SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

TENFOLD CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

TenFold Corporation

2005 Notice of Annual

Stockholders Meeting

and Proxy Statement

TenFold Corporation

April 29, 2005

Dear fellow stockholders:

We cordially invite you to attend our 2005 Annual Meeting of Stockholders. We will hold the meeting on Wednesday, June 22, 2005, at 11:30 a.m. local time at the Marriott Courtyard Hotel in Sandy, Utah for the following purposes:

| 1. | To elect three (3) directors of the Company to serve until the Company’s 2007 Annual Meeting of Stockholders; |

| 2. | To ratify the appointment of Tanner LC as the Company’s independent auditors for the fiscal year ending December 31, 2005; |

| 3. | To approve an amendment to the 1999 Stock Plan increasing the number of shares of our common stock reserved for issuance thereunder by 5,000,000 shares; and |

| 4. | To transact such other business as may properly come before the meeting. |

The Board recommends that you vote FOR the nominees for directors, FOR ratification of the selection of independent auditors, and FOR the amendment to the 1999 Stock Plan. We will also be available to answer your questions.

Thank you for your interest in TenFold Corporation. We look forward to seeing you at the meeting.

|

Sincerely, |

|

/s/ Nancy Harvey |

Nancy M. Harvey |

President, Chief Executive Officer |

and Chief Financial Officer |

TenFold Corporation

Notice of 2005 Annual Meeting of Stockholders

The 2005 Annual Meeting of Stockholders of TenFold Corporation will be held Wednesday, June 22, 2005, at 11:30 a.m. local time at the Marriott Courtyard Hotel located at 10701 South Holiday Park Drive, Sandy, Utah 84070 for the following purposes:

| | 1. | To elect three directors to hold office until the 2007 Annual Meeting of Stockholders; |

| | 2. | To ratify the selection of Tanner LC as TenFold’s independent auditors for the fiscal year ending December 31, 2005; |

| | 3. | To approve an amendment to the 1999 Stock Plan increasing the number of shares of our common stock reserved for issuance thereunder by 5,000,000 shares; and |

| | 4. | To transact other business properly coming before the meeting. |

Stockholders owning common stock of TenFold Corporation at the close of business on April 28, 2005, are entitled to notice of and to vote at the meeting. A complete list of these stockholders will be available at our principal executive offices before the meeting. Our principal executive offices are located at 698 West 10000 South, Suite 200, South Jordan, Utah 84095.

All stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you expect to attend the Annual Meeting in person, you are urged to mark, date, sign, and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope provided to ensure your representation and the presence of a quorum at the Annual Meeting. If you send in your proxy card and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

|

By Order of the Board of Directors, |

|

/s/ Robert P. Hughes |

Robert P. Hughes |

Corporate Secretary |

April 29, 2005 |

South Jordan, Utah |

Table of Contents

TenFold Corporation Proxy Statement

For the Annual Meeting to be Held June 22, 2005

Solicitation of Proxies and Record Date

Our Board of Directors is soliciting proxies for the 2005 Annual Meeting of Stockholders. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting.

Please read it carefully.

The Board set April 28, 2005, as the record date for the Annual Meeting. Stockholders who own Common Stock of TenFold on that date are entitled to notice of and to vote at the Annual Meeting, with each share entitled to one vote. There were 46,411,583 shares of common stock of TenFold outstanding on April 28, 2005. We will mail voting materials, which include this proxy statement, a proxy card, and TenFold’s 2004 Annual Report on Form 10-K to our stockholders on or about May 13, 2005. You should not consider any of these voting materials to be materials for soliciting the purchase or sale of stock of TenFold.

In this proxy statement:

| | • | | “Annual Meeting” or “Meeting” means the 2005 Annual Meeting of Stockholders of TenFold Corporation; |

| | • | | “Board of Directors” or “Board” means the Board of Directors of TenFold Corporation; |

| | • | | “SEC” means the Securities and Exchange Commission; |

| | • | | “We” and “TenFold” mean TenFold Corporation; and |

| | • | | “TenFold Proxy Officers” means Nancy M. Harvey, and Robert P. Hughes, or either of them, with full power of substitution. |

Questions & Answers

| Q: | When and where is the Annual Meeting? |

| A: | TenFold’s Annual Meeting of Stockholders is being held on Wednesday, June 22, 2005, at 11:30 a.m. local time at the Marriott Courtyard Hotel located at 10701 South Holiday Park Drive, Sandy, Utah 84070 (Tel: 801-571-3600, Fax: 801-572-1383). |

| Q: | Do I need a ticket to attend the Annual Meeting? |

| A: | No, you will not need a ticket to attend, but you may be requested to show identification. |

| Q: | Why am I receiving this proxy statement and a proxy card? |

| A: | You are receiving this proxy statement and a proxy card from us because you owned shares of common stock of TenFold on April 28, 2005, the record date. This proxy statement describes issues on which we would like you, as a stockholder, to vote. It also gives you information on these issues so that you can make an informed decision. |

When you sign the proxy card, you appoint the TenFold Proxy Officers as your representatives at the Annual Meeting. The TenFold Proxy Officers will vote your shares as you have instructed them on the proxy card at the Meeting. This way, your shares will be voted whether or not you attend the Meeting. Even if you plan to attend the Meeting, it is a good idea to complete, sign, and return your proxy card in advance of the Meeting just in

1

case your plans change. You can always vote in person at the Meeting, even if you have already sent in your proxy card.

If an issue comes up for a vote at the Meeting that is not on the proxy card, the TenFold Proxy Officers will vote your shares, under your proxy, in accordance with their best judgment.

| A: | You are being asked to vote on: |

| | • | | The election of three nominees to serve on our Board of Directors until our 2007 Annual Meeting of Stockholders (Richard H. Bennett, Jr., Robert E. Parsons, Jr., and Jeffrey L. Walker); |

| | • | | The ratification of the appointment of Tanner LC as our independent auditors for the fiscal year ending December 31, 2005; and |

| | • | | The amendment of our 1999 Stock Plan to increase the number of shares of our common stock reserved for issuance thereunder by 5,000,000 shares. |

| A: | There are two ways you may vote (please also see detailed instructions on your proxy card): |

| | • | | Mail in your completed, signed, and dated proxy card. |

If you return a signed card but do not provide voting instructions, your shares will be voted FOR the three named nominees, FOR ratification of the auditors, and FOR the amendment to the 1999 Stock Plan.

OR

| | • | | Vote in person by attending our Annual Meeting. |

We will pass out written ballots to anyone who wants to vote at the Meeting. If you hold your shares in street name, you must request a legal proxy from your stockbroker in order to vote at the Meeting. Holding shares in street name means your TenFold shares are held in an account at a brokerage firm and the stock certificates and record ownership are not in your name.

| Q: | What does it mean if I receive more than one proxy card? |

| A: | It means that you have multiple accounts at the transfer agent or with stockbrokers. Please sign and return all proxy cards to ensure that all your shares are voted. |

| Q: | What if I change my mind after I return my proxy card? |

| A: | You may revoke your proxy (cancel it) and change your vote at any time prior to the voting at the Annual Meeting by written notice to TenFold’s Corporate Secretary. The address for TenFold’s Corporate Secretary is 698 West 10000 South, Suite 200, South Jordan, Utah 84095. |

You may also do this by:

| | • | | Signing another proxy card with a later date; or |

| | • | | Voting in person at the Meeting. |

| Q: | Will my shares be voted if I do not sign and return my proxy card? |

| A: | If your shares are held in street name, your brokerage firm may either vote your shares on routine matters, such as the election of directors and ratification of independent auditors, or leave your shares un-voted. Your brokerage firm |

2

| | may not vote on non-routine matters, such as approval of the amendment to the 1999 Stock Plan. |

We encourage you to provide instructions to your brokerage firm by completing the proxy that they send to you. This ensures your shares will be voted at the Meeting.

| Q: | How are abstentions counted? |

| A: | Abstentions are counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum and as votes AGAINST for purposes of determining the approval of any matter submitted to the stockholders for a vote. |

| Q: | What is a “broker non-vote?” |

| A: | Under the rules that govern brokers who have record ownership of shares that are held in street name for their clients who are the beneficial owners of the shares, brokers have the discretion to vote such shares on routine matters (such as the election of directors and ratification of independent auditors), but not on non-routine matters (such as approval of the amendment to the 1999 Stock Plan as proposed by management). The broker may turn in a proxy card for uninstructed shares that votes “FOR” the routine matters, but expressly states that the broker is NOT voting on non-routine matters. The vote with respect to a proposal in this case is known as a broker non-vote. |

| Q: | How are broker non-votes counted? |

| A: | Broker non-votes will be counted for the purpose of determining the presence or absence of a quorum, but will not be counted for the purpose of determining the number of votes cast. |

| A: | A quorum is the number of shares that must be present, in person or by proxy, in order for business to be transacted at the Meeting. The required quorum for the Annual Meeting is a majority of the shares outstanding on April 28, 2005, the record date. All completed and signed proxy cards, regardless of the manner voted, will be counted toward the quorum. |

| Q: | How many shares are outstanding and how many votes can they cast? |

| A: | As of April 28, 2005, 46,411,583 shares of common stock were outstanding. Each outstanding share of common stock entitles the holder to one vote on all matters covered in this proxy statement. |

| Q: | What is the required vote for a proposal to pass? |

| A: | Assuming a quorum is present, the three nominees for election as directors at the Annual Meeting receiving the highest number of affirmative votes of shares entitled to be voted for them will be elected as directors of TenFold. Ratification of the appointment of the independent auditors and approval of the amendment to the 1999 Stock Plan requires the vote of a majority of the shares voting at the Meeting. |

| Q: | Where do I find the voting results of the Annual Meeting? |

| A: | We will announce preliminary voting results at the Meeting. We will publish the final results in our quarterly report on Form 10-Q for the second quarter of 2005. We will file that report with the Securities and Exchange Commission (the “SEC”), and you can obtain a copy from our website at www.tenfold.com or by contacting our Investor Relations Department at (801) 495-1010. You may also contact the SEC (call (800) SEC-0330 for the location of the public reference room), or visit the EDGAR system on the SEC’s website at www.sec.gov. |

| Q: | Who is soliciting my vote? |

| A: | TenFold’s board of directors is soliciting your proxy to vote your shares at the Annual Meeting. In addition to this solicitation by mail, proxies may be solicited by our directors, officers, and other employees by telephone, Internet, in person, or otherwise. Such persons will not receive any additional compensation for assisting in the solicitation. |

3

| | We will also request brokerage firms, nominees, custodians, and fiduciaries to forward proxy materials to the beneficial owners. We will reimburse such persons and TenFold’s transfer agent for their reasonable out-of-pocket expenses in forwarding such material. We have not retained the services of a proxy solicitor. |

| Q: | Where are TenFold’s principal executive offices located? |

| A: | TenFold’s principal executive offices are located at 698 West 10000 South, Suite 200, South Jordan, Utah 84095 (Tel 801-495-1010, Fax 801-495-0353). |

Proposals To Be Voted On

1. Election of Directors

Under TenFold’s Certificate of Incorporation, the Board of Directors is divided into two classes, with staggered two-year terms. The Class II directors, whose terms expire at TenFold’s 2005 Annual Meeting of Stockholders, are Richard H. Bennett, Jr., Robert E. Parsons, Jr., and Jeffrey L. Walker. The Class II directors are nominees for election at the Annual Meeting. Each has consented to serve a two-year term, which will expire at TenFold’s 2007 Annual Meeting of Stockholders. Stockholders elect only one class of directors at each annual meeting, with the other class continuing for the remainder of its respective two-year term. In the event that any nominee becomes unavailable, the proxies will be voted for the election of the person, if any, who is designated by the Board to replace the nominee. See “Board of Directors” section below.

The Board recommends a vote FOR Mr. Bennett, Mr. Parsons and Mr. Walker.

2. Ratification of Selection of Independent Auditors

Tanner LC (previously Tanner + Co.) has served as TenFold’s independent auditors since February 2003 and has been appointed by the Audit Committee of the Board of Directors to continue as TenFold’s independent auditors for the fiscal year ending December 31, 2005. In the event that ratification of this selection of auditors is not approved by a majority of the shares of common stock voting at the Annual Meeting in person or by proxy, the Audit Committee of the Board of Directors will reconsider its selection of auditors.

A representative of Tanner LC is expected to be present at the Annual Meeting. This representative will have an opportunity to make a statement and will be available to respond to appropriate questions.

The Board recommends a vote FOR ratification of the selection of Tanner LC as independent auditors of TenFold for the fiscal year ending December 31, 2005.

3. Approval of Amendment to the 1999 Stock Plan

At the Annual Meeting, the Company’s stockholders are being asked to approve an amendment to the Company’s 1999 Stock Plan (the “1999 Stock Plan” or the “Plan”) to increase the number of shares of our common stock available for issuance by 5,000,000 shares.

The following is a summary of principal features of the 1999 Stock Plan. This summary, however, does not purport to be a complete description of all provisions of the 1999 Stock Plan. Any stockholder of the Company who wishes to obtain a copy of the 1999 Stock Plan may do so upon written request to the Company Secretary at the Company’s principal offices at the address listed above.

Reason for Seeking Stockholder Approval of Plan

The Board of Directors believes that in order to attract and retain highly qualified employees, officers, directors and consultants, to provide such service providers with adequate incentive by ensuring that they have a proprietary interest in the Company, and to permit the Company to remain competitive during a difficult market environment in attracting highly qualified service providers, it is necessary to reserve additional shares of common stock for issuance under the 1999 Plan. Stockholder approval is sought with respect to this amendment.

4

Increase in Plan Shares.For the reasons stated above, our Board of Directors believes that it is necessary to reserve additional shares of common stock for issuance under the 1999 Plan. At the Annual Meeting, the stockholders are being asked to approve an amendment to the Plan increasing by 5,000,000 shares the number of shares reserved for issuance under the Plan. If stockholder approval is obtained, the total number of shares reserved for issuance under the Plan (including share amounts previously added as a result of the Plan’s earlier evergreen feature and an increase approved by shareholders at the 2003 Annual meeting) will be 21,500,000 shares. This number is subject to adjustment upon certain events involving our capital stock, such as stock splits and stock dividends, as described more fully below.

Failure to Obtain Stockholder Approval. If stockholder approval of this proposal is not obtained at the Annual Meeting, then the number of shares reserved for issuance under the Plan will not increase, and the Board may consider other alternatives to meet the goals identified above.

General Plan Information

The Company’s 1999 Stock Plan was adopted by the Board of Directors and approved by the stockholders in March 1999 and amended by stockholders in June 2002. A total of 6,500,000 shares of common stock were originally reserved for issuance under the 1999 Stock Plan, and there was an automatic annual increase on the first day of 2000, 2001, 2002, 2003, and 2004. This automatic annual increase is equal to the lesser of 1,000,000 shares or 3 percent of our outstanding common stock on the last day of the immediately preceding year, or such lesser number of shares as the Board of Directors determined. Under this provision, on each of January 1, 2004, January 1, 2003, January 1, 2002, January 1, 2001 and January 1, 2000, the number of shares reserved for issuance under the plan increased by 1,000,000 shares. At the 2003 Annual Meeting, the Company’s stockholders approved an amendment that increased the number of shares of common stock available for issuance by 5,000,000 shares, and increased the annual limit on the number of shares of common stock that may be granted to any one employee by 1,000,000 shares to an annual maximum of 2,000,000 shares. The Plan currently reserves 16,500,000 shares of common stock for issuance upon exercise of Plan awards. If stockholder approval is obtained with respect to the proposed 5,000,000 share increase, then thereafter an aggregate of 21,500,000 shares of common stock will be reserved for issuance under the Plan. These share numbers are subject to adjustment upon certain events involving our capital stock, such as stock splits and stock dividends, as described more fully below in “Adjustments Upon Changes in Capitalization; Liquidation.”

The 1999 Stock Plan provides for the granting to officers and employees of incentive stock options within the meaning of Section 422 of the Internal Revenue Code (the “Code”) and for the granting of nonstatutory stock options and stock purchase rights to officers, employees, consultants, and directors. See “United States Federal Income Tax Information” below for information concerning the tax treatment of both incentive stock options and nonstatutory stock options.

As of March 31, 2005, 334,569 shares had been issued upon exercise of options granted under the 1999 Stock Plan, options to purchase 15,911,236 shares were outstanding, and 254,195 shares remained available for future grant. To date, no stock purchase rights have been granted under the plan. The following table sets forth information with respect to the stock options granted to the named executive officers (those individuals listed in our Summary Compensation Table in this proxy statement), all current executive officers as a group, all current directors who are not executive officers as a group, each nominee for election as a director, each person who received 5 percent of such options, and all employees and consultants (including all current officers who are not executive officers) as a group under the 1999 Stock Plan as of March 31, 2005. Additional information about the Company’s option grants made to and options held by our named executive officers may be found in the Summary Compensation Table, the Option Grants table, and the Options Exercised table of this and our prior years’ proxy statements. It is not possible to determine at this time what portion of the additional 5,000,000 shares will be allocated to the individuals or groups referred to in the following table if the amendment to the Plan is approved. The 1999 Stock Plan was attached as Appendix B to the Company’s proxy statement for the 2002 Annual Meeting of Stockholders, and it is available upon written request to the Company’s Secretary at 698 West 10000 South, Suite 200, South Jordan, Utah 84095.

5

| | | | | |

Name

| | Number of Shares Subject to

Options Granted under the 1999 Stock Plan

| | Weighted Average

Exercise Price

Per Share

|

Nancy M. Harvey President, CEO And CFO, Director | | 5,361,875 | | $ | 1.77 |

| | |

Jeffrey L. Walker Chairman, Executive Vice President & CTO, and Director nominee | | 3,000,000 | | $ | 1.49 |

| | |

Jeanne Marie Kiss Former Sr. VP, Operations | | 750,000 | | $ | 0.20 |

| | |

Linda B. Valentine Former Sr. VP, Operations, Chief of Staff | | — | | | — |

| | |

All current executive officers as a group (4 persons) | | 9,296,875 | | $ | 1.63 |

| | |

All directors who are not executive officers (4 persons) | | 1,790,000 | | $ | 1.93 |

| | |

Richard H. Bennett, Jr., Director nominee | | 500,000 | | $ | 1.30 |

| | |

Robert E. Parsons, Jr., Director nominee | | 250,000 | | $ | 1.20 |

| | |

| All employees and consultants (including all current officers who are not executive officers) as a group (56 persons) | | 4,824,361 | | $ | 2.88 |

On April 28, 2005, the last bid for the Company’s common stock as quoted on the OTC Bulletin Board was $0.36 per share. The 1999 Stock Plan is not a qualified deferred compensation plan under Section 401(a) of the Code, and is not subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended.

6

Equity Compensation Plan Information

The following table provides the information about our common stock that may be issued upon the exercise of options and rights under all of our existing equity compensation plans as of December 31, 2004, including the 1993 Flexible Stock Incentive Plan, the 1999 Stock Plan, the 1999 Employee Stock Purchase Plan, and the 2000 Employee Stock Option Plan.

| | | | | | | | | |

Plan category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights as

of December 31, 2004 (a)

| | | Weighted-average

exercise price of

outstanding options,

warrants and rights (b)

| | Number of

securities

remaining

available for

future issuance

under equity

compensation

plans as of

December 31,

2004 (excluding

securities

reflected in

column (a)) (c)

| |

| Equity compensation plans approved by security holders | | 18,027,271 | (1) | | $ | 2.26 | | 5,224,966 | (2) |

| Equity compensation plans not approved by security holders | | 2,876,050 | (3) | | $ | 1.26 | | 3,890,377 | (4) |

| | |

|

| |

|

| |

|

|

| Total | | 20,903,321 | | | $ | 2.12 | | 9,115,343 | |

| | |

|

| |

|

| |

|

|

| (1) | 4,591,035 to be issued under the 1993 Flexible Stock Incentive Plan, and 13,436,236 to be issued under the 1999 Stock Plan. |

| (2) | 821,173 available for future issuance under the 1993 Flexible Stock Incentive Plan, 2,729,195 available for future issuance under the 1999 Stock Plan, and 1,674,598 available for future issuance under the 1999 Employee Stock Purchase Plan. |

| (3) | Issued under the 2000 Employee Stock Option Plan. |

| (4) | Shares available at December 31, 2004 under the 2000 Employee Stock Option Plan. |

| The | following information is a summary of our equity compensation plan not approved by security holders: |

2000 Employee Stock Option Plan. Our 2000 Employee Stock Option Plan was adopted by the Board of Directors in December 2000. A total of 7,000,000 shares of common stock have been reserved for issuance under the 2000 Stock Option Plan. The 2000 Stock Option Plan provides for the granting of nonstatutory options to purchase shares of our common stock to employees, excluding officers and members of our Board of Directors. Nonstatutory options do not qualify as an Incentive Stock Option within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended. The 2000 Employee Stock Option Plan is administered by the Board of Directors. The plan administrator determines the terms of options granted under the 2000 Stock Option Plan, including the number of shares subject to an option, the exercise price, the term and exercisability of options, and any vesting or other restrictions that apply to awards. The 2000 Stock Option Plan allows us to issue options with an exercise price equal to any price determined appropriate by the administrator. To date, all options issued under the 2000 Stock Option Plan have had exercise prices equal to the fair market value of the common stock on the date the option was granted. The plan allows for payment of the exercise price with cash, check, promissory note, or other shares of TenFold common stock, through a brokered cashless exercise program, or with any other form of consideration permitted by the administrator. Options issued under the 2000 Stock Option Plan generally vest over a four-year period and expire ten years from the date of grant.

The 2000 Stock Option Plan provides for automatic adjustment of shares remaining available for issuance as well as adjustment of outstanding awards in the event of any stock split, stock dividend, or similar change in our capital structure. In the event we were to be acquired by a third-party acquiror, we would expect that outstanding options would be assumed by our acquiror so that they would convert into awards to purchase acquiror stock (adjusted to reflect the terms of the transaction). If our acquiror did not agree to assume outstanding awards, then the vesting of such awards would accelerate in full prior to the closing of the acquisition and unexercised awards would terminate upon the closing. Unless terminated earlier, the 2000 Stock Plan will terminate in December 2010.

7

Purpose of 1999 Stock Plan

The purposes of the 1999 Stock Plan are to attract and retain the best available personnel for the Company, to provide additional incentive to the employees and consultants of the Company, and to promote the success of the Company’s business.

Administration

Our Board of Directors is responsible for administering our stock plans, including the 1999 Stock Plan. The Board has, however, delegated authority to administer the 1999 Stock Plan and therefore to grant awards under the Plan, to its Compensation Committee, currently comprised of Mr. Felton and Mr. Hardy. The Compensation Committee as Plan administrator selects the eligible recipient of a Plan award and determines the number of shares, the exercise price, the vesting, and other terms of each award granted under the 1999 Stock Plan. With respect to option grants to purchase up to 10,000 shares of common stock to any one employee (who is not an executive officer), option grants may be approved by a separate committee of the Board consisting of the Company’s Chief Executive Officer.

Eligibility

The 1999 Stock Plan provides that awards may be granted to employees (including officers and directors who are also employees) and consultants of the Company (including non-employee directors). Incentive stock options, however, may be granted only to employees.

As of March 31, 2005 there were approximately 76 employees, officers, and directors eligible to participate in the 1999 Stock Plan.

Limits on Plan Awards

The 1999 Stock Plan provides that the maximum number of shares of common stock that may be subject to awards granted to any one employee under the 1999 Stock Plan during any fiscal year is 2,000,000 shares of common stock (subject to adjustment as provided in the 1999 Stock Plan in the event of stock splits, stock dividends, and similar capital transactions).

The tax rules governing incentive stock options also impose a limit of $100,000 on the aggregate fair market value of shares (determined as of the option grant date) subject to all incentive stock options held by an individual that first become exercisable during any calendar year, with any excess option shares treated as nonstatutory stock options for federal income tax purposes.

Terms of Options

The terms of options granted under the 1999 Stock Plan are determined by the administrator. Each option is evidenced by a stock option agreement between the Company and the optionee and is subject to the following additional terms and conditions:

(a)Exercise of the Option. Generally, the optionee must earn the right to exercise the option by continuing to work for the Company, although the 1999 Stock Plan permits the grant of fully vested options. The administrator determines when options are exercisable. An option is exercised by giving written notice of exercise to the Company specifying the number of full shares of Common Stock to be purchased, and by tendering payment of the purchase price to the Company. The 1999 Stock Plan provides that the types of consideration used to exercise Plan awards may include cash, check, promissory note, other shares of stock owned by the optionee, or other consideration permitted by the administrator and permitted by law.

(b)Exercise Price. The exercise price of options granted under the 1999 Stock Plan is determined by the administrator, and must be at least equal to the fair market value of the shares on the date of grant, in the case of incentive stock options. Incentive stock options granted to stockholders owning more than 10% of the total combined voting power of all classes of the Company’s stock (such holders are referred to as “10% Stockholders”) are subject to the additional restriction that the exercise price of such options must be at least 110% of the fair market value on the date of the grant. Nonstatutory stock options granted to a Named Executive Officer are subject to the additional restriction that the exercise

8

price on such options must be at least 100% of the fair market value on the date of grant. Subject to the above requirements, the administrator may grant options to participants having exercise prices that are less than the fair market value of our stock on the date of grant.

“Fair market value” of a share of our common stock is determined by the Plan administrator, based upon the closing sales price (or the closing bid, if no sales were reported) quoted on the OTC Bulletin Board for the applicable date.

(c)Termination of Employment. If the optionee’s employment or consulting relationship with the Company is terminated for any reason other than death or total and permanent disability, options under the 1999 Stock Plan may be exercised within three months (or such other period, not less than 30 days but in no event later than expiration of the option’s term, as is determined by the administrator) after the date of such termination to the extent the option was vested on the date of such termination.

(d)Disability. If an optionee is unable to continue his or her employment or consulting relationship with the Company as a result of his or her total and permanent disability, options may be exercised within 12 months (or such other period of time, but in no event later than expiration of the option’s term, as is determined by the administrator) after the date of termination and may be exercised only to the extent the option was vested on the date of termination.

(e)Death. If an optionee should die while employed or retained by the Company, and such optionee has been continuously employed or retained by the Company since the date of grant of the option, the option may be exercised within twelve months after the date of death (or such other period of time, but in no event later than expiration of the option’s term, as is determined by the administrator) by the optionee’s estate or by a person who acquired the right to exercise the option by bequest or inheritance to the extent the optionee would have been vested in the option shares at the date of death.

If an optionee should die within 30 days after the optionee has ceased to be continuously employed or retained by the Company, the option may be exercised within 12 months after the date of death by the optionee’s estate or by a person who acquired the right to exercise the option by bequest or inheritance to the extent that the optionee was vested in the option shares at the date of termination, but in no event may the option be exercised after its termination date.

(f)Option Termination Date. Incentive stock options granted under the 1999 Stock Plan expire ten years from the date of grant unless a shorter period is provided in the option agreement. Incentive stock options granted to 10% Stockholders may not have a term of more than five years. Although nonstatutory stock options granted under the 1999 Stock Plan may have any term specified by the administrator, the applicable term is generally ten years.

(g)Nontransferability of Options. Incentive stock options are not transferable by the optionee, other than by will or the laws of descent and distribution, and are exercisable only by the optionee during his or her lifetime or, in the event of death, by a person who acquires the right to exercise the option by bequest or inheritance or by reason of the death of the optionee. In the case of nonstatutory stock options, the administrator may in its discretion allow limited transferability of such options.

(h)Other Provisions. The option agreement may contain such other terms, provisions, and conditions not inconsistent with the 1999 Stock Plan as may be determined by the administrator.

Stock Purchase Awards

The 1999 Stock Plan also permits the Company to issue stock purchase rights, giving the recipient the right to purchase stock subject to certain terms and conditions determined by the administrator and specified in an individual stock purchase agreement. To date, the Company has not granted any stock purchase rights under the 1999 Stock Plan. With respect to any stock purchase right that might be granted under the Plan, the administrator would determine the number of shares, the purchase price, and the time within which the recipient must purchase the shares. The purchase price for the shares subject to an award may be any price determined appropriate by the administrator (including a price that is less than the per-share fair market value of our common stock at the time of grant). Typically, the shares purchased upon exercise of a stock purchase right would be subject to vesting in that the purchase agreement would give the Company the right to repurchase any unvested shares from the recipient at the time the recipient’s employment relationship with the Company terminated for any reason, although the 1999 Stock Plan allows the Company to issue fully vested stock purchase rights. The purchase of shares by Plan participants may be made with any form of consideration allowed by the

9

administrator and permitted by law (the types of consideration permitted by the plan are described more fully in “Exercise of the Option” above).

Change of Control Provisions

In the event of a merger of the Company with or into another corporation or sale of substantially all of the Company’s assets, we would expect that options and other outstanding awards under the 1999 Stock Plan would be assumed by our acquiror so that they would convert into awards to purchase acquiror stock (adjusted to reflect the terms of the transaction). If, however, our acquiror did not agree to assume outstanding awards, then the vesting of such awards would accelerate, and any Company repurchase rights applicable to stock purchased upon exercise of stock purchase rights would lapse in full prior to the closing of the acquisition and unexercised awards would terminate upon the closing of the transaction.

Adjustments Upon Changes in Capitalization; Liquidation

In the event any change, such as a stock split, reverse stock split, stock dividend, combination, or reclassification, is made in the Company’s capitalization that results in an increase or decrease in the number of outstanding shares of common stock without receipt of consideration by the Company, appropriate proportionate adjustment shall be made in the exercise price of each outstanding award, the number of shares subject to each award, and the annual Section 162(m) limit on grants to employees, as well as the number of shares remaining available for issuance under the 1999 Stock Plan.

In the event of proposed dissolution or liquidation of the Company, each option will terminate unless otherwise provided by the administrator.

Amendment and Termination

The Board of Directors may at any time amend, alter, suspend, discontinue, or terminate the 1999 Stock Plan, but no amendment, alteration, suspension, discontinuance, or termination (except as otherwise provided in the 1999 Plan) shall be made that would materially and adversely affect the rights of any Plan participant under any outstanding stock option grant or stock purchase right without his or her consent. Unless terminated earlier, the 1999 Stock Plan will terminate in March 2009.

United States Federal Income Tax Information

The following is a brief summary of the U.S. federal income tax consequences of transactions under the 1999 Stock Plan based on federal income tax laws in effect on the date of this proxy statement. This summary is not intended to be exhaustive and does not address all matters that may be relevant to a particular optionee based on his or her specific circumstances. The summary addresses only current U.S. federal income tax law and expressly does not discuss the income tax laws of any state, municipality, or non-U.S. taxing jurisdiction, nor any gift, estate, or other tax laws other than federal income tax law. The Company advises all optionees to consult their own tax advisors concerning the tax implications of option grants and exercises and the disposition of stock acquired upon such exercises under the 1999 Stock Plan.

Options

The discussion below assumes that all options granted under the 1999 Stock Plan permit exercise only of vested option shares. Were the Company to grant options that permitted exercise of unvested option shares, the tax treatment of such options would differ from the following description.

U.S. Federal Income Tax Treatment of Incentive Stock Options.Options granted under the 1999 Stock Plan may be either incentive stock options, which are intended to qualify for the special tax treatment provided by Section 422 of the Code, or nonstatutory stock options, which will not qualify. If an option granted under the 1999 Stock Plan is an incentive stock option, the optionee will recognize no income upon grant of the incentive stock option and will incur no tax liability due to the exercise, except to the extent that such exercise causes the optionee to incur alternative minimum tax (see discussion below). The Company will not be allowed a deduction for federal income tax purposes as a result of the exercise of an incentive stock option regardless of the applicability of the alternative minimum tax. Upon the sale or exchange of the shares more than two years after grant of the option and one year after exercise of the option by the

10

optionee, any gain will be treated as a long-term capital gain. If both of these holding periods are not satisfied, the optionee will recognize ordinary income equal to the difference between the exercise price and the lower of the fair market value of the common stock on the date of the option exercise or the sale price of the common stock. The Company will be entitled to a deduction in the same amount as the ordinary income recognized by the optionee. Any gain or loss recognized on a disposition of the shares prior to completion of both of the above holding periods in excess of the amount treated as ordinary income will be characterized as long-term capital gain if the sale occurs more than one year after exercise of the option or as short-term capital gain if the sale is made earlier. For individual taxpayers, the current maximum U.S. federal income tax rate on long-term capital gains is 15%, whereas the maximum U.S. federal income tax rate on other income is 35%. Capital losses for individual taxpayers are allowed in full against capital gains plus $3,000 of other income.

U.S. Federal Income Tax Treatment of Nonstatutory Stock Options. All other options that do not qualify as incentive stock options are referred to as nonstatutory stock options. An optionee will not recognize any taxable income at the time he or she is granted a nonstatutory stock option. However, upon its exercise, the optionee will recognize ordinary compensation income for tax purposes measured by the excess of the fair market value of the shares as of the exercise date over the exercise price. The income recognized by an optionee who is also an employee of the Company will be subject to income and employment tax withholding by the Company by payment in cash by the optionee or out of the optionee’s current earnings, or otherwise as permitted under the 1999 Stock Plan. Upon the sale of such shares by the optionee, any difference between the sale price and the fair market value of the shares as of the date of exercise of the option will be treated as capital gain or loss, and will qualify for long-term capital gain or loss treatment if the shares have been held for more than one year from date of exercise. The Company is entitled to a deduction in the same amount and at the same time as the ordinary income recognized by the employee.

Alternative Minimum Tax Treatment of Incentive Stock Options.The exercise of an incentive stock option may subject the optionee to the alternative minimum tax under Section 55 of the Code. The alternative minimum tax is calculated by applying a tax rate of 26% to alternative minimum taxable income of joint filers up to $175,000 ($87,500 for married taxpayers filing separately) and 28% to alternative minimum taxable income above that amount. Alternative minimum taxable income is equal to (i) taxable income adjusted for certain items, plus (ii) items of tax preference, less (iii) an exemption amount of $58,000 for joint returns, $40,250 for unmarried individual returns, and $29,000 in the case of married taxpayers filing separately. These exemption amounts are phased out for upper income taxpayers. Alternative minimum tax will be due if the tax determined under the foregoing formula exceeds the regular tax of the taxpayer for the year.

In computing alternative minimum taxable income, shares purchased upon exercise of an incentive stock option are treated as if they had been acquired by the optionee pursuant to exercise of a nonstatutory stock option. As a result, the optionee recognizes alternative minimum taxable income equal to the excess of the fair market value of the Common Stock on the date of exercise over the option exercise price. Because the alternative minimum tax calculation may be complex, optionees should consult their own tax advisors prior to exercising incentive stock options. If an optionee pays alternative minimum tax, the amount of such tax may be carried forward as a credit against any subsequent year’s regular tax in excess of the alternative minimum tax for such year.

Stock Purchase Rights

An employee who receives a restricted stock purchase right will not recognize any taxable income at the time he or she is granted such a right. Upon exercising such right and acquiring common stock, the employee’s federal income tax consequences will depend on whether any of the common stock is subject to a right on the part of the Company to repurchase such shares at the employee’s original cost for such shares prior to the employee’s completion of a vesting period. If the common stock is not subject to such a Company repurchase right at the time of purchase, then the employee will recognize ordinary compensation income for tax purposes measured by the excess of the fair market value of the shares as of the purchase date over the purchase price. Upon the sale of such shares by the employee, any difference between the sale price and the fair market value of the shares as of the date of purchase will be treated as capital gain or loss, and will qualify for long-term capital gain or loss treatment if the shares have been held for more than one year from the date of purchase. The Company is entitled to a deduction in the same amount and at the same time as the ordinary income recognized by the employee.

If some or all of the shares are subject to a Company repurchase right at the time of purchase, then, unless the employee makes a Section 83(b) election within 30 days after the purchase date with respect to the shares subject to such Company

11

repurchase right, the employee will recognize ordinary compensation income for tax purposes on each date when shares vest (meaning when the Company’s repurchase right with respect to such shares lapses) equal to the excess of the fair market value of such shares as of such vesting date over the purchase price. In such event, upon the sale of such shares by the employee, any difference between the sale price and the fair market value of the shares as of the vesting date will be treated as capital gain or loss, and will qualify for long-term capital gain or loss treatment if the shares have been held for more than one year from the date they vested. If the employee does make a Section 83(b) election within 30 days after the purchase date, then the federal income tax consequences are the same as for shares that are not subject to a Company repurchase option as described in the preceding paragraph.

Amounts recognized as ordinary compensation income by an employee under either of the two alternatives set forth above are subject to income and employment tax withholding by the Company by payment in cash by the employee or out of the employee’s current earnings, or otherwise as permitted under the 1999 Stock Plan.

Required Vote

The approval of the increase in the number of shares of our common stock available for issuance by 5,000,000 shares requires the affirmative vote of the holders of a majority of the shares of the Company’s common stock present at the Annual Meeting in person or by proxy and entitled to vote.

Recommendation of the Board of Directors

The Board of Directors recommends a vote FOR approval of the amendment to the 1999 Stock Plan.

4. Other Business

The Board knows of no other business for consideration at the Meeting. If other matters are properly presented at the Meeting, or at any adjournment of the Meeting, the TenFold Proxy Officers will vote, or otherwise act, on your behalf in accordance with their judgment on such matters.

Board of Directors

The names of the Class II directors, each of whom is a nominee for director, their ages as of March 31, 2005, and certain other information about them are set forth below:

| | | | | | |

Name of Nominee

| | Age

| | Position with TenFold

| | Director Since

|

| Jeffrey L. Walker | | 62 | | Chairman, Executive Vice President, Chief Technology Officer, and Director | | 1993 |

| Richard H. Bennett, Jr. | | 58 | | Director | | 2002 |

| Robert E. Parsons, Jr. | | 49 | | Director | | 2004 |

Jeffrey L. Walker founded TenFold in February 1993 and has served as its Chairman, Executive Vice President, and Chief Technology Officer since October 1996. From TenFold’s inception to October 1996, Mr. Walker served as TenFold’s Chairman, President, Chief Executive Officer, and Chief Technology Officer. Prior to founding TenFold, from 1991 to 1993, Mr. Walker was an independent consultant. From 1985 to 1991, Mr. Walker held several management positions at Oracle Corporation, a large database and applications software company, including Executive Vice President from 1987 to 1991, General Manager Applications Division from 1985 to 1991, Chief Financial Officer from 1987 to 1991, and Senior Vice President of Marketing during 1986. Prior to joining Oracle, Mr. Walker founded and served as Chief Executive Officer of Walker Interactive Products, an application software company, from 1980 to 1985. Mr. Walker holds a BA in mathematics from Brown University.

Richard H. Bennett, Jr. has served as a member of TenFold’s Board of Directors since October 31, 2002. From September 2001 to October 2002, Mr. Bennett served as a marketing consultant to TenFold. Mr. Bennett founded Rick Bennett Advertising in 1984. His advertising agency has represented numerous companies in many technology sectors including, hardware, database, circuit design and artificial intelligence. From 1984 to 1990, he served as Oracle Corporation’s advertising agency during Oracle’s growth from $15 million to over a billion dollars in annual sales. From its inception to

12

its initial public offering in 2004, he advised Salesforce.com. He currently advises several other technology companies, including IntraLinks.

Robert E. Parsons, Jr. has served as a member of TenFold’s Board of Directors since September 2004. Mr. Parsons is Executive Vice President and Chief Financial Officer of Exclusive Resorts. Prior to joining Exclusive Resorts in 2004, Mr. Parsons had 23 years of experience with both Marriott and Host Marriott Corporation, and served for the last seven years as Executive Vice President and Chief Financial Officer of Host Marriott. Prior to the division of Marriott Corporation in the early 1990s (into Marriott International, Inc. and Host Marriott Corporation), Mr. Parsons was Vice President and Assistant Treasurer of Marriott Corporation. Mr. Parsons has also served as Chairman of the Hotel Development Committee of the Urban Land Institute, a member of the National Advisory Counsel of the Graduate School of Management at Brigham Young University, and is a Director of CNL Hotels and Resorts. Mr. Parsons was recommended for service on the Board by Ralph W. Hardy, Jr.

The names of the Class I directors, their ages as of March 31, 2005, and certain other information about them are set forth below:

| | | | | | |

Name of Class I Director

| | Age

| | Position with TenFold

| | Director Since

|

Nancy M. Harvey | | 51 | | President, Chief Executive Officer, Chief Financial Officer and Director | | 2001 |

Robert W. Felton | | 66 | | Director | | 1997 |

Ralph W. Hardy, Jr. | | 64 | | Director | | 1998 |

Nancy M. Harvey joined TenFold in July 2000, and has served as President and Chief Executive Officer since January 2001, and as Chief Financial Officer since November 2002. From July 2000 to December 2000, Dr. Harvey served as TenFold’s Chief Operating Officer. Prior to joining TenFold, Dr. Harvey served in various capacities with Computer Science Corporation’s (“CSC”) Healthcare Group, a large-scale applications development, outsourcing and consulting company, including from 1999 to 2000 as Executive Vice President, from 1998 to 1999 as Chief of Staff and Acting Group Vice President of Finance and Administration, from 1997 to 1998 as a Vice President, and from 1995 to 1997 as a Principal of APM Management Consultants, a management consulting firm acquired in 1996 by CSC. From 1994 to 1995, Dr. Harvey was a Senior Manager with Ernst & Young, a public accounting firm. In addition, Dr. Harvey held executive positions with MacNeal Health Services Corporation, a regional health delivery system. Dr. Harvey holds a BS in biology and chemistry from the College of Creative Studies at the University of California at Santa Barbara, an MBA from the Wharton School of the University of Pennsylvania, a Ph.D. in chemical physics from the University of Minnesota, and was a post-doctoral fellow at the California Institute of Technology.

Robert W. Felton has served as a member of TenFold’s Board of Directors since March 1997. Mr. Felton was the founder and served as a member of the Board of Directors of Indus International, Inc., a software applications company, since its inception in 1988 until 2002. From 1988 to January 1999, Mr. Felton also served as Indus’s Chairman, President, and Chief Executive Officer. Mr. Felton holds a BS in mechanical engineering from Cornell University and an MS in nuclear engineering from the University of Washington.

Ralph W. Hardy, Jr. has served as a member of TenFold’s Board of Directors since February 1998. Mr. Hardy is the principal operating officer, director and a stockholder of First Media Corporation, which is the ultimate parent of First Media TF Holdings, LLC, a stockholder of TenFold. Through other subsidiaries, First Media Corporation owns investments in commercial broadcasting stations and in various other private entities. First Media Corporation, which is substantially owned by the Richard E. Marriott family, also owns, through a subsidiary, stock of various publicly held companies such as Host Marriott Corporation and Marriott International, Inc. Mr. Hardy has served as a member of the law firm of Dow, Lohnes & Albertson PLLC, Washington, D.C., since 1974. Mr. Hardy holds a BS in political science from the University of Utah and a JD from the University of California at Berkeley School of Law (Boalt Hall).

13

Committees and Meetings

The Board of Directors has an Audit Committee and a Compensation Committee, the functions of which are described in the table below.

| | |

Name of Committee and Members

| | Functions of the Committee

|

Audit • Richard H. Bennett, Jr. • Robert W. Felton • Ralph W. Hardy, Jr. • Robert E. Parsons, Jr. | | • Confers with independent accountants regarding TenFold’s financial policies. • Reviews reports of independent accountants. • Reviews annual audit plans of independent accountants. • Reviews recommendations about internal controls. • Approves selection of and services to be provided by independent accountants. |

Compensation • Robert W. Felton • Ralph W. Hardy, Jr. | | • Determines the compensation of the Chief Executive Officer. • Reviews and approves senior management compensation plans and stock grants, and establishes performance goals. • Reviews and approves proposed stock option plan changes. • Approves compensation and stock grants intended to qualify as performance-based compensation under Internal Revenue Code Section 162(m). • Reports results of each meeting to the Board of Directors. |

Although TenFold’s stock is not listed for trading on Nasdaq or any other stock exchange, the Board of Directors has determined that Mr. Felton, Mr. Hardy and Mr. Parsons, all members of the audit committee, are “independent” in accordance with Rule 4200(a)(15) of the Nasdaq Stock Market’s listing standards. Mr. Bennett, who is also a member of the audit committee, was an employee of TenFold until October 2002 and therefore is not “independent” in accordance with Rule 4200(a)(15). The Board of Directors has also determined that Mr. Felton is an “audit committee financial expert” as that term is used in Item 401 of Regulation S-K promulgated under the Exchange Act.

The Board held 6 meetings in 2004, the Audit Committee held 4 meetings in 2004, and the Compensation Committee held 1 meeting in 2004. TenFold does not require its directors to attend annual meetings of stockholders, but all of the directors serving at the time attended the 2004 annual meeting, except for Mr. Felton.

Nominations

The Board does not have a nominating committee or a committee serving a similar function. TenFold believes that the Board is able to fully consider and select appropriate nominees for election to the Board without delegating that responsibility to a committee of independent directors or adopting formal procedures. For this same reason, TenFold does not have a formal policy by which its shareholders may recommend director candidates, but the Board will consider candidates recommended by shareholders. A shareholder wishing to submit such a recommendation should send a letter to the Secretary at 698 West 10000 South, Suite 200, South Jordan, Utah 84095. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications, as well as contact information for both the candidate and the shareholder. At a minimum, candidates for election to the Board should meet the independence requirements of the Nasdaq Stock Market and Rule 10A-3 under the Securities Exchange Act of 1934. Candidates should also have relevant business and financial experience, and they must be able to read and understand fundamental financial statements.

Candidates have traditionally been recommended to the Board by the directors themselves, and there is not a formal process for identifying or evaluating new director nominees. Candidates recommended by shareholders will be evaluated in the same manner as candidates recommended by anyone else, although the Board may prefer candidates who are personally known to the directors and whose reputations are highly regarded. The Board will consider all relevant qualifications as well as the needs of TenFold in terms of compliance with SEC rules and any applicable stock market listing standards.

14

Shareholder Communication with the Board

Shareholders who wish to communicate with the Board or with a particular director may send a letter to the Secretary at 698 West 10000 South, Suite 200, South Jordan, Utah 84095. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

Code of Ethics

TenFold has adopted a Code of Ethics applicable to all of its directors, officers and employees. A copy of the Code of Ethics may be obtained at no charge by written request to the attention of the Secretary at 698 West 10000 South, Suite 200, South Jordan, Utah 84095.

Director Compensation

We do not pay directors for their service as directors except for reimbursement of reasonable travel expenses relating to attendance at board and committee meetings. Non-employee directors may participate in TenFold’s 1993 and 1999 stock plans, and on March 24, 2004, TenFold granted each of Richard H. Bennett, Jr., Robert W. Felton, and Ralph W. Hardy, Jr. an option to purchase 200,000 shares of TenFold common stock at an exercise price of $2.92 per share. Twenty-five percent of these options vested on March 24, 2005 and 6.25% of the remaining options vest quarterly thereafter. On September 23, 2004, TenFold granted Robert E. Parsons, Jr. an option to purchase 200,000 shares of TenFold common stock at an exercise price of $1.39 per share. Twenty-five percent of these options vest on September 23, 2005 and 6.25% of the remaining options vest quarterly thereafter. On February 25, 2005, TenFold granted each of Richard H. Bennett, Jr., Robert W. Felton, Ralph W. Hardy, Jr., and Robert E. Parsons, Jr. an option to purchase 50,000 shares of TenFold common stock at an exercise price of $0.43 per share, which vested upon grant.

Compensation Committee Interlocks and Insider Participation

During 2004, Robert W. Felton and Ralph W. Hardy, Jr. (both non-employee directors) served as the sole members of the Compensation Committee. In addition, Nancy M. Harvey (current President, CEO and CFO) performed compensation committee functions as to non-executive and non-officer employees.

No member of the TenFold Board of Directors who performed Compensation Committee functions has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity. In addition, no executive officer of TenFold has served as a member of the board of directors or compensation committee of any entity for which a member of TenFold’s Board of Directors or Compensation Committee has served as an executive officer.

15

Common Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth information that has been provided to TenFold with respect to beneficial ownership of shares of TenFold’s Common Stock as of March 31, 2005, for (i) each person who is known by TenFold to own beneficially more than five percent of the outstanding shares of Common Stock, (ii) each director of TenFold, (iii) each of the named executive officers listed in the Summary Compensation Table of this proxy statement, and (iv) all directors and executive officers of TenFold as a group.

| | | | | | | | | | |

Name and Address (1)

| | Shares of

Common

Stock(2)

| | | Options

Exercisable (3)

| | Total

| | Percent

of

Common

Stock (4)

| |

Jeffrey L. & Cassandra M. Walker(8) | | 13,354,800 | | | 2,578,125 | | 15,932,925 | | 32.5 | % |

Nancy M. Harvey | | 78,125 | | | 7,573,750 | | 7,651,875 | | 14.2 | % |

Gary D. Kennedy(5)

36 South State Street

Suite 1400

Salt Lake City, UT 84111 | | 3,915,290 | | | — | | 3,915,290 | | 8.4 | % |

Walker Children’s Trust(6) | | 3,769,800 | | | — | | 3,769,800 | | 8.1 | % |

Ralph W. Hardy, Jr.(7)

c/o First Media TF Holdings, LLC

11400 Skipwith Lane

Potomac, MD 20854 | | 3,344,330 | | | 334,375 | | 3,678,705 | | 7.9 | % |

First Media TF Holdings, LLC

11400 Skipwith Lane

Potomac, MD 20854 | | 3,340,330 | | | — | | 3,340,330 | | 7.2 | % |

Robert W. Felton Trust

c/o Robert W. Felton | | 3,924,125 | | | 374,375 | | 4,298,500 | | 9.2 | % |

Richard H. Bennett, Jr. | | — | | | 568,750 | | 568,750 | | 1.2 | % |

Robert E. Parsons, Jr. | | — | | | 50,000 | | 50,000 | | 0.1 | % |

Jeanne Marie Kiss(9) | | — | | | 590,625 | | 590,625 | | 1.3 | % |

Linda B. Valentine(10) | | — | | | — | | — | | — | |

All directors and executive officers as a group (8 persons) | | 20,787,553 | (8) | | 12,122,325 | | 32,909,878 | | 56.2 | % |

| (1) | Unless otherwise indicated, the address of each of the persons and entities listed in the table is the address of TenFold’s principal executive offices. The address of TenFold’s principal executive offices is 698 West 10000 South, Suite 200, South Jordan, Utah 84095. |

| (2) | The persons named in this table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws where applicable and except as indicated in the other footnotes to this table. |

| (3) | All options included are exercisable within 60 days after March 31, 2005. |

| (4) | Based on 46,411,583 shares of Common Stock outstanding as of March 31, 2005. In computing the percentage ownership by a person, shares of Common Stock subject to options held by that person that are currently exercisable or exercisable on or before May 30, 2005, are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| (5) | Includes 143,594 shares owned by a limited liability company in which Mr. Kennedy is a co-managing member and as such exercises shared voting and investment power with respect to the shares. Mr. Kennedy disclaims beneficial ownership of the shares held by the limited liability company, except to the extent of his pecuniary interests in such shares. Information for Mr. Kennedy is to the best of TenFold’s knowledge based on reports filed with the SEC and a resignation agreement between the Company and Mr. Kennedy. |

| (6) | The Walker Children’s Trust is an irrevocable trust in which Mr. Walker, Mr. Walker’s wife and Paul M. Ginsburg are co-trustees. Mr. Ginsburg has sole voting and investment power with respect to the shares of TenFold held by the trust. |

| (7) | Includes 3,340,330 shares held by First Media TF Holdings, LLC, a wholly owned subsidiary of First Media Corporation. Mr. Hardy is a principal of First Media TF Holdings, LLC, and an officer, director, and stockholder of First Media Corporation. Mr. Hardy disclaims beneficial ownership of the shares held by First Media TF Holdings, LLC, except to the extent of his pecuniary interest in such shares. |

| (8) | Does not include 3,769,800 shares held by the Walker Children’s Trust. |

| (9) | Ms. Kiss is currently employed by the Company, but no longer serves in an Executive Officer capacity. |

| (10) | Ms. Valentine is no longer employed by the Company. |

16

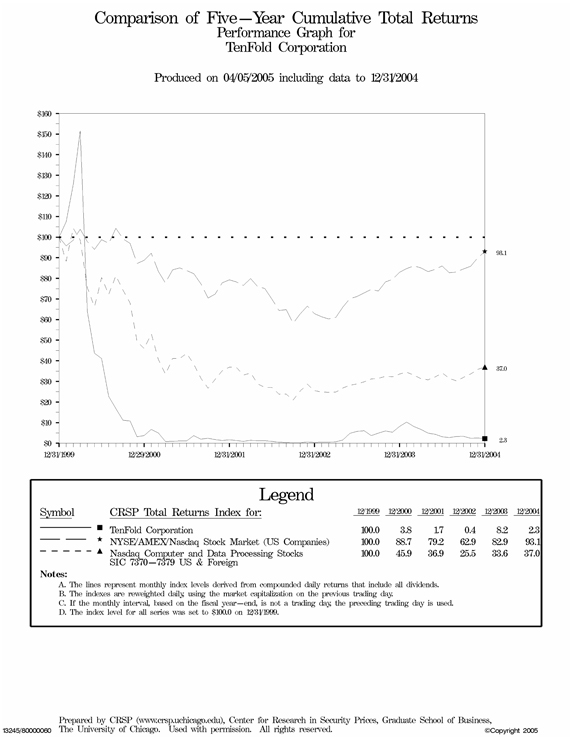

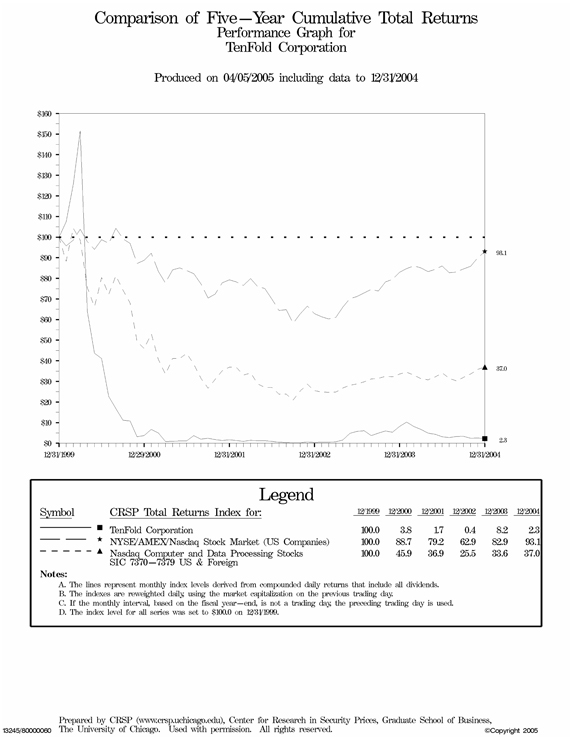

Stock Performance Graph

The following graph compares the cumulative total stockholder return data for TenFold’s common stock since December 31, 1999 to the cumulative return over such period of (i) the NYSE/ AMEX/ Nasdaq U.S. Companies Index, and (ii) the Nasdaq Computer & Data Processing Stocks Index. The graph assumes that $100 was invested in TenFold common stock on December 31, 1999, and in each of the comparative indices. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

Information presented is as of the last trading day of each month during the five years ended December 31, 2004.

17

Independent Public Accountants

On February 10, 2003, TenFold dismissed its independent accountant, KPMG LLP (“KPMG”), and engaged the services of Tanner LC (formerly Tanner + Co.) (“Tanner”) as TenFold’s new independent accountant for its fiscal years ending December 31, 2002, December 31, 2003 and December 31, 2004. The Audit Committee approved the dismissal of KPMG and the appointment of Tanner as of February 10, 2003.

For the fiscal years ended December 31, 2004 and December 31, 2003, Tanner billed the fees set forth below:

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees | | $ | 80,449 | | $ | 98,634 |

Audit-Related Fees | | | 28,990 | | | 11,511 |

Tax Fees | | | 250 | | | 650 |

All Other Fees | | | — | | | — |

The audit-related fees billed by Tanner for fiscal 2004 were for review of TenFold’s registration statement on Form S-1, and auditing of TenFold’s 401(k) retirement plan. The audit-related fees billed by Tanner for fiscal 2003 were for auditing of TenFold’s 401(k) retirement plan.

Pursuant to the rules and regulations of the Securities and Exchange Commission, before TenFold’s independent accountant is engaged to render audit or non-audit services, the engagement must be approved by TenFold’s Audit Committee or entered into pursuant to the committee’s pre-approval procedures. The Audit Committee has adopted a policy requiring pre-approval of audit and non-audit services to be provided by TenFold’s independent accountant. The policy is attached as Appendix A.

During TenFold’s fiscal years ended December 31, 2001 and December 31, 2002, and the subsequent interim period through February 10, 2003, there were no disagreements between TenFold and KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to KPMG’s satisfaction, would have caused KPMG to make reference to the subject matter of the disagreement in connection with its reports.

The audit reports of KPMG on TenFold’s consolidated financial statements for the fiscal years ended December 31, 2001 and December 31, 2000 did not contain any adverse opinions or disclaimers of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles except that:

(1) KPMG’s audit report on such financial statements as of and for the fiscal year on ended December 31, 2001 contained a separate paragraph stating, in relevant part:

“The accompanying consolidated financial statements and related financial statement schedule have been prepared assuming that the Company will continue as a going concern. The Company suffered a significant loss from operations during the year ended December 31, 2001, has a substantial deficit in working capital and stockholder’s equity at December 31, 2001, had negative cash flow from operations for the year ended December 31, 2001 and is involved in significant legal proceedings that raise substantial doubt about its ability to continue as a going concern”; and

(2) KPMG’s audit report on such financial statements as of and for the fiscal year ended December 31, 2000 contained a similar separate paragraph stating:

“The accompanying consolidated financial statements and related financial statement schedule have been prepared assuming that the Company will continue as a going concern. The Company suffered a significant loss from operations during the year ended December 31, 2000, has a substantial deficit in working capital and stockholder’s equity at December 31, 2000, had negative cash flow from operations for the year ended December 31, 2000 and is involved in significant legal proceedings that raise substantial doubt about its ability to continue as a going concern.”

There were no reportable events (as defined in Regulation S-K Item 304(a)(1)(v)) during TenFold’s fiscal years ended December 31, 2001 and December 31, 2002, or the subsequent interim period through February 10, 2003, except that, in a

18

letter to TenFold’s Audit Committee dated April 9, 2001, KPMG reported that during its audit of TenFold’s financial statements for the fiscal year ended December 31, 2000, it noted deficiencies in internal controls related to the recording of revenue under the percentage-of-completion method of contract accounting. The Audit Committee and TenFold’s management discussed the issue with KPMG and TenFold authorized KPMG to respond fully to the inquiries of Tanner concerning the issue.

The Registrant requested and received from KPMG a letter addressed to the SEC stating it agreed with the foregoing statements. A copy of such letter, dated February 14, 2003, was filed as Exhibit 16.2 to the related Form 8-K filed with the SEC on February 18, 2003, reporting the change in accountants.

During TenFold’s fiscal years ended December 31, 2001 and December 31, 2002, and the subsequent interim period through February 10, 2003, TenFold did not consult with Tanner regarding any of the matters or events set forth in Regulation S-K Items 304(a)(2)(i) or (ii).

The audit report of Tanner on TenFold’s consolidated financial statements for the fiscal year ended December 31, 2002 did not contain any adverse opinions or disclaimers of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles except that it contained a separate paragraph stating, in relevant part:

“The accompanying consolidated financial statements and related financial statement schedule have been prepared assuming that the Company will continue as a going concern. The Company suffered a significant loss from operations, has a substantial deficit in working capital and stockholder’s equity at December 31, 2002, had negative cash flow from operations for the year ended December 31, 2002 and is involved in legal proceedings that raise substantial doubt about its ability to continue as a going concern.”

The audit report of Tanner on the consolidated financial statements of TenFold for the fiscal year ended December 31, 2003 did not contain any adverse opinions or disclaimers of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles nor did it contain the paragraph immediately above regarding doubt about TenFold’s ability to continue as a going concern.

The audit report of Tanner on TenFold’s consolidated financial statements for the fiscal year ended December 31, 2004 did not contain any adverse opinions or disclaimers of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles except that it contained a separate paragraph stating, in relevant part:

“The accompanying consolidated financial statements and schedule referred to above have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has used significant balances of its cash in operating activities and at present levels of cash consumption will not have sufficient resources to meet operating needs. This raises substantial doubt about the Company’s ability to continue as a going concern.”

19

Report of the Audit Committee of the Board of Directors

As of December 31, 2004, the Audit Committee was composed of the following four non-employee directors: Richard H. Bennett, Jr., Robert W. Felton, Ralph W. Hardy, Jr., and Robert E. Parsons, Jr. The Audit Committee operates under a written charter that was included as Appendix A to TenFold’s proxy statement for the 2002 Annual Meeting of Stockholders.

The Audit Committee recommends to the Board of Directors, subject to stockholder ratification, the selection of Tanner LC to be engaged as TenFold’s independent accountants. Tanner LC is responsible for performing an independent audit of TenFold’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. Management is responsible for our internal controls and the financial reporting process. The Audit Committee is responsible for monitoring and overseeing these processes.

The Audit Committee held 4 meetings in 2004. The meetings were designed to facilitate and encourage communication between the Audit Committee, management, and our independent accountants. Management represented to the Audit Committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee reviewed and discussed the audited consolidated financial statements for 2004 with management and the independent accountants.

The Audit Committee discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended.

The Audit Committee has received and reviewed the written disclosures and the letter from the independent accountants, Tanner LC, as required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees. Additionally, the Audit Committee has discussed with Tanner LC the issue of its independence from TenFold.

Based on its review of the audited consolidated financial statements and the various discussions noted above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2004.

Respectfully submitted,

Richard H. Bennett, Jr.

Robert W. Felton

Ralph W. Hardy, Jr.

Robert E. Parsons, Jr.

20

Report of the Compensation Committee of the Board of Directors

Membership of the Committee

The Compensation Committee of the Board of Directors (the “Compensation Committee”) is composed of two non-employee directors: Robert W. Felton and Ralph W. Hardy, Jr. No member of the Compensation Committee has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity. From time to time the President and Chief Executive Officer, and certain officers of TenFold, attend meetings of the Committee. No officer of TenFold is present during discussions or deliberations regarding his or her own compensation.