UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | |

Commission File Number | | Registrant, State of Incorporation Address and Telephone Number | | I.R.S. Employer Identification No. |

| 333-42427 | | J.CREW GROUP, INC. | | 22-2894486 |

(Incorporated in Delaware)

770 Broadway

New York, New York 10003

Telephone: (212) 209 2500

Securities Registered Pursuant to Section 12(b) of the Act:

| | |

Title of Class | | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer x | | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

Based upon the closing sale price on the New York Stock Exchange on August 1, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, which ended August 3, 2008, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on such date was approximately $1,495,641,201. For purposes of determining this amount, the registrant has excluded shares of common stock held by directors and officers. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

There were 62,548,892 shares of the registrant’s $.01 par value common stock outstanding on March 6, 2009.

DOCUMENTS INCORPORATED BY REFERENCE:

| | |

Documents | | Form 10-K Reference |

Portions of Proxy Statement for the 2009 Annual Meeting of Stockholders | | Part III, Items 10-14 |

DISCLOSURE REGARDING FORWARD LOOKING STATEMENTS

This report contains “forward-looking statements,” which include information concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. Many of these statements appear, in particular, under the headings “Business,” “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” When used in this report, the words “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “believe” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, our examination of historical operating trends, are based upon our current expectations and various assumptions. We believe there is a reasonable basis for our expectations and beliefs, but there can be no assurance that we will realize our expectations or that our beliefs will prove correct.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this report. Important factors that could cause our actual results to differ materially from those expressed as forward-looking statements are set forth in this report, including but not limited to those under the heading “Risk Factors.” There may be other factors of which we are currently unaware or deem immaterial that may cause our actual results to differ materially from the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date they are made and are expressly qualified in their entirety by the cautionary statements included in this report. Except as may be required by law, we undertake no obligation to publicly update or revise any forward-looking statement to reflect events or circumstances occurring after the date they were made or to reflect the occurrence of unanticipated events.

2

PART I

In this section, “we,” “us” and “our” refer to J.Crew Group, Inc. (“Group”) and our wholly owned subsidiaries, including J.Crew Operating Corp. (“Operating”).

General

J.Crew® is a nationally recognized apparel and accessories retailer that we believe embraces a high standard of style, craftsmanship, quality and customer service. We are a fully integrated multi-channel, multi-brand, specialty retailer. We seek to consistently communicate our vision of J.Crew through every aspect of our business, including through the imagery in our catalogs and on our Internet website and the inviting atmosphere of our stores.

We focus on creating product lines featuring the high quality design, fabrics and craftsmanship as well as consistent fits and detailing that our customers expect of J.Crew. We offer complete assortments of women’s, men’s and children’s apparel and accessories, including wedding and special occasion attire, weekend clothes, swimwear, loungewear, outerwear, shoes, bags, belts, hair accessories and jewelry. The J.Crew brand is widely recognized and features high quality designs, fabrics and craftsmanship. We seek to project our brand image through consistent creative messages in our catalog and through our Internet website, our store environments and our superior customer service.

J.Crew products are distributed through our retail and factory stores, our J.Crew catalog and our Internet website located at www.jcrew.com. We introduced Madewell, a casual Women’s clothing, footwear and accessories retail concept in fiscal 2006. As of January 31, 2009, we operated 226 retail stores, including five crewcuts®, one Men’s store, one Women’s Collection store, and 10 Madewell stores; and 74 factory stores, including one crewcuts factory store, throughout the United States. We also operated 42 crewcuts shop in shops in our J.Crew retail stores and 10 crewcuts shop in shops in our factory stores. In fiscal 2008, we distributed 20 catalog editions with a circulation of approximately 44 million copies. Our website logged over 78 million visits in fiscal 2008, as compared to over 70 million in fiscal 2007, representing an 11% increase.

We conduct our business through two primary sales channels: Stores (consisting of our retail, crewcuts, Madewell and factory stores) and Direct (consisting of our catalog and Internet website). The following is a summary of our revenues:

| | | | | | | | | |

| (Dollars in millions) | | Fiscal

2006 | | Fiscal

2007 | | Fiscal

2008 |

Stores | | $ | 808.5 | | $ | 914.8 | | $ | 974.3 |

Direct | | | 308.6 | | | 377.4 | | | 408.9 |

Other | | | 35.0 | | | 42.5 | | | 44.8 |

| | | | | | | | | |

Total | | $ | 1,152.1 | | $ | 1,334.7 | | $ | 1,428.0 |

| | | | | | | | | |

Other revenues consist principally of shipping and handling fees derived from our Direct business.

We were incorporated in the State of New York in 1988 and reincorporated in the State of Delaware in October 2005. Our principal executive offices are located at 770 Broadway, New York, NY 10003, and our telephone number is (212) 209-2500.

Products

We offer complete assortments of women’s, men’s and children’s apparel and accessories, including wedding and special occasion attire, weekend clothes, swimwear, loungewear, outerwear, shoes, bags, belts, hair

3

accessories and jewelry. We focus on creating product lines featuring the high quality design, fabrics and craftsmanship as well as consistent fits and detailing, and are designed internally by our design team to embody our “classic with a twist” branding and styling strategies. We offer a product assortment ranging from casual t-shirts and broken-in chinos, to cashmere items and limited edition “collection” items, such as dresses, hand-beaded skirts and double-faced cashmere jackets.

In recent years we have introduced several new product lines and product line expansions, including our Italian cashmere collection, our wedding and party dresses, our Italian leather accessories and our women’s jewelry. Our J.Crew factory line offers the J.Crew brand with similar styles made at lower costs and sold at lower price points. Crewcuts, an apparel and accessories line for children ages two through 12, which offers a product assortment that reflects the high quality, styled-classic apparel and accessories we offer under the J.Crew brand, such as argyles, embroidered critters and cable knits for the children’s market.

We introduced Madewell, a casual women’s clothing, footwear and accessories retail concept in fiscal 2006. Additionally, we maintain a Madewell website at www.madewell1937.com that provides customers with a toll free number to place orders for Madewell merchandise and intend to add the necessary functionality to enable customers to place orders online.

Design and Merchandising

We believe one of our key strengths is our internal design team, which designs products that reinforce our brand image. Our products are designed to reflect a clean and fashionable aesthetic that incorporates high quality fabrics and construction as well as comfortable, consistent fits and detailing.

Our products are developed in four seasonal collections and are subdivided for monthly product introductions in our monthly catalog mailings and in our retail stores. The design process begins with our designers developing seasonal collections eight to twelve months in advance. Our designers regularly travel domestically and internationally to develop color and design ideas. Once the design team has developed a season’s color palette and design concepts, they order a sample assortment in order to evaluate the details of the assortment, such as how color takes to a particular fabric.

From the sample assortment, our merchandising team selects which items to market in each of our sales channels and edits the assortment as necessary to increase its commerciality. Our teams communicate regularly and work closely with each other in order to leverage market data, ensure the quality of our products and remain true to a unified brand image. Our technical design teams develop construction and fit specifications for every product, ensuring quality workmanship and consistency across product lines. Because our product offerings originate from a single concept assortment, we believe that we are able to efficiently offer an assortment of styles within each season’s line while still maintaining a unified brand image. As a final step that is intended to ensure image consistency, our senior management reviews all of our products from all of our sales channels before they are manufactured. We believe we further maintain our brand image by exercising substantial control over the presentation and pricing of our merchandise by selling all our products ourselves in North America.

Pricing

We offer our customers a mix of select designer-quality products and more casual items at various price points, consistent with our signature styling strategy of pairing luxury items with more casual items. We have introduced limited edition “collection” items such as hand-beaded skirts, which we believe elevates the overall perception of our brand. We believe offering a broad range of price points maintains a more accessible, less intimidating atmosphere.

Sales Channels

We conduct our business through two primary sales channels: Stores, which consists of our retail, crewcuts, Madewell and factory stores; and Direct, which consists of the J.Crew catalog and our Internet website.

4

Stores

The following is a summary of our net sales from Stores and the percentage relationship to total revenues:

| | | | | | | | | | | | |

| (Dollars in millions) | | Fiscal

2006 | | | Fiscal

2007 | | | Fiscal

2008 | |

Stores | | $ | 808.5 | | | $ | 914.8 | | | $ | 974.3 | |

Percentage of total revenues | | | 70.2 | % | | | 68.5 | % | | | 68.2 | % |

Retail Stores

As of January 31, 2009, we operated 226 retail stores, including five crewcuts, one Men’s store, one Women’s Collection store, and 10 Madewell stores, throughout the United States. Our retail stores are located in upscale regional malls, lifestyle centers, shopping centers and street locations. We believe situating our stores in desirable locations is critical to the success of our business, and we determine store locations, as well as individual store sizes, based on several factors, including geographic location, demographic information, presence of anchor tenants in mall locations and proximity to other higher-end specialty retail stores. Our retail stores are designed by our in-house design staff and fixtured with the goal of creating a distinctive, sophisticated and inviting atmosphere, with clear displays and information about product quality and fabrication.

Our retail stores averaged approximately 6,500 total square feet at the end of fiscal 2008, but are “sized to the market,” which means that we adjust the size of a particular retail store based on the projected revenues from that particular store. For example, at the end of fiscal 2008, our largest retail store, located in New York, was approximately 15,000 square feet, and our smallest retail store, our Men’s store, also located in New York, was approximately 900 square feet. The table below highlights certain information regarding our retail stores open during the five years ended January 31, 2009:

| | | | | | | | | | | | |

Fiscal Year | | Retail Stores Open

At Beginning of

Period | | Retail Stores

Opened During

Period | | Retail Stores

Closed During

Period | | Retail Stores

Open at

End of Period | | Total Gross

Square Footage

(in thousands) | | Average Gross

Square Footage Per

Retail Store |

2004 | | 154 | | 5 | | 3 | | 156 | | 1,198 | | 7,682 |

2005 | | 156 | | 5 | | 2 | | 159 | | 1,209 | | 7,604 |

2006 | | 159 | | 21 | | 4 | | 176 | | 1,247 | | 7,084 |

2007 | | 176 | | 27 | | 4 | | 199 | | 1,338 | | 6,723 |

2008 | | 199 | | 28 | | 1 | | 226 | | 1,460 | | 6,459 |

In light of the current economic conditions we have slowed the pace of our retail store expansion. We plan to expand our retail store base by 15 to 20 retail stores in fiscal 2009, including approximately four crewcuts and approximately eight Madewell stores.

Factory Stores

As of January 31, 2009, we operated 74 factory stores, including one factory crewcuts store, throughout the United States. We added crewcuts shop-in-shops into 10 of our factory stores in fiscal 2008. Our factory stores are located primarily in large factory-outlet malls. Factory stores are designed with simple, volume-driving visuals to maximize sales of key items and drive faster inventory turns. Our factory stores also use strategic and focused short-term promotional offerings designed to achieve higher margins and faster inventory turns. Sales associates in our factory stores adhere to the same customer-service focus as our retail stores, and are trained to help customers locate styles similar to those they have seen in our retail stores or catalog.

Our factory stores averaged 5,500 total square feet at the end of fiscal 2008, but are “sized to the market,” which means that we adjust the size of a particular factory store based on the projected revenues from that particular store. For example, at the end of fiscal 2008, our largest factory store, located in Connecticut, was

5

approximately 9,000 square feet, and our smallest factory store, our factory crewcuts store, located in Florida, was approximately 1,500 square feet. The table below highlights certain information regarding our factory stores open during the five years ended January 31, 2009:

| | | | | | | | | | | | |

Fiscal Year | | Factory Stores Open

At Beginning of

Period | | Factory Stores

Opened During

Period | | Factory Stores

Closed During

Period | | Factory Stores

Open at

End of Period | | Total Gross

Square Footage

(in thousands) | | Average Gross

Square Footage Per

Factory Store |

2004 | | 42 | | 0 | | 1 | | 41 | | 258 | | 6,296 |

2005 | | 41 | | 6 | | 3 | | 44 | | 269 | | 6,120 |

2006 | | 44 | | 8 | | 1 | | 51 | | 297 | | 5,827 |

2007 | | 51 | | 10 | | 0 | | 61 | | 350 | | 5,737 |

2008 | | 61 | | 14 | | 1 | | 74 | | 404 | | 5,464 |

In light of the current economic conditions we have slowed the pace of our factory store expansion. We plan to expand our factory store base by approximately five factory stores in fiscal 2009.

Direct

The following is a summary of our Direct business net sales and the percentage relationship to total revenues:

| | | | | | | | | | | | |

| (Dollars in millions) | | Fiscal

2006 | | | Fiscal

2007 | | | Fiscal

2008 | |

Internet | | $ | 218.6 | | | $ | 293.3 | | | $ | 338.2 | |

Phone | | | 90.0 | | | | 84.1 | | | | 70.7 | |

| | | | | | | | | | | | |

Total Direct | | $ | 308.6 | | | $ | 377.4 | | | $ | 408.9 | |

| | | | | | | | | | | | |

Direct net sales as a percentage of total revenues | | | 26.8 | % | | | 28.3 | % | | | 28.6 | % |

In addition to driving revenues, we use our Direct channel to introduce and test new product offerings, to sell specialty product lines such as crewcuts and Wedding and special occasion, to offer extended sizes and colors on various products and to expand customer files to drive targeted marketing campaigns by collecting customer data to further segment customer groups.

We currently obtain customer information for 100% of our catalog and Internet customers. As of January 31, 2009, our customer database contained approximately 26.0 million individual customer names, of which 3.5 million customers had placed a catalog or Internet order with us or made a store purchase from us within the previous twelve months, and 4.3 million email addresses of customers who had agreed to receive promotional emails from us.

We maintain a database of “customer records,” which include sales patterns, detailed purchasing information, certain demographic information, geographic locations and email addresses of our customers. This database enables us to see how our customers use our various sales channels to shop and facilitates targeted marketing strategies. We segment our customer files based on several variables, and we tailor our catalog offerings and email notifications to address the different product needs of our customer groups. We focus on continually improving the segmentation of customer files and the acquisition of additional customer names from several sources, including our retail stores, our Internet website, list rentals and list exchanges with other catalog companies.

Catalog

The J.Crew catalog is the primary branding and advertising vehicle for the J.Crew brand. We believe our catalog reinforces the J.Crew brand image and drives sales across all of our sales channels. For example,

6

approximately 25% of our Internet customers referenced using a catalog prior to their Internet purchase, which we believe shows that our catalog drives sales on our Internet channel. We believe we have distinguished ourselves from other catalog retailers by utilizing high quality photography and art direction. We further this image by not promoting clearance merchandise in our catalogs, and instead redirect primary liquidation activity to our www.jcrew.com website. In fiscal 2008, we distributed 20 catalog editions with a circulation of approximately 44.4 million copies and approximately 5.2 billion pages circulated.

While we do not have long-term contracts with our suppliers of paper for our catalog, we believe our long-standing relationships with a number of the largest coated paper mills in the United States allow us to purchase paper at favorable prices. Projected paper requirements are communicated on an annual basis to paper mills to ensure the availability of an adequate supply.

Internet Website

Since 1996, our website located at www.jcrew.com has allowed our customers to purchase our merchandise over the Internet. We continue to see an ongoing shift of orders to the Internet from our catalog. Using a consistent standard measure, our website logged over 78 million visits in fiscal 2008, as compared to over 70 million in fiscal 2007, representing an 11% increase. Internet revenues represented 83% of the Direct business in fiscal 2008, compared to 78% of the Direct business in fiscal 2007. We design and operate our websites using an in-house technical staff. Our www.jcrew.com website emphasizes simplicity and ease of customer use while integrating the J.Crew brand’s aspirational lifestyle imagery used in the catalog. We update our website periodically throughout the day to accurately reflect product availability and to determine where on the website a particular product generates the best sales. In addition to selling our regular merchandise on our www.jcrew.com website, we also use that website as a means to sell marked-down merchandise.

We have enhanced our online presence by adding category-based “shops” to our www.jcrew.com website, such as J.Crew swimfinder, wedding & party shop and our new accessories shop.

We implemented certain direct channel systems upgrades including a new platform for our website during fiscal 2008. These systems upgrades impaired our ability to capture, process and ship customer orders and resulted in the incurrence of additional costs in fiscal 2008. See “Management Information System” for additional information.

Marketing and Advertising

The J.Crew catalog is the primary branding and advertising vehicle for the J.Crew brand. We believe our catalog reinforces the J.Crew mission and image as well as drives sales in all of our channels. Our direct sales channels enable us to maintain a database of customer sales patterns and we are thus able to target segments of our customer base with specific marketing. Depending on their spending habits, we send certain customers special catalog editions and/or emails.

We also offer a private-label credit card through an agreement with World Financial Network National Bank (“WFNNB”), under which WFNNB owns the credit card accounts and Alliance Data Systems Corporation provides services to our private-label credit card customers. In fiscal 2008, sales on J.Crew credit cards made up 16.3% of our total net sales. We believe that our credit card program encourages frequent store and website visits and catalog sales and promotes multiple-item purchases, thereby cultivating customer loyalty to the J.Crew brand and increasing sales. We also maintain a J.Crew credit card loyalty program by offering rewards for customer spending on J.Crew credit cards.

Sourcing and Distribution

Sourcing

We have no long-term merchandise supply contracts, and we typically transact business on an order-by-order basis. We source our merchandise in two ways: through the use of buying agents, and by

7

purchasing merchandise directly from trading companies and manufacturers. In fiscal 2008, we worked with eight buying agents, who together supported our relationships with vendors that supplied approximately 55% of our merchandise, with one buying agent supporting our relationships with vendors that supplied approximately 44% of our merchandise. In exchange for a commission, our buying agents identify suitable vendors and coordinate our purchasing requirements with the vendors by placing orders for merchandise on our behalf, ensuring the timely delivery of goods to us, obtaining samples of merchandise produced in the factories, inspecting finished merchandise and carrying out other administrative communications on our behalf. In fiscal 2008, we worked with two trading companies, purchasing approximately 26% of our merchandise from these companies. Trading companies control factories which manufacture merchandise and also handle certain other shipping and customs matters related to importing the merchandise into the United States. We sourced the remaining 19% of our merchandise directly with manufacturers both within the United States and overseas with the majority of whom we have long-term, and what we believe to be, stable relationships.

Our sourcing base currently consists of approximately 138 vendors who operate 209 factories in approximately 21 countries. Our top 10 vendors supply 51% of our merchandise.

Each of our top 10 vendors uses multiple factories to produce its merchandise, which we believe gives us a high degree of flexibility in placing production of our merchandise. We believe we have developed strong relationships with our vendors, some of which rely upon us for a significant portion of their business.

In fiscal 2008, approximately 86% of our merchandise was sourced in Asia (with 73% of our products sourced from China, Hong Kong and Macau), 4% was sourced in the United States and 10% was sourced in Europe and other regions. Substantially all of our foreign purchases are negotiated and paid for in U.S. dollars.

Distribution

We operate two distribution facilities and one customer call center. We own a 282,000 square foot facility in Asheville, North Carolina that houses our distribution operations for our retail and factory stores. This facility currently employs approximately 200 full and part-time employees during our non-peak season and approximately 50 additional employees during our peak season. In fiscal 2007, we completed a 120,000 square foot expansion of this facility to support our expected future growth. Merchandise is transported from this distribution center to our retail and factory stores by independent trucking companies, Federal Express or UPS, with a transit time of approximately two to five days.

We also own a 262,000 square foot facility, and lease a 63,700 square foot facility, both located in Lynchburg, Virginia. These facilities contain our customer call center and order fulfillment operations for Direct. During fiscal 2008 we implemented certain Direct channel systems upgrades including a new order management system in our call center and a new warehouse management system. These systems upgrades impaired our ability to capture, process and ship customer orders and resulted in the incurrence of additional costs in fiscal 2008. See “Management Information Systems” for additional information.

These facilities currently employ approximately 1,000 full and part-time employees during our non-peak season and an additional 1,000 employees during our peak season. We outsource a portion of our customer calls to two service providers. Merchandise sold via our Direct channel is sent directly to customers from this distribution center via the United States Postal Service, UPS or Federal Express.

Management Information Systems

Our management information systems are designed to provide, among other things, comprehensive order processing, production, accounting and management information for the marketing, manufacturing, importing and distribution functions of our business. We utilize an SAP Enterprise Resource Planning system along with an IBM mainframe system for our information technology requirements. We have point-of-sale systems in our retail and factory stores that enable us to track inventory from store receipt to final sale on a real-time basis. We have

8

an agreement with Electronic Data Systems Corporation, a third party, to provide hosting services and administrative support for the infrastructure of our enterprise merchandising and financial systems, and our distribution and call center infrastructure. Our websites are hosted by a third party at its data center.

We believe our merchandising and financial systems, coupled with our point-of-sale systems and software programs, allow for item-level stock replenishment, merchandise planning and real-time inventory accounting practices. Our telephone and telemarketing systems, warehouse package sorting systems, automated warehouse locator and inventory bar coding systems use current technology, and are designed with our highest-volume periods, such as the holiday season, in mind, which results in our having substantial flexibility and ample capacity in our lower-volume periods.

We continue to expand and upgrade our information systems, networks and infrastructure to support recent and expected future growth. During fiscal 2008 we implemented certain Direct channel systems upgrades including a new platform for our website, a new order management system in our call center and a new warehouse management system. These systems upgrades impaired our ability to capture, process and ship customer orders, and transfer products between channels during the second, third and fourth quarters. We incurred additional costs associated with these upgrades which adversely impacted our operating results in fiscal 2008. We made progress in stabilizing our Direct channel systems during the second half of fiscal 2008 and are continuing our stabilization efforts in 2009.

Employees and Labor Relations

As of January 31, 2009, we had approximately 10,900 employees, of whom approximately 3,800 were full-time employees and 7,100 were part-time employees. Approximately 1,000 of these employees are employed in our customer call center and Direct order fulfillment operations facility in Lynchburg, Virginia, and approximately 200 of these employees work in our store distribution center in Asheville, North Carolina. In addition, approximately 3,200 employees are hired on a seasonal basis to meet demand during the peak season.

None of our employees are represented by a union. We have had no labor-related work stoppages and we believe our relationship with our employees is good.

Competition

The specialty retail industry is highly competitive. We compete primarily with specialty retailers, higher-end department stores, catalog retailers and Internet businesses that engage in the retail sale of women’s, men’s and children’s apparel, accessories, shoes and similar merchandise. We believe the principal bases upon which we compete are quality, design, customer service and price. We believe that our primary competitive advantages are consumer recognition of our brands and our presence in many major shopping malls in the United States as well as our multiple sale channels which enable our customers to shop in the setting they prefer. We believe that we also differentiate ourselves from competitors on the basis of our signature product design, our ability to offer both designer-quality products at higher price points and more casual items at lower price points, our focus on the quality of our product offerings and our customer-service oriented culture. We believe our success depends in substantial part on our ability to originate and define product and fashion trends as well as to timely anticipate, gauge and react to changing consumer demands. Certain of our competitors are larger and have greater financial, marketing and other resources than us. Accordingly, there can be no assurance that we will be able to compete successfully with them in the future.

Trademarks and Licensing

The J.Crew and Madewell trademarks and variations thereon, such as crewcuts, are registered or are subject to pending trademark applications with the United States Patent and Trademark Office and with the registries of many foreign countries. We believe our trademarks have significant value and we intend to continue to vigorously protect them against infringement.

9

In addition, we licensed our J.Crew trademark and know-how to Itochu Corporation in Japan for which we received royalty fees based on a percentage of sales. In February 2008, we provided notice that we did not intend to renew the agreement, which expired at the end of January 2009. In fiscal 2006, 2007, and 2008, licensing revenues totaled $2.8 million, $2.6 million, and $1.7 million, respectively.

Government Regulation

We are subject to customs, truth-in-advertising and other laws, including consumer protection regulations and zoning and occupancy ordinances that regulate retailers and/or govern the promotion and sale of merchandise and the operation of retail stores and warehouse facilities. We monitor changes in these laws and believe that we are in material compliance with applicable laws.

A substantial portion of our products are manufactured outside the United States. These products are imported and are subject to U.S. customs laws, which impose tariffs as well as import quota restrictions for textiles and apparel. Some of our imported products are eligible for duty-advantaged programs. While importation of goods from foreign countries from which we buy our products may be subject to embargo by U.S. Customs authorities if shipments exceed quota limits, we closely monitor import quotas and believe we have the sourcing network to efficiently shift production to factories located in countries with available quotas. The existence of import quotas has, therefore, not had a material adverse effect on our business.

Available Information

We make available free of charge on our Internet website, www.jcrew.com, copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after filing such material electronically with, or otherwise furnishing it to, the Securities and Exchange Commission (the “SEC”). The reference to our website address does not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document.

The following risk factors should be carefully considered when evaluating our business and the forward-looking statements in this report. See “Disclosure Regarding Forward Looking Statements.”

The current economic crisis could materially adversely affect our financial condition and results of operations.

The current economic crisis is having a significant negative impact on businesses and consumers around the world. Our results can be impacted by a number of macroeconomic factors, including, but not limited to, consumer confidence and spending levels, unemployment, consumer credit availability, fuel and energy costs, global factory production, commercial real estate market conditions, credit market conditions and the level of customer traffic in malls and shopping centers.

Demand for our merchandise is significantly impacted by negative trends in consumer confidence and other economic factors affecting consumer spending behavior. These factors have recently driven sharp declines in mall traffic and consumer spending. The downturn in the economy may continue to affect consumer purchases of our merchandise for the foreseeable future and adversely impact our results of operations.

We believe that our current cash position, cash flow from operations and availability under the Credit Facility will provide us with sufficient liquidity through the current economic crisis. However, the impact of this crisis on our customers and suppliers cannot be predicted and may be severe. A decrease in liquidity of our customers and suppliers could have a material adverse effect on our results of operations and liquidity.

10

Failure to achieve sufficient levels of revenue and cash flow at individual store locations could result in impairment charges related to our stores. In fiscal 2008, we recorded non-cash asset impairment charges related to underperforming stores. Various uncertainties, including changes in consumer preferences or continued deterioration in the economic environment could impact the expected cash flows to be generated by our store locations, and may result in an impairment of those assets. Although such an impairment charge would be a non-cash expense, any impairment could materially increase our expenses and reduce our profitability.

We operate in the highly competitive specialty retail industry and the size and resources of some of our competitors may allow them to compete more effectively than we can, which could result in loss of our market share.

We face intense competition in the specialty retail industry. We compete primarily with specialty retailers, high-end department stores, catalog retailers and Internet businesses that engage in the retail sale of women’s, men’s and children’s apparel, accessories, shoes and similar merchandise. We believe that the principal bases upon which we compete are the quality, style and design of merchandise and the quality of customer service. We also believe that price is an important factor in our customers’ decision-making process. Many of our competitors are, and many of our potential competitors may be, larger and have greater financial, marketing and other resources and therefore may be able to adapt to changes in customer requirements more quickly, devote greater resources to the marketing and sale of their products, generate greater national brand recognition or adopt more aggressive pricing policies than we can. In addition, increased levels of promotional activity by our competitors, both online and in stores, may negatively impact our revenues and gross profit.

If we are unable to gauge fashion trends and react to changing consumer preferences in a timely manner, our sales will decrease.

We believe our success depends in substantial part on our ability to:

| | • | | originate and define product and fashion trends, |

| | • | | anticipate, gauge and react to changing consumer demands in a timely manner, and |

| | • | | translate market trends into appropriate, saleable product offerings far in advance of their sale in our stores, our catalog or our Internet website. |

Because we enter into agreements for the manufacture and purchase of merchandise well in advance of the season in which merchandise will be sold, we are vulnerable to changes in consumer demand, pricing shifts and suboptimal merchandise selection and timing of merchandise purchases. We attempt to reduce the risks of changing fashion trends and product acceptance in part by devoting a portion of our product line to classic styles that are not significantly modified from year to year. Nevertheless, if we misjudge the market for our products or overall level of consumer demand, we may be faced with significant excess inventories for some products and missed opportunities for others. Our brand image may also suffer if customers believe we are no longer able to offer the latest fashions. The occurrence of these events could hurt our financial results by decreasing sales. We may respond by increasing markdowns or initiating marketing promotions to reduce excess inventory, which would further decrease our gross profits and net income.

The specialty retail industry is cyclical, and a decline in consumer spending on apparel and accessories could reduce our sales and slow our growth.

The industry in which we operate is cyclical. Purchases of apparel and accessories are sensitive to a number of factors that influence the levels of consumer spending, including general economic conditions and the level of disposable consumer income, the availability of consumer credit, interest rates, taxation and consumer confidence in future economic conditions. Because apparel and accessories generally are discretionary purchases, declines in consumer spending patterns may impact us more negatively as a specialty retailer. Therefore, we may not be able to grow revenues if there is a decline in consumer spending patterns, and we may decide to slow or alter our growth plans.

11

We rely on the experience and skills of key personnel, the loss of whom could damage our brand image and our ability to sell our merchandise.

We believe we have benefited substantially from the leadership and strategic guidance of our chief executive officer, and other key executives and members of our creative team, who are primarily responsible for developing our strategy. The loss, for any reason, of the services of any of these individuals and any negative market or industry perception arising from such loss could damage our brand image. Our executive and creative team has substantial experience and expertise in the specialty retail industry and has made significant contributions to our growth and success. The unexpected loss of one or more of these individuals could delay the development and introduction of, and harm our ability to sell, our merchandise. In addition, products we develop without the guidance and direction of these key personnel may not receive the same level of acceptance.

Our success depends in part on our ability to attract and retain key personnel. Competition for these personnel is intense, and we may not be able to attract and retain a sufficient number of qualified personnel in the future.

Our real estate strategy may not be successful, and new store locations may fail to produce desired results, which could impact our competitive position and profitability.

We expanded our store base by 40 net new stores in fiscal 2008. In light of the current economic conditions, we have slowed the pace of our store base expansion considerably and expect to open approximately half that number in fiscal year 2009. We are also reviewing our existing store base and identifying opportunities, where available, to renegotiate the terms of those leases. The success of our business depends, in part, on our ability to open new stores and renew our existing store leases on terms that meet our financial targets. Our ability to open new stores on schedule or at all, to renew our existing store leases on favorable terms or to operate them on a profitable basis will depend on various factors, including our ability to:

| | • | | identify suitable markets for new stores and available store locations, |

| | • | | negotiate acceptable lease terms for new locations or renewal terms for existing locations, |

| | • | | hire and train qualified sales associates, |

| | • | | develop new merchandise and manage inventory effectively to meet the needs of new and existing stores on a timely basis, |

| | • | | foster current relationships and develop new relationships with vendors that are capable of supplying a greater volume of merchandise, and |

| | • | | avoid construction delays and cost overruns in connection with the build-out of new stores. |

New stores and stores with renewed lease terms may not produce anticipated levels of revenue even though they increase our costs. As a result, our expenses as a percentage of sales would increase and our profitability would be adversely affected.

Our expanded product offerings, new sales channels and new brand concepts may not be successful, and implementation of these strategies may divert our operational, managerial and administrative resources, which could impact our competitive position.

We have grown our business in recent years by expanding our product offerings and sales channels, including by marketing our crewcuts line of children’s apparel and accessories and our Madewell line of women’s apparel, footwear and accessories. We have recently opened a small number of free-standing stores dedicated to men’s wear, crewcuts and “collections” items. These strategies involve various risks discussed elsewhere in these risk factors, including:

| | • | | implementation may be delayed or may not be successful, |

12

| | • | | if our expanded product offerings and sales channels fail to maintain and enhance our distinctive brand identity, our brand image may be diminished and our sales may decrease, |

| | • | | if customers do not respond to these product offerings and sales channels as anticipated, these strategies may not be profitable on a larger scale, and |

| | • | | implementation of these plans may divert management’s attention from other aspects of our business and place a strain on our management, operational and financial resources, as well as our information systems. |

In addition, our new product offerings and sales channels may be affected by, among other things, economic and competitive conditions, changes in consumer spending patterns and changes in consumer preferences and style trends. Further rollout of these strategies could be delayed or abandoned, could cost more than anticipated and could divert resources from other areas of our business, any of which could impact our competitive position and reduce our revenue and profitability.

If we fail to maintain the value of our brand, our sales are likely to decline.

Our success depends on the value of the J.Crew brand. The J.Crew name is integral to our business as well as to the implementation of our strategies for expanding our business. Maintaining, promoting and positioning our brand will depend largely on the success of our marketing and merchandising efforts and our ability to provide a consistent, high quality customer experience. Our brand could be adversely affected if we fail to achieve these objectives or if our public image or reputation were to be tarnished by negative publicity. Any of these events could result in decreases in sales.

Our declining levels of comparable store sales could cause our earnings to continue to decline.

If our future comparable store sales continue to decline, our earnings could continue to decline. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—How We Assess the Performance of Our Business—Comparable Store Sales.” In addition, our results have fluctuated in the past and can be expected to continue to fluctuate in the future. For example, over the past twelve fiscal quarters, our quarterly comparable store sales have declined to a decrease of 13.1% in the fourth quarter of fiscal 2008 from an increase of 18.7% in the third quarter of fiscal 2006. A variety of factors affect comparable store sales, including fashion trends, competition, current economic conditions, pricing, inflation, the timing of the release of new merchandise and promotional events, changes in our merchandise mix, the success of marketing programs, timing and level of markdowns and weather conditions. These factors may cause our comparable store sales results to be materially lower than previous periods, which could cause declines in our quarterly earnings and stock price.

An inability or failure to protect our trademarks could diminish the value of our brand and reduce demand for our merchandise.

The J.Crew and Madewell trademarks and variations thereon, such as crewcuts, are valuable assets that are critical to our success. We intend to continue to vigorously protect our trademarks against infringement, but we may not be successful in doing so. The unauthorized reproduction or other misappropriation of our trademarks would diminish the value of our brand, which could reduce demand for our products or the prices at which we can sell our products.

Ongoing reductions in the volume of mall traffic or closing of shopping malls as a result of the current economic crisis could significantly reduce our sales and leave us with unsold inventory.

Most of our stores are located in shopping malls. Sales at these stores are derived, in part, from the volume of traffic in those malls. Our stores benefit from the ability of the malls’ “anchor” tenants, generally large

13

department stores and other area attractions, to generate consumer traffic in the vicinity of our stores and the continuing popularity of the malls as shopping destinations. The current economic crisis, particularly in certain regions, has adversely affected mall traffic and resulted in the closing of certain anchor department stores and has threatened the viability of certain commercial real estate firms which operate major shopping malls. A continuation of this trend, including failure of a large commercial landlord or continued declines in the popularity of mall shopping generally among our customers, would reduce our sales and leave us with excess inventory. We may respond by increasing markdowns or initiating marketing promotions to reduce excess inventory, which would further decrease our gross profits and net income.

Fluctuations in our results of operations for the fourth fiscal quarter would have a disproportionate effect on our overall financial condition and results of operations.

We experience seasonal fluctuations in revenues and operating income, with a disproportionate amount of our revenues being generated in the fourth fiscal quarter holiday season. Our revenues and income are generally weakest during the first and second fiscal quarters. In addition, any factors that harm our fourth fiscal quarter operating results, including adverse weather or unfavorable economic conditions, could have a disproportionate effect on our results of operations for the entire fiscal year.

In order to prepare for our peak shopping season, we must order and keep in stock significantly more merchandise than we would carry at other times of the year. Any unanticipated decrease in demand for our products during our peak shopping season could require us to sell excess inventory at a substantial markdown, which could reduce our net sales and gross profit. We saw this occur in the fourth quarter of fiscal 2008, following a substantial decline in the overall economy and consumer spending beginning in October 2008. As a result, we were forced to take aggressive markdowns to clear our fall and holiday inventory. Additional unplanned decreases in demand for our products could produce further reductions to our net sales and gross profit.

Our quarterly results of operations may also fluctuate significantly as a result of a variety of other factors, including the timing of new store openings and of catalog mailings, the revenues contributed by new stores, merchandise mix and the timing and level of inventory markdowns. As a result, historical period-to-period comparisons of our revenues and operating results are not necessarily indicative of future period-to-period results. You should not rely on the results of a single fiscal quarter, particularly the fourth fiscal quarter holiday season, as an indication of our annual results or our future performance.

If our manufacturers are unable to produce our goods on time or to our specifications, we could suffer lost sales.

We do not own or operate any manufacturing facilities and therefore depend upon independent third party vendors for the manufacture of all of our products. Our products are manufactured to our specifications primarily by foreign manufacturers. We cannot control all of the various factors, which include inclement weather, natural disasters and acts of terrorism, that might affect a manufacturer’s ability to ship orders of our products in a timely manner or to meet our quality standards. Late delivery of products or delivery of products that do not meet our quality standards could cause us to miss the delivery date requirements of our customers or delay timely delivery of merchandise to our stores for those items. These events could cause us to fail to meet customer expectations, cause our customers to cancel orders or cause us to be unable to deliver merchandise in sufficient quantities or of sufficient quality to our stores, which could result in lost sales.

Third party failure to deliver merchandise from our distribution centers to our stores and to customers or a disruption or adverse condition affecting our distribution centers could result in lost sales or reduce demand for our merchandise.

The success of our stores depends on their timely receipt of merchandise from our distribution facilities, and the success of Direct depends on the timely delivery of merchandise to our customers. Independent third party

14

transportation companies deliver our merchandise to our stores and to our customers. Some of these third parties employ personnel represented by a labor union. Disruptions in the delivery of merchandise or work stoppages by employees of these third parties could delay the timely receipt of merchandise, which could result in cancelled sales, a loss of loyalty to our brand and excess inventory. Timely receipt of merchandise by our stores and our customers may also be affected by factors such as inclement weather, natural disasters, accidents, system failures and acts of terrorism. We may respond by increasing markdowns or initiating marketing promotions, which would decrease our gross profits and net income.

Interruption in our foreign sourcing operations could disrupt production, shipment or receipt of our merchandise, which would result in lost sales and could increase our costs.

In fiscal 2008, approximately 96% of our merchandise was sourced from foreign factories. In particular, approximately 73% of our merchandise was sourced from China, Hong Kong and Macau. Any event causing a sudden disruption of manufacturing or imports from Asia or elsewhere, including the imposition of additional import restrictions, could materially harm our operations. We have no long-term merchandise supply contracts, and many of our imports are subject to existing or potential duties, tariffs or quotas that may limit the quantity of certain types of goods that may be imported into the United States from countries in Asia or elsewhere. We compete with other companies for production facilities and import quota capacity. Our business is also subject to a variety of other risks generally associated with doing business abroad, such as political instability, currency and exchange risks, disruption of imports by labor disputes and local business practices.

Our sourcing operations may also be hurt by political and financial instability, strikes, health concerns regarding infectious diseases in countries in which our merchandise is produced, adverse weather conditions or natural disasters that may occur in Asia or elsewhere or acts of war or terrorism in the United States or worldwide, to the extent these acts affect the production, shipment or receipt of merchandise. Our future operations and performance will be subject to these factors, which are beyond our control, and these factors could materially hurt our business, financial condition and results of operations or may require us to modify our current business practices and incur increased costs.

In addition, the raw materials used to manufacture our products are subject to availability constraints and price volatility caused by high demand for fabrics, weather, supply conditions, government regulations, economic climate and other unpredictable factors. Increases in the demand for, or the price of, raw materials could hurt our profitability.

Our ability to source our merchandise profitably or at all could be hurt if new trade restrictions are imposed or existing trade restrictions become more burdensome.

Trade restrictions, including increased tariffs, safeguards or quotas, on apparel and accessories could increase the cost or reduce the supply of merchandise available to us. We source our merchandise through buying agents and by purchasing directly from trading companies and manufacturers, predominately in various foreign countries. There are quotas and trade restrictions on certain categories of goods and apparel from China and countries which are not subject to the World Trade Organization (“WTO”) Agreement which could have a significant impact on our sourcing patterns in the future. New initiatives may be proposed that may have an impact on our sourcing from certain countries and may include retaliatory duties or other trade sanctions that, if enacted, would increase the cost of products we purchase. We cannot predict whether any of the countries in which our merchandise is currently manufactured or may be manufactured in the future will be subject to additional trade restrictions imposed by the U.S. and foreign governments, nor can we predict the likelihood, type or effect of any such restrictions. Trade restrictions, including increased tariffs or quotas, embargoes, safeguards and customs restrictions against apparel items, as well as U.S. or foreign labor strikes, work stoppages or boycotts or enhanced security measures at U.S. ports could increase the cost, delay shipping or reduce the supply of apparel available to us or may require us to modify our current business practices, any of which could hurt our profitability.

15

Increases in costs of mailing, paper and printing will affect the cost of our catalog and promotional mailings, which will reduce our profitability.

Postal rate increases and paper and printing costs affect the cost of our catalog and promotional mailings. In fiscal 2008, approximately 10% of our selling, general and administrative expenses were attributable to such costs. In May 2008, the U.S. Postal Service implemented a postal rate increase of approximately 3%. We anticipate a similar rate increase in 2009. We receive discounts from the basic postal rate structure, such as discounts for bulk mailings and sorting by zip code and carrier routes. We are not a party to any long-term contracts for the supply of paper. Our cost of paper has fluctuated significantly, and our future paper costs are subject to supply and demand forces that we cannot control. Future additional increases in postal rates or in paper or printing costs would reduce our profitability to the extent that we are unable to pass those increases directly to customers or offset those increases by raising selling prices or by reducing the number and size of certain catalog editions.

If our independent manufacturers do not use ethical business practices or comply with applicable laws and regulations, the J.Crew brand name could be harmed due to negative publicity.

While our internal and vendor operating guidelines, as outlined in our Vendor Code of Conduct, promote ethical business practices and we, along with third parties that we retain for this purpose, monitor compliance with those guidelines, we do not control our independent manufacturers. Accordingly, we cannot guarantee their compliance with our guidelines. Our Vendor Code of Conduct is designed to ensure that each of our suppliers’ operations are conducted in a legal, ethical, and responsible manner. Our Vendor Code of Conduct requires that each of our suppliers operates in compliance with applicable wage benefit, working hours and other local laws, and forbids the use of practices such as child labor or forced labor.

Violation of labor or other laws by our independent manufacturers, or the divergence of an independent manufacturer’s or our licensing partner’s labor practices from those generally accepted as ethical in the United States could diminish the value of the J.Crew brand and reduce demand for our merchandise if, as a result of such violation, we were to attract negative publicity.

Any significant interruption in the operations of our customer call, order fulfillment and distribution facilities could disrupt our ability to process customer orders and to deliver our merchandise in a timely manner.

Our customer call center and Direct’s order fulfillment operations are housed together in a single facility, while distribution operations for J.Crew retail and factory stores are housed in another single facility. Although we maintain back-up systems for these facilities, they may not be able to prevent a significant interruption in the operation of these facilities due to natural disasters, accidents, failures of the inventory locator or automated packing and shipping systems we use or other events. In addition, we have recently upgraded certain Direct channel systems, including our web platform, order management system and warehouse management system in order to support recent and expected future growth. We experienced some interruptions during fiscal 2008 in connection with our implementation and while we made progress in stabilizing these systems during fiscal 2008, there can be no assurance that future interruptions will not occur. Any significant interruption in the operation of these facilities, including an interruption caused by our failure to successfully expand or upgrade our systems or manage our transition to utilizing the expansions or upgrades, could reduce our ability to receive and process orders and provide products and services to our stores and customers, which could result in lost sales, cancelled sales and a loss of loyalty to our brand.

We are subject to customs, advertising, consumer protection, privacy, zoning and occupancy and labor and employment laws that could require us to modify our current business practices and incur increased costs.

We are subject to numerous regulations, including customs, truth-in-advertising, consumer protection, privacy and zoning and occupancy laws and ordinances that regulate retailers generally and/or govern the importation, promotion and sale of merchandise and the operation of retail stores and warehouse facilities. If

16

these regulations were to change or were violated by our management, employees, suppliers, buying agents or trading companies, the costs of certain goods could increase, or we could experience delays in shipments of our goods, be subject to fines or penalties, or suffer reputational harm, which could reduce demand for our merchandise and hurt our business and results of operations. In addition, changes in federal and state minimum wage laws and other laws relating to employee benefits could cause us to incur additional wage and benefits costs, which could hurt our profitability.

Legal requirements are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations. We may be required to make significant expenditures or modify our business practices to comply with existing or future laws and regulations, which may increase our costs and materially limit our ability to operate our business.

Any material disruption of our information systems could disrupt our business and reduce our sales.

We are increasingly dependent on information systems to operate our website, process transactions, respond to customer inquiries, manage inventory, purchase, sell and ship goods on a timely basis and maintain cost-efficient operations. In fiscal 2008, we upgraded certain of our information systems to support recent and expected future growth. These system upgrades impaired our ability to capture, process and ship customer orders, and transfer product between channels. We incurred additional costs associated with these upgrades which impacted our operating results in fiscal 2008. We made progress in stabilizing these systems during fiscal 2008, but there can be no assurances that future disruptions will not occur. We may experience operational problems with our information systems as a result of system failures, viruses, computer “hackers” or other causes. Any material disruption or slowdown of our systems, including a disruption or slowdown caused by our failure to successfully upgrade our systems, could cause information, including data related to customer orders, to be lost or delayed which could—especially if the disruption or slowdown occurred during the holiday season—result in delays in the delivery of merchandise to our stores and customers or lost sales, which could reduce demand for our merchandise and cause our sales to decline. Moreover, we may not be successful in developing or acquiring technology that is competitive and responsive to the needs of our customers and might lack sufficient resources to make the necessary investments in technology to compete with our competitors. Accordingly, if changes in technology cause our information systems to become obsolete, or if our information systems are inadequate to handle our growth, we could lose customers.

Our Internet operations are an increasingly substantial part of our business, representing approximately 24% of our revenues in fiscal 2008. In addition to changing consumer preferences and buying trends relating to Internet usage, we are vulnerable to certain additional risks and uncertainties associated with the Internet, including changes in required technology interfaces, website downtime and other technical failures, security breaches, and consumer privacy concerns. Our failure to successfully respond to these risks and uncertainties could reduce Internet sales and damage our brand’s reputation.

We have taken over certain portions of our information systems needs that were previously outsourced to a third party and are making upgrades to our information systems. We may take over other outsourced portions of our information systems in the near future. If we are unable to manage these aspects of our information systems or the planned upgrades, our receipt and delivery of merchandise could be disrupted, which could result in a decline in our sales.

Our debt may limit the cash flow available for our operations, place us at a competitive disadvantage, and limit our ability to pursue our expansion plans.

As of January 31, 2009, we had total debt of approximately $100.0 million. The terms of our indebtedness may:

| | • | | require us to use a substantial portion of our cash flow from operations to pay interest and principal on our debt, which would reduce the funds available to use for working capital, capital expenditures and other general corporate purposes, |

17

| | • | | limit our ability to pay future dividends, |

| | • | | limit our ability to obtain additional financing for working capital, capital expenditures, expansion plans and other investments, which may limit our ability to implement our business strategy, |

| | • | | result in higher interest expense if interest rates increase on our floating rate borrowings, |

| | • | | heighten our vulnerability to further downturns in our business, the industry or in the general economy and limit our flexibility in planning for or reacting to changes in our business and the retail industry, |

| | • | | prevent us from taking advantage of business opportunities as they arise or successfully carrying out our plans to expand our store base, product offerings and sales channels, or |

| | • | | include restrictive covenants that limit management’s discretion in operating our business. In particular, these agreements include, or may include, covenants or restrictions relating to limitations on capital expenditures; liens and sale-leaseback transactions; loans and investments; debt and hedging arrangements; mergers, acquisitions and asset sales; transactions with affiliates; and changes in business activities conducted by us and our subsidiaries. |

We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us in amounts sufficient to enable us to make payments on our indebtedness or to fund our operations.

In addition, our indebtedness may require us, under certain circumstances, to maintain certain financial ratios. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Credit Facility” and “MD&A-Term Loan.”

Compliance with these covenants and these ratios may prevent us from pursuing opportunities that we believe would benefit our business, including opportunities that we might pursue as part of our plans to expand our store base, our product offerings and sales channels.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

We are headquartered in New York City. Our headquarters offices are leased under a lease agreement expiring in 2012, with an option to renew thereafter. We also have entered into a lease for additional corporate office space in New York City which expires in 2012 with an option to terminate early. We own two facilities: a 262,000 square foot customer contact call center, order fulfillment and distribution center in Lynchburg, Virginia and a 282,000 square foot distribution center in Asheville, North Carolina. We also lease a 63,700 square foot facility in Lynchburg, Virginia under a lease agreement expiring in April 2011, with an option to renew thereafter.

As of January 31, 2009, we operated 226 retail stores, including five crewcuts stores, one Men’s store, one Women’s Collection store, and 10 Madewell stores; and 74 factory stores, including one crewcuts factory store, in 42 states and the District of Columbia. All of the retail and factory stores are leased from third parties and the leases historically have in most cases had terms of 5 to 10 years. A portion of our leases have options to renew for periods typically ranging from 5 to 10 years. Generally, the leases contain standard provisions concerning the payment of rent, events of default and the rights and obligations of each party. Rent due under the leases is generally comprised of annual base rent plus a contingent rent payment based on the store’s sales in excess of a specified threshold. Some of the leases also contain early termination options, which can be exercised by us or the landlord under certain conditions. The leases also generally require us to pay real estate taxes, insurance and certain common area costs. Excluding our stores and headquarters offices, all of our properties, whether owned or leased, are subject to liens or security interests under our credit facility.

18

The table below sets forth the number of retail and factory stores, including crewcuts stores, one Men’s store, one Women’s Collection store, and Madewell stores, operated by us in the United States as of January 31, 2009.

| | | | | | |

| | | Retail

Stores | | Factory

Stores | | Total Number

of Stores |

Alabama | | 3 | | 1 | | 4 |

Arizona | | 4 | | 1 | | 5 |

California | | 29 | | 6 | | 35 |

Colorado | | 4 | | 3 | | 7 |

Connecticut | | 9 | | 2 | | 11 |

Delaware | | — | | 1 | | 1 |

Florida | | 12 | | 9 | | 21 |

Georgia | | 7 | | 3 | | 10 |

Hawaii | | 1 | | — | | 1 |

Illinois | | 9 | | 1 | | 10 |

Indiana | | 1 | | 2 | | 3 |

Iowa | | 1 | | — | | 1 |

Kentucky | | 2 | | — | | 2 |

Louisiana | | 2 | | — | | 2 |

Maine | | — | | 2 | | 2 |

Maryland | | 6 | | 3 | | 9 |

Massachusetts | | 11 | | 2 | | 13 |

Michigan | | 7 | | 2 | | 9 |

Minnesota | | 5 | | — | | 5 |

Mississippi | | 1 | | — | | 1 |

Missouri | | 3 | | 1 | | 4 |

Nebraska | | 1 | | — | | 1 |

Nevada | | 4 | | 2 | | 6 |

New Hampshire | | 1 | | 2 | | 3 |

New Jersey | | 14 | | 4 | | 18 |

New Mexico | | 1 | | — | | 1 |

New York | | 21 | | 4 | | 25 |

North Carolina | | 7 | | 2 | | 9 |

Ohio | | 6 | | 1 | | 7 |

Oklahoma | | 2 | | — | | 2 |

Oregon | | 3 | | — | | 3 |

Pennsylvania | | 10 | | 5 | | 15 |

Rhode Island | | 2 | | — | | 2 |

South Carolina | | 2 | | 3 | | 5 |

Tennessee | | 3 | | 1 | | 4 |

Texas | | 14 | | 5 | | 19 |

Utah | | 2 | | 1 | | 3 |

Vermont | | 1 | | 1 | | 2 |

Virginia | | 7 | | 2 | | 9 |

Washington | | 3 | | 1 | | 4 |

Wisconsin | | 3 | | 1 | | 4 |

District of Columbia | | 2 | | — | | 2 |

| | | | | | |

Total | | 226 | | 74 | | 300 |

| | | | | | |

19

| ITEM 3. | LEGAL PROCEEDINGS. |

We are subject to various legal proceedings and claims that arise in the ordinary course of our business. Although the outcome of these other claims cannot be predicted with certainty, management does not believe that the ultimate resolution of these matters will have a material adverse effect on our financial condition or results of operations.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

No matters were submitted to a vote of security holders during the quarter ended January 31, 2009.

20

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS. |

Our common stock has been traded on the New York Stock Exchange under the symbol “JCG” since June 28, 2006. Prior to that time there was no public market for our stock. The following table sets forth the high and low sale prices of our common stock as reported on the New York Stock Exchange:

Market Information

| | | | | | | | | | | | |

| | | Fiscal 2007 | | Fiscal 2008 |

| | | High | | Low | | High | | Low |

First Quarter | | $ | 43.05 | | $ | 33.50 | | $ | 50.21 | | $ | 39.53 |

Second Quarter | | $ | 57.17 | | $ | 38.06 | | $ | 50.35 | | $ | 27.23 |

Third Quarter | | $ | 56.43 | | $ | 33.69 | | $ | 38.00 | | $ | 15.13 |

Fourth Quarter | | $ | 51.96 | | $ | 34.03 | | $ | 20.59 | | $ | 8.02 |

Record Holders

As of March 6, 2009, there were 52 record holders of our common stock.

Dividends

We have never paid cash dividends on our common stock. We currently intend to retain all available funds and any future earnings to fund the development and growth of our business, and we do not anticipate paying any cash dividends in the foreseeable future. In addition, because we are a holding company, our ability to pay dividends depends on our receipt of cash dividends from our subsidiaries. The terms of certain of our and Operating’s outstanding indebtedness substantially restrict the ability of either company to pay dividends. For more information about these restrictions, see “MD&A—Credit Facility” and “MD&A—Term Loan”. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, restrictions contained in current and future financing instruments and other factors that our board of directors deems relevant.

21

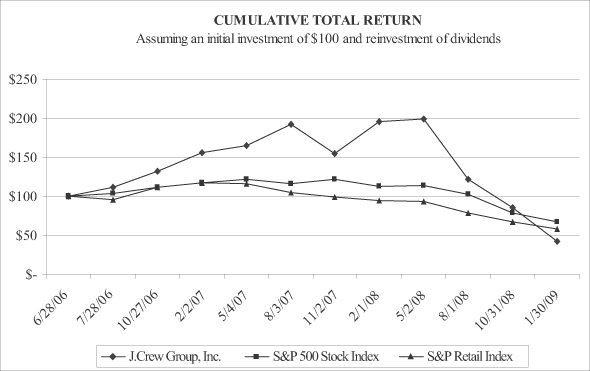

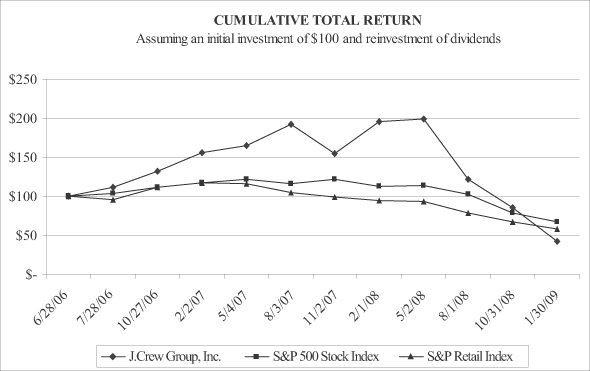

Performance Graph

The following graph and table shows the cumulative total stockholder return on the Company’s Common Stock with the S&P 500 Stock Index and the S&P Retail Index, in each case assuming an initial investment of $100 and reinvestment of dividends, if any.

| | | | | | | | | | | | |

| | | 1/28/06 | | 2/3/07 | | 2/2/08 | | 1/31/09 |

J.Crew Group, Inc. | | $ | 100 | | $ | 156 | | $ | 195 | | $ | 42 |

S&P 500 Stock Index | | $ | 100 | | $ | 117 | | $ | 113 | | $ | 67 |

S&P Retail Index | | $ | 100 | | $ | 117 | | $ | 95 | | $ | 58 |

All amounts rounded to the nearest dollar. The stock performance shown in the graph is included in response to the SEC’s requirements and is not intended to forecast or be indicative of future performance.

22

| ITEM 6. | SELECTED CONSOLIDATED FINANCIAL DATA. |

The selected historical consolidated financial data for each of the years in the three-year period ended January 31, 2009 and as of January 31, 2009 have been derived from our audited consolidated financial statements included elsewhere herein. The selected historical consolidated financial data for each of the years in the two-year period ended January 28, 2006 have been derived from our audited consolidated financial statements which are not included herein. The consolidated financial statements for each of the years in the five-year period ended January 31, 2009 and as of the end of each such year have been audited.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. The information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included herein.

| | | | | | | | | | | | | | | | | | |

| | | Year Ended(1) |

| | | January 29,

2005 | | | January 28,

2006 | | | February 3,

2007 | | | February 2,

2008 | | January 31,

2009 |

| | | (in thousands, except per share data) |

Income Statement Data | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 804,216 | | | $ | 953,188 | | | $ | 1,152,100 | | | $ | 1,334,723 | | $ | 1,427,970 |

Cost of goods sold(2) | | | 478,829 | | | | 555,192 | | | | 651,748 | | | | 746,180 | | | 872,547 |

| | | | | | | | | | | | | | | | | | |

Gross profit | | | 325,387 | | | | 397,996 | | | | 500,352 | | | | 588,543 | | | 555,423 |

Selling, general and administrative expense | | | 287,745 | | | | 318,499 | | | | 374,738 | | | | 416,064 | | | 458,738 |

| | | | | | | | | | | | | | | | | | |

Income from operations | | | 37,642 | | | | 79,497 | | | | 125,614 | | | | 172,479 | | | 96,685 |

Interest expense, net | | | 87,571 | | | | 72,903 | | | | 43,993 | | | | 11,224 | | | 5,940 |