- PWR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Quanta Services (PWR) DEF 14ADefinitive proxy

Filed: 17 Apr 20, 7:01am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

CHECK THE APPROPRIATE BOX:

| ||

☐ | Preliminary Proxy Statement | |

| ||

☐ | Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ||

☑ | Definitive Proxy Statement | |

| ||

☐ | Definitive Additional Materials | |

| ||

☐ | Soliciting Material Under Rule14a-12 | |

| ||

Quanta Services, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

| ||

☑ | No fee required. | |

| ||

☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |

| ||

1) Title of each class of securities to which transaction applies: | ||

2) Aggregate number of securities to which transaction applies: | ||

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

4) Proposed maximum aggregate value of transaction: | ||

5) Total fee paid: | ||

| ||

☐ | Fee paid previously with preliminary materials: | |

| ||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

1) Amount previously paid: | ||

2) Form, Schedule or Registration Statement No.: | ||

3) Filing Party: | ||

4) Date Filed: | ||

| ||

Quanta Services, Inc.

2800 Post Oak Boulevard, Suite 2600

Houston, TX 77056 | (713)629-7600

TO BE HELD MAY 28, 2020

To our Stockholders:

The annual meeting of stockholders of Quanta Services, Inc. (“Quanta”) will be held in the Williams Tower, 2nd Floor Conference Center, Auditorium No. 1, located at 2800 Post Oak Boulevard, Houston, Texas 77056*, on May 28, 2020, at 8:30 a.m. local time. At the meeting, you will be asked to consider and act upon the following matters, which are more fully described in the accompanying Proxy Statement:

| 1. | Election of ten directors nominated by our Board of Directors; |

| 2. | Approval, bynon-binding advisory vote, of Quanta’s executive compensation; |

| 3. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2020; and |

| 4. | Action upon any other matters that are properly brought before the meeting, or any adjournments or postponements of the meeting, by or at the direction of the Board of Directors. |

Our stockholders of record at the close of business on March 31, 2020, are entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements of the meeting.

By Order of the Board of Directors,

Carolyn M. Campbell

Corporate Secretary

Houston, Texas

April 17, 2020

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 28, 2020:

The Notice, Proxy Statement and 2019 Annual Report to Stockholders are available atwww.proxydocs.com/PWR.

*We intend to hold our annual meeting in person. However, we are actively monitoring coronavirus(COVID-19); we are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. Please monitor Quanta’s website athttps://investors. quantaservices.com/ and our annual meeting website atwww.proxydocs.com/PWR for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the annual meeting.

|

|

Quanta Services, Inc. | 2800 Post Oak Boulevard, Suite 2600 | Houston, TX 77056 | (713) 629-7600 |

This summary highlights selected information about the items to be voted on at the 2020 annual meeting of stockholders (the “Annual Meeting”) of Quanta Services, Inc. (“Quanta” or the “Company”). This summary does not contain all of the information that you should consider in deciding how to vote. You should read the entire Proxy Statement carefully before voting.

2020 ANNUAL MEETING OF STOCKHOLDERS

Where Williams Tower, 2nd Floor Conference Center, Auditorium No. 1, located at 2800 Post Oak Boulevard, Houston, Texas 77056*

When May 28, 2020, at 8:30 a.m. local time

Record Date Our stockholders of record at the close of business on March 31, 2020, are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the meeting. |

| ANNUAL MEETING AGENDA AND VOTING RECOMMENDATIONS

Stockholders are being asked to vote on three agenda matters:

| ||||

Proposal

| Board Recommendation

| |||||

Proposal 1 | ||||||

| Election of ten directors nominated by our Board of Directors | FOR Each Director Nominee | |||||

Proposal 2 | ||||||

| Approval, bynon-binding advisory vote, of Quanta’s executive compensation | FOR | |||||

Proposal 3 | ||||||

Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2020

| FOR | |||||

VOTING YOUR SHARES

| ||||||

| Your vote is important. Even if you plan to attend the Annual Meeting in person, the Board of Directors recommends that you cast your vote as soon as possible. Stockholders of record may vote by any of the below methods. | ||||||

| Internet | Telephone | |||

www.proxypush.com/PWR 24/7 up to 11:59 p.m. (Eastern Time) May 27, 2020. | 1-866-390-5316 24/7 up to 11:59 p.m. (Eastern Time) May 27, 2020. | If you received a paper copy of the proxy form by mail, complete, sign, date and return your proxy card in thepre-addressed, postage-paid envelope provided. |

*We intend to hold our annual meeting in person. However, we are actively monitoring coronavirus(COVID-19); we are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. Please monitor Quanta’s website athttps://investors. quantaservices.com/ and our annual meeting website atwww.proxydocs.com/PWR for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the annual meeting.

|

i

Proposal 1: Election of Directors

The Board of Directors unanimously recommends a voteFOR the election of each of the director nominees.

| u | Seepage 2 for further information |

Director Nominees

The following table provides summary information about each director nominee. Each director nominee is elected annually by a majority of votes cast.

Committees

| ||||||||||

| Name, Age, and Principal Position / Experience | Director Since | AC | CC | GNC | IC | |||||

Earl C. (Duke) Austin, Jr.(50) President, Chief Executive Officer, and Chief Operating Officer of Quanta | 2016 | |||||||||

Doyle N. Beneby(60)Independent President and Chief Executive Officer of Midland Cogeneration Venture | 2016 | ∎ | ∎ | |||||||

J. Michal Conaway(71) Independent Former Chief Financial Officer of Fluor Corporation | 2007 | ∎ | ∎ | |||||||

Vincent D. Foster(63) Independent Chairman of the Board and Former Chief Executive Officer of Main Street Capital Corporation | 1998 | ∎F | ∎ | |||||||

Bernard Fried(63) Independent Principal of BF Consulting and Former Chief Executive Officer of Plastikon Industries, Inc. | 2004 | ∎F | ∎ | |||||||

Worthing F. Jackman(55) Independent President and Chief Executive Officer of Waste Connections, Inc. | 2005 | ∎F | ∎ | |||||||

David M. McClanahan(70) Independent Former President and Chief Executive Officer of CenterPoint Energy, Inc. | 2016 | |||||||||

Margaret B. Shannon(70) Independent Former Vice President and General Counsel of BJ Services Company | 2012 | ∎ | ∎ | |||||||

Pat Wood, III(57) Independent President of Hunt Energy Network and Former Chairman of the Federal Energy Regulatory Commission | 2006 | ∎ | ∎ | |||||||

Martha B. Wyrsch(62) Independent Former Executive Vice President and General Counsel of Sempra Energy | 2019 | ∎ | ∎ | |||||||

| Commitees | ∎ Chairman

| |||

| AC- Audit Committee | ∎ Member

| |||

| GNC- Governance and Nominating Committtee | FFinancial Expert | |||

| CC- Compensation Committee | ||||

| IC- Investment Committee |

| ii PROXY STATEMENT 2020 |  |

Snapshot of 2020 Director Nominees

| Independence | Tenure | Age |

Board Qualifications, Skills and Experience

The Board regularly reviews the desired qualifications, skills and experiences that it believes are appropriate to oversee Quanta’s business and long-term strategy. Attributes brought by director nominees include:

Corporate Governance Highlights

We are committed to strong governance standards, as evidenced by the key best practices below.

✓ Annual election of directors

✓ Four new directors added since 2016

✓ Majority voting standard for election of directors in uncontested elections

✓ Director resignation policy

✓ Holders of Quanta common stock vote as a single class on all matters

✓ Independent Chairman of the Board

✓ Annual stockholder engagement

✓ Robust stock ownership requirements for directors and officers

✓ Code of Ethics and Business Conduct that applies to all directors, officers and employees

| QUANTASERVICES.COM | PROXY STATEMENT 2020 iii |

Proposal 2: Advisory Vote to Approve Executive Compensation

The Board of Directors unanimously recommends a voteFOR the advisory resolution approving Quanta’s executive compensation.

| u | Seepage 23for further information |

Compensation Overview

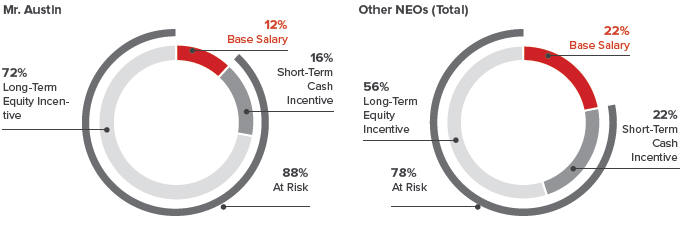

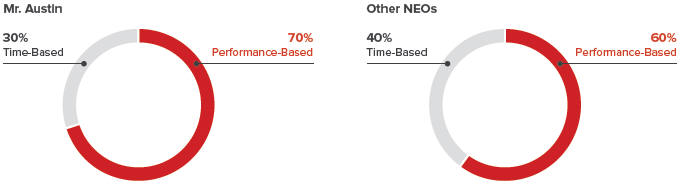

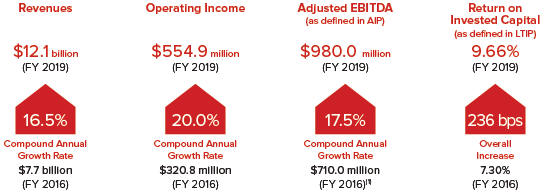

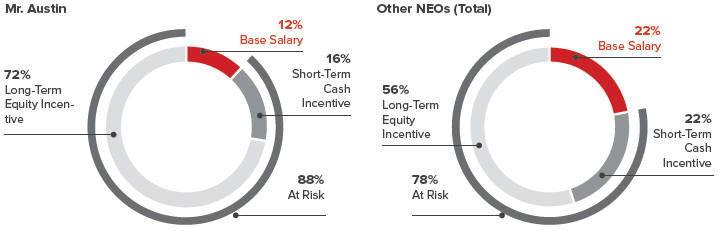

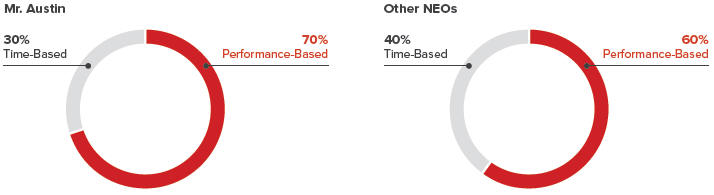

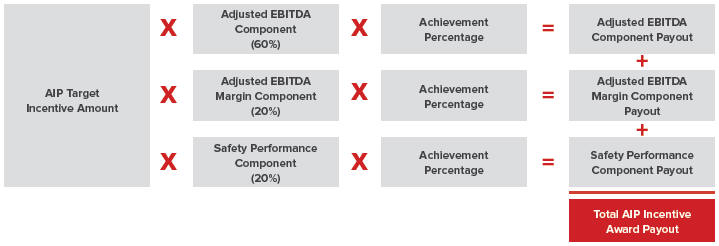

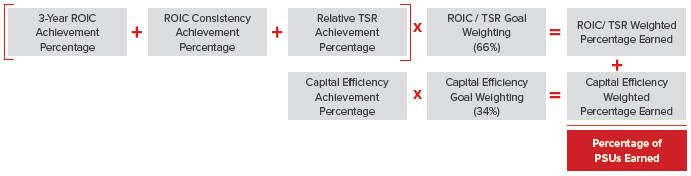

Quanta’s named executive officer (“NEO”) compensation is primarily comprised of base salary, short-term cash incentives and long-term equity incentives. Target award levels generally reflect competitive market levels and practices, with upside opportunity for performance above target levels. Performance measures are chosen to align the interests of executives with stockholders, and a significant portion of equity-based incentive awards (70% with respect to the CEO and 60% with respect to other NEOs) are subject to measurable company performance over a3-year performance period.

2019 TARGET COMPENSATION MIX

2019 LONG-TERM INCENTIVE PLAN EQUITY MIX

| iv PROXY STATEMENT 2020 |  |

Elements of Executive Compensation

Element and Form of Compensation

| Performance / Payment Criteria

| Purpose

| ||||

|

Base Salary Cash |

Individual performance and experience in the role are factors |

Attract and retain key executives, and offset the cyclicality in our business that may impact variable pay

| |||

Short-Term Incentive Cash |

Tied to the achievement of performance targets

|

Incentivize and reward achievement of annual | ||||

Long-Term Incentive Performance Stock Units (“PSUs”) |

Cliff-vest at the end of a3-year performance period |

Incentivize achievement of our long-term financial

Align management and stockholder interests and | ||||

Restricted Stock Units (“RSUs”) |

Vest over three years in equal annual installments |

Align management and stockholder interests and attract and promote retention of key executives

| ||||

Other Compensation Retirement Benefits and Perquisites |

Not applicable |

Maintain the health and safety of executives

Provide a competitive compensation package and,

|

| QUANTASERVICES.COM | PROXY STATEMENT 2020 v |

Compensation Governance

We are committed to strong governance standards that ensure our executive compensation programs are closely aligned with the interests of our stockholders, as evidenced by the policies and practices described below.

What We Do

| ✓ | Stock Ownership Guidelines. We maintain meaningful stock ownership guidelines that align our executives’ long-term interests with those of our stockholders and discourage excessive risk-taking. |

| ✓ | Clawback Policy. We maintain a clawback policy that permits our Board to recover from executive officers and key employees of Quanta and its subsidiaries cash or equity incentive compensation in certain circumstances, involving a restatement of the Company’s financial statements. |

| ✓ | Annual Review. Our Compensation Committee engages its own independent compensation consultant, which performs an annual comprehensive market analysis of our executive compensation program and pay levels. |

| ✓ | AnnualSay-on-Pay Vote. We provide our stockholders with an annual opportunity to participate in an advisory vote on NEO compensation. |

| ✓ | Performance-Based Compensation. The majority of the target compensation for our NEOs is subject to objective and measurable financial and operational performance metrics. |

| ✓ | Performance Thresholds and Maximums. All performance- based awards require that the Company achieve a threshold level of performance to receive any award and provide for a cap on the maximum award in the event the established performance criteria is dramatically exceeded. |

| ✓ | Modest Perquisites. Our NEOs receive a modest amount of perquisites, which are intended to promote wellness, provide convenience in light of the demands of their positions, assist them in serving necessary business purposes, and provide a competitive compensation package. |

What We Don’t Do

| X | Anti-Pledging Policy. We maintain an anti-pledging policy that prohibits directors and executive officers from pledging Quanta securities as collateral for a loan absentpre-clearance and demonstration of financial capacity to repay without resorting to the pledged securities. |

| X | Anti-Hedging Policy.We maintain an anti-hedging policy that prohibits directors and executive officers from hedging the economic risk of ownership of Quanta common stock. |

| X | NoGross-Up.Our employment agreements with NEOs do not provide forgross-ups of excise taxes on severance or other payments in connection with a change of control. |

Proposal 3: Ratification of the Appointment of Independent Registered Public Accounting Firm

The Board of Directors unanimously recommends a voteFOR ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

| u | Seepage 61 for further information |

| vi PROXY STATEMENT 2020 |  |

| i | ||||

| 2 | ||||

| 2 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 39 | ||||

Pledging, Hedging and Other Transactions in Quanta Securities | 40 | |||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

Impact of Regulatory Requirements on Our Executive Compensation Decisions | 43 | |||

| 43 |

| 44 | ||||

| 44 | ||||

| 49 | ||||

| 51 | ||||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 61 | ||||

Proposal 3: Ratification of the Appointment of Independent Registered Public Accounting Firm | 61 | |||

| 62 | ||||

| 63 | ||||

| 64 | ||||

Stockholder Proposals and Nominations of Directors for the 2021 Annual Meeting | 64 | |||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 74 | ||||

| 74 | ||||

| A-1 |

Proposal 1: Election of Directors

The Board of Directors unanimously recommends a voteFOR the election of each of the director nominees.

The Board of Directors (“Board”) of Quanta currently consists of ten directors, whose current terms of office all expire at the 2020 Annual Meeting. The Board proposes that the following ten nominees be elected for a new term of one year or until their successors are duly elected and qualified or until their earlier death, resignation or removal. Each of the nominees has consented to serve if elected. If a nominee becomes unwilling or unavailable to serve as a director, the Board may designate a substitute nominee or reduce the number of directors that constitute the Board. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named below.

The Board unanimously recommends a voteFOR the election of Ms. Shannon, Ms. Wyrsch and Messrs. Austin, Beneby, Conaway, Foster, Fried, Jackman, McClanahan and Wood.

Director Nominees

The following provides biographical information about each director nominee, including a description of the experience, qualifications and skills that have led the Board to determine that each nominee should serve on the Board.

EARL C. (DUKE) AUSTIN, JR.

Director Since: 2016 Age: 50 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Operations

Positions with Quanta • President • Chief Executive Officer • Chief Operating Officer |

Experience

Mr. Austin has served as a member of the Board and President and as Chief Executive Officer since March 2016 and as our Chief Operating Officer since January 2013. He previously served as President of the Electric Power Division and Oil and Gas Division from May 2011 to December 2012 and had responsibility for oversight of power and pipeline operations since January 2011. He served as President of the Oil and Gas Division from October 2009 to May 2011 and as President of North Houston Pole Line, L.P., an electric and natural gas specialty contractor and subsidiary of Quanta, from 2001 until September 2009. He is currently a member of the Texas State University System Board of Regents and a director of the Southwest Line Chapter of the National Electrical Contractors Association. Mr. Austin holds a Bachelor of Arts degree in Business Management.

Qualifications

The Board believes Mr. Austin’s qualifications to serve on the Board include his significant contributions to Quanta in strategy and operational and safety leadership, including as our Chief Operating Officer, as well as his extensive technical expertise and knowledge of the industries Quanta serves. Mr. Austin also brings extensive knowledge of all aspects of the Company’s operations as a result of his service as our Chief Executive Officer. |

| 2 PROXY STATEMENT 2020 |  |

DOYLE N. BENEBY

| ||

Director Since: 2016 Age: 60 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Operations • Government / Regulatory / Legal Affairs Other Public Company Board Service • Korn Ferry (2015 to current) • Capital Power Corp. (2012 to current) |

Experience

Mr. Beneby has been a member of the Board since March 2016. Mr. Beneby has served as President and Chief Executive Officer of Midland Cogeneration Venture, a naturalgas-fired combined electrical and energy generating plant located in the United States, since November 2018. He previously served as the Chief Executive Officer of New Generation Power International from October 2015 until May 2016 and as President and Chief Executive Officer of CPS Energy from August 2010 until September 2015. Mr. Beneby has served as a director of Korn Ferry since September 2015 and as a director of Capital Power Corp. since May 2012. Mr. Beneby holds a Bachelor of Science degree in Engineering and a Master of Business Administration degree.

Qualifications

The Board believes Mr. Beneby’s qualifications to serve on the Board include his extensive executive-level experience at a municipal electric and gas utility and his service as a chief executive officer and director of other public companies, as well as his operational, safety and financial expertise and knowledge of the industries Quanta serves.

Committee Memberships

• Compensation • Investment | |

J. MICHAL CONAWAY

| ||

Director Since: 2007 Age: 71 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Finance and Capital Management Other Public Company Board Service • GT Advanced Technologies, Inc. (2008 – 2016) |

Experience

Mr. Conaway has been a member of the Board since August 2007. Mr. Conaway has provided consulting and advisory services since 2000 and previously served as the Chief Executive Officer of Peregrine Group, LLC, an executive consulting firm, from 2002 to 2016. Prior to 2000, Mr. Conaway held various management and executive positions, including serving as Chief Financial Officer of Fluor Corporation, an engineering, procurement, construction and maintenance services provider. Mr. Conaway previously served as a director of GT Advanced Technologies, Inc., formerly known as GT Solar International, Inc., from 2008 until March 2016. Mr. Conaway holds a Master of Business Administration degree.

Qualifications

The Board believes Mr. Conaway’s qualifications to serve on the Board include his prior service as the chief financial officer of multiple public corporations, including those within Quanta’s line of business, his years of service on boards of other public and private companies, his extensive financial and accounting expertise, and his advisory experience in strategic, operational and financial matters.

Committee Memberships

• Governance and Nominating • Investment (Chairman)

| |

| QUANTASERVICES.COM | PROXY STATEMENT 2020 3 |

VINCENT D. FOSTER

| ||

Director Since: 1998 Age: 63 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Finance and Capital Management Other Public Company Board Service • Main Street Capital Corporation (2007 to current) • Team Industrial Services, Inc. (2005 – 2017) |

Experience

Mr. Foster has been a member of the Board since 1998. He has served as Chairman of the Board of Main Street Capital Corporation, a specialty investment company, since March 2007 and as Senior Managing Director of Main Street Capital Partners, LLC (and its predecessor firms), a private investment firm, since 1997. He also served as Chief Executive Officer of Main Street Capital Corporation from March 2007 until November 2018. Mr. Foster previously served as a director of Team Industrial Services, Inc. from 2005 until July 2017, U.S. Concrete, Inc. from 1999 to 2010, Carriage Services, Inc. from 1999 to 2011 and HMS Income Fund, Inc. from June 2012 to March 2013. Mr. Foster holds a Juris Doctor degree and is a Certified Public Accountant.

Qualifications

The Board believes Mr. Foster’s qualifications to serve on the Board include his significant contributions and service to Quanta since its inception, his experience as chief executive officer of a public corporation, his many years of service on boards of other public companies and his extensive tax, accounting, merger and acquisitions, financial and corporate governance expertise.

Committee Memberships

• Audit • Investment

| |

BERNARD FRIED

| ||

Director Since: 2004 Age: 63 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Operations • Finance and Capital Management |

Experience

Mr. Fried has been a member of the Board since March 2004. He has served as Principal of BF Consulting, a provider of management consulting services, since September 2011, and previously served as Chief Executive Officer and as a director of Plastikon Industries, Inc., a plastics manufacturing company, from April 2016 to September 2017. Mr. Fried also previously served as the Executive Chairman of OpTerra Energy Group, an energy conservation measures services provider, from June 2012 to February 2016, and as the Executive Chairman of Energy Solutions International, a software provider to the pipeline industry, from March 2011 to May 2015. Mr. Fried also served as Chief Executive Officer and President of Siterra Corporation, a software services provider, from May 2005 to March 2011, as Chief Executive Officer and President of Citadon, Inc., a software services provider, from 2001 until November 2003, and as Chief Financial Officer and Managing Director of Bechtel Enterprises, Inc. from 1997 until 2000. Mr. Fried holds a Bachelor of Engineering degree and a Master of Business Administration degree.

Qualifications

The Board believes Mr. Fried’s qualifications to serve on the Board include his executive management experience, including at companies within Quanta’s line of business, his prior service on company boards, and his extensive executive-level experience in operations, engineering, construction, project management, finance and international business.

Committee Memberships

• Audit • Compensation (Chairman)

|

| 4 PROXY STATEMENT 2020 |  |

WORTHING F. JACKMAN

| ||

Director Since: 2005 Age: 55 Key Skills and Attributes • Senior Leadership • Risk Oversight and Management • Operations • Finance and Capital Management Other Public Company Board Service • Waste Connections, Inc. (2019 to current) |

Experience

Mr. Jackman has been a member of the Board since May 2005. He has served as Chief Executive Officer and a director of Waste Connections, Inc., an integrated solid waste services company, since July 2019 and as President of Waste Connections, Inc. since July 2018. He previously served as its Executive Vice President and Chief Financial Officer from September 2004 until July 2018 and as Vice President - Finance and Investor Relations from April 2003 until August 2004. From 1991 until April 2003, Mr. Jackman held various positions with Deutsche Bank Securities, Inc., an investment banking firm, most recently serving as Managing Director, Global Industrial and Environmental Services Group. Mr. Jackman holds a Bachelor of Science degree in Business Administration – Finance and a Master of Business Administration degree.

Qualifications

The Board believes Mr. Jackman’s qualifications to serve on the Board include his experience as the president and chief financial officer of a public corporation and his investment banking experience, as well as his extensive financial and accounting expertise.

Committee Memberships

• Audit (Chairman) • Compensation

| |

DAVID M. McCLANAHAN

| ||

Director Since: 2016 Age: 70 Chairman of the Board Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Operations • Finance and Capital Management • Government / Regulatory / Legal Affairs Other Public Company Board Service • CenterPoint Energy, Inc. (2002 – 2013) |

Experience

Mr. McClanahan has been a member of the Board since March 2016 and Chairman of the Board since May 2017. He previously served as President and Chief Executive Officer of CenterPoint Energy, Inc. from October 2002 until December 2013 and as Special Advisor to the Chief Executive Officer of CenterPoint Energy, Inc. from January 2014 until July 2014. From 1999 until 2002, Mr. McClanahan served as President and Chief Operating Officer of all regulated operations for Reliant Energy, Inc. He also previously served as a director of CenterPoint Energy, Inc. from 2002 until 2013. Mr. McClanahan holds a Bachelor of Arts degree in Mathematics and a Master of Business Administration degree and is a Certified Public Accountant.

Qualifications

The Board believes Mr. McClanahan’s qualifications to serve on the Board include his extensive experience, including as a chief executive officer of a public company in the electric power and natural gas industries and his prior service on the board of a public company, as well as his technical expertise and knowledge of the industries Quanta serves and his financial and accounting expertise.

| |

| QUANTASERVICES.COM | PROXY STATEMENT 2020 5 |

MARGARET B. SHANNON

| ||

Director Since: 2012 Age: 70 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Government / Regulatory / Legal Affairs Other Public Company Board Service • Matador Resources Company (2011 – 2016) |

Experience

Ms. Shannon has been a member of the Board since December 2012. She served as Vice President and General Counsel of BJ Services Company, an international oilfield services company, from 1994 to 2010, when it was acquired by Baker Hughes Incorporated. Prior to 1994, she was a partner with the law firm of Andrews Kurth LLP. Ms. Shannon served on the board of directors of Matador Resources Company, an exploration and production company, from June 2011 to December 2016. In addition, she has been active in severalnot-for-profit organizations in Houston. Ms. Shannon holds a Bachelor of Arts degree and a Juris Doctor degree.

Qualifications

The Board believes Ms. Shannon’s qualifications to serve on the Board include her vast experience in the energy industry, as well as in corporate governance, and her years of service on boards of other public and private companies.

Committee Memberships

• Compensation • Governance and Nominating (Chairman)

| |

PAT WOOD, III

| ||

Director Since: 2006 Age: 57 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Government / Regulatory / Legal Affairs Other Public Company Board Service • SunPower Corporation (2005 to current) • Dynegy, Inc. (2012 – 2018) • Memorial Resource Development (2014 – 2016) |

Experience

Mr. Wood has been a member of the Board since May 2006. He has served as President of Hunt Energy Network, an energy storage development company, since February 2019 and as Principal of Wood3 Resources, an energy infrastructure developer, since July 2005. From 2001 until July 2005, Mr. Wood served as Chairman of the Federal Energy Regulatory Commission, and from 1995 until 2001, he chaired the Public Utility Commission of Texas. Prior to 1995, Mr. Wood was an attorney with Baker Botts L.L.P. and an associate project engineer with Arco Indonesia, an oil and gas company, in Jakarta. Mr. Wood has served as a director of SunPower Corporation since 2005. He previously served asnon-executive chairman of the board of directors of Dynegy, Inc. from October 2012 until April 2018 and as a director of Memorial Resource Development from June 2014 until September 2016. Mr. Wood holds a Bachelor of Science degree in Civil Engineering and a Juris Doctor degree.

Qualifications

The Board believes Mr. Wood’s qualifications to serve on the Board include his significant strategic and operational management experience, his unique perspective and extensive knowledge with regard to the legal and regulatory process and policy development at the government level, his years of service as a director of other public and private companies, and his energy infrastructure development expertise.

Committee Memberships

• Governance and Nominating • Investment

| |

| 6 PROXY STATEMENT 2020 |  |

MARTHA B. WYRSCH

| ||

Director Since: 2019 Age: 62 Key Skills and Attributes • Industry Experience • Senior Leadership • Risk Oversight and Management • Government / Regulatory / Legal Affairs • Operations Other Public Company Board Service • First American Capital Corporation (2018 to current) • Noble Energy, Inc. (2019 to current) • Spectris plc (2012 to current) |

Experience

Ms. Wyrsch has been a member of the Board since October 2019. She previously served as Executive Vice President and General Counsel of Sempra Energy, an energy infrastructure and services company with operations in the United States and internationally, from September 2013 until March 2019, where she oversaw legal and compliance matters. She also previously served as President – North America of Vestas American Wind Technology, a wind turbine services company, from 2009 until 2012, where she had direct responsibility for North American sales, construction, services and maintenance. From 2007 until 2008 she served as President and Chief Executive Officer of Spectra Energy Transmission, a natural gas transmission and storage business in the United States and Canada, and from 1999 through 2007, she served in various roles of increasing responsibility with Duke Energy Corporation, including as President and Chief Executive Officer, Gas Transmission from 2005 until 2007. Ms. Wyrsch has served as a director of First American Financial Corporation, a publicly traded financial services company, since 2018, as a director of Noble Energy, Inc., a publicly traded independent oil and natural gas exploration and production company, since December 2019 and as a director of Spectris plc, a provider of specialty instrumentation and controls that is listed on the London Stock Exchange, since 2012. Ms. Wyrsch holds a Bachelor of Arts degree and a Juris Doctor degree.

Qualifications

The Board believes Ms. Wyrsch’s qualifications to serve on the Board include her experience as an executive officer of large, publicly traded utility and energy companies and her experience serving as a public company director, as well as her technical expertise and knowledge of the industries Quanta serves and her legal expertise and experience with respect to corporate governance.

Committee Memberships

• Governance and Nominating • Investment

| |

| QUANTASERVICES.COM | PROXY STATEMENT 2020 7 |

Mix of Skills and Experience

The graphic below depicts a number of the key skills, experiences and attributes our Board believes to be important to have represented on the Board and identifies the number of continuing directors having those skills, experiences and attributes.

|  | |||

| Understanding of, and experience in, the industries or markets we serve as a result of serving as a director or executive officer of a company that operates in such industries or markets | Experience as a chief financial officer of, or service in similar financial oversight function for, a public or private company or meets the definition of financial expert within the meaning of U.S. Securities and Exchange Commission (“SEC”) regulations | |||

|  | |||

| Experience as a chief executive officer, president or other executive officer of a public or private company or leadership of a regulatory agency, with responsibility for, among other things, talent development and management of human capital | Service in, or experience interacting with, governmental or regulatory entities or experience overseeing the legal department of a public company | |||

|  | |||

| Experience managing and overseeing risk processes and procedures in a public or private company or other context, with responsibility for, among other things, business, financial, cybersecurity and sustainability risks | Current or prior service on the board of directors of a public company | |||

| ||||

| Experience in an executive officer role responsible for the oversight of operations and the development of a business strategy for a public or private company | ||||

| 8 PROXY STATEMENT 2020 |  |

We are committed to having sound corporate governance practices that maximize stockholder value in a manner consistent with legal requirements and the highest standards of integrity. In that regard, the Board has adopted guidelines that provide a framework for the governance of Quanta, and we continually review these guidelines and regularly monitor developments in the area of corporate governance. Our Corporate Governance Guidelines are posted in the Investor Relations / Governance section of our website atwww.quantaservices.com.

The Board believes that the leadership structure of Quanta’s Board should include either an independentnon-executive Chairman of the Board or a Lead Director who satisfies Quanta’s standards for independence. The Board reviews its leadership structure from time to time to assess whether it continues to serve the best interests of Quanta and its stockholders.

Chairman of the Board

Quanta’s Corporate Governance Guidelines provide that the Board will appoint a Chairman of the Board, who may but need not be an employee of Quanta. The Chairman of the Board generally presides over all regular sessions of the Board and Quanta’s annual meetings of stockholders. With input from the Chief Executive Officer (if the Chairman is an independent director), or in consultation with the Lead Director (if the Chairman is not an independent director), the Chairman sets the agenda for Board meetings, subject to the right of each Board member to suggest the inclusion of items on any agenda. The Chairman of the Board may vote at any meeting of the Board on any matter called to a vote, subject to the legal, fiduciary and governance requirements applicable to all members of the Board. If the Chairman of the Board is an independent director, the duties and responsibilities of the Chairman of the Board generally include the following:

| • | working with the Chief Executive Officer to ensure directors receive timely, accurate and complete information to enable sound decision making, effective monitoring and advice; |

| • | encouraging active engagement of all directors; |

| • | directing discussions toward a consensus view and summarizing discussions for a complete understanding of what has been agreed; |

| • | encouraging the Board’s involvement in strategic planning and monitoring the Chief Executive Officer’s implementation; |

| • | coordinating, monitoring and maintaining a record of all meetings of independent directors and discussing Board executive session results with the Chief Executive Officer; |

| • | promoting effective relationships and open communication between the independent directors and the management team; |

| • | coordinating, together with the Compensation Committee, the formal evaluation of the Chief Executive Officer on an annual basis; |

| • | coordinating, together with the Governance and Nominating Committee, the succession plans for the Chief Executive Officer; |

| • | identifying matters specifically reserved for the decision of the Board and ensuring that the Board sets appropriate levels of authority for management; |

| • | coordinating, together with the Governance and Nominating Committee, a process for the annual evaluation of the Board, its members and its committees; and |

| • | reviewing management’s investor relations strategy and participating, where appropriate, in its implementation. |

| QUANTASERVICES.COM | PROXY STATEMENT 2020 9 |

Additional duties and responsibilities of the Chairman of the Board may be established from time to time by the Board and the Governance and Nominating Committee of the Board.

In May 2019, the Boardre-appointed David McClanahan, an independent director, asnon-executive Chairman of the Board to serve as such until his successor is duly elected and qualified at the next annual meeting of the Board or until his earlier resignation or removal. Mr. McClanahan has served as Quanta’snon-executive Chairman of the Board since his initial appointment in May 2017. The Board may modify this structure in the future to ensure that the Board leadership structure for Quanta remains effective and advances the best interests of our stockholders.

Lead Director

In the event the Chairman of the Board is not an independent director, our Corporate Governance Guidelines provide that a Lead Director will be elected exclusively by the independent directors. The Lead Director must be an independent director and will assist the Chairman of the Board and the remainder of the Board in assuring effective corporate governance in managing the affairs of the Board. The Lead Director is responsible for ensuring that the quality, quantity and timeliness of the flow of information between management and the Board enables the Board to fulfill its functions and fiduciary duties in an efficient and effective manner. In addition, the Lead Director will coordinate the activities of the other independent directors, preside over the Board when the Chairman of the Board is not present, consult with the Chairman of the Board as to agenda items for Board and committee meetings, and perform such other duties and responsibilities as the Board deems appropriate.

The Board recognizes the importance of ensuring that the Company’s overall business strategy is designed to create long-term, sustainable value for stockholders. While the formulation and implementation of Quanta’s strategy is primarily the responsibility of management, the Board plays an active oversight role, carried out primarily through regular reviews and discussions with management, including both broad-based presentations and morein-depth analyses and discussions of specific areas of focus and evolving business, industry, societal, operating and economic conditions. Periodically, the Board undertakes a robust qualitative and quantitative review of management’s five-year strategic plan, which includes both financial and operational performance goals and the strategic initiatives designed to support those goals. The Board and management discuss, among other things, the Company’s commitment to workforce safety, planned strategic operating initiatives for each operating segment, growth opportunities in existing and adjacent markets, capital allocation initiatives and considerations, and expected investment and acquisition activity.

The Board also annually reexamines the strategic plan, reviewing management’s progress on its strategic initiatives and revised financial projections based on, among other things, prior period financial results and recent acquisition activity. The Board and management discuss and consider market trends and opportunities, the Company’s competitive positioning, recent regulatory and legal changes, and emerging technologies and challenges in the industries Quanta serves. Furthermore, on an ongoing basis, the Board evaluates specific business decisions in light of the strategic plan, including proposed acquisitions or investments and capital allocation decisions. The Board’s oversight of risk management (as described below) also enhances the directors’ understanding of the risks associated with the Company’s strategy and the Board’s ability to provide guidance to and oversight of management in executing the strategic plan.

The Board’s Role in Risk Oversight

The Board oversees an enterprise-wide approach to risk management, designed to support the achievement of long-term organizational objectives and enhance stockholder value. The annual enterprise risk management assessment, managed by Quanta’s Chief Executive Officer, General Counsel, Chief Accounting Officer and Chief Financial Officer, provides visibility to the Board about the identification, assessment, monitoring and management of critical risks and management’s risk mitigation strategies. In this process, risk is assessed throughout the business, including operational, financial and reputational risks, legal and regulatory risks and data and systems security risks. A component of the Board’s oversight function is not only understanding the risks the Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for Quanta. The involvement of the full Board in setting Quanta’s business strategy, both short-term and long-term, is a key part of its understanding of Quanta’s risks and how those risks may

| 10 PROXY STATEMENT 2020 |  |

evolve in response to changes in strategy or business environment, and what constitutes an appropriate level of risk for Quanta. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also oversee risk management in certain areas. Specifically, the Audit Committee focuses on risks relating to financial reporting, internal controls, information technology security programs, including cybersecurity, and compliance with legal and regulatory requirements; the Compensation Committee focuses on risks relating to Quanta’s compensation policies and programs and, in setting compensation, strives to create incentives that are aligned with Quanta’s risk management profile; and the Investment Committee focuses on risks associated with prospective acquisitions, dispositions and investments. Quanta’s Governance and Nominating Committee focuses on risks relating to Quanta’s corporate governance and Board membership and structure, as well as corporate responsibility and sustainability matters, including environmental and social issues. The Governance and Nominating Committee also periodically reviews Quanta’s risk management process, reporting its findings to the Board.

The Board has determined that each of our current directors, other than our Chief Executive Officer, Mr. Austin, has no material relationship with Quanta (either directly or as a partner, stockholder or officer of an organization that has a relationship with Quanta) and is “independent” within the meaning of the New York Stock Exchange (“NYSE”) corporate governance listing standards. The Board has made these determinations based in part on its finding that these independent directors meet the categorical standards for director independence set forth in our Corporate Governance Guidelines and in the NYSE corporate governance listing standards. With each current director other than Mr. Austin deemed independent, the Board exceeds the NYSE requirement that a majority of directors be independent.

When evaluating the independence of Mr. Wood, the Board considered his service as a director of SunPower Corporation and as an officer of Hunt Energy Network, which are potential customers of Quanta. When evaluating the independence of Ms. Wyrsch, the Board considered her prior employment as an executive officer of Sempra Energy, a customer of Quanta, as more fully described in Certain Transactions – Related Party Transactions. When evaluating the independence of Mr. Jackman, the Board considered Quanta’s employment of his son, who is employed at anon-management level and received less than $120,000 in aggregate compensation during 2019. The Board determined that these relationships were not material and that the positions held or previously held by these individuals and the amounts involved did not prevent a finding of independence under the NYSE standards or our Corporate Governance Guidelines.

Our Corporate Governance Guidelines, which include our categorical standards for director independence, are posted in the Investor Relations / Governance section of our website atwww.quantaservices.com.

Executive Sessions ofNon-Management Directors

In accordance with the NYSE corporate governance listing standards, ournon-management directors, each of whom is “independent” within the meaning of NYSE corporate governance listing standards and our Corporate Governance Guidelines, meet in executive session without management at each regularly scheduled Board meeting. The executive sessions are presided over by the Chairman of the Board or, if the Chairman of the Board is not independent, by the Lead Director, or in the absence of an independent Chairman of the Board or Lead Director, by an independent director selected by the executive session participants.

During the year ended December 31, 2019, the Board held seven meetings. Each director attended at least 85% of the meetings of the Board and the committees of the Board, if any, on which they served during the periods for which they served as a director. We encourage, but do not require, the members of the Board to attend the annual meeting of stockholders. Last year, all then-current directors attended the annual meeting of stockholders.

| QUANTASERVICES.COM | PROXY STATEMENT 2020 11 |

The Board has four standing committees: the Audit Committee, the Compensation Committee, the Governance and Nominating Committee, and the Investment Committee. The Board has examined the composition of each standing committee and has determined that each member of these committees is “independent” within the meaning of SEC regulations, NYSE corporate governance listing standards and our Corporate Governance Guidelines. Each standing committee operates under a formal charter adopted by the Board that governs its responsibilities, all of which are posted in the Investor Relations / Governance section of our website atwww.quantaservices.com. The current membership and the number of meetings held during the last fiscal year and the primary responsibilities of each committee are set forth below:

Audit Committee

|

Chairman of the Committee

Worthing F. Jackman (I)(F)

Committee Members

Vincent D. Foster (I)(F)

Bernard Fried (I)(F)

Meetings During 2019:

8 | |

• Appointing, compensating and overseeing the independent registered public accounting firm, considering, among other things, the accounting firm’s qualifications, independence and performance

• Reviewing and approving audit andnon-audit services performed by the accounting firm and determining whether the performance of such services is compatible with the accounting firm’s independence

• Reviewing and approving the scope and procedures of the accounting firm’s annual audit, and reviewing the final audit, including any comments, recommendations or problems encountered

• Reviewing and discussing quarterly reports from the accounting firm on, among other things, critical accounting policies and practices and any alternative treatments of financial information within generally accepted accounting principles (“GAAP”)

• Conducting an annual review of the accounting firm’s internal quality control measures and all relationships between the accounting firm and Quanta

• Reviewing management’s report on internal control over financial reporting and the accounting firm’s attestation of Quanta’s internal control over financial reporting

• Reviewing any significant deficiencies or material weaknesses in the design or operation of Quanta’s internal control over financial reporting and any fraud involving management or other financial reporting personnel

• Monitoring the quality and integrity of financial statements and earnings press releases, as well as the financial information and earnings guidance provided therein (includingnon-GAAP information)

• Reviewing the performance of Quanta’s internal audit function, including the internal audit director, and the scope and results of the annual internal audit plan

• Establishing and maintaining procedures for receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters and for the confidential submission of employee reports regarding questionable accounting or auditing matters

• Considering policies with respect to risk assessment and risk management

• Reviewing and approving, as appropriate, related party transactions

| ||

| (I) | Independent within the meaning of SEC regulations, NYSE corporate governance listing standards and our Corporate Governance Guidelines |

| (F) | Audit Committee Financial Expert within the meaning of SEC regulations, as determined by the Board |

| 12 PROXY STATEMENT 2020 |  |

Compensation Committee

|

Chairman of the Committee

Bernard Fried (I)

Committee Members

Doyle N. Beneby (I)

Worthing F. Jackman (I)

Margaret B. Shannon (I)

Meetings During 2019:

7 | |

• Reviewing, approving and overseeing the administration of Quanta’s incentive compensation plans, including the issuance of awards pursuant to equity-based incentive plans

• Evaluating the Chief Executive Officer’s performance annually in light of Quanta’s compensation goals and objectives and determining the Chief Executive Officer’s compensation based on this evaluation

• Reviewing and approving all compensation of other executive officers of Quanta and reviewing the Chief Executive Officer’s recommendations with respect to compensation of leadership personnel at Quanta’s key operating units and subsidiaries

• Reviewing and approving executive officer employment agreements and other compensation arrangements

• Reviewing the relationships between risk management policies and practices and compensation, including whether compensation arrangements encourage excessive risk-taking

• Considering the results of the most recent stockholder advisory vote on the compensation of Quanta’s NEOs

| ||

Governance and Nominating Committee

|

Chairman of the Committee

Margaret B. Shannon (I)

Committee Members

J. Michal Conaway (I)

Pat Wood, III (I)

Martha B. Wyrsch (I)

Meetings During 2019:

6 | |

• Developing, recommending and periodically reviewing corporate governance principles applicable to the Board and Quanta

• Establishing qualifications for membership on the Board and its committees and evaluating the structure of the Board

• Making recommendations to the Board regarding persons to be nominated for election orre-election to the Board and appointment of directors to Board committees

• Evaluating policies regarding the recruitment of directors

• Making recommendations to the Board regarding persons proposed by the Chief Executive Officer to be elected as executive officers of Quanta

• Supporting the Board’s Chief Executive Officer succession planning and talent development for succession candidates

• Periodically reviewing the processes for succession planning and talent development of Quanta’s executive officers and the leadership personnel at Quanta’s key operating units and subsidiaries

• Periodically reviewing Quanta’s enterprise risk management processes

• Periodically reviewing and discussing with management environmental, social and governance matters, and Quanta’s public reporting on corporate responsibility and sustainability

• Making recommendations to the Board regarding compensation and benefits fornon-employee directors

| ||

| (I) | Independent within the meaning of SEC regulations, NYSE corporate governance listing standards and our Corporate Governance Guidelines |

| QUANTASERVICES.COM | PROXY STATEMENT 2020 13 |

Investment Committee

|

Chairman of the Committee

J. Michal Conaway (I)

Committee Members

Doyle N. Beneby (I)

Vincent D. Foster (I)

Pat Wood, III (I)

Martha B. Wyrsch (I)

Meetings During 2019:

7 | |

• Considering and approving certain acquisitions, investments and dispositions by Quanta, including the terms, transaction structure, and consideration involved

• Evaluating certain capital expenditures by Quanta

• Monitoring ongoing activities in connection with certain investments and acquisitions

• Tracking certain completed acquisitions and investments

• Conducting a qualitative and quantitative review of certain historical transactions

• Assessing policies regarding transactions that hedge certain commodity, interest rate, currency and other business risks

| ||

| (I) | Independent within the meaning of SEC regulations, NYSE corporate governance listing standards and our Corporate Governance Guidelines |

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee served as an employee or officer of Quanta or any of its subsidiaries during 2019, was formerly an officer of Quanta or any of its subsidiaries, or had any relationship with Quanta requiring disclosure herein as a related party transaction. Additionally, no executive officers served on the compensation committee or as a director of another company, one of whose executive officers served on Quanta’s Compensation Committee or as a director of Quanta.

Code of Ethics and Business Conduct

The Board has adopted a Code of Ethics and Business Conduct that applies to all directors, officers and employees of Quanta and its subsidiaries, including the principal executive officer, principal financial officer and principal accounting officer or controller. The Code of Ethics and Business Conduct is posted in the Investor Relations / Governance section of our website atwww.quantaservices.com. We intend to post at the above location on our website any amendments or waivers to the Code of Ethics and Business Conduct that are required to be disclosed pursuant to Item 5.05 of Form8-K.

| 14 PROXY STATEMENT 2020 |  |

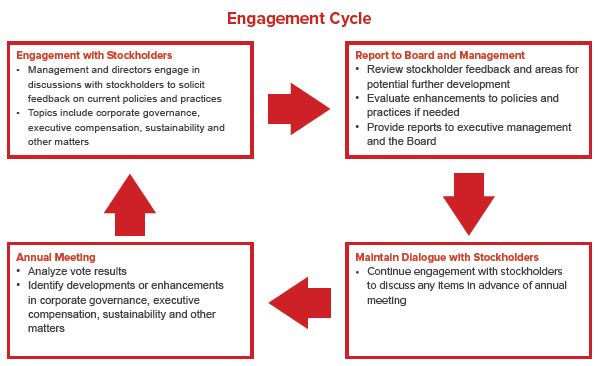

Engagement and Communications with the Board

The Board believes that effective corporate governance includes constructive conversations and the development of long-term relationships with our stockholders. We value such engagement and believe it is important to address any questions or concerns on Company policies and practices. We also review and analyze the voting results and feedback from our annual meetings to identify any topics of interest or concern.

Members of our management have historically engaged in extensive investor outreach on a variety of financial and operational topics, including long-term strategy, capital allocation priorities and industry dynamics. In a given year, we have numerous interactions with stockholders and members of the investment community on these matters and host or participate in various investor conferences and events.

We also conduct an annual stockholder engagement program focused on governance- and compensation-related topics, including board structure and oversight of strategy and risk, executive compensation, equity incentive compensation grant practices and corporate responsibility and sustainability. Our engagement team includes members of senior management, and when requested, independent directors or subject matter experts, and seeks to identify and address any areas of concern. During 2019, in connection with this new program, we contacted stockholders representing greater than 40% of our outstanding common stock, $0.00001 par value (“Common Stock”) as of December 31, 2019. Management and the Board received and reviewed valuable feedback on several topics, including board diversity and refreshment, executive compensation structure, political spending oversight and other sustainability matters, and certain of this feedback helped inform subsequent discussions regarding our governance and compensation practices

Stockholders and other interested parties may communicate with one or more of our directors, including ournon-management directors or independent directors as a group, a committee or the full Board by writing to Corporate Secretary, Quanta Services, Inc., 2800 Post Oak Blvd., Suite 2600, Houston, Texas 77056. All communications will be reviewed by the Corporate Secretary and forwarded to one or more of our directors, as appropriate.

| QUANTASERVICES.COM | PROXY STATEMENT 2020 15 |

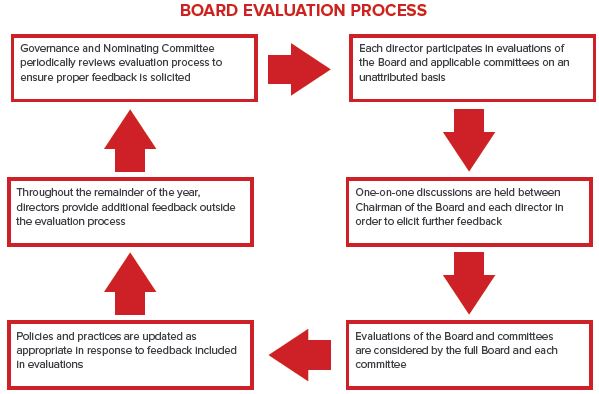

Board and Committee Evaluations

Board and committee evaluations play an important role in ensuring the effective functioning of the Board. Therefore, the Board and each committee conduct annual self-assessments, which are overseen by the Governance and Nominating Committee. The results of these assessments are compiled, without attribution, and sent to the directors for a full Board assessment and to the committee members of each committee for a committee assessment. Additionally, the Chairman of the Board conducts one-on-one discussions with each director to gather feedback on Board and committee operations, practices and performance. Information derived from the evaluation process is also considered by the Governance and Nominating Committee when searching for and evaluating potential future director candidates

Identifying and Evaluating Nominees for Director

The Governance and Nominating Committee regularly evaluates the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. If any vacancies are anticipated or arise, the Governance and Nominating Committee will consider director candidates suggested by incumbent directors, management, third-party search firms and others. The Governance and Nominating Committee will also consider director nominations by stockholders that are made in compliance with our bylaws. All applications, recommendations or proposed nominations for Board membership received by Quanta will be referred to the Governance and Nominating Committee. The manner in which the qualifications of a nominee are evaluated does not differ if the nominee is recommended by a stockholder.

The Governance and Nominating Committee has the authority to retain, at Quanta’s expense, a third-party search firm to help identify and facilitate the screening and interview process of potential director nominees. Once a potential director nominee is identified or recommended, the committee makes an initial determination as to whether to conduct a full evaluation based on, among other things, the information provided with the recommendation, the committee’s own knowledge of the candidate, supplemental inquiries to the recommending person or others, or a background check. If the committee determines to further pursue the candidate, the candidate is evaluated based on the qualifications described below.

| 16 PROXY STATEMENT 2020 |  |

The Governance and Nominating Committee also considers other relevant factors it deems appropriate, such as the current composition of the Board (including with respect to diversity in experience, background, gender and ethnicity), the balance of management and independent directors, the need for a certain Board committee expertise, and the candidate’s activities unrelated to Quanta (including service as a director on the boards of other public companies). After this evaluation, the committee determines whether to interview the candidate and may ask the candidate to meet with members of Quanta’s management or other Board members. After completing its evaluation, if the committee believes the candidate would be a valuable addition to the Board, it will recommend to the Board the candidate’s nomination for appointment or election as a director.

The Board values diversity in its broadest sense. With that goal in mind, and pursuant to our Corporate Governance Guidelines, the Board endeavors to have a group of directors representing:

| • | diverse experiences at policy-making levels of organizations that are relevant to Quanta’s activities and operations, which may come from business, government, education, technology andnon-profit organizations; |

| • | diversity of tenure, which ensures a proper balance between Board refreshment and director continuity; and |

| • | diverse backgrounds, including with respect to gender, ethnicity and geography. |

The Board, in connection with its most recent director candidate searches in 2016 and 2019, took deliberate steps to identify and appoint qualified, diverse candidates meeting the above characteristics. Specifically, the Board engaged and directed a search firm to conduct a national search for highly qualified, experienced and diverse candidates. As a result of these efforts, our Board is pleased with the progress made to date in connection with its diversity objectives, and intends to continue to focus on identifying qualified, diverse director candidates.

Our Corporate Governance Guidelines contain Board membership qualifications that the Governance and Nominating Committee considers in selecting nominees for our Board. The guidelines state that members of the Board should possess the highest standards of personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our stockholders, and must have an inquisitive and objective perspective, practical wisdom, mature judgment, the willingness to speak their mind and the ability to challenge and stimulate management in a constructive manner. They also provide that Board members should have experience in areas that are relevant to Quanta’s business and demonstrated leadership skills in the organizations with which they are or have been affiliated. The Board wants its members to represent a broad range of viewpoints and backgrounds, and our Corporate Governance Guidelines expressly mention seeking candidates who would add gender and ethnic diversity to our Board. Members of the Board must also be willing to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serve for an extended period of time. As such, a Board member should not serve on more than three additional public company boards, and a Board member that is a chief executive officer (or equivalent position) with another public company should not serve on more than one public company board in addition to Quanta’s Board and their own company board. Board members will not be nominated for election to the Board if the election would occur after their 73rd birthday; however, the full Board may make exceptions in special circumstances.

The Governance and Nominating Committee has the responsibility of recommending to the Board compensation and benefits fornon-employee directors. The committee is guided by certain director compensation principles set forth in our Corporate Governance Guidelines:

| • | compensation should fairly pay directors for work required; |

| • | compensation should be appropriate and competitive to ensure Quanta’s ability to attract and retain highly-qualified directors; |

| • | compensation should align directors’ interests with the long-term interests of stockholders; and |

| • | the structure of the compensation should be simple, transparent and easy for stockholders to understand. |

The Governance and Nominating Committee and the Board intend to set director compensation levels at or near the market median relative to directors at companies of comparable size, industry, and scope of operations in order to ensure directors are paid competitively for their time commitment and responsibilities. A market competitive compensation package is important because it enables us to attract and retain highly qualified directors who are critical to our long-term success. Additional director compensation practices have been adopted to align with market best practices and ensure director interests are closely aligned with the interests of our stockholders as set forth below.

| QUANTASERVICES.COM | PROXY STATEMENT 2020 17 |

| • | Annual Limit on Total Compensation. We adopted a meaningful annual limit onnon-employee director compensation, as described further in Annual Limit onNon-Employee Director Compensation. |

| • | Stock Ownership Guidelines.We maintain meaningful stock ownership guidelines that align our directors’ long-term interests with those of our stockholders, as described further in Stock Ownership Guidelines forNon-Employee Directors. |

| • | Anti-Hedging / Pledging Policy.We maintain a policy that prohibits directors from hedging the economic risk of ownership of Quanta Common Stock or pledging Quanta securities as collateral for a loan absentpre-clearance and demonstration of financial capacity to repay without resorting to the pledged securities. |

| • | Appropriate Compensation Mix.The majority of director compensation is equity-based. Cash retainers, including incremental Board and committee leadership retainers, are intended to provide fixed compensation for time spent, while the equity-based compensation component recognizes director responsibility for strategic oversight and stockholder value. |

| • | Annual Review.Our Governance and Nominating Committeere-assesses ournon-employee director compensation annually and intends to continue to engage an independent compensation consultant to perform a comprehensive market analysis of our director compensation program and practices. The results of this review for 2019 are described inCompensation Program Review and Prospective Change. |

| • | No Additional Compensation for Employee Directors.Directors who also serve as employees of Quanta receive no additional compensation for director service. |

Current Director Compensation

At every annual meeting of stockholders at which anon-employee director is elected orre-elected, each such director receives (i) an annual award of restricted stock units (“RSUs”) having a value of $150,000 and (ii) subject to the prospective increase in the Board membership cash retainer described below, the applicable annual cash retainer(s):

| Annual Membership Cash Retainer | Annual Cash Retainer Supplement For Committee Chairmanship | |||||||

Board of Directors | $85,000 | – | ||||||

Audit Committee | $15,000 | $20,000 | ||||||

Compensation Committee | $10,000 | $15,000 | ||||||

Governance and Nominating Committee | $10,000 | $15,000 | ||||||

Investment Committee | $10,000 | $15,000 | ||||||

Upon initial appointment to the Board other than at an annual meeting of stockholders, anon-employee director receives (for the period from the appointment through the end of the current director service year) a pro rata portion of the equity award and applicable cash amounts. Ournon-employee Chairman of the Board receives additional annual compensation in the amount of $180,000, of which 50% is payable in cash and 50% is payable in RSUs. Upon the initial appointment of anon-employee Chairman of the Board, other than immediately following the annual meeting of stockholders, such director receives (for the period from the appointment through the end of the current director service year) a pro rata portion of the additional annual compensation.

Unless thenon-employee director’s Board service is terminated earlier, RSUs generally vest upon conclusion of the director service year. Subject to the terms of applicable award agreements, unvested RSUs held by (i) anynon-employee director who is not nominated for or elected to a new term, including for example, due to a reduction in the size of the Board, age precluding are-nomination, the identification of a new nominee, or the desire to retire at the end of a term, or (ii) anynon-employee director who resigns at Quanta’s convenience, including any resignation resulting from thenon-employee director’s failure to receive a majority of the votes cast in an election for directors as required by Quanta’s bylaws, vest in full on the earlier of (a) the conclusion of the director service year, or (b) the date of suchnon-employee director’s termination of service. RSUs are generally settled in shares of Common Stock, provided that anon-employee director may elect to settle up to 50% of any award in cash if he or she is in compliance with Quanta’s stock ownership guidelines as of the date of settlement and is expected to remain in compliance immediately following settlement.

Generally, meeting fees are not paid. However, in order to compensate for the time required to accommodate extraordinary meeting activity, eachnon-employee director receives a fee for attendance at the tenth and any subsequent Board meeting or the tenth and any subsequent

| 18 PROXY STATEMENT 2020 |  |

committee meeting, in each case during a single director service year, as follows: $2,000 for attendance at anin-person board meeting; $1,000 for participation at a telephonic board meeting; $1,000 for attendance at anin-person committee meeting; and $500 for participation at a telephonic committee meeting.

Directors are also reimbursed for reasonableout-of-pocket expenses incurred to attend meetings of the Board or the committees thereof, and for other expenses reasonably incurred in their capacity as directors of Quanta. Directors who are also employees of Quanta or any of its subsidiaries do not receive additional compensation for serving as directors. Currently, ninenon-employee director nominees are standing for election at the annual meeting. As an executive officer of Quanta, Mr. Austin received no compensation for his service as a director of Quanta.

Compensation Program Review and Prospective Change

During 2019, the Governance and Nominating Committee retained a compensation consultant to, among other things, review and provide observations and recommendations regarding Quanta’snon-employee director compensation program and highlight relevant trends in director compensation. The consultant examined director compensation data for a group of peer companies, as well as director compensation survey data, and presented its findings and observations to the Governance and Nominating Committee. After reviewing the information presented in 2019 and upon recommendation by the Governance and Nominating Committee, in order to better align with competitive peer group practices, the Board approved a $7,500 increase in the annual Board membership cash retainer (from $85,000 to $92,500), effective as of May 28, 2020. No other changes to the director compensation program were made.

Annual Limit onNon-Employee Director Compensation

The Quanta Services, Inc. 2019 Omnibus Equity Incentive Plan (the “2019 Omnibus Plan”) contains an annual limit onnon-employee director compensation, inclusive of all cash compensation and any awards under the 2019 Omnibus Plan that may be made to anon-employee director for service during any calendar year. The annual limit is $500,000 per year, provided that a newly elected director or a director serving as Chairman of the Board or Lead Director may receive up to $250,000 more than such amount for service during any calendar year.

Deferred Compensation Plan forNon-Employee Directors

Non-employee directors are eligible to participate in a deferred compensation plan maintained by Quanta. No later than December 31 of each year, eachnon-employee director may voluntarily elect to defer all or a portion (in 5% increments) of his or her annual cash retainers, including but not limited to, compensation for board membership, committee membership and board/committee leadership, and RSUs to be earned with respect to services performed in the following year. Deferral elections are irrevocable and if no deferral election is made, no compensation is deferred. Deferred cash amounts are allocated to a separate recordkeeping account maintained for thenon-employee director that reflects the amounts deferred and any earnings (positive or negative). The account is credited with returns according to the performance of certain deemed investment choices selected by thenon-employee director from time to time. However, Quanta has no obligation to provide any deemed investment choice other than a default investment option selected by the Compensation Committee. The interest rate earned on the deferred cash amounts is not above-market or preferential. Deferred RSUs are recorded in an account maintained for thenon-employee director that reflects the number of shares deferred. Quanta also makes a cash payment of dividend equivalents on the shares deferred at the same time and at the same rate as dividends are paid on Quanta Common Stock. In general, deferred compensation is distributed to thenon-employee director (or his or her beneficiary) upon the director leaving the Board or at a date elected in advance by the director. Additionally, deferred amounts can be distributed upon certain unforeseen emergencies suffered by thenon-employee director or upon a change in control of Quanta. Mr. Foster elected to defer all or a portion of his cash compensation and/or RSU awards during 2019.

Stock Ownership Guidelines forNon-Employee Directors

Non-employee directors are required to hold stock with a value equivalent to five times the annual cash retainer for Board membership (excluding the annual cash retainer for committee membership or any supplement for serving as a committee chairman or as chairman of the Board).Non-employee directors have five years from the fiscalyear-end following initial election to the Board to accumulate the stock ownership prescribed by the guidelines. As of December 31, 2019, allnon-employee directors were in compliance with the requirements of the stock ownership guidelines either by exceeding the prescribed ownership level or making ratable progress toward the prescribed ownership level within the accumulation period.

| QUANTASERVICES.COM | PROXY STATEMENT 2020 19 |

2019 Director Compensation Table

The following table sets forth the compensation for eachnon-employee director during the 2019 fiscal year.

Name | Fees ($) | Stock Awards(1) ($) | Change in ($) | All Other Compensation ($) | Total ($) | |||||||||||||||

Doyle N. Beneby | 105,000 | 138,877 | – | – | 243,877 | |||||||||||||||