UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| ý | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

| First Niagara Financial Group, Inc. |

| (Name of registrant as specified in its charter) |

| (Name of person(s) filing proxy statement, if other than the registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | (5 | ) | | Total fee paid: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1 | ) | | Amount Previously Paid: |

| | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | (3 | ) | | Filing Party: |

| | | (4 | ) | | Date Filed: |

First Niagara Financial Group, Inc.

726 Exchange Street, Suite 618

Buffalo, New York 14210

(716) 819-5500

March 20, 2013

Dear Stockholder:

The enclosed supplement to our proxy statement, with the accompanying amended formal notice of meeting, is being furnished to you as a stockholder of First Niagara Financial Group, Inc. in connection with the annual meeting of stockholders to be held on Wednesday, April 24, 2013 at 10:00 a.m. local time.

In our March 14, 2013 proxy statement, we asked our stockholders to vote on three proposals, including the election of six directors. On March 19, 2013, and subsequent to the printing of the proxy statement, our President, Chief Executive Officer and Director, John R. Koelmel, departed First Niagara by mutual agreement. As a result, Mr. Koelmel will not stand for reelection to the board of directors at the 2013 annual meeting. To reflect this, our board of directors has reduced the slate of nominees for election to the board at the annual meeting from six nominees to five nominees.

The supplement includes information relating to the departure of Mr. Koelmel and the reduction of the slate of nominees for election at the annual meeting. Please read the proxy statement that was previously made available to you and the supplement in their entirety, as together they contain information that is important to your decision in voting at the annual meeting.

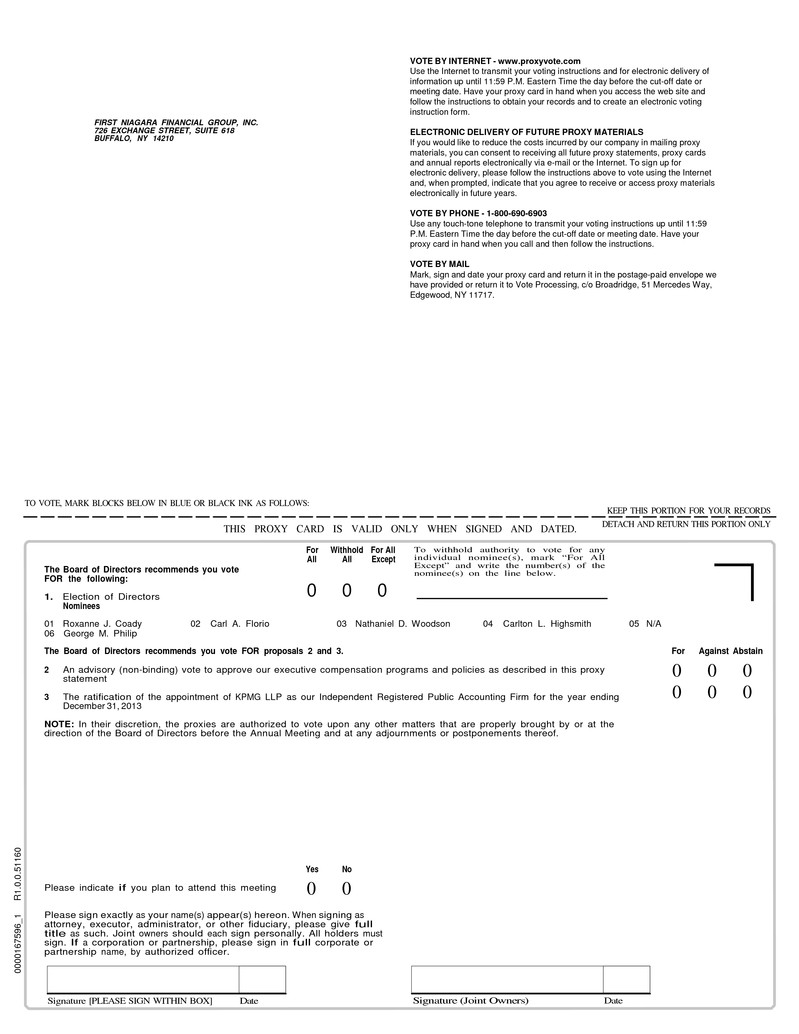

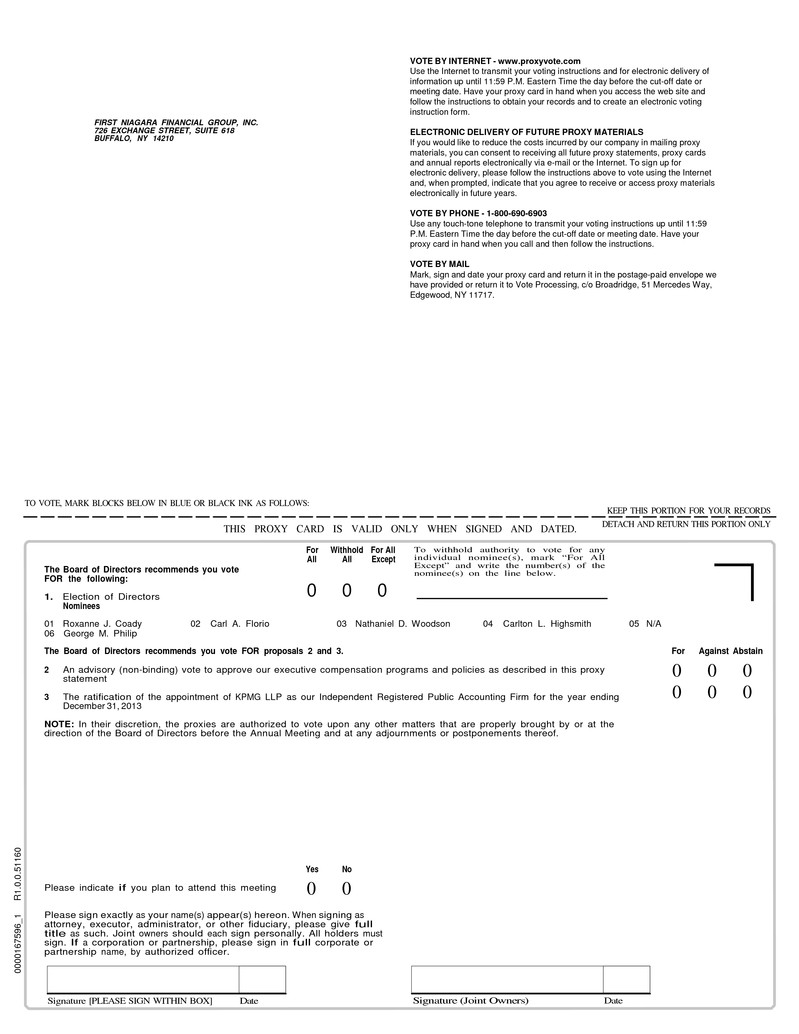

Accompanying the supplement is a new proxy card, which is identical to the previously distributed proxy card except that it omits Mr. Koelmel as a nominee and proxy holder. You may vote on all proposals by submitting the enclosed proxy card, or by submitting a proxy via the Internet or by telephone, in each case following the procedures on the proxy card. If you have already voted and do not submit a new proxy, your previously submitted proxy will be voted at the annual meeting in the same manner as you voted previously, except that any votes for the re-election of Mr. Koelmel to our board of directors will be disregarded. If you have already voted and submit a new proxy, your new proxy will supersede the one you previously submitted.

Your vote is important. We hope that you will be able to attend the meeting. Whether or not you plan to attend the meeting, please vote as soon as possible. Instructions on how to vote are contained on the proxy card.

|

| | |

| | | /s/ Gary Crosby |

| Buffalo, New York | | Gary Crosby |

| March 20, 2013 | | Interim President and Chief Executive Officer |

First Niagara Financial Group, Inc.

726 Exchange Street, Suite 618

Buffalo, New York 14210

(716) 819-5500

AMENDED NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

to be held on April 24, 2013

Notice is hereby given that the Annual Meeting of Stockholders will be held at Larkin at Exchange, 726 Exchange Street, Buffalo, New York 14210 on Wednesday, April 24, 2013 at 10:00 a.m. local time.

The Annual Meeting is for the purpose of considering and acting upon: |

| |

| 1 | the election of five directors; |

| 2 | an advisory (non-binding) vote to approve our executive compensation programs and policies as described in this proxy statement; |

| 3 | the ratification of the Audit Committee's appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2013. |

The Board of Directors is not aware of any other business that will be presented for consideration at the Annual Meeting. If any other matters should be properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting for action by stockholders, the persons named in the form of proxy will vote the proxy in accordance with their best judgment on that matter.

Stockholders who owned shares of common stock as of the close of business on March 1, 2013 are entitled to attend and vote at the Annual Meeting. A list of eligible stockholders will be available for inspection at the Annual Meeting, as well as for a period of ten days prior to the Annual Meeting, at our headquarters at Larkin at Exchange, located at 726 Exchange Street, Buffalo, New York 14210. If you plan to attend the Annual Meeting in person, please RSVP by marking the appropriate box on the proxy card, or via email to investor@fnfg.com with RSVP as the subject line. Also, if you are a registered stockholder and will be attending the meeting in person, please bring valid identification. Stockholders that hold their shares in street name are required to bring valid identification and proof of stock ownership in order to attend the meeting, and a legal proxy from their broker, bank or other nominee to vote their shares.

For instructions on voting, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail or, if you received a hard copy of the Proxy Statement, on your enclosed proxy card.

It is important that your shares be represented and voted at the Annual Meeting.

|

| | |

| | | /s/ Kristy Berner |

| Buffalo, New York | | Kristy Berner |

| March 20, 2013 | | Assistant Corporate Secretary |

|

| | | | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 24, 2013. The proxy statement, form of proxy and our 2012 Annual Report on Form 10-K are available at: |

| | | | | |

| https://materials.proxyvote.com/33582V |

| | | | | |

SUPPLEMENT TO FIRST NIAGARA FINANCIAL GROUP, INC. 2013 PROXY

STATEMENT FOR THE 2013 ANNUAL MEETING OF STOCKHOLDERS

This supplement to our proxy statement, dated March 20, 2013 (the “Supplement”), supplements the definitive proxy statement (the “Proxy Statement”) filed by First Niagara Financial Group, Inc. (the “Company”) with the U.S. Securities and Exchange Commission (the “SEC”) on March 14, 2013 and made available to the Company's stockholders in connection with the solicitation of proxies by the Company's Board of Directors for the 2013 Annual Meeting of Stockholders. The Annual Meeting will be held on Wednesday, April 24, 2013 at 10:00 a.m. local time, at Larkin at Exchange, 726 Exchange Street, Buffalo, New York 14210.

This Supplement is being filed with the SEC and is being made available to stockholders on March 20, 2013. Only stockholders of record as of the close of business on March 1, 2013 are entitled to receive notice of and to vote at the Annual Meeting.

Except as described in this Supplement, the information provided in the Proxy Statement continues to apply. To the extent that information in this Supplement differs from or updates information contained in the Proxy Statement, the information in this Supplement is more current. The Proxy Statement contains important additional information. This Supplement should be read in conjunction with the Proxy Statement.

This Supplement is being provided to you to update the Proxy Statement for the recent mutually agreed departure of our President, Chief Executive Officer and Director, John R. Koelmel, on March 19, 2013. Mr. Koelmel's departure occurred subsequent to the printing of the Company's Proxy Statement and, accordingly, the Proxy Statement contains information with respect to the Company's Board of Directors, management structure and proposed slate of nominees that is no longer correct following Mr. Koelmel's departure.

On March 19, 2013, the Board of Directors appointed Gary M. Crosby as interim President and Chief Executive Officer of the Company. Prior to his appointment, Mr. Crosby was Executive Vice President and Chief Operating Officer of the Company.

Under the Company's Corporate Governance Guidelines, if the Company's Chief Executive Officer is also a Director, his or her seat on the Board of Directors automatically expires upon his or her departure. As such, the size of the Company's Board of Directors has been reduced by one member, to a total of ten members.

Mr. Koelmel was included in the 2013 Proxy Statement as a nominee for director at the Annual Meeting, but will not in fact be a nominee in light of his departure. The Board of Directors has accordingly reduced the slate of nominees for election to the Board of Directors at the Annual Meeting from six nominees to five nominees. The Board of Directors continues to recommend a vote “For” each of the other nominees for election, namely: Roxanne J. Coady, Carl A. Florio, Carlton L. Highsmith, George M. Philip and Nathaniel D. Woodson. The Board of Directors also continues to recommend a vote “For” the advisory non-binding vote to approve our executive compensation programs and policies (Proposal II in the Proxy Statement) and the ratification of KPMG as independent registered public accounting firm for the Company (Proposal III in the Proxy Statement).

Enclosed is a new proxy card, which is identical to the previously distributed proxy card except that it omits Mr. Koelmel as a nominee and proxy holder. If you have already voted and do not submit a new proxy, your previously submitted proxy will be voted at the Annual Meeting in the same manner as you voted previously, except that any votes for the re-election of Mr. Koelmel to our Board of Directors will be disregarded. If you have already voted and submit a new proxy, your new proxy will supersede the one you previously submitted. You may vote on all proposals by submitting the proxy card enclosed with this Supplement, or by submitting a proxy via the Internet or by telephone, in each case following the procedures on the proxy card. By executing the enclosed proxy card, the executing party shall appoint either Gary M. Crosby or Gregory W. Norwood, and each of them, as proxies, with full power of substitution, for and in their name to vote all shares of common stock of First Niagara Financial Group, Inc. that such executing person would be entitled to vote at the Company's Annual Meeting, as specified on the proxy card.