Jon Ward, Chairman and CEO

Raymond James

27th Annual Institutional Investor Conference

March 7, 2006

Forward-Looking Statement

This presentation contains statements concerning future results and other matters that may

be deemed to be “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. The Company intends that these forward-looking statements,

which look forward in time and include everything other than historical information, be subject

to the safe harbors created by such legislation. Forward-looking statements involve risks and

uncertainties that may affect the Company’s results of operations, financial condition or cash

flows. Factors that may cause actual results to differ materially from those expressed or

implied in a forward-looking statement include the following (among others): weather

conditions that affect the demand for the Company’s services; changes in the source and

intensity of competition in the markets served by the Company; labor shortages or increases

in wage rates; unexpected increases in operating costs, such as higher insurance premiums,

self insurance and healthcare claim costs; higher fuel prices; changes in the types or mix of

the Company’s service offerings or products; increased governmental regulation including

telemarketing and environmental restrictions; general economic conditions in the United

States, especially as they may affect home sales or consumer spending levels; and other

factors described from time to time in documents filed by the Company with the Securities and

Exchange Commission. A copy of this presentation is available on our website at

www.svm.com in the Investor Relations Section.

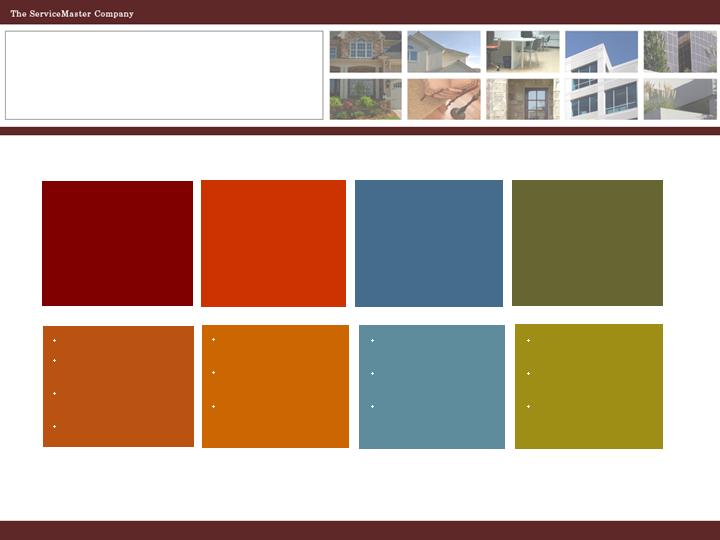

Values Based Company

We are accountable to:

Honor God

in all we do

Excel with

customers

Grow

profitably

Help people

develop

Do the right thing.

Treat each person with

dignity and respect.

Respect each person’s

spirituality.

Protect and maintain our

world.

Serve others as we

would be served.

Make it easy for the

customer.

Stand behind our work.

Help people to do

their best every day.

Build proud,

dynamic teams.

Help people reach

their goals.

Act as good stewards of

our investors’ capital.

Constantly improve and

innovate.

Meet our commitments.

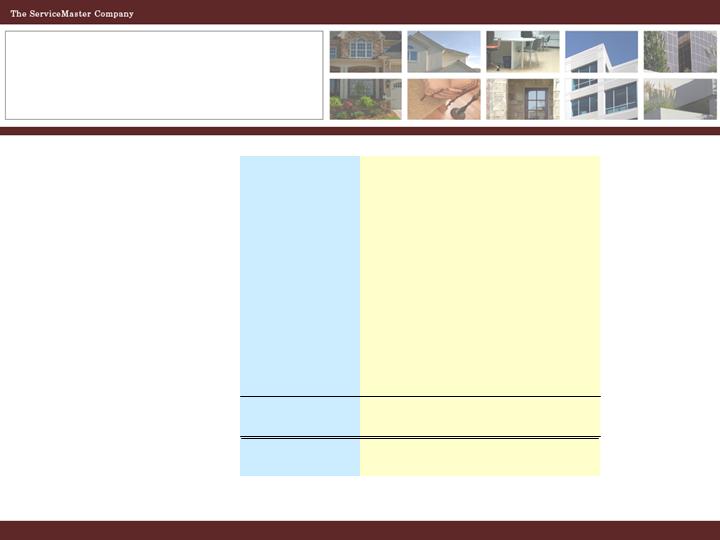

Highly Fragmented and

Under-penetrated Markets

15%

23%

Residential Lawn, Shrub and

Tree Care

#1

11%

5-12%

37%

3%

22%

Market

Share

6%

1-7%

4%

NA

12%

Household

Penetration

Commercial Landscape

Maintenance

#1

#1

#1

#1

#1

Market

Position

Maid Services

Disaster Restoration,

Cleaning, Janitorial, Furniture

Repair

Home Warranty and

Inspection

Pest and Termite Control

Services

Brand

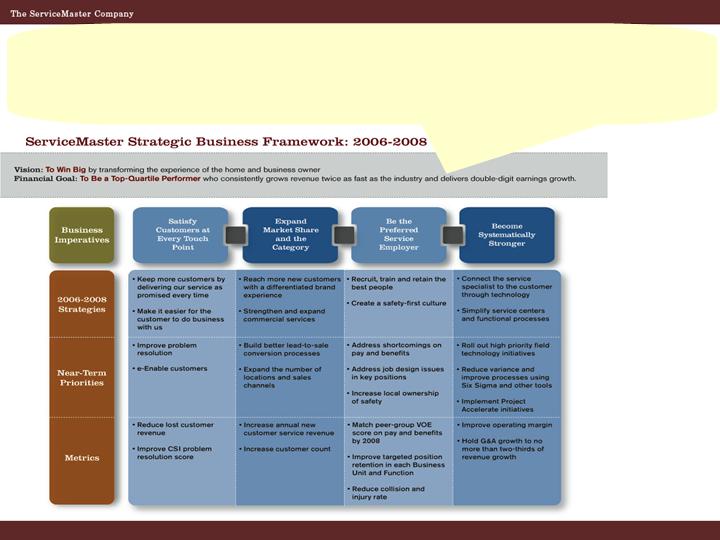

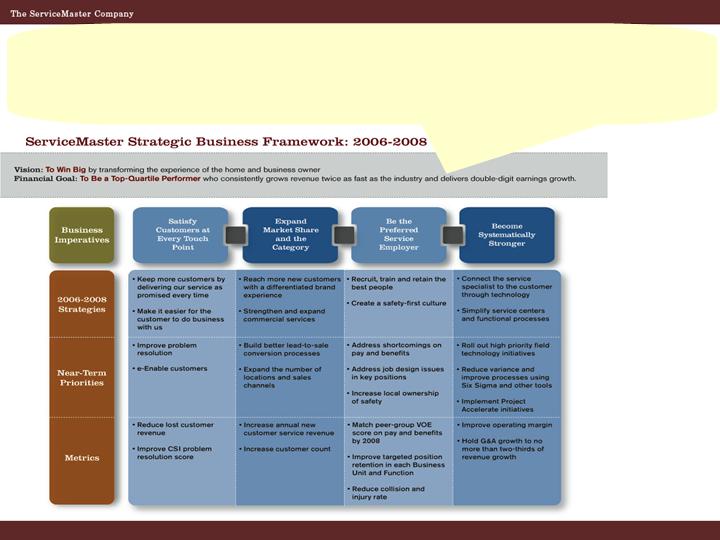

Financial Goal:

To Be a Top-Quartile Performer who consistently grows revenue twice as fast as the

industry and delivers double-digit earnings growth.

Become

Systematically

Stronger

Be the

Preferred Service

Employer

Expand Market

Share and the

Category

Satisfy Customers

at Every Touch

Point

Our Strategic Framework for

Accelerating Growth

Vision: To Win Big by Transforming the Experience

of the Home and Business Owner

The Foundation of the Strategic Plan for Every Brand

Satisfy

Customers at

Every Touch

Point

Our Strategic Framework for

Accelerating Growth

Strategies

Keep more customers by

delivering our service as

promised every time

Make it easier for the customer

to do business with us

Expand

Market Share

and the

Category

Our Strategic Framework for

Accelerating Growth

Strategies

Reach more new customers

with a differentiated brand

experience

Strengthen and expand

commercial services

Market leader in commercial disaster restoration

Revenue base of $130m; rapid growth and solid margins

Excellent strategic fit with ServiceMaster Clean

ServiceMaster provides #1 national presence in mitigation

InStar provides commercial relationships and construction expertise

Combination provides key competitive advantages

Full continuum of service

National footprint

Immediate response, limiting business disruption

Be the

Preferred

Service

Employer

Our Strategic Framework for

Accelerating Growth

Strategies

Recruit, train and retain

the best people

Create a safety-first culture

Become

Systematically

Stronger

Our Strategic Framework for

Accelerating Growth

Strategies

Connect the service specialist

to the customer through

technology

Simplify services centers and

functional processes

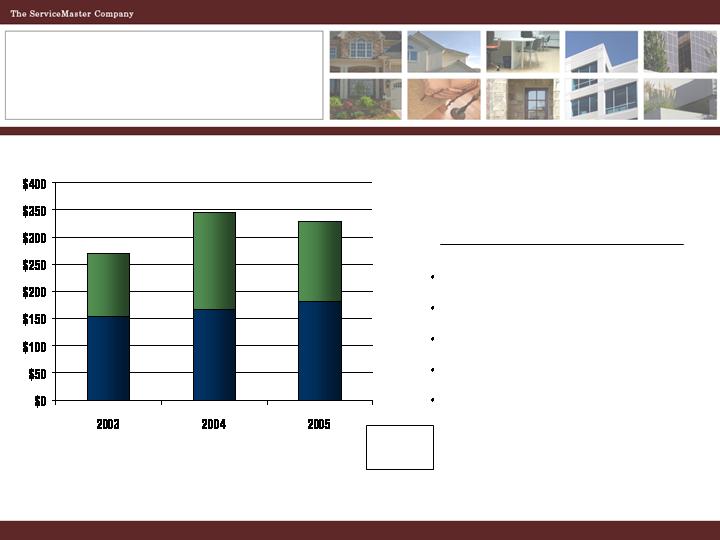

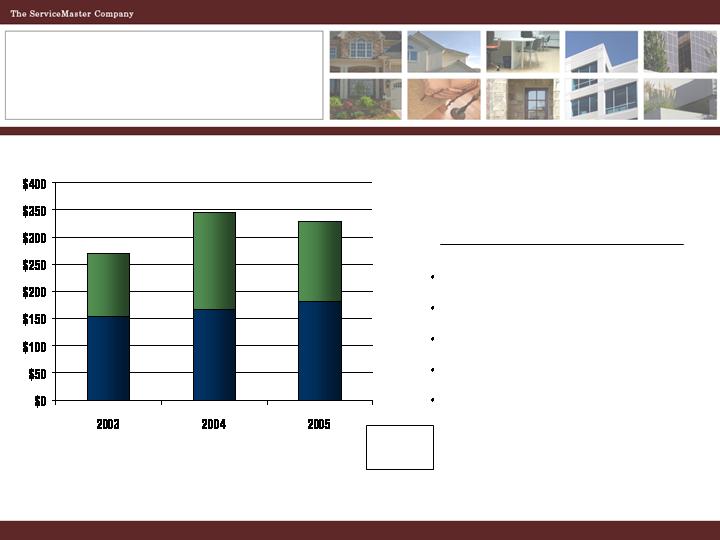

Performing as We Transform

+9%

+9%

+6%

2005

+2%

+1%

+4%

2003

Growth Rates

+10%

+12%

+6%

2004

Pre-Tax Income*

EPS*

Revenue

* Excludes unusual items in 2002 - 2004

Outlook: Growth Acceleration

Our Company will be comprised of leading service brands that

collectively have strong cash flow, higher revenue growth potential,

greater operating margins and stronger returns on invested capital.

… will enable us to deliver mid to high single-digit revenue growth and

low double-digit earnings per share growth in 2006 and to achieve

EPS growth in the mid-teen level during 2007 and beyond.

Driving Accelerated Growth

16%

13%

9%

EPS Growth

0.80

0.69

0.61

Total

(0.01)

(0.01)

Option Accounting

0.04

0.02

--

Accelerate

0.02

0.01

--

InStar

(0.05)

(0.04)

(0.04)

ARS/AMS

0.80

0.71

0.65

ServiceMaster

2007P

2006P

2005A

Compelling Business Model

High recurring revenue

Low volatility and risk

Returns exceeding cost of capital

Strong, reliable dividend

Solid balance sheet

Exceptional cash flows

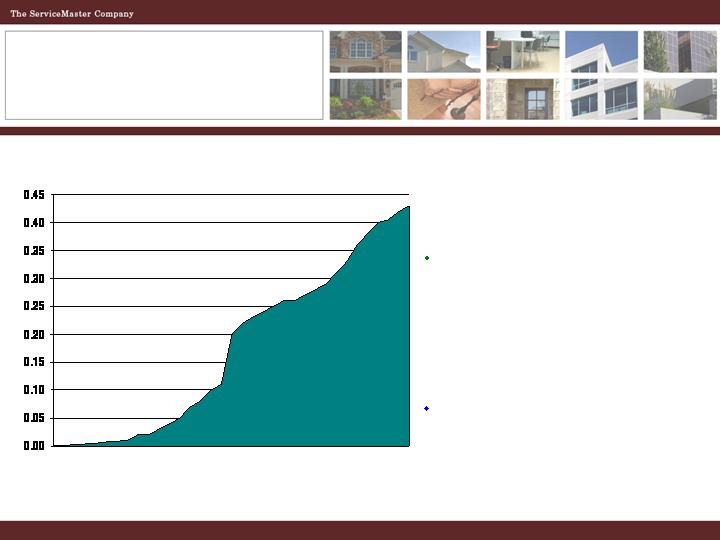

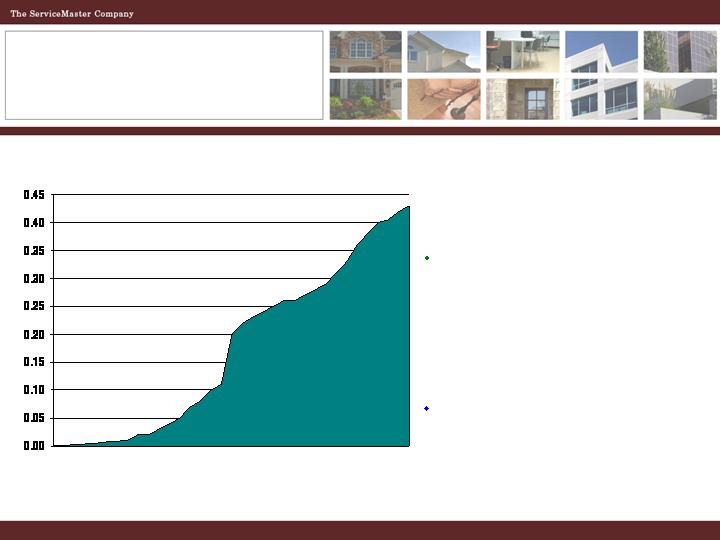

Compelling Business Model

Note: Income from continuing operations and cash from operations excludes unusual items

$ millions

Cash from Operations

Multiple 1.7X 2.1X 1.8X

Average

1.9X

Exceptional Cash Flows are

Based on Reliable Fundamentals

Low fixed asset requirements

Significant prepayments

Quick accounts receivable turnover

Minimal inventories

Recurring deferred tax benefit

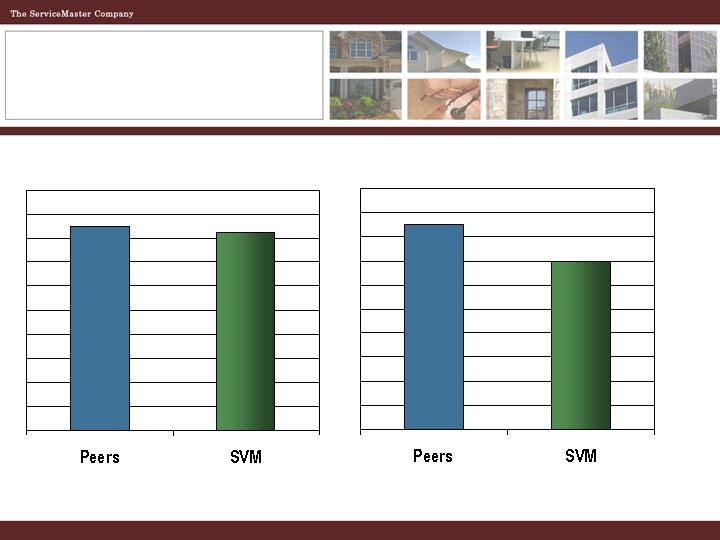

Deferred Tax Benefit of $.19

Impacts Valuation

* Current Multiple based on 02-28-06 price divided by fiscal ’05 EPS. Cash EPS = EPS plus the change in deferred taxes on the Cash Flow Statement.

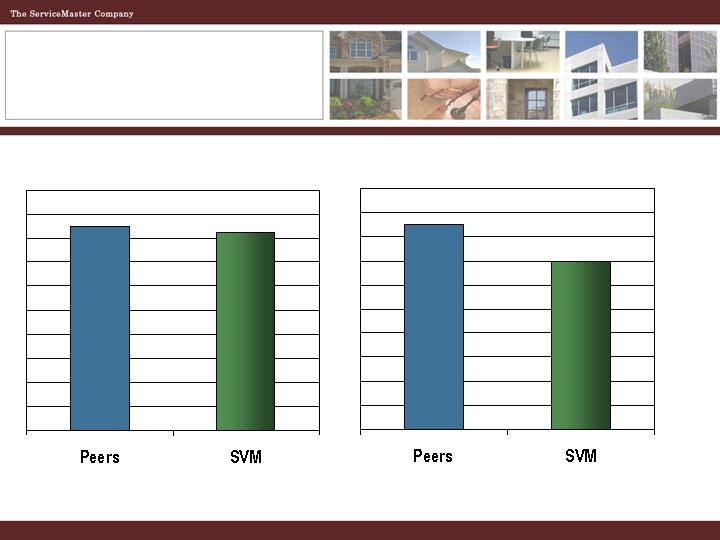

Peers: Cintas, Aramark, Rollins, Cendant, Ecolab, Scotts

P /E Multiple* Comparison to Peer Group

.61

.80

22X

21X

22X

15X

Book EPS

Cash EPS

Dividend Growth

Evaluating increasing rate of

growth based on improving

cash flows

Share Repurchase

$80m - $100m targeted in 2006

Strong History and

Commitment of Cash Returns

1970 - 2005

3.5% Current Yield

35 years of

consecutive

growth

Dividends

Large, expanding markets

Strong competitive position

Compelling business model

Multiple growth accelerators

Excellent dividend and total return

A Compelling

Investment Opportunity