AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 7, 2007

REGISTRATION NO. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TENFOLD CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | |

| DELAWARE | | 7371 | | 83-0302610 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

698 WEST 10000 SOUTH

SOUTH JORDAN, UTAH 84095

TELEPHONE (801) 495-1010

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert W. Felton

Chairman, President, and CEO

TenFold Corporation

698 West 10000 South

South Jordan, Utah 84095

Telephone (801) 495-1010

(Name, address, including zip code, and telephone number, including area code, of agent for service)

COPY TO:

Robert B. Knauss, Esq.

Brett J. Rodda, Esq.

Munger, Tolles & Olson LLP

355 South Grand Avenue

35th Floor

Los Angeles, CA 90071

Telephone No.: (213) 683-9100

Telecopier No.: (213) 687-3702

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, please check the following box.x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering.¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | | | |

| | |

Title of Each Class of Securities to be Registered | | Amount

to be

Registered | | | Proposed

Maximum

Offering Price

Per Share | | | Proposed

Maximum

Aggregate

Offering Price | | | Amount of

Registration

Fee(1) | |

Common Stock, par value $0.001 per share | | 36,812,416 | (1) | | $ | N/A | (1) | | $ | N/A | (1) | | $ | 0 | (1) |

| | |

| (1) | Pursuant to Rule 429 under the Securities Act of 1933, this Registration Statement is deemed to be a post – effective amendment to (i) the Registrant’s Registration Statement on Form S – 1 (File No. 333 – 140006) filed on January 16, 2007, and (ii) the Registrant’s Registration Statement on Form S – 1 (File No. 333 – 133415) filed on April 20, 2006, for which the Registrant previously paid registration fees of $238 and $1,044 to register 6,338,712 and 30,473,704 shares of Common Stock, respectively. |

Pursuant to Rule 429 under the Securities Act of 1933, this Registration Statement is deemed to be a post – effective amendment to (i) the Registrant’s Registration Statement on Form S – 1 (File No. 333 – 140006) filed on January 16, 2007, and (ii) the Registrant’s Registration Statement on Form S – 1 (File No. 333 – 133415) filed on April 20, 2006.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders named in this prospectus are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated March 7, 2007

PROSPECTUS

TENFOLD CORPORATION

36,812,416 SHARES COMMON STOCK

This is a resale prospectus for the resale of up to 36,812,416 shares of our common stock by the selling stockholders listed herein. We will not receive proceeds from the sale of our shares.

Our common stock is quoted on the OTC Bulletin Board under the symbol “TENF.OB.” On February 27, 2007, the last bid price for our common stock was $0.46 per share.

The selling stockholders may offer the shares through public or private transactions at prevailing market prices or at privately negotiated prices. See “Plan of Distribution.”

Investing in the common stock involves certain risks. See “Risk Factors” beginning on page 2 for a discussion of these risks.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS , 2007

(i)

We are a reporting company and have distributed to our stockholders annual reports containing financial statements. Our annual report on Form 10-K for the fiscal year ended December 31, 2006 was filed with the Securities and Exchange Commission February 21, 2007.

You should rely only on the information contained in this document or in documents to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where the sale of these securities is legal. The information contained in this document may only be accurate on the date on the front cover.

(ii)

FORWARD-LOOKING STATEMENTS

In addition to historical information, this prospectus contains forward-looking statements that involve risks and uncertainties that could cause our actual results to differ materially from those contained in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the section entitled “Risk Factors.” When used in this report, the words “expects,” “intends,” “anticipates,” “should,” “believes,” “will,” “plans,” “estimates,” “may,” “seeks,” “estimates” and similar expressions are generally intended to identify forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this prospectus. We undertake no obligation to publicly release any revisions to the forward-looking statements after the date of this document. You should carefully review the risk factors described in other documents we file from time to time with the Securities and Exchange Commission, including our Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K.

(iii)

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to Registration Statement on Form S-1 is being filed by TenFold Corporation, a Delaware corporation (the “Company”), relating to 36,812,416 shares of the Registrant’s Common Stock, par value $0.001 per share, for resale by the selling stockholders named herein. All of the proceeds from the resale of such shares will be paid to the selling stockholders. This Registration Statement is intended to consolidate in one place (i) the registration of 6,338,712 shares of Common Stock that were previously registered for offer and sale pursuant to a registration statement on Form S-1 (File No. 333-140006) filed on January 16, 2007, and (ii) the registration of 30,473,704 shares of Common Stock that were previously registered for offer and sale pursuant to a registration statement on Form S-1 (File No. 333-133415) filed on April 20, 2006. This Registration Statement also revises and updates certain information from the previous registration statements in accordance with Section 10(a)(3) of the Securities Act of 1933.

(iv)

PROSPECTUS SUMMARY

CORPORATE INFORMATION

We are a Delaware corporation having principal executive offices located at 698 West 10000 South, South Jordan, Utah 84095. Our telephone number is (801) 495-1010. The address of our website is www.tenfold.com. Information on our website is not part of this prospectus.

BUSINESS

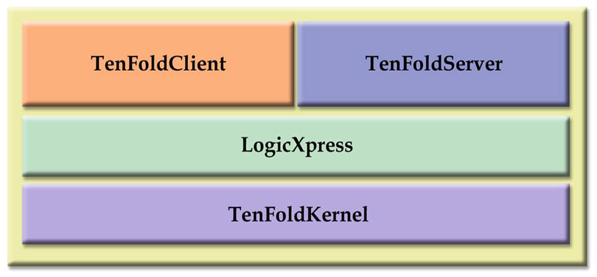

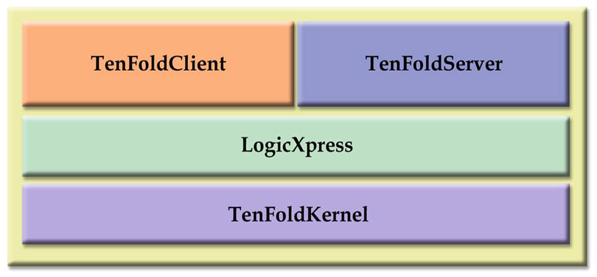

TenFold provides services and technology for building complex, Service Oriented Architecture (“SOA”)-compliant, mission-critical applications in significantly less time and cost than it would otherwise take using traditional development technologies. We believe that with TenFold’s technology, EnterpriseTenFold™ SOA (formerly “Universal Application”), customers will also experience significantly reduced ongoing applications maintenance and enhancement costs compared to what they generally experience with legacy applications.

At the end of 2005, we replaced our former Chief Executive Officer, with long-time TenFold director and shareholder, Robert W. Felton. Under his leadership, we have changed our business model to focus on selling larger consulting projects, instead of the smaller prototype application projects that we primarily sold in 2005. We believe that providing larger consulting projects (that include the full breadth of applications consulting from applications design through production implementation) will be a more successful model for both our customers and us. We believe that some of our earlier customers would have been more successful with their projects with more consulting assistance than they chose to purchase under our prior business model. We made steady progress closing new sales and beginning new consulting projects in 2006, quarter by quarter, to both existing and new customers. We also improved our quarterly operating cash flow from $(1.9) million for Q2 2006, to $(864,000) for Q3 2006, and to $21,000 for Q4 2006. However, such sales have not been sufficient to generate sustained positive cash flow from operations, or profitability. As a result, increasing sales further remains a key goal, and until we do so, we are likely to continue to experience negative cash flow from operations and losses. If we do not close significant future sales, our existing cash resources will not be sufficient to fund our operations beyond Q2 of 2007.

OUR COMMON STOCK

Our common stock is quoted on the OTC Bulletin Board under the symbol “TENF.OB.”

THE OFFERING

On December 18, 2006, we entered into a Securities Purchase Agreement for the sale of 312,009 shares of unregistered convertible preferred stock and warrants. The preferred shares are convertible into 4,225,808 shares of common stock. The warrants are to purchase 2,112,904 shares of common stock at an exercise price of $0.62 per share, with a 5 year term. The transaction generated gross proceeds of approximately $1.3 million (before expenses).

On March 29, 2006, we entered into a Securities Purchase Agreement for the sale of 1,500,000 shares of unregistered convertible preferred stock and warrants. The preferred shares are convertible into 20,315,805 shares of common stock. The warrants are to purchase 10,157,899 shares of common stock at an exercise price of $0.62 per share, with a 5 year term. The transaction generated gross proceeds of approximately $6.3 million (before expenses and repayment of $1.1 million of interim financing obligations).

The selling stockholders under this prospectus are offering for sale up to 36,812,416 shares of our common stock. We will not receive any proceeds from the resale of shares offered by the selling stockholders hereby, all of which proceeds will be paid to the selling stockholders. The purchase of our common stock involves a high degree of risk. You should carefully review and consider “Risk Factors” beginning on page 2.

1

RISK FACTORS

You should carefully consider the risks described below before purchasing our common stock. Our most significant risks and uncertainties are described below; however, they are not the only risks we face. If any of the following risks actually occur, our business, financial condition, or results of operations could be materially adversely affected, the trading of our common stock could decline, and you may lose all or part of your investment. You should acquire shares of our common stock only if you can afford to lose your entire investment.

If we are unable to generate sufficient cash flow from operations, or secure additional sources of financing in the future, we will be unable to continue operations as a going concern

While our financial statements have been prepared under the assumption that we will continue as a going concern, the independent accounting firm’s report on our December 31, 2006 financial statements, prepared by Tanner LC, included an explanatory paragraph relating to their substantial doubt as to our ability to continue as a going concern. Our business model relies upon generating new sales to existing and new customers. We closed new sales in 2006 and improved our quarterly operating cash flow from $(1.9) million for Q2 2006, to $(864,000) for Q3 2006, and to $21,000 for Q4 2006. However, such sales have not been sufficient to generate sustained positive cash flow from operations, or profitability. As a result, it is unclear if or when we can expect to close significant sales to new or existing customers; and until we repeatedly do so, we are likely to continue to experience negative cash flow from operations and losses. If we do not close significant future sales, our existing cash resources will not be sufficient to fund our operations beyond Q2 2007. Under such circumstances, we would be required to pursue one or a combination of the following remedies: seek additional sources of financing, further reduce operating expenses, sell part or all of our assets, or terminate operations. There can be no assurance that we will be successful achieving sufficient cash flow.

We continue to experience difficulty in securing customer revenue

We have experienced difficulty closing substantial new sales, and it is unclear when or if we can expect to predictably close material sales to new or existing customers. Our prior strategy of selling small, proof-of-concept initial “penetrate” projects, and then seeking to “radiate” into the account by selling additional services and licenses was not successful in generating sufficient sales to achieve profitability or positive cash flow. Under the leadership of our Chief Executive Officer, Robert W. Felton, we changed our business model to focus on selling larger consulting projects. Although we expect to be more successful with this new model, our experience with the new model is limited to this year. Furthermore, our uncertain future may make it less likely for customers to want to do business with us. As a result, there is no assurance that we will be able to convince existing customers or future prospective customers to purchase products or services from us or that any customer revenue that is achieved can be sustained. If we are unable to obtain future customer revenue or outside financing, our operations, financial condition, liquidity, and prospects will be materially and adversely affected, and we would be required to pursue one or a combination of the following remedies: seek additional sources of financing, further reduce operating expenses, sell part or all of our assets, or terminate operations.

Our sales cycle can be lengthy and subject to delays and these delays could cause our operating results to suffer

We believe that a customer’s decision to purchase significant products or services from us can involve a significant commitment of resources and be influenced by customer budget cycles. To successfully sell our products and services, we generally must educate our potential customers regarding the use and benefit of our products and services. Getting new customers to purchase significant licenses or services can require significant time and resources. Consequently, the period between initial contact and the purchase of our products or services can be long and subject to delays associated with the lengthy budgeting, approval, and competitive evaluation processes that typically accompany significant capital expenditures. Sales delays could cause our operating results to vary widely. There can be no assurance that we will not experience sales delays in the future. In addition, we face a challenging sales environment and there can be no assurance that we will have sales in the future.

We are substantially dependent on a small number of customers and the loss of one or more of these customers may cause revenues and cash flow to decline

We have derived, and over the near term we expect to continue to derive, a significant portion of our revenues and cash flow from a limited number of customers. For example, three customers accounted for a total of 47 percent of our total revenues for the year ended December 31, 2006 (individually 21 percent, 16 percent, and 10 percent, respectively). For the year ended December 31, 2005, three customers accounted for a total of 49 percent of total revenue (individually 20 percent, 18 percent and 11 percent, respectively). Significant reductions in the amount of business major customers conduct with us has previously and may in the future, materially and adversely affect our business, results of operations, financial position and liquidity. Replacing the loss of a major customer is unpredictable, and we have not been successful in doing so in the past. Revenues and cash flows from a single customer or a few major customers may constitute a significant portion of our total revenues and cash inflows in a particular period, then decline as the volume of work performed for specific customers decreases as they complete projects. A major customer in one period may not continue to purchase significant licenses or services from us in a subsequent period.

The customer accounting for 21 percent of our total revenues for the year ended December 31, 2006, DevonWay, is a related person. The revenue from DevonWay in 2006 was primarily from the recognition of previously deferred revenue from a single large license transaction in 2005. We do not expect DevonWay to account for a significant percentage of our revenues after December 31, 2006. See Note 17 of Notes to Financial Statements for more information.

Our growth and success depends on our ability to successfully implement our new business model; however, we have limited experience with the new model

Under the leadership of our new Chief Executive Officer, Robert W. Felton, we changed our business model to focus on selling larger consulting projects, instead of the smaller prototype application projects that we primarily sold in 2005. Although we hope to be more successful with this new model, our experience with the new model is limited to this year. Under this new model, we expect to take on larger, more difficult and complex consulting projects than we typically have in recent years. Under our original fixed-price project business model that we discontinued several years ago, we received customer complaints and lawsuits concerning some of our projects. Although we have substantially changed our business model, including no longer offering to do such large projects on a fixed-price basis or providing a money-back guarantee, we cannot be certain that we will not receive customer complaints in the future. Such complaints would likely adversely affect our ability to sell to other customers. If our new strategy for selling and delivering our services and products is unsuccessful, or if we are unable to close significant new business within the time frames anticipated, our revenues and operating results will continue to suffer.

2

Our historical quarterly operating results have varied significantly and our future operating results could vary

Historically, our quarterly operating results have varied significantly. For example, during some years, we have had quarterly profits followed by losses in subsequent quarters. Our future operating results may vary significantly in the future as well. Until we achieve and sustain material sales to new or existing customers, we expect to continue to experience negative cash flow from operations and losses.

Our future prospects are difficult to evaluate

In light of our operating results for recent periods and the continued difficult sales environment we face and in the technology sector in general, it is difficult to evaluate our future prospects. There can be no assurance that we will be able to successfully complete current or new projects. Additionally, our failure to successfully complete any current or new projects may have a material adverse impact on our financial position and results of operations. We cannot be certain that our business strategy will succeed.

Our failure to attract and retain highly skilled employees, particularly developers, consultants, project managers and other senior technical personnel, could impair our ability to complete projects and expand our business

Our Development organization and services business are labor intensive. We currently have only a small number of consultants in our consulting organization. We expect to supplement them on projects with members of our Development organization for projects in the near term. Longer term, our success will depend in large part upon our ability to attract, retain, train, and motivate highly skilled employees, particularly developers, consultants, project managers and other senior technical personnel. Any failure on our part to do so would impair our ability to develop new technology, adequately manage and complete existing projects, bid for and obtain new projects, and expand business. There exists significant competition for employees with the skills required to perform the services we offer. Qualified developers, consultants, project managers and senior technical staff are in great demand and are likely to remain a limited resource for the foreseeable future. Our current financial condition, and our prior restructurings and related headcount reductions, may make it more difficult for us to retain and compete for such employees. There can be no assurance that we will be successful in retaining, training, and motivating our employees or in attracting new, highly skilled employees. If we are unsuccessful in this effort or if our employees are unable to achieve expected performance levels, our business will be harmed.

A loss of Robert W. Felton, Jeffrey L. Walker, or any other key employee could impair our business

Our industry is competitive and we are substantially dependent upon the continued service of our existing executive personnel, especially Robert W. Felton, Chairman, President, and Chief Executive Officer. Furthermore, our products and technologies are complex and we are substantially dependent upon the continued service of our senior technical staff, including Jeffrey L. Walker, Executive Vice President, and Chief Technology Officer. If a key employee resigns to join a competitor or to form a competing company, the loss of the employee and any resulting loss of existing or potential customers to the competing company would harm our business. We do not carry key-man life insurance on any of our employees. We have not entered into employment agreements with our executives. In the event of the loss of key personnel, there can be no assurance that we would be able to prevent their unauthorized disclosure or use of our technical knowledge, practices, or procedures.

If we fail to adequately anticipate employee and resource utilization rates, our operating results could suffer

A high percentage of our operating expenses, particularly personnel and rent, are relatively fixed in advance of any particular quarter. As a result, unanticipated variations in the number, or progress toward completion, of our projects or in employee utilization rates did and may continue to cause significant variations in operating results in any particular quarter and could result in quarterly losses. Time-and-materials consulting arrangements can typically be terminated by a customer on short notice. An unanticipated termination of a major project, the delay of a project, or the completion during a quarter of several projects has in the past and may continue to result in under-utilized employees and could, therefore, cause us to suffer quarterly losses or cause adverse results of operations.

Our errors and omissions coverage may not cover contractual disputes

While we maintain errors and omissions insurance coverage for claims related to customer contract disputes within the coverage scope and term, given the nature and complexity of the factors affecting the estimated liabilities, actual liabilities may exceed or be outside the scope of our current errors and omissions coverage. We can give no assurance that our insurance carrier will extend coverage to future claims. In addition, no assurance can be given that we will not be subject to material additional liabilities and significant additional litigation relating to errors and omissions arising from future claims.

Our errors and omissions insurance policy is in the form of an industry standard software errors and omissions policy. As such, it only covers software errors and omissions that occur after the delivery of software and excludes contractual disputes such as service commitments and cost and time related guarantees. We have previously had contractual disputes related to our guarantees. While we have substantially changed our business model and no longer offer a money-back guarantee, no assurance can be given that we will not be subject to these types of claims in the future. In the event that liabilities from claims are not covered by or exceed our errors and omissions coverage, our business, results of operations, financial position, or liquidity could be materially and adversely affected.

If our software contains defects or other limitations, we could face product liability exposure

Because of our limited operating history and our small number of customers, we have completed a limited number of projects that are now in production. As a result, there may be undiscovered material defects in our products or technology. Furthermore, complex software products often contain errors or defects, particularly when first introduced or when new versions or enhancements are released. Despite internal testing and testing by current and potential customers, our current and future products may contain serious defects. Serious defects or errors could result in lost revenues or a delay in market acceptance, which would damage our reputation and business.

Because our customers may use our products for enterprise-scale applications, errors, defects, or other performance problems could result in financial or other damages to customers. Our customers could seek damages for these losses. Any successful claims for these losses, to the extent not covered by insurance, could result in our being obligated to pay substantial damages, which would cause operating results to suffer. Although our license agreements typically contain provisions designed to limit our liability, existing or future laws or unfavorable judicial decisions could negate these limitations of liability provisions. A product liability claim brought against us, even if not successful, would likely be time consuming and costly.

3

We are involved in one litigation matter, and may in the future be involved in further litigation or disputes that may be costly and time-consuming, and if we suffer adverse outcomes, our operating results could suffer

We are involved in a class action suit against more than 300 issuers involving the underwriters of those issuers’ initial public offerings. Although we currently expect to resolve this matter without significant cost to TenFold, that outcome is not assured, and we may in the future face other litigation or disputes with customers, employees, business partners, stockholders, or other third parties. Such litigation or disputes could result in substantial costs and diversion of resources that would harm our business. An unfavorable outcome of this matter may have a material adverse impact on our business, results of operations, financial position, or liquidity.

See Note 9 “Legal Proceedings and Contingencies” of Notes to Financial Statements for more information concerning our litigation and disputes.

If we cannot protect or enforce our intellectual property rights, our competitive position would be impaired and we may become involved in costly and time-consuming litigation

Our success is dependent, in large part, upon our proprietary EnterpriseTenFold technology and other intellectual property rights. If we are unable to protect and enforce these intellectual property rights, our competitors will have the ability to introduce competing products that are similar to ours, and our revenues, market share, and operating results will suffer. To date, we have relied primarily on a combination of patent, copyright, trade secret, and trademark laws, and nondisclosure and other contractual restrictions on copying and distribution to protect our proprietary technology. We have been issued three patents in the United States and intend to continue to seek patents on our technology when appropriate. There can be no assurance that the steps we have taken in this regard will be adequate to deter misappropriation of our proprietary information or that we will be able to detect unauthorized use and take appropriate steps to enforce our intellectual property rights. The laws of some countries may not protect our intellectual property rights to the same extent as do the laws of the United States. Furthermore, litigation may be necessary to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others, or to defend against claims of infringement or invalidity. This litigation could result in substantial costs and diversion of resources that would harm our business.

To date, we have not been notified that our products infringe the proprietary rights of third parties, but there can be no assurance that third parties will not claim infringement by us with respect to current or future products. We expect software developers will increasingly be subject to infringement claims as the number of products and competitors in our industry segment grows and the functionality of products in different industry segments overlaps. Any of these claims, with or without merit, could be time-consuming to defend, result in costly litigation, divert management’s attention and resources, cause product delivery delays, or require us to enter into royalty or licensing agreements. These royalty or licensing agreements, if required, may not be available on terms acceptable to us, or at all. A successful claim against us of product infringement and our failure or inability to license the infringed or similar technology on favorable terms would harm our business.

If we fail to successfully compete, our revenues and market share will be adversely affected

The market for our products and services is highly competitive, and if we are not successful in competing in this market, our revenues and market share will suffer. Many of our competitors have significantly greater financial, technical and marketing resources, generate greater revenues, and have greater name recognition than we do. In addition, there are relatively low barriers to entry into our markets and we have faced, and expect to continue to face, additional competition from new entrants into our markets.

International political and economic uncertainty could have an adverse impact on our business and on our operating results

Revenues from customers outside of North America were approximately 8 percent of total revenues for 2006, and approximately 11 percent of total revenues for 2005. The international political and economic uncertainty caused by the ongoing war on terrorism and other international political developments may adversely impact our ability to continue existing relationships with our foreign customers and to develop new business abroad.

Our stock price may continue to be volatile

Our stock price has fluctuated widely in the past and could continue to do so in the future. Your investment in our stock could lose value. Some of the factors that could significantly affect the market price of our stock, in addition to those mentioned in this section, include: further decreases in our cash resources, changes in our revenue; changes in our customer base including the loss of a major customer; changes in management; variations in our quarterly financial results; problems implementing our business model; reports or earnings estimates published by financial analysts; changes in political, economic and market conditions either generally or specifically to particular industries; and fluctuations in stock prices generally, particularly with respect to the stock prices for other technology companies. A significant drop in our stock price could expose us to the risk of securities class action lawsuits. Defending against such lawsuits could result in substantial costs and divert management’s attention and resources. An unfavorable outcome of such a matter may have a material adverse impact on our business, results of operations, financial position, or liquidity.

No corporate actions requiring stockholder approval can take place without the approval of our controlling stockholders

The executive officers, directors, and entities affiliated with them, in the aggregate, beneficially own approximately 67 percent of our voting stock (as calculated using the SEC’s conventions). These stockholders acting together or with others would be able to decide or significantly influence all matters requiring approval by our stockholders, including the election of directors and the approval of mergers or other business combination transactions. This concentration of ownership may have the effect of delaying or preventing a merger or other business combination transaction, even if the transaction would be beneficial to our other stockholders.

The anti-takeover provisions in our charter documents and/or under Delaware law could discourage a takeover that stockholders may consider favorable

Provisions of our certificate of incorporation, bylaws, stock incentive plans and Delaware law may discourage, delay, or prevent a merger or acquisition that a stockholder may consider favorable.

4

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of shares of our common stock offered by the selling stockholders. We are registering the shares for resale to provide the holders thereof with freely tradable securities, but the registration of such shares does not necessarily mean that any of such shares will be offered or sold by the holders thereof.

5

MARKET FOR OUR COMMON STOCK

Our common stock is quoted on the OTC Bulletin Board under the trading symbol “TENF.OB.” Our high and low prices by quarter during 2006 and 2005 are presented below. These prices reflect inter-dealer quotations and may not represent actual transactions.

| | | | | | |

| | | 2006 |

| | | HIGH | | LOW |

First Quarter | | $ | 0.45 | | $ | 0.20 |

Second Quarter | | $ | 0.50 | | $ | 0.21 |

Third Quarter | | $ | 0.32 | | $ | 0.15 |

Fourth Quarter | | $ | 0.41 | | $ | 0.15 |

| |

| | | 2005 |

| | | HIGH | | LOW |

First Quarter | | $ | 0.99 | | $ | 0.36 |

Second Quarter | | $ | 0.59 | | $ | 0.34 |

Third Quarter | | $ | 0.41 | | $ | 0.31 |

Fourth Quarter | | $ | 0.40 | | $ | 0.21 |

On December 31, 2006, we had approximately 243 stockholders of record of our common stock and 46,557,745 shares of our common stock were issued and outstanding. On February 27, 2007, the last bid price for our common stock was $0.46 per share.

We have never declared or paid dividends on our common stock. We expect to retain any earnings generated by our operations for the development and growth of our business, and we do not anticipate paying any dividends to our stockholders for the foreseeable future.

6

SELECTED FINANCIAL INFORMATION

The selected statement of operations data for the years ended December 31, 2006, 2005, 2004, 2003, and 2002, and the selected balance sheet data as of December 31, 2006, 2005, 2004, 2003, and 2002, are derived from, and are qualified by reference to, our audited financial statements. The historical results are not necessarily indicative of future results.

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| | | (in thousands, except per share data) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

License | | $ | 1,424 | | | $ | 515 | | | $ | 359 | | | $ | 248 | | | $ | 207 | |

Subscription | | | — | | | | — | | | | — | | | | 10,431 | | | | 15,548 | |

Services and other | | | 3,574 | | | | 5,195 | | | | 17,234 | | | | 17,030 | | | | 12,475 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 4,998 | | | | 5,710 | | | | 17,593 | | | | 27,709 | | | | 28,230 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Cost of revenues | | | 2,778 | | | | 2,940 | | | | 5,883 | | | | 9,454 | | | | 12,998 | |

Sales and marketing | | | 812 | | | | 2,896 | | | | 2,861 | | | | 1,088 | | | | 1,985 | |

Research and development | | | 4,100 | | | | 3,531 | | | | 3,734 | | | | 3,471 | | | | 6,229 | |

General and administrative | | | 2,818 | | | | 2,986 | | | | 2,315 | | | | 3,046 | | | | 7,803 | |

Special charges | | | — | | | | — | | | | — | | | | (673 | ) | | | 2,838 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 10,508 | | | | 12,353 | | | | 14,793 | | | | 16,386 | | | | 31,853 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations | | | (5,510 | ) | | | (6,643 | ) | | | 2,800 | | | | 11,323 | | | | (3,623 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total other income, net | | | 92 | | | | 137 | | | | 240 | | | | 2,456 | | | | 1,938 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (5,418 | ) | | | (6,506 | ) | | | 3,040 | | | | 13,779 | | | | (1,685 | ) |

Provision (benefit) for income taxes | | | (235 | ) | | | (1,072 | ) | | | (376 | ) | | | 32 | | | | (497 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | (5,183 | ) | | | (5,434 | ) | | | 3,416 | | | | 13,747 | | | | (1,188 | ) |

Deemed dividend related to warrants issued with preferred stock and beneficial conversion feature on preferred stock | | | (2,207 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) applicable to common shareholders | | $ | (7,390 | ) | | $ | (5,434 | ) | | $ | 3,416 | | | $ | 13,747 | | | $ | (1,188 | ) |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per common share | | $ | (0.16 | ) | | $ | (0.12 | ) | | $ | 0.07 | | | $ | 0.34 | | | $ | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per common share | | $ | (0.16 | ) | | $ | (0.12 | ) | | $ | 0.06 | | | $ | 0.29 | | | $ | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Weighted average shares - basic (1) | | | 46,518 | | | | 46,423 | | | | 46,204 | | | | 40,634 | | | | 37,249 | |

| | | | | | | | | | | | | | | | | | | | |

Weighted average shares - diluted (1) | | | 46,518 | | | | 46,423 | | | | 54,924 | | | | 47,623 | | | | 37,249 | |

| | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 3,601 | | | $ | 1,344 | | | $ | 5,225 | | | $ | 12,236 | | | $ | 3,838 | |

Total current assets | | | 4,461 | | | | 1,716 | | | | 5,715 | | | | 13,489 | | | | 7,654 | |

Total assets | | | 4,676 | | | | 2,142 | | | | 6,415 | | | | 14,417 | | | | 9,284 | |

Total current liabilities | | | 2,778 | | | | 5,078 | | | | 4,098 | | | | 15,857 | | | | 34,484 | |

Long-term obligations, redeemable preferred and common stock, less current portion | | | — | | | | 10 | | | | 36 | | | | — | | | | 25 | |

Stockholders’ equity (deficit) | | | 1,898 | | | | (2,946 | ) | | | 2,281 | | | | (1,440 | ) | | | (25,225 | ) |

Working capital (deficit) | | | 1,683 | | | | (3,362 | ) | | | 1,617 | | | | (2,368 | ) | | | (26,830 | ) |

| (1) | See Note 4 to the financial statements for an explanation of the determination of the method used to determine the number of shares used in computing net earnings (loss) per share. |

7

SUPPLEMENTARY FINANCIAL INFORMATION

The following tables set forth certain unaudited quarterly results of our operations for 2006 and 2005. In the opinion of management, this information has been prepared on the same basis as the audited financial statements and all necessary adjustments, consisting only of normal recurring adjustments, have been included in the amounts stated below to present fairly the quarterly information when read in conjunction with the audited financial statements and notes thereto included in our Annual Report on Form 10-K. The quarterly operating results are not necessarily indicative of future results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended | |

| | | Mar 31,

2005 | | | June 30,

2005 | | | Sept 30,

2005 | | | Dec 31,

2005 | | | Mar 31,

2006 | | | June 30,

2006 | | | Sept 30,

2006 | | | Dec 31,

2006 | |

| | | (in thousands, except per share data)(unaudited) | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

License | | $ | 93 | | | $ | 223 | | | $ | 124 | | | $ | 75 | | | $ | 87 | | | $ | 54 | | | $ | 176 | | | $ | 1,107 | |

Services and other | | | 1,515 | | | | 1,478 | | | | 1,368 | | | | 834 | | | | 512 | | | | 656 | | | | 931 | | | | 1,475 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 1,608 | | | | 1,701 | | | | 1,492 | | | | 909 | | | | 599 | | | | 710 | | | | 1,107 | | | | 2,582 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenues | | | 994 | | | | 757 | | | | 707 | | | | 482 | | | | 586 | | | | 634 | | | | 704 | | | | 854 | |

Sales and marketing | | | 714 | | | | 846 | | | | 667 | | | | 669 | | | | 191 | | | | 270 | | | | 216 | | | | 135 | |

Research and development | | | 943 | | | | 876 | | | | 824 | | | | 888 | | | | 1,123 | | | | 1,094 | | | | 1,073 | | | | 810 | |

General and administrative | | | 631 | | | | 592 | | | | 637 | | | | 1,126 | | | | 612 | | | | 409 | | | | 1,207 | | | | 590 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 3,282 | | | | 3,071 | | | | 2,835 | | | | 3,165 | | | | 2,512 | | | | 2,407 | | | | 3,200 | | | | 2,389 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations | | | (1,674 | ) | | | (1,370 | ) | | | (1,343 | ) | | | (2,256 | ) | | | (1,913 | ) | | | (1,697 | ) | | | (2,093 | ) | | | 193 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total other income (expense), net | | | 99 | | | | 20 | | | | 12 | | | | 6 | | | | (11 | ) | | | 45 | | | | 28 | | | | 30 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (1,575 | ) | | | (1,350 | ) | | | (1,331 | ) | | | (2,250 | ) | | | (1,924 | ) | | | (1,652 | ) | | | (2,065 | ) | | | 223 | |

Provision (benefit) for income taxes | | | 1 | | | | 6 | | | | (990 | ) | | | (89 | ) | | | — | | | | — | | | | — | | | | (235 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | (1,576 | ) | | | (1,356 | ) | | | (341 | ) | | | (2,161 | ) | | | (1,924 | ) | | | (1,652 | ) | | | (2,065 | ) | | | 458 | |

Deemed dividend related to warrants issued with preferred stock and beneficial conversion feature | | | — | | | | — | | | | — | | | | — | | | | (1,761 | ) | | | — | | | | — | | | | (446 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) applicable to common shareholders | | $ | (1,576 | ) | | $ | (1,356 | ) | | $ | (341 | ) | | $ | (2,161 | ) | | $ | (3,685 | ) | | $ | (1,652 | ) | | $ | (2,065 | ) | | $ | 12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per common share | | $ | (0.03 | ) | | $ | (0.03 | ) | | $ | (0.01 | ) | | $ | (0.05 | ) | | $ | (0.08 | ) | | $ | (0.04 | ) | | $ | (0.04 | ) | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per common share | | $ | (0.03 | ) | | $ | (0.03 | ) | | $ | (0.01 | ) | | $ | (0.05 | ) | | $ | (0.08 | ) | | $ | (0.04 | ) | | $ | (0.04 | ) | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

8

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Business Overview

TenFold provides services and technology for building complex, Service Oriented Architecture (“SOA”)-compliant, enterprise-scale applications in significantly less time and cost than it would otherwise take using traditional development technologies. We believe that with TenFold’s technology, EnterpriseTenFold SOA, customers will also experience significantly reduced ongoing applications maintenance and enhancement costs compared to what they generally experience with legacy applications.

Our business model focuses on providing applications development services and our EnterpriseTenFold SOA product, along with product support and training, to customers who can use a TenFold team or their own business teams to build and maintain applications.

Critical Accounting Policies

The fundamental objective of financial reporting is to provide useful information that allows a reader to comprehend our business activities. To aid in that understanding, management has identified the “critical accounting policies” below. These policies have the potential to have a more significant impact on our financial statements, either because of the significance of the financial statement item to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events which are continuous in nature.

Revenue Recognition and Project Profitability

We believe risks relating to revenue recognition include the judgment required to determine project profit or loss projections on time-and-material contracts. We recognize time-and-materials revenue at the lowest point in the range of estimated profit margin, which represents our best estimate of the profit to be achieved. Variances may occur if we are unable to collect time-and-materials billings or if we grant concessions to time-and-materials customers in order to sell additional business or collect cash under the contract. As we occasionally provide services on a fixed price basis, risks relating to revenue recognition also include the judgment and estimation required to determine fixed-price project completion percentages, and fixed-price project profit or loss projections. Variances between management’s estimates and actual results may result in significant adjustments to our results of operations and financial position.

Stock-Based Compensation

In accordance with SFAS 123(R), we measure compensation cost for stock awards at fair value and recognize compensation over the service period for awards expected to vest. The estimation of stock awards that will ultimately vest requires judgment, and to the extent actual results or updated estimates differ from our current estimates, such amounts will be recorded as a cumulative adjustment in the period estimates are revised. We consider many factors when estimating expected forfeitures, including types of awards, employee roles, and historical experience. Actual results, and future changes in estimates, may differ substantially from our current estimates. See Note 18 of Notes to Financial Statements for more information.

Litigation Reserves

We review asserted litigation claims each quarter to determine the likelihood that the claim will result in a loss. Significant management judgment is required to conclude on the likely outcome of outstanding litigation. If a loss is probable on a litigation claim, management estimates the loss and we accrue the estimated loss. If a loss is considered probable but cannot be reasonably estimated, we disclose the contingency in the notes to our financial statements. Losses may result on litigation claims that are not considered probable or are not estimable at the current time, potentially having a significant impact on future financial results.

Results of Operations

The following table sets forth, for the periods indicated, the percentage relationship of selected items from our statements of operations to total revenues.

| | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | |

Revenues: | | | | | | | | | |

License | | 28 | % | | 9 | % | | 2 | % |

Services and other | | 72 | % | | 91 | % | | 98 | % |

| | | | | | | | | |

Total revenues | | 100 | % | | 100 | % | | 100 | % |

Operating expenses: | | | | | | | | | |

Cost of revenues | | 56 | % | | 51 | % | | 34 | % |

Sales and marketing | | 16 | % | | 51 | % | | 16 | % |

Research and development | | 82 | % | | 62 | % | | 21 | % |

General and administrative | | 56 | % | | 52 | % | | 13 | % |

| | | | | | | | | |

Total operating expenses | | 210 | % | | 216 | % | | 84 | % |

| | | | | | | | | |

Income (loss) from operations | | (110 | %) | | (116 | %) | | 16 | % |

Total other income, net | | 2 | % | | 2 | % | | 1 | % |

| | | | | | | | | |

Income (loss) before income taxes | | (108 | %) | | (114 | %) | | 17 | % |

Provision (benefit) for income taxes | | (4 | %) | | (19 | %) | | (2 | %) |

| | | | | | | | | |

Net income (loss) | | (104 | %) | | (95 | %) | | 19 | % |

| | | | | | | | | |

Deemed dividend related to warrants issued with preferred stock and beneficial conversion feature on preferred stock | | (44 | %) | | — | | | — | |

| | | | | | | | | |

Net income (loss) applicable to common shareholders | | (148 | %) | | (95 | %) | | 19 | % |

| | | | | | | | | |

9

2006 as Compared to 2005

Revenues

Total revenues decreased $712,000 or 12 percent, to $5.0 million for the year ended December 31, 2006, as compared to $5.7 million for the year ended December 31, 2005.

Services and other revenues decreased $1.6 million, or 31 percent, to $3.6 million for the year ended December 31, 2006 as compared to $5.2 million for the year ended December 31, 2005. The decrease in services and other revenues is primarily due to decreases in revenues from certain customers who purchased less services from us over time as they completed their application development projects. Although we have sold and begun new consulting projects in 2006, they are not as large as these particular prior projects.

License revenues increased $909,000, or 177 percent, to $1.4 million for the year ended December 31, 2006 as compared to $515,000 for the year ended December 31, 2005. The 2006 license revenue includes $1 million from DevonWay, a related person, that was deferred from 2005, because the license agreement contained a discount that could not be determined at the inception of the agreement. We used the end of the estimated economic life to recognize the revenue because we did not have vendor specific objective evidence of fair value (“VSOE”) for the related post-contract customer support, due to the discount, and therefore we did not allocate the revenue until the discount was known at the end of the estimated economic life. Although we recognized the revenue in 2006, we received the cash from the transaction in 2005.

During 2005, we entered into agreements with a new customer, DevonWay, to provide licenses, consulting services, technical support services, and training. Our Chairman, CEO and President, Robert W. Felton, is the founder and owner of DevonWay. All disinterested members of our Board of Directors approved of these related person transactions and our general ongoing business relationship with DevonWay. Our revenues from DevonWay for the year ended December 31, 2006, and December 31, 2005, are license revenues of $1.0 million and $160,000, respectively, and services and other revenue of $55,000 and $439,000, respectively. See Note 17 of the Notes to Financial Statements for more information.

Three customers accounted for 21 percent, 16 percent and 10 percent of our total revenues for the year ended December 31, 2006, compared to three customers accounting for 20 percent, 18 percent and 11 percent of our total revenues for the year ended December 31, 2005. No other single customer accounted for 10 percent or more of our total revenues for the year ended December 31, 2006 or 2005.

The revenue from the customer accounting for 21 percent of our total revenues for the year ended December 31, 2006, DevonWay, was primarily from the recognition of previously deferred license revenue from a single transaction in 2005. We do not expect DevonWay to account for a significant percentage of our revenues after December 31, 2006.

We continue to actively market to new and existing customers. We have sold and begun several new consulting projects recently in 2006. However, such sales have not been sufficient to generate sustained positive cash flow from operations or profitability. We continue to face a challenging sales environment. As a result, it is unclear if or when we can expect to close significant sales to new or existing customers, and until we repeatedly do so we are likely to continue to experience negative cash flow from operations and losses.

Operating Expenses

Cost of Revenues.Cost of revenues consists primarily of compensation and other related costs of personnel and contractors to provide applications development and implementation consulting, support, and training services. Cost of revenues decreased $162,000, or 6 percent, to $2.8 million for the year ended December 31, 2006 as compared to $2.9 million for the year ended December 31, 2005. The decrease in cost of revenues is primarily due to having fewer staff working on customer projects in 2006. The decrease was partially offset by an increase in stock-based compensation expense in 2006 as a result of SFAS 123(R). See Note 18 of Notes to Financial Statements for more information on stock-based compensation expenses.

Sales and Marketing. Sales and marketing expenses consist primarily of compensation, travel, and other related expenses for sales and marketing personnel; and marketing seminars, public relations, advertising and other marketing expenses. Sales and marketing expenses decreased $2.1 million, or 72 percent, to $812,000 for the year ended December 31, 2006 as compared to $2.9 million for the year ended December 31, 2005. The decreases in sales and marketing expenses are due to our discontinuing most discretionary marketing programs in late 2005 in connection with the change in sales focus under our new Chief Executive Officer, Robert W. Felton, and to conserve our financial resources; as well as from a decrease in sales and marketing headcount.

Research and Development.Research and development expenses consist primarily of compensation and other related costs of personnel dedicated to research and development activities. Research and development expenses increased $569,000, or 16%, to $4.1 million for the year ended December 31, 2006, as compared to $3.5 million for the year ended December 31, 2005. The increase in research and development expenses is due to recognition of stock-based compensation expense in 2006 as a result of SFAS 123(R), which was partially offset by a decrease from having fewer staff working on research and development activities in 2006 compared to 2005. See Note 18 of Notes to Condensed Financial Statements for more information on stock-based compensation expenses.

General and Administrative.General and administrative expenses consist primarily of the costs of executive management, finance and administrative staff, business insurance, and professional fees. General and administrative expenses decreased $168,000, or 6 percent, to $2.8 million for the year ended December 31, 2006 as compared to $3.0 million for the year ended December 31, 2005. The decrease is due primarily to general and administrative expenses for 2005 including severance costs for our prior CEO, as well as from lower general and administrative staffing in 2006 compared to 2005. The decreases in general and administrative costs were partially offset by an increase in stock-based compensation expense in 2006 associated with SFAS 123(R). See Note 18 of Notes to Financial Statements for more information on stock-based compensation expenses.

10

Total Other Income, net

Net total other income was $92,000 for the year ended December 31, 2006, as compared to $137,000 for the year ended December 31, 2005.

Provision for Income Taxes

The benefit for income taxes was $235,000 for the year ended December 31, 2006 as compared to a benefit of $1.1 million for the year ended December 31, 2005. The benefit for income taxes for the years ended December 31, 2006 and 2005 relate primarily to reversing accruals for state taxes that were no longer deemed necessary.

At December 31, 2006, we had established a valuation allowance of $40.1 million for the net deferred tax assets related to temporary differences, foreign tax credit carryforwards and projected net operating loss carryforwards. The valuation allowance was recorded in accordance with the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 109, Accounting for Income Taxes, which requires that a valuation allowance be established when there is significant uncertainty as to the realizability of the deferred tax assets. Based on a number of factors, including the size of the prior operating losses, the currently available, objective evidence indicates that it is more likely than not that the net deferred tax assets will not be realized.

Deemed dividend related to convertible preferred stock

As a result of the warrants sold with the convertible preferred stock and the beneficial conversion feature inherent in the conversion rights and preferences of the convertible preferred stock issued in March and December 2006, we recognized non-cash deemed dividends totaling $2,207,000 in 2006. The deemed dividends were calculated based on the conversion price compared to the market price on the date of issuance of the convertible preferred shares.

Balance Sheet Items

Notes payable. In December 2005, we executed promissory notes due to three members of our Board of Directors (or investment entities associated with those Directors), for a total of $600,000. During the quarter ended March 31, 2006, we executed additional similar notes totaling $500,000 to our Chief Executive Officer, Robert W. Felton. We repaid these notes in full in March 2006, upon completing the March equity financing transaction. See Notes 7 and 11 of the Notes to Financial Statements for more information.

Deferred revenues. We had deferred revenues of $1.4 million at December 31, 2006 compared to $2.2 million at December 31, 2005. The decrease results primarily from recognizing as revenue during the year ended December 31, 2006, a $1 million license payment we received from DevonWay in August 2005. For accounting purposes we deferred revenue recognition of this revenue until December 2006, the end of the estimated economic life of the release of EnterpriseTenFold provided to DevonWay, because the license agreement contained a discount that could not be determined at inception of the agreement, as discussed above. This decrease was partially offset by a prepayment of $344,000 we received during the three months ended December 31, 2006 for a consulting project starting in early 2007, in exchange for our continuing this customers’ existing discounted time-and-materials consulting rate for the new project.

2005 as Compared to 2004

Revenues

Total revenues decreased $11.9 million or 68 percent, to $5.7 million for the year ended December 31, 2005, as compared to $17.6 million for the year ended December 31, 2004.

Services and other revenues decreased $12 million, or 70 percent, to $5.2 million for the year ended December 31, 2005 as compared to $17.2 million for the year ended December 31, 2004. Services and other revenues for the year ended December 31, 2004 include $8.1 million in revenues, and $150,000 in operating costs, recognized during the quarter ended June 30, 2004, related to the completion of an earlier fixed-price applications development project with Cedars-Sinai Medical Center (“Cedars”). This completed the recognition of these revenues and related costs that were deferred in prior years pending confirmation of the completion of the applications development project and resolution of potential disputes between the parties. Excluding the effect of this Cedars transaction, we would have had total revenues of $9.5 million, and a net loss of $4.5 million for the year ended December 31, 2004.

In addition to the decrease related to the Cedars transaction, services and other revenues decreased due to decreases in revenues from certain customers who purchased less time-and-materials consulting from us over time as they completed their applications development projects. One customer completed its use of our time-and-materials consulting services for its applications development project during the quarter ended September 30, 2004. Another large customer’s time-and-materials consulting engagement was substantially completed during the quarter ended March 31, 2005. These decreases were partially offset by consulting revenues from new customers.

During 2005, we entered into agreements with a new customer, DevonWay, to provide licenses, consulting services, technical support services, and training, for approximately $1.6 million. A long-time member of our Board of Directors and our recently elected Chairman, CEO and President, Robert W. Felton, is the founder and owner of DevonWay. All disinterested members of our Board of Directors approved of these related person transactions and our general ongoing business relationship with DevonWay. Our revenues from DevonWay for the year ended December 31, 2005, were license revenues of $160,000, and services and other revenue of $439,000. See Note 17 of the Notes to Financial Statements for more information.

Although customers purchased licenses with contract values totaling $1.5 million (including a $1 million license sold to DevonWay) for the year ending December 31, 2005, we recorded license revenues for accounting purposes of $515,000, up from $359,000 for the year ending December 31, 2004. For accounting purposes, the amounts allocated to individual contract elements (such as licenses) may differ from the amounts stated in the contract for those individual elements, and the timing of their recognition as revenue may be later than the period in which they are sold. See Note 3 of the Notes to Financial Statements for more information.

11

Three customers accounted for 20 percent, 18 percent and 11 percent of our total revenues for the year ended December 31, 2005, compared to three customers accounting for 50 percent (Cedars), 22 percent and 15 percent of our total revenues for the year ended December 31, 2004. No other single customer accounted for 10 percent or more of our total revenues for the year ended December 31, 2005 or 2004.

The customer accounting for 20 percent of our total revenues for the year ended December 31, 2005, completed its use of our time-and-materials consulting services for its application development project during the quarter ended December 31, 2005. The customer accounting for 18 percent of our total revenues for the year ended December 31, 2005, substantially completed its application development project during the quarter ended March 31, 2005. The customer accounting for 11 percent of our total revenues for the year ended December 31, 2005, DevonWay, is a related person, as noted above.

Operating Expenses

Cost of Revenues.Cost of revenues consists primarily of compensation and other related costs of personnel and contractors to provide applications development and implementation consulting, support, and training services. Cost of revenues decreased $2.9 million, or 50 percent, to $2.9 million for the year ended December 31, 2005 as compared to $5.9 million for the year ended December 31, 2004. The decrease in cost of revenues was primarily due to having a smaller staff (particularly subcontractors) working on customer projects as these customers completed their current application development projects. In particular, the UK project that ended during the quarter ended September 30, 2004 was staffed with subcontractors who we released upon completion of the services.

Sales and Marketing. Sales and marketing expenses consist primarily of compensation, travel, and other related expenses for sales and marketing personnel; and marketing seminars, public relations, advertising and other marketing expenses. Sales and marketing expenses increased $35,000, or 1 percent, to $2.9 million for the year ended December 31, 2005 as compared to $2.9 million for the year ended December 31, 2004. In connection with the change in sales focus under our new Chief Executive Officer, Robert W. Felton, and to conserve our financial resources, we discontinued most discretionary marketing spending in December 2005.

Research and Development.Research and development expenses consist primarily of compensation and other related costs of personnel dedicated to research and development activities. Research and development expenses decreased $203,000, or 5%, to $3.5 million for the year ended December 31, 2005, as compared to $3.7 million for the year ended December 31, 2004.

General and Administrative.General and administrative expenses consist primarily of the costs of executive management, finance and administrative staff, business insurance, and professional fees. General and administrative expenses increased $671,000, or 29 percent, to $3.0 million for the year ended December 31, 2005 as compared to $2.3 million for the year ended December 31, 2004. The increase in general and administrative expenses for the year ended December 31, 2005 was primarily due to the recognition of estimated severance related charges related to the departure of our prior CEO totaling $670,000, including an estimated option modification charge of $157,000.

During the quarter ended March 31, 2004, we reduced some variable compensation accrued during 2003, to lower levels that we believe better reflect our estimates. This reduced operating expenses for the first quarter of 2004 by $219,000.

Total Other Income, net

Net total other income was $137,000 for the year ended December 31, 2005, as compared to $240,000 for the year ended December 31, 2004.

Provision for Income Taxes

The benefit for income taxes was $1.1 million for the year ended December 31, 2005 as compared to a benefit of $376,000 for the year ended December 31, 2004. The benefit for income taxes for the years ended December 31, 2005 and 2004 relate primarily to reversing accruals for foreign and state taxes that were no longer deemed necessary.

At December 31, 2005, we had established a valuation allowance of $39.1 million for the net deferred tax assets related to temporary differences, foreign tax credit carryforwards and projected net operating loss carryforwards.

Liquidity and Capital Resources

Net cash used in operating activities was $4.4 million for the year ended December 31, 2006 as compared to $4.5 million for 2005. The decrease in cash flow used in operating activities results from decreases in cash outflows from reduced expenses, which was largely offset by decreases in cash inflows from certain large customers.

Net cash used in investing activities was $31,000 for the year ended December 31, 2006 as compared to net cash used in investing activities of $17,000 for 2005.

Net cash provided by financing activities was $6.7 million for the year ended December 31, 2006 as compared to $604,000 for 2005. Net cash provided by financing for the year ended December 31, 2006, included $7.3 million of net proceeds from the sale of convertible preferred stock and warrants, $500,000 from issuance of notes payable, less $1.1 million in principal payments on notes payable which were repaid in full upon closing our capital raising transaction in March 2006. Net cash provided by financing activities for the year ended December 31, 2005 also included $600,000 from the issuance of notes payable to three members of our Board of Directors (or investment entities associated with those Directors). See Note 7 of the Notes to Financial Statements for more information.

Our deferred revenue balance generally results from contractual commitments made by customers to pay amounts to us in advance of revenues earned. We had deferred revenue balances of $1.4 million at December 31, 2006 and $2.2 million at December 31, 2005. When, over time, we recognize these deferred revenue balances as revenues in the statement of operations, we will not have corresponding increases in cash, as the related cash amounts have previously been received by us. Our unbilled accounts receivable represents revenue that we have earned but which we have not yet billed.

12

As of December 31, 2006, our principal source of liquidity was our cash and cash equivalents of $3.6 million. Although we made progress in 2006 closing new sales and improving our cash flow, such sales have not been sufficient to generate sustained positive cash flow from operations, or profitability. As a result, significant challenges and risks remain:

| | • | | We have not been able to generate positive cash flow from operations for the four years ended December 31, 2006. Our net cash used in operating activities was $4.4 million for the year ended December 31, 2006, and $4.5 million for the year ended December 31, 2005. |

| | • | | During 2004 and 2005, we derived a significant portion of our cash inflows from time-and-materials consulting services performed for a limited number of large customers for whom we were completing enterprise applications development projects. As these customers completed their projects, they reduced their purchases of time-and-materials consulting services, which materially reduced our cash inflows. Although we have sold and begun new consulting projects in 2006, they are not as large as these particular prior projects. |

| | • | | We have experienced difficulty closing substantial new sales, and it is unclear when or if we can expect to predictably close material sales to new or existing customers, and to achieve and sustain positive cash flow from operations. Under the leadership of our new Chief Executive Officer, Robert W. Felton, we changed our business model to focus on selling larger consulting projects, instead of the smaller prototype application projects that we primarily sold in 2005. Although we expect to be more successful with this new model, our experience with the new model is limited to this year. We closed new sales in 2006 and improved our quarterly operating cash flow from $(1.9) million for Q2 2006, to $(864,000) for Q3 2006, and to $21,000 for Q4 2006. However, such sales have not been sufficient to generate sustained positive cash flow from operations, or profitability. If we do not close significant future sales, our existing cash resources will not be sufficient to fund our operations beyond Q2 2007. |

There can be no assurance that we will be successful closing sufficient new sales and an inability to do so would have a materially adverse affect on our future cash flow and operations.

See “Risk Factors” for more information about risks facing TenFold.

Disclosure about Contractual Obligations

The following table sets forth certain contractual obligations recorded in the audited financial statements as of December 31, 2006 and summary information is presented in the following table (in thousands):

| | | | | | | | | | | | |

Contractual Obligations | | Total | | Less than

1 year | | 1-3 years | | 4-5 years | | More than

5 years |

Long-term debt | | $ | — | | | — | | — | | — | | — |

Capital lease obligations | | | 10 | | | 10 | | — | | — | | — |

Operating lease obligations | | | 326 | | | 326 | | — | | — | | — |

Notes payable | | | — | | | — | | — | | — | | — |

Purchase obligations | | | 9 | | | 9 | | — | | — | | — |

Other long term liabilities reflected on the registrant’s Balance Sheet under GAAP | | | — | | | — | | — | | — | | — |

| | | | | | | | | | | | |

Total | | $ | 345 | | $ | 345 | | — | | — | | — |

| | | | | | | | | | | | |

Recent Accounting Pronouncements

On January 1, 2006, we adopted SFAS 123(R), Share-Based Payment, which requires the measurement and recognition of compensation expense for all share-based payment awards made to our employees and directors, including employee stock options and employee stock purchases related to the Employee Stock Purchase Plan, based on estimated fair values. See Note 18 of Notes to Financial Statements for more information.

On January 1, 2006, we adopted SFAS No. 154, Accounting Changes and Error Corrections. SFAS No. 154 is a replacement of APB No. 20, Accounting Changes, and SFAS No. 3, Reporting Accounting Changes in Interim Financial Statements. SFAS No. 154 provides guidance on the accounting for and reporting of accounting changes and error corrections. It establishes retrospective application as the required method for reporting a change in accounting principle. SFAS No. 154 provides guidance for determining whether retrospective application of a change in accounting principle is impracticable and how to report a change in such circumstances. SFAS No. 154 also provides that a change in method of depreciating or amortizing a long-lived non-financial asset be accounted for as a change in estimate effected by a change in accounting principle, and also provides that correction of errors in previously issued financial statements should be termed a “restatement.” SFAS No. 154 is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005

In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Instruments, which amends SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, and SFAS No. 140 Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. SFAS No. 155 allows financial instruments that have embedded derivatives to be accounted for as a whole (eliminating the need to bifurcate the derivative from its host) if the holder elects to account for the whole instrument on a fair value basis. SFAS No. 155 also clarifies and amends certain other provisions of SFAS No. 133 and SFAS No. 140. This statement is effective for all financial instruments acquired or issued in financial years beginning after September 15, 2006. We do not expect our adoption of this new standard to have a material impact on our financial position, results of operations or cash flows.

In March 2006, the FASB issued SFAS No. 156, Accounting for Servicing of Financial Assets to simplify accounting for separately recognized servicing assets and servicing liabilities. SFAS No. 156 amends SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. Additionally, SFAS No. 156 applies to all separately recognized servicing assets and liabilities acquired or issued after the beginning of an entity’s fiscal year that begins after September 15, 2006, although early adoption is permitted. We do not expect our adoption of this new standard to have a material impact on our financial position, results of operations or cash flows.

In June 2006, the FASB ratified Emerging Issues Task Force Issue, or EITF, No. 06-3, How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That Is, Gross versus Net Presentation). EITF No. 06-3 requires that, for interim and annual reporting periods beginning after December 15, 2006, we disclose our policy related to the presentation of sales taxes and similar assessments related to our revenue transactions. Early adoption is permitted. In our statements of operations, we present revenue net of sales taxes and any similar assessments. EITF No. 06-3 had no effect on our financial position and results of operations.

13