◇ Net interest income increased to $10 million for the quarter, compared to $9.8 million for 4Q20 and $8.5 million in 1Q20.

◇ A provision credit for loan losses of $173,000 for the quarter, compared to a provision credit for loan losses of $44,000 for 4Q20, and a provision for loan losses of $392,000 for 1Q20. The resulting allowance was 1.19% of total loans held for investment at March 31, 2021, and 1.34% of total loans held for investment excluding the $94.5 million of Paycheck Protection Program (“PPP”) loans at March 31, 2021, which are 100% guaranteed by the Small Business Administration (“SBA”).*

◇ Net interest margin improved to 4.19% for 1Q21, compared to 4.13% for 4Q20, and 3.97% for 1Q20.

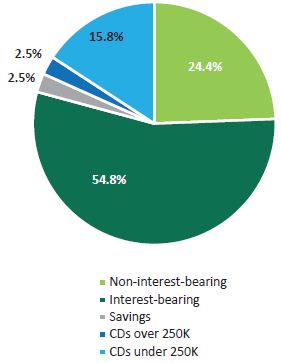

◇ Total demand deposits increased $57.2 million to $637.1 million at March 31, 2021, compared to $579.9 million at December 31, 2020, and increased $229.1 million compared to $408 million at March 31, 2020. Total demand deposits represented 79.2% of total deposits at March 31, 2021, compared to 75.7% at December 31, 2020, and 57.3% at March 31, 2020.

◇ Total loans increased $30.2 million to $887.8 million at March 31, 2021, compared to $857.6 million at December 31, 2020, and increased $105.8 million compared to $782 million at March 31, 2020.

◇ Book value per common share increased to $10.77 at March 31, 2021, compared to $10.50 at December 31, 2020, and $9.82 at March 31, 2020.

◇ The Bank’s community bank leverage ratio (CBLR) was 8.97% at March 31, 2021, compared to 9.29% at December 31, 2020, and 9.21% at March 31, 2020.

◇ Net non-accrual loans decreased by 51.3% to $1.8 million at March 31, 2021, compared to $3.7 million at December 31, 2020, and $2.6 million at March 31, 2020.

◇ Other assets acquired through foreclosure, net, was $2.6 million at March 31, 2021 and December 31, 2020, respectively, and $2.7 million at March 31, 2020.

◇ Increased quarterly cash dividend by 17% to $0.07 per common share, payable May 31, 2021 to common shareholders of record on May 10, 2021.

◇ Awarded a “Super Premier Performance” rating by The Findley Reports.

*Non GAAP