Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[GRAPHIC]

The ServiceMaster Company

Analyst & Investor Conference

Bruce Byots, Vice President, Investor Relations - ServiceMaster

Investor Day Agenda |

| |

State of the Business | Jon Ward, Chairman & CEO |

8:00 a.m. - 9:05 a.m. | Mitch Engel, CMO |

| Ernie Mrozek, President & COO |

| Steve Preston, Exec. VP & CFO |

| [Question & Answer Period] |

| |

Business Unit Review

9:05 a.m. - 9:45 a.m. | Dave Slott, President - TruGreen

ChemLawn |

| Don Karnes, President - TruGreen

Companies |

| [Question & Answer Period] |

| |

Break | |

9:45 a.m. - 10:00 a.m. | |

ServiceMaster

Business Unit Review | Scott Cromie, President - AHS |

10:00 a.m. - 11:15 a.m. | Mark Burel, President - ARS |

| • John Biedry, Senior VP, Continuous

Improvement & Six Sigma |

| Albert Cantu, President & COO - Terminix |

| • Jim Goetz, Senior VP & CIO |

| |

Concluding Remarks | Jon Ward & Management Team |

Question & Answer Period | |

11:15 a.m. - 11:45 a.m. | |

| |

Lunch | |

11:50 a.m. - 1:00 p.m. | |

Investor Day Information

• Webcast over www.svm.com

• Archived on site for 30 days

• Hard copy of slides available by request

(contact: bruce.byots@servicemaster.com)

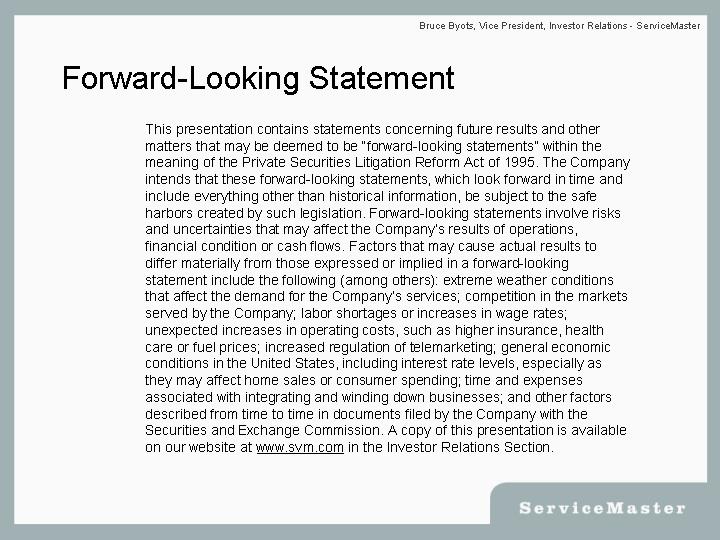

Forward-Looking Statement

This presentation contains statements concerning future results and other matters that may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends that these forward-looking statements, which look forward in time and include everything other than historical information, be subject to the safe harbors created by such legislation. Forward-looking statements involve risks and uncertainties that may affect the Company’s results of operations, financial condition or cash flows. Factors that may cause actual results to differ materially from those expressed or implied in a forward-looking statement include the following (among others): extreme weather conditions that affect the demand for the Company’s services; competition in the markets served by the Company; labor shortages or increases in wage rates; unexpected increases in operating costs, such as higher insurance, health care or fuel prices; increased regulation of telemarketing; general economic conditions in the United States, including interest rate levels, especially as they may affect home sales or consumer spending; time and expenses associated with integrating and winding down businesses; and other factors described from time to time in documents filed by the Company with the Securities and Exchange Commission. A copy of this presentation is available on our website at www.svm.com in the Investor Relations Section.

Jon Ward, CEO & Chairman - ServiceMaster

The ServiceMaster Family of Brands

[LOGOS]

Prepared for Marketplace Opportunities

• Investing so we can grow

• Biggest and best prospects are close to home

[GRAPHIC]

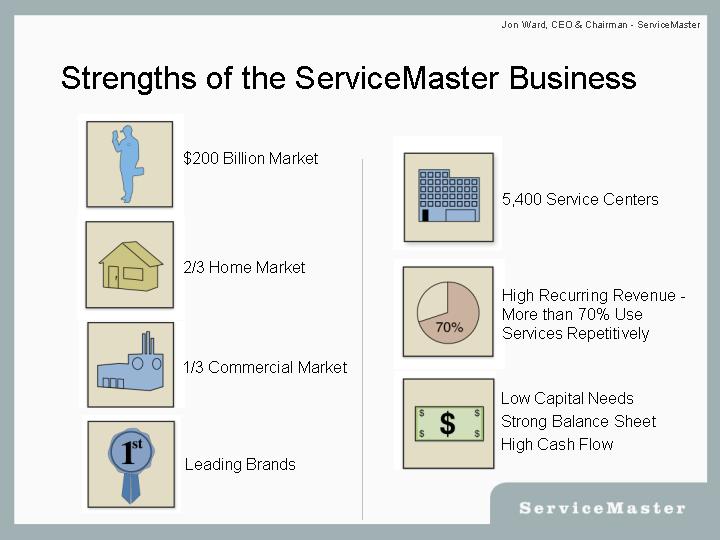

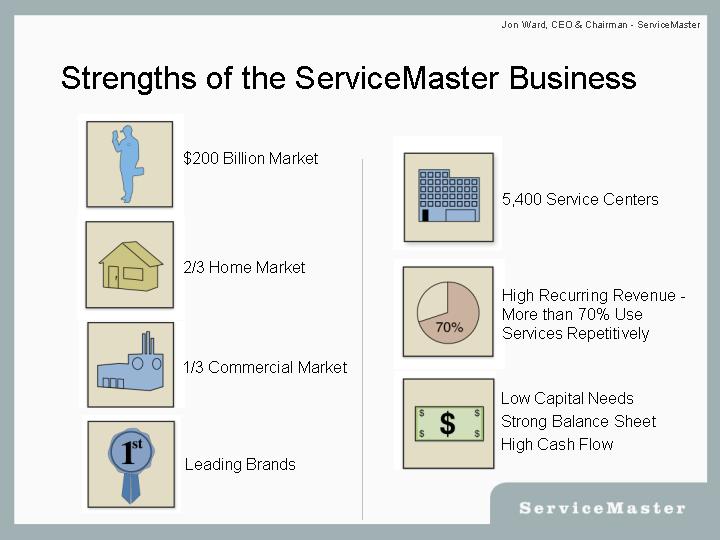

Strengths of the ServiceMaster Business |

|

[GRAPHIC] | $200 Billion Market |

| |

[GRAPHIC] | 2/3 Home Market |

| |

[GRAPHIC] | 1/3 Commercial Market |

| |

[GRAPHIC] | Leading Brands |

| |

[GRAPHIC] | 5,400 Service Centers |

| |

[GRAPHIC] | High Recurring Revenue - More than 70% Use Services Repetitively |

| |

[GRAPHIC] | Low Capital Needs

Strong Balance Sheet

High Cash Flow |

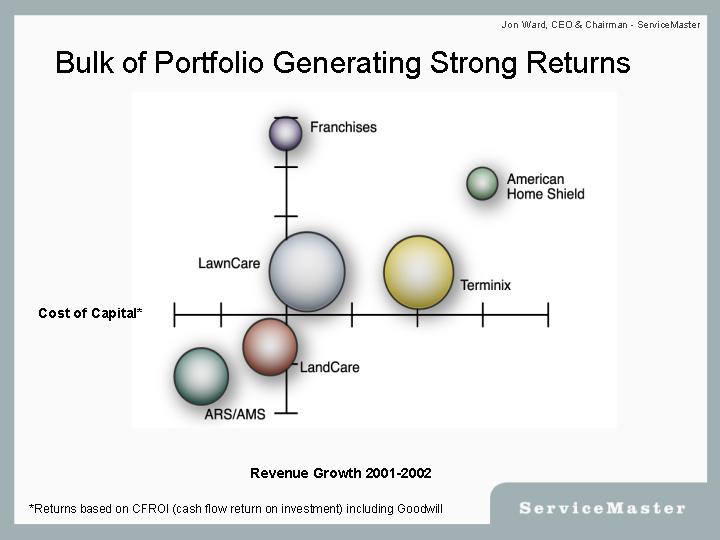

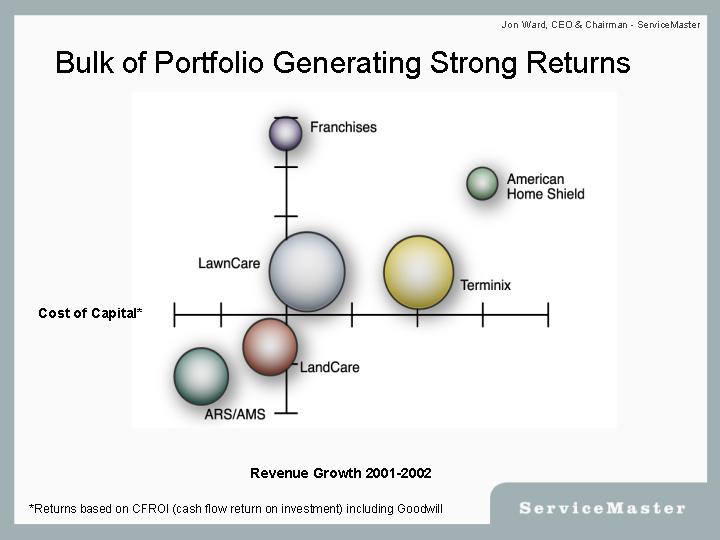

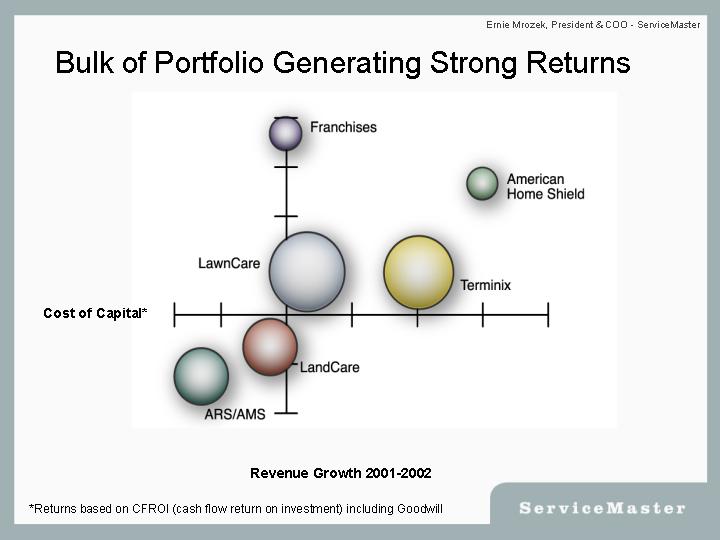

Bulk of Portfolio Generating Strong Returns

[CHART]

Revenue Growth 2001-2002

*Returns based on CFROI (cash flow return on investment) including Goodwill

Transform the experience of the home and business owner by delivering expert service —

matched to their needs, on-time, guaranteed.

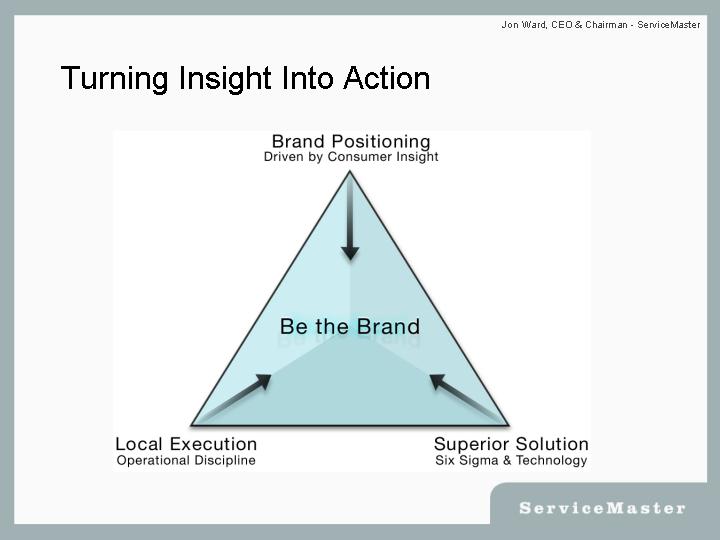

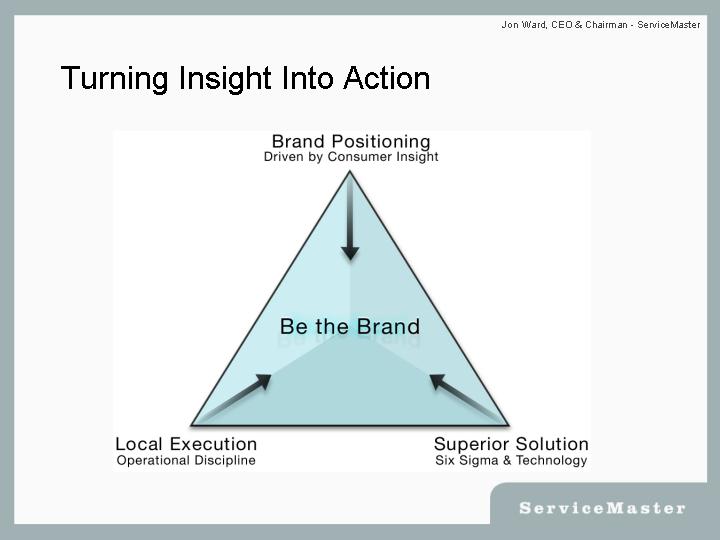

Turning Insight Into Action

[GRAPHIC]

Our Strategies

• Pragmatic

• Creates value

• Solid action plan

• Leadership commitment

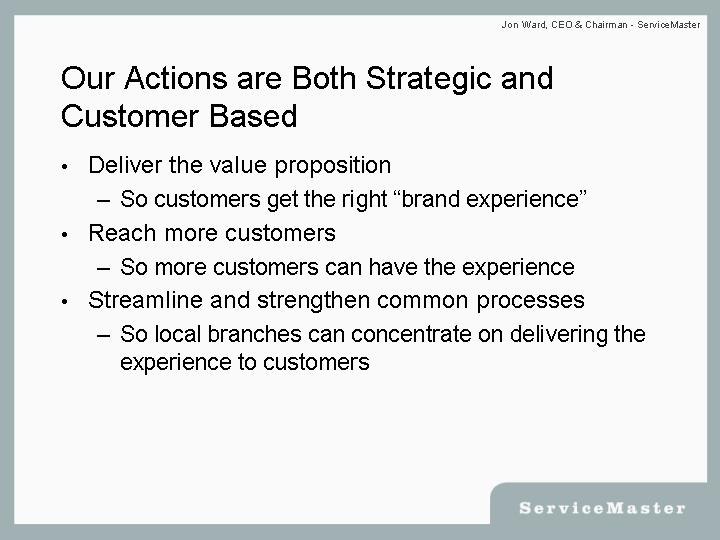

Our Actions are Both Strategic and Customer Based

• Deliver the value proposition

• So customers get the right “brand experience”

• Reach more customers

• So more customers can have the experience

• Streamline and strengthen common processes

• So local branches can concentrate on delivering the experience to customers

Mitch Engel, CMO - ServiceMaster

Using Research to Develop Brand

[GRAPHIC] | | [GRAPHIC] |

| | |

Customer Insights | | Differentiate Brand

by Changing the

Experience |

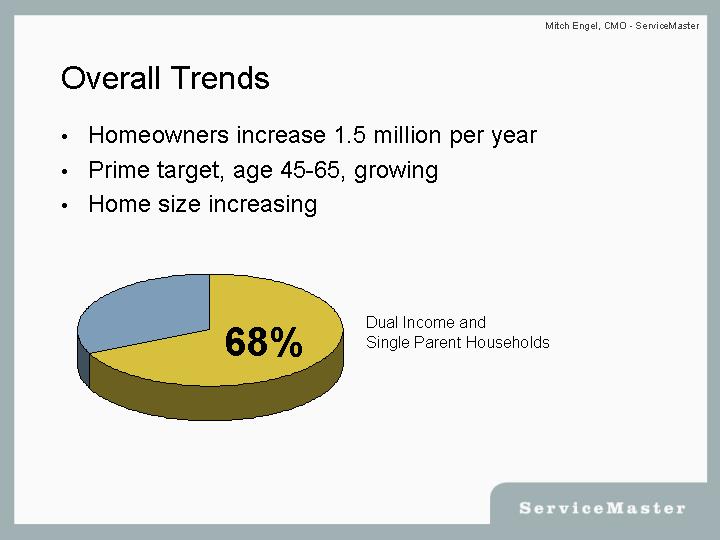

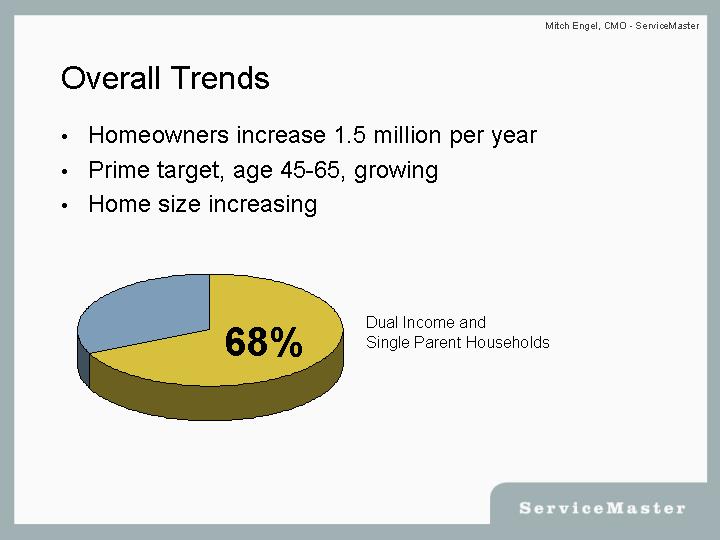

Overall Trends

• Homeowners increase 1.5 million per year

• Prime target, age 45-65, growing

• Home size increasing

[CHART] | | Dual Income and

Single Parent Households |

Service Category Growth

• Annual growth rates between 2% and 7% since 2000, except plumbing and HVAC

[GRAPHIC]

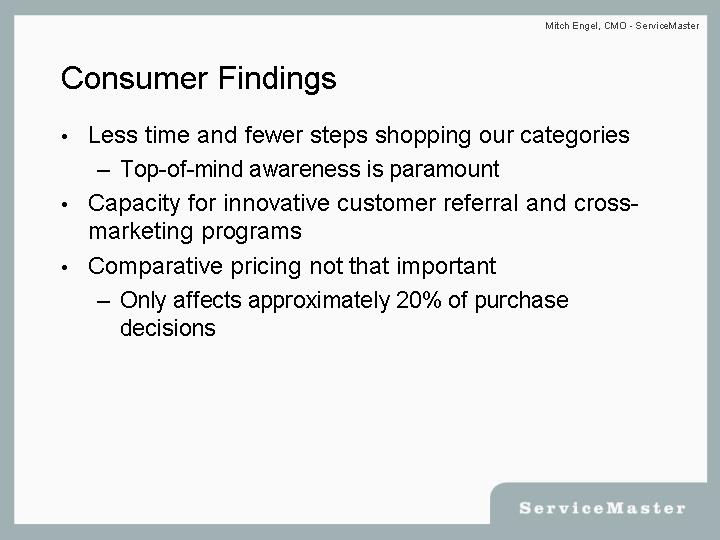

Consumer Findings

• Less time and fewer steps shopping our categories

• Top-of-mind awareness is paramount

• Capacity for innovative customer referral and cross-marketing programs

• Comparative pricing not that important

• Only affects approximately 20% of purchase decisions

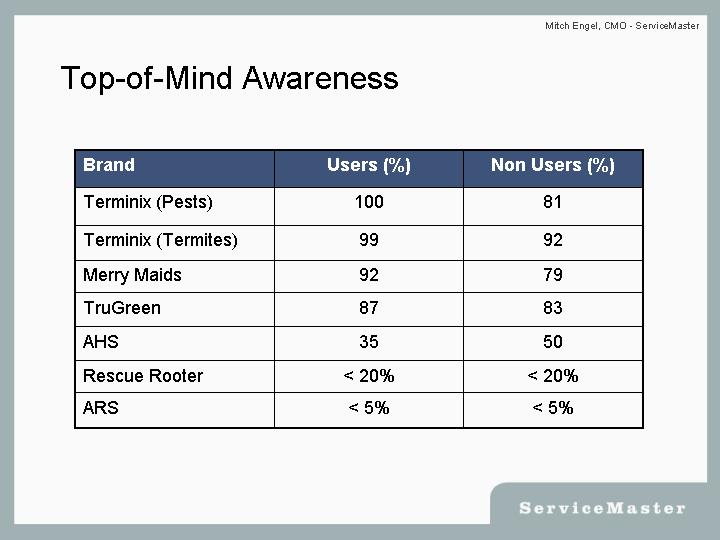

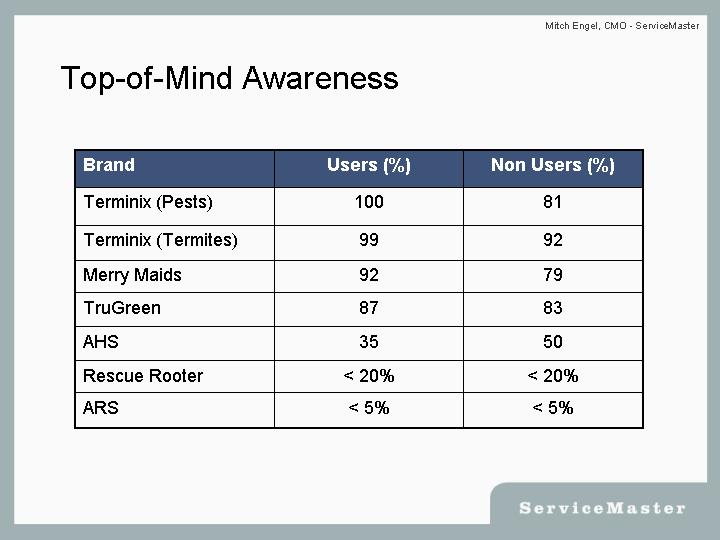

Top-of-Mind Awareness

Brand | | Users (%) | | Non Users (%) | |

| | | | | |

Terminix (Pests) | | 100 | | 81 | |

| | | | | |

Terminix (Termites) | | 99 | | 92 | |

| | | | | |

Merry Maids | | 92 | | 79 | |

| | | | | |

TruGreen | | 87 | | 83 | |

| | | | | |

AHS | | 35 | | 50 | |

| | | | | |

Rescue Rooter | | < 20% | | < 20% | |

| | | | | |

ARS | | < 5% | | < 5% | |

The ServiceMaster Identity

• Brands not differentiated, but as leaders we have the power to become distinct

• Regularly represent competitive advantage to consumers

[GRAPHIC]

Create Unique Brand

Positions and Value

Propositions

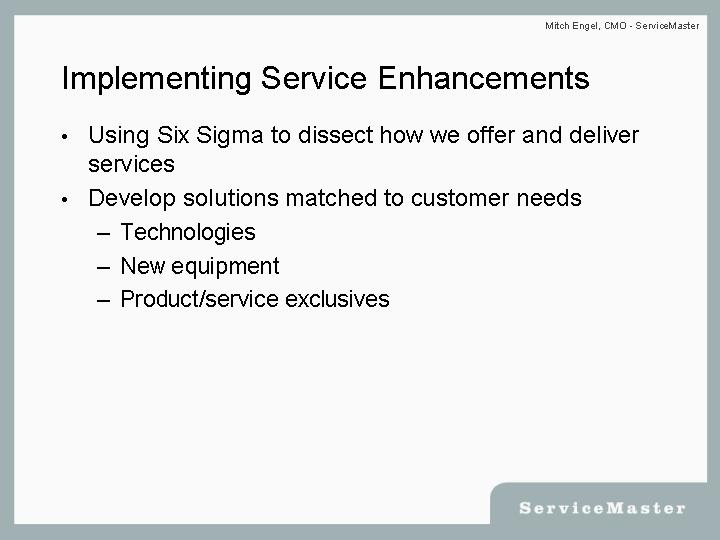

Implementing Service Enhancements

• Using Six Sigma to dissect how we offer and deliver services

• Develop solutions matched to customer needs

• Technologies

• New equipment

• Product/service exclusives

New Solutions in Recurring Service Models

• Service on the consumer’s terms

• Payment options: frequency and method of payment

• Communication options: convenient for the consumer

[LOGOS]

Setting and Meeting Expectations

• Ensure consumers can count on ServiceMaster brands to do exactly what they promise

• On time

• Do the job right the first time

• Do business on customers’ terms

• Qualified and trustworthy technicians

• Unmatched service guarantees

A Focus on Marketing

• Everyone, from the top down, is ready to “Be the Brand”

• Greater customer loyalty and retention

• Ability to pass on cost increases

• Aggressive marketing of brand differentiation and stronger referrals will enhance new customer acquisition

• Everyone, from the top down, is ready to “Be the Brand”

• Greater customer loyalty and retention

• Ability to pass on cost increases

• Aggressive marketing of brand differentiation and stronger referrals will enhance new customer acquisition

• Sustain revenue growth 2% - 5% above category growth

Ernie Mrozek, President & COO - ServiceMaster

Strong Foundation for Growth

• Experienced team

• Improved understanding of customers and competitors

• Intensified focus on brand differentiation

• Financial strength and flexibility

• Improving processes and strong cost controls

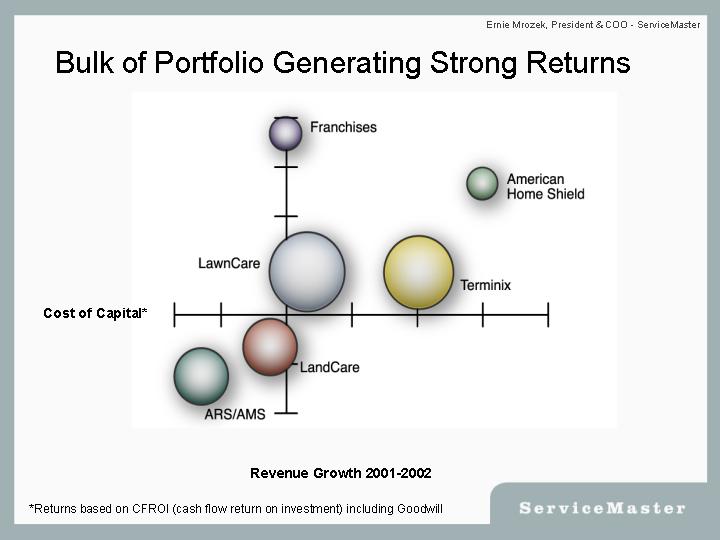

Bulk of Portfolio Generating Strong Returns

[CHART]

Revenue Growth 2001-2002

*Returns based on CFROI (cash flow return on investment) including Goodwill

Driving Revenue Growth

• Key Initiatives

• Existing customer satisfaction and retention

• Geographic expansion in under-penetrated areas

• Increased acquisitions in established businesses

• New product innovation

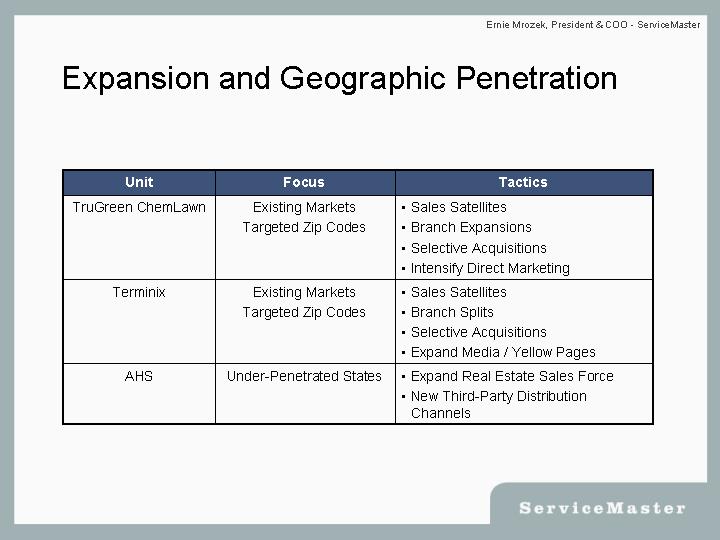

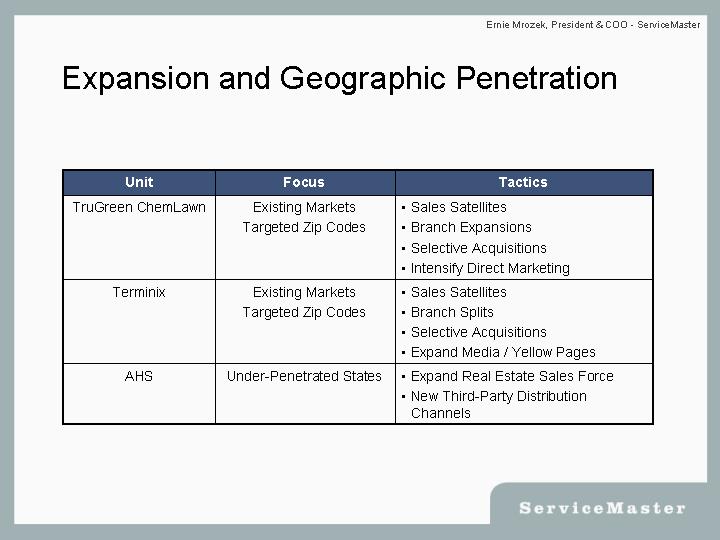

Expansion and Geographic Penetration

Unit | | Focus | | Tactics |

TruGreen ChemLawn | | Existing Markets | | • Sales Satellites |

| | Targeted Zip Codes | | • Branch Expansions |

| | | | • Selective Acquisitions |

| | | | • Intensify Direct Marketing |

| | | | |

Terminix | | Existing Markets | | • Sales Satellites |

| | Targeted Zip Codes | | • Branch Splits |

| | | | • Selective Acquisitions |

| | | | • Expand Media / Yellow Pages |

| | | | |

AHS | | Under-Penetrated States | | • Expand Real Estate Sales Force |

| | | | • New Third-Party Distribution Channels |

Driving Revenue Growth

• Key initiatives

• Existing customer satisfaction and retention

• Geographic expansion in under-penetrated areas

• Increased acquisitions in established businesses

• New product innovation

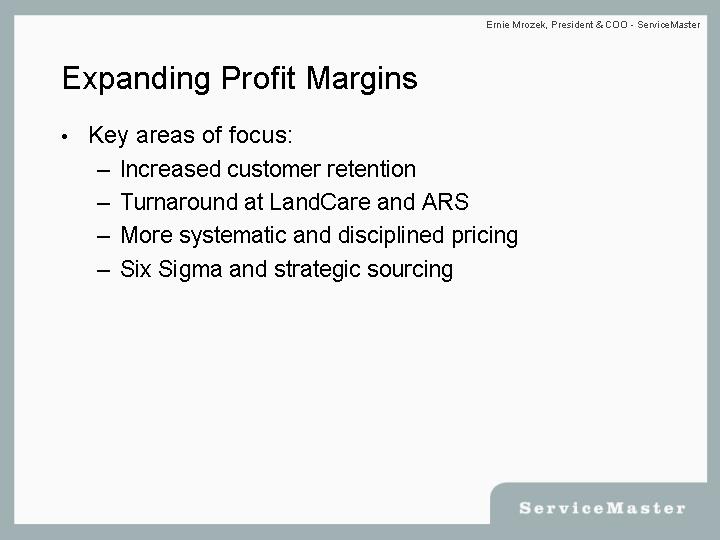

Expanding Profit Margins

• Key areas of focus:

• Increased customer retention

• Turnaround at LandCare and ARS

• More systematic and disciplined pricing

• Six Sigma and strategic sourcing

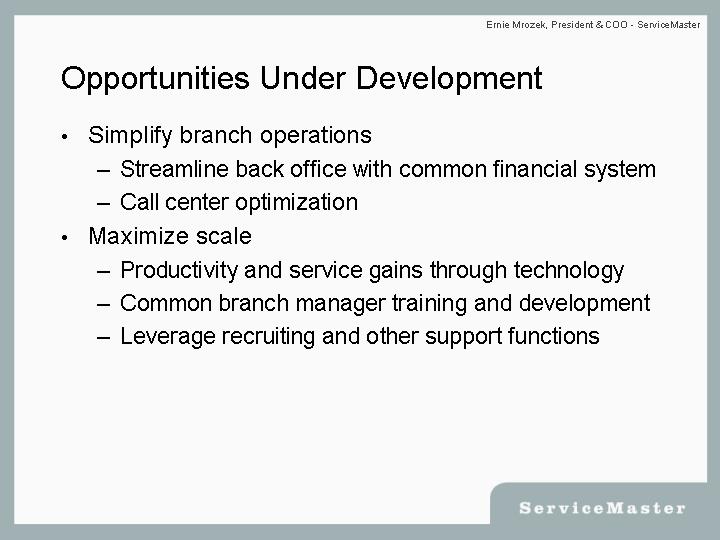

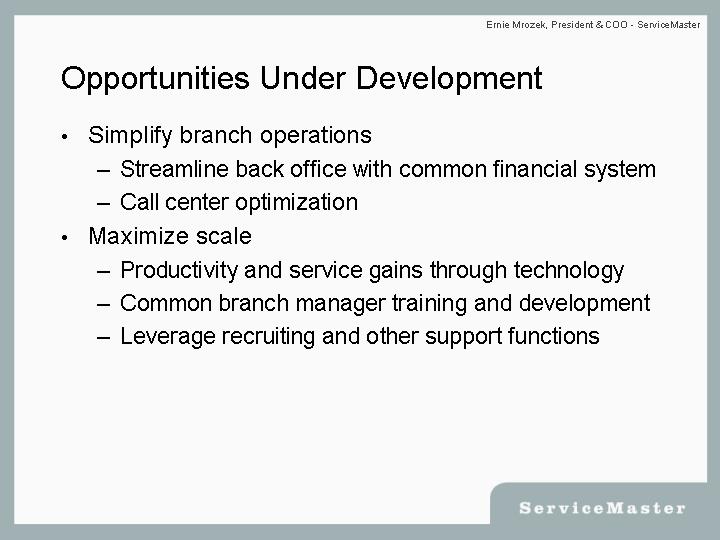

Opportunities Under Development

• Simplify branch operations

• Streamline back office with common financial system

• Call center optimization

• Maximize scale

• Productivity and service gains through technology

• Common branch manager training and development

• Leverage recruiting and other support functions

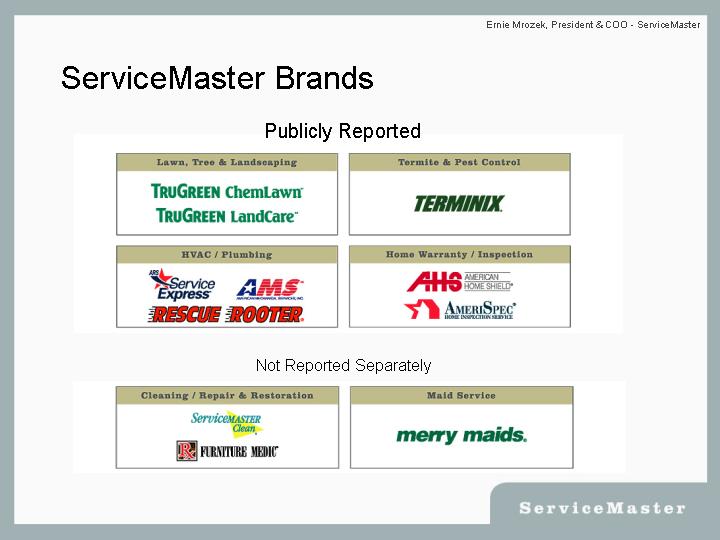

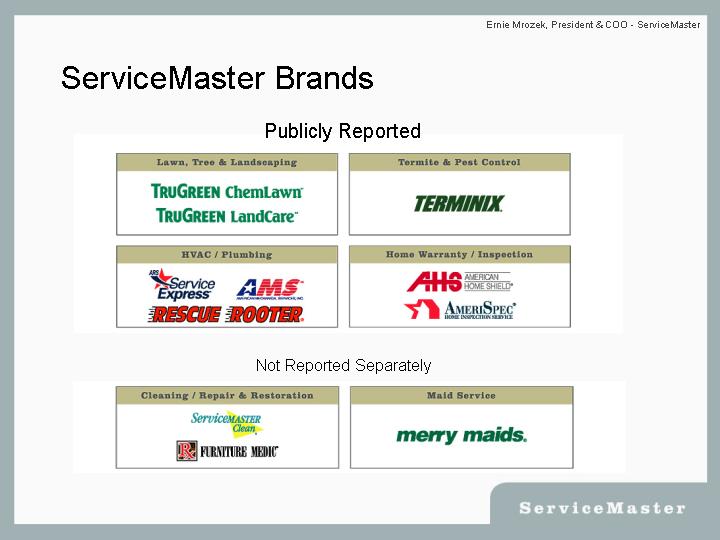

ServiceMaster Brands

Publicly Reported

[LOGOS]

Not Reported Separately

[LOGOS]

Company | | 2002 Locations/

Customer Level Revenue | | Company Overview |

[LOGO] | | 15 U.S. | | • HVAC and electrical services to large commercial customers |

| | $194 million | | • Both construction/retrofit (bid and build), repair and maintenance services |

| | | | |

[LOGO] | | 2,983 U.S | | • Industry leader in disaster restoration (DR) |

| | $762 million | | • Janitorial services, carpet and upholstery cleaning |

| | | | |

[LOGO] | | 812 U.S. | | • Industry leader in residential maid service |

| | $244 million | | • Primarily franchised; expanding branch base |

| | | | |

[LOGO] | | 226 U.S. | | • Industry leader in home inspections |

| | $38 million | | • Strategic fit with AHS |

| | | | |

[LOGO] | | 462 U.S. | | • Industry leader in on-site furniture repair |

| | $28 million | | • Strategic fit with disaster restoration |

Steve Preston, Executive Vice President & CFO - ServiceMaster

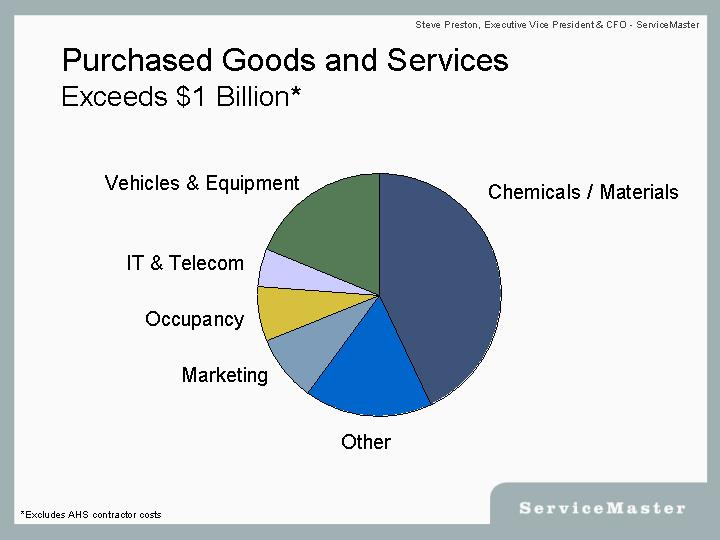

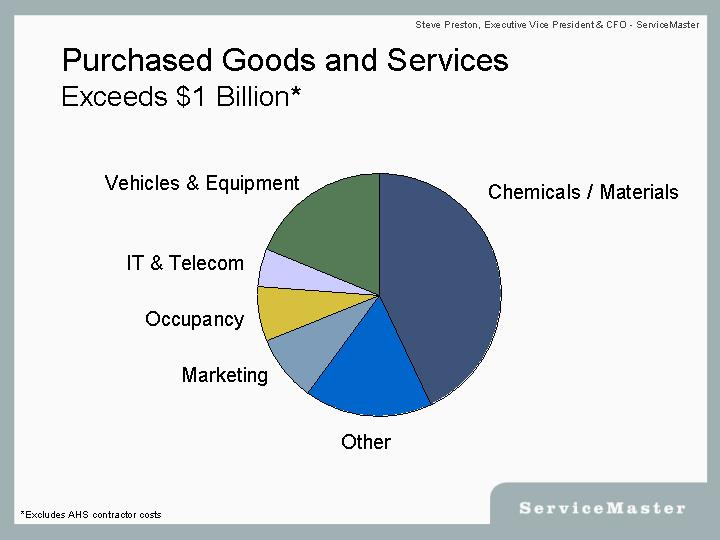

ServiceMaster Cost Structure Exceeds $3.3 Billion

[CHART]

Purchased Goods and Services

Exceeds $1 Billion*

[CHART]

*Excludes AHS contractor costs

Production Majority of $1.55 Billion Labor Spend

[CHART]

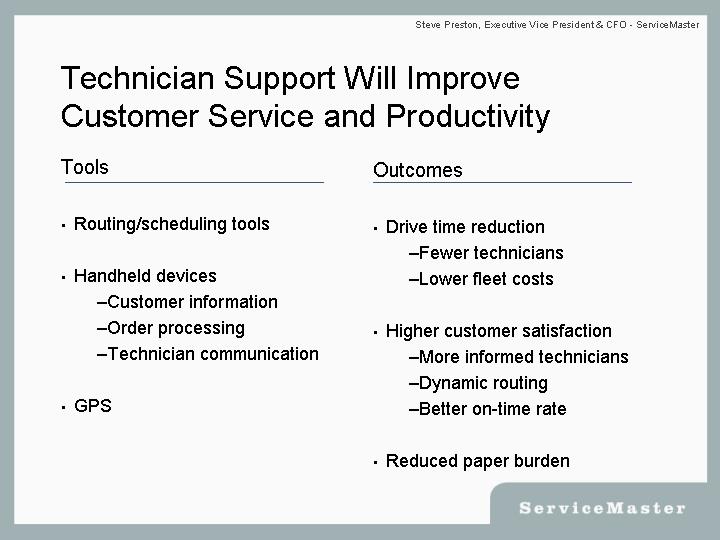

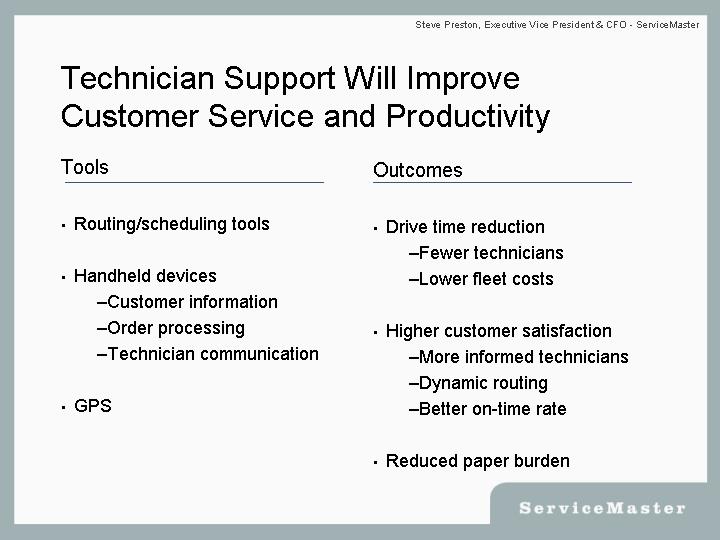

Technician Support Will Improve Customer Service and Productivity

Tools

• Routing/scheduling tools

• Handheld devices

• Customer information

• Order processing

• Technician communication

• GPS

Outcomes

• Drive time reduction

• Fewer technicians

• Lower fleet costs

• Higher customer satisfaction

• More informed technicians

• Dynamic routing

• Better on-time rate

• Reduced paper burden

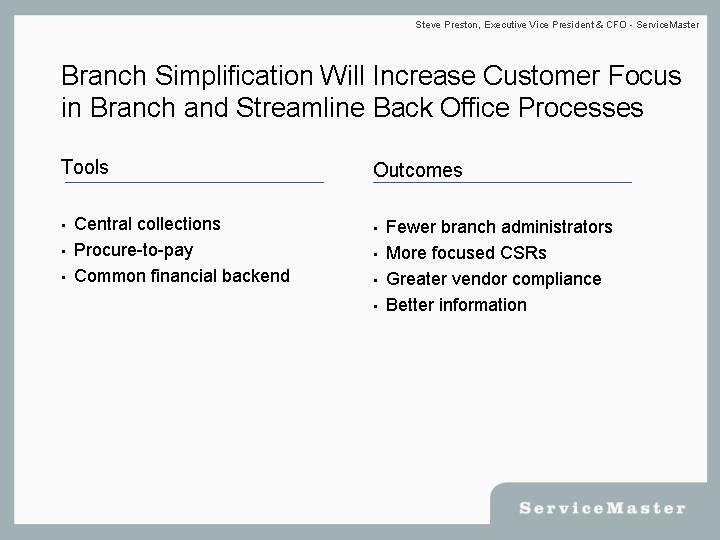

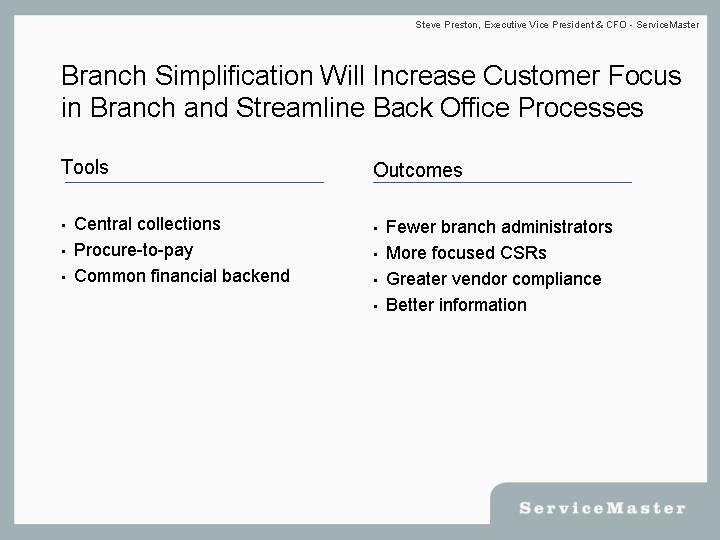

Branch Simplification Will Increase Customer Focus in Branch and Streamline Back Office Processes

Tools

• Central collections

• Procure-to-pay

• Common financial backend

Outcomes

• Fewer branch administrators

• More focused CSRs

• Greater vendor compliance

• Better information

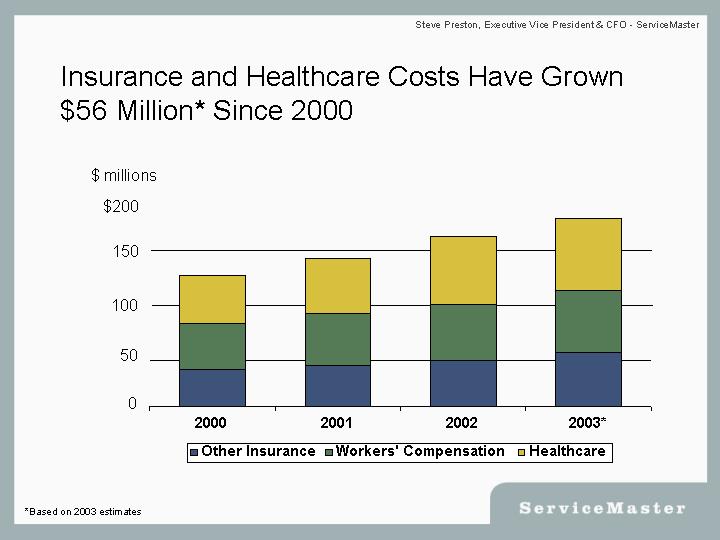

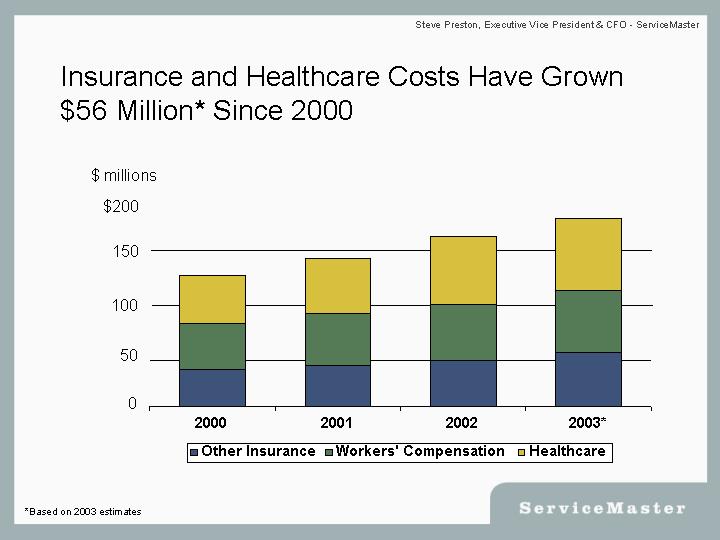

Insurance and Healthcare Costs Have Grown $56 Million* Since 2000

[CHART]

*Based on 2003 estimates

How Significant Could the Impact Be*?

| | Change | | $ Millions | | EPS Impact | |

Tech Productivity | | 5% | | $ 45 | | $ 0.09 | |

| | | | | | | |

Strategic Sourcing | | 3% | | $ 30 | | $ 0.06 | |

| | | | | | | |

Branch Simplification | | 1 FTE /

TG/TMX Br. | | $ 15 | | $ 0.03 | |

| | | | | | | |

Insurance / Healthcare | | 10% | | $ 17 | | $ 0.03 | |

| | | | | | | |

Pricing | | 1% | | $ 36 | | $ 0.07 | |

*Figures are hypothetical

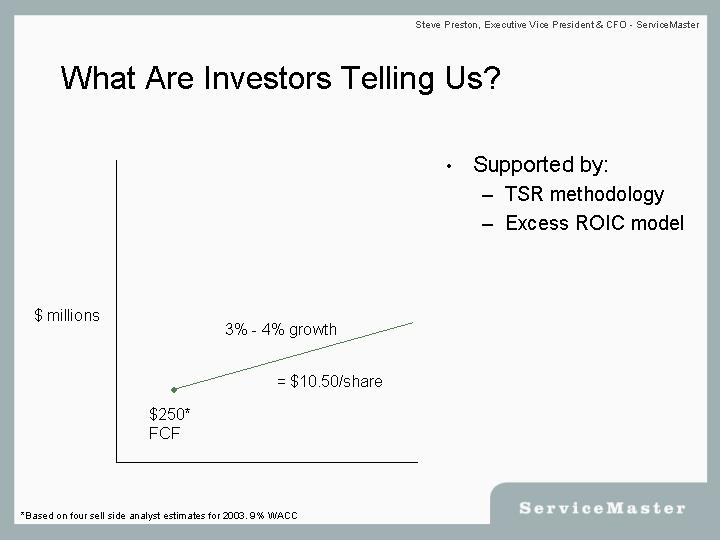

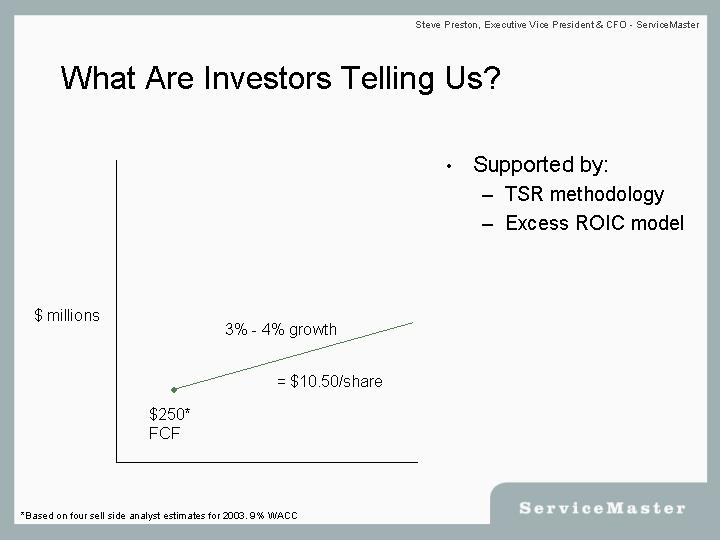

What Are Investors Telling Us?

• Supported by:

• TSR methodology

• Excess ROIC model

[CHART]

*Based on four sell side analyst estimates for 2003. 9% WACC

3 - 5 Year Growth Targets Support Double Digit EPS Growth

Business | | Revenue

(% Growth Rate) | | Change in Operating Margins |

TruGreen ChemLawn | | Mid-single | | Consistent in '04; 20-50 bps thereafter |

| | | | |

TruGreen LandCare | | Mid-single in '04; low-double thereafter | | 100 bps per year |

| | | | |

Terminix | | Mid-single | | Consistent in '04; 20-50 bps thereafter |

| | | | |

AHS | | Low-double | | Maintain at current levels |

| | | | |

ARS | | Flat in '04; mid-single thereafter | | 100-200 bps per year |

| | | | |

ServiceMaster Clean / Merry Maids | | Strong-single | | Maintain at current levels |

Driving Coordinated Execution

[CHART]

Scott Cromie, President - AHS

Overview and Operating Income

[CHART]

• Risk management and convenience tool for homeowners

• Risk management and selling tool for Realtors

• Only part of 1 in 4 real estate transactions

• Profits grown at compound rate of 30% annually for the past decade

• Revenue compound annual growth rate at 19% for past decade

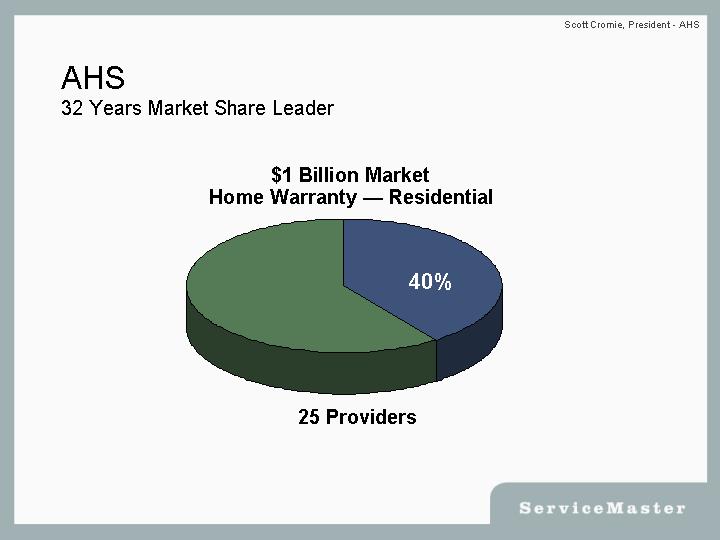

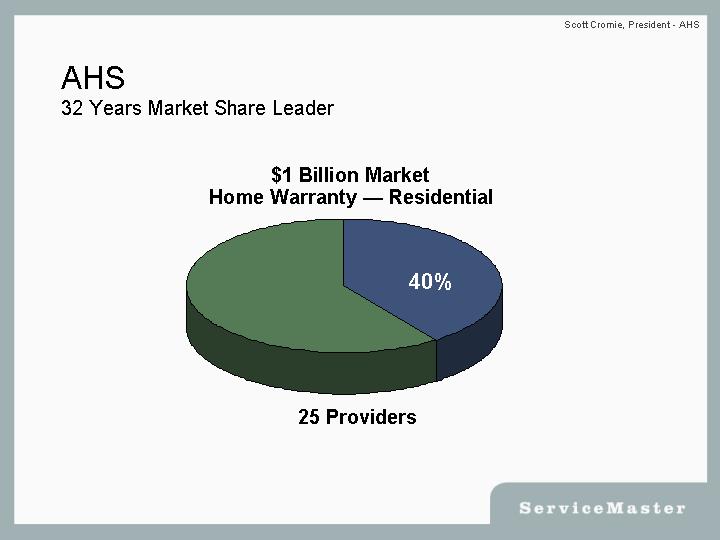

AHS

32 Years Market Share Leader

[CHART]

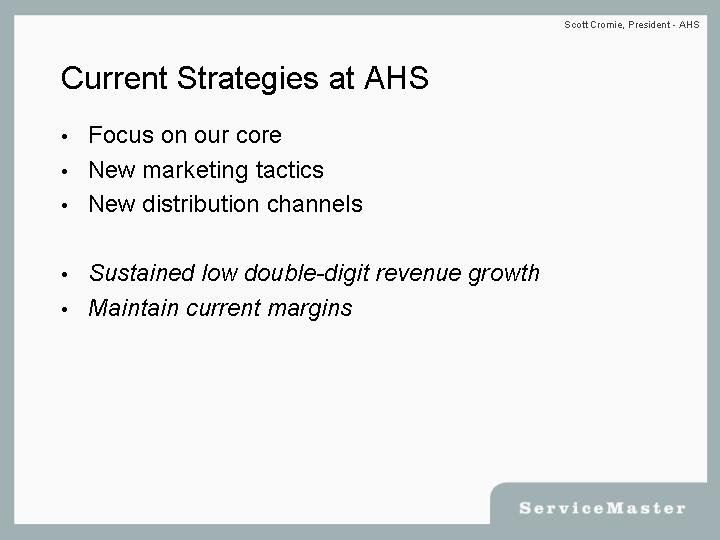

Current Strategies at AHS

• Focus on our core

• New marketing tactics

• New distribution channels

• Sustained low double-digit revenue growth

• Maintain current margins

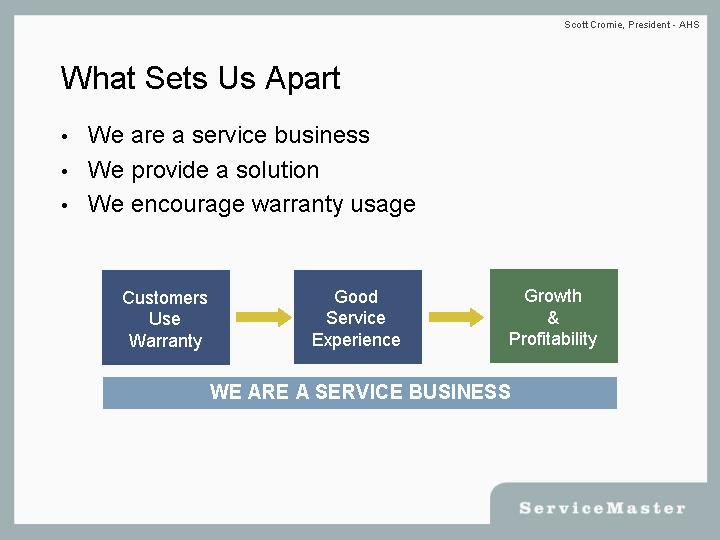

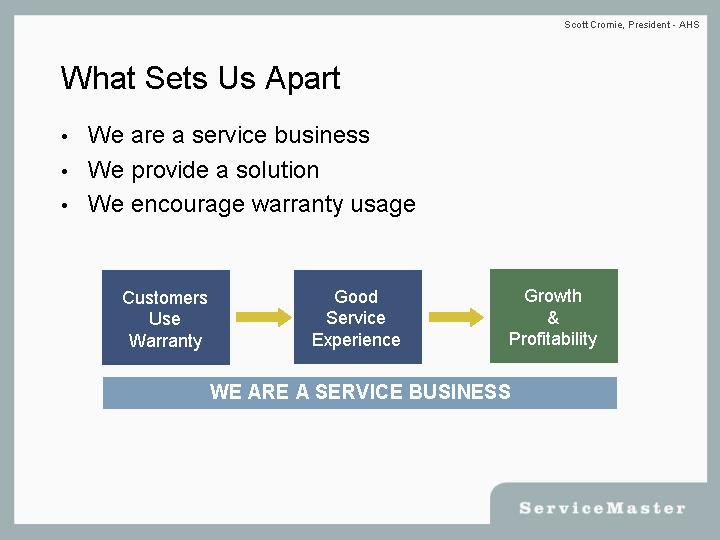

What Sets Us Apart

• We are a service business

• We provide a solution

• We encourage warranty usage

Customers

Use

Warranty | => | Good

Service

Experience | => | Growth

&

Profitability |

WE ARE A SERVICE BUSINESS

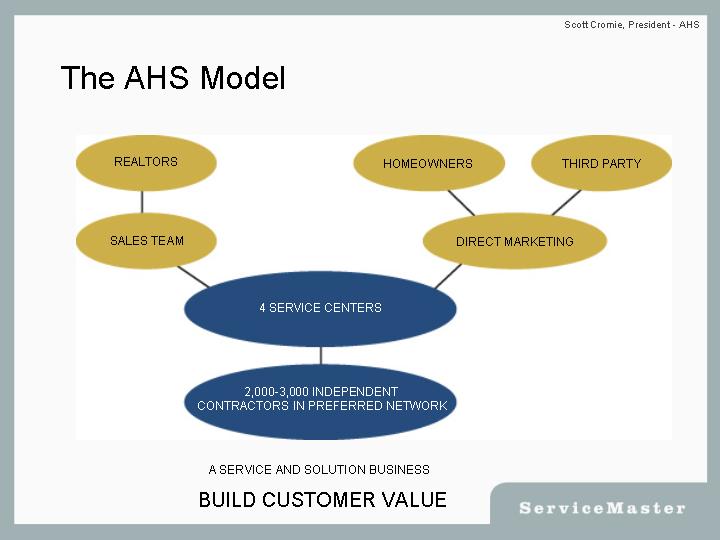

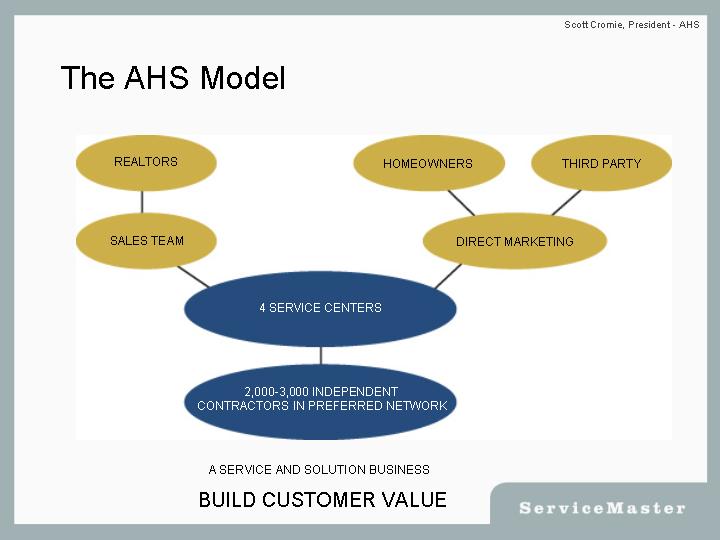

The AHS Model

[CHART]

A SERVICE AND SOLUTION BUSINESS

BUILD CUSTOMER VALUE

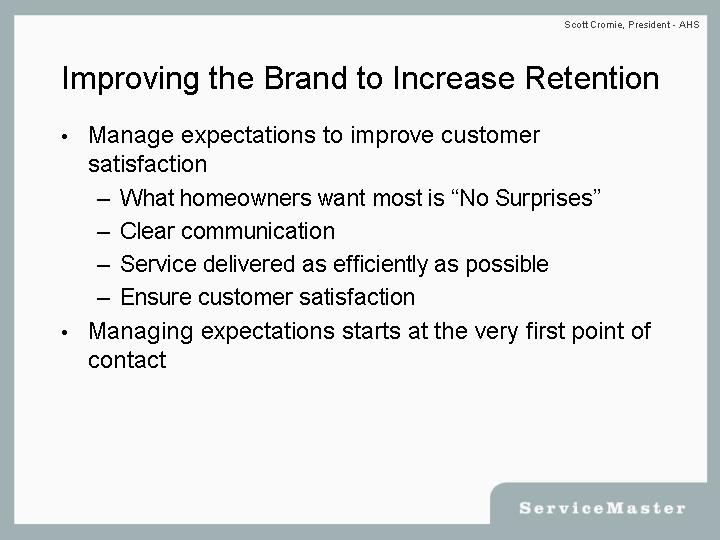

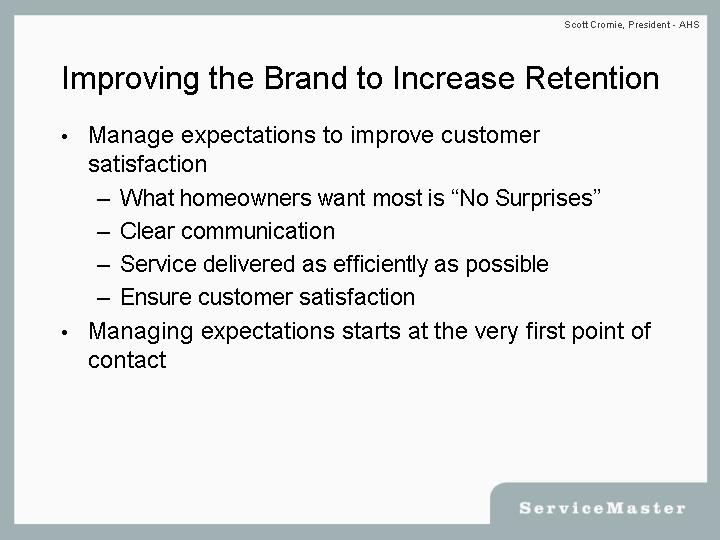

Improving the Brand to Increase Retention

• Manage expectations to improve customer satisfaction

• What homeowners want most is “No Surprises”

• Clear communication

• Service delivered as efficiently as possible

• Ensure customer satisfaction

• Managing expectations starts at the very first point of contact

Improving Service to Increase Retention

• Greater authority to customer service representatives

• New ways to handle service denials

• Changes are small, but combined help us reach goal of 10% - 15% customer retention improvement

[GRAPHIC]

Accelerating Growth With Initial Sale

• Accelerating growth rate

• Real Estate offers opportunity - 75% don’t include a home warranty today

• Continue building strong relationships with top players

• Expand metro market strategy

• Potential new tools

• Increase account executives

• Dedicated sales management

• Public relations and general advertising

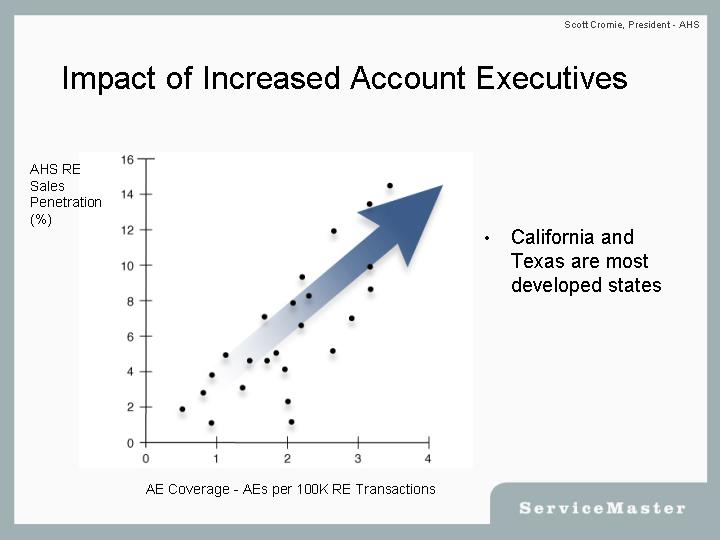

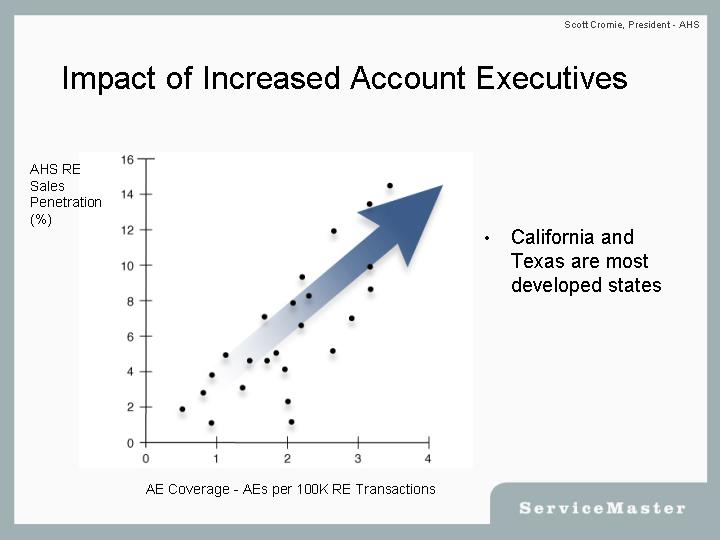

Impact of Increased Account Executives

[CHART]

• California and Texas are most developed states

More Avenues for Growth

• Direct-to-consumer sales

• Expand existing and new mortgage relationships

• Farmers Insurance Group - 13,000 agents

• Additional insurance companies, mortgage companies, banks and firms with homeowner relationships

[GRAPHIC]

Insurance

[GRAPHIC]

Mortgage

[GRAPHIC]

Bank

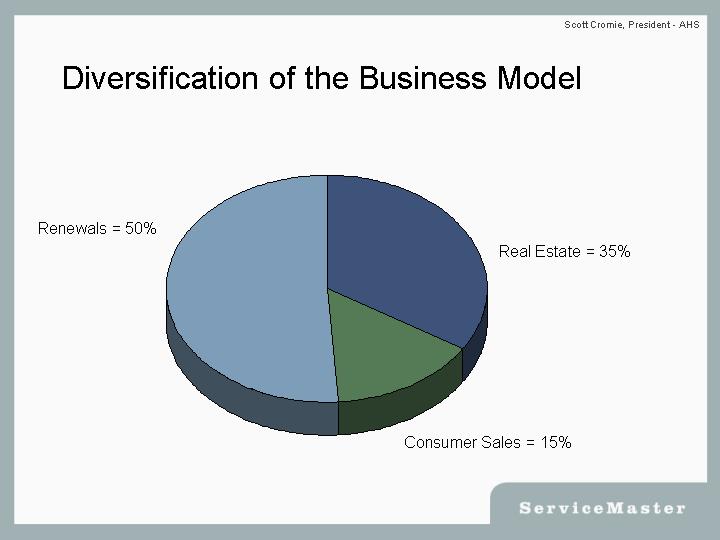

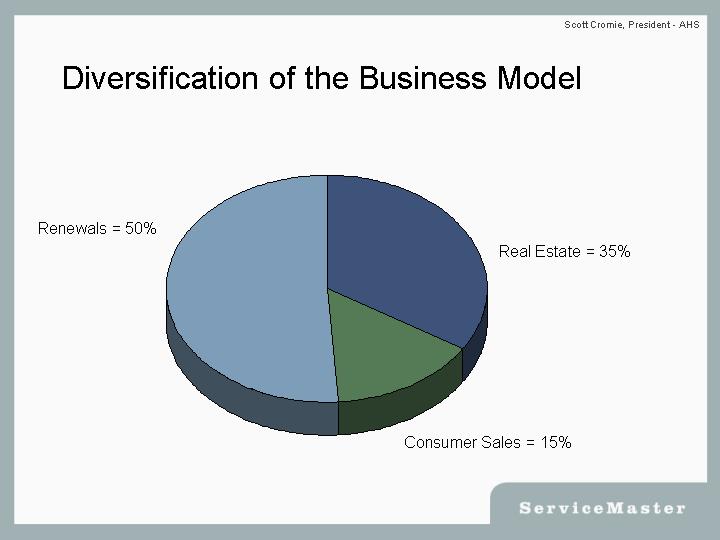

Diversification of the Business Model

[CHART]

AHS is Going Strong

• Gaining and using customer data

• Growth in traditional and new channels

• Experienced leaders

[GRAPHIC]

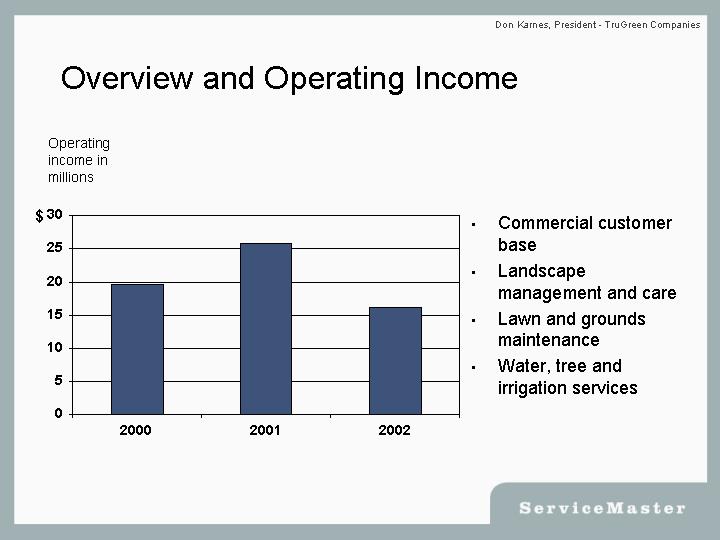

Don Karnes, President - TruGreen Companies

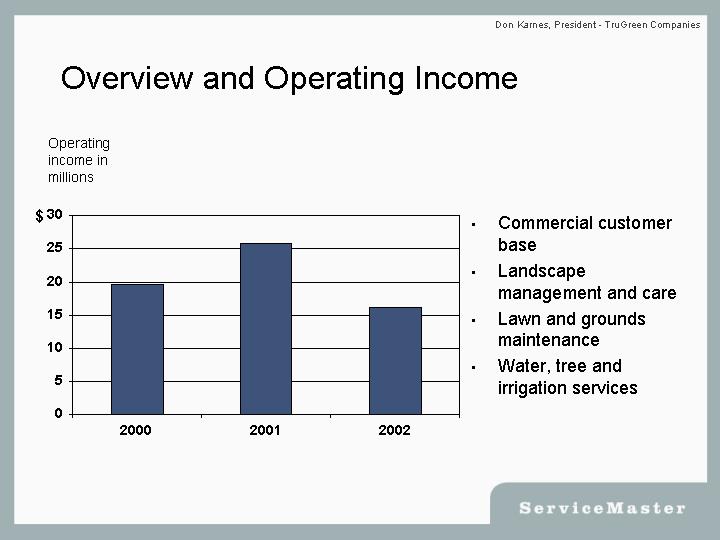

Overview and Operating Income

[CHART]

• Commercial customer base

• Landscape management and care

• Lawn and grounds maintenance

• Water, tree and irrigation services

Current Strategies at LandCare

• Increase operating margins

• Drive maintenance sales

• Grow enhancements

• Raise retention

• Mid single-digit revenue growth in '04; growing to low double-digit revenue growth after '04

• Margin improvement of at least 100 basis points a year

Job One is Margin Improvement

• Brickman is achieving mid-teen growth and gross margins of 32.4%

• Our stronger branches are generally in line with Brickman

• Exited utility line clearing business

[GRAPHIC]

Enhancement Business

• Services beyond lawn mowing - color changes, mulching, landscape tune-up, etc.

• Historically 1/3 of revenue

• Enhancement dropped 7%

• Margins are 10 percentage points higher than recurring maintenance

[GRAPHIC]

Consistent Execution

• New president of TruGreen LandCare, Bob Fates

• Focus on replication

• Replicate best practices of top 1/3 branches in remaining 2/3

[GRAPHIC]

Find out what works and repeat it

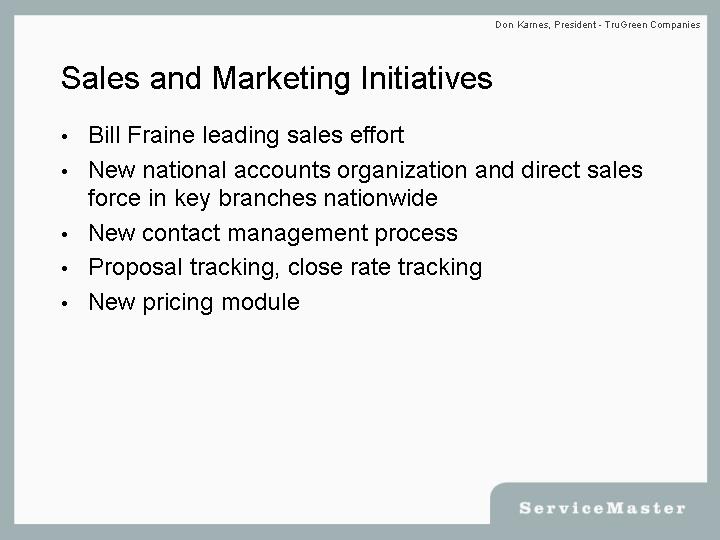

Sales and Marketing Initiatives

• Bill Fraine leading sales effort

• New national accounts organization and direct sales force in key branches nationwide

• New contact management process

• Proposal tracking, close rate tracking

• New pricing module

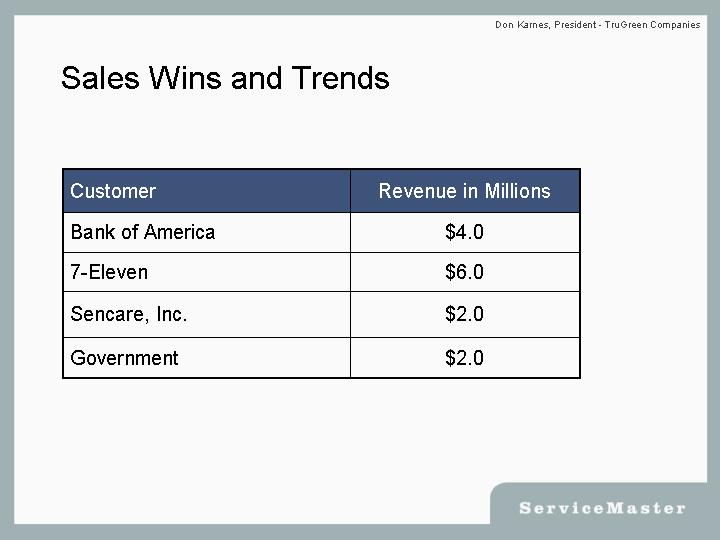

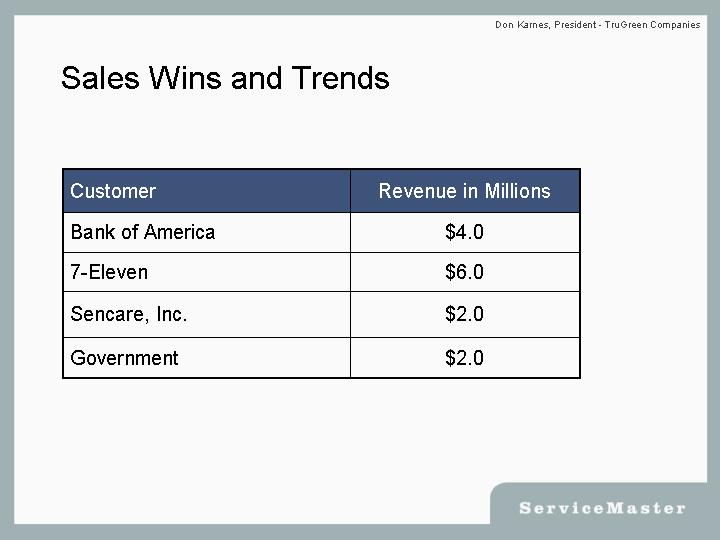

Sales Wins and Trends

Customer | | Revenue in Millions | |

Bank of America | | $ | 4.0 | |

7-Eleven | | $ | 6.0 | |

Sencare, Inc. | | $ | 2.0 | |

Government | | $ | 2.0 | |

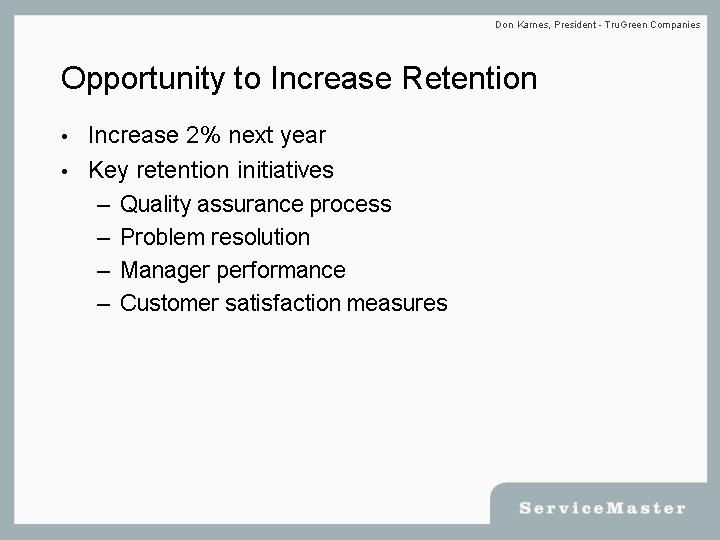

Opportunity to Increase Retention

• Increase 2% next year

• Key retention initiatives

• Quality assurance process

• Problem resolution

• Manager performance

• Customer satisfaction measures

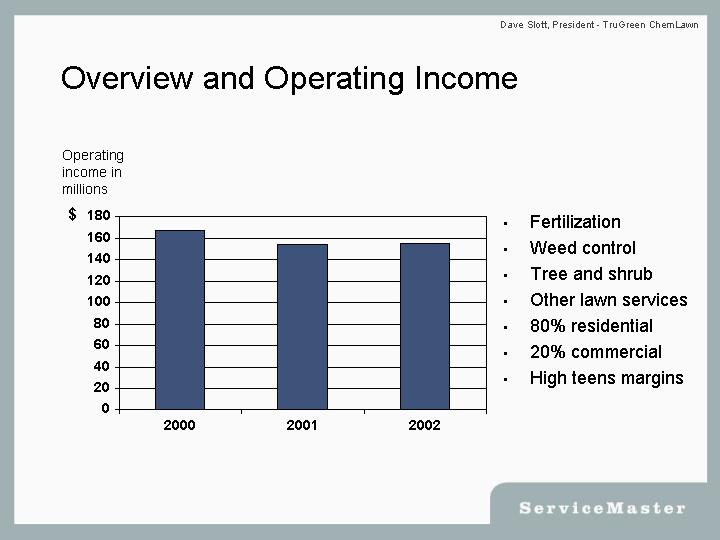

Dave Slott, President - TruGreen ChemLawn

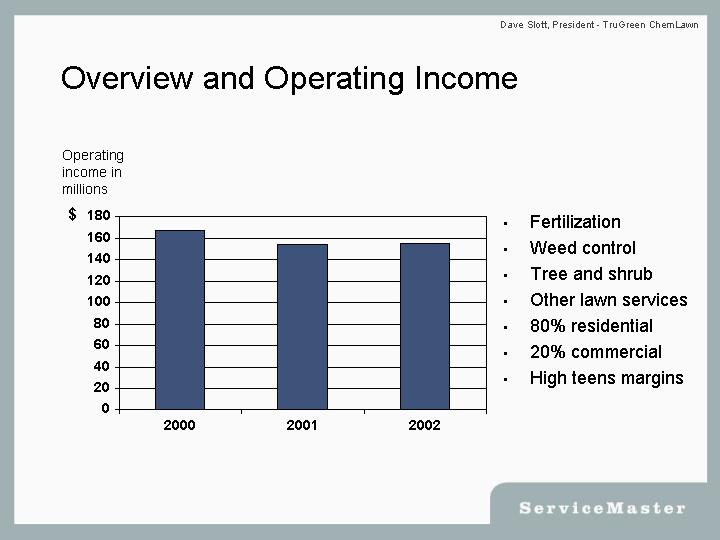

Overview and Operating Income

[CHART]

• Fertilization

• Weed control

• Tree and shrub

• Other lawn services

• 80% residential

• 20% commercial

• High teens margins

Current Strategies at TruGreen ChemLawn

• “Do Not Call” strategy

• Customer retention

• Geographic penetration

• Price realization

• Customer value proposition

• Tuck-in acquisitions

• Mid single-digit revenue growth

• Consistent margins in '04; 20-50 basis point annual improvement after '04

Reasons for Success

• Leading brand

• Effective processes

• Profitable route density

• Broadest geographic footprint

• Experienced management team

[GRAPHIC]

Experience With State “Do Not Call” Lists

• Highly regulated states have served as test markets

• The national “DNC” list will take away about 10 million names

• Already moved non-telemarketing sales from about 5% to about 20%

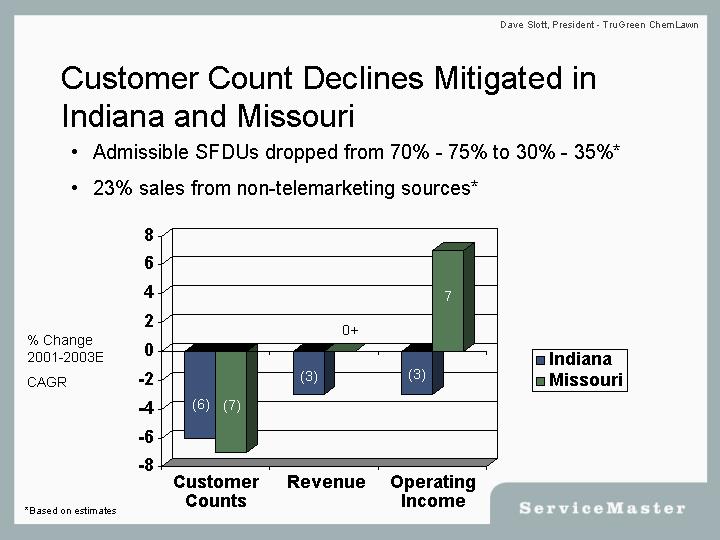

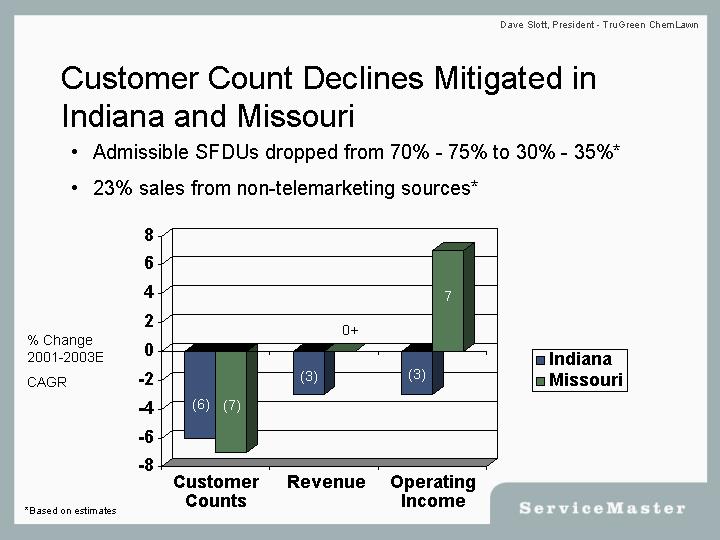

Customer Count Declines Mitigated in Indiana and Missouri

• Admissible SFDUs dropped from 70% - 75% to 30% - 35%*

• 23% sales from non-telemarketing sources*

[CHART]

*Based on estimates

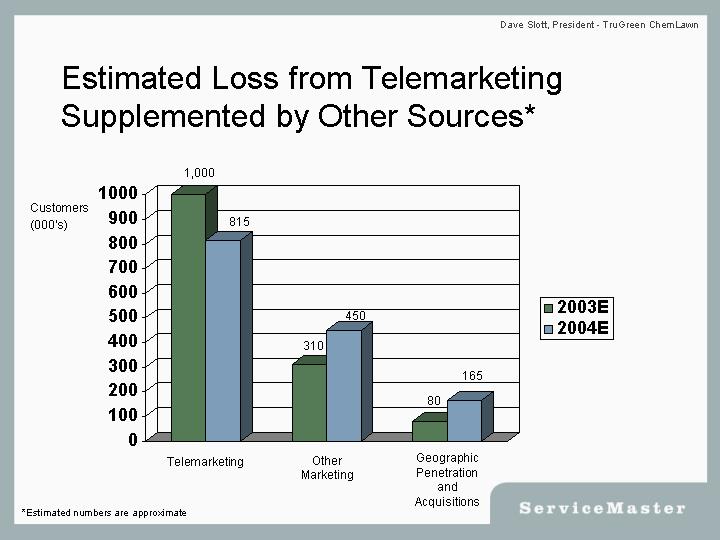

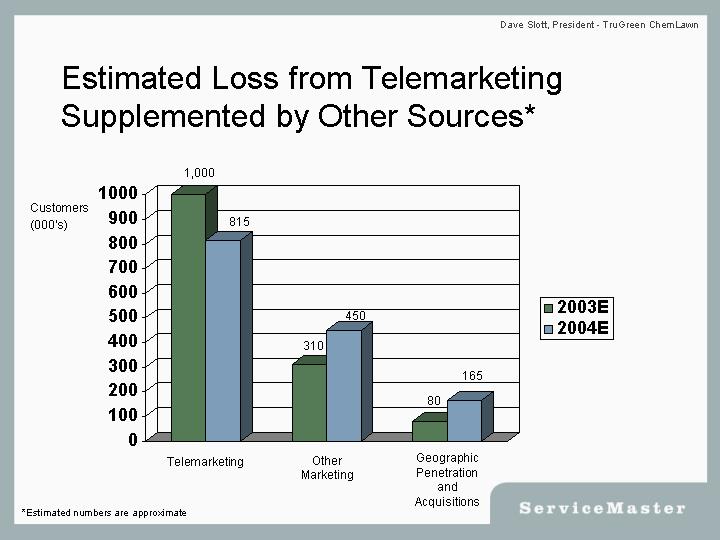

Estimated Loss from Telemarketing Supplemented by Other Sources*

[CHART]

*Estimated numbers are approximate

TruGreen Pathway to 4%* Customer Growth

[CHART]

*Estimated numbers are approximate

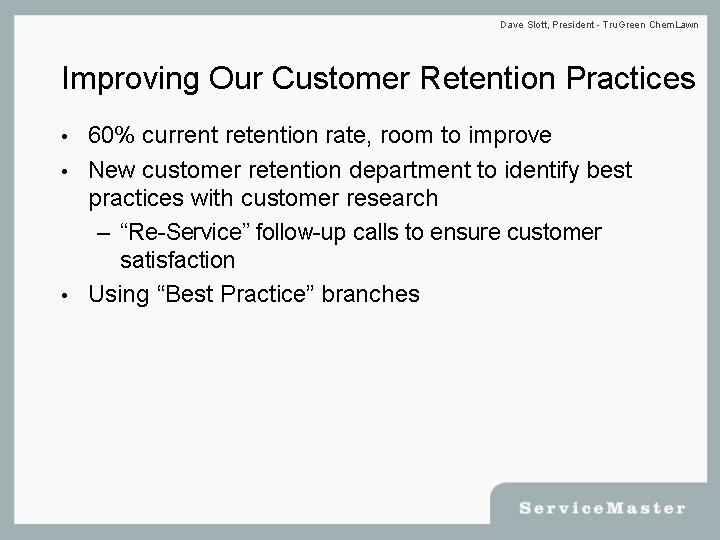

Improving Our Customer Retention Practices

• 60% current retention rate, room to improve

• New customer retention department to identify best practices with customer research

• “Re-Service” follow-up calls to ensure customer satisfaction

• Using “Best Practice” branches

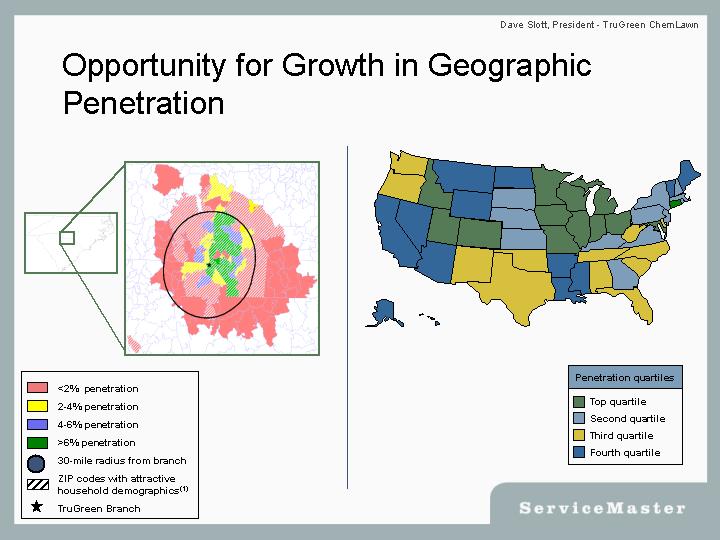

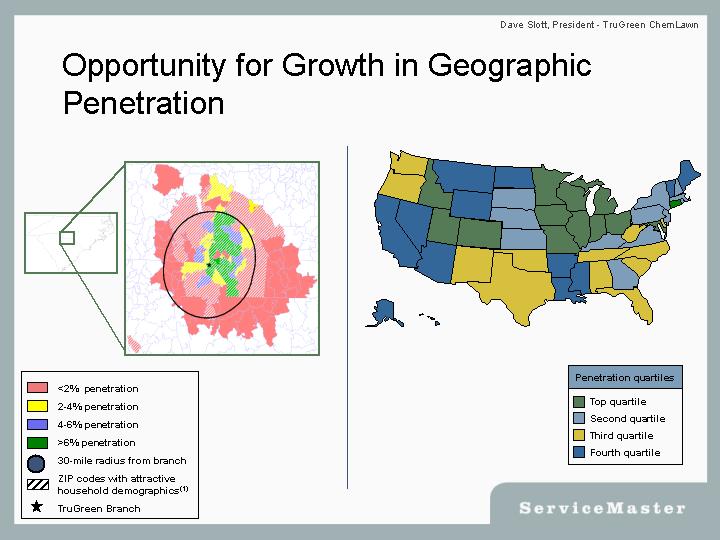

Opportunity for Growth in Geographic Penetration

[GRAPHIC]

Markets Targeted for Expansion '04- '08*

• 286 branches currently in place

[CHART]

* Preliminary multi-year plan

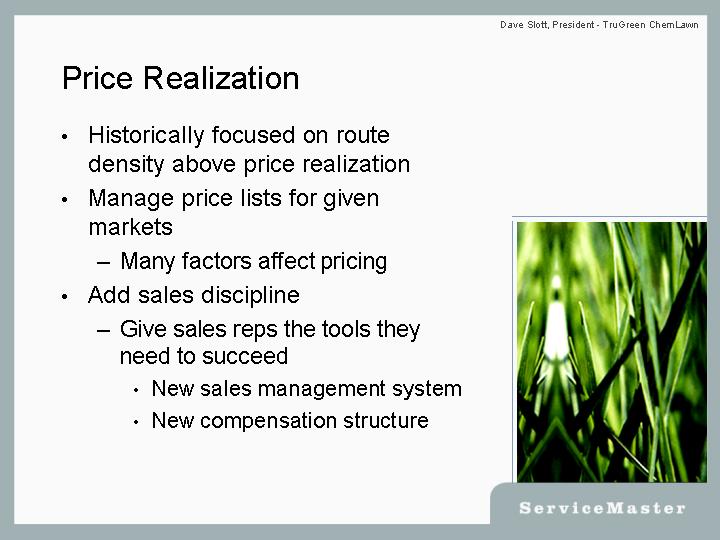

Price Realization

• Historically focused on route density above price realization

• Manage price lists for given markets

• Many factors affect pricing

• Add sales discipline

• Give sales reps the tools they need to succeed

• New sales management system

• New compensation structure

[GRAPHIC]

An Effective Brand Value Proposition Will Yield Results

1. Visible results

2. Service excellence

3. Customer choice

4. Solid guarantee

[GRAPHIC]

Tuck-In Acquisitions Will Continue

• High returns based on overhead elimination and route density

• Disciplined internal process, screening candidates

• Experienced integrators through network

• Fragmented market

• Ongoing opportunity for incremental growth

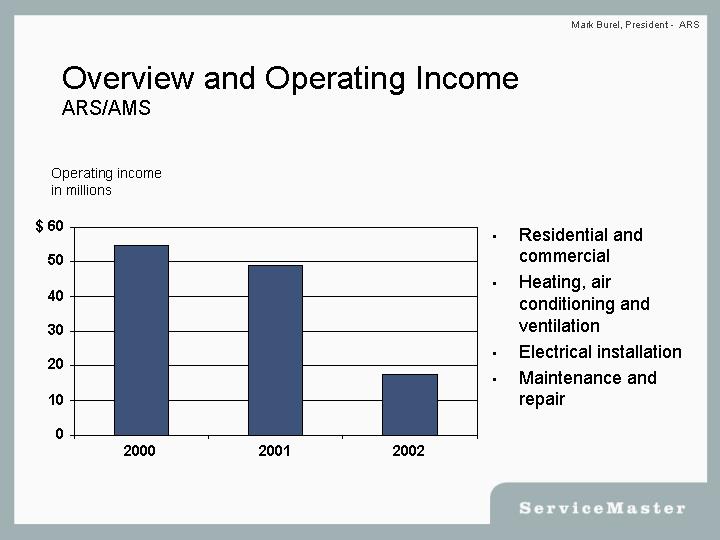

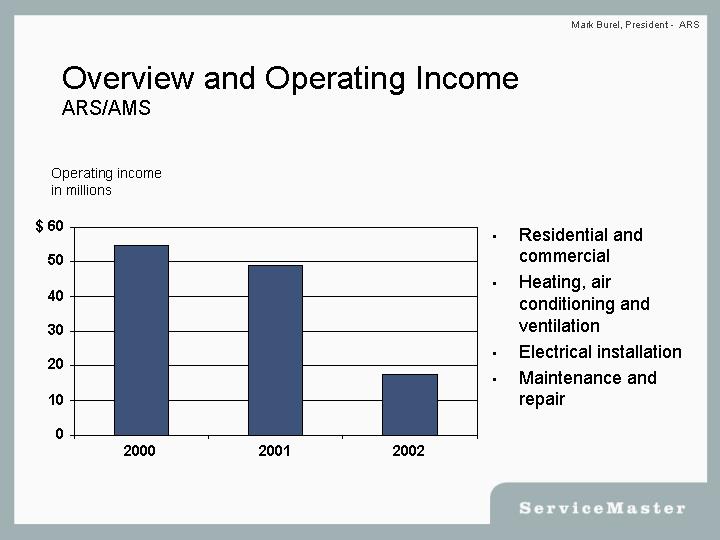

Mark Burel, President - ARS

Overview and Operating Income

ARS/AMS

[CHART]

• Residential and commercial

• Heating, air conditioning and ventilation

• Electrical installation

• Maintenance and repair

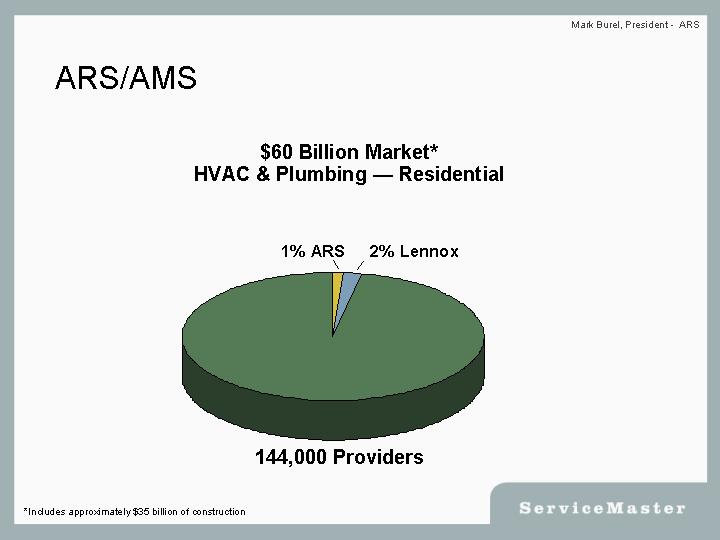

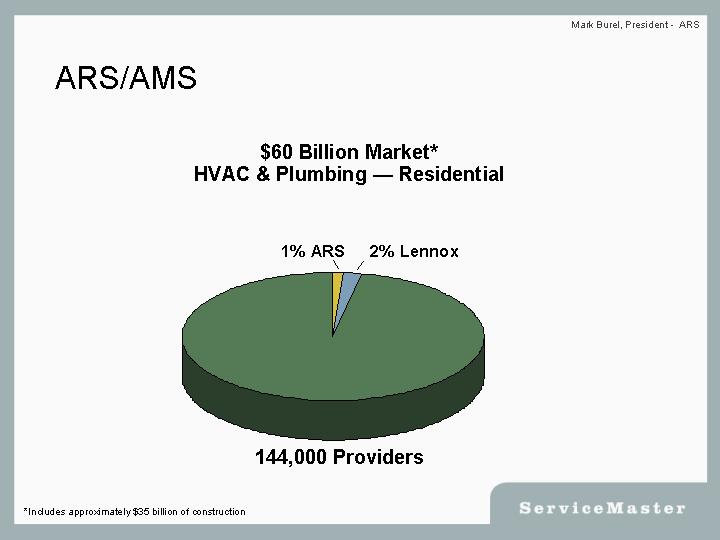

ARS/AMS

$60 Billion Market*

HVAC & Plumbing — Residential

[CHART]

144,000 Providers

*Includes approximately $35 billion of construction

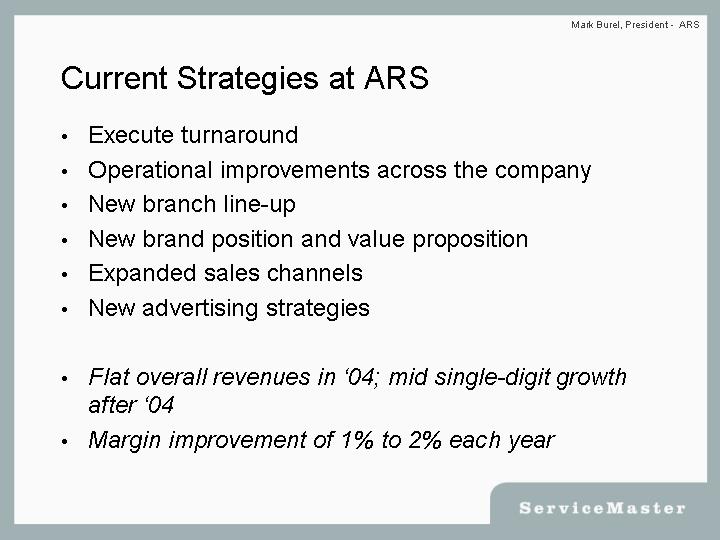

Current Strategies at ARS

• Execute turnaround

• Operational improvements across the company

• New branch line-up

• New brand position and value proposition

• Expanded sales channels

• New advertising strategies

• Flat overall revenues in '04; mid single-digit growth after '04

• Margin improvement of 1% to 2% each year

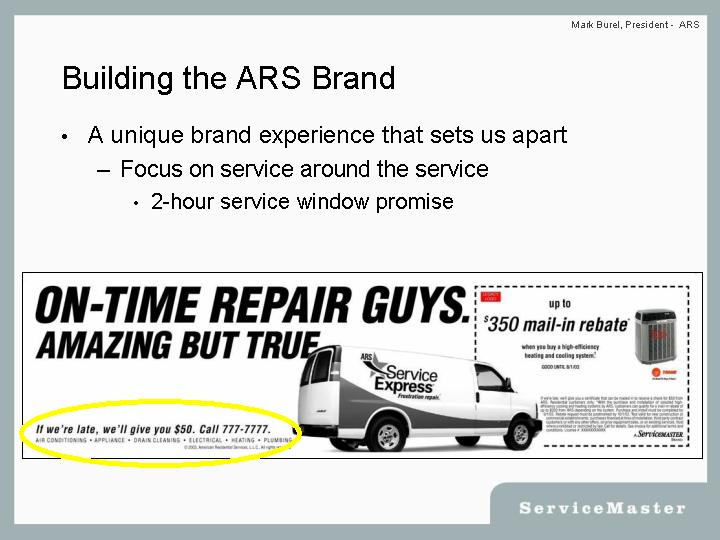

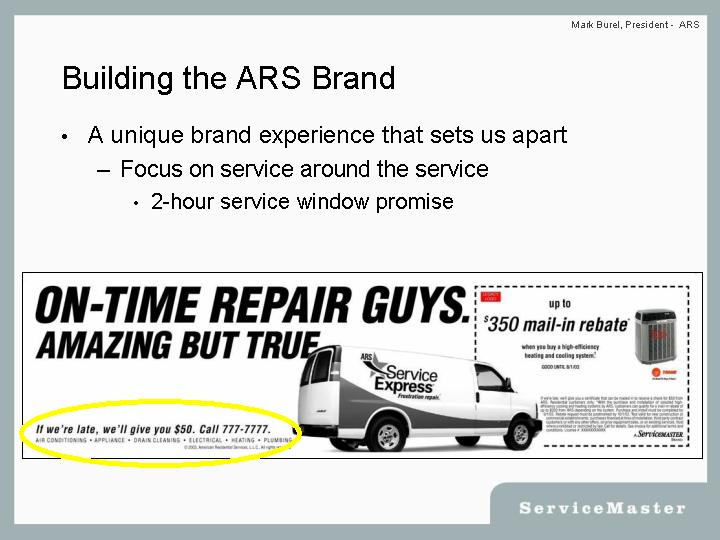

Building the ARS Brand

• A unique brand experience that sets us apart

• Focus on service around the service

• 2-hour service window promise

[GRAPHIC]

John Biedry, Sr. VP Continuous Improvement & Six Sigma - ServiceMaster

Bridging Knowledge and Performance

• Six Sigma works

• Accretive in year two

• Using Six Sigma strategically

• Tackle what matters most

• Using Six Sigma to enable the brand

• New project selection process

• Identify the projects that will differentiate our brands

[GRAPHIC]

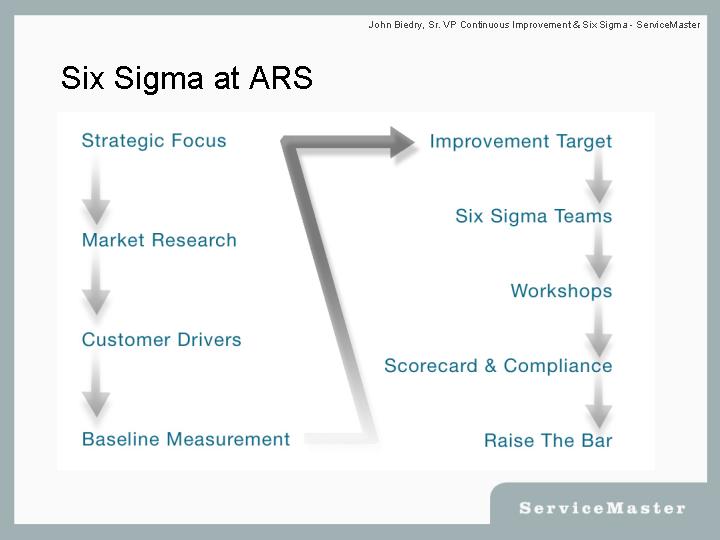

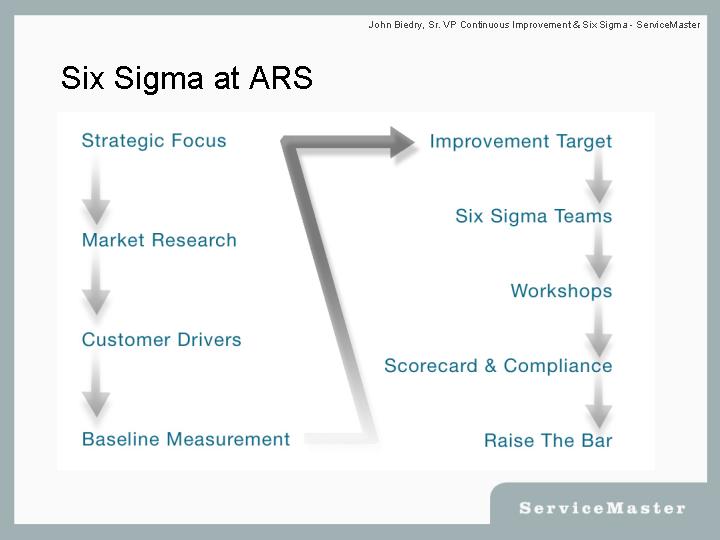

Six Sigma at ARS

Strategic Focus

Market Research

Customer Drivers

Baseline Measurement

Improvement Target

Six Sigma Teams

Workshops

Scorecard & Compliance

Raise The Bar

Mark Burel, President - ARS

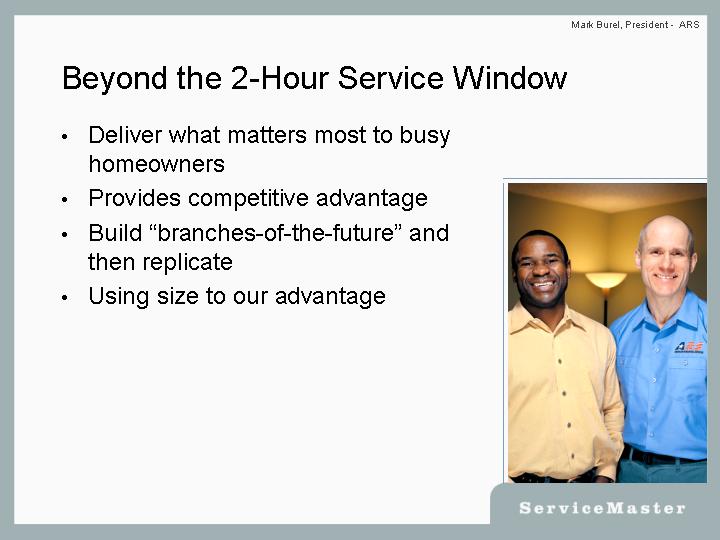

Beyond the 2-Hour Service Window

• Deliver what matters most to busy homeowners

• Provides competitive advantage

• Build “branches-of-the-future” and then replicate

• Using size to our advantage

[GRAPHIC]

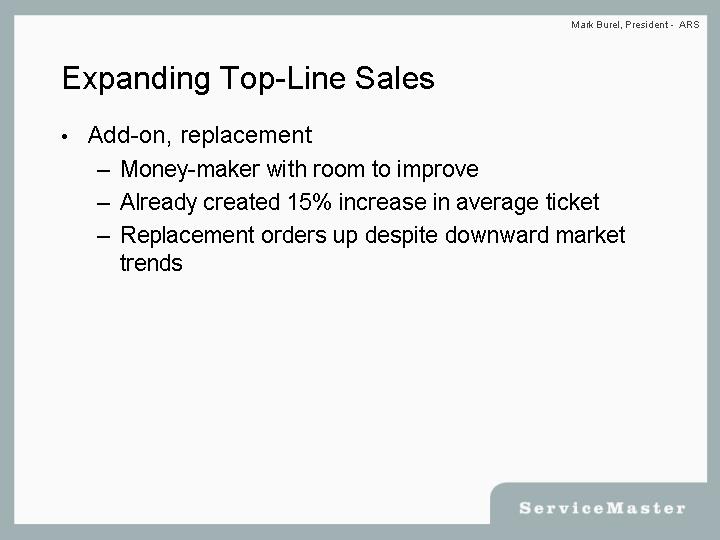

Expanding Top-Line Sales

• New distribution channels

• Retail opportunities

• In a unique position to partner

• Already seeing success

• Add-on, replacement

• Money-maker with room to improve

• Already created 15% increase in average ticket

• Replacement orders up despite downward market trends

Plumbing Issues and Opportunities

• Economic issues today

• “Game Changing” developments

• Result:

• A focus on commercial customer

• Sales and marketing of sewer work

[GRAPHIC]

Data-Driven Marketing

• Traditional advertising in Yellow Pages

• Little room for differentiation

• New marketing strategy

• Integrated marketing programs, including direct mail and mass media

• Using customer data to target efforts

[GRAPHIC]

Using data to target

marketing efforts

Positioned for Growth

• Execute well against all strategies

• Data-driven approach is the best fit

• Now we accelerate the process

Albert Cantu, President & COO - Terminix

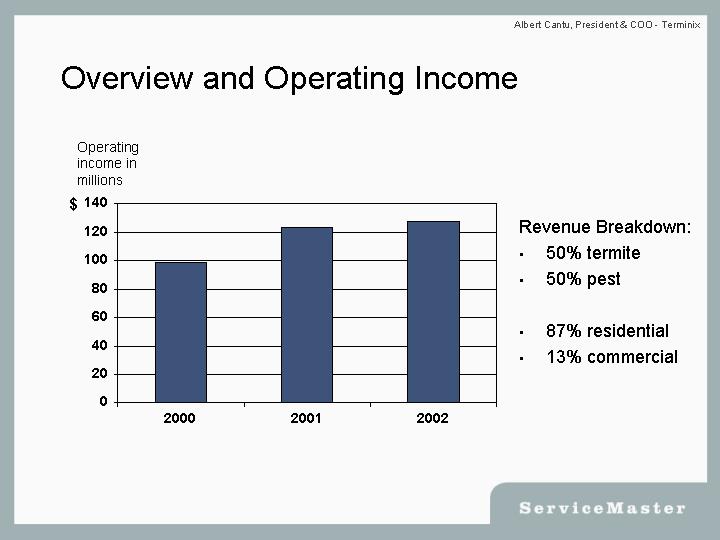

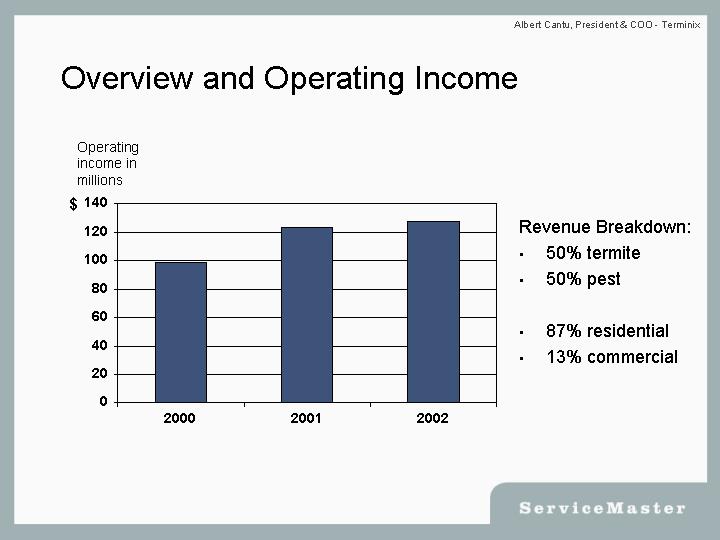

Overview and Operating Income

[CHART]

Revenue Breakdown:

• 50% termite

• 50% pest

• 87% residential

• 13% commercial

Terminix is Industry Leader

• Terminix is the number one provider of termite and pest control services in the country

• Industry has been hurt by poor termite season

• But Terminix is still going strong

[GRAPHIC]

Terminix

$4.4 Billion Market

Termite & Pest — Residential

[CHART]

18,000 Providers

Current Strategies at Terminix

• Sharpened brand value proposition

• Technology opportunities

• Termite liquid and bait solutions

• Pest control service frequency

• Mid single-digit revenue growth

• Consistent margins in '04; 20 to 50 basis point annual margin improvement after '04

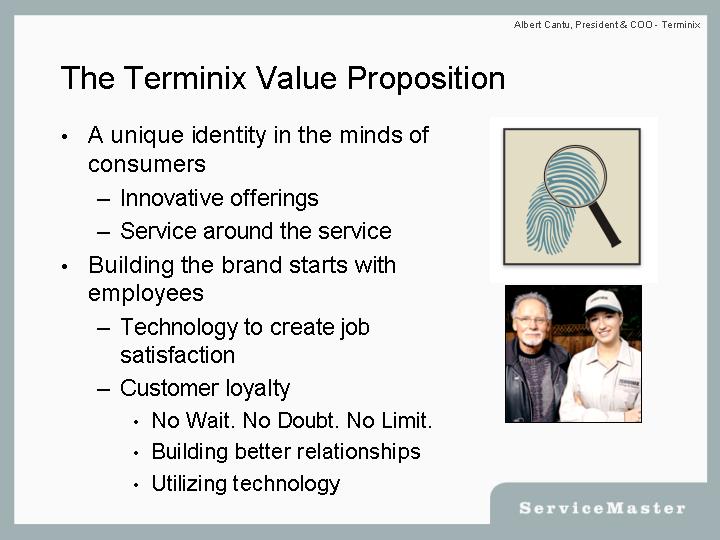

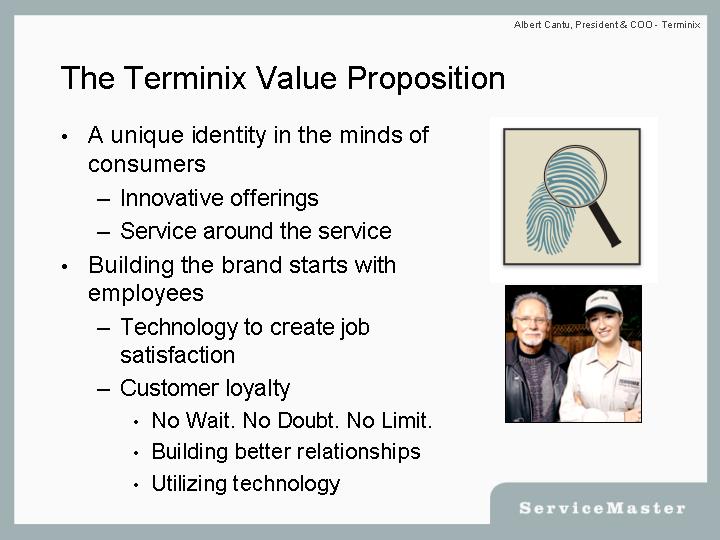

The Terminix Value Proposition

• A unique identity in the minds of consumers

• Innovative offerings

• Service around the service

• Building the brand starts with employees

• Technology to create job satisfaction

• Customer loyalty

• No Wait. No Doubt. No Limit.

• Building better relationships

• Utilizing technology

[GRAPHIC]

[GRAPHIC]

Jim Goetz, Senior Vice President & CIO - ServiceMaster

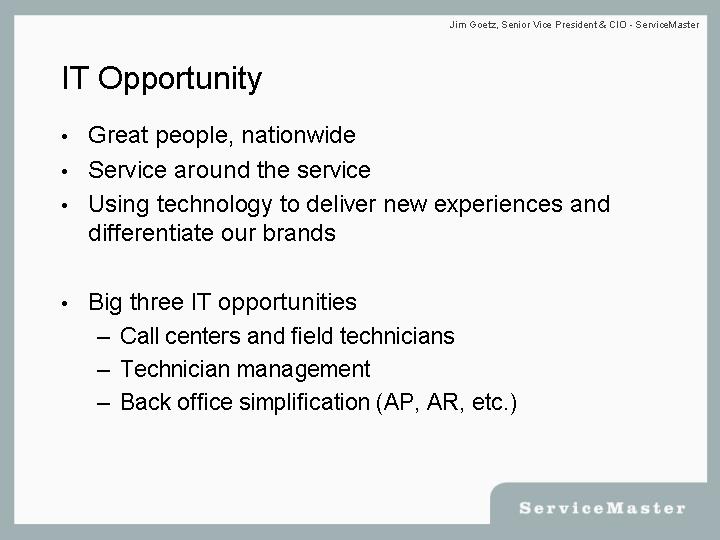

IT Opportunity

• Great people, nationwide

• Service around the service

• Using technology to deliver new experiences and differentiate our brands

• Big three IT opportunities

• Call centers and field technicians

• Technician management

• Back office simplification (AP, AR, etc.)

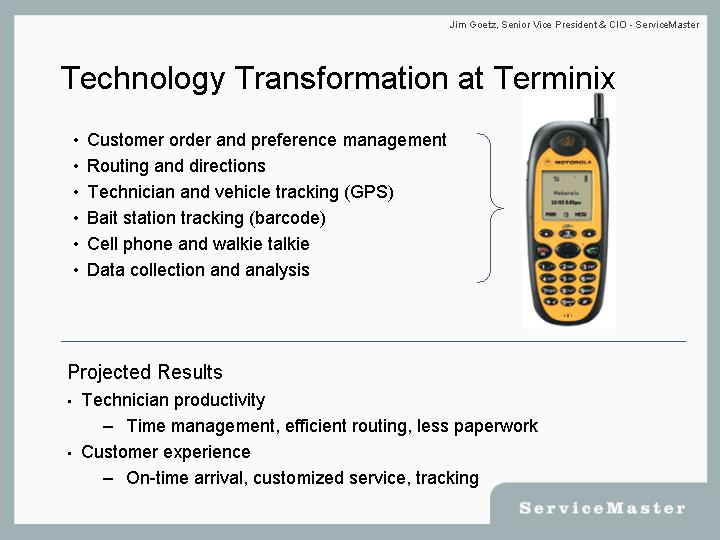

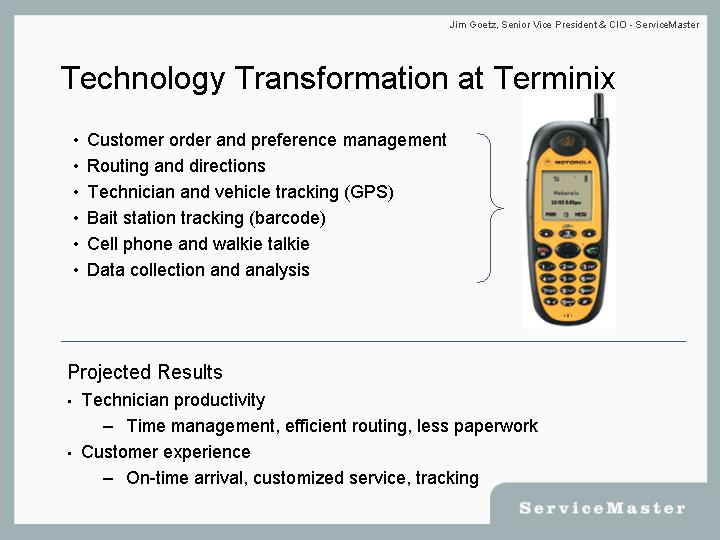

Technology Transformation at Terminix

[GRAPHIC]

• Customer order and preference management

• Routing and directions

• Technician and vehicle tracking (GPS)

• Bait station tracking (barcode)

• Cell phone and walkie talkie

& #149; Data collection and analysis | [GRAPHIC] |

Projected Results

• Technician productivity

• Time management, efficient routing, less paperwork

• Customer experience

• On-time arrival, customized service, tracking

Technology at Work

[GRAPHIC]

• Technology allows for real-time technician tracking and instantaneous communication

• Customer receives a status update in a matter of seconds rather than 15-30 minutes

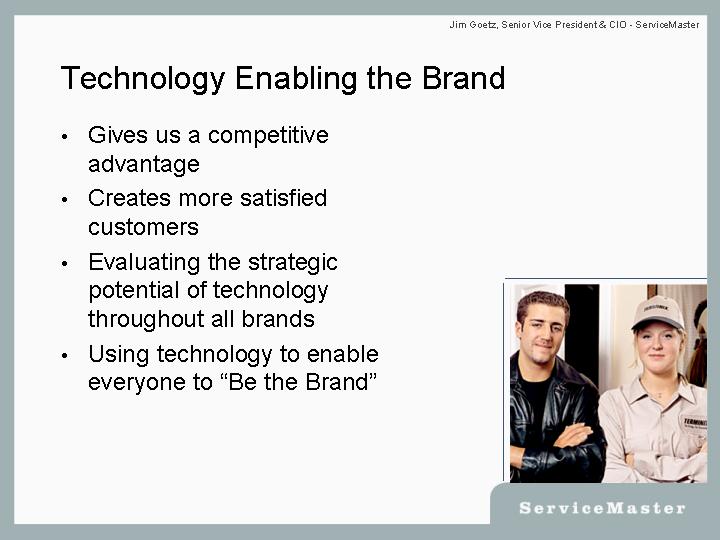

Technology Enabling the Brand

• Gives us a competitive advantage

• Creates more satisfied customers

• Evaluating the strategic potential of technology throughout all brands

• Using technology to enable everyone to “Be the Brand”

[GRAPHIC]

Albert Cantu, President & COO - Terminix

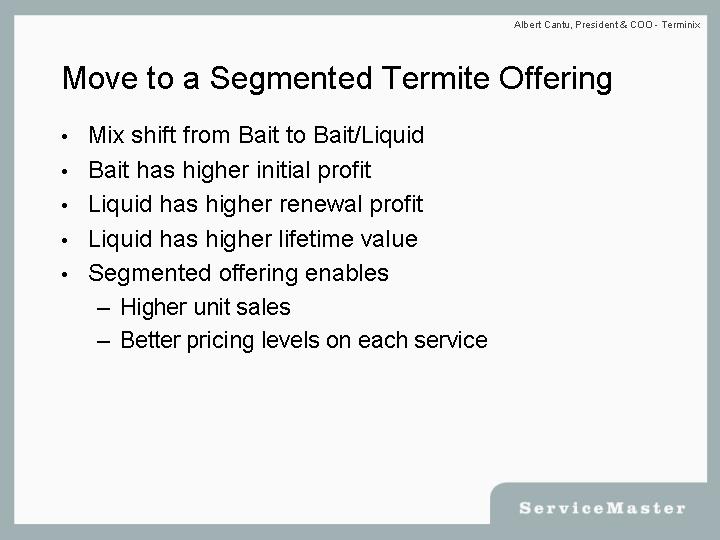

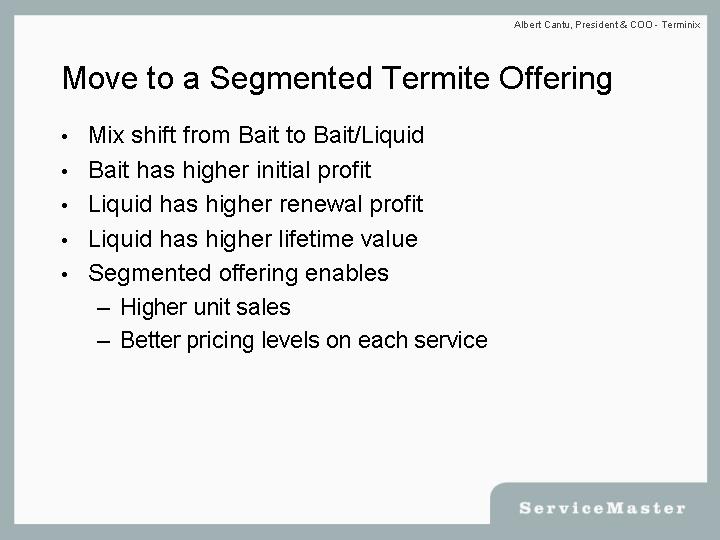

Move to a Segmented Termite Offering

• Mix shift from Bait to Bait/Liquid

• Bait has higher initial profit

• Liquid has higher renewal profit

• Liquid has higher lifetime value

• Segmented offering enables

• Higher unit sales

• Better pricing levels on each service

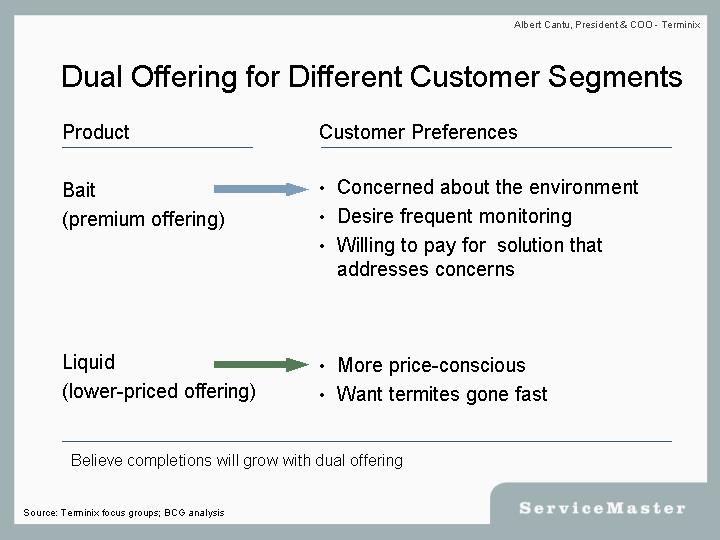

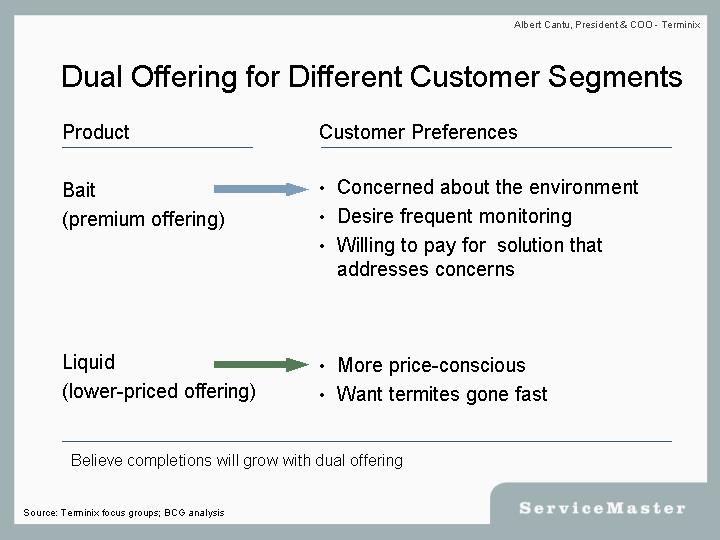

Dual Offering for Different Customer Segments

Product | | Customer Preferences |

| | | |

Bait | ==> | | • | Concerned about the environment |

(premium offering) | | • | Desire frequent monitoring |

| | • | Willing to pay for solution that addresses concerns |

| | | |

Liquid | ==> | | • | More price-conscious |

(lower-priced offering) | | • | Want termites gone fast |

Believe completions will grow with dual offering

Source: Terminix focus groups; BCG analysis