QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

TELEPHONE AND DATA SYSTEMS, INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| TELEPHONE AND DATA SYSTEMS, INC. 30 North LaSalle Street Suite 4000 Chicago, Illinois 60602 Phone: (312) 630-1900 Fax: (312) 630-1908 |  |

April 17, 2002

Dear Fellow Shareholders:

You are cordially invited to attend our 2002 annual meeting of shareholders on Thursday, May 23, 2002, at 10:00 a.m., Chicago time, at Northern Trust Bank, 50 South LaSalle Street, Chicago, Illinois, in the Assembly Room on the 6th Floor. At the meeting, we will report on the plans and accomplishments of Telephone and Data Systems, Inc.

The formal notice of the meeting, our board of directors' proxy statement and our 2001 annual report are enclosed. At our 2002 annual meeting, shareholders are being asked to elect four Class III directors.

The board of directors recommends a vote "FOR" its nominees for election as directors.

Our board of directors and members of our management team will be at the annual meeting to meet with shareholders and discuss our record of achievement and plans for the future. We would like to have as many shareholders as possible represented at the meeting. Therefore, please sign and return the enclosed proxy card(s), whether or not you plan to attend the meeting.

We look forward to visiting with you at the annual meeting.

Very truly yours,

| ||

Walter C.D. Carlson Chairman of the Board | LeRoy T. Carlson, Jr. President and Chief Executive Officer |

Please help us avoid the expense of follow-up

proxy mailings to shareholders by

signing and returning the enclosed proxy card(s) promptly

PLEASE NOTE: Due to heightened building security, attendees of the annual meeting will be required to register for admittance and obtain a visitor's badge. Registration will begin at 9:30 a.m. A registration table will be in the lobby near the LaSalle Street entrance. You will be asked to present a valid picture identification, such as a driver's license or passport. You will not be permitted into the elevators without a badge.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AND

PROXY STATEMENT

TO THE SHAREHOLDERS OF

TELEPHONE AND DATA SYSTEMS, INC.

The 2002 annual meeting of shareholders of Telephone and Data Systems, Inc., a Delaware corporation, will be held at Northern Trust Bank, 50 South LaSalle Street, Chicago, Illinois, in the Assembly Room on the 6th Floor on Thursday, May 23, 2002, at 10:00 a.m., Chicago time, for the following purposes:

- 1.

- To elect four Class III members of the board of directors. Your board of directors recommends that you voteFOR its nominees for Class III directors.

- 2.

- To transact such other business as may properly come before the meeting or any adjournments thereof.

We are first mailing this notice of annual meeting and proxy statement to you on or about April 17, 2002.

What is the record date for the meeting?

We have fixed the close of business on March 27, 2002, as the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting or any adjournments thereof.

A complete list of shareholders entitled to vote at the annual meeting, arranged in alphabetical order and by voting group, showing the address of and number of shares held by each shareholder, will be kept open at the offices of TDS, 30 North LaSalle Street, 40th Floor, Chicago, Illinois 60602, for examination by any shareholder during normal business hours, for a period of at least ten days prior to the annual meeting.

What shares of stock entitle holders to vote at the meeting?

We have the following classes or series of stock outstanding, each of which entitle holders to vote at the meeting:

- •

- Common Shares;

- •

- Series A Common Shares; and

- •

- Preferred Shares.

The Common Shares are listed on the American Stock Exchange under the symbol "TDS."

No public market exists for the Series A Common Shares, but the Series A Common Shares are convertible on a share-for-share basis into Common Shares.

No public market exists for the Preferred Shares. The Preferred Shares are divided into series, some of which are convertible into Common Shares. All holders of Preferred Shares vote together with the holders of Common Shares and Series A Common Shares, except in the election of directors. In the election of directors, all outstanding Preferred Shares vote together with the holders of Series A Common Shares.

How will the different classes or series of shares vote in the election of directors?

Our board of directors is divided into three classes. Each year, one class is elected to serve for three years. At our 2002 annual meeting of shareholders, four Class III directors will be elected for a term of three years or until their successors are elected and qualified.

The holders of Series A Common Shares and the holders of the outstanding Preferred Shares, voting as a group, will be entitled to elect three Class III directors. The holders of Common Shares will be entitled to elect one Class III director.

The following shows certain information relating to the outstanding shares and voting power of such shares as of the record date:

| Class or Series of Common Stock | Outstanding Shares | Votes Per Share | Voting Power | Number of Directors Elected by Voting Group | Number of Class III Directors Standing for Election | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Series A Common Shares | 6,690,539 | 10 | 66,905,390 | ||||||||

| Preferred Shares | 70,774 | 1 | 70,774 | ||||||||

| Subtotal | 66,976,164 | 8 | 3 | ||||||||

| Common Shares | 51,934,088 | 1 | 51,934,088 | 4 | 1 | ||||||

| Total Directors | 12 | 4 | |||||||||

How may I vote in the election of directors?

Shareholders may, with respect to the election of the Class III directors to be elected by such shareholders:

- •

- vote FOR the election of such director nominees; or

- •

- WITHHOLD authority to vote for such director nominees.

Our board of directors recommends a voteFOR its nominees for election as Class III directors.

How does the TDS Voting Trust intend to vote?

The Voting Trust under Agreement dated June 30, 1989, as amended (the "TDS Voting Trust") holds 6,210,058 Series A Common Shares, representing approximately 93% of the Series A Common Shares. By reason of such holding, the TDS Voting Trust has the voting power to elect all of the directors elected by the Series A Common Shares and Preferred Shares and has approximately 52% of the voting power with respect to matters other than the election of directors.

The TDS Voting Trust has advised us that it intends to vote FOR the board of directors' nominees for election as Class III directors by the holders of Series A Common Shares and Preferred Shares.

The TDS Voting Trust does not have any votes with respect to directors elected by the holders of Common Shares.

Whether or not you intend to be present at the meeting, please sign and mail your proxy in the enclosed self-addressed envelope to Computershare Investor Services, 2 North LaSalle Street, Chicago, Illinois 60602. If you hold more than one class of our shares, you will find enclosed a separate proxy card for each holding. To assure that all your shares are represented, please return the enclosed proxy cards, as follows:

- •

- a white proxy card for Common Shares, including Common Shares owned through the TDS dividend reinvestment plan and through the TDS tax-deferred savings plan;

- •

- a green proxy card for Series A Common Shares, including Series A Common Shares owned through the dividend reinvestment plan; and

- •

- a tan proxy card for Preferred Shares.

All properly executed and unrevoked proxies received in the accompanying form in time for our 2002 annual meeting of shareholders will be voted in the manner directed on the proxies.

If no direction is made, a proxy by any shareholder will be voted FOR the election of the board of directors' nominees to serve as Class III directors.

Proxies given pursuant to this solicitation may be revoked at any time prior to the closing of polls at the annual meeting, by written notice to the Secretary of TDS or attendance at the annual meeting of shareholders and notice to the Secretary of such revocation. Proxies may not be revoked after the polls are closed for voting.

2

What constitutes a quorum for the meeting?

In the election of directors, where a separate vote by a class or classes is required, the holders of a majority of the votes of the stock of such class or classes, present in person or represented by proxy, will constitute a quorum entitled to take action with respect to that vote on the matter.

What vote is required to elect directors?

The election of the Class III directors requires the affirmative vote of holders of a plurality of the votes of the shares present in person or represented by proxy and entitled to vote with respect to such director at the annual meeting. Accordingly, if a quorum exists, each person receiving a plurality of the votes of the shareholders entitled to vote with respect to the election of such Class III director will be elected to serve as a Class III director. A majority of the votes entitled to be cast with respect to the election of such Class III directors by such voting group constitutes a quorum for action on such proposal. Withheld votes and non-votes with respect to the election of such Class III directors will not affect the outcome of the election of such directors.

The board of directors' nominees for election as Class III directors are identified in the tables below. In the event any such nominee, who has expressed an intention to serve if elected, fails to stand for election, the persons named in the proxy presently intend to vote for a substitute nominee designated by the board of directors.

Class III Directors—Terms to Expire in 2005

The following persons, if elected at our 2002 annual meeting of shareholders, will serve as directors until the 2005 annual meeting of shareholders or until their successors are elected and qualified:

Nominee for Election by Holders of Common Shares

| Name | Age | Position with TDS and Principal Occupation | Served as Director since | |||

|---|---|---|---|---|---|---|

| Herbert S. Wander | 67 | Director of TDS and Partner, Katten Muchin Zavis Rosenman, Chicago, Illinois | 1968 |

Nominees for Election by Holders of Series A Common Shares and Preferred Shares

| Name | Age | Position with TDS and Principal Occupation | Served as Director since | |||

|---|---|---|---|---|---|---|

| LeRoy T. Carlson | 85 | Director and Chairman Emeritus of TDS | 1968 | |||

Walter C. D. Carlson | 48 | Director and non-executive Chairman of the Board of TDS and Partner, Sidley Austin Brown & Wood, Chicago, Illinois | 1981 | |||

Dr. Letitia G. C. Carlson | 41 | Director of TDS, Physician and Assistant Clinical Professor at George Washington University Medical Center | 1996 |

Herbert S. Wander. Herbert S. Wander has been a partner of Katten Muchin Zavis Rosenman for more than five years. Mr. Wander is a current Class III director who was elected by the holders of Common Shares.

LeRoy T. Carlson. LeRoy T. Carlson was elected Chairman Emeritus of TDS in February 2002. Prior to that, he was Chairman of TDS for more than five years. He is a Director of United States Cellular Corporation (American Stock Exchange listing symbol: USM), a subsidiary of TDS which operates and invests in cellular telephone companies and properties ("U.S. Cellular"). Mr. Carlson is the father of LeRoy T. Carlson, Jr., Walter C. D. Carlson and Dr. Letitia G. C. Carlson. He is a current Class III director who was elected by the holders of Series A Common Shares and Preferred Shares.

3

Walter C. D. Carlson. Walter C. D. Carlson was elected non-executive Chairman of the Board of the board of directors of TDS in February 2002. He has been a partner of Sidley Austin Brown & Wood for more than five years. He is a Director of U.S. Cellular. Walter C. D. Carlson is the son of LeRoy T. Carlson and the brother of LeRoy T. Carlson, Jr. and Dr. Letitia G. C. Carlson. The law firm of Sidley Austin Brown & Wood provides legal services to TDS and its subsidiaries on a regular basis. Mr. Carlson is a current Class III director who was elected by the holders of Series A Common Shares and Preferred Shares.

Dr. Letitia G. C. Carlson. Dr. Letitia G. C. Carlson has been a physician and Assistant Professor at George Washington University Medical Center for more than five years and an Assistant Clinical Professor since 2001. Dr. Carlson is the daughter of LeRoy T. Carlson and the sister of LeRoy T. Carlson, Jr. and Walter C. D. Carlson. Dr. Carlson is a current Class III director who was elected by the holders of Series A Common Shares and Preferred Shares.

The Board of Directors recommends a vote "FOR" the above-named nominees for director.

The following additional information is provided in connection with the election of directors.

Class I Directors—Terms to Expire in 2003

The following persons are current Class I Directors whose terms will expire at the 2003 annual meeting of shareholders:

Elected by Holders of Common Shares

| Name | Age | Position with TDS and Principal Occupation | Served as Director since | |||

|---|---|---|---|---|---|---|

| Martin L. Solomon | 65 | Director of TDS and Private Investor | 1997 |

Elected by Holders of Series A Common Shares and Preferred Shares

| Name | Age | Position with TDS and Principal Occupation | Served as Director since | |||

|---|---|---|---|---|---|---|

| James Barr, III | 62 | Director of TDS and President and Chief Executive Officer of TDS Telecommunications Corporation | 1990 | |||

Sandra L. Helton | 52 | Director and Executive Vice President—Chief Financial Officer of TDS | 1998 | |||

George W. Off | 55 | Director of TDS and Private Investor | 1997 |

Background of Class I Directors

Martin L. Solomon. Martin L. Solomon is a Director of American Country Holdings, Inc., an insurance holding company. He was the Chairman and Chief Executive Officer of American Country Holdings, Inc. from June 1997 until February 2001. Prior to that time, Mr. Solomon had been occupied primarily as a private investor since 1990. He is the former Vice Chairman and Director of Great Dane Holdings, Inc. and, in addition to TDS and American Country Holdings, Inc., is currently a Director of Hexcel Corporation, a manufacturer of composite materials.

James Barr, III. James Barr, III has been President and Chief Executive Officer and a Director of TDS Telecommunications Corporation ("TDS Telecom"), a wholly-owned subsidiary of TDS which operates local telephone companies, for more than five years.

Sandra L. Helton. Sandra L. Helton was appointed Executive Vice President and Chief Financial Officer in October of 2000. She joined TDS as Executive Vice President—Finance and Chief Financial Officer in August 1998. Prior to joining the Company, Ms. Helton was the Vice President and Corporate Controller of Compaq Computer Corporation between 1997 and 1998. Prior to that time, Ms. Helton was employed by Corning Incorporated for more than five years. At Corning Incorporated, Ms. Helton was Senior Vice President and Treasurer between 1994 and 1997 and was Vice President and Treasurer between 1991 and 1994. Pursuant to the terms of Ms. Helton's

4

employment letter agreement, dated August 7, 1998, Ms. Helton was appointed as a Class I Director of the board of directors in November 1998 and is also a Director of U.S. Cellular and TDS Telecom. Ms. Helton was elected to the board of directors of The Principal Financial Group, a global financial institution, effective May 21, 2001.

George W. Off. George W. Off was Chairman of the Board of Directors of Catalina Marketing Corporation, a New York Stock Exchange listed company, from July 1998 until he retired in July 2000. Mr. Off served as President and Chief Executive Officer of Catalina from 1994 to 1998. Prior to that, Mr. Off was President and Chief Operating Officer between 1992 and 1994 and its Executive Vice President between 1990 and 1992. Catalina is a leading supplier of in-store electronic scanner-activated consumer promotions. Mr. Off is a Director of SPAR Group, Inc., a provider of merchandising services for retailers and consumer package goods manufacturers.

Class II Directors—Terms to Expire in 2004

The following persons are current Class II Directors whose terms will expire at the 2004 annual meeting of shareholders:

Elected by Holders of Common Shares

| Name | Age | Position with TDS and Principal Occupation | Served as Director since | |||

|---|---|---|---|---|---|---|

| Michael D. Bills | 44 | Director of TDS and Chief Investment Officer—University of Virginia Investment Management Company | 2001 | |||

Kevin A. Mundt | 48 | Director of TDS and Vice President and Director of Mercer Management Consulting | 1997 |

Elected by Holders of Series A Common Shares and Preferred Shares

| Name | Age | Position with TDS and Principal Occupation | Served as Director since | |||

|---|---|---|---|---|---|---|

| LeRoy T. Carlson, Jr. | 55 | Director and President of TDS (Chief Executive Officer) | 1968 | |||

Donald C. Nebergall | 73 | Director and Consultant to TDS and other companies | 1977 |

Background of Class II Directors

Michael D. Bills. Michael D. Bills has been the Chief Investment Officer—University of Virginia Investment Management Company since June 2001. Prior to that time, he was a Professor of Finance at the McIntire School of Commerce at the University of Virginia from 2000 to 2001, and Senior Managing Director and Chief Operating Officer of Tiger Management, L.L.C., a global money management firm, from 1995 to 1999.

Kevin A. Mundt. Kevin A. Mundt has been Vice President and Director of Mercer Management Consulting, a management consulting firm, since 1997. Prior to that time, he was a co-founder, and had been a director since 1984, of Corporate Decisions, Inc., a strategy consulting firm, which merged with Mercer Management Consulting in 1997.

LeRoy T. Carlson, Jr. LeRoy T. Carlson, Jr., has been TDS's President and Chief Executive Officer for more than five years. Mr. LeRoy T. Carlson, Jr. is also Chairman and a Director of U.S. Cellular and TDS Telecom. He is the son of Mr. LeRoy T. Carlson and the brother of Mr. Walter C. D. Carlson and Dr. Letitia G. C. Carlson.

Donald C. Nebergall. Donald C. Nebergall has been a consultant to TDS and other companies since 1988. Mr. Nebergall was Vice President of The Chapman Company, a registered investment advisory company located in Cedar Rapids, Iowa, from 1986 to 1988. Prior to that, he was the Chairman of Brenton Bank & Trust Company, Cedar Rapids, Iowa, from 1982 to 1986, and was its President from 1972 to 1982.

5

The board of directors held six meetings during 2001. Each person who was a director during all of 2001 attended at least 75% of the meetings.

Stock Option Compensation Committee

The stock option compensation committee approves the annual salary, bonus and other cash compensation for the President, considers and approves long-term compensation for executive officers and considers and recommends to the board of directors any changes to long-term compensation plans or policies. The current members of the stock option compensation committee are: George W. Off (Chairman) and Dr. Letitia G. C. Carlson. All meetings and other actions of the stock option compensation committee in 2001 were attended or taken by both members of the committee.

The primary function of the compensation committee is to approve the annual salary, bonus and other cash compensation of officers and key employees of TDS other than the President. The sole member of the compensation committee is LeRoy T. Carlson, Jr., President of TDS. All actions of the compensation committee are taken by written consent.

The audit committee of the board of directors of TDS, among other things, reviews external and internal audit reports and reviews recommendations made by the internal auditing staff and independent public accountants.

The audit committee is currently comprised of three directors who are not past or present employees of TDS or its affiliates or immediate family members of any past or present employees: Messrs. George W. Off (chairperson), Donald C. Nebergall and Herbert S. Wander, each of whom qualifies as independent under the rules of the American Stock Exchange.

The audit committee held five meetings during 2001. Each member of the audit committee attended at least 75% of the meetings held during the period such person was a member in 2001.

6

This report is submitted by the current members of the audit committee of the board of directors of TDS. The audit committee operates under a written charter adopted by the TDS board of directors.

Management is responsible for TDS's internal controls and the financial reporting process. TDS has an internal audit staff, which performs testing of internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of TDS's consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The audit committee's responsibility is to monitor and oversee these processes.

In this context, the audit committee held meetings with management, the internal audit staff and representatives of Arthur Andersen LLP, TDS's independent accountants for 2001. In these meetings, the audit committee reviewed and discussed the audited financial statements as of and for the year ended December 31, 2001. Management represented to the audit committee that TDS's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the audit committee has reviewed and discussed the consolidated financial statements with management and representatives of Arthur Andersen.

The discussions with Arthur Andersen also included the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended, relating to information regarding the scope and results of the audit. In particular, the audit committee reviewed with Arthur Andersen its judgment as to the quality, not just the acceptability of TDS's accounting principles. The audit committee also received from Arthur Andersen written disclosures and a letter regarding its independence as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as amended, and this information was discussed with Arthur Andersen.

Based on, and in reliance upon these discussions, the audit committee recommended to the board of directors that the audited financial statements as of and for the year ended December 31, 2001 be included in TDS's Annual Report on Form 10-K for the year ended December 31, 2001.

The audit committee also determined that the payment of certain fees for non-audit services does not conflict with maintaining Arthur Andersen's independence.

By the members of the audit committee of the board of directors of TDS:

| George W. Off Chairperson | Donald C. Nebergall | Herbert S. Wander |

7

FEES PAID TO PRINCIPAL ACCOUNTANTS

The following sets forth the aggregate fees billed by TDS's principal accountants, Arthur Andersen, for 2001:

| Audit Fees(1) | $ | 1,179,390 | |||||

| Financial Information Systems Design and Implementation Fees(2) | 0 | ||||||

| All Other Fees(3) | |||||||

| Federal and state tax accounting services | $ | 1,193,797 | |||||

| Property tax planning assistance | 79,383 | ||||||

| Audit related fees: registration statements/comfort letters | 38,000 | ||||||

| Benchmarking tool subscription | 12,000 | ||||||

| Subtotal of all other fees | 1,323,180 | ||||||

| Total | $ | 2,502,570 | |||||

- (1)

- Represents the aggregate fees billed for professional services rendered for the audit of the annual financial statements for the year 2001 and the reviews of the financial statements included in TDS's Form 10-Qs for 2001.

- (2)

- Represents the aggregate fees billed for financial information systems design and implementation (as described in Rule 2-01(c)(4)(ii) of Regulation S-X of the SEC), rendered by Arthur Andersen for the year 2001.

- (3)

- Represents fees billed by Arthur Andersen, as identified above, other than services covered in (1) or (2) above, for the year 2001.

INDEPENDENT PUBLIC ACCOUNTANTS

Arthur Andersen served as our independent public accountants for the 2001 fiscal year. Representatives of Arthur Andersen are expected to be present at the 2002 annual meeting of shareholders and will have the opportunity to make a statement and to respond to appropriate questions raised by shareholders at such meeting or submitted in writing to the Secretary prior thereto.

On March 14, 2002, Arthur Andersen was indicted on federal charges of obstruction of justice arising from the federal government's investigation of Enron Corp. Arthur Andersen has pled not guilty and indicated that it intends to contest the indictment. As a public company, we are required to file with the SEC periodic financial statements audited or reviewed by an independent public accountant. The SEC has stated that it will continue accepting financial statements audited by Arthur Andersen, and interim financial statements reviewed by it, so long as Arthur Andersen is able to make certain representations to its clients concerning audit quality controls. TDS is monitoring developments relating to these matters and is considering the implications of such matters on our audit and quarterly review requirements.

Although we are not required to obtain shareholder ratification of the selection of our independent public accountants, in recent years we had requested shareholders to ratify our selection of auditors at the annual meeting. As of the date of this proxy statement, TDS's audit committee and board of directors have not concluded the selection of our auditors for 2002. TDS has recently distributed a request for and received proposals relating to the engagement of an independent public accountant for 2002 and subsequent years. It is not expected that Arthur Andersen will be engaged to audit the 2002 financial statements. This action is not being undertaken due to any disagreements with Arthur Andersen. Because no decision relating to such matter has been made as of the date of this proxy statement, the board of directors is not submitting a proposal at the 2002 annual meeting of shareholders to request that shareholders ratify the selection of TDS's independent public accountants for 2002. This decision will be made by the board of directors based on the recommendation of the audit committee.

8

In addition to the executive officers identified in the tables regarding the election of directors, set forth below is a table identifying current officers of TDS and its subsidiaries who may be deemed to be executive officers of TDS for disclosure purposes under the rules of the SEC. Unless otherwise indicated, the position held is an office of TDS.

| Name | Age | Position | ||

|---|---|---|---|---|

| John E. Rooney | 59 | President and CEO of United States Cellular Corporation | ||

| Scott H. Williamson | 51 | Senior Vice President—Acquisitions and Corporate Development | ||

| Thomas A. Burke | 48 | Vice President and Chief Information Officer | ||

| Michael K. Chesney | 46 | Vice President—Corporate Development | ||

| George L. Dienes | 71 | Vice President—Corporate Development | ||

| Kevin C. Gallagher | 54 | Vice President and Corporate Secretary | ||

| Jerry A. Gleisner | 42 | Vice President—Corporate Systems | ||

| C. Theodore Herbert | 66 | Vice President—Human Resources | ||

| Rudolph E. Hornacek | 74 | Vice President—Engineering | ||

| D. Michael Jack | 59 | Vice President and Corporate Controller | ||

| J. Timothy Kleespies | 51 | Vice President—Tax | ||

| Peter L. Sereda | 43 | Vice President and Treasurer | ||

| Mark A. Steinkrauss | 56 | Vice President—Corporate Relations | ||

| James W. Twesme | 49 | Vice President—Corporate Finance | ||

| Byron A. Wertz | 55 | Vice President—Corporate Development | ||

| Michael G. Hron | 57 | General Counsel and Assistant Secretary |

Background of Executive Officers

John E. Rooney. John E. Rooney has been the President and Chief Executive Officer of U.S. Cellular since April 10, 2000. Mr. Rooney was previously employed by Ameritech Corporation for more than five years most recently as President of Ameritech Consumer Services and, prior to that, as President of Ameritech Cellular Services. Mr. Rooney is also a director of U.S. Cellular pursuant to his employment letter agreement described below in "Other Agreements."

Scott H. Williamson. Scott H. Williamson was appointed Senior Vice President—Acquisitions and Corporate Development of TDS in February 1998. Prior to that time, he was Vice President—Acquisitions of TDS since 1995.

Thomas A. Burke. Thomas A. Burke was appointed Vice President and Chief Information Officer as of April 1, 2000. Prior to that, he was employed by TDS for more than five years, most recently as President of TDS Computing Services, a division of TDS.

Michael K. Chesney. Michael K. Chesney has been Vice President—Corporate Development of TDS for more than five years.

George L. Dienes. George L. Dienes has been Vice President—Corporate Development of TDS for more than five years.

Kevin C. Gallagher. Kevin C. Gallagher was appointed Vice President and Corporate Secretary on December 1, 2001. He was also appointed Vice President and Corporate Secretary of U.S. Cellular and TDS Telecom in December 2001. Prior to that time, he was Senior Vice President, General Counsel and Secretary of 360o Communications Company between 1996 and 1998. Prior to that, Mr. Gallagher was Vice President and General Counsel of Sprint Cellular Company between 1993 and 1996.

Jerry A. Gleisner. Jerry A. Gleisner was appointed Vice President—Corporate Systems as of November 9, 2000. Prior to that, he was employed by TDS for more than five years, most recently as TDS Computing Services Vice President—Corporate Systems.

C. Theodore Herbert. C. Theodore Herbert has been Vice President—Human Resources of TDS for more than five years.

Rudolph E. Hornacek. Rudolph E. Hornacek has been Vice President—Engineering of TDS for more than five years. He was a director of TDS until his resignation in November 1998. He is currently Director Emeritus of TDS. Mr. Hornacek is a Director of TDS Telecom.

9

D. Michael Jack. D. Michael Jack was appointed Vice President and Corporate Controller of TDS in November 1999. Prior to joining TDS, Mr. Jack was employed by Cummins Engine Company, Inc. for more than five years. At Cummins Engine Company, Mr. Jack was Executive Director of its financial services division between 1998 and 1999; Chief Financial Officer of the industrial business unit between 1996 and 1998; and Controller of worldwide operations prior to 1996.

J. Timothy Kleespies J. Timothy Kleespies was appointed Vice President—Tax in October 2000. Prior to joining TDS, Mr. Kleespies was employed by Universal Foods Corporation from 1999 to 2000 as Director of Corporate Taxes and by Stone Container Corporation from 1988 to 1999 as Director of Corporate Taxes and Tax Counsel.

Peter L. Sereda. Peter L. Sereda was appointed Vice President and Treasurer of TDS in February 1998. Prior to joining TDS, he was employed by Specialty Foods Corporation, a privately held company which produces meat and bakery products, between 1994 and 1998. At Specialty Foods Corporation, Mr. Sereda was Vice President of Finance—Operations between 1997 and 1998, and was Vice President and Treasurer between 1994 and 1997.

Mark A. Steinkrauss. Mark A. Steinkrauss was appointed Vice President—Corporate Relations of TDS in March 1998. Prior to joining TDS, Mr. Steinkrauss was employed by Fruit of the Loom, Inc., an international apparel company, for more than five years, most recently as Vice President of Corporate Relations.

James W. Twesme. James W. Twesme was appointed Vice President—Corporate Finance of TDS in January 1999. Prior to that time, he was the Assistant Treasurer of TDS for more than five years.

Byron A. Wertz. Byron A. Wertz has been a Vice President—Corporate Development of TDS for more than five years. Mr. Wertz is the nephew of LeRoy T. Carlson and the cousin of each of LeRoy T. Carlson, Jr., Walter C. D. Carlson and Dr. Letitia G. C. Carlson.

Michael G. Hron. Michael G. Hron was appointed General Counsel and Assistant Secretary of TDS in November 1999. Prior to that time, he was the Secretary of TDS for more than five years. He was also appointed General Counsel and Assistant Secretary of U.S. Cellular and TDS Telecom in December 1999. He has been a partner at the law firm of Sidley Austin Brown & Wood for more than five years. Sidley Austin Brown & Wood provides legal services to TDS and its subsidiaries.

All of TDS's executive officers devote substantially all their time to TDS or its subsidiaries, except for Michael G. Hron who is a practicing attorney.

The following table summarizes the compensation paid by TDS to the President and Chief Executive Officer of TDS and the other four most highly compensated executive officers (based on the aggregate of the salary and bonus for 2001).

10

| | | | | | Long-Term Compensation | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | Awards | | |||||||||||||||

| Name and Principal Position | Year | Salary(2) | Bonus(3) | Other Annual Compensation(4) | Restricted Stock Award(s)(5) | Securities Underlying Options/SARs(6) | All Other Compensation(7) | ||||||||||||

| LeRoy T. Carlson Chairman Emeritus | 2001 2000 1999 | $ | 547,000 501,000 458,000 | $ | — 266,000 240,000 | $ | — 72,500 69,600 | — — — | 15,590 52,360 17,600 | $ | 41,052 57,187 65,072 | ||||||||

LeRoy T. Carlson, Jr. President (Chief Executive Officer) | 2001 2000 1999 | $ | 780,000 708,750 630,000 | $ | 378,000 500,000 504,000 | $ | — 72,500 — | — — — | 29,429 88,720 27,850 | $ | 36,507 36,765 27,619 | ||||||||

Sandra L. Helton Executive Vice President—Chief Financial Officer | 2001 2000 1999 | $ | 460,000 420,000 381,000 | $ | 310,000 278,000 270,000 | $ | — — — | — — — | 12,115 43,320 — | $ | 41,738 34,508 89,423 | ||||||||

James Barr III President (Chief Executive Officer) of TDS Telecommunications Corporation | 2001 2000 1999 | $ | 458,000 419,000 384,000 | $ | 298,000 251,000 203,000 | $ | — — — | — — — | 6,785 30,400 — | $ | 44,331 43,781 31,426 | ||||||||

John E. Rooney(8) President (Chief Executive Officer) of United States Cellular Corporation | 2001 2000 1999 | $ | 485,459 309,375 — | $ | 190,000 190,000 — | $ | 55,414 55,414 — | $ | 396,911 — — | 20,000 55,000 — | $ | 20,570 2,815 — | |||||||

- (1)

- Does not include the discount amount under any dividend reinvestment plan or any employee stock purchase plan because such plans are generally available to all eligible shareholders or salaried employees, respectively. Does not include the value of any perquisites and other personal benefits, securities or property because the aggregate amount of such compensation is less than the lesser of either $50,000 or 10% of the total of annual salary and bonus reported for the above-named executive officers.

- (2)

- Represents the dollar value of base salary (cash and non-cash) earned by the named executive officer during the fiscal year identified.

- (3)

- Represents the dollar value of bonus (cash and non-cash) earned (whether received in cash or deferred) by the named executive officer for 2001, 2000 and 1999. Final bonuses for 2001 have not yet been determined for LeRoy T. Carlson and LeRoy T. Carlson, Jr. The amount listed above for LeRoy T. Carlson, Jr. represents a partial advance of his 2001 bonus. See "Executive Officer Compensation Report."

- (4)

- Represents the fair market value of phantom stock units credited to such officer with respect to deferred bonus compensation. See "Bonus Deferral and Stock Unit Match Program." LeRoy T. Carlson deferred 100% of his 1999 bonus, LeRoy T. Carlson and LeRoy T. Carlson, Jr., deferred the lesser of 100% of their 2000 bonuses or $250,000 and LeRoy T. Carlson has elected to defer the lesser of 100% of his 2001 bonus or $250,000 pursuant to the TDS 2001 Long-Term Incentive Plan. Because the bonus for 2001 has not yet been determined for LeRoy T. Carlson the dollar value of the Company match phantom stock units cannot be determined at this time.

- (5)

- Represents the value of 6,682 restricted U.S. Cellular Common Shares granted to Mr. Rooney based on the closing price of U.S. Cellular Common Shares on the date of grant.

- (6)

- Represents the number of shares subject to stock options and /or stock appreciation rights ("SARs") awarded during the fiscal year identified. Unless otherwise indicated by footnote, the awards represent options without tandem SARs and relate to TDS Common Shares, except for John E. Rooney, in which case the awards represent options with respect to U.S. Cellular shares.

- (7)

- Includes contributions by the Company for the benefit of the named executive officer under the TDS tax-deferred savings plan ("TDSP"), the TDS pension plan ("Pension Plan"), including earnings accrued under a related supplemental benefit agreement, the TDS supplemental executive retirement plan ("SERP") and the dollar value of any insurance premiums paid during the covered fiscal year with respect to life insurance for the benefit of the named executive ("Life Insurance"), as indicated below for 2001:

| | LeRoy T. Carlson | LeRoy T. Carlson, Jr. | Sandra L. Helton | James Barr III | John E. Rooney | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TDSP | $ | 6,120 | $ | 6,120 | $ | 6,120 | $ | 6,120 | $ | 6,120 | ||||||

| Pension Plan | 34,528 | 8,316 | 13,575 | 13,375 | 7,788 | |||||||||||

| SERP | — | 21,118 | 21,425 | 21,628 | 4,410 | |||||||||||

| Life Insurance | 404 | 953 | 618 | 3,208 | 2,252 | |||||||||||

| Total | $ | 41,052 | $ | 36,507 | $ | 41,738 | $ | 44,331 | $ | 20,570 | ||||||

- (8)

- All of Mr. Rooney's compensation is paid by U.S. Cellular. Mr. Rooney's annual compensation is approved by LeRoy T. Carlson, Jr., the Chairman of U.S. Cellular, and Mr. Rooney's long-term compensation is approved by the stock option compensation committee of U.S. Cellular. Mr. Rooney was hired on April 10, 2000.

11

General Information Regarding Options and SARs

The following tables show, as to the executive officers who are named in the Summary Compensation Table, information regarding options and/or SARs.

Individual Option/SAR Grants in 2001

| | | | | | | Potential Realizable Value at Assumed Annual Realized Stock Price Appreciation for Option Terms(4) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Options/SARs Granted(1) | | | | | |||||||||||||

| | % of Total Options/SARs Granted to Employees(2) | | | | ||||||||||||||

| Name | Exercise Price | Market Price(3) | Expiration Date | |||||||||||||||

| 5% | 10% | |||||||||||||||||

| LeRoy T. Carlson(5) | 15,590 | 7.2% | $ | 99.44 | $ | 99.44 | 04/30/11 | $ | 974,956 | $ | 2,470,730 | |||||||

LeRoy T. Carlson, Jr.(5) | 29,429 | 13.6% | $ | 99.44 | $ | 99.44 | 04/30/11 | $ | 1,840,410 | $ | 4,663,959 | |||||||

Sandra L. Helton(5) | 12,115 | 5.6% | $ | 99.44 | $ | 99.44 | 04/30/11 | $ | 757,639 | $ | 1,920,006 | |||||||

James Barr III(5) | 6,785 | 3.1% | $ | 99.44 | $ | 99.44 | 04/30/11 | $ | 424,315 | $ | 1,075,299 | |||||||

John E. Rooney(6) | 20,000 | 3.6% | $ | 59.40 | $ | 59.40 | 03/31/11 | $ | 747,127 | $ | 1,893,366 | |||||||

- (1)

- Represents the number of TDS shares underlying options awarded during the year, except in the case of John E. Rooney, in which case the amount represents the number of U.S. Cellular shares underlying options or SARs awarded during the fiscal year.

- (2)

- Represents the percent of total TDS shares underlying options awarded to all TDS employees during the fiscal year, except in the case of John E. Rooney, in which case the figure represents the percent of total U.S. Cellular shares underlying options awarded to all U.S. Cellular employees during the fiscal year.

- (3)

- Represents the per share fair market value of shares as of the award date.

- (4)

- Represents the potential realizable value of each grant of options, assuming that the market price of the shares underlying the options appreciates in value from the award date to the end of the option term at the indicated annualized rates.

- (5)

- Pursuant to the TDS long-term incentive plan, on April 30, 2001 such named executive officers were granted options (the "2000 Performance Options") to purchase TDS Common Shares based on the achievement of certain levels of corporate and individual performance in 2000 as contemplated by the TDS long-term incentive plan. The purchase price per TDS Common Share subject to the 2000 Performance Options is the average of the closing price of the TDS Common Shares on the American Stock Exchange for the 20 trading days ended on the trading day immediately preceding the grant date. The 2000 Performance Options became exercisable on December 15, 2001.

- (6)

- These represent options with respect to U.S. Cellular Common Shares. Such options were granted as of May 29, 2001 and become exercisable with respect to 20% of the shares underlying the option on March 31 of each year beginning in 2002 and ending in 2006.

12

AGGREGATED OPTION/SAR EXERCISES IN 2001, AND

DECEMBER 31, 2001 OPTION/SAR VALUE

| | | | As of December 31, 2001 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2001 | Number of Securities Underlying Unexercised Options/SARs(3) | Value of Unexercised In-the-Money Options/SARs(4) | |||||||||||||||

| Name | Shares Acquired on Exercise(1) | Value Realized(2) | ||||||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||||||

| LeRoy T. Carlson | ||||||||||||||||||

| 2000 Performance Options(5) | — | $ | — | 15,590 | — | $ | — | $ | — | |||||||||

| 2000 Automatic Options(6) | — | — | 8,590 | 25,770 | — | — | ||||||||||||

| 1999 Performance Options(7) | — | — | 18,000 | — | — | — | ||||||||||||

| 1998 Performance Options(8) | — | — | 17,600 | — | 404,800 | — | ||||||||||||

| 1998 Automatic Options(9) | — | — | 39,600 | — | 1,821,600 | — | ||||||||||||

| 1997 Performance Options(10) | — | — | 17,820 | — | 891,000 | — | ||||||||||||

| 1996 Performance Options(11) | — | — | 8,295 | — | 380,491 | — | ||||||||||||

| 1995 Performance Options(12) | — | — | 9,367 | — | 394,819 | — | ||||||||||||

| 1994 Performance Options(13) | — | — | 9,476 | — | 489,246 | — | ||||||||||||

| 1994 Automatic Options(14) | — | — | 36,050 | — | 1,519,868 | — | ||||||||||||

| Total | — | $ | — | 180,388 | 25,770 | $ | 5,901,824 | $ | — | |||||||||

| LeRoy T. Carlson, Jr. | ||||||||||||||||||

| 2000 Performance Options(5) | — | $ | — | 29,429 | — | $ | — | $ | — | |||||||||

| 2000 Automatic Options(6) | — | — | 14,180 | 42,540 | — | — | ||||||||||||

| 1999 Performance Options(7) | — | — | 32,000 | — | — | — | ||||||||||||

| 1998 Performance Options(8) | — | — | 27,850 | — | 640,550 | — | ||||||||||||

| 1998 Automatic Options(9) | — | — | 54,600 | — | 2,511,600 | — | ||||||||||||

| 1997 Performance Options(10) | — | — | 27,300 | — | 1,365,000 | — | ||||||||||||

| 1996 Performance Options(11) | — | — | 11,770 | — | 539,890 | — | ||||||||||||

| 1995 Performance Options(12) | — | — | 13,233 | — | 557,771 | — | ||||||||||||

| 1994 Performance Options(13) | — | — | 13,114 | — | 677,076 | — | ||||||||||||

| 1994 Automatic Options(14) | 47,100 | 2,939,511 | — | — | — | — | ||||||||||||

| Total | 47,100 | $ | 2,939,511 | 223,476 | 42,540 | $ | 6,291,887 | $ | — | |||||||||

| Sandra L. Helton | ||||||||||||||||||

| 2000 Performance Options(5) | — | $ | — | 12,115 | — | $ | — | $ | — | |||||||||

| 2000 Automatic Options(6) | — | — | 6,330 | 18,990 | — | — | ||||||||||||

| 1999 Performance Options(7) | — | — | 18,000 | — | — | — | ||||||||||||

| 1998 Automatic Options(15). | — | — | 36,000 | — | 2,011,680 | — | ||||||||||||

| Total | — | $ | — | 72,445 | 18,990 | $ | 2,011,680 | $ | — | |||||||||

| James Barr III | ||||||||||||||||||

| 2000 Performance Options(5) | — | $ | — | 6,785 | — | $ | — | $ | — | |||||||||

| 2000 Options(16) | — | — | 12,160 | 18,240 | — | — | ||||||||||||

| Total | — | $ | — | 18,945 | 18,240 | $ | — | $ | — | |||||||||

| John E. Rooney | ||||||||||||||||||

| 2001 USM Automatic Options(17) | — | $ | — | — | 20,000 | $ | — | $ | — | |||||||||

| 2000 USM Initial Options(18) | — | — | 11,000 | 44,000 | — | — | ||||||||||||

| Total | — | $ | — | 11,000 | 64,000 | $ | — | $ | — | |||||||||

- (1)

- Represents the number of TDS Common Shares with respect to which the options or SARs were exercised or, in the case of John E. Rooney, Common Shares of U.S. Cellular ("USM shares").

- (2)

- Represents the aggregate dollar value realized upon exercise, based on the difference between the exercise price and the fair market value of the shares on the date of exercise.

- (3)

- Represents the number of TDS Common Shares subject to options and/or SARs, except for John E. Rooney, in which case the information is presented with respect to USM shares. All options are transferable to permitted transferees.

- (4)

- Represents the aggregate dollar value of in-the-money, unexercised options and SARs held at the end of the fiscal year, based on the difference between the exercise price and $89.75, the market value of TDS Common Shares on December 31, 2001 or, with respect to options for USM shares, $45.25, the market value of USM Common Shares on December 31, 2001.

- (5)

- Such options became exercisable on December 15, 2001 and are exercisable until April 30, 2011 at the exercise price of $99.44 per share.

- (6)

- Such options become exercisable in annual increments of 25% on December 15, 2001 and on each anniversary of such date until December 15, 2004 and are exercisable until September 15, 2010 at the exercise price of $121.12 per share.

13

- (7)

- Such options became exercisable on December 15, 2000 and are exercisable until May 5, 2010 at the exercise price of $105.13 per share.

- (8)

- Such options became exercisable on December 15, 1999 and are exercisable until April 30, 2009 at the exercise price of $66.75 per share.

- (9)

- Such options became exercisable with respect to one-third of the shares on each of December 15, 1998, December 15, 1999 and December 15, 2000, and are exercisable until November 5, 2007 at the exercise price of $43.75 per share.

- (10)

- Such options became exercisable on December 15, 1998 and are exercisable until June 22, 2008 at the exercise price of $39.75 per share.

- (11)

- Such options became exercisable on December 15, 1997 and are exercisable until December 15, 2007 at the exercise price of $43.88 per share.

- (12)

- Such options became exercisable on December 15, 1996 and are exercisable until December 15, 2006 at the exercise price of $47.60 per share.

- (13)

- Such options became exercisable on December 15, 1995 and are exercisable until December 15, 2005 at the exercise price of $38.12 per share.

- (14)

- Such options became exercisable in annual increments of 20% on each of December 15, 1994 and on the first through the fourth anniversaries of such date, and are exercisable until November 4, 2004 at the exercise price of $47.59 per share.

- (15)

- Such options became exercisable with respect to 12,000 shares on December 15, 1998, December 15, 1999 and December 15, 2000, are exercisable until September 15, 2008 at an exercise price of $33.87 per share.

- (16)

- Such options become exercisable in annual increments of 20% on December 15, 2000 and on each anniversary of such date through December 15, 2004 and are exercisable until March 10, 2010 at the exercise price of $104.00 per share.

- (17)

- The 2001 USM Automatic Options become exercisable in annual increments of 20% on March 31 of each year beginning in 2002 and ending in 2006, and are exercisable until March 31, 2011 at an exercise price of $59.40.

- (18)

- The 2000 USM Initial Options become exercisable with respect to 20% of the shares underlying the option on April 10 of each year, beginning in 2001 and ending in 2005, and are exercisable until April 10, 2010 at an exercise price of $69.19 per share.

TDS Telecom Phantom Incentive Option Plan

James Barr III participated in the TDS Telecom phantom stock incentive plan (the "TDS Telecom Plan"). The TDS Telecom Plan was adopted by TDS Telecom in 1997 and related to the five-year period beginning on January 1, 1995 and ending on December 31, 1999. Under the TDS Telecom Plan, Mr. Barr was awarded certain phantom stock units by the Chairman of TDS Telecom. The award consisted of automatic awards and performance awards. The automatic awards vested in five equal annual installments beginning on December 15, 1995. The performance awards included a corporate performance award and an individual performance award. The performance awards vested on December 15 of the year following the performance year to which they relate. When vested, the phantom stock option units became exercisable at an exercise price determined in accordance with the terms of the plan. All phantom stock unit options expire on July 1, 2003. Upon exercise of the phantom stock units, Mr. Barr will receive a cash payment equal to the difference between the exercise price and the implied value of the phantom stock unit as provided in the TDS Telecom Plan.

Mr. Barr received his last performance award in 2000 for 1999 performance.

Mr. Barr has vested options with respect to a total of 124,617 phantom stock units which may be exercised until July 1, 2003.

Pension Plans and Supplemental Benefit Agreements

The TDS employees' pension trust (the "TDS Target Pension Plan") was a defined contribution plan designed to provide retirement benefits for eligible employees of TDS and certain of its affiliates which adopted the TDS Target Pension Plan. Annual employer contributions based upon actuarial assumptions were made under a formula designed to fund a target pension benefit for each participant commencing generally upon the participant's attainment of retirement age. The amounts of the annual contributions are included above in the Summary Compensation Table under "All Other Compensation."

U.S. Cellular previously had adopted the TDS wireless companies' pension plan (the "Wireless Pension Plan"). The Wireless Pension Plan, a qualified non-contributory defined contribution pension plan, provided pension benefits for employees of U.S. Cellular. Under the Wireless Pension Plan, pension contributions were calculated separately for each participant, based on a fixed percentage of the participant's qualifying compensation, and are funded currently. The amount of the annual contributions for John E. Rooney is included above in the Summary Compensation Table under "All Other Compensation."

14

Effective January 1, 2001, the TDS Target Pension Plan was merged with and into the Wireless Pension Plan and the new merged plan has been titled the TDS Pension Plan. All of the plan assets which had been held for the TDS Target Pension Plan and the Wireless Pension Plan were combined to be held on a consolidated basis for the new TDS Pension Plan, which will pay all benefits which previously accrued under both the TDS Target Pension Plan and the Wireless Pension Plan and all future pension plan accruals. All eligible participants who have been receiving target pension benefits under the TDS Target Pension Plan will continue to be eligible for target pension benefits under the TDS Pension Plan. Similarly, eligible participants who have been receiving a pension benefit contribution based on a fixed percentage of their qualifying compensation under the Wireless Pension Plan will continue to be eligible for such benefit under the TDS Pension Plan. All newly eligible employees of both TDS and U.S. Cellular and their affiliates will only be eligible for the pension benefit contribution based on a fixed percentage of qualifying compensation as previously provided under the Wireless Pension Plan.

The TDS supplemental executive retirement plan ("SERP") has provided supplemental benefits under the TDS Pension Plan and the Wireless Pension Plan and effective January 1, 2001, the new TDS Pension Plan. The SERP was established to offset the reduction of benefits caused by the limitation on annual employee compensation which can be considered for tax qualified pension plans under the Internal Revenue Code. The SERP is a non-qualified deferred compensation plan and is intended to be unfunded. The amounts of the accruals for the benefit of the named executive officers are included above in the Summary Compensation Table under "All Other Compensation."

In 1980, TDS entered into a non-qualified supplemental benefit agreement with LeRoy T. Carlson which, as amended, requires TDS to pay a supplemental retirement benefit to Mr. Carlson in the amount of $47,567 plus interest at a rate equal to1/4% under the prime rate for the period from May 15, 1981 (the date of Mr. Carlson's 65th birthday) to May 31, 1992, in five annual installments beginning June 1, 2001, plus interest at 91/2% compounded semi-annually from June 1, 1992. The agreement was entered into because certain amendments made to the TDS Pension Plan in 1974 had the effect of reducing the amount of retirement benefits, which Mr. Carlson would receive under the TDS Pension Plan. The payments to be made under the agreement, together with the retirement benefits under the TDS Pension Plan, were designed to permit Mr. Carlson to receive approximately the same retirement benefits he would have received had the TDS Pension Plan not been amended. All the interest accrued under this agreement is included above in the Summary Compensation Table under "All Other Compensation" and identified in footnote 7 thereto as contributions under the TDS Pension Plan.

Deferred Compensation Agreements

James Barr III is party to an executive deferred compensation agreement, pursuant to which a specified percentage of his gross compensation is deferred and credited to a deferred compensation account. The deferred compensation account is credited with interest compounded monthly, computed at a rate equal to one-twelfth of the sum of the average thirty-year Treasury Bond rate plus 1.25 percentage points until the deferred compensation amount is paid to such person. The amount of compensation deferred by such person is included in and reported with all other non-deferred compensation in the "Summary Compensation Table." No amount is included in the Summary Compensation Table for the interest earned on such deferred compensation because such interest rate is intended to approximate a market rate.

Bonus Deferral and Stock Unit Match Program

The 1998 long-term incentive plan (the "1998 Plan") provides the opportunity for those who are employed by TDS at the position of Vice President or above to defer receipt of a portion of their bonuses and receive TDS matching stock unit credits. Executives may elect to defer receipt of all or a portion of their annual bonuses and to receive stock unit matches on the amount deferred up to $250,000. Deferred compensation will be deemed invested in phantom TDS Common Shares. TDS match amounts will depend on the amount of annual bonus that is deferred into stock units. Participants receive a 25% stock unit match for amounts deferred up to 50% of their total annual bonus and a 33% match for amounts that exceed 50% of their total annual bonus. The matched stock units vest ratably at a rate of one-third per year over three years. The fair market value of the matched stock units is reported in the Summary Compensation Table under "Other Annual Compensation."

LeRoy T. Carlson elected to defer 100% of his 1999 bonus under the 1998 Plan. LeRoy T. Carlson and LeRoy T. Carlson, Jr. each elected to defer the lesser of 100% of their 2000 bonuses or $250,000. LeRoy T. Carlson has elected to defer the lesser of 100% of his 2001 bonus or $250,000. Accordingly, each of LeRoy T. Carlson and LeRoy T. Carlson, Jr. will receive a 25% stock unit match for 50% of their deferred bonuses and a 33% match for 50% of their deferred bonuses up to $250,000 for such years under the 1998 Plan. The bonus for 2001 has not yet been

15

determined for LeRoy T. Carlson and, therefore, the dollar value of the company match phantom stock units cannot be determined at this time. See the "Summary Compensation Table."

In addition, U.S. Cellular has a similar plan pursuant to which John E. Rooney may defer compensation and receive stock unit matches with respect to U.S. Cellular Common Shares. Any stock unit matches received by Mr. Rooney are reported in the Summary Compensation Table under "Other Annual Compensation."

TDS has entered into an agreement with LeRoy T. Carlson whereby it will employ Mr. Carlson until he elects to retire from TDS. Mr. Carlson is to be paid at least $60,000 per annum until his retirement. The agreement also provides that upon his retirement, Mr. Carlson will be retained by TDS as a part-time consultant (for not more than 60 hours in any month) until his death or disability. Upon his retirement, Mr. Carlson will receive $75,000 per annum as a consultant, plus increments beginning in 1985 equal to the greater of three percent of his consulting fee or two-thirds of the percentage increase in the consumer price index for the Chicago metropolitan area. If Mr. Carlson becomes disabled before retiring, TDS can elect to discontinue his employment and retain him in accordance with the consulting arrangement described above. Upon Mr. Carlson's death (unless his death follows his voluntary termination of his employment or the consulting arrangement), his widow will receive until her death an amount equal to that which Mr. Carlson would have received as a consultant. TDS may terminate payments under the agreement if Mr. Carlson becomes the owner of more than 21% of the stock, or becomes an officer, director, employee or paid agent of any competitor of TDS within the continental United States. No amounts were paid or payable under this agreement in 2001, 2000 or 1999, and no amounts related thereto are included above in the Summary Compensation Table.

Sandra L. Helton was hired pursuant to the terms of a letter agreement with TDS dated August 7, 1998. The obligations of TDS under such letter agreement with respect to initial compensation and benefits have been satisfied. Ms. Helton continues to be entitled to be considered for annual salary reviews and a bonus opportunity based on performance. The letter agreement also provided that Ms. Helton would receive a seat on the TDS board of directors.

Pursuant to an employment letter agreement, John E. Rooney was entitled to a base salary at the annual rate of $450,000 per year through December 31, 2000, with a performance review following year-end 2000. The agreement provided that, assuming a start date of April 10, 2000, Mr. Rooney would receive a minimum bonus prorated for nine months of 2000 of $169,000 and that, if Mr. Rooney and his team exceed business plan objectives, his 2000 bonus could increase. Starting in 2001, Mr. Rooney's target bonus opportunity is 50% of his base salary for the year and is based on U.S. Cellular's results for the year. With superior performance, he will be eligible for bonus awards significantly above the targeted 50% level. Pursuant to the letter agreement, Mr. Rooney received a grant of stock options with respect to 55,000 U.S. Cellular Common Shares. The letter agreement provides that Mr. Rooney is also entitled to an annual grant of U.S. Cellular restricted stock beginning March 31, 2001, and to a seat on the U.S. Cellular Board of Directors.

The board of directors has adopted a compensation plan (the "Non-Employee Directors' Plan") for non-employee directors. A non-employee director is a director of TDS who is not an employee of TDS or its affiliates, U.S. Cellular or TDS Telecom. The purpose of the Non-Employee Directors' Plan is to provide reasonable compensation to non-employee directors for their services to TDS, and to induce qualified persons to serve as non-employee members of the board of directors.

The Non-Employee Directors' Plan provides that each non-employee director will receive an annual director's fee of $24,000; and each non-employee director will receive a fee of $1,000, plus reimbursement of reasonable expenses incurred in connection with travel to, and attendance at, each regularly scheduled or special meeting of the board of directors. The Non-Employee Directors' Plan also provides that each non-employee director of TDS will receive a fee of $750, plus reimbursement of reasonable out-of-pocket expenses incurred in connection with travel to, and attendance at, each meeting of the audit committee, stock option compensation committee or other committee established by the board of directors.

Under the Non-Employee Directors' Plan, an amount equal to 50% of the annual director's fee will be paid immediately prior to TDS's annual meeting of shareholders by the delivery of Common Shares of TDS having a fair market value as of the date of payment equal to such percentage of the annual fee. In addition, under the Non-Employee Directors' Plan, an amount equal to 33% of each committee meeting fee will be accumulated and

16

paid immediately prior to TDS's annual meeting of shareholders by the delivery of Common Shares of TDS having a fair market value as of the date of payment equal to such percentage of such fee. TDS has reserved 15,000 TDS Common Shares of TDS for issuance pursuant to the Non-Employee Directors' Plan.

Donald C. Nebergall, a director of TDS, was paid $60,000 for consulting services provided to TDS in 2001.

In addition, TDS pays life insurance premiums on behalf of its directors. Except for such life insurance premiums, directors who are also employees of TDS or any affiliate do not receive any additional compensation for services rendered as directors.

Executive Officer Compensation Report

This report is submitted by LeRoy T. Carlson, Jr., President, who serves as the compensation committee of the board of directors for all executive officers of TDS (other than the President), and by the TDS stock option compensation committee of the board of directors which approves all compensation for the President and approves long-term compensation for executive officers who are employees of TDS. Long-term compensation for John E. Rooney is approved by the stock option compensation committee of U.S. Cellular (as described in its report in the proxy statement of U.S. Cellular).

TDS's compensation policies for executive officers are intended to provide incentives for the achievement of corporate and individual performance goals and to provide compensation consistent with the financial performance of TDS. TDS's policies establish incentive compensation performance goals for executive officers based on factors over which such officers have control and which are important to TDS's long-term success. Compensation should be appropriate to the financial performance of TDS and should be sufficient to enable TDS to attract and retain individuals possessing the talents required for long-term successful performance.

Executive compensation consists of both annual and long-term compensation. Annual compensation consists of base salary and an annual bonus. Annual compensation decisions are based partly on individual and corporate short-term performance and partly on the individual and corporate cumulative long-term performance during the executive's tenure in his or her position, particularly with regard to the President (chief executive officer). Long-term compensation is intended to compensate executives primarily for their contributions to long-term increases in shareholder value and is generally provided through the grant of stock options.

The process of determining base salary begins with establishing an appropriate salary range for each officer, based upon the particular duties and responsibilities of the officer, as well as salaries for comparable positions with other companies. These other companies include those in the peer group index described below under "Stock Performance Chart", as well as other companies in the telecommunications industry and other industries with similar characteristics. The President is provided with information about executive compensation at other companies, as reported in proxy statements and salary surveys published by various organizations. The President uses these sources and makes the determination of appropriate ranges for each executive officer based on his informed judgment, using the information provided to him by the Vice President of Human Resources, as discussed below. The range is not based on any formal analysis nor is there any documentation of the range. The base salary of each officer is set within this range based on an assessment of the responsibilities and the performance of such officer, also taking into account the performance of TDS and/or its business units or divisions, other comparable companies, the industry and the overall economy during the preceding year. The salary of each of the executive officers is believed to be at or slightly above the median of the range considered to be appropriate in the judgment of the President.

Annually, the nature and extent of each executive officer's personal accomplishments and contributions for the year are determined, based on information submitted by the executive and by others familiar with his or her performance, including the executive's direct supervisor. The President evaluates the information in terms of the personal objectives established for such executive officer for the performance appraisal period. The President also makes an assessment of how well TDS did as a whole during the year and the extent to which the President believes the executive officer contributed to the results. With respect to executive officers having primary responsibility over a certain business unit or division of TDS, the President considers the performance of the business unit or division and the contribution of the executive officer thereto. No specific measures of performance are considered determinative in the compensation of executive officers. Instead, all the facts and circumstances are taken into consideration by the President. Ultimately, it is the informed judgment of the President that determines an executive's salary and bonus.

17

The primary focus of TDS is increasing long-term shareholder value through growth, measured primarily in such terms as revenues, customer units in service, operating cash flow (operating income plus depreciation and amortization) and operating income. However, there is no quantifiable relationship between compensation and such measures of performance. Instead, compensation decisions are made subjectively, considering certain performance measures, as well as other appropriate facts and circumstances.

The President of TDS also approves annual bonus compensation for executive officers of TDS and each of its business units or divisions. The Vice President-Human Resources prepares appropriate information, for the annual compensation reviews of executive officers. TDS has no written or formal corporate executive bonus plan. The bonuses for corporate executive officers are determined by the President based on his evaluation of each executive's contribution to TDS, the achievement of individual objectives, the performance of TDS and/or its business units and divisions and all other facts and circumstances considered appropriate in his judgment. The 2001 bonuses approved for the named executives are listed above in the Summary Compensation Table.

The annual compensation of the President (Chief Executive Officer) of TDS is approved by the stock option compensation committee. The Vice President—Human Resources prepares for the committee an analysis of compensation paid to chief executive officers of other comparable companies, including the companies in the peer group index described below under "Stock Performance Chart", as well as other companies in the telecommunications industry and other industries, to the extent considered appropriate, based on similar size, function, geography or otherwise. This information is presented to the stock option compensation committee, which approves the final base salary and bonus of the President based on such information. The stock option compensation committee approved a bonus of $500,000 for the President for the year 2000, and increased his 2001 base salary to $780,000, representing an increase of $71,250 or 10.1% over his base salary of $708,750 in 2000. The stock option compensation committee has not yet approved the President's bonus for 2001 or the President's base salary for 2002. As with the other executive officers, the compensation of the President is determined on the basis of the committee's analysis of multiple factors rather than specific measures of performance. The stock option compensation committee has access to numerous performance measures and financial statistics prepared by TDS. This financial information includes the audited financial statements of TDS, as well as internal financial reports such as budgets and their results, operating statistics and other analyses. The stock option compensation committee may also consider such other factors the committee deems appropriate in making its compensation decisions. Ultimately, it is the informed judgment of the stock option compensation committee, after reviewing the compensation information provided by the Vice President—Human Resources, that determines the salary and bonus for the President.

As discussed above, the primary focus of TDS is the increase of long-term shareholder value through growth, measured primarily in such terms as revenues, customer units in service, operating cash flow (operating income plus depreciation and amortization) and operating income. However, as discussed above, there is no quantifiable relationship between compensation and such measures of performance. Instead, compensation decisions are made subjectively, considering certain performance measurers, as well as all other appropriate facts and circumstances.

The stock option compensation committee believes that the total compensation (base salary and bonus) of the President has been set at a level less than the average for executives at companies which it considers comparable. Each of the members of the committee base this belief on his or her personal assessment and judgment of the President's responsibilities in comparison to those of chief executive officers and chief operating officers of the companies included in the peer group index described below under "Stock Performance Chart", as well as other companies in the telecommunications industry and other industries with similar characteristics, based on the information prepared by the Vice President—Human Resources, as discussed above. The President has a substantial beneficial interest in TDS, as described below under "Security Ownership of Management", and will benefit together with other shareholders based on the performance of TDS. The committee has taken this fact into account in its review and approval of the President's salary and bonus.

The President may also recommend to the stock option compensation committee long-term compensation in the form of additional stock option grants, stock appreciation rights or otherwise for executive officers. The long-term compensation decisions for executive officers are made by the stock option compensation committee in a manner similar to that described for annual base salary and bonus decisions, except that the stock options will generally vest over several years, in order to reflect the goal of relating long-term compensation of executive officers, including the President, to increases in shareholder value over the same period.

The performance of TDS is also a factor in determining the number of stock options which will be awarded and become exercisable with respect to the executive officers. As indicated under the table "Individual Option/SAR

18

Grants in 2001", certain named executive officers received an award of Performance Options in 2001 based on the achievement of certain levels of corporate and individual performance in 2000.

Section 162(m) of the Code. Subject to certain exceptions, section 162(m) of the Internal Revenue Code generally provides a $1 million annual limit on the amount that a publicly held corporation is allowed to deduct as compensation paid to each of the corporation's chief executive officer and the corporation's other four most highly compensated officers. TDS does not believe that the $1 million deduction limitation should have a material effect on TDS in the immediate future. If the $1 million deduction limitation is expected to have a material effect on TDS in the future, TDS will consider ways to maximize the deductibility of executive compensation, while retaining the discretion TDS deems necessary to compensate executive officers in a manner commensurate with performance and the competitive environment for executive talent.

This Executive Officer Compensation Report is submitted by LeRoy T. Carlson, Jr., sole member of the compensation committee and by the stock option compensation committee: George W. Off (Chairman) and Dr. Letitia G. C. Carlson.

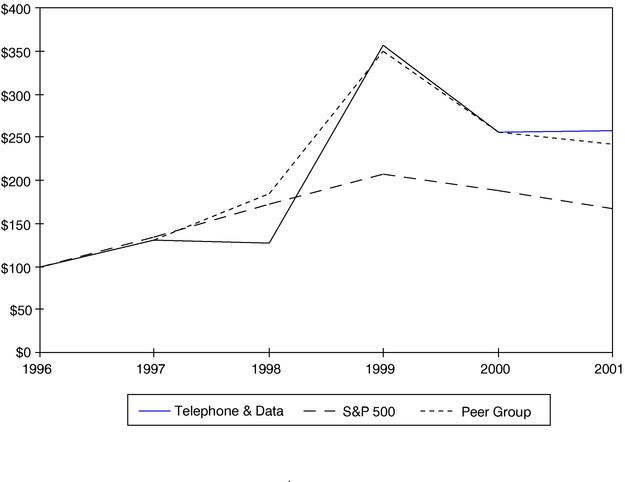

The following chart graphs the performance of the cumulative total return to shareholders (stock price appreciation plus dividends) during the previous five years in comparison to returns of the Standard & Poor's 500 Composite Stock Price Index and a peer group index. The peer group index was constructed specifically for TDS and includes the following companies: ALLTEL Corp., Centennial Communications Corp. (formerly known as Centennial Cellular Corp.) (Class A), CenturyTel, Inc. (formerly known as Century Telephone Enterprise, Inc.), Citizens Communications Co. (formerly known as Citizen Utilities) (Series B), Rural Cellular Corp. (Class A, IPO Feb 1996), Western Wireless Corp. (Class A, IPO May 1996) and TDS. In calculating the peer group index, the returns of each company in the group have been weighted according to such company's market capitalization at the beginning of the period.

19

COMPARATIVE FIVE-YEAR TOTAL RETURNS*

TDS, S&P 500, PEER GROUP

(PERFORMANCE RESULTS THROUGH 12/31/01)

| | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TDS | $ | 100.00 | $ | 129.75 | $ | 126.57 | $ | 356.95 | $ | 256.22 | $ | 256.94 | ||||||

| S&P 500 | $ | 100.00 | $ | 133.36 | $ | 171.48 | $ | 207.56 | $ | 188.66 | $ | 166.24 | ||||||

| Peer Group | $ | 100.00 | $ | 130.18 | $ | 183.72 | $ | 349.46 | $ | 255.00 | $ | 241.46 | ||||||

Assumes $100.00 invested at the close of trading on the last trading day preceding the first day of the fifth preceding fiscal year in TDS Common Shares, S&P 500 and Peer Group.

*Cumulative total return assumes reinvestment of dividends.

Compensation Committee Interlocks and Insider Participation