To the Shareholders of Community West Bancshares:

We are happy to report that Community West Bancshares recently released its financial results for the third quarter of 2020. Among the highlights was net income of $2.9 million for the quarter ending on September 30, compared to $1.2 million for the prior quarter, and net income of $5.6 million for the first nine months of 2020, compared to $5.2 million in the first nine months of 2019. Attached is an investor fact sheet for your review, providing information about growth in deposits, stockholders’ equity and other benchmarks.

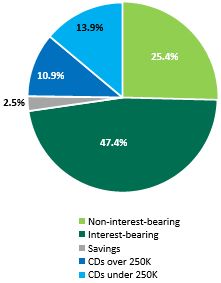

Community West produced strong earnings for the third quarter, with solid top and bottom line results, core deposit growth and a slightly expanded net interest margin. Loan growth has been steady, with a 8% increase in the loan portfolio compared to a year ago, along with strong growth in total demand deposits, which increased 21% year-over-year. We continue to focus on high quality earnings growth, while managing our operating efficiencies.

Our bank generated 517 Paycheck Protection Program (PPP) loans, which are 100% guaranteed by the Small Business Administration (SBA), totaling $75.7 million to our clients since the program’s inception in April. The effect of the pandemic on our employees, clients and communities remains our primary concern. Since the start of the pandemic, we have maintained all branch activity, taking conservative measures to keep our employees and clients safe. We remain focused on assessing the risks in our loan portfolio and working with our clients to minimize losses, and have implemented a loan modification program to assist clients impacted by the pandemic with loan deferrals.

The Board of Directors declared a quarterly cash dividend of $0.05 per common share, payable November 30, 2020 to common shareholders of record on November 13, 2020. Book value per common share increased to $10.23 at September 30, 2020, compared to $9.93 at June 30, 2020, and $9.40 at September 30, 2019.

From Ventura County in the south to Paso Robles in the north, Community West Bank is the largest publicly traded and only community bank headquartered and serving all of Ventura, Santa Barbara and San Luis Obispo counties. And we are proud that our bank was again awarded a “Premier” rating in April 2020, by The Findley Reports. For 50 years, Findley has recognized the financial performance of banking institutions in California and the western United States, focusing on four ratios: growth, return on beginning equity, net operating income as a percentage of average assets, and loan losses as a percentage of gross loans.

Community West Bank is also rated 5-star Superior by Bauer Financial. It is an honor to be recognized so favorably.

We appreciate the continued support from you, our shareholders, as we pursue our growth opportunities.

Sincerely,

|  |

William R. Peeples | Martin E. Plourd |

Chairman of the Board | President and Chief Executive Officer |