Supplemental Information Package

and Non-GAAP Reconciliations

Fourth Quarter • December 31, 2021

The pathway to possible.

CrownCastle.com

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | |

| TABLE OF CONTENTS |

| Page |

| Company Overview | |

| Company Profile | |

| Strategy | |

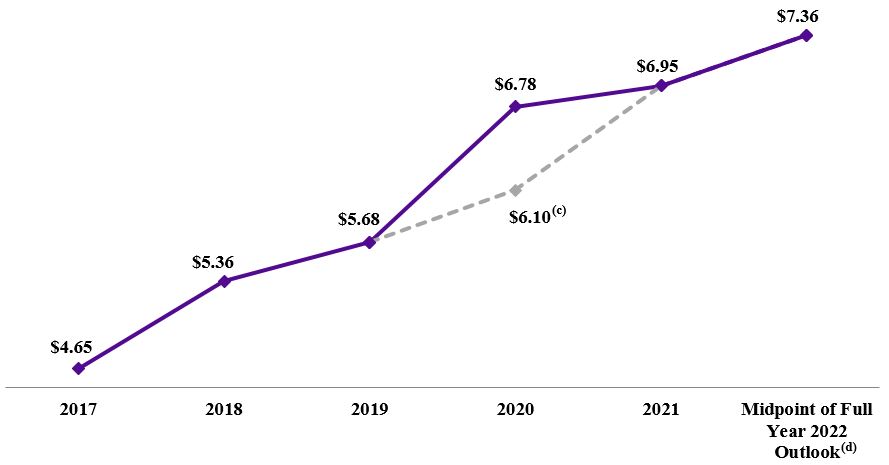

| AFFO per Share | |

| Asset Portfolio Footprint | |

| General Company Information | |

| Research Coverage | |

| Historical Common Stock Data | |

| Portfolio and Financial Highlights | |

| Outlook | |

| New Leasing Activity by Segment | |

| Financials & Metrics | |

| Condensed Consolidated Balance Sheet | |

| Condensed Consolidated Statement of Operations | |

| Segment Operating Results | |

| Fiber Segment Site Rental Revenues Summary | |

| FFO and AFFO Reconciliations | |

| Condensed Consolidated Statement of Cash Flows | |

| Components of Changes in Site Rental Revenues | |

| Summary of Straight-Lined Revenues and Expenses and Prepaid Rent Activity | |

| Summary of Capital Expenditures | |

| Projected Revenues from Tenant Contracts | |

| Projected Expenses from Existing Ground Leases and Fiber Access Agreements | |

| Lease Renewal and Lease Distribution | |

| Consolidated Tenant Overview | |

| Fiber Solutions Revenue Mix | |

| Segment Cash Yields on Invested Capital | |

| Consolidated Return on Invested Capital | |

| Asset Portfolio Overview | |

| Summary of Tower Portfolio by Vintage | |

| Tower Portfolio Overview | |

| Ground Interest Overview | |

| Ground Interest Activity | |

| Capitalization Overview | |

| Capitalization Overview | |

| Debt Maturity Overview | |

| Liquidity Overview | |

| Maintenance and Financial Covenants | |

| Interest Rate Sensitivity | |

| Appendix | |

Crown Castle International Corp.

Fourth Quarter 2021

Cautionary Language Regarding Forward-Looking Statements

This supplemental information package ("Supplement") contains forward-looking statements and information that are based on our management's current expectations as of the date of this Supplement. Statements that are not historical facts are hereby identified as forward-looking statements. Words such as "Outlook," "guide," "forecast," "estimate," "anticipate," "project," "plan," "intend," "believe," "expect," "likely," "predicted," "positioned," and any variations of these words and similar expressions are intended to identify such forward looking statements. Such statements include plans, projections and estimates regarding (1) demand for data and our communications infrastructure, and benefits derived therefrom, (2) cash flow growth, (3) tenant additions, (4) our Outlook for full year 2022, (5) our strategy, (6) strategic position of our assets, (7) revenues from tenant contracts, (8) expenses from existing ground leases and fiber access agreements, (9) the recurrence and impact of Nontypical Items, (10) availability under our 2016 Revolver and (11) the impact of our recent long-term agreement with T-Mobile.

Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including, but not limited to, prevailing market conditions. Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. Crown Castle assumes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. More information about potential risk factors which could affect our results is included in our filings with the Securities and Exchange Commission ("SEC"). Our filings with the SEC are available through the SEC website at www.sec.gov or through our investor relations website at investor.crowncastle.com. We use our investor relations website to disclose information about us that may be deemed to be material. We encourage investors, the media and others interested in us to visit our investor relations website from time to time to review up-to-date information or to sign up for e-mail alerts to be notified when new or updated information is posted on the site.

This Supplement contains certain figures, projections and calculations based in part on management's underlying assumptions. Management believes these assumptions are reasonable; however, other reasonable assumptions could provide differing outputs.

The components of financial information presented herein, both historical and forward looking, may not sum due to rounding. Definitions and reconciliations of non-GAAP financial measures, segment measures and other calculations are provided in the Appendix to this Supplement.

As used herein, the term "including" and any variation thereof, means "including without limitation." The use of the word "or" herein is not exclusive.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

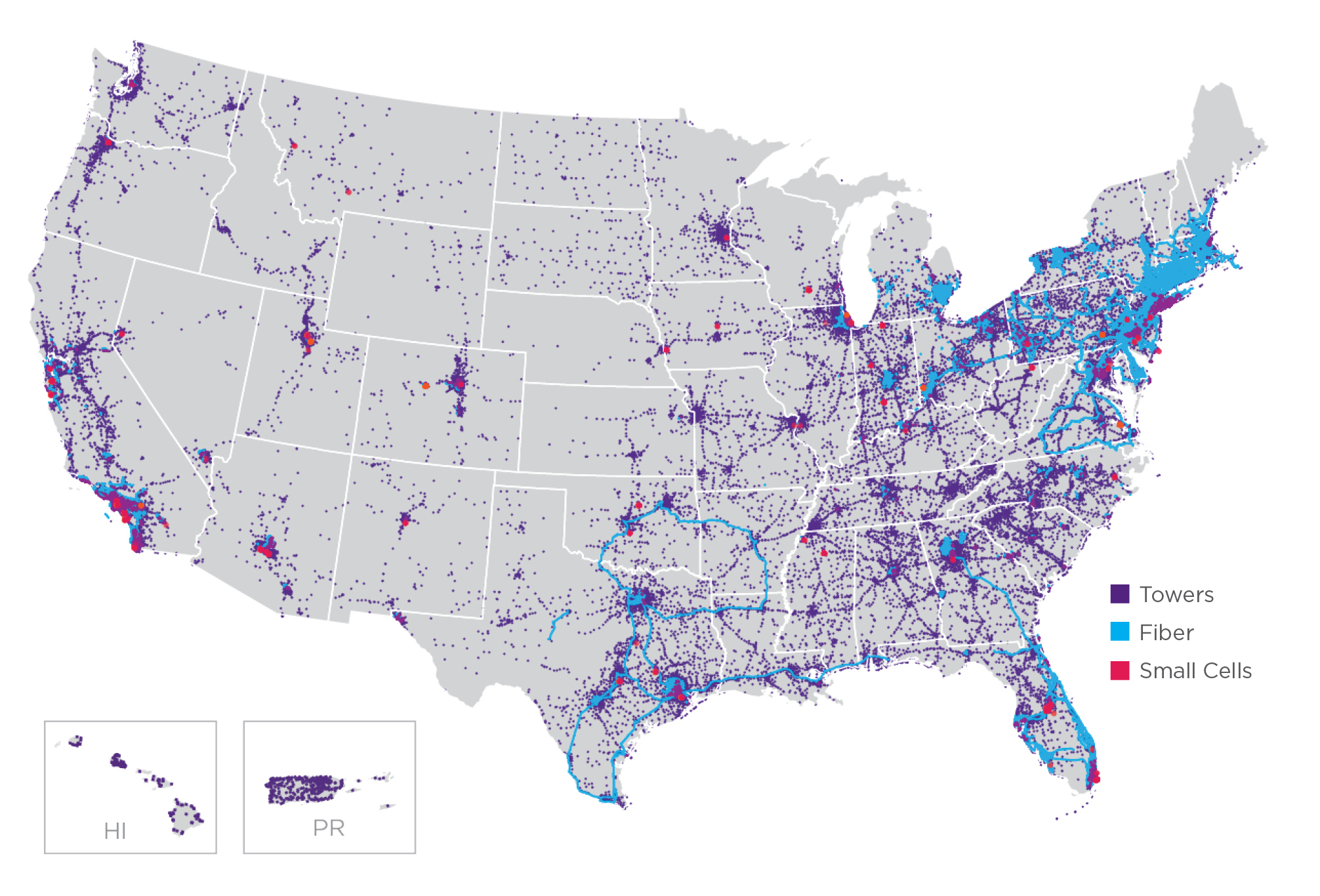

Crown Castle International Corp. (to which the terms "Crown Castle," "CCIC," "we," "our," "the Company" or "us" as used herein refer) owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including (1) more than 40,000 towers and other structures, such as rooftops (collectively, "towers"), and (2) more than 80,000 route miles of fiber primarily supporting small cell networks ("small cells") and fiber solutions. We refer to our towers, fiber and small cells assets collectively as "communications infrastructure," and to our customers on our communications infrastructure as "tenants." Our towers have a significant presence in each of the top 100 basic trading areas, and the majority of our small cells and fiber are located in major metropolitan areas, including a presence within every major U.S. market.

Our operating segments consist of (1) Towers and (2) Fiber, which includes both small cells and fiber solutions. Our core business is providing access, including space or capacity, to our shared communications infrastructure via long-term contracts in various forms, including lease, license, sublease and service agreements (collectively, "tenant contracts"). We seek to increase our site rental revenues by adding more tenants on our shared communications infrastructure, which we expect to result in significant incremental cash flows due to our low incremental operating costs.

We operate as a Real Estate Investment Trust ("REIT") for U.S. federal income tax purposes.

As a leading provider of shared communications infrastructure in the U.S., our strategy is to create long-term stockholder value via a combination of (1) growing cash flows generated from our existing portfolio of communications infrastructure, (2) returning a meaningful portion of our cash generated by operating activities to our common stockholders in the form of dividends and (3) investing capital efficiently to grow cash flows and long-term dividends per share. Our strategy is based, in part, on our belief that the U.S. is the most attractive market for shared communications infrastructure investment with the greatest long-term growth potential. We measure our efforts to create "long-term stockholder value" by the combined payment of dividends to stockholders and growth in our per-share results. The key elements of our strategy are to:

•Grow cash flows from our existing communications infrastructure. We are focused on maximizing the recurring site rental cash flows generated from providing our tenants with long-term access to our shared infrastructure assets, which we believe is the core driver of value for our stockholders. Tenant additions or modifications of existing tenant equipment (collectively, "tenant additions") enable our tenants to expand coverage and capacity in order to meet increasing demand for data, while generating high incremental returns for our business. We believe our product offerings of towers and small cells provide a comprehensive solution to our wireless tenants' growing network needs through our shared communications infrastructure model, which is an efficient and cost-effective way to serve our tenants. Additionally, we believe our ability to share our fiber assets across multiple tenants to deploy both small cells and offer fiber solutions allows us to generate cash flows and increase stockholder return.

•Return cash generated by operating activities to common stockholders in the form of dividends. We believe that distributing a meaningful portion of our cash generated by operating activities appropriately provides common stockholders with increased certainty for a portion of expected long-term stockholder value while still allowing us to retain sufficient flexibility to invest in our business and deliver growth. We believe this decision reflects the translation of the high-quality, long-term contractual cash flows of our business into stable capital returns to common stockholders.

•Invest capital efficiently to grow cash flows and long-term dividends per share. In addition to adding tenants to existing communications infrastructure, we seek to invest our available capital, including the net cash generated by our operating activities and external financing sources, in a manner that will increase long-term stockholder value on a risk-adjusted basis. These investments include constructing and acquiring new communications infrastructure that we expect will generate future cash flow growth and attractive long-term returns by adding tenants to those assets over time. Our historical investments have included the following (in no particular order):

◦construction of towers, fiber and small cells;

◦acquisitions of towers, fiber and small cells;

◦acquisitions of land interests (which primarily relate to land assets under towers);

◦improvements and structural enhancements to our existing communications infrastructure;

◦purchases of shares of our common stock from time to time; and

◦purchases, repayments or redemptions of our debt.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

Our strategy to create long-term stockholder value is based on our belief that there will be considerable future demand for our communications infrastructure based on the location of our assets and the rapid growth in the demand for data. We believe that such demand for our communications infrastructure will continue, will result in growth of our cash flows due to tenant additions on our existing communications infrastructure, and will create other growth opportunities for us, such as demand for newly constructed or acquired communications infrastructure, as described above. Further, we seek to augment the long-term value creation associated with growing our recurring site rental cash flows by offering certain ancillary site development and installation services within our Towers segment.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | |

| ASSET PORTFOLIO FOOTPRINT |

|

(a)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for further information and reconciliation of non-GAAP financial measures to Income (loss) from continuing operations, as computed in accordance with GAAP.

(b)Attributable to CCIC common stockholders.

(c)Excludes the impact of nontypical items that were completed in fourth quarter 2020 ("Nontypical Items"), as described in our press release dated January 27, 2021 and reconciled in "Non-GAAP Financial Measures, Segment Measures and Other Calculations" herein.

(d)Calculated based on midpoint of Outlook for full year 2022, issued on January 26, 2022.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | |

| GENERAL COMPANY INFORMATION |

| Principal executive offices | 8020 Katy Freeway, Houston, TX 77024 |

| Common shares trading symbol | CCI |

| Stock exchange listing | New York Stock Exchange |

| Fiscal year ending date | December 31 |

| Fitch - Long Term Issuer Default Rating | BBB+ |

| Moody’s - Long Term Corporate Family Rating | Baa3 |

| Standard & Poor’s - Long Term Local Issuer Credit Rating | BBB- |

Note: These credit ratings may not reflect the potential risks relating to the structure or trading of the Company’s securities and are provided solely for informational purposes. Credit ratings are not recommendations to buy, sell or hold any security, and may be revised or withdrawn at any time by the issuing organization in its sole discretion. The Company does not undertake any obligation to maintain the ratings or to advise of any change in the ratings. Each agency’s rating should be evaluated independently of any other agency’s rating. An explanation of the significances of the ratings can be obtained from each of the ratings agencies.

| | | | | | | | | | | |

| EXECUTIVE MANAGEMENT TEAM |

| Name | Age | Years with Company | Position |

| Jay A. Brown | 49 | 22 | President and Chief Executive Officer |

| Daniel K. Schlanger | 48 | 5 | Executive Vice President and Chief Financial Officer |

| Catherine Piche | 51 | 10 | Executive Vice President and Chief Operating Officer - Towers |

| Christopher D. Levendos | 54 | 3 | Executive Vice President and Chief Operating Officer - Fiber |

| Kenneth J. Simon | 61 | 6 | Executive Vice President and General Counsel |

| Michael J. Kavanagh | 53 | 11 | Executive Vice President and Chief Commercial Officer |

| Philip M. Kelley | 49 | 24 | Executive Vice President - Corporate Development and Strategy |

| Laura B. Nichol | 61 | 7 | Executive Vice President - Business Support |

| | | | | | | | | | | | | | |

| BOARD OF DIRECTORS |

| Name | Position | Committees | Age | Years as Director |

| J. Landis Martin | Chair | NESG(a) | 76 | 25 |

| P. Robert Bartolo | Director | Audit, Compensation | 50 | 7 |

| Cindy Christy | Director | Compensation, NESG(a), Strategy | 55 | 14 |

| Ari Q. Fitzgerald | Director | Compensation, NESG(a), Strategy | 59 | 19 |

| Anthony J. Melone | Director | Audit, NESG(a), Strategy | 61 | 6 |

| Jay A. Brown | Director | | 49 | 5 |

| Andrea J. Goldsmith | Director | NESG(a), Strategy | 57 | 3 |

| Lee W. Hogan | Director | Audit, Compensation, Strategy | 77 | 20 |

| Tammy K. Jones | Director | Audit, NESG(a) | 56 | 1 |

| W. Benjamin Moreland | Director | Strategy | 58 | 15 |

| Kevin A. Stephens | Director | Audit, Strategy | 60 | 1 |

| Matthew Thornton III | Director | Compensation, Strategy | 63 | 1 |

(a)Nominating, Environmental, Social and Governance Committee

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | |

| RESEARCH COVERAGE |

| Equity Research |

Bank of America

David Barden

(646) 855-1320 | Barclays

Tim Long

(212) 526-4043 | Citigroup

Michael Rollins

(212) 816-1116 |

Cowen and Company

Colby Synesael

(646) 562-1355 | Credit Suisse

Sami Badri

(212) 538-1727 | Deutsche Bank

Matthew Niknam

(212) 250-4711 |

Goldman Sachs

Brett Feldman

(212) 902-8156 | Green Street

David Guarino

(949) 640-8780 | Jefferies

Jonathan Petersen

(212) 284-1705 |

JPMorgan

Philip Cusick

(212) 622-1444 | KeyBanc

Brandon Nispel

(503) 821-3871 | LightShed Partners

Walter Piecyk

(646) 450-9258 |

MoffettNathanson

Nick Del Deo

(212) 519-0025 | Morgan Stanley

Simon Flannery

(212) 761-6432 | New Street Research

Jonathan Chaplin

(212) 921-9876 |

Oppenheimer & Co.

Timothy Horan

(212) 667-8137 | Raymond James

Ric Prentiss

(727) 567-2567 | RBC Capital Markets

Jonathan Atkin

(415) 633-8589 |

Truist Securities

Greg Miller

(212) 303-4169 | UBS

Batya Levi

(212) 713-8824 | Wells Fargo Securities, LLC

Eric Luebchow

(312) 630-2386 |

Wolfe Research

Andrew Rosivach

(646) 582-9350 | | |

| Rating Agencies |

Fitch

John Culver

(312) 368-3216 | Moody’s

Lori Marks

(212) 553-1098 | Standard & Poor’s

Ryan Gilmore

(212) 438-0602 |

| | | | | | | | | | | | | | | | | |

| HISTORICAL COMMON STOCK DATA |

| Three Months Ended |

| (in millions, except per share amounts) | 12/31/21 | 9/30/21 | 6/30/21 | 3/31/21 | 12/31/20 |

High price(a) | $ | 209.87 | | $ | 201.70 | | $ | 196.39 | | $ | 171.68 | | $ | 165.74 | |

Low price(a) | $ | 165.05 | | $ | 171.86 | | $ | 168.03 | | $ | 141.76 | | $ | 146.73 | |

Period end closing price(b) | $ | 208.74 | | $ | 172.04 | | $ | 192.30 | | $ | 168.53 | | $ | 154.53 | |

| Dividends paid per common share | $ | 1.47 | | $ | 1.33 | | $ | 1.33 | | $ | 1.33 | | $ | 1.33 | |

Volume weighted average price for the period(a) | $ | 182.39 | | $ | 190.02 | | $ | 183.32 | | $ | 155.47 | | $ | 155.81 | |

| Common shares outstanding, at period end | 432 | | 432 | | 432 | | 432 | | 431 | |

Market value of outstanding common shares, at period end(c) | $ | 90,220 | | $ | 74,355 | | $ | 83,111 | | $ | 72,837 | | $ | 66,651 | |

(a) Based on the sales price, adjusted for common stock dividends, as reported by Bloomberg.

(b) Based on the period end closing price, adjusted for common stock dividends, as reported by Bloomberg.

(c) Period end market value of outstanding common shares is calculated as the product of (1) shares of common stock outstanding at period end and (2) closing share price at period end, adjusted for common stock dividends, as reported by Bloomberg.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | |

| SUMMARY PORTFOLIO HIGHLIGHTS |

| (as of December 31, 2021) | |

| Towers |

Number of towers (in thousands)(a) | 40 | |

| Average number of tenants per tower | 2.3 | |

Remaining contracted tenant receivables ($ in billions)(b)(c) | $ | 26 | |

Weighted average remaining tenant contract term (years)(c)(d) | 6 | |

| Percent of towers in the Top 50 / 100 Basic Trading Areas | 56% / 71% |

Percent of ground leased / owned(e) | 59% / 41% |

Weighted average maturity of ground leases (years)(e)(f) | 36 | |

| Fiber |

| Number of route miles of fiber (in thousands) | 80 | |

Remaining contracted tenant receivables ($ in billions)(b)(c) | $ | 5 | |

Weighted average remaining tenant contract term (years)(c)(d) | 4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SUMMARY FINANCIAL HIGHLIGHTS |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in millions, except per share amounts) | | 2021 | | 2020 | | 2021 | | 2020 |

| Operating Data: | | | | | | | | |

| Net revenues | | | | | | | | |

| Site rental | | $ | 1,474 | | | $ | 1,352 | | | $ | 5,719 | | | $ | 5,320 | |

| Services and other | | 180 | | | 141 | | | 621 | | | 520 | |

| Net revenues | | $ | 1,654 | | | $ | 1,493 | | | $ | 6,340 | | | $ | 5,840 | |

| | | | | | | | |

| Costs of operations (exclusive of depreciation, amortization and accretion) | | | | | | | | |

| Site rental | | $ | 387 | | | $ | 401 | | | $ | 1,554 | | | $ | 1,521 | |

| Services and other | | 138 | | | 123 | | | 439 | | | 448 | |

| Total cost of operations | | $ | 525 | | | $ | 524 | | | $ | 1,993 | | | $ | 1,969 | |

| | | | | | | | |

| Net income (loss) attributable to CCIC common stockholders | | $ | 353 | | | $ | 508 | | | $ | 1,096 | | | $ | 999 | |

Net income (loss) attributable to CCIC common stockholders per share—diluted(g) | | $ | 0.81 | | | $ | 1.17 | | | $ | 2.53 | | | $ | 2.35 | |

| | | | | | | | |

Non-GAAP Data:(h) | | | | | | | | |

| Adjusted EBITDA | | $ | 984 | | | $ | 1,179 | | | $ | 3,816 | | | $ | 3,706 | |

FFO(i) | | 767 | | | 960 | | | 2,772 | | | 2,600 | |

AFFO(i) | | 768 | | | 1,008 | | | 3,013 | | | 2,878 | |

AFFO per share(g)(i) | | $ | 1.77 | | | $ | 2.33 | | | $ | 6.95 | | | $ | 6.78 | |

(a)Excludes third-party land interests.

(b)Excludes renewal terms at tenants' option.

(c)Excludes the impact of the Company’s long-term agreement with T-Mobile, effective January 1, 2022, as further described in the Form 8-K filed with the Securities and Exchange Commission on January 6, 2022 ("January 8-K"), which will be reflected beginning with the Company’s first quarter 2022 Supplement.

(d)Excludes renewal terms at tenants' option, weighted by site rental revenues.

(e)Weighted by Towers segment site rental gross margin exclusive of straight-lined revenues, amortization of prepaid rent, and straight-lined expenses.

(f)Includes all renewal terms at the Company's option.

(g)Based on diluted weighted-average common shares outstanding of 434 million and 433 million for the three months ended December 31, 2021 and 2020, respectively, and 434 million and 425 million for the twelve months ended December 31, 2021 and 2020, respectively.

(h)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for further information and reconciliation of non-GAAP financial measures to Income (loss) from continuing operations, as computed in accordance with GAAP.

(i)Attributable to CCIC common stockholders.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | |

| SUMMARY FINANCIAL HIGHLIGHTS (CONTINUED) |

| | | | Twelve Months Ended December 31, |

| (in millions) | | | | | | 2021 | | 2020 |

Summary Cash Flow Data:(a) | | | | | | | | |

| Net cash provided by (used for) operating activities | | | | | | $ | 2,789 | | | $ | 3,055 | |

Net cash provided by (used for) investing activities(b) | | | | | | (1,332) | | | (1,741) | |

| Net cash provided by (used for) financing activities | | | | | | (1,310) | | | (1,271) | |

| | | | | | | | | | | | | | |

| (in millions) | | December 31, 2021 | | December 31, 2020 |

| Balance Sheet Data (at period end): | | | | |

| Cash and cash equivalents | | $ | 292 | | | $ | 232 | |

| Property and equipment, net | | 15,269 | | | 15,162 | |

| Total assets | | 39,040 | | | 38,768 | |

| Total debt and other long-term obligations | | 20,629 | | | 19,280 | |

| Total CCIC stockholders' equity | | 8,258 | | | 9,461 | |

| | | | | | | | |

| | Three Months Ended December 31, 2021 |

| Other Data: | | |

Net debt to last quarter annualized Adjusted EBITDA(c) | | 5.2 | x |

| Dividend per common share | | $ | 1.47 | |

| | |

| | | | | | | | | | | | | | |

| OUTLOOK FOR FULL YEAR 2022 |

| (in millions, except per share amounts) | Full Year 2022(d) | |

| Site rental revenues | $6,202 | to | $6,247 | | | |

Site rental cost of operations(e) | $1,548 | to | $1,593 | | | |

| Income (loss) from continuing operations | $1,634 | to | $1,714 | | | |

| | | | | | |

Income (loss) from continuing operations per share—diluted(f)(g) | $3.76 | to | $3.94 | | | |

Adjusted EBITDA(h) | $4,249 | to | $4,294 | | | |

Interest expense and amortization of deferred financing costs(i) | $615 | to | $660 | | | |

FFO(g)(h) | $3,318 | to | $3,363 | | | |

AFFO(g)(h) | $3,178 | to | $3,223 | | | |

AFFO per share(f)(g)(h) | $7.31 | to | $7.41 | | | |

(a)Includes impacts of restricted cash. See the condensed consolidated statement of cash flows for further information.

(b)Includes net cash used for acquisitions of approximately $111 million and $107 million for the twelve months ended December 31, 2021 and 2020, respectively.

(c)See the "Net Debt to Last Quarter Annualized Adjusted EBITDA Calculation" in the Appendix.

(d)As issued on January 26, 2022.

(e)Exclusive of depreciation, amortization and accretion.

(f)The assumption for diluted weighted-average common shares outstanding for full year 2022 Outlook is based on the diluted common shares outstanding as of December 31, 2021.

(g)Attributable to CCIC common stockholders.

(h)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for further information and reconciliation of non-GAAP financial measures to Income (loss) from continuing operations, as computed in accordance with GAAP.

(i)See the reconciliation of "Components of Current Outlook for Interest Expense and Amortization of Deferred Financing Costs" in the Appendix.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | |

| FULL YEAR 2021 AND OUTLOOK FOR FULL YEAR 2022 COMPONENTS OF CHANGES IN SITE RENTAL REVENUES |

| (dollars in millions) | Full Year 2021 Actual | | Full Year 2022 Outlook(a) | |

| Components of changes in site rental revenues: | | | | |

Prior year site rental revenues exclusive of straight-lined revenues associated with fixed escalators(b)(c) | $5,298 | | $5,608 | |

| | | | |

New leasing activity(b)(c) | 384 | | $325 | to | $355 | | | |

| Escalators | 93 | | $95 | to | $105 | | | |

| Non-renewals | (170) | | $(195) | to | $(175) | | | |

Organic Contribution to Site Rental Revenues(d) | 307 | | $235 | to | $275 | | | |

| Impact from full year straight-lined revenues associated with fixed escalators | 111 | | $359 | to | $379 | | | |

Acquisitions(e) | 3 | | — | |

| Other | — | | — | |

| Total GAAP site rental revenues | $5,719 | | $6,202 | to | $6,247 | | | |

| | | | |

| Year-over-year changes in revenues: | | | | |

| Reported GAAP site rental revenues | 7.5% | | 8.8%(f) | |

Organic Contribution to Site Rental Revenues(d)(g) | 5.8% | | 4.5%(f) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NEW LEASING ACTIVITY BY SEGMENT |

| Full Year 2021 Actual | | Full Year 2022 Outlook(a) |

| Towers | | Fiber | | Total | Towers | Fiber | Total |

| (in millions) | | | Small Cells | | Fiber Solutions | | | | | | Small Cells | | Fiber Solutions | | |

New leasing activity(h) | $159 | | $53 | | $172 | | $384 | | $155-$165 | | $20-$30 | | $150-$160 | | $325-$355 |

| Less: Year-over-year change in prepaid rent amortization | (20) | | (19) | | (3) | | (42) | | (5) | | 5 | | (5) | | (5) |

Core leasing activity(h) | $139 | | $34 | | $169 | | $342 | | $150-$160 | | $25-$35 | | $145-$155 | | $320-$350 |

|

| | | |

| | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(a)As issued on January 26, 2022.

(b)Includes revenues from amortization of prepaid rent in accordance with GAAP.

(c)Includes revenues from the construction of new small cell nodes, exclusive of straight-lined revenues related to fixed escalators.

(d)See "Non-GAAP Measures, Segment Measures and Other Calculations" for a discussion of our definition of Organic Contribution to Site Rental Revenues.

(e)Represents the contribution from recent acquisitions. The financial impact of recent acquisitions is excluded from Organic Contribution to Site Rental Revenues until the one-year anniversary of the acquisition.

(f)Calculated based on midpoint of full year 2022 Outlook.

(g)Calculated as the percentage change from prior year site rental revenues, exclusive of straight-lined revenues associated with fixed escalations, compared to Organic Contribution to Site Rental Revenues for the current period.

(h)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for a discussion of our definitions of new leasing activity and core leasing activity.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) |

| (in millions, except par values) | December 31, 2021 | | December 31, 2020 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 292 | | | $ | 232 | |

| Restricted cash | 169 | | | 144 | |

| Receivables, net | 543 | | | 431 | |

| Prepaid expenses | 105 | | | 95 | |

| Other current assets | 145 | | | 202 | |

| Total current assets | 1,254 | | | 1,104 | |

| Deferred site rental receivables | 1,588 | | | 1,408 | |

| Property and equipment, net | 15,269 | | | 15,162 | |

| Operating lease right-of-use assets | 6,682 | | | 6,464 | |

| Goodwill | 10,078 | | | 10,078 | |

| Other intangible assets, net | 4,046 | | | 4,433 | |

| Other assets, net | 123 | | | 119 | |

| Total assets | $ | 39,040 | | | $ | 38,768 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 246 | | | $ | 230 | |

| Accrued interest | 182 | | | 199 | |

| Deferred revenues | 776 | | | 704 | |

| Other accrued liabilities | 401 | | | 378 | |

| Current maturities of debt and other obligations | 72 | | | 129 | |

| Current portion of operating lease liabilities | 349 | | | 329 | |

| Total current liabilities | 2,026 | | | 1,969 | |

| Debt and other long-term obligations | 20,557 | | | 19,151 | |

| Operating lease liabilities | 6,031 | | | 5,808 | |

| | | |

| Other long-term liabilities | 2,168 | | | 2,379 | |

| Total liabilities | 30,782 | | | 29,307 | |

| Commitments and contingencies | | | |

| CCIC stockholders' equity: | | | |

| Common stock, $0.01 par value; 600 shares authorized; shares issued and outstanding: December 31, 2021—432 and December 31, 2020—431 | 4 | | | 4 | |

| Additional paid-in capital | 18,011 | | | 17,933 | |

| Accumulated other comprehensive income (loss) | (4) | | | (4) | |

| Dividends/distributions in excess of earnings | (9,753) | | | (8,472) | |

| Total equity | 8,258 | | | 9,461 | |

| Total liabilities and equity | $ | 39,040 | | | $ | 38,768 | |

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited) |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in millions, except per share amounts) | 2021 | | 2020 | | 2021 | | 2020 |

| Net revenues: | | | | | | | |

| Site rental | $ | 1,474 | | | $ | 1,352 | | | $ | 5,719 | | | $ | 5,320 | |

| Services and other | 180 | | | 141 | | | 621 | | | 520 | |

| Net revenues | 1,654 | | | 1,493 | | | 6,340 | | | 5,840 | |

| Operating expenses: | | | | | | | |

Costs of operations:(a) | | | | | | | |

| Site rental | 387 | | | 401 | | | 1,554 | | | 1,521 | |

| Services and other | 138 | | | 123 | | | 439 | | | 448 | |

| Selling, general and administrative | 180 | | | 185 | | | 680 | | | 678 | |

| Asset write-down charges | 12 | | | 64 | | | 21 | | | 74 | |

| Acquisition and integration costs | — | | | 1 | | | 1 | | | 10 | |

| Depreciation, amortization and accretion | 415 | | | 401 | | | 1,644 | | | 1,608 | |

| Total operating expenses | 1,132 | | | 1,175 | | | 4,339 | | | 4,339 | |

| Other operating (income) expense | — | | | (362) | | | — | | | (362) | |

| Operating income (loss) | 522 | | | 680 | | | 2,001 | | | 1,863 | |

| Interest expense and amortization of deferred financing costs | (164) | | | (167) | | | (657) | | | (689) | |

| Gains (losses) on retirement of long-term obligations | — | | | — | | | (145) | | | (95) | |

| Interest income | — | | | — | | | 1 | | | 2 | |

| Other income (expense) | (4) | | | — | | | (21) | | | (5) | |

| Income (loss) before income taxes | 354 | | | 513 | | | 1,179 | | | 1,076 | |

| Benefit (provision) for income taxes | (1) | | | (5) | | | (21) | | | (20) | |

| Income (loss) from continuing operations | 353 | | | 508 | | | 1,158 | | | 1,056 | |

| Discontinued operations: | | | | | | | |

| Net gain (loss) from disposal of discontinued operations, net of tax | — | | | — | | | (62) | | | — | |

| Income (loss) from discontinued operations, net of tax | — | | | — | | | (62) | | | — | |

| Net income (loss) | 353 | | | 508 | | | 1,096 | | | 1,056 | |

| Dividends/distributions on preferred stock | — | | | — | | | — | | | (57) | |

| Net income (loss) attributable to CCIC common stockholders | $ | 353 | | | $ | 508 | | | $ | 1,096 | | | $ | 999 | |

| | | | | | | |

| Net income (loss) attributable to CCIC common stockholders, per common share: | | | | | | | |

| Income (loss) from continuing operations, basic | $ | 0.82 | | | $ | 1.17 | | | $ | 2.68 | | | $ | 2.36 | |

| Income (loss) from discontinued operations, basic | — | | | — | | | (0.14) | | | — | |

| Net income (loss) attributable to CCIC common stockholders, basic | $ | 0.82 | | | $ | 1.17 | | | $ | 2.54 | | | $ | 2.36 | |

| Income (loss) from continuing operations, diluted | $ | 0.81 | | | $ | 1.17 | | | $ | 2.67 | | | $ | 2.35 | |

| Income (loss) from discontinued operations, diluted | — | | | — | | | (0.14) | | | — | |

| Net income (loss) attributable to CCIC common stockholders, diluted | $ | 0.81 | | | $ | 1.17 | | | $ | 2.53 | | | $ | 2.35 | |

| | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | |

| Basic | 432 | | | 431 | | | 432 | | | 423 | |

| Diluted | 434 | | | 433 | | | 434 | | | 425 | |

(a)Exclusive of depreciation, amortization and accretion shown separately.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SEGMENT OPERATING RESULTS |

| Three Months Ended December 31, 2021 | | Three Months Ended December 31, 2020 |

| (in millions) | Towers | | Fiber | | Other | | Consolidated Total | | Towers | | Fiber | | Other | | Consolidated Total |

| Segment site rental revenues | $ | 985 | | | $ | 489 | | | | | $ | 1,474 | | | $ | 884 | | | $ | 468 | | | | | $ | 1,352 | |

| Segment services and other revenues | 174 | | | 6 | | | | | 180 | | | 133 | | | 8 | | | | | 141 | |

| Segment revenues | 1,159 | | | 495 | | | | | 1,654 | | | 1,017 | | | 476 | | | | | 1,493 | |

| Segment site rental costs of operations | 231 | | | 148 | | | | | 379 | | | 218 | | | 173 | | | | | 391 | |

| Segment services and other costs of operations | 130 | | | 6 | | | | | 136 | | | 117 | | | 5 | | | | | 122 | |

Segment costs of operations(a)(b) | 361 | | | 154 | | | | | 515 | | | 335 | | | 178 | | | | | 513 | |

Segment site rental gross margin(c) | 754 | | | 341 | | | | | 1,095 | | | 666 | | | 295 | | | | | 961 | |

Segment services and other gross margin(c) | 44 | | | — | | | | | 44 | | | 16 | | | 3 | | | | | 19 | |

Segment selling, general and administrative expenses(b) | 29 | | | 41 | | | | | 70 | | | 30 | | | 49 | | | | | 79 | |

| Segment other operating (income) loss | — | | | — | | | | | — | | | — | | | (362) | | | | | (362) | |

Segment operating profit(c) | 769 | | | 300 | | | | | 1,069 | | | 652 | | | 611 | | | | | 1,263 | |

Other selling, general and administrative expenses(b) | | | | | $ | 85 | | | 85 | | | | | | | $ | 84 | | | 84 | |

| Stock-based compensation expense | | | | | 31 | | | 31 | | | | | | | 28 | | | 28 | |

| Depreciation, amortization and accretion | | | | | 415 | | | 415 | | | | | | | 401 | | | 401 | |

| Interest expense and amortization of deferred financing costs | | | | | 164 | | | 164 | | | | | | | 167 | | | 167 | |

Other (income) expenses to reconcile to income (loss) before income taxes(d) | | | | | 20 | | | 20 | | | | | | | 70 | | | 70 | |

| Income (loss) before income taxes | | | | | | | $ | 354 | | | | | | | | | $ | 513 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIBER SEGMENT SITE RENTAL REVENUES SUMMARY |

| Three Months Ended December 31, |

| 2021 | | 2020 |

| (in millions) | Fiber Solutions | | Small Cells | | Total | | Fiber Solutions | | Small Cells | | Total |

| Site rental revenues | $ | 331 | | | $ | 158 | | | $ | 489 | | | $ | 325 | | | $ | 143 | | | $ | 468 | |

(a)Exclusive of depreciation, amortization and accretion shown separately.

(b)Segment costs of operations excludes (1) stock-based compensation expense of $6 million in each of the three months ended December 31, 2021 and 2020 and (2) prepaid lease purchase price adjustments of $4 million and $5 million for the three months ended December 31, 2021 and 2020, respectively. Selling, general and administrative expenses exclude stock-based compensation expense of $25 million and $22 million for the three months ended December 31, 2021 and 2020, respectively.

(c)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for a discussion of our definitions of segment site rental gross margin, segment services and other gross margin and segment operating profit.

(d)See condensed consolidated statement of operations for further information.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SEGMENT OPERATING RESULTS |

| Twelve Months Ended December 31, 2021 | | Twelve Months Ended December 31, 2020 |

| (in millions) | Towers | | Fiber | | Other | | Consolidated Total | | Towers | | Fiber | | Other | | Consolidated Total |

| Segment site rental revenues | $ | 3,804 | | | $ | 1,915 | | | | | $ | 5,719 | | | $ | 3,497 | | | $ | 1,823 | | | | | $ | 5,320 | |

| Segment services and other revenues | 601 | | | 20 | | | | | 621 | | | 500 | | | 20 | | | | | 520 | |

| Segment revenues | 4,405 | | | 1,935 | | | | | 6,340 | | | 3,997 | | | 1,843 | | | | | 5,840 | |

| Segment site rental costs of operations | 889 | | | 633 | | | | | 1,522 | | | 866 | | | 620 | | | | | 1,486 | |

| Segment services and other costs of operations | 414 | | | 17 | | | | | 431 | | | 429 | | | 12 | | | | | 441 | |

Segment costs of operations(a)(b) | 1,303 | | | 650 | | | | | 1,953 | | | 1,295 | | | 632 | | | | | 1,927 | |

Segment site rental gross margin(c) | 2,915 | | | 1,282 | | | | | 4,197 | | | 2,631 | | | 1,203 | | | | | 3,834 | |

Segment services and other gross margin(c) | 187 | | | 3 | | | | | 190 | | | 71 | | | 8 | | | | | 79 | |

Segment selling, general and administrative expenses(b) | 107 | | | 174 | | | | | 281 | | | 100 | | | 186 | | | | | 286 | |

| Segment other operating (income) loss | — | | | — | | | | | — | | | — | | | (362) | | | | | (362) | |

Segment operating profit(c) | 2,995 | | | 1,111 | | | | | 4,106 | | | 2,602 | | | 1,387 | | | | | 3,989 | |

Other selling, general and administrative expenses(b) | | | | | $ | 290 | | | 290 | | | | | | | $ | 283 | | | 283 | |

| Stock-based compensation expense | | | | | 131 | | | 131 | | | | | | | 133 | | | 133 | |

| Depreciation, amortization and accretion | | | | | 1,644 | | | 1,644 | | | | | | | 1,608 | | | 1,608 | |

| Interest expense and amortization of deferred financing costs | | | | | 657 | | | 657 | | | | | | | 689 | | | 689 | |

Other (income) expenses to reconcile to income (loss) before income taxes(d) | | | | | 205 | | | 205 | | | | | | | 200 | | | 200 | |

| Income (loss) before income taxes | | | | | | | $ | 1,179 | | | | | | | | | $ | 1,076 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIBER SEGMENT SITE RENTAL REVENUES SUMMARY |

| Twelve Months Ended December 31, |

| 2021 | | 2020 |

| (in millions) | Fiber Solutions | | Small Cells | | Total | | Fiber Solutions | | Small Cells | | Total |

| Site rental revenues | $ | 1,318 | | | $ | 597 | | | $ | 1,915 | | | $ | 1,275 | | | $ | 548 | | | $ | 1,823 | |

(a)Exclusive of depreciation, amortization and accretion shown separately.

(b)Segment costs of operations excludes (1) stock-based compensation expense of $22 million and $24 million for the twelve months ended December 31, 2021 and 2020, respectively and (2) prepaid lease purchase price adjustments of $18 million in each of the twelve months ended December 31, 2021 and 2020. Selling, general and administrative expenses exclude stock-based compensation expense of $109 million in each of the twelve months ended December 31, 2021 and 2020.

(c)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for a discussion of our definitions of segment site rental gross margin, segment services and other gross margin and segment operating profit.

(d)See condensed consolidated statement of operations for further information.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | | | | | |

| FFO AND AFFO RECONCILIATIONS |

| Three Months Ended December 31, | | Twelve Months Ended December 31, | |

| (in millions, except per share amounts) | 2021 | | 2020 | | 2021 | | 2020 | |

| Income (loss) from continuing operations | $ | 353 | | | $ | 508 | | | $ | 1,158 | | (a) | $ | 1,056 | | |

| Real estate related depreciation, amortization and accretion | 402 | | | 388 | | | 1,593 | | | 1,555 | | |

| Asset write-down charges | 12 | | | 64 | | | 21 | | | 74 | | |

| Dividends/distributions on preferred stock | — | | | — | | | — | | | (85) | | |

FFO(b)(c)(d)(e) | $ | 767 | | | $ | 960 | | | $ | 2,772 | | | $ | 2,600 | | |

| Weighted-average common shares outstanding—diluted | 434 | | | 433 | | | 434 | | | 425 | | |

FFO per share(b)(c)(d)(e) | $ | 1.77 | | | $ | 2.22 | | | $ | 6.39 | | | $ | 6.12 | | |

| | | | | | | | |

| FFO (from above) | $ | 767 | | | $ | 960 | | | $ | 2,772 | | | $ | 2,600 | | |

| Adjustments to increase (decrease) FFO: | | | | | | | | |

| Straight-lined revenue | (38) | | | 5 | | | (111) | | | (22) | | |

| Straight-lined expense | 18 | | | 22 | | | 76 | | | 83 | | |

| Stock-based compensation expense | 31 | | | 28 | | | 131 | | | 133 | | |

| Non-cash portion of tax provision | (1) | | | (1) | | | 1 | | | 1 | | |

| Non-real estate related depreciation, amortization and accretion | 13 | | | 13 | | | 51 | | | 53 | | |

| Amortization of non-cash interest expense | 4 | | | 1 | | | 13 | | | 6 | | |

| Other (income) expense | 4 | | | — | | | 21 | | | 5 | | |

| (Gains) losses on retirement of long-term obligations | — | | | — | | | 145 | | | 95 | | |

| Acquisition and integration costs | — | | | 1 | | | 1 | | | 10 | | |

| Sustaining capital expenditures | (30) | | | (21) | | | (87) | | | (86) | | |

AFFO(b)(c)(d)(e) | $ | 768 | | | $ | 1,008 | | | $ | 3,013 | | | $ | 2,878 | | |

| Weighted-average common shares outstanding—diluted | 434 | | | 433 | | | 434 | | | 425 | | |

AFFO per share(b)(c)(d)(e) | $ | 1.77 | | | $ | 2.33 | | | $ | 6.95 | | | $ | 6.78 | | |

(a)Does not reflect the impact related to the ATO Settlement (as defined in the Form 8-K filed with the Securities and Exchange Commission on April 26, 2021 ("April 8-K"), which is attributable to discontinued operations as discussed in the April 8-K.

(b)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for a discussion of our definitions of FFO and AFFO, including per share amounts.

(c)FFO and AFFO are reduced by cash paid for preferred stock dividends during the period in which they are paid.

(d)Attributable to CCIC common stockholders.

(e)The above reconciliation excludes line items included in our definition which are not applicable for the periods shown.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited) |

| Twelve Months Ended December 31, |

| (in millions) | | | | | 2021 | | 2020 |

| Cash flows from operating activities: | | | |

| Income (loss) from continuing operations | $ | 1,158 | | | $ | 1,056 | |

| Adjustments to reconcile Income (loss) from continuing operations to net cash provided by (used for) operating activities: | | | |

| Depreciation, amortization and accretion | 1,644 | | | 1,608 | |

| (Gains) losses on retirement of long-term obligations | 145 | | | 95 | |

| | | |

| Amortization of deferred financing costs and other non-cash interest, net | 13 | | | 6 | |

| Stock-based compensation expense | 129 | | | 138 | |

| Asset write-down charges | 21 | | | 74 | |

| Deferred income tax (benefit) provision | 4 | | | 3 | |

| Other non-cash adjustments, net | 21 | | | 5 | |

| Changes in assets and liabilities, excluding the effects of acquisitions: | | | |

| Increase (decrease) in liabilities | (120) | | | (111) | |

| Decrease (increase) in assets | (226) | | | 181 | |

| Net cash provided by (used for) operating activities | 2,789 | | | 3,055 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (1,229) | | | (1,624) | |

| Payments for acquisitions, net of cash acquired | (111) | | | (107) | |

| | | |

| Other investing activities, net | 8 | | | (10) | |

| Net cash provided by (used for) investing activities | (1,332) | | | (1,741) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | 3,985 | | | 3,733 | |

| Principal payments on debt and other long-term obligations | (1,076) | | | (105) | |

| Purchases and redemptions of long-term debt | (2,089) | | | (2,490) | |

| Borrowings under revolving credit facility | 1,245 | | | 2,430 | |

| Payments under revolving credit facility | (870) | | | (2,665) | |

| Net borrowings (repayments) under commercial paper program | (20) | | | 130 | |

| Payments for financing costs | (42) | | | (38) | |

| | | |

| | | |

| Purchases of common stock | (70) | | | (76) | |

| Dividends/distributions paid on common stock | (2,373) | | | (2,105) | |

| Dividends/distributions paid on preferred stock | — | | | (85) | |

| Net cash provided by (used for) financing activities | (1,310) | | | (1,271) | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash - continuing operations | 147 | | | 43 | |

| Discontinued operations: | | | |

| Net cash provided by (used for) operating activities | (62) | | | — | |

| Net increase (decrease) in cash, cash equivalents and restricted cash - discontinued operations | (62) | | | — | |

| Effect of exchange rate changes on cash | — | | | — | |

| Cash, cash equivalents, and restricted cash at beginning of period | 381 | | | 338 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 466 | | | $ | 381 | |

| Supplemental disclosure of cash flow information: | | | |

| Interest paid | 661 | | | 653 | |

| Income taxes paid | 20 | | | 19 | |

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | |

| COMPONENTS OF CHANGES IN SITE RENTAL REVENUES |

| Three Months Ended December 31, |

| (dollars in millions) | 2021 | | 2020 |

| Components of changes in site rental revenues: | | | |

Prior year site rental revenues exclusive of straight-lined revenues associated with fixed escalators(a)(b) | $ | 1,357 | | $ | 1,282 | |

| | | |

New leasing activity(a)(b) | 98 | | 90 | |

| Escalators | 24 | | 23 | |

| Non-renewals | (43) | | (39) | |

Organic Contribution to Site Rental Revenues(c) | 79 | | 74 | |

| Impact from straight-lined revenues associated with fixed escalators | 38 | | (5) | |

Acquisitions(d) | — | | 1 | |

| Other | — | | — | |

| Total GAAP site rental revenues | $ | 1,474 | | $ | 1,352 | |

| | | |

| Year-over-year changes in revenue: | | | |

| Reported GAAP site rental revenues | 9.0 | % | | |

Organic Contribution to Site Rental Revenues(c)(e) | 5.8 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SUMMARY OF SITE RENTAL STRAIGHT-LINED REVENUES AND EXPENSES ASSOCIATED WITH FIXED ESCALATORS(f) |

| Three Months Ended December 31, |

| | 2021 | | 2020 |

| (in millions) | Towers | | Fiber | | Total | | Towers | | Fiber | | Total |

| Site rental straight-lined revenues | $ | 39 | | | $ | (1) | | | $ | 38 | | | $ | (6) | | | $ | 1 | | | $ | (5) | |

| Site rental straight-lined expenses | 18 | | | — | | | 18 | | | 22 | | | — | | | 22 | |

|

| Twelve Months Ended December 31, |

| | 2021 | | 2020 |

| (in millions) | Towers | | Fiber | | Total | | Towers | | Fiber | | Total |

| Site rental straight-lined revenues | $ | 110 | | | $ | 1 | | | $ | 111 | | | $ | 16 | | | $ | 6 | | | $ | 22 | |

| Site rental straight-lined expenses | 75 | | | 1 | | | 76 | | | 82 | | | 1 | | | 83 | |

(a)Includes revenues from amortization of prepaid rent in accordance with GAAP.

(b)Includes revenues from the construction of new small cell nodes, exclusive of straight-lined revenues related to fixed escalators.

(c)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for a discussion of our definition of Organic Contribution to Site Rental Revenues.

(d)Represents the contribution from recent acquisitions. The financial impact of recent acquisitions is excluded from Organic Contribution to Site Rental Revenues until the one-year anniversary of the acquisition.

(e)Calculated as the percentage change from prior year site rental revenues, exclusive of straight-lined revenues associated with fixed escalations, compared to Organic Contribution to Site Rental Revenues for the current period.

(f)In accordance with GAAP accounting, if payment terms call for fixed escalations or rent free periods, the revenue is recognized on a straight-line basis over the fixed, non-cancelable term of the contract. Since the Company recognizes revenue on a straight-line basis, a portion of the site rental revenue in a given period represents cash collected or contractually collectible in other periods.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SUMMARY OF PREPAID RENT ACTIVITY(a) |

| Three Months Ended December 31, |

| | 2021 | | 2020 |

| (in millions) | Towers | | Fiber | | Total | | Towers | | Fiber | | Total |

| Prepaid rent additions | $ | 26 | | | $ | 107 | | | $ | 133 | | | $ | 26 | | | $ | 57 | | | $ | 83 | |

| Amortization of prepaid rent | 80 | | | 66 | | | 146 | | | 76 | | | 57 | | | 133 | |

|

| Twelve Months Ended December 31, |

| 2021 | | 2020 |

| (in millions) | Towers | | Fiber | | Total | | Towers | | Fiber | | Total |

| Prepaid rent additions | $ | 105 | | | $ | 290 | | | $ | 395 | | | $ | 193 | | | $ | 242 | | | $ | 435 | |

| Amortization of prepaid rent | 318 | | | 242 | | | 560 | | | 298 | | | 221 | | | 519 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SUMMARY OF CAPITAL EXPENDITURES |

| Three Months Ended December 31, |

| 2021 | | 2020 |

| (in millions) | Towers | | Fiber | | Other | | Total | | Towers | | Fiber | | Other | | Total |

| Discretionary: | | | | | | | | | | | | | | | |

| Purchases of land interests | $ | 19 | | | $ | 2 | | | $ | — | | | $ | 21 | | | $ | 23 | | | $ | — | | | $ | — | | | $ | 23 | |

| Communications infrastructure improvements and other capital projects | 34 | | | 239 | | | 13 | | | 286 | | | 38 | | | 292 | | | 12 | | | 342 | |

| | | | | | | | | | | | | | | |

| Sustaining | 8 | | | 14 | | | 8 | | | 30 | | | 3 | | | 14 | | | 4 | | | 21 | |

| | | | | | | | | | | | | | | |

| Total | $ | 61 | | | $ | 255 | | | $ | 21 | | | $ | 337 | | | $ | 64 | | | $ | 306 | | | $ | 16 | | | $ | 386 | |

|

| Twelve Months Ended December 31, |

| 2021 | | 2020 |

| (in millions) | Towers | | Fiber | | Other | | Total | | Towers | | Fiber | | Other | | Total |

| Discretionary: | | | | | | | | | | | | | | | |

| Purchases of land interests | $ | 64 | | | $ | 2 | | | $ | — | | | $ | 66 | | | $ | 64 | | | $ | — | | | $ | — | | | $ | 64 | |

| Communications infrastructure improvements and other capital projects | 138 | | | 905 | | | 33 | | | 1,076 | | | 257 | | | 1,179 | | | 38 | | | 1,474 | |

| Sustaining | 19 | | | 49 | | | 19 | | | 87 | | | 14 | | | 53 | | | 19 | | | 86 | |

| Total | $ | 221 | | | $ | 956 | | | $ | 52 | | | $ | 1,229 | | | $ | 335 | | | $ | 1,232 | | | $ | 57 | | | $ | 1,624 | |

| | | | | | | | | | | | | | | | | | |

PROJECTED REVENUES FROM TENANT CONTRACTS(b)(c) |

| | Years Ending December 31, |

| (as of December 31, 2021; in millions) | | 2022 | 2023 | 2024 | 2025 | 2026 |

| Components of site rental revenues: | | | | | | |

| Site rental revenues exclusive of straight-line associated with fixed escalators | | $ | 5,765 | | $ | 5,839 | | $ | 5,850 | | $ | 5,920 | | $ | 6,000 | |

| Straight-lined site rental revenues associated with fixed escalators | | 67 | | (18) | | (71) | | (169) | | (242) | |

| GAAP site rental revenues | | $ | 5,832 | | $ | 5,821 | | $ | 5,779 | | $ | 5,751 | | $ | 5,758 | |

(a)Reflects up-front consideration from long-term tenants and other deferred credits (commonly referred to as prepaid rent), and the amortization thereof for GAAP revenue recognition purposes.

(b)Based on tenant licenses in-place as of December 31, 2021. All tenant licenses are assumed to renew for a new term no later than the respective current term end date, and as such, projected revenues do not reflect the impact of estimated annual churn. CPI-linked tenant contracts are assumed to escalate at 3% per annum.

(c)Excludes the impact of the Company’s long-term agreement with T-Mobile, effective January 1, 2022, as further described in the January 8-K, which will be reflected beginning with the Company’s first quarter 2022 Supplement.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | |

PROJECTED EXPENSES FROM EXISTING GROUND LEASES AND FIBER ACCESS AGREEMENTS(a) |

| | Years Ending December 31, |

| (as of December 31, 2021; in millions) | | 2022 | 2023 | 2024 | 2025 | 2026 |

| Components of ground lease and fiber access agreement expenses: | | | | | | |

| Ground lease and fiber access agreement expenses exclusive of straight-line associated with fixed escalators | | $ | 944 | | $ | 963 | | $ | 982 | | $ | 1,001 | | $ | 1,022 | |

| Straight-lined site rental lease expenses associated with fixed escalators | | 65 | | 52 | | 41 | | 30 | | 18 | |

| GAAP ground lease and fiber access agreement expenses | | $ | 1,009 | | $ | 1,015 | | $ | 1,023 | | $ | 1,031 | | $ | 1,040 | |

| | | | | | | | | | | | | | | | | | |

ANNUALIZED RENTAL CASH PAYMENTS AT TIME OF RENEWAL(b) |

| | Years Ending December 31, |

| (as of December 31, 2021; in millions) | | 2022 | 2023 | 2024 | 2025 | 2026 |

T-Mobile(c) | | $ | 324 | | $ | 260 | | $ | 71 | | $ | 83 | | $ | 78 | |

| AT&T | | 27 | | 330 | | 18 | | 20 | | 32 | |

| Verizon | | 17 | | 16 | | 20 | | 30 | | 36 | |

| All Others Combined | | 214 | | 211 | | 166 | | 90 | | 98 | |

| Total | | $ | 582 | | $ | 817 | | $ | 275 | | $ | 223 | | $ | 244 | |

| | | | | | | | | | | |

| CONSOLIDATED TENANT OVERVIEW |

| (as of December 31, 2021) | Percentage of Q4 2021 LQA Site

Rental Revenues | Weighted Average Current

Term Remaining(d) | Long-Term Credit Rating

(S&P / Moody’s) |

| T-Mobile | 33% | 5(c) | BB+ / Ba1 |

| AT&T | 20% | 5 | BBB / Baa2 |

| Verizon | 21% | 9 | BBB+ / Baa1 |

| All Others Combined | 26% | 3 | N/A |

| Total / Weighted Average | 100% | 5 | |

| | | | | |

| FIBER SOLUTIONS REVENUE MIX |

| (as of December 31, 2021) | Percentage of Q4 2021 LQA Site

Rental Revenues |

Carrier(e) | 38% |

| Education | 13% |

| Healthcare | 11% |

| Financial Services | 9% |

| Other | 29% |

| Total | 100% |

(a)Based on existing ground leases and fiber access agreements as of December 31, 2021. CPI-linked leases are assumed to escalate at 3% per annum.

(b)Reflects lease renewals by year by tenant; dollar amounts represent annualized cash site rental revenues from assumed renewals or extensions as reflected in the table "Projected Revenues from Tenant Contracts."

(c)Excludes the impact of the Company’s long-term agreement with T-Mobile, effective January 1, 2022, as further described in the January 8-K, which will be reflected beginning with the Company’s first quarter 2022 Supplement.

(d)Weighted by site rental revenue revenues; excludes renewals at the tenants' option.

(e)Includes revenues derived from both wireless carriers and wholesale carriers.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | |

SEGMENT CASH YIELDS ON INVESTED CAPITAL(a) |

| Q4 2021 LQA |

| (as of December 31, 2021; dollars in millions) | Towers | | Fiber |

| | | |

| | | |

| | | |

| | | |

Segment site rental gross margin(b) | $ | 3,016 | | | $ | 1,364 | |

| Less: Amortization of prepaid rent | (320) | | | (264) | |

| Less: Site rental straight-lined revenues | (156) | | | 4 | |

| Add: Site rental straight-lined expenses | 72 | | | — | |

Add: Indirect labor costs(c) | — | | | 109 | |

| Numerator | $ | 2,612 | | | $ | 1,213 | |

| | | |

Segment net investment in property and equipment(d) | $ | 13,127 | | | $ | 8,020 | |

| Segment investment in site rental contracts and tenant relationships | 4,567 | | | 3,287 | |

Segment investment in goodwill(e) | 5,351 | | | 4,073 | |

Segment net invested capital(a) | $ | 23,045 | | | $ | 15,380 | |

| | | |

Segment Cash Yield on Invested Capital(a) | 11.3 | % | | 7.9 | % |

| | | | | |

CONSOLIDATED RETURN ON INVESTED CAPITAL(a) |

| (as of December 31, 2021; dollars in millions) | Q4 2021 LQA |

Adjusted EBITDA(f) | $ | 3,936 | |

| Cash taxes refunded (paid) | (10) | |

| Numerator | $ | 3,926 | |

| |

Historical gross investment in property and equipment(g) | $ | 26,267 | |

| Historical gross investment in site rental contracts and tenant relationships | 7,854 | |

| Historical gross investment in goodwill | 10,078 | |

Consolidated invested capital(a) | $ | 44,199 | |

| |

Consolidated Return on Invested Capital(a) | 8.9 | % |

(a)See "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for further information on, and definition and our calculation of segment cash yields on invested capital, segment net invested capital, consolidated return on invested capital and consolidated invested capital.

(b)See "Segment Operating Results" and "Non-GAAP Financial Measures, Segment Measures and Other Calculations" for further information on, and definition and our calculation of segment site rental gross margin.

(c)This adjustment represents indirect labor costs in the Fiber segment that are not capitalized, but that primarily support the Company's ongoing expansion of its small cells and fiber networks that management expects to generate future revenues for the Company. Removal of these indirect labor costs presents segment cash yield on invested capital on a direct cost basis, consistent with the methodology used by management when evaluating project-level investment opportunities.

(d)Segment investment in property and equipment excludes the impact of construction in process and non-productive assets (such as information technology assets and buildings) and is reduced by the amount of prepaid rent received from customers (excluding any deferred credits recorded in connection with acquisitions).

(e)Segment investment in goodwill excludes the impact of certain assets and liabilities recorded in connection with acquisitions (primarily deferred credits).

(f)See "Reconciliations of Non-GAAP Financial Measures to Comparable GAAP Financial Measures and Other Calculations" for further information and reconciliation of this non-GAAP financial measure to net income (loss). See also "Non-GAAP Financial Measures, Segment Measures and Other Calculations" in the Appendix for our definition of Adjusted EBITDA.

(g)Historical gross investment in property and equipment excludes the impact of construction in process.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

| COMPANY OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | |

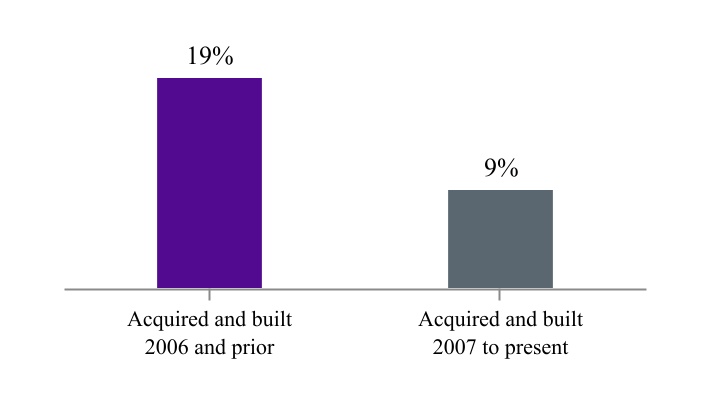

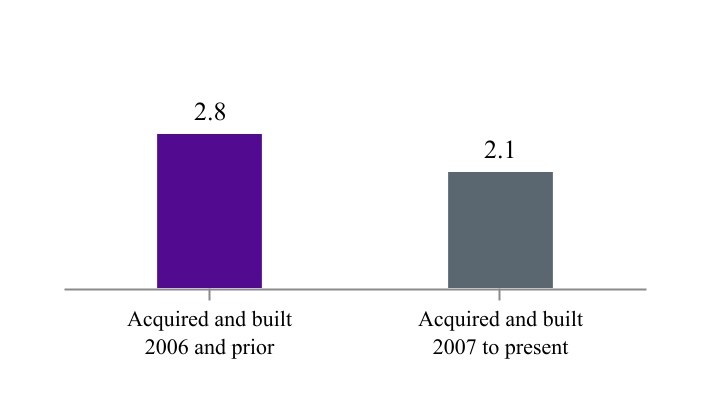

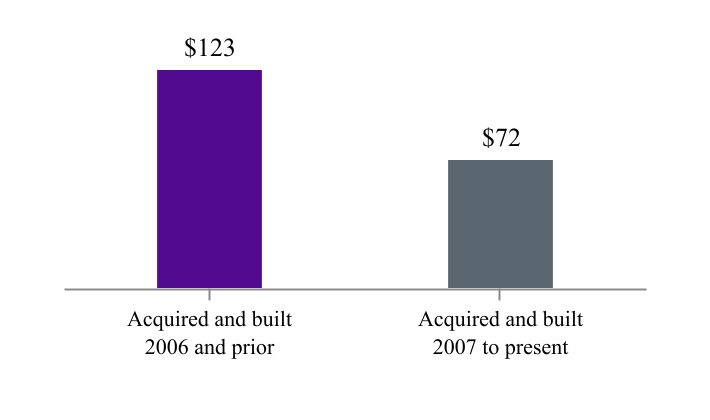

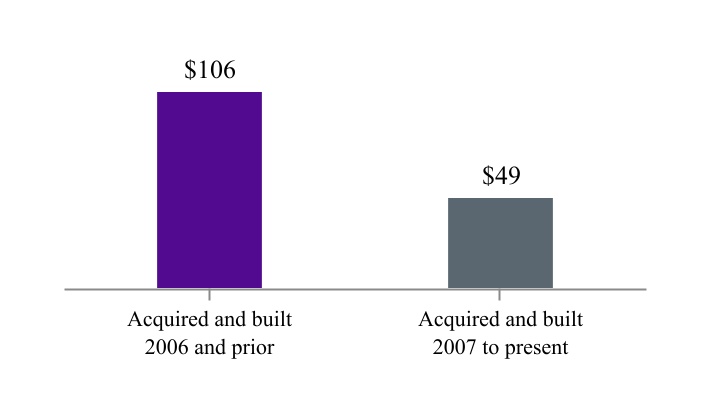

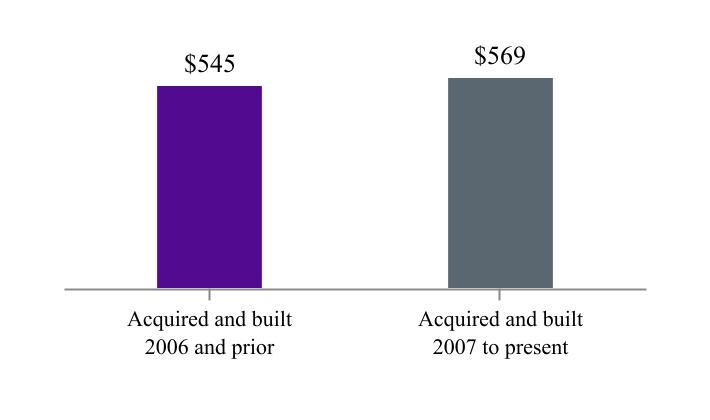

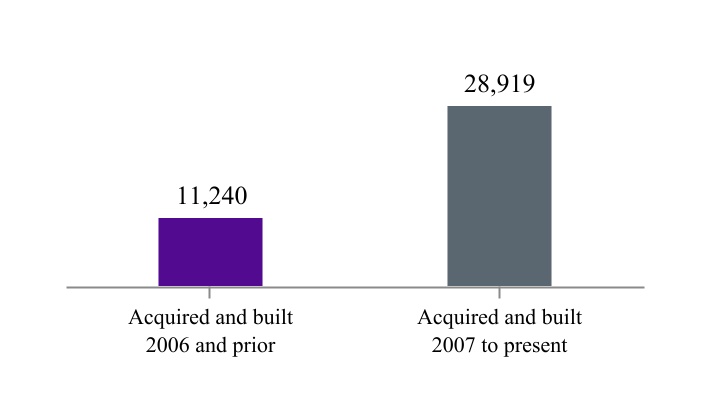

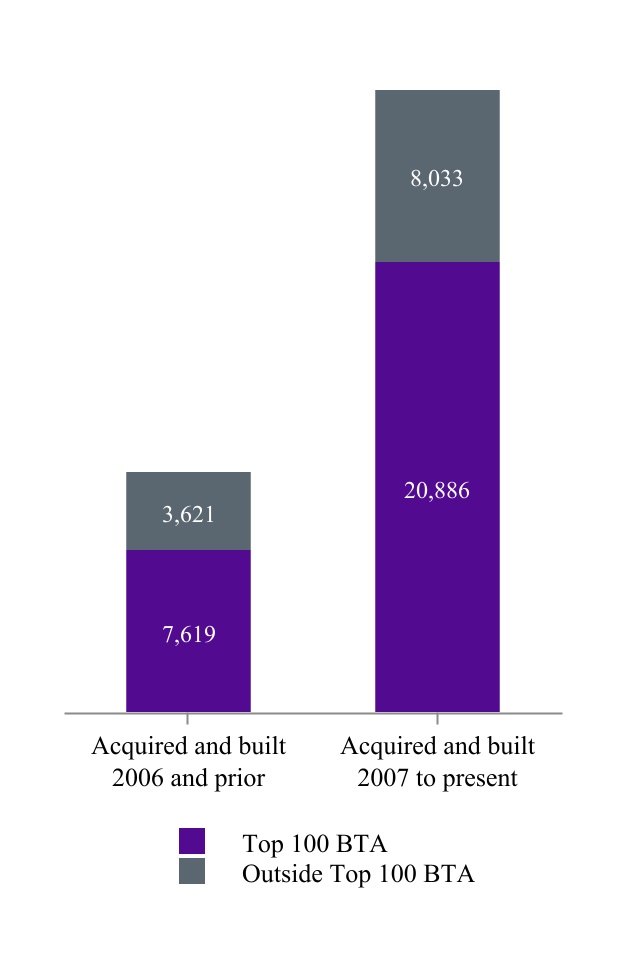

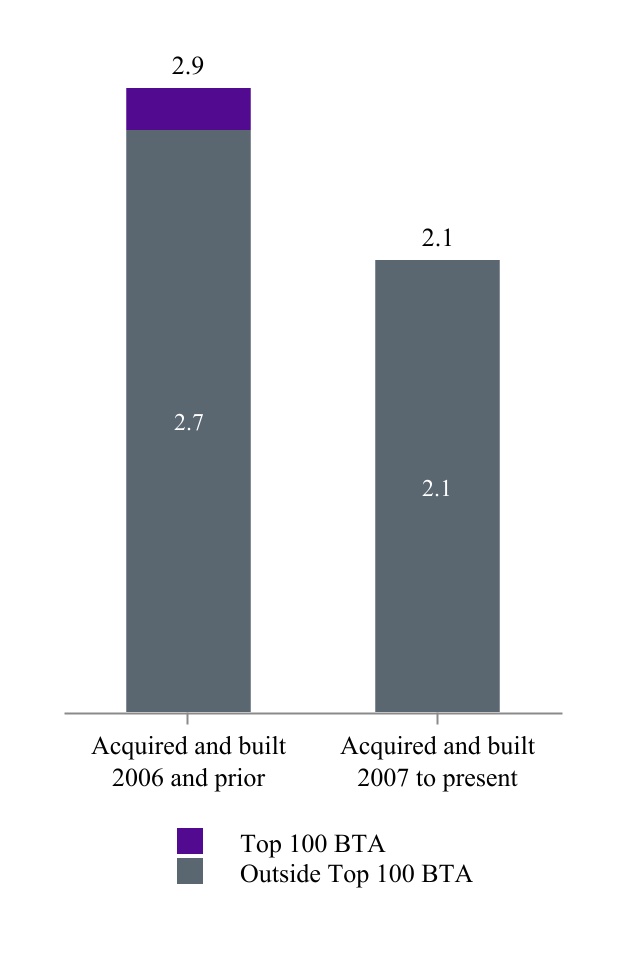

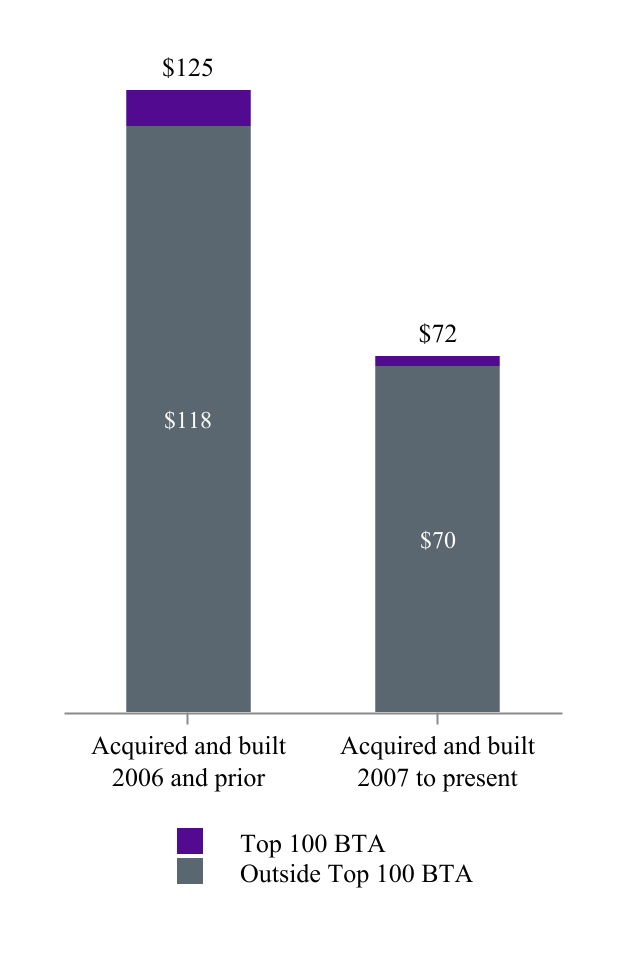

SUMMARY OF TOWER PORTFOLIO BY VINTAGE(a) |

| (as of December 31, 2021; dollars in thousands) | |

CASH YIELD(b) | NUMBER OF TENANTS PER TOWER |

| | | | | |

LQA CASH SITE RENTAL REVENUE PER TOWER(c) | LQA TOWERS SEGMENT SITE RENTAL GROSS CASH MARGIN PER TOWER(d) |

| | | | | |

NET INVESTED CAPITAL PER TOWER(e) | NUMBER OF TOWERS |

(a)All tower portfolio figures are calculated exclusively for the Company’s towers and rooftops and do not give effect to other activities within the Company’s Towers segment.

(b)Cash yield is calculated as LQA Towers segment site rental gross margin, exclusive of straight-lined revenues and amortization of prepaid rent, divided by invested capital net of the amount of prepaid rent received from customers.

(c)Exclusive of straight-lined revenues and amortization of prepaid rent.

(d)Exclusive of straight-lined revenues, amortization of prepaid rent, and straight-lined expenses.

(e)Reflects gross total assets (including incremental capital invested by the Company since time of acquisition or construction completion), less any prepaid rent. Inclusive of invested capital related to land at the tower site.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | |

TOWER PORTFOLIO OVERVIEW(a) |

| (as of December 31, 2021; dollars in thousands) |

| NUMBER OF TOWERS | TENANTS PER TOWER | LQA CASH SITE RENTAL REVENUE PER TOWER(b) |

(a) All tower portfolio figures are calculated exclusively for the Company’s towers and rooftops and do not give effect to other activities within the Company’s Towers segment.

(b) Exclusive of straight-lined revenues and amortization of prepaid rent.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | |

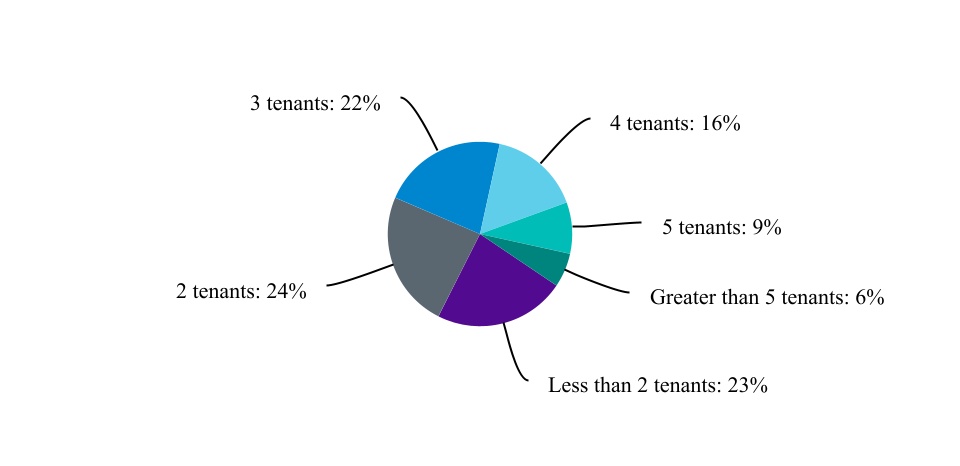

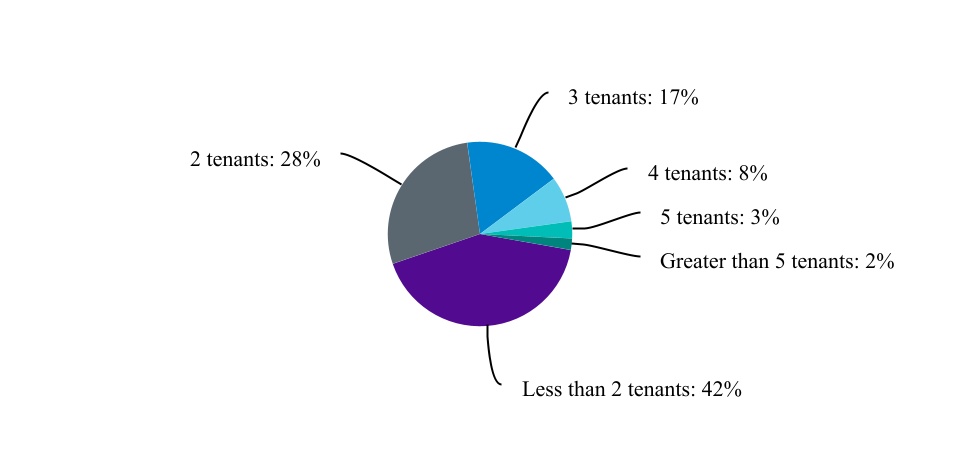

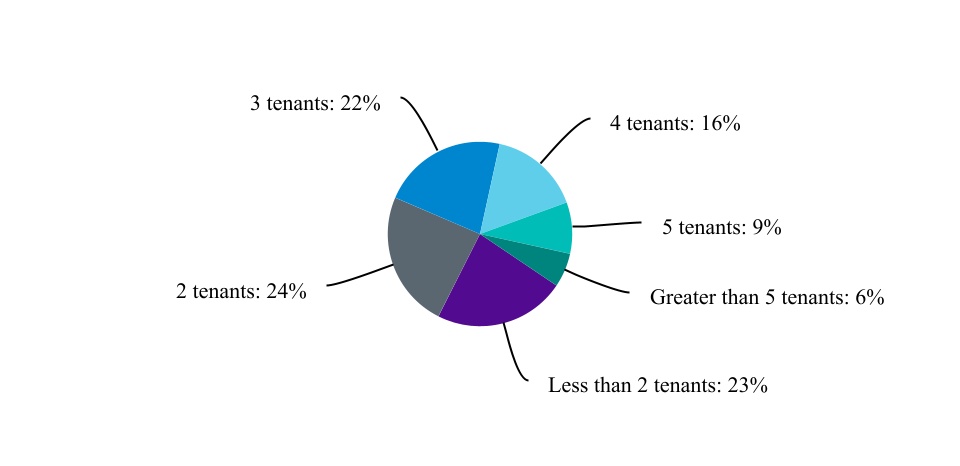

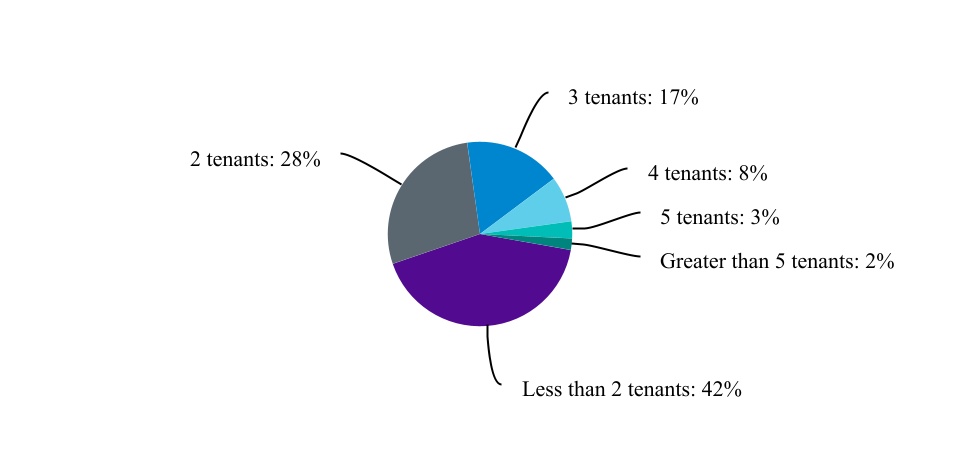

DISTRIBUTION OF TOWER TENANCY (as of December 31, 2021)(a) |

| PERCENTAGE OF TOWERS BY TENANTS PER TOWER |

| SITES ACQUIRED AND BUILT 2006 AND PRIOR | SITES ACQUIRED AND BUILT 2007 TO PRESENT |

| | | | | |

| Average: 2.8 | Average: 2.1 |

| |

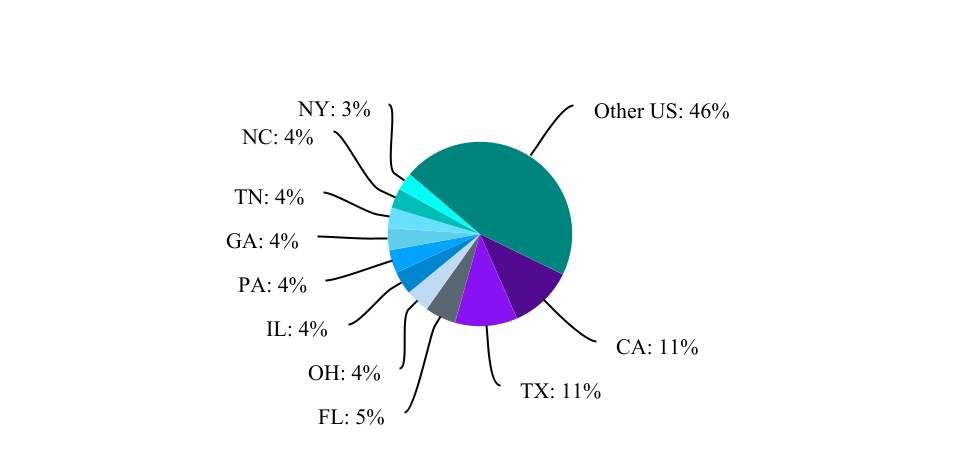

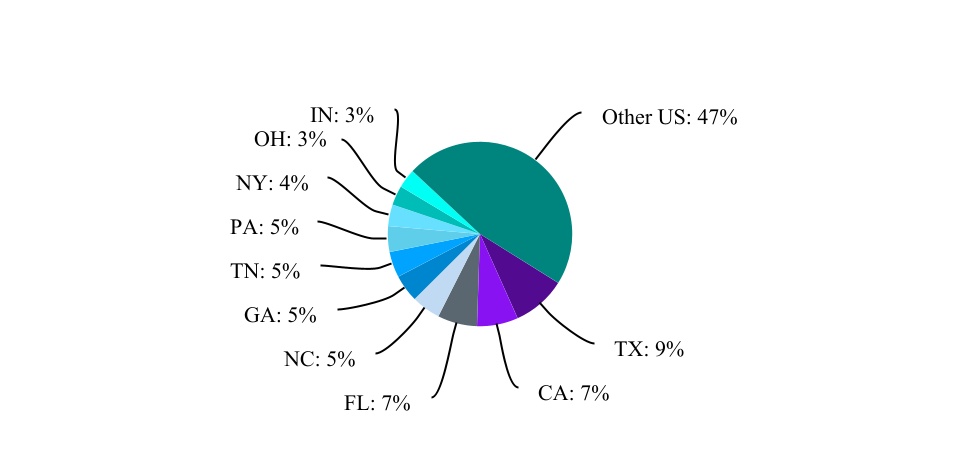

GEOGRAPHIC TOWER DISTRIBUTION (as of December 31, 2021)(a) |

| PERCENTAGE OF TOWERS BY GEOGRAPHIC LOCATION | PERCENTAGE OF LQA CASH SITE RENTAL REVENUE BY GEOGRAPHIC LOCATION(b) |

(a) All tower portfolio figures are calculated exclusively for the Company’s towers and rooftops and do not give effect to other activities within the Company’s Towers segment.

(b) Exclusive of straight-lined revenues and amortization of prepaid rent.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | | | | |

| GROUND INTEREST OVERVIEW |

| (as of December 31, 2021; dollars in millions) | LQA Cash Site Rental Revenues(a) | Percentage of LQA Cash Site Rental Revenues(a) | LQA Towers Segment Site Rental Gross Cash Margin(b) | Percentage of LQA Towers Segment Site Rental Gross Cash Margin(b) | Number of Towers(c) | Percentage of Towers | Weighted Average Term Remaining (by years)(d) |

| Less than 10 years | $ | 369 | | 11 | % | $ | 195 | | 7 | % | 5,347 | | 13 | % | |

| 10 to 20 years | 461 | | 13 | % | 276 | | 11 | % | 5,951 | | 15 | % | |

| Greater than 20 years | 1,483 | | 43 | % | 1,067 | | 41 | % | 17,647 | | 44 | % | |

| Total leased | $ | 2,313 | | 67 | % | $ | 1,538 | | 59 | % | 28,945 | | 72 | % | 36 | |

| | | | | | | |

| Owned | $ | 1,146 | | 33 | % | $ | 1,063 | | 41 | % | 11,214 | | 28 | % | |

| Total / Average | $ | 3,459 | | 100 | % | $ | 2,601 | | 100 | % | 40,159 | | 100 | % | |

| | | | | | | | | | | |

| GROUND INTEREST ACTIVITY |

| (dollars in millions) | Three Months Ended December 31, 2021 | | Twelve Months Ended December 31, 2021 |

| Ground Extensions Under Crown Castle Towers: | | | |

| Number of ground leases extended | 161 | | | 654 | |

| Average number of years extended | 28 | | | 30 | |

Percentage increase in consolidated cash ground lease expense due to extension activities(e) | 0.1 | % | | 0.1 | % |

| | | |

| Ground Purchases Under Crown Castle Towers: | | | |

| Number of ground leases purchased | 49 | | | 200 | |

| Ground lease purchases (including capital expenditures, acquisitions and installment purchases) | $ | 43 | | | $ | 106 | |

| Percentage of Towers segment site rental gross margin from towers on purchased land | <1% | | <1% |

(a)Exclusive of straight-lined revenues and amortization of prepaid rent.

(b)Exclusive of straight-lined revenues, amortization of prepaid rent, and straight-lined expenses.

(c)Excludes small cells, fiber and third-party land interests.

(d)Includes all renewal terms at the Company's option; weighted by Towers segment site rental gross margin exclusive of straight-lined revenues, amortization of prepaid rent, and straight-lined expenses.

(e)Includes the impact from the amortization of lump sum payments.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | |

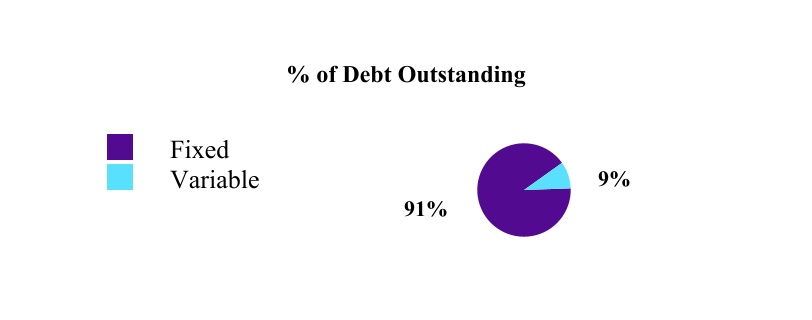

| CAPITALIZATION OVERVIEW |

| (as of December 31, 2021; dollars in millions) | Face Value | Fixed vs. Variable | Interest Rate(a) | Net Debt to LQA Adjusted EBITDA(b) | | Maturity |

| Cash, cash equivalents and restricted cash | $ | 466 | | | | | | |

| | | | | | |

| 3.849% Secured Notes | 1,000 | | Fixed | 3.9% | | | 2023 |

Senior Secured Notes, Series 2009-1, Class A-2(c) | 54 | | Fixed | 9.0% | | | 2029 |

Senior Secured Tower Revenue Notes, Series 2018-1(d) | 250 | | Fixed | 3.7% | | | 2043 |

Senior Secured Tower Revenue Notes, Series 2015-2(d) | 700 | | Fixed | 3.7% | | | 2045 |

Senior Secured Tower Revenue Notes, Series 2018-2(d) | 750 | | Fixed | 4.2% | | | 2048 |

| Finance leases and other obligations | 242 | | Various | Various | | | Various |

| Total secured debt | $ | 2,996 | | | 4.0% | 0.8x | | |

2016 Revolver(e) | 665 | | Variable | 1.2% | | | 2026 |

| 2016 Term Loan A | 1,223 | | Variable | 1.2% | | | 2026 |

Commercial Paper Notes(f) | 265 | | Variable | 0.5% | | | 2022 |

| 3.150% Senior Notes | 750 | | Fixed | 3.2% | | | 2023 |

| 3.200% Senior Notes | 750 | | Fixed | 3.2% | | | 2024 |

| 1.350% Senior Notes | 500 | | Fixed | 1.4% | | | 2025 |

| 4.450% Senior Notes | 900 | | Fixed | 4.5% | | | 2026 |

| 3.700% Senior Notes | 750 | | Fixed | 3.7% | | | 2026 |

| 1.050% Senior Notes | 1,000 | | Fixed | 1.1% | | | 2026 |

| 4.000% Senior Notes | 500 | | Fixed | 4.0% | | | 2027 |

| 3.650% Senior Notes | 1,000 | | Fixed | 3.7% | | | 2027 |

| 3.800% Senior Notes | 1,000 | | Fixed | 3.8% | | | 2028 |

| 4.300% Senior Notes | 600 | | Fixed | 4.3% | | | 2029 |

| 3.100% Senior Notes | 550 | | Fixed | 3.1% | | | 2029 |

| 3.300% Senior Notes | 750 | | Fixed | 3.3% | | | 2030 |

| 2.250% Senior Notes | 1,100 | | Fixed | 2.3% | | | 2031 |

| 2.100% Senior Notes | 1,000 | | Fixed | 2.1% | | | 2031 |

| 2.500% Senior Notes | 750 | | Fixed | 2.5% | | | 2031 |

| 2.900% Senior Notes | 1,250 | | Fixed | 2.9% | | | 2041 |

| 4.750% Senior Notes | 350 | | Fixed | 4.8% | | | 2047 |

| 5.200% Senior Notes | 400 | | Fixed | 5.2% | | | 2049 |

| 4.000% Senior Notes | 350 | | Fixed | 4.0% | | | 2049 |

| 4.150% Senior Notes | 500 | | Fixed | 4.2% | | | 2050 |

| 3.250% Senior Notes | 900 | | Fixed | 3.3% | | | 2051 |

| Total unsecured debt | $ | 17,803 | | | 2.9% | 4.5x | | |

| Total net debt | $ | 20,333 | | | 3.1% | 5.2x | | |

Market Capitalization(g) | 90,220 | | | | | | |

Firm Value(h) | $ | 110,553 | | | | | | |

(a)Represents the weighted-average stated interest rate, as applicable.

(b)Represents the applicable amount of debt divided by LQA consolidated Adjusted EBITDA. See the "Net Debt to Last Quarter Annualized Adjusted EBITDA Calculation" in the Appendix.

(c)The Senior Secured Notes, 2009-1, Class A-2 principal amortizes over a period ending in August 2029.

(d)If the respective series of such debt is not paid in full on or prior to an applicable anticipated repayment date, then the Excess Cash Flow (as defined in the indenture) of the issuers of such notes will be used to repay principal of the applicable series, and additional interest (of an additional approximately 5% per annum) will accrue on the respective series. The Senior Secured Tower Revenue Notes 2015-2 have an anticipated repayment date in 2025. The Senior Secured Tower Revenue Notes, 2018-1 and 2018-2 have anticipated repayment dates in 2023 and 2028, respectively. Notes are prepayable at par if voluntarily repaid within certain repayment windows (typically twelve to eighteen months or less prior to maturity); earlier prepayment may require additional consideration.

(e)As of December 31, 2021, the undrawn availability under the $5.0 billion 2016 Revolver was $4.3 billion.

(f)As of December 31, 2021, the Company had $735 million available for issuance under the $1.0 billion unsecured commercial paper program ("CP Program"). The maturities of the Commercial Paper Notes, when outstanding, may vary but may not exceed 397 days from the date of issue.

(g)Market capitalization calculated based on $208.74 closing price and 432 million shares outstanding as of December 31, 2021.

(h)Represents the sum of net debt and market capitalization.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

| COMPANY OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | |

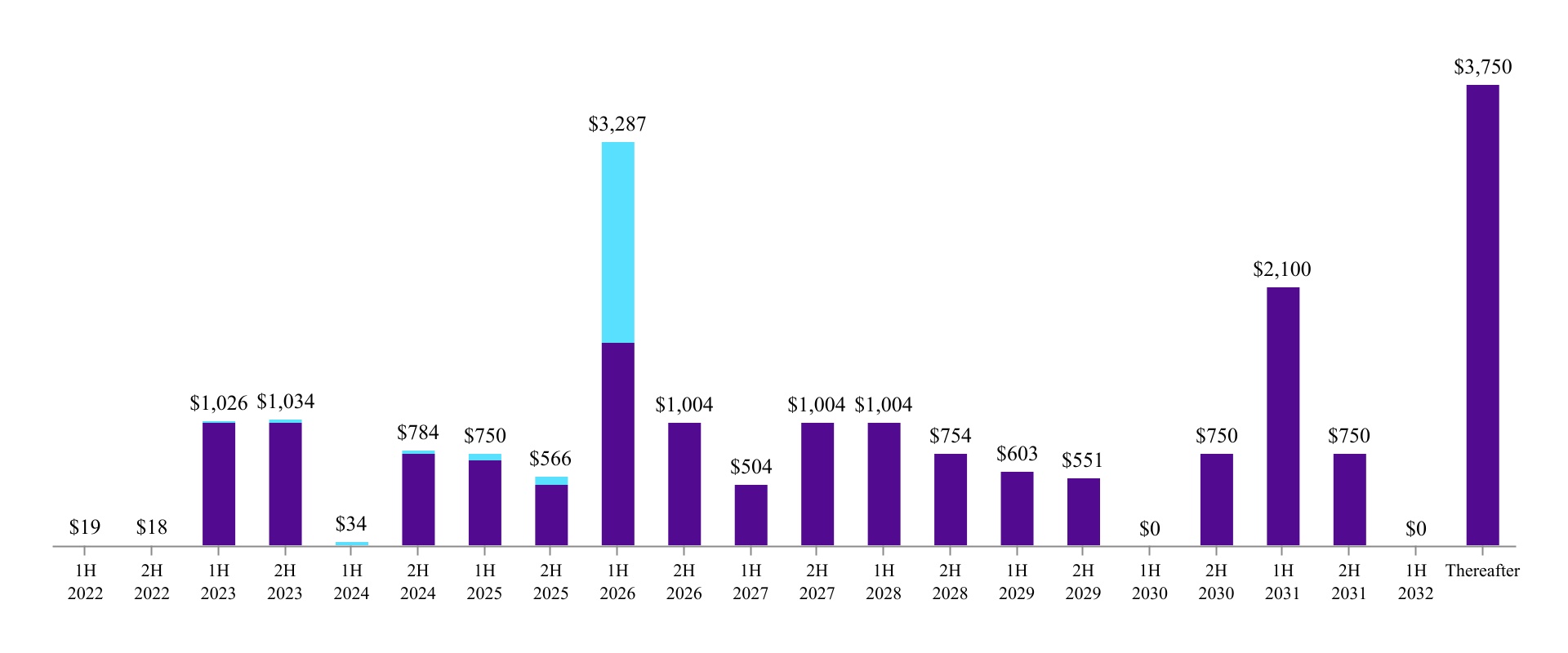

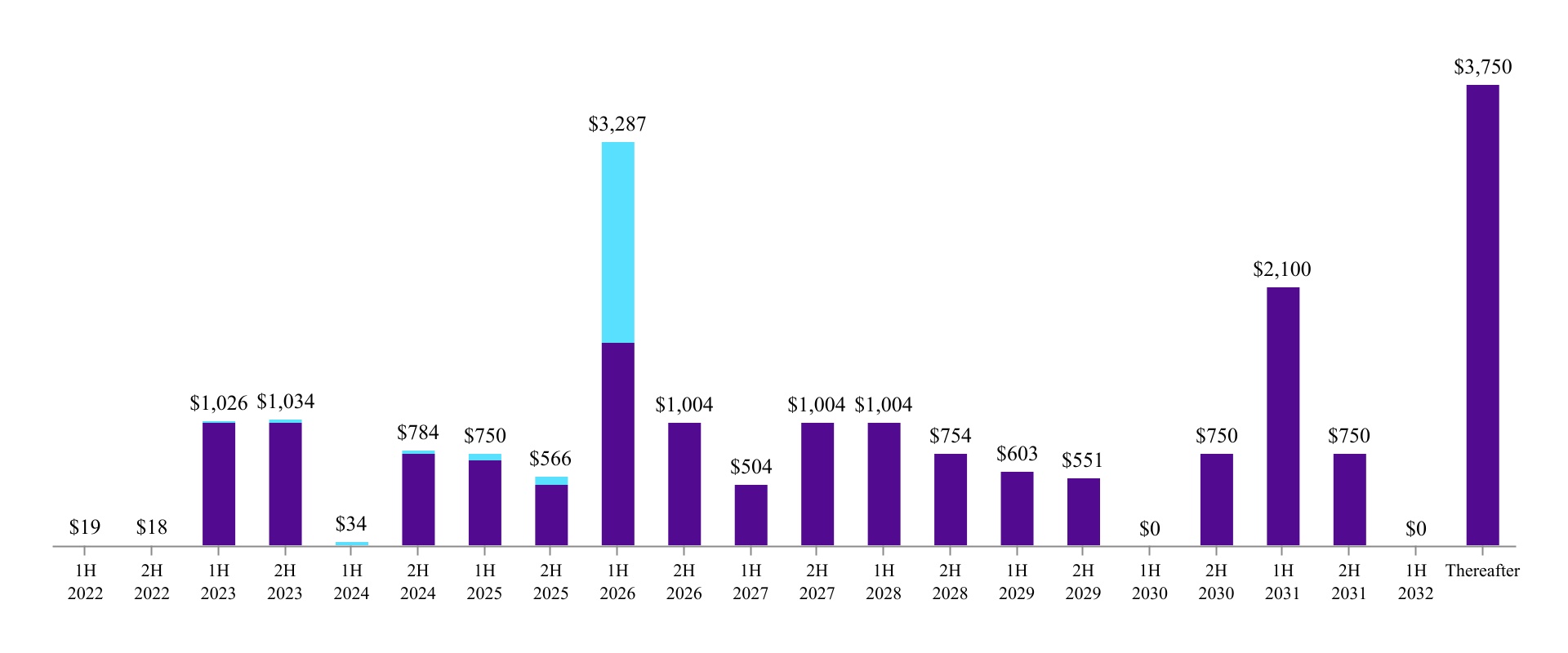

DEBT MATURITY OVERVIEW(a)(b) |

(as of December 31, 2021; dollars in millions)

(a)Where applicable, maturities reflect the Anticipated Repayment Date, as defined in the respective debt agreement; excludes finance leases and other obligations; amounts presented at face value, net of repurchases held at CCIC.

(b)The $265 million outstanding in commercial paper notes ("CP Notes") have been excluded from this table. Amounts available under the CP Program may be borrowed, repaid and re-borrowed from time to time. We intend to maintain available commitments under our 2016 Revolver in an amount at least equal to the amount of CP Notes outstanding at any point in time.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

COMPANY

OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | |

LIQUIDITY OVERVIEW(a) |

| (in millions) | December 31, 2021 |

Cash, cash equivalents, and restricted cash(b) | $ | 466 | |

Undrawn 2016 Revolver availability(c) | 4,301 | |

| Total debt and other long-term obligations | 20,629 | |

| Total equity | 8,258 | |

(a)In addition, we have the following sources of liquidity:

i.In March 2021, we established an at-the-market stock offering program ("ATM Program") through which we may, from time to time, issue and sell shares of our common stock having an aggregate gross sales price of up to $750 million to or through sales agents. No shares of common stock have been sold under the ATM Program.

ii.In April 2019, we established a CP Program through which we may issue short term, unsecured CP Notes. Amounts available under the CP Program may be issued, repaid and re-issued from time to time, with the aggregate principal amount of CP Notes outstanding under the CP Program at any time not to exceed $1.0 billion. As of December 31, 2021, there were $265 million of CP Notes outstanding under our CP Program. We intend to maintain available commitments under our 2016 Revolver in an amount at least equal to the amount of CP Notes outstanding at any point in time.

(b)Inclusive of $5 million included within "Other assets, net" on our condensed consolidated balance sheet.

(c)Availability at any point in time is subject to reaffirmation of the representations and warranties in, and there being no default under, the credit agreement governing our 2016 Revolver.

Crown Castle International Corp.

Fourth Quarter 2021

| | | | | | | | | | | | | | |

| COMPANY OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

| | | | | | | | | | | | | | | | | | | | |

| SUMMARY OF MAINTENANCE AND FINANCIAL COVENANTS |

| Debt | Borrower / Issuer | Covenant(a) | Covenant Level Requirement | | As of December 31, 2021 |

Maintenance Financial Covenants(b) | |

| 2016 Credit Facility | CCIC | Total Net Leverage Ratio | ≤ 6.50x | | 5.4x | |

| 2016 Credit Facility | CCIC | Total Senior Secured Leverage Ratio | ≤ 3.50x | | 0.7x | |

| 2016 Credit Facility | CCIC | Consolidated Interest Coverage Ratio(c) | N/A | | N/A | |

| | | | | | |

| Restrictive Negative Financial Covenants | | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Financial covenants restricting ability to incur additional debt | |

| | | | | | |

| | | | | | |

| 2012 Secured Notes | CC Holdings GS V LLC and Crown Castle GS III Corp. | Debt to Adjusted Consolidated Cash Flow Ratio | ≤ 3.50x | | 1.8x | |

| | | | | | |

| Financial covenants requiring excess cash flows to be deposited in a cash trap reserve account and not released | |

| | | | | | |

| 2015 Tower Revenue Notes | Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.75x | (d) | 14.5x | |

| 2018 Tower Revenue Notes | Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.75x | (d) | 14.5x | |

| 2009 Securitized Notes | Pinnacle Towers Acquisition Holdings LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.30x | (d) | 16.8x | |

| | | | | | |