Exhibit 99.1

Introduction

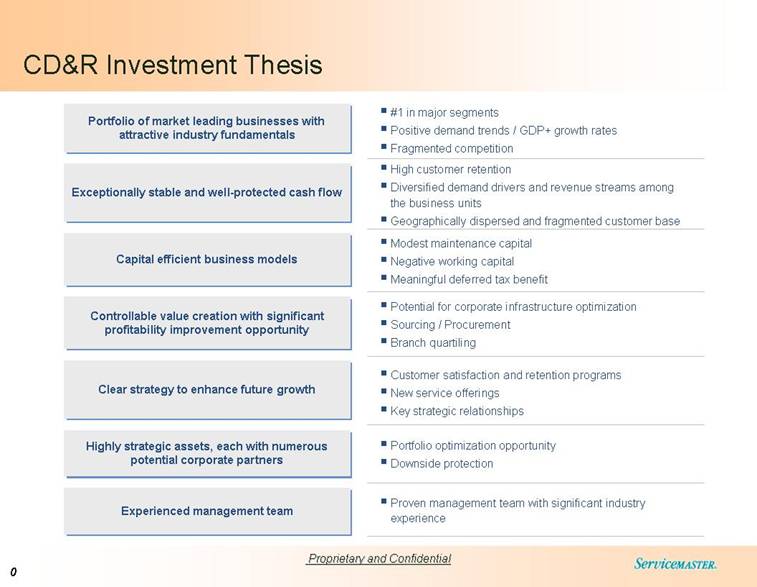

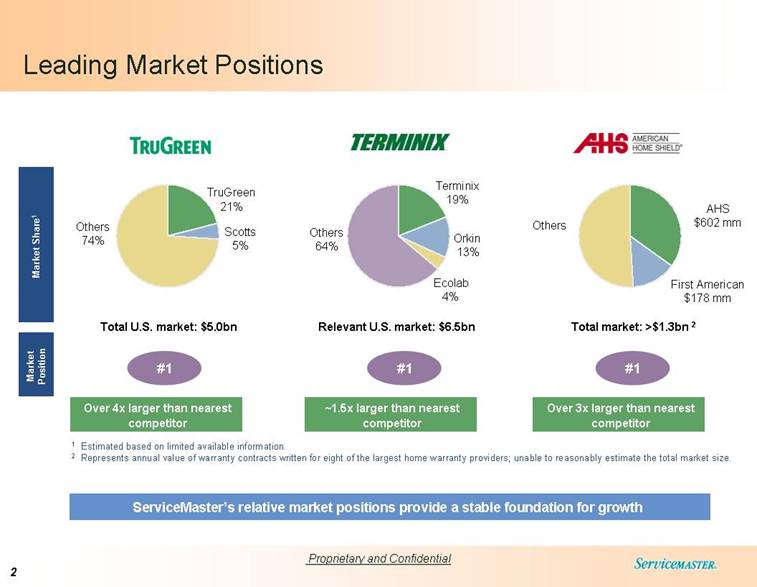

ServiceMaster is a leading provider of outsourced services to residential and commercial customers in its target markets, primarily in the United States. The Company’s services include lawn care under the TruGreen brand, termite and pest control under the Terminix brand and home warranty under the American Home Shield brand, as well as disaster response and reconstruction, cleaning and disaster restoration, house cleaning, furniture repair and home inspection. Each of the Company’s TruGreen LawnCare, Terminix and American Home Shield businesses maintains the largest market share, by operating revenue, in its respective market. ServiceMaster believes that these leading market positions, combined with its high brand awareness and low household penetration, provide for a reliable and growing market opportunity.

ServiceMaster operates through a network of approximately 5,400 company-owned locations and franchised licenses and outside of the United States through licensing arrangements in 10 other countries. The Company estimates that more than 70% of its 2006 operating revenue was generated from residential services. The Company had approximately 24,000 employees as of December 31, 2006. As of March 31, 2007, the Company had approximately 6.3 million residential customer service agreements in its company-owned operations.

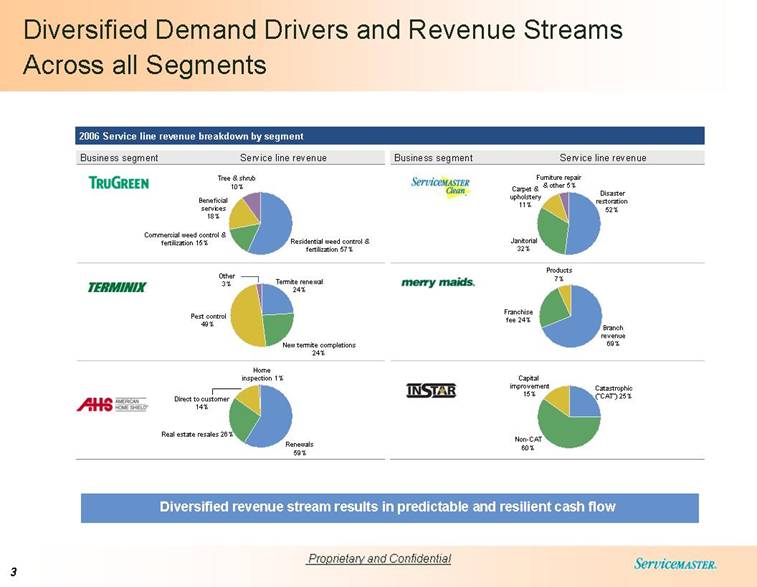

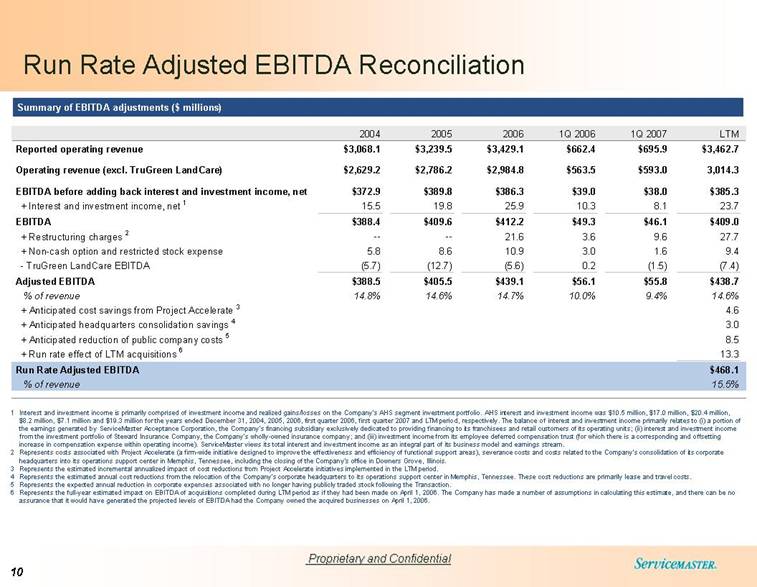

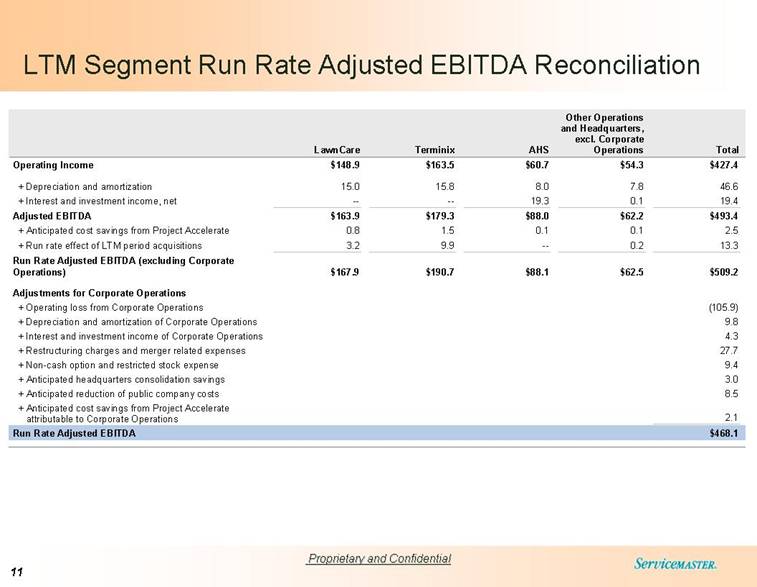

ServiceMaster is organized into four principal operating segments: TruGreen LawnCare, Terminix, American Home Shield, and Other Operations and Headquarters. The Company’s TruGreen LawnCare, Terminix and American Home Shield segments collectively contributed 88% of its Run Rate Adjusted EBITDA, excluding Corporate Operations, for the twelve months ended March 31, 2007 (“LTM period”). The Company generated operating revenue of $3,014 million, excluding LandCare, and Run Rate Adjusted EBITDA(a) of $468 million for the LTM period. The following charts illustrate the percentage of the Company’s operating revenue, excluding Corporate Operations and LandCare, and Run Rate Adjusted EBITDA, excluding Corporate Operations, derived from each of its segments for the LTM period.

(a) ServiceMaster operates its landscape maintenance business through its TruGreen LandCare (“LandCare”) segment. LandCare is structured as an unrestricted subsidiary for this financing. As a result, it has been excluded from all information unless otherwise noted. Refer to Run Rate Adjusted EBITDA reconciliation for adjustment details.

LTM 3/31/07 Operating Revenue by Segment | | LTM 3/31/07 Run-Rate Adjusted EBITDA by Segment |

| | |

| |

|

Note: Excludes Corporate Operations. Refer to Run Rate Adjusted EBITDA reconciliation for details. |

1

Business strategy

ServiceMaster’s business strategy is focused on the following initiatives:

— Execute on strategic initiatives. ServiceMaster believes that the following initiatives, most of which were introduced in 2006, will contribute significantly to its earnings over the next few years:

· TruGreen LawnCare implemented a series of initiatives to increase its customer retention from its current level of 67% for the LTM period. For example, the Company introduced the Lawn Quality Audit (“LQA”) program, with the dual objective of forging closer customer relationships and educating customers about the lawn fertilization process. The LQA program involves an annual visit to the homeowner by a qualified representative to discuss or remediate any potential service issues. The initial results of the LQA program have been very positive, increasing 2006 year-end customer retention by 800 basis points for new customers who received a LQA versus new customers who did not receive a LQA and by 260 basis points for existing customers who received a LQA versus existing customers who did not receive a LQA. Also, the Company is steadily reducing its reliance on telemarketing and refocusing its sales efforts on alternate channels, such as direct marketing and other print media, which have historically produced higher customer retention rates. In addition, in 2006, the Company rolled out an expanded automatic payment option called “EasyPay,” which enables customers to automatically make recurring credit card or automated payments for treatment applications. Although EasyPay penetration at TruGreen LawnCare was less than 5% of customers at the end of the first quarter of 2007, the retention rate for customers using the service to date is approximately 720 basis points higher than those paying by check at the time of each application.

· Terminix recently introduced the Termite Inspection and Protection Plan (“TIPP”), a new service offering designed to expand Terminix’s addressable market. The program, which costs approximately one-third the cost of a traditional preventative liquid termite treatment, offers homeowners who do not currently have a termite infestation with one year of protection against termite damage, with the opportunity to renew for the payment of an additional annual fee. ServiceMaster believes that the TIPP initiative will both expand the addressable market for its termite services and create a significant revenue and earnings stream over the next few years.

· American Home Shield signed an agreement with Realogy Corporation, one of the preeminent providers of real estate brokerage services in the world with brands including Century21®, Coldwell Banker®, ERA® and Sotheby’s International Realty®, to become the exclusive provider to Realogy’s company-owned operations and a preferred provider to Realogy’s franchise operations. ServiceMaster believes that its sales force has the potential to further penetrate Realogy’s business with the home warranty product, and that this agreement will add significant contract volume to its current AHS platform.

— Re-energize the business units. Although ServiceMaster’s businesses have grown, the Company believes they have the potential for further improvement both operationally and financially. In recent years, the Company has developed a strategy to capitalize on the significant potential of its businesses with the following initiatives:

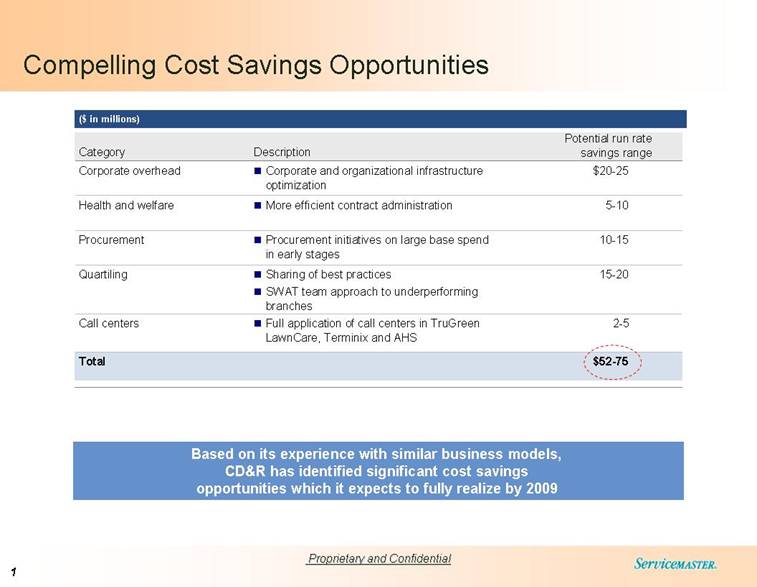

· Drive productivity increases and profitability enhancement. ServiceMaster intends to pursue the following strategies for improving the profitability of its operations.

· Improve profitability of company-owned operations. There is currently a significant disparity in performance across the branch locations of the Company’s business units. ServiceMaster seeks to drive substantial improvement in its operating margins through disciplined performance measurement and benchmarking, best practice sharing and productivity initiatives.

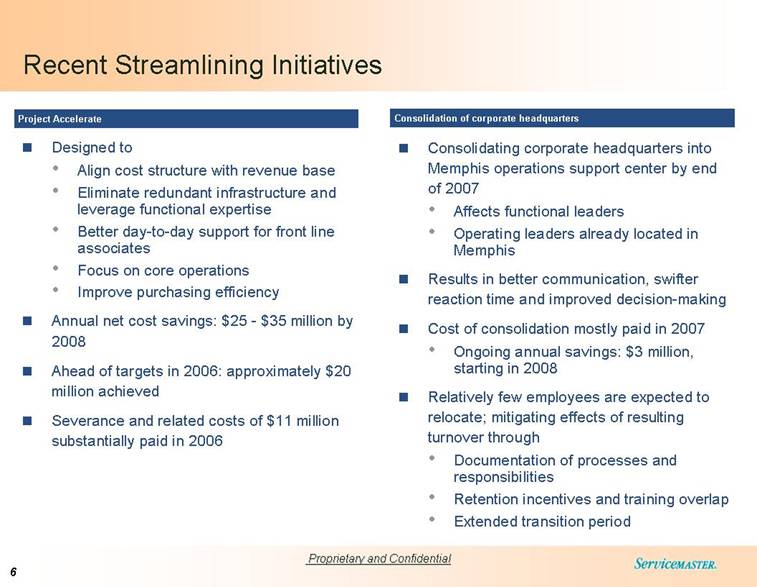

· Streamline the organization and reduce overhead. ServiceMaster believes its current corporate, divisional and regional overhead structures can be further streamlined without impairing customer services. In 2006, the Company implemented “Project Accelerate,” an initiative that is expected to improve the effectiveness and efficiency of its functional support areas and to result in annualized pre-tax savings of $30 million to $35 million by the end of 2007. However, the Company believes that significant additional savings can be achieved by further streamlining its overhead structures and increasing the spans of control of certain

2

regional and divisional managers. The Company believes these actions will also improve the efficiency and responsiveness of its organization.

· Invest in key strategic initiatives. ServiceMaster plans to re-invest a portion of its cost savings in key strategic initiatives identified by its business units. The Company believes that investment in these initiatives will further reinforce the Company’s market leading positions and will result in profitable revenue growth.

· Enhance and realign management incentive plans. ServiceMaster intends to enhance and realign management incentive compensation plans to more strongly correlate to the successful execution of its long-term business plan. The Company believes this compensation realignment will focus management’s attention on the critical factors driving its success, such as innovation, customer retention and cash flow.

— Increase share and household penetration of the Company’s services. ServiceMaster believes that its size and geographic scale, strong brand awareness and improved customer service focus will enable the Company to increase its market share across its portfolio of businesses. In addition, the Company believes there are significant opportunities to increase the relatively low household penetration of its businesses and thus expand its addressable markets.

— Utilize new technology. ServiceMaster believes that technological support is critical to the productivity of its front-line associates. For instance, in 2006, the Company introduced SmartTruck, a GPS and wireless synchronization system for its Terminix trucks, which it is in the process of rolling out to the Terminix branch network. SmartTruck and associated scheduling enhancements are expected to enable the Company to reduce its fuel consumption, speed the arrival of the appropriate technicians at customers’ premises and increase the percentage of time its technicians spend with customers. AHS’s new Customer Service Center application equips its associates with the tools and information they need to serve and fulfill their customers’ needs efficiently. The Company is also rolling out division sales centers for Terminix, where it is deploying improved sales scripting and enhanced scheduling capabilities to convert more pest leads into new pest sales. The Company believes it has additional technology-driven opportunities to improve the effectiveness of its sales force, improve safety and reduce costs.

— Continue to train and retain the Company’s key associates. ServiceMaster intends to continue its efforts to improve the recruitment, training and retention of its associates. For example, at TruGreen LawnCare, the Company has implemented a series of initiatives to improve retention of its route managers, such as more rigorous pre-screening of qualified candidates and improved on-boarding of processes. These initiatives are designed to both significantly reduce the costs associated with employee turnover and improve customer service. At Terminix, the Company has implemented more seasonally-timed training for its pest technicians, designed to provide specific refresher training on treatment protocols immediately prior to the anticipated onset of specific pest issues in a given region. This training is designed to improve customer service and reduce the number of additional services required.

— Expand commercial services. ServiceMaster’s extensive national coverage, brand strength and broad product and service offerings provide the Company with a significant competitive advantage in serving multi-location commercial accounts, especially relative to its local and regional competition. The Company believes that it has the opportunity to further leverage its broad national service network to increase its share of the commercial market.

3

ServiceMaster believes the Company has the following competitive strengths:

Leading market positions, critical size and broad geographic footprint

ServiceMaster believes that TruGreen LawnCare, Terminix and AHS, which collectively contributed 88% of its Run Rate Adjusted EBITDA, excluding Corporate Operations, for the LTM period, each hold the number one position in their respective markets. Measured by operating revenue, TruGreen LawnCare is over four times larger than its nearest competitor, Terminix is approximately 46% larger than its nearest competitor, and AHS is more than three times larger than its nearest competitor. American Home Shield is also the only home warranty provider in the United States with both national sales and technical services networks, which provide a significant competitive advantage enabling the Company to educate real estate agents about the benefits of the home warranty product. The Company believes that its size and scale improve its purchasing leverage, route density, marketing, operating efficiencies and profit margins compared to smaller, local competitors.

ServiceMaster’s Brands Portfolio

Est. market

position | | Brands | | Services | | Relationship | | Locations(1) |

#1 | |

| | Lawn fertilization and weed control, shrub and tree care | | Branch/ Franchise | | 209 company-owned locations; 55 franchised locations |

#1 | |

| | Pest and termite control | | Branch/ Franchise | | 394 company-owned locations; 134 franchised locations |

#1 | |

| | Home warranty | | Virtual Network | | Contractor-based network |

N/A | |

| | Home inspection | | Branch/ Franchise | | One company-owned location; 210 franchised locations |

N/A | |

| | Disaster restoration, carpet and upholstery cleaning, janitorial | | Franchise | | 3,211 franchise licenses |

N/A | |

| | House cleaning | | Branch/ Franchise | | 70 company-owned locations; 767 franchise licenses |

N/A | |

| | Furniture repair | | Franchise | | 318 franchise licenses |

N/A | |

| | Commercial disaster response and reconstruction | | Branch | | 21 company-owned locations |

Source: ServiceMaster Investor Presentation (8-K dated November 28, 2006) and 2006 10-K.

(1) As of December 31, 2006.

Portfolio of well-known brands across multiple end-markets

ServiceMaster believes that its brands are well known and established residential and commercial services brands throughout the United States. The Company believes the image and familiarity of its brands attract potential customers to seek out service providers affiliated with these brands. For example, Terminix has 94% brand awareness across the markets in which it competes.

Favorable long-term industry dynamics

ServiceMaster believes that the residential and commercial services outsourcing industry will continue to benefit over the long term from strong positive fundamentals, including:

4

— Positive gross domestic product (“GDP”) outlook. ServiceMaster believes that demand for its services is driven in part by growth in GDP. According to Global Insight, an economic and financial information provider, GDP per capita in the U.S. is expected to grow from approximately $38,000 in 2006 to approximately $45,000 in 2015, implying higher levels of disposable income and potentially increased spending on outsourcing household services.

— Favorable demographic factors:

· Increasing home ownership. The percentage of households that own their home (measured by the national home ownership rate published by the U.S. Census Bureau) has grown from 63% in 1965 to approximately 69% in 2006. According to the Joint Center for Housing Studies of Harvard University, approximately 15 million new households are likely to be created in the 2005-2015 period, partially driven by minority home ownership.

· Rising percentage of dual-income households. The percentage of dual-income married households has increased from 55% in 1967 to 62% in 2004. ServiceMaster believes that dual-income married couple families are likely to have greater disposable income but less free time for household tasks, potentially contributing to demand for the services it offers.

5

· Aging of baby-boomers. ServiceMaster believes that the aging of the population will increase demand for outsourced services, as retirees may prefer to outsource labor-intensive household tasks. In addition, many baby-boomers have second homes, which ServiceMaster believes should increase the demand for outsourced services.

· �� Increasing size of homes. During the period from 1973-2005, home sizes in the United States increased at a CAGR of approximately 1% from an average of 1,660 square feet to an average of 2,434 square feet according to the U.S. Census Bureau, which the Company believe contributes to higher spending on outsourced home services.

— Higher population-growth in the South and West. According to the U.S. Census Bureau, markets in the South and West regions of the U.S. are experiencing higher population growth than other regions of the U.S. ServiceMaster believes this trend should be favorable to the Company over the long term because households in these markets generally have a greater need for its outsourced home services due to the climate and the year-round growing season in these regions.

In addition to the positive industry fundamentals outlined above, ServiceMaster also believes that the industries in which it operates exhibit favorable characteristics given their high fragmentation and potential for higher penetration of outsourced services like the ones it provides.

Resilient business model with diverse business drivers and fragmented customer base

ServiceMaster’s revenues and cash flows have historically been strong irrespective of the overall macroeconomic environment for the following reasons:

— Benefits of portfolio diversification. ServiceMaster’s business units each respond to a different set of drivers. New sales are driven, in part, by a variety of factors, including magnitude of termite swarms, weather patterns, resales of existing homes in the United States, and natural or human-caused disasters calling for emergency response services. In addition, a significant share of the Company’s operating revenue at TruGreen LawnCare, Terminix and AHS are driven by existing customer retention and related service agreement renewals.

— Diversified customer base. ServiceMaster has a large customer base as evidenced by approximately 6.3 million residential customer service agreements for company-owned operations as of March 31, 2007, and no single customer that accounts for more than 1% of the Company’s consolidated operating revenue. Additionally, none of the Company’s operating segments is dependent on a single customer or a few customers, the loss of which would have a material adverse effect on that segment.

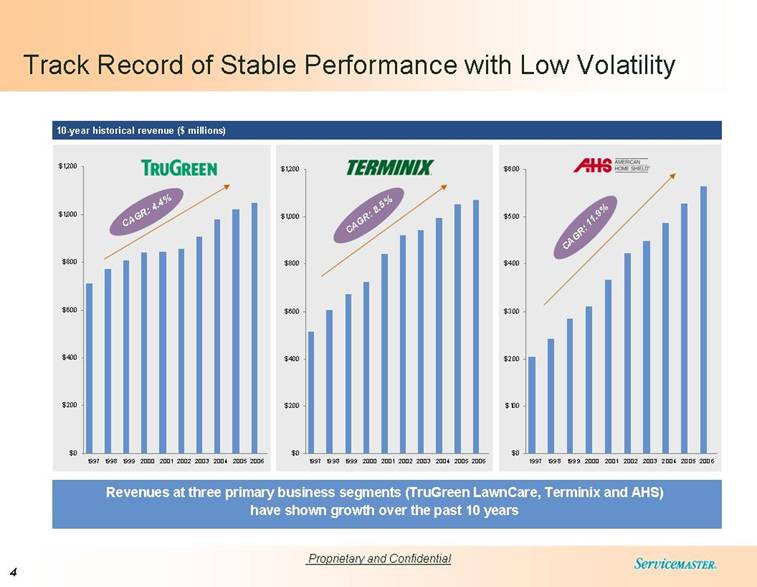

As a result of the above, the impact of a single or group of related factors on ServiceMaster’s earnings or cash flows in any one year is mitigated. Historically, revenue at TruGreen LawnCare, Terminix and AHS has grown consistently through internal and external growth. Over the 1997—2006 period, the operating revenue of TruGreen LawnCare, Terminix and AHS grew at a CAGR of 4.4%, 8.5% and 11.9%, respectively, through organic growth and acquisitions.

6

High customer retention rate with potential for further upside

The customers in ServiceMaster’s three largest segments typically enter into one-year renewable agreements. The Company’s customer retention rates were approximately 67% for TruGreen LawnCare, 79% for Terminix Pest Control, 88% for Terminix Termite and 59% for AHS for the LTM period. Retention rates improved by 380 basis points, 180 basis points, 30 basis points and 100 basis points for the Company’s TruGreen LawnCare, Terminix Pest Control, Terminix Termite and AHS services, respectively — from March 31, 2006 to March 31, 2007. The Company believes that these retention rates significantly contribute to the stability of its overall revenue base. The Company recently implemented a series of new initiatives targeted at further increasing its customer retention rates and thereby contributing to increasing its earnings and cash flows.

Significant free cash flow generation

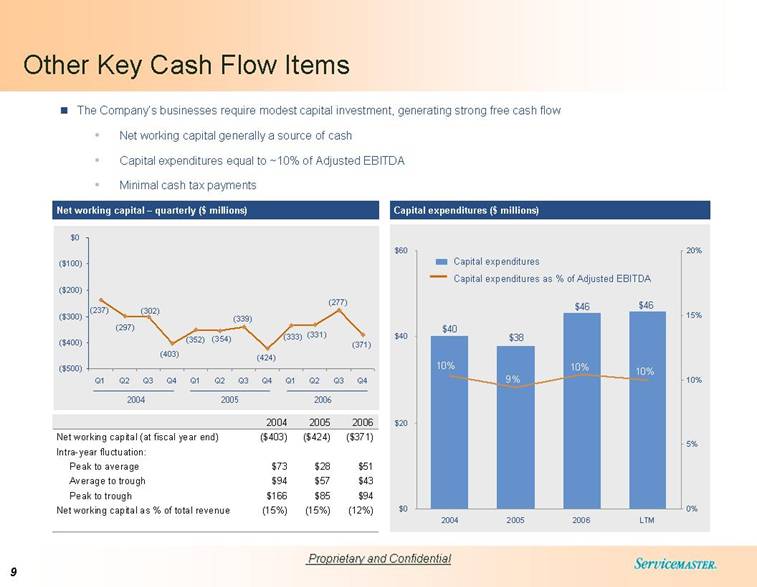

ServiceMaster generates significant operating cash flow as a result of historically strong earnings, low capital expenditures, modest working capital requirements and favorable tax attributes.

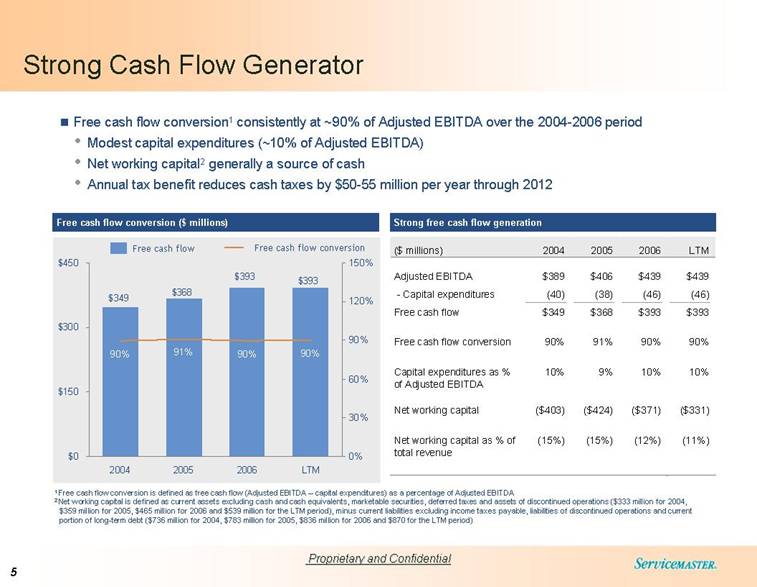

— The Company’s average Adjusted EBITDA for the last three years was $411 million, while its average capital expenditures over the same period was $41 million, translating into an average free cash flow conversion of 90%. The Company defines free cash flow conversion as free cash flow (Adjusted EBITDA — capital expenditures) as a percentage of Adjusted EBITDA. The service model for the operation of the business requires relatively low capital expenditures.

— ServiceMaster also believes that its businesses require relatively little working capital to fund growth. With low inventory requirements and significant customer prepayments for many of the Company’s services, ServiceMaster benefited from negative net working capital over the past three years. The average of the Company’s quarter-end negative net working capital balances in 2006 represented approximately (11)% of its operating revenue in 2006.

— ServiceMaster receives a significant annual cash tax benefit due to a large base of amortizable intangible assets which exist for federal income tax reporting purposes and arose in part from its 1997 conversion from a master limited partnership to a corporation. The combination of the amortization of these intangible assets and the impact of the Transactions is expected to result in the Company’s paying a minimal amount of federal cash income taxes through 2012.

7

Business Segment Overview

TruGreen LawnCare segment

TruGreen LawnCare is the leading provider of lawn care services in the United States, based on operating revenue in 2006. TruGreen LawnCare specializes primarily in residential and commercial fertilization and weed control but also offers aeration and seeding, tree and shrub care and grub control. The Company’s lawn care technicians typically visit customers once every 4 to 6 weeks during the service season. The Company markets its lawn care services primarily through direct marketing, neighborhood sales and telemarketing. The Company continues to shift its marketing channels towards direct marketing and neighborhood sales which have demonstrated higher customer retention rates than marketing through other channels. Overall, customer retention at TruGreen LawnCare for the LTM period was 67%. The TruGreen LawnCare segment contributed 33% of ServiceMaster’s Run Rate Adjusted EBITDA, excluding Corporate Operations, for the LTM period.

As of December 31, 2006, TruGreen LawnCare provided these services in 43 states and the District of Columbia through 209 company-owned locations and 55 franchised locations. As of December 31, 2006, TruGreen LawnCare also provided lawn care services through a subsidiary in Canada and has licensing arrangements with licensees who provide these services in Japan and the United Kingdom.

The TruGreen LawnCare business is seasonal in nature. Weather conditions, such as a drought, or snow in the late spring or fall, can affect the demand for lawn care services and may result in a decrease in revenues or an increase in costs.

Detailed below are TruGreen LawnCare’s market share and revenues by service line.

Market Share | | Revenue by Service Line |

| | |

| |

|

Source: Company. | | |

Terminix segment

Terminix is the leading provider of termite and pest control services in the United States, based on operating revenue in 2006, serving both residential and commercial customers. Terminix specializes in termite inspection, prevention and elimination, insect control and other pest control using a variety of treatments and other techniques. Approximately one-half of ServiceMaster’s Terminix operating revenue is generated from termite services. Approximately 50% of the Company’s termite services operating revenue is derived from renewals of existing customer contracts. The other half of the Company’s termite services

8

operating revenue depends on new termite servicing contracts, which are significantly influenced by the annual level of seasonal termite swarms. Termite swarms typically begin in the early spring in the southern United States and advance north as the spring season progresses. Depending on the type of termite treatment selected by its customers, the Company’s scheduled technicians’ visits can vary from every quarter to once a year, with additional visits if warranted by conditions. Customer retention for the Company’s termite services during the LTM period was 88%. The remaining half of Terminix operating revenue is generated from pest control services. The Company uses a variety of techniques for its pest control services which are typically provided on a quarterly basis. Customer retention for pest control services was 79% for the LTM period. The Terminix segment contributed 38% of ServiceMaster’s Run Rate Adjusted EBITDA, excluding Corporate Operations, for the LTM period.

As of December 31, 2006, Terminix provided these services in 47 states and the District of Columbia through 394 company-owned locations and 134 franchised locations. As of December 31, 2006, Terminix also provided termite and pest control services through a subsidiary in Mexico and has licensing arrangements whereby licensees provide these services in 9 other countries, primarily in Asia, the Caribbean and the Middle East.

The Terminix business is seasonal in nature. The termite swarm season, leads to the highest demand for termite control services and therefore the highest level of revenues in each year. Termite swarms typically begin in the early spring in the southern United States and advance north as the spring season progresses. Similarly, increased pest activity in the warmer months leads to the highest demand for pest control services and, therefore, the highest level of revenues in each year.

Detailed below are Terminix’s market share and revenues by service line.

Market Share | | Revenue by Service Line |

| | |

| |

|

Source: Company. | | |

American Home Shield segment

American Home Shield is the leading provider of home warranty contracts for systems and appliances in the United States, based on operating revenue in 2006. ServiceMaster believes AHS is the only home warranty service provider serving customers in 49 states and Washington D.C. ServiceMaster’s AHS customers typically enter into a one-year renewable contract. AHS markets its home warranty contracts through a national sales network consisting of participating third-party real estate brokerage offices and direct marketing arrangements with financial institutions and insurance agencies. AHS recently signed an agreement with Realogy Corporation to become the exclusive provider of warranty services to Realogy’s company owned operations and the preferred provider to its franchise operations. AHS claims are not serviced directly by AHS employees, but by a national “virtual network” of approximately 12,000 local,

9

independent contractors, all of which are pre-qualified and regularly monitored by AHS. Approximately 2,600 of these independent contractors are preferred contractors which provide services to ServiceMaster on terms favorable to the Company and are required to uphold higher standards than other contractors. In 2006, approximately 75% of the warranty contracts written by AHS were derived from existing contract renewals and direct-to-consumer sales, while the balance was derived from sales made in conjunction with existing home resale transactions. AHS’s overall customer retention rate was 59% for the LTM period, while the retention rate for AHS customers who had previously renewed their contracts more than once was 76%. The AHS segment contributed 17% of ServiceMaster’s Run Rate Adjusted EBITDA, excluding Corporate Operations, for the LTM period.

The American Home Shield business is seasonal in nature. Sales volume in the American Home Shield segment depends, in part, on the number of home resale closings, which historically has been highest in the spring and summer months. AHS costs related to service call volume are highest in the summer months, especially during periods of unseasonably warm temperatures.

AHS provides home appliance warranty contracts which are regulated as service contracts in various states. Certain states require that AHS maintain investment balances to support reserves for future payments under the warranty contracts. Depending on the state, the investments include but are not limited to certificates of deposit, repurchases agreements, municipal bonds, corporate bonds and equities. This portfolio generates investment income which includes interest earned on certificates of deposit, repurchase agreements and bonds, dividends and realized gains and losses on sales of marketable securities. AHS maintains an investment policy which requires the evaluation and recording of potential impairment on the securities under certain circumstances. The investment policy is designed to ensure that the portfolio meets the state regulatory requirements. The investments are monitored to ensure that they meet the standards of the investment policy as well as the regulatory requirements.

Detailed below are AHS’s market share and revenues by service line.

Market Share(1) | | Revenue by Service Line |

| |

|

Source: Company. | | |

(1) Total market size greater than $1.3 billion reflecting annual value of warranty contracts written for eight of the largest home warranty providers; unable to reasonably estimate the total market size.

Other operations and headquarters segment

The Other Operations and Headquarters segment provides disaster response and reconstruction services under the InStar brand name, residential and commercial disaster restoration and cleaning services primarily under the ServiceMaster and ServiceMaster Clean brand names, domestic house cleaning services primarily

10

under the Merry Maids brand name, on-site furniture repair and restoration services primarily under the Furniture Medic brand name and home inspection services under the AmeriSpec brand name. The Other Operations segment also includes ServiceMaster’s headquarters functions.

ServiceMaster Clean

ServiceMaster Clean is a franchisor in the residential and commercial disaster restoration and cleaning field in the United States. ServiceMaster Clean is the largest contributor to earnings of its Other Operations. As of December 31, 2006, ServiceMaster Clean provided these services in all 50 states and the District of Columbia through 3,211 franchise licenses. As of December 31, 2006, ServiceMaster Clean also provided disaster restoration and cleaning services through affiliated subsidiaries in Canada and the United Kingdom and had entered into licensing arrangements to provide these services in six other countries, primarily in Asia and the Middle East.

Merry Maids

Merry Maids is a provider of domestic house cleaning services in the United States. As of December 31, 2006, these services were provided in 48 states and the District of Columbia through 72 company-owned locations and 767 franchise licenses. As of December 31, 2006, Merry Maids also provided domestic house cleaning services through affiliated subsidiaries in Canada and the United Kingdom and had entered into licensing arrangements to provide these services in six other countries, primarily in Asia.

InStar

InStar is a direct provider of disaster response and reconstruction services for customers in the United States, which ServiceMaster acquired in February 2006. As of December 31, 2006, InStar provided these services in 33 states and the District of Columbia through 21 company-owned locations and had no international operations.

Furniture Medic

Furniture Medic is a provider of on-site furniture repair and restoration services in the United States serving residential customers. As of December 31, 2006, Furniture Medic provided these services in 49 states and the District of Columbia through 318 franchise licenses. As of December 31, 2006, Furniture Medic also provided on-site furniture repair and restoration services through affiliated subsidiaries in Canada and the United Kingdom and had entered into licensing arrangements to provide these services in Saudi Arabia.

AmeriSpec

AmeriSpec is a provider of home inspection services in the United States serving residential customers. As of December 31, 2006, AmeriSpec provided these services in 46 states and the District of Columbia through one company-owned location and 210 franchised locations. AmeriSpec also provided home inspection services through a subsidiary in Canada. AmeriSpec’s financial results are included in ServiceMaster’s Other Operations and Headquarters segment effective January 1, 2007 and were previously included in its American Home Shield Segment.

Other Operations contributed 12% of ServiceMaster’s Run Rate Adjusted EBITDA, excluding Corporate Operations, for the LTM period. The Other Operations and Headquarters segment also includes Corporate Operations and related costs that are not charged back to the other segments. Corporate Operations consist primarily of certain senior executive, accounting, finance, marketing, information technology, sourcing,

11

human resources and legal functions, and also includes certain compensation awards based on enterprise-wide (or consolidated) results.

TruGreen LandCare segment

The TruGreen LandCare segment provides landscape maintenance services primarily under the TruGreen LandCare brand name. The TruGreen LandCare business is seasonal in nature. As of December 31, 2006, TruGreen LandCare provided these services in 43 states and the District of Columbia through 102 company-owned locations and had no international operations. LandCare will be designated as an “unrestricted subsidiary” under the credit agreement and is anticipated to be transferred to Holding Parent or one of its affiliates after the closing.

Recent acquisition and dispositions

Historically, ServiceMaster has grown in part through tuck-in acquisitions, primarily in its Terminix and TruGreen LawnCare segments. In addition, Merry Maids has acquired some franchise territories to operate as company-owned branches. The Company expects to continue its tuck-in acquisition program at Terminix and TruGreen LawnCare, as well as franchise territory repurchases. The Company expects to fund tuck-in and franchise territory acquisitions through available cash, available borrowings, seller financed notes and/or deferred payment obligations.

Purchase of InStar Services Group

In February 2006, ServiceMaster acquired InStar for approximately $85 million in cash.

Sales of American Residential Services and American Mechanical Services

In the third quarter of 2006, ServiceMaster completed the sales of ARS and AMS generating gross cash proceeds of approximately $115 million, which was used to reduce outstanding debt balances. The ARS and AMS operations provided heating, ventilation, air conditioning (HVAC), plumbing and electrical installation and repair services.

12

Industry Overview

Markets

ServiceMaster competes in the residential and commercial services industry. The Company targets markets that meet its criteria for size, growth and profit potential. While the Company competes with a broad range of competitors in each discrete market, ServiceMaster does not believe that any of its competitors provides all of the services it provides in all of the markets the Company serves. ServiceMaster believes that its widely recognized brands, size, geographic footprint, and reputation for service quality provide the Company with significant competitive advantages in the markets the Company serves. Each of the Company’s segments operates in several markets within the broader residential and commercial services outsourcing industry. All of the primary marketplaces in which the Company operates are highly fragmented and characterized by attractive industry conditions.

Lawn care market

According to Packaged Facts, a division of MarketResearch.com, the United States market for professional lawn services specializing in lawn treatments (including a number of ancillary services for which the Company’s TruGreen LawnCare segment does not compete) was estimated at $5.0 billion in 2006. According to New Strategist Publications, approximately 14% of U.S. surveyed consumer units outsourced lawn or gardening services in 2004. According to Packaged Facts, the lawn care market has grown at a 6.5% compound annual growth rate (“CAGR”) over the 2002-2006 period, with no down years during this period, and is projected to grow at a 3% CAGR over the next two years.

Based on Packaged Facts’ market size analysis, ServiceMaster’s share of the U.S. lawn care services market is approximately 21% based upon the Company’s U.S. customer level operating revenue (including operating revenue from franchisees) of $1.1 billion in 2006. Competition in the market for professional lawn care services comes mainly from local, independently owned firms and from homeowners who care for their own lawns. ServiceMaster’s TruGreen LawnCare segment generated $1.1 billion of operating revenue in 2006 compared to Scotts LawnService®, a segment of The Scotts Miracle-Gro Company, which generated approximately $250 million of system-wide sales in fiscal 2006. According to the Company’s estimates, those two market participants together command approximately 26% of the outsourced lawn care market.

The U.S. professional lawn care services market has historically been characterized by favorable fundamentals, including growth, the ability of market participants to implement moderate price increases, and high fragmentation with numerous privately-held local providers.

Termite and pest control market

Based on Specialty Products LLC’s analysis of market size, the U.S. market for professional termite and pest control services (including pre-construction termite treatments, which is a business in which the Company does not compete) was a $6.7 billion industry in 2006. This industry grew at a CAGR of 4.3% from 2000 to 2006. The relevant portion of this market in which the Company competes is approximately $6.5 billion. The termite and pest control services industry is generally characterized by high customer retention rates. The Company estimates that Terminix’s market share for the termite and pest control services it provides is approximately 19% based on U.S. customer-level operating revenue (including operating revenue from franchisees) of $1.3 billion in 2006. According to MediaMark Research, Inc. (“MRI”), 15.5% of U.S. households hired a professional exterminator in 2006.

13

Competition in the market for termite and pest control services comes mainly from regional and local, independently owned firms, from homeowners who treat their own termite and pest control problems, and from Orkin, Inc., a subsidiary of Rollins, Inc., which operates nationally like the Company’s Terminix segment. Ecolab Inc. also competes nationally with a focus on the commercial pest control segment.

ServiceMaster estimates that the top three providers (including the Company) comprise approximately 36% of the outsourced termite and pest control services market. The termite and pest control services market is very fragmented with numerous privately-held local termite and pest control service providers.

Home warranty market

ServiceMaster estimates that the U.S. home warranty market (including structural home warranties, which is a business in which the Company does not compete) was at least an approximately $1.3 billion industry in 2006, as measured by the annual value of warranty contracts written of eight of the largest home warranty providers. One of the primary drivers of new home warranty contracts is the number of existing homes sold in the United States, since a home warranty product is typically recommended by a broker or offered by the seller of a home in conjunction with the signing of a real estate transaction. Existing homes unit sales in the U.S. have grown at a 3.2% CAGR over the 1972-2006 period, according to the National Association of Realtors (“NAR”).

According to NAR, existing homesale units decreased by 8.5% in 2006 and are currently projected to decrease by 4.6% in 2007 and increase by 3.7% in 2008. The Company estimates that only approximately 25% of the operating revenue of AHS in 2006 was tied to existing home resales.

Competition in the market for home warranty contracts for systems and appliances comes mainly from regional providers of home warranties. Several competitors are initiating expansion efforts into additional states. AHS and The First American Corporation are the two largest participants in the industry, collectively holding 50% of the market, according to the Company’s estimates.

Disaster restoration and reconstruction, emergency response and other services

Most emergency response work is triggered by extreme weather environments and natural disasters such as hurricanes, floods, mudslides, tornadoes, and earthquakes. Firms in this market also respond to non-weather-related emergency situations for residential and commercial customers, such as fires and floods. Critical factors in the selection of an emergency response firm are the firm’s reputation in the market, available resources, proper insurance and credentials, timeliness, and responsiveness. The market is highly fragmented, and key competitors of ServiceMaster Clean and InStar business segments include companies such as ServPro, Belfor, and BMS CAT.

14