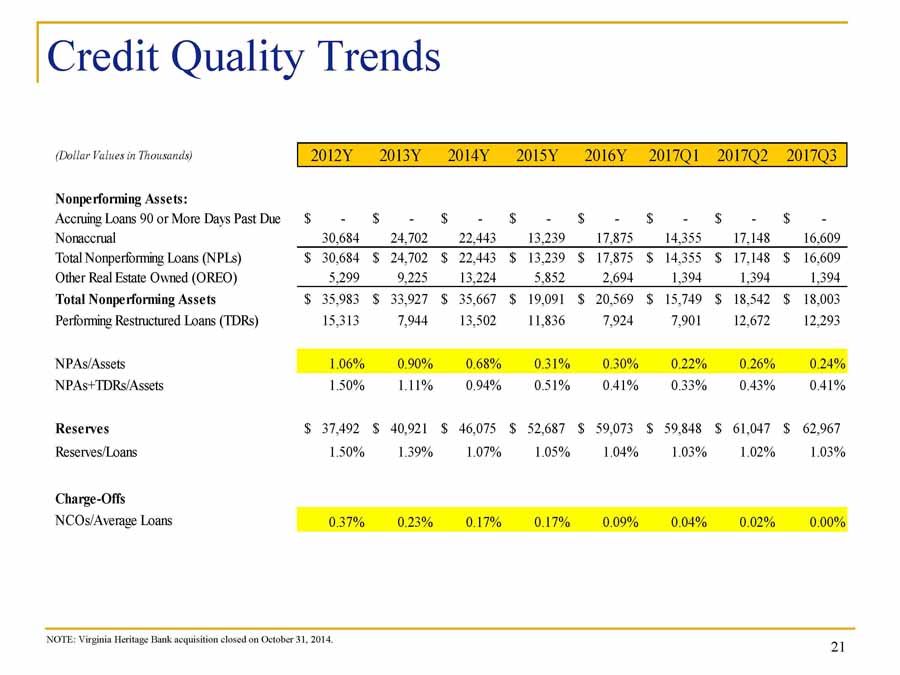

Credit Quality Trends 21 NOTE: Virginia Heritage Bank acquisition closed on October 31, 2014. (Dollar Values in Thousands) 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Nonperforming Assets: Accruing Loans 90 or More Days Past Due -$ -$ -$ -$ -$ -$ -$ -$ Nonaccrual 30,684 24,702 22,443 13,239 17,875 14,355 17,148 16,609 Total Nonperforming Loans (NPLs) 30,684$ 24,702$ 22,443$ 13,239$ 17,875$ 14,355$ 17,148$ 16,609$ Other Real Estate Owned (OREO) 5,299 9,225 13,224 5,852 2,694 1,394 1,394 1,394 Total Nonperforming Assets 35,983$ 33,927$ 35,667$ 19,091$ 20,569$ 15,749$ 18,542$ 18,003$ Performing Restructured Loans (TDRs) 15,313 7,944 13,502 11,836 7,924 7,901 12,672 12,293 NPAs/Assets 1.06% 0.90% 0.68% 0.31% 0.30% 0.22% 0.26% 0.24% NPAs+TDRs/Assets 1.50% 1.11% 0.94% 0.51% 0.41% 0.33% 0.43% 0.41% Reserves 37,492$ 40,921$ 46,075$ 52,687$ 59,073$ 59,848$ 61,047$ 62,967$ Reserves/Loans 1.50% 1.39% 1.07% 1.05% 1.04% 1.03% 1.02% 1.03% Charge-Offs NCOs/Average Loans 0.37% 0.23% 0.17% 0.17% 0.09% 0.04% 0.02% 0.00%

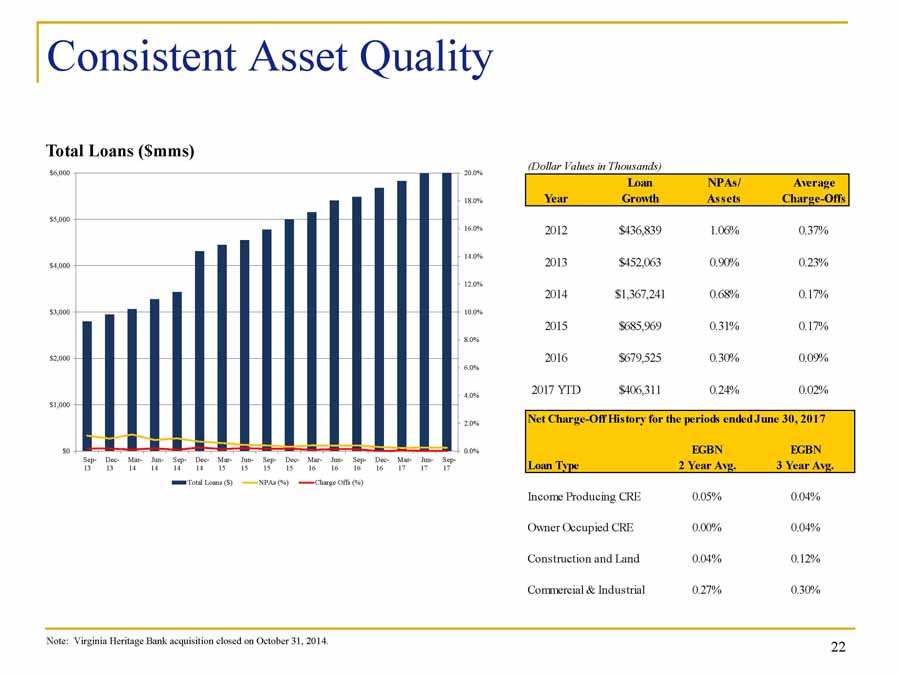

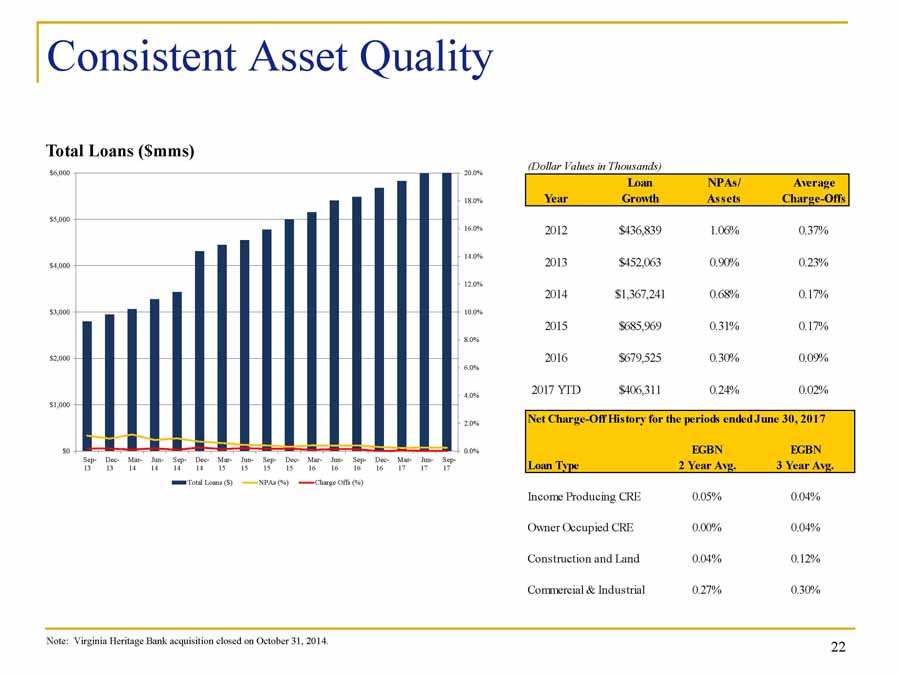

Consistent Asset Quality Total Loans ($mms) 22 Note: Virginia Heritage Bank acquisition closed on October 31, 2014. Net Charge-Off History for the periods ended June 30, 2017 EGBN EGBN Loan Type 2 Year Avg. 3 Year Avg. Income Producing CRE 0.05% 0.04% Owner Occupied CRE 0.00% 0.04% Construction and Land 0.04% 0.12% Commercial & Industrial 0.27% 0.30% (Dollar Values in Thousands) Loan NPAs/ Average Year Growth Assets Charge-Offs 2012 $436,839 1.06% 0.37% 2013 $452,063 0.90% 0.23% 2014 $1,367,241 0.68% 0.17% 2015 $685,969 0.31% 0.17% 2016 $679,525 0.30% 0.09% 2017 YTD $406,311 0.24% 0.02% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Sep- 13 Dec- 13 Mar- 14 Jun- 14 Sep- 14 Dec- 14 Mar- 15 Jun- 15 Sep- 15 Dec- 15 Mar- 16 Jun- 16 Sep- 16 Dec- 16 Mar- 17 Jun- 17 Sep- 17 Total Loans ($) NPAs (%) Charge Offs (%)

CRE Risk Management Executive & Board Level Oversight of Approval Process Disciplined Underwriting Proactive Portfolio Management Quarterly Stress Testing of CRE Portfolio Quarterly Independent Credit Review Dedicated Special Assets Team 23

CRE Concentration 24 (1) All peer group and other data is from the FR Y - 9C and Bank Holding Company Performance Report. Peer group data is based on the Compa ny’s asset size at the time of reporting. (2) Represents CRE (excluding owner occupied) concentration as a percentage of EGBN consolidated risk - based capital. * F&T Ban k acquisition closed on August 30, 2008. ** Virginia Heritage Bank acquisition closed on October 31, 2014 . (Dollar Values in Thousands) 2008Y* 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y** 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Total CRE Portfolio (excl Own Occ) 709,447$ 820,442$ 909,058$ 1,147,897$ 1,431,984$ 1,660,266$ 2,453,662$ 2,978,550$ 3,246,636$ 3,347,354$ 3,521,902$ 3,707,987$ CRE/Total Loans 55.81% 58.50% 51.77% 47.63% 57.44% 56.37% 56.78% 59.59% 57.71% 57.76% 59.33% 61.21% CRE Nonperforming Loans NPLs/Total CRE 2.38% 1.76% 1.43% 1.67% 1.40% 0.88% 0.23% 0.22% 0.34% 0.25% 0.27% 0.29% Peer NPLs/Total CRE (1) 2.94% 4.45% 4.42% 3.52% 2.40% 1.50% 0.86% 0.53% 0.40% 0.39% 0.34% Total Net Charge Offs NCOs/Total CRE 0.00% 0.07% 0.18% 0.09% 0.18% 0.07% 0.07% 0.06% 0.04% 0.04% 0.11% 0.03% Peer NCOs/Total CRE (1) 0.57% 1.55% 1.53% 1.10% 0.67% 0.22% 0.06% 0.01% 0.01% 0.00% 0.00% CRE Concentration (2) 429.81% 403.06% 401.12% 392.96% 375.05% 377.00% 388.64% 394.40% 319.33% 319.62% 326.97% 333.97%

ADC Concentration 25 (1) All peer group and other data is from the FR Y - 9C and Bank Holding Company Performance Report. Peer group data is based on t he Company’s asset size at the time of reporting . (2) Represents ADC concentration as a percentage of EGBN consolidated risk - based capital. (3) Adjusted ADC Concentration exclud es loans which are income producing and have a U & O permit. * F&T Bank acquisition closed on August 30, 2008. ** Virginia Heritage Bank acquisition closed on October 31, 2014 . (Dollar Values in Thousands) 2008Y* 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y** 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Total ADC Portfolio 283,041$ 252,494$ 327,718$ 448,470$ 539,069$ 628,880$ 798,241$ 909,654$ 976,599$ 1,030,415$ 1,141,386$ 1,451,453$ ADC/Total Loans 22.27% 18.00% 18.66% 18.61% 21.62% 21.35% 18.47% 18.20% 17.36% 17.78% 19.23% 23.96% Adjusted ADC Portfolio 1,281,795$ ADC Nonperforming Loans NPLs/Total ADC 6.28% 6.30% 4.50% 3.89% 3.45% 1.33% 0.51% 0.08% 0.13% 0.19% 0.42% 0.35% Peer NPLs/Total ADC (1) 5.60% 10.75% 11.24% 8.85% 6.51% 2.91% 1.28% 0.63% 0.35% 0.33% 0.24% Total Net Charge Offs NCOs/Total ADC 0.16% 0.07% 0.52% 0.28% 0.44% 0.21% 0.26% -0.02% 0.16% 0.17% 0.05% 0.00% Peer NCOs/Total ADC (1) 1.30% 3.88% 4.30% 3.09% 2.37% 0.46% -0.11% -0.04% -0.06% -0.02% -0.03% ADC Concentration (2) 171.48% 124.04% 144.60% 153.52% 141.19% 142.80% 126.44% 120.45% 96.05% 98.39% 105.97% 130.73% Adjusted ADC Concentration (3) 115.45%

Capital Strength $150 million of 10 Year, 5 Year non - call, 5.00% Subordinated Notes sold in July 2016 $100 million of Common Equity raised through an underwritten offering in March 2015 $70 million of 10 Year non - call 5.75% Subordinated Notes sold in August 2014 $10 million of Common Equity raised through an underwritten offering in October 2012 $35 million of Common Equity raised through an At the Market Offering during May through October 2012 (1) This constitutes a non - GAAP financial measure. P lease refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. 26 (Dollar Values in Thousands) 2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1 2017Q2 2017Q3 Total Assets 3,409,441$ 3,771,503$ 5,247,880$ 6,075,577$ 6,890,096$ 7,090,163$ 7,244,527$ 7,393,656$ Total Common Stockholders' Equity 293,376$ 337,263$ 548,859$ 738,601$ 842,799$ 873,042$ 902,675$ 933,982$ Total Regulatory Capital 381,808$ 440,332$ 631,340$ 755,212$ 1,016,713$ 1,046,296$ 1,077,121$ 1,110,282$ Tier 1 Leverage Ratio 10.44% 10.93% 10.69% 10.90% 10.72% 11.51% 11.61% 11.78% Tier 1 Risk Based Capital Ratio 10.80% 11.53% 10.39% 10.68% 10.80% 10.97% 11.18% 11.40% Total Risk Based Capital Ratio 12.20% 13.01% 12.97% 12.75% 14.89% 14.97% 15.13% 15.30% Common Equity Tier 1 (CETI) Ratio N/A N/A N/A 10.68% 10.80% 10.97% 11.18% 11.40% Tangible Common Equity Ratio (1) 8.50% 8.86% 8.54% 10.56% 10.84% 10.97% 11.15% 11.35%

Key Success Factors Building and maintaining core relationships o Cross sales o Focus on key customers Maintenance of strong credit culture o Conservative underwriting criteria and loan policies o Disciplined committee approval and review process o Periodic loan and portfolio stress testing o Proactive identification and resolution of problem c redits Built and preserved a strong capital position and balance sheet o Nine capital raising events since August 2008 o 35 consecutive quarters of increasing profitability (since January 1, 2009) have consistently bolstered the capital position 27

Key Success Factors (continued) Disciplined ALCO process Maintained focus on areas of strength o Concentration on core geographic markets and products Built the proper infrastructure to support the increased volume of business and regulation Comprehensive Management and Board level reporting Human Resources o Recruiting of strong, seasoned bankers with local market knowledge and experience o Well designed, incentive based compensation plans o Stability of staff, low turnover rate 28

EagleBank Growth Strategy Profitability • Pricing discipline to sustain Net Interest Margin • Diligent expense control to maintain Efficiency Ratio Maintain Credit Quality • Enhanced monitoring of portfolio • Expanded stress testing Emphasis on Organic Growth • Only 3.00% deposit market share in DC Metro Area • Significant opportunities to expand relationships, particularly in Northern Virginia • Attract new relationships and develop cross sell opportunities Improve Growth of Noninterest Income Components of Revenue • SBA guaranteed loans, residential mortgage origination , FHA commercial mortgage origination, treasury management services, insurance 29

Stock Price Performance 1 Year 3 Year 5 Year EGBN 35.6% 85.5% 251.5% NASDAQ Bank Stock Index 29.5% 50.2% 111.5% NASDAQ Stock Market Index 29.6% 45.3% 126.0% S & P 500 Index 21.1% 27.6% 82.4% EGBN Stock Price Performance SOURCE : SNL Financial, Chart and calculations as of close of trading on October 31, 2017 30

Appendices 31

Non - GAAP Reconciliation 32 GAAP Reconciliation (Unaudited) (dollars in thousands except per share data) December 31, 2016 March 31, 2017 June 30, 2017 September 30, 2017 Common shareholders' equity 842,799$ 873,042$ 902,675$ 933,982$ Less: Intangible assets (107,419) (107,061) (107,061) (107,150) Tangible common equity 735,380$ 765,981$ 795,614$ 826,832$ Book value per common share 24.77$ 25.59$ 26.42$ 27.33$ Less: Intangible book value per common share (3.16) (3.13) (3.14) (3.14) Tangible book value per common share 21.61$ 22.46$ 23.28$ 24.19$ Total assets 6,890,097$ 7,090,163$ 7,244,527$ 7,393,656$ Less: Intangible assets (107,419) (107,061) (107,061) (107,150) Tangible assets 6,782,678$ 6,983,102$ 7,137,466$ 7,286,506$ Tangible common equity ratio 10.84% 10.97% 11.15% 11.35%

Non - GAAP Reconciliation 33 GAAP Reconciliation (Unaudited) (dollars in thousands except per share data) December 31, 2012 December 31, 2013 December 31, 2014 December 31, 2015 December 31, 2016 Common shareholders' equity 293,376$ 337,263$ 548,859$ 738,601$ 842,799$ Less: Intangible assets (3,785) (3,510) (109,908) (108,542) (107,419) Tangible common equity 289,591$ 333,753$ 438,951$ 630,059$ 735,380$ Book value per common share 11.62$ 13.03$ 18.21$ 22.07$ 24.77$ Less: Intangible book value per common share (0.15) (0.14) (3.65) (3.24) (3.16) Tangible book value per common share 11.47$ 12.89$ 14.56$ 18.83$ 21.61$ Total assets 3,409,441$ 3,771,503$ 5,247,880$ 6,076,649$ 6,890,097$ Less: Intangible assets (3,785) (3,510) (109,908) (108,542) (107,419) Tangible assets 3,405,656$ 3,767,993$ 5,137,972$ 5,968,107$ 6,782,678$ Tangible common equity ratio 8.50% 8.86% 8.54% 10.56% 10.84%

Non - GAAP Reconciliation Footnotes 34 (1) Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per common share are non -GAAP financial measures derived from GAAP -based amounts. The Company calculates the tangible common equity ratio by excluding the balance of intangible assets from common shareholders' equity and dividing by tangible assets. The Company calculates tangible book value per common share by dividing tangible common equity by common shares outstanding, as compared to book va lue per common share, which the Company calculates by dividing common shareholders' equity by common shares outstanding. The Company considers this information important to shareholders' as tangible equity is a measure that is consistent with the calculati on of capital for bank regulatory purposes, which excludes intangible assets from the c alculation of risk based ratios and as such is useful for investors, regulators, management and others to evaluate capital adequacy and to compare against other financial institutions.

35 Market Information – Washington, DC MSA Population 6.2 Million □ 6 th largest market in the U.S. Employment 3.3 Million □ 83,100 new jobs created in 12 months ended July 2017 □ Employment growth driven by private sector, over 210,000 net new private sector jobs created over last five years □ Unemployment rate of 3.9% vs. US average of 4.3% (July 2017) Gross Regional Product (GRP) $491 Billion □ 5th largest regional economy in the U.S. □ 16.7% growth in GRP over the last 10 years □ Federal Government Spending is 30.0% of GRP □ Highest median household income of any major U.S. market SOURCE: Greater Washington Board of Trade Regional Report, Bureau of Labor Statistics, Center for Regional Analysis, George Mason University

36 Other 8.9% Non-Local Business 10.6% Associations 2.2% Hospitality 3.6% International 4.9% Other Federal 13.7% Federal Procurement 16.3% Local Business 39.9% Greater Washington Economy NOTE: Other includes Health Care/Education and Media SOURCE: The Wall Street Journal, George Mason University - Center for Regional Analysis, Bureau of Economic Analysis Total Federal Spending = 30% of GRP GRP Contribution by Sub - market Gross Regional Product $491 Billion Suburban Maryland 28.0% District of Columbia 24.0% Northern Virginia 48.0%

Loan Portfolio and Growth 37 (Dollar Values in Thousands) Annual Growth Rate Loan Type Balance % of Total Balance % of Total Balance % of Total % Commercial and Industrial 1,130,042$ 20.6% 1,200,728$ 21.1% 1,244,184$ 20.4% 10.1% Commercial Real Estate: Owner Occupied 590,427 10.8% 640,870 11.3% 749,580 12.3% 27.0% Income Producing 2,551,186 46.5% 2,509,518 44.3% 1,941,068 32.1% (23.9%) CRE Bridge Financing 957,880 15.7% N/A Subtotal 3,141,613$ 57.3% 3,150,388$ 55.6% 3,648,528$ 60.0% 16.1% Construction & Land: Owner Occupied 104,676 1.9% 126,038 2.2% 55,828 0.9% (46.7%) CRE Construction 778,081 14.2% 853,339 15.0% 833,397 13.7% 7.1% Land 60,056 1.1% 79,192 1.4% 82,096 1.3% 36.7% Subtotal 942,813$ 17.2% 1,058,569$ 18.6% 971,321$ 16.0% 3.0% Residential Mortgage 154,439$ 2.8% 152,748$ 2.7% 109,460$ 1.8% (29.1%) Consumer & Other 113,068$ 2.1% 115,460$ 2.0% 110,711$ 1.8% (2.1%) Total Loans 5,481,975$ 100.0% 5,677,893$ 100.0% 6,084,204$ 100.0% 11.0% As of September 30, 2016 As of December 31, 2016 As of September 30, 2017

Geographic Detail - Income Producing CRE NOTE: Data as of September 30, 2017 Focus in core sub - markets: Washington, DC, Montgomery County, Fairfax County 38 (Dollar Value in Thousands) Single Office/ Redevel./ Multi- Mixed & 1-4 County Hotel Condo Retail Family Use Single & 1-4 Family Industrial Other TOTAL % of Total Maryland Montgomery 14,105$ 52,840$ 21,277$ 18,922$ 85,272$ 21,434$ 10,196$ 25,887$ 249,933$ 12.9% Prince George's 14,997 25,672 43,999 1,167 2,909 4,211 10,901 4,096 107,952 5.6% Baltimore 24,424 2,316 5,968 5,806 30,686 3,397 12,241 140 84,978 4.4% Anne Arundel 9,730 3,140 10,909 - - - - 10,889 34,668 1.8% Frederick - 12,452 41,572 - 2,768 1,388 2,385 5,865 66,430 3.4% Eastern Shore 61,091 2,001 - - - 3,312 - - 66,404 3.4% Howard - 4,238 1,857 - 2,519 10,106 10,750 2,315 31,785 1.6% Charles - - 671 - - 166 - 4,882 5,719 0.3% Other MD - 5,651 1,546 - 166 199 12,660 709 20,931 1.1% Washington DC 202,010 35,309 88,233 179,500 53,665 60,733 - 43,166 662,616 34.1% Virginia Fairfax - 91,989 39,057 954 492 17,499 585 71,874 222,450 11.5% Loudoun - 15,323 13,205 - - 920 2,673 9,106 41,227 2.1% Arlington 40,500 27,331 200 265 - 3,026 - 5,591 76,913 4.0% Alexandria - 27,310 3,357 - 3,996 2,248 248 - 37,159 1.9% Prince William 29,231 13,387 18,575 - - 530 5,128 10,792 77,643 4.0% Fauquier - - 2,033 - - 500 - 5,035 7,568 0.4% Other VA - 59,414 16,902 - 109 2,297 14,445 4,306 97,473 5.0% Other USA 2,471 9,362 10,212 - 3,179 1,336 1,365 21,294 49,219 2.5% Total $398,559 $387,735 $319,573 $206,614 $185,761 $133,302 $83,577 $225,947 $1,941,068 100.0% % of Total 20.5% 20.0% 16.5% 10.6% 9.6% 6.9% 4.3% 11.6% 100.0%

Geographic Detail – Construction NOTE: Data as of September 30, 2017 Focus in core sub - markets: Washington, DC, Montgomery County, Fairfax County Recognized expertise in Single Family and Condo construction lending Portfolio is diversified among collateral types 39 (Dollar Value in Thousands) Single & 1-4 Residential Mixed Multi- County Single & 1-4 Family Condo Use Office Family Hotel Retail Other TOTAL % of Total Maryland Montgomery 54,628$ 40,530$ -$ 11,013$ -$ -$ -$ 15,203$ 121,374$ 14.6% Prince George's 4,380 - 27,280 - 10,722 - - 23,002 65,384 7.8% Baltimore 523 - - - - - - 5,172 5,695 0.7% Anne Arundel 35 - - - - - - - 35 0.0% Frederick - - - - - - - - - 0.0% Eastern Shore - - - - - - - - 0.0% Howard 516 - - - - - - - 516 0.1% Charles - - - - - - - - - 0.0% Other MD 438 - 1,259 - 5,042 - - - 6,739 0.8% Washington DC 57,498 107,035 72,588 68,937 82,245 9,982 1,154 7,082 406,521 48.8% Virginia Fairfax 35,632 4,793 3,318 44,197 792 - - 1,325 90,057 10.8% Loudoun 400 5,571 1,123 - - - - 48,371 55,465 6.7% Arlington 21,554 7,029 - - - - - - 28,583 3.4% Alexandria 3,467 - 23,179 1,940 - - - - 28,586 3.4% Prince William 3,875 - 5,595 - - - - 10,806 20,276 2.4% Fauquier - - - - 2,764 - 2,764 0.3% Other VA 618 307 - - 405 - - 72 1,402 0.2% Other USA - - - - - - - - - 0.0% Total $183,564 $165,265 $134,342 $126,087 $101,970 $9,982 $1,154 $111,033 $833,397 100.0% % of Total 22.1% 19.9% 16.1% 15.1% 12.2% 1.2% 0.1% 13.3% 100.0% Renovation 81,238$ 35,457$ 39,980$ 118,947$ 36,226$ 7,000$ -$ 82,978$ 401,826$ 48.2% Ground-Up 102,326$ 129,808$ 94,362$ 7,140$ 65,744$ 2,982$ 1,154$ 28,055$ 431,571$ 51.8%

Portfolio has $1.7 million of net unrealized losses at September 30, 2017 No holdings of GSE equities or bank Trust Preferred or bank Trust Preferred CDOs Average life of portfolio is 3.5 years Excludes Federal Reserve and Federal Home Loan Bank stock Conservative Securities Portfolio 40 (Dollar Values in Thousands) September 30, 2017 Gross Gross Estimated Amrt. Cost Amortized Unrealized Unrealized Fair % of Total Security Type Cost Gain Losses Value Securities US Government Agency Securities $179,100 $342 $1,524 $177,918 32.1% Mortgage Backed Securites - GSEs 303,822 374 2,670 301,526 54.6% Municipal Bonds 61,593 1,673 119 63,147 11.0% Corporate Bonds 13,011 206 - 13,217 2.3% Other Equity Investments 218 - - 218 0.0% Total Securities $557,744 $2,595 $4,313 $556,026 100.0% December 31, 2016 Gross Gross Estimated Amrt. Cost Amortized Unrealized Unrealized Fair % of Total Security Type Cost Gain Losses Value Securities US Government Agency Securities $107,425 $519 $1,802 $106,142 19.8% Mortgage Backed Securites - GSEs 329,606 324 3,691 326,239 60.9% Municipal Bonds 94,607 1,723 400 95,930 17.5% Corporate Bonds 9,508 82 11 9,579 1.8% Other Equity Investments 218 - - 218 0.0% Total Securities 541,364$ 2,648$ 5,904$ 538,108$ 100.0% September 30, 2016 Gross Gross Estimated Amrt. Cost Amortized Unrealized Unrealized Fair % of Total Security Type Cost Gain Losses Value Securities US Government Agency Securities $55,862 $638 $136 $56,364 13.2% Mortgage Backed Securites - GSEs 264,101 2,284 350 266,035 62.4% Municipal Bonds 94,923 4,954 - 99,877 22.4% Corporate Bonds 8,009 68 23 8,054 1.9% Other Equity Investments 310 28 - 338 0.1% Total Securities $423,205 $7,972 $509 $430,668 100.0%

▪ Designated as a “Challenger” Bank 2015 & 2016 ▪ Honor Roll of Community Banks 2010 - 2016 Nationally Recognized Financial Performance ▪ Community Bankers Cup Award 2012 - 2016 ▪ Ronald D. Paul named East Coast Region Community Banker of the Year 2014 Independent Community Bankers of America 41 ▪ “Top Investment Idea” Recommendation 2012 ▪ “Sm - All Stars” Designation 2011, 2013, 2014, 2015, 2016 & 2017

Highly Regarded by Bank Rating Firms FIRM BANK RATING 300/300 Green - *** B AUER F INANCIAL , I NC A - 42

Experienced Management Team 43 R onald D. Paul, Chairman, President and CEO Mr. Paul, a founder of EagleBank, has served as Chairman since May 2008, and prior to that time was Vice Chairman and Chief E xec utive Officer since the organization of the Company. Since June 2006, he has served as Chief Executive Officer of the Bank. Mr. Pau l is also President of Ronald D. Paul Companies and RDP Management, which are engaged in the business of real estate investment and man age ment for office and multi - family properties. Mr. Paul was a director of Allegiance Bank and of Allegiance Banc Corporation from 1990 until its acquisition by F&M, including serving as Vice Chairman of the Board of Directors from 1995. Mr. Paul is also active in various charitable organizations, including serving as Vice Chairman of the Board of Directors of the National Kidney Foundation from 1996 to 19 97, and Chairman from 2002 to 2003. Mr. Paul is a Trustee of the University of Maryland College Park Foundation. He sits on the Board of the Washington Hospital Center and the Metropolitan Washington Board of Trade. Mr. Paul has been named “Washingtonian of the Year ” b y Washingtonian magazine and in 2009 was named the “Greater Washington Entrepreneur of the Year” by Ernst & Young. In 2012 he was elected to the Washington Business Hall of Fame and was named “Community Banker of the Year” by the American Banker magazine. In 2014 Mr. Paul was named Community Banker of the Year for the Eastern Region by the Independent Community Bankers of America. Susan G. Riel, Senior EVP, Chief Operating Officer of EagleBank & EVP, Eagle Bancorp, Inc. Ms. Riel, Senior Executive Vice President - Chief Operating Officer of the Bank, and formerly Chief Administrative Officer. Ms . Riel has been with the bank for 16 years. She previously served as Executive Vice President - Chief Operating Officer of Columbia First Bank, FSB from 1989 until that institution’s acquisition by First Union Bancorp in 1995. She is one of the founding officers of EagleBank. Ms. Riel has over 35 years of experience in the commercial banking industry. Charles D. Levingston, EVP, Chief Financial Officer, Eagle Bancorp, Inc. and EagleBank Mr. Levingston, Executive Vice President and Chief Financial Officer of the Bank and Company as of April 2017, most recently served as Executive Vice President of Finance at the Bank. Mr . Levingston, a CPA, served in various financial and senior management roles at the bank prior to his current role. Mr. Levingston joined the bank in January 2012, and previously worked at the Federal Reserve Bank s o f Atlanta and Philadelphia as a commissioned Bank Examiner, and at PriceWaterhouseCoopers as a Manager in the Advisory practice. He has over 16 years of experience in the banking industry.

Experienced Management Team 44 Janice L. Williams, EVP, Chief Credit Officer Ms. Williams, Executive Vice President and Chief Credit Officer of the Bank, has served the Bank as Credit Officer, Senior Cr edi t Officer and Chief Credit Officer for the past 11 years. Prior to employment with the Bank, Ms. Williams was with Capital Bank, Sequoia Bank , and American Security Bank. Additionally, Ms. Williams, a graduate of Georgetown University Law Center and a Member of the Maryland Bar, was previously employed in the private practice of law in Maryland. Laurence E. Bensignor, EVP & General Counsel, Eagle Bancorp, Inc. and EagleBank Mr. Bensignor joined the bank after 29 years in the legal and real estate industries in the Washington, DC area. For ten year s, Mr. Bensignor served as Trustee of the Van Metre Family Trusts, the controlling owner of a private, multifaceted real estate organization. Pre viously, he was a partner and chaired the real estate practice group in the Washington, DC office of the national law firm of Arter & Hadden an d f ormerly was a partner in the Washington, DC law firm of Melrod, Redman & Gartlan. Mr. Bensignor is a Fellow of the American College of Real Es tate Lawyers. Antonio F. Marquez, EVP, Chief Commercial Real Estate Lending Officer Mr. Marquez, Executive Vice President, joined EagleBank in 2011 as the Chief Real Estate Lender. Prior to joining EagleBank, Mr. Marquez established the real estate lending franchise for HSBC for the Washington, DC market Earlier he was the head of Commercial Re al Estate lending at Chevy Chase Bank from 1999 to 2005 and prior to that held various lending positions at Chase Manhattan Bank in New Yo rk and The Riggs National Bank in Washington, D.C. Mr. Marquez has over 30 years of experience in the banking industry in the Washin gto n, DC metropolitan area. Lindsey S. Rheaume, EVP, Chief C&I Lending Officer Mr. Rheaume joined EagleBank as Chief C&I Lending Officer in December 2014 and has over 25 years of commercial lending, credi t r isk and managerial experience in the financial industry. Most recently, he served as relationship executive for JP Morgan Chase, res pon sible for business development in the DC, suburban Maryland and Northern Virginia market with clients ranging in revenue from $20MM to $50 0MM. Previously, he served as executive vice president and commercial lending manager at Virginia Commerce Bank — which was acquired by United Bank in 2014 — where he managed the bank’s entire commercial and industrial lending activities. Earlier in his career, he held senior commercial lending and credit positions with SunTrust Bank, GE Capital and Bank of America .

45 Historical Balance Sheet (Dollar Values in Thousands) 2012Y 2013Y 2014Y 2015Y 2016Y 5 Year Compound Growth Rate 2017YTD Assets Cash and Equivalents $339,334 $306,960 $256,025 $298,363 $368,163 9.6% $448,950 Securities Available for Sale 310,514 389,405 404,903 504,772 559,708 11.5% 587,006 Total Cash and Securities 649,848 696,365 660,928 803,135 927,871 10.8% 1,035,956 Gross Loans HFI 2,493,095 2,945,158 4,312,399 4,998,368 5,677,893 22.5% 6,084,204 Loan Loss Reserves 37,492 40,921 46,075 52,687 59,074 14.8% 62,967 Loans Held for Sale 226,923 42,030 44,317 47,492 51,629 (21.8%) 25,980 Total Net Loans 2,682,526 2,946,267 4,310,641 4,993,173 5,670,448 20.8% 6,047,217 Real Estate Owned 5,299 9,225 13,224 5,852 2,694 (3.5%) 1,394 Total Intangibles 3,642 3,276 109,626 108,155 106,947 93.3% 106,753 Total Servicing Rights 143 234 282 387 472 21.4% 397 Other Assets 67,983 116,136 153,179 164,875 181,664 23.2% 201,939 Total Assets $3,409,441 $3,771,503 $5,247,880 $6,075,577 $6,890,096 19.5% $7,393,656 Liabilities Deposits $2,897,222 $3,225,414 $4,310,768 $5,158,444 $5,716,114 19.0% $5,913,952 FHLB Borrowings 30,000 30,000 140,000 0 0 (100.0%) 200,000 Repurchase Agreements 101,338 80,471 61,120 72,356 68,876 (7.8%) 73,569 Subordinated Debt 9,300 9,300 79,300 68,928 216,514 87.7% 216,807 Other Liabilities 21,605 32,455 35,933 37,248 45,793 18.3% 55,346 Total Liabilities 3,059,465 3,377,640 4,627,121 5,336,976 6,047,297 18.7% 6,459,674 Equity Preferred Equity 56,600 56,600 71,900 0 0 (100.0%) 0 Common Equity 287,911 340,582 546,212 738,410 845,180 32.7% 934,931 Net Unrealized Gain (Loss) 5,465 (3,319) 2,647 191 (2,381) (186.6%) (949) Total Stockholders Equity 349,976 393,863 620,759 738,601 842,799 25.9% 933,982 Total Liabilities and Equity $3,409,441 $3,771,503 $5,247,880 $6,075,577 $6,890,096 19.5% $7,393,656 Balance Sheet Analysis (%) Total Gross Loans/ Total Assets 73.12 78.09 82.17 82.27 82.41 82.29 Loans/ Deposits 86.05 91.31 100.04 96.90 99.33 102.88 Reserves/ Loans 1.50 1.39 1.07 1.05 1.04 1.03 Annualized Growth Rates (%) Asset Growth Rate 20.42 10.62 39.15 15.77 13.41 9.72 Gross Loans HFI 21.24 18.13 46.42 15.91 13.59 9.52 Deposit Growth Rate 21.12 11.33 33.65 19.66 10.81 4.60

46 Historical Income Statement Virginia Heritage Bank acquisition closed on October 31, 2014. Data for 2014 is shown on an operating basis, net of merger related expenses; P lease refer to the Non - GAAP reconciliation and footnotes in the appendices on pages 32 - 34. (Dollar Values in Thousands, except per share data) 2012Y 2013Y 2014Y 2015Y 2016Y 5 Year Compound Growth Rate 2017YTD Total Interest Income 141,943$ 157,294$ 191,573$ 253,180$ 285,805$ 19.1% 237,508$ Total Interest Expense 14,414 12,504 13,095 19,238 27,641 6.6% 28,980 Net Interest Income 127,529 144,790 178,478 233,942 258,164 21.1% 208,528 Loan Loss Provision 16,190 9,602 10,879 14,638 11,331 0.6% 4,884 Service Charges on Deposits 3,937 4,607 4,906 5,397 5,821 11.9% 4,641 Gain/Loss on Sale of Loans 13,942 14,578 6,886 11,973 11,563 13.8% 6,740 Gain/Loss on Sale of Securities 690 19 22 2,254 1,194 (3.7%) 542 Loss on early extinguishment of debt (529) - - (1,130) - 100.0% - BOLI Revenue 392 720 1,283 1,589 1,554 31.1% 1,108 Other Noninterest Income 2,932 4,792 5,248 6,545 7,152 25.7% 6,846 Total Noninterest Income 21,364 24,716 18,345 26,628 27,284 15.1% 19,877 Salaries and Employee Benefits 43,684 47,481 57,268 61,749 67,010 14.2% 50,451 Premises and Equipment Expenses 10,218 11,923 13,317 16,026 15,118 12.5% 11,613 Marketing and Advertising 1,759 1,686 1,999 2,748 3,495 16.5% 2,873 Data Processing 4,415 5,903 6,163 7,533 7,747 16.9% 6,057 Legal, Accounting and Professional Fees 4,253 2,969 3,439 3,729 3,673 (1.6%) 3,539 FDIC Insurance 2,089 2,263 2,333 3,154 2,718 4.4% 2,063 Merger Expenses - - 4,699 141 - 100.0% - Other Noninterest Expenses 10,113 12,354 10,510 15,636 15,254 11.0% 12,153 Total Noninterest Expense 76,531 84,579 99,728 110,716 115,015 12.7% 88,749 Net Income Before taxes 56,172 75,325 86,216 135,216 159,102 33.0% 134,772 Income taxes 20,883 28,318 31,958 51,049 61,395 34.9% 50,109 Net Income 35,289 47,007 54,258 84,167 97,707 31.8% 84,663 Preferred Dividends 566 566 614 601 - (100.0%) - Net Income Available to Common 34,723$ 46,441$ 53,644$ 83,566$ 97,707$ 33.5% 84,663$ Earnings per Share - Diluted 1.46$ 1.76$ 2.08$ 2.50$ 2.86$ 2.47$