Citizens South Banking Corporation (also referred to as the “Company”, the “Registrant”, “We”, “Us”, or “Our”) is a Delaware corporation that owns all of the outstanding shares of common stock of Citizens South Bank (the “Bank”). The shares of common stock of the Company trade on the Nasdaq Global Market under the ticker symbol “CSBC.” The Company’s principal business activities are overseeing and directing the business of the Bank. The Company’s assets consist primarily of the outstanding capital stock of the Bank, deposits held at the Bank, and investment securities. The Company became the holding company for the Bank on September 30, 2002, in connection with the mutual-to-stock conversion of Citizens South Holdings, MHC, the mutual holding company of Citizens South Banking Corporation, a federal corporation, formerly named Gaston Federal Bancorp, Inc., which was originally formed on March 18, 1998, for the purpose of acting as the holding company for the Bank.

The Company’s executive office is located at 519 South New Hope Road, P.O. Box 2249, North Carolina 28053-2249. Its telephone number at this address is (704) 868-5200. The Company also maintains a website at www.citizenssouth.com that includes important information on our Company, including a list of our products and services, branch locations, current financial information, and links to the Company’s Securities Exchange Act filings with the SEC.

Citizens South Bank, which was chartered in 1904, is a federally chartered savings bank headquartered in Gastonia, North Carolina. The Bank’s principal business activity is offering FDIC-insured deposits to local customers through its 14 branch offices and investing those deposits, together with funds generated from operations and borrowings, in residential and nonresidential real estate loans, construction loans, commercial business loans, consumer loans, investment securities, and mortgage-backed securities. The Bank also acts as a broker in both the origination of loans secured by one-to-four family dwellings and in the sale of uninsured financial products. The Bank’s results of operations are heavily dependent on net interest income, which is the difference between the interest earned on loans and securities and the interest paid on deposits and borrowings. Results of operations are also materially affected by the Bank’s provision for loan losses, gains or losses from the sales of assets, fee income generated from deposit and loan accounts, commissions earned from the sale of uninsured investment products, and noninterest expense. The Bank’s noninterest expense primarily consists of compensation and employee benefits, occupancy expense, professional services, advertising, and other noninterest expenses. Results of operations are also significantly affected by general economic and competitive conditions, changes in interest rates, and actions of regulatory and governmental authorities.

Citizens South Bank has 14 full-service branch offices in the North Carolina Counties of Gaston, Union, Rowan, and Iredell and two loan production offices located in Mecklenburg County, North Carolina, and York County, South Carolina. The Bank’s executive office is located at 519 South New Hope Road, P.O. Box 2249, Gastonia, North Carolina 28053-2249. Its telephone number at this address is (704) 868-5200.

Under the terms of the merger agreement, the Company issued a combination of shares of common stock and cash for the outstanding shares of common stock of Trinity Bank. Trinity shareholders were given the option of receiving 1.3931 shares of Citizens South common stock for each share of Trinity common stock, $18.25 in cash for each share of Trinity common stock, or a mixture of stock and cash for each Trinity share, such that 50% of the shares of Trinity common stock would be exchanged for Citizens South common stock. On October 31, 2005, Trinity shareholders received merger consideration of approximately 1,280,052 shares of common stock of the Company (subject to payment of cash in lieu of fractional shares) and approximately $16.8 million in cash (including cash paid in lieu of fractional shares), resulting in a total transaction value of approximately $37.8 million. The transaction price represented approximately 255% of Trinity’s book value as of September 30, 2005. Additional information regarding this transaction may be obtained by reviewing the Registration Statement that the Company filed with the Securities and Exchange Commission on August 1, 2005, and amended September 14, 2005.

In order to provide financing for the cash portion of the Trinity acquisition, on October 28, 2005, the Company completed a private placement of an aggregate amount of $15.0 million in trust preferred securities, liquidation amount of $1,000 per security (the “Preferred Securities”), through a newly formed Delaware statutory trust subsidiary, CSBC Statutory Trust I (the “Trust”). In connection with the issuance of the Preferred Securities, on October 28, 2005, the Company entered into an Indenture by and between the Company and Wilmington Trust Company, as trustee. The Preferred Securities mature on December 15, 2035, but may be redeemed beginning December 15, 2010, if the Company exercises its rights to redeem the Debentures. The Preferred Securities require quarterly interest payments to the holders of the Preferred Securities, initially at a fixed rate of 6.095% through December 2010, and thereafter at a variable rate of three-month LIBOR plus 1.57%, reset quarterly. Additional information regarding the Preferred Securities may be obtained by reviewing the Current Report on Form 8-K filed with the Securities and Exchange Commission on November 4, 2005.

Market Area and Competition

We consider our primary market area to be the North Carolina Counties of Gaston, Rowan, Iredell, Union, Mecklenburg, Cabarrus, Lincoln, and Cleveland, and the South Carolina County of York. Our market area predominately centers in the suburbs surrounding the metropolitan area of Charlotte, North Carolina. The metropolitan area of Charlotte has a diverse economic base that includes business sectors in banking and finance, insurance, manufacturing, textiles, apparel, fabricated metals, construction, health care, transportation, retail trade, telecommunications, government services, and education. The Bank’s corporate headquarters is located in Gastonia, North Carolina, which is located in the I-85 corridor, approximately 20 miles west of Charlotte.

The Bank’s corporate headquarters and seven of its branch offices are located in Gaston County, North Carolina. These offices are located in the cities of Gastonia (three offices), Dallas, Mount Holly, Belmont, and Stanley. According to data provided by the FDIC as of June 30, 2006, there were 14 banks and thrifts operating in Gaston County with $2.1 billion in deposits. As of June 30, 2006, the Bank had $213.1 million in deposits in Gaston County, or 10.1% of the total County deposits. This represents the third highest market share in Gaston County.

We also have three branch offices in Union County, North Carolina, in the cities of Monroe, Stallings, and Weddington. According to data provided by the FDIC as of June 30, 2006, there were 14 banks and thrifts operating in Union County with $1.5 billion in deposits. As of June 30, 2006, the Bank had $123.5 million in deposits in Union County, or 8.4% of the total County deposits. This represents the seventh highest market share in the County.

The Bank also has two branch offices in Rowan County, North Carolina, in the cities of Salisbury and Rockwell. According to data provided by the FDIC as of June 30, 2006, there were 13 banks and thrifts operating in Rowan County with $1.4 billion in deposits. As of June 30, 2006, the Bank had $116.1 million in deposits in Rowan County, or 8.3% of the total County deposits. This represents the fourth highest market share in the County.

We also have two branch offices in Iredell County, North Carolina, in the cities of Statesville and Mooresville. According to data provided by the FDIC as of June 30, 2006, there were 17 banks and thrifts operating in Iredell County with $1.9 billion in deposits. As of June 30, 2006, the Bank had $86.7 million in deposits in Iredell County, or 4.5% of the total County deposits. This represents the eighth highest market share in the County.

2

Employees

As of December 31, 2006, the Company had 133 full-time and 18 part-time employees, none of whom is represented by a collective bargaining unit. The Company provides employee benefit programs, including an Employee Stock Ownership Plan, matching contributions to a 401(k) retirement/savings plan, group life, disability, heath, and dental insurance, and paid vacation and sick leave. Management believes its relationship with its employees is good.

Supervision and Regulation

Citizens South Banking Corporation is a unitary savings and loan holding company, subject to regulation and supervision by the Office of Thrift Supervision (“OTS”). The OTS has enforcement authority over Citizens South Banking Corporation and its subsidiaries. This authority permits the OTS to restrict or prohibit activities that are determined to be a risk to Citizens South Bank. Federal law prohibits a savings and loan holding company from acquiring control of another savings institution or holding company thereof, without prior written approval of the OTS. It also prohibits the acquisition or retention of, with specified exceptions, more than 5% of the equity securities of a company engaged in activities that are not closely related to banking or financial in nature or acquiring or retaining control of an institution that is not federally insured. In evaluating applications by holding companies to acquire savings institutions, the OTS must consider the financial and managerial resources, future prospects of the savings institution involved, the effect of the acquisition on the risk to the insurance fund, the convenience and needs of the community and competitive factors.

Citizens South Bank is a federal savings bank and derives its lending and investment powers from the Home Owners’ Loan Act, as amended, and the regulations of the OTS. Under these laws and regulations, Citizens South Bank may invest in mortgage loans secured by residential and commercial real estate, commercial business and consumer loans, certain types of debt securities and certain other assets. Citizens South Bank also may establish subsidiaries that may engage in activities not otherwise permissible for Citizens South Bank, including real estate investment and securities and insurance brokerage. Citizens South Bank is a federally chartered stock savings bank, subject to examination, supervision, and regulation by the OTS, as its primary federal regulator, and the Federal Deposit Insurance Corporation (“FDIC”), as the deposit insurer. Citizens South Bank is also a member of and owns stock in the Federal Home Loan Bank of Atlanta, which is a part of the Federal Home Loan Bank System. The Bank must file reports with the OTS and the FDIC concerning its activities and financial condition in addition to obtaining regulatory approvals prior to entering into certain transactions such as mergers or acquisitions. This regulation and supervision establishes a comprehensive framework of activities in which an institution may engage and is intended primarily for the protection of the insurance fund and depositors. Under this system of federal regulation, financial institutions are periodically examined to ensure that they satisfy applicable standards with respect to their capital adequacy, assets, management, earnings, liquidity and sensitivity to market interest rates. Citizens South Bank is also regulated to a lesser extent by the Board of Governors of the Federal Reserve System, governing reserves to be maintained against deposits and other matters. Citizens South Bank’s relationship with its depositors and borrowers also is regulated to a great extent by both federal and state laws, especially in matters concerning the ownership of deposit accounts and the form and content of Citizens South Bank’s loan documents.

The following discussion summarizes certain material elements of the regulatory framework applicable to Citizens South Banking Corporation and its subsidiaries. These summaries of statutes and regulations are not intended to be complete and such summaries are qualified in their entirety by reference to such statutes and regulations. A change in the statutes, regulations, or regulatory policies applicable to the Company, or its subsidiaries, could have a material effect on the business of the Company.

Standards for Safety and Soundness. Federal law requires each federal banking agency to prescribe certain standards for all insured depository institutions. These standards relate to, among other things, internal controls, information systems and audit systems, loan documentation, credit underwriting, interest rate risk exposure, asset growth, compensation, and other operational and managerial standards as the agency deems appropriate. If the appropriate federal banking agency determines that an institution fails to meet any standard prescribed by the guidelines, the agency may require the institution to submit to the agency an acceptable plan to achieve compliance with the standard. If an institution fails to meet these standards, the appropriate federal banking agency may require the institution to submit a compliance plan. The OTS has primary enforcement responsibility over federal savings institutions and has the authority to bring enforcement action against all “institution-affiliated parties,” including certain stockholders, and attorneys, appraisers and accountants who knowingly or recklessly participate in wrongful action likely to have an adverse effect on an insured institution. Formal enforcement action may range from the issuance of a capital directive, a cease and desist order, removal of officers and/or directors of the institution, receivership, conservatorship, civil penalties, or the termination of deposit insurance. The FDIC also has the authority to recommend to the Director of the OTS that enforcement action be taken with respect to a particular savings institution. If action is not taken by the Director, the FDIC has authority to take action under specified circumstances.

3

OTS regulations require savings banks to meet three minimum capital standards: a 1.5% tangible capital ratio, a 4% leverage ratio and an 8% risk-based capital ratio. At December 31, 2006, Citizens South Bank’s capital exceeded all applicable requirements. Under prompt corrective action regulations, the OTS is required and authorized to take supervisory actions against undercapitalized savings banks. For this purpose, a savings bank is placed in one of the following five categories based on the bank’s capital: 1) well-capitalized (at least 5% leverage capital, 6% tier 1 risk-based capital and 10% total risk-based capital); 2) adequately capitalized (at least 4% leverage capital, 4% tier 1 risk-based capital and 8% total risk-based capital); 3) undercapitalized (less than 8% total risk-based capital, 4% tier 1 risk-based capital or 3% leverage capital); 4) significantly undercapitalized (less than 6% total risk-based capital, 3% tier 1 risk-based capital or 3% leverage capital); and 5) critically undercapitalized (less than 2% tangible capital). At December 31, 2006, Citizens South Bank met the criteria for being considered “well-capitalized.”

OTS regulations govern capital distributions by a federal savings bank, which include cash dividends, stock repurchases and other transactions charged to the capital account. A savings bank must file an application for approval of a capital distribution if: (1) the total capital distributions for the applicable calendar year exceed the sum of the savings bank’s net income for that year to date plus the savings bank’s retained net income for the preceding two years; (2) the bank would not be at least adequately capitalized following the distribution; (3) the distribution would violate any applicable statute, regulation, agreement or OTS-imposed condition; or (4) the savings bank is not eligible for expedited treatment of its filings. Even if an application is not otherwise required, every savings bank that is a subsidiary of a holding company must file a notice with the OTS at least 30 days before the board of directors declares a dividend or approves a capital distribution. The OTS may disapprove a notice or application if: (1) the savings bank would be undercapitalized following the distribution; (2) the proposed capital distribution raises safety and soundness concerns; or (3) the capital distribution would violate a prohibition contained in any statute, regulation or agreement.

Community Reinvestment Act and Fair Lending Laws. All savings banks have a responsibility under the Community Reinvestment Act and related regulations of the OTS to help meet the credit needs of their communities, including low- and moderate-income neighborhoods. In connection with its examination of a federal savings bank, the OTS is required to assess the savings bank’s record of compliance with the Community Reinvestment Act. In addition, the Equal Credit Opportunity Act and the Fair Housing Act prohibit lenders from discriminating in their lending practices on the basis of characteristics specified in those statutes. A bank’s failure to comply with the provisions of the Community Reinvestment Act could, at a minimum, result in regulatory restrictions on its activities. The failure to comply with the Equal Credit Opportunity Act and the Fair Housing Act could result in enforcement actions by the OTS, as well as other federal regulatory agencies and the Department of Justice. Citizens South Bank received a “Satisfactory” Community Reinvestment Act rating in its most recent federal examination.

Transactions with Affiliates. A federal savings bank’s authority to engage in transactions with its “affiliates” is limited by OTS regulations and by Sections 23A and 23B of the Federal Reserve Act (the “FRA”) and its implementing regulations. The term “affiliates” for these purposes generally means any company that controls or is under common control with an institution. Citizens South Banking Corporation and its subsidiaries are affiliates of Citizens South Bank. In general, transactions with affiliates must be on terms that are as favorable to the savings bank as comparable transactions with non-affiliates. In addition, certain types of these transactions are restricted to an aggregate percentage of the savings bank’s capital. Collateral in specified amounts must usually be provided by affiliates in order to receive loans from the savings bank. In addition, OTS regulations prohibit a savings bank from lending to any of its affiliates that are engaged in activities that are not permissible for bank holding companies and from purchasing the securities of any affiliate, other than a subsidiary.

Citizens South Bank’s authority to extend credit to its directors, executive officers and 10% shareholders, as well as to entities controlled by such persons, is currently governed by the requirements of Sections 22(g) and 22(h) of the FRA and Regulation O of the Federal Reserve Board. Among other things, these provisions require that extensions of credit to insiders (i) be made on terms that are substantially the same as, and follow credit underwriting procedures that are not less stringent than, those prevailing for comparable transactions with unaffiliated persons and that do not involve more than the normal risk of repayment or present other unfavorable features, and (ii) not exceed certain limitations on the amount of credit extended to such persons, individually and in the aggregate, which limits are based, in part, on the amount of Citizens South Bank’s capital. In addition, extensions of credit in excess of certain limits must be approved by Citizens South Bank’s Board of Directors.

4

Qualified Thrift Lender Test. As a federal savings bank, Citizens South Bank is subject to a qualified thrift lender, or “QTL,” test. Under the QTL test, Citizens South Bank must maintain at least 65% of its portfolio assets in qualified thrift investments in at least nine months of the most recent 12-month period. Portfolio assets generally means total assets of a savings institution, less the sum of specified liquid assets up to 20% of total assets, goodwill and other intangible assets, and the value of property used in the conduct of the savings bank’s business. Qualified thrift investments includes various types of loans made for residential and housing purposes, investments related to such purposes, including certain mortgage-backed and related securities, and loans for personal, family, household and certain other purposes up to a limit of 20% of portfolio assets. Qualified thrift investments also include 100% of an institution’s credit card loans, education loans and small business loans. Citizens South Bank also may satisfy the QTL test by qualifying as a “domestic building and loan association” as defined in the Internal Revenue Code of 1986. A savings bank that fails the qualified thrift lender test must either convert to a bank charter or operate under specified restrictions. At December 31, 2006, Citizens South Bank maintained approximately 77% of its portfolio assets in qualified thrift investments and satisfied the QTL test as of that date.

Insurance of Deposit Accounts. Citizens South Bank’s deposits are subject to assessments by the Federal Deposit Insurance Corporation (“FDIC”). These deposit accounts are insured by the Deposit Insurance Fund of the FDIC, generally up to a maximum of $100,000 per separately insured depositor and up to a maximum of $250,000 for self-directed retirement accounts. Effective March 31, 2006, the FDIC merged the Bank Insurance Fund (“BIF”) and the Savings Association Insurance Fund (“SAIF”) into a single insurance fund called the Deposit Insurance Fund. As a result of the merger, the BIF and SAIF were abolished. The merger of the BIF and SAIF into the Deposit Insurance Fund does not affect the authority of the Financing Corporation (“FICO”) to impose and collect, with approval of the FDIC, assessments and anticipated payments, insurance costs and custodial fees on bonds issued by the FICO in the 1980’s to recapitalize the Federal Savings and Loan Insurance Corporation. The bonds issued by the FICO are due to mature in 2017 through 2019. For the quarter ended December 31, 2006, the FICO assessment was equal to 1.24 basis points for each $100 in domestic deposits maintained at an institution.

On November 2, 2006, the FDIC adopted final regulations establishing a risk-based assessment system that will enable the FDIC to more closely tie each financial institution’s premiums with the risk it poses to the Deposit Insurance Fund. Under the new risk-based assessment system, which becomes effective in the beginning of 2007, the FDIC will evaluate the risk of each financial institution based on three primary sources of information: 1) its supervisory rating, 2) its financial rations, and 3) its long-term debt issuer rating, if the institution has one. The new rates for nearly all of the financial institution industry will vary between five and seven cents for every $100 of domestic deposits. At the same time, the FDIC also adopted final regulations designating the reserve ratio for the Deposit Insurance Fund during 2007 at 1.25% of estimated insured deposits.

Federal Home Loan Bank System. Citizens South Bank is a member of the Federal Home Loan Bank System (“FHLB”), which provides a central credit facility primarily for member institutions. As a member of the FHLB of Atlanta, Citizens South Bank is required to acquire and hold shares of capital stock in the FHLB in an amount at least equal to 1% of the aggregate principal amount of its unpaid residential mortgage loans and similar obligations at the beginning of each year, or 1/20 of its borrowings from the FHLB, whichever is greater. As of December 31, 2006, Citizens South Bank was in compliance with this requirement.

Federal Reserve System. The Federal Reserve Board regulations require savings banks to maintain non-interest-earning reserves against their transaction accounts, such as negotiable order of withdrawal and regular checking accounts. At December 31, 2006, Citizens South Bank was in compliance with these reserve requirements. The balances maintained to meet the reserve requirements imposed by the Federal Reserve Board may be used to satisfy liquidity requirements imposed by the Office of Thrift Supervision.

The USA PATRIOT Act. The USA PATRIOT Act of 2001 gives the federal government new powers to address terrorist threats through enhanced domestic security measures, expanded surveillance powers, increased information sharing and broadened anti-money laundering requirements. The USA PATRIOT Act also requires the federal banking agencies to take into consideration the effectiveness of controls designed to combat money laundering activities in determining whether to approve a merger or other acquisition application of a member institution. Accordingly, if we engage in a merger or other acquisition, our controls designed to combat money laundering would be considered as part of the application process. We have established policies, procedures and systems designed to comply with these regulations.

5

Sarbanes-Oxley Act of 2002. The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with certain accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the Securities and Exchange Commission, under the Securities Exchange Act of 1934.

The Sarbanes-Oxley Act includes specific additional disclosure requirements and requires the Securities and Exchange Commission and national securities exchanges to adopt extensive additional disclosure, corporate governance and other related rules. The Sarbanes-Oxley Act represents significant federal involvement in matters traditionally left to state regulatory systems, such as the regulation of the accounting profession, and to state corporate law, such as the relationship between a board of directors and management and between a board of directors and its committees.

Federal Securities Laws. Citizens South Banking Corporation common stock is registered with the Securities and Exchange Commission under the Securities Exchange Act of 1934. Citizens South Banking Corporation is subject to the information, proxy solicitation, insider trading restrictions and other requirements under the Securities Exchange Act of 1934. Shares of common stock purchased by persons who are not affiliates of Citizens South Banking Corporation may be resold without registration. Shares purchased by an affiliate of Citizens South Banking Corporation will be subject to the resale restrictions of Rule 144 under the Securities Act of 1933. If Citizens South Banking Corporation meets the current public information requirements of Rule 144 under the Securities Act of 1933, each affiliate of Citizens South Banking Corporation that complies with the other conditions of Rule 144, including those that require the affiliate’s sale to be aggregated with those of other persons, would be able to sell in the public market, without registration, a number of shares not to exceed, in any three-month period, the greater of 1% of the outstanding shares of Citizens South Banking Corporation, or the average weekly volume of trading in the shares during the preceding four calendar weeks. In the future, Citizens South Banking Corporation may permit affiliates to have their shares registered for sale under the Securities Act of 1933.

Taxation

Federal. The Company and the Bank are subject to the provisions of the Internal Revenue Code of 1986, as amended (the “Code”) in the same general manner as other corporations. For federal income tax purposes, the Bank reports its income and expenses on the accrual method of accounting and uses a tax year ending December 31 for filing its federal income tax returns.

The Small Business Protection Act of 1996 (the “1996 Act”) eliminated the use of the reserve method of accounting for bad debt reserves by savings institutions, effective for taxable years beginning after 1995. Prior to the 1996 Act, the Bank was permitted to establish a reserve for bad debts and to make annual additions to the reserve.

State of North Carolina. Under North Carolina law, the corporate income tax is 6.9% of federal taxable income as computed under the Code, subject to certain prescribed adjustments. In addition, an annual state franchise tax is imposed at a rate of 0.15% applied to the greatest of the company’s capital stock, surplus and undivided profits, investment in tangible property in North Carolina or 55% of the appraised valuation of property in North Carolina.

State of Delaware. Delaware franchise taxes are imposed on the Company. Two methods are provided for calculating the tax and the lesser tax is payable. The first method is based on the authorized number of shares. The tax under this method is $90.00 for the first 10,000 authorized number of shares plus $50.00 for each additional 10,000 shares or part thereof. The second method is based on an assumed par value capital. The tax rate under this method is $200 per $1,000,000 or portion thereof of assumed par value capital. Assumed par is computed by dividing total assets by total issued shares (including treasury shares). Assumed par value capital is calculated by multiplying the lesser of assumed par or stated par value by total authorized shares.

6

You should consider carefully the following risk factors in evaluating an investment in the shares of Citizens South Banking Corporation common stock.

Changes in market interest rates could adversely affect the Company’s financial condition and results of operations.

Citizens South Banking Corporation’s results of operations and financial condition are affected by changes in interest rates. The Company’s results of operations depend substantially on net interest income, which is the difference between the interest income earned on interest-earning assets and the interest expense paid on interest-bearing liabilities. Because interest-earning assets generally reprice or mature more quickly than interest-bearing liabilities, a decrease in interest rates generally would result in a decrease in the Company’s net interest income. Based on results generated by its interest rate risk model, an immediate and sustained decrease of 300 basis points throughout the yield curve would decrease its annual net interest income by 4.8% for the period ended December 31, 2007. The assumptions used in the model do not provide for actions that may be taken by management during the period to offset the effects of changes in interest rates on net interest income. We are also subject to reinvestment risk associated with changes in interest rates. Changes in interest rates may affect the average life of loans and mortgage-related securities. Decreases in interest rates can result in increased prepayments of loans and mortgage-related securities, as borrowers refinance to reduce borrowing costs. Under these circumstances, the Company is subject to reinvestment risk to the extent that it is unable to reinvest the cash received from such prepayments at rates that are comparable to the rates on existing loans and securities. Additionally, increases in interest rates may decrease loan demand and make it more difficult for borrowers to repay adjustable rate loans.

Changes in interest rates also affect the value of Citizens South Banking Corporation’s interest-earning assets, and in particular its securities portfolio. Generally, the value of securities fluctuates inversely with changes in interest rates. At December 31, 2006, The Company’s investment and mortgage-backed securities available for sale totaled $126.0 million. Unrealized losses on securities available for sale, net of tax, amounted to $991,000 and are reported as a separate component of stockholders’ equity. Decreases in the fair value of securities available for sale, therefore, could have an adverse effect on stockholders’ equity.

A prolonged period with a flat or inverted yield curve could reduce future earnings.

Since June 30, 2004, the Federal Reserve Board has increased its target for the federal funds rate from 1.0% to 5.25%. While these short-term interest rates have increased, longer-term market interest rates have not increased to the same degree. This “flattening” of the yield curve has had a negative impact on our interest rate spread and net interest margin, as our cost of deposits and borrowings has increased at a faster rate than our yield on loans and investments. A prolonged period of time with a “flat” or “inverted” (short-term interest rates are higher than long-term interest rates) could result in continued margin compression, which would have a negative effect on our profitability.

A slowdown in our local economy could impair the ability of our customers to repay their loans.

We have added a significant number of loans over the past five years from new relationships as we have entered new markets through acquisitions and de novo offices. As a result, our loan portfolio may not be as seasoned as the loan portfolios of our competitors in some of these new markets. Should local real estate markets or economies weaken, we may begin to experience higher default rates resulting in increased levels of non-performing loans, which would likely result in higher loan losses and reduced earnings.

The Company’s commercial real estate loan portfolio exposes the Company to increased lending risks.

At December 31, 2006, Citizens South Banking Corporation’s portfolio of commercial real estate, multifamily, and construction loans totaled $329.5 million, or 63.96% of total gross loans. These types of loans generally expose a lender to greater risk of non-payment and loss than one- to four-family residential mortgage loans because repayment of the loans often depends on the successful operations and the income stream of the borrowers. Such loans typically involve larger loan balances to single borrowers or groups of related borrowers compared to one- to four-family residential mortgage loans. Also, many of the Company’s borrowers have more than one commercial loan outstanding. Consequently, an adverse development with respect to one loan or one credit relationship can expose the Company to a significantly greater risk of loss compared to an adverse development with respect to a one- to four-family residential mortgage loan.

7

Strong competition within our market areas may limit our growth and profitability.

We face numerous competitors in both our community banking and mortgage banking operations in our primary market area which is the Charlotte, North Carolina metropolitan area. We compete for loan and deposit growth with large banks that have either a regional or a national presence, other community banks, de novo financial institutions, thrifts or savings institutions, credit unions, brokerage and insurance firms, and other nonbank businesses, such as retailers that engage in consumer financing activities. Price competition for loans and deposits might result in earning less on our loans and paying more on our deposits, which would reduce our net interest income. Competition also makes it more challenging to grow loans and deposits and to hire and retain experienced employees. Some of the institutions with which we compete have substantially greater resources and lending limits than we do and may offer services that we do not provide. We expect competition to continue to increase in the future as a result of legislative, regulatory, and technological changes and the continuing trend of consolidation in the financial services industry.

The mortgage banking business is also highly competitive, with both large and small bank and nonbank mortgage originators competing in our mortgage banking markets. We conduct our mortgage banking operations in the Charlotte, North Carolina metropolitan area.

If the Company’s allowance for loan losses is not sufficient to cover actual loan losses, then our earnings could decrease.

We make various assumptions and judgments about the collectibility of our loan portfolio, including the creditworthiness of our borrowers and the value of the real estate and other assets serving as collateral for the repayment of many of our loans. In determining the amount of allowance for loan losses, we review our loan loss and delinquency experience, we evaluate current local economic conditions, and we analyze the collateral position of our loan portfolio. If our assumptions are incorrect, our allowance for loan losses may not be sufficient to cover losses inherent in our loan portfolio, resulting in increases to our allowance. Material additions to our allowance would materially decrease our net income.

In addition, federal regulators periodically review our allowance for loan losses and may require us to increase our provision for loan losses or recognize additional loan charge-offs. Any increase in our allowance for loan losses or loan charge-offs as required by these regulatory authorities could have a material adverse effect on our financial condition and results of operations.

The Company operates in a highly regulated environment and may be adversely affected by changes in laws and regulations.

Citizens South Banking Corporation and its subsidiaries are highly regulated. Our holding company is regulated by the Office of Thrift Supervision and the Securities and Exchange Commission. Our community banking subsidiary is also regulated by the Office of Thrift Supervision. Such regulation and supervision govern the activities in which we may engage and are intended primarily for the protection of the deposit insurance fund and depositors. Regulatory authorities have extensive discretion in connection with their supervisory and enforcement activities, including the imposition of restrictions on the operation of an institution, the classification of assets by the institution and the adequacy of an institution’s allowance for loan losses. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations or legislation, may have a material impact on the Company’s operations. In addition to the risks of noncompliance, we are required to dedicate considerable time and monetary resources in our efforts to comply with the numerous laws and regulations that govern the ways in which we conduct our community banking and mortgage banking activities.

8

Various factors may make takeover attempts more difficult to achieve.

Citizens South Banking Corporation’s board of directors has no current intention to sell control of the Company. Provisions of the Company’s certificate of incorporation and bylaws, federal regulations, Delaware law and various other factors may make it more difficult for companies or persons to acquire control of Citizens South Banking Corporation without the consent of its board of directors. As a Citizens South Banking Corporation stockholder, you may want a takeover attempt to succeed because, for example, a potential acquirer could offer a premium over the then-prevailing price of Citizens South Banking Corporation’s common stock. The factors that may discourage takeover attempts or make them more difficult include:

Certificate of incorporation and statutory provisions. Provisions of the certificate of incorporation and bylaws of Citizens South Banking Corporation and Delaware law may make it more difficult and expensive to pursue a takeover attempt that management opposes. These provisions also would make it more difficult to remove Citizens South Banking Corporation’s current board of directors or management, or to elect new directors. These provisions include limitations on voting rights of beneficial owners of more than 10% of its common stock, supermajority voting requirements for certain business combinations and the election of directors to staggered terms of three years. Citizens South Banking Corporation’s bylaws also contain provisions regarding the timing and content of stockholder proposals and nominations and qualification for service on the board of directors.

Required change in control payments and issuance of stock options and recognition plan shares. Citizens South Banking Corporation has entered into employment agreements and change of control agreements with certain executive officers, which will require payments to be made to them in the event their employment is terminated following a change in control of Citizens South Banking Corporation or Citizens South Bank. Citizens South Banking Corporation also has adopted plans to permit additional issuances of stock options and recognition plan shares to key employees and directors that will require payments to them in connection with a change in control of Citizens South Banking Corporation. These payments will have the effect of increasing the costs of acquiring Citizens South Banking Corporation, thereby discouraging future takeover attempts.

Citizens South Banking Corporation’s stock-based benefit plans may dilute your ownership interest.

Citizens South Banking Corporation has adopted stock option plans and recognition and retention plans. These stock-based benefit plans can be funded from the issuance of authorized but unissued shares of common stock or through open market purchases by the Company. The Company currently is purchasing shares of its common stock in a Board-authorized share repurchase program. Stockholders will experience a reduction or dilution in ownership interest in the event newly issued shares, instead of repurchased shares, are used to fund stock option exercises and stock awards.

ITEM 1.B. | Unresolved Staff Comments |

None.

9

The following table sets forth certain information regarding offices currently in operation at December 31, 2006. Management considers the facilities to be well maintained and sufficiently suitable for present operations. The net book value of the properties, including land, building, and leasehold improvements, net of accumulated depreciation was $16.3 million at December 31, 2006.

Location | | Principal Use | | Approximate

Facility Size | | Owned

or Leased |

| |

| |

| |

|

| | | | (square feet) | | |

519 South New Hope Road | | Headquarters and | | 22,400 | | Owned |

Gastonia, North Carolina 28054-4040 | | Banking Office | | | | |

245 West Main Avenue | | Banking Office and | | 12,400 | | Owned |

Gastonia, North Carolina 28052-4140 | | Back Office Processing | | | | |

192 East Woodrow Avenue | | Banking Office | | 3,400 | | Owned |

Belmont, North Carolina 28012-3163 | | | | | | |

233 South Main Street | | Banking Office | | 2,370 | | Owned |

Mount Holly, North Carolina 28120-1620 | | | | | | |

1670 Neal Hawkins Road | | Banking Office and | | 5,320 | | Owned |

Gastonia, North Carolina 28056-6429 | | Mortgage Center | | | | |

3135 Dallas High Shoals Highway | | Banking Office | | 3,225 | | Owned |

Dallas, North Carolina 28034-1307 | | | | | | |

412 South Highway 27 | | Banking Office | | 3,225 | | Owned |

Stanley, North Carolina 28164-2055 | | | | | | |

401 West Innes Street | | Banking Office | | 5,560 | | Owned |

Salisbury, North Carolina 28144-4232 | | | | | | |

106 West Main Street | | Banking Office | | 1,500 | | Owned |

Rockwell, North Carolina 28138-8859 | | | | | | |

307 North Center Street | | Banking Office and | | 8,260 | | Owned |

Statesville, North Carolina 28677-4063 | | Leased Space | | | | |

19410 Jetton Road, Suite 110 | | Loan Production Office | | 1,490 | | Leased |

Cornelius, North Carolina 28031-4403 | | | | | | |

1348 Ebenezer Road, Suite 101 | | Loan Production Office | | 1,590 | | Leased |

Rock Hill, South Carolina 29732-2727 | | | | | | |

310 West Franklin Street | | Banking Office | | 4,692 | | Leased |

Monroe, North Carolina 28112-4704 | | | | | | |

13731 Providence Road | | Banking Office | | 2,520 | | Owned |

Weddington, North Carolina 28104-8615 | | | | | | |

101 Stallings Road | | Banking Office | | 3,560 | | Leased |

Stallings, North Carolina 28104-5065 | | | | | | |

649 Brawley School Road | | Banking Office | | 3,800 | | Owned |

Mooresville, North Carolina 28177-9121 | | | | | | |

10

Periodically, there have been various claims and lawsuits involving the Company or the Bank, such as claims to enforce liens, condemnation proceedings on properties in which we hold security interests, claims involving the making and servicing of real property loans and other issues incident to our business. We are not a party to any pending legal proceedings that we believe would have a material adverse effect on the financial condition, operations, or cash flows of the Company or the Bank.

ITEM 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of the security holders during the fourth quarter of 2006.

PART II

ITEM 5. | Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities |

a. The Company’s common stock, $0.01 par value per share, trades on the Nasdaq Global Market under the ticker symbol CSBC. Price and volume information is contained in The Wall Street Journal and other daily newspapers in the Nasdaq section under the Global Market System listings. As of February 1, 2007, the Company had 1,626 stockholders of record (excluding the number of persons or entities holding stock in street name through various brokerage firms), and 8,023,447 shares outstanding. The following brokers made a market in the Company’s stock during 2006:

| Citigroup Global Markets, Inc. | 1-800-223-7743 |

| Fig Partners, LLC | 1-404-601-7200 |

| Friedman, Billings, Ramsey & Co. | 1-800-688-3272 |

| FTN Midwest Securities Corp. | 1-800-880-7264 |

| Howe Barnes Investments, Inc. | 1-800-621-2364 |

| Keefe, Bruyette & Woods, Inc. | 1-800-342-5529 |

| Knight Equity Markets, L.P. | 1-800-222-4910 |

| Merrill Lynch, Pierce, Fenner | 1-800-937-0501 |

| Morgan Keegan & Co., Inc. | 1-800-238-7533 |

| Morgan Stanley & Co., Inc. | 1-800-223-6559 |

| Ryan Beck & Co., Inc. | 1-800-325-7926 |

| Sandler O’Neill & Partners | 1-212-466-8020 |

| Sterne, Agee & Leach | 1-800-239-2408 |

| UBS Capital Markets L.P. | 1-203-719-7400 |

11

The following table sets forth quarterly market sales price ranges, dividend information, and repurchase activity for the Company’s common stock over the past two years.

2006 | | Quarter 1 | | Quarter 2 | | Quarter 3 | | Quarter 4 | |

| |

|

| |

|

| |

|

| |

|

| |

Price Range: | | | | | | | | | | | | | |

High | | $ | 13.35 | | $ | 12.80 | | $ | 13.86 | | $ | 13.28 | |

Low | | | 12.35 | | | 11.94 | | | 12.25 | | | 12.57 | |

Dividend | | | 0.075 | | | 0.075 | | | 0.075 | | | 0.075 | |

Shares Repurchased | | | 18,263 | | | 41,000 | | | 52,825 | | | 95,000 | |

Avg. Price Paid Per Share | | $ | 12.15 | | | 12.43 | | $ | 12.87 | | $ | 12.91 | |

2005 | | Quarter 1 | | Quarter 2 | | Quarter 3 | | Quarter 4 | |

| |

|

| |

|

| |

|

| |

|

| |

Price Range: | | | | | | | | | | | | | |

High | | $ | 14.25 | | $ | 13.90 | | $ | 12.80 | | $ | 12.75 | |

Low | | | 12.91 | | | 11.76 | | | 11.41 | | | 11.70 | |

Dividend | | | 0.07 | | | 0.07 | | | 0.07 | | | 0.07 | |

Shares Repurchased | | | 184,600 | | | 0 | | | 48,300 | | | 211,023 | |

Avg. Price Paid Per Share | | $ | 13.56 | | | NA | | $ | 12.44 | | $ | 12.09 | |

12

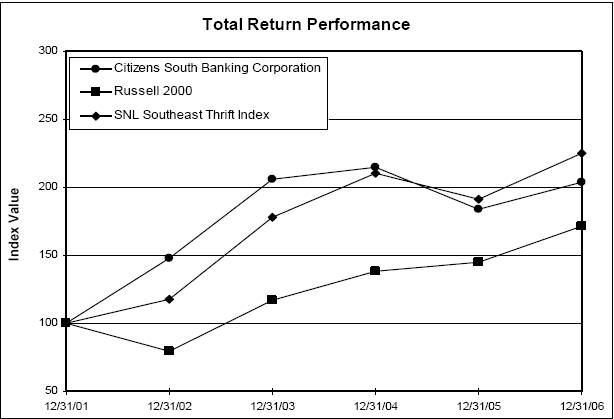

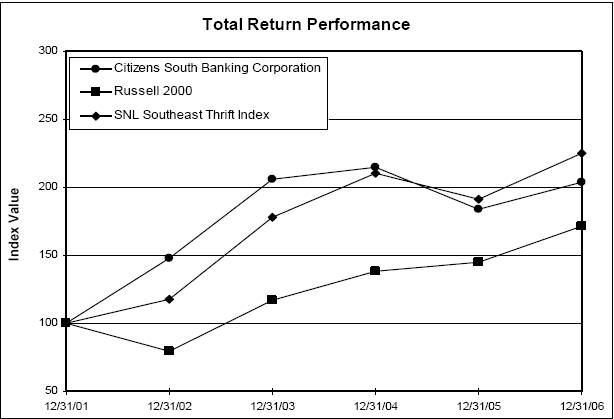

Set forth herein under is a stock performance graph comparing (a) the cumulative total return on the common stock for the period beginning with the last trade of Citizens South Banking Corporation’s stock on December 31, 2001, as reported on the Nasdaq Stock Market, through December 31, 2006, (b) the cumulative total return on stocks included in the Russell 2000 index over such period, and (c) the cumulative total return on stocks included in the SNL Southeast Thrift Index over such period. Cumulative return assumes the reinvestment of dividends, and is expressed in dollars based on an assumed initial investment of $100.

Citizens South Banking Corporation

| | Period Ending | |

| |

| |

Index | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Citizens South Banking Corporation | | | 100.00 | | | 147.91 | | | 206.12 | | | 214.98 | | | 183.92 | | | 203.89 | |

Russell 2000 | | | 100.00 | | | 79.52 | | | 117.09 | | | 138.55 | | | 144.86 | | | 171.47 | |

SNL Southeast Thrift Index | | | 100.00 | | | 117.30 | | | 177.89 | | | 210.29 | | | 191.37 | | | 224.90 | |

There can be no assurance that the common stock’s performance will continue in the future with the same or similar trend depicted in the graph. Citizens South Banking Corporation will not make or endorse any predictions as to future performance.

13

b. Not applicable.

c. During the three-month period ended December 31, 2006, the Company repurchased the following shares of stock.

2006 | | Total

Number of

Shares

Purchased | | Average

Price Paid

per Share | | Total Number of Shares

Purchased as Part of the

Current Repurchase Plan | | Maximum Number of

Shares that May be

Purchased Under Current

Repurchase Plan | |

| |

|

| |

|

| |

|

| |

|

| |

October | | | 29,000 | | $ | 12.94 | | | 29,000 | | | 73,989 | |

November | | | 44,000 | | $ | 12.88 | | | 44,000 | | | 29,989 | |

December | | | 22,000 | | $ | 12.92 | | | 22,000 | | | 7,989 | |

Total | | | 95,000 | | $ | 12.91 | | | 95,000 | | | 7,989 | |

On January 23, 2006, the Board of Directors of the Company authorized the repurchase of up to 200,000 shares, or approximately 5% of the Company’s then outstanding shares of common stock. These repurchases may be carried out through open market purchases, block trades, and negotiated private transactions. The stock may be repurchased on an ongoing basis and will be subject to the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital, and the Company’s financial performance. As of December 31, 2006, the Company had repurchased a total of 192,011 shares at an average price of $12.78 per share and had 7,989 shares remaining to be repurchased under this plan. The Company will consider repurchasing additional shares of common stock of the Company at prices management considers to be attractive and in the best interests of both the Company and its stockholders. Any repurchased shares will be held as treasury stock and will be available for general corporate purposes.

On February 28, 2005, the Board of Directors of the Company authorized the repurchase of up to 370,000 shares, or approximately 5%, of the Company’s then outstanding shares of common stock. This stock repurchase program was completed in March 2006, with the repurchase of 370,000 shares at an average price of $12.49. In May 2004, the Company authorized the repurchase of up to 815,000 shares, or approximately 10% of the then outstanding shares. This program was completed in March 2005, with the repurchase of 815,000 shares at an average price of $13.09.

14

ITEM 6. | Selected Financial Data |

The following table sets forth certain information concerning the financial position of Citizens South Banking Corporation and its subsidiaries as of and for the dates indicated. The consolidated data is derived from, and should be read in conjunction with the Consolidated Financial Statements of the Company and its subsidiaries and related notes presented in Item 8.

| | At and for the years ended December 31, | |

| |

| |

(Dollars in thousands, except per share data) | | 2006 (1) | | 2005 (1) | | 2004 | | 2003 | | 2002 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Income Statement Data: | | | | | | | | | | | | | | | | |

Interest income | | $ | 42,919 | | $ | 26,948 | | $ | 21,110 | | $ | 21,969 | | $ | 24,716 | |

Interest expense | | | 22,279 | | | 11,469 | | | 7,943 | | | 8,732 | | | 10,195 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net interest income | | | 20,640 | | | 15,479 | | | 13,167 | | | 13,237 | | | 14,521 | |

Provision for loan losses | | | 1,165 | | | 985 | | | 330 | | | 60 | | | 225 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net interest income after provision for loan losses | | | 19,475 | | | 14,494 | | | 12,837 | | | 13,177 | | | 14,296 | |

Noninterest income | | | 6,141 | | | 4,441 | | | 4,824 | | | 5,561 | | | 4,121 | |

Noninterest expense | | | 17,544 | | | 14,339 | | | 13,629 | | | 13,891 | | | 11,381 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Income before income taxes | | | 8,072 | | | 4,596 | | | 4,032 | | | 4,847 | | | 7,036 | |

Income tax expense | | | 2,617 | | | 1,323 | | | 1,077 | | | 1,456 | | | 2,528 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net income | | $ | 5,455 | | $ | 3,273 | | $ | 2,955 | | $ | 3,391 | | $ | 4,508 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Per Share Data: | | | | | | | | | | | | | | | | |

Basic net income | | $ | 0.68 | | $ | 0.45 | | $ | 0.39 | | $ | 0.39 | | $ | 0.51 | |

Diluted net income | | | 0.67 | | | 0.45 | | | 0.38 | | | 0.39 | | | 0.51 | |

Cash dividends declared | | | 0.30 | | | 0.28 | | | 0.26 | | | 0.24 | | | 0.16 | |

Year-end book value | | | 10.61 | | | 10.16 | | | 9.74 | | | 10.11 | | | 10.64 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | |

Total assets | | $ | 743,370 | | $ | 701,094 | | $ | 508,961 | | $ | 495,751 | | $ | 492,873 | |

Loans receivable, net | | | 509,638 | | | 468,232 | | | 314,124 | | | 295,026 | | | 299,906 | |

Mortgage-backed and related securities | | | 60,691 | | | 70,236 | | | 81,169 | | | 89,168 | | | 70,409 | |

Investment securities | | | 65,326 | | | 53,429 | | | 52,407 | | | 56,233 | | | 39,594 | |

Deposits | | | 562,802 | | | 517,544 | | | 374,744 | | | 342,446 | | | 340,862 | |

Borrowings | | | 85,964 | | | 91,342 | | | 55,772 | | | 58,981 | | | 47,575 | |

Stockholders’ equity | | | 85,961 | | | 84,258 | | | 72,394 | | | 87,699 | | | 96,383 | |

Performance Ratios: | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.76 | % | | 0.60 | % | | 0.59 | % | | 0.68 | % | | 0.98 | % |

Return on average equity | | | 6.42 | | | 4.40 | | | 3.78 | | | 3.61 | | | 7.61 | |

Avg. interest-earning assets to avg. interest-bearing liabilities | | | 106.53 | | | 109.40 | | | 110.96 | | | 118.65 | | | 109.19 | |

Noninterest expense to average total assets | | | 2.45 | | | 2.64 | | | 2.73 | | | 2.81 | | | 2.48 | |

Interest rate spread | | | 3.07 | | | 3.00 | | | 2.78 | | | 2.57 | | | 3.26 | |

Net interest margin (2) | | | 3.30 | | | 3.23 | | | 2.98 | | | 2.94 | | | 3.48 | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | |

Allowance for loan losses to total loans | | | 1.12 | % | | 1.08 | % | | 0.95 | % | | 1.00 | % | | 0.99 | % |

Net charge-offs to average loans | | | 0.10 | | | 0.12 | | | 0.09 | | | 0.03 | | | 0.11 | |

Nonperforming loans to total loans | | | 0.58 | | | 0.54 | | | 0.30 | | | 0.18 | | | 0.17 | |

Nonperforming assets to total assets | | | 0.42 | | | 0.53 | | | 0.34 | | | 0.14 | | | 0.37 | |

Capital Ratios: | | | | | | | | | | | | | | | | |

Average equity to average total assets | | | 11.86 | % | | 13.69 | % | | 15.64 | % | | 18.96 | % | | 12.93 | % |

Equity to assets at year end | | | 11.56 | | | 12.02 | | | 14.22 | | | 17.68 | | | 19.56 | |

Dividend payout ratio (3) | | | 44.12 | | | 62.22 | | | 66.67 | | | 61.54 | | | 31.37 | |

|

(1) | Includes operations of Trinity Bank which was acquired on October 31, 2005. |

(2) | Net interest margin is calculated by dividing net interest income by average interest-earning assets for the period. |

(3) | Dividend payout ratio is calculated by dividing cash dividends per share declared for the period by net income per share for the period. Citizens South Holdings, MHC, the former mutual holding company for Citizens South Banking Corporation, began waiving dividends in August 2000 and as of September 30, 2002, had waived dividends totaling approximately $1.8 million. The MHC owned between 53% and 58% of the outstanding common stock of the Company during the periods in which the dividends were waived. |

15

ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview of Financial Condition and Results of Operations.

Citizens South Banking Corporation (the “Company”) is a Delaware corporation that owns all of the outstanding shares of common stock of Citizens South Bank (the “Bank”), a federally chartered savings bank headquartered in Gastonia, North Carolina. The Company’s principal business activities are overseeing and directing the business of the Bank and investing the net stock offering proceeds retained by the Company. The Company’s assets consist primarily of the outstanding capital stock of the Bank, deposits held at the Bank, and investment securities. The Bank’s principal business activity is offering FDIC-insured deposit accounts to local customers through its 14 branch offices and investing those deposits, together with funds generated from operations and borrowings, in residential and nonresidential real estate loans, construction loans, commercial business loans, consumer loans, investment securities, and mortgage-backed securities. The Bank also acts as a broker in both the origination of loans secured by one-to-four family dwellings and in the sale of uninsured financial products (see Item 1. “Business” of this report).

Our primary business strategy since our initial public stock offering in 1998 has been to transform the Bank from a traditional savings bank to a full-service community bank, offering a complete array of both commercial and retail loan and deposits, wealth management services, mortgage banking activities, brokerage services, and other related financial services. In executing this strategy, the Company has 1) concentrated much of its lending efforts on nonresidential real estate and construction loans, 2) originated substantially all fixed-rate one-to-four family residential loans as a broker for a third party, and 3) focused its deposit gathering efforts on core deposits (demand deposit accounts, money market accounts, and savings accounts). As a result, nonresidential real estate and construction loans comprised approximately 64% of the Company’s loan portfolio at December 31, 2006, compared to approximately 29% at December 31, 2002. Also, during the same period, the Company’s portfolio of one-to-four family residential loans decreased from 46% of the Company’s loan portfolio at December 31, 2002, to 16% of the Company’s loan portfolio at December 31, 2006. Core deposits have increased as a percentage of total deposits from approximately 34% at December 31, 2002 to approximately 40% at December 31, 2006. Management expects to continue to execute this business strategy in 2007.

On October 31, 2005, the Company consummated the merger of Trinity Bank (“Trinity”) into Citizens South Bank. At the time of the acquisition, Trinity had total assets of $165.5 million, net loans of $112.8 million, deposits of $135.6 million, borrowed money of $14.0 million and equity of $13.3 million. Trinity was headquartered in Monroe, North Carolina, which is approximately 50 miles east of the Company’s headquarters. Trinity had three offices located in Union County, North Carolina, which had the fastest population growth of any county in North Carolina. The combined bank had 14 full-service locations and two loan production offices, and ranked 8th in the Charlotte Metropolitan Statistical Area in deposit market share.

Under the terms of the merger agreement, the Company issued a combination of common stock and cash for the outstanding common shares of Trinity Bank. Trinity shareholders were given the option of receiving 1.3931 shares of Citizens South common stock for each share of Trinity common stock, $18.25 in cash for each share of Trinity common stock, or a mixture of stock and cash for each Trinity share, such that 50% of the shares of Trinity common stock will be exchanged for Citizens South common stock. On October 31, 2005, Trinity shareholders received merger consideration of approximately 1,280,052 shares of common stock of the Company (subject to payment of cash in lieu of fractional shares) and approximately $16.8 million in cash (including cash paid in lieu of fractional shares), resulting in a total transaction value of approximately $37.8 million. The transaction price represented approximately 255% of Trinity’s book value. Additional information regarding this transaction may be obtained by reviewing the Registration Statement that the Company filed with the Securities and Exchange Commission on August 1, 2005, and amended September 14, 2005.

In order to provide financing for the cash portion of the Trinity acquisition, on October 28, 2005, the Company completed a private placement of an aggregate amount of $15.0 million in trust preferred securities, liquidation amount of $1,000 per security (the “Preferred Securities”), through a newly formed Delaware statutory trust subsidiary, CSBC Statutory Trust I (the “Trust”). In connection with the issuance of the Preferred Securities, on October 28, 2005, the Company entered into an Indenture by and between the Company and Wilmington Trust Company, as trustee. The Preferred Securities mature on December 15, 2035, but may be redeemed beginning December 15, 2010, if the Company exercises its rights to redeem the Debentures. The Preferred Securities require quarterly interest payments to the holders of the Preferred Securities, initially at a fixed rate of 6.095% through December 2010, and thereafter at a variable rate of three-month LIBOR plus 1.57%, reset quarterly. Additional information regarding the Preferred Securities may be obtained by reviewing the Form 8-K filed with the Securities and Exchange Commission on November 4, 2005.

16

On September 30, 2002, the Company’s mutual holding company completed its mutual-to-stock conversion and related stock offering, resulting in an equity to assets ratio of 19.56% at December 31, 2002. In order to leverage the Company’s capital position, the Company has executed a number of strategies including 1) repurchasing Company stock at prices that are considered attractive, 2) paying dividends on outstanding stock, 3) building new banking offices in areas that the Company believes improve the value of the franchise, and 4) strategically pursuing acquisitions of other financial institutions or related companies. As of December 31, 2006, the Company had repurchased a total of 2,596,446 shares, or 28.7% of the outstanding shares of common stock, at an average price of $13.30. As a result of the execution of these capital management strategies, the Company’s equity to assets ratio was 11.56% at December 31, 2006. Management plans to continue to execute these strategies until it believes the Company’s capital is appropriately leveraged.

The Bank’s results of operations are heavily dependent on net interest income, which is the difference between the interest earned on loans and securities and the interest paid on deposits and borrowings. Results of operations are also materially affected by the Bank’s provision for loan losses, gains or losses from the sales of assets, fee income generated from deposit and loan accounts, commissions earned from the sale of uninsured investment products, and noninterest expenses. The Bank’s noninterest expense primarily consists of compensation and employee benefits, occupancy expense, professional services, advertising, and other noninterest expenses. Results of operations are also significantly affected by general economic and competitive conditions, changes in interest rates, and actions of regulatory and governmental authorities.

Net income was $5.5 million, or $0.67 per diluted share, for the year ended December 31, 2006, compared to $3.3 million, or $0.45 per diluted share, for the year ended December 31, 2005. The earnings resulted in a return on average equity of 6.42% in 2006, compared to 4.40% in 2005, and a return on average assets of 0.76% in 2006, compared to 0.60% in 2005.

Certain actions have been taken that have adversely impacted our results of operations for the years ended December 31, 2005 and 2004. In 2005 we acquired Trinity Bank, resulting in merger and computer conversion related expenses of $384,000. In 2004, we determined that unrealized losses on $2.0 million in perpetual preferred stock issued by Fannie Mae and $2.0 million in perpetual preferred stock issued by Freddie Mac were “other-than-temporary” impairments. As a result, management recorded a noncash, pretax loss of $983,000. All of these securities were sold during 2005 and the Company did not have any other perpetual preferred stock on its books at December 31, 2006.

Management’s Discussion and Analysis is provided to assist in understanding and evaluating the results of operations and financial condition of the Company and its subsidiaries. The following discussion should be read in conjunction with the consolidated financial statements and related notes included in Item 8. of this report.

Forward-Looking Statements

This report contains certain forward-looking statements that represent the Company’s expectations or beliefs concerning future events. Such forward-looking statements are based on our current beliefs and expectations and are inherently subject to significant business, economic, and competitive uncertainties and contingencies, many of which are beyond our control. These forward-looking statements are based on assumptions with respect to future business strategies and decisions that are subject to change based on changes in the economic and competitive environment in which we operate. Forward-looking statements speak only as of the date they are made and the Company is under no duty to update these forward-looking statements or to reflect the occurrence of unanticipated events. A number of factors could cause actual conditions, events, or results to differ significantly from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, the timing and amount of revenues that may be recognized by the Company, changes in local or national economic trends, increased competition among depository and financial institutions, continuation of current revenue and expense trends (including trends affecting chargeoffs and provisions for loan losses), and adverse legal, regulatory or accounting changes. Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on these statements. Readers should carefully review the risk factors described in other documents the Company files from time to time with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, and Current Reports on Form 8-K.

17

Critical Accounting Policies

The accounting and financial policies of the Company and its subsidiaries are prepared in accordance with accounting principles generally accepted in the United States and conform to general practices in the banking industry. We consider accounting policies that require significant judgment and assumptions by management that have, or could have, a material impact on the carrying value of certain assets or on income to be critical accounting policies. Changes in underlying factors, assumptions or estimates could have a material impact on our future financial condition and results of operations. Based on the size of the item or significance of the estimate, the following accounting policies are considered critical to our financial results.

Allowance for Loan Losses. The allowance for loan losses is calculated with the objective of maintaining an allowance sufficient to absorb estimated probable loan losses inherent in the Bank’s portfolio at the measurement date. Management’s determination of the adequacy of the allowance is based on quarterly evaluations of the loan portfolio and other relevant factors. However, this evaluation is inherently subjective, as it requires an estimate of the loss for each type of loan and for each impaired loan, an estimate of the amounts and timing of expected future cash flows, and an estimate of the value of the collateral.

Management has established a systematic method for periodically evaluating the credit quality of the loan portfolio in order to establish an allowance for loan losses. The methodology is set forth in a formal policy and includes a review of all loans in the portfolio on which full collectibility may or may not be reasonably assured. The loan review considers among other matters, the estimated fair value of the collateral, economic conditions, historical loan loss experience, our knowledge of inherent losses in the portfolio that are probable and reasonable estimable and other factors that warrant recognition in providing an appropriate loan loss allowance. Specific allowances are established for certain individual loans that management considers impaired under Statement of Financial Accounting Standards (“SFAS”) No. 114, “Accounting by Creditors for Impairment of a Loan.” The remainder of the portfolio is segmented into groups of loans with similar risk characteristics for evaluation and analysis. In originating loans, we recognize that losses will be experienced and that the risk of loss will vary with, among other things, the type of loan being made, the creditworthiness of the borrower, the term of the loan, general economic conditions, and in the case of a secured loan, the quality of the collateral. We increase our allowance for loan losses by charging provisions for loan losses against our current period income. Management’s periodic evaluation of the adequacy of the allowance is consistently applied and is based on our past loan loss experience, particular risks inherent in the different kinds of lending that we engage in, adverse situations that may affect the borrower’s ability to repay, the estimated value of any underlying collateral, current economic conditions, and other relevant internal and external factors that affect loan collectibility. Management believes this is a critical accounting policy because this evaluation involves a high degree of complexity and requires us to make subjective judgments that often require assumptions or estimates about various matters.

Other-Than-Temporary Impairment of Securities. We have historically reviewed investment securities with significant declines in fair value for potential other-than-temporary impairment pursuant to the guidance provided by SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities. Effective December 31, 2006, management evaluated the Company’s investment portfolio and determined that all unrealized losses were the direct result of temporary changes in interest rates and that such losses may be recovered in the foreseeable future. As a result, management did not consider any unrealized losses as “other-than-temporary” as of December 31, 2006.

Effective December 31, 2004, the Company determined that unrealized losses on $2.0 million in perpetual preferred stock issued by Fannie Mae and $2.0 million in perpetual preferred stock issued by Freddie Mac were “other-than-temporary” impairments. As a result, management recorded a noncash, pretax loss of $983,000. The unrealized losses on these securities were considered to be “other-than-temporary” by management for the following reasons: 1) both Fannie Mae and Freddie Mac had experienced accounting irregularities that have resulted in restated financial results from prior periods; 2) the yield on perpetual preferred stock recently issued by Fannie Mae is much higher than the yield of the preferred stock held by the Company, which decreased the value of the Company’s securities; 3) the preferred stock for Fannie Mae was downgraded and the preferred stock for both companies was on a negative watch list; 4) the Freddie Mac preferred stock repriced in December 2004, yet it continued to have significant unrealized losses at year end; and 5) neither of the preferred stock issues had stated maturity dates, so the recovery of the unrealized losses was not expected to occur in the foreseeable future. The credit issues facing Fannie Mae and Freddie Mac only affected the performance of the Company’s perpetual preferred stock. Management sold the subject securities in 2005 and the Company did not own any other perpetual preferred stock at December 31, 2006.

18

Comparison of Financial Condition for the Years Ended December 31, 2006 and 2005

Total assets increased by $42.3 million, or 6.0%, from $701.1 million at December 31, 2005, to $743.4 million at December 31, 2006. The majority of this growth was due to a $42.1 million, or 8.9%, increase in outstanding loans from $473.3 million at December 31, 2005, to $515.4 million at December 31, 2006. Most of the Company’s loan growth was in loans secured by commercial real estate. During 2006, these loans, which include construction loans, multifamily residential loans, and nonresidential real estate loans, increased by $56.9 million, or 20.9%, to $329.5 million at December 31, 2006. These loans are typically secured by owner-occupied professional office buildings, churches, speculative residential properties, or residential subdivisions located in the Charlotte, North Carolina metropolitan area, which is the Company’s primary lending area. Management does not generally pursue commercial real estate loans that are secured by hotels, motels, golf courses, or resort properties. Management plans to continue to emphasize the origination of commercial real estate loans in the Company’s primary lending area. Also during 2006, the Company’s portfolio of one-to-four family residential loans decreased from $98.6 million to $83.3 million due to normal prepayments and principal amortization. The Company originates and closes substantially all new one-to-four family residential loans as a broker for independent third parties on a servicing-released basis. This generates additional fee income and reduces the potential adverse effects of rising interest rates on the Company’s future earnings that normally result from holding long-term fixed-rate loans. Management expects that in 2007 the Company’s portfolio of one-to-four family mortgage loans will continue to decrease as most new loan originations will be made as a broker for the third party. During 2006, consumer loans decreased by $2.0 million, or 2.8%, to $70.2 million at December 31, 2006. Approximately $56.6 million, or 80.6%, of these consumer loans were revolving home equity lines of credit secured by a second lien on residential properties. These loans typically have a loan-to-value ratio of 90% or less and are secured by owner-occupied residential properties located in the Company’s normal lending area. Management plans to grow its portfolio of consumer loans in 2007 by implementing an incentive plan for its retail branch managers and creating marketing campaigns directed toward growing outstanding home equity lines of credit. Commercial business loans increased by $2.1 million, or 6.9%, to $32.2 million. Management expects similar growth of its commercial business loans in 2007.

In order to facilitate continued loan growth during 2007, the Company plans to add at least two commercial lenders and an additional credit officer. However, the Company’s ability to grow the existing loan portfolio is largely dependent on the continued strong local economy of the Charlotte metropolitan area. Management will also continue to focus on maintaining the current credit quality of the portfolio and will not forsake the credit quality of the loan portfolio for additional growth.

Cash and cash equivalents decreased by $433,000, or 1.6%, from $26.6 million at December 31, 2005, to $26.2 million at December 31, 2006. This decrease was primarily due to loan growth of $42.1 million, a $2.4 million net increase in investment and mortgage-backed securities, a $5.6 million net decrease in borrowed money, stock repurchases of $2.6 million, and the payment of $2.4 million in cash dividends during 2006. These decreases in cash and cash equivalents were partly offset by a $45.3 million increase in deposits, net proceeds of $1.6 million from the sale of real estate acquired through foreclosure and other assets, and net income of $5.5 million during 2006. Management expects that cash and cash equivalents will continue to decrease in 2007 as excess liquidity is invested in new loans and higher-yielding investment securities.