Citizens South Banking Corporation

KBW Community Bank

Investor Conference

New York, New York

July 29, 2009

Forward Looking Statements

Statements contained in this presentation, which are

not historical facts, are forward looking statements. The

Company’s senior management or directors may from

time to time make public forward looking statements

concerning matters herein. Such forward looking

statements are estimates reflecting the best judgment of

senior management or the directors based on current

information. A number of factors that could affect the

accuracy of such forward looking statements are

identified in the public filings made by the Company with

the Securities and Exchange Commission on Forms 10-Q

and 10-K. The Company undertakes no obligation to

publicly revise any forward looking statements to reflect

events and circumstances that may arise after the date

hereof. There can be no assurance the such factors will

not affect the accuracy of such forward looki

ng statements.

2

Overview of Presentation

Corporate Profile

Charlotte Market Data

Stock / Financial Information

CSBC Business Strategy

Historical Financial Performance

Why own CSBC stock?

3

Corporate Profile

Founded in 1904

Converted from a Mutual in 1998

Two acquisitions since 2001

Fifteen full-service offices and

one LPO in the Charlotte Region

Assets exceeding $800 million

4

Executive Management Team

Experience Prior Employer

Kim S. Price 27 First Nat’l Bank / FHLB

President & CEO

Gary F. Hoskins 22 FHLB Atlanta / OTS

Chief Financial Officer

Michael R. Maguire 28 First Union Nat’l Bank

Chief Credit Officer

Daniel M. Boyd, IV 24 Wachovia / First Gaston

Chief Operating Officer

Paul L. Teem, Jr. 25 Citizens South Bank

Chief Administrative Officer

5

Market Area

Charlotte Region

6

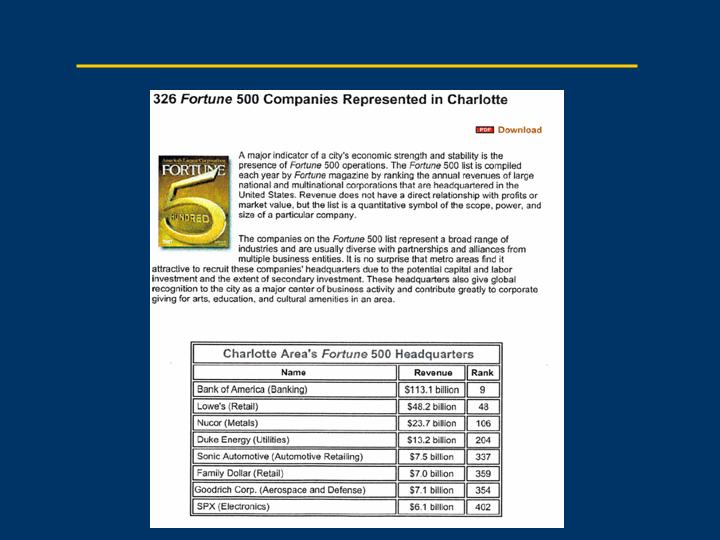

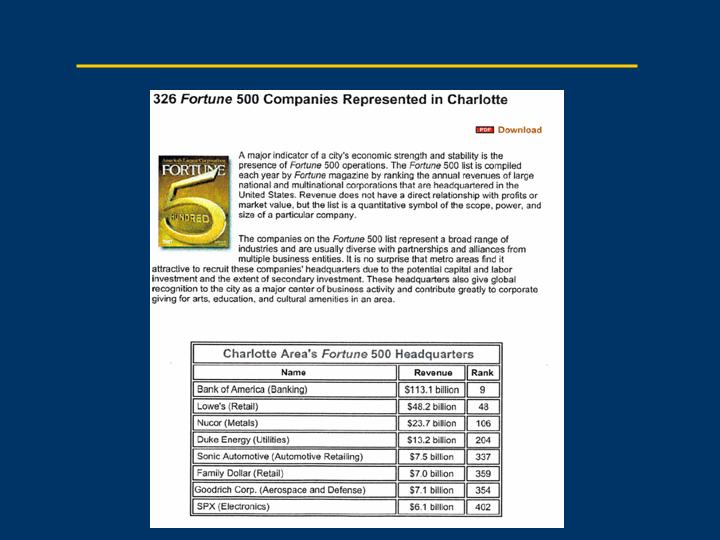

Fortune 500 Companies in Charlotte

7

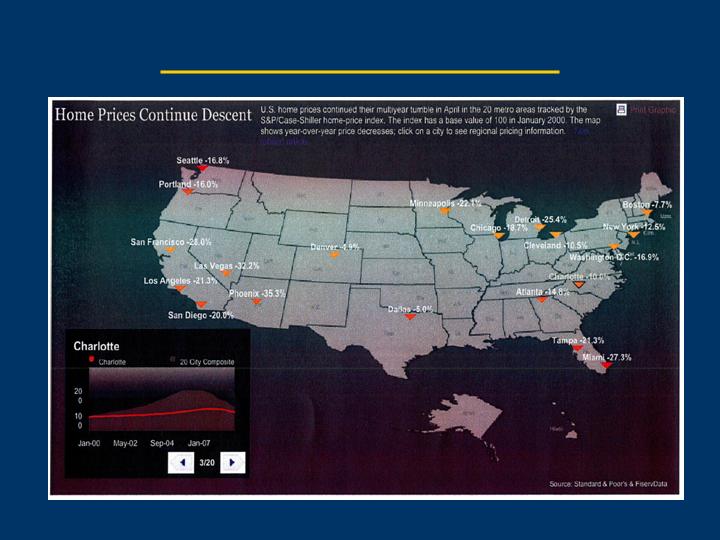

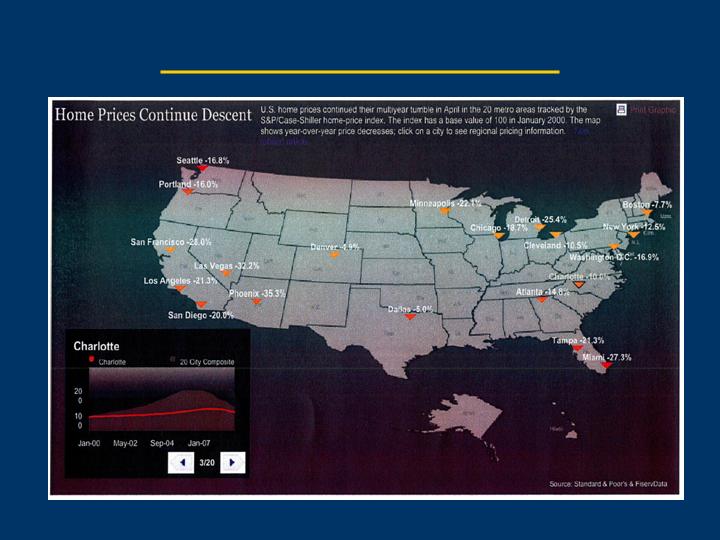

Housing Prices by Metro Area

8

Historical Housing Prices

9

Deposit Market Share

Counties Where Citizens South has a Branch Office

Gaston, Rowan, Iredell, & Union Counties

As of June 30, 2008

* = Recently merged

100.00%

$9,510,867

243

Total Deposits - All CSB Counties

25.06%

$2,383,354

86

All other institutions

2.51%

$239,120

6

Yadkin Valley B&T Co.

10

2.53%

$240,365

6

American Community (Yadkin) *

9

3.79%

$360,569

11

Community One Bank

8

3.81%

$362,501

8

Fifth Third Bank (First Charter) *

7

3.96%

$376,291

9

Farmers and Merchants Bank

6

5.64%

$536,151

16

SunTrust Bank

5

6.18%

$587,437

15

Citizens South Bank

4

9.74%

$926,374

23

Bank of America

3

15.75%

$1,497,913

29

Branch Banking and Trust Co.

2

21.04%

$2,000,792

34

Wachovia Bank (Wells Fargo) *

1

Market %

Deposits

Branches

Financial Institution

Rank

Source: FDIC

10

Deposit Market Share

Charlotte Metropolitan Area

As of June 30, 2008

Source: FDIC

100.00%

$108,994,464

432

Total Deposits - Charlotte MSA

2.07%

$2,256,992

79

All other institutions

0.16%

$173,483

4

Bank of Granite

15

0.16%

$179,029

5

Community One Bank

14

0.21%

$230,503

6

South Carolina B&T (Scottish) *

13

0.22%

$242,796

1

Park Sterling Bank

12

0.27%

$296,063

2

First Trust Bank

11

0.33%

$362,960

10

American Comm Bank (Yadkin) *

10

0.34%

$373,534

11

Citizens South Bank

9

0.36%

$389,800

4

New Dominion Bank

8

0.71%

$776,149

18

RBC Bank USA

7

0.80%

$875,475

31

First Citizens B&T Co.

6

1.09%

$1,188,163

35

SunTrust Bank

5

1.69%

$1,846,996

34

Fifth Third Bank (First Charter) *

4

3.15%

$3,438,361

55

Branch Banking and Trust

3

19.13%

$20,848,398

57

Bank of America

2

69.28%

$75,515,762

80

Wachovia Bank (Wells Fargo) *

1

Market %

Deposits

Branches

Financial Institution

Rank

* = Recently merged

11

Peer Group Data

12

Texas Ratio

On 06-30-09 CSBC had a Texas

ratio of 20.1% and traded at 72.8%

of tangible book

13

Balance Sheet Data

06-30-09

Total Assets $ 836,283

Gross Loans $ 629,963

Total Deposits $ 616,233

Common Equity $ 83,609

Preferred Stock 20,548

Total Capital $ 104,157

14

Stock Information

Stock Price (06-30-09) $ 5.15

Price to BV ($11.11) 46.4 %

Price to TBV ($7.07) 72.8 %

2008 EPS Actual $ 0.42

2009 EPS Consensus $ (0.06)

2010 EPS Consensus $ 0.26

Dividend Yield ($0.16) 3.1 %

NASDAQ Global Market – CSBC

15

Selected Financial Ratios

06-30-09

Net Interest Margin 2.87 %

NPA’s / Total Assets 1.49 %

Efficiency Ratio (1) 70.55 %

TCE / Tang. Assets 6.61 %

Total RB-Capital Ratio 14.31 %

(1) Efficiency Ratio excludes gains (losses) on sales of assets, impairment on

securities, and FDIC special assessment.

16

2009 Key Points

Well Capitalized

- 14.3 % Total Risk-based Capital

- 13.3 % Tier 1 Risk-based Capital

- 10.4 % Tangible Capital

Strong Credit Quality Ratios

- 1.97 % NPAs to Loans + OREO

- 1.49 % NPAs to Total Assets

- 1.64 % NPLs to Total Loans

- 1.38% ALLL to Total Loans

Note: Ratios are as of June 30, 2009

17

Positive Publicity to TARP Utilization

Creation of CPP Mortgage Program

- Low Interest Rate

- No Closing Costs

- CSB Builders / Developers

National Recognition

- The Washington Post

- NBC Nightly News with Brian Williams

Local Recognition

- The Gaston Gazette

- The Charlotte Observer

18

Citizens South Outlook for 2009

Rough Waters Throughout 2009

- High Unemployment

- Continued Real Estate Weakness

Capital is KING!

Asset Quality is Very Important

Smart Growth - Leaner is Better

Citizens South is Well Positioned

- FDIC Assisted Transactions

- Branch Acquisitions

19

Citizens South Long Term Objectives

Create the Dominant Community

Banking Franchise in the Charlotte

Region

Focus on Gathering Core Deposits

Asset Quality – Job One

Personal Attention to our Customers

Pricing and Growth Discipline

20

Expense Control Actions

Reduced Budgeted 2009 Operating

Expenses by $1.5 Million, or 7% of 2008

Total Noninterest Expenses

Froze All Executive Salaries

Eliminated Executive Cash Bonuses

Suspended the Bank’s 401-K Match

21

Expense Control Actions

Reduced Retainer of Holding Company

Directors by 25%

Reduced and Restructured the Capacity

of the Commercial Lending Team

Deferred Current Expansion Plans

Reduced Dividend to Preserve Capital

22

Loan Portfolio Mix

June 30, 2009

23

0.9 %

$ 1,002

$ 116,562

Consumer Loans

0.2 %

$ 94

$ 44,536

Commercial Business Loans

2.1 %

$ 4,473

$ 210,706

Other Commercial RE Loans

0.5 %

$ 432

$ 82,346

Residential Permanent Loans

1.6 %

$10,360

$ 629,962

Total Loans

2.2 %

$ 683

$ 31,770

Residential 1-4 Family Rental Property

-

-

$ 20,416

Multifamily Property Loans

0.9 %

$ 379

$ 43,231

Residential A & D Loans

4.6 %

$ 1,962

$ 42,934

Land and Lot Loans

-

-

$ 12,416

Commercial Construction Loans

5.3 %

$ 1,335

$ 25,045

Residential Construction Loans

% Portfolio

NPL’s

Balance (000's)

Loan Portfolio (June 30, 2009)

Nonperforming Loans

24

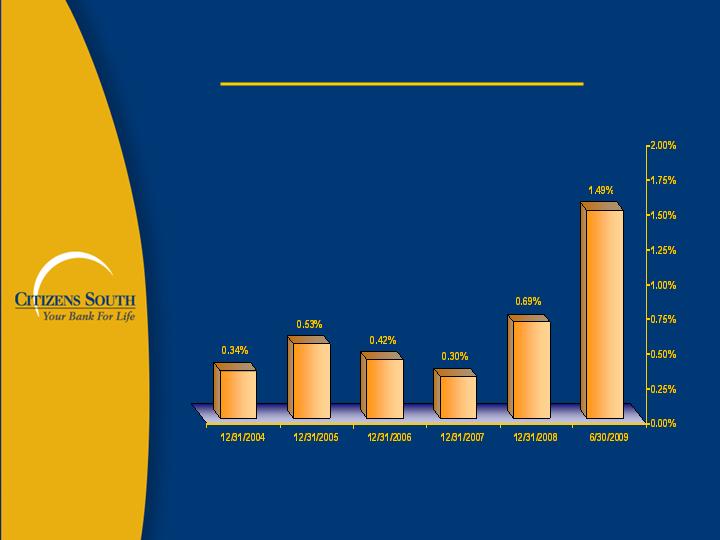

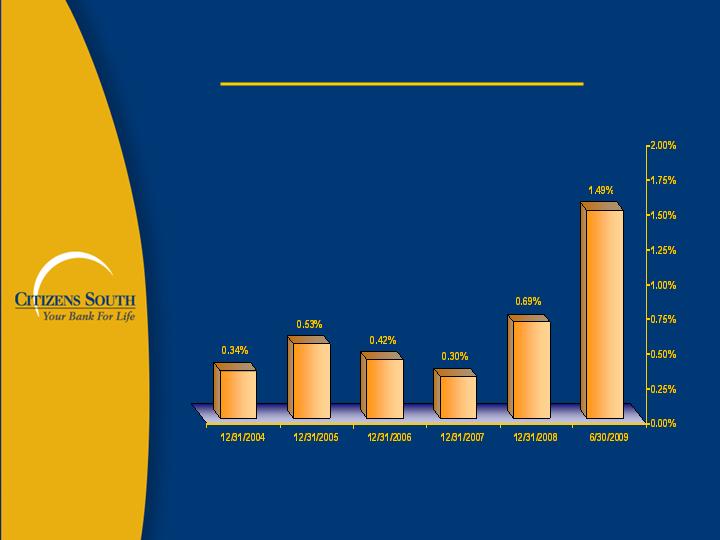

Nonperforming Assets

(as a percentage of total assets)

25

Deposit Mix

June 30, 2009

Note: Brokered CDs totaled $99,000

26

Total Core Non-Time Deposits

27

Net Interest Margin

28

Why Own CSBC Stock?

Capital Strength

Solid Asset Quality

Strong Core Deposit Franchise

Market Share Strength

Experienced Management Team

Opportunistic Position

Attractive Valuation

29

We appreciate your interest

in Citizens South Banking

Corporation.

Thank You

30