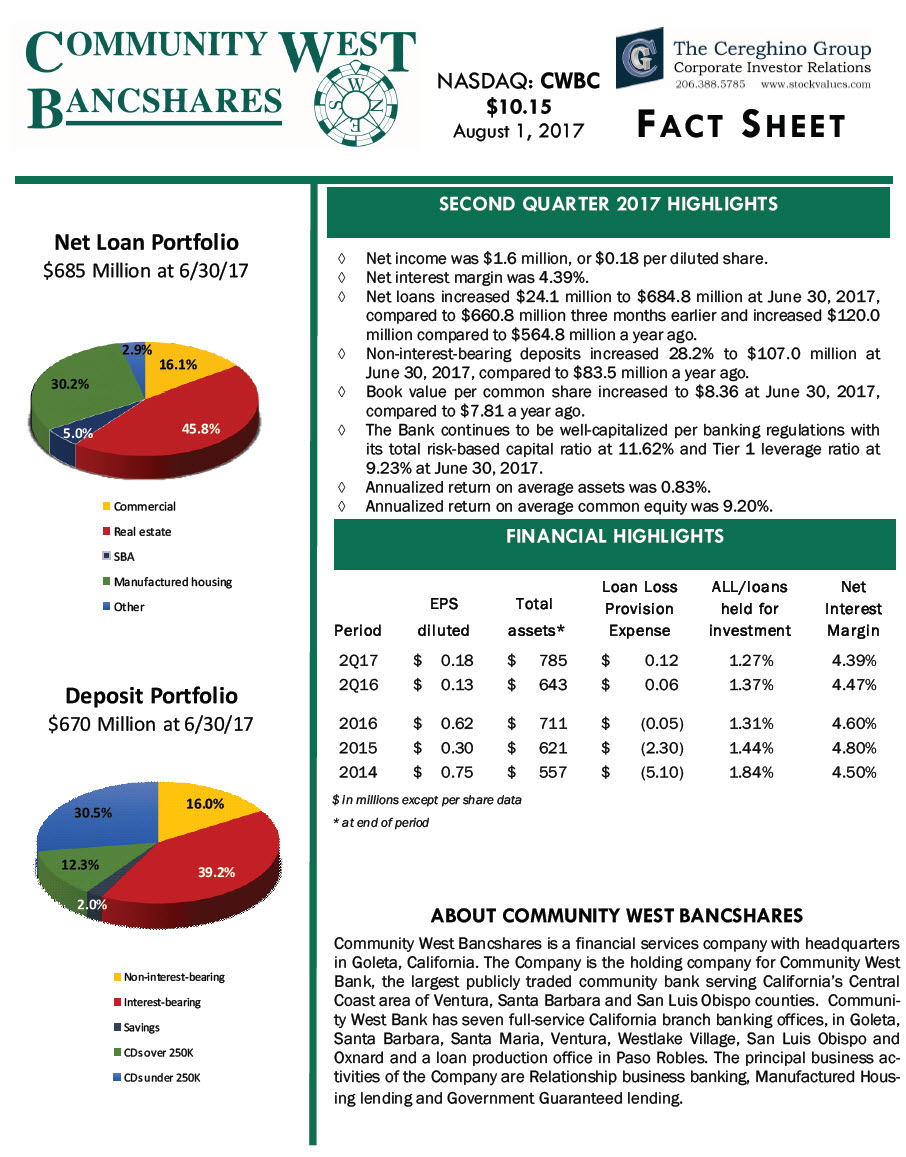

CWBC AUGUST 1, 2017 Recent Price $10.15 Shares Outstanding 8.2M Estimated Float 6.0M52-Week Price Range $7.70-$10.65 Net Interest Margin* 4.39% *most recent quarter Market Cap $82.8MBook Value per Common Share $8.36 Price/Book 1.21x Institutional Ownership 37.1% Insider Ownership 26.8% CORPORATE HEADQUARTERS Community West Bank 445 Pine Avenue Goleta, CA 93117Phone (805) 692-5821 www.communitywestbank.com FINANCIAL HIGHLIGHTS (in thousands, except per share) Income Statement Three Months Ended 30-Jun-17 31-Mar-17 30-Jun-16 Interest income $ 9,066 $ 8,703 $ 7,674 Interest expense 1,030 929 777Net interest income before provision for loan losses 8,036 7,774 6,897 Provision for loan losses 120 144 61Net interest income after provision for loan losses 7,916 7,630 6,836 Non-interest income 697 641 577 Non-interest expenses 6,007 5,923 5,506 Income before income taxes 2,606 2,348 1,907 Provision for income taxes 1,050 992 782 Net income 1,556 1,356 1,125 Earnings per common share: Basic $ 0.19 $ 0.17 $ 0.14 Diluted $ 0.18 $ 0.16 $ 0.13 Balance Sheet 30-Jun-17 31-Mar-17 30-Jun-16 Total assets $ 784,972 $ 748,300 $ 642,624 Total stockholders' equity $ 68,216 $ 66,567 $ 63,238 Total deposits $ 670,280 $ 640,130 $ 565,184 Net loans $ 684,836 $ 660,761 $ 564,826 Asset Quality 30-Jun-17 31-Mar-17 30-Jun-16 Nonaccrual loans, net $ 1,988 $ 2,302 $ 3,988 Nonaccrual loans, net/total loans 0.29% 0.34% 0.70%Nonaccrual loans plus other assets acquired through foreclosure, net $ 2,350 $ 2,447 $ 4,117Nonaccrual loans plus other assets acquired through foreclosure, net/total assets 0.30% 0.33% 0.64% Net loan (recoveries) charge-offs in the quarter $ (88) $ (177) $ (148)Net loan (recoveries) charge-offs in the quarter/total loans (0.01%) (0.03%) (0.03%) TOP INSTITUTIONAL SHAREHOLDERS * First Securities America 6.97% Wellington 6.39% Stieven Capital 6.28% Siena Capital 3.78% Maltese Capital Mgmt. 3.19% AllianceBernstein Holding 2.16% Cutler Capital 1.74% Dimensional Fund 1.55% M3F 1.21% Context BH Capital 0.70% Northwestern Mutual 0.68% Bridgeway Capital 0.47% *information from SNL as of 31--Mar-17 MANAGEMENT TEAM Martin E. Plourd President & Chief Executive OfficerSusan C. Thompson EVP & Chief Financial OfficerMaureen C. Clark EVP , Chief Operating Officer & ChiefInformation Officer William F. Filippin EVP & Chief Banking OfficerKristine D. Price EVP & Chief Credit Officer The company described in this report is a client of Len Cereghino & Co., d.b.a. The Cereghino Group, a securities industry relations firm. This report was prepared using information obtained from management and from publications available to the public. This report does not purport to be a complete statement of all material facts and is not to be construed as a recommendation or solicitation to buy or sell securities of the company described herein. Upon receiv-ing a written request sent to its website at www.stockvalues.com, The Cereghino Group will provide a package of detailed information on the client company. The Cereghino Group is compensated by the client company for servicesrendered on a continuing basis and consequently, the amount of such compensation related to the preparation and distribution of this report is not separately determinable. The Cereghino Group and/or its employees and/or membersof their families, may have a long position in the securities of the company described herein. Issued: August 1, 2017