Exhibit 8.1

April 6, 2018

Tax Opinion Regarding Certain U.S. Federal Income Tax Matters

Ladies and Gentlemen:

We have acted as counsel for Crown Castle International Corp., a Delaware corporation (the “Company”), in connection with the proposed issuance and sale from time to time of common stock, par value $0.01 per share of the Company, as described in the prospectus supplement (the “Prospectus Supplement”) to the registration statement filed by the Company with the Securities and Exchange Commission on FormS-3 (FileNo. 333-223921) (the “Registration Statement”). At your request, we are rendering our opinion concerning the qualification of the Company as a real estate investment trust (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”), commencing with its taxable year ending December 31, 2014.

In rendering our opinion, we have examined and, with your consent, are relying upon the accuracy of: (i) a certificate (the “Officers’ Certificate”) dated as of April 6, 2018 and executed by duly appointed officers of the Company containing certain factual representations and covenants relating to the operation of the Company and its direct and indirect subsidiaries and (ii) such public filings and other documents and corporate records you have either provided to us or that we have deemed necessary or appropriate for purposes of our opinion.

We have not made an independent investigation of all of the facts, statements, representations and covenants set forth in the items listed above, including the Officers’ Certificate. Our opinion is conditioned on the continuing accuracy and completeness of such statements, representations and covenants. Any material change or inaccuracy in the facts, statements, representations and covenants set forth in the Officers’ Certificate may affect our opinion.

In addition, we have assumed, with your consent, that: (i) all signatures are genuine, all natural persons are of legal capacity, all other documents submitted to us are authentic originals, or if submitted as duplicates or certified or conformed copies that

they faithfully reproduce the originals thereof; (ii) all such documents have been or will be duly executed to the extent required in the form presented to us; and (iii) all obligations imposed by any such document on the parties thereto have been or will be performed or satisfied in accordance with their terms.

Our opinion is based on statutory, regulatory and judicial authority existing as of the date hereof, any of which may be changed at any time with retroactive effect. Accordingly, a change in applicable law may affect our opinion. In addition, our opinion is based solely on the documents that we have examined and the facts and assumptions set forth herein. Our opinion cannot be relied upon if any of our assumptions are inaccurate in any material respect. We assume no responsibility to inform you of any subsequent changes in the matters stated or represented in the documents described above or assumed herein or in statutory, regulatory and judicial authority and interpretations thereof. Further, our opinion is not binding upon the Internal Revenue Service or the courts, and there is no assurance that the Internal Revenue Service or a court will not take a contrary position. We express our opinion herein only as to those matters specifically set forth below, and no opinion has been expressed or should be inferred with respect to any state, local or foreign laws or with respect to other areas of U.S. Federal taxation. We are members of the Bar of the State of New York, and we express no opinion as to any law other than the Federal law of the United States of America.

Based upon and subject to the foregoing, we are of opinion that, commencing with its taxable year ending on December 31, 2014, the Company has been organized and operated in conformity with the requirements for qualification and taxation as a REIT under the Code, and its actual method of operation through the date hereof has enabled, and its proposed method of operation will enable, it to meet the requirements for qualification and taxation as a REIT under the Code. The Company’s qualification and taxation as a REIT depend upon its ability to meet, through actual operating results, certain requirements relating to the sources of its income, the nature of its assets, its distribution levels and the diversity of its stock ownership, and various other qualification tests imposed under the Code, the results of which will not be reviewed by us. Accordingly, no assurance can be given that the actual results of the Company’s operation for any one taxable year will satisfy the requirements for taxation as a REIT under the Code.

We are aware that we are referred to under the headings “Material United States Federal Income Tax Considerations” and “Legal Matters” in the Prospectus Supplement. We hereby consent to such use of our name therein and to the filing of this opinion as Exhibit 8.1 to the Company’s Current Report on Form8-K filed on April 6, 2018, and to the incorporation by reference of this opinion into the Registration Statement. In giving this consent, we do not hereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act of 1933 or the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

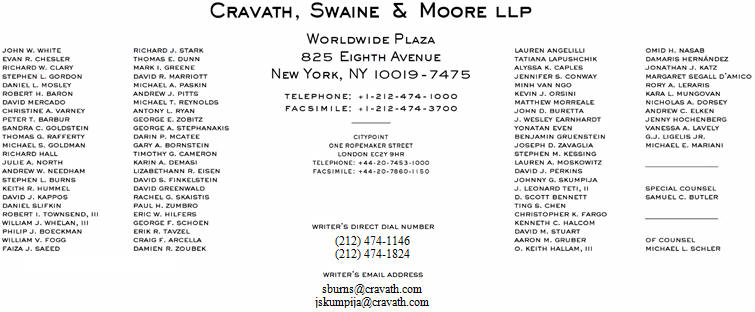

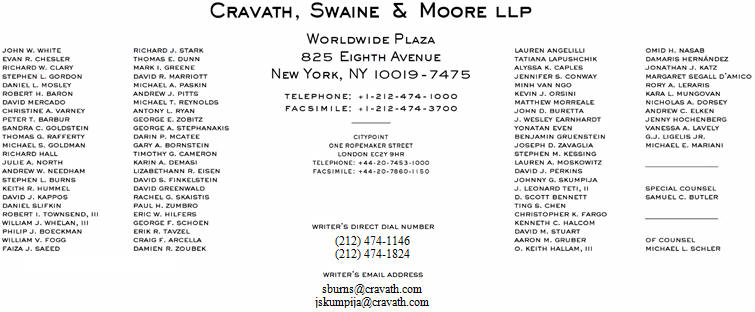

Very truly yours,

/s/ Cravath, Swaine & Moore LLP

Crown Castle International Corp.

1220 Augusta Drive, Suite 600

Houston, Texas 77057

2