COMBINED INFORMATION STATEMENT

OF

PIONEER RESEARCH FUND

PIONEER DISCIPLINED VALUE FUND

a series of Pioneer Series Trust V

PIONEER DISCIPLINED GROWTH FUND

a series of Pioneer Series Trust V

PIONEER SELECT MID CAP GROWTH FUND

a series of Pioneer Series Trust I

AND

PROSPECTUS FOR

PIONEER VALUE FUND

(to be renamed Pioneer Core Equity Fund)

PIONEER FUNDAMENTAL VALUE FUND

(to be renamed Pioneer Disciplined Value Fund)

a series of Pioneer Series Trust III

PIONEER INDEPENDENCE FUND

(to be renamed Pioneer Disciplined Growth Fund)

PIONEER GROWTH OPPORTUNITIES FUND

(to be renamed Pioneer Select Mid Cap Growth Fund)

a series of Pioneer Series Trust II

(each, a “Pioneer Fund” and together, the “Pioneer Funds”)

The address and telephone number of each Pioneer Fund is:

60 State Street

Boston, Massachusetts 02109

1-800-225-6292

To the Shareholders of Pioneer Research Fund, Pioneer Disciplined Value Fund, Pioneer Disciplined Growth Fund and Pioneer Select Mid Cap Growth Fund:

The Board of Trustees of your fund has approved a reorganization of your fund with another Pioneer fund after considering the recommendation of Pioneer Investment Management, Inc., the investment manager to your fund, and concluding that such reorganization would be in the best interests of your fund.

Following the completion of the reorganization of your fund, you will be a shareholder in a combined fund that has the same investment objective, strategies and policies, investment adviser, portfolio management team, and performance history as your fund, and that has management fees that are no higher than your fund’s management fees. However, the combined fund will be substantially larger in size.

| | |

If you are a shareholder in: | You will become a shareholder in: |

Pioneer Research Fund | Pioneer Value Fund, |

| | which will be re-named Pioneer Core Equity Fund |

Pioneer Disciplined Value Fund | Pioneer Fundamental Value Fund, |

| | which will be re-named Pioneer Disciplined Value Fund |

Pioneer Disciplined Growth Fund | Pioneer Independence Fund, |

| | which will be re-named Pioneer Disciplined Growth Fund |

Pioneer Select Mid Cap Growth Fund | Pioneer Growth Opportunities Fund, |

| | which will be re-named Pioneer Select Mid Cap Growth Fund |

Each reorganization is expected to occur on or about May 17, 2013. The reorganization is expected to be tax-free to you for federal income tax purposes, and no commission, redemption fee or other transactional fee will be charged as a result of the reorganization.

None of the reorganizations requires shareholder approval, and you are not being asked to vote. We do, however, ask that you review the enclosed information statement/prospectus, which contains information about the combined fund, outlines the differences between your fund and the combined fund, and provides details about the terms and conditions of the reorganizations.

The Board of Trustees of your fund has unanimously approved your fund’s reorganization and believes the reorganization is in the best interests of your fund.

If you have any questions, please call 1-800-225-6292.

Sincerely,

Christopher J. Kelley

Secretary

Boston, Massachusetts

______________, 2013

COMBINED INFORMATION STATEMENT

OF

PIONEER RESEARCH FUND

PIONEER DISCIPLINED VALUE FUND

a series of Pioneer Series Trust V

PIONEER DISCIPLINED GROWTH FUND

a series of Pioneer Series Trust V

PIONEER SELECT MID CAP GROWTH FUND

a series of Pioneer Series Trust I

AND

PROSPECTUS FOR

PIONEER VALUE FUND

(to be renamed Pioneer Core Equity Fund)

PIONEER FUNDAMENTAL VALUE FUND

(to be renamed Pioneer Disciplined Value Fund)

a series of Pioneer Series Trust III

PIONEER INDEPENDENCE FUND

(to be renamed Pioneer Disciplined Growth Fund)

PIONEER GROWTH OPPORTUNITIES FUND

(to be renamed Pioneer Select Mid Cap Growth Fund)

a series of Pioneer Series Trust II

(each, a “Pioneer Fund” and together, the “Pioneer Funds”)

The address and telephone number of each Pioneer Fund is:

60 State Street

Boston, Massachusetts 02109

1-800-225-6292

Shares of the Pioneer Funds have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”). The SEC has not passed on upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

An investment in any Pioneer Fund (each sometimes referred to herein as a “fund”) is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This Information Statement/Prospectus sets forth information that an investor needs to know before investing. Please read this Information Statement/Prospectus carefully before investing and keep it for future reference.

1

INTRODUCTION

This combined information statement/prospectus, dated ______________, 2013 (the “Information Statement/Prospectus”), is being furnished to shareholders of each of Pioneer Research Fund, Pioneer Disciplined Value Fund, Pioneer Disciplined Growth Fund and Pioneer Select Mid Cap Growth Fund in connection with the reorganization of each such fund with another Pioneer Fund. Following the completion of the reorganization, you will be a shareholder in a fund that has the same investment objective, strategies and policies, investment adviser, portfolio management team, and performance history as your fund, and that has management fees that are no higher than your fund’s management fees. However, each combined fund will be substantially larger in size. None of the reorganizations requires shareholder approval, and you are not being asked to vote.

The Information Statement/Prospectus contains information you should know about the reorganizations. The following table indicates the page of this Information Statement/Prospectus on which the discussion regarding the reorganization of your fund begins.

| | |

Reorganization | Page |

Pioneer Research Fund with Pioneer Value Fund (to be renamed Pioneer Core Equity Fund) | 8 |

Pioneer Disciplined Value Fund with Pioneer Fundamental Value Fund (to be renamed Pioneer Disciplined Value Fund) | 26 |

Pioneer Disciplined Growth Fund with Pioneer Independence Fund (to be renamed Pioneer Disciplined Growth Fund) | 42 |

Pioneer Select Mid Cap Growth Fund with Pioneer Growth Opportunities Fund (to be renamed Pioneer | |

Select Mid Cap Growth Fund) | 59 |

Copies of the agreement and plan of reorganization for each reorganization are attached to this Information Statement/Prospectus as Exhibits A-D. Shareholders should read this entire Information Statement/Prospectus, including the applicable exhibit, carefully.

The date of this Information Statement/Prospectus is ______________, 2013.

For more complete information about each Pioneer Fund, please read the fund’s prospectus and statement of additional information, as they may be amended and/or supplemented. Each fund’s prospectus and statement of additional information has been filed with the SEC (http://www.sec.gov) and is available upon oral or written request and without charge. See “Where to Get More Information” below.

| | |

Where to Get More Information | |

Each Pioneer Fund’s current summary prospectus, | On file with the SEC (http://www.sec.gov) and available at no charge by |

prospectus, statement of additional information, and | calling our toll-free number: 1-800-225-6292 |

any applicable supplements. | |

Each Pioneer Fund’s most recent annual and semi-annual | On file with the SEC (http://www.sec.gov) and available at no charge by |

reports to shareholders. | calling our toll-free number: 1-800-225-6292. See “Available |

| | Information.” |

A statement of additional information for this Information | On file with the SEC (http://www.sec.gov) and available at no charge by |

Statement/Prospectus (the “SAI”), dated _________, | calling our toll-free number: 1-800-225-6292. This SAI is incorporated |

2013. It contains additional information about the | by reference into this Information Statement/Prospectus. |

Pioneer Funds. | |

To ask questions about this Information | Call our toll-free telephone number: 1-800-225-6292. |

Statement/Prospectus. | |

The prospectus and statement of additional information of each of the following Pioneer Funds are incorporated by reference into this Information Statement/Prospectus:

| · | Pioneer Research Fund’s summary prospectus, prospectus and statement of additional information dated May 1, 2012, as supplemented; |

| · | Pioneer Disciplined Value Fund’s summary prospectus, prospectus and statement of additional information dated December 31, 2012, as supplemented; |

2

| · | Pioneer Disciplined Growth Fund’s summary prospectus, prospectus and statement of additional information dated December 31, 2012, as supplemented; and |

| · | Pioneer Select Mid Cap Growth Fund’s summary prospectus, prospectus and statement of additional information dated April 1, 2012, as supplemented. |

Background to the Reorganization

Pioneer Investment Management, Inc. (“Pioneer”), your fund’s investment adviser, recommended the reorganization of your fund with another Pioneer Fund that, after the reorganization, will have substantially similar investment objectives and strategies as your fund, as follows:

| · | Pioneer Research Fund will reorganize with Pioneer Value Fund (to be renamed Pioneer Core Equity Fund); |

| · | Pioneer Disciplined Value Fund will reorganize with Pioneer Fundamental Value Fund (to be renamed Pioneer Disciplined Value Fund); |

| · | Pioneer Disciplined Growth Fund will reorganize with Pioneer Independence Fund (to be renamed Pioneer Disciplined Growth Fund); and |

| · | Pioneer Select Mid Cap Growth Fund will reorganize with Pioneer Growth Opportunities Fund (to be renamed Pioneer Select Mid Cap Growth Fund) |

(each, a “Reorganization”). Pioneer recommended the Reorganization of your fund for a number of reasons, including:

| · | You will be a shareholder of a fund that will have the same investment strategy and portfolio management team as your fund, but that will be significantly larger in asset size; |

| · | Combining the funds will enable Pioneer to focus resources on its research investment team, which has produced favorable investment performance results for your fund over recent years; and |

| · | The combined fund may be better positioned in the market to further increase asset size and achieve economies of scale. The combined fund’s greater asset size may allow it, relative to your fund, to obtain better net prices on securities trades and reduce per share expenses as fixed expenses are shared over a larger asset base. |

At a meeting held on January 15, 2013, the Board of Trustees of the funds unanimously approved the Reorganization of your fund. The Reorganization of your fund is not subject to approval by the shareholders of your fund.

How Will the Reorganization Work?

| · | The Reorganization is scheduled to occur on or about May 17, 2013, but may occur on such later date as the parties may agree in writing (the “Closing Date”). |

| · | Your fund will transfer all of its assets to the Pioneer Fund with which your fund is reorganizing, and that fund will assume all of your fund’s liabilities. |

| · | Shares of the Pioneer Fund with which your fund is reorganizing will be distributed to you in proportion to the relative net asset value of your holdings of shares of your fund on the Closing Date. Therefore, on the Closing Date, you will hold shares of such Pioneer Fund with the same aggregate net asset value as your holdings of shares of your fund immediately prior to the Reorganization. The net asset value attributable to a class of shares of each Pioneer Fund will be determined using the Pioneer Funds’ valuation policies and procedures. Each fund’s valuation policy and procedures are identical. |

| · | No sales load, contingent deferred sales charge, commission, redemption fee or other transactional fee will be charged as a result of the Reorganization. After the Reorganization, any contingent deferred sales charge that applied to your Class A (if applicable), Class B or Class C shares of your fund at the time of the Reorganization will continue to apply for the remainder of the applicable holding period at the time of the Reorganization. In calculating any applicable contingent deferred sales charge, the period during which you held your shares will be included in the holding period of the shares you receive as a result of the Reorganization. |

| · | The Reorganization generally is not expected to result in income, gain or loss being recognized for federal income tax purposes by either Pioneer Fund involved in the Reorganization or by the shareholders of either Pioneer Fund involved in the Reorganization. |

3

| · | In approving the Reorganization, the Board of Trustees of each Pioneer Fund, including all of the Trustees who are not “interested” persons (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Pioneer Funds, Pioneer, or Pioneer Funds Distributor, Inc., the Pioneer Funds’ principal underwriter and distributor (“PFD”) (the “Independent Trustees”), has determined that the Reorganization is in the best interest of each Pioneer Fund and will not dilute the interests of shareholders. The Trustees have made this determination based on factors that are discussed below. |

In addition to the Class A, Class B (if applicable), Class C and Class Y shares to be issued in each Reorganization, certain of the Pioneer Funds also offer other classes of shares. This Information Statement/Prospectus relates only to the Class A, Class B (if applicable), Class C and Class Y shares to be issued in each Reorganization.

What Was the Basis of the Trustees’ Determination that the Reorganization Was in the Best Interests of Your Fund?

The Board of Trustees believes that reorganizing your fund with another open-end Pioneer Fund that will have substantially similar investment policies and greater assets offers you a number of potential benefits. These potential benefits and considerations include, with respect to each Reorganization:

| · | Continuity of portfolio management, investment policies and historical investment performance. The combined fund would continue to follow your fund’s investment strategy and would continue your fund’s performance history. The combined fund would continue to be managed by your fund’s investment team. |

| · | The combined fund may be better positioned to attract assets than your fund. The larger size of the combined fund may result in greater economies of scale. Any such economies of scale would benefit the combined fund in two ways. First, a larger fund, which trades in larger blocks of securities, will be able to hold larger positions in individual securities and, consequently, have an enhanced ability to obtain better net prices on securities trades. And second, each fund incurs substantial operating costs for accounting, legal and custodial services. The combined fund resulting from the Reorganization would spread fixed expenses over a larger asset base, potentially contributing to a lower expense ratio in the long term than your fund would achieve separately. |

| · | No increase in management fees. The pro forma management fee paid by the combined fund will the same or lower than the management fee paid by your fund. |

| · | The transaction is expected to be treated as a reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and you therefore are not expected to recognize any taxable gain or loss on the exchange of your fund shares for shares of the combined fund. |

What are the Federal Income Tax Consequences of the Reorganization?

As a condition to the closing of each Reorganization, the applicable funds must receive an opinion of Bingham McCutchen LLP to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368(a) of the Code. Accordingly, subject to the limited exceptions described below under the heading “Tax Status of the Reorganizations,” it is expected that neither you nor your fund will recognize gain or loss as a direct result of the Reorganization, and that the aggregate tax basis of the shares that you receive in the Reorganization will be the same as the aggregate tax basis of the shares that you surrender in the Reorganization. In addition, the holding period of shares you receive in the Reorganization will include the holding period of the shares of the fund that you surrender in the Reorganization, provided that you held those shares as capital assets on the date of the Reorganization. However, in accordance with the Pioneer Funds’ policy that each Pioneer Fund distributes its investment company taxable income, net tax-exempt income and net capital gains for each taxable year (in order to qualify for tax treatment as a regulated investment company and avoid federal income tax thereon at the fund level), your fund will declare and pay a distribution of such income and gains to its shareholders, if any, shortly before the Reorganization. Such distribution may affect the amount, timing or character of taxable income that you realize in respect of your fund shares. For more information, see “Tax Status of the Reorganizations” on page 80 of the Information Statement/Prospectus. The Pioneer Fund with which your fund is being reorganized may make a comparable distribution to its shareholders shortly before the Reorganization. Additionally, following the Reorganization, the applicable combined fund will continue to make distributions according to its regular distribution schedule. You will generally need to pay tax on those distributions even though they may include income and gains that were accrued and/or realized before you became a shareholder of the combined fund.

Who Bears the Expenses Associated with the Reorganization?

Pioneer Research Fund - Pioneer Value Fund Reorganization: Each fund will bear 25% of the expenses incurred in connection with the Reorganization, including expenses associated with the preparation, printing and mailing of any shareholder communications (including this Information Statement/Prospectus), any filings with the SEC and other governmental agencies in connection with the Reorganization, audit fees and legal fees (“Reorganization Costs”). Pioneer will bear the remaining 50% of the Reorganization Costs. In addition to the

4

Reorganization Costs, Pioneer Value Fund will bear 50% of the expenses related to a meeting of shareholders of the fund to be held on May 7, 2013 to consider a new management fee and investment objective for the fund ("Proxy Costs"). Pioneer will bear the remaining 50% of the Proxy Costs.

Pioneer Disciplined Value Fund - Pioneer Fundamental Value Fund Reorganization: Pioneer Fundamental Value Fund will bear 25% of the expenses incurred in connection with the Reorganization and Pioneer will bear 75% of the Reorganization Costs.

Pioneer Disciplined Growth Fund - Pioneer Independence Fund Reorganization: Pioneer will bear 100% of the expenses incurred in connection with the Reorganization.

Pioneer Select Mid Cap Growth Fund - Pioneer Growth Opportunities Fund Reorganization: Pioneer Growth Opportunities Fund will bear 25% of the expenses incurred in connection with the Reorganization and Pioneer will bear 75% of the Reorganization Costs.

5

This page for your notes.

| | |

| TABLE OF CONTENTS |

| |

| | Page |

INTRODUCTION | 2 |

REORGANIZATION OF PIONEER RESEARCH FUND WITH PIONEER VALUE FUND (TO BE RENAMED PIONEER CORE | |

EQUITY FUND) | 8 |

REORGANIZATION OF PIONEER DISCIPLINED VALUE FUND WITH PIONEER FUNDAMENTAL VALUE FUND (TO BE | |

RENAMED PIONEER DISCIPLINED VALUE FUND) | 26 |

REORGANIZATION OF PIONEER DISCIPLINED GROWTH FUND WITH PIONEER INDEPENDENCE FUND (TO BE | |

RENAMED PIONEER DISCIPLINED GROWTH FUND) | 42 |

REORGANIZATION OF PIONEER SELECT MID CAP GROWTH FUND WITH PIONEER GROWTH OPPORTUNITIES | |

FUND (TO BE RENAMED PIONEER SELECT MID CAP GROWTH FUND) | 59 |

OTHER IMPORTANT INFORMATION CONCERNING THE REORGANIZATIONS | 76 |

TERMS OF EACH AGREEMENT AND PLAN OF REORGANIZATION | 78 |

TAX STATUS OF THE REORGANIZATIONS | 80 |

ADDITIONAL INFORMATION ABOUT THE PIONEER FUNDS | 84 |

FINANCIAL HIGHLIGHTS | 98 |

OWNERSHIP OF SHARES OF THE PIONEER FUNDS | 125 |

EXPERTS | 126 |

AVAILABLE INFORMATION | 126 |

EXHIBIT A — FORM OF AGREEMENT AND PLAN OF REORGANIZATION - PIONEER RESEARCH FUND - PIONEER | |

VALUE FUND | A–1 |

EXHIBIT B — FORM OF AGREEMENT AND PLAN OF REORGANIZATION - PIONEER DISCIPLINED VALUE FUND - | |

PIONEER FUNDAMENTAL VALUE FUND | B–1 |

EXHIBIT C — FORM OF AGREEMENT AND PLAN OF REORGANIZATION - PIONEER DISCIPLINED GROWTH FUND - | |

PIONEER INDEPENDENCE FUND | C–1 |

EXHIBIT D — FORM OF AGREEMENT AND PLAN OF REORGANIZATION - PIONEER SELECT MID CAP GROWTH FUND - | |

PIONEER GROWTH OPPORTUNITIES FUND | D–1 |

7

REORGANIZATION OF PIONEER RESEARCH FUND WITH PIONEER VALUE FUND (TO BE RENAMED

PIONEER CORE EQUITY FUND)

SUMMARY

The following is a summary of more complete information appearing later in this Information Statement/Prospectus or incorporated herein. You should read carefully the entire Information Statement/Prospectus pertaining to your fund, including the form of Agreement and Plan of Reorganization attached as Exhibit A, because it contains details that are not in the summary.

The Board of Trustees of your fund has approved the Reorganization of the fund with Pioneer Value Fund, another fund managed by Pioneer. Currently, the investment objective and investment strategies of Pioneer Value Fund and your fund are similar, but there are certain differences. In addition, the funds currently are managed by different investment teams and pay different fees and expenses. The Board of Trustees of Pioneer Value Fund has approved certain changes in connection with the Reorganization. The changes to Pioneer Value Fund’s management fee and investment objective are subject to approval by shareholders of Pioneer Value Fund. Effective upon completion of the Reorganization (assuming shareholders approve the new management fee and investment objective):

| · | The combined fund will be named “Pioneer Core Equity Fund.” |

| · | Your fund’s investment team will manage the combined fund. |

| · | The combined fund will have the same investment objective, investment strategies and investment policies as your fund. |

| · | The historical performance of Pioneer Research Fund will continue as the combined fund’s historical performance. |

| · | The management fee payable by the combined fund (an annual rate equal to 0.50% of the fund’s average daily net assets) will be lower than the management fee payable by Pioneer Research Fund (an annual rate equal to 0.65% of the fund’s average daily net assets up to $1 billion, 0.60% of the next $4 billion and 0.55% on assets over $5 billion). |

The tables below provide a comparison of certain features of Pioneer Research Fund and Pioneer Value Fund, and also show certain features of the combined fund, post-Reorganization, which, except as noted, are substantially similar to the corresponding features of your fund. In the table below, if a row extends across the entire table, the policy disclosed applies to Pioneer Research Fund, Pioneer Value Fund and the combined fund.

Comparison of Pioneer Research Fund with Pioneer Value Fund and the Combined Fund, Post-Reorganization

| | | | |

| | Pioneer Research Fund | Pioneer Value Fund | Combined Fund, Post-Reorganization |

Investment | Long-term capital growth. | Reasonable income and capital growth.* | Long-term capital growth.* |

objective | | | |

| | The fund’s investment objective | The fund’s investment objective is | The fund’s investment objective is |

| | may be changed without | fundamental and may not be changed | fundamental and may not be changed |

| | shareholder approval. The fund | without shareholder approval. | without shareholder approval. |

| | will provide notice prior to | | |

| | implementing any change to | | |

| | its investment objective. | | |

| | | *At a meeting to be held on May 7, 2013, shareholders of Pioneer Value Fund will be |

| | | asked to approve changing the fund’s investment objective to “long-term capital |

| | | growth.” If approved, the new investment objective will become effective upon |

| | | consummation of the Reorganization. |

8

| | | | |

| | Pioneer Research Fund | Pioneer Value Fund | Combined Fund, Post-Reorganization |

Principal | Normally, the fund invests at least | The fund seeks to invest in a broad | Normally, the fund invests at least 80% |

investment | 80% of its net assets (plus the | group of carefully selected, reasonably | of its net assets (plus the amount of |

strategies | amount of borrowings, if any, | priced securities rather than in | borrowings, if any, from investment |

| | from investment purposes) in | securities whose prices reflect a | purposes) in equity securities, primarily |

| | equity securities, primarily of | premium resulting from their current | of U.S. issuers. |

| | U.S. issuers. | market popularity. The fund invests the | |

| | | major portion of its assets in | For purposes of the fund’s investment |

| | For purposes of the fund’s | equity securities. | policies, equity securities include |

| | investment policies, equity securities | | common stocks, convertible debt and |

| | include common stocks, convertible | For purposes of the fund’s investment | other equity instruments, such as |

| | debt and other equity instruments, | policies, equity securities include | exchange-traded funds (ETFs) that |

| | such as exchange-traded funds | common stocks, convertible debt | invest primarily in equity securities, |

| | (ETFs) that invest primarily in | and other equity instruments, such as | equity interests in real estate |

| | equity securities, equity interests | exchange-traded funds (ETFs) that | investment trusts (REITs), preferred |

| | in real estate investment trusts | invest primarily in equity securities, | stocks, depositary receipts, rights |

| | (REITs), preferred stocks, depositary | depositary receipts, warrants, | and warrants. |

| | receipts, rights and warrants. | rights, equity interests in real estate | |

| | | investment trusts (REITs) and | The fund may invest up to 10% of its total |

| | The fund may invest up to 10% of | preferred stocks. | assets in equity and debt securities of |

| | its total assets in equity and debt | | non-U.S. issuers, including up to 5% of |

| | securities of non-U.S. issuers, | The fund primarily invests in securities of | its total assets in the securities of |

| | including up to 5% of its total | U.S. issuers. The fund may invest up to | emerging markets issuers. |

| | assets in the securities of | 25% of its total assets in equity and debt | |

| | emerging markets issuers. | securities of non-U.S. issuers. The fund | The fund may invest in debt securities of |

| | | will not invest more than 5% of its total | U.S. and non-U.S. issuers. Generally, the |

| | The fund may invest in debt | assets in securities of emerging | fund acquires investment grade debt |

| | securities of U.S. and non-U.S. | markets issuers. | securities, but the fund may invest up to |

| | issuers. Generally, the fund acquires | | 5% of its net assets in below investment |

| | investment grade debt securities, but | The fund may invest up to 20% of its net | grade debt securities (known as “junk |

| | the fund may invest up to 5% of its | assets in REITs. | bonds”), including below investment |

| | net assets in below investment grade | | grade convertible debt securities. The fund |

| | debt securities (known as “junk | The fund may invest in debt securities of | invests in debt securities when Pioneer |

| | bonds”), including below investment | U.S. and non-U.S. issuers. The fund may | believes they are consistent with the fund’s |

| | grade convertible debt securities. | invest up to 5% of its net assets in below | investment objective of long-term capital |

| | The fund invests in debt securities | investment grade debt securities (known | growth or for greater liquidity. |

| | when Pioneer believes they are | as “junk bonds”), including below | |

| | consistent with the fund’s | investment grade convertible debt | |

| | investment objective of long-term | securities. The fund invests in debt | |

| | capital growth or for greater liquidity. | securities when the adviser believes they | |

| | | are consistent with the fund’s investment | |

| | | objective, to diversify the fund’s portfolio | |

| | | or for greater liquidity. | |

| |

9

| | | | |

| | Pioneer Research Fund | Pioneer Value Fund | Combined Fund, Post-Reorganization |

| | Pioneer uses a valuation-conscious | Pioneer uses a value approach to select | Pioneer uses a valuation-conscious |

| | approach to select the fund’s | the fund’s investments to buy and sell. | approach to select the fund’s investments |

| | investments based upon the | Using this investment style, Pioneer | based upon the recommendations of |

| | recommendations of Pioneer’s | seeks securities selling at reasonable | Pioneer’s research team. Pioneer’s |

| | research team. Pioneer’s research | prices or at substantial discounts to | research team supports the portfolio |

| | team supports the portfolio | their underlying values and then | management teams that manage various |

| | management teams that manage | holds these securities until the market | Pioneer equity funds and provides |

| | various Pioneer equity funds and | values reflect their intrinsic values. | rankings for a universe of large and mid |

| | provides rankings for a universe | Pioneer evaluates a security’s potential | cap issuers that are traded in the U.S. and |

| | of large and mid cap issuers that | value, including the attractiveness of | abroad. The fund seeks to benefit from |

| | are publicly traded in the U.S. | its market valuation, based on the | this research effort by selecting |

| | and abroad. The fund seeks | company’s assets and prospects for | securities that are highly ranked by the |

| | to benefit from this research effort | earnings and revenue growth. In | research team and selling at |

| | by selecting securities that are | making that assessment, Pioneer | reasonable prices or substantial |

| | highly ranked by the research team | employs fundamental research and | discounts to their underlying values. From |

| | and selling at reasonable prices | an evaluation of the issuer based on its | the universe of highly ranked securities, |

| | or substantial discounts to their | financial statements and operations, | the research team constructs a portfolio |

| | underlying values. From the universe | employing a bottom-up analytic style. | that is reflective of overall sector |

| | of highly ranked securities, the | In selecting securities, Pioneer also | weightings in the fund’s benchmark |

| | research team constructs a | considers a security’s potential to | index. A security will not be included in |

| | portfolio that is reflective of overall | provide a reasonable amount of income. | the portfolio simply because it is highly |

| | sector weightings in the fund’s | Pioneer relies on the knowledge, | ranked by the research team. A security |

| | benchmark index. A security will | experience and judgment of its staff | may be sold if its ranking by the research |

| | not be included in the portfolio | and the staff of its affiliates who | team is reduced or the security price |

| | simply because it is highly ranked | have access to a wide variety of research. | reaches a reasonable valuation. |

| | by the research team. A security | Pioneer focuses on the quality and | |

| | may be sold if its ranking by the | price of individual issuers, not on | Pioneer’s research team evaluates a |

| | research team is reduced or the | economic sector or market-timing | security’s potential value based on the |

| | security price reaches a reasonable | strategies. Factors Pioneer looks for | company’s assets and prospects for |

| | valuation. | in selecting investments include: | earning growth. In making that |

| | | • Above average potential for | assessment, it employs due diligence |

| | Pioneer’s research team evaluates a | earnings and revenue growth | and fundamental research, and an |

| | security’s potential value based on | • Favorable expected returns relative | evaluation of the issuer based on its |

| | the company’s assets and prospects | to perceived risks | financial statements and operations. |

| | for earning growth. In making that | • Management with demonstrated | The research team focuses on the |

| | assessment, it employs due | ability and commitment to the | quality and price of individual issuers, |

| | diligence and fundamental research, | company | not on economic sector or |

| | and an evaluation of the issuer | • Low market valuations relative to | market-timing strategies. The fund’s |

| | based on its financial statements and | earnings forecast, book value, cash | portfolio includes securities from a |

| | operations. The research team | flow and sales | broad range of market sectors that |

| | focuses on the quality and price of | • Turnaround potential for companies | have received favorable rankings from |

| | individual issuers, not on economic | that have been through difficult | the research team. Factors for selecting |

| | sector or market-timing strategies. | periods | investments include: |

| | The fund’s portfolio includes | • Good prospects for dividend | • Favorable expected returns relative to |

| | securities from a broad range of | growth | perceived risk |

| | market sectors that have received | • Pioneer generally sells a portfolio | • Above average potential for |

| | favorable rankings from the | security when it believes that the | earnings and revenue growth |

| | research team. Factors for selecting | security’s market value reflects its | • Low market valuations relative to |

| | investments include: | underlying value | earnings forecast, book value, cash |

| | • Favorable expected returns | | flow and sales |

| | relative to perceived risk | | • A sustainable competitive advantage, |

| | • Above average potential for | | such as a brand name, customer base, |

| | earnings and revenue growth | | proprietary technology or economies |

| | • Low market valuations relative | | of scale |

| | to earnings forecast, book value, | | |

| | cash flow and sales | | |

| | • A sustainable competitive | | |

| | advantage, such as a brand name, | | |

| | customer base, proprietary | | |

| | technology or economies of scale. | | |

10

| | | | |

| | Pioneer Research Fund | Pioneer Value Fund | Combined Fund, Post-Reorganization |

Portfolio | The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A |

turnover | higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held |

| | in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the |

| | fund’s performance. | | |

| | During the most recent fiscal year, | During the most recent fiscal year, the | |

| | the fund’s portfolio turnover rate | fund’s portfolio turnover rate was 84% | |

| | was 57% of the average value of | of the average value of its portfolio. | |

| | its portfolio. | | |

Non-U.S. | The fund may invest in securities of non-U.S. issuers, including securities of emerging markets issuers. Non-U.S. issuers are |

investments | issuers that are organized and have their principal offices outside of the United States. Non-U.S. securities may be issued by |

| | non-U.S. governments, banks or corporations, or private issuers, and certain supranational organizations, such as the World |

| | Bank and the European Union. | | |

| | The fund may invest up to 10% of its | The fund may invest up to 25% of its | The fund may invest up to 10% of its total |

| | total assets in equity and debt | total assets in equity and debt | assets in equity and debt securities of |

| | securities of non-U.S. issuers, | securities of non-U.S. issuers. The fund | non-U.S. issuers, including up to 5% of its |

| | including up to 5% of its total assets | will not invest more than 5% of its total | total assets in the securities of |

| | in the securities of emerging | assets in securities of emerging | emerging markets issuers. |

| | markets issuers. | markets issuers. | |

Investments | REITs are companies that invest primarily in income producing real estate or real estate related loans or interests. Some |

in REITs | REITs invest directly in real estate and derive their income from the collection of rents and capital gains on the sale of |

| | properties. Other REITs invest primarily in mortgages, including “sub-prime” mortgages, secured by real estate and derive |

| | their income from collection of interest. | |

| | There is no stated limit with respect to | The fund may invest up to 20% of its net | There is no stated limit with respect to the |

| | the fund’s investments in REITs. | assets in REITs. | fund’s investments in REITs. |

Debt securities | The fund may invest in debt securities of U.S. and non-U.S. issuers. Generally the fund may acquire debt securities that are |

| | investment grade, but the fund may invest in below investment grade debt securities (known as “junk bonds”), including |

| | below investment grade convertible debt securities. A debt security is investment grade if it is rated in one of the top four |

| | categories by a nationally recognized statistical rating organization or determined to be of equivalent credit quality by the |

| | adviser. The fund may invest in debt securities rated “C” or better, or comparable unrated securities. |

| | The fund may invest up to 5% of its | The fund may invest up to 5% of its net | The fund may invest up to 5% of its net |

| | net assets in below investment | assets in below investment grade debt | assets in below investment grade debt |

| | grade debt securities, including below | securities, including below investment | securities, including below investment |

| | investment grade convertible | grade convertible debt securities. | grade convertible debt securities. |

| | debt securities. | | |

Derivatives | The fund may, but is not required to, use futures and options on securities, indices and currencies, forward foreign currency |

| | exchange contracts, swaps and other derivatives. A derivative is a security or instrument whose value is determined by |

| | reference to the value or the change in value of one or more securities, currencies, indices or other financial instruments. The |

| | fund may use derivatives for a variety of purposes, including: | |

| | • As a hedge against adverse changes in the market prices of securities, interest rates or currency exchange rates |

| | • As a substitute for purchasing or selling securities | |

| | • To increase the fund’s return as a non-hedging strategy that may be considered speculative | |

| | • To manage portfolio characteristics | | |

| |

| | The fund may choose not to make use of derivatives for a variety of reasons, and any use may be limited by applicable law |

| | and regulations. | | |

Cash management | Normally, the fund invests substantially all of its assets to meet its investment objective(s). The fund may invest the |

and temporary | remainder of its assets in securities with remaining maturities of less than one year or cash equivalents, or may hold cash. |

investments | For temporary defensive purposes, including during periods of unusual cash flows, the fund may depart from its principal |

| | investment strategies and invest part or all of its assets in these securities or may hold cash. The fund may adopt a defensive |

| | strategy when the adviser believes securities in which the fund normally invests have special or unusual risks or are less |

| | attractive due to adverse market, economic, political or other conditions. | |

Reverse repurchase | The fund may enter into reverse repurchase agreements pursuant to which the fund transfers securities to a counterparty in |

agreements and | return for cash, and the fund agrees to repurchase the securities at a later date and for a higher price. Reverse repurchase |

borrowing | agreements are treated as borrowings by the fund, are a form of leverage and may make the value of an investment in the |

| | fund more volatile and increase the risks of investing in the fund. The fund also may borrow money from banks or other |

| | lenders for temporary purposes. The fund may borrow up to 33 1/3% of its total assets. Entering into reverse repurchase |

| | agreements and other borrowing transactions may cause the fund to liquidate positions when it may not be advantageous to |

| | do so in order to satisfy its obligations or meet segregation requirements. | |

11

| | | | |

| | Pioneer Research Fund | Pioneer Value Fund | Combined Fund, Post-Reorganization |

Short-term trading | The fund usually does not trade for short-term profits. The fund will sell an investment, however, even if it has only been held |

| | for a short time, if it no longer meets the fund’s investment criteria. If the fund does a lot of trading, it may incur additional |

| | operating expenses, which would reduce performance, and could cause shareowners to incur a higher level of taxable |

| | income or capital gains. | | |

Investment adviser | Pioneer Investment Management, Inc. | | |

Portfolio managers | Day-to-day management of the | Day-to-day management of the fund’s | Day-to-day management of the fund’s |

| | fund’s portfolio is the responsibility | portfolio is the responsibility of Edward | portfolio will be the responsibility of a |

| | of a team of equity analysts that | T. Shadek, Jr. (portfolio manager of the | team of equity analysts that coordinate the |

| | coordinate the fundamental research | fund since January 2012) and John | fundamental research on companies |

| | on companies provided by Pioneer’s | Peckham portfolio manager of the fund | provided by Pioneer’s research teams, |

| | research teams, which include | since 2010). (The portfolio managers | which include members from Pioneer’s |

| | members from Pioneer’s affiliate, | also may draw upon the research and | affiliate, Pioneer Investment Management |

| | Pioneer Investment Management | investment management expertise of the | Limited. Paul Cloonan, senior vice |

| | Limited. Paul Cloonan, senior vice | research teams, which provide | president of Pioneer and co-head of |

| | president of Pioneer and co-head of | fundamental and quantitative research on | equity research — U.S., joined Pioneer |

| | equity research — U.S. (portfolio | companies on a global basis and include | in 1997. Bradley Galko, vice president |

| | manager of the fund since 2005), | members from Pioneer’s affiliate, Pioneer | and analyst at Pioneer, joined Pioneer in |

| | joined Pioneer in 1997. Bradley | Investment Management Limited (PIML). | 2001. John Peckham, senior vice |

| | Galko, vice president and analyst | Mr. Shadek, senior vice president of | president of Pioneer and co-head of equity |

| | at Pioneer (portfolio manager of the | Pioneer, joined Pioneer in January 2012. | research – U.S., joined Pioneer in 2001. |

| | fund since 2005), joined Pioneer in | Prior to joining Pioneer, he was | James Moynihan, vice president and |

| | 2001. John Peckham, senior vice | co-founder and portfolio manager at | analyst at Pioneer, joined Pioneer in 2007. |

| | president of Pioneer and co-head | Shaylor Capital. From 1997 to 2009, | |

| | of equity research – U.S. (portfolio | Mr. Shadek was senior managing | |

| | manager of the fund since 2012), | director and deputy head of investments | |

| | joined Pioneer in 2001. James | at Putnam Investments. Mr. Peckham, | |

| | Moynihan, vice president and analyst | executive vice president of Pioneer | |

| | at Pioneer (portfolio manager of | and co-head of equity research – U.S., | |

| | the fund since September 2010), | joined Pioneer in 2002. | |

| | joined Pioneer in 2007. | | |

| | | The fund’s statement of additional | |

| | The fund’s statement of additional | information provides additional | |

| | information provides additional | information about the portfolio | |

| | information about the portfolio | manager’s compensation, other | |

| | managers’ compensation, other | accounts managed by the portfolio | |

| | accounts managed by the portfolio | manager, and the portfolio manager’s | |

| | managers, and the portfolio | ownership of shares of the fund. | |

| | managers’ ownership of shares | | |

| | of the fund. | | |

Fiscal Year End | December 31 | September 30 | December 31 |

Business | A diversified open-end management investment company organized as a Delaware statutory trust. |

Net assets (as | $63 million | $1.3 billion | $1.36 billion (pro forma) |

of December 31, | | | |

2012) | | | |

12

Comparison of Principal Risks

The following describes the risks of investing in each of Pioneer Research Fund, Pioneer Value Fund and the combined fund:

Market risk. The values of securities held by the fund may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, inflation, changes in interest or currency rates or adverse investor sentiment. Adverse market conditions may be prolonged and may not have the same impact on all types of securities. The values of securities may fall due to factors affecting a particular issuer, industry or the securities market as a whole. The stock market may perform poorly relative to other investments (this risk may be greater in the short term). The equity and debt capital markets in the United States and internationally have experienced unprecedented volatility in recent years. High public debt in the U.S. and other countries creates ongoing systemic and market risks and policy making uncertainty. The financial crisis that began in 2008 has caused a significant decline in the value and liquidity of many securities; in particular, the values of some sovereign debt and of securities of issuers that invest in sovereign debt and related investments have fallen, credit has become more scarce worldwide and there has been significant uncertainty in the markets. Some governmental and non-governmental issuers (notably in Europe) have defaulted on, or been forced to restructure, their debts; and many other issuers have faced difficulties refinancing existing obligations. These market conditions may continue, worsen or spread, including in the U.S., Europe and beyond. Further defaults or restructurings by governments and others of their debt could have additional adverse effects on economies, financial markets and asset valuations around the world. In response to the crisis, the U.S. and other governments and the Federal Reserve and certain foreign central banks have taken steps to support financial markets. The withdrawal of this support, failure of efforts in response to the crisis, or investor perception that such efforts are not succeeding could negatively affect financial markets generally as well as the value and liquidity of certain securities. This environment could make identifying investment risks and opportunities especially difficult for the adviser, and whether or not the fund invests in securities of issuers located in or with significant exposure to countries experiencing economic and financial difficulties, the value and liquidity of the fund’s investments may be negatively affected. In addition, policy and legislative changes in the U.S. and in other countries are affecting many aspects of financial regulation. The impact of these changes, and the practical implications for market participants, may not be fully known for some time. The fund may experience a substantial or complete loss on any individual security.

Value style risk. The prices of securities the adviser believes are undervalued may not appreciate as expected or may go down. Value stocks may fall out of favor with investors and underperform the overall equity market.

Portfolio selection risk. The adviser’s judgment about a particular security or issuer, or about the economy or a particular sector, region or market segment, or about an investment strategy, may prove to be incorrect.

Risks of non-U.S. investments. Investing in non-U.S. issuers or issuers with significant exposure to foreign markets may involve unique risks compared to investing in securities of U.S. issuers. These risks are more pronounced for issuers in emerging markets or to the extent that the fund invests significantly in one region or country. These risks may include:

| · | Less information about non-U.S. issuers or markets may be available due to less rigorous disclosure or accounting standards or regulatory practices |

| · | Many non-U.S. markets are smaller, less liquid and more volatile. In a changing market, the adviser may not be able to sell the fund’s securities at times, in amounts and at prices it considers reasonable |

| · | Adverse effect of currency exchange rates or controls on the value of the fund’s investments, or its ability to convert non-U.S. currencies to U.S. dollars |

| · | The economies of non-U.S. countries may grow at slower rates than expected or may experience a downturn or recession |

| · | Economic, political, regulatory and social developments may adversely affect the securities markets |

| · | It may be difficult for the fund to pursue claims against a foreign issuer in the courts of a foreign country |

| · | Withholding and other non-U.S. taxes may decrease the fund’s return |

| · | Some markets in which the fund may invest are located in parts of the world that have historically been prone to natural disasters that could result in a significant adverse impact on the economies of those countries and investments made in those countries |

| · | A governmental entity may delay, or refuse or be unable to pay, interest or principal on its sovereign debt due to cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of the governmental entity’s debt position in relation to the economy or the failure to put in place economic reforms |

13

Risks of investments in REITs. The fund has risks associated with the real estate industry. Although the fund does not invest directly in real estate, it may invest in REITs and other equity securities of real estate industry issuers. These risks may include:

| · | The U.S. or a local real estate market declines due to adverse economic conditions, foreclosures, overbuilding and high vacancy rates, reduced or regulated rents or other causes |

| · | Interest rates go up. Rising interest rates can adversely affect the availability and cost of financing for property acquisitions and other purposes and reduce the value of a REIT’s fixed income investments |

| · | The values of properties owned by a REIT or the prospects of other real estate industry issuers may be hurt by property tax increases, zoning changes, other governmental actions, environmental liabilities, natural disasters or increased operating expenses |

| · | A REIT in the fund’s portfolio is, or is perceived by the market to be, poorly managed |

Investing in REITs involves certain unique risks. REITs are dependent on management skills, are not diversified and are subject to the risks of financing projects. REITs are typically invested in a limited number of projects or in a particular market segment or geographic region, and therefore are more susceptible to adverse developments affecting a single project, market segment or geographic region than more broadly diversified investments. REITs are subject to heavy cash flow dependency, defaults by mortgagors or other borrowers and tenants, self-liquidation and the possibility of failing to qualify for certain tax and regulatory exemptions. REITs may have limited financial resources and may experience sharper swings in market values and trade less frequently and in a more limited volume than securities of larger issuers. In addition to its own expenses, the fund will indirectly bear its proportionate share of any management and other expenses paid by REITs in which it invests.

Many real estate companies, including REITs, utilize leverage (and some may be highly leveraged), which increases investment risk and could adversely affect a real estate company’s operations and market value. In addition, capital to pay or refinance a REIT’s debt may not be available or reasonably priced. Financial covenants related to real estate company leveraging may affect the company’s ability to operate effectively.

Risks of initial public offerings. Companies involved in initial public offering (IPOs) generally have limited operating histories, and prospects for future profitability are uncertain. The market for IPO issuers has been volatile, and share prices of newly public companies have fluctuated significantly over short periods of time. Further, stocks of newly-public companies may decline shortly after the IPO. There is no assurance that the fund will have access to IPOs. The purchase of IPO shares may involve high transaction costs. Because of the price volatility of IPO shares, the Fund may choose to hold IPO shares for a very short period of time. This may increase the turnover of the Fund’s portfolio and may lead to increased expenses to the fund, such as commissions and transaction costs. The market for IPO shares can be speculative and/or inactive for extended periods of time. There may be only a limited number of shares available for trading. The limited number of shares available for trading in some IPOs may also make it more difficult for the fund to buy or sell significant amounts of shares without an unfavorable impact on prevailing prices.

Debt securities risk. Factors that could contribute to a decline in the market value of debt securities in the fund include rising interest rates, if the issuer or other obligor of a security held by the fund fails to pay principal and/or interest, otherwise defaults or has its credit rating downgraded or is perceived to be less creditworthy or the credit quality or value of any underlying assets declines. Junk bonds involve greater risk of loss, are subject to greater price volatility and are less liquid, especially during periods of economic uncertainty or change, than higher quality debt securities; they may also be more difficult to value. Junk bonds have a higher risk of default or are already in default and are considered speculative.

Market segment risk. To the extent the fund emphasizes, from time to time, investments in a market segment, the fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. For example, industries in the financial segment, such as banks, insurance companies, broker-dealers and real estate investment trusts (REITs), may be sensitive to changes in interest rates and general economic activity and are generally subject to extensive government regulation.

Industries in the technology segment, such as information technology, communications equipment, computer hardware and software, and office and scientific equipment, are generally subject to risks of rapidly evolving technology, short product lives, rates of corporate expenditures, falling prices and profits, competition from new market entrants, and general economic conditions.

Industries in the industrials segment, such as companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and governmental regulation and spending, import controls, commodity prices, and worldwide competition.

Industries in the energy segment, such as those engaged in the development, production and distribution of energy resources, can be significantly affected by supply and demand both for their specific product or service and for energy products in general. The

14

price of oil, gas and other consumable fuels, exploration and production spending, government regulation, world events and economic conditions likewise will affect the performance of companies in these industries.

Industries in the health care segment, such as health care supplies, health care services, biotechnology and pharmaceuticals, may be significantly affected by government regulation and reimbursement rates, approval of products by government agencies, and patent expirations and litigation.

Industries in the consumer staples segment, such as food and drug retailing, beverages, food and tobacco products, household products and personal products, are subject to government regulation affecting ingredients and production methods. These industries also may be affected by competition, changes in consumer tastes and other factors affecting supply and demand, and litigation.

Derivatives risk. Using derivatives exposes the fund to additional risks, may increase the volatility of the fund’s net asset value and may not provide the expected result. Derivatives may have a leveraging effect on the fund, and they can disproportionately increase losses and reduce opportunities for gain. Some derivatives have the potential for unlimited loss, regardless of the size of the fund’s initial investment. If changes in a derivative’s value do not correspond to changes in the value of the fund’s other investments or do not correlate well with the underlying assets, rate or index, the fund may not fully benefit from, or could lose money on, or could experience unusually high expenses as a result of, the derivative position. Derivatives involve the risk of loss if the counterparty defaults on its obligation. Certain derivatives may be less liquid, which may reduce the returns of the fund if it cannot sell or terminate the derivative at an advantageous time or price. The fund also may have to sell assets at inopportune times to satisfy its obligations. Some derivatives may involve the risk of improper valuation. Suitable derivatives may not be available in all circumstances or at reasonable prices and may not be used by the fund for a variety of reasons. Recent legislation calls for new regulation of the derivatives markets. The extent and impact of the regulation is not yet fully known and may not be for some time. New regulation of derivatives may make them more costly, may limit their availability, or may otherwise adversely affect their value or performance. Risks associated with the use of derivatives are magnified to the extent that a large portion of the fund’s assets are committed to derivatives in general or are invested in just one or a few types of derivatives.

Leveraging risk. The value of your investment may be more volatile and other risks tend to be compounded if the fund borrows or uses derivatives or other investments, such as ETFs, that have embedded leverage. Leverage generally magnifies the effect of any increase or decrease in the value of the fund’s underlying assets or creates investment risk with respect to a larger pool of assets than the fund would otherwise have, potentially resulting in the loss of all assets. Engaging in such transactions may cause the fund to liquidate positions when it may not be advantageous to do so to satisfy its obligations or meet segregation requirements.

Valuation risk. The sales price the fund could receive for any particular portfolio investment may differ from the fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. Investors who purchase or redeem fund shares on days when the fund is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the fund had not fair-valued the security or had used a different valuation methodology.

Cash management risk. The value of the investments held by the fund for cash management or temporary defensive purposes may be affected by changing interest rates and by changes in credit ratings of the investments. To the extent that the fund has any uninvested cash, the fund would be subject to risk with respect to the depository institution holding the cash. If the fund holds cash uninvested, the fund will not earn income on the cash and the fund’s yield will go down. During such periods, it may be more difficult for the fund to achieve its investment objective.

Expense risk. Your actual costs of investing in the fund may be higher than the expenses shown in “Annual fund operating expenses” for a variety of reasons. For example, expense ratios may be higher than those shown if overall net assets decrease. Net assets are more likely to decrease and fund expense ratios are more likely to increase when markets are volatile.

In addition to the common risks of investing in Pioneer Research Fund and Pioneer Value Fund noted above, the following is an additional principal risk of an investment in Pioneer Research Fund or in the combined fund:

Mid-size companies risk. Compared to large companies, mid-size companies, and the market for their equity securities, may be more sensitive to changes in earnings results and investor expectations, have more limited product lines and capital resources, experience sharper swings in market values, be harder to sell at the times and prices the subadviser thinks appropriate, and offer greater potential for gain and loss.

The following is an additional principal risk of an investment in Pioneer Value Fund:

Portfolio turnover risk. If the fund does a lot of trading, it may incur additional operating expenses, which would reduce performance, and could cause shareowners to incur a higher level of taxable income or capital gains.

15

Comparison of Fees and Expenses

Shareholders of both Pioneer Research Fund and Pioneer Value Fund pay various fees and expenses, either directly or indirectly. The tables below show the fees and expenses that you would pay if you were to buy and hold shares of each Pioneer Fund. The expenses in the tables appearing below are based on (i) for your fund, the expenses of your fund for the twelve-month period ended December 31, 2012, and (ii) for Pioneer Value Fund, the expenses of Pioneer Value Fund for the twelve-month period ended September 30, 2012. Future expenses for all share classes may be greater or less. The tables also show the pro forma expenses of the combined fund assuming the Reorganization occurred on December 31, 2012. Pioneer Research Fund will be the accounting survivor of the Reorganization. As the accounting survivor, Pioneer Research Fund’s operating history will be used for the combined fund’s financial reporting purposes.

| | | | | | | |

| | Pioneer | Pioneer | Combined Fund | Pioneer | Pioneer | Combined Fund |

| | Research Fund | Value Fund | (Pro Forma | Research Fund | Value Fund | (Pro Forma |

| | (12 months | (12 months | 12 months | (12 months | (12 months | 12 months |

| | ended | ended | ended | ended | ended | ended |

| | December 31, | September 30, | | December 31, | September 30, | |

| | 2012) | 2012) | 2012) | 2012) | 2012) | 2012) |

Shareholder transaction fees | | | | | | |

(paid directly from your investment) | Class A | Class A | Class A | Class B | Class B | Class B |

Maximum sales charge (load) when you buy | | | | | | |

shares as a percentage of offering price | 5.75% | 5.75% | 5.75% | None | None | None |

Maximum deferred sales charge (load) as a percentage | | | | | | |

of offering price or the amount you receive when | | | | | | |

you sell shares, whichever is less | None | None | None | 4% | 4% | 4% |

Redemption fee as a percentage of amount | | | | | | |

redeemed, if applicable | None | None | None | None | None | None |

Annual Fund operating expenses (deducted from | | | | | | |

fund assets) as a % of average daily net assets | | | | | |

Management Fee | 0.65% | 0.49%(1) | 0.50%(2) | 0.65% | 0.49%(1) | 0.50%(2) |

Distribution and Service (12b-1) Fee | 0.25% | 0.25% | 0.25% | 1.00% | 1.00% | 1.00% |

Other Expenses | 0.69% | 0.25% | 0.25% | 0.93% | 1.16% | 0.97% |

Total Annual Fund Operating Expenses (3) | 1.59% | 0.99% | 1.00% | 2.58% | 2.65% | 2.47% |

Less: Fee Waiver and Expense Limitations (3) | -0.34% | 0.00% | 0.00% | -0.43% | 0.00% | -0.32% |

Net Expenses (3) | 1.25% | 0.99% | 1.00% | 2.15% | 2.65% | 2.15% |

| | | | | | | |

| | Pioneer | Pioneer | Combined Fund | Pioneer | Pioneer | Combined Fund |

| | Research Fund | Value Fund | (Pro Forma | Research Fund | Value Fund | (Pro Forma |

| | (12 months | (12 months | 12 months | (12 months | (12 months | 12 months |

| | ended | ended | ended | ended | ended | ended |

| | December 31, | September 30, | December 31, | December 31, | September 30, | December 31, |

| | 2012) | 2012) | 2012) | 2012) | 2012) | 2012) |

Shareholder transaction fees | | | | | | |

(paid directly from your investment) | Class C | Class C | Class C | Class Y | Class Y | Class Y |

Maximum sales charge (load) when you buy shares | | | | | | |

as a percentage of offering price | None | None | None | None | None | None |

Maximum deferred sales charge (load) as a percentage | | | | | | |

of offering price or the amount you receive when | | | | | | |

you sell shares, whichever is less | 1.00% | 1.00% | 1.00% | None | None | None |

Redemption fee as a percentage of amount | | | | | | |

redeemed, if applicable | None | None | None | None | None | None |

Annual Fund operating expenses (deducted from | | | | | | |

fund assets) as a % of average daily net assets | | | | | |

Management Fee | 0.65% | 0.49%(1) | 0.50%(2) | 0.65% | 0.49%(1) | 0.50%(2) |

Distribution and Service (12b-1) Fee | 1.00% | 1.00% | 1.00% | None | None | None |

Other Expenses | 0.66% | 0.61% | 0.51% | 0.37% | 0.12% | 0.09% |

Total Annual Fund Operating Expenses (3) | 2.31% | 2.10% | 2.01% | 1.02% | 0.61% | 0.59% |

Less: Fee Waiver and Expense Limitations(3) | -0.16% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Net Expenses (3) | 2.15% | 2.10% | 2.01% | 1.02% | 0.61% | 0.59% |

16

| (1) | Pioneer Value Fund pays a management fee that is adjusted upward or downward based on its performance relative to an index. Pioneer Value Fund’s annual basic fee, before any performance adjustment, is equal to 0.60% of average daily net assets up to $5 billion, 0.575% on the next $5 billion and 0.550% on the excess over $10 billion. The management fee in the table above has been adjusted based on Pioneer Value Fund’s performance as of September 30, 2012. |

| (2) | At a meeting to be held on May 7, 2013, shareholders of Pioneer Value Fund will be asked to approve an amended and restated management agreement. If approved, the amended and restated management agreement will become effective upon the consummation of the Reorganization. Pursuant to the amended and restated management agreement, the fund’s performance-adjusted management fee would be replaced by a “flat” fee equal to 0.50% of the combined fund’s average daily net assets. |

| (3) | Pioneer Research Fund’s investment adviser has contractually agreed to limit ordinary operating expenses (ordinary operating expenses means all fund expenses other than extraordinary expenses, such as litigation, taxes and brokerage commissions) to the extent required to reduce Pioneer Research Fund’s expenses to 1.25%, 2.15% and 2.15% of the average daily net assets attributable to Class A, Class B and Class C shares, respectively. These expense limitations are in effect through May 1, 2014. Pioneer has contractually agreed to limit ordinary operating expenses of the combined fund to the extent required to reduce expenses to 1.25%, 2.15% and 2.15% of the average daily net assets attributable to Class A, Class B and Class C shares, respectively. Pioneer Value Fund’s total annual fund operating expenses in the table have not been reduced by any expense offset arrangements. |

| | |

Examples:

The examples are intended to help you compare the cost of investing in each fund with the cost of investing in other mutual funds. The examples assume that you invest $10,000 in each fund for the time periods shown, and then, except as indicated, redeem all of your shares at the end of those periods. The examples also assume that (a) your investment has a 5% return each year and (b) each fund’s total annual operating expenses remain the same except for year one (which considers the effect of the expense limitation). Pro forma expenses are included assuming consummation of the Reorganization as of December 31, 2012. The examples are for comparison purposes only and are not a representation of any fund’s actual expenses or returns, either past or future. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | |

Number of years | Pioneer | Pioneer | Combined Fund |

you own your shares | Research Fund | Value Fund | (Pro Forma) |

Class A – assuming redemption at end of period | | | |

Year 1 | $ 695 | $ 670 | $ 671 |

Year 3 | $1,017 | $ 872 | $ 875 |

Year 5 | $1,361 | $1,091 | $1,096 |

Year 10 | $2,329 | $1,718 | $1,729 |

Class A – assuming no redemption | | | |

Year 1 | $ 695 | $ 670 | $ 671 |

Year 3 | $1,017 | $ 872 | $ 875 |

Year 5 | $1,361 | $1,091 | $1,096 |

Year 10 | $2,329 | $1,718 | $1,729 |

Class B – assuming redemption at end of period | | | |

Year 1 | $ 618 | $ 668 | $ 618 |

Year 3 | $1,062 | $1,123 | $1,039 |

Year 5 | $1,432 | $1,505 | $1,387 |

Year 10 | $2,640 | $2,578 | $2,416 |

Class B – assuming no redemption | | | |

Year 1 | $ 218 | $ 268 | $ 218 |

Year 3 | $ 762 | $ 823 | $ 739 |

Year 5 | $1,332 | $1,405 | $1,287 |

Year 10 | $2,640 | $2,578 | $2,416 |

Class C – assuming redemption at end of period | | | |

Year 1 | $ 318 | $ 313 | $ 304 |

Year 3 | $ 706 | $ 658 | $ 630 |

Year 5 | $1,221 | $1,129 | $1,083 |

Year 10 | $2,633 | $2,431 | $2,338 |

17

| | | | |

Number of years | Pioneer | Pioneer | Combined Fund |

you own your shares | Research Fund | Value Fund | (Pro Forma) |

Class C – assuming no redemption | | | |

Year 1 | $ 218 | $ 213 | $ 204 |

Year 3 | $ 706 | $ 658 | $ 630 |

Year 5 | $1,221 | $1,129 | $1,083 |

Year 10 | $2,633 | $2,431 | $2,338 |

Class Y – with or without redemption at end of period | | | |

Year 1 | $ 104 | $ 62 | $ 60 |

Year 3 | $ 325 | $ 195 | $ 189 |

Year 5 | $ 563 | $ 340 | $ 329 |

Year 10 | $1,248 | $ 762 | $ 738 |

18

Comparison of the Funds’ Past Performance

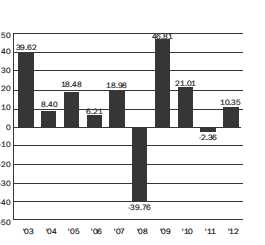

The bar charts and tables below indicate the risks and volatility of an investment in the funds by showing how the funds have performed in the past. The bar charts show changes in the performance of each fund’s Class A shares from calendar year to calendar year. The tables show average annual total returns for each class of shares of a fund over time and compare these returns to a broad-based measure of market performance that has characteristics relevant to the fund’s investment strategies. You can obtain updated performance information by visiting https://us.pioneerinvestments.com/performance or by calling 1-800-225-6292. A fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. The bar charts do not reflect any sales charge you may pay when you buy fund shares. If this amount was reflected, returns would be less than those shown.

Upon consummation of the Reorganization, (i) the historical performance of Pioneer Research Fund will become the combined fund’s historical performance, and (ii) the combined fund will compare its performance to the Standard & Poor’s 500 Index.

Pioneer Research Fund’s Annual Returns — Class A Shares (%)*

(Years ended December 31)

| * | During the period shown in the bar chart, Pioneer Research Fund’s highest quarterly return was 16.10% for the quarter ended 9/30/2009, and the lowest quarterly return was

-20.00% for the quarter ended 12/31/2008. |

19

Pioneer Value Fund’s Annual Returns — Class A Shares (%)*

(Years ended December 31)

| * | During the period shown in the bar chart, Pioneer Value Fund’s highest quarterly return was 15.93% for the quarter ended 6/30/2003, and the lowest quarterly return was -22.00% for the quarter ended 12/31/2008. |

20

| | | | | | |

| Average Annual Total Returns (%) | | |

| (for periods ended December 31, 2012) | | |

| | | | | | | | | | | | Since | | Inception |

Pioneer Research Fund | | 1 Year | | | 5 Years | | | 10 Years | | | Inception | | Date |

Class A | | | | | | | | | | | | | 11/18/99 |

Return Before Taxes | | | 7.90 | | | | 1.04 | | | | 6.79 | | | | 1.93 | | |

Return After Taxes on Distributions | | | 7.64 | | | | 0.85 | | | | 6.38 | | | | 1.63 | | |

Return After Taxes on Distributions and | | | | | | | | | | | | | | | | | |

Sale of Fund Shares | | | 5.14 | | | | 0.81 | | | | 5.90 | | | | 1.60 | | |

Class B | | | 9.42 | | | | 1.32 | | | | 6.48 | | | | 1.51 | | 11/18/99 |

Class C(1) | | | 13.37 | | | | 1.34 | | | | 6.51 | | | | 1.57 | | 11/19/99 |

Class Y | | | 14.81 | | | | 2.55 | | | | N/A | | | | 6.75 | | 8/11/04 |

Standard & Poor’s 500 Index (reflects no | | | | | | | | | | | | | | | | | |

deduction for fees, expenses or taxes) | | | 16.00 | | | | 1.66 | | | | 7.10 | | | | 1.89 | | 11/18/99 |

| |

| | | | | | | | | | | | | | | Since | | Inception |

Pioneer Value Fund | | 1 Year | | | 5 Years | | | 10 Years | | | Inception | | Date |

Class A | | | | | | | | | | | | | | | | | 9/30/69 |

Return Before Taxes | | | 5.78 | | | | -4.57 | | | | 3.38 | | | | 10.13 | | |

Return After Taxes on Distributions | | | 5.17 | | | | -4.98 | | | | 2.38 | | | | 7.58 | | |

Return After Taxes on Distributions and | | | | | | | | | | | | | | | | | |

Sale of Fund Shares | | | 3.74 | | | | -4.02 | | | | 2.84 | | | | 7.70 | | |

Class B | | | 6.39 | | | | -4.85 | | | | 2.66 | | | | 2.34 | | 7/1/96 |

Class C(1) | | | 10.96 | | | | -4.50 | | | | 2.86 | | | | 2.46 | | 7/1/96 |

Class Y | | | 12.66 | | | | -3.02 | | | | N/A | | | | 2.18 | | 8/11/04 |

Russell 1000 Value Index (reflects no | | | | | | | | | | | | | | | | | |

deduction for fees, expenses or taxes) | | | 17.51 | | | | 0.59 | | | | 7.38 | | | | 11.96 | | 12/31/78(2) |

| (1) | The performance of Class C shares does not reflect the 1% front-end sales charge in effect prior to February 1, 2004. If you paid a 1% sales charge, your returns would be lower than those shown above. |

| (2) | Index return information is not available for prior periods. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold a Pioneer Fund’s shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

After-tax returns are shown only for Class A shares. After-tax returns for Class B, Class C and Class Y shares of each Pioneer Fund will vary.

21

| | | | |

| | Pioneer Research Fund | Pioneer Value Fund* | Combined Fund, Post-Reorganization* |

Management fees | The fund pays Pioneer a fee for | The fund pays Pioneer a fee for | The fund will pay Pioneer a fee for |

| | managing the fund and to cover the | managing the fund and to cover the | managing the fund and to cover the cost |

| | cost of providing certain services to | cost of providing certain services to | of providing certain services to the |

| | the fund. | the fund. | fund. |

| |

| | Pioneer’s annual fee is equal to | Pioneer’s fee varies based on: | Pioneer’s annual fee will be equal to 0.50% |

| | 0.65% of the fund’s average daily | • The fund’s assets. Pioneer earns an | of the fund’s average daily net assets. The |