- MSTR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MicroStrategy (MSTR) DEF 14ADefinitive proxy

Filed: 6 Jul 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

MicroStrategy Incorporated

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

July 5, 2005

Dear MicroStrategy Stockholder:

You are cordially invited to our Annual Meeting of Stockholders on Thursday, August 4, 2005, beginning at 10:00 a.m., local time, at MicroStrategy’s offices, 1861 International Drive, First Floor, McLean, Virginia 22102. The enclosed notice of annual meeting sets forth the proposals that will be presented at the meeting, which are described in more detail in the enclosed proxy statement. The Board of Directors recommends that stockholders vote “FOR” these proposals.

We look forward to seeing you there.

Very truly yours,

Michael J. Saylor

Chairman of the Board, President and

Chief Executive Officer

1861 International Drive

McLean, Virginia 22102

Notice of Annual Meeting of Stockholders to

be held on Thursday, August 4, 2005

The Annual Meeting of Stockholders (the “Annual Meeting”) of MicroStrategy Incorporated, a Delaware corporation (the “Company”), will be held at MicroStrategy’s offices, 1861 International Drive, First Floor, McLean, Virginia 22102, on Thursday, August 4, 2005 at 10:00 a.m., local time, to consider and act upon the following matters:

| 1. | To elect six (6) directors for the next year; |

| 2. | To approve the material terms of performance goals for certain executive incentive compensation; |

| 3. | To ratify the selection of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Stockholders of record at the close of business on June 6, 2005 will be entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors,

Sanju K. Bansal

Vice Chairman, Executive Vice President,

Chief Operating Officer and Secretary

McLean, Virginia

July 5, 2005

A STOCKHOLDER MAY OBTAIN ADMISSION TO THE MEETING BY IDENTIFYING HIMSELF OR HERSELF AT THE MEETING AS A STOCKHOLDER AS OF THE RECORD DATE. FOR A RECORD OWNER, POSSESSION OF A COPY OF A PROXY CARD WILL BE ADEQUATE IDENTIFICATION. FOR A BENEFICIAL-BUT-NOT-OF-RECORD OWNER, A COPY OF A BROKER’S STATEMENT SHOWING SHARES HELD FOR HIS OR HER BENEFIT ON JUNE 6, 2005 WILL BE ADEQUATE IDENTIFICATION.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO HELP ENSURE REPRESENTATION OF YOUR SHARES AT THE ANNUAL MEETING. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

MICROSTRATEGY INCORPORATED

1861 International Drive

McLean, Virginia 22102

Proxy Statement for the Annual Meeting of Stockholders

to be held on Thursday, August 4, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of MicroStrategy Incorporated (the “Company” or “MicroStrategy”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, August 4, 2005 at MicroStrategy’s offices, 1861 International Drive, First Floor, McLean, Virginia 22102 at 10:00 a.m., local time, and at any adjournment thereof. All executed proxies will be voted in accordance with the stockholders’ instructions, and if no choice is specified, executed proxies will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting of Stockholders. Any proxy may be revoked by a stockholder at any time before its exercise by delivery of written revocation or a subsequently dated proxy to the Secretary of the Company or by voting in person at the Annual Meeting.

On June 6, 2005, the record date for the determination of stockholders entitled to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 10,401,373 shares of the Company’s class A common stock, par value $0.001 per share, and an aggregate of 3,394,399 shares of the Company’s class B common stock, par value $0.001 per share (the class A common stock and the class B common stock are collectively referred to as the “Common Stock”). Each share of class A common stock entitles the record holder thereof to one vote on each of the matters to be voted on at the Annual Meeting and each share of class B common stock entitles the record holder thereof to ten votes on each of the matters to be voted on at the Annual Meeting.

The Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2004 (“Fiscal Year 2004”) is being mailed to stockholders, along with these proxy materials, on or about July 8, 2005. The Company’s Annual Report to Stockholders includes the Company’s Annual Report on Form 10-K for Fiscal Year 2004 as filed with the Securities and Exchange Commission (“SEC”) except for any exhibits thereto. The Company will provide such exhibits to any stockholder upon written request. Please address requests to MicroStrategy Incorporated, Attention: Secretary, 1861 International Drive, McLean, Virginia 22102.

Votes Required

The holders of shares of Common Stock representing a majority of the votes entitled to be cast at the Annual Meeting shall constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

The affirmative vote of the holders of a plurality of the votes cast by the holders of Common Stock voting on the matter is required for the election of directors (Proposal 1). The affirmative vote of a majority of the votes cast by the holders of Common Stock voting on the matter is required for the approval of the material terms of performance goals for certain executive incentive compensation (Proposal 2) and the ratification of the selection of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005 (Proposal 3).

Shares which abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and will also not be counted as shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on the proposals referenced above.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of the Company’s Common Stock, as of May 31, 2005 unless otherwise indicated, by (i) each person who is known by the Company to beneficially own more than 5% of any class of the Company’s Common Stock, (ii) each director or nominee for director, (iii) each of the executive officers named in the Summary Compensation Table set forth under the caption “Executive Compensation” below, and (iv) all directors and executive officers as a group:

Beneficial Owner(1) | Number of Shares Beneficially Owned(2)(3) | Percentage of Shares of Class A Common Stock Outstanding(3)(4) | |||

Michael J. Saylor(5) | 3,004,382 | 21.7 | % | ||

Sanju K. Bansal(6) | 453,018 | 4.0 | |||

Eric F. Brown(7) | 0 | * | |||

Jonathan F. Klein(8) | 72,563 | * | |||

Jeffrey A. Bedell(9) | 82,734 | * | |||

Eduardo S. Sanchez(10) | 165,373 | 1.5 | |||

Matthew W. Calkins | 0 | * | |||

F. David Fowler(11) | 24,000 | * | |||

Jarrod M. Patten | 0 | * | |||

Carl J. Rickertsen(12) | 5,000 | * | |||

Stuart B. Ross(13) | 20,800 | * | |||

Massachusetts Financial Services Company(14) | 1,594,130 | 14.7 | |||

Barclays Global Investors, NA., Barclays Global Fund Advisors and Palomino Limited(15) | 1,094,901 | 10.1 | |||

Waddell & Reed Financial, Inc.(16) | 1,011,954 | 9.3 | |||

All directors and executive officers as a group (12 persons)(17) | 3,838,962 | 26.3 | % | ||

| * | Less than 1%. |

| (1) | Each beneficial owner named in the table above (except as otherwise indicated in the footnotes below) has an address in care of MicroStrategy Incorporated, 1861 International Drive, McLean, Virginia 22102. |

| (2) | The shares of the Company listed in this table include shares of class A common stock and class B common stock, as set forth in the footnotes below. Shares of class B common stock are convertible into the same number of shares of class A common stock at any time at the option of the holder. |

| (3) | The inclusion of any shares of Common Stock deemed beneficially owned does not constitute an admission of beneficial ownership of those shares. In accordance with the rules of the SEC, each stockholder is deemed to beneficially own any shares subject to stock options that are exercisable on or within 60 days after May 31, 2005. Any reference below to shares subject to outstanding stock options held by the person in question refers only to such stock options. |

| (4) | Percentages in the table and these footnotes have been calculated based on 10,850,245 shares of class A common stock and 3,394,399 shares of class B common stock outstanding as of May 31, 2005. In addition, for the purpose of calculating each person’s percentage of shares outstanding, any shares of class A common stock subject to outstanding stock options held by such person which are exercisable on or within 60 days after May 31, 2005 and any shares of class B common stock held by such person are deemed to be outstanding shares of class A common stock. |

| (5) | Mr. Saylor’s holdings of Common Stock consist of 2,849,700 shares of class B common stock owned by Alcantara LLC which is wholly owned by Mr. Saylor (approximately 84.0% of the class B common stock outstanding), 882 shares of class A common stock owned by Alcantara LLC and options exercisable on or within 60 days after May 31, 2005 to purchase 153,800 shares of class A common stock. |

2

| (6) | Mr. Bansal’s holdings of Common Stock consist of 336,556 shares of class B common stock owned by Shangri-La LLC which is wholly owned by Mr. Bansal, 38,305 shares of class B common stock owned by a trust for which Mr. Bansal acts as the sole trustee, 2,357 shares of class B common stock held in Mr. Bansal’s own name (collectively constituting approximately 11.1% of the class B common stock outstanding), 50,000 shares of class A common stock owned by a trust for which Mr. Bansal acts as the sole trustee, 5,800 shares of class A common stock owned by a foundation for which Mr. Bansal acts as the sole trustee and options exercisable on or within 60 days after May 31, 2005 to purchase 20,000 shares of class A common stock. |

| (7) | Mr. Brown resigned as President and Chief Financial Officer of the Company effective December 31, 2004. |

| (8) | Mr. Klein’s holdings of Common Stock consist of options exercisable on or within 60 days after May 31, 2005 to purchase 72,563 shares of class A common stock. |

| (9) | Mr. Bedell’s holdings of Common Stock consist of 8,196 shares of class A common stock and options exercisable on or within 60 days after May 31, 2005 to purchase 74,538 shares of class A common stock. |

| (10) | Mr. Sanchez’s holdings of Common Stock consist of 67,481 shares of class B common stock (approximately 2.0% of the class B common stock outstanding), 842 shares of class A common stock and options exercisable on or within 60 days after May 31, 2005 to purchase 97,050 shares of class A common stock. |

| (11) | Mr. Fowler’s holdings of Common Stock consist of options exercisable on or within 60 days after May 31, 2005 to purchase 24,000 shares of class A common stock. |

| (12) | Mr. Rickertsen’s holdings of Common Stock consist of options exercisable on or within 60 days after May 31, 2005 to purchase 5,000 shares of class A common stock. |

| (13) | Mr. Ross’s holdings of Common Stock consist of 18,800 shares of class A common stock and options exercisable on or within 60 days after May 31, 2005 to purchase 2,000 shares of class A common stock. |

| (14) | Massachusetts Financial Services Company (“MFS”), beneficially owns 1,594,130 shares of class A common stock, for which it has sole voting power as to 1,594,130 shares and sole dispositive power as to 1,594,130 shares. Information regarding the number of shares of Common Stock beneficially owned by MFS is based on the most recent Schedule 13G filed by MFS, which reports as of March 31, 2005 that MFS beneficially owns 1,594,130 shares of class A common stock, for which it has sole voting power as to 1,594,130 shares and sole dispositive power as to 1,594,130 shares. The address of MFS is 500 Boylston Street, Boston, Massachusetts 02116. |

| (15) | Barclays Global Investors, NA has sole voting power as to 849,639 shares and sole dispositive power as to 945,337 shares, Barclays Global Fund Advisors has sole voting power as to 130,202 shares and sole dispositive power as to 130,819 shares, and Palomino Limited has sole voting power as to 18,745 shares and sole dispositive power as to 18,745 shares. Information regarding the number of shares of Common Stock beneficially owned by Barclays Global Investors, NA, Barclays Global Fund Advisors and Palomino Limited (collectively, “Barclays”) is based on the most recent Schedule 13G filed by Barclays, which reports as of December 31, 2004 that Barclays beneficially owns 1,094,901 shares of class A common stock, for which it has sole voting power as to 998,586 shares and sole dispositive power as to 1,094,901 shares. The address of Barclays is 43 Fremont Street, San Francisco, California 94105. |

| (16) | Waddell & Reed Financial, Inc. (“Waddell”), beneficially owns 1,011,954 shares of class A common stock, for which it has sole voting power as to 1,011,954 shares and sole dispositive power as to 1,011,954 shares. The address of Waddell is 6300 Lamar Avenue, Overland Park, Kansas 66202. |

| (17) | Shares held by the directors and executive officers as a group include 84,520 shares of class A common stock, options to purchase 460,043 shares of class A common stock that are exercisable on or within 60 days after May 31, 2005 and 3,294,399 shares of class B common stock (approximately 97.1% of the class B common stock outstanding), which shares are convertible into the same number of shares of class A common stock at any time at the option of the holder. |

3

Executive Officers of the Company

The Company’s executive officers and their ages and positions as of May 31, 2005 are as follows:

Name | Age | Title | ||

Michael J. Saylor | 40 | Chairman of the Board of Directors, President and Chief Executive Officer | ||

Sanju K. Bansal | 39 | Vice Chairman, Executive Vice President and Chief Operating Officer | ||

Jonathan F. Klein | 38 | Vice President, Law and General Counsel | ||

Arthur S. Locke, III | 41 | Vice President, Finance and Chief Financial Officer | ||

Jeffrey A. Bedell | 36 | Vice President, Technology and Chief Technology Officer | ||

Eduardo S. Sanchez | 48 | Vice President, Worldwide Sales | ||

Adam M. McDonald | 31 | Vice President, Worldwide Services | ||

Set forth below is certain information regarding the professional experience of each of the above-named persons.

Michael J. Saylor has served as chief executive officer and chairman of the Board of Directors since founding MicroStrategy in November 1989, and as president since January 2005 as well as from November 1989 to November 2000. Prior to that, Mr. Saylor was employed by E.I. du Pont de Nemours & Company as a Venture Manager from 1988 to 1989 and by Federal Group, Inc. as a consultant from 1987 to 1988. Mr. Saylor received an S.B. in Aeronautics and Astronautics and an S.B. in Science, Technology and Society from the Massachusetts Institute of Technology.

Sanju K. Bansal has served as executive vice president and chief operating officer since 1993 and was previously vice president, consulting since joining MicroStrategy in 1990. He has been a member of the Board of Directors of MicroStrategy since September 1997 and has served as vice chairman of the Board of Directors since November 2000. Prior to joining MicroStrategy, Mr. Bansal was a consultant at Booz Allen & Hamilton, a worldwide technical and management consulting firm, from 1987 to 1990. Mr. Bansal received an S.B. in Electrical Engineering from the Massachusetts Institute of Technology and an M.S. in Computer Science from The Johns Hopkins University.

Jonathan F. Klein has served as vice president, law and general counsel since November 1998 and as corporate counsel from June 1997 to November 1998. From September 1993 to June 1997, Mr. Klein was an appellate litigator with the United States Department of Justice. Mr. Klein received a B.A. in Economics from Amherst College and a J.D. from Harvard Law School.

Arthur S. Locke, III has served as vice president, finance and chief financial officer since January 2005 and was previously vice president, finance and worldwide controller since joining MicroStrategy in January 2001. Prior to joining MicroStrategy, Mr. Locke served as chief financial officer of Metropolitan Area Networks, a start-up wireless broadband company, from February 2000 to January 2001, and as corporate controller of EIS International, Inc., a publicly-traded provider of solutions and applications for the call center industry, from March 1997 to February 2000. Mr. Locke is a certified public accountant and received a Bachelor of Science in Business Administration (BSBA) in Accounting and Computer Systems from American University.

Jeffrey A. Bedell has served as vice president, technology and chief technology officer since April 2001, as vice president, platform technology from 1999 to 2001, and as senior program manager and director of technology programs from 1992 to 1999. Mr. Bedell received a B.A. in Religion from Dartmouth College.

Eduardo S. Sanchez has served as vice president, worldwide sales since April 2005, as vice president, worldwide sales and services from April 2001 to April 2005, as vice president, worldwide sales from 2000 to

4

2001, as vice president, international operations from 1998 to 2000, as vice president, European operations from 1996 to 1998, as managing director, European operations from 1994 to 1996, and as consulting manager, US operations from 1992 to 1994. Mr. Sanchez received a bachelor’s degree in Electrical Engineering from the University of LaPlata in Argentina and a master’s degree in Systems Engineering from George Mason University. Prior to joining MicroStrategy, Mr. Sanchez worked as a consultant in Europe, the United States, South America and Japan, developing and deploying large-scale optimization systems for the manufacturing and power utility sector. In this capacity, he was engaged in significant projects with companies such as Mitsubishi, Groupe Saint Gobain, ABB, Siemens and Xerox.

Adam M. McDonald has served as vice president, worldwide services since April 2005, as vice president, technology services from November 2000 to April 2005, as senior manager and director, advanced product support from 1999 to 2000, as manager, advanced product support from 1998 to 1999 and as technical support lead engineer from 1996 to 1998. Mr. McDonald received a B.A. in History from Dartmouth College.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Board of Directors proposes the election of the persons listed below as directors of the Company. Each current director of the Company has been nominated for re-election, except for Mr. Stuart B. Ross, a member of the Board of Directors since June 2001, who is retiring from the Board at the Annual Meeting.

In accordance with the Amended and Restated By-Laws of the Company, the Board of Directors has adopted a resolution reducing the size of the Board of Directors from seven to six members, effective upon the Annual Meeting. The persons named in the enclosed proxy will vote to elect as directors the six nominees named below, unless authority to vote for the election of any or all of the nominees is withheld by marking the proxy to that effect. All of the nominees have indicated their willingness to serve, if elected, but if any should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board of Directors. Each director will be elected to hold office until the next annual meeting of stockholders (and until the election and qualification of his successor or his earlier death, resignation or removal).

Nominees

Set forth below, for each nominee, are his name and age, his positions with the Company, his principal occupation and business experience during at least the past five years and the year of the commencement of his term as a director of the Company:

Michael J. Saylor (40) has served as chief executive officer and chairman of the Board of Directors since founding MicroStrategy in November 1989, and as president since January 2005 as well as from November 1989 to November 2000. Prior to that, Mr. Saylor was employed by E.I. du Pont de Nemours & Company as a Venture Manager from 1988 to 1989 and by Federal Group, Inc. as a consultant from 1987 to 1988. Mr. Saylor received an S.B. in Aeronautics and Astronautics and an S.B. in Science, Technology and Society from the Massachusetts Institute of Technology.

Sanju K. Bansal (39) has served as executive vice president and chief operating officer since 1993 and was previously vice president, consulting since joining MicroStrategy in 1990. He has been a member of the Board of Directors of MicroStrategy since September 1997 and has served as vice chairman of the Board of Directors since November 2000. Prior to joining MicroStrategy, Mr. Bansal was a consultant at Booz Allen & Hamilton, a worldwide technical and management consulting firm, from 1987 to 1990. Mr. Bansal received an S.B. in Electrical Engineering from the Massachusetts Institute of Technology and an M.S. in Computer Science from The Johns Hopkins University.

5

Matthew W. Calkins (32) has been a member of the Board of Directors of MicroStrategy since November 2004. In 1999, Mr. Calkins founded Appian Corporation, a privately-held Business Process Management company, where he has served as the president and chief executive officer since its founding. Mr. Calkins received a B.A. in Economics from Dartmouth College in 1994.

F. David Fowler (71) has been a member of the Board of Directors of MicroStrategy since June 2001. Mr. Fowler was the dean of the School of Business and Public Management at The George Washington University from July 1992 until his retirement in June 1997 and a member of KPMG LLP from 1963 until his retirement in June 1992. As a member of KPMG, Mr. Fowler served as managing partner of the Washington, DC office from 1987 until 1992, as partner in charge of human resources for the firm in New York City, as a member of the firm’s board of directors, operating committee and strategic planning committee and as chairman of the KPMG Foundation and the KPMG personnel committee. Mr. Fowler is also a member of the board of directors of FBR Funds located in Bethesda, Maryland. Mr. Fowler received a B.A./B.S. in Business from the University of Missouri at Columbia in 1955.

Jarrod M. Patten (33) has been a member of the Board of Directors of MicroStrategy since November 2004. In 1996, Mr. Patten founded Real Estate Resource Group, L.L.C. (“RRG”), and has served as the president and chief executive officer of RRG since 1996. RRG develops and implements lease auditing programs and cost containment strategies designed to tighten corporate controls and increase operating efficiencies. Mr. Patten received a B.S. in Biology and a B.A. in Biological Anthropology and Anatomy from the Trinity College of Arts and Sciences at Duke University in 1994.

Carl J. Rickertsen (45) has been a member of the Board of Directors of MicroStrategy since October 2002. Mr. Rickertsen is currently managing partner of Pine Creek Partners, a private equity investment firm, a position he has held since January 2004. From January 1998 until January 2004, Mr. Rickertsen was chief operating officer and a partner at Thayer Capital Partners, a private equity investment firm. From September 1994 until January 1998, Mr. Rickertsen was a managing partner at Thayer. Mr. Rickertsen was a founding partner of three Thayer investment funds totaling over $1.4 billion and is a published author. Mr. Rickertsen is also a member of the board of directors of Convera Corporation, a publicly-traded search-engine software company, and United Agricultural Products, a distributor of farm and agricultural products. Mr. Rickertsen received a B.S. from Stanford University and an M.B.A. from Harvard Business School.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR ELECTION AS DIRECTOR NAMED HEREIN.

Involvement in Certain Legal Proceedings

On December 14, 2000, Mr. Saylor and Mr. Bansal each entered into a settlement with the SEC in connection with the restatement of the Company’s financial results for 1999, 1998 and 1997. In the settlement, each of Mr. Saylor and Mr. Bansal consented, without admitting or denying the allegations in the SEC’s complaint, to the entry of a judgment enjoining him from violating the antifraud and recordkeeping provisions of the federal securities laws and ordering him to pay disgorgement and a civil penalty.

Board and Committee Meetings

The Board of Directors met eight times during Fiscal Year 2004. Each director attended at least 75% of the aggregate of the number of Board of Directors meetings and the number of meetings held by all committees on which he then served. The Board of Directors has determined that each of the non-employee directors of the Company (Messrs. Calkins, Fowler, Patten, Rickertsen and Ross), who collectively constitute a majority of the Board, is an “independent director” as defined in Rule 4200(a)(15) of the Marketplace Rules of The Nasdaq Stock Market, Inc. (“Nasdaq”). The independent members of the Board of Directors regularly meet in executive session without any employee directors or other members of management in attendance.

6

The Board of Directors has established standing Audit and Compensation Committees. The Company’s Fourth Amended and Restated Audit Committee Charter is attached asAppendix A to this Proxy Statement. The Company is a “Controlled Company” as defined in Rule 4350(c)(5) of the Nasdaq Marketplace Rules, because more than 50% of the voting power of the Company is controlled by the Company’s Chairman, President and Chief Executive Officer, Michael J. Saylor.

As a controlled company under Nasdaq rules, the Board has determined that the Board, rather than a nominating committee, is the most appropriate body for identifying director candidates and selecting nominees to be presented at the annual meeting of stockholders.

The Audit Committee of the Board of Directors provides the opportunity for direct contact between the Company’s independent registered public accounting firm and the Board of Directors. The Audit Committee met eight times during Fiscal Year 2004. The Audit Committee is currently comprised of Messrs. Calkins, Fowler, Patten and Ross. From January 2004 through October 2004, the Audit Committee was comprised of Messrs. Fowler and Ross and Ralph S. Terkowitz. Mr. Terkowitz resigned as a member of the Company’s Board of Directors and as a member of the Audit Committee in October 2004. Messrs. Patten and Calkins were appointed to the Audit Committee in November 2004 and January 2005, respectively. The Board of Directors has determined that each member of the Audit Committee meets the Nasdaq Marketplace Rule definition of “independent” for audit committee purposes, as well as the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). The Board of Directors has designated each of Messrs. Fowler and Ross as an “audit committee financial expert” as defined in Item 401(h)(2) of Regulation S-K. Additional information regarding the Audit Committee and its functions and responsibilities is included in this Proxy Statement under the caption “Audit Committee Report.”

The Compensation Committee of the Board of Directors makes compensation decisions regarding the Company’s President and Chief Executive Officer. The Compensation Committee acted solely by written actions in lieu of meetings during Fiscal Year 2004. The Compensation Committee was comprised of two non-employee directors, Messrs. Rickertsen (Chairman) and Ross, during Fiscal Year 2004. Mr. Patten, a non-employee director, was appointed to the Compensation Committee in January 2005. The current members of the Compensation Committee are Messrs. Rickertsen (Chairman), Patten and Ross. The Board of Directors has determined that each member of the Compensation Committee meets the Nasdaq Marketplace Rule definition of “independent” for compensation committee purposes.

Each member of the Compensation Committee is a “non-employee director” as defined in Rule 16b-3 under the Exchange Act. Additional information regarding the Compensation Committee and its functions and responsibilities is included in this Proxy Statement under the caption “Compensation Committee Report on Executive Compensation.”

Director Attendance at Annual Meeting of Stockholders

Although the Company does not have a policy with regard to Board members’ attendance at the Company’s annual meeting of stockholders, all directors are encouraged to attend the annual meeting. Six of the seven members of the then-current Board of Directors attended the 2004 Annual Meeting of Stockholders.

Director Candidates

As noted above, the Company does not have a standing nominating committee and the functions of evaluating and selecting directors have been performed by the Board of Directors as a whole. The Board will from time to time evaluate biographical information and background material relating to potential candidates and interview selected candidates. The Board does not currently have a charter or written policy with regard to the nomination process. The Company has not engaged a third party to assist in identifying and evaluating the individuals nominated for election as directors at this meeting.

7

At the Annual Meeting, stockholders will be asked to consider the election of Matthew W. Calkins and Jarrod M. Patten, each of whom has been nominated for election as a director. During 2004, each of Messrs. Calkins and Patten was recommended to the Board by the Company’s Chairman, President and Chief Executive Officer, and elected by the Board as a new director.

In considering whether to nominate any particular candidate for election to the Board, the Board uses various criteria to evaluate each candidate, including an evaluation of each candidate’s integrity, business acumen, knowledge of the Company’s business and industry, experience, diligence, conflicts of interest and the ability to act in the interests of the Company’s stockholders. The Board also considers whether a potential nominee would satisfy the Nasdaq Marketplace Rule definition of “independent” and the SEC’s definition of “audit committee financial expert.” The Board does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. The Company believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

The Company does not have a formal policy with regard to the consideration of director candidates recommended by its stockholders because of the Company’s status as a controlled company under Nasdaq rules. Stockholder recommendations relating to director nominees or otherwise may be submitted in accordance with the procedures set forth below under the heading “Stockholder Proposals”. Stockholders may also send communications to the Board of Directors in accordance with the procedures set forth below under the heading “Communicating with the Board of Directors”.

Communicating with the Board of Directors

Stockholders who wish to send communications to the Board may do so by writing to the Secretary of the Company, MicroStrategy Incorporated, 1861 International Drive, McLean, Virginia 22102. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication.” All such letters must identify the author as a stockholder and must include the stockholder’s full name, address and a valid telephone number. The name of any specific intended Board recipient should be noted in the communication. The Secretary will forward any such correspondence to the intended recipients; however, prior to forwarding any such correspondence, the Secretary or his designee will review such correspondence, and in his or her discretion, may not forward communications that relate to ordinary business affairs, communications that are primarily commercial in nature, personal grievances or communications that relate to an improper or irrelevant topic or are otherwise inappropriate for the Board’s consideration.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act, requires the Company’s directors, executive officers and holders of more than 10% of the Company’s class A common stock to file with the SEC initial reports of ownership of the Company’s class A common stock and other equity securities on a Form 3 and reports of changes in such ownership on a Form 4 or Form 5. Directors, executive officers and holders of 10% of the Company’s class A common stock are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To the Company’s knowledge, based solely on a review of the Company’s records and representations made by the Company’s directors and executive officers regarding their filing obligations, all Section 16(a) filing requirements were satisfied with respect to Fiscal Year 2004.

Code of Ethics

On March 5, 2004, the Board of Directors, through its Audit Committee, adopted a Code of Ethics that applies to MicroStrategy’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and such other personnel of MicroStrategy or its majority-owned subsidiaries as may be designated from time to time by the chairman of the Audit Committee. The Code of Ethics is publicly available on the Corporate Governance section of the Company’s website,

8

www.microstrategy.com. The Company intends to disclose any amendments to the Code of Ethics or any waiver from a provision of the Code of Ethics on the Corporate Governance section of the Company’s website,www.microstrategy.com.

Directors’ Compensation

2004 Director Compensation Arrangements

Equity Compensation. Except as otherwise described below, in Fiscal Year 2004, directors who were not employees of the Company or any subsidiary (“Outside Directors”) were granted stock options under the Company’s Second Amended and Restated 1999 Stock Option Plan (“1999 Plan”) pursuant to the following standard arrangement: (1) each Outside Director was granted an option to purchase 17,000 shares of class A common stock upon an Outside Director’s initial election or appointment to the Board of Directors (“First Option”), and (2) each Outside Director was granted an option to purchase an additional 8,000 shares of class A common stock upon the initial election or appointment of an Outside Director as the chairperson of the Compensation Committee or Audit Committee of the Board of Directors (the “Chairperson Option”), provided that the aggregate number of shares of class A common stock subject to the First Option and any Chairperson Option granted to any individual Outside Director may not exceed 25,000 shares. First Options and Chairperson Options become exercisable in equal annual installments over a five-year period.

Each option granted to an Outside Director under the 1999 Plan has an exercise price equal to the last reported sale price of the class A common stock as reported on the Nasdaq National Market for the most recent trading day prior to the date of grant. In the event of a merger of MicroStrategy with or into another corporation or another qualifying acquisition event, each option will be assumed or an equivalent option will be substituted by the successor corporation. If the successor corporation does not assume outstanding options or such options are not otherwise exchanged, all outstanding options automatically will become immediately exercisable.

Fees. Except as otherwise described below, in Fiscal Year 2004, each Outside Director received an annual retainer of $15,000 (in quarterly installments payable on the first day of each calendar quarter in arrears) for serving on the Company’s Board of Directors, and a fee of $3,750 for each quarterly meeting of the Board of Directors that such Outside Director attended in person. Each Outside Director who was a member of the Audit Committee (except the chairperson) also received $1,000 for each meeting of the Audit Committee that such member attended in person. The chairperson of each of the Audit Committee and the Compensation Committee also received an annual retainer of $7,500 (in four equal quarterly installments payable on the first day of each calendar quarter in arrears), and a fee of $1,875 for each meeting of their respective committees that such chairperson attended in person. The annual retainer fees described above were prorated for the number of days that the individual served as an Outside Director or as a committee chairperson, as the case may be, during the immediately preceding calendar quarter. Each Outside Director was reimbursed for all reasonable out-of-pocket expenses incurred by him or her in attending meetings of the Board of Directors and any committee thereof and otherwise in performing his or her duties as an Outside Director, subject to compliance with the Company’s standard documentation policies regarding reimbursement of business expenses.

In connection with the election of Messrs. Calkins and Patten to the Board of Directors in November 2004, the Board of Directors determined that the compensation arrangements described above would not apply to Messrs. Calkins and Patten.

On October 25, 2004, MicroStrategy amended stock option grants made on February 8, 2003 to each of Ralph S. Terkowitz and David B. Blundin, each a member of MicroStrategy’s Board of Directors at the time of such amendment. Each option provided the recipient the right to purchase an aggregate of 17,000 shares of class A common stock (the “Shares”), vesting in five equal annual installments beginning on the first anniversary of the grant date. The options were amended to provide that one-fifth of the Shares, scheduled to vest on February 8, 2005, would instead be vested on October 25, 2004. Each of Messrs. Terkowitz and Blundin resigned from MicroStrategy’s Board of Directors effective October 26, 2004.

9

2005 Director Compensation Arrangements

Effective January 1, 2005, each Outside Director receives a fee of $8,000 for each quarterly meeting of the Board of Directors (“Quarterly Board Meeting Fee”) which the Outside Director attends in person. An Outside Director may be paid a Quarterly Board Meeting Fee for attending a quarterly board meeting via telephonic conference call if the Outside Director has good reason for the Outside Director’s failure to attend such meeting in person as determined by the Chairman of the Board, but such payment is limited to one occurrence in any given fiscal year. Each Outside Director who is a member of the Audit Committee also receives a fee of $4,000 for each quarterly meeting of such committee which the Outside Director attends in person. Each Outside Director may receive fees up to $12,000 in any fiscal quarter for additional services delegated by the Board of Directors to such Outside Director in the Outside Director’s capacity as a member of the Audit Committee, the Board of Directors or any other committees of the Board of Directors, provided that any such fee paid with respect to a particular service must be approved by the Board of Directors following the completion of such service by the Outside Director. Each Outside Director is reimbursed for all reasonable out-of-pocket expenses incurred by him or her in attending meetings of the Board of Directors and any committee thereof and otherwise in performing his or her duties as an Outside Director, subject to compliance with the Company’s standard documentation policies regarding reimbursement of business expenses.

Executive Compensation

The compensation information set forth below relates to compensation paid by the Company to its chief executive officer and the Company’s five other most highly compensated executive officers who were serving as executive officers as of December 31, 2004 (collectively, the “Named Executive Officers”).

The following table sets forth certain information concerning the compensation of the Named Executive Officers for each of the last three fiscal years:

SUMMARY COMPENSATION TABLE

| Annual Compensation | Long-Term Compensation Awards | ||||||||||||

Name and Principal Position | Fiscal Year | Salary | Bonus | Other Annual Compensation | Number of Shares Underlying Options | ||||||||

Michael J. Saylor Chairman of the Board, President and Chief Executive Officer | 2004 2003 2002 | $ | 375,000 375,000 150,000 | $ | 954,775 532,889 — | — — — | | — 410,000 — | |||||

Sanju K. Bansal Vice Chairman of the Board, Executive Vice President, and Chief Operating Officer | 2004 2003 2002 | | 200,000 200,000 115,000 | | 509,213 284,207 — | — — — | | — 100,000 — | |||||

Eric F. Brown President and Chief Financial Officer | 2004 2003 2002 | | 250,000 250,000 225,000 | | — 213,155 100,000 | 20,348 — — | (1) | — 50,000 75,000 | |||||

Jonathan F. Klein Vice President, Law and General Counsel | 2004 2003 2002 | | 212,083 186,250 175,000 | | 425,000 100,000 60,000 | — — — | | — 50,000 70,000 | |||||

Jeffrey A. Bedell Vice President, Technology and Chief Technology Officer | 2004 2003 2002 | | 197,500 186,250 161,875 | | 115,423 55,468 55,971 | — — — | | — 50,000 51,610 | |||||

Eduardo S. Sanchez Vice President, Worldwide Sales | 2004 2003 2002 | | 250,000 250,000 250,000 | | 599,173 214,414 116,301 | — — — | | — 50,000 35,000 | |||||

| (1) | Mr. Brown resigned as President and Chief Financial Officer of MicroStrategy effective December 31, 2004. The amount shown represents Mr. Brown’s accrued vacation payout. |

10

Option Grants

No grants of stock options were made to any of the Named Executive Officers during Fiscal Year 2004.

Option Exercises and Holdings

The following table sets forth information concerning exercises of stock options during Fiscal Year 2004 by each of the Named Executive Officers and the number and value of unexercised options held by each of the Named Executive Officers on December 31, 2004.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

Number of Shares of Class A Acquired on Exercise | Value Realized(1) | Number of Shares of Class A Common Stock Underlying Unexercised Options at Fiscal Year-End | Value of Unexercised In- the-Money Options at Fiscal Year-End(2) | ||||||

Name | Exercisable/Unexercisable | Exercisable/Unexercisable | |||||||

Michael J. Saylor | 10,200 | $ | 459,654 | 71,800 / 328,000 | $2,840,408 / $12,975,680 | ||||

Sanju K. Bansal | 20,000 | 809,800 | 0 / 80,000 | 0 / 3,164,800 | |||||

Eric F. Brown | 35,000 | 1,713,755 | 40,000 / 0 | 0 / 0 | |||||

Jonathan F. Klein | — | — | 40,686 / 79,377 | 1,498,094 / 3,656,329 | |||||

Jeffrey A. Bedell | — | — | 75,094 / 74,227 | 2,809,721 / 3,216,702 | |||||

Eduardo S. Sanchez | 5,200 | 313,144 | 76,050 / 64,750 | 2,548,113 / 2,776,088 | |||||

| (1) | Represents the difference between the exercise price and the fair market value of the Company’s class A common stock on the date of exercise. |

| (2) | Value of an unexercised in-the-money option is determined by subtracting the exercise price per share from the fair market value per share for the underlying shares as of December 31, 2004, multiplied by the number of such underlying shares. The fair market value of the Company’s class A common stock is based upon the last reported sale price as reported on the Nasdaq National Market on December 31, 2004 ($60.25 per share). |

11

Equity Compensation Plan Information

The following table provides information about the securities authorized for issuance under the Company’s equity compensation plans as of December 31, 2004:

EQUITY COMPENSATION PLAN INFORMATION

| (a) | (b) | (c) | |||||||

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||

Equity compensation plans approved by stockholders(1) | 1,968,976 | (2) | $ | 86.21 | 2,081,989 | (3) | |||

Equity compensation plans not approved by stockholders | — | — | — | ||||||

Total | 1,968,976 | (2) | $ | 86.21 | 2,081,989 | (3) | |||

| (1) | Includes the Company’s 1996 Stock Plan (“1996 Plan”), 1997 Stock Option Plan for French Employees (“French Plan”), 1997 Director Option Plan (“1997 Director Plan”), 1998 Employee Stock Purchase Plan (“ESPP”) and 1999 Plan. The Company is no longer issuing options under the 1996 Plan, 1997 Director Plan or French Plan. |

| (2) | Does not include options issued under the ESPP for the offering period that began on August 1, 2004 and ended on January 31, 2005. |

| (3) | Includes 2,054,269 shares of class A common stock issuable under the 1996 Plan, French Plan, 1997 Director Plan and 1999 Plan, as of December 31, 2004. Although there are 424,683 shares available for future issuance under the 1996 Plan, the Company does not anticipate making any future stock option grants under this plan. The ESPP provides for an increase in the number of shares of the Company’s class A common stock available for issuance under the plan on June 4 of each year by 20,000 shares, or a lesser amount as may be determined by the Board of Directors. As of December 31, 2004, 27,720 shares of class A common stock were available for issuance under the ESPP, excluding any options granted for the offering period that began on August 1, 2004 and ended on January 31, 2005. |

12

Employment Agreements

MicroStrategy employees, including executive officers, are generally required to enter into confidentiality agreements prohibiting the employees from disclosing any of the Company’s confidential or proprietary information. In addition, the agreements generally provide that upon termination, an employee will not provide competitive products or services and will not solicit the Company’s customers and employees for a period of one year. At the time of commencement of employment, MicroStrategy employees also generally sign offer letters specifying certain basic terms and conditions of employment. Otherwise, MicroStrategy employees are generally not subject to written employment agreements.

In July 2002, each of Messrs. Bedell, Brown, Klein and Sanchez were granted options to purchase 50,000, 75,000, 70,000 and 35,000 shares of class A common stock, respectively, under the Company’s 1999 Plan. The option agreements for each of these grants provide for the acceleration of vesting in the event of a change in control of the Company such that, as of the effective date of the change in control, at least fifty percent of the original grant is fully vested and the remaining unvested portion will vest as to fifty percent of the remaining unvested shares on the last day of the third month after the effective date of the change in control and the remaining unvested shares will vest on the last day of the sixth month after the effective date of the change in control. In addition, these option agreements provide that if, following the change in control, such officer’s employment is terminated by MicroStrategy other than for cause or by such officer for good reason, the option will vest in full on the effective date of such termination.

13

AUDIT COMMITTEE REPORT

The Audit Committee of the Company’s Board of Directors acts under a written charter most recently amended and restated on April 26, 2005. A copy of this charter is attached to this Proxy Statement as Appendix A. From January 2004 until October 2004, the members of the Audit Committee were Messrs. F. David Fowler (Chairman), Stuart B. Ross and Ralph S. Terkowitz. Mr. Terkowitz resigned as a member of the Company’s Board of Directors and as a member of the Audit Committee in October 2004. Messrs. Jarrod M. Patten and Matthew W. Calkins were appointed to the Audit Committee in November 2004 and January 2005, respectively. The current members of the Audit Committee are Messrs. Fowler (Chairman), Calkins, Patten and Ross. The members of the Audit Committee are independent directors, as defined by its charter and the rules of The Nasdaq Stock Market.

The Audit Committee reviewed the Company’s audited financial statements for Fiscal Year 2004 and discussed these financial statements with the Company’s management. Management has the primary responsibility for the Company’s financial statements and the reporting process, including the system of internal controls. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with auditing standards generally accepted in the United States of America and for issuing a report on those financial statements. The Audit Committee is responsible for monitoring and overseeing these processes. As appropriate, the Audit Committee reviews and evaluates, and discusses with the Company’s management, internal accounting, financial and auditing personnel and the independent registered public accounting firm, the following:

| • | the plan for, and the independent registered public accounting firm’s report on, each audit of the Company’s financial statements; |

| • | the Company’s financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to stockholders; |

| • | changes in the Company’s accounting practices, principles, controls or methodologies; |

| • | management’s selection, application and disclosure of critical accounting policies; |

| • | significant developments or changes in accounting rules applicable to the Company; and |

| • | the adequacy of the Company’s internal controls and accounting, financial and auditing personnel. |

PricewaterhouseCoopers LLP (“PwC”) was the Company’s independent registered public accounting firm during Fiscal Year 2004 and until the May 10, 2005 completion of its procedures on the Company’s financial statements as of and for the quarter ended March 31, 2005. Through periodic meetings during Fiscal Year 2004 and until May 10, 2005, the Audit Committee discussed the following significant items with management and PwC: significant revenue contracts, significant and complex transactions, significant accounting and reporting issues and policies, and quarterly business results and financial statements. During Fiscal Year 2004 and until May 10, 2005, the Audit Committee also monitored the annual independent audit by PwC, selected Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005, pre-approved all audit and permitted non-audit services to be provided to the Company by PwC, reviewed the Company’s risk assessment and management procedures, reviewed and approved a charter for the Company’s Disclosure Committee, reviewed and approved a Code of Ethics for Designated Senior Financial Managers of the Company, oversaw the Company’s implementation of the mandates of Section 404 (Internal Controls over Financial Reporting) of the Sarbanes-Oxley Act of 2002, performed an Audit Committee self-assessment, reviewed and considered whether to approve related party transactions with any director or executive officer of the Company, and reviewed quarterly reports as required by the Company’s Board of Directors regarding significant revenue contracts requiring advance approval from the Audit Committee, litigation and regulatory matters and the status of internal controls and procedures. During this period, the Audit Committee also met in separate executive sessions with each of PwC, the Company’s Chief Executive Officer, President, Chief Financial Officer, Vice President, Finance and Worldwide Controller and Director of Internal Audit.

14

Management represented to the Audit Committee that the Company’s financial statements relating to Fiscal Year 2004 had been prepared in accordance with accounting principles generally accepted in the United States.

The Audit Committee also reviewed and discussed with PwC the audited financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees). SAS 61 requires the Company’s independent registered public accounting firm to discuss with the Company’s Audit Committee, among other things, the following:

| • | methods to account for significant unusual transactions; |

| • | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| • | the process used by management in formulating particularly sensitive accounting estimates and the basis for the independent registered public accounting firm’s conclusions regarding the reasonableness of those estimates; and |

| • | disagreements, if any, with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements (there were no such disagreements). |

PwC also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires independent registered public accounting firms to disclose annually in writing all relationships that in the independent registered public accounting firm’s professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. Accordingly, the Audit Committee discussed with PwC its independence from the Company. The Audit Committee also considered whether PwC’s provision of the other, non-audit related services to the Company, which are identified below under the caption “Independent Registered Public Accounting Firm Fees and Services”, is compatible with maintaining PwC’s independence.

Based on its discussions with management and PwC, as well as its review of the representations and information provided by management and PwC, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004.

By the Audit Committee of the Board of Directors of MicroStrategy Incorporated.

F. David Fowler

Matthew W. Calkins

Jarrod M. Patten

Stuart B. Ross

15

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

This report addresses the compensation policies of the Compensation Committee of the Board of Directors (the “Committee”) applicable to certain of the Company’s executive officers during Fiscal Year 2004. The Company’s executive compensation program was administered by the Committee and the Chief Executive Officer as described below.The Committee was comprised of two non-employee directors, Messrs. Carl J. Rickertsen (Chairman) and Stuart B. Ross, during Fiscal Year 2004. Mr. Jarrod M. Patten, a non-employee director, was appointed to the Committee in January 2005. The current members of the Committee are Messrs. Rickertsen (Chairman), Patten and Ross.

Executive Compensation Policy

The Committee determined base salary and bonus for Fiscal Year 2004 for the Company’s Chief Executive Officer and the Executive Vice President and Chief Operating Officer. The Committee determined, in consultation with the Audit Committee, the base salary and bonus for Fiscal Year 2004 for the President and Chief Financial Officer. The Chief Executive Officer determined base salary and bonus for Fiscal Year 2004 for other executive officers in periodic consultation with the Committee consistent with the Nasdaq rules applicable to controlled companies.

The objectives of the Committee in determining executive compensation in Fiscal Year 2004 were (i) to recognize and reward exceptional performance by the Company’s executives, (ii) to provide incentives for high levels of current and future performance, and (iii) to align the objectives and rewards of Company executives with those of the stockholders of the Company. The Committee believes that an executive compensation program that achieves these objectives will not only properly motivate and compensate the Company’s current officers, but will enable the Company to attract other officers that may be needed by the Company in the future.

In Fiscal Year 2004, the executive compensation program administered by the Committee was implemented through two principal elements: base salary and cash bonuses. After considering the stock options granted to executive officers in fiscal year 2003, the Committee determined not to grant any stock options to executive officers in Fiscal Year 2004. The Committee may elect to grant stock option awards or other equity based awards in future periods.

Executive Officer Compensation

Base Salary.In setting base salaries for Fiscal Year 2004, the Committee used a subjective evaluation process considering the performance of the Company or a particular department of the Company, the officer’s position, level and scope of responsibility and the officer’s job performance and contributions. Base salaries were generally set at levels that, in the opinion of the Committee, approximate the salary levels for executives of companies that are comparable to the Company.

Annual Bonus. The purpose of the Company’s bonus program is to support the Company’s objective of enhancing shareholder value by linking incentive compensation to selected financial goals. The key financial performance measure used by the Committee in determining bonuses for Fiscal Year 2004 to the Chief Executive Officer and the Executive Vice President and Chief Operating Officer was net operating income. The Committee also determined the amount of such bonuses on the basis of the subjective assessment of the Committee of the extent to which the executive officer contributed to the overall performance of the Company and particular departments of the Company during Fiscal Year 2004. The Committee, after consultation with the Audit Committee, determined that no bonus for Fiscal Year 2004 would be awarded to the President and Chief Financial Officer, Eric F. Brown. Mr. Brown resigned from the Company effective December 31, 2004.

Chief Executive Officer Compensation

In determining the Chief Executive Officer’s compensation for Fiscal Year 2004, the Committee considered the Company’s overall performance and its progress and performance on strategic objectives as well as the

16

contribution of the Chief Executive Officer to the overall performance of the Company and particular departments of the Company. The Committee considered that in Fiscal Year 2004, the Company achieved growth in total revenues, continued to realize improvements in operational efficiency and operating margins, and achieved improvements in income from operations. In addition, during Fiscal Year 2004, the Company enhanced its technology platform with the release of a UNIX-based version and introduced several new products, including MicroStrategy Office™ and MicroStrategy Intelligence Server Universal Edition™. No stock option grants were awarded to the Chief Executive Officer in Fiscal Year 2004 for the reasons set forth above under “Executive Compensation Policy”.

Section 162(m) of the Internal Revenue Code

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for compensation over $1 million paid to its chief executive officer and its four other most highly compensated executive officers. However, qualified performance-based compensation will not be subject to the deduction limit if certain requirements are met. The Committee takes into account, to the extent it believes appropriate, the limitations on the deductibility of executive compensation imposed by Section 162(m) in determining compensation levels and practices. The Committee believes that there may be circumstances in which the Company’s interests are best served by maintaining flexibility in the way compensation is provided, whether or not compensation is fully deductible under Section 162(m). A portion of the compensation awarded by the Committee to the Chief Executive Officer with respect to Fiscal Year 2004 was non-deductible.

By the Compensation Committee of the Board of Directors of MicroStrategy Incorporated.

Carl J. Rickertsen

Jarrod M. Patten

Stuart B. Ross

17

STOCK PERFORMANCE GRAPH

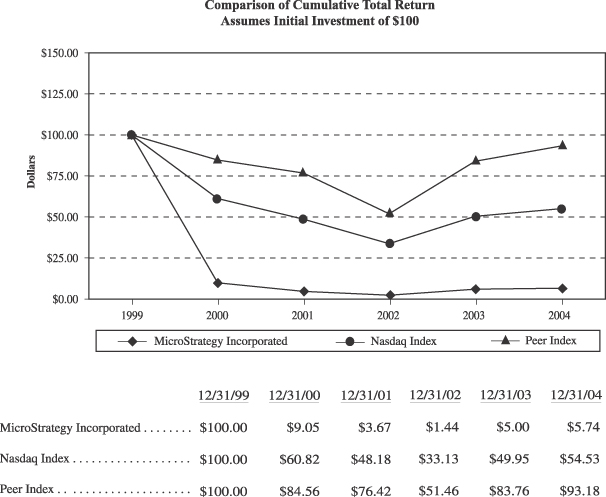

The following graph compares the cumulative total stockholder return on the class A common stock of the Company from December 31, 1999 (the last trading day before the beginning of the Company’s fifth preceding fiscal year) to December 31, 2004 (the end of Fiscal Year 2004) with the cumulative total return of (i) the Total Return Index for The Nasdaq Stock Market (U.S. Companies) (the “Nasdaq Index”) and (ii) a peer group of companies consisting of Business Objects S.A., Cognos Incorporated and Actuate Corporation (the “Peer Index”). This graph assumes the investment of $100.00 on December 31, 1999 in the class A common stock of the Company, the Nasdaq Index and the Peer Index, and assumes any dividends are reinvested. Measurement points are December 31, 1999, 2000, 2001, 2002, 2003 and 2004.

18

PROPOSAL 2

APPROVAL OF THE MATERIAL TERMS OF PERFORMANCE GOALS FOR

CERTAIN EXECUTIVE INCENTIVE COMPENSATION

The stockholders of MicroStrategy are asked to consider and vote upon a proposal to approve the material terms of performance goals for certain incentive compensation to the Company’s most highly compensated executive officers. If the stockholders approve this proposal, the compensation paid pursuant to such material terms will be fully deductible by the Company under Section 162(m) of the Internal Revenue Code (the “Code”).

Section 162(m) of the Code generally provides that no federal income tax business expense deduction is allowed for annual compensation in excess of $1 million paid by a publicly traded corporation to its chief executive officer and four other most highly compensated officers (the “covered executive officers”), as determined in accordance with the applicable rules under the Code and the Exchange Act. However, under the Code there is no limitation on the deductibility of “qualified performance-based compensation.” Qualified performance-based compensation by the Company must be paid solely on account of the attainment of one or more objective performance goals established in writing by the Compensation Committee at a time when the attainment of such goals is substantially uncertain. Performance goals may be based on one or more business criteria that apply to an individual, a business unit or the Company as a whole, but need not be based on an increase or positive result under the business criteria selected. For compensation that qualifies as performance-based compensation, the Compensation Committee is prohibited from increasing the amount of compensation payable if a performance goal is met, but may reduce or eliminate compensation even if such performance goal is attained. Stockholders must approve the types of performance goals and the maximum amount that may be paid to covered executive officers or the formula used to calculate such amount.

Payment of qualified performance-based compensation to a covered executive officer will be contingent upon the attainment of one or more performance goals (which may be stated as alternative goals) established in writing by the Compensation Committee for a covered executive officer for each performance period, which period may be the Company’s taxable year or such other period as determined by the Compensation Committee. Performance goals will be based on one or more of the following business criteria, which may be measured on a GAAP (generally accepted accounting principles) or non-GAAP basis: (1) total stockholder return; (2) such total stockholder return as compared to total return (on a comparable basis) of a publicly available index such as, but not limited to, the Standard & Poor’s 500 Stock Index; (3) net income; (4) pretax earnings; (5) earnings before interest expense, taxes, depreciation and amortization; (6) pretax operating earnings after interest expense and before bonuses and extraordinary or special items; (7) operating margin; (8) earnings per share; (9) return on equity; (10) return on capital; (11) return on investment; (12) operating earnings; (13) working capital; (14) ratio of debt to stockholders’ equity; and (15) revenue.

The maximum qualified performance-based compensation award that may be granted to any covered executive officer based on attainment of one or more of the foregoing performance goals for a performance period that is one year or less is $8 million (with any amount paid for a performance period of less than one year counting against the limit for the fiscal year in which or with which such performance period ends). The maximum qualified performance-based compensation award that may be granted to any covered executive officer based on attainment of one or more of the foregoing performance goals for a performance period that is longer than one year is $40 million.

The Committee takes into account, to the extent it believes appropriate, the limitations on the deductibility of executive compensation imposed by Section 162(m) in determining compensation levels and practices. The Compensation Committee from time to time may approve payment of discretionary incentive compensation based on business criteria other than the foregoing performance goals. Any such discretionary compensation would not qualify for the exclusion from the $1 million limitation of deductible compensation under Section 162(m).

19

Payment of incentive compensation relating to fiscal year 2005 or any period within such fiscal year to one or more covered executive officers may be subject to attainment of one or more of the performance goals described above. The incentive compensation that would have been payable with respect to the last fiscal year or that would be payable with respect to future periods based on such performance goals cannot be determined, because the payment of such compensation would be contingent upon attainment of the pre-established performance goals, the maximum amount of such compensation would depend on the Company’s performance for the applicable performance period, and the actual incentive compensation to a covered executive officer may reflect exercise of the Compensation Committee’s discretion to reduce the incentive compensation otherwise payable upon attainment of the performance goal.

Approval of this proposal will require the affirmative vote of a majority of the votes cast by the holders of Common Stock voting on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE FOREGOING PROPOSED MATERIAL TERMS OF PERFORMANCE GOALS FOR CERTAIN EXECUTIVE INCENTIVE COMPENSATION.

20

PROPOSAL 3

RATIFICATION OF THE SELECTION OF GRANT THORNTON LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2005

Change of Independent Registered Public Accounting Firm

On March 9, 2005, the Company was notified by PricewaterhouseCoopers LLP (“PwC”) that it declined to stand for reelection as the Company’s independent registered public accounting firm for the year ending December 31, 2005, subject to completion of its procedures on the Company’s financial statements as of and for the year ended December 31, 2004 and as of and for the quarter ending March 31, 2005. On May 10, 2005, PwC completed its procedures on the Company’s financial statements as of and for the quarter ended March 31, 2005 and PwC’s appointment as the Company’s independent registered public accounting firm ceased. The reports of PwC on the Company’s financial statements for the years ended December 31, 2004 and 2003 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle. During the years ended December 31, 2004 and 2003 and through May 10, 2005, there were no disagreements with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC, would have caused PwC to make reference thereto in its reports on the Company’s financial statements for such years. During the years ended December 31, 2004 and 2003 and through May 10, 2005, there were no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

Selection of Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2005

On April 28, 2005, the Audit Committee of the Board of Directors of the Company appointed Grant Thornton LLP (“Grant Thornton”) as the Company’s independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending December 31, 2005, such appointment to be effective upon the completion by PwC of its procedures related to the Company’s financial statements as of and for the quarter ended March 31, 2005 in connection with the Company’s filing of a Form 10-Q for such quarter. As such procedures were completed by PwC on May 10, 2005, the appointment of Grant Thornton as the Company’s independent registered public accounting firm became effective as of May 10, 2005.

During the years ended December 31, 2004 and 2003 and through May 10, 2005, the Company did not consult Grant Thornton with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, or regarding any other matters or reportable events described under Item 304(a)(2) of Regulation S-K.

Although stockholder approval of the selection of Grant Thornton is not required by law, the Company believes that it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Audit Committee may reconsider its selection of Grant Thornton.

Representatives of Grant Thornton are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from stockholders. Representatives of PwC are not expected to be present at the Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF GRANT THORNTON.

21

Independent Registered Public Accounting Firm Fees and Services

Aggregate fees for professional services rendered to the Company by PwC as of or for the years ended December 31, 2004 and 2003 are summarized in the table below.

| 2004 | 2003 | |||||

Audit | $ | 1,807,962 | $ | 862,949 | ||

Audit Related | 32,130 | 75,530 | ||||

Tax | 453,277 | 453,977 | ||||

All Other | 1,500 | 6,400 | ||||

Total | $ | 2,294,869 | $ | 1,398,856 | ||

Audit fees for the years ended December 31, 2004 and 2003, respectively, were for professional services rendered for the audits of the consolidated financial statements of the Company and statutory and subsidiary audits, services related to Sarbanes-Oxley Act compliance, income tax provision procedures, and assistance with review of documents filed with the SEC.

Audit Relatedfees for the years ended December 31, 2004 and 2003, respectively, were for assurance and related services, employee benefit plan audits, accounting consultations and consultations concerning financial and accounting and reporting standards.

Taxfees for the years ended December 31, 2004 and 2003, respectively, were for services related to tax compliance, including the preparation of tax returns, tax planning and tax advice.

All Other fees for the years ended December 31, 2004 and 2003, respectively, were primarily for license fees for online financial reporting and accounting literature.

Audit Committee Pre-Approval Policies and Procedures

During Fiscal Year 2004, the Audit Committee pre-approved all services (audit and non-audit) provided to MicroStrategy by the Company’s independent registered public accounting firm. In situations where a matter cannot wait until a full Audit Committee meeting, a subcommittee of the Audit Committee, consisting of the Chairman of the Audit Committee, has authority to consider, and if appropriate, approve audit and non-audit services. Any decision by this subcommittee of the Audit Committee to pre-approve services must be presented to the full Audit Committee for approval at its next scheduled quarterly meeting. The Audit Committee requires MicroStrategy to make required disclosure in the Company’s Securities and Exchange Commission periodic reports relating to the approval by the Audit Committee of audit and non-audit services to be performed by the independent registered public accounting firm and the fees paid by the Company for such services.

OTHER MATTERS

The Board of Directors does not know of any other matters which may come before the Annual Meeting. However, if any other matters are properly presented at the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

All costs of solicitation of proxies will be borne by the Company. In addition to solicitations by mail, the Company’s directors, officers and employees, without additional remuneration, may solicit proxies by telephone and personal interviews, and the Company reserves the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and, as required by law, the Company will reimburse them for their out-of-pocket expenses in this regard.

22

Householding of Annual Meeting Materials