is subject to the Audit Report issued by Ernst & Young (EY (2021) Shen Zi No. 61641535_B01). In May 2021, the Company completed the foreign exchange registration procedures involved in the payment of the purchase price, and paid US$1 to AXT for the share transfer in June 2021.

5. Sales by the Company of its 45.9677% shares in Dongfang Hi-purity to Chaoyang Limei

The Company transferred its 45.9677% of shares in Dongfang Hi-purity to Chaoyang Limei based on its business demand and with reference to the actual conditions of Dongfang Hi-purity.

The Company held the 6th session of the first board of directors on November 11, 2021, agreeing that the Company transfers RMB14,250,000 contributed by Dongfang Hi-purity to the registered capital (corresponding to Dongfang Hi-purity’s 45.9677% of shares) to Chaoyang Limei at the price of RMB14,000,000. The Company and Chaoyang Limei signed the Share Transfer Agreement. The Company has received the consideration of share transfer from Chaoyang Limei. Dongfang Hi-purity completed the formalities for changes in industrial and commercial registration particulars for this transfer on November 24, 2021.

The said transfer consideration is determined based on the Asset Assessment Report on 45.9677% of Shares in Donghai Dongfang Hi-purity Electronic Materials Co., Ltd. Involved in Proposed Share Transfer by Beijing Tongmei Xtal Technology Co., Ltd. issued by Beijing North Asia Asset Assessment Firm (Special General Partnership).

6. Other related party transactions

(1) Payment of freight by the Company on behalf of AXT

The freight and other expenses paid by the Company on behalf of AXT during the reporting period were RMB3,352,700, RMB2,525,200, RMB1,796,600 and RMB415,400, respectively, and AXT has repaid such freight advanced by the Company.

(2) Payment of remuneration by AXT on behalf of the Company’s executive and the Company entrusting AXT with paying employees’ travel expenses

During the reporting period, AXT paid the remuneration amounting to RMB2,580,100, RMB2,435,400, RMB3,835,000 and RMB736,100, respectively, for the general manager

VINCENT WENSEN LIU of the Company. As discussed by ATX, AXT did not require the Company to repay such amount, and the Company has accounted for same.

The travel expenses and freight which the Company entrusted AXT with paying were RMB21,000, RMB728,100 and RMB309,800, respectively, in 2018, 2019 and 2020.

(3) The Company, as a domestic agency, undergoing the foreign exchange registration formalities for its employees’ participation in the equity incentive plan issued by AXT

AXT, the controlling shareholder of the Company granted some employees of the Company AXT’s stock options and restricted stocks. The Company determined the share-based payments for acquisition by the above personnel of AXT’s stock options and restricted stocks, and the Company collected and paid on behalf of AXT

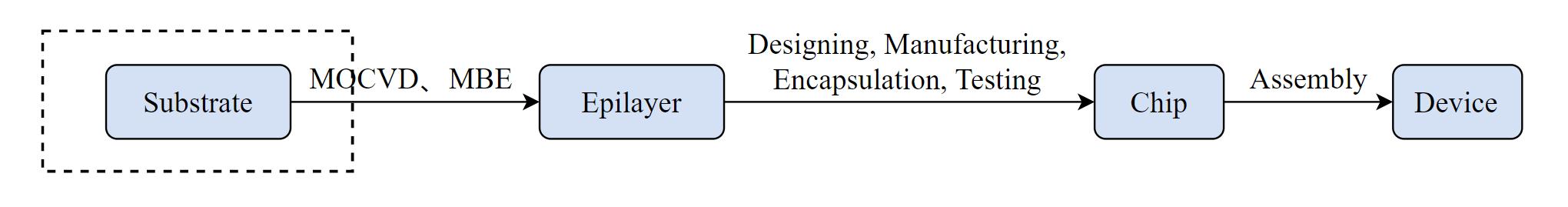

Industrial lasers

Industrial lasers