SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

Volterra Semiconductor Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

ý No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 6. | Amount Previously Paid: |

| 7. | Form, Schedule or Registration Statement No.: |

| 8. | Filing Party: |

| 9. | Date Filed: |

VOLTERRA SEMICONDUCTOR CORPORATION

3839 Spinnaker Court

Fremont, California 94538

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 18, 2005

Dear Stockholder:

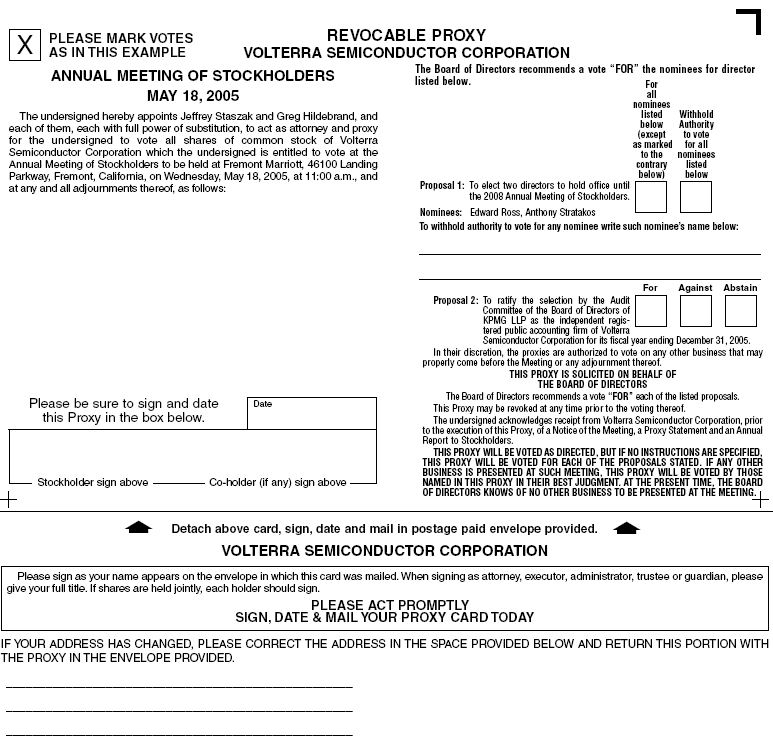

You are cordially invited to attend the Annual Meeting of Stockholders of Volterra Semiconductor Corporation, a Delaware corporation. The meeting will be held on Wednesday, May 18, 2005 at 11:00 a.m. local time at the Fremont Marriott, 46100 Landing Parkway, Fremont, California, for the following purposes:

1. To elect two directors to hold office until the 2008 Annual Meeting of Stockholders.

2. To ratify the selection by the Audit Committee of the Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2005.

3. To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the annual meeting is March 23, 2005. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors  Greg Hildebrand Secretary |

Fremont, California

April 7, 2005

VOLTERRA SEMICONDUCTOR CORPORATION

3839 Spinnaker Court

Fremont, California 94538

PROXY STATEMENT

FOR THE 2005 ANNUAL MEETING OF STOCKHOLDERS

May 18, 2005

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Volterra Semiconductor Corporation (sometimes referred to as the “Company” or “Volterra”) is soliciting your proxy to vote at the 2005 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

Volterra intends to mail this proxy statement and accompanying proxy card on or about April 7, 2005 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on March 23, 2005 will be entitled to vote at the annual meeting. On this record date, there were 23,466,237 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 23, 2005 your shares were registered directly in your name with Volterra’s transfer agent, Registrar and Transfer Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 23, 2005 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

• Election of two directors; and

• Ratification of KPMG LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2005.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For Proposal No. 2, the ratification of the selection by the Audit Committee of KPMG LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2005, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

• To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

• To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Volterra. Simply complete and mail the proxy card to ensure that your vote is counted. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 23, 2005.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of both nominees for director and “For” the ratification of the selection by the Audit Committee of the Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2005. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and returneach proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

• You may submit another properly completed proxy card with a later date.

• You may send a written notice that you are revoking your proxy to Volterra’s Secretary at 3839 Spinnaker Court, Fremont, CA 94538.

• You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

2

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 8, 2005, to Volterra’s Secretary at 3839 Spinnaker Court, Fremont, CA 94538. If you wish to submit a proposal that is not to be included in next year’s proxy materials or nominate a director, you must do so not later than the close of business on January 18, 2006 nor earlier than the close of business on November 19, 2005. You are also advised to review Volterra’s Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Withhold” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

• For Proposal No. 1, the election of directors, the two nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Only votes “For” or “Withheld” will affect the outcome.

• To be approved, Proposal No. 2, the ratification of the selection by the Audit Committee of the Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2005, must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the meeting or by proxy. On the record date, there were 23,466,237 shares outstanding and entitled to vote. Thus, assuming all such shares remain outstanding on the date of the annual meeting, 11,733,119 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in the Company’s quarterly report on Form 10-Q for the second quarter of 2005.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Volterra’s Board of Directors (the “Board”) is divided into three classes. Each class consists of three directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class shall serve for the remainder of the full term of that class, and until the director’s successor is elected and qualified. This includes vacancies created by an increase in the number of directors.

The Board presently has nine members. There are three directors in the class whose term of office expires in 2005: Chris Branscum, Edward Ross and Anthony Stratakos. Mr. Branscum will not seek election in 2005 and his term as a member of the Board ends on the date of the annual meeting. In addition, Craig Teuscher, a member of the Board whose term as director would have otherwise expired at the 2006 annual meeting, has resigned from the Board effective as of the date of the 2005 annual meeting. On the date of the annual meeting, the authorized number of directors will be reduced from nine to seven.

Each of the two nominees listed below is currently a director of the Company who was recommended for election to the Board by the Nominating and Corporate Governance Committee of the Board. Proxies may not be voted for a greater number of persons than the number of nominees named. Dr. Ross was previously elected as a director by the Board in 2004 and Dr. Stratakos was appointed as a director of the Company when the Company was formed in 1996. If elected at the annual meeting, each of these nominees would serve until the 2008 annual meeting and until his successor is elected and has qualified, or until the director’s death, resignation or removal. It is the Company’s policy to encourage directors and nominees for director to attend the annual meeting. The Company did not hold an annual meeting of stockholders in 2004, during part of which year the Company was privately held.

The following is a brief biography of each nominee, each director whose term will continue after the annual meeting, and each director whose term will not continue after the annual meeting.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2008 ANNUAL MEETING

Edward Ross

Dr. Edward Ross, age 63, has been a member of our Board of Directors since May 2004. Since January 2005, Dr. Ross has been the President Emeritus of TSMC North America, the U.S. subsidiary of Taiwan Semiconductor Manufacturing Company Ltd., a semiconductor manufacturer. From March 2000 to December 2004, he was the President and Chief Executive Officer of TSMC North America. From July 1998 to March 2000, Dr. Ross was Senior Vice President of the Professional Services Group at Synopsys, Inc., a semiconductor design software company. From September 1995 to July 1998, he served as President of Technology and Manufacturing at Cirrus Logic, Inc., a semiconductor manufacturer. Dr. Ross is a member of the board of directors of RAE Systems, Inc., a manufacturer of scientific instruments, California Micro Devices Corporation, a semiconductor company, and Open Silicon, Inc., a semiconductor company. Dr. Ross holds a B.S.E.E. from Drexel University and an M.S.E.E., M.A. and Ph.D. from Princeton University.

Anthony Stratakos

Dr. Anthony Stratakos, age 34, co-founded Volterra and has been our Vice President of Advanced Research and Development and Chief Technology Officer since October 1997 and a member of our Board of Directors since September 1996. From August 1996 to October 1997, Dr. Stratakos led our product development efforts. Dr. Stratakos holds a B.S.E.E. and an M.S.E.E. from Johns Hopkins University and a Ph.D. in electrical engineering from the University of California at Berkeley.

4

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2006ANNUAL MEETING

Mel Friedman

Mr. Mel Friedman, age 66, has been a member of our Board since May 2004. From July 2002 to October 2003, Mr. Friedman served as a consultant to Sun Microsystems, Inc., a network computing company. Mr. Friedman retired as Senior Vice President of Customer Advocacy at Sun Microsystems in July 2002 after serving in that position since July 2000. From April 1989 to June 2000, Mr. Friedman served in several other roles for Sun Microsystems, including President of its Microelectronics Division, Vice President of Worldwide Operations for its Systems Operation, Vice President of West Coast Operations and Vice President of Supply Management. Mr. Friedman currently serves on the board of directors of Blue Martini Software, Inc., a software company, and Electroglas, Inc., a semiconductor equipment company. He holds a B.S.M.E. from City College of New York and has completed masters courses in Industrial Management at the Massachusetts Institute of Technology.

Christopher Paisley

Mr. Christopher Paisley, age 52, has been a member of our Board since April 2000. Since January 2001, Mr. Paisley has served as the Dean’s Executive Professor of Accounting and Finance at the Leavey School of Business at Santa Clara University. Mr. Paisley retired from his position as Senior Vice President of Finance and Chief Financial Officer of 3Com Corporation, a networking products company, in May 2000 after having served as an officer at 3Com since September 1985. Mr. Paisley currently serves on the boards of directors of Electronics for Imaging, Inc., a printing solutions provider, Brocade Communications Systems, Inc., a networking company, and Silicon Image, Inc., a semiconductor company. Mr. Paisley holds a B.A. in Economics from the University of California at Santa Barbara and an M.B.A. from the University of California at Los Angeles.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2007 ANNUAL MEETING

Alan King

Mr. Alan King, age 69, has been our Chairman of the Board since October 1997 and a member of our Board since November 1996. Mr. King served as our Chief Executive Officer from November 1996 to August 2000. From September 1991 to November 1994, Mr. King served as President and Chief Executive Officer of Silicon Systems, Inc., a semiconductor company then affiliated with TDK Corporation. From September 1986 to September 1991, Mr. King served as President and Chief Executive Officer of Precision Monolithics, Inc., a semiconductor company. Mr. King holds a B.S. in Engineering from the University of Washington.

Jeffrey Staszak

Mr. Jeffrey Staszak, age 52, joined Volterra as our President and Chief Operating Officer in March 1999, and has been our Chief Executive Officer since August 2000 and a member of our Board since April 2000. Prior to joining Volterra, Mr. Staszak was Senior Vice President in the Storage Products Group of Texas Instruments Inc., a semiconductor company, from July 1996 to March 1999. From May 1993 to July 1996, Mr. Staszak served as Senior Vice President and General Manager of the Storage Products Division of Silicon Systems, Inc., a semiconductor company then affiliated with TDK Corporation. Mr. Staszak holds a B.S. in Industrial Technology from the University of Wisconsin — Stout and an M.B.A. from Pepperdine University.

5

Edward Winn

Mr. Edward Winn, age 66, has been a member of our Board since April 2004. From March 1992 to January 2000, Mr. Winn served in various capacities at TriQuint Semiconductor, Inc., a semiconductor company, most recently as Executive Vice President, Finance and Administration and Chief Financial Officer. From 1985 to 1992, Mr. Winn served in various capacities at Avantek, Inc., a microwave component and subsystem company, most recently as Product Group Vice President. Mr. Winn serves as a member of the board of directors of NASSDA Corporation, a semiconductor design software company, and Endwave Corporation, a radio frequency subsystem company. Mr. Winn received a B.S. in Physics from Rensselaer Polytechnic Institute and an M.B.A. from Harvard Business School.

DIRECTORS NOT CONTINUING IN OFFICE AFTER THE 2005 ANNUAL MEETING

Chris Branscum

Mr. Chris Branscum, age 56, has been a member of our board of directors since November 1996. Since May 2004, Mr. Branscum has served as Chairman of the Board of Wavestream Corporation, an electronics company, where he has also served as Chief Executive Officer and a director since May 2003. Since October 1996, Mr. Branscum has served as Managing Director of Hallador Venture Partners LLC and since June 1990 he has served as General Partner of Hallador Venture Partners, both of which are venture capital firms. From January 1990 to October 2002, Mr. Branscum was a director of Repeater Technologies, Inc., a wireless network equipment company, where he also served as Chief Executive Officer from December 2000 to September 2002 and as President from December 2000 to October 2002, when that company filed for voluntary bankruptcy protection. Mr. Branscum served as a director of Endgate Corporation (now Endwave Corporation), a radio frequency subsystem company, from March 1992 to May 2000, as a director of SureWest Communications, a communications products and services company, from January 1999 to March 2004, and as a director of California Dental Association Holding Company, Inc., a provider of insurance and insurance-related services, from April 1999 to December 2003. Mr. Branscum holds a B.S. in Business Administration from California State University, Sacramento and a J.D. from the University of Pacific, McGeorge School of Law.

Craig Teuscher

Dr. Craig Teuscher, age 37, co-founded Volterra and has been our Vice President of Sales and Applications Engineering since January 2003 and a member of our Board since September 1996. From July 1998 to January 2003, Dr. Teuscher served as our Director of Applications Engineering. Dr. Teuscher holds a B.S.E.E. from Princeton University and an M.S.E.E. and Ph.D. in electrical engineering from the University of California at Berkeley.

INDEPENDENCE OF THE BOARD OF DIRECTORS

As required under the Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The board consults with the company’s counsel to ensure that the board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has determined that all of the Company’s directors are independent directors within the meaning of the applicable Nasdaq listing standards, except for Mr. Staszak, the President and Chief Executive Officer of the Company, Dr. Stratakos, the Company’s Vice President of Advanced Research and Development and Chief Technology Officer, and Dr. Teuscher, the Company’s Vice President of Sales and Applications Engineering.

6

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

In June 2004, the Board documented the governance practices followed by the Company by adopting Corporate Governance Guidelines to ensure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations as needed and, where appropriate, to make decisions that are independent of the Company’s management. The guidelines are also intended to align the interests of directors and management with those of the Company’s stockholders. The Corporate Governance Guidelines set forth the practices the Board will follow with respect to: Board organization and independence of directors; committee composition; board meetings; communication with management, employees stockholders, journalists, analysts and other outside parties; retention of advisors; election and service of directors; and continuing director education. The Corporate Governance Guidelines were adopted by the Board to, among other things, reflect changes to the Nasdaq listing standards and Securities and Exchange Commission rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002.

Persons interested in communicating with the independent directors with their concerns or issues may address correspondence to a particular director, or to the independent directors generally, in care of the Chief Financial Officer of Volterra Semiconductor Corporation at 3839 Spinnaker Court, Fremont, CA 94538. If no particular director is named, letters will be forwarded, depending on the subject matter, to the Chair of the Audit, Compensation, or Nominating and Corporate Governance Committee.

The Board has three committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for 2004 for each of the Board committees:

Name | Audit | Compensation | Nominating and Corporate Governance(1) |

| Chris Branscum (2) | X | X | |

| Kevin Compton (3) | X | ||

| Mel Friedman (4) | X | ||

| Alan King | X* | ||

| Christopher Paisley | X* | X | |

| Edward Ross (5) | X* | X | |

| Jeffrey Staszak | |||

| Anthony Stratakos | |||

| Craig Teuscher (6) | |||

| Edward Winn (7) | X | ||

| Total meetings in fiscal year 2004 | 7 | 7 | 0 |

*Committee Chairperson

(1) The Nominating and Corporate Governance Committee was formed on April 27, 2004 in connection with preparations for the Company’s initial public offering.

(2) Mr. Branscum’s term as a member of the Board ends on the date of the annual meeting and he will not seek election in 2005.

(3) Mr. Compton served on the Compensation Committee through April 2004. Mr. Compton resigned from the Board in May 2004.

(4) Mr. Friedman joined the Board in May 2004, was appointed to the Nominating and Corporate Governance Committee in May 2004, and will serve on the Audit Committee effective on the date of the annual meeting.

(5) Dr. Ross joined the Board and was appointed Chairman of the Compensation Committee in May 2004. He was also appointed to the Nominating and Corporate Governance Committee in May 2004.

7

(6) Dr. Teuscher has resigned from the Board effective as of the date of the annual meeting.

(7) Mr. Winn joined the Board in April 2004, was appointed to the Audit Committee in April 2004, and will serve on the Compensation Committee effective on the date of the annual meeting.

Below is a description of each committee of the Board. Each of the Audit and Compensation committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his individual exercise of independent judgment with regard to the Company.

AUDIT COMMITTEE

The Audit Committee of the Board of Directors oversees the Company’s corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions, including:

• evaluating the performance of our independent auditors, assessing their qualifications and independence, and determining and approving their engagements;

• reviewing our annual financial statements, discussing with management and our independent auditors the results of our annual audit, and discussing with management and our independent auditors the results of the auditors’ review of our quarterly financial statements;

• reviewing with management and our independent auditors significant issues that arise regarding accounting principles and financial statement presentation;

• reviewing and discussing with management and our independent auditors, as appropriate, our guidelines and policies with respect to risk assessment and risk management;

• reviewing with our independent auditors any significant difficulties with our annual audit or any restrictions on the scope of their activities or access to required records, data and information, significant disagreements with management and management’s response, if any;

• reviewing with our independent auditors and management any conflicts or disagreements between management and our independent auditors regarding financial reporting or accounting practices or policies and resolving any such conflicts regarding financial reporting;

• conferring with our independent auditors and management regarding the scope, adequacy and effectiveness of our internal financial reporting controls; and

• reviewing and approving related-party transactions and reviewing other issues arising under our Code of Conduct or similar policies.

Three directors currently comprise the Audit Committee: Messrs. Paisley, Branscum, and Winn. Mr. Paisley serves as Chairperson. Following the annual meeting, the audit committee will be composed of Messrs. Paisley, Winn, and Friedman. The Audit Committee met seven times during 2004. The Board has adopted a written Audit Committee Charter that is attached as Appendix A to these proxy materials. The Audit Committee charter can also be found on our corporate website at http://investors.volterra.com.

The Board of Directors annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A)(i) and (ii) of the Nasdaq listing standards). The Board of Directors has determined that Mr. Paisley qualifies as an “audit committee financial expert,” as defined in applicable Securities and Exchange Commission (“SEC”) rules. The Board made a qualitative assessment of Mr. Paisley’s level of knowledge and experience based on a number of factors, including his formal education and experience as the chief financial officer of a public company.

8

COMPENSATION COMMITTEE

The Compensation Committee of the Board reviews and approves the overall compensation strategy and policies for the Company. For this purpose, the Compensation Committee performs several functions, including:

• reviewing and approving the compensation of our chief executive officer;

• reviewing and approving the compensation policies, plans and programs for our executive officers and other senior management, as well as our overall compensation plans and structure;

• recommending to our board of directors the compensation for our independent directors; and

• administering our stock plans and employee benefit plans.

The Company also has a Non-Officer Stock Option Committee, which is a sub-committee of the Compensation Committee and is composed of the Company’s Chief Executive Officer, Jeffrey Staszak. The Non-Officer Stock Option Committee may award stock options to new employees, excluding employees reporting directly to the Chief Executive Officer, subject to certain guidelines approved by the Board. The Company’s policy is that all grants made by the Non-Officer Stock Option Committee are to be reviewed and ratified by the Compensation Committee at its quarterly meetings.

Three directors currently comprise the Compensation Committee: Messrs. Branscum, Paisley, and Ross. Mr. Ross serves as chairperson. Following the annual meeting, and with respect to Mr. Ross, contingent upon his election at the annual meeting, the Compensation Committee will be composed of Messrs. Ross, Paisley, and Winn. Mr. Compton was a member of the Compensation Committee prior to his resignation from the Board in May 2004. All members of the Company’s Compensation Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Compensation Committee met seven times during 2004. The Compensation Committee charter can be found on our corporate website at http://investors.volterra.com.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for:

• establishing criteria for board membership and reviewing and recommending nominees for election as directors;

• considering board nominations and proposals submitted by our stockholders;

• assessing the performance of our board of directors and the independence of directors; and

• developing our corporate governance principles.

The Nominating and Corporate Governance Committee charter can be found on our corporate website at http://investors.volterra.com. Three directors comprise the Nominating and Corporate Governance Committee: Messrs. King, Friedman and Ross. Mr. King serves as chairperson. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Nominating and Corporate Governance Committee was formed in April 2004 and did not meet during 2004. However, the independent directors of the Company considered the relevant qualifications, function and needs of the Board, and conducted what they believed to be appropriate and necessary inquiries into the backgrounds and qualifications of Messrs. Friedman, Ross and Winn prior to their appointment in April and May 2004.

The Nominating and Corporate Governance Committee has not established any stated specific, minimum qualifications that must be met by a candidate for a position on our Board. The Nominating and Corporate Governance Committee will consider all of the relevant qualifications of Board candidates, including such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of Volterra, demonstrated excellence in his or her field, having the ability to exercise sound business judgment, having the commitment to rigorously represent the long-term interests of our stockholders, and whether the Board candidates will be independent for Nasdaq purposes, as well as the needs of the Board and Volterra. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee will also review such directors’ overall service to Volterra during their terms, and any relationships and transactions that might impair such directors’ independence. The Nominating and Corporate Governance Committee will conduct any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. At this time, the Nominating and Corporate Governance Committee does not believe that the establishment of stated specific, minimum qualifications that must be met by a candidate for a position on our Board is necessary or appropriate. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates.

9

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 3839 Spinnaker Court, Fremont, CA 94538 at least 120 days prior to the anniversary date of the mailing of the Company’s proxy statement for the last annual meeting of stockholders. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of our common stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

10

MEETINGS OF THE BOARD OF DIRECTORS

The Board met ten times during 2004. All directors except Edward Winn attended at least 75% of the aggregate of the meetings of the Board and of the committees on which they served, held during the period for which they were a director or committee member, respectively. Mr. Winn was unable to attend three of the nine Board meetings held during the period for which he was a director.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Company has not adopted a formal process for stockholder communications with the Board. Nevertheless, every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. We believe our responsiveness to stockholder communications to the Board has been excellent. Nevertheless, the Nominating and Corporate Governance Committee will consider, from time to time, whether adoption of a formal process for stockholder communications with the Board has become necessary or appropriate.

CODE OF CONDUCT

The Company has adopted a Code of Conduct that applies to all of Volterra’s officers, directors and employees. The Code of Conduct is available on the Company’s website at http://investors.volterra.com. If the Company makes any substantive amendments to the Code of Conduct or grants any waiver from a provision of the Code of Conduct to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website, or as otherwise required by applicable law, rules or regulations.

11

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS(1)

The Audit Committee of the Board currently consists of three members: Messrs. Branscum, Paisley and Winn. Mr. Paisley serves as Chairperson of the Audit Committee. Prior to May 2004, the Audit Committee consisted of Messrs. Branscum and Paisley. In May 2004 Mr. Winn was appointed to the Audit Committee. Following the annual meeting, the Audit Committee will consist of Messrs. Paisley, Winn and Friedman. All members of Volterra’s Audit Committee are independent (as independence is defined in Rules 4200(a)(15) and 4350(d) of the Nasdaq listing standards).

The Audit Committee oversees Volterra’s corporate accounting and financial reporting process on behalf of the Board. Management has primary responsibility for the financial statements and the reporting process, including the systems of internal controls and disclosure controls and procedures. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in Volterra’s Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee is responsible for reviewing, approving and managing the engagement of the Company’s independent auditors, including the scope, extent and procedures of the annual audit and compensation to be paid thereto, and all other matters the Audit Committee deems appropriate, including the independent auditors’ accountability to the Board and the Audit Committee. The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of Volterra’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards and those matters required to be discussed by the Statement on Auditing Standards No. 61. In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and Volterra, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1, and has considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with Volterra’s independent auditors the overall scope and plans for their audits. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluation of Volterra’s internal controls and the overall quality of Volterra’s financial reporting. The Audit Committee held seven meetings during the fiscal year ended December 31, 2004.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in Volterra’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004 for filing with the Securities and Exchange Commission. The Audit Committee has also retained, subject to stockholder ratification described in Proposal 2, KPMG LLP as Volterra’s independent registered public accounting firm for the fiscal year ending December 31, 2005.

AUDIT COMMITTEE Christopher Paisley,Chairperson Chris Branscum Edward Winn |

(1) The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”) or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

12

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the annual meeting. KPMG LLP has audited the Company’s financial statements since 1996. Representatives of KPMG LLP are expected to be present at the annual meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of KPMG LLP. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table represents aggregate fees billed to the Company for fiscal years ended December 31, 2004 and December 31, 2003, by KPMG LLP, the Company’s principal accountant.

Fiscal Year Ended December 31, | |||||||

2004 | 2003 | ||||||

Audit Fees | $ | 944,880 | $ | 72,000 | |||

Audit-related Fees (for services rendered in connection with a Singapore grant application) | 1,230 | — | |||||

Tax Fees | — | — | |||||

All Other Fees | — | — | |||||

| Total Fees | $ | 946,110 | $ | 72,000 | |||

All fees described above were approved by the Audit Committee.

During the fiscal year ended December 31, 2004, none of the hours expended on the Company’s financial audit by KPMG LLP were provided by persons other than KPMG LLP’s full-time permanent employees.

PRE-APPROVAL OF SERVICES

The Audit Committee has adopted procedures for the pre-approval of audit and non-audit services rendered by our independent registered public accounting firm, KPMG LLP. The Audit Committee generally pre-approves specified services in the defined categories of audit services, audit-related services, and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual explicit case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

13

The Audit Committee has determined that the rendering of the services other than audit services by KPMG LLP is compatible with maintaining the principal accountant’s independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

14

EXECUTIVE OFFICERS

Set forth below is information regarding our executive officers as of March 1, 2005. Information regarding our directors is set forth in “Proposal 1 — Election of Directors” presented earlier in this proxy statement.

Name | Age | Position |

| Jeffrey Staszak | 52 | President, Chief Executive Officer and Director |

| Greg Hildebrand | 34 | Vice President of Finance and Chief Financial Officer, Treasurer and Secretary |

| William Numann | 48 | Vice President of Marketing |

| Anthony Stratakos | 34 | Vice President of Advanced Research and Development, Chief Technology Officer and Director |

| Craig Teuscher | 37 | Vice President of Sales and Applications Engineering and Director |

| Daniel Wark | 49 | Vice President of Operations |

Jeffrey Staszak

Mr. Jeffrey Staszak joined Volterra as our President and Chief Operating Officer in March 1999, and has been our Chief Executive Officer since August 2000 and a member of our board of directors since April 2000. Prior to joining Volterra, Mr. Staszak was Senior Vice President in the Storage Products Group of Texas Instruments Inc., a semiconductor company, from July 1996 to March 1999. From May 1993 to July 1996, Mr. Staszak served as Senior Vice President and General Manager of the Storage Products Division of Silicon Systems, Inc., a semiconductor company then affiliated with TDK Corporation. Mr. Staszak holds a B.S. in Industrial Technology from the University of Wisconsin — Stout and an M.B.A. from Pepperdine University.

Greg Hildebrand

Mr. Greg Hildebrand co-founded Volterra and has been our Treasurer since August 1996, our corporate Secretary since December 1998, and our Vice President of Finance and Chief Financial Officer since April 2004. From August 1996 to April 2004, Mr. Hildebrand held various positions at Volterra, most recently as our Director of Finance. Mr. Hildebrand holds a B.A. in Philosophy and Economics and an M.B.A. from the University of California at Berkeley.

William Numann

Mr. William Numann joined Volterra as our Vice President of Marketing in November 2000. Prior to joining Volterra, Mr. Numann was Vice President of Standard Products of Supertex, Inc., a semiconductor company, from October 1997 to October 2000. From June 1985 to September 1997, Mr. Numann served as Product Marketing and Applications Director at Siliconix, Inc., a semiconductor company. Mr. Numann holds a B.S.E.E. and an M.B.A. from Rennselear Polytechnic Institute.

Anthony Stratakos

Dr. Anthony Stratakos co-founded Volterra and has been our Vice President of Advanced Research and Development and Chief Technology Officer since October 1997 and a member of our board of directors since September 1996. From August 1996 to October 1997, Dr. Stratakos led our product development efforts. Dr. Stratakos holds a B.S.E.E. and an M.S.E.E. from Johns Hopkins University and a Ph.D. in electrical engineering from the University of California at Berkeley.

Craig Teuscher

Dr. Craig Teuscher co-founded Volterra and has been our Vice President of Sales and Applications Engineering since January 2003 and a member of our board of directors since September 1996. From July 1998 to January 2003, Dr. Teuscher served as our Director of Applications Engineering. Dr. Teuscher holds a B.S.E.E. from Princeton University and an M.S.E.E. and Ph.D. in electrical engineering from the University of California at Berkeley.

15

Daniel Wark

Mr. Daniel Wark joined Volterra as our Vice President of Operations in September 2000. Prior to joining Volterra, Mr. Wark was Vice President, Operations of Pericom Semiconductor Corporation, a semiconductor company, from April 1996 to September 2000. From May 1983 to December 1995, Mr. Wark held various positions at Linear Technology Corporation, a semiconductor company, most recently as Director of Corporate Services. Other positions that Mr. Wark held at Linear included Managing Director of its Singapore subsidiary, Linear Technology Pte. Ltd., and Production Control Manager. Mr. Wark holds a B.S. in Business Administration from San Jose State University.

16

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s common stock as of March 1, 2005 by: (i) each director and nominee for director; (ii) each of the executive officers named in the Summary Compensation Table (the “Named Executive Officers”); (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its common stock. Unless otherwise indicated, the address for each listed beneficial owner is c/o Volterra Semiconductor Corporation, 3839 Spinnaker Court, Fremont, CA 94538.

Beneficial Ownership (1) | |||||||

Beneficial Owner | Number of Shares | Percent of Total (%) | |||||

Entities Affiliated with Kleiner Perkins Caufield & Byers(2) 2750 Sand Hill Rd. Menlo Park, CA 94025 | 2,877,990 | 12.3 | |||||

Entities Affiliated with INVESCO Private Capital, Inc.(3) 1166 Avenue of the Americas 27th Floor New York, NY 10036 | 1,379,661 | 5.9 | |||||

| Anthony Stratakos(4) | 1,387,093 | 5.8 | |||||

| Chris Branscum(5) | 936,277 | 4.0 | |||||

| Alan King(6) | 925,000 | 3.9 | |||||

| Jeffrey Staszak(7) | 741,562 | 3.1 | |||||

| Craig Teuscher(8) | 538,937 | 2.3 | |||||

| Daniel Wark(9) | 116,000 | * | |||||

| William Numann(10) | 109,625 | * | |||||

| Christopher Paisley(11) | 27,812 | * | |||||

| Edward Ross | 6,250 | * | |||||

| Edward Winn(12) | 5,000 | * | |||||

| Mel Friedman | 0 | * | |||||

| All executive officers and directors as a group (12 persons)(13) | 5,378,774 | 22.9 | |||||

* Less than one percent.

(1) This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 23,448,997 shares outstanding on March 1, 2005, adjusted as required by rules promulgated by the SEC.

(2) Consists of 2,663,317 shares held by Kleiner Perkins Caufield & Byers VIII, L.P., 60,465 shares held by KPCB Information Sciences Zaibatsu Fund II, L.P., and 154,208 shares held by KPCB VIII Founders Fund, L.P. KPCB VIII Associates, L.P. (KPCB VIII) is the general partner of Kleiner Perkins Caufield & Byers VIII, L.P. and KPCB VIII Founders Fund, L.P., and KPCB VII Associates, L.P. (KPCB VII) is the general partner of KPCB Information Sciences Zaibatsu Fund II, L.P. Brook H. Byers, Kevin R. Compton, L. John Doerr, William R. Hearst III, Vinod Khosla, Joseph S. Lacob and Douglas Mackenzie are general partners of KPCB VII and KPCB VIII and have shared voting and investment authority over these shares. James P. Lally, Floyd Kvamme and Bernard J. Lacroute are general partners of KPCB VII and have shared voting and investment authority over the shares held by KPCB Information Sciences Zaibatsu Fund II, L.P. These individuals disclaim beneficial ownership of these shares except to the extent of their pecuniary interest therein.

17

(3) Consists of 798,312 shares held by Citiventure 96 Partnership, L.P., 336,145 shares held by Chancellor Private Capital Offshore Partners II, L.P. (CPC II), 204,098 shares held by Chancellor Private Capital Partners III, L.P. (CPC III), 31,231 shares held by Chancellor Private Capital Offshore Partners I, C.V. (CPC I), and 9,875 shares held by various clients of which INVESCO Private Capital, Inc. is the full discretion investment advisor. INVESCO Private Capital, Inc. is the full discretion investment advisor to Citiventure 96 Partnership, L.P., CPC I, CPC II and CPC III. The general partner of CPC I is Chancellor KME IV Partner, L.P., the general partner of which is INVESCO Private Capital Investments, Inc.; the general partner of CPC II is CPCO Associates, L.P., the general partner of which is INVESCO Private Capital Investments, Inc.; and the general partner of CPC III is CPCP Associates, L.P., the general partner of which is INVESCO Private Capital Investments, Inc. Parag Saxena, Alessandro Piol, Howard Goldstein, Johnston Evans, Esfandiar Lohrasbpour and Alan Kittner are members of the investment committee of INVESCO Private Capital, Inc. and have shared voting and investment power over these shares. These individuals disclaim beneficial ownership of these shares except to the extent of their pecuniary interest therein. Such voting and investment authority may be deemed to be shared with the general partner of each entity that holds such shares, where applicable, and the general partner of such general partner, where applicable. INVESCO Private Capital, Inc. disclaims beneficial ownership of these shares except to the extent of its pecuniary interest therein.

(4) Includes 25,250 shares held by Dr. Stratakos’ wife and 362,968 shares issuable upon the exercise of options exercisable within 60 days after March 1, 2005.

(5) Includes 363,958 shares held by Hallador Venture Fund II, LP and 563,319 shares held by Hallador Venture Fund III, LP. Mr. Branscum is a general partner of Hallador Venture Partners, the general partner of Hallador Venture Fund II, LP; and a Managing Director of Hallador Venture Partners LLC, the general partner of Hallador Venture Fund III, LP. Mr. Branscum disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein.

(6) Includes 325,000 shares held by the King Trust of 1986, of which Mr. King is a co-trustee.

(7) Consists of 161,000 shares held by the Staszak Family Living Trust, of which Mr. Staszak is a co-trustee, and 580,562 shares issuable upon the exercise of options exercisable within 60 days after March 1, 2005.

(8) Includes 87,187 shares issuable upon the exercise of options held by Dr. Teuscher, and 500 shares issuable upon the exercise of an option held by Dr. Teuscher’s wife, that are exercisable within 60 days after March 1, 2005.

(9) Includes 91,000 shares issuable upon the exercise of options exercisable within 60 days after March 1, 2005.

(10)Includes 90,250 shares issuable upon the exercise of options exercisable within 60 days after March 1, 2005.

(11)Consists of shares issuable upon the exercise of options exercisable within 60 days after March 1, 2005.

(12)Consists of shares issuable upon the exercise of options exercisable within 60 days after March 1, 2005.

(13)Consists of shares held by Messrs. Branscum, King, Numann and Wark and Drs. Ross, Stratakos and Teuscher, the shares described in notes (4) through (12) above, 509,750 shares held by Greg Hildebrand, an executive officer who is not a Named Executive Officer, and 75,468 shares issuable upon the exercise of options held by Mr. Hildebrand that are exercisable within 60 days after March 1, 2005.

18

EQUITY COMPENSATION PLAN INFORMATION(1)(2)

The following table provides certain information with respect to all of the Company’s equity compensation plans in effect as of December 31, 2004.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for issuance under equity compensation plans (excluding securities reflected in column (a)) (c) (3) | |||||||

| Equity compensation plans approved bysecurity holders | 4,097,170 | $ | 4.13 | 3,902,119 | ||||||

| Equity compensation plans not approved bysecurity holders | — | — | — | |||||||

| Total | 4,097,170 | 3,902,119 | ||||||||

(1) Information in the above table is as of December 31, 2004.

(2) Under the 2004 Equity Incentive Plan, the number of authorized shares will be increased annually on December 31 of each year, from 2005 until 2013, by 5% of the number of fully-diluted shares of common stock outstanding; provided, however, that the Board may designate a smaller number of shares by which the authorized number of shares will be increased on such dates. Under the 2004 Non-Employee Directors’ Stock Option Plan, the number of authorized shares will be increased annually on December 31 of each year, from 2005 and until 2013, by no more than the number of shares of common stock subject to options granted during that calendar year. Under the 2004 Employee Stock Purchase Plan, the number of authorized shares will be increased on December 31 of each year, from 2005 until 2013, by the lesser of 1,000,000 shares of common stock or 1.75% of the fully-diluted number of shares of common stock outstanding on that date; provided, however, that the Board may designate a smaller number of shares by which the authorized number of shares will be increased on such dates.

(3) Includes 450,000 shares attributable to the 2004 Employee Stock Purchase Plan.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2004, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with, except that one report, covering one transaction, was filed late by Mr. Wark, and one report, covering one transaction, was filed late by Mr. Branscum.

COMPENSATION OF DIRECTORS

We provide cash compensation to each non-employee director at a rate of $15,000 per year for serving on our Board, an additional $5,000 per year for serving on any committee of our Board, an additional $2,500 per year for serving on our Audit Committee, an additional $5,000 per year for serving as Chairperson of our Audit Committee and an additional $2,500 per year for serving as Chairperson of any other committee of our Board. In addition, we reimburse our non-employee directors for all reasonable expenses incurred in attending meetings of the Board and its committees.

19

Our 2004 Non-Employee Directors’ Stock Option Plan (the “Directors’ Plan”), which became effective on July 29, 2004, provides for the automatic grant of options to purchase shares of common stock to our non-employee directors on the following terms.

New directors are initially automatically granted an option to purchase 25,000 shares of common stock upon election or appointment to the Board. Initial grants vest as follows: 1/4th of the shares subject to the grant vest one year after the date of grant and 1/16th of the shares vest quarterly thereafter over three years. Any person who is a non-employee director on the date of an annual meeting of our stockholders, commencing with the annual meeting in 2005, will automatically be granted an option to purchase 6,250 shares of common stock on such date; provided, however, that if an individual has not served as a non-employee director for the entire period since the prior annual meeting, the number of shares subject to such non-employee director’s annual grant will be reduced pro rata for each quarter during which such person did not serve as a non-employee director. Annual grants will vest as follows: 1/4th of the shares subject to the grant will vest one year after the date of grant and 1/16th of the shares will vest quarterly thereafter over three years.

In the event that there is a specified type of change in our capital structure, such as a stock split, the number of shares reserved under the Directors’ Plan and the number of shares subject to, and exercise price of, all outstanding stock options will be appropriately adjusted.

In the event of specified corporate transactions, all outstanding options under the Directors’ Plan may be assumed, continued or substituted by any surviving or acquiring entity (or its parent company). If the surviving or acquiring entity (or its parent company) elects not to assume, continue or substitute such options, then (i) with respect to any such options held by optionees then performing services for us or our affiliates, the vesting and exercisability of such options will be accelerated in full and such options will be terminated if not exercised prior to the effective date of such corporate transaction and (ii) all other such outstanding options will be terminated if not exercised prior to the effective date of the corporate transaction. In the event of specified changes in control, the vesting and exercisability of outstanding options under the Directors’ Plan granted to non-employee directors whose service has not terminated prior to such change in control, other than as a condition of such change in control, will be accelerated in full.

In fiscal year 2004, no options were granted under the Directors’ Plan. Between January 1, 2004 and the effective date of the Directors’ Plan, we made the following grants to directors under our 1996 Stock Option Plan. We granted to Christopher Paisley options to purchase an aggregate of 17,500 shares at a weighted average exercise price of $6.05 per share, to Edward Winn options to purchase an aggregate of 25,000 shares at a weighted average exercise price of $5.73 per share and to each of Mel Friedman and Edward Ross an option to purchase 25,000 shares at an exercise price of $8.66 per share.

20

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following table shows for the fiscal years ended December 31, 2003 and 2004, compensation awarded or paid to, or earned by, the Company’s Chief Executive Officer and its other four most highly compensated executive officers at December 31, 2004:

Annual Compensation | Long-Term Compensation Awards | |||||||||||||||

Name and Principal Position | Year | Salary ($) | Other Annual Compensation ($) (1) | Number of Shares Underlying Options | All Other Compensation ($) (2) | |||||||||||

| Jeffrey Staszak | 2004 | 247,692 | 686 | 75,000 | 654 | |||||||||||

| President and Chief | 2003 | 207,187 | 470 | — | 690 | |||||||||||

| Executive Officer | ||||||||||||||||

| William Numann | 2004 | 177,346 | — | 50,000 | 594 | |||||||||||

| Vice President of Marketing | 2003 | 160,865 | — | — | 448 | |||||||||||

| Daniel Wark | 2004 | 162,462 | 102 | 40,000 | 543 | |||||||||||

| Vice President of Operations | 2003 | 147,285 | 271 | — | 423 | |||||||||||

| Anthony Stratakos | 2004 | 150,808 | 686 | 37,500 | 492 | |||||||||||

| Vice President of Advanced | 2003 | 133,648 | 470 | — | 208 | |||||||||||

Research and Development and Chief Technology Officer | ||||||||||||||||

| Craig Teuscher | 2004 | 150,808 | 127 | 75,000 | 492 | |||||||||||

| Vice President of Sales and | 2003 | 131,173 | — | — | 208 | |||||||||||

| Applications Engineering | ||||||||||||||||

(1) Consists of health club membership fees reimbursed by the Company.

(2) Represents term life insurance premiums paid by the Company.

21

STOCK OPTION GRANTS AND EXERCISES

The Company grants options to its executive officers under its 2004 Equity Incentive Plan (the “Plan”). As of March 1, 2005, options to purchase 4,412,442 shares were outstanding under the Plan and options to purchase 2,992,150 shares remained available for grant. The following tables show for the fiscal year ended December 31, 2004 certain information regarding options granted to, exercised by, and held at year end by, the Company’s Chief Executive Officer and each of its four other most highly compensated executive officers at December 31, 2004:

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants | |||||||||||||||||||

Percentage of | Potential | ||||||||||||||||||

Total | Realizable Value at | ||||||||||||||||||

Number of | Options | Assumed Annual | |||||||||||||||||

Shares | Granted to | Exercise | Rates of Stock Price | ||||||||||||||||

Underlying | Employees | or Base | Appreciation | ||||||||||||||||

Options | in Fiscal | Price Per | Expiration | For Option Term (3) | |||||||||||||||

Name | Granted | 2004 (1) | Share (2) | Date | 5% | 10% | |||||||||||||

| Jeffrey Staszak(4) | 75,000 | 6.6 | % | $ | 5.00 | 1/26/2014 | $ | 602,337 | $ | 1,181,245 | |||||||||

| William Numann(4) | 50,000 | 4.4 | % | $ | 5.00 | 1/26/2014 | $ | 401,558 | $ | 787,497 | |||||||||

| Daniel Wark(4) | 40,000 | 3.5 | % | $ | 5.00 | 1/26/2014 | $ | 321,246 | $ | 629,998 | |||||||||

| Anthony Stratakos(4) | 37,500 | 3.3 | % | $ | 5.00 | 1/26/2014 | $ | 301,168 | $ | 590,623 | |||||||||

| Craig Teuscher(4) | 75,000 | 6.6 | % | $ | 5.00 | 1/26/2014 | $ | 602,337 | $ | 1,181,245 | |||||||||

(2) The exercise price is equal to 100% of the fair market value of the common stock on the date of the grant.

(3) The potential realizable value is calculated based on the ten-year term of the stock option at the time of grant. Stock price appreciation of 5% and 10% is assumed pursuant to rules promulgated by the SEC and does not represent our prediction of our stock price performance. The potential realizable values at 5% and 10% appreciation are calculated by: (i) multiplying the number of shares of common stock subject to a given stock option by our initial public offering price of our common stock of $8.00 per share; (ii) assuming that the aggregate stock value derived from that calculation compounds at the annual 5% or 10% rate shown in the table until the expiration of the option; and (iii) subtracting from that result the aggregate option exercise price.

(4) The options have a ten-year term, subject to earlier termination upon death, disability or termination of employment. Options vest and become exercisable as follows: 25% on January 1, 2005; 6.25% quarterly thereafter.

22

AGGREGATED OPTION EXERCISES IN FISCAL 2004 AND

VALUE OF OPTIONS AT END OF FISCAL 2004

Name | Number of Shares Acquired on Exercise | Value Realized(1) | Number of Shares Underlying Unexercised Options at Fiscal Year-End Exercisable/ Unexercisable | Value of Unexercised In-the-Money Options at Fiscal Year-End Exercisable/ Unexercisable(2) | |||||||||

| Jeffrey Staszak | — | — | 535,250/173,750 | $10,714,260/$3,159,300 | |||||||||

| William Numann | — | — | 73,125/65,000 | $1,386,450/$1,142,400 | |||||||||

| Daniel Wark | 25,000 | $ | 246,000 | 75,000/55,000 | $1,422,000/$970,800 | ||||||||

| Anthony Stratakos | — | — | 346,875/65,625 | $6,576,750/$1,176,750 | |||||||||

| Craig Teuscher | — | — | 62,500/87,500 | $1,185,000/$1,524,000 | |||||||||

(1) Value realized is based on the fair market value of our common stock on the date of exercise minus the exercise price, multiplied by the number of shares issued upon exercise of the stock option, without taking into account any taxes that may be payable in connection with the transaction. For any option exercise that occurred prior to the date public trading commenced in our common stock, the fair market value of our common stock is based on the initial public offering price of our common stock of $8.00 per share.

(2) Represents the fair market value of the underlying shares on the last day of the fiscal year ($22.16 based on the closing sales price of the common stock as reported on the Nasdaq National Market on December 31, 2004) less the exercise price of the options multiplied by the number of shares underlying the option.

EMPLOYMENT AND CHANGE OF CONTROL AGREEMENTS

Each of our Named Executive Officers and current executive officers has signed an offer letter. These offer letters provide that the officer is an at-will employee and provide for salary and other customary benefits and terms. The offer letters signed by William Numann and Daniel Wark also provide for stock option grants.

All options to purchase common stock issued to our Named Executive Officers may be subject to accelerated vesting upon a change of control as follows. In the event of specified corporate transactions, all outstanding options and stock appreciation rights under the 2004 Equity Incentive Plan may be assumed, continued or substituted for by any surviving or acquiring entity (or its parent company). If the surviving or acquiring entity (or its parent company) elects not to assume, continue or substitute such awards, then (i) with respect to any such options and stock appreciation rights that are held by participants then performing services for us or our affiliates, the vesting and exercisability provisions of such options and stock appreciation rights will be accelerated in full and such options and stock appreciation rights will be terminated if not exercised prior to the effective date of the corporate transaction, and (ii) all other outstanding options and stock appreciation rights will be terminated if not exercised prior to the effective date of the corporate transaction. Other forms of equity awards under the 2004 Equity Incentive Plan such as stock purchase awards may have their repurchase or forfeiture rights assigned to the surviving or acquiring entity (or its parent company). If such repurchase or forfeiture rights are not assigned, then such equity awards will become fully vested. Following specified change in control transactions, the vesting and exercisability of specified equity awards generally will be accelerated only if the awardee’s award agreement so specifies.

23

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

ON EXECUTIVE COMPENSATION(1)

Compensation Philosophy and Practice

Volterra’s compensation philosophy is based on providing employees with an equitable compensation package and the opportunity for outstanding performers to earn competitive compensation over the long term through a pay-for-performance approach. The key objectives of Volterra’s executive compensation programs are to attract, motivate and retain executives who drive Volterra’s success and industry leadership. The programs are designed to:

• Provide executives with competitive compensation that maintains a balance between cash and stock compensation and provides a significant portion of total compensation at risk, tied both to annual and long-term performance of Volterra as well as to the creation of stockholder value.

• Provide equitable pay based on each executive’s contribution relative to the market.

• Encourage executives to manage from the perspective of owners with an equity stake in Volterra.

• Set executives total compensation competitively with the median of peer companies.

Components of Executive Compensation

The compensation program for executives consists of the following components:

Cash. This includes base salary and any bonus award earned for the fiscal year’s performance. Volterra’s cash compensation policies provide a competitive base salary and offer bonuses that reward superior performance. Executives have the opportunity to earn an annual bonus, expressed as a fixed dollar amount, based on the attainment of specific quarterly financial, strategic, operational and personal goals critical to Volterra’s success. The bonus is designed to promote executive retention by measuring progress on a quarterly basis, with the potential to exceed target award levels payable at the end of each period for exceeding objectives. For executives and other senior leaders, total compensation at risk increases with responsibility.

Stock-Based Incentives. Employees, including executives, have historically been eligible for stock option grants, and stock option grants were awarded during 2004. Volterra’s stock option program was designed to promote excellent performance over an employee’s career through compensation that increases with Volterra’s long-term performance. In addition, as part of its review of its equity compensation program, Volterra issued stock awards to certain executives and senior level personnel during 2004. The size of stock option grants was based on various factors relating to the responsibilities of the individual employees and their expected future contributions.

How Executive Pay is Determined

To ensure alignment of executive compensation with Volterra’s business strategy and objectives, Volterra conducts an annual evaluation of its executive compensation practices. In October 2004, Volterra engaged an independent outside compensation consultant to review and study various forms of executive compensation and to make recommendations to the Compensation Committee. A peer group of 20 companies, primarily in the semiconductor industry, with similar revenues and market capitalizations was selected for the consultant’s study and recommendations.

(1) The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Volterra under the Securities Act or Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

24

The consultant’s report and recommendations were reviewed by the Compensation Committee in January 2005 and have been implemented with minor modifications for 2005 executive compensation.

How Volterra’s Use of Stock-Based Awards is Determined

As described above, during 2004, Volterra’s compensation and retention strategy included the use of stock options. Stock option levels for executives were based in part on the same data used for salary and bonus levels from the selected peer group. The committee also considers the level of responsibility of each executive, the relative impact upon overall Company performance each executive has as well as current and past stock holdings. The Compensation Committee also considers the impact of equity awards on stockholder dilution, while striving to achieve the long-term objectives of the Company and its stockholders.

Compensation for the Chief Executive Officer