First Quarter 2014 Earnings Highlights April 24, 2014 Gary M. Crosby President & Chief Executive Officer Gregory W. Norwood Chief Financial Officer

Safe Harbor Statement Any statements contained in this presentation regarding the outlook for FNFG’s business and markets, such as projections of future earnings performance, statements of FNFG’s plans and objectives, forecasts or market trends and other matters, are forward-looking statements based on FNFG’s assumptions and beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “outlook,” “will benefit,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, FNFG claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events. Certain factors could cause FNFG’s future results to differ materially from those expressed or implied in any forward-looking statements contained in this presentation. These factors include the factors discussed in Part I, Item 1A of FNFG’s 2013 Annual Report on Form 10-K under the heading “Risk Factors” and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive. 2

25% 25% Strategic Investment Plan 3 Generate long-term shareholder value by investing in… People Process Technology 50% $ 2 0 0 -$ 2 5 0 Mill ion In iti ati ve Revenue Generation Next Gen Infrastructure Integration Layer New commercial and consumer customer acquisition Fee income generation opportunities through product enhancements Greater loan and core deposit volumes Cross-sell effectiveness Drive operating leverage Lower cost to serve Lower operational risk by addressing emerging risks such as cyber security Minimize product integration complexity lowering cost to build and maintain Cost-effective platform to faster launch new products in future Enable consistent customer experience Enhance customer engagement through more sophisticated data analytics

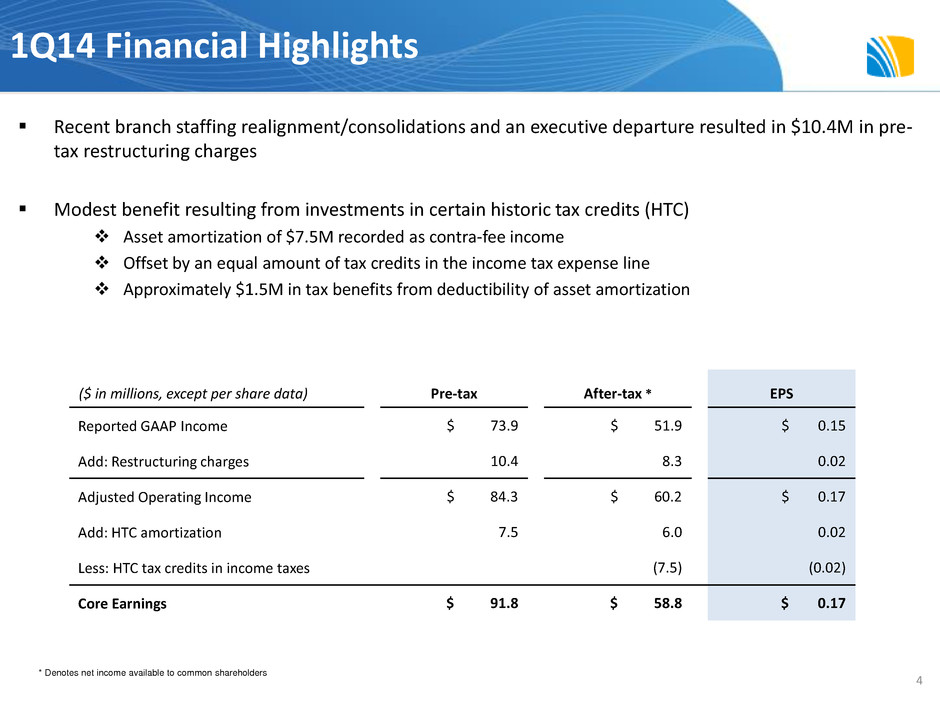

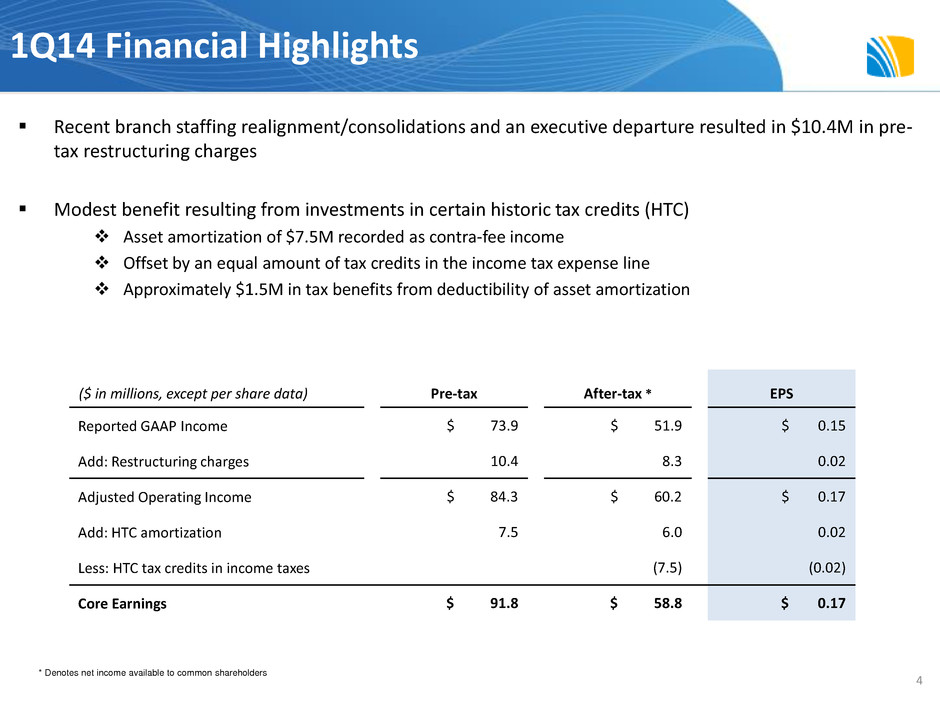

1Q14 Financial Highlights 4 ($ in millions, except per share data) Pre-tax After-tax * EPS Reported GAAP Income $ 73.9 $ 51.9 $ 0.15 Add: Restructuring charges 10.4 8.3 0.02 Adjusted Operating Income $ 84.3 $ 60.2 $ 0.17 Add: HTC amortization 7.5 6.0 0.02 Less: HTC tax credits in income taxes (7.5) (0.02) Core Earnings $ 91.8 $ 58.8 $ 0.17 Recent branch staffing realignment/consolidations and an executive departure resulted in $10.4M in pre- tax restructuring charges Modest benefit resulting from investments in certain historic tax credits (HTC) Asset amortization of $7.5M recorded as contra-fee income Offset by an equal amount of tax credits in the income tax expense line Approximately $1.5M in tax benefits from deductibility of asset amortization * Denotes net income available to common shareholders

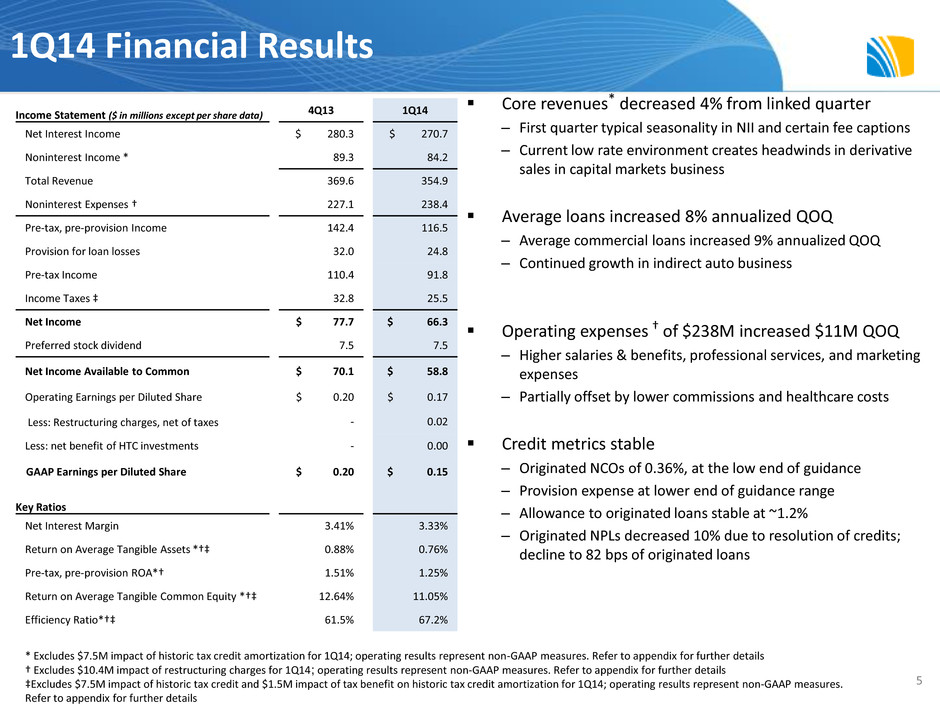

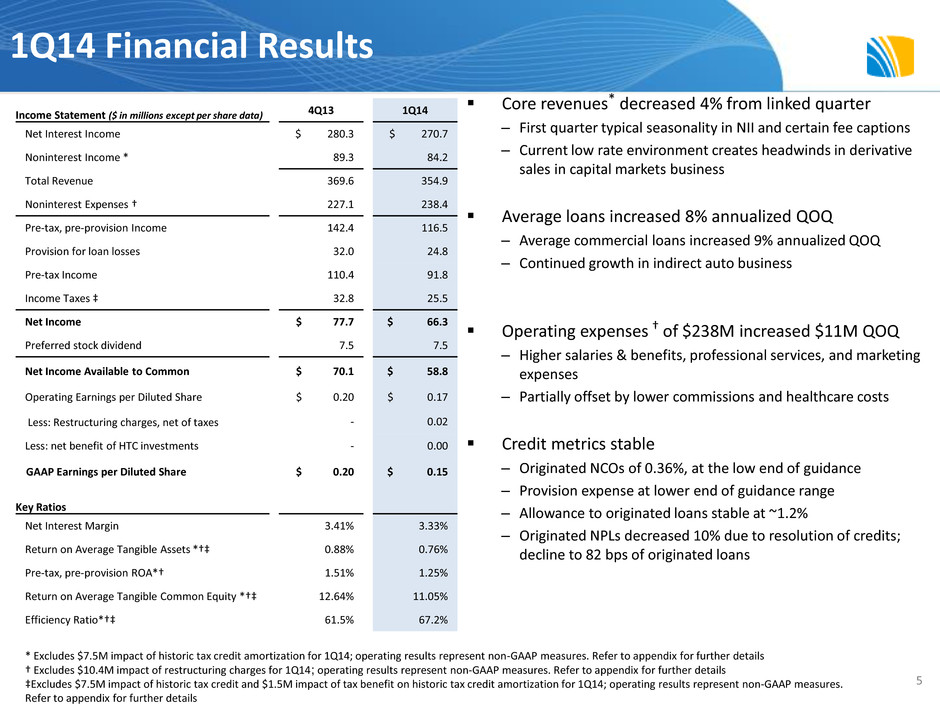

1Q14 Financial Results Income Statement ($ in millions except per share data) 4Q13 1Q14 Net Interest Income $ 280.3 $ 270.7 Noninterest Income * 89.3 84.2 Total Revenue 369.6 354.9 Noninterest Expenses † 227.1 238.4 Pre-tax, pre-provision Income 142.4 116.5 Provision for loan losses 32.0 24.8 Pre-tax Income 110.4 91.8 Income Taxes ‡ 32.8 25.5 Net Income $ 77.7 $ 66.3 Preferred stock dividend 7.5 7.5 Net Income Available to Common $ 70.1 $ 58.8 Operating Earnings per Diluted Share $ 0.20 $ 0.17 Less: Restructuring charges, net of taxes - 0.02 Less: net benefit of HTC investments - 0.00 GAAP Earnings per Diluted Share $ 0.20 $ 0.15 Key Ratios Net Interest Margin 3.41% 3.33% Return on Average Tangible Assets *†‡ 0.88% 0.76% Pre-tax, pre-provision ROA*† 1.51% 1.25% Return on Average Tangible Common Equity *†‡ 12.64% 11.05% Efficiency Ratio*†‡ 61.5% 67.2% Core revenues* decreased 4% from linked quarter – First quarter typical seasonality in NII and certain fee captions – Current low rate environment creates headwinds in derivative sales in capital markets business Average loans increased 8% annualized QOQ – Average commercial loans increased 9% annualized QOQ – Continued growth in indirect auto business Operating expenses † of $238M increased $11M QOQ – Higher salaries & benefits, professional services, and marketing expenses – Partially offset by lower commissions and healthcare costs Credit metrics stable – Originated NCOs of 0.36%, at the low end of guidance – Provision expense at lower end of guidance range – Allowance to originated loans stable at ~1.2% – Originated NPLs decreased 10% due to resolution of credits; decline to 82 bps of originated loans 5 * Excludes $7.5M impact of historic tax credit amortization for 1Q14; operating results represent non-GAAP measures. Refer to appendix for further details † Excludes $10.4M impact of restructuring charges for 1Q14; operating results represent non-GAAP measures. Refer to appendix for further details ‡Excludes $7.5M impact of historic tax credit and $1.5M impact of tax benefit on historic tax credit amortization for 1Q14; operating results represent non-GAAP measures. Refer to appendix for further details

Annualized average loan growth of 8% Commercial loans increased 9% QOQ annualized – 12% increase in C&I – 7% increase in CRE Commercial growth was strongest in our New York (+8%) and Western Pennsylvania (+17%) markets Middle market / Healthcare segments delivered strongest growth CRE increase reflects strong late-Dec and early-January activity + benefit of RM adds in 2013 – Construction, Multi-family, and investor real estate drive increase The commercial pipeline remains stable Average Indirect auto loans increased $160M in the quarter – $242M in new originations at 3.21% yield, net of dealer reserve; – Average FICO score of originations = 753 Balance Sheet Summary 6 Loans Average transactional deposit balances remained relatively flat QOQ despite seasonality Transactional deposits represent 36% of total deposits in Q1, up from 32% a year ago Interest-bearing deposits were down modestly driven by lower CD and MMDA balances Checking balances were flat as seasonal weakness in business checking was offset by increases in retail non-interest checking Deposits

7 New Lending Products Drive Strategic Portfolio Growth over last five years 2013 2012 2011 2010 2009 Equipment finance Capital Markets Loan Portfolio Private Client Healthcare lending Small business Asset based lending Credit cards Indirect Auto Equipment finance Capital Markets Loan Portfolio Private Client Healthcare lending Small business Credit cards Indirect Auto Equipment finance Capital Markets Loan Portfolio Private Client Healthcare lending Small business (SBA) Asset based lending Equipment finance Capital Markets Loan Portfolio Private Client Equipment finance Healthcare lending Asset based lending $1.7B $0.2B $0.2B $0.9B $0.6B $0.6B $1.2B $0.3B Mar 2014 Balance Western PA Eastern PA New England HSBC (Upstate NY) N ew / Im p ro ve d P ro d u ct R eg io n $5.7B Year of product inception / enhancement

1Q14 reported GAAP NII declined $9.5M QOQ to $271M Excluding day effect and net nonrecurring beneficial items, core net interest income relatively stable QOQ • $3.5M lower from 2 fewer days in the quarter (lower interest income on actual/actual day products) • $5.5M less of net nonrecurring beneficial items in 1Q: $1.5M in 1Q versus $7.0M in the prior quarter 4% annualized increase in average earning assets QOQ generally offset yield declines Loan yields down 6 bps QOQ to 3.98% as new origination yields continue to trend lower than those rolling off – Commercial loan spreads continue to remain in line with expectations; Indirect origination yields improved 15 bps QOQ Interest-bearing deposit costs unchanged at 23 bps ($ in millions) NII (FTE) NIM Notes 1Q14 As Reported $275.5 3.33% Less: CLO pay-off discount recognition ($1.5) (0.02%) Earlier than expected pay-offs of CLOs purchased at a discount Less: CMO retroactive adjustment ($1.1) (0.01%) Retroactive adjustment for changes in prepayment projections in CMO portfolio Add: Other items $1.1 0.02% Prepayment adjustments: Higher than expected prepayments on CMBS and lower than normal fees due to slower CRE prepayment activity SUB-TOTAL ($1.5) (0.01%) 1Q14 Normalized $274.0 3.32% Net Interest Income and Margin Overview 8

Revenue Overview ($ in millions) 4Q13 1Q14 QOQ Change $ Net interest income $ 280.3 $ 270.7 $ (9.5) Noninterest Income Deposit Service Charges $ 25.7 $ 23.4 $ (2.4) Insurance Commissions 15.4 15.7 0.3 Merchant and Card Fees 12.6 11.5 (1.1) Wealth Management Services 15.4 15.6 0.1 Mortgage Banking 2.8 3.4 0.6 Capital Markets Income 6.3 3.6 (2.7) Lending & Leasing 4.1 4.7 0.6 Bank Owned Life Insurance 6.0 5.4 (0.6) Other Income * 0.9 0.9 - Core Noninterest Income * $ 89.3 $ 84.2 $ (5.1) HTC Amortization - (7.5) (7.5) GAAP Noninterest income 89.3 76.7 (12.6) Total Revenue – Core * $ 369.6 $ 354.9 $ (14.6) Net interest income in-line with guidance – Favorable CMO portfolio retroactive adjustment of $1.1M in 1Q, compared to $3.5M last quarter; related to moderating prepayment expectations Noninterest income declined $5M QOQ excluding HTC amortization – Decrease in Capital Markets income driven by low interest rate environment – Deposit fees decline reflecting continue lower industry NSF incident rate trends and seasonality – Merchant and card fees decline driven by typical seasonal patterns – Mortgage banking fee income increased modestly from last quarter – BOLI income elevated in 4Q13 and 1Q14 reflecting elevated benefit payouts – Wealth management revenue continued to increase; growth driven by annuity sales – HTC amortization of $7.5M offset by reduction to tax expense by an equal amount 9 * Excludes $7.5M impact of historic tax credit amortization; Operating results represent a non-GAAP measure. Refer to the Appendix for further information.

Noninterest Expense ($ in millions) 4Q13 1Q14 QOQ Change $ Salaries & Benefits $ 113.8 $ 117.9 $ 4.2 Occupancy & Equipment 27.4 27.9 0.5 Technology & Communication 29.5 30.3 0.9 Marketing 4.9 7.4 2.5 Professional Services 9.3 11.9 2.6 Amortization of Intangibles 7.6 7.5 (0.1) FDIC Premiums 7.4 8.9 1.4 Other Expense 27.3 26.6 (0.7) Operating Expense * $ 227.1 $ 238.3 $ 11.2 Restructuring Charges - 10.4 10.4 GAAP Noninterest expense $ 227.1 $ 248.7 $ 21.6 Noninterest Expense Summary Reported GAAP noninterest expense of $249M; $238M net of restructuring costs $10.4M in restructuring expenses related primarily to: – Exit costs on consolidation of 10 branches – Branch staffing realignment related to ongoing shift to Universal Banker Model – Executive & other severance costs 1Q operating expenses* increased $11 million from prior quarter $4 million increase in salaries and benefits driven by increased hiring related to strategic investment plan and payroll tax expense resets partially offset by health care liability adjustments Professional services increase reflects consulting expenses related to strategic investment plan QOQ increase in marketing expense driven by promotional campaigns 10 * Excludes restructuring charges in 1Q14. Operating results represent a non-GAAP measure. Refer to the Appendix for further information.

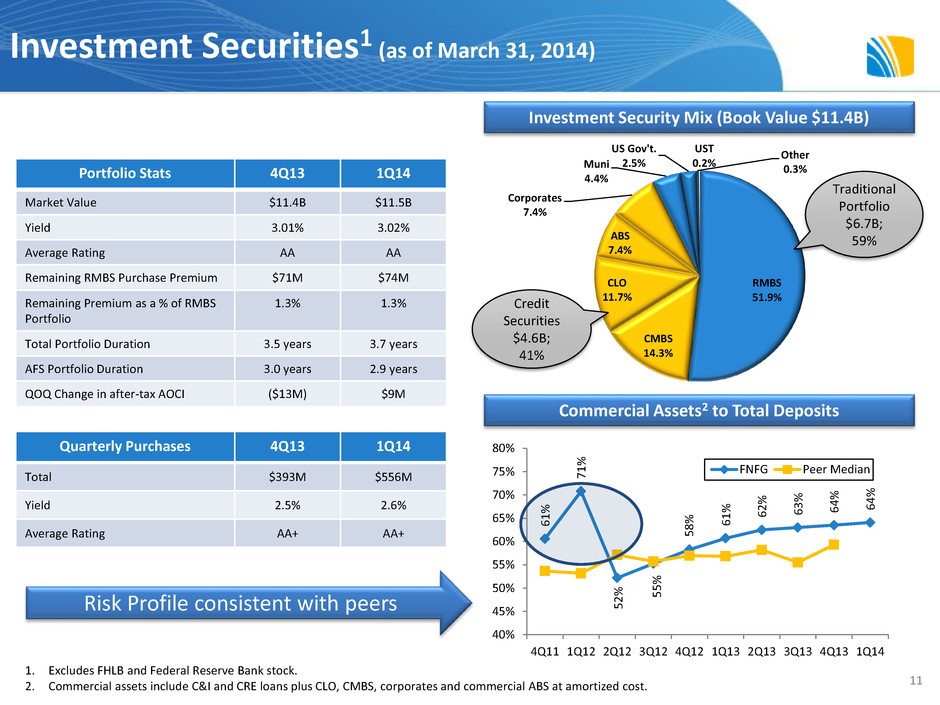

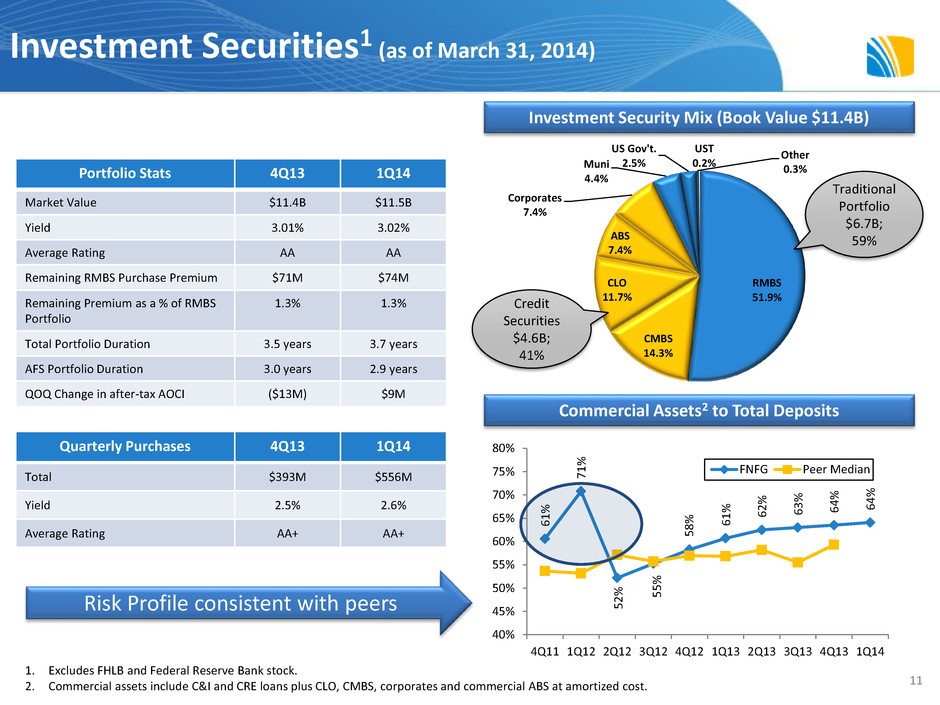

Portfolio Stats 4Q13 1Q14 Market Value $11.4B $11.5B Yield 3.01% 3.02% Average Rating AA AA Remaining RMBS Purchase Premium $71M $74M Remaining Premium as a % of RMBS Portfolio 1.3% 1.3% Total Portfolio Duration 3.5 years 3.7 years AFS Portfolio Duration 3.0 years 2.9 years QOQ Change in after-tax AOCI ($13M) $9M Quarterly Purchases 4Q13 1Q14 Total $393M $556M Yield 2.5% 2.6% Average Rating AA+ AA+ 1. Excludes FHLB and Federal Reserve Bank stock. 2. Commercial assets include C&I and CRE loans plus CLO, CMBS, corporates and commercial ABS at amortized cost. 11 Investment Securities1 (as of March 31, 2014) RMBS 51.9% CMBS 14.3% CLO 11.7% ABS 7.4% Corporates 7.4% Muni 4.4% US Gov't. 2.5% Other 0.3% UST 0.2% Traditional Portfolio $6.7B; 59% Credit Securities $4.6B; 41% Investment Security Mix (Book Value $11.4B) Commercial Assets2 to Total Deposits 6 1 % 7 1 % 5 2 % 5 5 % 5 8 % 6 1 % 6 2 % 6 3 % 6 4 % 6 4 % 40% 45% 50% 55% 60% 65% 70% 75% 80% 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 FNFG Peer Median Risk Profile consistent with peers

1. Based on the computed median of all 15 analyst models where available and SNL Financial; 2Q14 expectations as of April 24, 2014. 2Q14 Outlook (as of April 24, 2014) 12 Metric Street Median Management Commentary on Street Expectations Net Interest Margin T/E 3.29% Modest downward bias to Street 2Q expectations Average Earning Assets $33.8B Modest upward bias to Street 2Q expectations Noninterest Income $92M Excluding $7.5M in HTC amortization in both quarters (with an equal credit to tax expense), core fee income expected to increase mid-to-high single digits from adjusted 1Q14 Noninterest Expense $244M Consistent with Street 2Q expectations Loan loss provision $27M Consistent with Street 2Q expectations NCOs of +/- 40 bps of average originated loans Tax rate – GAAP NA 16% - 17% including HTC tax credit Operating EPS $0.18 Consistent with Street 2Q expectations

Appendix 13

Net charge-offs of 36 bps in Q1; down 7 bps from Q4 – Favorable trends in originated NCOs driven by recoveries in CRE Reserve build continued as provision expense of $21.2M was well in excess of $15.6M in NCOs – $0.5 billion in organic loan growth – Coverage ratio of originated allowance consistent with prior quarters – Reserve build reduced EPS by ~$0.01 in Q1 Originated NPLs decreased 10% QOQ attributable to resolution of a few credits – Originated NPLs declined 11 bps to 82 bps of originated loan balances ($ in millions) 1Q13 4Q13 1Q14 Provision for loan losses $18.9 $28.2 $21.2 Net Charge-offs $9.1 $17.8 $15.6 NCOs / Average Loans 0.27% 0.43% 0.36% Nonperforming Originated Loans $145.6 $157.4 $142.0 NPLs / Loans – Originated 1.03% 0.93% 0.82% Total Originated Loans $14,100 $16,922 $17,389 Allowance – Originated $170.7 $205.3 $210.8 Allowance / Loans – Originated 1.21% 1.21% 1.21% Criticized1 $618.2 $677.2 $765.9 Criticized as a % of Total Originated Loans 4.4% 4.0% 4.4% Classified2 $406.3 $452.3 $461.8 Classified as a % of Total Originated Loans 2.9% 2.7% 2.7% 14 Note: Originated loans represent loans excluding acquired loans (i.e., loans originated under First Niagara ownership) 1. Loans classified as special mention, substandard or doubtful. 2. Loans classified as substandard or doubtful. Credit Quality – Originated Portfolio

In 1Q14, provision on acquired loans was $3.2 million, compared to $3.4 million in 4Q Reclassified $9M of credit marks into accretable yield Credit mark of $113 million equals 2.5% of remaining $4.5B acquired book; ~20 bps of tangible capital 15 * Acquired loans before associated credit discount. Refer to the ending balance sheet in our Q1 2014 press release tables for a reconciliation to total loans and leases. Credit Quality – Acquired Portfolio Q4 2013 Q1 2014 ($ in millions) NCC HNBC NAL HSBC Acquired NCC HNBC NAL HSBC Acquired Provision for loan losses - 3.4 - - 3.4 - 3.2 - - 3.2 Net charge-offs - 2.4 - - 2.4 - 3.0 - - 3.0 NCOs / avg loans 0.21% 0.28% Nonperforming loan 2.7 14.2 7.4 5.9 30.1 2.6 12.3 8.9 6.8 30.6 Total loans 228 957 2,585 872 4,643 232 920 2,462 861 4,476 Allowance - 4.0 - - 4.0 - 4.2 - - 4.2 Credit discount on Acq loans 9.5 23.9 69.4 22.5 125.3 4.6 23.0 65.3 20.4 113.3 Credit discount / Acq loans 4.1% 2.5% 2.7% 2.6% 2.7% 2.0% 2.5% 2.7% 2.4% 2.5% Criticized 33.5 95.4 146.9 32.0 307.8 31.8 82.7 162.4 32.7 309.6 Classified 21.5 81.6 82.7 25.6 211.4 20.6 73.0 85.9 26.1 205.5 Accruing 90+ days delinquent 9.3 36.1 55.1 9.9 110.3 9.7 40.1 55.8 10.5 116.1

16 1. Excludes acquired loans that are marked to market at acquisition. Strong Asset Quality Originated NPL to Loans by Loan Category1 Originated NCO to Loans by Loan Category1 0.24% -0.11% 0.53% 0.74% 0.04% 0.04% 0.29% 0.21% 1.24% 1.29% -0.20% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1Q13 2Q13 3Q13 4Q13 1Q14 CRE C&I RRE Home Equity Total Other Consumer 0.84% 0.63% 0.86% 0.70% 1.65% 1.72% 1.14% 1.22% 0.56% 0.58% 0.00% 0.40% 0.80% 1.20% 1.60% 2.00% 1Q13 2Q13 3Q13 4Q13 1Q14 CRE C&I RRE Home Equity Total Other Consumer

Strong Asset Quality Moving Up Market with Discipline 17 1. Multiple loans to one borrower have not been aggregated for purposes of this chart 2. Excludes acquired loans that are marked to market at acquisition. Commercial Loan Count1 Originated Criticized & Classified Loans to Total Loans2 4.38% 4.07% 3.91% 4.00% 4.40% 2.88% 2.69% 2.44% 2.67% 2.66% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 1Q13 2Q13 3Q13 4Q13 1Q14 Criticized Classified 1 ,623 2 5 2 1 0 1 1 7 1 ,841 3 1 5 1 5 0 2 5 1 ,953 3 5 0 1 6 6 3 3 2 ,000 3 7 6 1 7 1 3 0 - 300 600 900 1,200 1,500 1,800 2,100 $1M to $5M $5M to $10M $10M to $20M > $20M 4Q11 4Q12 4Q13 1Q14

$5.1 $5.2 $5.3 $5.4 $7.4 $7.6 $7.7 $7.8 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2Q13 3Q13 4Q13 1Q14 C&I CRE $3.6 $3.5 $3.5 $3.4 $2.7 $2.7 $2.7 $2.8 $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 $0.9 $1.2 $1.5 $1.6 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 2Q13 3Q13 4Q13 1Q14 Residential RE Home Equity Other Consumer Credit Card Indirect Auto ($ in billions) 8% annualized increase in average loans QOQ Double-digit growth in Middle Market lending Continued momentum in indirect auto lending platform $12.5 18 Continued Momentum in Loan Growth $12.7 $12.9 $13.2 ($ in billions) $7.8 $8.1 $8.3 $8.4 Average Commercial Loans Average Consumer Loans Notes: Growth rates are annualized.

($ in millions) 4Q13 1Q14 QOQ ∆ Indirect Auto Period end loan balance $1,544 $1,655 7% Origination Volume $317 $242 -24% Origination Yield 3.06% 3.21% 15 bps # of dealers 1,187 1,209 2% % of used units 65% 69% 4% Credit Card Period end loan balance $325 $306 -6% Purchase Volume $258 $223 -14% Interchange Fee Income $4.90 $4.30 -12% Total Active Accounts (Units) 155,587 153,526 -1% Mortgage Banking Total Origination Volume $269 $196 -27% Retail Origination Volume $253 $188 -26% Purchase Volume $165 $113 -32% HFS Lock Volume $149 $132 -11% Application Volume $349 $366 5% Indirect Auto – Net origination yield of 3.21%, 15 bps above Q4 – $242 million in originations in 1Q14, down from 4Q13 Average FICO of 753 on new originations during the quarter, consistent with prior quarter (754) 69% of originations are for used vehicles at new car dealers Credit cards – Purchase volume down seasonally QOQ and flat to 1Q13 – Continued focus in building the balance sheet through origination, activation and usage campaigns scheduled throughout 2014 Residential Lending – Application volumes up 5% in 1Q14 Outperformed MBA averages 10 of the last 14 weeks – Purchase volumes account for 58% of total production in quarter – HELOC: 4th consecutive quarter of growth driven by targeted promotional campaigns 19 Consumer Finance

Transactional deposits represent 36% of total deposits in Q1, up from 32% a year ago Interest-bearing deposit cost of 23 bps consistent QOQ Transactional deposits remained flat QOQ – Seasonal weakness in business checking balances was offset by Retail non-interest deposits Mobile banking adoption rates continue to outperform expectations – More than 160,000 customers have registered since inception in January 2013 – Early adoption rates of remote deposit capture feature launched in January 2014 are encouraging Over 70 branches consolidated since 2011, ten completed in Q1 2014 20 Retail: Focus on Checking Account Growth Average Transactional Deposits ($ in billions) 4.47 4.71 4.79 4.88 4.86 4.38 4.50 4.48 4.73 4.73 32% 34% 35% 36% 36% -10% 0% 10% 20% 30% 40% 50% 60% $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 1Q13 2Q13 3Q13 4Q13 1Q14 Noninterest-bearing Interest-bearing Percent of Total Deposits $8.85 $9.22 $9.27 $9.60 $9.60

Non-GAAP Measures – This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (GAAP). The Company believes that these non-GAAP financial measures provide a meaningful comparison of the underlying operational performance of the Company, and facilitate investors’ assessments of business and performance trends in comparison to others in the financial services industry. In addition, the Company believes the exclusion of these non- operating items enables management to perform a more effective evaluation and comparison of the Company’s results and to assess performance in relation to the Company’s ongoing operations. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Where non-GAAP disclosures are used in this presentation, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this Appendix. Non-GAAP Measures 21

22 GAAP to non-GAAP Reconciliation (in thousands) 4Q13 1Q14 Total noninterest income on operating basis (Non-GAAP) 89,312$ 84,197$ Amortization of Historic Tax Credit projects - (7,473) Total reported noninterest income (GAAP) 89,312$ 76,724$ Total noninterest expense on operating basis (Non-GAAP) 227,148$ 238,380$ Merger and acquisition integration expenses - 10,356 Total reported noninterest expense (GAAP) 227,148$ 248,736$ Total income tax expense on operating basis (Non-GAAP) 32,752$ 25,465$ Tax benefit received on amortization of Historic Tax Credit projects - (1,476) Historic Tax Credit - (7,487) Total reported income tax expense (GAAP) 32,752$ 16,502$ Quarter ended Quarter ended December 31, 2013 (in 000s) March 31, 2014 (in 000s) Computation of Average Tangible Assets: Total average assets 37,378,780$ 37,747,873$ Less: Average goodwill and other intangibles (2,546,031) (2,538,891) Average tangible assets 34,832,749$ 35,208,982$ Computation of Average Tangible Common Equity: Total average stockholders' equity 4,984,003$ 5,034,096$ Less: Average goodwill and other intangibles (2,546,031) (2,538,891) Less: Average preferred stockholders' equity (338,002) (338,002) Average tangible common equity 2,099,970$ 2,157,203$ Reconciliation of noninterest expense on operating basis to reported noninterest expense: Reconciliation of noninterest income on operating basis to reported noninterest income: Reconciliation of income tax expense on operating basis to reported income tax expense: