Project Paddle Ad hoc Group proposal 1 Exhibit 99.3

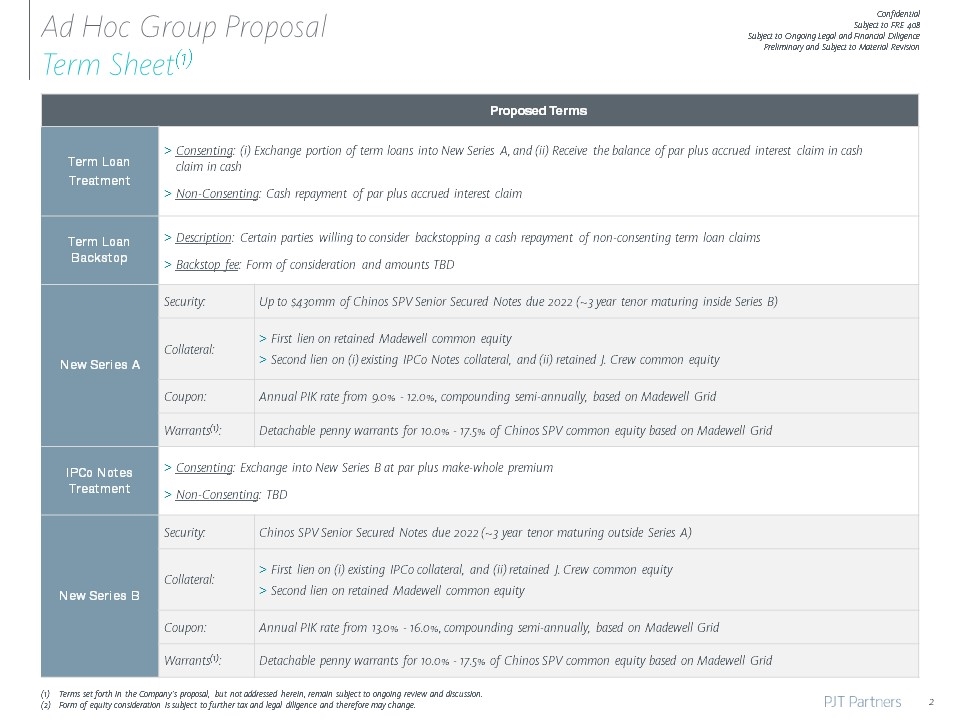

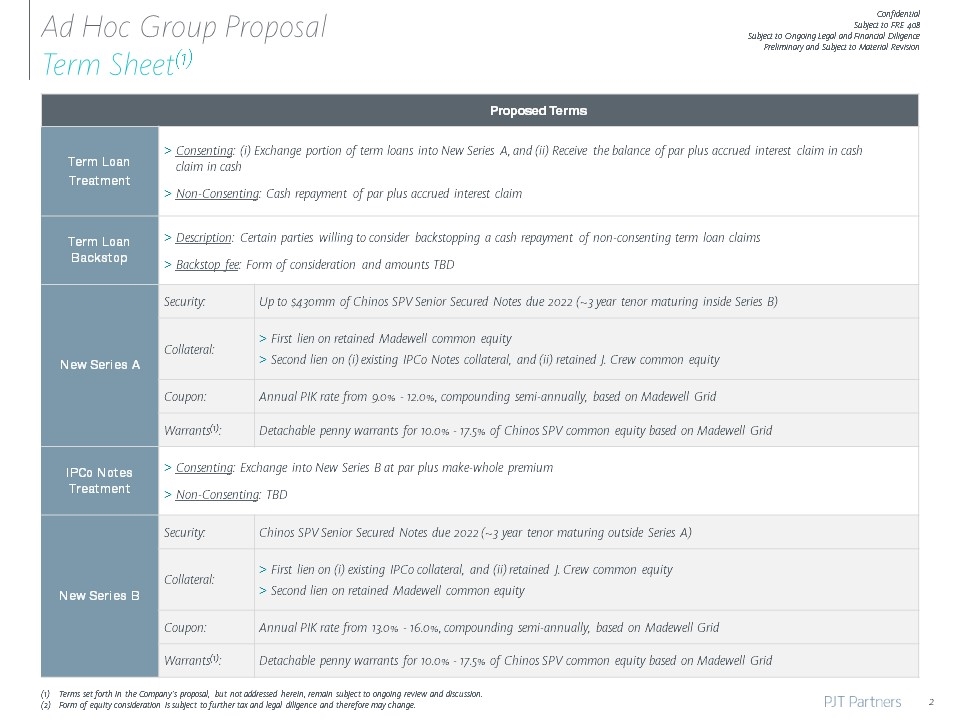

Ad Hoc Group Proposal Term Sheet(1) Terms set forth in the Company’s proposal, but not addressed herein, remain subject to ongoing review and discussion. Form of equity consideration is subject to further tax and legal diligence and therefore may change. 2 Proposed Terms Term Loan Treatment Consenting: (i) Exchange portion of term loans into New Series A, and (ii) Receive the balance of par plus accrued interest claim in cash Non-Consenting: Cash repayment of par plus accrued interest claim Term Loan Backstop Description: Certain parties willing to consider backstopping a cash repayment of non-consenting term loan claims Backstop fee: Form of consideration and amounts TBD New Series A Security: Up to $430mm of Chinos SPV Senior Secured Notes due 2022 (~3 year tenor maturing inside Series B) Collateral: First lien on retained Madewell common equity Second lien on (i) existing IPCo Notes collateral, and (ii) retained J. Crew common equity Coupon: Annual PIK rate from 9.0% - 12.0%, compounding semi-annually, based on Madewell Grid Warrants(1): Detachable penny warrants for 10.0% - 17.5% of Chinos SPV common equity based on Madewell Grid IPCo Notes Treatment Consenting: Exchange into New Series B at par plus make-whole premium Non-Consenting: TBD New Series B Security: Chinos SPV Senior Secured Notes due 2022 (~3 year tenor maturing outside Series A) Collateral: First lien on (i) existing IPCo collateral, and (ii) retained J. Crew common equity Second lien on retained Madewell common equity Coupon: Annual PIK rate from 13.0% - 16.0%, compounding semi-annually, based on Madewell Grid Warrants(1): Detachable penny warrants for 10.0% - 17.5% of Chinos SPV common equity based on Madewell Grid

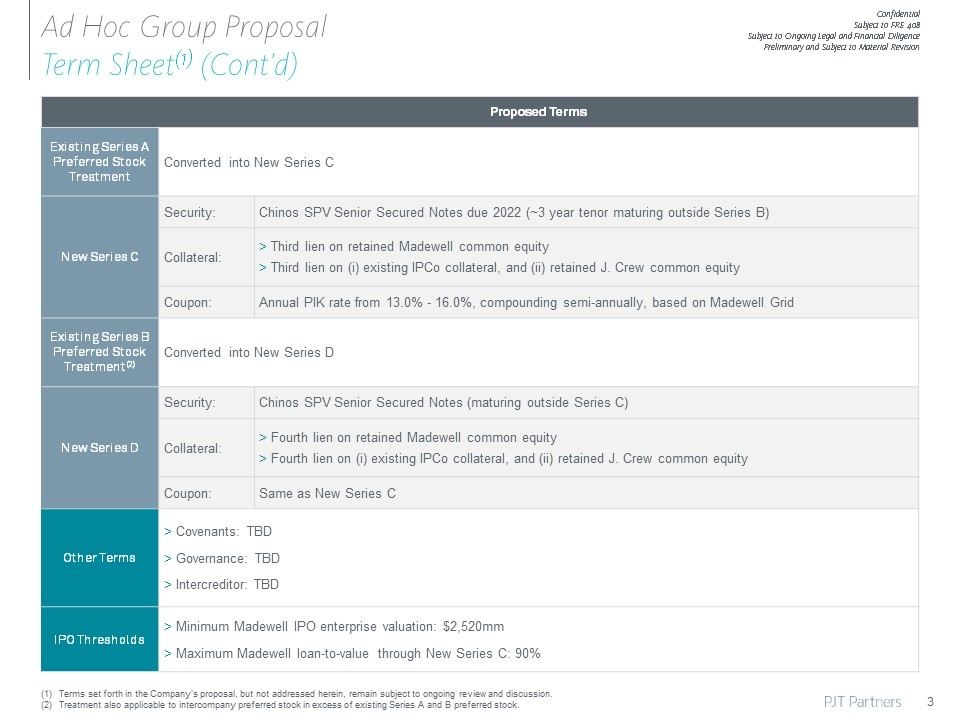

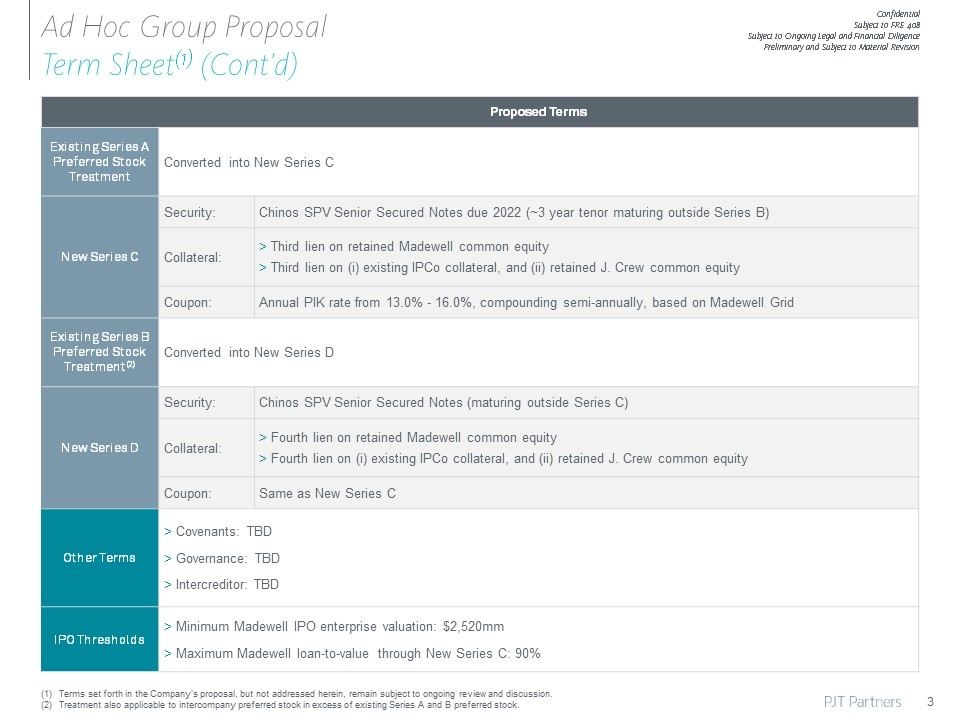

Proposed Terms Existing Series A Preferred Stock Treatment Converted into New Series C New Series C Security: Chinos SPV Senior Secured Notes due 2022 (~3 year tenor maturing outside Series B) Collateral: Third lien on retained Madewell common equity Third lien on (i) existing IPCo collateral, and (ii) retained J. Crew common equity Coupon: Annual PIK rate from 13.0% - 16.0%, compounding semi-annually, based on Madewell Grid Existing Series B Preferred Stock Treatment(2) Converted into New Series D New Series D Security: Chinos SPV Senior Secured Notes (maturing outside Series C) Collateral: Fourth lien on retained Madewell common equity Fourth lien on (i) existing IPCo collateral, and (ii) retained J. Crew common equity Coupon: Same as New Series C Other Terms Covenants: TBD Governance: TBD Intercreditor: TBD IPO Thresholds Minimum Madewell IPO enterprise valuation: $2,520mm Maximum Madewell loan-to-value through New Series C: 90% Ad Hoc Group Proposal Term Sheet(1) (Cont’d) Terms set forth in the Company’s proposal, but not addressed herein, remain subject to ongoing review and discussion. Treatment also applicable to intercompany preferred stock in excess of existing Series A and B preferred stock. 3

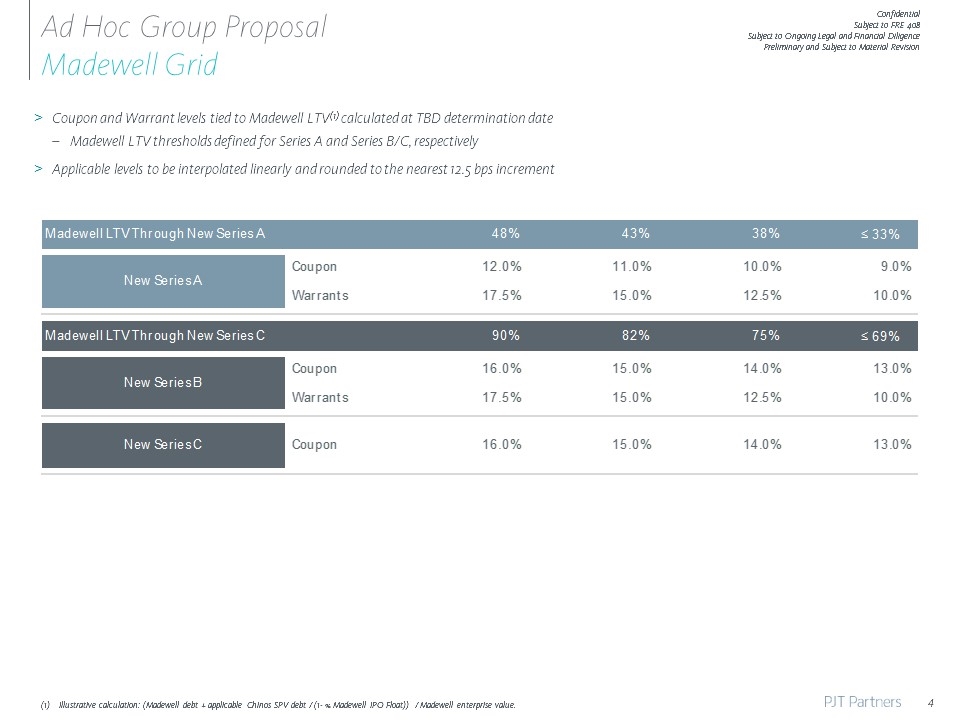

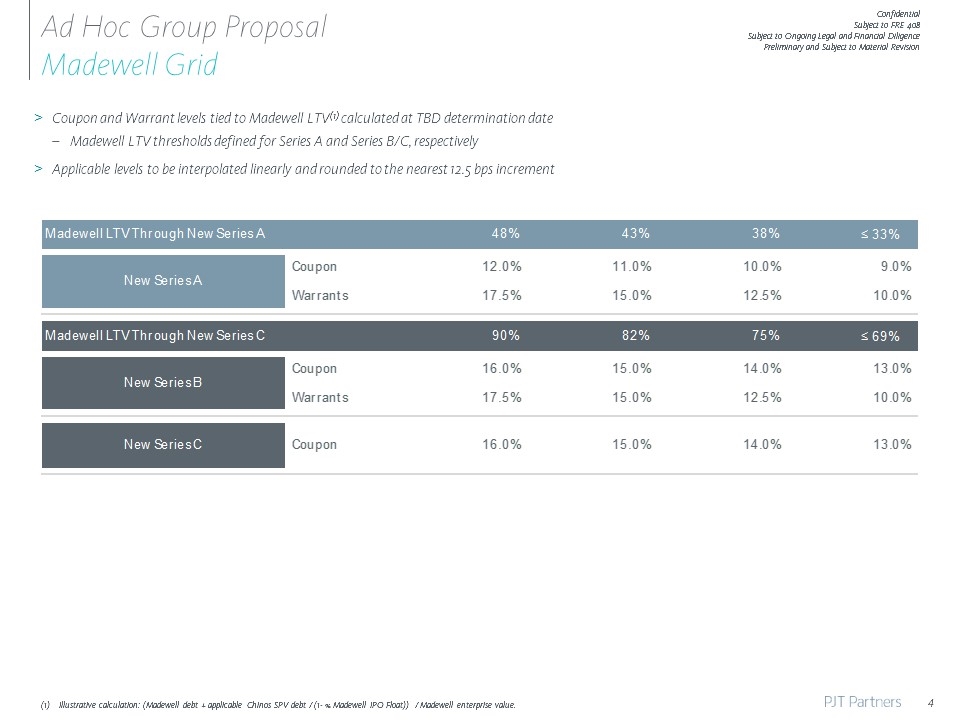

Ad Hoc Group Proposal Madewell Grid Coupon and Warrant levels tied to Madewell LTV(1) calculated at TBD determination date Madewell LTV thresholds defined for Series A and Series B/C, respectively Applicable levels to be interpolated linearly and rounded to the nearest 12.5 bps increment Illustrative calculation: (Madewell debt + applicable Chinos SPV debt / (1- % Madewell IPO Float)) / Madewell enterprise value. 4

5