| Manner of | | If the Separation Time occurs before the Expiry Time and Rights Certificates are not distributed by the time that a |

| Acceptance: | | Shareholder deposits its Adastra Shares pursuant to the Offer, Shareholders may deposit their SRP Rights before receiving |

| (cont’d) | | Rights Certificates by using the guaranteed delivery procedure set out in the Offer and Circular. In any case, a deposit of |

| | | Adastra Shares shall be deemed to constitute an agreement by the signatory to deliver Rights Certificates representing SRP |

| | | Rights equal in number to the number of Adastra Shares deposited pursuant to the Offer to the Depositary, on or before the |

| | | third trading day on the TSX after the date, if any, that Rights Certificates are distributed. The Offeror reserves the right to |

| | | require, if the Separation Time occurs before the Expiry Time, that the Depositary receive, prior to the Offeror taking up the |

| | | Adastra Shares for payment pursuant to the Offer, Rights Certificates from a Shareholder representing SRP Rights equal in |

| | | number to the Adastra Shares deposited by such holder. |

| |

| | | The Offeror reserves the right to permit the Offer to be accepted and the issue of First Quantum Shares pursuant to the Offer |

| | | to be completed in a manner other than as set forth in Section 4 of the Offer, subject to any required extensions and |

| | | announcements, if, in its sole discretion, it is satisfied that the transaction in question can be undertaken in compliance with |

| | | all applicable Laws. |

| |

|

| |

| Conditions to the | | The Offeror reserves the right to withdraw the Offer and not take up and pay for any Adastra Shares deposited under the |

| Offer: | | Offer unless all of the conditions of the Offer contained in Section 2 of the Offer to Purchase are satisfied or, where |

| | | permitted, waived. These conditions include, among others (i) the Minimum Tender Condition; and (ii) the Offeror shall |

| | | have determined in its reasonable judgment that no property right, franchise or licence of Adastra or any of the Material |

| | | Interests has been or may be impaired (which impairment has not been cured or waived) or otherwise adversely affected, or |

| | | threatened to be impaired or adversely affected, whether as a result of the making of the Offer, the taking up and paying for |

| | | Adastra Shares deposited under the Offer, the completion of a Compulsory Acquisition or Subsequent Acquisition |

| | | Transaction or otherwise. See Section 2 of the Offer to Purchase, ‘‘Conditions of the Offer’’. |

| |

|

| |

| Notice to | | This document does not constitute a prospectus for the purposes of the Prospectus Rules published by the Financial Services |

| Shareholders in the | | Authority of the United Kingdom (the ‘‘FSA’’). Accordingly, this document has not been, and will not be, approved by the |

| United Kingdom: | | FSA or by London Stock Exchange plc. |

| |

| | | Accordingly, as regards UK Shareholders resident in, or receiving the Offer or the Offer and Circular in, the United |

| | | Kingdom, the Offer is only being made to or directed at, and deposits of Adastra Shares will only be accepted from, a U.K. |

| | | Shareholder who is a Eligible UK Shareholder as defined in the Offer and Circular. |

| |

|

| Certain Canadian | | A Canadian resident Shareholder who holds Adastra Shares as capital property and who sells such shares pursuant to the |

| Federal Income Tax | | Offer will generally not realize a capital gain or capital loss under the Income Tax Act (Canada) unless the Shareholder |

| Considerations: | | elects to recognize a capital gain or capital loss. |

| |

| | | A Subsequent Acquisition Transaction may give rise to either a taxable event or tax deferred exchange of Adastra Shares |

| | | depending upon the form of the transaction and the consideration offered. See Section 17 of the Circular, ‘‘Certain |

| | | Canadian Federal Income Tax Considerations -- Shareholders Resident in Canada.’’ |

| |

| | | A Shareholder who is not a resident of Canada who disposes of Adastra Shares for First Quantum Shares under the Offer |

| | | will generally not be subject to tax in Canada if the Adastra Shares are not taxable Canadian property. See Section 17 of the |

| | | Circular, ‘‘Certain Canadian Federal Income Tax Considerations -- Shareholders Not Resident in Canada’’. |

| |

|

| |

| Certain U.S. | | The Offeror may purchase some Adastra Shares for cash in connection with, or subsequent to, the transactions described |

| Federal Income Tax | | herein. If no such cash purchases were to occur, the exchange of Adastra Shares pursuant to the Offer could be treated as a |

| Considerations: | | tax-free transaction for U.S. federal income tax purposes, subject to the application of the PFIC rules described in Section |

| | | 18 of the Circular, ‘‘Certain U.S. Federal Income Tax Considerations’’. Due to the possibility that one or more cash |

| | | purchases may occur, the Offeror believes that the exchange of Adastra Shares pursuant to the Offer will be taxable for U.S. |

| | | federal income tax purposes. See Section 18 of the Circular, ‘‘Certain U.S. Federal Income Tax Considerations’’. |

| |

|

| |

| Certain U.K. | | Eligible U.K. Shareholders who receive First Quantum Shares under the Offer will generally not be treated as having made |

| Federal Income Tax | | a disposal of their Adastra Shares for the purposes of capital gains tax or corporation tax on chargeable gains until the First |

| Considerations: | | Quantum Shares are ultimately disposed of. See Section 19 of the Circular, ‘‘Certain U.K. Tax Considerations’’. |

| |

|

| Solicitation Fees: | | In Canada, RBC Dominion Securities Inc. may form a soliciting dealer group comprised of members of the Investment |

| | | Dealers Association of Canada and members of the stock exchanges in Canada to solicit acceptances of the Offer (each |

| | | member of such group, a ‘‘Soliciting Dealer’’). The Offeror has agreed to pay to each Soliciting Dealer whose name |

| | | appears in the appropriate space in the Letter of Transmittal accompanying a deposit of Adastra Shares a fee of Cdn.$0.02 |

| | | for each Adastra Share deposited and taken up by the Offeror pursuant to the Offer. The aggregate amount payable to a |

| | | Soliciting Dealer with respect to any single depositing Shareholder will be not less than Cdn.$100 and not more than |

| | | Cdn.$1,500, provided that at least 1,000 Adastra Shares are deposited per beneficial Shareholder. |

| |

|

| |

| Depositary: | | Computershare Investor Services Inc. is acting as Depositary under the Offer. |

| |

|

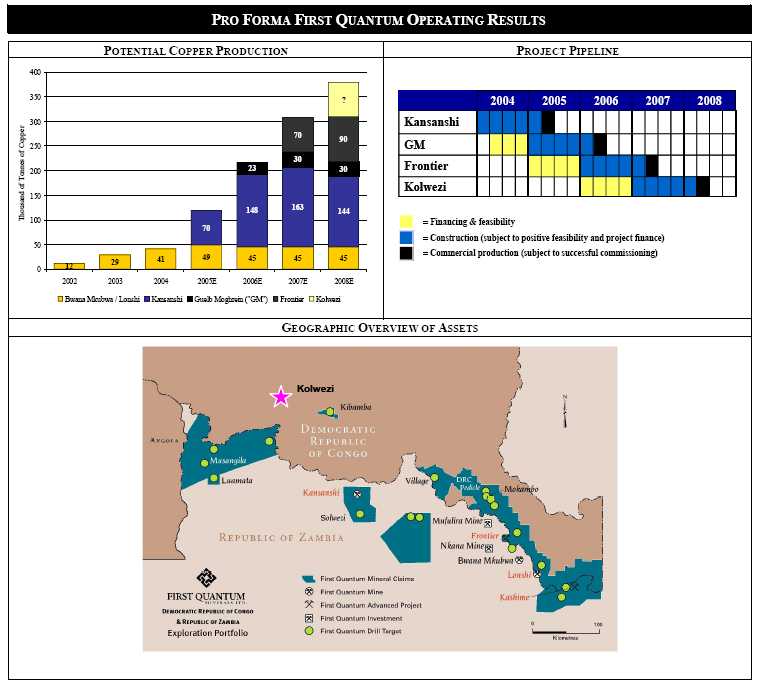

Adastra is an international mining company in the business of acquiring, exploring and developing mineral resource properties in the DRC, Angola and Zambia. The target metals and precious minerals for which Adastra is exploring are cobalt, copper, zinc and diamonds. Adastra is currently engaged in developing several mineral assets in Central Africa, including the Kolwezi Copper-Cobalt Tailings Project and the Kipushi Copper Zinc Mine in the DRC.

The Adastra Shares are listed and posted for trading on the TSX and have been admitted for trading on AIM under the symbol ‘‘AAA’’. See Section 2 of the Circular, ‘‘Adastra’’.

For further information regarding Adastra, refer to Adastra’s filings with the Canadian securities regulatory authorities which may be obtained through the SEDAR website at www.sedar.com.

4

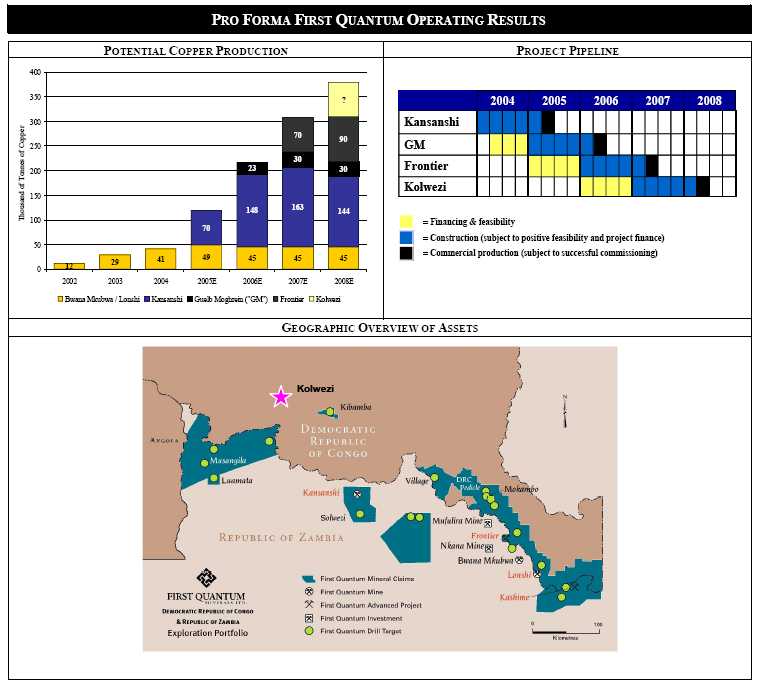

| • | Significant Premium: Based on the closing price of First Quantum’s common shares on the Toronto Stock Exchange on January 17, 2006, the implied offer price represents a premium of approximately 24% over the Adastra closing price on the Toronto Stock Exchange of $1.80 as at January 17, 2006. The implied offer price represents a 31% premium over the $1.70 Adastra equity financing completed in December 2005. |

| |

| • | Management Strength: First Quantum has significant exploration, technical and operating experience with respect to mining in the DRC, as is evidenced by current operations at the Lonshi copper mine and the planned development of the Frontier project. The base metal capability and experience demonstrated by First Quantum, coupled with Adastra’s recent experience in negotiations with the Government of the DRC and its mining arm, Gécamines, will be invaluable in developing the Kolwezi tailings project and Adastra’s Kipushi mine, which is also located in the DRC. |

| |

| • | Substantial Experience in the DRC: First Quantum has significant exploration, technical and operating experience with respect to mining in the DRC, as is evidenced by current operations at the Lonshi copper mine and the planned development of the Frontier project. The base metal capability and experience demonstrated by First Quantum, coupled with Adastra’s recent experience in negotiations with the Government of the DRC and its mining arm, Gécamines, will be invaluable in developing the Kolwezi tailings project and Adastra’s Kipushi mine. |

| |

| • | Copper and Cobalt Production: First Quantum is already a substantial copper producer growing from its origins developing the tailings dump at Bwana Mkubwa in Zambia. The experience and expertise necessary for tailings reclamation established and proven at the Bwana operation would be invaluable in developing Adastra’s Kolwezi copper tailings project. |

| |

| • | Financial Strength: First Quantum has the balance sheet and cash flow from existing profitable operations to enable the combined company to access a much broader range of capital markets in order to ensure that the development of the Kolwezi tailings project can be undertaken at a lower overall cost, and therefore higher return, to shareholders. First Quantum believes that its financial strength and strong credibility in the capital markets would provide the capital required for Adastra’s exploration and development properties. |

| |

| • | Significant Cost Savings: First Quantum believes that the combined company would achieve significant savings, primarily though a combination of corporate overhead cost reductions and rationalization of the two companies’ exploration programs. |

| |

Price Range and Trading Adastra Minerals Inc.

The following table sets forth, for the periods indicated, the reported high and low trading prices and the aggregate volumes of trading of the Shares on the TSX and the AIM:

5

The method of delivery of the certificate(s) representing Shares, the Letter of Transmittal, the Notice of Guaranteed Delivery and all other required documents is at the option and risk of the depositing Shareholder. It is recommended that those documents be delivered by hand to the Depositary and that a receipt be obtained or, if mailed, that registered mail, properly insured, be used with an acknowledgement of receipt requested. It is suggested that any such mailing be made sufficiently in advance of the Expiry Time to permit delivery to the Depositary before the Expiry Time. Delivery will only be effective upon actual receipt by the Depositary.

The Depositary will receive deposits of certificates representing the Shares and accompanying Letters of Transmittal at the offices specified in the Letter of Transmittal and on this page. The Depositary will also receive Notices of Guaranteed Delivery at the offices specified on this page.

COMPUTERSHARE INVESTOR SERVICES INC.

|

| By Mail | | By Registered Mail, by Hand or by Courier |

| P.O. Box 7021 | | 100 University Avenue |

| 31 Adelaide Street, E. | | 9th Floor |

| Toronto, ON M5C 3H2 | | Toronto, ON M5J 2Y1 |

| Attention: Corporate Actions | | Attention: Corporate Actions |

Fax Number: (905) 771-4082

Toll Free (North America): 1-866-982-9674

Overseas Calls: 1-514-982-7135

E-Mail: adastraquantumoffer@computershare.com

| Montreal | | Vancouver | | Calgary |

| 650 de Maisonneuve Blvd West | | 510 Burrard Street | | Western Gas Tower |

| Suite 700, | | 2nd Floor | | Suite 600, 530 8th Avenue, S.W. |

| Montreal, QC | | Vancouver, BC | | Calgary, AB |

| H3A 3S8 | | V6C 3B9 | | T2P 3S8 |

|

| RBC CAPITAL MARKETS |

| In Canada | | | | In the United States |

| |

| RBC Dominion Securities Inc. | | | | RBC Capital Markets Corporation |

| 200 Bay Street, 4thFloor | | | | Two Embarcadero Center |

| Royal Bank Plaza,South Tower | | | | Suite 1200 |

| Toronto, Ontario M5J 2W7 | | | | San Francisco, California 94111 |

| Telephone: (416) 842-7517 | | | | Toll Free: 1-888-293-4855 |

| Toll Free: 1-866-293-4855 | | | | |

INNISFREE M&A INCORPORATED

501 Madison Avenue

20th Floor

New York, NY 10022

Shareholders Call Toll-Free:

1-888-750-5834 (English speakers)

1-877-825-8777 (French speakers)

Banks and Brokers Call Collect:

(212) 750-5833

|

6

This announcement does not constitute or form part of any offer to sell or invitation to purchase any securities or solicitation of an offer to buy any securities, pursuant to the Offer or otherwise in any jurisdiction where such offer or invitation to purchase or solicitation of an offer to buy securities would be prohibited.

This announcement is for information purposes and is not a substitute for the formal offer and take-over bid circular. First Quantum has filed with the U.S. Securities and Exchange Commission a Registration Statement on Form F-80, which includes the offer and take-over bid circular, and a tender offer statement on Schedule 14D-1F. Adastra Shareholders are urged to read the circular and any other materials relating to the Offer, including the registration statement on Form F-80 and the tender offer statement on Schedule 14D-1F because they contain important information. Copies of the circular and other materials relating to the Offer can be obtained free of charge at the SEDAR website at www.sedar.com or on the EDGAR website at www.sec.gov or from RBC Dominion Securities, Inc. in Canada or RBC Capital Markets Corporation in the United States, who are acting as First Quantum’s dealer managers (Toll Free 1-866-246-3902 (Canada) or 1-866-246-3902 (United States)) or Innisfree M&A Incorporated for the United States and other locations (Toll Free 1-888-750-5834 (English speakers) or 1-877-825-8777 (French speakers)), who is acting as First Quantum’s Information Agent.

This document contains forward-looking statements. The words "expect", "will", “intend”, “estimate” and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. These risk factors include, but are not limited to: realization of operational synergies, reliance on Adastra’s publicly available information which may not fully identify all risks related to their performance, success in integrating the retail distribution systems, and the integration of supply chain management processes, as well as other risk factors listed from time to time in First Quantum’s reports, comprehensive public disclosure documents including the Annual Information Form, and in other filings with securities commissions in Canada (on SEDAR at www.sedar.com) and the United States (on EDGAR at www.sec.gov).

7