UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

| First Niagara Financial Group, Inc. |

| (Name of registrant as specified in its charter) |

| (Name of person(s) filing proxy statement, if other than the registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | (5 | ) | | Total fee paid: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1 | ) | | Amount Previously Paid: |

| | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | (3 | ) | | Filing Party: |

| | | (4 | ) | | Date Filed: |

|

| | | | |

| Notice of 2013 Annual Meeting and Proxy Statement |

First Niagara Financial Group, Inc.

726 Exchange Street, Suite 618

Buffalo, New York 14210

March 14, 2013

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of First Niagara Financial Group, Inc. to be held at Larkin at Exchange, 726 Exchange Street, Buffalo, New York 14210, on Wednesday, April 24, 2013 at 10:00 a.m. local time.

All holders of record of First Niagara Financial Group, Inc. Common Stock as of the close of business on March 1, 2013 are entitled to vote at the Annual Meeting.

As described in the accompanying Notice and Proxy Statement, holders of Common Stock will be asked to elect six (6) directors for one-year terms expiring in 2014, to provide advisory approval of First Niagara Financial Group, Inc.'s executive compensation and to ratify the appointment of KPMG LLP as First Niagara Financial Group, Inc.'s independent registered public accounting firm for the year ending December 31, 2013.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting, please vote your shares electronically via the Internet, by telephone or, if you receive a paper copy of the proxy materials, by signing, dating and completing the accompanying proxy card in the enclosed postage-paid envelope. Voting electronically via the Internet, by telephone, or by returning your proxy card in advance of the Annual Meeting does not deprive you of your right to attend the Annual Meeting. If you attend the Annual Meeting, you may vote your shares in person, even if you have previously submitted a proxy in writing, by telephone or via the Internet. Our Proxy Statement includes additional instructions on voting procedures for stockholders whose shares are held by a brokerage firm or other custodian.

|

| | |

| | |

| Sincerely, |

| |

| /s/ John R. Koelmel |

John R. Koelmel President and Chief Executive Officer |

First Niagara Financial Group, Inc.

726 Exchange Street, Suite 618

Buffalo, New York 14210

(716) 819-5500

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

to be held on April 24, 2013

Notice is hereby given that the Annual Meeting of stockholders will be held at Larkin at Exchange, 726 Exchange Street, Buffalo, New York 14210 on Wednesday, April 24, 2013 at 10:00 a.m. local time.

The Annual Meeting is for the purpose of considering and acting upon:

|

| |

| 1 | the election of six directors; |

| 2 | an advisory (non-binding) vote to approve our executive compensation programs and policies as described in this proxy statement; |

| 3 | the ratification of the Audit Committee's appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2013. |

The Board of Directors is not aware of any other business that will be presented for consideration at the Annual Meeting. If any other matters should be properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting for action by stockholders, the persons named in the form of proxy will vote the proxy in accordance with their best judgment on that matter.

Stockholders who owned shares of common stock as of the close of business on March 1, 2013 are entitled to attend and vote at the Annual Meeting. A list of eligible stockholders will be available for inspection at the Annual Meeting, as well as for a period of ten days prior to the Annual Meeting, at our headquarters at Larkin at Exchange, located at 726 Exchange Street, Buffalo, New York 14210. If you plan to attend the Annual Meeting in person, please RSVP by marking the appropriate box on the proxy card, or via email to investor@fnfg.com with RSVP as the subject line. Also, if you and are a registered stockholder and will be attending the meeting in person, please bring valid identification. Stockholders that hold their shares in street name are required to bring valid identification and proof of stock ownership in order to attend the meeting, and a legal proxy from their broker, bank or other nominee to vote their shares.

For instructions on voting, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail or, if you received a hard copy of the Proxy Statement, on your enclosed proxy card.

It is important that your shares be represented and voted at the Annual Meeting.

|

| | |

| | | |

| | | /s/ Kristy Berner |

| Buffalo, New York | | Kristy Berner |

| March 14, 2013 | | Assistant Corporate Secretary |

|

| | | | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 24, 2013. The proxy statement, form of proxy and our 2012 Annual Report on Form 10-K are available at: |

| | | | | |

| https://materials.proxyvote.com/33582V |

| | | | | |

PROXY STATEMENT

First Niagara Financial Group, Inc.

726 Exchange Street, Suite 618

Buffalo, New York 14210

(716) 819-5500

ANNUAL MEETING OF STOCKHOLDERS

April 24, 2013

This proxy statement is being made available to stockholders of First Niagara Financial Group, Inc. (the “Company”) on or about March 14, 2013 via the Internet or by delivery of printed copies by mail, and is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of the Company for use at the Annual Meeting, which will be held at Larkin at Exchange, 726 Exchange Street, Buffalo, New York 14210 on Wednesday, April 24, 2013 at 10:00 a.m. local time, and at all adjournments or postponements of the Annual Meeting. On or about March 14, 2013, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access this proxy statement and our 2012 Annual Report on Form 10-K (the “Annual Report”) online, as well as instructions on how to vote. Also on or about March 14, 2013, we began mailing printed copies of these proxy materials to stockholders that have requested printed copies. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy statement and Annual Report. The Notice also instructs you on how you may vote via the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice. Our 2012 Annual Report is not part of the proxy solicitation material.

|

| | | | |

| STOCKHOLDERS ENTITLED TO VOTE |

Holders of record of our common stock, par value $0.01 per share (“Common Stock”), as of the close of business on March 1, 2013 (the “Record Date”) are entitled to one vote for each share held, except as described below. As of the Record Date, we had 352,567,905 shares of Common Stock issued. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary in order to constitute a quorum at the Annual Meeting. In the event there are not sufficient shares present for a quorum, or to approve or ratify any matter being presented at the Annual Meeting, the Annual Meeting may be adjourned or postponed in order to permit the further solicitation of proxies.

In accordance with the provisions of our Certificate of Incorporation, record holders of Common Stock who beneficially own in excess of 10% of the outstanding shares of Common Stock (the “Limit”) are not entitled to any vote with respect to the shares held in excess of the Limit. Our Certificate of Incorporation authorizes the Board:

|

| |

| 1. | to make all determinations necessary to implement and apply the Limit, including determining whether persons or entities are acting in concert, and |

|

| |

| 2. | to require that any person who is reasonably believed to beneficially own stock in excess of the Limit provide information to enable the Board to implement and appropriately apply the Limit. |

|

| | | | |

| VOTING PROCEDURES AND METHOD OF COUNTING VOTES |

Votes Required to Adopt Proposals

As to the election of directors, a stockholder may vote “FOR” the election of the six nominees proposed by the Board, or “WITHHOLD AUTHORITY” to vote for one or more of the proposed nominees. Under our Certificate of Incorporation and Bylaws, and as permitted under Delaware law, our directors are elected by a plurality of votes cast.

As to each of the other proposals on the agenda, a stockholder may vote FOR or AGAINST the proposal, or the stockholder may ABSTAIN from voting on the proposal. Under our Certificate of Incorporation and Bylaws and Delaware law, approval of each of these proposals requires a majority of the votes cast on the proposal.

Effect of Abstentions and Broker Non-Votes

Shares not present at the meeting and shares marked “withhold authority” will have no effect on the election of directors. For each of the other proposals, abstentions are not treated as votes cast and will have no effect on the outcome of the vote, although abstentions are counted towards establishing a quorum. Broker non-votes (shares held by brokers, banks and other nominees that do not have discretionary authority to vote on a matter and have not received voting instructions from their customers) will have no effect on the outcome of the vote, although they are counted towards establishing a quorum. If you are a beneficial holder and do not provide specific voting instructions to your broker, bank or other nominee, the organization that holds your shares will not be authorized to vote on the proposals (other than the ratification of KPMG LLP as our independent registered public accounting firm). Accordingly, we encourage you to vote promptly, even if you plan to attend the Annual Meeting.

Registered Stockholders

If you are a registered stockholder as of the Record Date, you can vote your shares using any of the following options:

| |

| • | vote in person—If you are a stockholder of record and attend the Annual Meeting, you may vote in person at the meeting. If your shares of Common Stock are held in street name and you wish to vote in person at the meeting, you will need to obtain a “legal proxy” from the broker, bank or other nominee that holds your shares of Common Stock of record; |

| |

| • | by mail—if you received printed materials and would like to vote by mail, complete and sign the accompanying proxy card and return it in the postage-paid envelope provided; |

| |

| • | by telephone—call 1-800-690-6903 and then follow the voice instructions. Please have your proxy card and your social security number or tax identification number available when you call; or |

| |

| • | online—as prompted by the menu found at www.proxyvote.com; follow the instructions to obtain your records and submit an electronic ballot. Please have your Notice or proxy card and your social security number or tax identification number available when you access this voting site. |

Shares Held in Street Name

If you have selected a broker, bank, or other intermediary to hold your shares of Common Stock rather than having the shares directly registered with our transfer agent, American Stock Transfer & Trust Company LLC (“AST”), you will receive instructions directly from your broker, bank, or other intermediary in order to vote your shares. Your brokerage firm may also provide the ability to vote your proxy by telephone or online. Please be advised that if you choose to not vote your proxy, your brokerage firm has the authority under applicable stock market rules to vote your shares “FOR” or “AGAINST” the ratification of KPMG LLP. Accordingly, we urge you to vote by following the instructions provided by your broker, bank, or other intermediary. Proxies solicited for the Annual Meeting will be returned to and tabulated by Broadridge Financial Solutions, Inc., the inspector of election designated by the Board.

If you plan to attend the Annual Meeting but are not a shareholder of record because you hold your shares in street name, please bring evidence of your beneficial ownership of your shares (e.g., a copy of a recent brokerage statement showing the shares) with you to the Annual Meeting. If you intend to vote in person and you own your shares in street name, you are required to bring with you to the meeting a legal proxy from your bank or broker.

|

| | | | |

REVOCATION OF PROXIES/VOTING OF SHARES |

Stockholders retain the right to revoke their proxies or change their voting instructions in the manner described below. Unless so revoked, the shares represented by such proxies or voting instructions will be voted at the Annual Meeting and all adjournments or postponements of the Annual Meeting. Proxies solicited on behalf of the Board will be voted in accordance with the directions given on the proxy card or voting instructions. Where no instructions are indicated, validly executed proxies will be voted “FOR” the director nominees, “FOR” the approval of executive compensation and “FOR” the ratification of KPMG LLP.

Regardless of the voting method you use, you may revoke your proxy or change your voting instructions and cast a new vote at the Annual Meeting at any time before the polls close by:

| |

| • | Delivering a written notice of revocation to the Assistant Corporate Secretary at the address set forth in this proxy statement. |

| |

| • | Properly submitting in person or electronically a later dated vote. |

| |

| • | Attending the Annual Meeting and voting in person. |

However, if you are a stockholder whose shares are not registered in your own name, you will need appropriate documentation from your broker or record holder in order to vote in person at the Annual Meeting or to revoke any prior voting instructions.

If you and other residents at your mailing address own shares of Common Stock in street name, your broker, bank or other nominee may have sent you a notice that your household will receive only one Annual Report, Notice of Internet Availability of Proxy Materials, notice of annual meeting and/or proxy statement. This procedure, known as “householding,” is intended to reduce the volume of duplicate information stockholders receive and also reduce our printing and postage costs. Under applicable law, if you consented or were deemed to have consented, your broker, bank or other nominee may send one copy of our Annual Report, Notice of Internet Availability of Proxy Materials, notice of annual meeting and/or proxy statement to your address for all residents that own shares of Common Stock in street name. If you wish to revoke your consent to householding, you must contact your broker, bank or other nominee. If you are receiving multiple copies of our Annual Report, Notice of Internet Availability of Proxy Materials, notice of annual meeting and/or proxy statement, you may be able to request householding by contacting your broker, bank or other nominee. If you wish to request extra copies free of charge of our Annual Report or proxy statement, please send your request to Jason Benten, Investor Relations Analyst, First Niagara Financial Group, Inc., Larkin at Exchange, 726 Exchange Street, Suite 618, Buffalo, New York 14210; call the Company with your request at (716) 270-8636; or visit the Company's website at http://www.firstniagara.com.

ELECTRONIC ACCESS TO PROXY MATERIALS

This proxy statement and our 2012 Annual Report are available at https://materials.proxyvote.com/33582V. Instead of receiving copies of our future Annual Reports, proxy statements, proxy cards and, when applicable, Notices of Internet Availability of Proxy Materials, by mail, we encourage you to elect to receive an email that will provide electronic links to our proxy materials and also will give you an electronic link to the proxy voting site. Choosing to receive your future proxy materials online will save us the cost of producing and mailing the proxy materials or Notices of Internet Availability of Proxy Materials to you and help conserve natural resources. You may sign up for electronic delivery by visiting http://enroll.icsdelivery.com/FNFG. If you have agreed to electronic delivery of proxy materials, but wish to receive printed copies, please contact our Corporate Secretary or Investor Relations Analyst at the address provided above.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Persons and groups who beneficially own in excess of 5% of our Common Stock are required to file certain reports with the Company and Securities and Exchange Commission (“SEC”) regarding such ownership. The following table summarizes certain information regarding persons whose beneficial ownership is in excess of 5% based on reports filed with the SEC:

|

| | |

Name and Address

of Beneficial Owners | Amount of Shares

Owned and Nature of

Beneficial Ownership | Percent of Shares of

Common Stock Outstanding |

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022 (1) | 28,368,040 | 8.05% |

Janus Capital Management LLC

151 Detroit Street

Denver, CO 80206 (2) | 18,563,138 | 5.3% |

The Vanguard Group

100 Vanguard Boulevard

Malvern PA 19355 (3) | 18,492,254 | 5.2% |

(1)Based on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on February 1, 2013.

(2)Based on a Schedule 13G/A filed by Janus Capital Management LLC with the SEC on February 14, 2013.

(3)Based on a Schedule 13G filed by The Vanguard Group with the SEC on February 13, 2013.

|

| | | | |

| SECURITIES OWNED BY DIRECTORS AND NAMED EXECUTIVE OFFICERS |

The following table details, as of the Record Date, information concerning the beneficial ownership of our Common Stock by;

| |

| • | Our principal executive officer, principal financial officer, and the three other most highly compensated executive officers in 2012 (collectively, “Named Executive Officers”). |

| |

| • | All directors and executive officers as a group. |

In general, beneficial ownership includes those shares that can be voted or transferred, including shares which may be acquired under stock options that are currently exercisable or become exercisable within 60 days.

Stock Ownership of Directors and Executive Management

|

| | | | | | | | | | | | | | | |

| Name | Position(s) Held in the Company | Common Stock | Preferred Stock |

Shares

Owned

Directly

and

Indirectly(1) | Options

Exercisable

Within 60

Days | Beneficial

Ownership(2) | Percent

of Class | Unvested

Awards

Included in

Beneficial

Ownership(2) | Shares

Owned

Directly | Percent

of Class |

| Nominees | | | | | |

| Roxanne J. Coady | Director | 79,396 |

| 235,400 |

| 314,796 |

| | * | — |

| — |

| — |

| Carl A. Florio | Director | 737,151 |

| 50,000 |

| 787,151 |

| | * | — |

| 4,000 |

| * |

| Carlton L. Highsmith | Director | 45,448 |

| 34,078 |

| 79,526 |

| | * | — |

| — |

| — |

| John R. Koelmel | Director, President and CEO | 379,167 |

| 717,186 |

| 1,096,353 |

| (3) | * | 103,207 |

| — |

| — |

| George M. Philip | Director | 52,329 |

| 33,060 |

| 85,389 |

| | * | — |

| 4,000 |

| * |

| Nathaniel D. Woodson | Director | 198,454 |

| 235,400 |

| 433,854 |

| | * | — |

| — |

| — |

| Other Directors | | | | | |

| Thomas E. Baker | Director | 77,254 |

| 33,060 |

| 110,314 |

| | * | — |

| 4,000 |

| * |

| G. Thomas Bowers | Director, Chairman | 127,750 |

| 24,500 |

| 152,250 |

| | * | — |

| — |

| — |

Barbara S. Jeremiah (4) | Director | 52,033 |

| — |

| 52,033 |

| | * | — |

| 600 |

| * |

William H. (Tony) Jones (5) | Director | 161,122 |

| 25,480 |

| 186,602 |

| | * | — |

| 3,200 |

| * |

| Peter B. Robinson | Director | 31,605 |

| — |

| 31,605 |

| | * | — |

| — |

| — |

| Named Executive Officers who are Not Directors | | | |

| Gregory W. Norwood | Chief Financial Officer | 93,641 |

| 40,756 |

| 134,397 |

| | * | 65,185 |

| 2,000 |

| * |

| Daniel E. Cantara, III | Chief Banking Officer | 160,602 |

| 214,086 |

| 374,688 |

| | * | 46,781 |

| — |

| — |

| Gary M. Crosby | Executive Vice President | 93,583 |

| 117,631 |

| 211,214 |

| | * | 68,914 |

| — |

| — |

| Oliver H. Sommer | Executive Vice President | 71,768 |

| 57,599 |

| 129,367 |

| | * | 49,179 |

| 3,000 |

| * |

| | | | | | | | | | |

| All Directors and Executive Officers (20 persons) | 4,649,178 |

| (6) | 1.31 | % | | | |

* Less than 1%

(1)Unless otherwise indicated, each person effectively exercises sole, or shared with spouse, voting and dispositive power as to the shares reported.

| |

(2) | Includes shares granted under the First Niagara Financial Group, Inc. 1999 Recognition and Retention Plan, the 2002 Long-Term Incentive Stock Benefit Plan, and the 2012 Equity Incentive Plan, which are subject to future vesting, but as to which voting may currently be directed. |

(3)Mr. Koelmel has pledged 176,089 shares of Common Stock to secure a loan.

(4)Ms. Jeremiah is not standing for re-election and her service as a director concludes with the Annual Meeting.

(5)Mr. Jones' service as director concludes effective with the Annual Meeting.

| |

(6) | Includes 15,018 shares of Common Stock allocated to the accounts of the Named Executive Officers under the First Niagara Financial Group, Inc. Employee Stock Ownership Plan (“ESOP”) and excludes the remaining 4,124,098 shares of Common Stock owned by the ESOP for the benefit of the employees. Under the terms of the ESOP, shares of Common Stock allocated to the account of employees are voted in accordance with the instructions of the respective employees. Unallocated shares are voted by the ESOP Trustee in the same proportion as the vote obtained from participants on allocated shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

The Company's Common Stock is registered with the SEC pursuant to Section 12 of the Securities Exchange Act of 1934. Accordingly, our directors, executive officers and beneficial owners of more than 10% of our Common Stock are required to disclose beneficial ownership and changes in beneficial ownership on Forms 3, 4, and 5 which are filed with the SEC. At the present time, we have no knowledge of any individual, group, or entity with beneficial ownership of more than 10% of our outstanding Common Stock. In addition, based on our review of ownership reports for our directors and executive officers, we believe our directors and executive officers complied with the regulatory reporting requirements of Section 16(a) for the year ended December 31, 2012.

PROPOSAL I – ELECTION OF DIRECTORS

Our Board currently consists of eleven members. At the Annual Meeting, six directors will be elected to serve for a one-year period and until their respective successors have been duly elected and qualified. We are phasing in declassification of the Board as approved at our 2011 annual meeting of stockholders. The phase-in provides that the term of the directors who were elected at the 2011 annual meeting will expire at the 2014 annual meeting of stockholders, the term of the directors elected at the 2012 Annual Meeting is for one year, expiring at the 2013 annual meeting of stockholders and the term of the directors elected at this Annual Meeting of stockholders will be one year, expiring at the 2014 annual meeting of stockholders. As a result, all directors of the Company will be elected to one-year terms starting with the 2014 annual meeting of the Company’s stockholders.

The Board has nominated Roxanne J. Coady, Carl A. Florio, Carlton L. Highsmith, John R. Koelmel, George M. Philip and Nathaniel D. Woodson for election as directors, each of whom has agreed to serve if so elected for a term that expires in 2014. Please refer to the sections entitled “Nominees for Director” and “Stock Ownership of Directors and Named Executive Officers” for additional information regarding the nominees.

It is intended that the proxies solicited on behalf of the Board (other than proxies in which the vote is withheld as to the nominees) will be voted at the Annual Meeting for the election of the nominees. If any nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board may recommend. At this time, the Board is not aware of any reason why any nominee would be unable to serve if elected. Except as indicated in this document, there are no arrangements or understandings between the nominees and any other person involved in the nomination and selection process.

|

| | | | |

| THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED UNDER PROPOSAL I |

The following includes a discussion of the business experience for the past five years for each of our nominees, directors, and Named Executive Officers as well as the qualifications that were the basis for the Board determining that each director or nominee should serve on the Company’s Board. The term of office noted for directors also includes the appointment to the Board of our subsidiary, First Niagara Bank, N.A.

Nominees for Director

ROXANNE J. COADY, 63, has been a director since April 2011. She was elected to the Board upon completion of the merger between the Company and NewAlliance Bancshares, Inc. where she served on the Audit Committee, as well as the Trust Committee which she chaired. She also chaired the Loan Committee, and served on the board of its predecessor, New Haven Savings Bank, since 1995. She is the founder, President and Chief Executive Officer of R.J. Julia Booksellers, Ltd. and the founder of an on-line retailer, JustTheRightBook.com. Ms. Coady is a former National Tax Director and Partner in BDO Seidman, Chairman of the Tax Division of the New York State Society of CPAs and Chair of the Partnership Committee Task Force of the American Institute of CPAs and has served as a Delegate for the White House Conference on Small Business. She is the founder and Chair of Read to Grow, a statewide literacy organization in Connecticut. Her business and community involvement also includes the Boards of the Connecticut Business and Industry Association, Governor’s Early Childhood Research and Policy Council, The Connecticut Council for Education Reform and the Kenyon Review. She provides expertise to the Board in the areas of accounting, risk management and tax legislation.

CARL A. FLORIO, 64, has been a director since January 2009. He has been the Vice Chairman of Paradigm Capital Management, Inc., an institutional money management firm since 2008 and Vice Chairman of CL King and Associates, an institutional fixed income equity trading and research group since 2008. He served as a senior executive of the Company upon completion of the merger between the Company and Hudson River Bancorp, Inc., from January 2005 to January 2008. Prior to that, he had been President and Chief Executive Officer of Hudson River Bancorp, Inc. beginning in 1995. He is currently a director of American Bio Medica Corporation, where he is a

member of the Audit, Compensation and Executive Committees. As former Audit Chair of the Federal Home Loan Bank of New York, Mr. Florio brings valuable risk management experience. His service as President and Chief Executive Officer of Hudson River Bank & Trust Company gives him a deep knowledge of the Eastern New York sector of the Company’s business, and his prior executive positions with the Company provide first-hand knowledge of the Company and its personnel. He provides expertise to the Board in the areas of risk management, investment banking, and institutional stockholders.

NATHANIEL D. WOODSON, 71, has been a director since April 2011. He was elected to the Board upon completion of the merger between the Company and NewAlliance Bancshares, Inc., where he served on Compensation and Governance Committees, and chaired the Loan and Audit Committees at various times, and served on the board of its predecessor, New Haven Savings Bank since 2000. He is the former Chairman, President, and Chief Executive Officer of UIL Holdings Corporation and its subsidiary, United Illuminating Company. Previously, he was President of the Energy Systems Business Unit for Westinghouse Electric Corporation where he was responsible for the company’s global, commercial nuclear power generation activities. Mr. Woodson has served as Chairman of the Regional Leadership Council and the Regional Growth Partnership in the Greater New Haven area and was a member of the Advisory Committee on Investor Responsibility at Yale University and a Member of the Governor’s Council on Competitiveness and Technology. He was co-chair of the Governor’s Committee to redesign Connecticut’s Vo-Tech High Schools, and a member of the Board of C.U.R.E. and Yale New Haven Hospital. He provides expertise to the Board in the areas of risk management, finance, and management.

CARLTON L. HIGHSMITH, 61, has been a director since April 2011. He was elected to the Board upon completion of the merger between the Company and New Alliance Bancshares, Inc. where he served on the Compensation and Loan Committees of the Board since 2006. He founded, and was President and CEO of The Specialized Packaging Group based in Hamden, Connecticut. He grew his company to become one of North America’s largest independent paperboard packaging manufacturers. He merged his company with PaperWorks Industries in 2009 to form the third largest integrated recycled paperboard manufacturing company in North America, and assumed the role of Vice Chairman of the Board. Mr. Highsmith is a Trustee of Quinnipiac University, Chairman of Connecticut Center for Arts & Technology, a Director of Achievement First Charter School Management Organization, and Chairman of I Have a Dream, New Haven. He serves on the Federal Reserve Bank of Boston Community Development Advisory Council of New England and is a member of the Yale New Haven Hospital Board of Trustees, where he serves on the Finance and Budget Committee. He provides expertise to the Board in the areas of strategy and management.

JOHN R. KOELMEL, 60, has been a director since 2007. He was elected President and Chief Executive Officer in December 2006. Upon joining the Company in January 2004, he served as Executive Vice President and Chief Financial Officer. Mr. Koelmel spent the initial 26 years of his career at KPMG LLP ("KPMG"), where he served many banking and financial services clients, serving as Managing Partner of the Buffalo office and the firm’s Upstate New York Business Unit. As CEO of the Company, Mr. Koelmel provides the Board with unique insight into Company strategy, business planning, and operations. His professional experience, as well as his role in numerous professional and community organizations, give him deep familiarity with customers and the economic variables in all of the company's regions. Mr. Koelmel serves as chair of the Kaleida Health Board of Directors, the largest health care provider in Western New York. In 2012, he was nominated by Governor Cuomo to serve as Chair of the New York Power Authority Board of Trustees.

GEORGE M. PHILIP, 65, has been a director since 2007. He has served as the President of the University at Albany, State University of New York, from November 2007 to January 13, 2013, when he retired. He retired as Executive Director of the New York State Teachers’ Retirement System, one of the ten largest public retirement funds in the nation, where he worked from 1971 to 2007. Mr. Philip serves on the Board of Directors of US Airways Group, Inc., where he is the Chair of the Audit Committee and a member of the Corporate Governance and Nominating Committee, and the Research Foundation of the State University of New York, where he is the Chair of the Finance Committee and a member of the Investment Committee. He is a current or past member of numerous professional organizations and governing bodies involved in financial, educational and community activities. With his long service with the New York State Teachers’ Retirement System, Mr. Philip brings expertise in financial matters and risk management. His position at US Airways Group, Inc. provides additional large public company experience in a government regulated industry, and his numerous other nonpublic company board positions give him special understanding of the education, health care and technology sectors, which are all important constituencies in the Company’s strategic growth planning.

Continuing Directors—term to Expire 2014

THOMAS E. BAKER, 69, has been a director since 2007. He is currently a director of Computer Task Group Incorporated, a company which provides high value, industry specific information technology solutions and services, where he also serves as financial expert and Chair of the Audit Committee. He is a retired President of The John R. Oishei Foundation, the largest private foundation in Western New York, where he served from 1998 through 2006, and where he served on the Board until May 2012. Prior to that, he was with Price Waterhouse for 33 years, including 20 years as a partner and several years as Managing Partner of the Buffalo office. Mr. Baker brings highly desirable audit and risk management skills to the Board, having formerly served as the engagement partner for two commercial banks while he was with Price Waterhouse. His service on the Computer Task Group board brings additional audit committee experience. He is deeply familiar with the Company’s Western New York service territory, having served in high profile public service positions there, and possesses wide knowledge of its business community.

G. THOMAS BOWERS, 69, has been a director since 2003. He has been Chairman of the Board since October 2007. He was elected to the Board in January 2003 upon completion of the merger between the Company and Finger Lakes Bancorp, Inc. where he had been Chairman, President, and Chief Executive Officer from 1995 to 2003. He is the former President, Chief Executive Officer and Chairman of Ithaca Bancorp, Inc., and he is the former President and Chief Executive Officer of Columbia Banking Savings and Loan Association, a Federal savings and loan. He has served two terms on the Board of the Federal Home Loan Bank of New York and on the board of over twenty non-profit organizations. Mr. Bowers also served as Chairman of the Board of Catalyst Direct, a privately held company in Rochester, New York. Mr. Bowers offers experience as President and Chief Executive Officer of three different banks in upstate New York during his 40 year career in banking. His knowledge of the regulatory landscape, merger and acquisition activity, and principles of effective corporate governance demonstrate his experience necessary to serve as nonexecutive chairman of the board.

PETER B. ROBINSON, 64, has been a director since March 2011. He retired in 2010 from the Burger King Corporation, where he most recently served as Executive Vice President, with responsibility for Burger King’s global marketing and strategy functions. From 2006 to 2009 he was the Executive Vice President and President of Burger King’s Europe, Middle East and Africa business segment. Before joining Burger King, Mr. Robinson worked for General Mills, Inc. as President of Pillsbury, U.S.A. and Senior Vice President of General Mills, Inc. from 2001 to 2006, and earlier in his career he held positions of increasing responsibility at The Pillsbury Company, Pepsico, Kraft General Foods and Procter & Gamble. He is currently a director of Lumber Liquidators, Inc., a rapidly-growing supplier and retailer of hardwood flooring. As a Board member, Mr. Robinson brings larger public company experience, with skills in marketing, strategy and corporate governance.

Named Executive Officers who are not Directors

GREGORY W. NORWOOD, 56, is Senior Executive Vice President and Chief Financial Officer. He joined First Niagara in April 2011, and previously served as Chief Risk Officer of Ally Bank. He also served as a Senior Risk Officer for the parent company, Ally Financial, formerly known as GMAC Financial, Inc. Prior to joining Ally in 2009, Norwood served as Treasurer of Wachovia from July 2008, having served in various other senior treasury positions since joining Wachovia in 2005. From 2001 to 2005, he was Corporate Controller for Bank of America. Previously, he was a partner with KPMG, serving financial services clients including some of the nation's largest banks from the firm's New York and Charlotte, North Carolina offices. He started his career with KPMG in 1980 and was a Professional Accounting Fellow at the Securities and Exchange Commission from 1989 - 1991. Mr. Norwood earned his bachelor's degree in accounting from Northern Arizona University.

GARY M. CROSBY, 59, is Executive Vice President and Chief Administrative and Operations Officer. He has served in this capacity since July 2009. Before joining First Niagara, he had left the private sector in 2004 for full-time community service with the Buffalo City School District, the second largest in New York State, as Chief Financial Officer and Chief Operating Officer until 2009. From 1999 to 2003 he was a venture capital partner with Seed Capital Partners. From 1991 to 1999, he was a founding stockholder of ClientLogic Corporation, where he was Chief Financial and Operating Officer. Prior to this he held senior financial leadership positions in banking and manufacturing and was a CPA with KPMG. Crosby is a magna cum laude graduate of Canisius College.

DANIEL E. CANTARA III, 53, is Senior Executive Vice President and Chief Banking Officer. He is responsible for oversight and leadership of all First Niagara's customer facing businesses including Commercial Services, Consumer Finance and Retail Banking operations. He has led the Commercial Services Group since 2007, and its financial services businesses, including insurance, benefits consulting and wealth management since 2001, when he first joined the Company. Under his leadership, the Company's commercial lending business has established

itself as a top regional franchise, with industry leading growth and performance. Prior to joining First Niagara, Cantara spent more than 20 years in public accounting, including eight with Price Waterhouse and 12 as the managing partner of a regional accounting firm he co-founded. He earned his bachelor's degree in accounting and a MBA from the State University of New York at Buffalo.

OLIVER H. SOMMER, 45, is Executive Vice President, Corporate Development. Mr. Sommer has helped lead First Niagara's Merger and Acquisition Strategy, Acquired-Bank Integration, internal project management and other strategic corporate initiatives. He joined First Niagara in April 2010. Prior to joining the Company, he served as a consultant to the Company as President of Aston Associates, which he had been with since 1996. In that capacity, he led Aston's advisory team that played an integral role in executing and integrating the First Niagara's expansion into Pennsylvania through two acquisitions, which doubled the bank's size to nearly $20 billion in assets, with nearly $14 billion in deposits and 255 branches in two states. Before his time at Aston, Mr. Sommer held various positions at CoreStates Bank in corporate and international banking, personal financial services, and investment management divisions. He has an MBA from the Fox School of Business at Temple University and a bachelor's degree from the Carroll School of Management at Boston College.

BOARD OF DIRECTORS

Board Independence

The Board has determined that, except for Mr. Koelmel, each member of the Board is an “independent director” within the meaning of the NASDAQ corporate governance listing standards and our corporate governance guidelines. Mr. Koelmel is not considered independent because he is an executive officer of the Company.

In its assessment of independence of the non-employee directors, the Board considered the mortgage loan made to Mr. Bowers by First Niagara Bank, N.A., the Company’s wholly owned subsidiary ("the Bank"). As discussed under “Transactions with Certain Related Persons,” this loan was made in the ordinary course of business on substantially the same terms and conditions as those prevailing at the time the loan was made for comparable loans.

Board Leadership Structure

The Board has been chaired by an independent director, rather than by the chief executive officer, since 2003. The current Chair is Mr. Bowers. The Board believes that this separation of roles enhances the Chair's leadership of the Board, which in turn oversees management, and enhances the chief executive officer's focus on managing Company operations. The Board believes, however, that the appropriate leadership structure should reflect a variety of factors, including the composition and dynamics of the board, with an emphasis on independence and experience of the directors.

The Role of the Board in Risk Oversight

The Board’s Risk and Audit Committees, each comprised entirely of independent directors, play key roles in the Board’s understanding, identification and management of risk. The Risk Committee assists the Board in fulfilling its oversight responsibilities with respect to corporate risk management, lending and credit related activities and trust activities. The Risk Committee meets at least three times a year. It is charged with:

| |

| • | Providing specific oversight of the Company’s enterprise risk management functions and reporting to the Board on its activities. |

| |

| • | Overseeing the implementation of an effective process for managing the Company’s interest rate, liquidity and market risks. |

| |

| • | Reviewing the Company’s risk-related capital plan and reviewing and providing guidance to the Board on significant financial policies and matters of corporate finance, including the Company’s dividend policy, share repurchase program, and the issuance or retirement of debt and other securities. |

The Audit Committee, in the course of assisting the Board in fulfilling its financially related oversight responsibilities, reviews the annual risk-based audit plan. The Audit Committee has oversight responsibility with respect to the integrity of the Company’s financial reporting process and systems of internal controls regarding finance and accounting, as well as its financial statements.

Board Meetings and Committees

During 2012, the Board met eleven times. Each director attended at least 90% of the combined total number of meetings of the Board and Board Committees of which he or she was a member. Consistent with the Company’s corporate governance guidelines, the independent directors meet in executive session at each planned Board meeting. In addition, our corporate governance guidelines provide that all directors are expected to attend each Annual Meeting. All directors attended the Annual Meeting held on April 25, 2012, and we anticipate that all directors will attend the 2013 Annual Meeting.

The Board has five standing committees: Executive, Governance/Nominating, Audit, Compensation, and Risk. The Board has adopted written charters for each of the standing committees and they are available on our website at www.firstniagara.com.

Executive Committee

The Executive Committee’s primary responsibilities are to act on behalf of the Board between meetings, to handle administrative issues in order to allow for more efficient operations of the Board, as well as to provide advice and counsel to the CEO. The Executive Committee met two times during 2012.

Governance/Nominating Committee

The Governance/Nominating Committee is responsible for matters of corporate governance and matters relating to the practices, policies and procedures of the Board. The Governance/Nominating Committee identifies qualified individuals for Board membership, determines the size and composition of the Board and its committees, monitors the process of assessing the effectiveness of the Board and Board members, ensures appropriate plans for leadership succession and oversees the development and implementation of the Corporate Governance Guidelines. Our Governance/Nominating Committee is also responsible for the determination of director independence as defined by NASDAQ corporate governance listing standards and administration of the Board’s peer review evaluation. Each member of the Governance/Nominating Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards. The Governance/Nominating Committee met five times during 2012.

Audit Committee

The primary role of the Audit Committee is to assist the Board in fulfilling oversight responsibilities with respect to the integrity of our financial statements and other financial information provided to our stockholders and others. Our Audit Committee oversees the retention of our Independent Registered Public Accounting Firm, including oversight of the terms of the engagement, as well as their independence and objectivity. However, Audit Committee members are not acting as professional accountants or auditors, and their functions are not intended to duplicate or substitute for the activities of management and the Independent Registered Public Accounting Firm. In addition, the Audit Committee monitors the performance of our internal audit function, internal controls over financial reporting and disclosure controls. The Audit Committee is empowered to retain independent legal counsel and other advisors as deemed necessary or appropriate to assist the committee in fulfilling its responsibilities.

Each member of the Audit Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards and under SEC Rule 10A-3, and the Board believes that Mr. Baker qualifies as an “audit committee financial expert” as that term is used in the rules and regulations of the SEC. The report of the Audit Committee is included elsewhere in this proxy statement. The Audit Committee met eighteen times during 2012.

Compensation Committee

The primary responsibilities of the Compensation Committee are to assist the Board in overseeing compensation

and benefit plans for all employees and setting specific pay levels for directors and Named Executive Officers. The

Compensation Committee also administers and has discretionary authority over the issuance of equity awards

under the Company's stock compensation plans. Five members of the Board serve on the Compensation

Committee, each of whom is independent by NASDAQ standards. The report of the Compensation Committee is included elsewhere in this proxy statement. The Compensation Committee met nine times during 2012.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is currently comprised of Ms. Jeremiah and Messrs. Bowers, Jones, Philip and Woodson. No member of the Compensation Committee is or has been an officer or employee of the Company. In addition, none of our executive officers serve as a member of the board of directors or compensation committee of any outside company that has an executive officer serving as a member of our Board.

Risk Committee

The primary responsibilities of the Risk Committee are to assist the Board in fulfilling its oversight responsibilities with respect to risk related matters of the Company, overseeing the Company’s lending policies and approving significant loans, as well as reviewing the trust operations for Bank. The Risk Committee met ten times during 2012. See above under the caption “The Role of the Board in Risk Oversight.”

Board Committee Membership

The following chart provides information about Board committee membership and the number of meetings that each committee held in 2012.

|

| | | | | |

| Name | Executive | Governance/

Nominating | Audit | Compensation | Risk |

| Chairman of the Board | | | | | |

| G. Thomas Bowers | Chair | X | | X | |

| Directors | | | | | |

| Thomas E. Baker | X | | Chair | | |

| Roxanne J. Coady | | | X | | X |

| Carl A. Florio | | |

| | X |

| Carlton L. Highsmith | | X | X | |

|

| Barbara S. Jeremiah | X | | | Chair | X |

| William H. (Tony) Jones | | Chair | | X | |

| George M. Philip | |

| | X | |

| Peter B. Robinson | | X | | | X |

| Nathaniel D. Woodson | X | | X | X | Chair |

| Executive Officer | | | | | |

| John R. Koelmel | X | | | | |

| Number of meetings in 2012 | 2 | 5 | 18 | 9 | 10 |

Director Compensation

Our primary goal is to provide competitive and reasonable compensation to non-executive directors in order to attract and retain qualified candidates to serve on our Board. Directors who are also officers of the Company are not eligible to receive board fees. In establishing compensation levels, we consult such resources as The National Association of Corporate Directors Director Compensation Report and receive analyses from the Compensation Committee’s independent consultant. We utilize a combination of cash and stock, with a focus on providing a significant portion of our compensation in the form of stock. Outside directors are subject to a minimum Common Stock ownership requirement. Each outside director is required to own $325,000 of our Common Stock, which is five times cash compensation.

Compensation

All retainer fees are paid in cash and are eligible for deferral under the Directors’ Deferred Fees Plan, as defined below. Set forth below is the fee schedule for non-executive directors for 2012 after the 2012 annual stockholders meeting:

|

| | | |

| Annual Retainer Fees (Cash Compensation) | |

| Company and First Niagara Bank, N.A. combined: | |

Board Chair(1) | $ | 104,000 |

|

| Director | 65,000 |

|

| Committee Chair: | |

| Audit | 10,000 |

|

| Compensation | 7,000 |

|

| Risk | 7,500 |

|

| Governance/Nominating | 7,000 |

|

| Executive | — |

|

| Value of Annual Restricted Stock Awards | |

Board Chair(1) | $ | 104,000 |

|

| Director | 65,000 |

|

(1)The Board Chair receives a premium of 1.6x member compensation.

Stock Benefit Plans

In 2012, we granted restricted stock to each of our non-executive directors. The restricted stock vested at the end of the calendar year. Our plan documents provide for accelerated vesting of the restricted stock upon a director's retirement, death or disability, or upon a change in control of the Company.

Deferred Fees Plan

The Directors' Deferred Fees Plan (the “Deferred Fees Plan”) is a nonqualified compensation plan which allows directors to defer their annual cash retainer and elect to receive restricted stock units instead of annual restricted stock awards. The cash deferrals are fully vested at all times and restricted stock units vest on the last day of the calendar year in which they are awarded.

Amounts credited to a deferred fee account may be invested in equity securities, including Common Stock, fixed income securities, or money market accounts. Restricted stock units and dividend equivalent units earned thereon are deemed invested in Common Stock. There are no preferential earnings on deferred amounts. Amounts credited to a director's account are payable in substantially equal annual installments, as selected by the director at the time of deferral. Such payments commence, as selected by the director, on either the first day of the calendar year following cessation of Board service, or the later of the first day of the calendar year following cessation of Board service and the first day of a calendar year designated by the director on the deferral election form.

In the event a director dies before all payments have been made under the Deferred Fees Plan, the balance will be paid to the director's designated beneficiary on the terms that would have applied to payments to the director. If the death occurs before payments have commenced, then the amounts credited to a director's account will be paid to the director's beneficiary in a single lump sum or in substantially equal annual installments, as elected by the director at the time the deferral was made. Directors may also receive a whole or partial distribution in the event of an unforeseeable financial emergency.

2012 Total Director Fees

The table below sets forth the total compensation earned by non-executive directors who served on our Board during 2012.

|

| | | | | | | | | | | | | | | |

| Names | Fees Earned or

Paid in Cash | Stock Awards(1)(2) | Option

Awards | All Other Compensation(3) | Total |

| Thomas E. Baker | $ | 75,000 |

| $ | 65,800 |

| $ | — |

| $ | 5,507 |

| $ | 146,307 |

|

| G. Thomas Bowers | 104,000 |

| 105,288 |

| — |

| 7,188 |

| 216,476 |

|

| Roxanne J. Coady | 65,000 |

| 65,800 |

| — |

| 2,733 |

| 133,533 |

|

| Carl A. Florio | 65,000 |

| 65,800 |

| — |

| 1,605 |

| 132,405 |

|

| Carlton L. Highsmith | 65,000 |

| 65,800 |

| — |

| 1,605 |

| 132,405 |

|

| Barbara S. Jeremiah | 72,000 |

| 65,800 |

| — |

| 3,931 |

| 141,731 |

|

| William H. (Tony) Jones | 72,000 |

| 65,800 |

| — |

| 4,255 |

| 142,055 |

|

| George M. Philip | 65,000 |

| 65,800 |

| — |

| 1,840 |

| 132,640 |

|

| Peter B. Robinson | 65,000 |

| 65,800 |

| — |

| 1,605 |

| 132,405 |

|

| Louise Woerner | 21,667 |

| 65,800 |

| — |

| 70 |

| 87,537 |

|

| Nathaniel D. Woodson | 70,250 |

| 65,800 |

| — |

| 1,605 |

| 137,655 |

|

| David M. Zebro | 24,000 |

| 65,800 |

| — |

| 70 |

| 89,870 |

|

| |

(1) | The amounts reflect the grant date fair value for awards granted on March 30, 2012 to all directors. Assumptions used in the calculation of these amounts are included in Note 15 to the Company’s audited financial statements for the year ended December 31, 2012, included in the Company’s Annual Report on Form 10-K filed with the SEC on February 25, 2013. |

| |

(2) | The aggregate number of outstanding awards as of December 31, 2012 is as follows: |

|

| | | | | | |

| Names | Unvested Stock

Awards | Options

Exercisable | Options

Unexercisable |

| Thomas E. Baker | — |

| 33,060 |

| — |

|

| G. Thomas Bowers | — |

| 24,500 |

| — |

|

| Roxanne J. Coady | — |

| 235,400 |

| — |

|

| Carl A. Florio | — |

| 50,000 |

| — |

|

| Carlton L. Highsmith | — |

| 34,078 |

| — |

|

| Barbara S. Jeremiah | — |

| — |

| — |

|

| William H. (Tony) Jones | — |

| 25,480 |

| — |

|

| George M. Philip | — |

| 33,060 |

| — |

|

| Peter B. Robinson | — |

| — |

| — |

|

| Nathaniel D. Woodson | — |

| 235,400 |

| — |

|

| |

(3) | Represents dividends received during 2012 on unvested restricted stock awards. |

Board Nominations

We believe that each of our directors should possess the highest personal and professional ethics and be committed to representing the best interests of our stockholders. Through our governance processes, we seek a Board comprised of directors with:

| |

| • | Leadership experience and achievements that demonstrate an inquiring and independent mind and the ability to exercise good business judgment. |

| |

| • | Knowledge and understanding of our organization, industry, and the markets and communities in which we operate. |

| |

| • | Commitment to devote the time required to fulfill duties on the Board and its committees. |

| |

| • | Independence, including absence of relationships or interests that would create a conflict with a director’s responsibilities to us and our stockholders. |

The Governance Committee and our Board believe, and our Corporate Governance Guidelines provide, that Board membership should reflect diversity in a broad sense, including persons diverse in skills, background, gender and

ethnicity. The Governance Committee also takes into account regulatory and NASDAQ listing requirements applicable to our Board and Committees, including “independence” requirements applicable to our Audit, Compensation and Governance Committees, the financial statement literacy requirement applicable to Audit Committee members and the requirement for an audit committee financial expert on the Audit Committee.

In making its recommendations as to nominees for election to our Board, our Governance Committee evaluates our current directors, taking into account their skills, experience and willingness to continue to serve on the Board. As part of its evaluation, the Governance Committee also reviews submissions by each director to the Chair of the Governance Committee containing the director’s self-assessment and view as to continuation of Board service. In making recommendations to the Board on nominees, the Governance Committee considers the benefits of continuity of service and those associated with new perspectives.

The Governance Committee also considers candidates submitted by stockholders and may engage a third party to assist in the identification of nominees. The Governance Committee has not adopted criteria for evaluating differently a candidate nominated by a stockholder versus by a director, member of management or other third party.

Procedures for the Consideration of Board Candidates Submitted by Stockholders

The Governance Committee has adopted procedures for the consideration of Board candidates submitted by stockholders. A stockholder may submit the names of candidates by writing to the Corporate Secretary, at First Niagara Financial Group, Inc., 726 Exchange Street, Suite 618, Buffalo, New York 14210. The submission must include the following information:

| |

| • | A statement that the writer is a stockholder and is proposing a candidate for consideration by the Governance/Nominating Committee. |

| |

| • | The qualifications of the candidate and why this candidate is being proposed. |

| |

| • | The name and address of the nominating stockholder as it appears on our stock ownership records, and number of shares of our Common Stock that are beneficially owned (if the stockholder is not a holder of record, appropriate evidence of stock ownership should be provided). |

| |

| • | The name, address, and contact information for the nominated candidate, and the number of shares of our Common Stock that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the stock ownership should be provided). |

| |

| • | A statement of the candidate’s business and educational experience. |

| |

| • | Such other information regarding the candidate as would be required to be included in the proxy statement pursuant to SEC Regulation 14A. |

| |

| • | A statement detailing any relationship between the candidate and the Company and between the candidate and any customer, supplier or competitor of the Company. |

| |

| • | Detailed information about any relationship or understanding between the proposing stockholder and the candidate. |

| |

| • | A statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected. |

A nomination submitted by a stockholder for presentation at an Annual Meeting must comply with the timing, procedural and informational requirements in our Bylaws and as described in “Advance Notice of Business to Be Conducted at an Annual Meeting”.

Stockholder Communications with the Board

Stockholders who wish to communicate with our Board or with any director may write to the Chairman of the Board at First Niagara Financial Group, Inc., 726 Exchange Street, Suite 618, Buffalo, New York 14210. The letter should indicate that the writer is a stockholder, and if not a stockholder of record, should include appropriate evidence of stock ownership. Depending on the subject matter, the Chair will:

| |

| • | Forward the communication to the director(s) to whom it is addressed. |

| |

| • | Handle the inquiry directly, for example, a request for information about the Company or a stock-related matter. |

| |

| • | Not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal, or otherwise inappropriate. |

At each Board meeting, the Chairman of the Board presents a summary of all communications received since the last meeting and makes those communications available to the directors.

Code of Conduct

We have adopted a general Code of Conduct that sets forth standards of ethical business conduct for all directors, officers, and employees of the Company. Additionally, we have adopted a Code of Conduct for senior financial officers that is in conformity with the requirements of the Sarbanes-Oxley Act of 2002 and the NASDAQ listing standards. Both documents, in addition to any amendments to or waivers from the Code of Conduct, are available on our website at www.firstniagara.com.

The Board has established a means for employees, customers, suppliers, stockholders, and other interested parties to submit confidential and anonymous reports of suspected or actual violations of our Code of Conduct relating, among other things:

| |

| • | Accounting practices, internal accounting controls, or auditing matters and procedures. |

| |

| • | Theft or fraud of any amount. |

| |

| • | Performance and execution of contracts. |

| |

| • | Violations of securities and antitrust laws. |

Any employee, stockholder, or other interested party can submit a report to the Audit Committee either:

| |

| • | By calling a 24-hour, toll-free hotline: 1-877-874-8416. |

| |

| • | By secure email at the following website: https://firstniagara.silentwhistle.com. |

Transactions with Certain Related Persons

Federal laws and regulations generally require that all loans or extensions of credit that the Bank makes to executive officers and directors be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with the general public and must not involve more than the normal risk of repayment or present other features unfavorable to us. However, regulations also permit executive officers and directors to receive the same terms through loan programs that are widely available to other employees, as long as the director or executive officer is not given preferential treatment compared to the other participating employees.

The schedule below sets forth the information with respect to the loans or extensions of credit in excess of $120,000 that the Bank has made to executive officers and directors as of December 31, 2012. All other credit extended to employees and directors is made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the lender. All of the loans are current, in compliance with their original contractual terms and were made in the ordinary course of business. Additionally, they do not involve more than the normal risk of repayment or collectability or contain other terms which may be unfavorable to the Bank. We do not regard any of the loans as potential problem loans.

|

| | | | | | | | | | | | | | | | | | | |

| Related person | Relationship | Credit extended during 2012 | Maximum indebtedness during 2012(1) | Principal repaid during 2012 | Amount Outstanding 12/31/2012 | Interest paid during 2012 | Interest payable during 2012 |

| Bowers, G. Thomas | Director, Chairman | $ | — |

| $ | 653,275 |

| $ | 44,748 |

| $ | 608,527 |

| $ | 21,006 |

| $ | 21,006 |

|

| Koelmel, John R. | President and CEO | — |

| 382,585 |

| 25,622 |

| 356,963 |

| 12,926 |

| 12,926 |

|

| Norwood, Gregory | Chief Financial Officer | — |

| 689,900 |

| 44,105 |

| 645,795 |

| 21,898 |

| 21,898 |

|

| Cantara, Daniel | Chief Banking Officer | — |

| 242,607 |

| 22,312 |

| 220,295 |

| 9,542 |

| 9,542 |

|

| Crosby, Gary | Executive Vice President | — |

| 405,484 |

| 7,670 |

| 397,814 |

| 16,582 |

| 16,582 |

|

| Sommer, Oliver H. | Executive Vice President | 720,000 |

| 720,000 |

| — |

| 720,000 |

| 6,804 |

| 6,804 |

|

| TOTAL | | $ | 720,000 |

| $ | 3,093,851 |

| $ | 144,457 |

| $ | 2,949,394 |

| $ | 88,758 |

| $ | 88,758 |

|

| |

(1) | All loans are residential mortgage loans. |

Section 402 of the Sarbanes-Oxley Act of 2002 generally prohibits an issuer from: (1) extending or maintaining credit; (2) arranging for the extension of credit; or (3) renewing an extension of credit in the form of a personal loan for an officer or director. An exception to this general prohibition applicable to the Bank covers loans made by an FDIC-insured depository institution that is subject to the insider lending restrictions of the Federal Reserve Act. All loans that we have made to our directors and executive officers conform with the Federal Reserve Act and Regulation O.

Our Audit Committee Charter requires that the Audit Committee approve all related party transactions required to be disclosed under Item 404(a) of SEC Regulation S-K.

THE AUDIT COMMITTEE REPORT

As part of its activities for 2012, the Audit Committee has:

1. Reviewed and discussed with management and KPMG LLP (“KPMG”) the Company's audited consolidated financial statements for the year ended December 31, 2012 and management's assessment of the effectiveness of internal controls over financial reporting as of December 31, 2012.

2. Met regularly with our Chief Executive Officer, Chief Financial Officer, internal auditors and KPMG, both together and in separate executive sessions, to discuss the scope and the results of their respective examinations and overall quality of the Company's financial reporting and internal controls.

3. Discussed with KPMG the required communications of Statement on Auditing Standards No. 61, Communication with Audit Committees.

4. Received the written disclosures from KPMG required by Rule 3526, Communications with Audit Committees Concerning Independence, of the PCAOB and discussed with KPMG its independence from the Company.

5. Pre-approved all audit, audit related and other services to be provided by KPMG.

6. Reviewed and approved the Risk Based Internal Audit Plan.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2012 and filed with the SEC. In addition, the Audit Committee appointed KPMG as the Company's Independent Registered Public Accounting Firm for the year ending December 31, 2013, subject to the ratification of this appointment by the stockholders.

The Audit Committee

|

| | | | | | |

| | | Thomas E. Baker (Chair) | | Roxanne J. Coady | | |

| | | Carl A. Florio | | Carlton L. Highsmith | | |

| | | | | | | |

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Discussion and Analysis summarizes the objectives and elements of the Company's executive compensation program for the Named Executive Officers whose compensation is detailed in the Summary Compensation Table and other compensation tables contained in this proxy statement. The Named Executive Officers are the CEO, the CFO and the three most highly compensated officers (other than the CEO and CFO) at the end of 2012.

| |

| • | John R. Koelmel, President and Chief Executive Officer |

| |

| • | Gregory W. Norwood, Chief Financial Officer |

| |

| • | Daniel E. Cantara III, Chief Banking Officer |

| |

| • | Gary M. Crosby, Executive Vice President and Chief Operating Officer |

| |

| • | Oliver H. Sommer, Executive Vice President, Corporate Development |

EXECUTIVE SUMMARY

2012 Business Highlights

In 2012, we reported non-GAAP operating earnings per share of $0.75, compared to $0.98 of non-GAAP operating earnings per share in 2011. Operating income was negatively impacted by several factors including: (1) our decision to sell $3.1 billion of mortgage-backed securities in the second quarter of 2012 and the resulting reduction in net interest income; (2) continued pressures on commercial and consumer loan pricing given the sustained level of historical low interest rates; (3) the impact of accelerated prepayments driven by the low interest rate environment on both our investment and loan portfolios; and, (4) the financial impact of our December 2011 capital raise to pre-fund the May 2012 purchase of deposits and loans in the HSBC branch transaction.

Further details regarding our performance can be found in our recently filed 2012 Form 10-K, including:

| |

| • | The successful completion of the HSBC acquisition and integration, including the divestiture of branches as required by the US Department of Justice. |

| |

| • | An average increase of more than 10% (annualized) in Commercial loan balances which is attributed to our expanded services and traction in specialty lending, including healthcare and leasing. We also launched or significantly enhanced several new lending products: indirect automobile, credit cards and commercial real estate loan syndications. |

| |

| • | An increase in Capital Markets revenue from $8 million in 2011 to $27 million in 2012 based on the current interest rate environment and strong sales efforts and integration with the Commercial Relationship Managers. |

| |

| • | A provision for credit losses was $92 million in 2012, up from $58 million in 2011, reflecting continued growth in our commercial lending portfolios, offset by credit quality improvements in our commercial real estate portfolio and, to a lesser extent, in our home equity portfolio. |

2012 Executive Compensation Highlights

2012 Executive Compensation Pay Adjustments

| |

| • | Aligned Named Executive Officers' compensation pay mix with competitive practice and focused on pay for performance through the following decisions: |

| |

| ◦ | Approved no base salary increase for the CEO and 2.5% increases for all other Named Executive Officers; |

| |

| ◦ | Maintained existing short-term incentive targets for the Named Executive Officers; and |

| |

| ◦ | Increased long-term incentive targets to align with the Company's compensation peer group and the interests of stockholders. For addition information on the compensation peer group, please refer to the section titled “How We Make Compensation Decisions.” |

Executive Compensation Program Review

| |

| • | Reviewed and modified the Executive Short-Term Incentive Plan to include a new performance metric, pre-tax pre-provision earnings per share growth performance relative to peers. The modified metric, and calculation approach, enabled a comparison of profitability not impacted by the current industry environment of large and unsustainable releases of allowance for credit losses. |

| |

| • | As disclosed in the 2012 Annual Proxy Statement, the Company reviewed and updated the compensation peer group for use in determining 2012 compensation decisions. |

| |

| • | Reviewed the Executive Severance Plan and Change in Control Agreements to ensure competitiveness and alignment with the Company's business strategy and the interests of stockholders. No changes were made based on such review. |

Compensation-Related Risk Assessment of Named Executive Officer Compensation

| |

| • | Improved risk assessment process by enhancing the Risk Assessment Working Group procedures that ensure short-term and long-term incentive plans do not encourage imprudent risk taking and are consistent with the safety and soundness of the Company. |

| |

| • | Provided the Company the right under the 2012 Equity Incentive Plan to recoup compensation paid or payable by the Company at any time to the extent required by applicable law or as determined by the Company to be necessary in light of business circumstances or employee misconduct. |

| |

| • | The Company's external auditors evaluated the accuracy of the Executive Short-term Incentive Plan calculation and the Compensation Committee reviewed and approved financial performance associated with payouts under the Executive Short-Term Incentive Plan. |

Compensation Program Highlights

Below are highlights of the Company's compensation practices that provide a link to performance and stockholders' short-term and long-term interests:

What we do:

| |

| • | Pay for Performance: The majority of Named Executive Officer pay is not guaranteed. The Company sets clear financial and individual performance goals and differentiates based on individual contributions. |

| |

| • | Balanced Scorecard Approach: The Company determines short-term incentive awards based on a review of a mix of performance metrics thereby reducing the risk associated with any single measure of performance. |

| |

| • | “Double-Trigger” Change in Control Agreements: Aligns the interests of our Named Executive Officers with the interests of our stockholders without providing a severance benefit to executives who continue to be employed following a change-in-control transaction. |

| |

| • | Limited Perquisites: The Company provides modest perquisites limited to automobile allowances and club membership fees. |

| |

| • | Stock Ownership Guidelines and Holding Requirements: The Company utilizes robust ownership guidelines and holding requirements. |

| |

| • | Independent Compensation Consultant: The Committee uses an independent compensation consulting firm which provides no other services to the Company. |

What we don't do:

| |

| • | No option repricing (i.e., exchanging stock options that are no longer “in-the-money” for options that are currently “at-the-money”). |

| |

| • | No dividends paid with respect to unvested performance-based shares. |

| |

| • | No employment agreements. |

| |

| • | No excise tax gross-ups on change in control benefits. |

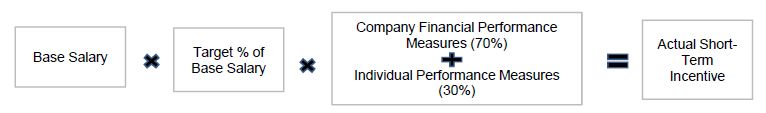

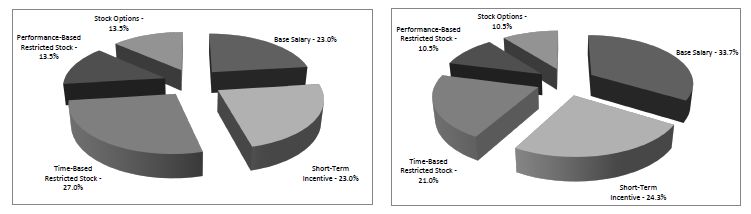

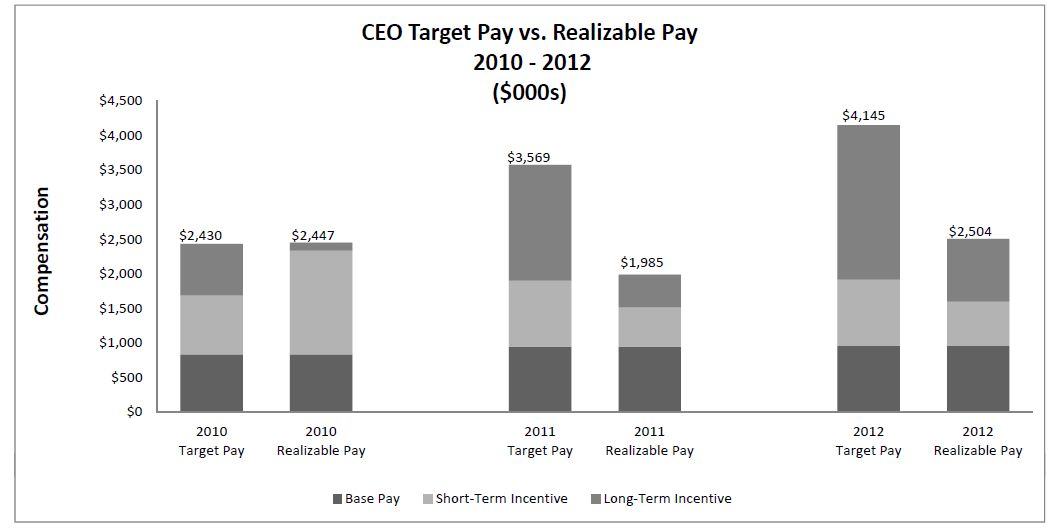

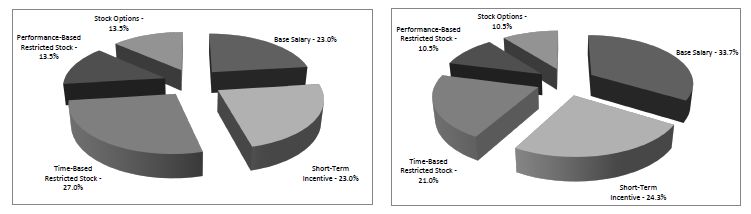

SAY ON PAY