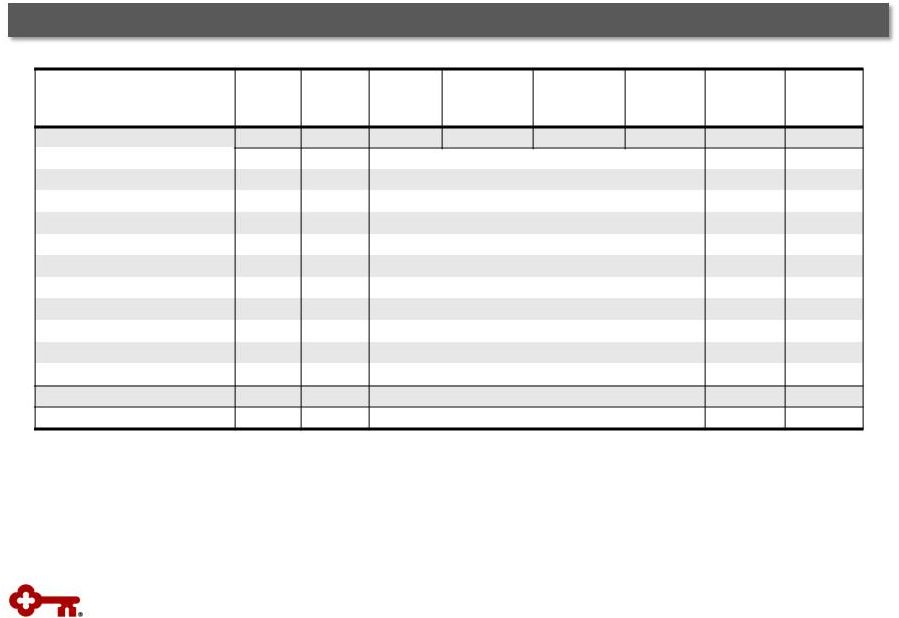

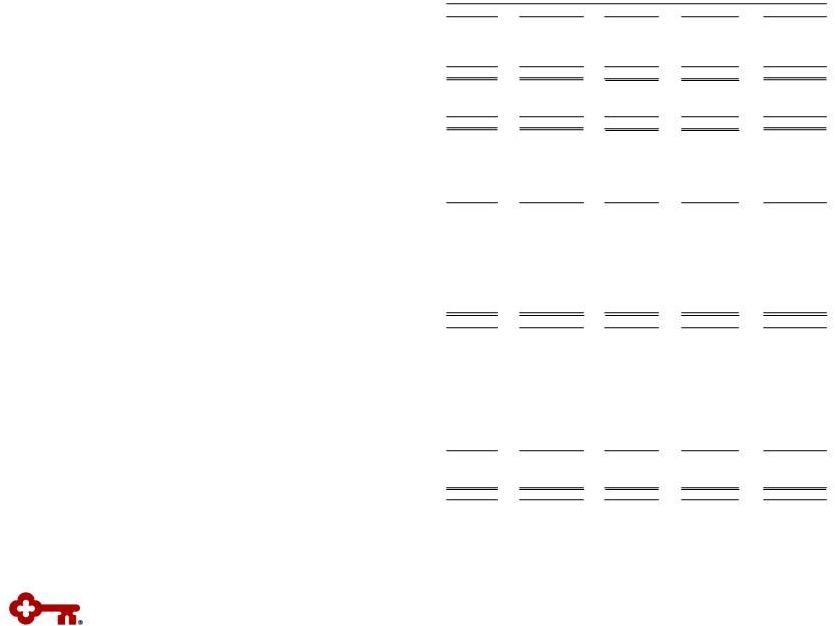

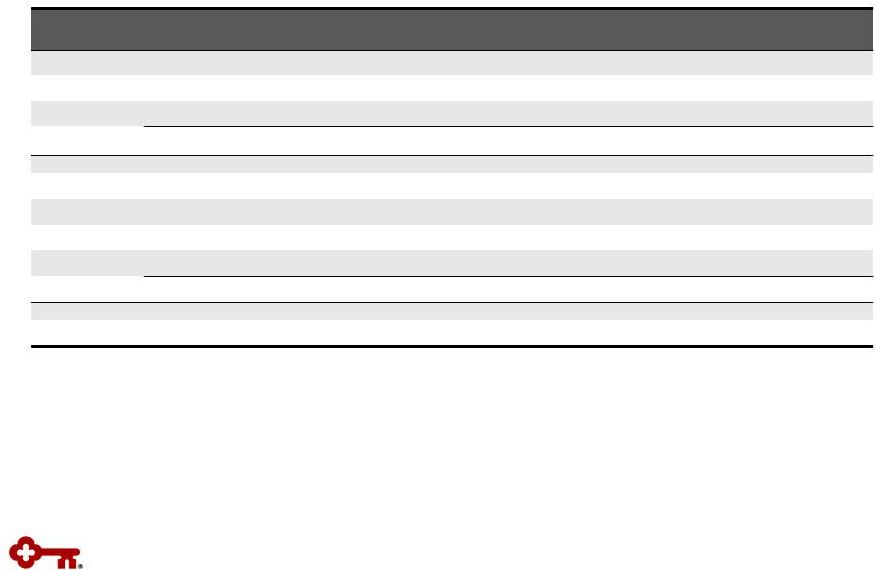

Three months ended 12-31-15 9-30-15 6-30-15 3-31-15 12-31-14 Tangible common equity to tangible assets at period end Key shareholders’ equity (GAAP) $ 10,746 $ 10,705 $ 10,590 $ 10,603 $ 10,530 Less: Intangible assets (a) 1,080 1,084 1,085 1,088 1,090 Preferred Stock, Series A (b) 281 281 281 281 282 Tangible common equity (non-GAAP) $ 9,3485 $ 9,340 $ 9,224 $ 9,234 $ 9,158 Total assets (GAAP) $ 95,133 $ 95,422 $ 94,606 $ 94,206 $ 93,821 Less: Intangible assets (a) 1,080 1,084 1,085 1,088 1,090 Tangible assets (non-GAAP) $ 94,053 $ 94,338 $ 93,521 $ 93,118 $ 92,731 Tangible common equity to tangible assets ratio (non-GAAP) 9.98 % 9.90 % 9.86 % 9.92 % 9.88 % Common Equity Tier 1 at period end Key shareholders’ equity (GAAP) $ 10,746 $ 10,705 $ 10,590 $ 10,603 - Less: Preferred Stock, Series A (b) 281 281 281 281 - Common Equity Tier 1 capital before adjustments and deductions 10,465 10,424 10,309 10,322 - Less: Goodwill, net of deferred taxes 1,036 1,036 1,034 1,036 - Intangible assets, net of deferred taxes 26 29 33 36 - Deferred tax assets 1 1 1 1 - Net unrealized gains (losses) on available-for-sale securities, net of deferred taxes (58) 54 - 52 - Accumulated gains (losses) on cash flow hedges, net of deferred taxes (20) 21 (20) (8) - Amounts in accumulated other comprehensive income (loss) attributed to pension and postretirement benefit costs, net of deferred taxes (365) (385) (361) (364) - Total Common Equity Tier 1 capital (c) $ 9,845 $ 9,668 $ 9,622 $ 9,569 - Net risk-weighted assets (regulatory) (c) $ 89,889 $ 92,307 $ 89,851 $ 89,967 - Common Equity Tier 1 ratio (non-GAAP) (c) 10.95 % 10.47 % 10.71 % 10.64 % - Tier 1 common equity at period end Key shareholders’ equity (GAAP) - - $ 10,530 Qualifying capital securities - - 339 Less: Goodwill - - - - 1,057 Accumulated other comprehensive income (loss) (d) - - - - (395) Other assets (e) - - - - 83 Total Tier 1 capital (regulatory) - - - - 10,124 Less: Qualifying capital securities - - - - 339 Preferred Stock, Series A (b) - - - - 282 Total Tier 1 common equity (non-GAAP) - - - - $ 9,503 Net risk-weighted assets (regulatory) - - - - $ 85,100 Tier 1 common equity ratio (non-GAAP) - - - - 11.17 % GAAP to Non-GAAP Reconciliation $ in millions 24 a) Three months ended 12/31/15, 9/30/15, 6/30/15, 3/31/15, and 12/31/14, exclude $45 million, $50 million, $55 million, $61 million, and $68 million, respectively, of period-end purchased credit card receivables b) Net of capital surplus c) 12-31-15 amount is estimated d) Includes net unrealized gains or losses on securities available for sale (except for net unrealized losses on marketable equity securities), net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other postretirement plans e) Other assets deducted from Tier 1 capital and net risk-weighted assets consist of disallowed intangible assets (excluding goodwill) and deductible portions of nonfinancial equity investments. There were no disallowed deferred tax assets at December 31, 2014. |